Attached files

Table of Contents

As filed with the Securities and Exchange Commission on August 3, 2011

File No. 333-175458

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GENERAL FINANCE CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 7359 | 32-0163571 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

39 East Union Street

Pasadena, California 91103

(626) 584-9722

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Ronald F. Valenta,

Chief Executive Officer

39 East Union Street

Pasadena, California 91103

(626) 584-9722

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Christopher A. Wilson, Esq.

General Counsel, Vice President & Secretary

39 East Union Street

Pasadena, California 91103

(626) 584-9722

(626) 795-8090 — Facsimile

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | þ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be |

Proposed Maximum Offering Price Per Security(2) |

Proposed Offering Price(1) |

Amount of Registration Fee | ||||

| Common stock, par value $.0001 per share(2) |

100,000 | $2.73 | $273,000 | $31.70 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Consists of shares of common stock issued to the selling stockholder in connection with the acquisition of Mobile Office Acquisition Corp. on October 1, 2008. |

| (2) | Estimated, pursuant to Rule 457(c), solely for the purpose of calculating the amount of the registration fee based upon the average of the high and the low sales prices for shares of the common stock on August 3, 2011, as reported on the NASDAQ Global Market. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated August 3, 2011

PROSPECTUS

GENERAL FINANCE CORPORATION

100,000 Shares of Common Stock

The selling stockholder listed in this prospectus is offering for sale up to 100,000 shares of our common stock.

We will not receive any proceeds from the sale of common stock by the selling stockholder. We are registering the offer and sale of these shares pursuant to certain registration rights granted to the selling stockholder. We will pay the expenses incurred in connection with the registration of the shares, including all registration, listing and qualification fees, printer and accounting fees, our legal fees and up to $50,000 of the selling stockholder’s legal fees and legal counsel to the selling stockholder. The selling stockholder will pay any underwriting fees, discounts, concessions, or brokerage commissions associated with the sale of its shares of common stock.

The selling stockholder will determine when it will sell its shares, and in all cases will sell its shares at the current market price or at negotiated prices at the time of the sale. Securities laws and Securities and Exchange Commission regulations may require the selling stockholder to deliver this prospectus to purchasers when it resells its shares of common stock.

Our units, warrants and common stock are listed on the NASDAQ Global Market under the symbols “GFNCL,” “GFNCZ” and “GFN,” respectively. On August 2, 2011 on the NASDAQ Global Market, the closing price of the units was $3.50 per unit, the bid price of the warrants was $0.17 per warrant and the closing price of the common stock was $2.82 per share.

The purchase of our common stock, warrants and units involves a high degree of risk. You are urged to carefully read the “Risk Factors” section beginning on page 15 of this prospectus which describes specific risks and certain other information associated with an investment in our securities that you should consider before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2011.

Table of Contents

| Page | ||||

| ii | ||||

| ii | ||||

| 1 | ||||

| 9 | ||||

| 10 | ||||

| 12 | ||||

| 14 | ||||

| 15 | ||||

| 23 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

39 | |||

| 54 | ||||

| 59 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

63 | |||

| 66 | ||||

| 68 | ||||

| 71 | ||||

| 71 | ||||

| 71 | ||||

| Index to Unaudited Interim Condensed Consolidated Financial Statements |

I-1 | |||

| F-1 | ||||

i

Table of Contents

You should rely only on the information contained in or incorporated by reference into this prospectus or any supplement. We have not authorized anyone else to provide you with different information. You should not assume that the information in this prospectus or any supplement is accurate as of any date other than the date on the front of those documents.

References in this prospectus to “we,” “us,” “our” or the “Company” refer to General Finance Corporation, a Delaware corporation, and its direct and indirect subsidiaries, including GFN North America Corp., a Delaware corporation, which we refer to as “GFNNA,” and its subsidiary Pac-Van, Inc., an Indiana corporation which we refer to as "Pac-Van," GFN Mobile Storage Inc., a Delaware corporation which we refer to as "GFNMS," GFN U.S. Australasia Holdings, Inc., a Delaware corporation which we refer to as “GFN U.S.,” its majority-owed subsidiary Royal Wolf Holdings Limited, an Australian corporation which we refer to as “Royal Wolf Holdings,” its subsidiary GFN Australasia Finance Pty Limited, an Australian corporation, which we refer to as “GFN Finance,” its subsidiary RWA Holdings Pty Limited, an Australian corporation which we refer to as “RWA,” and Royal Wolf Trading Australia Pty Limited, which we refer to as “Royal Wolf Trading.” Royal Wolf Holdings and its subsidiaries are collectively referred to herein as “Royal Wolf.”

References in this prospectus to “$” are to United States Dollars, and references to “A$” are to Australian Dollars.

This prospectus is part of a resale registration statement that we filed with the United States Securities and Exchange Commission, which we refer to as the SEC. The selling stockholder may offer and sell, from time to time, an aggregate of up to 100,000 shares of our common stock under this prospectus.

This prospectus, including the documents incorporated by reference into this prospectus, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, referred to in this prospectus as the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, referred to in this prospectus as the Exchange Act. Forward-looking statements involve risks and uncertainties that could cause results or outcomes to differ materially from those expressed in the forward-looking statements. Forward-looking statements may include, without limitation, statements relating to our plans, strategies, objectives, expectations and intentions and are intended to be made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Some of the forward-looking statements can be identified by the use of forward-looking terms such as “believes,” “expects,” “may,” “will,” “should,” “could,” “seek,” “intends,” “plans,” “estimates,” “anticipates” or other comparable terms. A number of important factors could cause actual results to differ materially from those in the forward-looking statements. The risks and uncertainties discussed in “Risk Factors” should be considered in evaluating the Company’s forward-looking statements. You should not place undue reliance on our forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statements.

ii

Table of Contents

PROSPECTUS SUMMARY

The following summary contains information about General Finance Corporation and the offering of our common stock. For a more complete understanding of this offering, you should read the entire prospectus carefully, including the risk factors. You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any jurisdiction where the offer is not permitted. It does not contain all of the information that may be important to you in making a decision to purchase our common stock. For a more complete understanding of General Finance Corporation and the offering of its common stock, we urge you to read this entire prospectus and the documents incorporated by reference carefully, including the “Risk Factors” sections and our financial statements and the notes to those statements incorporated by reference herein.

References in this prospectus to “we”, “us,” “General Finance,” “GFN” or the “Company” refer to General Finance Corporation and its consolidated subsidiaries. These subsidiaries include: GFN North America Corp., a Delaware corporation which we refer to as “GFNNA;” Pac-Van, Inc., an Indiana corporation which we refer to as “Pac-Van;” GFN Mobile Storage Inc., a Delaware corporation which we refer to as “GFNMS;” GFN U.S. Australasia Holdings, Inc., a Delaware corporation which we refer to as “GFN U.S.;” Royal Wolf Holdings Limited, an Australian corporation which we refer to as “Royal Wolf Holdings;” GFN Australasia Finance Pty Ltd, an Australian corporation which we refer to as “GFN Finance;” RWA Holdings Pty Limited, an Australian corporation which we refer to as “RWA;” and Royal Wolf Trading Australia Pty Limited, an Australian corporation which we refer to as “Royal Wolf Trading.” We refer to Royal Wolf Holdings and its subsidiaries collectively as “Royal Wolf.”

Company Overview

Our strategy and business plan is to acquire rental services and specialty finance businesses in North America, Europe and the Asia-Pacific area. We currently have two operating subsidiaries, Royal Wolf and Pac-Van, that lease and sell storage container products, modular buildings and mobile offices through 23 customer service centers, which we refer to as “CSCs,” in Australia and New Zealand and 26 branch locations across 18 states in the United States. Royal Wolf and Pac-Van operate in two distinct, but related industries, modular space and mobile storage, which we collectively refer to as the “portable services industry.”

In September 2007, we acquired Royal Wolf. We paid $64.3 million to acquire Royal Wolf. The purchase price consisted of $44.7 million of cash and shares of common stock of GFN U.S., constituting 13.8% of the capital stock of GFN U.S. following the issuance. We issued the shares of common stock of GFN U.S. to Bison Capital Australia, L.P., which we refer to as “Bison Capital,” as one of the sellers of Royal Wolf. Following the acquisition, we owned 86.2% of the outstanding capital stock of GFN U.S., and Bison Capital owned the remaining 13.8% of the capital stock of GFN U.S.

In October 2008, we acquired Pac-Van through a merger in which Mobile Office Acquisition Corp., or MOAC, the parent company of Pac-Van, merged with and into the Company’s wholly-owned subsidiary, GFNNA. To purchase all of the capital stock of MOAC we paid $19.4 million in cash, issued 4,000,000 shares of restricted General Finance common stock valued at $7.50 per share under the merger agreement and caused GFNNA to issue a $1.5 million 20-month subordinated promissory note. We also assumed the outstanding senior indebtedness of Pac-Van.

In May 2011, Royal Wolf Holdings completed an initial public offering on the Australian Securities Exchange which raised gross proceeds of A$91.5 million from the issuance of 50 million new ordinary shares. Royal Wolf used a portion of the net proceeds of the offering to prepay in full $22.3 million of Bison Capital subordinated notes and to reduce borrowings under its senior credit facility, and General Finance used a portion of the net proceeds from the offering to repurchase the 13.8% of the capital stock of GFN U.S., to reduce borrowings under the senior credit facility of Pac-Van and the remaining amount of the net proceeds was used for general working capital purposes. At the completion of the offering, General Finance still owned a majority of the ordinary shares of Royal Wolf Holdings.

ROYAL WOLF

Royal Wolf’s lease fleet, nationwide presence and experienced management team position it as the leading provider in Australia and New Zealand of portable storage containers, portable container buildings and freight containers, which we refer to collectively as “storage container products.” Royal Wolf leases and sells storage container products through its 23 Customer Service Centers, which we refer to as “CSCs,” in every state in Australia and New Zealand.

Royal Wolf’s storage container products are used by a diverse client base of approximately 21,000 customers who conduct business in a broad range of industries that include mining, road and rail, construction, moving and storage, manufacturing, transportation, defense and in the support of small and medium-size entities. Our customers use our products for a wide variety of storage applications, including retail and manufacturing inventory, construction materials and equipment, documents and records and household goods.

1

Table of Contents

Business Strengths

Royal Wolf believes it possesses the following principal strengths:

Leading Market Share in Australia and New Zealand. Royal Wolf believes its lease fleet of storage container products is the largest in Australia and New Zealand.

CSC Branch Network. Royal Wolf is the only portable container lease and sales company with CSCs in all major business centers in Australia and New Zealand.

Broad Product Range and Young Fleet. Royal Wolf believes it has the broadest product range and youngest lease fleet in Australia and New Zealand.

Diversified Blue Chip Customer Base. Royal Wolf has a broad base of approximately 21,000 active customers, with only one customer constituting more than 2% of our annual revenue for the fiscal year ended June 30, 2010. Our customer base includes the retail and manufacturing sectors, councils and government departments, the farming and agricultural community, the building and construction industry, clubs and sporting associations, the mining sector and the general public.

Experienced Management Team. Royal Wolf’s experienced management team is lead by Robert Allan, the chief executive officer of Royal Wolf, who has 25 years of experience in the industry. The senior management team of Royal Wolf has an average of over 14 years of experience in the industry. We believe the experience of this management team will be critical to growing Royal Wolf’s business.

Business Strategy

We are pursuing a business strategy focused on growing our leasing operations, generating strong internal growth and eventually leveraging our infrastructure through acquisitions, as follows:

Focus on Mobile Storage Leasing Business. We focus on growing our core leasing business because it provides predictable, recurring revenue and high margins. We believe that we can generate substantial demand for our storage container products as the container storage and portable container building industry is relatively underdeveloped in Australia and New Zealand. We believe the underdeveloped nature of the market presents significant growth opportunities for Royal Wolf. Although mobile storage, domestic freight movement and portable building applications are increasing, we believe many more uses for our storage container products are still to be developed. Royal Wolf’s market opportunity is to fully develop and service these applications.

Generate Strong Internal Growth. We define internal growth as an increase in lease revenues on a year-over-year basis at our CSCs in operation for at least one year, without inclusion of leasing revenue attributed to same-market acquisitions. We continue to focus on increasing the number of storage containers we lease from our existing branches to both new and repeat customers as well as changing the billing methodologies used in the U.S. market, such as advance billing, a 28-day billing cycle, fuel surcharges and a damage waiver program. Historically, we have been able to generate strong internal growth within our existing markets through sales and marketing programs designed to increase brand recognition, expand market awareness of the uses of mobile storage and differentiate our products from our competitors.

Leverage our Infrastructure through Acquisitions. Our branch network infrastructure serves a broad geographic area and is capable of serving additional volume at minimal levels of additional fixed costs. Our long-term objective is to add volume by organically growing the lease fleet in these locations and through acquisitions. Asset purchases of “tuck in” competitors to existing branches or adding newly acquired fleet with branches in better locations can be very effective. In addition, the corporate infrastructure of Royal Wolf is capable of managing existing fleets and locations in geographies outside of Australia and New Zealand, but within the Asia-Pacific area.

2

Table of Contents

Products and Services

Royal Wolf is the only storage container product company in Australia and New Zealand with both the national presence and product range capable of servicing all sectors of the domestic rental and sales market. The Company’s key products include:

| Mobile storage containers: |

10-foot, 20-foot and 40-foot general purpose units | |

| Double pallet-wide high cube units | ||

| Hazardous goods containers | ||

| Refrigerated containers | ||

| Portable container: buildings: |

Site offices and cabins | |

| Workforce accommodation units | ||

| Luxury accommodation units | ||

| Restroom blocks | ||

| Blast-resistant units | ||

| Specialized office and infrastructure suites | ||

| Freight Containers: |

Curtain-side containers | |

| 20-foot and 40-foot Hi-cube containers | ||

| 20-foot and 40-foot two pallet-wide containers | ||

| Side-opening door containers | ||

Mobile Storage Containers. Royal Wolf leases and sells mobile storage containers, some of which are customized for specific customers, for on-site storage by customers. These customers include retail outlets and manufacturers, government departments, farming and agricultural concerns, building and construction companies, clubs and sporting associations, mine operators and the general public. Royal Wolf’s products include general purpose dry storage containers, refrigerated containers and hazardous goods containers in a range of standard and modified sizes, designs and storage capacities.

Portable Container Buildings. Royal Wolf also leases and sells portable container buildings as site offices and for temporary accommodations. Royal Wolf customizes mobile storage container buildings for some customers. Royal Wolf entered the portable building market in August 2005 with 20-foot and 40-foot portable buildings manufactured from steel container platforms which it markets to a subset of its mobile storage container customer base.

Freight Containers. Royal Wolf leases and sells freight containers specifically designed for transport of products by road and rail. Customers include national moving and storage companies, distribution and logistics companies, freight forwarders, transport companies, rail freight operators and the Australian military. Royal Wolf’s freight container products include curtain-side, refrigerated and bulk cargo containers, together with a range of standard and industry-specific dry freight containers.

Branch network

Royal Wolf leases and sells its storage container products from its network of 23 CSCs, the largest branch network of any storage container company in Australia and New Zealand. Royal Wolf is represented in all major metropolitan areas, and Royal Wolf is the only container leasing and sales company with a nationally integrated infrastructure and work force.

A typical Royal Wolf CSC consists of a leased site of approximately two to five acres with a sales office, forklifts and all-weather container repair workshop. CSC office staffing ranges from two to 15 people and include a branch manager supported by the appropriate level of sales, operations and administrative personnel. Yard and workshop staffing usually ranges between one and 12 people and can consist of welders, spray painters, boilermakers, forklift drivers and production supervisors. CSC inventory holding usually ranges between 150 and 700 storage containers at any one time, depending on market size and throughput demand.

3

Table of Contents

The following map shows Royal Wolf’s existing CSC locations at June 30, 2010:

Customers

Royal Wolf has a broad base of approximately 21,000 active customers, with only one customer constituting more than 2% of our annual revenue for the fiscal year ended June 30, 2010. Our customer base includes the retail and manufacturing sectors, councils and government departments, the farming and agricultural community, the building and construction industry, clubs and sporting associations, the mining sector and the general public. We believe the diversity of Royal Wolf’s customer base reduces the business exposure to a significant downturn in any particular industry.

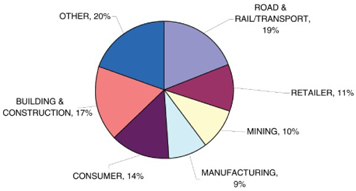

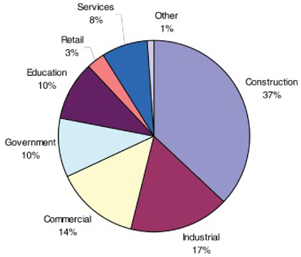

Royal Wolf storage container products provide its customers with a solutions-oriented approach with high quality equipment, superior service and product knowledge. This is supported by a highly responsive national marketing team, in-house finance, and control and engineering expertise and nationally linked fleet management and accounting systems. Royal Wolf is the largest and only truly national supplier of container products in Australia and New Zealand, and the only container company with the scale and capacity to service a full range of customers, from small local accounts right through to the largest national businesses. Royal Wolf’s diverse customer base is depicted in the following chart for the fiscal year ended June 30, 2010:

PAC-VAN

Pac-Van competes in the modular space and the mobile storage industries. Modular space includes mobile offices and modular buildings and involves the rental and sales of factory built structures and the delivery and installation of the equipment at customer properties. Mobile storage generally includes providing customers with secure, temporary storage at their site locations. Both lines of business serve a broad range of industries, including construction, services, retail, manufacturing, transportation, utilities and government.

4

Table of Contents

Business Strengths

Pac-Van is a recognized provider of modular buildings, mobile offices and mobile storage products on a national, regional and local basis in the United States. Pac-Van believes it possesses the following strengths:

Extensive Geographic Coverage. With a lease fleet of approximately 11,000 units, Pac-Van is a national participant in the mobile and modular sectors of the portable services industry. Pac-Van’s branch offices serve 17 of the 50 largest Metropolitan Statistical Areas, or MSAs, in the United States. Pac-Van serves a diverse base of national, regional and local customers. The size of Pac-Van’s fleet also allows Pac-Van to offer a wide selection of products to its customers and to achieve purchasing efficiencies.

Diversified Customer Base. Pac-Van has established strong relationships with a diverse customer base in the U.S., ranging from large companies with a national presence to small local businesses. During the fiscal year ended June 30, 2010, which we refer to as “FY 2010,” Pac-Van leased or sold its equipment to over 6,200 customers. In FY 2010, Pac-Van’s largest customer accounted for approximately 5% of its total revenues and Pac-Van’s top ten customers accounted for approximately 15% of its total revenues. Pac-Van believes that the diversity of its business limits the impact on Pac-Van of changes in any given customer, geography or market.

Focus On Customer Service and Support. Pac-Van’s operating infrastructure in the U.S. is designed to ensure that Pac-Van consistently meets or exceeds customer expectations. On the national and regional level, Pac-Van’s administrative support services and scalable management information systems enhance its service by enabling Pac-Van to access real-time information on product availability, customer reservations, customer usage history and rates. Pac-Van believes this focus on customer service attracts new and retains existing customers. In FY 2010, more than 90% of its lease and lease-related revenues were generated from customers who leased from Pac-Van in prior years.

Significant Cash Flow Generation and Discretionary Capital Expenditures. Pac-Van has consistently generated significant cash flow from operations by maintaining high utilization rates and leasing margins and controlling capital expenditures. A significant portion of Pac-Van’s capital expenditures are discretionary in nature, thus providing Pac-Van with the flexibility to readily adjust the amount that it spends based on its business needs and prevailing economic conditions.

High Quality Fleet. Pac-Van’s branches maintain their lease fleet to consistent quality standards. Maintenance is expensed as incurred and branch managers and operations staff are responsible for managing a maintenance program aimed at providing equipment to customers that meets or exceed customer expectations and industry standards.

Experienced Management Team. Pac-Van has an experienced and proven senior management team, with its seven most senior managers having worked at Pac-Van for an average of more than ten years. Pac-Van’s President, Theodore M. Mourouzis, joined Pac-Van in 1997 and the consistency of the senior management, corporate and branch management teams has been integral in developing and maintaining its high level of customer service, deploying technology to improve operational efficiencies and integrating acquisitions.

Business Strategy

We are pursuing a business strategy focused on growing our leasing operations, diversifying our product offerings in storage containers and modular buildings, maintaining disciplined cost controls, reducing indebtedness and eventually completing accretive acquisitions, as follows:

Focus on Leasing Business. We focus on increasing our core leasing business because it generates predictable, recurring revenues and high profit margins. Pac-Van’s management team strives to optimize leasing rates and lease fleet utilization in the 26 core markets it serves. Pac-Van branch office system permits it to shift its fleet to branches where customer demand is greatest, and Pac-Van’s planning and sourcing expertise permits it to procure new product on an as needed basis.

Diversifying Our Product Offerings. We plan to continue to expand the size and breadth of our lease fleet. We will emphasize expansion of our higher return products, particularly storage containers. In addition, we will continue to pursue the introduction of specialty storage and office products that can attain long lease durations and high leasing operating margins.

5

Table of Contents

Disciplined Cost Controls. Pac-Van’s size permits it to more rapidly adjust to changing market conditions than many of its larger competitors. This size enables Pac-Van to quickly introduce storage container products demanded by customers, adjust capital expenditures and other spending and maintain more disciplined cost controls than competitors whose cost structures include manufacturing, large payrolls and large investments in outdated product classes, such as storage trailers.

Reducing Indebtedness. We continue to focus on reducing the indebtedness of Pac-Van. We believe this focus on debt reduction will provide great flexibility in the future and will position Pac-Van to capture future growth opportunities. In down or recovering economic cycles, such as we are experiencing in the United States, Pac-Van focuses on optimizing lease fleet utilization, lease rates and collections.

Accretive Acquisitions. Pac-Van plans to complete acquisitions that are accretive or offer other benefits such as expanded customer service or product offerings. Acquisitions, especially “tuck in” acquisitions, also allow Pac-Van to leverage the fixed costs of its branch offices with additional lease fleet that deliver scale and increased profitability.

Products and Services

Pac-Van provides a broad range of products to meet the needs of its customer base. These products include modular buildings, mobile offices and storage containers. The following provides a description of Pac-Van’s product lines:

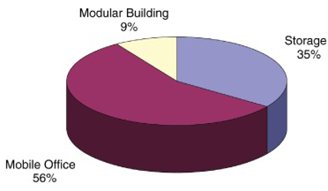

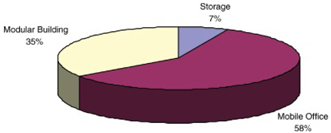

Modular Buildings. Modular buildings are factory-built, portable structures generally consisting of two or more floors and are used in a wide variety of applications, ranging from schools to restaurants to medical offices. Ranging in size from 1,000 to more than 30,000 square feet, the company’s modular buildings are constructed in many sizes and are usually designed to satisfy unique customer requirements. Pac-Van procures modular buildings from an established network of manufacturing partners to meet state building requirements. Modular buildings represent 34% of Pac-Van’s lease fleet.

Mobile Offices. Sales and construction offices, also known as field offices, are relocatable, single-unit structures primarily used for temporary office space. These units are generally built on frames that are connected to axles and wheels and have either a fixed or removable hitch for easy transportation. Standard construction office models range in size from approximately 160 square feet to 1,000 square feet, and are available in standard 8, 10, 12, and 14 foot widths, and include air conditioning and heating, lighting, plan tables, shelving, electrical wiring, phone jacks, and other features normally associated with basic office space. Sales offices range in size from 384 to 672 square feet and typically come in 12 foot widths. Sales offices generally have wood siding, carpeting, high ceilings, custom windows, and glass storefront doors, which provide a professional, customer-friendly building in which to conduct business. Ground offices are storage containers that have been modified to include office space with feature similar to those found in construction offices. Like storage containers, ground level offices (GLOs) typically come in lengths of 20 feet and 40 feet. Some models combine both office and storage functions. All of Pac-Van’s mobile offices are built, or modified as with ground offices, by an established network of manufacturing partners to standard specification, which may vary depending on regional preferences. In addition, Pac-Van builds these units to meet state building code requirements and generally obtains multi-state codes enabling the company to move equipment among its branch network to meet changing demand and supply conditions. Mobile offices comprise approximately 59% of Pac-Van’s lease fleet.

Mobile Storage Equipment. Mobile storage equipment is generally classified into the following product groupings: storage containers, domestic storage containers and storage trailers. Storage containers vary in size from 10 feet to 48 feet in length, with 20-foot and 40-foot length containers being the most common. Storage containers are steel units, which are generally eight feet wide and eight and one-half feet high, and are built to the International Organization for Standardization standards for carrying ocean cargo. Pac-Van purchases new and used storage containers. Domestic storage containers are generally eight feet wide, ten feet in width and come in lengths ranging from 40 to 53 feet. Storage trailers, which vary in size from 28 to 53 feet in length, have wheels and hitches and provide dock height storage. Mobile storage equipment comprises approximately 7% of Pac-Van’s rental fleet.

Delivery and Installation, Return and Dismantle, and Other Site Services. Pac-Van delivers and where necessary installs all three product lines directly to its customers’ premises. Installation services range from simple leveling for portable storage to complex seaming and joining for modular buildings. Pac-Van will also provide skirting and ramps as needed by the customer. Depending on the type of unit some states will also require tie downs and other features to secure the unit. Once a unit is on site at a customer location, Pac-Van’s site services include relocating the unit.

Ancillary Products and Services. In addition to leasing it core product line, Pac-Van provides ancillary products such as steps, furniture, portable toilets, security systems, and other items to its customers for their use in connection with its equipment. Pac-Van also offers its lease customers a damage waiver program that protects them in case the leased unit is damaged. For customers who do not select the damage waiver program, Pac-Van bills them for the cost of any repairs.

6

Table of Contents

Pac-Van complements its core leasing business by selling either existing rental fleet assets or assets purchased specifically for resale. In FY 2010, management estimates that nearly 29% of the sales came from existing fleet units. The sale of- lease fleet units has historically been a cost-effective method of replenishing and upgrading the lease fleet. As with the leasing business, Pac-Van provides additional services when selling units. These services range from delivery to full scale turnkey solutions. In a turnkey solution, Pac-Van provides not only the underlying equipment but also a full range of ancillary services, such as a foundation, specialty interior finishes, and landscaping, necessary to make the equipment fully operational for the customer.

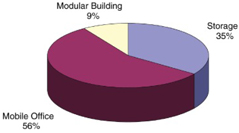

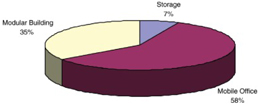

Lease Fleet Summary by Number of Units as June 30, 2010:

Lease Fleet Summary by Gross Dollar Value (thousands) at June 30, 2010:

Leasing. Leasing revenue is a function of average monthly rental rate, fleet size and utilization. Pac-Van monitors fleet utilization at each branch. For FY 2010, average unit utilization of the lease al fleet was approximately 71% on a gross dollar basis and 69% on a unit basis. While Pac-Van adjusts its pricing to respond to local market conditions, management believes that it generally achieves a rental rate equal to or above that of competitors because of the quality of Pac-Van’s products and its high level of customer service. As part of its leasing operations, Pac-Van sells used units from its rental fleet at fair market value or, to a much lesser extent, pursuant to pre-established lease purchase options included in the terms of its lease agreements. Due in part to an active fleet maintenance program, Pac-Van’s units maintain a substantial portion of their initial value which includes the cost of the units as well as costs of significant improvements made to the units.

Sales. Pac-Van will sell units out of its sale inventory as well as its lease fleet. Pac-Van does not generally purchase new units for resale until it has obtained firm purchase orders (which are generally non-cancelable) for such units.

Delivery and Installation. Pac-Van provides delivery, site-work, installation and other services to its customers as part of its leasing and sales operations. Revenues from delivery, site-work and installation result from the transportation of units to a customer’s location, site-work required prior to installation and installation of the units which have been leased or sold. Typically units are placed on temporary foundations constructed by service technicians, and service personnel will also generally install ancillary products. Pac-Van also derives revenues from dismantling and transporting units upon lease expiration.

7

Table of Contents

Branch Network

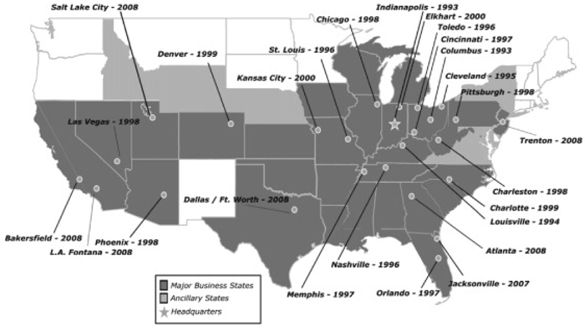

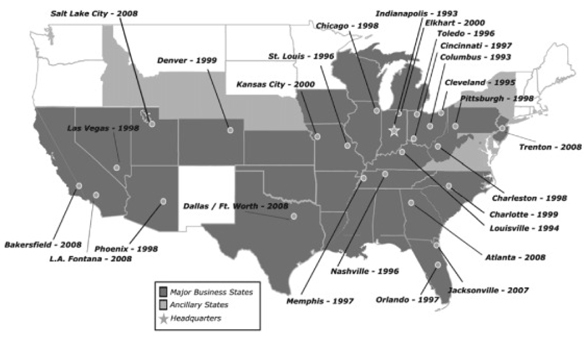

The following map shows Pac-Van’s existing branch network as of June 30, 2010:

As a key element to its market strategy, Pac-Van maintains a network of 26 branch offices throughout the United States. This network enables it to maintain product availability and provide customer service within regional and local markets. Customers benefit because they are provided with improved service availability, reduced time to occupancy, better access to sales representatives, the ability to inspect units prior to rental and lower freight costs which are typically paid by the customer. Pac-Van benefits because it is able to spread regional overhead and marketing costs over a larger lease base, redeploy units within its branch network to optimize utilization.

Customers

Pac-Van has established strong relationships with a diverse set of customers, ranging from large national retailers and manufacturers to local sole proprietors. During FY2010, Pac-Van provided its portable storage, mobile office and modular building products to a diversified base of approximately 6,200 national, regional and local companies in a variety of industries including construction, industrial, manufacturing, education, service, and government sectors.

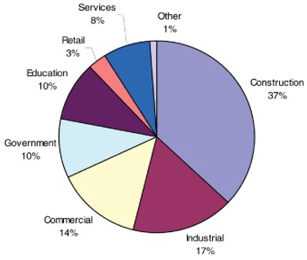

In fiscal year 2010, Pac-Van generated 65% of its revenues from leasing and 35% of its revenues from sales. Pac-Van’s largest leasing customer accounted for approximately 2% of total leasing revenues and its top ten customers accounted for approximately 8% of its total leasing revenues. The following chart shows the percentage of revenues generated by different industries in FY 2010:

Additional Information

Our principal executive offices are located at 39 East Union Street, Pasadena, California 91103 and our telephone number is (626) 584-9722.

8

Table of Contents

On October 1, 2008, in connection with our acquisition of Mobile Office Acquisition Corp., or MOAC, we issued 100,000 shares of common stock to D. E. Shaw Laminar Portfolios, L.L.C. We also issued 3,900,000 shares of our common stock to Ronald F. Valenta, Ronald L. Havner, Jr. and other former stockholders of MOAC in the same acquisition.

We are only registering the 100,000 shares of our common stock issued to D. E. Shaw Laminar Portfolios, L.L.C. with this prospectus pursuant to the registration rights granted to the selling stockholders under the terms of a stockholders agreement entered into in connection with the acquisition of MOAC. Once this registration statement is declared effective, D. E. Shaw Laminar Portfolios, L.L.C. may elect to resell or otherwise dispose of these shares of common stock from time to time. The beneficial ownership information in the below table is based solely on information provided to General Finance Corporation by D. E. Shaw Laminar Portfolios, L.L.C.

Pursuant to this prospectus, D. E. Shaw Laminar Portfolios, L.L.C. may offer an aggregate of 100,000 shares of our common stock for resale. The shares are being offered for the account of D. E. Shaw Laminar Portfolios, L.L.C. as identified in the table below.

D. E. Shaw Laminar Portfolios, L.L.C. is an affiliate of the registered broker-dealer, D. E. Shaw Securities, L.L.C. D. E. Shaw Laminar Portfolios, L.L.C. acquired the 100,000 shares of common stock in the ordinary course of business. On October 1, 2008, D. E. Shaw Laminar Portfolios, L.L.C. entered into a Stockholders Agreement under which we agreed to register the 100,000 shares of common stock issued to D. E. Shaw Laminar Portfolios, L.L.C. On October 1, 2008, the date of the issuance of 100,000 shares of General Finance Corporation common stock, D. E. Shaw Laminar Portfolios, L.L.C. was not a party to any agreement to distribute the 100,000 shares of General Finance Corporation common stock.

The following table sets forth information as of August 3, 2011 and includes the number of shares of our common stock beneficially owned by D. E. Shaw Laminar Portfolios, L.L.C. prior to the offering, the number of shares of common stock offered by D. E. Shaw Laminar Portfolios, L.L.C., and the number of shares of common stock that will be owned by D. E. Shaw Laminar Portfolios, L.L.C. upon completion of the offering or offerings pursuant to this prospectus, assuming D. E. Shaw Laminar Portfolios, L.L.C. sells all of the shares of common stock offered hereby. Only D. E. Shaw Laminar Portfolios, L.L.C. or its transferees, pledgees, donees, assignees, distributees, successors and others who later come to hold the interest of D. E. Shaw Laminar Portfolios, L.L.C. may offer and sell the common stock pursuant to this prospectus and any accompanying prospectus supplement. D. E. Shaw Laminar Portfolios, L.L.C. may offer for sale pursuant to this prospectus and any accompanying prospectus supplement from time to time, any or all of the common stock listed below. Accordingly, no estimate can be given as to the shares of common stock that D. E. Shaw Laminar Portfolios, L.L.C. will hold upon consummation of any such sales.

Applicable percentages are based on 22,013,299 shares of our common stock outstanding on August 3, 2011, adjusted as required by rules promulgated by the Securities and Exchange Commission.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission.

There are no material relationships between D. E. Shaw Laminar Portfolios, L.L.C. and us other than as disclosed herein and the documents we incorporate by reference.

| Common Stock Beneficially Owned Before the Offering |

Shares of Common |

Common Stock Beneficially Owned After Completion of Offering (1) |

||||||||||||||||||

| Number of | Stock Being | Number of | ||||||||||||||||||

| Name | Shares | Percentage | Offered | Shares | Percentage | |||||||||||||||

| D. E. Shaw Laminar Portfolios, L.L.C. |

100,000 | * | 100,000 | -0- | * | |||||||||||||||

| * | Less than 1% |

| (1) | Assumes that D. E. Shaw Laminar Portfolios, L.L.C. sells all of the shares being offered. |

9

Table of Contents

The selling stockholder and any transferees, pledgees, donees, assignees, distributees or other successors in interest to the selling stockholder may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of our common stock covered by this prospectus on the NASDAQ Global Market or any other stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. A selling stockholder may use any one or more of the following methods when disposing of shares:

| • | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| • | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| • | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| • | an exchange distribution in accordance with the rules of the applicable exchange; |

| • | privately negotiated transactions; |

| • | settlement of short sales entered into after the effective date of the registration statement of which this prospectus is a part; |

| • | broker-dealers may agree with the selling stockholder to sell a specified number of such shares at a stipulated price per share; |

| • | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| • | a combination of any such methods of sale; or |

| • | any other method permitted pursuant to applicable law (including underwritten transactions). |

The selling stockholder may also sell shares under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker-dealers, underwriters and agents engaged by the selling stockholder may arrange for other brokers dealers, underwriters or agents to participate in sales. Broker-dealers, underwriters or agents may receive commissions, discounts or concessions from the selling stockholder (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA NASD Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with NASD IM-2440.

In connection with the sale of the common stock or interests therein, the selling stockholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling stockholder may also sell shares of the common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholder may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one (1) or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

10

Table of Contents

The selling stockholder and any broker-dealers, underwriters or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers, underwriters or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

We will pay the expenses incurred in connection with the registration of the shares, including all registration, listing and qualification fees, printer and accounting fees, our legal fees and up to $50,000 of the selling stockholder’s legal fees, and legal counsel to the selling stockholder. The selling stockholder will pay any underwriting fees, discounts, concessions, or brokerage commissions associated with the sale of their shares of common stock.

Because the selling stockholder may be deemed to be an “underwriter” within the meaning of the Securities Act, it will be subject to the prospectus delivery requirements of the Securities Act including Rule 172 thereunder. In addition, any securities covered by this prospectus which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than under this prospectus.

To the extent required, the shares of our common stock to be sold; the names of the selling stockholder; the respective purchase prices and public offering prices; the names of any agents, dealers or underwriters; and any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus. The resale shares will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale shares may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale shares may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the selling stockholder will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of shares of our common stock by the selling stockholder or any other person. We will make copies of this prospectus available to the selling stockholder and have informed the selling stockholder of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

11

Table of Contents

Our summary historical consolidated financial data set forth below as of and for the year ended June 30, 2010 and 2009 (as Successor) was derived from the audited consolidated financial statements included elsewhere in this prospectus. Our summary historical consolidated financial data set forth below as of and for the year ended June 30, 2008 (as Successor), the summary historical consolidated financial data for Royal Wolf (as our Predecessor) for the period from July 1 to September 13, 2007 and as of and for the year ended June 30, 2007 and 2006, was derived from the audited financial statements of Royal Wolf. Our summary consolidated financial data as of and for the quarter ended March 31, 2011 was derived from the unaudited interim condensed financial statements included elsewhere in this prospectus.

Consolidated Statement of Operations Information:

| Predecessor | Successor | |||||||||||||||||||||||||||||||

| Year Ended June 30, |

Period from July 1 to September 13, 2007 |

Year Ended June 30, |

(Unaudited) Nine Months Ended March 31 |

|||||||||||||||||||||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||||||||||||||||

| Sales |

$ | 34,473 | $ | 52,929 | $ | 10,944 | $ | 68,029 | $ | 75,528 | $ | 79,207 | $ | 55,135 | $ | 66,087 | ||||||||||||||||

| Leasing |

15,921 | 21,483 | 4,915 | 27,547 | 70,932 | 77,102 | 57,715 | 65,597 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| 50,394 | 74,412 | 15,859 | 95,575 | 146,460 | 156,309 | 112,850 | 131,684 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Operating income |

2,412 | 4,672 | 1,530 | 8,373 | 14,058 | 3,575 | 7,695 | 12,293 | ||||||||||||||||||||||||

| Other expense, net |

(2,626 | ) | (3,870 | ) | (1,062 | ) | (1,785 | ) | (25,177 | ) | (13,792 | ) | (7,877 | ) | (8,527 | ) | ||||||||||||||||

| Income (loss) before provision for income taxes and noncontrolling interest |

(214 | ) | 802 | 468 | 6,588 | (11,119 | ) | (10,217 | ) | (182 | ) | (3,766 | ) | |||||||||||||||||||

| Net income (loss) |

(428 | ) | 312 | 288 | 4,554 | (6,745 | ) | (8,956 | ) | (116 | ) | 2,341 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net income (loss) per common share: |

||||||||||||||||||||||||||||||||

| Basic |

$ | 0.40 | $ | (0.22 | ) | $ | (0.64 | ) | $ | (0.11 | ) | $ | (0.06 | ) | ||||||||||||||||||

| Diluted |

0.39 | (0.22 | ) | (0.64 | ) | (0.11 | ) | (0.06 | ) | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

Consolidated Balance Sheet Information:

| Predecessor | Successor | |||||||||||||||||||||||

| June 30, | (Unaudited) March 31 2011 |

|||||||||||||||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||||||||||||||

| Trade and other receivables, net |

$ | 7,451 | $ | 13,322 | $ | 18,327 | $ | 26,402 | $ | 25,667 | $ | 27,363 | ||||||||||||

| Inventories |

5,460 | 5,472 | 21,084 | 22,511 | 19,063 | 20,049 | ||||||||||||||||||

| Lease fleet, net |

27,773 | 40,928 | 87,748 | 188,915 | 188,410 | 213,946 | ||||||||||||||||||

| Total assets |

47,903 | 68,788 | 207,861 | 358,696 | 346,880 | 376,467 | ||||||||||||||||||

| Trade payables and accrued liabilities |

10,789 | 10,452 | 18,731 | 24,657 | 25,246 | 28,867 | ||||||||||||||||||

| Senior and other debt |

33,681 | 44,170 | 81,252 | 200,304 | 186,183 | 196,083 | ||||||||||||||||||

| Stockholders’ equity |

3,018 | 13,040 | 93,731 | 103,174 | 101,734 | 111,143 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

12

Table of Contents

Selected Unaudited Quarterly Financial Data

The following table sets forth unaudited operating data for each quarter of the years ended June 30, 2010 and June 30, 2009. This quarterly information has been prepared on the same basis as the annual consolidated financial statements and, in the opinion of management, contains all significant adjustments necessary to state fairly the information set forth herein. These quarterly results are not necessarily indicative of future results, growth rates or quarter-to-quarter comparisons.

| First | Second | Third | Fourth | |||||||||||||

| Quarter | Quarter | Quarter | Quarter | |||||||||||||

| (in thousands, except per share data) | ||||||||||||||||

| Successor | ||||||||||||||||

| For the Fiscal Year Ended June 30, 2010: |

||||||||||||||||

| Revenues |

$ | 35,219 | $ | 39,146 | $ | 38,485 | $ | 43,459 | ||||||||

| Gross profit |

4,088 | 4,259 | 3,923 | 5,571 | ||||||||||||

| Operating income (a) |

2,075 | 2,641 | 2,979 | (4,120 | ) | |||||||||||

| Net income (loss) |

648 | (561 | ) | (203 | ) | (8,840 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) per common share: |

||||||||||||||||

| Basic |

$ | 0.00 | $ | (0.07 | ) | $ | (0.05 | ) | $ | (0.53 | ) | |||||

| Diluted |

0.00 | (0.07 | ) | (0.05 | ) | (0.53 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| For the Fiscal Year Ended June 30, 2009: |

||||||||||||||||

| Revenues |

$ | 31,653 | $ | 42,601 | $ | 34,455 | $ | 37,751 | ||||||||

| Gross profit |

4,819 | 4,648 | 3,654 | 4,034 | ||||||||||||

| Operating income |

1,727 | 5,275 | 5,253 | 1,803 | ||||||||||||

| Net income (loss) |

(6,668 | ) | (2,204 | ) | 93 | 2,034 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) per common share: |

||||||||||||||||

| Basic |

$ | (0.36 | ) | $ | (0.06 | ) | $ | 0.01 | $ | 0.11 | ||||||

| Diluted |

(0.36 | ) | (0.06 | ) | 0.01 | 0.11 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Includes a non-cash impairment charge to the goodwill recorded in the Pac-Van acquisition of $7,633 in the fourth quarter. |

13

Table of Contents

Our units, common stock and warrants are listed on The NASDAQ Global Market (NASDAQ) under the symbols “GFNCL,” “GFN” and “GFNCZ,” respectively. The following table sets forth for the periods indicated the range of high and low closing sales prices for the units, common stock and warrants:

| Units | Common Stock | Warrants | ||||||||||||||||||||||

| High | Low | High | Low | High | Low | |||||||||||||||||||

| FY 2012: |

||||||||||||||||||||||||

| First Quarter (through August 2, 2011) |

$ | 3.50 | $ | 3.50 | $ | 3.05 | $ | 2.63 | $ | 0.12 | $ | 0.00 | ||||||||||||

| FY 2011: |

||||||||||||||||||||||||

| Fourth Quarter |

$ | 4.40 | $ | 2.80 | $ | 3.40 | $ | 2.61 | $ | 0.12 | $ | 0.12 | ||||||||||||

| Third Quarter |

3.51 | 2.22 | 3.65 | 2.01 | 0.12 | 0.12 | ||||||||||||||||||

| Second Quarter |

4.00 | 1.50 | 2.60 | 1.30 | 0.12 | 0.12 | ||||||||||||||||||

| First Quarter |

2.70 | 0.05 | 1.28 | 1.01 | 0.12 | 0.12 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| FY 2010: |

||||||||||||||||||||||||

| Fourth Quarter |

$ | 3.75 | $ | 0.80 | $ | 1.65 | $ | 1.06 | $ | 0.09 | $ | 0.01 | ||||||||||||

| Third Quarter |

1.15 | 1.00 | 1.40 | 1.15 | 0.09 | 0.01 | ||||||||||||||||||

| Second Quarter |

2.25 | 1.05 | 1.65 | 1.11 | 0.20 | 0.02 | ||||||||||||||||||

| First Quarter |

2.80 | 1.07 | 1.60 | 1.22 | 0.15 | 0.05 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| FY 2009: |

||||||||||||||||||||||||

| Fourth Quarter |

$ | 3.80 | $ | 1.00 | $ | 2.16 | $ | 1.05 | $ | 0.34 | $ | 0.08 | ||||||||||||

| Third Quarter |

3.12 | 0.92 | 2.50 | 0.85 | 0.13 | 0.02 | ||||||||||||||||||

| Second Quarter |

6.49 | 1.88 | 6.40 | 1.59 | 0.75 | 0.03 | ||||||||||||||||||

| First Quarter |

8.05 | 5.90 | 7.10 | 4.90 | 1.20 | 0.50 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Record Holders

As of August 2, 2011, there were 28 stockholders of record for our common stock, 59 holders of record for our units and 12 holders of record for our warrants. We believe that there are thousands of beneficial owners of our common stock, units and warrants.

Dividend Policy

We have not paid any dividends on our common stock to date. The payment of dividends in the future will be contingent upon our revenues and earnings, if any, capital requirements and general financial condition. The payment of any dividends will be within the discretion of our board of directors. It is the present intention of our Board of Directors to retain all earnings, if any, for use in our business operations and, accordingly, our board does not anticipate declaring any dividends in the foreseeable future.

14

Table of Contents

An investment in our common stock involves a high degree of risk. You should consider carefully all the risks described below, together with the other information contained in this prospectus, before making a decision to invest in the common stock.

Risks Relating to Our Businesses in Australia and in the United States

Our inability to raise capital.

Our inability to obtain capital in the amounts and at the times when needed, may have a material adverse affect on our business, financial condition and results of operations, including substantially increasing our cost of borrowing and restricting our future operations. These events may significantly reduce the value of your investment.

Global economic conditions and market disruptions may adversely affect our business, financial condition and results of operations.

Financial markets and economic conditions throughout the world have been experiencing disruption, including, among other things, volatility in security prices, diminished liquidity and credit availability, rating downgrades of certain investments and declining valuations of others, failure and potential failures of major financial institutions, unprecedented government support of financial institutions and high unemployment rates. These developments and the related general global economic downturn has and may continue to adversely affect our business and financial condition, as well as the ability of our customers and suppliers to obtain financing to perform their obligations to us. Though we are strengthening our efforts in collections and inventory control, continued worsening of conditions could adversely affect the collection of trade receivables on a timely basis, could result in additional reserves for uncollectible accounts and, in the event of continued contraction in container and modular unit sales and leasing, could lead to a further build-up of inventory and lease fleet levels. These factors would have a further adverse impact on operating results and cash flows. In addition, fluctuations in the rates of exchange for the U.S. dollar against the Australian and New Zealand dollars could significantly affect our results of operations through lower than anticipated reported revenues and profitability as a result of the translation of Royal Wolf’s financial results into U.S. dollars.

If the results of our operations continue to be weak or worsen, we may be unable to meet the covenants governing the indebtedness of GFN, Pac-Van and Royal Wolf, which may require our seeking amendments, waivers of covenant compliance or alternative borrowing arrangements. While we believe our relationships with our senior lenders are good, there is no assurance that they would consent to such an amendment or waiver in the event of noncompliance, or that such consent would not be conditioned upon the receipt of a cash payment, revised principal payout terms, increased interest rates, or restrictions in the expansion of the credit facilities for the foreseeable future, or that our senior lenders would not exercise rights that would be available to them; including, among other things, demanding payment of outstanding borrowings. In addition, our ability to obtain additional capital or alternative borrowing arrangements at reasonable rates, including through the issuance of our preferred stock, has been and may continue to be adversely affected by the current conditions in the financial markets. All or any of these adverse events would further limit our flexibility in planning for or reacting to downturns in our business.

We are unable to predict the duration and severity of the current economic downturn and disruption in financial markets or their effects on our business and results of operations, but the consequences may be materially adverse and more severe than other recent economic slowdowns.

We operate with a significant amount of indebtedness, which is secured by all or substantially all of our assets, subject to variable interest rates and contain restrictive covenants.

Our substantial indebtedness could have adverse consequences, such as:

| • | require us to dedicate a substantial portion of our cash flow from operations at Royal Wolf and Pac-Van to payments on our indebtedness, which could reduce the availability of our cash flow to fund future operating capital, capital expenditures, acquisitions and other general corporate purposes; |

| • | expose us to the risk of increased interest rates, as our borrowings on our secured senior credit facilities are at variable rates of interest; |

| • | require us to sell assets to reduce indebtedness or influence our decisions about whether to do so; |

| • | increase our vulnerability to general adverse economic and industry conditions; |

15

Table of Contents

| • | limit our flexibility in planning for, or reacting to, changes in our business and our industry; |

| • | restrict us from making strategic acquisitions or pursuing business opportunities; |

| • | limit, along with the financial and other restrictive covenants in our indebtedness, among other things, our ability to borrow additional funds; and |

| • | violating covenants in these agreements could have a material adverse effect on our business, financial condition and results of operations; including substantially increasing our cost of borrowing and restricting our future operations, if not cured or waived. In addition, the lenders may be able to terminate any commitments they had made to supply us with further funds. Accordingly, we may not be able to fully repay our debt obligations, if some or all of our debt obligations are accelerated upon an event of default. |

Our senior credit and subordinated notes agreements also contain various restrictive covenants that limit the operations of our business. In particular, these agreements include covenants and restrictions relating to:

| • | payments and distributions to GFN; |

| • | liens and sale-leaseback transactions; |

| • | loans and investments; |

| • | debt and hedging arrangements; |

| • | mergers, acquisitions and asset sales; |

| • | transactions with affiliates; and |

| • | changes in business activities. |

Reference is made to Notes 5 and 13 of Notes to the Annual Consolidated Financial Statements included in this prospectus for more information regarding our indebtedness.

Our overall financial results will be affected by the relative value of the Australian dollar and/or the New Zealand dollar to the U.S. dollar and may be affected by other currencies with future acquisitions.

We purchase a portion of our lease fleet in Australia in U.S. dollars and unrealized gains and losses resulting from the Australian exchange rate to the U.S. dollar not hedged could have a significant impact in our reported results of operations. In addition, a weakening in the Australian or New Zealand dollars could result in lower than anticipated reported revenues and profitability as a result of the translation of Royal Wolf’s financial results into U.S. dollars.

A write-off of all or a part of our goodwill and intangibles would hurt our operating results and reduce our stockholders’ equity.

As a result of our acquisitions of Royal Wolf, Pac-Van and other smaller businesses, we have recorded significant amounts of goodwill and intangible assets. Goodwill represents the excess of the total purchase price of these acquisitions over the fair value of the net assets acquired. We are not permitted to amortize goodwill under U.S. accounting standards and instead we review goodwill, as well as intangible assets, at least annually for impairment. Impairment may result from, among other things, deterioration in the performance of acquired businesses, adverse market conditions and adverse changes in applicable laws or regulations, including changes that restrict the activities of the acquired business. In the event impairment is identified, a charge to earnings would be recorded. Although it does not affect our cash flow, a write-off of all or a part of our goodwill or intangibles would adversely affect our operating results and stockholders’ equity.

During the fiscal year ended June 30, 2010, we recognized an impairment charge to the goodwill recorded in the Pac-Van acquisition of $7,633,000. Reference is made to Note 2 of Notes to the Annual Consolidated Financial Statements included in this prospectus for more information regarding goodwill and intangible assets.

16

Table of Contents

Future acquisitions of businesses could subject us to additional business, operating and industry risks, the impact of which cannot presently be evaluated, and could adversely impact our capital structure.

The global economic downturn discussed above is having a negative impact upon our business and we have responded by making a determined effort to reduce personnel costs, capital expenditures, discretionary spending and curtail acquisition activity. While this is our approach for the foreseeable future, we intend to eventually commence pursuing additional acquisition opportunities in an effort to diversify our investments and grow our business. Any business we acquire may cause us to be affected by numerous risks inherent in the acquired business’s operations. If we acquire a business in an industry characterized by a high level of risk, we may be affected by the currently unascertainable risks of that industry. Although we will endeavor to evaluate the risks inherent in a particular industry or target business, we cannot assure that we will be able to properly ascertain or assess all of the significant risk factors.

In addition, the financing of any acquisition we complete could adversely impact our capital structure as any such financing would likely include the issuance of additional equity securities and/or the borrowing of additional funds. The issuance of additional equity securities may significantly reduce the equity interest of our stockholders and/or adversely affect prevailing market prices for our common stock. Increasing our indebtedness could increase the risk of a default that would entitle the holder to declare all of such indebtedness due and payable and/or to seize any collateral securing the indebtedness. In addition, default under one debt instrument could in turn permit lenders under other debt instruments to declare borrowings outstanding under those other instruments to be due and payable pursuant to cross default clauses. Accordingly, the financing of future acquisitions could adversely impact our capital structure and any equity interests in our company.

While part of our long-term business strategy is to acquire additional businesses, there is no assurance that we will be able to identify businesses that we can acquire upon terms we believe acceptable, or if such acquisitions require additional financing, that we could obtain such additional financing.

If we do seek to complete other acquisitions, we cannot ascertain the capital requirements for other future transactions. We cannot assure that, if required, additional financing will be available on acceptable terms, if at all. To the extent that additional financing proves to be unavailable when needed to consummate a particular acquisition, we would be compelled to either restructure the transaction or abandon that particular acquisition. In addition, if we consummate a future acquisition, we may require additional financing to fund the operations or growth of the target business. The failure to secure additional financing may impact the continued development or growth of the target business.

Our long-term growth could strain our management resources.

Our future performance will depend in large part on our ability to manage our long-term planned growth that could strain our existing management, human and other resources. To successfully manage this growth, we must continue to add managers and employees and improve our operating, financial and other internal procedures and controls. We also must effectively motivate, train and manage employees. If we do not manage our growth effectively, it would adversely affect our future operating results.

Our long-term growth plan includes the expansion of operations into markets outside of the United States, Australia and New Zealand, including Asia/Pacific and European markets. Such international expansion may not prove successful, and may divert significant capital, resources and management’s time and attention and adversely affect our on-going operations.

To date, we have conducted all of our business within the United States, Australia and New Zealand. However, we have intentions to enter international markets, including the Asia/Pacific and European markets, in the future, which will require substantial amounts of management time and attention. Our products and overall marketing approach may not be accepted in other markets to the extent needed to make our international expansion profitable. In addition, the additional demands on management from these activities may detract from our efforts in the United States, Australian and New Zealand markets and adversely affect our operating results in these principal markets. Any international expansion will expose us to the risks normally associated with conducting international business operations, including unexpected changes in regulatory requirements, changes in foreign legislation, possible foreign currency controls, currency exchange rate fluctuations or devaluations, tariffs, difficulties in staffing and managing foreign operations, difficulties in obtaining and managing vendors and distributors, potential negative tax consequences and difficulties collecting accounts receivable.

To complete future business combinations, we may issue shares of our capital stock that would reduce the equity interest of our stockholders and could cause a change in control of our ownership, or incur debt, which could adversely affect our financial condition.

Our certificate of incorporation authorizes the issuance of up to 100,000,000 shares of common stock and up to 1,000,000 shares of preferred stock. At March 31, 2011, there were 72,478,008 authorized shares of our common stock available for issuance (after appropriate reservation for the issuance of shares upon full exercise of our outstanding warrants and options issued under our 2006 Stock Option Plan and 2009 Stock Incentive Plan.

17

Table of Contents

If we seek to consummate future business combinations, we may be required to issue a substantial number of additional shares of our common or preferred stock, or a combination of common and preferred stock, to complete the other business combination. The issuance of additional shares of our common stock or any number of shares of our preferred stock:

| • | may significantly reduce the equity interest of investors; |

| • | may subordinate the rights of holders of common stock if preferred stock is issued with rights senior to those afforded to our common stock; |

| • | may cause a change in control if a substantial number of our shares of common stock are issued, which may affect, among other things, our ability to use our net operating loss carry forwards, if any, and could result in the resignation or removal of our present officers and directors; and |

| • | may adversely affect prevailing market prices for our common stock. |

In addition, we may incur substantial debt to complete another business combination. The incurrence of debt could result in:

| • | default and foreclosure on our assets if our operating revenues after a business combination are insufficient to repay our debt obligations; |

| • | our immediate payment of all principal and accrued interest, if any, if the debt security is payable on demand; and |

| • | our inability to obtain necessary additional financing if the debt security instrument covenants restricting our ability to obtain such financing while the debt instrument is outstanding. |

The price of our common stock may fluctuate significantly, which may make it difficult for stockholders to resell common stock when they want or at a price they find attractive.

We expect that the market price of our common stock will fluctuate. Our common stock price can fluctuate as a result of a variety of factors, many of which are beyond our control. These factors include:

| • | actual or anticipated variations in our quarterly operating results; |

| • | changes in interest rates and other general economic conditions; |

| • | significant acquisitions or business combinations, strategic partnerships, joint ventures or capital commitments by or involving us or our competitors; |

| • | operating and stock price performance of other companies that investors deem comparable to us; |

| • | news reports relating to trends, concerns, litigation, regulatory changes and other issues in our industry; |