Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K 11-7-29 - MIDSOUTH BANCORP INC | form_8k.htm |

| EX-99.2 - MIDSOUTH PRESS RELEASE DATED 11-7-29 - MIDSOUTH BANCORP INC | ex_99-2.htm |

Exhibit 99.1

Jefferson Branch Acquisition

July 29, 2011

Transaction Summary

Description: Purchase of five Jefferson Bank branches in the Dallas Ft. Worth MSA

Seller: First Bank & Trust Co. (Following their acquisition of Jefferson Bank via

Section 363 sale through Jefferson Bank’s parent bankruptcy filing)

Section 363 sale through Jefferson Bank’s parent bankruptcy filing)

Purchase Price: $10.5 million

($7.5 M Deposit Premium + $3.6 M Fixed Assets - $0.6 M Loan Discount)

($7.5 M Deposit Premium + $3.6 M Fixed Assets - $0.6 M Loan Discount)

Assets Purchased: $70 million performing loans - credit diligence on over 80% of portfolio

Deposits Purchased: $164 million

Deposit Premium: 4.6%

Loan Discount: 1%

Transaction Expenses: $880,000 pretax (50% professional fees, 50% deconversion costs)

($98,000 Q1A; $115,000 Q2A, $627,000 Q3E ($0.04 per sh), $40,000 Q4E)

($98,000 Q1A; $115,000 Q2A, $627,000 Q3E ($0.04 per sh), $40,000 Q4E)

Cost Savings: Approx. 35% cost reductions vs. Jefferson stand alone level - from

reductions in credit costs and corporate overhead

reductions in credit costs and corporate overhead

Earnings Accretion: 2011E - breakeven after transaction expenses

2012E - $0.11

2012E - $0.11

2

3

Strategic Rationale

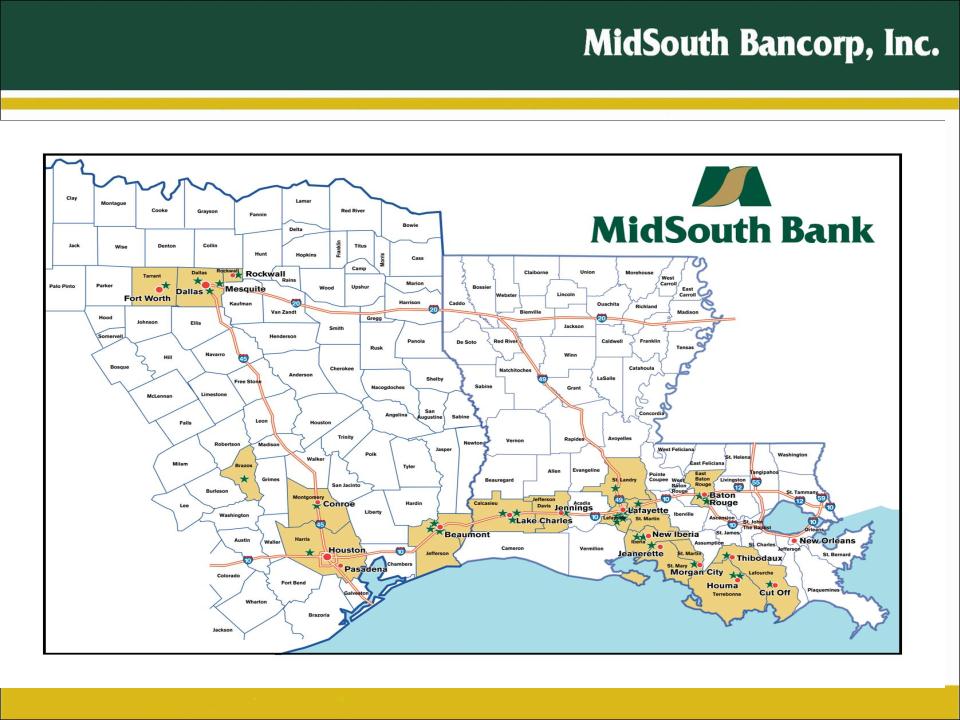

Ø The Dallas/Ft. Worth Metroplex is one of the most attractive markets in the

country with a strong regional economy, attractive demographics and

significant growth opportunities

country with a strong regional economy, attractive demographics and

significant growth opportunities

Ø Approximately 29% of deposits will be in Texas, more than double prior

levels

levels

Ø Approximately 32% of loans will be in Texas, up 50% from prior levels

Ø Legal Lending Limit will increase more than 6X prior levels at Jefferson

expanding potential for loan growth

expanding potential for loan growth

Ø Allows for diversification of customer base from oil services industry other

attractive industries such as healthcare, technology and education

attractive industries such as healthcare, technology and education

4

Pro Forma Impact

MidSouth

Bancorp,

Inc.

Jefferson

Bank

MidSouth

Bancorp, Inc.

Pro Forma With

Jefferson Bank

Loans

$580,099

$69,518

$650,099

Deposits

$825,896

$164,321

$990,217

Assets

$1,049,105

$164,321

$1,213,426

Branches

34

5

39

5

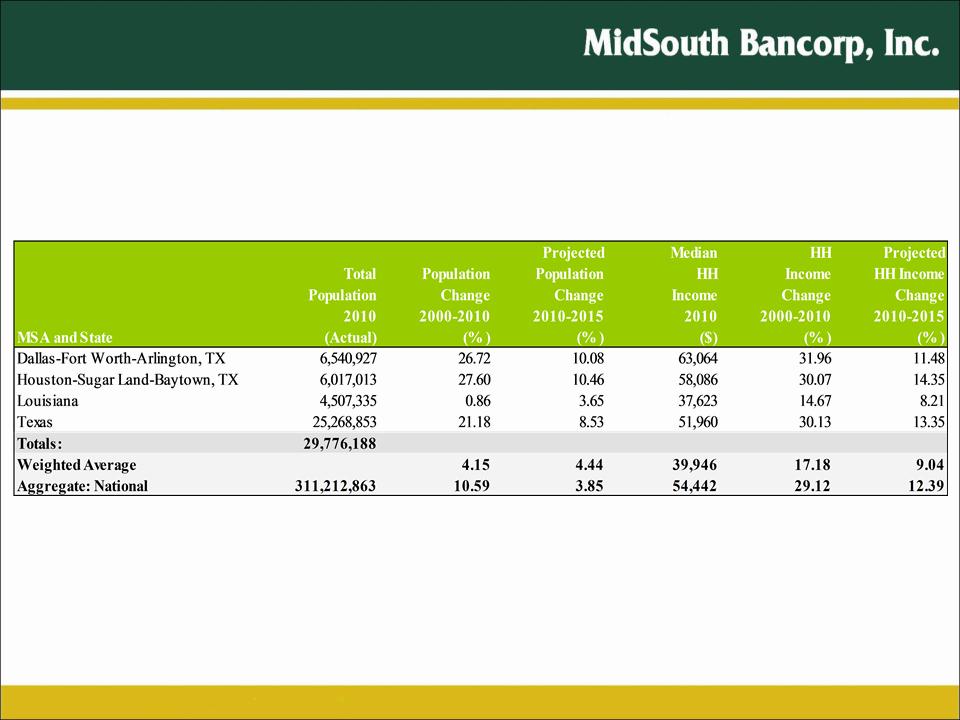

Demographic Profile

6