Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST NIAGARA FINANCIAL GROUP INC | d8k.htm |

| EX-2.1 - EX-2.1 - FIRST NIAGARA FINANCIAL GROUP INC | dex21.htm |

| EX-99.1 - EX-99.1 - FIRST NIAGARA FINANCIAL GROUP INC | dex991.htm |

August 1,

2011 Building to be Even Better …

Acquisition of HSBC Upstate NY Branches

Exhibit 99.2 |

2

Safe Harbor Statement

The information presented may contain forward-looking

statements within the meaning of the Private Securities

Litigation Reform Act of 1995.

These statements are based upon

current beliefs and expectations and are subject to significant

risks and uncertainties (some of which are beyond First Niagara’s

control).

Factors that could cause First Niagara’s results to differ

materially can be found in the risk factors set forth in First

Niagara’s Annual Report on Form 10-K for the year ended

December 31, 2010 and First Niagara’s other filings with the SEC.

|

3

Unique Opportunity that Creates A Market Leader

Strategically Compelling

–

Upstate NY market share increases from 8% to 22%

–

Adds $11.0 billion in deposits and 100 branches

–

Long standing presence; talented team

Financially Attractive

–

2013 Operating EPS accretion of 11-12%

–

Deposit funding has grown from 70% to 90% of total liabilities

–

ROTCE up more than 400 bps

–

IRR > 20%

Low Risk

–

In market transaction

–

Proven integrator –

prepared and ready

–

Very limited credit risk

Building to be Even Better |

4

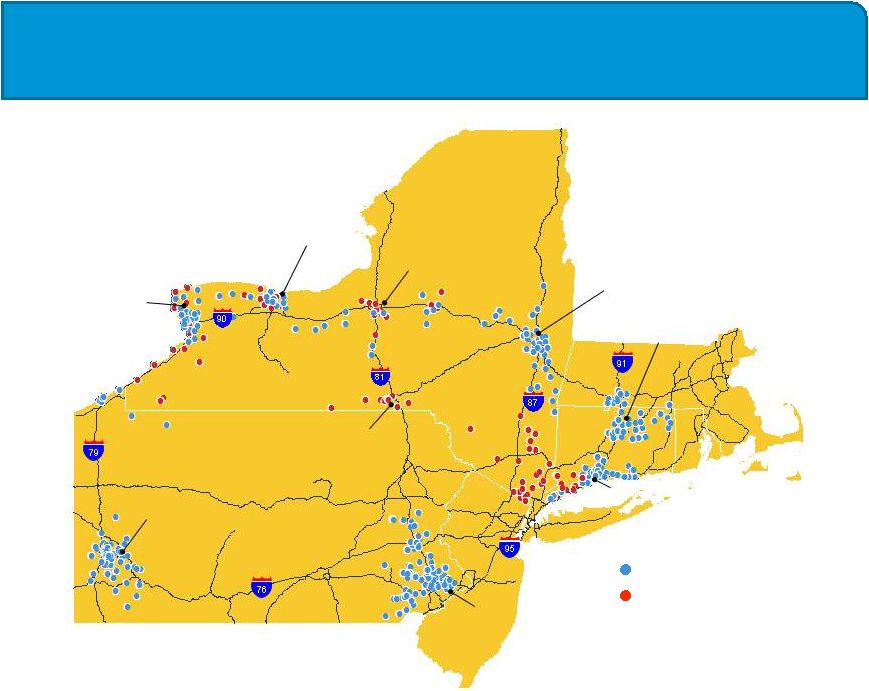

Northeast Regional Banking Profile

First Niagara

HSBC

Pro Forma First Niagara:

•

$38B in assets

•

$30B in deposits

•

$18B in loans

•

450 branches

Acquired Branches:

•

$15B in deposits

•

$3B in loans

•

195 locations

Rochester

Syracuse

Albany

Buffalo

Binghamton

Hartford

New Haven

Philadelphia

Pittsburgh |

5

Strategically Compelling

•

Accelerates Upstate NY retail growth strategy

•

Solidifies market leadership in Buffalo, Albany, Rochester and Syracuse

•

Adds strong, experienced retail bankers that know our market well

•

Brings scale to business banking, consumer finance and wealth management

•

Connects Lower Hudson to Southern CT markets

Upstate NY

(¹)

BAC, 5%

FNFG,

8%

Citizens,

9%

KEY,

15%

HSBC,

16%

MTB,

22%

BAC,5%

Citizens

%

KEY,

15%

MTB,

22%

FNFG,

22%

9

(1) Combination of Buffalo, Rochester, Syracuse and Albany MSAs; Excludes ~$7B in

HSBC corporate deposits in Buffalo which are not included in this

transaction. Includes impact of estimated divestitures. SNL Data as of June 30, 2010.

|

6

Key Strengths of Acquired Franchise

•

Well positioned, with a similar strategy

-

Mature, profitable business platform

-

Relationship focused

-

Knows our marketplace

-

Experienced talent

•

Consumer Banking

-

Adds more than 1 million accounts; over 650 thousand retail customers

-

~250 thousand consumer credit card accounts

•

Wealth Management

-

Source of strong fee revenue generation

-

Over 60 financial advisors providing a broad range of financial products

-

Nearly doubles AUM adding $4.3 billion

•

Business Banking

-

Strong relationship between business banking and branch network

-

Focus on deposit gathering and fee income generation

-

Target customer has annual sales of $30 million or less and credit exposure <$3

million |

7

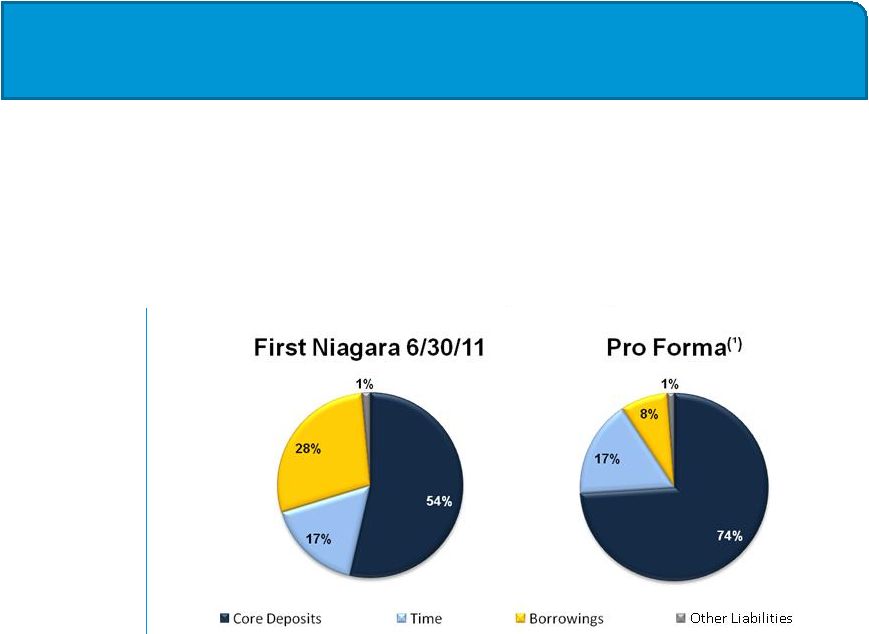

Financially Attractive

•

EPS accretion of 10-11% in 2012; 11-12% in 2013

•

TBV dilution of 17-18%, earn back period of 4-5 years

•

Drives return on tangible equity up more than 400bps

•

IRR 20-22%; ROIC of approximately 10%

•

Low cost core deposit funding base

Core Deposits

improve to

74% of total

liabilities

Borrowings

decrease to

8% of total

liabilities

(1): Pro forma based on net increase of $11B deposits.

Liability Funding |

8

Low Risk

Transaction Risk

•

In market transaction with

deep experience

•

Predictability and stability of

net interest margin

•

Limited credit exposure

•

Readily achievable efficiencies

driven by branch optimizations

•

Strong risk adjusted capital

position

Conversion Risk

•

Branch/deposit deal simpler

than whole bank deal

•

Significant capacity to facilitate

conversion

•

Proven conversion track record

driven by seasoned, deep team

•

Ready and prepared with New

Alliance successfully completed

Highly confident in financial outcomes |

9

Northeast Regional Profile

•

Leading position to drive profitable growth

•

Significant market share opportunity within major Northeast markets

•

Access to nearly 15 million customers in very attractive markets

$ Billions

Upstate New

York

(1)

Central

Connecticut

(2)

Philadelphia

MSA

Pittsburgh MSA

Market Share

22%

(³)

7%

1%

4%

Ranking

1

4

13

5

Market

Deposits

(4)

$69.5

$67.8

$190.3

$75.2

Population (2010)

3.7M

2.7M

5.9M

2.4M

Median Household

Income (2010)

$54.6K

$61.4K

$64.6K

$49.5K

Source: SNL, Deposit Data as of June 30, 2010

(1) Average of Buffalo, Rochester, Syracuse, and Albany MSAs

(2) Average of New Haven, Hartford, and Springfield MSAs

(3) Does not include ~$7B in HSBC corporate deposits in Buffalo that are not

included in this transaction. Includes impact of estimated divestitures. (4) Includes

Home Office Deposits National

Average

$54.4K |

10

Transaction Summary

•

Attractive, low cost deposit franchise with 195 branch locations

and $15.0B in deposits; $2.8B in loans

•

6.67% or $1.0B (based on May 31, 2011 deposit balances)

Transaction Scope

•

Common equity raise of $750-800MM prior to closing

•

Debt issuance of $350-400MM prior to closing

•

Timing to be determined based on market conditions

Capital Issuance

•

OCC approval; Other customary conditions

•

First Niagara shareholder approval not required

Closing Conditions

•

First Half of 2012

Expected Closing

Branch Optimization

•

Expected divestitures and consolidations include approximately

100 locations

•

Deposits per branch in Upstate NY increases by 40-45% to

~$80MM per branch

•

Net retention of approximately $11.0B in deposits; $2.0B in loans

Deposit premium |

11

Financially

Attractive Transaction

•

10-11% accretive to 2012 operating EPS

•

11-12% accretive to 2013 operating EPS

Accretion

•

20-22% IRR

IRR

•

6.67% total deposit premium

•

Deposit premium comparable to recent industry deals, with lower cost of

deposits and business risk

Attractive

Comparative Pricing

•

2013 ROATCE: ~19%

•

ROA: ~1.20%

ROE & ROA

•

Tangible book value per share dilution of 17-18% at close

•

4-5 year earn back period

Tangible Book Value

per Share

Pro Forma Metrics |

First Niagara

/ HSBC Median of Selected

Transactions

(1)

Transaction Metrics

Deposit Premium

6.67%

8.40%

1-Mile Branch Overlap

(2)

~30%

5%

Target’s Financial Metrics

(3)

Cost of Deposits

0.3%

0.8%

NPAs / Assets

0.0%

1.8%

Transaction Pricing

(1)

Source: SNL Financial. Based on

selected bank transactions with at least $1B of deposits in the last 12

months (2)

Overlap as a percentage of acquired branches

(3)

Metrics for selected transactions based on most recent quarter prior to transaction

announcement 12 |

13

Key Financial Assumptions

On Acquired Operations

Incremental Loan Growth

$100-200MM per year

Loan Credit Mark

3% of loans outstanding at close (~$80MM)

Deposit Attrition

~5% of total deposits over 9 months post close

Core Deposit Intangibles

2.0% of deposits, amortized using SYD over 8 years

Balance Sheet Restructuring

~$5B wholesale liability pay down at close

Net Interest Margin

(1)

4.50%-5.00%

Noninterest Income

0.80%-0.90% of average deposits

Synergy-Adjusted Operating Costs

~1.4% of average deposits

Provisions

Target reserves of 1.20% of new loan originations

Restructuring Expenses

$150-$175MM (pre-tax) expensed 100% in 2012

Income Tax Treatment

CDI and goodwill are tax deductible

(1)

Represents net interest margin on the incremental increase in First Niagara’s earning

assets of approximately $6B following wholesale liability pay down |

14

Pro Forma Capital & Liquidity Impact

•

Strong Pro Forma capital ratios reflect risk profile

•

Low risk, highly liquid balance sheet

Ratios

First Niagara

(6/30/2011)

Pro Forma with

HSBC (At Close)

TCE/TA

7.4%

6.0%-6.3%

Tier 1 Common Capital

11.4%

9.6-10.0%

Tier 1 Risk Based Capital

12.0%

10.1-10.5%

Total Risk Based Capital

12.7%

12.3-12.7%

Tier 1 Leverage

7.8%

6.3-6.5%

RWA / Assets

57%

~55%

Loans / Deposits

85%

~65%

Deposits / Total Liabilities

70%

~90%

Note: All capital ratios are at the consolidated level and assumes divestitures occur in the

same quarter as the acquisition |

15

•

Liquidity will be used to pay down ~$5B in wholesale funding; 100-110 basis points

improvement

•

Significant benefit to funding profile and cost; acquired deposit cost 32 basis points

6249 LRA

Improved Funding Profile

Cost of Funds

(1)

0.75%

Total Deposits

$19B

Total Borrowings

$8B

Cost of Funds

(1)

0.52%

Total Deposits

$30B

Total Borrowings

$3B

First Niagara (6/30/11)

Pro Forma

(1)

Calculated using weighted average cost of funding for deposits and borrowings as of most

recent quarter |

•

Transaction affords an opportunity to diversify securities portfolio, reducing MBS

concentration, while minimizing interest rate risk

•

Cash flow profile of pro forma investment portfolio supports strong liquidity position and

allows for redeployment into loans

High Grade Securities Portfolio

First Niagara (6/30/11)

Pro Forma

Securities Portfolio Composition

16

Market

Value

$11B

Market Value

$14B |

17

•

Primarily branch related portfolio

•

Excludes

loans

60

days

or

more delinquent

•

Conducted extensive due diligence

–

Reviewed by in-market First Niagara credit

team

–

Focused on underwriting quality and

regulatory compliance

•

Estimated credit mark at closing ~3.0%

Loan Portfolio Composition

(1)

Total Acquired Loans

$2.8B

Net Retained Loans

$2.0B

(1)

Balance excludes 60+ delinquent loans, as of May 30, 2011.

Acquired Loan Portfolio |

18

Proven Integrator

Source: SNL Financial for acquired balances

Percentage calculations based on First Niagara’s prior reported quarter

(1) Represents Pro Forma net retained operations

$ in Billions

National City

Harleysville

NewAlliance

HSBC

(1)

Date of Close

Sept, 2009

April, 2010

April, 2011

Assets

3.9

5.6

8.7

11.0

% of First Niagara assets

34%

38%

41%

35%

Loans

0.8

3.5

4.9

2.0

% of First Niagara loans

12%

48%

46%

12%

Deposits

3.9

4.1

5.1

11.0

% of First Niagara deposits

62%

42%

38%

58%

•

Experienced leadership and integration team

–

Deep talent pool dedicated to conversions / integrations

•

Comprehensive and tested project plans

–

Simultaneous close / convert process

•

Existing market presence further deepens experience

•

Consistent track record of core deposit retention

•

Solid post-acquisition loan growth in new markets |

19

Unique Opportunity that Creates A Market Leader

Strategically Compelling

–

Upstate NY market share increases from 8% to 22%

–

Adds $11.0 billion in deposits and 100 branches

–

Long standing presence; talented team

Financially Attractive

–

2013 Operating EPS accretion of 11-12%

–

Deposit funding has grown from 70% to 90% of total liabilities

–

ROTCE up more than 400 bps

–

IRR > 20%

Low Risk

–

In market transaction

–

Proven integrator –

prepared and ready

–

Very limited credit risk

Building to be Even Better |

Q&A

|