Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BBX CAPITAL CORP | d8k.htm |

JUNE

2011 JUNE 2011

NYSE

NYSE

BBX

BBX

Prepared as of July 27, 2011

Prepared as of July 27, 2011

Exhibit 99.1 |

NYSE

BBX

2

•

Assets -

$3.9 Billion

•

Exchange

Listing

–

NYSE:BBX

•

Major

Subsidiary

-

BankAtlantic

–

Founded in 1952

–

“Florida’s Most Convenient Bank”

–

78 branches

–

Headquartered in Fort Lauderdale, FL

–

Operates in top 5 counties in Florida

–

Franchise value built on the strength of its low cost deposit base

•

On June 3, 2011, BankAtlantic Bancorp sold its Tampa region, including 19

branches, to PNC National Bank.

•

77.2 million total Class A common shares outstanding as of June 30, 2011

BANKATLANTIC BANCORP

BANKATLANTIC BANCORP

OVERVIEW AS OF JUNE 30, 2011

OVERVIEW AS OF JUNE 30, 2011 |

NYSE

BBX

BankAtlantic

1.

Compelling franchise value based on the strength of the

deposit base and recognized customer service excellence

2.

Core operating earnings and fundamental operating trends of

the business have remained resilient throughout the

economic downturn

3.

Capital ratios have been consistent and are in excess of all

applicable regulatory requirements

4.

Credit trends are stable to improving in the loan portfolios

5.

Economic trends in Florida are improving

Investment Highlights

Investment Highlights

3 |

NYSE

BBX

BankAtlantic has:

•

No

Subprime

lending

programs

•

No Negative amortization or option ARM loans

•

No High-rise condo exposure

•

No Collateralized debt obligations

•

No Asset-backed commercial paper

•

No Structured investment vehicles

•

No Fannie Mae or Freddie Mac equity or debt securities

•

No Trust preferred holdings

Investment Highlights

Investment Highlights

4 |

NYSE

BBX

5

Investment Highlight #1:

BankAtlantic’s compelling franchise value based on

the strength of the deposit base and recognized

customer service excellence |

NYSE

BBX

6

BankAtlantic

BankAtlantic

Core Deposit Balances

Core Deposit Balances

(1)

(1)

12/31/2001

$ in Millions

12/31/2003

12/31/2005

12/31/2007

12/31/2009

06/30/2001

(1)

Core

deposits

include

DDA,

NOW

and

savings

deposit

accounts

held

by

individuals

and

business

customers.

June

30,

2011

balances include the effect of the June 2011 sale of BankAtlantic’s Tampa

branches which reduced core deposits by approximately $251 million.

$602

$1,026

$1,388

$1,819

$2,090

$2,240

$2,305

$2,154

$2,649

$2,847

$2,575 |

NYSE

BBX

7

BANKATLANTIC FOOTPRINT

BANKATLANTIC FOOTPRINT

78 Locations as

of June 30, 2011 |

NYSE

BBX

8

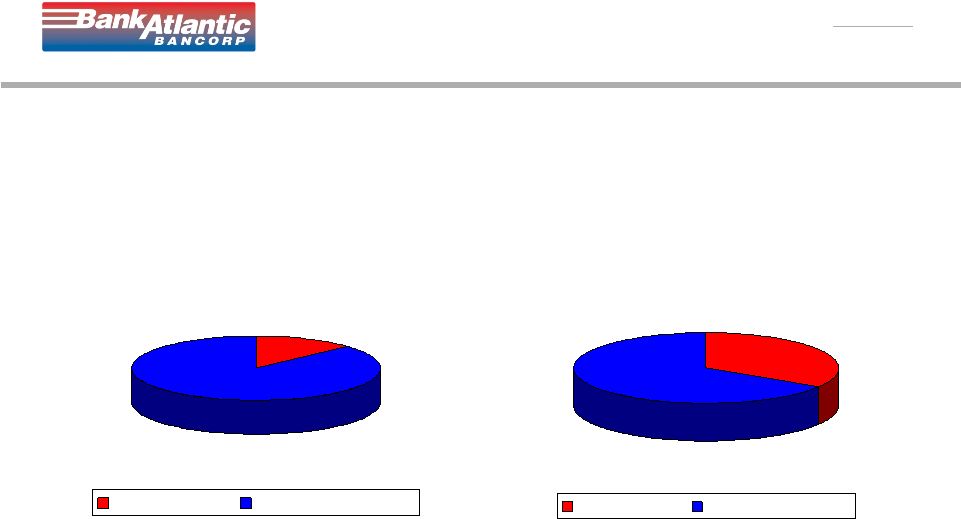

BankAtlantic

As of 6/30/11

13%

87%

Time Deposits

Non-Time Deposits

All Publicly Traded Florida Banks & Thrifts

34%

66%

Time Deposits

Non-Time Deposits

BankAtlantic

BankAtlantic

Deposit Mix

Deposit Mix

Source: SNL Financial. Data as of the most recent quarter available.

|

NYSE

BBX

9

BankAtlantic

BankAtlantic

Cost of Deposits

Cost of Deposits

Publicly Traded Florida Banks &

Thrifts Median Cost of Deposits

(as of March 31, 2011)

1

:

1.08%

1

Source: SNL Financial. Data as of the most recent quarter available.

4Q2007

4Q2008

4Q2009

4Q2010

1Q2011

2Q2011

2.15%

1.58%

0.92%

0.46%

0.44%

0.41% |

NYSE

BBX

10

BankAtlantic

BankAtlantic

Core

Core

Deposits

Deposits

Cost

Cost

of

of

Funds

Funds

(1)

(1)

(1) Core deposits is a non-GAAP measure that we use to refer to Demand,

NOW, and Savings accounts. See BankAtlantic Bancorp’s website for

supplemental financials and a reconciliation to GAAP. 4Q2007

4Q2008

4Q2009

4Q2010

1Q2011

2Q2011

0.94%

0.49%

0.38%

0.25%

0.25%

0.22% |

NYSE

BBX

11

BankAtlantic

BankAtlantic

Total Cost of Funds

Total Cost of Funds

3.54%

2.30%

1.13%

0.62%

0.59%

0.57%

4Q2007

4Q2008

4Q2009

4Q2010

1Q2011

2Q2011 |

NYSE

BBX

12

BankAtlantic

FLORIDA BRANCH RANKING

(1) As of 3/31/11 Source: SNL Financial

(2) 78 branches as of June 30, 2011

Institution

Branches

1. Wells Fargo

703

2. Bank of America

659

3. SunTrust

555

4. Regions Bank

399

5. BB&T

274

6. JPMorgan Chase

273

7. PNC Financial

217

8. Toronto-Dominion Bank

172

9. Fifth Third Bancorp

167

10. BankUnited

81

11. BankAtlantic

2

78

12. Hancock

69

13. CenterState Banks

66

1 |

NYSE

BBX

13

In 2010, BankAtlantic was honored with the award

of the “Highest in Customer Satisfaction with

Retail Banking in Florida”

from J.D. Power and

Associates*

BankAtlantic

BankAtlantic

Customer Service

Customer Service

* BankAtlantic

received

the

highest

numerical

score

among

retail

banks

in

Florida

in

the

proprietary

J.D.

Power

and

Associates

2010

Retail

Banking Satisfaction Study based on 47,673 total responses measuring 9 providers in

Florida and measures opinions of consumers with their primary banking

provider. Proprietary study results are based on experiences and perceptions of consumers surveyed in January 2010. Your

experiences may vary. Visit jdpower.com |

NYSE

BBX

14

Investment Highlight #2:

Core operating earnings and fundamental

operating trends of the business have remained

resilient throughout the economic

downturn |

NYSE

BBX

15

BankAtlantic

BankAtlantic

Total Assets

Total Assets

($ in thousands, period end)

($ in thousands, period end)

12/31/2007

12/31/2008

12/31/2010

12/31/2009

6/30/2011

$6,161,962

$5,713,690

$4,755,122

$4,469,168

$3,831,471 |

NYSE

BBX

Mar-

07

Jun-

07

Sep-

07

Dec-

07

Mar-

08

Jun-

08

Sep-

08

Dec-

08

Mar-

09

Jun-

09

Sep-

09

Dec-

09

Mar-

10

Jun-

10

Sep-

10

Dec-

10

Mar-

11

Jun-

11

BankAtlantic Borrowings

BankAtlantic Borrowings

(Leverage)

(Leverage)

$1.5 Bil

$1.8 Bil

$1.3 Bil

$667 Mil

$172 Mil

$226 Mil

16

$23 Mil |

NYSE

BBX

BankAtlantic

BankAtlantic

Total Liquidity *

Total Liquidity *

(as a % of deposits)

(as a % of deposits)

17

6/30/2008

12/31/2008

12/31/2009

12/31/2010

* Total Liquidity = Cash, unencumbered securities & the unused portion of lines

of credit 6/30/2011

18.73%

26.76%

23.92%

37.71%

34.69% |

NYSE

BBX

18

BankAtlantic

BankAtlantic

Net Interest Margin

Net Interest Margin

3.62%

3.45%

3.35%

3.55%

3.30%

2007

2008

2009

2010

6/30/11 |

NYSE

BBX

19

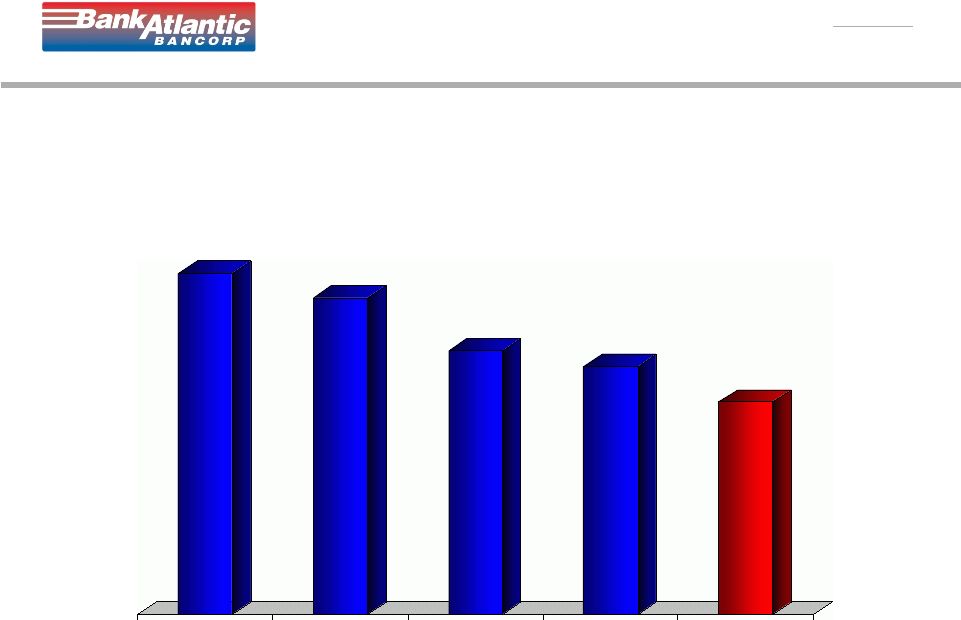

BankAtlantic

BankAtlantic

Number of Employees, period end

Number of Employees, period end

12/31/2006

12

/31

/2007

12

/31

/2008

12/31/2009

12/31/2010

6

/30

/2011

2,811

2,562

1,841

1,532

1,265

1,045 |

NYSE

BBX

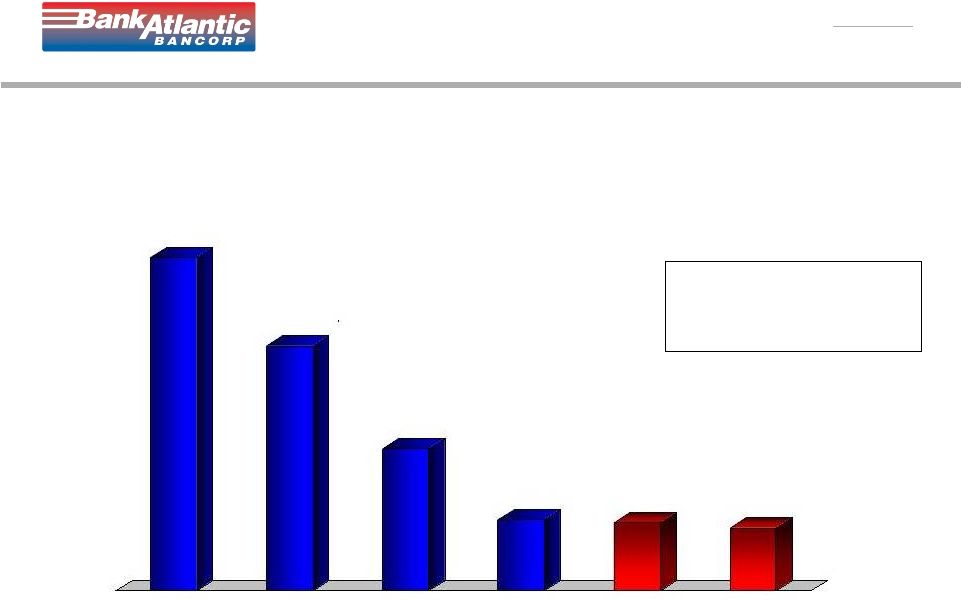

20

$292,707

$263,786

$223,405

$209,999

$88,780

2007

2008

2009

2010

2011 YTD

BankAtlantic

BankAtlantic

Core Non-Interest Expense

Core Non-Interest Expense

¹ 1

($ in thousands)

($ in thousands)

1

Core non-interest expense is a non-GAAP measure. See BankAtlantic

Bancorp’s website for supplemental financials and a reconciliation to

GAAP. 1Q2011 =

$46,042

2Q2011 =

$42,738 |

NYSE

BBX

21

$50,685

$67,170

$69,211

$47,097

$23,232

2007

2008

2009

2010

2011 YTD

BankAtlantic

BankAtlantic

Core

Core

Operating

Operating

Earnings

Earnings

1

1

($ in thousands)

($ in thousands)

1

Core Operating Earnings is a non-GAAP measure. See BankAtlantic Bancorp’s

website for supplemental financials and a reconciliation to GAAP.

1Q2011 =

$11,575

2Q2011 =

$11,657 |

NYSE

BBX

22

22

$12,505

$27,170

$46,813

$39,900

$33,900

2007

2008

2009

2010

2011 YTD

BANKATLANTIC BANCORP (BBX)

BANKATLANTIC BANCORP (BBX)

CORE

CORE

OPERATING

OPERATING

EARNINGS

EARNINGS

1

1

($ in thousands)

($ in thousands)

1

Core Operating Earnings is a non-GAAP measure. See BankAtlantic

Bancorp’s website for supplemental financials and a reconciliation to

GAAP. 1Q2011 =

$7,210

2Q2011 =

$5,295 |

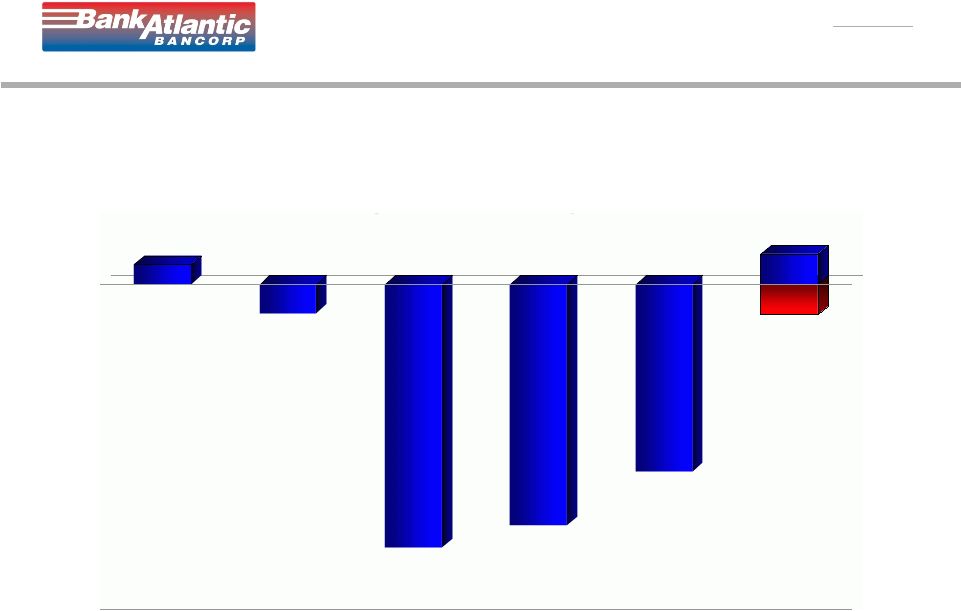

NYSE

BBX

23

23

BANKATLANTIC BANCORP (BBX)

BANKATLANTIC BANCORP (BBX)

GAAP INCOME/LOSSES

GAAP INCOME/LOSSES

($ in thousands)

($ in thousands)

($202,600)

($185,800)

($144,181)

2006

2007

2008

2009

2010

2011 YTD

1Q2011 =

($23,182)

2Q2011 =

$23,111

$15,400

($22,200)

($71) |

NYSE

BBX

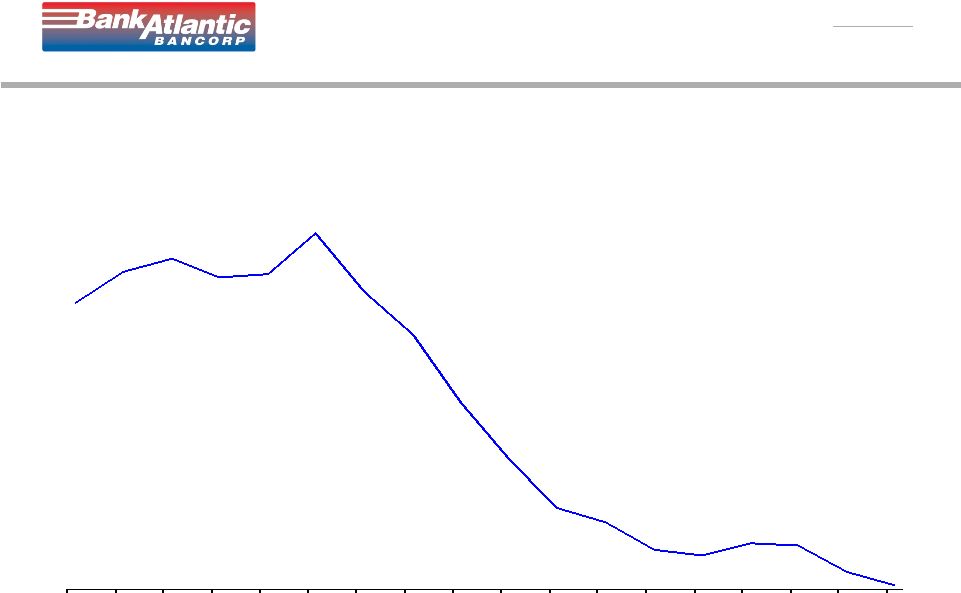

24

BANKATLANTIC BANCORP

STOCK

PERFORMANCE

CLOSING

PRICE

1

NYSE:BBX

1

Stock

price

represents

adjusted

closing

price

at

the

last

day

of

trading

each

year,

and

reflects

the

impact

of

a

1:5

reverse

stock

split

in

September 2008.

Dec-97

Dec-98

Dec-99

Dec-00

Dec-01

Dec-02

Dec-03

Dec-04

Dec-05

Dec-06

Dec-07

Dec-08

Dec-09

Dec-10

Mar-11

'Jun-11

$36.06

$18.01

$13.53

$12.52

$31.28

$32.58

$66.03

$94.59

$67.15

$66.97

$20.17

$5.76

$1.30

$1.15

$0.92

$0.95 |

NYSE

BBX

25

Investment Highlight #3:

Capital ratios have been consistent and are in

excess of all applicable regulatory

requirements |

NYSE

BBX

26

BankAtlantic

BankAtlantic

Regulatory Capital Requirements

Regulatory Capital Requirements

Historical Regulatory

Requirement

BankAtlantic

6/30/2011 Ratios

BankAtlantic New Regulatory

Requirements

(1)

Tier 1 (Core)

5.00%

8.24%

8.00%

Total Risk-Based

10.00%

14.52%

14.00%

(1) On February 23, 2011, BankAtlantic Bancorp and BankAtlantic entered into a Stipulation

and Consent to the issuance of an Order to Cease and Desist (the “Order”) with

the Office of Thrift Supervision. The Order requires corrective measures in a

number of areas, including a requirement that, by June 30, 2011, BankAtlantic is to have

and maintain a Tier 1 (Core) Capital Ratio equal to or greater than 8% and a Total

Risk-Based Capital Ratio equal to or greater than 14%. For further information,

including a copy of the Orders, see the Form 8-K filed by BankAtlantic Bancorp with the SEC

on February 25, 2011. |

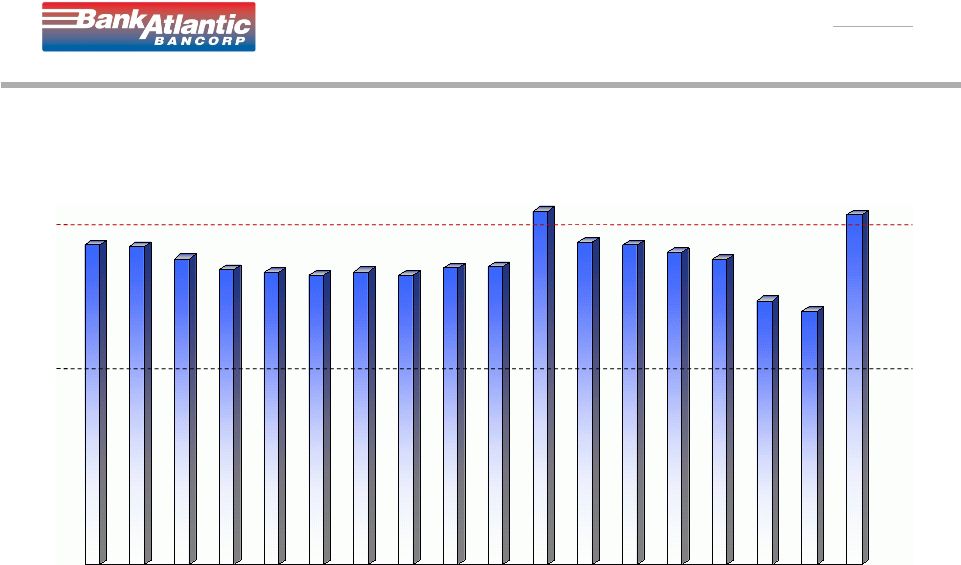

NYSE

BBX

27

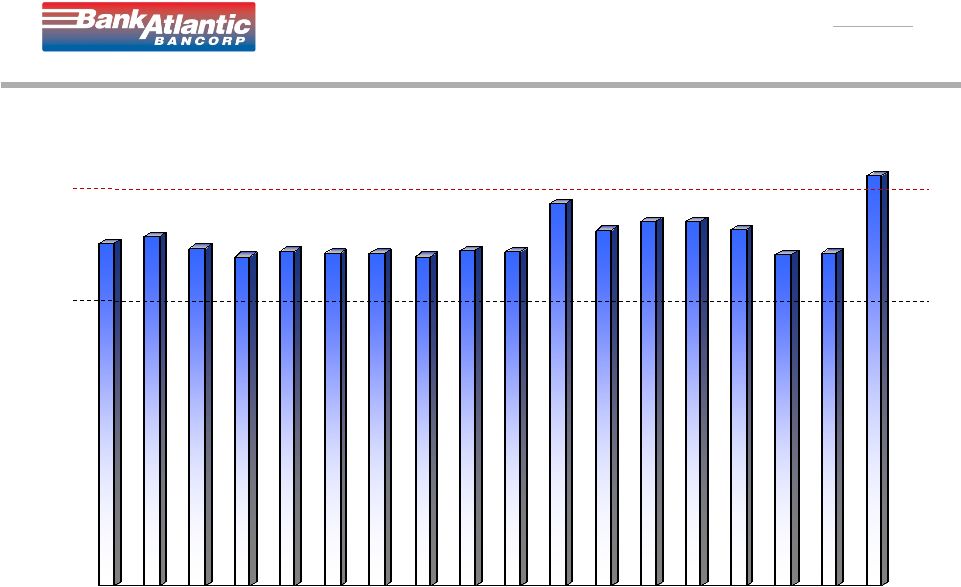

BankAtlantic

BankAtlantic

Tier 1 (Core) Capital

Tier 1 (Core) Capital

Prior

requirement

(5%)

Current

requirement

(8%)

Mar-

07

Jun-

07

Sep-

07

Dec-

07

Mar-

08

Jun-

08

Sep-

08

Dec-

08

Mar-

09

Jun-

09

Sep-

09

Dec-

09

Mar-

10

Jun-

10

Sep-

10

Dec-

10

Mar-

11

Jun-

11

7.51%

7.49%

7.20%

6.94%

6.87%

6.82%

6.89%

6.80%

6.97%

7.01%

8.31%

7.58%

7.51%

7.36%

7.17%

6.22%

5.97%

8.24% |

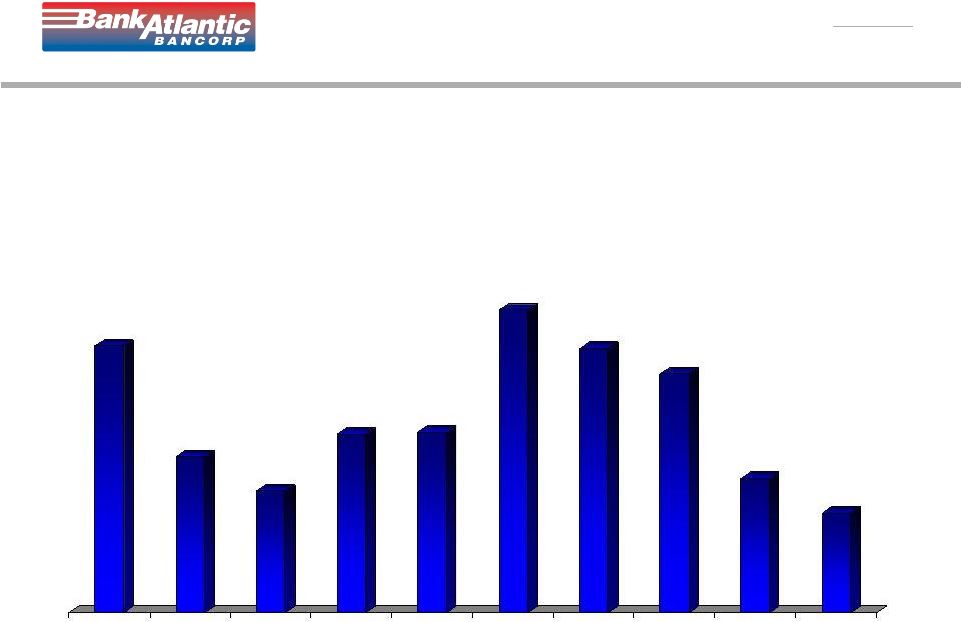

NYSE

BBX

28

12.11%

12.34%

11.93%

11.63%

11.83%

11.77%11.75%

11.63%

11.86%

11.81%

13.51%

12.56%

12.86%12.86%

12.59%

11.72%

11.76%

14.52%

Mar-

07

Jun-

07

Sep-

07

Dec-

07

Mar-

08

Jun-

08

Sep-

08

Dec-

08

Mar-

09

Jun-

09

Sep-

09

Dec-

09

Mar-

10

Jun-

10

Sep-

10

Dec-

10

Mar-

11

Jun-

11

BankAtlantic

BankAtlantic

Total Risk-Based Capital

Total Risk-Based Capital

Current

requirement

(14%)

Prior

requirement

(10%) |

NYSE

BBX

29

Investment Highlight #4:

BankAtlantic’s credit trends are stable to

improving in the loan portfolios |

NYSE

BBX

30

These balances and the following BankAtlantic Credit Trend slides exclude

information on the loans that were transferred to BankAtlantic Bancorp

Partners, Inc. effective 3/31/08, which total approximately $12.0 million as of 6/30/11.

BankAtlantic

BankAtlantic

Credit Composition

Credit Composition

Average Balances

Loans

6/30/2011

% of Total

Residential real estate

$ 1.1 Bil

37%

Commercial real estate

822 Mil

28%

Consumer

605 Mil

21%

Commercial business

124 Mil

4%

Small business

298 Mil

10%

Total Loans

$ 2.9 Bil

100%

Allowance for Loan Losses (Ending Balance)

138 Mil

-

as a % of total loans, gross

4.92% |

NYSE

BBX

31

($ in Thousands)

BankAtlantic

BankAtlantic

Credit Quality

Credit Quality

Loan Provision

Loan Provision

1Q2011 =

$27,832

2Q2011 =

$10,195

$8,574

$135,383

$70,842

$214,244

$138,824

$38,027

2006

2007

2008

2009

2010

2011 YTD |

NYSE

BBX

BankAtlantic

BankAtlantic

New

New

Non-Performing

Non-Performing

Loans

Loans

(Total

(Total

Bank)

Bank)

by

by

Quarter

Quarter

($ in Thousands)

32

1

Of these amounts, the following were designated as non-performing, but

continued to pay as agreed: 2Q2010 - $49,770, 3Q2010 -

$59,040, 4Q2010 -

$48,173, 1Q2011 -

$11,820, 2Q2011 -

$6,869.

1

$88,785

$51,831

$40,462

$59,522

$60,118

$100,669

$87,984

$79,487

$44,655

$33,133

1Q2009

2Q2009

3Q2009

4Q2009

1Q2010

2Q2010

3Q2010

4Q2010

1Q2011

2Q2011 |

NYSE

BBX

$56,122

$20,938

$7,812

$25,328

$31,809

$73,267

$65,155

$58,885

$17,248

$12,202

1Q2009

2Q2009

3Q2009

4Q2009

1Q2010

2Q2010

3Q2010

4Q2010

1Q2011

2Q2011

BankAtlantic

BankAtlantic

New

New

Non-Performing

Non-Performing

Loans

Loans

(Commercial

(Commercial

Real

Real

Estate)

Estate)

by

by

Quarter

Quarter

($ in Thousands)

33

1

Of these amounts, the following were designated as non-performing, but

continued to pay as agreed: 2Q2010 - $49,770, 3Q2010 -

$59,040, 4Q2010 -

$48,173, 1Q2011 -

$11,820, 2Q2011 -

$6,869

1 |

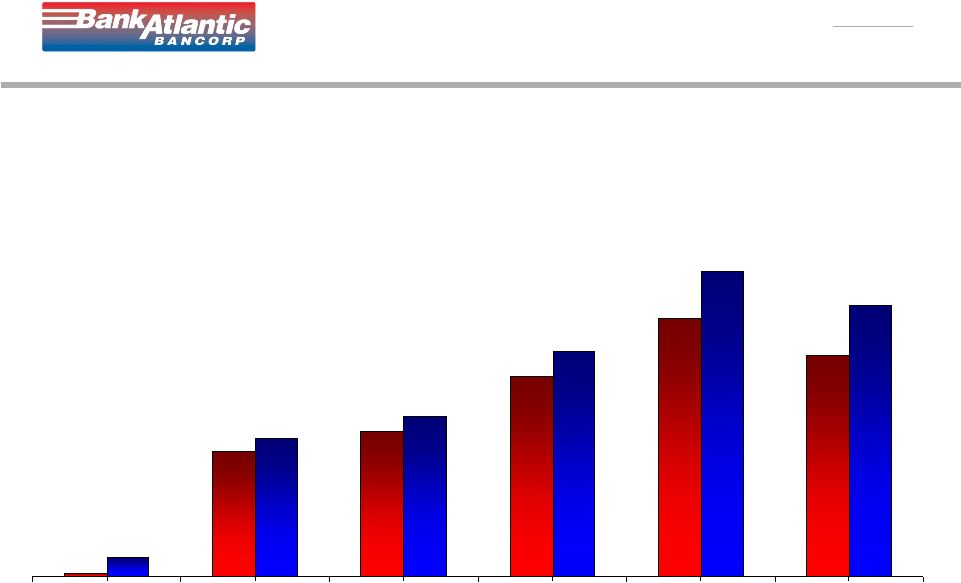

NYSE

BBX

34

BankAtlantic

BankAtlantic

Non-Performing Loans and

Non-Performing Loans and

Non-Performing Assets

Non-Performing Assets

($ in Thousands)

12/31/06

12/31/07

12/31/08

12/31/09

12/31/10

6/30/11

$4,436

$26,814

$324,226

$438,923

$389,789

$315,973

$178,591

$208,088

$286,120

$370,959

$228,574

$197,901 |

NYSE

BBX

35

BankAtlantic

BankAtlantic

Total Delinquency Trends

Total Delinquency Trends

(excluding non-performing loans)

12/31/2005

12/31/2006

12/31/2007

12/31/2008

12/31/2009

12/31/2010

6/30/2011

0.18%

0.32%

0.43%

2.54%

2.17%

1.20%

0.99% |

NYSE

BBX

36

BankAtlantic

BankAtlantic

Commercial Real Estate Delinquency Trends

Commercial Real Estate Delinquency Trends

(excluding non-performing loans)

12/31/2005

12/31/2006

12/31/2007

12/31/2008

12/31/2009

12/31/2010

6/30/2011

6.11%

3.07%

0.00%

0.00%

0.00%

0.41%

0.00% |

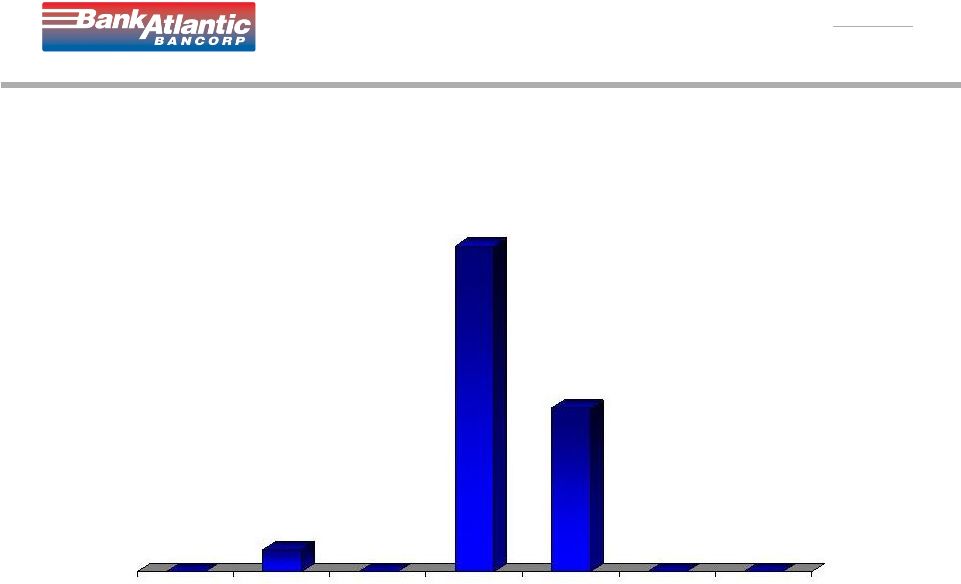

NYSE

BBX

37

BankAtlantic

BankAtlantic

Commercial Real Estate Residential Land Portfolio

Commercial Real Estate Residential Land Portfolio

Outstanding Balance ($ in thousands)

Outstanding Balance ($ in thousands)

1

Net of specific reserves

3Q 2007

2Q 2011

82 Loans -

$550,702

1

26 Loans -

$76,830 |

NYSE

BBX

38

Investment Highlight #5:

Economic trends in Florida are improving |

NYSE

BBX

39

Improving South Florida

Improving South Florida

Housing Market

Housing Market

“We have seen year-over-year increase for pending sales for nearly one

year. Pending sales have also increased month-over-month 10

out of the last 13 months.” -

Jack H. Levine, chairman of the Miami Association of Realtors, South Florida

Business Journal, February 28, 2011

“All market trends indicate continued growth for Miami-Dade County’s

real estate market. This is very positive for the local real estate

market. Increased pending sales reflect the existence of pent-up

demand and should result in strengthening home values as distressed housing

inventory continues to be absorbed.” -

Jack H. Levine, chairman of the Miami Association of Realtors, South Florida

Business Journal, March 29, 2011

Miami-Dade County

1

•

March 2011 pending home sales up 18% year-over-year

Broward County

1

•

March 2011 pending home sales up 6% year-over-year

1.

Source: South Florida Business Journal, March 29, 2011

|

NYSE

BBX

40

FLORIDA MARKET

FLORIDA MARKET

“Florida is #3 in

national deposits at

$369 billion”

•

Florida is projected to have 4.25% population growth over

the next 5 years (2010 to 2015)

•

Florida is #4 in national deposits at $410 billion

1.

Source: FDIC, June 30, 2010

1 |

NYSE

BBX

41

Source:

SunSentinel;

Impact

of

the

2010

Census

–

Population

and

Economic

Trends,

May

20,

2011

(Rick

Gilbert)

Data from 2010 Census

FLORIDA MARKET

Rank

2010 Population

% Change

from 2000

Rank

2010 Population

% Change

from 2000

-

United States

308,745,538

9.7%

-

United States

308,745,538

9.7%

1

California

37,253,956

10.0%

1

Nevada

2,700,551

35.1%

2

Texas

25,145,561

20.6%

2

Arizona

6,392,017

24.6%

3

New York

19,378,102

2.1%

3

Utah

2,763,885

23.8%

4

Florida

18,801,310

17.6%

4

Idaho

1,567,582

21.1%

5

Illinois

12,830,632

3.3%

5

Texas

25,145,561

20.6%

6

Pennsylvania

12,702,379

3.4%

6

North Carolina

9,535,483

18.5%

7

Ohio

11,536,504

1.6%

7

Georgia

9,687,653

18.3%

8

Michigan

9,883,640

-0.6%

8

Florida

18,801,310

17.6%

9

Georgia

9,687,653

18.3%

9

Colorado

5,029,196

16.9%

10

North Carolina

9,535,483

18.5%

10

South Carolina

4,625,364

15.3%

2010 U.S. Census

States Ranked by 2010 Population

2010 U.S. Census

States Ranked by 10-Year Growth Rate |

NYSE

BBX

42

Source:

SunSentinel;

Impact

of

the

2010

Census

–

Population

and

Economic

Trends,

May

20,

2011

(Rick

Gilbert)

Data from 2010 Census

Rank

MSA

Population

Rank

MSA

Population

Rank

MSA

Population

1

New York

16,846,046

1

New York

18,323,002

1

New York

18,897,109

2

Los Angeles

11,273,720

2

Los Angeles

12,365,627

2

Los Angeles

12,828,837

3

Chicago

8,182,076

3

Chicago

9,098,316

3

Chicago

9,461,105

4

Philadelphia

5,435,468

4

Philadelphia

5,687,147

4

Dallas-Forth Worth

6,371,773

5

Detroit

4,248,699

5

Dallas-Forth Worth

5,161,544

5

Philadelphia

5,965,343

6

Boston

4,133,895

6

Miami-Fort Lauderdale

5,007,564

6

Houston

5,946,800

7

Washington DC

4,122,914

7

Washington DC

4,796,183

7

Washington DC

5,582,170

8

Miami-Fort Lauderdale

4,056,100

8

Houston

4,715,407

8

Miami-Fort Lauderdale

5,564,635

9

Dallas-Forth Worth

3,989,294

9

Detroit

4,452,557

9

Atlanta

5,268,860

10

Houston

3,767,335

10

Boston

4,391,344

10

Boston

4,552,402

2010 Census

2010 U.S. Census

Metro Area Rankings

1990 Census

2000 Census

FLORIDA MARKET |

NYSE

BBX

BankAtlantic

1.

Compelling franchise value based on the strength of the

deposit base and recognized customer service excellence

2.

Core operating earnings and fundamental operating trends of

the business have remained resilient throughout the

economic downturn

3.

Capital ratios have been consistent and are in excess of all

applicable regulatory requirements

4.

Credit trends are stable to improving in the loan portfolios

5.

Economic trends in Florida are improving

Value Proposition

Value Proposition

43 |

NYSE

BBX

44

Forward-Looking Statements

Forward-Looking Statements

Except for historical information contained herein, the matters discussed in this press release

contain forward-looking statements within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), that involve substantial risks and uncertainties. Actual

results, performance, or achievements could differ materially from those contemplated, expressed, or

implied by the forward- looking statements contained herein. These forward-looking

statements are based largely on the expectations of BankAtlantic Bancorp, Inc. (“the

Company”) and are subject to a number of risks and uncertainties that are subject to change based on factors

which are, in many instances, beyond the Company’s control. These include, but are not

limited to, risks and uncertainties associated with: the impact of economic, competitive and

other factors affecting the Company and its operations, markets, products and services,

including the impact of the changing regulatory environment, a continued or deepening recession,

continued decreases in real estate values, and increased unemployment or sustained high unemployment

rates on our business generally, BankAtlantic’s regulatory capital ratios, the ability of

our borrowers to service their obligations and of our customers to maintain account balances

and the value of collateral securing our loans; credit risks and loan losses, and the related sufficiency

of the allowance for loan losses, including the impact on the credit quality of our loans (including

those held in the asset workout subsidiary of the Company) of the economy; the risk that loan

losses have not peaked and risks of additional charge-offs, impairments and required

increases in our allowance for loan losses; the impact of regulatory proceedings and litigation including

but not limited to proceedings and litigation relating to overdraft fees and tax certificates; risks

associated with maintaining compliance with the Cease and Desist Orders entered into by the

Company and BankAtlantic with the Office of Thrift Supervision, including risks that

BankAtlantic will not maintain required capital levels, that compliance will adversely impact operations, and

that failing to comply with regulatory mandates will result in the imposition of additional regulatory

requirements and/or fines; changes in interest rates and the effects of, and changes in, trade,

monetary and fiscal policies and laws including their impact on the bank’s net interest

margin; adverse conditions in the stock market, the public debt market and other financial and credit

markets and the impact of such conditions on our activities and our ability to raise capital; we may

raise additional capital and such capital may be highly dilutive to BankAtlantic Bancorp’s

shareholders or may not be available; and the risks associated with the impact of periodic

valuation testing of goodwill, deferred tax assets and other assets. Past performance and perceived trends

may not be indicative of future results. In addition to the risks and factors identified above,

reference is also made to other risks and factors detailed in reports filed by the Company with

the Securities and Exchange Commission, including the Company’s Annual Report on Form

10-K for the year ended December 31, 2010, and the Quarterly Report on Form 10-Q for the quarter

ended March 31, 2011. The Company cautions that the foregoing factors are not exclusive. |

NYSE

BBX

45

This presentation contains financial information determined by methods

other than in accordance with accounting principles generally

accepted in the United States of America (“GAAP”). Management uses non-GAAP financial

measures to supplement its GAAP financial information and to provide

additional useful measures in the evaluation of BankAtlantic's

operating results and any related trends that may be affecting BankAtlantic's

business. Management uses pre-tax core operating earnings to

measure BankAtlantic's financial performance excluding items

that are not currently controllable by management. Management uses core expenses to measure

expense reduction trends excluding items that are not currently

controllable by management. The core operating efficiency ratio

is used by management to measure the costs expended to generate a dollar of revenues excluding

items that are not currently controllable by management. The return on

average tangible equity and average tangible assets is used by

management to measure BankAtlantic's effectiveness in its use of capital and assets,

respectively, and to allow for comparison to other companies in the

industry. The tangible equity to tangible asset ratio is used by

management to evaluate capital adequacy trends and to allow for comparison to other companies

in the industry. Management uses the core deposit measure to assess

trends relating to its lower cost deposit categories, which

management believes may generally be more indicative of relationship deposits. These

disclosures should not be viewed as a substitute for operating results

determined in accordance with GAAP, nor are they necessarily

comparable to non-GAAP performance measures that may be presented by other companies.

See reconciliations of GAAP to non-GAAP measures in the financial

information presented on BankAtlantic Bancorp’s website

under Investor Relations. Non-GAAP Information

Non-GAAP Information |

NYSE

BBX

46 |