Attached files

| file | filename |

|---|---|

| EX-1.1 - FORM OF UNDERWRITING AGREEMENT - InvenSense Inc | dex11.htm |

| EX-5.1 - OPINION OF MORRISON & FOERSTER LLP - InvenSense Inc | dex51.htm |

| EX-23.2 - CONSENT OF DELOITTE & TOUCHE LLP - InvenSense Inc | dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on July 27, 2011

Registration No. 333-167843

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

INVENSENSE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3674 | 01-0789977 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1197 Borregas Avenue

Sunnyvale, CA 94089

(408) 988-7339

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Steven Nasiri

President, Chief Executive Officer and Chairman

1197 Borregas Avenue

Sunnyvale, CA 94089

(408) 988-7339

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| John W. Campbell III, Esq. | Steven E. Bochner, Esq. | |

| Andrew D. Thorpe, Esq. | Aaron J. Alter, Esq. | |

| Alfredo B. D. Silva, Esq. | Jon C. Avina, Esq. | |

| Morrison & Foerster LLP | Wilson Sonsini Goodrich & Rosati | |

| 425 Market Street | Professional Corporation | |

| San Francisco, CA 94105 | 650 Page Mill Road | |

| Tel: (415) 268-7000 | Palo Alto, CA 94304 | |

| Fax: (415) 268-7522 | Tel: (650) 493-9300 | |

| Fax: (650) 493-6811 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ |

(Do not check if a smaller reporting company)

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title Of Each Class Of Securities To Be Registered |

Amount To Be Registered(1) |

Proposed Maximum Aggregate Offering Price Per Share |

Proposed Maximum Aggregate Offering Price(2) |

Amount Of Registration Fee(3) | ||||

| Common Stock, par value $0.001 per share |

12,075,000 | $10.50 | $126,787,500.00 | $10,240.03 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 1,575,000 shares that the underwriters have the option to purchase from the selling stockholders. |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended. |

| (3) | The Registrant previously paid $7,130 pursuant to Rule 457(o) under the Securities Act, as amended, in connection with the registration of $100,000,000 worth of Common Stock in the initial filing of this Registration Statement on June 28, 2010. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated July 27, 2011.

10,500,000 Shares

Common Stock

This is an initial public offering of shares of common stock of InvenSense, Inc.

InvenSense is offering 10,500,000 shares to be sold in the offering.

Prior to this offering, there has been no public market for our common stock. It is currently estimated that the initial public offering price per share will be between $8.50 and $10.50. Our common stock has been approved for listing on the New York Stock Exchange under the symbol “INVN.”

See “Risk Factors” on page 10 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to InvenSense |

$ | $ | ||||||

To the extent the underwriters sell more than 10,500,000 shares of common stock, the underwriters have the option to purchase up to an additional 1,575,000 shares of common stock from the selling stockholders at the initial public offering price less the underwriting discount. We will not receive any of the proceeds from the sale of shares by the selling stockholders.

The underwriters expect to deliver the shares against payment in New York, New York on , 2011.

| Goldman, Sachs & Co. | Morgan Stanley |

| Oppenheimer & Co. | Piper Jaffray | |

| Baird | ThinkEquity LLC | |

Prospectus dated , 2011.

Table of Contents

Table of Contents

Prospectus

| 1 | ||||

| 10 | ||||

| 31 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 36 | ||||

| 38 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

41 | |||

| 65 | ||||

| 85 | ||||

| 92 | ||||

| 97 | ||||

| 112 | ||||

| 114 | ||||

| 118 | ||||

| 123 | ||||

| 126 | ||||

| 130 | ||||

| 134 | ||||

| 134 | ||||

| 134 | ||||

| F-1 |

Through and including , 2011, (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

InvenSense, Inc.

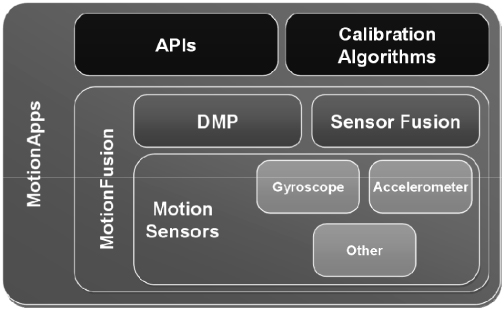

We are the pioneer and a global market leader in intelligent motion processing solutions. We define motion processing as the ability to detect, measure, synthesize, analyze and digitize an object’s motion in three-dimensional space. Our MotionProcessing solution is comprised of our proprietary MotionProcessor and MotionApps platform. Our single-chip MotionProcessor combines micro-electro-mechanical system, or MEMS, based motion sensors, such as accelerometers and gyroscopes, with mixed-signal integrated circuits (ICs) to deliver the world’s first integrated MotionProcessing solution. Our MotionProcessors incorporate proprietary algorithms and firmware that intelligently process and synthesize sensor output for use by software applications. Our MotionApps platform, which consists of application programming interfaces (APIs) and calibration algorithms, helps accelerate the development of motion-based applications using our products. Our MotionProcessing solution is differentiated by its small form factor, high level of integration, performance, reliability and cost effectiveness. While our solutions have broad applicability across consumer, industrial, military and other industry verticals, we currently target consumer electronics within a variety of end markets that we believe demand a more intuitive and immersive user experience, such as console and portable video gaming devices, smartphones, tablet devices, digital still and video cameras, smart TVs (including digital set-top boxes, televisions and multi-media hard disk drives (HDDs)), 3D mice, navigation devices, toys, and health and fitness accessories. As of July 3, 2011 (the end of our first quarter of fiscal year 2012), we had shipped over 131 million units of our products. Our net revenue was $29.0 million, $79.6 million, $96.5 million and $35.6 million for fiscal years 2009, 2010 and 2011 and the three months ended July 3, 2011, respectively, and our net income was $0.2 million, $15.1 million, $9.3 million and $9.0 million for these periods, respectively.

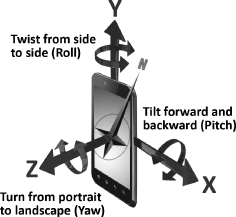

Historically, the incorporation of motion sensors in consumer electronics was limited primarily to accelerometers that provided basic motion sensing capabilities, such as tilt-sensing and changing screen orientation from portrait to landscape mode in smartphones. Devices incorporating these early motion sensors experienced strong demand, as they provided consumers with applications that included a more intuitive user interface. As consumers have become increasingly accustomed to motion-based applications, they have created a demand for applications that require more robust, intelligent motion processing solutions. Until recently, there have been a number of challenges that inhibited the development of such solutions. These challenges include accurately detecting complex motion across multiple axes with an integrated, small scale, cost-effective, single-chip component, and synthesizing and processing motion data into meaningful information for use in applications.

We believe our MotionProcessing solution addresses these challenges by integrating industry leading die size, cost effectiveness and performance while facilitating rapid application development and faster time-to-market. Just as microprocessors provide a platform for building computing applications and graphics processors enable visually rich applications, we believe there is an opportunity to deliver advanced, intelligent motion processing solutions that enable broader development and adoption of motion-based applications.

1

Table of Contents

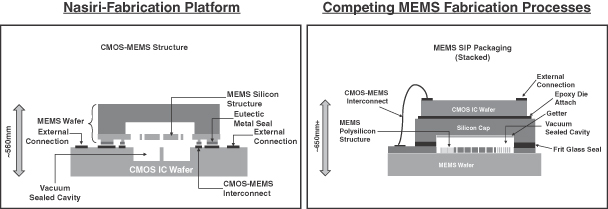

Our Technology and Solutions

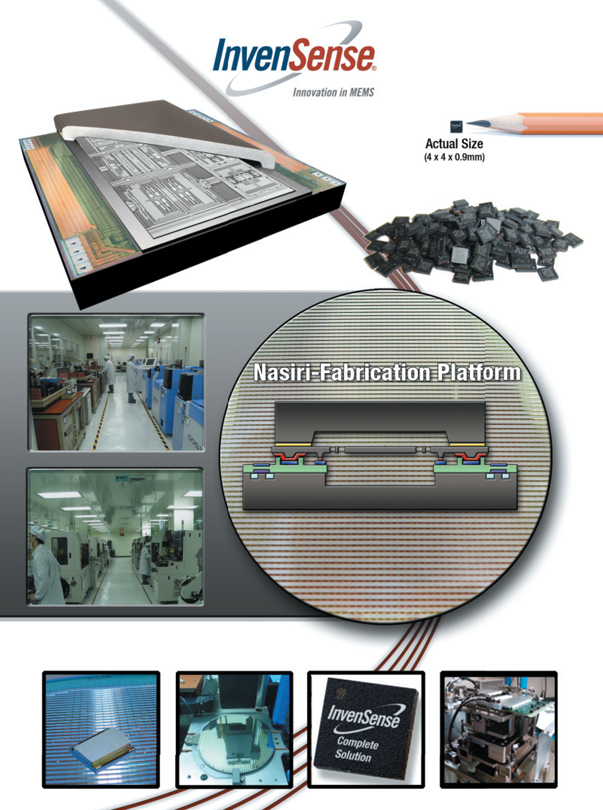

We believe we are the first provider of a motion processing solution for consumer devices. Our products span increasing levels of integration, from single-axis gyroscopes to fully-integrated, intelligent dual- and three-axis, and the industry’s only six-axis, MotionProcessor units (MPUs). Our technology is comprised of five core proprietary components: our Nasiri-Fabrication platform, our advanced MEMS motion sensor designs, our application-specific mixed-signal circuitry for sensor signal processing, our sensor fusion algorithms in firmware that intelligently assimilate data from multiple sensors for use by end applications, and finally our MotionApps platform consisting of APls and calibration algorithms.

Our Nasiri-Fabrication platform combines MEMS with standard complementary metal oxide semiconductors (CMOS) at the wafer level, which has allowed us to pioneer one of the industry’s first high-volume, commercial MEMS fabless business models. We perform our own wafer-level sorting, testing and calibration using our proprietary automated testing equipment at our facilities in Taiwan. We sell our products through our direct worldwide sales organization and through our indirect channel of distributors to manufacturers of consumer electronics devices, original design manufacturers and contract manufacturers.

The competitive advantages of our technology and solutions are:

| Ÿ | Highly integrated and cost-effective solutions enabled by our patented Nasiri-Fabrication platform. The foundation of our MotionProcessing solution is our patented Nasiri-Fabrication platform, which allows us to reduce the number of MEMS manufacturing steps, perform wafer-level testing and use wafer-level packaging, thereby reducing back-end costs and improving overall yield. By combining this unique process capability with our expertise in MEMS motion sensor designs, mixed-signal IC integration technologies, algorithms and firmware, we are able to produce MotionProcessing solutions with industry-leading integration and cost effectiveness. |

| Ÿ | Ability to rapidly accelerate time-to-market by leveraging our MotionApps platform. |

Our MotionApps platform provides APIs and calibration algorithms that simplify access to complex functionality commonly needed by our customers and application developers who intend to leverage our MotionProcessing solutions. We believe our MotionApps platform can significantly accelerate the time-to-market for software applications and consumer devices by eliminating the need to develop separate software libraries. In addition, our MotionApps platform enables device manufacturers with limited motion processing experience to rapidly incorporate higher level motion-enabled applications into their products.

| Ÿ | Scalable MotionProcessing solution with opportunities for continuing integration. Our Nasiri-Fabrication platform enables the integration of multiple motion sensors, such as gyroscopes and accelerometers, on a single chip with processing capability. This enables the offloading of computation intensive motion processing from the main application processor to our chip. As a result, our solution delivers enhanced performance and reliability with a smaller form factor and at a lower cost, and saves customers the time and expense involved in selecting and integrating multiple sensors and processors from multiple suppliers. Over time, we believe we will be able to integrate more advanced features and functionalities into our solution. |

| Ÿ | Flexible manufacturing, performance and reliability. Our fabless model enables cost-effective, high-volume production and provides us with the flexibility to quickly react to our customers’ needs. Additionally, our ability to perform wafer-level testing combined with our close collaborative relationships with third-party foundries enables us to better control the |

2

Table of Contents

| manufacturing process and product yields, resulting in lower cost and improved device performance and reliability. Our Nasiri-Fabrication platform provides low cost, integrated, hermetically sealed cavities at the die level to house the MEMS sensor, enabling greater reliability under harsh environmental conditions. The use of single crystal silicon in our MEMS fabrication process reduces sensitivity to interference from noise and vibrations, enabling higher performance and accuracy. As a result, our solutions enable a motion-based user interface that has greater tolerance to environmental factors. |

Our Strategy

Our objective is to enable broad adoption of our MotionProcessing solutions. To accomplish our objective, we are pursuing the following key strategies:

| Ÿ | Continue to leverage our Nasiri-Fabrication platform to drive performance, integration and cost advantages. We will continue to leverage our fabless model while also continually enhancing our fabrication process to maintain our leadership in size, sensor and system integration, performance and cost. Over the long term, we intend to pursue complementary MEMS markets to expand our product portfolio. |

| Ÿ | Advance our MotionProcessing platform technology leadership. We will continue to invest in advanced manufacturing processes, sensor design, firmware and system-level technology, device integration, platform solutions and market development activities to maintain our technological leadership in motion processing. |

| Ÿ | Drive broader and faster adoption of our MotionProcessing solutions in the consumer electronics market. In order to support and expand our customer base and promote the broad adoption of motion processing, we intend to continue to develop easy-to-integrate, complete solutions, grow our direct sales and field application engineering teams, and work closely with customers to facilitate the development of new use cases. |

| Ÿ | Expand and strengthen the third-party application developer community. We intend to continue to work closely with third-party software and application developers to create new, compelling use cases for motion processing, as well as to accelerate the development of compelling motion-based applications that leverage the unique capabilities of our solution. |

| Ÿ | Identify new and emerging markets for our MotionProcessing solutions. We intend to leverage the growing interest in motion processing into markets such as power tools, sports equipment, wearable computing and industrial applications. |

3

Table of Contents

Risk Factors

Our business is subject to numerous risks, which are described in the section entitled “Risk Factors” immediately following this prospectus summary on page 10. In particular, the following considerations, among others, may offset our competitive strengths or have a negative effect on our growth strategy, which could cause a decline in the price of our common stock and result in a loss of all or a portion of your investment:

| Ÿ | We are dependent upon the continued market acceptance and adoption of motion processing, and, in particular, the adoption of our MotionProcessing solutions in consumer electronics products. |

| Ÿ | Nintendo Co. Limited was our largest customer in fiscal years 2009, 2010 and 2011, comprising 80%, 85% and 73% of our net revenue, respectively. According to third-party reports, sales of the Nintendo Wii, which have historically accounted for the majority of our sales, have declined in each of Nintendo’s last three fiscal years and are expected to continue to decline. The loss of, or a substantial reduction in, orders from Nintendo would significantly reduce our net revenue and adversely impact our operating results. |

| Ÿ | If we fail to expand sales in our current markets and penetrate new markets, particularly the market for smartphones and tablet devices, our net revenue and potential net revenue growth rate could be materially and adversely affected. |

| Ÿ | We face intense competition on a number of factors, including price, and we expect competition to increase in the future, which could have an adverse effect on our net revenue, potential net revenue growth rate and market share. |

Corporate Information

We were incorporated in the State of California in June 2003 and reincorporated in the State of Delaware in October 2004. Our principal executive offices are located at 1197 Borregas Avenue, Sunnyvale, CA 94089. Our telephone number is (408) 988-7339. Our website is www.invensense.com. The reference to our website is an inactive textual reference only and the information contained on our website is not a part of this prospectus.

InvenSenseTM, MotionProcessingTM, MotionProcessorTM, DigitalMotionTM, DMPTM, MotionFusionTM, MotionAppsTM, AirLockTM, AirSignTM, MotionCommandTM, BlurFreeTM and LoPedTM are our trademarks. Trade names, trademarks and service marks of other companies appearing in this prospectus are the property of the respective holders.

4

Table of Contents

The Offering

| Common stock offered by us |

10,500,000 shares |

| Common stock to be outstanding after this offering |

79,000,498 shares |

| Underwriters’ option to purchase additional shares |

Certain selling stockholders may sell up to 1,575,000 additional shares if the underwriters exercise their option to purchase additional shares. |

| Use of proceeds |

We intend to use the net proceeds from this offering primarily for general corporate purposes, including working capital and capital expenditures. See the section titled “Use of Proceeds.” |

| If the underwriters’ option to purchase additional shares is exercised, we will not receive any proceeds from the sale of such shares. See the section titled “Principal and Selling Stockholders.” |

| Risk factors |

See the section titled “Risk Factors” and the other information included in this prospectus for a discussion of the factors you should consider carefully before deciding to invest in our common stock. |

| Proposed NYSE symbol |

INVN |

The number of shares of our common stock to be outstanding after this offering is based on 68,500,498 shares outstanding as of July 3, 2011, on an as converted basis, and excludes:

| Ÿ | 8,422,035 shares of common stock issuable upon the exercise of options outstanding as of July 3, 2011 with exercise prices ranging from $0.04 to $6.11 and a weighted average exercise price of $2.46 per share; |

| Ÿ | 927,500 shares of common stock issuable upon the exercise of outstanding options granted subsequent to July 3, 2011 at an exercise price of $7.32 per share; |

| Ÿ | 60,000 shares of Series A convertible preferred stock issuable upon the exercise of a warrant outstanding as of July 3, 2011 with an exercise price of $1.00 per share. Unless earlier exercised, upon the completion of this offering, this warrant will, in accordance with its terms, be converted into a warrant to purchase 150,000 shares of common stock with an exercise price of $0.40 per share; |

| Ÿ | 645,874 shares of Series B convertible preferred stock issuable upon the exercise of warrants outstanding as of July 3, 2011 with a weighted average exercise price of $1.77 per share. Unless earlier exercised, upon the completion of this offering, these warrants will, in accordance with their terms, be converted into warrants to purchase 1,614,680 shares of common stock with a weighted average exercise price of $0.71 per share; and |

| Ÿ | 10,121,027 shares of common stock reserved for future issuance under our 2011 Stock Incentive Plan, including 835,000 shares of common stock issuable upon the exercise of stock options to be granted in connection with our initial public offering at an exercise price equal to the initial public offering price per share, and additional shares of common stock that will be reserved for future issuance under the automatic increase provisions of our 2011 Stock Incentive Plan. |

5

Table of Contents

Except as otherwise indicated, all information in this prospectus assumes:

| Ÿ | the automatic conversion of all outstanding shares of our convertible preferred stock into an aggregate of 50,311,053 shares of common stock immediately prior to the completion of this offering; |

| Ÿ | the filing of our amended and restated certificate of incorporation immediately prior to the completion of this offering; |

| Ÿ | no exercise of options or warrants subsequent to July 3, 2011; and |

| Ÿ | no exercise of the underwriters’ option to purchase additional shares of our common stock from the selling stockholders. |

6

Table of Contents

Summary Consolidated Financial Data

The following tables summarize the consolidated financial data for our business. You should read this summary financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes, all included elsewhere in this prospectus.

We derived the summary consolidated financial data as of April 3, 2011, and for the fiscal years ended March 29, 2009, March 28, 2010 and April 3, 2011, from our audited consolidated financial statements included elsewhere in this prospectus. We derived the summary consolidated financial data as of July 3, 2011, and for the three months ended June 27, 2010 and July 3, 2011, from our unaudited interim consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future.

The pro forma net income per common share data is computed using the weighted average number of shares of common stock outstanding, after giving effect to the conversion (using the if-converted method) of all shares of our convertible preferred stock into common stock as though the conversion had occurred on the original date of issuance.

We end our fiscal quarters and years on Sundays, rather than using calendar periods. Our fiscal year is either a 52- or 53-week period ending on the Sunday closest to March 31. Our three most recent fiscal years ended on March 29, 2009 (“fiscal year 2009”), March 28, 2010 (“fiscal year 2010”) and April 3, 2011 (“fiscal year 2011”). Fiscal year 2011 was comprised of 53 weeks, while fiscal years 2010 and 2009 were comprised of 52 weeks. The first fiscal quarter in each of our two most recent fiscal years ended on June 27, 2010 (“three months ended June 27, 2010”) and July 3, 2011 (“three months ended July 3, 2011”).

7

Table of Contents

Consolidated Statement of Operations Data:

| Fiscal Year | Three Months Ended | |||||||||||||||||||

| 2009 | 2010 | 2011 | June

27, 2010 |

July

3, 2011 |

||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Net revenue |

$ | 29,025 | $ | 79,556 | $ | 96,547 | $ | 22,001 | $ | 35,627 | ||||||||||

| Cost of revenue(1) |

15,548 | 36,073 | 43,647 | 9,870 | 15,009 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

13,477 | 43,483 | 52,900 | 12,131 | 20,618 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development(1) |

8,545 | 13,085 | 15,826 | 4,279 | 4,376 | |||||||||||||||

| Selling, general and administrative(1) |

4,632 | 8,427 | 15,596 | 3,258 | 4,511 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

13,177 | 21,512 | 31,422 | 7,537 | 8,887 | |||||||||||||||

| Income from operations |

300 | 21,971 | 21,478 | 4,594 | 11,731 | |||||||||||||||

| Other income (expense): |

||||||||||||||||||||

| Change in fair value of warrant liabilities(2) |

– | (6,363 | ) | (4,025 | ) | (4,025 | ) | – | ||||||||||||

| Other income (expense), net |

(66 | ) | (67 | ) | 31 | (2 | ) | 181 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other income (expense)—net |

(66 | ) | (6,430 | ) | (3,994 | ) | (4,027 | ) | 181 | |||||||||||

| Income before income taxes |

234 | 15,541 | 17,484 | 567 | 11,912 | |||||||||||||||

| Income tax provision |

38 | 399 | 8,137 | 1,686 | 2,888 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) income(3) |

196 | 15,142 | 9,347 | (1,119 | ) | 9,024 | ||||||||||||||

| Net income allocable to preferred stockholders(3) |

196 | 12,150 | 7,716 | – | 6,842 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) income attributable to common stockholders(3) |

$ | – | $ | 2,992 | $ | 1,631 | $ | (1,119 | ) | $ | 2,182 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) income per common share: |

||||||||||||||||||||

| Basic |

$ | – | $ | 0.18 | $ | 0.09 | $ | (0.06 | ) | $ | 0.12 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

$ | – | $ | 0.17 | $ | 0.08 | $ | (0.06 | ) | $ | 0.11 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average shares outstanding in computing net (loss) income per share attributable to common stockholders: |

||||||||||||||||||||

| Basic |

15,430 | 16,542 | 17,592 | 17,276 | 18,124 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

17,519 | 20,867 | 22,202 | 17,276 | 22,547 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pro forma net income per common share (unaudited): |

||||||||||||||||||||

| Basic |

$ | 0.14 | $ | 0.13 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Diluted |

$ | 0.13 | $ | 0.12 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Weighted average shares outstanding pro forma (unaudited): |

||||||||||||||||||||

| Basic |

67,903 | 68,435 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Diluted |

74,079 | 74,159 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

8

Table of Contents

| (1) | Includes stock-based compensation expense attributable to employees and non-employees as follows: |

| Fiscal Year | Three Months Ended | |||||||||||||||||||

| 2009 | 2010 | 2011 | June 27, 2010 |

July 3, 2011 |

||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Cost of revenue |

$ | 68 | $ | 233 | $ | 261 | $ | 66 | $ | 74 | ||||||||||

| Research and development |

184 | 536 | 946 | 216 | 344 | |||||||||||||||

| Selling, general and administrative |

258 | 537 | 983 | 252 | 369 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total stock-based compensation expense |

$ | 510 | $ | 1,306 | $ | 2,190 | $ | 534 | $ | 787 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (2) | Refers to the change in fair value of our warrants as required by ASC 815-40-15. Please see Note 6 to our consolidated financial statements for an additional explanation of the change in fair value of warrant liabilities. |

| (3) | Please see Note 1 to our consolidated financial statements for an explanation of the method used to calculate net income allocable to preferred stockholders and net income attributable to common stockholders, including the method to calculate the number of shares used in the computation of the per share amounts. |

The pro forma consolidated balance sheet data as of July 3, 2011 in the table below gives effect to the conversion of all outstanding shares of our convertible preferred stock into shares of our common stock as if the conversion had occurred at July 3, 2011. The pro forma as adjusted consolidated balance sheet data as of July 3, 2011 also gives effect to our receipt of the estimated net proceeds from this offering, based on an assumed initial public offering price of $9.50 per share (the mid-point of the range set forth on the cover page of this prospectus), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

Consolidated Balance Sheet Data:

| As of July 3, 2011 | ||||||||||||

| Actual | Pro Forma | Pro Forma As Adjusted |

||||||||||

| (in thousands) |

||||||||||||

| (unaudited) |

||||||||||||

| Cash and cash equivalents |

$ | 40,339 | $ | 40,339 | $ | 131,364 | ||||||

| Short-term investments |

4,538 | 4,538 | 4,538 | |||||||||

| Working capital(1) |

62,699 | 62,699 | 153,724 | |||||||||

| Total assets |

84,150 | 84,150 | 174,492 | |||||||||

| Total debt, including current portion |

30 | 30 | 30 | |||||||||

| Convertible preferred stock |

50,241 | – | – | |||||||||

| Common stock |

6,913 | 57,154 | 148,179 | |||||||||

| Total stockholders’ equity |

69,320 | 69,320 | 160,345 | |||||||||

| (1) | Working capital is defined as total current assets minus total current liabilities. |

9

Table of Contents

Investing in our common stock involves a high degree of risk. Before making an investment in our common stock, you should carefully consider the following risk factors, in addition to the other information included in this prospectus. If any of the following risks occur, our business, financial condition or results of operations would likely suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of the money you paid to buy our common stock.

Risks Related to Our Business

We are dependent upon the continued market acceptance and adoption of motion processing and, in particular, the adoption of our MotionProcessing solutions in consumer electronics products.

Our products are currently used to provide motion sensing and processing functionality, primarily in consumer electronics products for the video gaming industry. Motion sensing utilizes gyroscopes, accelerometers and other sensors to measure the motion of the device when manipulated by the user, and enables applications such as re-orienting a screen on a smartphone from portrait mode to landscape mode and providing an interface for motion-based commands for video gaming. A motion processing platform, on the other hand, is a complete system-level solution that delivers improved functionality and performance because it integrates various motion sensors with digital control and processing, and provides high-level programming interfaces. Motion processing is a relatively new technology for many consumer electronics products that can be utilized in a number of applications, including motion-based video games or user interfaces for smartphones. We have developed a MotionProcessing platform that we consider to be proprietary.

Market adoption and acceptance of motion processing technology, including our MotionProcessing platform, in consumer electronics products is dependent on a number of factors that are outside of our control. For example, device manufacturers must decide whether incorporating the improved functionality and performance that comes with motion processing will result in improved sales and market acceptance of their products. In addition, device manufacturers may not be able to integrate motion sensing or processing technologies into their products in a manner that they, or their customers, consider to deliver cost-effective, compelling functionality, and developers may not introduce applications that employ motion processing in a compelling way. In addition, there are a number of companies that claim intellectual property ownership over motion as a user interface, and these claims could discourage manufacturers from integrating motion processing technology into their products. At least one company has been successful in entering into a license agreement with a major video gaming manufacturer after commencing patent infringement litigation over these claims, and others have commenced patent infringement litigation as well as administrative proceedings before the United States International Trade Commission that attempt to prohibit the importation into the United States of the Nintendo Wii. Concern over potential patent infringement claims and related litigation may discourage consumer electronics manufacturers from incorporating motion processing functionality into their products. We have little control over market adoption and acceptance of our motion sensing products and motion processing technology, and, to the extent the market does not embrace the added functionality and performance that our products can provide to various consumer electronics products, our net revenue and operating results may be adversely affected.

We are particularly dependent upon the continued adoption of motion processing solutions, including our MotionProcessing solution, in mobile handheld devices, including smartphones and tablet devices. While smartphone manufacturers have begun to incorporate advanced motion sensing functionality, including three-axis gyroscopes, into their devices, if applications that utilize this functionality are not developed or if consumers do not find the applications provided by motion

10

Table of Contents

processing technology compelling, mobile device manufacturers may curtail their adoption of this technology. Consequently, our net revenue may fall short of our expectations and operating results could be adversely affected. Any unanticipated delay in the launch or decline in the volume of our customers’ smartphone and tablet device platforms in which we are designed into may negatively impact our net revenue.

The adoption of motion processing solutions, and, in particular, our MotionProcessing solution, in mobile handheld devices and other consumer electronics products, is dependent to a substantial degree upon the development of software applications written by third-party developers that utilize motion processing technology to provide a compelling user experience and consumer demand for such applications. If consumers or device manufacturers do not find the enhanced performance of devices employing motion processing technology to be compelling or sufficient to justify the additional cost of including the technology in their products, our net revenue and operating results may be adversely affected.

We currently depend on Nintendo for a substantial portion of our net revenue, and the loss of, or a substantial reduction in orders from, Nintendo would significantly reduce our net revenue and adversely impact our operating results.

Nintendo Co. Limited accounted for approximately 73% of our net revenue in fiscal year 2011. We expect that sales to Nintendo will continue to account for a substantial portion of our net revenue for the foreseeable future. The loss of, or a substantial reduction in orders from, Nintendo would have a significant negative impact on our business. While we work closely with Nintendo to develop forecasts for periods of up to one year, these forecasts are not legally binding and may be unreliable, and we do not typically obtain firm purchase orders or commitments from Nintendo that extend beyond a short period. Nintendo, like other customers, might increase, cancel, reduce or reschedule forecasts and orders with us on relatively short notice, which could expose us to the risks of insufficient capacity or excess inventory and could have a material adverse impact on our operating results. For example, Nintendo reduced its orders for our products below levels we had anticipated during fiscal years 2011 and 2010, which negatively impacted our net revenue.

To date, a substantial majority of the products we have sold to Nintendo have been incorporated into the Wii MotionPlus accessory and Wii Remote Plus controller used with the Nintendo Wii video gaming console. Because a large portion of our net revenue is tied to Nintendo gaming products, we expect to remain dependent on the continued success of products and related video games utilizing motion processing for the foreseeable future.

Reported sales of the Wii declined from 20.5 million units for the twelve months ended March 31, 2010 to 15 million units for the 12 months ended March 31, 2011. Forecasted sales of the Wii are reported to be approximately 13 million units for the 12 months ending March 31, 2012. The Wii is in the fifth year of its console cycle, which refers to the life cycle of video game consoles, which we believe is typically about five years. Nintendo has announced its intention to introduce a successor to the Wii. If sales of the Wii console decline, our sales based on Wii MotionPlus accessories and Wii Remote Plus controllers included with new console sales will also decline.

We do not know whether Nintendo will incorporate our products into their future video gaming consoles or related accessories. Further, Nintendo may choose to develop a second source for motion processing components in order to reduce its exposure to the risks associated with a single source of supply. In addition, Nintendo may in the future choose to adopt a solution that is different from ours or use motion processing components or motion processing solutions supplied by competitors or developed internally. Any of these developments would significantly harm our business.

11

Table of Contents

We face intense competition based on a number of factors, including price, and we expect competition to increase in the future, which could have an adverse effect on our net revenue, potential net revenue growth rate and market share.

The market for motion processing products is highly competitive, particularly in the market for consumer electronics, which is highly sensitive to price. In the market for consumer electronics, we compete to various degrees on the basis of our products’ size, price, integration, performance, product roadmap, and reliability. Competition may increase and intensify if more and larger semiconductor companies, or the internal resources of large, integrated original equipment manufacturers, or OEMs, enter our markets. Increased competition could result in price pressure, reduced profitability and loss of market share, any of which could materially and adversely affect our business, net revenue and operating results.

We face competition primarily from integrated semiconductor manufacturers, such as Analog Devices, Inc., Epson Toyocom Corporation, Freescale Semiconductor, Inc., Kionix, Inc. (a wholly owned subsidiary of Rohm Co., Ltd.), MEMSIC, Inc., Murata Manufacturing Co., Ltd., Panasonic Corporation, Robert Bosch GmbH, Sensor Dynamics, Inc., Sony Corporation, STMicroelectronics N.V. and VTI Technologies, Inc., from in-house development organizations within some of our potential customers and from smaller companies specializing in MEMS and motion-sensing products, including those that provide motion-sensing products offering less functionality at a lower cost, such as accelerometers. Our primary competitor in most of our target markets is STMicroelectronics. We also compete with large, sophisticated platform developers that may prefer to integrate less sophisticated motion sensors and to develop their own motion processing application interfaces for developers, marginalizing the total solution we offer. Additionally, competitors that have traditionally focused on industrial or automotive applications for MEMS motion sensors may pursue the consumer electronics market, thus intensifying competition for our products. We expect competition in the markets in which we participate to increase in the future as existing competitors improve or expand their product offerings.

Most of our current competitors have longer operating histories, significantly greater resources, greater brand recognition and a larger base of customers than we do. Some of our competitors also have in-house vertically integrated manufacturing capabilities. In addition, these competitors may have greater credibility with our existing or prospective customers and in some cases are already providing components for products to such existing and prospective customers that may in the future include motion processing solutions. Moreover, many of our competitors have been doing business with our customers or potential customers for a long period of time and have established relationships that may provide them with information regarding future market trends and requirements that may not be available to us. Additionally, some of our larger competitors may be able to provide greater incentives to customers through rebates and similar programs. Finally, some of our competitors with multiple product lines may bundle their products to offer customers a broader product portfolio at a more competitive price point. These factors may make it difficult for us to gain or maintain market share.

To date, the significant majority of our net revenue has been attributable to demand for our products in the video gaming market. This market may decline or remain flat. Even if the market grows, such growth may not benefit the video game consoles that incorporate our products. Any of these potential developments could have a material adverse effect on our business, net revenue and operating results.

We derive the significant majority of our net revenue from the video gaming market. Currently, there are three major providers of video gaming consoles, and our products have only been incorporated by one of these console providers. While the other two video gaming companies have introduced video gaming accessories or consoles that incorporate motion-based video gaming functionality, our MotionProcessing solutions have not been incorporated into these new products. Future generations of video gaming consoles and video gaming accessories may not adopt motion

12

Table of Contents

processing at all or, if they do, may use our competitors’ products, internally developed solutions or alternative technologies not based on MEMS sensors. If we are not successful in obtaining design wins in new generations of video gaming accessories or consoles, if video gaming consoles or accessories that incorporate our products are not successful, or if video games that utilize the functionality provided by our MotionProcessing products are not successful, our net revenue and operating results will decline. Further, while the overall video gaming market has performed well over the past several years, even if we achieve design wins, the video gaming market or the market for specific products incorporating our solutions may not continue to grow or may decline for a number of reasons outside of our control, including competition among video gaming companies, market saturation, the lack of compelling video game titles or the emergence of alternative forms of entertainment. Additionally, the video gaming market is subject to volatility from changes in the macroeconomic environment as well as industry specific trends, such as trends resulting from announcements by one of the major video gaming companies or from the console cycle of video gaming consoles. Any decline or volatility in the overall video gaming industry could cause our net revenue and operating results to fall short of expectations or decline.

If we fail to expand sales in our current markets and penetrate new markets, particularly the market for handheld devices, our net revenue and potential net revenue growth rate could be materially and adversely affected.

Other than applications in the video gaming market, where we derive the significant majority of our net revenue, until recently our MotionProcessing solutions have been employed in only a limited number of applications, such as digital still and video cameras, digital television and set-top box remote controls, 3D mice and remote-controlled toys. We have only recently begun to supply our products for use in smartphones and tablet devices. Our future net revenue growth, if any, will depend on our ability to expand sales in our current markets and penetrate new markets. If new markets do not develop as we currently anticipate or if we are unable to penetrate them successfully, our net revenue and net revenue growth rate could be materially and adversely affected.

We anticipate that there may be a significant near-term opportunity for our products in the market for handheld devices, such as smartphones, tablet devices and portable video gaming devices. While the general market for handheld devices is very fragmented, a limited number of manufacturers command a relatively large share of the market for smartphones with enhanced functionality, and it is this portion of the market that presents the most attractive opportunity for our MotionProcessing solutions. All of these potential customers are large, multinational companies with substantial negotiating power relative to us over price and terms of supply. Securing design wins with any of these companies or other smartphone manufacturers will require a substantial investment of our time and resources. Some of these companies produce products that already include motion sensors, and they may decide not to adopt our MotionProcessing solutions. Additionally, the smartphone market is subject to a unique set of industry dynamics, such as shorter design cycles and multiple devices and manufacturers. The market is highly competitive, and if we are unable to successfully navigate the unique dynamics of the smartphone market, or the products of manufacturers that choose to incorporate our solutions are not commercially successful, our net revenue may not grow and our operating results may be adversely affected.

In addition, we are targeting the market for digital television and set-top box remote controls that we believe will benefit from motion processing functionality for enhanced user interfaces. Currently, applications for motion processing in this market are limited due to the limited marginal adoption of next generation digital televisions and set-top boxes that utilize a motion-based interface. While we believe this market represents a large growth opportunity, it is still in the early stages of development. If this market fails to develop as we anticipate, or if we are unable to manage our business in a way that

allows us to capture this growth opportunity, our net revenue and operating results may be adversely affected.

13

Table of Contents

Even if we are successful in securing design wins with handheld device manufacturers, many of them produce a large number of products and models, and our products may be incorporated into only a few of them. If we fail to penetrate this market or other new markets upon which we target our resources, or we are successful in penetrating only relatively low volume product lines, our net revenue and potential net revenue growth rate will be adversely affected and our financial condition could suffer.

Our sales are subject to a competitive selection process conducted by our prospective customers that can be lengthy and require us to expend significant resources, even though we ultimately may not be selected.

The process of identifying potential new customers, developing their interest in our products, moving through their design cycle, obtaining a design win, obtaining purchase orders and entering into volume production is extremely time consuming. We compete during our customers’ product design and planning processes to achieve “design wins,” which refers to a customer’s decision to include one of our solutions in its products under development. These selection processes can be lengthy and can require us to invest significant time and effort. Our products may not be selected during a customer’s design process, and we may not generate net revenue despite incurring expenses and devoting significant resources to achieving a design win. Because the life cycles for our customers’ products can last several years and changing suppliers involves significant cost, time, effort and risk, our failure to be selected in a competitive design process can result in our foregoing net revenue from a given customer’s product line for the life of that product.

Although we have a number of customers that have purchased our products in production volumes, such customers are significantly smaller than our largest customer. Typically, many customers, including most of our current customers, initially include our products in only one or a few product lines. It generally takes time for sales volumes of a new product line to grow and for customers to incorporate one of our solutions into additional product lines, if any. Even after we achieve a design win, a customer may decide to cancel or change its product plans, may fail to commercialize its products, or those products may fail to achieve market acceptance, any of which could cause us to fail to generate sales from a particular design win and adversely affect our results of operations. Further, failure to achieve design wins could result in lost sales and hurt our prospects in future competitive selection processes because we may not be perceived as a preferred or competitive vendor.

The average selling prices of our products could decrease, which could have a material adverse effect on our net revenue and gross margins.

From time to time, we have reduced the average unit price of our products in anticipation of competitive pricing pressures, new product introductions by us or our competitors, product end-of-life programs and for other reasons. We expect that we will have to do so again in the future. We may experience substantial period-to-period fluctuations in future operating results due to the erosion of the average selling prices of our products. The consumer electronics markets that we are targeting are characterized by substantial price competition, which in turn creates pressure to reduce the prices of the components used in consumer electronics devices. In addition, we may be unable to negotiate favorable manufacturing prices with our foundries because of our relatively low volume of production. If we are unable to offset any reductions in our average selling prices by increasing our sales volumes or introducing new products with higher operating margins, our net revenue and gross margins will suffer. Additionally, because we do not operate our own MEMS fabrication facilities unlike many of our competitors, we may not be able to reduce our costs as rapidly as they do or our costs may potentially increase as a result of outsourcing these activities, which could also reduce our gross margins.

14

Table of Contents

We rely on a limited number of third parties to supply, manufacture and assemble our products, and the failure to manage our relationships with our third-party contractors could adversely affect our ability to produce, market and sell our products.

We do not have our own manufacturing facilities. We operate based on an outsourced manufacturing business model that utilizes third-party foundry and packaging capabilities. Relying on third-party manufacturing, assembly and packaging presents significant risks to us, including the following:

| Ÿ | reduced control over delivery schedules, yields and product reliability; |

| Ÿ | price increases; |

| Ÿ | the failure of a key supplier to perform its obligations to us for technical, market or other reasons; |

| Ÿ | challenges presented by introducing our fabrication processes to new suppliers or deploying them in new foundries; |

| Ÿ | difficulties in establishing additional manufacturing suppliers if we are presented with the need to transfer our manufacturing process technologies to them; |

| Ÿ | shortages of materials; |

| Ÿ | misappropriation of our intellectual property; and |

| Ÿ | limited warranties on wafers or products supplied to us. |

The performance of our third-party manufacturers is outside of our control. At present, we depend upon Taiwan Semiconductor Manufacturing Company (TSMC) to manufacture most of our products. Although we are not obligated to purchase a specific volume of products from, or to contract with, TSMC on an exclusive basis, we anticipate that we will be dependent on TSMC to supply most of our commercial volume shipments of products during the remainder of this fiscal year and a substantial portion of our products in the following fiscal year. We expect that it would take approximately nine to 16 months to transition our manufacturing to new third-party manufacturers that have not already begun installing our manufacturing processes. Such a transition would likely require certain customers to qualify our new manufacturers. If one or more of our third-party contractors or other outsourcers fail to perform their obligations in a timely manner or at satisfactory quality levels, our ability to bring products to market, the reliability of our products and our reputation could suffer. For example, in 2007, one of our former third-party manufacturers failed to supply us with the number of wafer components that it had accepted as a firm commitment order, which adversely impacted our ability to meet our commitments to ship products to our customers. In the future, if our third-party manufacturers fail to deliver quality products and components on time and at reasonable prices, we could have difficulties fulfilling our customer orders, our net revenue could decline and our business, financial condition and results of operations would be adversely affected. In addition, if our foundry partners materially increase their prices for the fabrication of our products, our business would be materially harmed.

Our third-party manufacturers may not allocate sufficient capacity for us to have our products produced and shipped to our customers on a timely basis, which may materially adversely affect our growth and our results of operations.

We rely on third-party foundry MEMS and CMOS wafer fabrication, assembly and packaging services. We make substantially all of our purchases through purchase orders based on our own rolling forecasts, and our third-party manufacturers are not required to supply us products beyond these forecasted quantities. Beyond minimal capacity guarantees, most of our third-party manufacturers do not have any obligations to provide us with additional capacity on a timely basis. We generally place orders for products with some of our suppliers approximately three to four months prior to the

15

Table of Contents

anticipated delivery date, with order volumes based on our forecasts of demand from our customers. Accordingly, if we inaccurately forecast demand for our products, we may be unable to obtain adequate and cost-effective foundry or assembly capacity from our third-party manufacturers to meet our customers’ delivery requirements, or we may accumulate excess inventories. On occasion, we have been unable to adequately respond to unexpected increases in customer purchase orders and therefore were unable to benefit from this incremental demand. In addition, our third-party manufacturers may prioritize orders placed by other companies that order higher volumes of products, many of whom are larger and more established than us. In the event that manufacturing capacity is reduced or eliminated at one or more of our third-party manufacturers’ facilities, we could have difficulties fulfilling our customer orders, and our net revenue and results of operations could decline.

Failure to achieve expected manufacturing yields for our products could negatively impact our operating results.

Manufacturing yields for our products are a function of product design, which is developed largely by us, and process technology, some of which is proprietary to our foundries. Low yields may result from either product design or process technology failures. We do not know whether a yield problem exists until our products are manufactured based on our design. When a yield issue is identified, the product is analyzed and tested to determine the cause. As a result, yield deficiencies may not be identified until well into the production process. We are in the process of bringing up a new, high volume foundry and, based on our past experience, we may experience delays or product yield issues as this facility increases production volumes in the future. Resolution of yield problems requires cooperation among, and communication between, us and our foundries. Because of our potentially limited access to wafer foundry capacity, decreases in manufacturing yields could result in an increase in our costs, cause us to fail to meet product delivery commitments and force us to allocate our available product supply among end customers. Lower than expected yields could potentially harm our operating results, our customer relationships and our reputation.

If we fail to develop and introduce new or enhanced products on a timely basis, our ability to attract and retain customers could be impaired, and our competitive position could be harmed.

We operate in a dynamic environment characterized by rapidly changing technologies and industry standards, and rapid technological obsolescence. To compete successfully, we must design, develop, market and sell new or enhanced products that provide increasingly higher levels of performance, integration and reliability and meet the cost expectations of our customers. A key element of our product strategy is to integrate additional sensors and motion processing functionality into our products. For instance, we are expanding our product line from three-axis gyroscopes to a six-axis device that includes both a three-axis gyroscope and three-axis accelerometer, and we intend to continue to introduce products integrating additional sensors and motion processing functionality. The introduction of new products by our competitors, the market acceptance of products based on new or alternative technologies, or the emergence of new industry standards could render our existing or future products obsolete. Our failure to anticipate or timely develop new or enhanced products or technologies in response to technological change could result in decreased net revenue and our competitors achieving more design wins. In particular, we may experience difficulties with product design, manufacturing or marketing that could delay or prevent our development, introduction or marketing of new or enhanced products, including products with higher levels of sensor integration such as our six-axis device, which has not yet commenced production in commercial quantities. If we fail to introduce new or enhanced products with potentially greater integration that meet the needs of our customers or penetrate new markets in a timely fashion, we will lose market share and our operating results will be adversely affected.

16

Table of Contents

Our future success depends on the continuing efforts of our founder, President, Chief Executive Officer and Chairman, Steven Nasiri, and other key personnel, and on our ability to successfully attract, train and retain additional key personnel.

Our future success depends heavily upon the continuing services of the members of our senior management team and various engineering and other technical personnel. In particular, our founder, President, Chief Executive Officer and Chairman, Steven Nasiri, has been and remains central to the development and advancement of the Nasiri-Fabrication platform and the MEMS technology that is the foundation of our ability to design, develop and manufacture our MotionProcessing solutions, and to the management of our engineering, product development, manufacturing, operations and sales organizations. In addition, our engineers and other technical personnel are critical to our future technological and product innovations. If one or more of our senior executives or other key personnel are unable or unwilling to continue in their present positions, we may not be able to replace them easily or at all, our business may be disrupted, and our financial condition and results of operations may be materially and adversely affected. In addition, if any member of our senior management team or any of our other key personnel joins a competitor or forms a competing company, we may experience material disruption of our operations and development plans and lose customers, distributors, know-how and key professionals and staff members, and we may incur increased operating expenses as the attention of other senior executives is diverted to recruit replacements for key personnel. Our industry is characterized by high demand and intense competition for talent, and the pool of qualified candidates is very limited. We cannot ensure that we will be able to retain existing, or attract and retain new, qualified personnel, including senior executives and skilled engineers, whom we will need to achieve our strategic objectives. In addition, our ability to train and integrate new employees into our operations may not meet the growing demands of our business. The loss of any of our key personnel or our inability to attract or retain qualified personnel, including engineers and others, could delay the development and introduction of, and would have an adverse effect on our ability to sell, our products, which could harm our overall business and growth prospects.

Our intellectual property is integral to our business. If we are unable to protect our intellectual property, our business could be adversely affected.

Our success depends in part upon our ability to protect our intellectual property. To accomplish this, we rely on a combination of intellectual property rights, including patents, copyrights, trademarks and trade secrets in the United States and in selected foreign countries where we believe filing for such protection is appropriate. Our ability to use and prevent others from using our Nasiri-Fabrication platform, which is the subject of several patents and patent applications, is crucial to our success. Effective patent, copyright, trademark and trade secret protection may be unavailable, limited or not applied for in some countries. Some of our products and technologies are not covered by any patent or patent application. We cannot guarantee that:

| Ÿ | any of our present or future patents or patent claims will not lapse or be invalidated, circumvented, challenged or abandoned; |

| Ÿ | our intellectual property rights will provide competitive advantages to us; |

| Ÿ | our ability to assert our intellectual property rights against potential competitors or to settle current or future disputes will not be limited by our agreements with third parties; |

| Ÿ | any of our pending or future patent applications will be issued or have the coverage originally sought; |

| Ÿ | our intellectual property rights will be enforced in jurisdictions where legal protection may be weak; |

| Ÿ | third parties will not infringe our key intellectual property, and specifically, the Nasiri-Fabrication platform; |

17

Table of Contents

| Ÿ | any of the trademarks, copyrights, trade secrets or other intellectual property rights that we presently employ in our business will not lapse or be invalidated, circumvented, challenged or abandoned; or |

| Ÿ | we will not lose the ability to assert our intellectual property rights against others. |

In addition, our competitors or others may design around our protected patents or technologies. Effective intellectual property protection may be unavailable or more limited in one or more relevant jurisdictions relative to the protections available in the United States, or may not be applied for in one or more relevant jurisdictions. If we pursue litigation to assert our intellectual property rights, an adverse judicial decision in any of these legal actions could limit our ability to assert our intellectual property rights, limit the value of our technology or otherwise negatively impact our business, financial condition and results of operations.

Monitoring unauthorized use of our intellectual property is difficult and costly. Unauthorized use of our intellectual property may have occurred or may occur in the future. Although we have taken steps to try to minimize the risk of this occurring, any such failure to identify unauthorized use and otherwise adequately protect our intellectual property would adversely affect our business. Moreover, if we are required to commence litigation, whether as a plaintiff or defendant, not only would this be time-consuming, but we would also be forced to incur significant costs and divert our attention and efforts of our employees, which could, in turn, result in product development delays, lower net revenue and higher expenses and potentially invite counter claims and other legal challenges.

We also rely on customary contractual protections with our customers, suppliers, distributors, employees and consultants, and we implement security measures to protect our trade secrets. We cannot ensure that these contractual protections and security measures will not be breached, that we will have adequate remedies for any such breach or that our suppliers, employees or consultants will not assert rights to intellectual property arising out of such contracts.

We may face claims of intellectual property infringement, which could be time-consuming and costly to defend or settle and, if adversely adjudicated, could result in the loss of significant rights.

The semiconductor and MEMS industries are characterized by companies that hold large numbers of patents and other intellectual property rights and that vigorously pursue, protect and enforce intellectual property rights. For example, a third party has asserted that our Z-axis gyroscope infringes a patent held by it. In the future other third parties may assert against us and our customers and distributors their patent and other intellectual property rights to technologies that are important to our business.

Claims that our products, processes or technology infringe third-party intellectual property rights, regardless of their merit or resolution, could be costly to defend or settle and could divert the efforts and attention of our management and technical personnel. In addition, many of our customer and distributor agreements, including our agreement with our largest customer, require us to indemnify and defend our customers or distributors, as applicable, from third-party infringement claims and pay damages in the case of adverse rulings. Claims of this sort also could harm our relationships with our customers or distributors and might deter future customers from doing business with us. We do not know whether we will prevail in the current proceeding to which we are a party or in any future proceedings given the complex technical issues involved and the inherent uncertainties in intellectual property litigation. If any such proceedings result in an adverse outcome, we could be required to:

| Ÿ | cease the manufacture, use or sale of the infringing products, processes or technology; |

| Ÿ | pay substantial damages for infringement; |

| Ÿ | expend significant resources to develop non-infringing products, processes or technology; |

18

Table of Contents

| Ÿ | license technology from the third party claiming infringement, which license may not be available on commercially reasonable terms, or at all; |

| Ÿ | cross-license our technology to a competitor to resolve an infringement claim, which could weaken our ability to compete with that competitor; or |

| Ÿ | pay substantial damages to our customers or end users to discontinue their use of or to replace infringing technology sold to them with non-infringing technology. |

Any of the foregoing results could have a material adverse effect on our business, financial condition and results of operations.

If we fail to successfully manage the transition to products using our next generation six-axis MotionProcessor or more highly integrated products, we will lose net revenue and our operations could be materially and adversely affected.

Substantially all of recent product shipments have been motion sensing devices incorporating two- and three-axis gyroscopes. We intend to introduce more highly integrated products in the future that include greater motion sensing functionality and further enhancements to on-board motion processing capabilities. We may not be successful in achieving market acceptance of our more highly integrated products on the financial or other terms that we expect to obtain. Any inability to do so could result in the loss of net revenue and earnings and potential inventory write-downs or obsolescence.

Due to our limited operating history, we may have difficulty in accurately predicting our future net revenue and appropriately budgeting our expenses.

We began doing business in 2003 and did not begin to generate net revenue until the first quarter of fiscal year 2007. We generated approximately 73% of our net revenue for fiscal year 2011 from a single customer. As a result, we have only a limited operating history from which to predict future net revenue from multiple customers. This limited operating experience, combined with the rapidly evolving nature of the markets in which we sell our products, substantial uncertainty concerning how these markets may develop and other factors beyond our control, reduces our ability to accurately forecast quarterly or annual net revenue. We are currently expanding our staffing, implementing new internal systems, and increasing our expense levels in anticipation of future growth. If our net revenue does not increase as we expect relative to the growth of our operating expenses, our operating margins could be negatively affected or we could incur significant losses.

We are subject to order and shipment uncertainties, and differences between our estimates of customer demand and actual results could negatively affect our inventory levels, sales and operating results.

Our net revenue is generated on the basis of purchase orders with our customers rather than long-term purchase commitments. In addition, our customers can cancel purchase orders or defer the shipments of our products under certain circumstances. For example, in September 2009, our major customer requested that we delay shipment of products that we had expected to ship pursuant to firm purchase orders to that customer during the third quarter of fiscal year 2010. Our products are manufactured by third-party manufacturers according to our estimates of customer demand, which requires us to make separate demand forecast assumptions for every customer, each of which may introduce significant variability into our aggregate estimates. We have limited visibility into future customer demand and the product mix that our customers will require, which could adversely affect our net revenue forecasts and operating margins. Moreover, because products with motion processing platforms have only recently been introduced into many of our target markets, many of our customers could have difficulty accurately forecasting demand for their products and the timing of their new

19

Table of Contents

product introductions, which ultimately affects their demand for our MotionProcessing solutions. Historically, because of this limited visibility, at times our actual results have been different from our forecasts of customer demand. Some of these differences have been material, leading to net revenue and margin forecasts different from the results we were actually able to achieve. For example, our major customer reduced its orders for our products below levels we had anticipated during fiscal year 2011. These differences may occur in the future. Conversely, if we were to underestimate customer demand or if sufficient manufacturing capacity were unavailable, we could be unable to take advantage of net revenue opportunities, potentially lose market share and damage our customer relationships and market reputation. In addition, any significant future cancellations or deferrals of product orders could materially and adversely impact our profit margins, increase our write-offs due to product obsolescence and restrict our ability to fund our operations.

We may not sustain our growth rate, and we may not be able to manage any future growth effectively.

We have experienced significant growth in a short period of time. Our net revenue increased from $29.0 million in fiscal year 2009 to $79.6 million in fiscal year 2010 and $96.5 million in fiscal year 2011 and from $22.0 million for the three months ended June 27, 2010 to $35.6 million for the three months ended July 3, 2011. We may not achieve similar growth rates in future periods. You should not rely on our operating results for any prior quarterly or annual period as an indication of our future operating performance. If we are unable to maintain adequate net revenue growth, our financial results could suffer and our stock price could decline.

To manage our growth successfully and handle the responsibilities of being a public company, we believe we must effectively, among other things: