Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EXELON GENERATION CO LLC | d8k.htm |

| EX-99.1 - PRESS RELEASE AND EARNINGS RELEASE ATTACHMENTS - EXELON GENERATION CO LLC | dex991.htm |

Earnings Conference Call

2

nd

Quarter 2011

July 27, 2011

EXHIBIT 99.2 |

Cautionary Statements Regarding

Forward-Looking Information

2

Except for the historical information contained herein, certain of the matters discussed in this

communication constitute “forward- looking statements” within the meaning of the

Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended by the Private

Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,”

“plan,” “believe,” “target,” “forecast,” and words and terms

of similar substance used in connection with any discussion of future plans, actions, or

events identify forward-looking statements. These forward-looking statements include, but are not limited to,

statements regarding benefits of the proposed merger of Exelon Corporation (Exelon) and Constellation

Energy Group, Inc. (Constellation), integration plans and expected synergies, the expected

timing of completion of the transaction, anticipated future financial and operating performance

and results, including estimates for growth. These statements are based on the current

expectations of management of Exelon and Constellation, as applicable. There are a number of risks and

uncertainties that could cause actual results to differ materially from the forward-looking

statements included in this communication regarding the proposed merger. For example, (1) the

companies may be unable to obtain shareholder approvals required for the merger; (2) the companies

may be unable to obtain regulatory approvals required for the merger, or required regulatory approvals

may delay the merger or result in the imposition of conditions that could have a material

adverse effect on the combined company or cause the companies to abandon the merger; (3)

conditions to the closing of the merger may not be satisfied; (4) an unsolicited offer of another company to

acquire assets or capital stock of Exelon or Constellation could interfere with the merger; (5)

problems may arise in successfully integrating the businesses of the companies, which may

result in the combined company not operating as effectively and efficiently as expected; (6)

the combined company may be unable to achieve cost-cutting synergies or it may take longer than expected to

achieve those synergies; (7) the merger may involve unexpected costs, unexpected liabilities or

unexpected delays, or the effects of purchase accounting may be different from the

companies’ expectations; (8) the credit ratings of the combined company or its

subsidiaries may be different from what the companies expect; (9) the businesses of the companies may

suffer as a result of uncertainty surrounding the merger; (10) the companies may not realize

the values expected to be obtained for properties expected or required to be divested; (11) the

industry may be subject to future regulatory or legislative actions that could adversely affect the

companies; and (12) the companies may be adversely affected by other economic, business, and/or

competitive factors. Other unknown or unpredictable factors could also have material adverse

effects on future results, performance or achievements of Exelon or the combined company. |

Discussions of some of these other important factors and assumptions are contained

in Exelon’s and Constellation’s respective filings with the

Securities and Exchange Commission (SEC), and available at the SEC’s website at

www.sec.gov,

including:

(1)

Exelon’s

2010

Annual

Report

on

Form

10-K

in

(a)

ITEM

1A.

Risk

Factors,

(b)

ITEM

7.

Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operations

and

(c)

ITEM

8.

Financial

Statements

and

Supplementary

Data:

Note

18;

(2)

Exelon’s

Quarterly

Report

on

Form

10-Q

for

the

quarterly

period

ended

June

30,

2011

(to

be

filed

on

July

27,

2011)

in

(a)

Part

II,

Other

Information,

ITEM

1A.

Risk

Factors,

(b)

Part

1,

Financial Information, ITEM

2. Management’s Discussion and Analysis of Financial Condition and Results of

Operations and (c)

Part

I,

Financial

Information,

ITEM

1.

Financial

Statements:

Note

13;

(3)

Constellation’s

2010

Annual

Report

on

Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s

Discussion and Analysis of Financial Condition and Results of Operations and

(c) ITEM 8. Financial Statements and Supplementary Data: Note 12; and (4) Constellation’s

Quarterly

Report

on

Form

10-Q

for

the

quarterly

period

ended

March

31,

2011

in

(a)

Part

II,

Other

Information,

ITEM

5.Other

Information,

(b)

Part

I,

Financial

Information,

ITEM

2.

Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operations

and

(c)

Part

I,

Financial

Information,

ITEM

1.

Financial

Statements:

Notes to

Consolidated Financial Statements, Commitments and Contingencies. These

risks, as well as other risks associated with the proposed

merger,

are

more

fully

discussed

in

the

preliminary

joint

proxy

statement/prospectus

included

in

the

Registration Statement on Form S-4 that Exelon filed with the SEC on June 27,

2011 in connection with the proposed merger.

In

light

of

these

risks,

uncertainties,

assumptions

and

factors,

the

forward-looking

events

discussed

in

this

communication may not occur. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date of

this communication. Neither Exelon nor Constellation undertake any obligation to

publicly release any revision to its forward-looking statements to reflect

events or circumstances after the date of this communication.

Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an

offer to buy any securities, or a solicitation of any vote or approval, nor

shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities laws

of any such jurisdiction. On June 27, 2011,

Exelon

filed

with

the

SEC

a

Registration

Statement

on

Form

S-4

that

included

a

preliminary

joint

proxy

statement/prospectus and other relevant documents to be mailed by Exelon and

Constellation to their respective security holders in connection with the

proposed merger of Exelon and Constellation. Cautionary Statements Regarding

Forward-Looking Information (Continued)

3 |

Additional Information and Where to Find It

These materials are not yet final and may be amended. WE URGE INVESTORS AND

SECURITY HOLDERS TO READ THE PRELIMINARY JOINT PROXY STATEMENT/PROSPECTUS

AND THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT

DOCUMENTS WHEN THEY BECOME AVAILABLE, BECAUSE

THEY

CONTAIN

OR

WILL

CONTAIN

IMPORTANT

INFORMATION

about

Exelon,

Constellation

and the

proposed

merger.

Investors

and

security

holders

will

be

able

to

obtain

these

materials

(when

they

are

available)

and

other

documents

filed

with

the

SEC

free

of

charge

at

the

SEC's

website,

www.sec.gov.

In

addition,

a

copy

of

the

preliminary

joint

proxy statement/prospectus and definitive joint proxy statement/prospectus (when it

becomes available) may be obtained free of charge from Exelon Corporation,

Investor Relations, 10 South Dearborn Street, P.O. Box 805398, Chicago, Illinois

60680-5398, or from Constellation Energy Group, Inc., Investor Relations, 100

Constellation Way, Suite 600C, Baltimore, MD 21202. Investors and security

holders may also read and copy any reports, statements and other information filed by

Exelon, or Constellation, with the SEC, at the SEC public reference room at 100 F

Street, N.E., Washington, D.C. 20549. Please call the SEC at

1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room.

Participants in the Merger Solicitation

Use of Non-GAAP Financial Measures

This presentation includes references to adjusted (non-GAAP) operating earnings

and non-GAAP cash flows that exclude the impact of certain factors. We

believe that these adjusted operating earnings and cash flows are representative of the

underlying

operational

results

of

the

Companies.

Please

refer

to

the

appendix

to

this

presentation

for

a

reconciliation of

adjusted (non-GAAP) operating earnings to GAAP earnings. Please refer to

the footnotes of the following slides for a reconciliation of non-GAAP

cash flows to GAAP cash flows. 4

Exelon, Constellation, and their respective directors, executive officers and certain other members of

management and employees may be deemed to be participants in the solicitation of proxies in

respect of the proposed transaction. Information regarding Exelon’s directors and

executive officers is available in its proxy statement filed with the SEC by Exelon on March

24, 2011 in connection with its 2011 annual meeting of shareholders, and information regarding

Constellation’s directors and executive officers is available in its proxy statement filed with

the SEC by Constellation on April 15, 2011 in connection with its 2011 annual meeting of

shareholders. Other information regarding the participants in the proxy solicitation and a

description of their direct and indirect interests, by security holdings or otherwise, is contained

in the preliminary joint proxy statement/prospectus and will be contained in the definitive joint

proxy statement/prospectus. |

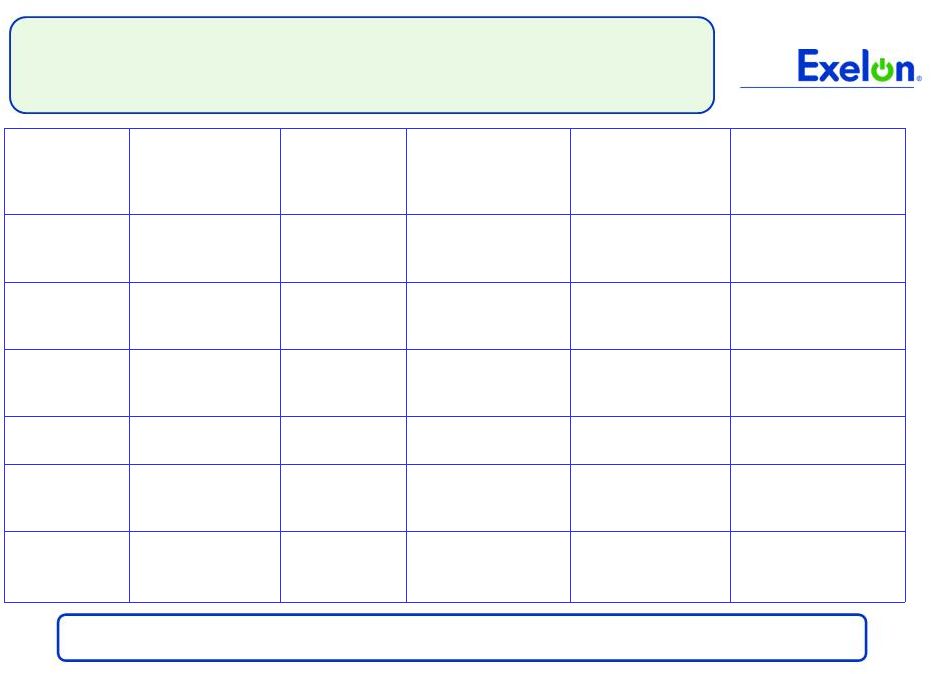

5

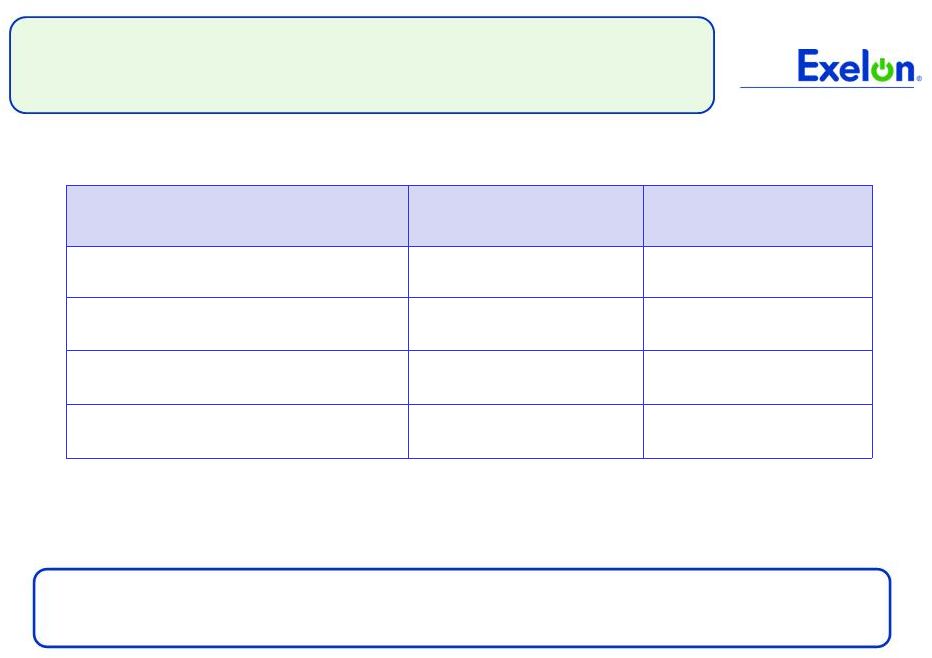

2011 Operating Earnings Guidance

2011 Prior

Guidance

(2)

ComEd

PECO

Exelon

Generation

Holdco

Exelon

$3.90 -

$4.20

(1)

$0.55 -

$0.65

$0.50 -

$0.60

$2.85 -

$3.05

2Q 2011 operating earnings of

$1.05/share

Strong operating results in second

quarter

•

Nuclear capacity factor of 89.6% largely

due to a higher number of nuclear

refueling outages

•

Strong operating results at utilities

despite severe storms in ComEd

service territory

2011 Revised

Guidance

(2)

$4.05 -

$4.25

(1)

$0.55 -

$0.65

$0.50 -

$0.60

$2.95 -

$3.10

Updating

2011

operating

earnings

guidance

to

$4.05

-

$4.25/share

from

$3.90 -

$4.20/share

(1)

(1)

Refer to Earnings Release Attachments for additional details and to the Appendix for a reconciliation

of adjusted (non-GAAP) operating EPS to GAAP EPS.

(2)

Earnings guidance for OpCos may not add up to consolidated EPS guidance. |

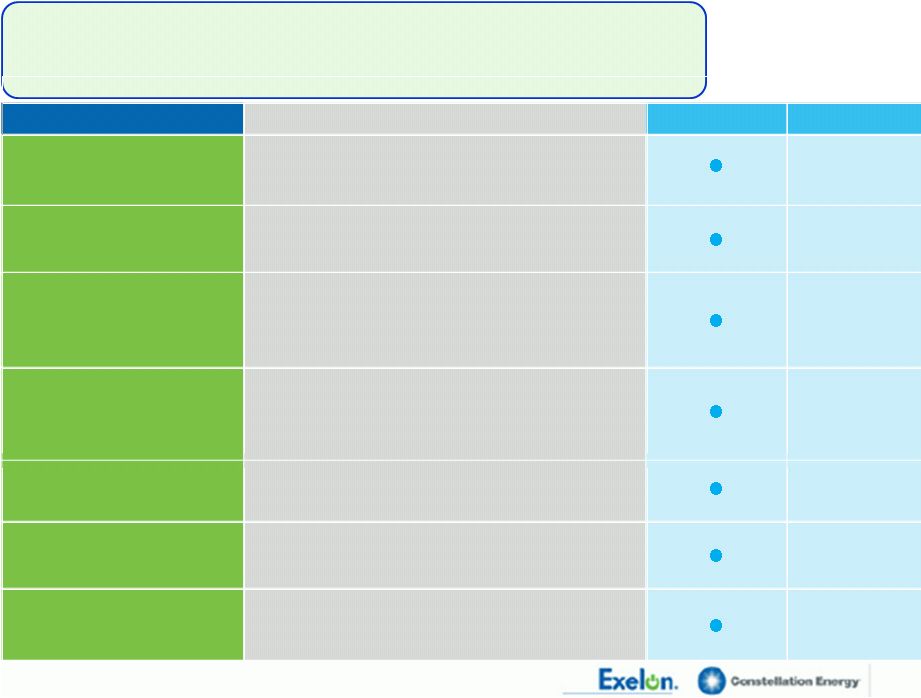

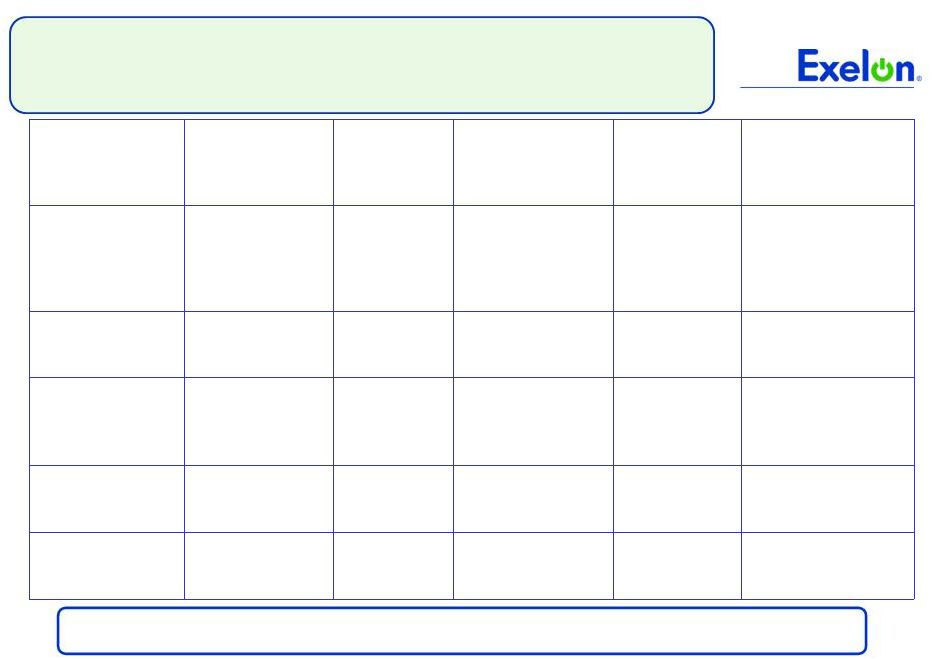

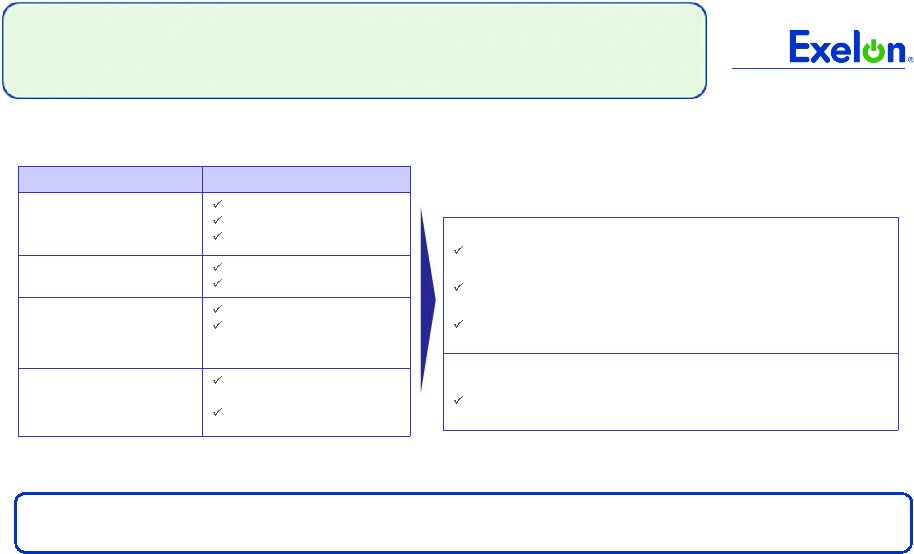

Status of

Merger Approvals (as of 7/26/11) Stakeholder

Status of Key Milestones

Filed

Approved

Securities

and

Exchange

Commission

(SEC)

(File

No.

333-175162)

•

Filed S-4 Registration Statement June 27, 2011

•

Shareholder approval anticipated in Q3 2011

Department

of

Justice

(DOJ)

•

Submitted Hart-Scott-Rodino filing on May 31, 2011

for review under U.S. antitrust laws

•

Approval expected by January 2012

Federal

Energy

Regulatory

Commission

(FERC)

(Docket

No.

EC

11-83)

•

Filed merger approval application and related filings

on May 20, 2011, which assesses market power-

related issues

•

Approval expected in Q4 2011

Nuclear

Regulatory

Commission

(Docket

Nos.

50-317,

50-318,

50-

220,

50-410,

50-244,

72-8,

72-67)

•

Filed for indirect transfer of Constellation Energy

licenses on May 12, 2011

•

Approval expected by January 2012

Maryland

PSC

(Case

No.

9271)

•

Commission on May 25, 2011

•

Approval expected by January 2012

New

York

PSC

(Case

No.

11-E-0245)

•

Filed for approval with the New York State Public

Service Commission on May 17, 2011

•

Approval expected in Q4 2011

Texas

PUC

(Case

No.

39413)

•

Filed for approval with the Public Utility Commission

of Texas on May 17, 2011

•

Approval expected in Q3 2011

6

Filed for approval with the Maryland Public Service |

Significant Events

Date of Event

Filing of Application

May 25, 2011

Intervention Deadline

June 24, 2011

Prehearing Conference

June 28, 2011

Filing of Staff, Office of People Counsel and Intervenor Testimony

September 16, 2011

Filing of Rebuttal Testimony

October 12, 2011

Filing of Surrebuttal Testimony

October 26, 2011

Status Conference

October 28, 2011

Evidentiary Hearings

October 31, 2011 -

November 10, 2011

Public Comment Hearings

November 29, December 1 &

December 5, 2011

Filing of Initial Briefs

December 1, 2011

Filing of Reply Briefs

December 15, 2011

Decision Deadline

January 5, 2012

7

Maryland PSC Review Schedule |

8

Factors Influencing RPM

Auction (PY 14/15 vs. PY

13/14)

Expected

Exelon

Price

Impact

Actual

Price

Impact

Actual Auction Results and Supplier

Bidding Behavior

Cost of Environmental

Upgrades and Higher Net

ACRs for Coal Units

3,237 MW reduction in offered capacity

(coal/oil/gas)

7,746 MW reduction in cleared capacity

(coal/oil/gas)

Import Transmission Limits

and Objectives

(muted impact on portfolio

revenues due to regional

diversification)

Total revenue from PY 14/15 capacity

auction close to PY 13/14 revenues for

Exelon fleet

Balanced portfolio, split evenly between east

and west, reduces volatility in revenues due

to transmission or demand changes.

Demand Response Growth

Increase in cleared DR (~4,836 MW) was

close to internal estimates.

Limited DR was capped, causing price

separation for premium products

RPM Results: Favorable and As Expected

Auction results were in line with Exelon’s expectations with EPA

regulations being one of the primary drivers of bidding behavior

|

9

NRC Near-Term Task Force Recommendations

Key Findings :

U.S nuclear plants are safe

No major changes to spent nuclear fuel

storage and licensing

Key Recommendations:

Clarifying regulatory framework

Ensuring protection and enhancing mitigation

Strengthening emergency preparedness

Improving efficiency of NRC programs

Report

is

first

step

in

systematic

review

that

NRC

will

conduct;

stakeholder

input

will

be

sought |

10

Key Financial Messages

Higher than expected 2Q 2011 operating earnings of

$1.05/share

(1)

•

NDT funds special transfer tax deduction benefit of $0.07 per share in 2Q;

additional benefit of $0.01 per share expected in second half of

2011

ICC approved revenue increase of $143 million in ComEd’s

2010 distribution rate case

Expect to generate $4.3 billion cash from operations in 2011

Expect

3Q

2011

operating

earnings

of

$1.00

-

$1.10/share

(1)

(1) Refer to Earnings Release Attachments for additional details

and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS.

Note: NDT = Nuclear Decommissioning Trust |

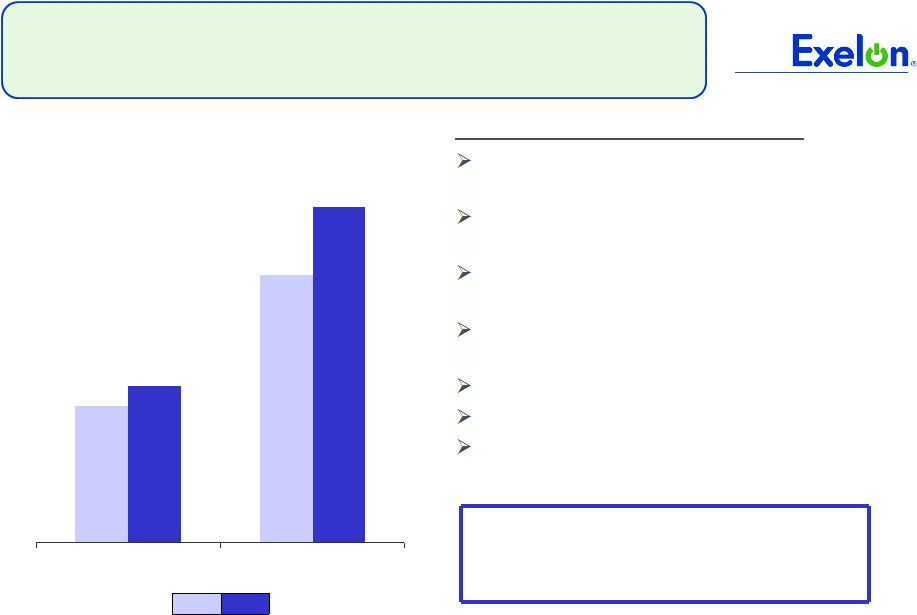

11

Exelon Generation

Operating EPS Contribution

2010

2011

Outage Days

(3)

2Q10

2Q11

Refueling

44

103

Non-refueling

15

24

2Q

YTD

$0.69

$1.35

Note: PPA = Power Purchase Agreement

Key Drivers –

2Q11 vs. 2Q10

(1)

Higher margins due to expiration of the

PECO PPA: $0.15

Favorable market/portfolio conditions:

$0.07

(2)

NDT funds special transfer tax deduction:

$0.07

Higher O&M costs, including planned

nuclear refueling outages: $(0.07)

Nuclear volume: $(0.05)

Higher nuclear fuel costs: $(0.02)

Higher depreciation and interest expense:

$(0.03)

$0.79

$1.69

(1)

Refer to the Earnings Release Attachments for additional details and to the Appendix for a

reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. (2)

Favorable market/portfolio conditions include: $0.02 Wind, $0.02 Hydro volume and $0.03 higher

realized prices in Mid-Atlantic (3) Outage days exclude

Salem. |

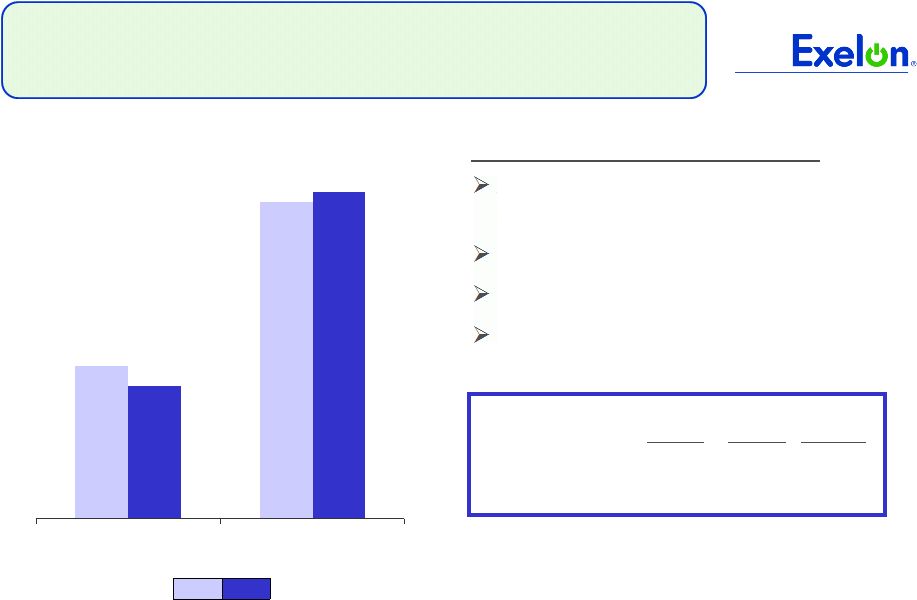

12

Key Drivers –

2Q11 vs. 2Q10

(1)

IL distribution tax refund recorded in

2010: $(0.02)

Higher O&M costs: $(0.02)

Higher depreciation and interest

expense: $(0.02)

One-time impacts of distribution rate

case order: $0.03

Electric distribution rates: $0.01

ComEd Operating EPS Contribution

(1) Refer to the Earnings Release Attachments for additional details and to the

Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS.

2010

2011

2Q

YTD

$0.18

2Q11

Actual

Actual

Normal

Heating Degree-Days

519 823 766

Cooling Degree-Days 312

237

224 $0.37

$0.15

$0.26

2Q10 |

13

PECO Operating EPS Contribution

Key Drivers –

2Q11 vs. 2Q10

(1)

2010 CTC collections, net of

amortization expense: $(0.06)

Electric and gas distribution rates: $0.02

Decreased storm costs: $0.01

Lower interest expense: $0.01

2010

2011

(1) Refer to the Earnings Release Attachments for additional details and to the

Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. 2Q

YTD

$0.15

2Q11

$0.31

Note: CTC = Competitive Transition Charge

$0.32

$0.13

Actual

Actual

Normal

Heating Degree-Days

299 331 458

Cooling Degree-Days 586

494

332 2Q10

|

14

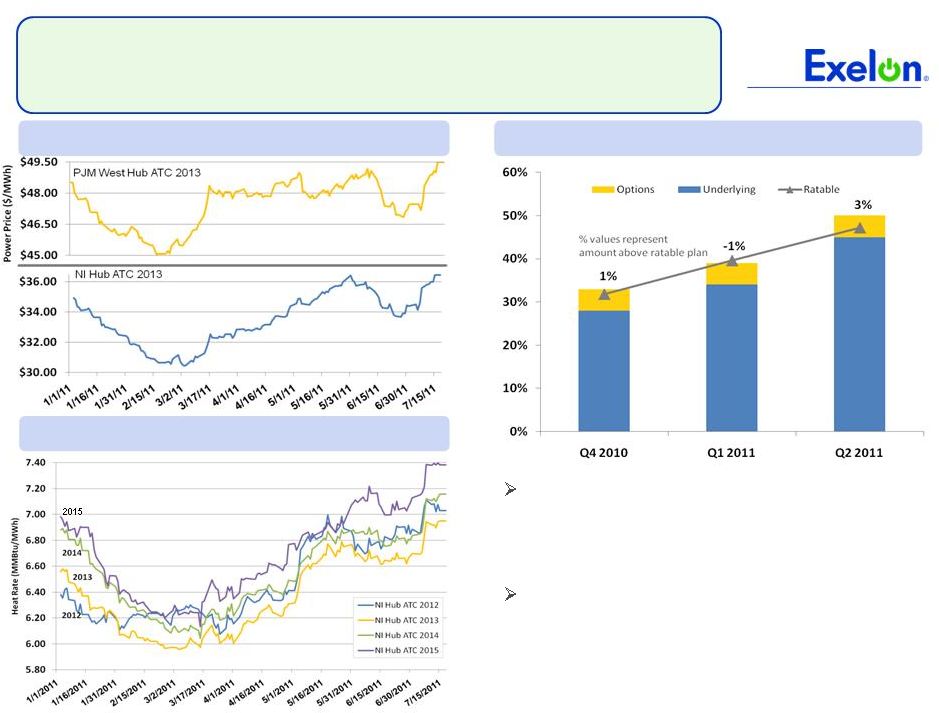

Exelon Generation Hedging Program

Q2 provided favorable 2013 sales

opportunities

•

Reflects successful participation in Illinois IPA

procurements in the first half of May

Price movements

•

Recovery in heat rates, especially at NI Hub

•

Upward move in NI Hub wrap

2013 Hedge % and Value Above Ratable

2013 PJM West Hub & NI Hub ATC Prices

PJM NI Hub ATC Heat Rates |

15

Diverse Generation and Sales Mix

Exelon’s diverse portfolio is well positioned to serve a variety of

products 2011-2013 Sales as a Percentage

of Expected Generation

Current Owned & Contracted

Generation

Capacity

by

Fuel

Type

(1)

Matching Exelon’s favorable asset position with a diverse set of products is

an important aspect of the hedging program

•

Reduces and diversifies our collateral exposure

•

Enables sales to be made closer to assets

•

Increases opportunities for margin via retail, utility solicitations and

mid-marketing channels •

Use of alternate channels and locations help minimize liquidity and congestion

risks Data as of 6/30/2011

(1) Reflects owned and contracted generation as of 6/30/2011. Excludes Cromby

Station 1 & 2, Eddystone 1&2 and PPA with Tenaska Georgia Partners. Includes Wolf Hollow PPA

volume only (350 MW). |

RITE

Line Project Update Project Background

420 miles of 765kV transmission

stretches from Northern Illinois to

Ohio. The RITE Line will be built

from the existing 765kV system in

Ohio in the East to the West

Estimated construction to begin

2015 pending regulatory approvals

and siting

Strategic and Financial Objectives

Ensures reliability, enables states to

meet RPS standards, and supports

the integration of more renewables

ComEd/Exelon investment ~ $1.1

billion

Requested ROE 12.70%

Latest Developments

Signed partnership agreement with

ETA on July 13

Completed FERC incentive rate

filing on July 18. Expect FERC ruling

by October 2011.

16

Note: ETA = Electric Transmission America

RPS = Renewable Portfolio Standards

RTEP = Regional Transmission Expansion Planning |

17

($ millions)

Exelon

(8)

Beginning Cash Balance

(1)

$800

Cash Flow from Operations

(2)

375

875

3,175

4,350

CapEx (excluding Nuclear Fuel, Nuclear

Uprates, Exelon Wind, Utility Growth CapEx

and Wolf Hollow)

(725)

(325)

(850)

(1,950)

Nuclear Fuel

n/a

n/a

(1,050)

(1,050)

Dividend

(3)

(1,400)

Nuclear Uprates

and Exelon Wind

(4)

n/a

n/a

(625)

(625)

Wolf Hollow Acquisition

n/a

n/a

(300)

(300)

Utility Growth CapEx

(5)

(300)

(125)

n/a

(425)

Net Financing (excluding Dividend):

Planned Debt Issuances

(6)

1,000

--

--

1,000

Planned Debt Retirements

(350)

(250)

--

(600)

Other

(7)

300

(125)

200

550

Ending Cash Balance

(1)

$350

2011 Projected Sources and Uses of Cash

(1)

Excludes counterparty collateral activity.

(2)

Cash Flow from Operations primarily includes net cash flows provided by operating activities and net

cash flows used in investing activities other than capital expenditures. (3)

Assumes 2011 dividend of $2.10/share. Dividends are subject to declaration by the Board of

Directors. (4)

Includes $400 million in Nuclear Uprates and $225 million for Exelon Wind spend.

(5)

Represents new business, smart grid/smart meter investment and transmission growth projects.

(6)

Excludes ComEd’s $191 million of tax-exempt bonds that are backed by letters of credit

(LOCs). Excludes PECO’s $225 million Accounts Receivable (A/R) Agreement with Bank

of Tokyo. PECO’s A/R Agreement was extended in accordance with its terms through September 6, 2011.

(7)

“Other” includes proceeds from options and expected changes in short-term debt.

(8)

Includes cash flow activity from Holding Company, eliminations, and other corporate entities.

|

18

Exelon Generation Hedging Disclosures

(as of June 30, 2011) |

19

Important Information

The following slides are intended to provide additional information regarding the hedging

program at Exelon Generation and to serve as an aid for the purposes of modeling Exelon

Generation’s gross margin (operating revenues less purchased power and fuel expense). The

information on the following slides is not intended to represent earnings guidance or a

forecast of future events. In fact, many of the factors that ultimately will determine Exelon

Generation’s actual gross margin are based upon highly variable market factors outside of

our control. The information on the following slides is as of June 30, 2011. We

update this information on a quarterly basis.

Certain information on the following slides is based upon an internal simulation model that

incorporates assumptions regarding future market conditions, including power and

commodity prices, heat rates, and demand conditions, in addition to operating performance

and dispatch characteristics of our generating fleet. Our simulation model and the

assumptions therein are subject to change. For example, actual market conditions and the

dispatch profile of our generation fleet in future periods will likely differ – and may differ

significantly – from the assumptions underlying the simulation results included in the

slides. In addition, the forward-looking information included in the following slides will

likely change over time due to continued refinement of our simulation model and changes in our

views on future market conditions. |

20

Portfolio Management Objective

Align Hedging Activities with Financial Commitments

Power Team utilizes several product types

and channels to market

•

Wholesale and retail sales

•

Block products

•

Load-following products

and load auctions

•

Put/call options

Exelon’s hedging program is designed to

protect the long-term value of our

generating fleet and maintain an

investment-grade balance sheet

•

Hedge enough commodity risk to meet future cash

requirements if prices drop

•

Consider: financing policy (credit rating objectives,

capital structure, liquidity); spending (capital and

O&M); shareholder value return policy

Consider market, credit, operational risk

Approach to managing volatility

•

Increase hedging as delivery approaches

•

Have enough supply to meet peak load

•

Purchase fossil fuels as power is sold

•

Choose hedging products based on generation

portfolio –

sell what we own

•

Heat rate options

•

Fuel products

•

Capacity

•

Renewable credits

% Hedged

High End of Profit

Low End of Profit

Open Generation

with LT Contracts

Portfolio

Optimization

Portfolio

Management

Portfolio Management Over Time |

21

Percentage of Expected

Generation Hedged

•

How many equivalent MW have been

hedged at forward market prices; all hedge

products used are converted to an

equivalent average MW volume

•

Takes ALL

hedges into account whether

they are power sales or financial products

Equivalent MWs Sold

Expected Generation

=

Our normal practice is to hedge commodity risk on a ratable basis

over the three years leading to the spot market

•

Carry operational length into spot market to manage forced outage and

load-following risks

•

By

using

the

appropriate

product

mix,

expected

generation

hedged

approaches the

mid-90s percentile as the delivery period approaches

•

Participation in larger procurement events, such as utility auctions, and some

flexibility in the timing of hedging may mean the hedge program is not

strictly ratable from quarter to quarter

Exelon Generation Hedging Program |

22

2011

2012

2013

Estimated Open Gross Margin ($ millions)

(1)(2)

$5,450

$5,000

$5,600

Open gross margin assumes all expected generation is sold

at the Reference Prices listed below

Reference Prices

(1)

Henry Hub Natural Gas ($/MMBtu)

NI-Hub ATC Energy Price ($/MWh)

PJM-W ATC Energy Price ($/MWh)

ERCOT

North

ATC

Spark

Spread

($/MWh)

(3)

$4.37

$33.18

$46.07

$3.77

$4.84

$33.10

$46.02

$1.40

$5.16

$34.45

$47.45

$2.27

Exelon Generation Open Gross Margin and

Reference Prices

(1)

Based on June 30, 2011 market conditions.

(2)

(3)

ERCOT North ATC spark spread using Houston Ship Channel Gas, 7,200 heat rate, $2.50

variable O&M. Gross margin is defined as operating revenues less fuel expense and purchased

power expense, excluding the impact of decommissioning and other incidental revenues. Open

gross margin is estimated based upon an internal model that is developed by dispatching our expected generation to current market power and fossil fuel prices. Open

gross margin assumes there is no hedging in place other than fixed assumptions for capacity cleared in

the RPM auctions and uranium costs for nuclear power plants. Open gross margin contains

assumptions for other gross margin line items such as various ISO bill and ancillary revenues and costs and PPA capacity revenues and payments. The

estimation of open gross margin incorporates management discretion and modeling assumptions that are

subject to change. |

23

2011

2012

2013

Expected Generation

(GWh)

(1)

166,100

165,600

163,000

Midwest

99,000

97,900

95,800

Mid-Atlantic

56,300

57,100

56,500

South & West

10,800

10,600

10,700

Percentage of Expected Generation Hedged

(2)

95-98%

82-85%

49-52%

Midwest

95-98

81-84

48-51

Mid-Atlantic

96-99

85-88

50-53

South & West

86-89

63-66

45-48

Effective Realized Energy Price

($/MWh)

(3)

Midwest

$43.00

$41.00

$40.00

Mid-Atlantic

$57.00

$50.00

$50.50

South & West

$4.50

$0.00

($2.00)

Generation Profile

(1)

Expected generation represents the amount of energy estimated to be generated or purchased through

owned or contracted for capacity. Expected generation is based upon a simulated dispatch

model that makes assumptions regarding future market conditions, which are calibrated to market quotes for power, fuel, load following products,

and options. Expected generation assumes 12 refueling outages in 2011 and 10 refueling outages in 2012

and 2013 at Exelon-operated nuclear plants and Salem. Expected generation assumes

capacity factors of 93.0%, 93.4% and 93.2% in 2011, 2012 and 2013 at Exelon-operated nuclear plants. These estimates of expected generation in

2012 and 2013 do not represent guidance or a forecast of future results as Exelon has not completed

its planning or optimization processes for those years. (2)

Percent of expected generation hedged is the amount of equivalent sales divided by the expected

generation. Includes all hedging products, such as wholesale and retail sales of power,

options, and swaps. Uses expected value on options. Reflects decision to permanently retire Cromby Station and Eddystone Units 1&2 as of May 31, 2011.

(3)

Effective realized energy price is representative of an all-in hedged price, on a per MWh basis,

at which expected generation has been hedged. It is developed by considering the energy

revenues and costs associated with our hedges and by considering the fossil fuel that has been purchased to lock in margin. It excludes uranium

costs and RPM capacity revenue, but includes the mark-to-market value of capacity contracted

at prices other than RPM clearing prices including our load obligations. It can be

compared with the reference prices used to calculate open gross margin in order to determine the mark-to-market value of Exelon Generation's energy hedges.

|

24

Gross Margin Sensitivities with Existing Hedges ($ millions)

(1)

Henry Hub Natural Gas

+ $1/MMBtu

-

$1/MMBtu

NI-Hub ATC Energy Price

+$5/MWH

-$5/MWH

PJM-W ATC Energy Price

+$5/MWH

-$5/MWH

Nuclear Capacity Factor

+1% / -1%

2011

$5

$(5)

$5

$(5)

$5

$(5)

+/-

$25

2012

$85

$(35)

$95

$(75)

$55

$(55)

+/-

$45

2013

$340

$(290)

$250

$(245)

$155

$(150)

+/-

$50

Exelon Generation Gross Margin Sensitivities

(with Existing Hedges)

(1)

Based on June 30, 2011 market conditions and hedged position. Gas price

sensitivities are based on an assumed gas-power relationship derived from an internal

model that is updated periodically.

Power prices sensitivities are derived by adjusting the power price assumption

while keeping all other prices inputs constant. Due to

correlation

of

the

various

assumptions,

the

hedged

gross

margin

impact

calculated

by

aggregating

individual

sensitivities

may

not

be

equal

to

the

hedged

gross

margin impact calculated when correlations between the various assumptions are also

considered. |

25

95% case

5% case

$5,500

$7,100

$6,900

$6,000

Exelon Generation Gross Margin Upside / Risk

(with Existing Hedges)

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

2011

2012

2013

$6,800

$5,200

(1)

Represents an approximate range of expected gross margin, taking into account hedges in place, between

the 5th and 95th percent confidence levels assuming all unhedged supply is sold into the spot

market. Approximate gross margin ranges are based upon an internal simulation model and are subject to change based upon market

inputs, future transactions and potential modeling changes. These ranges of approximate gross margin

in 2012 and 2013 do not represent earnings guidance or a forecast of future results as Exelon

has not completed its planning or optimization processes for those years. The price distributions that generate this range are calibrated to market

quotes for power, fuel, load following products, and options as of June 30, 2011.

|

26

Midwest

Mid-Atlantic

South & West

Step 1

Start

with

fleetwide

open

gross

margin

$5.45 billion

Step 2

Determine

the

mark-to-market

value

of

energy hedges

99,000GWh * 96% *

($43.00/MWh-$33.18MWh)

= $0.93 billion

56,300GWh * 97% *

($57.00/MWh-$46.07MWh)

= $0.60 billion

10,800GWh * 87% *

($4.50/MWh-$3.77MWh)

= $0.00 billion

Step 3

Estimate

hedged

gross

margin

by

adding open gross margin to mark-to-

market value of energy hedges

Open gross margin:

MTM value of energy

hedges:

Estimated hedged gross margin:

Illustrative Example

of Modeling Exelon Generation 2011 Gross Margin

(with Existing Hedges)

$0.93 billion + $0.60 billion + $0.00 billion

$5.45 billion

$6.98 billion |

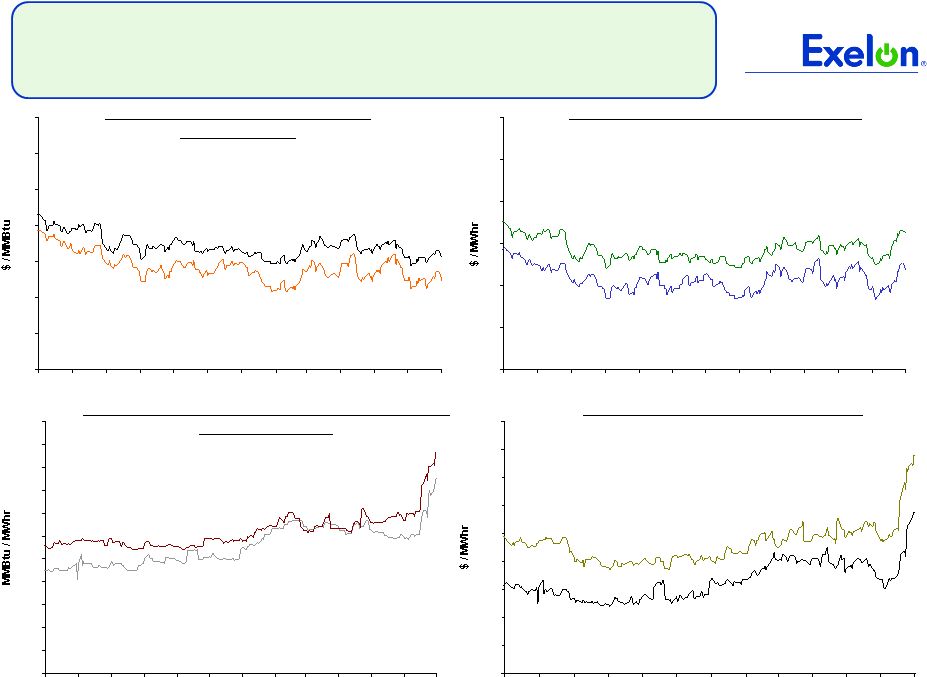

Market Price Snapshot

20

25

30

35

40

45

7/10

8/10

9/10

10/10

11/10

12/10

1/11

2/11

3/11

4/11

5/11

6/11

7/11

35

40

45

50

55

60

65

70

75

7/10

8/10

9/10

10/10

11/10

12/10

1/11

2/11

3/11

4/11

5/11

6/11

7/11

4.0

4.5

5.0

5.5

6.0

6.5

7.0

7/10

8/10

9/10

10/10

11/10

12/10

1/11

2/11

3/11

4/11

5/11

6/11

7/11

50

55

60

65

70

75

80

85

90

95

7/10

8/10

9/10

10/10

11/10

12/10

1/11

2/11

3/11

4/11

5/11

6/11

7/11

Forward NYMEX Natural Gas

PJM-West and Ni-Hub On-Peak Forward Prices

PJM-West and Ni-Hub Wrap Forward Prices

2012

$4.79

2013 $5.16

Forward NYMEX Coal

2012

$81.91

2013

$86.11

2012 Ni-Hub $42.20

2013 Ni-Hub

$44.54

2013 PJM-West $56.95

2012 PJM-West

$54.64

2012 Ni-Hub

$27.02

2013 Ni-Hub

$28.96

2013 PJM-West

$42.06

2012 PJM-West

$39.97

27

Rolling

12

months,

as

of

July

21 2011.

Source:

OTC

quotes

and

electronic

trading

system.

Quotes

are

daily.

st |

4.5

5.5

6.5

7.5

8.5

9.5

10.5

11.5

12.5

13.5

7/10

8/10

9/10

10/10

11/10

12/10

1/11

2/11

3/11

4/11

5/11

6/11

7/11

8.2

8.4

8.6

8.8

9.0

9.2

9.4

9.6

9.8

10.0

10.2

10.4

7/10

8/10

9/10

10/10

11/10

12/10

1/11

2/11

3/11

4/11

5/11

6/11

7/11

35

40

45

50

55

60

65

7/10

8/10

9/10

10/10

11/10

12/10

1/11

2/11

3/11

4/11

5/11

6/11

7/11

3.5

4.0

4.5

5.0

5.5

6.0

6.5

7.0

7/10

8/10

9/10

10/10

11/10

12/10

1/11

2/11

3/11

4/11

5/11

6/11

7/11

Market Price Snapshot

2013

10.13

2012

9.91

2012

$46.86

2013

$51.26

2012

$4.73

2013

$5.06

Houston Ship Channel Natural Gas

Forward Prices

ERCOT North On-Peak Forward Prices

ERCOT North On-Peak v. Houston Ship Channel

Implied Heat Rate

2012

$10.24

2013

$12.25

ERCOT North On Peak Spark Spread

Assumes a 7.2 Heat Rate, $1.50 O&M, and $.15 adder

28

Rolling

12

months,

as

of

July

21 2011.

Source:

OTC

quotes

and

electronic

trading

system.

Quotes

are

daily.

st |

29

Appendix |

30

EPA Regulations are Moving Forward

2010

2011

2012

2013

2014

2015

2016

2017

2018

PJM RPM Auction

14/15

15/16

16/17

17/18

Hazardous Air

Pollutants

Criteria

Pollutants

Greenhouse

Gases

Coal

Combustion

By-Products

Cooling Water

Effluents

Develop Toxics Rule

Pre Compliance Period

Compliance With Toxics Rule

Compliance With Cross-State Air Pollution Rule (CSAPR)

Interim CAIR

Develop CSAPR (2)

Estimated Compliance

Develop Criteria

NSPS revision

Compliance with Revised Criteria NSPS

Develop Revised

NAAQS

SIP provisions developed in response to revised NAAQS

(e.g., Ozone, PM2.5, SO2, NO2, NOx/SOx, CO)

Compliance with Federal GHG Reporting Rule

PSD/BACT and Title V Apply to GHG Emissions (PSD only for new and modified

sources) Develop GHG NSPS

Pre Compliance Period

Compliance With GHG NSPS

Develop Coal Combustion

By-Products Rule

Pre Compliance Period

Compliance With Federal CCB Regulations

Develop 316(b) Regulations

Pre Compliance Period

Phase In Of Compliance

Develop Effluent Regulations

Pre Compliance Period

Phase In Of

Compliance

Develop Cross-

State Air Pollution

Rule

Notes: RPM auctions take place annually in May.

For definition of the EPA regulations referred to on this slide, please see the EPA’s Terms of

Environment (http://www.epa.gov/OCEPAterms/). |

Wolf

Hollow Acquisition 31

Wolf Hollow Overview

Diversifies generation portfolio

•

Expands geographic and fuel characteristics

of fleet

•

Advances Exelon and Constellation merger

strategy of matching load with generation in

key competitive markets

Creates value for shareholders

•

$305M purchase price compares favorably to

cost of other recent transactions

•

Free cash flow accretive beginning in 2012;

earnings and credit neutral

•

Eliminates current above market purchase

power agreement (PPA) with Wolf Hollow

•

Enhances opportunity to benefit from future

market heat rate expansion in ERCOT

Transaction expected to close in Q3 2011

Location

Granbury, Texas

Commercial Operation Date

August 2003

Nominal Net Operating Capacity

720MW

Equipment Technology

2 Mitsubishi combined-cycle gas

turbines

Primary Fuel

Natural Gas

Secondary Fuel

None

ERCOT = Electric Reliability Council of Texas |

32

Exelon Nuclear Fleet Overview -

IL

Plant

Location

Type/

Containment

Water Body

License Extension

Status / License

Expiration

(1)

Ownership

Spent Fuel Storage/

Date to lose full

core discharge

capacity

(2)

Braidwood, IL

(Units 1 and 2)

PWR

Concrete/Steel

Lined

Kankakee

River

Expect to file

application in 2013/

2026, 2027

100%

Dry Cask (Summer

2011)

Byron, IL

(Units 1 and 2)

PWR

Concrete/Steel

Lined

Rock River

Expect to file

application in 2013/

2024, 2026

100%

Dry Cask

Clinton, IL

(Unit 1)

BWR

Concrete/Steel

Lined

Clinton Lake

2026

100%

2018

Dresden, IL

(Units 2 and 3)

BWR

Steel Vessel

Kankakee

River

Renewed / 2029,

2031

100%

Dry cask

LaSalle, IL

(Units 1 and 2)

BWR

Concrete/Steel

Lined

Illinois River

2022, 2023

100%

Dry Cask

Quad Cities, IL

(Units 1 and 2)

BWR

Steel Vessel

Mississippi

River

Renewed / 2032

75% Exelon, 25%

Mid-American

Holdings

Dry cask

(1)

Operating license renewal process takes approximately 4-5 years from

commencement until completion of NRC review. (2)

Exelon pursues license extensions well in advance of expiration to ensure adequate time

for review by the NRC

The date for loss of full core reserve identifies when the on-site storage pool will no longer

have sufficient space to receive a full complement of fuel from the reactor core. Dry cask

storage will be in operation at those sites prior to losing full core discharge capacity in their on-site storage pools. |

33

Exelon Nuclear Fleet Overview –

PA and NJ

Plant, Location

Type,

Containment

Water Body

License Extension

Status / License

Expiration

(1)

Ownership

Spent Fuel Storage/

Date to lose full

core discharge

capacity

(2)

Limerick, PA

(Units 1 and 2)

BWR

Concrete/Steel

Lined

Schuylkill

River

Filed application in

June 2011

(decision expected

in 2013)/ 2024,

2029

100%

Dry cask

Oyster Creek, NJ

(Unit 1)

BWR

Steel Vessel

Barnegat Bay

Renewed / 2029

(3)

100%

Dry cask

Peach Bottom, PA

(Units 2 and 3)

BWR

Steel Vessel

Susquehanna

River

Renewed / 2033,

2034

50% Exelon,

50% PSEG

Dry cask

TMI, PA (Unit 1)

PWR

Concrete/Steel

Lined

Susquehanna

River

Renewed / 2034

100%

2023

Salem, NJ (Units 1

and 2)

PWR

Concrete/Steel

Lined

Delaware

River

Renewed / 2036,

2040

42.6% Exelon,

57.4% PSEG

Dry Cask

(1)

Operating license renewal process takes approximately 4-5 years from

commencement until completion of NRC review. (2)

The date for loss of full core reserve identifies when the on-site storage pool

will no longer have sufficient space to receive a full complement of fuel from the

reactor

(3)

On December 8, 2010, Exelon announced that Generation will permanently cease

generation operations at Oyster Creek by December 31, 2019. The current NRC

license for Oyster Creek expires in 2029. Exelon pursues license extensions well in advance of

expiration to ensure adequate time for review by the NRC

core. Dry cask storage will be in operation at those sites prior to losing full core discharge

capacity in their on-site storage pools. |

ComEd

2010 Rate Case Final Order (ICC Docket No. 10-0467)

On 5/24/11, the Illinois Commerce Commission (ICC) issued an order in ComEd’s

2010 distribution rate case –

new rates went into effect in June 2011

Rate Case Details

ICC Order

(5/24/11)

ComEd Reply Brief

(2/23/11)

Revenue Requirement Increase

$143M

(1)

$343M

Rate Base

$6,549M

$7,349M

ROE

10.50%

11.30%

(2)

Equity Ratio

47.28%

47.28%

(1)

Reflects ~$(13)M adjustment to ICC Order

(2)

Included 40 bp adder for energy efficiency, not approved by ICC

34 |

ComEd

Load Trends Chicago

U.S.

Unemployment rate

(1)

9.3%

9.2%

2011 annualized growth in

gross

domestic/metro

product

(2)

2.5%

2.7%

Note: C&I = Commercial & Industrial

Weather-Normalized Load Year-over-Year

Key Economic Indicators

Weather-Normalized Load

2010

2Q11 2011E

Average Customer Growth

0.2%

0.4%

0.4%

Average Use-Per-Customer

(1.4)%

(2.0)%

0.0%

Total Residential

(1.2)%

(1.6)% 0.4%

Small C&I

(0.6)%

(0.2)%

(0.3)%

Large C&I

2.6%

(0.9)%

0.0%

All Customer Classes

0.2%

(0.8)%

0.0%

(1)

Source: U.S. Dept. of Labor (June 2011) and Illinois

Department of Security (June 2011)

(2) Source: Global Insight (May 2011)

35

6.0%

3.0%

0.0%

-3.0%

-6.0%

6.0%

3.0%

0.0%

-3.0%

-6.0%

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

All Customer Classes

Residential

Large C&I

Gross Metro Product |

Illinois Power Agency (IPA)

RFP Procurement

June 2012

June 2013

June 2014

Financial Swap Agreement with ExGen

(ATC baseload energy –

notional quantity

3,000 MW)

Standard Products and Annual REC Procurement held in

May 2011

–

Effective ATC of $34.77/MWh for 9 winning Standard Product

suppliers for the 2011-12 plan-year

–

2.12 million MWh of renewable resources for the 2011-12 plan-year

from 12 winning suppliers

–

Provisions included:

•

Annual energy procurements over a three-year time frame

•

Target a 35%/35%/30% laddered procurement approach

•

No additional Energy Efficiency, Demand Response purchases

•

No additional long-term contracts for renewables

•

No 10% overprocurement for summer peak energy

June 2015

Delivery

Period

Peak

Off-Peak

June 2011 -

May 2012

5,118

4,001

June 2012 -

May 2013

1,129

358

June 2013 -

May 2014

6,494

6,062

Volume procured in the 2011 IPA

Procurement Event (GWh)

Term

Fixed Price

($/MWh)

1/1/11-12/31/11

$51.26

1/1/12-12/31/12

$52.37

1/13/13-5/31/13

$53.48

36

June 2011

Financial Swap

2010 RFP

2011 RFP

2011 RFP

2011 RFP

2012 RFP

2012 RFP

2012 RFP

2013 RFP

2013 RFP

2014 RFP

Note: Chart is for illustrative purposes only.

REC = Renewable Energy Credit; RFP = request for proposal; ATC = Around the Clock

|

37

PECO Load Trends

Philadelphia

U.S.

Unemployment rate

(1)

7.9%

9.2%

2011 annualized growth in

gross domestic/metro product

(2)

2.4%

2.7% Note: C&I = Commercial &

Industrial Weather-Normalized Load Year-over-Year

Key Economic Indicators

Weather-Normalized Load

2010

2Q11 2011E

Average Customer Growth

0.3%

0.5%

0.4%

Average Use-Per-Customer

0.3%

2.8%

1.7%

Total Residential

0.5%

3.2% 2.2%

Small C&I

(1.9)%

1.7% 0.7%

Large C&I

0.8%

(3.3)% (2.3)%

All Customer Classes

0.1%

(0.1)% (0.0)%

(1) Source:

U.S

Dept.

of

Labor

data

June

2011

-

US

U.S

Dept.

of

Labor

prelim.

data

February

2011

-

Philadelphia

(2) Source: Global Insight May 2011 |

38

PECO Procurement Plan

Customer Class

Products

Residential

75% full requirements

20% block energy

5% energy only spot

Small Commercial

(peak demand <100 kW)

90% full requirements

10% full requirements spot

Medium Commercial

(peak demand >100 kW but

<= 500 kW)

85% full requirements

15% full requirements spot

Large Commercial &

Industrial (peak demand

>500 kW)

Fixed-Priced full

requirements

(2)

Hourly full requirements

PECO

Procurement Plan

(1)

Residential –

weighted average wholesale prices

80 MW of baseload (24x7) block energy product (for Jan-Dec 2012) –

$51.52/MWh

70 MW of Jun-Aug 2011 summer on-peak block energy product –

$67.24/MWh

40 MW of Dec 2011-Feb 2012 winter on-peak block energy product

– $63.05/MWh

Large Commercial and Industrial (Hourly) –

weighted average

wholesale price

36%

of

hourly

full

requirements

product

(for

Jun

2011-May

2012)

(3)

–

$4.97/MWh

(4)

May 2, 2011

RFP

-

Fifth

in

a

series

of nine

procurements for the PUC-approved

Default Service Plan

Spring

2011

RFP

was

held

on

May

2,

2011,

with

results

announced

on

May

18

th

(1)

See PECO Procurement website (http://www.pecoprocurement.com) for additional details regarding

PECO’s procurement plan and RFP results. (2)

For Large C&I customers who previously opted to participate in the 2011 fixed-priced full

requirements product. (3)

Large C&I tranches which were not fully subscribed in the fall 2010 procurement.

(4)

The price for the hourly full requirements product includes only ancillary services/Alternative Energy

Portfolio Standard (AEPS) and miscellaneous costs. The price does not include energy and

capacity costs. Energy costs will be based on the PECO Zone Day-Ahead locational marginal pricing (LMP) price, and capacity will be based on the

PJM RPM price per day. |

39

Sufficient Liquidity

($ millions)

Exelon

(3)

Aggregate Bank Commitments

(1)

$1,000

$600

$5,600

$7,700

Outstanding Facility Draws

--

--

--

--

Outstanding Letters of Credit

(195)

(1)

(121)

(324)

Available Capacity Under Facilities

(2)

805

599

5,479

7,376

Outstanding Commercial Paper

--

--

--

(139)

Available Capacity Less Outstanding

Commercial Paper

$805

$599

$5,479

$7,237

Exelon bank facilities are largely untapped

(1) Excludes commitments from Exelon’s Community and Minority Bank

Credit Facility (2) Available Capacity Under Facilities represents the

unused bank commitments under the borrower’s credit agreements net of outstanding letters of credit and facility draws. The

amount of commercial paper outstanding does not reduce the available capacity under

the credit agreements. (3) Includes Exelon Corporate’s

$500M credit facility, letters of credit and commercial paper outstanding.

Available Capacity Under Bank Facilities as of July 14, 2011

|

40

Key Credit Metrics

0.0x

2.0x

4.0x

6.0x

8.0x

10.0x

12.0x

2009A

2010A

2011E

ExGen/Corp

ComEd

PECO

Exelon

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

2009A

2010A

2011E

ExGen/Corp

ComEd

PECO

Exelon

FFO / Debt

(1)

(1)

See slide 41 for reconciliations to GAAP.

(2)

Current senior unsecured ratings for Exelon and Exelon Generation and senior

secured ratings for ComEd and PECO as of July 22, 2011. (3)

FFO/Debt Target Range reflects Generation FFO/Debt in addition to the debt

obligations of Exelon Corp. (4)

Moody’s placed Exelon and Generation under review for a possible downgrade

after the proposed merger with Constellation Energy was announced.

Moody’s

Credit

Ratings

(2)

S&P

Credit

Ratings

(2)

Fitch

Credit

Ratings

(2)

FFO / Debt

Target

Range

(2)

Exelon:

Baa1

(4)

BBB-

BBB+

ComEd:

Baa1

A-

BBB+

15-18%

PECO:

A1

A-

A

15-18%

Generation:

A3

(4)

BBB

BBB+

30-35%

(3)

Interest Coverage

(1)

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2009A

2010A

2011E

ExGen/Corp

ComEd

PECO

Exelon

Debt / Cap

(1) |

41

Exelon Consolidated Metric Calculations and Ratios

(1)

Includes changes in A/R, Inventories, A/P and other accrued expenses, option

premiums, counterparty collateral and income taxes. Impact to FFO is

opposite of impact to cash flow (2)

Reflects retirement of variable interest entity + change in restricted cash

(3)

Reflects

net

capacity

payment

–

interest

on

PV

of

PPAs

(using

weighted

average

cost

of debt)

(4)

Reflects

employer

contributions

–

(service

costs

+

interest

costs

+

expected

return

on

assets),

net of

taxes at 35%

(5)

Reflects

operating

lease

payments

–

interest

on

PV

of

future

operating

lease

payments

(using

weighted average cost of debt)

(6)

Includes AFUDC / capitalized interest

(7)

Reflects PV of net capacity purchases (using weighted average cost of debt)

$ in millions

(8)

Reflects unfunded status, net of taxes at 35%

(9)

Reflects PV of minimum future operating lease payments (using weighted average cost

of debt) (10)

Nuclear decommissioning trust fund balance > asset retirement obligation.

No debt imputed (11)

Includes accrued interest less securities qualifying for hybrid treatment (50% debt

/ 50% equity) (12)

Reflects interest on PV of minimum future operating lease payments (using weighted

average cost of debt)

(13)

Reflects interest on PV of PPAs

(using weighted average cost of debt)

(14)

Includes

AFUDC

/

capitalized

interest

and

interest

on

securities

qualifying

for

hybrid

treatment

(50% debt / 50% equity)

(15)

Includes interest on securities qualifying for hybrid treatment (50% debt / 50%

equity) FFO / Debt Coverage =

FFO (a)

Adjusted Debt (b)

FFO Interest Coverage =

FFO (a) + Adjusted Interest (c)

Adjusted Interest (c)

Adjusted Capitalization (e) =

Adjusted Debt (b) + Adjusted Equity (d)

=

32,606

Rating Agency Debt Ratio =

Adjusted Debt (b)

Adjusted Capitalization (e)

32%

7.2x

58%

=

=

=

2010A Credit Metrics

Exelon 2010 YE Adjustments

FFO Calculation

2010 YE

Source -

2010 Form 10-K (.pdf

version)

Net Cash Flows provided by Operating Activities

5,244

Pg 159 -

Stmt. of Cash Flows

+/-

Change in Working Capital

644

Pg 159 -

Stmt. of Cash Flows

(1)

-

PECO Transition Bond Principal Paydown

(392)

Pg 174 -

Stmt. of Cash Flows

(2)

+ PPA Depreciation Adjustment

207

Pg 295 -

Commitments and Contingencies

(3)

+/-

Pension/OPEB Contribution Normalization

448

Pg 268-269 -

Post-retirement Benefits

(4)

+ Operating Lease Depreciation Adjustment

35

Pg 299 -

Commitments and Contingencies

(5)

+/-

Decommissioning activity

(143)

Pg 159-

Stmt. of Cash Flows

+/-

Other Minor FFO Adjustments

(6)

(54)

= FFO (a)

5,989

Debt Calculation

Long-term Debt (incl. Current Maturities and A/R agreement)

12,828

Pg 161 -

Balance Sheet

Short-term debt (incl. Notes Payable / Commercial Paper)

-

Pg 161 -

Balance Sheet

-

PECO Transition Bond Principal Paydown

-

N/A -

no debt outstanding at year-end

+ PPA Imputed Debt

1,680

Pg 295 -

Commitments and Contingencies

(7)

+ Pension/OPEB Imputed Debt

3,825

Pg 268 -

Post-retirement benefits

(8)

+ Operating Lease Imputed Debt

428

Pg 299 -

Commitments and Contingencies

(9)

+ Asset Retirement Obligation

-

Pg 261-267 -

Asset Retirement Obligations

(10)

+/-

Other Minor Debt Equivalents

(11)

84

= Adjusted Debt (b)

18,845

Interest Calculation

Net Interest Expense

817

Pg 158 -

Statement of Operations

-

PECO Transition Bond Interest Expense

(22)

Pg 182 -

Significant Accounting Policies

+ Interest on Present Value (PV) of Operating Leases

29

Pg 299 -

Commitments and Contingencies

(12)

+ Interest on PV of Purchased Power Agreements (PPAs)

99

Pg 295 -

Commitments and Contingencies

(13)

+/-

Other Minor Interest Adjustments

(14)

37

= Adjusted Interest (c)

960

Equity Calculation

Total Equity

13,563

Pg 161 -

Balance Sheet

+ Preferred Securities of Subsidaries

87

Pg 161 -

Balance Sheet

+/-

Other Minor Equity Equivalents

(15)

111

= Adjusted Equity (d)

13,761 |

42

2Q GAAP EPS Reconciliation

Three Months Ended June 30, 2011

ExGen

ComEd

PECO

Other

Exelon

2011 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share

$0.79

$0.15

$0.13

$(0.01)

$1.05

Mark-to-market impact of economic hedging activities

(0.12)

-

-

-

(0.12)

Unrealized gains related to nuclear decommissioning trust funds

0.01

-

-

-

0.01

Retirement of fossil generating units

(0.02)

-

-

-

(0.02)

Recovery of costs pursuant to distribution rate case order

-

0.03

-

-

0.03

Constellation merger costs

-

-

-

(0.02)

(0.02)

2Q 2011 GAAP Earnings (Loss) Per Share

$0.67

$0.17

$0.13

$(0.03)

$0.93

NOTE: All amounts shown are per Exelon share and represent contributions to

Exelon's EPS. Amounts may not add due to rounding. Three Months Ended

June 30, 2010 ExGen

ComEd

PECO

Other

Exelon

2010 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share

$0.69

$0.18

$0.15

$(0.02)

$0.99

2007 Illinois electric rate settlement

(0.01)

-

-

-

(0.01)

Mark-to-market impact of economic hedging activities

(0.11)

-

-

-

(0.11)

Unrealized losses related to nuclear decommissioning trust funds

(0.08)

-

-

-

(0.08)

Retirement of fossil generating units

(0.02)

-

-

-

(0.02)

Non-cash remeasurement of income tax uncertainties

0.10

(0.16)

(0.03)

(0.01)

(0.10)

2Q 2010 GAAP Earnings (Loss) Per Share

$0.57

$0.02

$0.11

$(0.03)

$0.67 |

43

YTD GAAP EPS Reconciliation

Six Months Ended June 30, 2011

ExGen

ComEd

PECO

Other

Exelon

2011 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share

$1.69

$0.26

$0.32

$(0.04)

$2.22

Mark-to-market impact of economic hedging activities

(0.25)

-

-

-

(0.25)

Unrealized gains related to nuclear decommissioning trust funds

0.04

-

-

-

0.04

Retirement of fossil generating units

(0.04)

-

-

-

(0.04)

Non-cash charge resulting from Illinois tax rate change legislation

(0.03)

(0.01)

-

-

(0.04)

Recovery of costs pursuant to distribution rate case order

-

0.03

-

-

0.03

Constellation merger costs

-

-

-

(0.02)

(0.02)

YTD 2011 GAAP Earnings (Loss) Per Share

$1.41

$0.28

$0.32

$(0.06)

$1.94

NOTE: All amounts shown are per Exelon share and represent contributions to

Exelon's EPS. Amounts may not add due to rounding. Six Months Ended June

30, 2010 ExGen

ComEd

PECO

Other

Exelon

2010 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share

$1.35

$0.37

$0.31

$(0.04)

$1.99

2007 Illinois electric rate settlement

(0.01)

-

-

-

(0.01)

Mark-to-market impact of economic hedging activities

0.10

-

-

-

0.10

Unrealized losses related to nuclear decommissioning trust funds

(0.05)

-

-

-

(0.05)

Non-cash charge resulting from health care legislation

(0.04)

(0.02)

(0.02)

(0.02)

(0.10)

Non-cash charge remeasurement of income tax uncertainties

0.10

(0.16)

(0.03)

(0.01)

(0.10)

Retirement of fossil generating units

(0.03)

-

-

-

(0.03)

YTD 2010 GAAP Earnings (Loss) Per Share

$1.42

$0.19

$0.26

$(0.07)

$1.80 |

44

GAAP to Operating Adjustments

Exelon’s 2011 adjusted (non-GAAP) operating earnings outlook excludes the

earnings effects of the following:

•

Mark-to-market adjustments from economic hedging activities

•

Unrealized gains and losses from nuclear decommissioning trust fund investments to

the extent not offset by contractual accounting as described in the notes

to the consolidated financial statements

•

Significant impairments of assets, including goodwill

•

Changes in decommissioning obligation estimates

•

Non-cash charge to remeasure deferred taxes at higher Illinois corporate tax

rates •

Financial impacts associated with the planned retirement of fossil generating

units •

One-time benefits reflecting ComEd’s 2011 distribution rate case order

for the recovery of previously

incurred

costs

related

to

the

2009

restructuring

plan

and

for

the

passage

of

Federal

health care legislation in 2010

•

Certain costs associated with Exelon’s proposed merger with

Constellation •

Other unusual items

•

Significant changes to GAAP

Operating

earnings

guidance

assumes

normal

weather

for

remainder

of

the

year |