Attached files

| file | filename |

|---|---|

| EX-21.1 - INTEGRATED FREIGHT Corp | ifc10kaex21.htm |

| EX-3.1 - INTEGRATED FREIGHT Corp | ifc10kaex31.htm |

| EX-3.2 - INTEGRATED FREIGHT Corp | ifc10kaex32.htm |

| EX-32.1 - INTEGRATED FREIGHT Corp | integrat10ka153111x321_71411.htm |

| EX-31.2 - INTEGRATED FREIGHT Corp | integrat10ka153111_x31271411.htm |

| EX-31.1 - INTEGRATED FREIGHT Corp | integrat10ka153111x311_71411.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

AMENDMENT NO. 1

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934: For the fiscal year ended March 31, 2011

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934:

|

Commission file number: 000–14273

INTEGRATED FREIGHT CORPORATION

(Exact name of registrant as specified in its charter)

|

FLORIDA

|

84–0868815

|

|

|

State or other jurisdiction of

incorporation or organization

|

I.R.S. Employer

Identification No.

|

|

Suite 200

6371 Business Boulevard

Sarasota, Florida

|

34240

|

|

|

(Address of principal executive offices)

|

(Zip code)

|

Issuer’s telephone number: (941) 907-8372

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act:

|

Title of each class:

|

Name of Exchange on which registered:

|

|

Common Stock, $0.001 par value per share

|

(None)

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes

o

|

No

þ

|

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

Yes

o

|

No

þ

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Yes

þ

|

No

o

|

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes

o

|

No

þ

|

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

þ

|

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

Large accelerated filer

|

o |

Accelerated filer

|

o |

|

Non-accelerated filer

|

o |

Smaller reporting company

|

þ |

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

|

Yes

o

|

No

þ

|

|

The aggregate market value* of the voting and non-voting common equity held by non-affiliates was: $3,939,496

|

|

|

The number of shares of the registrant’s common stock outstanding at June 30, 2011 was: 37,632,082 shares

|

|

||||

Table of Contents

|

Page

|

||

|

Part I

|

||

|

Item 1.

|

Business

|

5

|

|

Item 1A.

|

Risk Factors

|

12

|

|

Item 1B.

|

Unresolved Staff Comments

|

18

|

|

Item 2.

|

Properties

|

19

|

|

Item 3.

|

Legal Proceedings

|

20

|

|

Item 4.

|

Submission of Matters to a Vote of Security Holders

|

20

|

|

Part II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

21

|

|

Item 6.

|

Selected Financial Data

|

22

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

22

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

30

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

30

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

30

|

|

Item 9A.

|

Controls and Procedures

|

30

|

|

Item 9B.

|

Other Information

|

31

|

|

Part III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

30

|

|

Item 11.

|

Executive Compensation

|

34

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

36

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

37

|

|

Item 14.

|

Principal Accounting Fees and Services

|

37

|

|

Part IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

39

|

|

Signatures

|

40

|

3

DOCUMENTS INCORPORATED BY REFERENCE

We have not incorporated any documents by reference.

SUMMARIES OF REFERENCED DOCUMENTS

This amendment No. 1 to this annual report on Form 10-K/A contains references to, summaries of and selected information from agreements and other documents. These agreements and documents are not incorporated by reference; but, they are filed as exhibits to this annual report or to other reports we have filed with the U.S. Securities and Exchange Commission.Whenever we make reference in this annual report to any of our agreements and other documents, the references are not necessarily complete. The summaries of and selected information from those agreements and other documents are qualified in their entirety.You may obtain the full text of the agreements and documents from the Public Reference Section of or online from the Commission. See “Where You Can Find Agreements And Other Documents Referred To In This Annual Report” for instructions as to how to access and obtain this information.

WHERE YOU CAN FIND AGREEMENTS AND OTHER DOCUMENTS REFERRED TO IN THIS ANNUAL REPORT

We file reports with the U.S. Securities and Exchange Commission pursuant to Section 13 of the Securities Exchange Act of 1934. You may read and copy any reports and other materials we have filed with the Commission at the Commission’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. The Commission maintains an Internet site at which you may obtain all reports, proxy and information statements, and other information that we file with the Commission. The address of the Commission’s web site is http://www.sec.gov. Under “Forms and Filings”, select “Search for Company Filings”.

FORWARD-LOOKING STATEMENTS

This annual report on Form 10–K and the information incorporated by reference, if any, includes “forward–looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended. We intend the forward–looking statements to be covered by the safe harbor provisions for forward–looking statements in these sections.

This annual report on Form 10–K contains forward-looking statements that involve risks and uncertainties. We use words such as “project,” “believe,” “anticipate,” “plan,” “expect,” “estimate,” “intend,” “should,” “would,” “could,” “will,” or “may,” or other such words, verbs in the future tense and words and phrases that convey similar meaning and uncertainty of future events or outcomes to identify these forward-looking statements. There are a number of important factors beyond our control that could cause actual results to differ materially from the results anticipated by these forward-looking statements. While we make these forward–looking statements based on various factors and derived using numerous assumptions, we have no assurance the factors and assumptions will prove to be materially accurate when the events they anticipate actually occur in the future.

These important factors include those that we discuss in this annual report under the caption “Risk Factors”, as well as elsewhere in this annual report. You should read these factors and the other cautionary statements made in this annual report as being applicable to all related forward-looking statements wherever they appear in this annual report. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

4

PART I

ITEM 1. BUSINESS.

Our corporate and business history.

“We”, “our” and “us", as used in this annual report, refer to Integrated Freight Corporation and our predecessor, PlanGraphics, Inc., and includes the following wholly owned subsidiaries, during the periods indicated:

|

· PlanGraphics, Inc., a Maryland corporation, (“PGI-MD”) our only subsidiary prior to December 27, 2009, when we sold it.

|

|

· Integrated Freight Corporation, a Florida corporation, (“Original IFC”) between December 3, 2009, when we acquired a controlling interest, and December 23, 2009, when we merged Original IFC into us.

|

|

· Morris Transportation, Inc., an Arkansas corporation, beginning December 23, 2009, when we acquired a controlling interest in Original IFC. Original IFC purchased all of Morris Transportation’s common stock as of September 1, 2008.

|

|

· Smith Systems Transportation, Inc., a Nebraska corporation, beginning December 23, 2009, when we acquired a controlling interest in Original IFC. Original IFC purchased all of Smith System’s common stock as of September 1, 2008.

|

|

· Triple C Transport, Inc., a Nebraska corporation, beginning as of May 5, 2010, when we purchase all of its common stock. We have filed an action to rescind this acquisition. See Item 3. Legal Proceedings, below.

|

|

· Cross Creek Trucking, Inc., an Oregon corporation, beginning April 1, 2011, when we purchased all of its common stock. Financial information for Cross Creek Trucking is not include in our financial statements at and for the year ended March 31, 2011.

|

The address of our principal executive offices is Suite 200, 6371 Business Boulevard, Sarasota, FL 34240, and our telephone number at that address is (941) 907-8372. The address of our web site is www.integrated-freight.com.

We were incorporated as Douglas County Industries, Inc. in Colorado in 1981. We underwent several name changes prior to 1997, our name at that time being DCX, Inc. In 1997, we acquired all of the outstanding shares of what is now PGI–MD. In 1998, we changed our name to Integrated Spatial Information Solutions, Inc. from DCX, Inc. In 2002, we changed our name to PlanGraphics, Inc. from Integrated Spatial Information Solutions, Inc. On August 18, 2010, we changed our name to Integrated Freight Corporation when we changed our corporate domicile to Florida from Colorado.

Original IFC was incorporated as Integrated Freight Systems, Inc. in Florida on May 13, 2008 by Paul A. Henley, its founder. Original IFC changed its name to Integrated Freight Corporation on July 27, 2009. Mr. Henley is currently one of our directors and our chief executive officer. Mr. Henley founded Original IFC for the purpose of acquiring and consolidating operating motor freight companies. Original IFC acquired the following companies:

|

Company Name

|

Year Established

|

Acquisition Date

|

||||||

|

Morris Transportation, Inc.

|

1998 |

As of September 1, 2008

|

||||||

|

Smith Systems Transportation, Inc.

|

1992 |

As of September 1, 2008

|

||||||

In 2010, we acquired a third motor freight carrier:

|

Company Name

|

Year Established

|

Acquisition Date

|

||||||

|

Triple C Transport, Inc.

|

2006 |

As of May 5, 2010

|

||||||

We have filed an action to rescind this acquisition, based on fraud and breach of representations and warrants by the sellers. See Item 3. Legal Proceedings, below. This company discontinued operationsafter the end of our fiscal year.

In 2011, after our fiscal year 2011 end, we acquired a fourth motor freight carrier:

|

Company Name

|

Year Established

|

Acquisition Date

|

||||||

|

Cross Creek Trucking, Inc.

|

1986 |

As of April 1, 2011

|

||||||

Although we have begun to consolidate some operational functions of these subsidiaries, such as insurance , fuel and tire purchasing, we are operating these subsidiaries as independent companies under the management of their founders and stockholders from whom we purchased them, with the exception of Cross Creek Trucking in which the founder and stockholder is no longer involved. We expect this management arrangement to continue until we are able to obtain sufficient debt or equity funding to cover the cost of combining and consolidating other functions of their operations that are duplicative. We estimate that this consolidating activity will cost approximately $1,000,000.

5

In February 2011, we incorporated Integrated Freight Services, Inc. to operate as a freight brokerage company.

Overview of Our Truck Transportation Business

We are, beginning December 27, 2009, the date of our acquisition of Original IFC, a holding company exclusively of three operating motor freight carriers, providing truck load service throughout the forty-eight contiguous United States and one freight broker. We do not specialize in any specific types of freight or commodities. We carry dry freight, refrigerated freight and hazmat and certain hazardous materials including hazardous waste. We provide long-haul, regional and local service to our customers. The following description of our business includes information about Cross Creek Trucking, a fourth motor freight carrier, which we purchased after the end of our most recent fiscal year. Triple C Transport discontinued operationsafter the end of our most recent fiscal year. Accordingly, we have not included any information, other than financial information, related to the operations of Triple C Transport during our 2011 fiscal year. All data in this Item 1 reflects our business at the date we have filed this annual report.

Our Strategy

Truck transportation in general has suffered during the recent economic recession. According to the American Trucking Association, freight transportation tonnage and revenue retracted 19 and 18 percent, respectively, from peak to trough during the so-called “Great Recession" (Transport Topics The American Trucking Association, May 31, 2011). Although the economy has staged a slow recovery since that time, carriers are presently dealing with both extraordinarily high fuel prices and a growing shortage of qualified drivers. We believe the trucking companies that have survived in the recent economic recession, whether presently profitable or marginally unprofitable, represent good future value at the prices for which we believe many of them can be acquired. Our management believes that many of them will require debt and equity funding and cost reductions which they may be unlikely to obtain or achieve individually. We believe that the demand for truck transportation services is returning to pre-recession levels, with an inadequate supply of trucks to meet demand. The American Trucking Association Tonnage Index reported a 3.5 percent increase in tonnage of freight shipped in the first two months of 2010. (Transport Topics, March 29, 2011). According to the ATA tonnage has improved another 5.9% for the same period in 2011 (ATA’s Monthly Truck Tonnage Report, March 31, 2011). We believe our strategy will position us to fill part of the demand for over-the-road freight services.

We intend to continue acquiring well established trucking companies when we can do so at prices which we deem to be advantageous. In the alternative, we may acquire assets. We also plan to expand beyond our truckload service through acquisitions into logistics, less-than-truckload (LTL) and expedited/just-in-time services, as opportunities are presented to us.. Our strategy is highly dependent on our ability to obtain financing for acquisitions, including more favorable refinancing of revenue producing assets and accounts receivables, when we cannot make acquisitions for stock and with extended cash payment terms. We have experienced difficulty obtaining such financing. You have no assurance we will be able to obtain financing for additional acquisitions which require immediate payment of cash consideration.

We believe that we can achieve savings in operating costs by centralizing certain common functions of our subsidiaries, such as administration, insurance, fuel and tire purchasing, billing and collections, dispatching, maintenance scheduling and other functions. While some of these cost-saving actions can be taken without significant cost, others will require us to obtain additional funding, as noted above. We have begun our consolidating activities in insurance and fuel and tire purchasing. We believe that with a larger service territory and customer base than any one subsidiary would have working alone, we will be able to achieve greater efficiencies in route and equipment utilization.

Our Markets

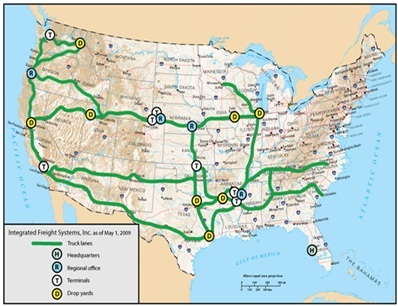

Historically our subsidiary companies have operated in well-established geographic traffic lanes or routes. These lanes are defined by our customers’ distribution patterns. Because there is some overlap within the most heavily traveled lanes, especially between points in the upper Midwest and Texas, we believe we will realize increased cost and productivity improvements.

Our market is concentrated in the western half of the U.S., ranging from the Ohio Valley and North Central moving through the Mid & Southwest and more recently in the Pacific Northwest. We have light coverage in the Northeast. Our dry van and hazardous materials subsidiaries operate in regional areas, and thus have length of hauls typical of a day to two days of travel. Our refrigerated operations cover a larger geographic area with longer lengths of haul. Our brokerage services enable us to expand our customer service offerings by providing the non-asset-based capability of arranging with other carriers to haul our customers' freight when the shipments do not fit our asset-based model.

6

*A drop yard is a temporary or semi permanent location we rent to store trailers when not in use between pick-ups and deliveries. Typically, we rent drop yards in terminal facilities of other motor freight carriers, which provide security.

Our Customers and Marketing

We serve approximately 250 customers on a regular basis. Although we do not have contracts with any of these customers, we have long-standing relationships with most of them.

The following table presents information regarding the percentage-of-revenue concentration of the business with our customers.

|

Four customers

|

Up to 43%

|

|

All other customers

|

57% or more

|

The following table presents information regarding the average length of our trips.

|

Longest haul (overnight)

|

1,950 miles

|

|

Shortest haul

|

175 miles

|

|

Average haul

|

850 miles

|

All of the freight we hauled in fiscal year 2011 is dry van and/or refrigerated freight. The following table presents information regarding the approximate percentage makeup of the freight we haul.

|

Forest and paper products

|

50%

|

|

Hazmat and hazwaste

|

20%

|

|

All other freight (freight of all kinds, particularly food and refrigerated goods)

|

30%

|

Marketing

Our sales and marketing force currently consists of seven individuals. We have no formal marketing plan at the present time. We attend relevant trade shows and trade association meetings, and seek to maintain good relations with our existing customers. As we grow our carrier base, of which you have no assurance, we plan to establish a central national account sales and marketing group that will support the operations and customer service efforts of each subsidiary.

Our People

We believe our employees are our most important asset. The table on the following page presents information about our employees, other than drivers.

7

|

Platform and warehouse

|

18

|

|

Fleet technicians

|

17

|

|

Dispatch

|

30

|

|

Sales

|

7

|

|

Office

|

11

|

|

Administrative and Executive

|

9

|

None of our employees are represented by a collective bargaining unit. We consider relations with our employees to be good. We offer basic health insurance coverage to employees.

Our Drivers

The following table presents information about our drivers.

|

Drivers – company

|

289

|

|

Drivers – independent contract

|

40

|

We believe that maintaining a safe and productive professional driver group is essential to providing excellent customer service and achieving profitability. All of our drivers must have three years of verifiable driving experience, a hazmat endorsement (if hauling hazmat), no major violations in the previous thirty-six months, and must comply with all requirements of employment by federal Department of Transportation and applicable state laws.

We select drivers, including independent contractors, using our specific guidelines for safety records, driving experience, and personal evaluations. We maintain stringent screening, training, and testing procedures for our drivers to reduce the potential for accidents and the corresponding costs of insurance and claims. We train new drivers in all phases of our policies and operations, as well as in safety techniques and fuel-efficient operation of the equipment. All new drivers also must pass DOT required tests prior to assignment to a vehicle.

We primarily pay company-employed drivers a fixed rate per mile. The rate increases based on length of service. Drivers also are eligible for bonuses based upon safe, efficient driving. We pay independent contractors on a fixed rate per mile. Independent contractors pay for their own fuel, insurance, maintenance, and repairs.

Competition in the trucking industry for qualified drivers is normally intense. Our operations have been impacted, and from time-to-time we have experienced under-utilization and increased expense, as a result of a shortage of qualified drivers. We place a high priority on the recruitment and retention of an adequate supply of qualified drivers. Our average annual turn-over rate is less than fifteem percent, compared to an industry average of fifty percent as published in Transport Topics, June 23, 2011.

Our Operations

We currently conduct all of our freight transportation operations, including dispatch and accounting functions, from the headquarters facilities of our operating subsidiaries. During fiscal year 2011 we continued using the legacy information management systems and personnel that were employed when our operating subsidiaries were acquired. These arrangements produce many overlaps and duplications in facilities, office systems and personnel. We believe that these operating arrangements provide less than optimal results and controls. We have begun to centralize many of these functions, as noted above. Centralization is subject to obtaining adequate internal or external financing, of which there is no assurance.

8

Our Revenue Equipment

The following table presents information regarding the mix of our revenue producing equipment.

|

Power units (tractors) – sleeper

|

173

|

|

|

Power units (tractors) – day cab

|

2

|

|

|

Trailers

|

||

|

Flatbed

|

2

|

|

|

Dry van

|

270

|

|

|

Refrigerated

|

202

|

|

|

Other specialized

|

9

|

|

|

Tanker

|

9

|

|

The average age of our power units is approximately 4.82 years. All of our power units are GPS equipped. The majority of our power units are Freightliner and Peterbuilt vehicles. This uniformity allows for reduced inventory of parts required by our maintenance departments. In addition, the training required for our technicians is focused on limited equipment lines. We replace our power units at approximately four years of age. The average age of our trailers is approximately 8.2 years. We maintain all of our revenue producing equipment in good order and repair.

We believe we have an optimal tractor to trailer ratio based upon our current and anticipated customer activity.

Diesel Fuel Availability and Cost

Our operations are heavily dependent upon the use of diesel fuel. The price and availability of diesel fuel can vary and are subject to political, economic, and market factors that are beyond our control. Fuel prices have fluctuated dramatically and quickly at various times during the last three years. They remain high based on historical standards and can be expected to increase with increased demand for truck transportation in a recovering economy. We actively manage our fuel costs with volume purchasing arrangements with national fuel centers that allow our drivers to purchase fuel at a discount while in transit. During fiscal 2011, over eighty-five percent of our fuel purchases were made at contracted locations.

In addition to measures we have adopted over the years such as auxiliary power units in our tractors, we have also added more aerodynamically designed equipment, and have had additional driver training regarding fuel mileage.

Our cost-cutting measures include utilizing technology such as Peoplenet and Carrierweb to monitor travel speed/idling/rpm/high overspeed operations. In addition, governing the top speed of our power units helps reduce our fuel costs. We are installing the newly designed roll resistant, and thus more fuel efficient, tires as replacements as needed.

The Federal fuel surcharge program cushions our exposure to increased fuel prices. The fuel surcharge program has enabled us historically to pass through most long-term increases in fuel prices and related taxes to customers in the form of fuel surcharges. These fuel surcharges, which adjust weekly with the cost of fuel, enable us to recover a substantial portion of the higher cost of fuel as prices increase, except for non-revenue miles, out-of-route miles or fuel used while the tractor is idling. All fuel surcharges are based onnational averages. As of March 31, 2011, we had no derivative financial instruments to reduce our exposure to fuel price fluctuations.

Among the greatest challenges presented by high and relatively unstable diesel fuel prices is monitoring and maintaining our fuel costs and insuring that the fuel surcharge levels are adequate to recapture incremental costs. The Company monitors the weekly Department of Energy regional and national diesel fuel pricing information and regulatethe fuel surcharge levels accordingly. In addition, customer service representatives and operations personnel have been trained to take into account the cost of fuel (to include all empty miles) during the process of accepting and booking all shipments.

9

Our Competition and Industry

Trucks provide transportation services to virtually every industry operating in the United States and generally offer higher levels of reliability and faster transit times than other surface transportation options. Trucks hauled 68.8 percent of all freight, with estimated total revenues from this industry sector are $563 billion in 2010, according to American Trucking Association. Trucks provide transportation services to virtually every industry operating in the United States and generally offer higher levels of reliability and faster transit times than other surface transportation options. The transportation industry is highly competitive on the basis of both price and service. The trucking industry is comprised principally of two types of motor carriers: truckload and less-than-a-load, generally identified as LTL. Truckload carriers generally provide an entire trailer to one customer from origin to destination. LTL carriers pick up multiple shipments from multiple customers on a single truck and then route those shipments through service centers, where freight may be transferred to other trucks with similar delivery destinations. All of our service is truckload service.

The surface freight transportation market in which we operate is frequently referred to as highly fragmented and competitive. There are an estimated 172,000 transportaiton and warehousing companies in the US, according to the National Cooperative Freight ResearchProgram’s 2011 report. Even the largest motor freight companies haul a small percentage of the total freight. The following table presents information regarding the estimated percentage of freight hauled by the largest trucking companies compared to all other trucking companies. [Information obtained from the American Transportation Research Institute.] According to the American Trucking Association’s June 2011 issue of ‘Trucklines’, “Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.”

|

Ten largest trucking companies

|

10.7%

|

|

All other trucking companies

|

89.3%

|

|

*Transport Topics 2011 Top 100 Survey

|

Competition in the motor freight industry is based primarily on service (including on-time pickup and delivery), price, equipment availability and business relationships. We believe that we are able to compete effectively in our markets by providing high-quality and timely service at competitive prices. We believe our relationships with our customers are good. We compete with smaller and several larger transportation service providers. Our larger competitors, who include JB Hunt Transport Services, Inc., C.R. England, Inc. and Knight Transportation, Inc., may have more equipment, a broader coverage network and a wider range of services than we have. They also have greater financial resources and, in general, the ability to reduce prices to gain business, especially during times of reduced growth rates in the economy. This could potentially limit our ability to maintain or increase prices, and could also limit our growth in shipments and tonnage.

We believe that we do not compete with transportation by train, barge or ship, which we believe are not options for our existing customers.

Regulation

Our operations as a for-hire motor freight carrier are subject to regulation by the U.S. Department of Transportation (USDOT) and its agency, the Federal Motor Carrier Safety Administration (FMCSA), and certain business is also subject to state rules and regulations. These agencies exercise broad powers over our business, generally governing such activities as authorization to engage in motor carrier operations, safety and insurance requirements. The FMCSA periodically conducts reviews and audits to ensure our compliance with all federal safety requirements, and we report certain accident and other information to the FMCSA.

Our company drivers and independent contract drivers also must comply with the safety and fitness regulations promulgated by the FMCSA, including those relating to drug and alcohol testing and hours-of-service. Drivers may drive up to eleven hours within a fourteen-hour non-extendable window from the start of the workday, following at least ten consecutive hours off duty. Motor freight carriers and drivers may restart calculations of weekly on-duty limits after the driver has at least thirty-four consecutive hours off duty.

We are also subject to various environmental laws and regulations dealing with the handling of hazardous materials, air emissions from our vehicles and facilities, engine idling, and discharge and retention of storm water. These regulations have not had a significant impact on our operations or financial results and we do not expect a negative impact in the future.

Terms of Our Acquisitions

We acquired Morris Transportation and Smith Systems Transportation in the merger with Original IFC. We acquired Triple C Transport after our merger with Original IFC. We have filed an action to rescind the Triple C Transport transaction. See Item 3. Legal Proceedings, below. We acquired Cross Creek Trucking after our most recent fiscal year end. Prior to negotiations for these acquisitions, there were no prior or existing relationships between our management and the owners/management of the acquired companies. The final terms of each acquisition, which may differ from the original terms, are as follows:

10

|

Name of subsidiary

|

Stock issued

|

Cash payment

|

Promissory note

|

Warrants

|

||||||||||

|

Morris Transportation

|

3,000,000

|

none

|

$1,000,000(2)

|

none

|

||||||||||

|

Smith Systems Transportation

|

825,000

|

none

|

$

|

250,000

|

none

|

|||||||||

|

Triple C Transport (1)

|

2,000,000

|

$

|

100,000

|

$

|

150,000

|

none

|

||||||||

|

Cross Creek Trucking (3)

|

2,500,000

|

none

|

$

|

4,000,000

|

1,500,000(3)

|

|||||||||

____________________

(1) We have filed suit to rescind this acquisition. See Item 3. Legal Proceedings, below.

(2) $1,000,000 principal amount of notes, plus accrued and unpaid interest, which was converted for 2,281,458 shares issued to T. Mark Morris, one of our directors, in full satisfaction of the balance of our note for acquisition of Morris Transportation, Inc. plus interest on all note obligations IFC owed to Mr. Morris. 3

(3) Subject to termination as the election of the seller in the event we do not list our common stock on a national securities exchange within nine months, extendable to eighteen months upon payment of $250,000 to the seller, or the payment of $12,500,000 to the seller against surrender of our common stock and warrants for cancellation.

Morris Transportation –An entity which is owned by Mr. Morris owns the real estate used by Morris Transportation. We have been paying the mortgage on this real estate to an unrelated lender, as rental for our use of the real estate without a formal lease. We intend to purchase the real estate or the owning entity at fair market value, to be determined by appraisal, which may require us to refinance the mortgage. Our agreement for the acquisition of Morris Transportation provides that Mr. Morris will serve as one of our directors, will be employed as the general manager of Morris Transportation for three years and serve with Mr. Henley on its board of directors.

Terms of our sale of PGI-MD

The agreement to sell PGI-MD to Mr. Antenucci was made in an arm’s length transaction in connection with Original IFC’s purchase of our preferred stock in connection with the original structure of our business combination transaction in which we would have merged into the Original IFC. The agreement included the following provisions, as modified due to delays in completing the original combination transaction and the revised combination transaction, which were satisfied in the completion of the sale on December 27, 2009:

|

•

|

We transferred all of our assets to PGI-MD with a depreciated book value of nil, excluding the stock we owned in PGI and the assets we acquired by merger with Integrated Freight.

|

|

•

|

PGI-MD assumed all of our operating debts and obligations as of May 1, 2009, totaling $88,340, excluding $28,000 in accrued auditing fees and our operating costs incurred subsequent to May 1, 2009.

|

|

•

|

We issued a promissory note to PGI-MD for $22,345 of our operating costs incurred subsequent to May 1, 2009 which PGI-MD had paid.

|

|

•

|

We are subject, as a result of the merger, to Original Integrated Freight’s obligation to issue 177,170 shares of common stock and 177,170 common stock purchase warrants good for two years at a price of $0.50 per share in consideration for PGI-MD’s release of us from our obligation to repay inter-company loans totaling $684,311.

|

We accepted Mr. Antenucci’s termination of his employment agreement as our chief executive officer, which included an obligation for us to pay him approximately $335,000 in severance, as full payment for his purchase of PGI-MD.

As a result of the merger, we are subject to Original Integrated Freight’s obligation to issue to Mr. Antenucci 59,327 shares of common stock and 59,327 common stock purchase warrants good for two years at a price of $0.50 per share in consideration for Mr. Antenucci’s release from payment of his deferred compensation and expense reimbursement in the amount of $88,954.

As a result of the merger, we are subject also to Original Integrated Freight’s obligation to issue to Frederick G. Beisser, our former senior vice president - finance, 75,525 shares of common stock and 75,525 common stock purchase warrants good for two years at a price of $0.50 per share in consideration for Mr. Beisser’s release of us from payment of his deferred compensation in the amount of $112,830 (but not including unpaid wages, automobile allowance and reimbursable expenses totaling $24,126 owed to him at November 9, 2009).

We are also required to maintain directors and officers’ tail coverage for three years for the benefit of Messrs. Antenucci and Beisser.

11

We had no interest in maintaining, managing and funding the business of PGI-MD as a subsidiary company after our acquisition of Original IFC. The transactions outlined above resulted in our relief from liabilities in an aggregate amount of $1,309,435, in consideration for common stock which Original IFC valued at the time of negotiations at $0.10 per share (the price at which it was selling its common stock at that time in private placements), for an aggregate value of $31,175, before valuing the warrants. Furthermore, the sale of PGI-MD removed approximately $3,281,679 in liabilities from our consolidated balance sheet that were liabilities of PGI-MD and relieve us of all the operational and business difficulties centered in PGI-MD. We did not obtain an independent appraisal of PGI-MD. Nor, did we seek other buyers for PGI-MD or its business and technologies. We believe that our management composed of Mr. Antenucci during our negotiations with Original IFC would have been less interested or uninterested in entering into the transactions with Original IFC, as compared to declaring bankruptcy or terminating our reporting status under the Securities Exchange Act if the transactions had not involved our sale of PGI-MD to Mr. Antenucci. Notwithstanding the foregoing, at May 1, 2009, our management, the management of Original IFC and Mr. Antenucci believed that these related transactions were fair and acceptable to all parties. We believe the negotiations for our sale of PGI-MD were conducted at arms’ length, because fundamentally Mr. Antenucci was not negotiating against us, when he was our sole director and chief executive officer, but was negotiating against Original IFC.

ITEM 1A. RISK FACTORS.

In addition to the forward-looking statements described previously in this annual report and other comments regarding risks and uncertainties included in the description of our business, the following risk factors should be carefully considered when evaluating our business. Our business, financial condition or financial results could be materially and adversely affected by any of these risks.

Recent improvements in the motor freight industry may hinder or prevent our acquisition of additional trucking companies.

The motor freight industry, as a whole, has experienced an increased demand for truck and an improvement in revenues, as our general economy seems to be emerging from the recent recessionary period. (Heavy Duty Trucking, May 2010) For April and May 2011 the truck tonnage increases were 4.8% and 2.7% above the same times last year according to the American Trucking Associations’ monthly tonnage report. Although not as robust an economic recovery as many have hoped for, the economy seems to be slowly recovering. We cannot predict, as of the date of filing this amended annual report on Form 10-K, what impact a failure to raise the U.S. government debt limit in the next several weeks may have on the U.S. and worldwide economy as a whole. If these improvements continue to improve the financial viability of motor freight carriers who have survived the recession may decrease their interest in being acquired. Our acquisition and growth strategy has been based in part on depressed values for motor freight carriers and a desire to sell based on poorer than historical financial performance. Without these incentives, we may find it more difficult to locate trucking companies with an interest in being acquire, or if they have such an interest, being acquired for consideration that fits our financial model.

We may experience difficulty in combining and consolidating the management and operations of our acquired companies which could have a material adverse impact on our operations and financial performance.

We have purchased our operating subsidiaries and expect any additional subsidiaries we purchase to be made from the founders and management of the acquired companies, all of whom have been responsible for their own businesses and methods of operations as independent business owners. While these individuals will continue to be responsible to a degree for the continuing operations of our operating subsidiaries, with the exception of Cross Creek Trucking, we intend to centralize and standardize many areas of operations. Notwithstanding that many of these individuals from whom we have and plan to acquire our operating subsidiaries will serve on our board of directors, we may be unable to develop a cohesive corporate culture in which these individuals will be willing to forego their former independence, as we have experienced with Triple C Transport. Our inability to successfully combine and consolidate the policies, procedures and operations of our subsidiaries can be expected to have a material adverse effect on our business and prospects, financial and otherwise.

Our information management systems are diverse, may prove inadequate and may be difficult to integrate or replace.

We depend upon our information management systems for many aspects of our business. Each operating subsidiary and each company we acquire will have its own information management system with which its employees are acquainted. None of these systems are adequate to our consolidated operations and may not be compatible with our centralized information management system. We expect to require additional software to initially integrate existing systems or to ultimately replace these diverse systems. Switching to new information management systems is often difficult, resulting in disruption, delays and lost productivity, which could impact our dispatching, collections and other operations. Our business will be materially and adversely affected if our information management systems are disrupted or if we are unable to improve, upgrade, integrate, expand or replace our systems as we continue to execute our growth strategy. We anticipate the cost of consolidating our management systems and duplicative operations of our acquired subsidiaries will be approximately $1 million.

Our management information systems are subject to certain risks that we cannot control.

Our management information systems, including dispatching and accounting systems, are dependent upon third-party software, global communications providers, telephone systems and other aspects of technology and Internet infrastructure that are susceptible to failure. Our management information systems is susceptible to outages, computer viruses, break-ins and similar disruptions that may inhibit our ability to provide services to our customers and the ability of our customers to access our systems. This may result in the loss of customers or a reduction in demand for our services.

12

If we are unable to successfully execute our growth strategy, our business and future results of operations may suffer.

Our growth strategy includes the acquisition of additional motor freight companies to increase revenues, to selectively expand our geographic footprint and to broaden the scope of our service offerings. If we are unable to acquire additional motor freight companies at prices that meet our financial model, our growth will be limited to expanding sales and reducing expenses in our existing subsidiaries. In connection with our growth strategy, we may purchase additional equipment, expand and upgrade service centers, hire additional personnel and increase our sales and marketing efforts.

Our growth strategy exposes us to a number of risks, including the following:

|

•

|

geographic expansion and acquisitions require start-up costs that could expose us to temporary losses;

|

|

•

|

growth and geographic expansion is dependent on the availability of freight and customer needs. Shortages of suitable real estate that accommodates both customers and carriers’ needs may limit our geographic expansion and might cause congestion in our service center network, which could result in increased operating expenses;

|

|

•

|

growth may strain our management, capital resources, information systems and customer service;

|

|

•

|

hiring new employees may increase training costs and may result in temporary inefficiencies until those employees become proficient in their jobs;

|

|

•

|

expanding our service offerings may require us to enter into new markets and encounter new competitive challenges; and

|

|

•

|

growth through acquisition could require us to temporarily match existing freight rates of the acquiree’s markets, which may be lower than the rates that we would typically charge for our services;

|

|

•

|

we may be unable to obtain financing of the cash portion of an acquisition price or to provide a working capital infusion for an acquisition.

|

We have no assurance we will overcome the risks associated with our growth. If we fail to overcome these risks, we may not be able to make additional acquisitions, realize additional revenue or profits from our efforts, we may incur additional expenses and therefore our financial position and results of operations could be materially and adversely affected.

We are significantly dependent on the continued services of Paul A. Henley to realize our growth strategy.

We are dependent upon the vision and efforts of Mr. Henley, our founder and principal stockholder, for the realization of our growth strategy. In the event Mr. Henley’s services were to be unavailable to us, our continued activity to expand our business operations through acquisition could be substantially impaired or be abandoned.. Mr. Henley has pledged a significant portion of our common stock which he owns to guarantee certain of our borrowings. In the event Mr. Henley loses this common stock in foreclosure, his interest in us may be reduced.

Our management owns a majority of our outstanding common stock and outside stockholders will be unable to influence management decisions or elect their nominees to our board of directors, if they should so desire.

Our management controls approximately fifty percent of our common stock. All corporate actions involving amendment of our articles of incorporation (such as name change and increase in authorized shares), election of directors and other extraordinary actions and transactions such as certain mergers, consolidations and recapitalizations and sales of all or substantially all of our assets, require the approval of only a majority of the issued and outstanding shares of our common stock. Accordingly, our management will be able to approve any such actions and transactions and elect all directors even if all of the outside stockholders oppose such transactions, or in the case of directors, nominate other persons for election. Our minority stockholders will be unable to effect changes in our management or in our business.

We have significant ongoing cash requirements and expect to incur additional cash requirements that could limit our growth and adversely affect our profitability if we are unable to obtain sufficient financing.

We anticipate that we may need to spend as much as $5,000,000 or more in new equipment in fiscal year 2011. In addition, we have issued promissory notes to cover part of the costs of our acquisitions of Cross Creek Trucking and expect to continue issuing promissory notes for part of the cost of future acquisitions. Due to the existing uncertainty in the capital and credit markets, capital and loans may not be available on terms acceptable to us. If we are unable in the future to generate sufficient cash flow from operations or borrow the necessary capital to fund our operations and acquisitions, we will be forced to operate our equipment for longer periods of time and to limit our growth, which could have a material adverse effect on our operating results. In addition, our business has significant operating cash requirements. If our cash requirements are high or our cash flow from operations is low during particular periods, we may need to seek additional financing, which may be costly or difficult to obtain.We have experienced difficulty in obtaining debt and equity funding, which could have a material and adverse impact on our financial condition , working capital, capital expenditures, acquisitions and other corporate purposes.

13

Recent instability of the credit markets and the resulting effects on the economy could have a material adverse impact on our replacement of revenue producing equipment and ability to meet our financial obligations.

Recently, there has been widespread concern over the instability of the credit markets and the current credit market effects on the economy. In the event the federal debt ceiling is not raise or a raise is delayed, we would expect to experience an increase in our costs of borrowing. If the economy and credit markets do not recover quickly, or even weaken further for any reason, our business, financial results, and results of operations could be materially and adversely affected, especially if consumer confidence declines and domestic spending decreases. We are highly dependent on borrowing and leasing to fund the cost of new and replacement revenue producing equipment and to fund our cash-flow shortfalls. An increase in general interest rates can be expected to increase our cost of borrowing, potentially delaying our ability to replace tractors and trailers and to expand our fleet to meet increased demand, if any, to pay our operating expenses, including litigation expenses, and to meet our obligations arising from our acquisition of Cross Creek Trucking. Additionally, the stresses in the credit market have caused uncertainty in the equity markets, which may result in volatility of the market price for our securities.

We have experienced difficulty in obtaining debt and equity funding for operations, acquisitions and the costs associated with acquisitions, which can be expected to have an adverse impact on our growth and cause us to issue more common stock at lower values.

We have experienced difficulty in obtaining debt and equity funding for operations and acquisitions. As a result of this difficulty, we were unable to complete one acquisition under contract and do not expect to be able to complete acquisitions of larger companies which may be available to us if we were able to make larger cash payments as part of the acquisition price. This difficulty may also be reflected in our stock price, causing it to be lower than it might otherwise be.

We derive forty-three percent of our revenue from four customers, the loss of one or more of which could have a material adverse effect on our business.

For the year ended March 31, 2011, our top four customers, based on revenue, accounted for approximately forty-three percent of our revenue. A reduction in or termination of our services by one or more of our major customers could have a material adverse effect on our business and operating results. A default in payments of invoices by one or more of these customers could have a material adverse effect on our financial condition. See “Our Business – Our customers and marketing”.

We operate in a highly competitive and fragmented industry, and our business will suffer if we are unable to adequately address potential downward pricing pressures and other factors that may adversely affect our operations and profitability.

We compete with many other truckload carriers of varying size that provide dry-van and temperature-sensitive service of varying sizes and, to a lesser extent, with less-than-truckload carriers, air freight, railroads and other transportation companies, many of which have more equipment, a wider range of services and greater capital resources than we do or have other competitive advantages. We expect to experience difficulty in competing with larger companies. Numerous other competitive factors could impair our ability to maintain our revenues and achieve profitability. These factors include, but are not limited to, the following:

|

•

|

we compete with many other transportation service providers of varying sizes, some of which may have more equipment, a broader coverage network, a wider range of services, greater capital resources or have other competitive advantages;

|

|

•

|

some of our competitors periodically reduce their prices to gain business, especially during times of reduced growth rates in the economy, which may limit our ability to maintain or increase prices or maintain revenue growth;

|

|

•

|

many customers reduce the number of carriers they use by selecting “core carriers,” as approved transportation service providers, and in some instances we may not be selected;

|

|

•

|

many customers periodically accept bids from multiple carriers for their shipping needs, and this process may depress prices or result in the loss of some business to competitors;

|

|

•

|

the trend towards consolidation in the ground transportation industry may create other large carriers with greater financial resources and other competitive advantages relating to their size;

|

|

•

|

advances in technology require increased investments to remain competitive, and our customers may not be willing to accept higher prices to cover the cost of these investments; and

|

|

•

|

competition from non-asset-based logistics and freight brokerage companies may adversely affect our customer relationships and pricing policies.

|

14

If our employees were to unionize, our operating costs would increase and our ability to compete would be impaired.

None of our employees are currently represented under a collective bargaining agreement. From time to time there may be efforts to organize our employees. There is no assurance that our employees will not unionize in the future, particularly if legislation is passed that facilitates unionization, such as the Employee Free Choice Act. The unionization of our employees could have a material adverse effect on our business, financial condition and results of operations because:

|

•

|

some shippers have indicated that they intend to limit their use of unionized trucking companies because of the threat of strikes and other work stoppages;

|

|

•

|

restrictive work rules could hamper our efforts to improve and sustain operating efficiency;

|

|

•

|

restrictive work rules could impair our service reputation and limit our ability to provide next-day services;

|

|

•

|

a strike or work stoppage would negatively impact our profitability and could damage customer and employee relationships; and

|

|

•

|

an election and bargaining process could divert management’s time and attention from our overall objectives and impose significant expenses.

|

Insurance and claims expenses could significantly reduce our profitability.

We are exposed to claims related to cargo loss and damage, property damage, personal injury, workers’ compensation, long-term disability and group health. We have insurance coverage with third-party insurance carriers, but retain or self-insure a portion of the risk associated with these claims. If the number or severity of claims increases, or we are required to accrue or pay additional amounts because the claims prove to be more severe than our original assessment, our operating results would be adversely affected. Insurance companies may require us to obtain letters of credit to collateralize our self-insured retention. If these requirements increase, our borrowing capacity could be adversely affected. Our future insurance and claims expense might exceed historical levels, which could reduce our earnings. We expect our growth strategy to require a periodic reassessment or our insurance strategy, including self-insurance of a greater portion of our claims exposure resulting from workers’ compensation, auto liability, general liability, cargo and property damage claims, as well as employees’ health insurance under pending federal legislation, which we are unable to predict. We may also become responsible for our legal expenses relating to such claims. With growth, we will be required to periodically evaluate and adjust our claims reserves to reflect our experience. However, ultimate results may differ from our estimates, which could result in losses over our reserved amounts. We maintain insurance above the amounts for which we self-insure with licensed insurance carriers. Although we believe the aggregate insurance limits should be sufficient to cover reasonably expected claims, it is possible that one or more claims could exceed our aggregate coverage limits. Insurance carriers have raised premiums for many businesses, including trucking companies. As a result, our insurance and claims expense could increase, or we could raise our self-insured retention when our policies are renewed. If these expenses increase, or if we experience a claim in excess of our coverage limits, or we experience a claim for which coverage is not provided, results of our operations and financial condition could be materially and adversely affected.

Our customers and suppliers’ business may be slow to recover from the recent downturn in the worldwide economy and disruption of financial markets. We cannot predict the impact on the national and worldwide economy of a failure or delay to increase the U.S. debt limit.

Our business is dependent on a number of general economic and business factors that may have a materially adverse effect on our results of operations, many of which are beyond our control. table terms, because of the disruptions to the capital and credit markets. These customers represent a greater potential for bad debt losses, which may require us to increase our reserve for bad debt. Economic conditions resulting in bankruptcies of one or more of our large customers could have a significant impact on our financial position, results of operations or liquidity in a particular year or quarter. Our supplier’s business levels have also been and may continue to be adversely affected by current economic conditions or financial constraints, which could lead to disruptions in the supply and availability of equipment, parts and services critical to our operations. A significant interruption in our normal supply chain could disrupt our operations, increase our costs and negatively impact our ability to serve our customers.

15

We may be adversely impacted by fluctuations in the price and availability of diesel fuel.

We require large amounts of diesel fuel to operate our tractors and to power the temperature-control units on our trailers. Fuel is one of our largest operating expenses. Fuel prices tend to fluctuate, and prices and availability of all petroleum products are subject to political, economic and market factors that are beyond our control. We do not hedge against the risk of diesel fuel price increases. We depend primarily on fuel surcharges, auxiliary power units for our tractors, volume purchasing arrangements with truck stop chains and bulk purchases of fuel at our terminals to control and recover our fuel expenses. We have no assurance that we will be able to collect fuel surcharges or enter into volume purchase agreements in the future. An increase in diesel fuel prices or diesel fuel taxes, or any change in federal or state regulations that results in such an increase, could have a material adverse effect on our operating results, unless the increase is offset by increases in freight rates or fuel surcharges charged to our customers. Historically, we have been able to offset significant increases in diesel fuel prices through fuel surcharges to our customers, and we were able to minimize the negative impact on our profitability in fiscal 2010 that resulted from the rapid and significant increase to the cost of diesel fuel. Depending on the base rate and fuel surcharge levels agreed upon by individual shippers, a rapid and significant decline in the cost of diesel fuel could also have a material adverse effect on our operating results. We continuously monitor the components of our pricing, including base freight rates and fuel surcharges, and address individual account profitability issues with our customers when necessary. While we have historically been able to adjust our pricing to offset changes to the cost of diesel fuel, through changes to base rates and/or fuel surcharges, we cannot be certain that we will be able to do so in the future. The absence of meaningful fuel price protection through these measures, fluctuations in fuel prices, or a shortage of diesel fuel, could materially and adversely affect our results of operations.

Our operations are subject to various environmental laws and regulations, the violation of which could result in substantial fines or penalties.

We are subject to various federal, state and local environmental laws and regulations dealing with the handling and transportation of hazardous materials ("hazmat") and waste ("hazwaste") (which accounts for approximately twenty percent of our current business). We operate in industrial areas, where truck terminals and other industrial activities are located, and where groundwater or other forms of environmental contamination have occurred. Our operations involve the risks of fuel spillage or seepage, environmental damage and hazardous waste disposal, among others. If a spill or other accident involving fuel, oil or hazardous substances occurs, or if we are found to be in violation of applicable laws or regulations, it could have a material adverse effect on our business and operating results. One of our subsidiaries specializes in transport of hazardous materials and waste. If we should fail to comply with applicable environmental laws and regulations, we could be subject to substantial fines or penalties, to civil and criminal liability and to loss of our licenses to transport the hazardous materials and waste. Under certain environmental laws, we could also be held responsible for any costs relating to contamination at our past facilities and at third-party waste disposal sites. Any of these consequences from violation of such laws and regulations could be expected to have a material adverse effect on our business and prospects, financial and otherwise.

Increased prices, reduced productivity, and restricted availability of new revenue equipment could cause our financial condition, results of operations and cash flows to suffer.

Prices for new tractors have increased over the past few years, primarily as a result of higher commodity prices, better pricing power among equipment manufacturers, and government regulations applicable to newly manufactured tractors and diesel engines. We expect to continue to pay increased prices for revenue equipment and incur additional expenses and related financing costs for the foreseeable future. Our business could be harmed if we are unable to continue to obtain an adequate supply of new tractors and trailers or if we have to pay increased prices for new revenue equipment. We face increasing prices for new power units.

Seasonality and the impact of weather can adversely affect our profitability.

Our tractor productivity generally decreases during the winter season because inclement weather impedes operations and some shippers reduce their shipments. At the same time, operating expenses generally increase, with harsh weather creating higher accident frequency, increased claims and more equipment repairs. We can also suffer short-term impacts from weather-related events such as hurricanes, blizzards, ice-storms, and floods that could harm our results or make our results more volatile.

16

Increases in driver compensation, difficulty in attracting drivers and driver turn-over could affect our profitability and ability to grow.

We periodically experience difficulties in attracting and retaining qualified drivers, including independent contract drivers. With increased competition for drivers, we could experience greater difficulty in attracting sufficient numbers of qualified drivers. Our competitors may offer better compensation plans, and thus increase the driver turnover we experience. Due to current economic conditions and regulatory changes which have recently increased the demand for drivers and the cost of fuel and insurance, the available pool of independent contractor drivers is smaller than it was during 2008 through 2010. Accordingly, we may and periodically do face difficulty in attracting and retaining drivers for all of our current tractors and for those we may add. We may face difficulty in increasing the number of our independent contractor drivers. In addition, our industry suffers from high turnover rates of drivers. Our turnover rate requires us to recruit a substantial number of drivers. Moreover, our turnover rate could increase. If we are unable to continue to attract drivers and contract with independent contractors, we could be required to continue adjusting our driver compensation package beyond the norm or let equipment sit idle. An increase in our expenses or in the number of power units without drivers could materially and adversely affect our growth and profitability. Our operations may be affected in other ways by a shortage of qualified drivers in the future, such as temporary under-utilization of our fleet, difficulty in meeting shipper demands and increases in compensation levels for our drivers. When we encounter difficulty in attracting or retaining qualified drivers, our ability to service our customers and increase our revenue could be adversely affected. A shortage of qualified drivers in the future could cause us to temporarily under-utilize our fleet, face difficulty in meeting shipper demands and increase our compensation levels for drivers.

Shrinkage in the pool of eligible drivers could affect our profitability and ability to grow.

The ongoing Comprehensive Safety Analysis, often referred to as CSA 2010, is projected to reduce the driver pool. Every driver receives a score based upon his or her individual performance in six categories, which are then combined into a single score, and this score is compared to the scores of all other drivers to determine how “safe” the driver is. (BigRigDriving.com, January 19, 2010) Drivers with lower scores are less hirable or not hirable.(Transport Topics, June 14, 2010) A shortage of qualified drivers from time to time could cause us to temporarily under-utilize our fleet, face difficulty in meeting shipper demands and increase our compensation levels for drivers.

We operate in a highly regulated industry and increased costs of compliance with, or liability for violation of, existing or future regulations could have a materially adverse effect on our business.

The USDOT and various state and local agencies exercise broad powers over our business, generally governing such activities as authorization to engage in motor carrier operations, safety and insurance requirements. Our company drivers and independent contractors also must comply with the safety and fitness regulations promulgated by the USDOT, including those relating to drug and alcohol testing and hours-of-service. We also may become subject to new or more restrictive regulations relating to fuel emissions, drivers’ hours-of-service, ergonomics, or other matters affecting safety or operating methods. Other agencies, such as the EPA and the Department of Homeland Security, or DHS, also regulate our equipment, operations, and drivers. Future laws and regulations may be more stringent and require changes in our operating practices, influence the demand for transportation services, or require us to incur significant additional costs. Higher costs incurred by us or by our suppliers who pass the costs onto us through higher prices could adversely affect our results of operations.

In the aftermath of the September 11, 2001 terrorist attacks, federal, state, and municipal authorities have implemented and continue to implement various security measures, including checkpoints and travel restrictions on large trucks. As a result, it is possible we may fail to meet the needs of our customers or may incur increased expenses to do so. These security measures could negatively impact our operating results.

Some states and municipalities have begun to restrict the locations and amount of time where diesel-powered tractors, such as ours, may idle, in order to reduce exhaust emissions.

From time to time, various federal, state, or local taxes are increased, including taxes on fuels. We cannot predict whether, or in what form, any such increase applicable to us will be enacted, but such an increase could adversely affect our profitability.

Higher interest rates on borrowed funds would adversely impact our results of operations.

We rely on borrowings to finance our revenue equipment and receivables. We are subject to interest rate risk to the extent our borrowings. Even though we attempt to manage our interest rate risk by managing the amount of debt we carry, our debt levels are not entirely within our control in the short term. An increase in the rates of interest we incur on borrowings and financing we cannot decrease in the short term without adversely impacting our level of service to our customers and expansion of our business will adversely affect our results of operations. We cannot predict what impact a failure to implement a higher debt ceiling for the U.S. government will have on interest rates, or the national or international economy in general. We believe that without a debt ceiling increase, the U.S. government could default on its obligations, triggering increased interest rates and a decline in gross domestic product, which would involve a reduction in freight shipments. If the U.S. debt ceiling is not raised in time to avoid default on U.S. government obligations, we believe we will experience higher interest rates and lease payment levels, increased difficulty in obtaining financing for both equipment and acquisitions and a decline in demand for freight transportation.

17

"Penny stock” rules may make buying and selling our common stock difficult.

Trading in our common stock is subject to the "penny stock" rules of the Securities and Exchange Commission. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock the broker-dealer make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules. Our securities are subject to the penny stock rules, and investors may find it more difficult to sell their securities.

We do not have controls and procedures in place as required by Section 404 of the Sarbanes-Oxley Act of 2002.

As noted above, the operational and financial control of our subsidiaries has remained under the management of the founders of and stockholder from we acquired the respective companies. We do not have controls and procedures in place from a parent company level or the subsidiary level to satisfy Section 404 of the Sarbanes-Oxley Act of 2002. While we expect to put controls and procedures in place for these purpose in the process of consolidating and centralizing overlapping and duplicative elements of these companies, doing so will require debt or equity funding you have no assurance we will be able to obtain. Until we are able to put these controls and procedures in place, we expect to devote additional management time to confirming the accuracy and timeliness of our reports.

We will incur significant expense in complying with Section 404 of the Sarbanes-Oxley Act of 2002 on a timely basis.

The SEC, as directed by Section 404 of the Sarbanes-Oxley Act, adopted rules generally requiring each public company to include a report of management on the company's internal controls over financial reporting in its annual report on Form 10-K that contains an assessment by management of the effectiveness of the company's internal controls over financial reporting. Under current rules, commencing with our annual report for the fiscal year ending September 30, 2011, our independent registered accounting firm must attest to and report on management's assessment of the effectiveness of our internal controls over financial reporting.

We expect that we may need to hire and/or engage additional personnel and incur incremental costs in order to complete the work as required by Section 404. We have initially concluded that our internal controls are not effective; in the event that in the future we conclude that our internal controls are effective, our independent accountants may disagree with our assessment and may issue a report that is qualified. Any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations.

ITEM 1B. UNRESOLVED STAFF COMMENTS.