Attached files

| file | filename |

|---|---|

| EX-32.2 - UNIVERSAL TRAVEL GROUP | v229427_ex32-2.htm |

| EX-31.1 - UNIVERSAL TRAVEL GROUP | v229427_ex31-1.htm |

| EX-31.2 - UNIVERSAL TRAVEL GROUP | v229427_ex31-2.htm |

| EX-32.1 - UNIVERSAL TRAVEL GROUP | v229427_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended March 31, 2011

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT

|

For the transition period from ______________ to _____________

Commission file number: 001-34284

UNIVERSAL TRAVEL GROUP

(Exact name of registrant as specified in its charter)

|

Nevada

|

90-0296536

|

|

|

(State or other jurisdiction of incorporation or

organization)

|

(I.R.S. Employer Identification No.)

|

|

9F, Building A, Rongchao Marina Bay Center

NO. 2021 Haixiu Road, Bao’an District, Shenzhen

People’s Republic of China |

518133

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

86 755 836 68489

(Registrant’s telephone number, including area code)

_____________________________________________________________

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13, or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ¨ No ¨

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date:

As of July 21, 2011, there are 19,898,235 shares of $0.001 par value common stock issued and outstanding.

FORM 10-Q

UNIVERSAL TRAVEL GROUP

INDEX

|

Page

|

||||

|

PART I.

|

Financial Information

|

|||

|

Item 1. Financial Statements (Unaudited).

|

||||

| Report of Independent Registered Public Accounting Firm | ||||

|

Consolidated Balance Sheets as of March 31, 2011 (Unaudited) and December 31, 2010

|

1 | |||

|

Consolidated Statements of Income for the Three Months Ended March 31, 2011 and 2010 (Unaudited)

|

2 | |||

|

Consolidated Statements of Cash Flows for the Three Months Ended March 31, 2011 and 2010 (Unaudited)

|

3 | |||

|

Consolidated Statements of Stockholders' Equity

|

||||

|

Notes to Consolidated Financial Statements as of March 31, 2011 (Unaudited)

|

4 | |||

|

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

18 | |||

|

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

|

26 | |||

|

Item 4. Controls and Procedures.

|

27 | |||

|

PART II.

|

Other Information

|

|||

|

Item 1. Legal Proceedings.

|

27 | |||

|

Item 1A. Risk Factors.

|

27 | |||

|

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

|

28 | |||

|

Item 3. Defaults Upon Senior Securities.

|

28 | |||

|

Item 4. (Removed and Reserved).

|

28 | |||

|

Item 5. Other Information.

|

28 | |||

|

Item 6. Exhibits.

|

28 |

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

UNIVERSAL TRAVEL GROUP

CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2011

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Stockholders of Universal Travel Group

We have reviewed the accompanying consolidated balance sheet of Universal Travel Group as of March 31, 2011, and the related consolidated statements of income and comprehensive income, and cash flows for the three-month periods ended March 31, 2011 and 2010. These consolidated financial statements are the responsibility of the company’s management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with standards of the Public Company Accounting Oversight Board (United States), the objective of which is the expression of an opinion regarding the consolidated financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to the accompanying consolidated financial statements for them to be in conformity with accounting principles generally accepted in the United States of America.

/s/ EFP Rotenberg, LLP

EFP Rotenberg, LLP

Rochester, New York

July 20, 2011

TABLE OF CONTENTS

|

Consolidated Condensed Balance Sheets

|

1

|

|

|

Unaudited Condensed Consolidated Statements of Income and Comprehensive Income

|

2

|

|

|

Unaudited Condensed Consolidated Statements of Cash Flows

|

3

|

|

|

Notes to the Unaudited Condensed Consolidated Financial Statements

|

|

4 - 17

|

UNIVERSAL TRAVEL GROUP

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

March 31,

|

December 31,

|

||||||

|

2011

|

2010

|

|||||||

|

|

Unaudited

|

|||||||

|

ASSETS

|

||||||||

|

Cash and cash equivalents

|

$ | 58,682,354 | $ | 39,618,988 | ||||

|

Restricted Cash

|

523,656 | 307,027 | ||||||

|

Accounts receivable, net

|

26,458,386 | 38,658,011 | ||||||

|

Other receivables and deposits, net

|

620,588 | 780,400 | ||||||

|

Trade deposit

|

8,303,907 | 8,173,426 | ||||||

|

Prepayments

|

1,179,991 | 1,216,857 | ||||||

|

Short term investments, at fair value

|

19,343,216 | 19,681,308 | ||||||

|

Note receivable

|

- | 2,314,259 | ||||||

|

Total Current Assets

|

115,112,099 | 110,750,276 | ||||||

|

Property & equipment, net

|

1,576,600 | 1,692,595 | ||||||

|

Intangible assets, net

|

2,949,241 | 3,110,882 | ||||||

|

Goodwill

|

24,508,909 | 24,508,909 | ||||||

|

Total Noncurrent Assets

|

29,034,750 | 29,312,386 | ||||||

|

Total Assets

|

$ | 144,146,849 | $ | 140,062,662 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts payable and accrued expenses

|

$ | 4,373,769 | $ | 5,045,674 | ||||

|

Customer deposits

|

2,298,978 | 2,203,487 | ||||||

|

Income tax payable

|

1,889,988 | 3,189,965 | ||||||

|

Total Current Liabilities

|

8,562,735 | 10,439,126 | ||||||

|

Warrants - derivative liability

|

461,117 | 810,929 | ||||||

|

Deferred tax liability

|

477,397 | 477,397 | ||||||

|

Long-term income tax payable

|

30,804 | 30,804 | ||||||

|

Total Liabilities

|

9,532,053 | 11,758,256 | ||||||

|

Stockholders' Equity

|

||||||||

|

Common stock, $.001 par value, 70,000,000 shares authorized, 19,898,235 issued and outstanding at March 31, 2011 and December 31, 2010, respectively

|

19,898 | 19,898 | ||||||

|

Preferred stock, $0.001 par value, 5,000,000 shares authorized, no shares issued and outstanding at March 31, 2011 and December 31, 2010, respectively.

|

- | - | ||||||

|

Additional paid in capital

|

65,105,494 | 64,171,555 | ||||||

|

Statutory reserve

|

1,062,741 | 1,062,741 | ||||||

|

Retained earnings

|

64,079,716 | 59,624,186 | ||||||

|

Accumulated other comprehensive income

|

4,346,947 | 3,426,026 | ||||||

|

Total Stockholders' Equity

|

134,614,796 | 128,304,406 | ||||||

|

Total Liabilities and Stockholders' Equity

|

$ | 144,146,849 | $ | 140,062,662 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

1

UNIVERSAL TRAVEL GROUP

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

FOR THE THREE MONTHS ENDED MARCH 31,

|

2011

|

2010

|

|||||||

|

Revenues

|

||||||||

|

Air ticketing, net

|

$ | 5,260,428 | $ | 3,905,975 | ||||

|

Hotel reservation, net

|

3,693,953 | 3,030,106 | ||||||

|

Packaged tours, gross

|

24,841,112 | 13,489,698 | ||||||

| 33,795,493 | 20,425,779 | |||||||

|

Cost of services

|

||||||||

|

Air ticketing, net

|

1,916,323 | 1,367,871 | ||||||

|

Hotel reservation, net

|

1,374,384 | 998,417 | ||||||

|

Packaged tours, gross

|

21,629,570 | 11,803,197 | ||||||

| 24,920,277 | 14,169,485 | |||||||

|

Gross Profit

|

8,875,216 | 6,256,294 | ||||||

|

Selling, general and administrative expenses

|

(2,998,098 | ) | (1,565,987 | ) | ||||

|

Income from operations

|

5,877,118 | 4,690,307 | ||||||

|

Other income (expense)

|

||||||||

|

Other income (expense)

|

(14,390 | ) | 3,554 | |||||

|

Gain on change of fair value of derivative liabilities

|

349,812 | 109,451 | ||||||

|

Interest income

|

117,534 | 22,189 | ||||||

|

Total other income

|

452,956 | 135,194 | ||||||

|

Income before income taxes–continuing operations

|

6,330,074 | 4,825,501 | ||||||

|

Provision for income taxes

|

1,874,544 | 1,279,066 | ||||||

|

Net Income

|

$ | 4,455,530 | $ | 3,546,435 | ||||

|

Comprehensive Income

|

||||||||

|

Net income

|

$ | 4,455,530 | $ | 3,546,435 | ||||

|

Foreign currency translation adjustments

|

920,921 | (503,904 | ) | |||||

|

Total Comprehensive income

|

$ | 5,376,451 | $ | 3,042,531 | ||||

|

Net income per common share

|

||||||||

|

Basic

|

$ | 0.22 | $ | 0.21 | ||||

|

Diluted

|

$ | 0.22 | $ | 0.20 | ||||

|

Weighted average common shares outstanding

|

||||||||

|

Basic

|

19,898,235 | 16,822,339 | ||||||

|

Diluted

|

20,559,943 | 18,019,257 | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

2

UNIVERSAL TRAVEL GROUP

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED MARCH 31,

|

2011

|

2010

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

||||||||

|

Net income

|

$ | 4,455,530 | $ | 3,546,435 | ||||

|

Add:

|

||||||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||

|

Depreciation and amortization

|

307,279 | 301,104 | ||||||

|

Provision for doubtful accounts

|

- | 24,931 | ||||||

|

Stock based compensation

|

933,939 | 336,632 | ||||||

|

(Gain)/Loss on change in fair value of derivative liabilities

|

(349,812 | ) | (109,451 | ) | ||||

|

(Increase) / decrease in assets:

|

||||||||

|

Restricted cash

|

(213,048 | ) | (70,190 | ) | ||||

|

Accounts receivable

|

12,523,242 | (1,365,395 | ) | |||||

|

Other receivable

|

166,623 | (392,698 | ) | |||||

|

Advances

|

- | 559 | ||||||

|

Prepayments

|

48,172 | 199,876 | ||||||

|

Trade deposits

|

(53,318 | ) | (796,862 | ) | ||||

|

Escrow deposits

|

- | - | ||||||

|

Increase / (decrease) in current liabilities:

|

||||||||

|

Accounts payable and accrued expenses

|

(717,113 | ) | 5,167,468 | |||||

|

Customer deposits

|

74,494 | (456,392 | ) | |||||

|

Income tax payable

|

(1,325,735 | ) | (589,990 | ) | ||||

|

Deferred tax liabilities

|

- | 495,589 | ||||||

|

Net cash provided by operating activities

|

15,850,253 | 6,291,615 | ||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

||||||||

|

Purchase of property & equipment

|

(18,249 | ) | (619,616 | ) | ||||

|

Purchase of intangibles

|

- | (29,298 | ) | |||||

|

(Increase)/Decrease in short term investments

|

521,795 | - | ||||||

|

(Increase)/Decrease in notes receivable

|

2,328,522 | 972,935 | ||||||

|

Acquisition deposits

|

- | 4,077,921 | ||||||

|

Cash paid for acquisition – net of cash acquired

|

- | (9,354,457 | ) | |||||

|

Net cash (used in) investing activities

|

2,832,068 | (4,952,515 | ) | |||||

|

Effect of exchange rate changes on cash and cash equivalents

|

381,045 | (253,640 | ) | |||||

|

Net change in cash and cash equivalents

|

19,063,366 | 1,085,460 | ||||||

|

Cash and cash equivalents, beginning balance

|

39,618,988 | 36,574,741 | ||||||

|

Cash and cash equivalents, ending balance

|

$ | 58,682,354 | $ | 37,660,201 | ||||

|

SUPPLEMENTAL DISCLOSURES:

|

||||||||

|

Cash paid during the period for:

|

||||||||

|

Interest payments

|

$ | - | $ | - | ||||

|

Income taxes

|

$ | 3,174,521 | $ | 1,354,660 | ||||

|

Purchased goodwill

|

$ | - | $ | (9,025,215 | ) | |||

|

Purchased intangible assets

|

- | (1,982,354 | ) | |||||

|

Fair value of assets purchased less cash acquired

|

- | (382,477 | ) | |||||

|

Acquisition financed with stock issuance

|

- | 2,035,589 | ||||||

|

Acquisition paid for with cash - net of acquired

|

$ | - | $ | (9,354,457 | ) | |||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

UNIVERSAL TRAVEL GROUP

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2011

Note 1 - ORGANIZATION

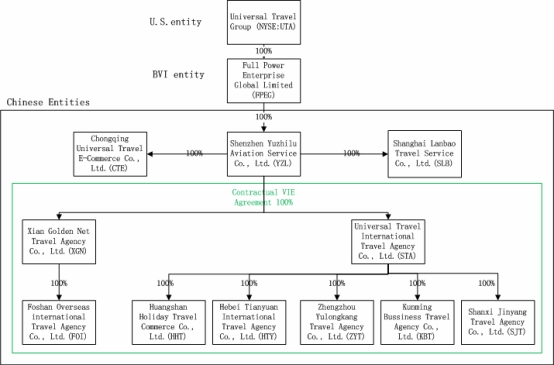

Universal Travel Group was incorporated on January 28, 2004 under the laws of the State of Nevada. Full Power Enterprise Global Limited – BVI was incorporated under the laws of the British Virginia Islands. Shenzhen Yuzhilu Aviation Service Co., Ltd. was incorporated on March 9, 1998 under the laws of the People’s Republic of China (PRC)., Xian Golden Net Travel Serve Services was incorporated on July 25, 2001 under the laws of PRC, Shanghai Lanbao Travel Service Co., Ltd. was established in 2002 under the laws of Shanghai China. Foshan Overseas International Travel Service Co., Ltd. was incorporated in 1990 under the laws of PRC, Chongqing Universal Travel E-Commerce Co., Ltd. and Universal Travel International Travel Agency Co., Ltd. (former named Shenzhen Universal Travel Agency Co., Ltd.) were both incorporated in 2009 under the laws of PRC, Hebei Tianyuan Travel Agency Co., Ltd. was incorporated in April 1999 under the laws of PRC, Huangshan Holiday Travel Service Co., Ltd. was incorporated in April 1999 under the laws of PRC, Zhengzhou Yulongkang Travel Agency Co., Ltd. was incorporated in 2000 under the laws of PRC, Kunming Business Travel Service Co., Ltd. was incorporated in 1993 under the laws of PRC, Shanxi Jinyang Travel Agency Co., Ltd. was incorporated in 1988 under the laws of PRC. Collectively these corporations are referred to herein as the Company. And Universal Travel Group owns 100% of the equity interest in Full Power Enterprise Global Limited, a wholly owned foreign entity incorporated under the laws of the British Virginia Islands. Full Power Enterprise Global Limited owns 100% of the equity interest in Shenzhen Yuzhilu Aviation Service Co., Ltd., a wholly owned foreign entity incorporated under the laws of the Peoples Republic of China ("PRC" or "China"). Universal Travel Group and Full Power Enterprise Global Limited do not conduct any substantive operations of their own. Instead, all operations of the consolidated company is through its subsidiary, Shenzhen Yuzhilu Aviation Service Co., Ltd. ("YZL") and various variable interest entities. Collectively, related to herein as subsidiaries.

In 2007 and 2009, YZL entered into certain shareholding agreements with various related PRC residents and Shenzhen Yuzhixing Aviation Service, Co. Limited (“YZX”) (“Party B”) to hold YZL shares of ownership of Xian Golden Net Travel Serve Services ("XGN") and Shenzhen Universal Travel Agency Co., Ltd. ("STA").The significant details of the agreements and other important information, among others, are outlined below:

Universal Travel Group funded the start up activities and incorporation of XGN and STA and related subsidiaries, through cash or common stock issuance;

YZL entrusted Party B as the name holder only of YZL equity interest in XGN and STA;

Party B shall neither participate in the management of operation nor shareholder meeting decisions of YZX, XGN or STA;

YZL, as the actual fund provider of XGN and STA, will enjoy all shareholder rights and profit sharing;

YZL, is entitled to all profits and is required to absorb all losses of XGN and STA and its subsidiaries;

Party B is not responsible for losses nor to benefit from any income of XGN and/or STA;

YZL will cover any capital infusion requirements of XGN and STA and related subsidiaries; and

If XGN and/or STA were to dissolve, YZL will enjoy the right to allocate and divide assets.

Based on these contractual arrangements, management believes that XGN and STA and related subsidiaries should be considered “Variable Interest Entity” (“VIE”) under ASC 810 “Consolidation of Variable Interest Entities, an Interpretation of ARB No. 51”, because the equity holders in XGN and STA no longer have the characteristics of a controlling financial interest, and the Company, through YZL, is the primary beneficiary of XGN and STA and its operations. Accordingly, management believes that XGN and STA should be consolidated under ASC 810.

Universal Travel Group and YZL are responsible to fund any capital share shortfalls for XGN and STA and its subsidiaries. In addition, Universal Travel Group funded through cash and common stock the acquisitions as discussed in Note 2.

The Company, through its subsidiaries and VIEs, engaged in the travel business, including airline ticketing, hotel reservation services, and packaged tours planning and tours guide services primarily in the PRC.

4

UNIVERSAL TRAVEL GROUP

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2011

Note 1 - ORGANIZATION (CONTINUED)

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

These accompanying condensed financial statements present the Company's results of operations, financial position and cash flows on a consolidated basis. The condensed consolidated financial statements include Universal Travel Group and its wholly-owned subsidiaries and its subsidiaries owned through shareholding agreements with Chinese residents, significant intercompany transactions and accounts have been eliminated in consolidation. Our policy is to consolidate all subsidiaries in which we hold a greater than 50% voting interest or otherwise control its operating activities and financial interest. It is management's opinion that all adjustments necessary for a fair statement of the results for the interim periods have been made, and all adjustments are of a normal recurring nature. The results of operations for the three-month period ended March 31, 2011, are not necessarily indicative of the results that may be expected for the year ending December 31, 2011. These interim unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and related notes included in our Annual Report on Form 10-K for the year ended December 31, 2010, previously filed with the Securities and Exchange Commission ("SEC").

The Company operates in three segments in accordance with accounting guidance FASB ASC Topic 280, "Segment Reporting." Our Chief Executive Officer has been identified as the chief operating decision maker as defined by FASB ASC Topic 280.

Reclassification

Certain prior-year amounts have been reclassified to conform to the current-year presentation. These reclassifications had no effect on reported income or losses.

5

UNIVERSAL TRAVEL GROUP

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2011

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Acquisitions

In March and June of 2010, the Company had 5 acquisitions to fit the its geographic expansion strategy, and in all and every acquisition, the Company negotiated in arm's length with acquisition target and got Board approval before closing.

Acquisitions (Continued)

On June 28, 2010, the Company through its VIE structure and strategy consummated the acquisition of a 100% interest in Kunming Business Travel Agency Co., Ltd. ("KBT") for a cash and stock transaction valued at approximately US$5.7 million in aggregate.

The stock consideration consisted of 79,487 newly issued shares of the company's common stock, which were given to KBT’s Shareholder immediately before the completion of the Share Exchange Transaction. The cash consideration consisted of $5,163,625. The shares were valued at $572,243, which was the average fair value of the shares 15 days prior to the date of the exchange agreement. This amount is included in the cost of net assets, identified intangible assets, and goodwill purchased.

KBT is engaged in the business of Chinese domestic tourism. The purchase price was determined based on arms' length negotiations between Universal Travel Group and the shareholder of KBT, and approved by board of directors.

The acquisition had been accounted for as a purchase business combination and the results of operations from the acquisition date have been included in the Company's consolidated financial statements in accordance with ASC810. The allocation of the purchase price is as follows:

|

Cash acquired

|

$

|

814,097

|

||

|

Other assets

|

441,494

|

|||

|

Property Plant & Equipment

|

80,121

|

|||

|

Identifiable Intangibles

|

892,898

|

|||

|

Goodwill

|

3,977,608

|

|||

|

Total assets acquired

|

6,206,218

|

|||

|

Liabilities assumed

|

||||

|

Accounts & Income Taxes payable

|

174,732

|

|||

|

Deferred Tax Liability

|

223,224

|

|||

|

Other payable

|

72,394

|

|||

|

Total

|

$

|

5,735,868

|

The excess of purchase price over tangible assets acquired and liabilities assumed was $4,870,506 of which $3,977,608 was recorded as goodwill. At the time of the acquisition $892,898 of identifiable intangible assets and related deferred tax liability of $223,224 existed under the contractual legal or the reparability criterion as required under ASC 805 and ASC 740, respectively.

Prior to the acquisition, Kunming Business Travel Agency Co., Ltd. prepared its financial statements under accounting principles generally accepted in the United States of America.

On June 28, 2010, the Company through its VIE structure and strategy consummated the acquisition of a 100% interest in Shanxi Jinyang Travel Agency Co., Ltd. ("SJT") for a cash and stock transaction valued at approximately US$2.3 million in aggregate.

6

UNIVERSAL TRAVEL GROUP

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2011

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Acquisitions (Continued)

The stock consideration consisted of 31,387 newly issued shares of the company's common stock, which were given to SJT’s Shareholder immediately before the completion of the Share Exchange Transaction. The cash consideration consisted of $2,038,946. The shares were valued at $225,986, which was the average fair value of the shares 15 days prior to the date of the exchange agreement. This amount is included in the cost of net assets, identified intangible assets, and goodwill purchased.

SJT is engaged in the business of Chinese domestic tourism. The purchase price was determined based on arms' length negotiations between Universal Travel Group and the shareholder of SJT, and approved by board of directors.

The acquisition had been accounted for as a purchase business combination and the results of operations from the acquisition date have been included in the Company's consolidated financial statements in accordance with ASC810. The allocation of the purchase price is as follows:

|

Cash acquired

|

$

|

7,258

|

||

|

Other assets

|

534,373

|

|||

|

Property Plant & Equipment

|

20,339

|

|||

|

Identifiable Intangibles

|

361,124

|

|||

|

Goodwill

|

1,609,816

|

|||

|

Total assets acquired

|

2,532,910

|

|||

|

Liabilities assumed

|

||||

|

Accounts & Income Taxes payable

|

78,574

|

|||

|

Deferred Tax Liability

|

90,281

|

|||

|

Other payable

|

99,123

|

|||

|

Total

|

$

|

2,264,932

|

The excess of purchase price over tangible assets acquired and liabilities assumed was $1,970,940 of which $1,609,816 was recorded as goodwill. At the time of the acquisition $361,124 of identifiable intangible assets and related deferred tax liability of $90,281 existed under the contractual legal or the reparability criterion as required under ASC 805 and ASC 740, respectively.

Prior to the acquisition, Shanxi Jinyang Travel Agency Co., Ltd. prepared its financial statements under accounting principles generally accepted in the United States of America.

On March 29, 2010 the Company through its VIE structure and strategy consummated the acquisition of a 100% interest in Zhengzhou Yulongkang Travel agency Co. Ltd ("ZYT") for a cash and stock transaction valued at approximately US$5.7 million in aggregate.

The stock consideration consisted of 60,633 newly issued shares of the Company’s common stock, which were given to ZYT’s Shareholder immediately before the completion of the Share Exchange Transaction. The cash consideration consisted of $5,141,764. The shares were valued at $571,172, which was the average fair value of the shares 15 days prior to the date of the exchange agreement. This amount is included in the cost of net assets, identified intangible assets, and goodwill purchased.

ZYT is engaged in the business of Chinese domestic tourism. The purchase price was determined based on arms' length negotiations between Universal Travel Group and the shareholder of ZYT.

The acquisition had been accounted for as a purchase business combination and the results of operations from the acquisition date have been included in the Company's consolidated financial statements in accordance with ASC 810. The allocation of the purchase price is as follows:

7

UNIVERSAL TRAVEL GROUP

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2011

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Acquisitions (Continued)

|

Cash acquired

|

$

|

1,513,636

|

||

|

Accounts receivable

|

29,154

|

|||

|

Other assets

|

11,779

|

|||

|

Property Plant & Equipment

|

29,019

|

|||

|

Identifiable Intangibles

|

805,626

|

|||

|

Goodwill

|

3,812,004

|

|||

|

Total assets acquired

|

6,201,218

|

|||

|

Liabilities assumed

|

||||

|

Accounts & Income Taxes payable

|

230,107

|

|||

|

Deferred Tax Liability

|

201,406

|

|||

|

Other payable

|

56,769

|

|||

|

Total

|

$

|

5,712,936

|

The excess of purchase price over tangible assets acquired and liabilities assumed was $4,617,630 of which $3,812,004 was recorded as goodwill. At the time of the acquisition $805,626 of identifiable intangible assets and related deferred tax liability of $201,406 existed under the contractual legal or the reparability criterion as required under ASC 805 and ASC 740, respectively.

Prior to the acquisition, Zhengzhou Yulongkang Travel agency Co. Ltd prepared its financial statements under accounting principles generally accepted in the United States of America.

On March 26, 2010 the Company through its VIE structure and strategy consummated the acquisition of a 100% interest in Huangshan Holiday Travel Service Co., Ltd ("HHT") for a cash and stock transaction valued at approximately US$2.9 million in aggregate.

The stock consideration consisted of 61,846 newly issued shares of the company’s common stock, which were given to HHTs Shareholder immediately before the completion of the Share Exchange Transaction. The cash consideration consisted of $2,343,824. The shares were valued at $585,691, which was the average fair value of the shares 15 days prior to the date of the exchange agreement. This amount is included in the cost of net assets, identified intangible assets, and goodwill purchased.

HHT is engaged in the business of Chinese domestic tourism. The purchase price was determined based on arms' length negotiations between Universal Travel Group and the shareholder of HHT, and approved by board of directors.

The acquisition had been accounted for as a purchase business combination and the results of operations from the acquisition date have been included in the Company's consolidated financial statements in accordance with ASC 810. The allocation of the purchase price is as follows:

8

UNIVERSAL TRAVEL GROUP

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2011

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Acquisitions (Continued)

|

Cash acquired

|

$

|

340,174

|

||

|

Accounts receivable

|

21,450

|

|||

|

Other assets

|

452,193

|

|||

|

Property Plant & Equipment

|

69,682

|

|||

|

Identifiable Intangibles

|

479,870

|

|||

|

Goodwill

|

1,892,511

|

|||

|

Total assets acquired

|

3,255,880

|

|||

|

Liabilities assumed

|

||||

|

Accounts & Income Taxes payable

|

176,863

|

|||

|

Deferred Tax Liability

|

119,968

|

|||

|

Other payable

|

29,534

|

|||

|

Total

|

$

|

2,929,515

|

The excess of purchase price over tangible assets acquired and liabilities assumed was $2,372,381 of which $1,892,511 was recorded as goodwill. At the time of the acquisition $479,870 of identifiable intangible assets and related deferred tax liability of $119,968 existed under the contractual legal or the reparability criterion as required under ASC 805 and ASC 740, respectively.

Prior to the acquisition, Huangshan Holiday Travel Service Co., Ltd prepared its financial statements under accounting principles generally accepted in the United States of America.

On March 29, 2010 the Company through its VIE structure and strategy consummated the acquisition of a 100% interest in Hebei Tianyuan Travel Agency Co., Ltd ("HTT") for a cash and stock transaction valued at approximately US$4.4 million in aggregate.

The stock consideration consisted of 93,282 newly issued shares of the company’s common stock, which were given to HTT’s Shareholder immediately before the completion of the Share Exchange Transaction. The cash consideration consisted of $3,519,736. The shares were valued at $878,726, which was the average fair value of the shares prior to the date of the exchange agreement. This amount is included in the cost of net assets, identified intangible assets, and goodwill purchased.

HTT is engaged in the business of Chinese domestic tourism. The purchase price was determined based on arms' length negotiations between Universal Travel Group and the shareholder of HTT, and approved by board of directors.

The acquisition had been accounted for as a purchase business combination and the results of operations from the acquisition date have been included in the Company's consolidated financial statements in accordance with ASC 810. The allocation of the purchase price is as follows:

9

UNIVERSAL TRAVEL GROUP

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2011

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Acquisitions (Continued)

|

Cash acquired

|

$

|

532,349

|

||

|

Accounts receivable

|

120,152

|

|||

|

Other assets

|

208,771

|

|||

|

Property Plant & Equipment

|

49,637

|

|||

|

Identifiable Intangibles

|

696,858

|

|||

|

Goodwill

|

3,320,700

|

|||

|

Total assets acquired

|

4,928,467

|

|||

|

Liabilities assumed

|

||||

|

Accounts & Income Taxes payable

|

232,188

|

|||

|

Deferred Tax Liability

|

174,215

|

|||

|

Other payable

|

123,602

|

|||

|

Total

|

$

|

4,398,462

|

The excess of purchase price over tangible assets acquired and liabilities assumed was $4,017,558 of which $3,320,700 was recorded as goodwill. At the time of the acquisition $696,858 of identifiable intangible assets and related deferred tax liability of $174,215 existed under the contractual legal or the reparability criterion as required under ASC 805 and ASC 740, respectively.

Prior to the acquisition, Hebei Tianyuan Travel Agency Co., Ltd prepared its financial statements under accounting principles generally accepted in the United States of America.

Translation Adjustment

As of March 31, 2011 and December 31, 2010, the accounts of Universal Travel Group were maintained, and its condensed financial statements were expressed, in Chinese Yuan Renminbi (CNY). Such financial statements were translated into U.S. Dollars (USD) in accordance with the Foreign Currency Matters Topic of the FASB Accounting Standards Codification (“ASC 830”) with the CNY as the functional currency. According to the Statement, all assets and liabilities were translated at the current exchange rate, stockholders equity are translated at the historical rates and income statement items are translated at the average exchange rate for the period. The resulting translation adjustments are reported under other comprehensive income in accordance with the Comprehensive Income Topic of the FASB Accounting Standard Codification (“ASC 830”). Transaction gains and losses are reflected in the income statement and such differences may be material to the financial statements.

Use of Estimates

The preparation of condensed financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and such differences maybe material to the financial statements. The more significant estimates and assumptions made by management include among others, consolidation of VIE's, allowance for doubtful accounts, long-lived asset impairment, useful lives and residual values of fixed assets, stock based compensation, valuation of warrant derivative liability, purchase price allocation of fair market value of assets and liabilities acquired and deferred income taxes. The current economic environment has increased the degree of uncertainty inherent in these estimates and assumptions.

10

UNIVERSAL TRAVEL GROUP

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2011

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Principles of Consolidation

The condensed consolidated financial statements include the accounts of Universal Travel Group and its wholly owned subsidiaries and Variable Interest Entities Shenzhen Yuzhilu Aviation Service Co., Ltd., Shenzhen Speedy Dragon Enterprises Limited, Shanghai Lanbao Travel Service Co., Ltd., Xian Golden Net Travel Serve Services, Ltd., Foshan Overseas International Travel Service Co. Ltd., Chongqing Universal Travel E-Commerce Co., Ltd., Shenzhen Universal Travel Agency Co., Ltd., Hebei Tianyuan Travel Agency Co., Ltd., Huangshan Holiday Travel Service Co., Ltd., Zhengzhou Yulongkang Travel Agency Co., Ltd., Kunming Business Travel Service Co., Ltd., Shanxi Jinyang Travel Agency Co., Ltd., and Full Power Enterprise Global Limited collectively referred to herein as the Company. All material inter-company accounts, transactions and profits have been eliminated in consolidation.

Risks and Uncertainties

The Company's operation is located in the PRC. There can be no assurance that the Company will be able to successfully continue the operation and failure to do so would have a material adverse effect on the Company's financial position, results of operations and cash flows. Also, the success of the Company's operations is subject to numerous contingencies, some of which are beyond management's control. These contingencies include general economic conditions, competition, governmental and political conditions, and changes in regulations. Among other risks, the Company's operations will be subject to risk of restrictions on transfer of funds, domestic and international customs, changing taxation policies, foreign exchange restrictions, and political and governmental regulations.

Contingencies

Certain conditions may exist as of the date the condensed financial statements are issued. These conditions may result in a future loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company’s management and legal counsel assess such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company’s legal counsel evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought.

If the assessment of a contingency indicates that it is probable given the current economic environment that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates that a potential material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss if determinable and material would be disclosed. Loss contingencies considered to be remote by management are generally not disclosed unless they involve guarantees, in which case the guarantee would be disclosed.

As of March 31, 2011, the Company is not involved in any material legal dispute, other than those which occur in the normal operations of a business.

11

UNIVERSAL TRAVEL GROUP

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2011

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Net Income (Loss) Per Share

The Company accounts for net income (loss) per share EPS in accordance with FASB Accounting Standards Codification Topic on Earning Per Share (“ASC 260”), which requires presentation of basic and diluted EPS on the face of the statement of income for all entities with complex capital structures and requires a reconciliation of the numerator and denominator of the basic EPS computation to the numerator and denominator of the diluted EPS. Basic net income (loss) per share is computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding during each period. It excludes the dilutive effects of potentially issuable common shares such as those related to the Company’s warrants and stock options (calculated using the treasury stock method). Diluted net income (loss) per share is calculated by including potentially dilutive share issuances in the denominator.

The following table sets forth the computation of basic and diluted earnings per share of common stock:

|

Three months ended March 31,

|

||||||||

|

2011

|

2010

|

|||||||

|

Basic earnings per share from continuing operations

|

||||||||

|

Numerator:

|

||||||||

|

Income from continuing operations used in computing basic earnings per share

|

$

|

4,455,530

|

$

|

3,546,435

|

||||

|

Income from continuing operations applicable to common shareholders

|

$

|

4,455,530

|

$

|

3,546,435

|

||||

|

Denominator:

|

||||||||

|

Weighted average common shares outstanding

|

19,898,235

|

16,822,339

|

||||||

|

Basic earnings per share from continuing operations

|

$

|

0.22

|

$

|

0.21

|

||||

|

Diluted earnings per share from continuing operations:

|

||||||||

|

Numerator:

|

||||||||

|

Income from continuing operations used in computing basic earnings per share

|

$

|

4,455,530

|

$

|

3,546,435

|

||||

|

Income from continuing operations applicable to common shareholders

|

$

|

4,455,530

|

$

|

3,546,435

|

||||

|

Denominator:

|

||||||||

|

Weighted average common shares outstanding

|

19,898,235

|

16,822,339

|

||||||

|

Weighted average effect of dilutive securities:

|

||||||||

|

Stock options and warrants

|

661,708

|

1,196,918

|

||||||

|

Shares used in computing diluted net income per share

|

20,559,943

|

18,019,257

|

||||||

|

Diluted earnings per share from continuing operations

|

$

|

0.22

|

$

|

0.20

|

||||

|

Total net income per common share

|

||||||||

|

Basic

|

$

|

0.22

|

$

|

0.21

|

||||

|

Diluted

|

$

|

0.22

|

$

|

0.20

|

||||

12

UNIVERSAL TRAVEL GROUP

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2011

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Recent Accounting Pronouncements

In December 2010, the FASB issued ASU No. 2010-28—When to Perform Step 2 of the Goodwill Impairment Test for Reporting Units with Zero or Negative Carrying Amounts. This update provides amendments to Accounting Standards Codification (“ASC”) Topic 350—Intangibles, Goodwill and Other that requires an entity to perform Step 2 impairment test even if a reporting unit has zero or negative carrying amount. Step 1 tests whether the carrying amount of a reporting unit exceeds its fair value. Previously reporting units with zero or negative carrying value passed Step 1 because the fair value was generally greater than zero. Step 2 requires impairment testing and impairment valuation be calculated in between annual tests if an event or circumstances indicate that it is more likely than not that goodwill has been impaired. ASU No. 2010-28 is effective beginning January 1, 2011. As a result of this standard, goodwill impairments may be reported sooner than under current practice. The implementation of ASU No. 2010-28 did not have a material impact on our consolidated financial statements.

In July 2010, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2010-20, Receivables – Disclosures about the Credit Quality of Financing Receivables and the Allowance for Credit Losses ("ASU No. 2010-20"). ASU No. 2010-20 will require a company to provide more information about the credit quality of its financing receivables in the disclosures to the financial statements, including aging information and credit quality indicators. Both new and existing disclosures must be disaggregated by portfolio segment or class. The disaggregation of information is based on both how a company develops its allowance for credit losses and it manages its credit exposure. ASU No. 2010-20 is effective for interim and annual reporting periods after December 15, 2010. The adoption of ASU 2010-20 is not expected to have a material effect on our financial statements.

In April 2010, the FASB issued Accounting Standards Update, 2010-17, Revenue Recognition—Milestone Method (Topic 605): “Milestone Method of Revenue Recognition—a consensus of the FASB Emerging Issues Task Force.” This is an update regarding the milestone method of revenue recognition. The scope of this update is limited to arrangements that include milestones relating to research or development deliverables. The update specifies criteria that must be met for a vendor to recognize consideration that is contingent upon achievement of a substantive milestone in its entirety in the period in which the milestone is achieved. The criteria apply to milestones in arrangements within the scope of this update regardless of whether the arrangement is determined to have single or multiple deliverables or units of accounting. The update will be effective for fiscal years, and interim periods within those years, beginning on or after June 15, 2010. Early application is permitted. Companies can apply this guidance prospectively to milestones achieved after adoption. However, retrospective application to all prior periods is also permitted. This update did not have a material impact on the Company’s financial statements.

In April 2010, the FASB issued ASU No. 2010-13, “Compensation - Stock Compensation (Topic 718): Effect of Denominating the Exercise Price of a Share-Based Payment Award in the Currency of the Market in Which the Underlying Equity Security Trades ,” which addresses the classification of a share-based payment award with an exercise price denominated in the currency of a market in which the underlying equity security trades. Topic 718 is amended to clarify that a share-based payment award with an exercise price denominated in the currency of a market in which a substantial portion of the entity’s equity securities trades shall not be considered to contain a market, performance, or service condition. Therefore, such an award is not to be classified as a liability if it otherwise qualifies as equity classification. The amendments in this Update should be applied by recording a cumulative effect adjustment to the opening balance of retained earnings. The cumulative-effect adjustment should be calculated for all awards outstanding as of the beginning of the fiscal year in which the amendments are initially 12 applied, as if the amendments had been applied consistently since the inception of the award. ASU No. 2010-13 is effective for interim and annual periods beginning on or after December 15, 2010 and did not have a material impact on the Company’s consolidated financial position or results of operations.

13

UNIVERSAL TRAVEL GROUP

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2011

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Recent Accounting Pronouncements (Continued)

In May, 2010, the FASB issued ASU 2010-19¸ "Foreign Currency" (Topic 830): Foreign Currency Issues: Multiple Foreign Currency Exchange Rates (SEC Update). The purpose of this Update is to codify the SEC Staff Announcement made at the March 18, 2010 meeting of the FASB Emerging Issues Task Force (EITF) by the SEC Observer to the EITF. The Staff Announcement provides the SEC staff’s view on certain foreign currency issues related to investments in Venezuela. The Company does not expect the provisions of ASU 2010-19 to have a material effect on the financial position, results of operations, or cash flows of the Company.

In March, 2010, the FASB issued Accounting Standards Update, 2010-11, Derivatives and Hedging (Topic 815): “Scope Exception Related to Embedded Credit Derivatives.” This update clarifies the type of embedded credit derivative that is exempt from embedded derivative bifurcation requirements. Specifically, only one form of embedded credit derivative qualifies for the exemption – one that is related only to the subordination of one financial instrument to another. As a result, entities that have contracts containing an embedded credit derivative feature in a form other than such subordination may need to separately account for the embedded credit derivative feature. This update also has transition provisions, which permit entities to make a special one-time election to apply the fair value option to any investment in a beneficial interest in securitized financial assets, regardless of whether such investments contain embedded derivative features. This update is effective on the first day of the first fiscal quarter beginning after June 15, 2010. The adoption of this update did not have a material impact on the Company’s financial statements

In January 2010, the FASB issued Accounting Standards Update, 2010-06, Fair Value Measurements and Disclosures (Topic 820): “Improving Disclosures about Fair Value Measurements.” This update provides guidance to improve disclosures about fair value measurements. This guidance amends previous guidance on fair value measurements to add new requirements for disclosures about transfers into and out of Levels 1 and 2 and separate disclosures about purchases, sales, issuances, and settlements relating to Level 3 measurement on a gross basis rather than on a net basis as currently required. This update also clarifies existing fair value disclosures about the level of disaggregation and about inputs and valuation techniques used to measure fair value. This guidance is effective for annual and interim periods beginning after December 15, 2009, except for the requirement to provide the Level 3 activities of purchases, sales, issuances, and settlements on a gross basis, which will be effective for annual and interim periods beginning after December 15, 2010. Early application is permitted and, in the period of initial adoption, entities are not required to provide the amended disclosures for any previous periods presented for comparative purposes. The adoption of this update did not have a significant impact on the Company’s financial statements.

In December 2009, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2009-17, which requires a qualitative approach for determining the primary beneficiary of a variable interest entity and replaces the quantitative evaluation previously set forth under FASB Interpretation No. 46 (revised December 2003), “Consolidation of Variable Interest Entities.” This approach is focused on identifying the reporting entity that has the ability to direct the activities of a variable interest entity that most significantly affects the entity’s economic performance and has the obligation to absorb the entity’s losses or has the right to receive benefits from the entity. ASU No. 2009-17, among other things, requires enhanced disclosures about a reporting entity’s involvement in variable interest entities. The guidance under ASU No. 2009-17 became effective for the first annual period beginning after November 15, 2009, and interim periods within that first annual period. The Company adopted the pronouncement on January 1, 2010 resulting in no impact to the Company’s consolidated balance sheets, statements of income and cash flows.

14

UNIVERSAL TRAVEL GROUP

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2011

Note 3 - INCOME TAXES

The Company is subject to U.S. federal income tax, and the Company’s subsidiaries incorporated in the People’s Republic of China (the “PRC”) are subject to enterprise income taxes in the PRC.

During the three months ended March 31, 2011 and 2010, the Company recorded an income tax expense of approximately $1.9 million and $1.3 million, respectively. The increase of approximately $0.6 million in the Company’s income tax expense was primarily due to the increase in profits of its PRC subsidiaries.

The effective tax rate increased by 1% from a 27% effective rate for the three months ended March 31, 2010 to a 28% effective rate for the three months ended March 31, 2011.

As of March 31, 2011, unrecognized tax benefits was $30,804. The total amount of unrecognized tax benefits that, if recognized, would favorably affect the effective tax rate at March 31, 2011. As of March 31, 2010, unrecognized tax benefits were approximately $0. The total amount of unrecognized tax benefits that, if recognized, would favorably affect the effective tax rate was $0 at March 31, 2010.

For the three months ended March 31, 2011 and 2010, the Company recorded uncertain tax benefits of approximately $0 and $0, respectively.

Aggregate undistributed earnings of approximately $91 million as of March 31, 2011 of the Group's PRC subsidiaries that are available for distribution to the Company are considered to be indefinitely reinvested, and, accordingly, no provision has been made for the Chinese dividend withholding taxes that would be payable upon distribution to the Company. Additionally, the Chinese tax authorities have clarified that distributions made out of pre-January 1, 2008 retained earnings would not be subject to the withholding tax.

The Company's tax years from 2006 to 2010 remain open in various jurisdictions.

Income Tax Expense

We are subject to U.S. federal income tax, and our subsidiaries incorporated in the PRC are subject to enterprise income taxes in the PRC. We recorded an income tax expense of approximately $1.9 million and $1.3 million for the three months ended March 31, 2011 and 2010, respectively. The increase of approximately $0.6 million in income tax expense was primarily due to the increase in profits of its PRC subsidiaries

As of March 31, 2011, unrecognized tax benefits were $30,804. The total amount of unrecognized tax benefits that, if recognized, would favorably affect the effective tax rate at March 31, 2011. As of March 31, 2010, unrecognized tax benefits were approximately $0. The total amount of unrecognized tax benefits that, if recognized, would favorably affect the effective tax rate was $0 at March 31, 2010.

For the three months ended March 31, 2011 and 2010, we recorded uncertain tax benefits of approximately $0 and $0, respectively.

15

UNIVERSAL TRAVEL GROUP

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2011

Note 4 - SEGMENT INFORMATION

Pursuant to ASC 280 the Company operates and discloses three reportable segments: air ticketing, hotel reservation and packaged tours. Substantially all of the Company’s revenues and long-lived assets are in Peoples Republic of China.

The Company currently operates and prepares accounting and other financial reports separately to management for eleven major business organizations (Shenzhen Yuzhilu Aviation Service Co., Ltd., Shanghai Lanbao Travel Service Co., Ltd., Foshan International Travel Service Co., Ltd., Xian Golden Net Travel Serve Services, Chongqing Travel World E-Business Co., Ltd., Shenzhen Universal Travel Agency Co., Ltd., Hebei Tianyuan Travel Agency Co., Ltd., Zhengzhou Yulongkang Travel Agency Co., Ltd., Huangshan Holiday Travel Service Co., Ltd., Kunming Business Travel Service Co., Ltd., and Shanxi Jinyang Travel Agency Co., Ltd.).

Our air-ticketing segment relates to the segment reporting of Shenzhen Yuzhilu Aviation Service Co., Ltd. and Chongqing Travel World E-Business Co., Ltd.; Hotel reservation segment relates to Shanghai Lanbao Travel Service Co., Ltd. and Huangshan Holiday Travel Service Co., Ltd.; Packaged tours segment relates to Chongqing Travel World E-Business Co., Ltd., Foshan International Travel Service Co., Ltd., Xian Golden Net Travel Serve Service Company Ltd., Shenzhen Universal Travel Agency Co., Ltd., Hebei Tianyuan Travel Agency Co., Ltd., Zhengzhou Yulongkang Travel Agency Co., Ltd., Huangshan Holiday Travel Service Co., Ltd., Kunming Business Travel Service Co., Ltd., and Shanxi Jinyang Travel Agency Co., Ltd.. Management monitors these segments regularly to make decisions about resources to be allocated to the segment and assess its performance.

The following tables present summarized information by segment:

|

Air

|

Hotel

|

Packaged

|

Other

|

Total

|

||||||||||||||||

|

Ticketing

|

Reservation

|

Tours

|

||||||||||||||||||

|

Three Months Ended March 31, 2011

|

||||||||||||||||||||

|

Revenue, net

|

$ | 5,260,428 | $ | 3,693,953 | $ | 24,841,112 | $ | - | $ | 33,795,493 | ||||||||||

|

Cost of services

|

$ | 1,916,323 | $ | 1,374,384 | $ | 21,629,570 | $ | - | $ | 24,920,277 | ||||||||||

|

Gross profit

|

$ | 3,344,105 | $ | 2,319,569 | $ | 3,211,542 | $ | - | $ | 8,875,216 | ||||||||||

|

Income from operations

|

$ | 2,267,197 | $ | 2,045,132 | $ | 2,911,819 | $ | (1,347,030 | ) | $ | 5,877,118 | |||||||||

|

Income tax expenses

|

$ | 606,372 | $ | 511,656 | $ | 763,375 | $ | (6,859 | ) | $ | 1,874,544 | |||||||||

|

Depreciation & Amortization

|

$ | 272,369 | $ | 2,160 | $ | 32,750 | $ | - | $ | 307,279 | ||||||||||

|

Asset expenditures

|

$ | 18,249 | $ | - | $ | - | $ | - | $ | 18,249 | ||||||||||

|

Goodwill

|

$ | - | $ | 3,081,799 | $ | 21,427,110 | $ | - | $ | 24,508,909 | ||||||||||

|

Total assets

|

$ | 114,283,780 | $ | 5,676,167 | $ | 23,746,474 | $ | 440,428 | $ | 144,146,849 | ||||||||||

|

Three Months Ended March 31, 2010

|

||||||||||||||||||||

|

Revenue, net

|

$ | 3,905,975 | $ | 3,030,106 | $ | 13,489,698 | $ | - | $ | 20,425,779 | ||||||||||

|

Cost of services

|

$ | 1,367,871 | $ | 998,417 | $ | 11,803,197 | $ | - | $ | 14,169,485 | ||||||||||

|

Gross profit

|

$ | 2,538,104 | $ | 2,031,689 | $ | 1,686,501 | $ | - | $ | 6,256,294 | ||||||||||

|

Income from operations

|

$ | 1,768,126 | $ | 1,994,178 | $ | 1,535,358 | $ | (607,355 | ) | $ | 4,690,307 | |||||||||

|

Income tax expenses

|

$ | 393,724 | $ | 506,128 | $ | 379,214 | $ | - | $ | 1,279,066 | ||||||||||

|

Depreciation & Amortization

|

$ | 233,762 | $ | 1,483 | $ | 65,859 | $ | - | $ | 301,104 | ||||||||||

|

Asset expenditures

|

$ | 608,210 | $ | - | $ | 11,406 | $ | - | $ | 619,616 | ||||||||||

|

Goodwill

|

$ | $ | 3,081,799 | $ | 15,839,686 | $ | - | $ | 18,921,485 | |||||||||||

|

Total assets

|

$ | 61,797,751 | $ | 6,065,249 | $ | 23,590,476 | $ | 5,024,091 | $ | 96,477,567 | ||||||||||

16

UNIVERSAL TRAVEL GROUP

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2011

Note 5 - PRO FORMA FINANCIAL STATEMENTS

Pro Forma financial statements present revenue and related data of five subsidiaries acquired in 2010 as if the acquisitions were made at the earliest date presented of January 1, 2010.

For the three months ended March 31, 2010, the revenue, income from operations, net income, and net income per common share in Pro Forma financial statements are as follow:

|

For the three months ended

|

||||

|

March 31. 2010

|

||||

|

Revenues

|

$ | 29,683,165 | ||

|

Income from operations

|

$ | 5,935,170 | ||

|

Net Income

|

$ | 4,486,550 | ||

|

Net income per common share

|

||||

|

Basic

|

$ | 0.27 | ||

|

Dilute

|

$ | 0.25 | ||

Note 6 - SUBSEQUENT EVENTS

On April 12, 2011, UTA stock was suspended for trading when UTA was unable to file its Annual Report on Form 10-K by April 15, 2011 as a result of Windes & McClaughry Accountancy Corporation resignation on April 9, 2011. On June 8, 2011, UTA filed its Annual Report on Form 10-K.

On April 15, 2011, the plaintiff Albert Snellink commenced putative class action in the United States District Court, District of New Jersey against Universal Travel Group, and Jiangping Jiang, Yizhao Zhang and Jing Xie, officers of the Company. In the complaint, plaintiff alleges a claim for violations of Section 10(b) and Rule 10b-5 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), against all defendants, and a claim for a violation of Section 20(a) of the Exchange Act against the individual defendants in connection with purported misrepresentations contained in the Company’s public filings and press releases. The complaint seeks unspecified compensatory damages, and his costs incurred in the action. The Company’s time to answer or move with respect to the complaint has not yet expired. The Company believes that the allegations of complaint are without merit, and intends to vigorously defend the lawsuit.

On May 20, 2011, the plaintiff Alex Lob commenced derivative action in the First Judicial District Court of the State of Nevada in and for Carson City against Universal travel Group, and Jiangping Jiang, Jing Xie, Huijie Gao, Jiduan Yuan, Lizong Wang, Wenbin An, Lawrence Lee, Yizhao Zhang and Liquan Wang, officers and directors of the Company. In the complaint, plaintiff purports to assert derivative claims against the individual defendants for alleged breaches of fiduciary duties, waste of corporate assets and unjust enrichment based upon alleged conduct of the individual defendants which damaged the Company’s reputation, goodwill and standing in the business community. The complaint also alleges that such conduct may result in liability for violations of federal law. The complaint seeks, among other relief, the amount of damages sustained by the Company as a result of the Defendants’ breach of fiduciary duties, waste of corporate assets and unjust enrichment and plaintiff’s counsel’s, accountant’s and experts’ fees. The Company’s time to answer or move with respect to the complaint has not yet expired. The Company believes that the complaint has no merit and intends to vigorously defend the lawsuit.

As of March 31, 2011, the Company has evaluated subsequent events for potential recognition and disclosure through the date of the financial statement issuance.

17

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Forward-Looking Statements: No Assurances Intended

In addition to historical information, this quarterly report contains forward-looking statements, which are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans to,” “estimates,” “projects,” or similar expressions. These forward-looking statements represent Management’s belief as to the future of Universal Travel Group. Whether those beliefs become reality will depend on many factors that are not under management’s control. Many risks and uncertainties exist that could cause actual results to differ materially from those reflected in these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements.

Business Overview

We are a travel services provider in the People’s Republic of China (“PRC”) engaged in providing air ticketing and hotel booking services as well as domestic and international packaged tourism services throughout the PRC via the internet, the customer representatives and the kiosks.

|

Name of Entities

|

Place of

Incorporation

|

Expiration date

|

Ownership

Percentage

|

|||||||

|

Universal Travel Group

|

Nevada, USA

|

-

|

100

|

%

|

||||||

|

Full Power Enterprise Global Limited – BVI

|

British Virginia Islands

|

-

|

100

|

%

|

||||||

|

Shenzhen Yuzhilu Aviation Service Co., Ltd.

|

China

|

1998.3.9-2018.3.9

|

100

|

%

|

||||||

|

Xian Golden Net Travel Serve Services Co., Ltd.

|

China

|

2001.8.1-2016.9.4

|

100

|

% VIE

|

||||||

|

Shanghai Lanbao Travel Service Co., Ltd.

|

China

|

2002.5.29-2015.4.28

|

100

|

%

|

||||||

|

Foshan Overseas International Travel Service Co., Ltd.

|

China

|

Infinite Term

|

100

|

%

|

||||||

|

Chongqing Universal Travel E-Commerce Co., Ltd.

|

China

|

Infinite Term

|

100

|

%

|

||||||

|

Universal Travel International Travel Agency Co., Ltd. (formerly named: Shenzhen Universal Travel Agency Co., Ltd.)

|

China

|

Infinite Term

|

100

|

% VIE

|

||||||

|

Hebei Tianyuan International Travel Agency Co., Ltd.

|

China

|

1999.10.8-2019.10.7

|

100

|

%

|

||||||

|

Huangshan Holiday Travel Service Co., Ltd.

|

China

|

Infinite Term

|

100

|

%

|

||||||

|

Zhengzhou Yulongkang Travel Agency Co., Ltd.

|

China

|

2000.11.1-2020.11.1

|

100

|

%

|

||||||

|

Kunming Business Travel Service Co., Ltd.

|

China

|

2001.10.8-2011.10.8

|

100

|

%

|

||||||

|

Shanxi Jinyang Travel Agency Co., Ltd.

|

China

|

2005.5.19-2015.5.18

|

100

|

%

|

||||||

In 2007 and 2009, YZL entered into certain shareholding agreements with various related PRC residents and Shenzhen Yuzhixing Aviation Service, Co. Limited (“YZX”) (“Party B”) to hold YZL shares of ownership of Xian Golden Net Travel Serve Services ("XGN") and Shenzhen Universal Travel Agency Co., Ltd. ("STA").The significant details of the agreements and other important information, among others, are outlined below:

Universal Travel Group funded the startup activities and incorporation of XGN and STA and related subsidiaries, through cash or common stock issuance;

YZL entrusted Party B as the name holder only of YZL equity interest in XGN and STA;

Party B shall neither participate in the management of operation nor shareholder meeting decisions of YZX, XGN or STA;

YZL, as the actual fund provider of XGN and STA, will enjoy all shareholder rights and profit sharing;

18

YZL, is entitled to all profits and is required to absorb all losses of XGN and STA and its subsidiaries;

Party B is not responsible for losses nor to benefit from any income of XGN and/or STA;

YZL will cover any capital infusion requirements of XGN and STA and related subsidiaries; and

If XGN and/or STA were to dissolve, YZL will enjoy the right to allocate and divide assets.

Based on these contractual arrangements, management believes that XGN and STA and related subsidiaries should be considered “Variable Interest Entities” (“VIE”) under ASC 810 “Consolidation of Variable Interest Entities, an Interpretation of ARB No. 51”, because the equity holders in XGN and STA no longer have the characteristics of a controlling financial interest, and the Company, through YZL, is the primary beneficiary of XGN and STA and its operations. Accordingly, management believes that XGN and STA should be consolidated under ASC 810.

Universal Travel Group and YZL are responsible to fund any capital share shortfalls for XGN and STA and its subsidiaries. In addition, Universal Travel Group funded through cash and common stock the acquisitions as discussed in Note 2.

In 2007, we completed the acquisitions of Xi'an Golden Net Travel Serve Service Co., Ltd., which specializes in domestic packaged tour services, and Shanghai Lanbao Travel Service Co., Ltd., which specializes in hotel reservations and Foshan Overseas International Travel Service Co., Ltd, which handles both domestic and international travel inquiries.

In early 2008, we successfully integrated our packaged tours, air-ticketing and hotel reservation businesses onto our newly developed on-line platform, which provides rich and comprehensive travel information to primarily leisure travelers.

In October 2008, we successfully rolled out our Kiosks, the type of innovate self-service terminals capable of handling a full ranging of booking services including packaged tours through a secured built in payment function that accepts all major Chinese bank cards. On September 9, 2010, we sold all of 1,523 Kiosks to Shenzhen Xunbao E-commerce Co. Ltd. with a slight gain. The strategy of sales of Kiosks was to minimize our capital expenditures and related expenses. We still have the full right to use these kiosks after the sales for two years according to the agreement.

In December 2008, we established Universal Travel International Travel Agency Co., Ltd. (formerly known as Shenzhen Universal Travel Agency Co. Ltd.), a PRC company, to meet the increasing packaged-tour demand in Shenzhen City.

In March 2009, in order to seize the opportunities arising from the economic promotion by the Chinese government of the mid and western regions of the PRC, we strategically set up Chongqing Universal Travel E-Commerce Co., Ltd., a PRC company, to strengthen our presence in that region. It began generating revenues in the third quarter of 2009.

In 2010, we acquired a total of five companies for stock and cash through our VIE structure and strategy, namely Huangshan Holiday Travel Service Co., Ltd. (“Huangshan Holiday”), Hebei Tianyuan International Travel Agency Co., Ltd. (“Tianyuan”), Zhengzhou Yulongkang Travel Agency Co., Ltd. (“Zhengzhou Yulongkang”), Kunming Business Travel Agency Co., Ltd. ("Kunming Business Travel") and Shanxi Jinyang Travel Agency Co., Ltd. ("Shanxi Jinyang").

In order to finance the abovementioned acquisitions and our working capital, on December 10, 2009, we entered into a definitive subscription agreement to sell to institutional investors an aggregate of 2,222,222 shares of its common stock at a price of $9.00 per share for net proceeds of approximately $19.0 million. The sale of the common stock closed on December 15, 2009. The offer and sale of the shares were made pursuant to an effective Registration Statement on Form S-3 (Registration No. 333- 161139) initially filed with the Securities and Exchange Commission on August 7, 2009 and amended on November 2, 2009. The Registration Statement was declared effective on November 5, 2009.

19

On June 15, 2010, we entered into an underwriting agreement (the "Underwriting Agreement") with Brean Murray, Carret & Co., LLC, as representative of the underwriters (the "Representative"), related to a public offering of 2,857,143 shares of the Company's common stock at a price of $7.00 per share less a 5% underwriting commission. Under the terms of the Underwriting Agreement, we granted the Representative an option, exercisable for 30 days, to purchase up to an additional 428,572 shares of common stock to cover over-allotments, if any. The offering was made pursuant to an effective registration statement on Form S-3, as amended and supplemented (Registration Statement No. 333-161139) filed with the Securities and Exchange Commission. On June 21, 2010, we closed the common stock offering announced on June 16, 2010. In the transaction, we issued 2,857,143 shares of common stock at $7.00 per share for an aggregate amount of $20 million. In 2009, we were selected one of the Top Ten Brands of Travel Services in the PRC. We believe our quality of services will distinguish us in our long term competitiveness.