Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

| x | FOR ANNUAL REPORTS PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended May 28, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 0-12906

(Exact name of registrant as specified in its charter)

| Delaware | 36-2096643 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

40W267 Keslinger Road, P.O. Box 393,

LaFox, Illinois 60147-0393

(Address of principal executive offices)

Registrant’s telephone number, including area code:(630) 208-2200

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Common stock, $0.05 Par Value | |

| Name of each exchange of which registered | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | ¨ | Accelerated Filer | x | |||

| Non-Accelerated Filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of November 27, 2010, was approximately $158.6 million.

As of July 18, 2011, there were outstanding 14,267,492 shares of Common Stock, $.05 par value and 2,951,961 shares of Class B Common Stock, $.05 par value, which are convertible into Common Stock of the registrant on a one-for-one basis.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the Annual Meeting of Stockholders scheduled to be held October 4, 2011, which will be filed pursuant to Regulation 14A, are incorporated by reference in Part III of this report. Except as specifically incorporated herein by reference, the above mentioned Proxy Statement is not deemed filed as part of this report.

Table of Contents

| Page | ||||||

| Part I |

||||||

| Item 1. |

Business | 3 | ||||

| Item 1A. |

Risk Factors | 7 | ||||

| Item 1B. |

Unresolved Staff Comments | 11 | ||||

| Item 2. |

Properties | 12 | ||||

| Item 3. |

Legal Proceedings | 13 | ||||

| Part II |

||||||

| Item 5. |

14 | |||||

| Item 6. |

Selected Financial Data | 16 | ||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 17 | ||||

| Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk | 30 | ||||

| Item 8. |

Financial Statements and Supplementary Data | 31 | ||||

| Item 9A. |

Controls and Procedures | 59 | ||||

| Item 9B. |

Other Information | 60 | ||||

| Part III |

||||||

| Item 10. |

Directors, Executive Officers and Corporate Governance | 61 | ||||

| Item 11. |

Executive Compensation | 61 | ||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

61 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence | 61 | ||||

| Item 14. |

Principal Accountant Fees and Services | 61 | ||||

| Part IV |

||||||

| Item 15. |

Exhibits and Financial Statement Schedules | 62 | ||||

| 63 | ||||||

| 64 | ||||||

2

Table of Contents

Forward Looking Statements

Certain statements in this report may constitute “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. The terms “may,” “should,” “could,” “anticipate,” “believe,” “continues,” “estimate,” “expect,” “intend,” “objective,” “plan,” “potential,” “project” and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties, and assumptions that are difficult to predict. These statements are based on management’s current expectations, intentions, or beliefs and are subject to a number of factors, assumptions, and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause or contribute to such differences or that might otherwise impact the business include the risk factors set forth in Item 1A of this Form 10-K. We undertake no obligation to update any such factor or to publicly announce the results of any revisions to any forward-looking statements contained herein whether as a result of new information, future events, or otherwise.

PART I

General

Richardson Electronics, Ltd. (“we”, “us”, “the Company”, and “our”) is incorporated in the state of Delaware. We are a leading global provider of engineered solutions, power grid and microwave tubes and related consumables, and customized display solutions, serving customers in the radio frequency (“RF”) and microwave communications, military, marine, aviation, industrial, scientific, and medical markets. Our strategy is to provide specialized technical expertise and “engineered solutions” based on our core engineering and manufacturing capabilities. We provide solutions and add value through design-in support, systems integration, prototype design and manufacturing, testing, logistics, and aftermarket technical service and repair.

Our products include semiconductor fabrication equipment, electron tubes, microwave generators, and visual technology solutions. These products are used to control, switch or amplify electrical power signals, or are used as display devices in a variety of industrial, commercial, and communication applications.

On March 1, 2011, we completed the sale of the assets primarily used or held for use in, and certain liabilities of, our RF, Wireless and Power Division (“RFPD”), as well as certain other Company assets, including our information technology assets, to Arrow Electronics, Inc. (“Arrow”) in exchange for $238.8 million, which included an estimated pre-closing working capital adjustment of approximately $27.0 million (“the Transaction.”) The final purchase price is subject to a post-closing working capital adjustment.

On June 29, 2011, we received notification from Arrow seeking a post-closing working capital adjustment, which would reduce the purchase price by approximately $4.2 million. The $4.2 million is included in our results from discontinued operations for the fiscal year ended May 28, 2011.

The consolidated balance sheet for the fiscal year ended May 29, 2010, and our consolidated statements of operations for the fiscal years ended May 29, 2010, and May 30, 2009, have been restated to reflect the Transaction. Refer to Part II, Item 8, Note 4 “Discontinued Operations” of our notes to our consolidated financial statements for additional discussion on the Transaction.

Our fiscal year 2011 began on May 30, 2010, and ended on May 28, 2011. Unless otherwise noted, all references in this document to a particular year shall mean our fiscal year.

We have two continuing operating segments, which we define as follows:

Electron Device Group (“EDG”) provides engineered solutions and distributes electronic components to customers in diverse markets including the steel, automotive, textile, plastics, semiconductor manufacturing, avionics, and broadcast equipment industries.

3

Table of Contents

Canvys provides global integrated display solutions serving the financial, corporate enterprise, healthcare, industrial, and medical original equipment manufacturer (“OEM”) markets.

We currently have operations in the following major geographic regions:

| • | North America; |

| • | Asia/Pacific; |

| • | Europe; and |

| • | Latin America. |

Selected financial data attributable to each segment and geographic region for fiscal 2011, 2010, and 2009 is set forth in Note 10 “Segment and Geographic Information” of the notes to our consolidated financial statements in Part II, Item 8 of this Annual Report on Form 10-K.

Electron Device Group

EDG manufactures and distributes electron tubes, microwave generators, vacuum capacitors and related components and sub-assemblies. EDG also provides engineered solutions consisting of design and assembly services, component modification and development of customer-specific solutions, designed to fit unique applications. EDG serves customers in diverse markets including manufacturers and users of equipment in the steel, automotive, textile, plastics, semiconductor manufacturing, avionics, and broadcast equipment industries. We design solutions and provide components for applications such as industrial heating, laser technology, semiconductor manufacturing, radar, and welding.

Typically, our engineered solutions and products are used in applications requiring high power and high frequency. We provide our solutions and products to original manufacturers of systems and equipment requiring such high power or high frequency and provide replacement products to the industrial end-users of such systems and equipment.

We represent and support leading manufacturers of electron tubes and microwave devices, including Amperex, CPI, Draloric, Eimac, General Electric, Hitachi, Jennings, Litton, L3, National, NJRC, and Thales.

Canvys

Canvys is a global provider of integrated display products, workstations, and value-add services to the financial, corporate enterprise, healthcare, industrial and OEM markets. Our engineers design, manufacture, source, and support a full spectrum of solutions to match the needs of our customers. We offer custom display solutions that include touch screens, protective panels, custom enclosures, specialized cabinet finishes, and application specific software packages. We also offer display products under our own brands, including Image Systems and Pixelink. In addition, we partner with leading branded hardware vendors to offer the highest quality liquid crystal displays, mounting devices, and customized computing platforms.

As a longtime provider of healthcare solutions, we specialize in creating comprehensive solutions for diagnostic and clinical review, 3-D and post processing, surgical suites and modality-specific applications. In addition, all of our solutions meet certifications and calibration standards for patient monitoring, bio-medical displays, ultrasound, cardiac imaging, picture archiving, and communication systems.

We have long-standing relationships with key component and finished goods manufacturers including 3M, HP, IBM, Intel, LG, NEC Displays, Sharp Electronics, Samsung, and WIDE Corporation. We believe our distributor relationships, combined with our manufacturing capabilities and private label brands, allow us to maintain a well-balanced and technologically advanced line of products.

4

Table of Contents

Products and Suppliers

Our inventory levels reflect our commitment to maintain an inventory of a broad range of products for customers who are buying product for replacement of components used in critical product equipment. In many cases, the market for our products is characterized by rapid change and obsolescence as a result of the introduction of new technologies. As of May 28, 2011, on average, we hold 72 days of inventory in the normal course of operations. This level of inventory reflects the fact that we also sell a number of products representing trailing edge technology. While the market for these trailing edge technology products is declining, we are increasing our market share. As manufacturers for these products exit the business, we often purchase a substantial portion of their remaining inventory.

We have distribution agreements with many of our suppliers; however, a number of these agreements provide for nonexclusive distribution rights and often include territorial restrictions that limit the countries in which we can distribute their products. The agreements are generally short-term, subject to periodic renewal, and some contain provisions permitting termination by either party, without cause, upon relatively short notice. Although some of these agreements allow us to return inventory periodically, others do not, in which case we may have obsolete inventory that we cannot return to the supplier.

Our suppliers generally warrant the products we distribute and allow return of defective products, including those returned to us by our customers. Except for certain displays, we generally do not provide additional warranties on the products we sell. For information regarding the warranty reserves, see Note 3 “Significant Accounting Policies” of the notes to our consolidated financial statements in Part II, Item 8 of this Annual Report on Form 10-K.

In addition to third party products, we sell proprietary products principally under certain trade names we own including: Amperex®, Cetron®, Image Systems®, Pixelink®, and National®. Our proprietary products include thyratrons and rectifiers, power tubes, ignitrons, magnetron tubes, phototubes, microwave generators, large screen display monitors, liquid crystal display monitors, and computer workstations. The materials used in the manufacturing process consist of glass bulbs and tubing, nickel, stainless steel and other metals, plastic and metal bases, ceramics, and a wide variety of fabricated metal components. These materials are generally readily available, but some components may require long lead times for production, and some materials are subject to shortages or price fluctuations based on supply and demand.

Sales and Product Management

As of the end of fiscal 2011, we employed 147 sales and product management personnel worldwide. In addition, we have authorized representatives, who are not our employees, selling our products, primarily in regions where we do not have a direct sales presence.

We offer various credit terms to qualifying customers as well as prepayment, credit card, and cash on delivery terms. We establish credit limits for each sale prior to selling product to our customers and routinely review delinquent and aging accounts.

Distribution

We maintain approximately 65,500 part numbers in our product inventory database and we estimate that more than 80% of orders received by 6:00 p.m. local time are shipped complete the same day. Customers can access our product inventory on our web site, www.rell.com, through electronic data interchange, or by telephone. Customer orders are processed by our regional sales offices and supported primarily by one of our distribution facilities in LaFox, Illinois; Amsterdam, Netherlands; Marlborough, Massachusetts; Plymouth, Minnesota; or Donaueschingen, Germany. Our data processing network provides on-line, real-time interconnection of all sales offices and central distribution operations, 24 hours per day, seven days per week. Information on stock availability, cross-reference information, customers, and market analyses are obtainable throughout the entire distribution network.

5

Table of Contents

International Sales

During fiscal 2011, approximately 57.0% of our sales were made outside the U.S. We continue to pursue new international sales to further expand our geographic reach.

Employees

As of May 28, 2011, we employed 307 individuals, of which 295 were full-time and 12 were part-time. Of these, 195 were located in the United States and 112 were located internationally. The worldwide employee base included 147 in sales and product management, 24 in distribution support, 80 in administrative positions, and 56 in value-add and product manufacturing. All of our employees are non-union, and we consider our relationships with our employees to be good.

Website Access to SEC Reports

We maintain an Internet website at www.rell.com. Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934 are accessible through our website, free of charge, as soon as reasonably practicable after these reports are filed electronically with the Securities and Exchange Commission. To access these reports, go to our website at www.rell.com. The foregoing information regarding our website is provided for convenience and the content of our website is not deemed to be incorporated by reference in this report filed with the Securities and Exchange Commission.

6

Table of Contents

Investors should consider carefully the following risk factors in addition to the other information included and incorporated by reference in this Annual Report on Form 10-K. While we believe we have identified the key risk factors affecting our business, there may be additional risks and uncertainties that are not presently known or that are not currently believed to be significant that may adversely affect our results of operations.

We intend to reduce costs to improve our profitability.

Our EDG and Canvys businesses generated modest operating income during fiscal 2011. With the closing of the Transaction, we are taking actions to re-align our cost structure to fit the remaining businesses. Our ability to complete these actions may be limited by a variety of factors. Cost-reduction actions to achieve our cost reduction objectives could have the effect of reducing our talent pool and available resources whether or not achieved, and, consequently, could affect our ability to serve customers and to hire and retain key personnel.

We maintain a significant investment in inventory. We have also incurred significant charges for inventory obsolescence, and may incur similar charges in the future.

We maintain significant inventories in an effort to ensure that customers have a reliable source of supply. The market for many of our products is characterized by rapid change as a result of the development of new technologies, evolving industry standards, and frequent new product introductions by some of our customers. We do not have many long-term supply contracts with our customers. If we fail to anticipate the changing needs of our customers and accurately forecast our customer demands, our customers may not continue to place orders with us, and we may accumulate significant inventories of products which we will be unable to sell or return to our vendors. This may result in a significant decline in the value of our inventory.

We face competitive pressure in the markets we serve.

We face many competitors, both global and local, in the markets we serve. Our overall competitive position depends on a number of factors including price, engineering capability, vendor representation, product diversity, lead times and the level of customer service. Our competition includes hundreds of electronic component distributors of various sizes, locations, and market focuses, as well as original equipment manufacturers and refurbishers. Some of our competitors have greater resources and broader name recognition than we do. As a result, these competitors may be able to better withstand changing conditions within our markets and throughout the economy as a whole. Increased competition may result in price reductions, reduced margins, or a loss of market share, any of which could materially and adversely affect our business, operating results, and financial condition.

EDG is dependent on a limited number of vendors to supply it with essential products.

Electron tubes and certain other products supplied by EDG are currently produced by a relatively small number of manufacturers. Our success depends, in large part, on maintaining current vendor relationships and developing new relationships. We believe that vendors supplying products to some of the product lines of EDG are consolidating their distribution relationships or exiting the business. To the extent that our significant suppliers reduce the amount of products they sell through distribution are unwilling to continue to do business with us, or are unable to continue to meet or significantly alter their obligations to us, such as by extending lead times, limiting supplies, or other factors, there could be a material adverse effect on our business.

Economic, political, and other risks associated with international sales and operations could adversely affect our results of operations.

Because we sell and source our products worldwide, our business is subject to risks associated with doing business internationally. We anticipate that revenue from international operations will continue to represent a

7

Table of Contents

majority of our total revenue. In addition, many of our employees, suppliers, and warehouse facilities are located outside the United States. Accordingly, our future results could be harmed by a variety of factors including:

| • | interruption of transportation needed for delivery of products to us and to our customers; |

| • | changes in foreign currency exchange rates; |

| • | changes in political or economic conditions; |

| • | trade protection measures and import or export licensing requirements; |

| • | changes in tax laws; |

| • | difficulty in staffing and managing global operations; |

| • | differing labor regulations; |

| • | difficulty collecting accounts receivable; |

| • | unexpected changes in regulatory requirements; and |

| • | geopolitical turmoil, including terrorism, war, or natural disasters, may negatively affect our results from operations |

Our products may be found to be defective and, as a result, warranty and/or product liability claims may be asserted against us.

We sell many of our components at prices that are significantly lower than the cost of the equipment or other goods in which they are incorporated. Since a defect or failure in a product could give rise to failures in the end products that incorporate them, we may face claims for damages that are disproportionate to the revenues and profits we receive from the components involved in the claims. While we typically have provisions in our agreements with our suppliers that hold the supplier accountable for defective products, and we and our suppliers generally exclude consequential damages in our standard terms and conditions, our ability to avoid such liabilities may be limited as a result of various factors, including the inability to exclude such damages due to the laws of some of the countries where we do business. Our business could be materially adversely affected as a result of a significant quality or performance issue in the components sold by us if we are required to pay for the damages that result. Although we have product liability insurance, such insurance is limited in coverage and amount.

A single stockholder has voting control over us.

As of July 22, 2011, Edward J. Richardson, our Chairman, Chief Executive Officer and President, beneficially owned approximately 99% of the outstanding shares of our Class B common stock, representing approximately 67% of the voting power of the outstanding common stock. This share ownership permits Mr. Richardson to exert control over the outcome of most stockholder votes, including votes concerning the election of directors, by-law amendments, possible mergers, corporate control contests, and other significant corporate transactions.

Foreign currency exchange rates may materially affect our results.

Since a significant portion of our business is conducted outside the U.S., we face exposure to movements in non-U.S. currency exchange rates, which may harm our results of operations. Price increases caused by currency exchange rate fluctuations may make our products less competitive or have an adverse effect on our margins. Our international revenues and expenses generally are derived from sales and operations in currencies other than the U.S. dollar. Accordingly, when the U.S. dollar strengthens in relation to the currencies of the countries in which we sell our products, our U.S. dollar reported net revenue and income will decrease. We currently do not engage in any currency hedging transactions. We cannot predict whether foreign currency exchange risks inherent in doing business in foreign countries will have a material adverse effect on our operations and financial results in the future.

8

Table of Contents

Substantial defaults by our customers on our accounts receivable or the loss of significant customers could have a significant negative impact on our business.

A significant portion of our working capital consists of accounts receivable from customers. If customers with a significant accounts receivable balance were to become insolvent or otherwise unable to pay for products and services, or were to become unwilling or unable to make payments in a timely manner, our business, results of operations, financial condition, or liquidity could be adversely affected.

Future acquisitions are subject to integration and other risks.

We anticipate that we may, from time to time, selectively acquire additional businesses or assets. Acquisitions are accompanied by risks, such as potential exposure to unknown liabilities of acquired companies and the possible loss of key employees and customers of the acquired business. In addition, we may not obtain the expected benefits or cost savings from acquisitions. Acquisitions are subject to risks associated with financing the acquisition and integrating the operations and personnel of the acquired businesses or assets. If any of these risks materialize, they may result in disruptions to our business and the diversion of management time and attention, which could increase the costs of operating our existing or acquired businesses or negate the expected benefits of the acquisitions.

If we fail to maintain an effective system of internal controls or discover material weaknesses in our internal controls over financial reporting, we may not be able to detect fraud or report our financial results accurately or timely.

An effective internal control environment is necessary for us to produce reliable financial reports and is an important part of our effort to prevent financial fraud. We are required to periodically evaluate the effectiveness of the design and operation of our internal controls over financial reporting. Based on these evaluations, we may conclude that enhancements, modifications or changes to internal controls are necessary or desirable. While management evaluates the effectiveness of our internal controls on a regular basis, these controls may not always be effective. There are inherent limitations on the effectiveness of internal controls, including fraud, collusion, management override, and failure in human judgment. In addition, control procedures are designed to reduce rather than eliminate business risks.

If we fail to maintain an effective system of internal controls, or if management or our independent registered public accounting firm discovers material weaknesses in our internal controls, we may be unable to produce reliable financial reports or prevent fraud. In addition, we may be subject to sanctions or investigation by regulatory authorities, such as the Securities and Exchange Commission or NASDAQ Global Select Market. Any such actions could result in an adverse reaction in the financial markets due to a loss of confidence in the reliability of our financial statements.

We may be subject to intellectual property rights claims, which are costly to defend, could require payment of damages or licensing fees, and could limit our ability to use certain technologies in the future.

Substantial litigation and threats of litigation regarding intellectual property rights exist in the display systems and electronics industries. From time to time, third parties (including certain companies in the business of acquiring patents not for the purpose of developing technology but with the intention of aggressively seeking licensing revenue from purported infringers) may assert patent and/or other intellectual property rights to technologies that are important to our business. In any dispute involving products that we have sold, our customers could also become the target of litigation. We are obligated in many instances to indemnify and defend our customers if the products we sell are alleged to infringe any third party’s intellectual property rights. In some cases, depending on the nature of the claim, we may be able to seek indemnification from our suppliers for our self and our customers against such claims, but there is no assurance that we will be successful in obtaining such

9

Table of Contents

indemnification or that we are fully protected against such claims. Any infringement claim brought against us, regardless of the duration, outcome or size of damage award, could:

| • | result in substantial cost to us; |

| • | divert management’s attention and resources; |

| • | be time consuming to defend; |

| • | result in substantial damage awards; |

| • | cause product shipment delays; or |

| • | require us to seek to enter into royalty or other licensing agreements. |

Additionally, if an infringement claim is successful we may be required to pay damages or seek royalty or license arrangements, which may not be available on commercially reasonable terms. The payment of any such damages or royalties may significantly increase our operating expenses and harm our operating results and financial condition. Also, royalty or license arrangements may not be available at all. We may have to stop selling certain products or using technologies, which could affect our ability to compete effectively.

We are currently a defendant in one patent infringement lawsuit and have received a claim for indemnification from a customer who is a defendant in a second patent infringement lawsuit. Any of these suits could have a material adverse effect on our business.

In March 2011, Kyocera International, Inc. filed a complaint against us, Richardson RFPD, Inc., Arrow Electronics Inc. and Fractus, S.A., in the United States District Court for the Southern District of California. The complaint alleges, among other things, that certain products manufactured by Fractus, S.A., and offered for sale by our former RFPD division, infringe two patents owned by Kyocera Corporation and exclusively licensed to Kyocera International, Inc. The complaint seeks monetary damages, injunctive relief, and costs. We sold the products at issue under the terms of a Distribution Agreement with Fractus pursuant to which Fractus agreed to indemnify us from any losses, costs, liabilities, damages or expenses arising from infringement or alleged infringement of intellectual property rights in connection with our sale of Fractus products.

In March 2011, we were notified by 3M Company that a complaint had been filed against us on March 16, 2011, by Ogma, LLC in the Eastern District of Texas. The complaint alleges that several of 3M’s products infringe U.S. Patent No. 5,825,427 owned by Ogma. Our Canvys division supplies at least one of the products at issue to 3M pursuant to a Product Supply Agreement, and 3M has asserted a claim for indemnity against us pursuant to the terms of the Product Supply Agreement.

These lawsuits, with or without merit, may divert our management’s attention, and we may incur significant expenses in our defense. In addition, we may be required to pay damage awards or settlements, become subject to injunctions or other equitable remedies, or determine to abandon certain lines of business, that may cause a material adverse effect on our results of operations, financial position, and cash flows.

We depend on key management and employees, the loss of whom may prevent us from implementing our business plans, limit our profitability and decrease the value of our common stock.

We are dependent on the talent and resources of our key executives and employees. In particular, the success of our business depends to a great extent on Edward J. Richardson, our President, Chief Executive Officer and the Chairman of our Board of Directors. Mr. Richardson has extensive experience in the electron device industry, and his services are critical to our success. We have not obtained key man insurance with respect to Mr. Richardson or any of our executive officers. The loss of Mr. Richardson may prevent us from implementing our business plan, which may limit our profitability and decrease the value of our common stock.

10

Table of Contents

If we are deemed to be an investment company, we will be required to meet burdensome compliance requirements and restrictions on our activities.

As a result of the closing of the Transaction, we have significant cash reserves. If we are deemed to be an “investment company” as defined under the Investment Company Act of 1940 (the “Investment Company Act”), the nature of our investments may be subject to various restrictions. In addition, we may be subject to burdensome compliance requirements and may have to:

| • | register as an investment company; |

| • | adopt a specific form of corporate structure; and |

| • | report, maintain records and adhere to voting, proxy, disclosure and other requirements. |

We do not believe that our principal activities subject us to the Investment Company Act. If we are deemed to be subject to the Investment Company Act, compliance with these additional regulatory burdens would increase our operating expenses.

The Acquisition Agreement exposes us to contingent liabilities that could have a material adverse effect on our financial condition.

We have agreed to indemnify Arrow Electronics for breaches of any representation, warranty, or covenant made by us in the Acquisition Agreement, for losses arising out of or in connection with excluded assets or excluded liabilities, and for certain other matters. Significant indemnification claims by Arrow Electronics could have a material adverse effect on our financial condition. We are not obligated to indemnify Arrow Electronics for any breach of the representations, warranties or covenants made by us under the Acquisition Agreement unless any individual claim for indemnification exceeds $10,000 and the aggregate amount of all such claims for indemnification exceed $2.1 million. In the event that claims for indemnification for breach of most of the representations and warranties made by us under the Acquisition Agreement exceed this threshold, we will be obligated to indemnify Arrow Electronics for any damages or loss resulting from such breach in excess of $2.1 million up to $42 million. Claims for indemnification for breaches of covenants made by us under the Acquisition Agreement and for breaches of representations and warranties related to authorization, taxes and brokers will not be subject to the deductible or aggregate liability cap described above. Claims for indemnification for losses by Arrow Electronics arising out of or in connection with excluded assets or excluded liabilities and certain other matters are not subject to any of the individual limit, the deductible or the aggregate liability cap described above.

If the information technology services that are rendered to us pursuant to the Transition Services Agreement with Arrow Electronics do not adequately support us, our business may suffer.

Pursuant to the Acquisition Agreement with Arrow Electronics, Arrow Electronics purchased our entire IT operations, and pursuant to the Transition Services Agreement between us and Arrow, Arrow provides IT services to us consistent with those services provided to us by our IT operations prior to the Transaction. We rely on these information systems to process, analyze, and manage data to facilitate the purchase and distribution of our products, as well as to receive, process, bill, and ship orders on a timely basis. If the IT services provided by Arrow Electronics are not provided to us in an adequate manner, we may be unable to find an alternative means of obtaining such IT services, which could significantly impair our ability to effectively serve our customers and perform other vital company functions.

ITEM 1B. Unresolved Staff Comments

None.

11

Table of Contents

We own three facilities and lease 33 facilities. We own our corporate facility and largest distribution center, which is located on approximately 96 acres in LaFox, Illinois and consists of approximately 242,000 square feet of manufacturing, warehouse, and office space. We maintain geographically diverse facilities because we believe this will limit market risk and exchange rate exposure. We consider our properties to be well maintained, in sound condition and repair, and adequate for our present needs. The extent of utilization varies from property to property and from time to time during the year.

Our facility locations, their primary use, and segments served are as follows:

| Location |

Leased/ Owned |

Use |

Segment | |||

| Charlotte, North Carolina |

Leased | Sales | EDG | |||

| Lake Mary, Florida |

Leased | Sublet | n/a | |||

| Plymouth, Minnesota |

Leased | Sales/Distribution | Canvys | |||

| Marlborough, Massachusetts |

Leased | Sales/Distribution/Manufacturing | Canvys | |||

| Long Beach, New York |

Leased | Sales | EDG | |||

| Farmington, Connecticut |

Leased | Sales | EDG | |||

| Woodland Hills, California |

Leased | Sales | EDG | |||

| Rockland, Massachusetts |

Leased | Sales | EDG | |||

| Fort Lauderdale, Florida |

Leased | Sales | EDG | |||

| LaFox, Illinois * |

Owned | Sales/Distribution/Manufacturing | EDG/Canvys | |||

| Ho Chi Minh City, Vietnam |

Leased | Sales | EDG | |||

| Beijing, China |

Leased | Sales | EDG | |||

| Bangkok, Thailand |

Leased | Sales/Distribution | EDG | |||

| Shenzhen, China |

Leased | Sales/Distribution | EDG | |||

| Shanghai, China |

Leased | Sales/Distribution | EDG | |||

| Lincoln, United Kingdom |

Leased | Sales | EDG/Canvys | |||

| Donaueschingen, Germany |

Leased | Sales/Distribution/Manufacturing | Canvys | |||

| Amsterdam, Netherlands |

Leased | Sales/Distribution | EDG | |||

| Florence, Italy |

Owned | Sales | EDG | |||

| Madrid, Spain |

Owned | Sales | EDG | |||

| Sao Paulo, Brail |

Leased | Sales/Distribution | EDG | |||

| Mexico City, Mexico |

Leased | Sales | EDG | |||

| Taipei, Taiwan |

Leased | Sales | EDG/Canvys | |||

| Hong Kong, Hong Kong |

Leased | Distribution | EDG | |||

| Seoul, South Korea |

Leased | Sales | EDG | |||

| Selangor, Malaysia |

Leased | Sales | EDG | |||

| Singapore, Singapore |

Leased | Sales/Distribution | EDG | |||

| Tokyo, Japan |

Leased | Sales | EDG | |||

| Milan, Italy |

Leased | Sales | EDG | |||

| Colombes, France |

Leased | Sales | EDG | |||

| Noida, India |

Leased | Sales | EDG | |||

| Puchheim, Germany |

Leased | Sales | EDG |

| * | LaFox, Illinois is also the location of our corporate headquarters. |

12

Table of Contents

On March 31, 2011, Kyocera International, Inc. filed a complaint against us, Richardson RFPD, Inc., Arrow Electronics Inc. and Fractus, S.A., in the United States District Court for the Southern District of California. The complaint alleges, among other things, that certain products manufactured by Fractus, S.A., and offered for sale by our former RFPD division, infringe two patents owned by Kyocera Corporation and exclusively licensed to Kyocera International, Inc. The complaint seeks monetary damages, injunctive relief, and costs.

By letter dated March 28, 2011, we were notified by 3M Company that a complaint had been filed against us on March 16, 2011, by Ogma, LLC in the Eastern District of Texas. The complaint alleges that several of 3M’s products infringe U.S. Patent No. 5,825,427 owned by Ogma. Our Canvys division supplies at least one of the products at issue to 3M pursuant to a Product Supply Agreement, and 3M has asserted a claim for indemnity against us pursuant to the terms of the Product Supply Agreement.

From time to time, we or our subsidiaries are involved in legal actions that arise in the ordinary course of our business. While the outcome of these matters cannot be predicted with certainty, we do not believe that the outcome of any current claims, including the above mentioned legal matters, will have a material adverse effect on our consolidated financial position, results of operations, or cash flows.

13

Table of Contents

PART II

ITEM 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Unregistered Sales of Equity Securities

None.

Share Repurchases

| Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number (or Approximate Dollar Value) of Shares That May Yet Be Purchased Under the Plans or Programs |

||||||||||||

| March 27, 2011—April 23, 2011 (1) |

101,000 | $ | 13.48 | 101,000 | $ | 23,600,000 | ||||||||||

| April 24, 2011—May 28, 2011 (1) |

544,900 | $ | 13.42 | 645,900 | $ | 16,300,000 | ||||||||||

| (1) | On April 5, 2011, our Board of Directors approved a share repurchase plan authorizing us to purchase up to $25.0 million of our outstanding common stock. Stock repurchases may be in the open market or in privately negotiated transactions, depending on factors including market conditions and other factors. |

In November 2011, we repurchased an additional 15,400 shares of our common stock under a previous Board approved share repurchase plan.

Dividends

Our quarterly dividend was $0.02 per common share and $0.018 per Class B common share. On April 6, 2011, our Board of Directors increased our quarterly dividend to $0.05 per common share and $0.045 per Class B common share. Annual dividend payments for fiscal 2011 and fiscal 2010 were approximately $1.9 million and $1.4 million, respectively. All future payments of dividends are at the discretion of the Board of Directors. Dividend payments will depend on earnings, capital requirements, operating conditions, and such other factors that the Board may deem relevant.

Common Stock Information

Our common stock is traded on The NASDAQ Global Select Market (“NASDAQ”) under the trading symbol (“RELL”). There is no established public trading market for our Class B common stock. As of July 18, 2011, there were approximately 817 stockholders of record for the common stock and approximately 18 stockholders of record for the Class B common stock. The following table sets forth, for the periods indicated, the high and low closing sales price per share of RELL common stock as reported on the NASDAQ.

| 2011 | 2010 | |||||||||||||||

| Fiscal Quarter |

High | Low | High | Low | ||||||||||||

| First |

$ | 10.25 | $ | 8.00 | $ | 4.06 | $ | 2.84 | ||||||||

| Second |

$ | 12.93 | $ | 8.73 | $ | 6.46 | $ | 3.80 | ||||||||

| Third |

$ | 13.32 | $ | 10.60 | $ | 8.43 | $ | 5.31 | ||||||||

| Fourth |

$ | 13.82 | $ | 12.27 | $ | 12.35 | $ | 7.43 | ||||||||

14

Table of Contents

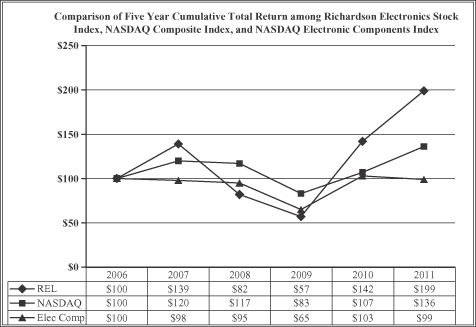

Performance Graph

The following graph compares the performance of our common stock for the periods indicated with the performance of the NASDAQ Composite Index, and NASDAQ Electronic Components Index. The graph assumes $100 invested on the last day of our fiscal year 2006, in our common stock, the NASDAQ Composite Index, and NASDAQ Electronic Components Index. Total return indices reflect reinvestment of dividends at the closing stock prices at the date of the dividend declaration.

15

Table of Contents

ITEM 6. Selected Financial Data

Five-Year Financial Review

Information should be read in conjunction with our consolidated financial statements, accompanying notes, and Management’s Discussion and Analysis Financial Condition and Results of Operations included elsewhere herein.

| Fiscal Year Ended(1) | ||||||||||||||||||||

| (in thousands, except per share amounts) | ||||||||||||||||||||

| May 28, 2011 |

May 29, 2010 |

May 30, 2009 |

May 31, 2008(2)(3) |

June 2, 2007(3)(4) |

||||||||||||||||

| Statements of Income |

||||||||||||||||||||

| Net sales |

$ | 158,867 | $ | 135,372 | $ | 141,190 | $ | 192,206 | $ | 187,355 | ||||||||||

| Continuing Operations |

||||||||||||||||||||

| Income (loss) from continuing operations before tax |

$ | 2,450 | $ | (4,250 | ) | $ | (27,043 | ) | $ | (28,093 | ) | $ | (19,083 | ) | ||||||

| Income taxes provision (benefit) |

468 | (68 | ) | 600 | (732 | ) | 214 | |||||||||||||

| Income (loss) from continuing operations |

$ | 1,982 | $ | (4,182 | ) | $ | (27,643 | ) | $ | (27,361 | ) | $ | (19,297 | ) | ||||||

| Discontinued Operations |

||||||||||||||||||||

| Income from discontinued operations |

$ | 88,092 | $ | 20,277 | $ | 15,479 | $ | 18,890 | $ | 59,976 | ||||||||||

| Net income (loss) |

$ | 90,074 | $ | 16,095 | $ | (12,164 | ) | $ | (8,471 | ) | $ | 40,679 | ||||||||

| Per Share Data |

||||||||||||||||||||

| Net income (loss) per Common share—Basic: |

||||||||||||||||||||

| Income (loss) from continuing operations |

$ | 0.11 | $ | (0.24 | ) | $ | (1.57 | ) | $ | (1.56 | ) | $ | (1.12 | ) | ||||||

| Income from discontinued operations |

4.99 | 1.16 | 0.88 | 1.08 | 3.47 | |||||||||||||||

| Total net income (loss) per Common share—Basic: |

$ | 5.10 | $ | 0.92 | $ | (0.69 | ) | $ | (0.48 | ) | $ | 2.35 | ||||||||

| Net income (loss) per Class B common share—Basic: |

||||||||||||||||||||

| Income (loss) from continuing operations |

$ | 0.10 | $ | (0.21 | ) | $ | (1.41 | ) | $ | (1.40 | ) | $ | (1.01 | ) | ||||||

| Income from discontinued operations |

4.49 | 1.04 | 0.79 | 0.97 | 3.13 | |||||||||||||||

| Total net income (loss) per Class B common share—Basic: |

$ | 4.59 | $ | 0.83 | $ | (0.62 | ) | $ | (0.43 | ) | $ | 2.12 | ||||||||

| Net income (loss) per Common share—Diluted: |

||||||||||||||||||||

| Income (loss) from continuing operations |

$ | 0.11 | $ | (0.24 | ) | $ | (1.57 | ) | $ | (1.56 | ) | $ | (1.12 | ) | ||||||

| Income from discontinued operations |

4.84 | 1.16 | 0.88 | 1.08 | 3.47 | |||||||||||||||

| Total net income (loss) per Common share—Diluted: |

$ | 4.95 | $ | 0.92 | $ | (0.69 | ) | $ | (0.48 | ) | $ | 2.35 | ||||||||

| Net income (loss) per Class B common share—Diluted: |

||||||||||||||||||||

| Income (loss) from continuing operations |

$ | 0.10 | $ | (0.21 | ) | $ | (1.41 | ) | $ | (1.40 | ) | $ | (1.01 | ) | ||||||

| Income from discontinued operations |

4.43 | 1.04 | 0.79 | 0.97 | 3.13 | |||||||||||||||

| Total net income (loss) per Class B common share—Diluted: |

$ | 4.53 | $ | 0.83 | $ | (0.62 | ) | $ | (0.43 | ) | $ | 2.12 | ||||||||

| Cash Dividend Data |

||||||||||||||||||||

| Dividends per common share |

$ | 0.110 | $ | 0.080 | $ | 0.080 | $ | 0.120 | $ | 0.160 | ||||||||||

| Dividends per Class B common share(5) |

$ | 0.099 | $ | 0.072 | $ | 0.072 | $ | 0.108 | $ | 0.144 | ||||||||||

| Balance Sheet Data |

||||||||||||||||||||

| Total assets |

$ | 314,054 | $ | 234,815 | $ | 294,198 | $ | 286,235 | $ | 349,071 | ||||||||||

| Short-term debt |

$ | — | $ | 19,517 | $ | — | $ | — | $ | 65,711 | ||||||||||

| Long-term debt |

$ | — | $ | — | $ | 52,353 | $ | 55,683 | $ | 55,683 | ||||||||||

| Stockholders’ equity |

$ | 224,173 | $ | 129,863 | $ | 222,039 | $ | 141,430 | $ | 136,545 | ||||||||||

| (1) | Our fiscal year ends on the Saturday nearest the end of May. Each of the fiscal years presented contain 52/53 weeks. |

| (2) | A goodwill impairment charge of $ 9.2 million, net of an income tax benefit of $ 2.3 million, was recorded during fiscal 2008. We recorded employee termination related charges of approximately $ 3.3 million during fiscal 2008, primarily relating to implementing a new business plan for Canvys . Canvys incurred inventory obsolescence charges during fiscal 2008 of $ 1.9 million. |

| (3) | Fiscal 2008 and fiscal 2007 have been restated to reflect the Transaction. |

| (4) | In fiscal 2007, we recorded retirement of long-term debt expenses of $ 2.5 million in Other Expenses, net as we entered into two separate exchange agreements in August 2006 with certain holders of our 8% convertible senior subordinated notes (8% notes) to purchase $ 14.0 million of the 8% notes . During fiscal 2007, we sold two buildings and land resulting in a gain of approximately $ 4.0 million. During the fourth quarter of fiscal 2007, we sold the Security Systems Division/Burtek Systems (“SSD/Burtek”) strategic business unit to Honeywell International Inc for $ 80 million. After transaction expenses paid through June 2, 2007, net cash proceeds from the sale were $ 78.1 million. The transaction resulted in an after-tax gain of $ 41.6 million after additional transaction costs of $ 2.5 million were accrued as of June 2, 2007. Loss from discontinued operations for fiscal 2007 was $ 2.4 million, net of tax. In addition, during fiscal 2007, we recorded $ 2.9 million of severance expense and other costs associated with the 2007 Restructuring Plan. |

| (5) | The dividend per Class B common share is 90% of the dividend per Class A common share. |

16

Table of Contents

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the consolidated financial statements and notes thereto.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to assist the reader in better understanding our business, results of operations, financial condition, changes in financial condition, critical accounting policies and estimates, and significant developments. MD&A is provided as a supplement to, and should be read in conjunction with, our consolidated financial statements and the accompanying notes thereto appearing elsewhere herein. This section is organized as follows:

| • | Business Overview |

| • | Results of Continuing Operations—an analysis and comparison of our consolidated results of operations for the fiscal years ended May 28, 2011, May 29, 2010, and May 30, 2009, as reflected in our consolidated statements of operations. |

| • | Liquidity, Financial Position, and Capital Resources—a discussion of our primary sources and uses of cash for the fiscal years ended May 28, 2011, May 29, 2010, and May 30, 2009, and a discussion of selected changes in our financial position. |

Business Overview

Richardson Electronics, Ltd. is incorporated in the state of Delaware. We are a leading global provider of engineered solutions, power grid and microwave tubes and related consumables, and customized display solutions, serving customers in the RF and microwave communications, military, marine, aviation, industrial, scientific, and medical markets. Our strategy is to provide specialized technical expertise and “engineered solutions” based on our core engineering and manufacturing capabilities. We provide solutions and add value through design-in support, systems integration, prototype design and manufacturing, testing, logistics, and aftermarket technical service and repair.

Our products include semiconductor fabrication equipment, electron tubes, microwave generators, and visual technology solutions. These products are used to control, switch or amplify electrical power signals, or are used as display devices in a variety of industrial, commercial, and communication applications.

On March 1, 2011, we completed the sale of the assets primarily used or held for use in, and certain liabilities of RFPD, as well as certain other Company assets, including our information technology assets, to Arrow in exchange for $238.8 million, which included an estimated pre-closing working capital adjustment of approximately $27.0 million. The final purchase price is subject to a post-closing working capital adjustment.

On June 29, 2011, we received notification from Arrow seeking a post-closing working capital adjustment, which would reduce the purchase price by approximately $4.2 million. The $4.2 million is included in our results from discontinued operations for the fiscal year ended May 28, 2011.

We have two continuing operating segments, which we define as follows:

Electron Device Group (“EDG”) provides engineered solutions and distributes electronic components to customers in diverse markets including the steel, automotive, textile, plastics, semiconductor manufacturing, and broadcast industries.

Canvys provides global integrated display solutions serving the financial, corporate enterprise, healthcare, industrial and medical OEM markets.

We currently have operations in the following major geographic regions:

| • | North America; |

| • | Asia/Pacific; |

17

Table of Contents

| • | Europe; and |

| • | Latin America. |

Results of Continuing Operations

Overview—Fiscal Year Ended May 28, 2011

| • | Net sales for fiscal 2011 were $158.9 million, up 17.4%, compared to net sales of $135.4 million during fiscal 2010. |

| • | Gross margin as a percentage of net sales decreased to 29.0% during fiscal 2011, compared to 30.5% during fiscal 2010. |

| • | Selling, general, and administrative expenses remained relatively flat at $43.3 million during fiscal 2011, compared to $43.2 million during fiscal 2010. |

| • | Operating income during fiscal 2011 was $2.8 million, compared to an operating loss of $1.9 million during fiscal 2010. |

| • | Income from continuing operations during fiscal 2011 was $2.0 million, or $0.11 per diluted common share, versus a net loss of $4.2 million during fiscal 2010. |

| • | Income from discontinued operations, net of tax, was $88.1 million, or $4.84 per diluted common share, during fiscal 2011 compared to $20.3 million, or $1.16 per diluted common share, during fiscal 2010. |

| • | Net income during fiscal 2011 was $90.1 million, or $4.95 per diluted common share, compared to net income of $16.1 million, or $0.92 per diluted common share, during fiscal 2010. |

Net Sales and Gross Profit Analysis

During fiscal 2011 consolidated net sales increased 17.4% compared to fiscal 2010. Sales for EDG grew by 31.4%, offset by a 7.5% decline in sales for Canvys. Consolidated net sales during fiscal 2010 decreased 4.1% compared to fiscal 2009, reflecting an increase in EDG sales of 5.3%, offset by a 17.3% decline in sales for Canvys.

Net sales by segment and percent change for fiscal 2011, 2010, and 2009 were as follows (in thousands):

| FY 2011 | FY 2010 | FY 2009 | FY11 vs. FY10 % Change |

FY10 vs. FY09 % Change |

||||||||||||||||

| Net Sales |

||||||||||||||||||||

| EDG |

$ | 113,715 | $ | 86,541 | $ | 82,168 | 31.4 | % | 5.3 | % | ||||||||||

| Canvys |

45,152 | 48,831 | 59,019 | (7.5 | %) | (17.3 | %) | |||||||||||||

| Corporate |

— | — | 3 | |||||||||||||||||

| Total |

$ | 158,867 | $ | 135,372 | $ | 141,190 | 17.4 | % | (4.1 | %) | ||||||||||

Consolidated gross profit was $46.1 million during fiscal 2011, compared to $41.3 million during fiscal 2010. Consolidated gross margin as a percentage of net sales decreased to 29.0% during fiscal 2011, from 30.5% during fiscal 2010. Gross margin during fiscal 2011 included expense related to inventory provisions for EDG and Canvys of $0.7 million and $0.3 million, respectively. Gross margin during fiscal 2010 included expense related to inventory provisions for Canvys of $0.2 million.

Consolidated gross profit was $41.3 million during fiscal 2010, compared to $33.6 million during fiscal 2009. Consolidated gross margin as a percentage of net sales increased to 30.5% during fiscal 2010, from 23.8% during fiscal 2009. Gross margin during fiscal 2010 included expense related to inventory provisions for Canvys

18

Table of Contents

of $0.2 million. Gross margin during fiscal 2010 improved slightly due to the sale of reserved inventory, as compared to fiscal 2009. EDG and Canvys incurred inventory provisions during fiscal 2009 of $5.0 million, and $2.6 million, respectively.

Gross profit reflects the distribution and manufacturing product margin less manufacturing variances, inventory obsolescence charges, customer returns, scrap and cycle count adjustments, engineering costs, and other provisions. Corporate gross profit for fiscal 2009 includes unallocated freight costs and other miscellaneous charges.

Gross profit by segment and percent of segment net sales for fiscal 2011, 2010, and 2009 were as follows (in thousands):

| FY 2011 | FY 2010 | FY 2009 | ||||||||||||||||||||||

| Gross Profit |

||||||||||||||||||||||||

| EDG |

$ | 35,020 | 30.8 | % | $ | 28,721 | 33.2 | % | $ | 21,512 | 26.2 | % | ||||||||||||

| Canvys |

11,093 | 24.6 | % | 12,563 | 25.7 | % | 12,405 | 21.0 | % | |||||||||||||||

| Subtotal |

46,113 | 29.0 | % | 41,284 | 30.5 | % | 33,917 | 24.0 | % | |||||||||||||||

| Corporate |

— | — | (318 | ) | ||||||||||||||||||||

| Total |

$ | 46,113 | 29.0 | % | $ | 41,284 | 30.5 | % | $ | 33,599 | 23.8 | % | ||||||||||||

Electron Device Group

Net sales for EDG increased 31.4% to $113.7 million during fiscal 2011, from $86.5 million during fiscal 2010. The increase reflects incremental sales volume from a strategic distribution agreement and growing demand as our customers benefited from improving economic conditions. Net sales of tubes increased to $75.3 million during fiscal 2011, as compared to $58.8 million during fiscal 2010, due primarily to increased worldwide demand from industrial manufacturers. Net sales of semiconductor fabrication equipment products increased to $25.6 million during fiscal 2011, as compared to $17.4 million during fiscal 2010. The semiconductor fabrication equipment industry, primarily in North America, continues to improve from the overall industry-wide decline experienced in fiscal 2009. Gross margin as a percentage of net sales decreased to 30.8% during fiscal 2011, as compared to 33.2% during fiscal 2010. This significant decline in gross margin percentage primarily reflects the lower-margin business under the terms of a strategic distribution agreement which began in March 2010. As the pricing commitments included in the strategic distribution agreement expire, we expect EDG’s gross margin percentage to improve.

Net sales for EDG increased 5.3% to $86.5 million during fiscal 2010, from $82.2 million during fiscal 2009, due primarily to an increase in tube and semiconductor fabrication equipment net sales. Net sales of tubes increased to $58.8 million during fiscal 2010, as compared to $57.0 million during fiscal 2009. The increase was due primarily to an increased demand from industrial manufacturers resulting from the usage of excess tube supply maintained during the economic downturn. Net sales of semiconductor fabrication equipment products increased to $17.4 million during fiscal 2010, as compared to $14.1 million during fiscal 2009. The semiconductor fabrication equipment industry, primarily in North America, has improved during fiscal 2010 from the overall industry-wide decline experienced in fiscal 2009. Gross margin as a percentage of net sales increased to 33.2% during fiscal 2010, as compared to 26.2% during fiscal 2009. Gross margin as a percentage of net sales from fiscal 2009 included $4.8 million of expense related to inventory provisions.

Canvys

Canvys net sales declined 7.5% to $45.2 million during fiscal 2011, from $48.8 million during fiscal 2010. Sales were down in both its original equipment manufacturer (“OEM”) and healthcare segments in North

19

Table of Contents

America, while sales in Europe increased slightly. Gross margin as a percentage of net sales decreased to 24.6% during fiscal 2011 as compared to 25.7% during fiscal 2010, due primarily to an increase in inbound freight cost and inventory reserve expense during fiscal 2011.

Canvys net sales declined 17.3% to $48.8 million during fiscal 2010, from $59.0 million during fiscal 2009, due primarily to a decrease in medical industrial markets in North America along with a decrease in medical imaging and custom OEM sales in both North America and Europe. The decline of these product lines was due primarily to lower capital investments, primarily in hospitals and medical market manufacturers, as a result of the weakening global economy. Gross margin as a percentage of net sales increased to 25.7% during fiscal 2010 as compared to 21.0% during fiscal 2009, due primarily to shifts in customer mix and process improvements. Expense related to inventory provisions was $2.6 million during fiscal 2009.

Sales by Geographic Area

On a geographic basis, our sales are categorized by destination to include: North America; Europe; Asia/Pacific; Latin America; and Other.

Net sales by geographic area and percent change for fiscal 2011, 2010, and 2009 were as follows (in thousands):

| FY 2011 | FY 2010 | FY 2009 | FY11 vs. FY10 % Change |

FY10 vs. FY09 % Change |

||||||||||||||||

| Net Sales |

||||||||||||||||||||

| North America |

$ | 67,646 | $ | 64,265 | $ | 68,323 | 5.3 | % | (5.9 | %) | ||||||||||

| Asia/Pacific |

26,354 | 20,943 | 18,964 | 25.8 | % | 10.4 | % | |||||||||||||

| Europe |

54,040 | 40,800 | 45,118 | 32.5 | % | (9.6 | %) | |||||||||||||

| Latin America |

10,239 | 9,049 | 8,274 | 13.2 | % | 9.4 | % | |||||||||||||

| Other |

588 | 315 | 511 | |||||||||||||||||

| Total |

$ | 158,867 | $ | 135,372 | $ | 141,190 | 17.4 | % | (4.1 | %) | ||||||||||

Gross profit by geographic area and percent of geographic net sales for fiscal 2011, 2010, and 2009 were as follows (in thousands):

| FY 2011 | FY 2010 | FY 2009 | ||||||||||||||||||||||

| Gross Profit |

||||||||||||||||||||||||

| North America |

$ | 19,873 | 29.4 | % | $ | 17,927 | 27.9 | % | $ | 10,088 | 14.8 | % | ||||||||||||

| Asia/Pacific |

9,441 | 35.8 | % | 7,550 | 36.1 | % | 5,499 | 29.0 | % | |||||||||||||||

| Europe |

14,356 | 27.8 | % | 12,552 | 30.8 | % | 11,484 | 25.5 | % | |||||||||||||||

| Latin America |

4,093 | 40.0 | % | 3,522 | 38.9 | % | 2,846 | 34.4 | % | |||||||||||||||

| Other |

(1,650 | ) | (267 | ) | 3,682 | |||||||||||||||||||

| Total |

$ | 46,113 | 29.0 | % | $ | 41,284 | 30.5 | % | $ | 33,599 | 23.8 | % | ||||||||||||

Selling, General, and Administrative Expenses

Selling, general, and administrative expenses (“SG&A”) increased slightly during fiscal 2011 to $43.3 million from $43.2 million during fiscal 2010. SG&A as a percentage of sales, from continuing operations, improved 470 basis points to 27.2% during fiscal 2011 from 31.9% during fiscal 2010. SG&A costs for EDG increased approximately $1.7 million primarily due to incremental costs associated with a strategic distribution agreement. SG&A costs for Canvys decreased by approximately $0.8 million due to headcount reductions. Support function costs decreased approximately $0.8 million, which resulted from a $1.5 million decrease in employee related expenses due primarily to headcount reductions, partially offset by higher legal and operating expenses of $0.7 million.

20

Table of Contents

SG&A for fiscal 2010 decreased to $43.2 million from $55.0 million during fiscal 2009. SG&A as a percentage of sales, from continuing operations, improved 700 basis points to 31.9% during fiscal 2010 from 38.9% during fiscal 2009. SG&A costs for EDG decreased $0.7 million due primarily to headcount reductions. SG&A costs for Canvys decreased by $3.6 million comprised of a $2.8 million decrease due to headcount reductions and a $0.8 million decrease in operating expenses. Support function costs decreased $7.5 million due to headcount reductions of $3.9 million and a $3.6 million reduction in operating expenses.

Goodwill and Intangible Assets

As of May 30, 2009, we had fully impaired all of our goodwill related to each of our segments.

During the fourth quarter of fiscal 2009, the results of our goodwill impairment tests indicated that the value of goodwill attributable to our EDG segment was fully impaired. The goodwill impairment tests revealed that the carrying values of these segments exceeded their fair value, and the carrying amount of goodwill of our EDG segment exceeded the implied goodwill value as of the February 28, 2009, measurement date. As a result, we recorded pre-tax goodwill impairment charge of $0.9 million for EDG, during the fourth quarter of fiscal 2009.

(Gain) Loss on Disposal of Assets

Loss on disposal of assets from continuing operations was less than $0.1 million during fiscal 2011.

During the third quarter of fiscal 2009, we decided not to proceed with the implementation of various modules of enterprise resource management software that were in the development stage and thus were capitalized in accordance with ASC 350-40, Intangibles—Goodwill and Other: Internal-Use Software (“ASC 350-40”). As a result, we recorded a loss on disposal of assets of $5.8 million during the third quarter of fiscal 2009.

On February 20, 2009, we sold our building in Mexico City, Mexico, for $0.1 million. We recorded an immaterial gain during the third quarter of fiscal 2009 with respect to the sale of this property.

Other (Income) Expense

Other (income) expense was expense of $0.4 million during fiscal 2011, compared with expense of $2.3 million during fiscal 2010. The decrease in expense during fiscal 2011 was due primarily to income from new investments, offset by unfavorable changes in foreign currency exchange rates relative to the U.S. dollar. Other (income) expense included investment/interest income of $0.4 million during fiscal 2011. Foreign exchange was a loss of $0.6 million during fiscal 2011, as compared to a foreign exchange loss of $1.1 million during fiscal 2010. Our foreign exchange gains and losses are primarily due to the translation of U.S. currency we have in non-U.S. bank accounts. We currently do not utilize derivative instruments to mitigate our risk with respects to foreign currency. Fiscal 2011 included a loss of $0.1 million related to the redemption of our 7 3/4% convertible senior subordinated notes, while fiscal 2010 included a loss of $0.2 million related to the redemption of $7.7 million of our 8% convertible senior subordinated notes, as well as the redemption of $25.2 million of our 7 3/4% convertible senior subordinated notes. Interest expense decreased to $0.1 million during fiscal 2011, as compared to $1.2 million during fiscal 2010, due to the full redemption of our convertible notes. See Note 6 “Debt” of the notes to our consolidated financial statements in Part II, Item 8 of this Annual Report on Form 10-K for additional discussion on the redemption of our short-term debt and interest expense.

Other (income) expense was an expense of $2.3 million during fiscal 2010, compared with income of $1.1 million during fiscal 2009. The increase in expense during fiscal 2010 was due primarily to unfavorable changes in foreign currency exchange rates relative to the U.S. dollar and a loss related to the redemption of a portion of our short-term debt. Other (income) expense included a foreign exchange loss of $1.1 million during fiscal 2010, as compared to a foreign exchange gain of $1.3 million during fiscal 2009. Our foreign exchange gains and

21

Table of Contents

losses are primarily due to the translation of our U.S. currency we have in non-U.S. bank accounts. We currently do not utilize derivative instruments to mitigate our risk with respects to foreign currency. Fiscal 2010 included a loss of $0.2 million related to the redemption of $7.7 million of our 8% convertible senior subordinated notes, as well as the redemption of $25.2 million of our 7 3/4% convertible senior subordinated notes. Comparatively, fiscal 2009 included a gain of $0.8 million related to the redemption of $3.3 million of our 8% convertible senior subordinated notes. Interest expense increased to $1.2 million during fiscal 2010, as compared to $1.0 million during fiscal 2009. See Note 6 “Debt” of the notes to our consolidated financial statements in Part II, Item 8 of this Annual Report on Form 10-K for additional discussion on the redemption of our short-term debt and interest expense.

Income Tax Provision (Benefit)

Our income tax provision during fiscal 2011 and 2009 was $0.5 million and $0.6 million, respectively, while fiscal 2010 included an income tax benefit of $0.1 million.

The effective income tax rates for continuing operations during fiscal 2011, 2010, and 2009, were 19.1%, (2.4%), and 28.1%, respectively. The difference between the effective tax rates as compared to the U.S. federal statutory rate of 35% during fiscal 2011 and 2010, and 34% during fiscal 2009, primarily results from our geographical distribution of taxable income or losses, release of valuation allowances related to net operating losses, and release of various income tax reserves due to audit closures or statutes expiring.

As of May 28, 2011, all domestic federal net operating loss (“NOL”) carryforwards were fully utilized. Domestic state NOL carryforwards amounted to approximately $2.0 million, primarily related to states where the utilization of NOLs have been suspended for the next four taxable years. Foreign NOL carryforwards totaled approximately $0.9 million with various or indefinite expiration dates. The alternative minimum tax credit carryforward and all foreign tax credit carryforwards were also fully utilized as of May 28, 2011. Based on this, our future U.S. federal statutory tax rate is expected to be closer to 35%, our state effective tax rate is expected to be approximately 3.5%, and our foreign effective tax rate is expected to be approximately 25%.

Income taxes paid, including foreign estimated tax payments, were $3.4 million, $1.5 million, and $2.6 million during fiscal 2011, 2010, and 2009, respectively.

As of May 28, 2011, $41.1 million of cumulative positive earnings of some of our foreign subsidiaries are still considered permanently reinvested pursuant to ASC 740-30, Income Taxes—Other Considerations or Special Areas (“ASC 740-30”). Due to various tax attributes that are continuously changing, it is not practical to determine what, if any, tax liability might exist if such earnings were to be repatriated.

In the normal course of business, we are subject to examination by taxing authorities throughout the world. We are no longer subject to either U.S. federal, state or local, or non-U.S. tax examinations by tax authorities for years prior to fiscal 2004. Currently, we are under federal audit in the U.S. for fiscal years 2009 and 2010. Based on the recent commencement of the audit, no tax matters have arisen that would result in material adjustments. Our primary foreign tax jurisdictions are China, Japan, Germany, Singapore, and the Netherlands. We have tax years open in Singapore beginning in fiscal 2004; in Japan beginning in fiscal 2005; in the Netherlands and Germany beginning in fiscal 2006; and in China beginning in calendar year 2006.

Discontinued Operations

Arrow Transaction

On March 1, 2011, we completed the closing of the Transaction. The total consideration paid by Arrow at the closing of the Transaction was $238.8 million which included an estimated pre-closing working capital adjustment. The final purchase price is subject to a post-closing working capital adjustment.

22

Table of Contents

On June 29, 2011, we received notification from Arrow seeking a post-closing working capital adjustment, which would reduce the purchase price by approximately $4.2 million. The $4.2 million is included in our results from discontinued operations for the fiscal year ended May 28, 2011.

Following the Transaction, the Compensation Committee of our Board of Directors granted cash bonus compensation to certain executive officers and former employees in recognition of their efforts for successfully completing the Transaction. The cash bonus compensation amount awarded was approximately $3.8 million, and was recorded as expense from discontinued operations during the fourth quarter of fiscal 2011.

To help facilitate the transition of RFPD to Arrow, we agreed to provide certain transitional services to Arrow such as financial support services, warehouse services, and access to facilities in accordance with the terms of the Transition Services Agreement. Arrow also agreed to provide certain transitional services such as information technology services, warehouse services, and access to facilities and equipment in accordance with the terms of the Transition Services Agreement. The duration of the transitional services are less than one year from March 1, 2011, except for the information technology services which is three years. In addition, we entered into a Manufacturing Agreement with Arrow, in connection with the Transaction, for a term of three years. Pursuant to the Manufacturing Agreement, we agreed to manufacture certain products for Arrow.

The Transition Services Agreement, which commenced on March 1, 2011, will allow us to exert very limited influence over Arrow’s operating and financial policies. Also, the continuing cash flows related to our Transition Services Agreement as well as the Manufacturing Agreement, are insignificant. We believe it is appropriate to include fees and associated costs with the Transition Services Agreement that relate to financial support, certain facilities, and certain warehouse services in discontinued operations as they relate specifically to RFPD. We further believe it is appropriate to treat the revenue and costs associated with the Manufacturing Agreement as discontinued operations as it relates specifically to RFPD.

Honeywell Transaction

On May 31, 2007, we completed the sale of the Security Systems Division/Burtek Systems (“SSD/Burtek”) to Honeywell International Inc. (“Honeywell”). The sale agreement of SSD/Burtek to Honeywell contemplated a post-closing working capital-based purchase price adjustment. During the third quarter of fiscal 2008, we received notification from Honeywell seeking a purchase price adjustment and we issued a dispute notice in a timely manner. On December 18, 2009, we reached an agreement with Honeywell to settle the pending working capital disputes as well as other related claims. As a result, we recorded $1.2 million of expense, net of zero tax effect, as a loss from discontinued operations during fiscal 2010.

Financial Summary—Discontinued Operations

Summary financial results for fiscal 2011, 2010, and 2009 are presented in the following table (in thousands):

| Fiscal 2011 | Fiscal 2010 | Fiscal 2009 | ||||||||||

| Net sales |

$ | 321,826 | $ | 356,475 | $ | 355,189 | ||||||

| Gross profit |

66,718 | 76,727 | 76,031 | |||||||||

| Selling, general, and administrative expenses |

44,570 | 53,831 | 55,497 | |||||||||

| Goodwill impairment |

— | — | 557 | |||||||||

| (Gain) loss on disposal of assets |

5 | (1 | ) | 3 | ||||||||

| Interest expense, net |

387 | 2,718 | 3,345 | |||||||||

| Foreign exchange gain |

(258 | ) | — | — | ||||||||

| Pre-tax gain on sale |

(111,432 | ) | — | — | ||||||||

| Income tax provision (benefit) |

45,354 | (98 | ) | 1,150 | ||||||||

| Income from discontinued operations, net of tax |

88,092 | 20,277 | 15,479 | |||||||||

23

Table of Contents