Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ManpowerGroup Inc. | form_8-k.htm |

| EX-99.1 - PRESS RELEASE DATED JULY 21, 2011 - ManpowerGroup Inc. | exhibit_99-1.htm |

Exhibit 99.2

ManpowerGroup 2011 2nd Quarter Results July 2011

ManpowerGroup

2nd Quarter

July 21, 2011

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

Forward-Looking Statement

This presentation includes forward-looking statements,

including earnings projections which are subject to risks and

uncertainties. Actual results might differ materially from those

projected in the forward-looking statements. Additional

information concerning factors that could cause actual results

to materially differ from those in the forward-looking statements

is contained in the Manpower Inc. Annual Report on Form 10-K

dated December 31, 2010, which information is incorporated

herein by reference, and such other factors as may be

described from time to time in the Company’s SEC filings.

including earnings projections which are subject to risks and

uncertainties. Actual results might differ materially from those

projected in the forward-looking statements. Additional

information concerning factors that could cause actual results

to materially differ from those in the forward-looking statements

is contained in the Manpower Inc. Annual Report on Form 10-K

dated December 31, 2010, which information is incorporated

herein by reference, and such other factors as may be

described from time to time in the Company’s SEC filings.

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

|

|

Q2 Financial Highlights

|

|

24%

|

Revenue $5.7B

|

|

12% CC

|

|

|

40 bps

|

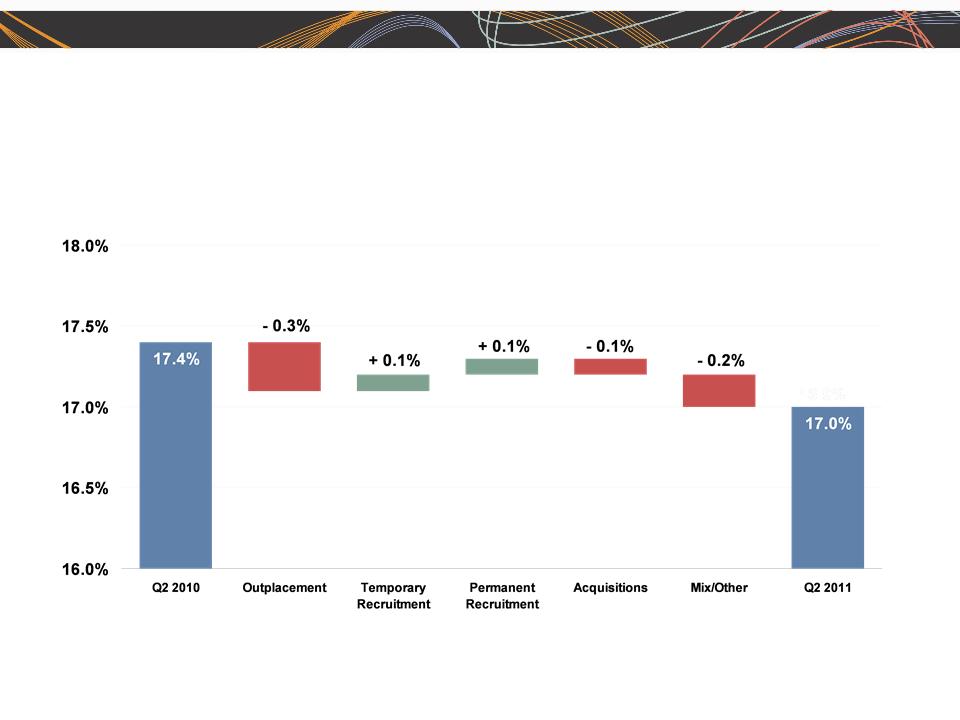

Gross Margin 17.0%

|

|

91%

|

Operating Profit $151M

|

|

67% CC

|

|

|

100 bps

|

OP Margin 2.7%

|

|

118%

|

EPS $0.87

|

|

90% CC

|

Throughout this presentation, the difference between reported variances and Constant Currency (CC) variances

represents the impact of currency on our financial results. Constant Currency is further explained on our Web site.

represents the impact of currency on our financial results. Constant Currency is further explained on our Web site.

Consolidated Financial Highlights

3

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

Consolidated Gross Margin Change

4

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

|

|

Q2 Financial Highlights

|

|

13%

|

Revenue $1.2B

|

|

12% CC

|

|

|

69%

|

OUP $40M

|

|

67% CC

|

|

|

110 bps

|

OUP Margin 3.4%

|

Americas Segment

(21% of Revenue)

(1) Included in these amounts is the US, which had revenue of $792M (+9%) and OUP of $27M (+85%).

Operating Unit Profit (OUP) is the measure that we use to evaluate segment performance.

OUP is equal to segment revenues less direct costs and branch and national

headquarters operating costs.

OUP is equal to segment revenues less direct costs and branch and national

headquarters operating costs.

(1)

5

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

Americas - Q2 Revenue Growth YoY

Revenue Growth - CC

Revenue Growth

% of Segment

Revenue

68%

12%

6%

14%

6

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

7

|

111

|

Q2 Financial Highlights

|

|

30%

|

Revenue $2.2B

|

|

15% CC

|

|

|

95%

|

OUP $50M

|

|

72% CC

|

|

|

80 bps

|

OUP Margin 2.3%

|

Southern Europe Segment

(38% of Revenue)

(1)

(1) Included in these amounts is France, which had revenue of $1.6B (+15% CC) and OUP of $25M (+118% CC).

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

Southern Europe - Q2 Revenue Growth YoY

Revenue Growth - CC

Revenue Growth

% of Segment

Revenue

75%

16%

5%

4%

8

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

|

|

Q2 Financial Highlights

|

|

24%

|

Revenue $1.6B

|

|

9% CC

|

|

|

97%

|

OUP $56M

|

|

72% CC

|

|

|

130 bps

|

OUP Margin 3.6%

|

Northern Europe Segment

(28% of Revenue)

9

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

Northern Europe - Q2 Revenue Growth YoY

Revenue Growth - CC

Revenue Growth

10

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

|

|

Q2 Financial Highlights

|

|

31%

|

Revenue $663M

|

|

16% CC

|

|

|

59%

|

OUP $19M

|

|

43% CC

|

|

|

50 bps

|

OUP Margin 2.8%

|

APME Segment

(12% of Revenue)

11

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

APME - Q2 Revenue Growth YoY

Revenue Growth - CC

Revenue Growth

% of Segment

Revenue

43%

28%

29%

12

(1) On an organic basis, Other revenue growth was 23% (+16% CC).

(1)

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

|

|

Q2 Financial Highlights

|

|

14%

|

Revenue $85M

|

|

20% CC

|

|

|

64%

|

OUP $3M

|

|

64% CC

|

|

|

460 bps

|

OUP Margin 3.3%

|

Right Management Segment

(1% of Revenue)

13

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

Cash Flow Summary - First Half

|

($ in millions)

|

2011

|

|

2010

|

|

Cash from Operations

|

(192)

|

|

(66)

|

|

Capital Expenditures

|

(28)

|

|

(28)

|

|

Free Cash Flow

|

(220)

|

|

(94)

|

|

Change in Debt

|

4

|

|

(5)

|

|

Share Repurchases

|

(19)

|

|

-

|

|

Acquisitions of Business

net of cash acquired

|

(15)

|

|

(259)

|

|

Effect of Exchange Rate Changes

|

31

|

|

(92)

|

|

Other

|

(10)

|

|

(12)

|

|

Change in Cash

|

(229)

|

|

(462)

|

|

|

|

|

|

|

|

|

|

|

14

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

Balance Sheet Highlights

Total Debt

($ in millions)

Total Debt to

Total Capitalization

Total Debt

Net Debt

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

(b)

Credit Facilities as of June 30, 2011

($ in millions)

($ in millions)

(a)

(a)

This $400M agreement requires, as of June 30, that we comply with a Debt-to-EBITDA ratio of less than 3.75 to 1 and a fixed charge coverage

ratio of greater than 1.35 to 1. As defined in the agreement, we had a Debt-to-EBITDA ratio of 1.35 and a fixed charge coverage ratio of 2.84

as of June 30, 2011. As of June 30, there were $2.2M of standby letters of credit issued under the agreement.

ratio of greater than 1.35 to 1. As defined in the agreement, we had a Debt-to-EBITDA ratio of 1.35 and a fixed charge coverage ratio of 2.84

as of June 30, 2011. As of June 30, there were $2.2M of standby letters of credit issued under the agreement.

Interest

Rate

Maturity

Date

Total

Outstanding

Remaining

Available

Euro Notes:

- Euro 200M

4.86%

June 2013

290

-

- Euro 300M

4.58%

June 2012

435

-

Revolving Credit Agreement

2.74%

Nov 2012

-

398

387

Uncommitted lines and Other

Various

Various

34

Total Debt

759

785

(b)

Represents subsidiary uncommitted lines of credit & overdraft facilities, which total $419.8M. Total subsidiary borrowing are limited to $300M

due to restrictions in our Revolving Credit Facility, with the exception of Q3 when subsidiary borrowings are limited to $600M.

due to restrictions in our Revolving Credit Facility, with the exception of Q3 when subsidiary borrowings are limited to $600M.

16

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

Third Quarter Outlook

|

Revenue

|

Total

|

Up 16-18% (Up 8-10% CC)

|

|

|

Americas

|

Up 8-10% (Up 6-8% CC)

|

|

|

Southern Europe

|

Up 19-21% (Up 9-11% CC)

|

|

|

Northern Europe

|

Up 17-19% (Up 7-9% CC)

|

|

|

APME

|

Up 25-27% (Up 14-16% CC)

|

|

Right Management

|

Down 4-6% (Down 9-11% CC)

|

|

|

Gross Profit Margin

|

16.5 - 16.7%

|

|

|

Operating Profit Margin

|

2.6 - 2.8%

|

|

|

Tax Rate

|

46.5%

|

|

|

EPS

|

$0.90-$1.00 (Favorable $.10 Currency)

|

|

17

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

Our brand and messages are resonating worldwide

“Prepare to play part in a new era: 20 epic shifts to

the Human Age”

the Human Age”

— South African newspaper, The Star

“Do changes as subtle

as those exemplified

by Manpower's

renaming matter?

Absolutely, said

Columbia University

business professor

Bernd Schmitt - right

down to the single-

word styling and the

replacement of ‘Inc.’

with ‘Group.’”

as those exemplified

by Manpower's

renaming matter?

Absolutely, said

Columbia University

business professor

Bernd Schmitt - right

down to the single-

word styling and the

replacement of ‘Inc.’

with ‘Group.’”

— Milwaukee Journal-

Sentinel

Sentinel

“Group is more

contemporary”

contemporary”

— Deborah Mitchell,

marketing professor,

University Wisconsin-

Madison

University Wisconsin-

Madison

“The Human Age

marks the pinnacle

marks the pinnacle

of a journey, when the

raw potential of

raw potential of

individuals ultimately

takes center stage.”

takes center stage.”

— HR Asia magazine

“Inc. sounds like a

faceless corporation,

where ‘group’ sounds

more human, more in

touch”

faceless corporation,

where ‘group’ sounds

more human, more in

touch”

— Jonathan Schroeder,

communications professor,

Rochester Institute of

Technology

communications professor,

Rochester Institute of

Technology

“[Manpower] used this

experience to identify a

new era, what it calls

experience to identify a

new era, what it calls

the human age.

It’s changing its name

and logo to fit a world

and logo to fit a world

where it says talent

replaces capital as the

key driver of economic

growth.”

replaces capital as the

key driver of economic

growth.”

— Bloomberg TV

a rebranding…

in a bid to improve

the marketing of its

services.”

the marketing of its

services.”

“Talent is the new

capital”

capital”

— Swedish newspaper

Sundsvalls Tidning

Sundsvalls Tidning

18

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

19

Gross Profit Growth

in CC %

Gross Profit Development - Q2 2011

█ Staffing █ Professional Resourcing █ Permanent Recruitment (excluding RPO)

█ ManpowerGroup Solutions █ Talent & Career Management █ ManpowerGroup - Total

ManpowerGroup 2011 2nd Quarter Results July

2011

2011

Employers foresee a more flexible and virtual

labor force

labor force

How will your company’s workforce change over the next 5 years?

% of respondents (n = 2,000)

Source: McKinsey Global Institute US Jobs Survey, 2011; McKinsey Global Institute analysis

More telecommuting

More offshored or

outsourced workers

outsourced workers

More older workers

(aged 55+)

Don’t know

Other types of changes

to the nature of work

to the nature of work

21.5%

25.5%

57.8%

19.9%

16.8%

2.9%

More part-time, temporary,

or contract workers

or contract workers

20

Questions