Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TIDEWATER INC | d8k.htm |

| EX-99.2 - TRANSCRIPT TO THE 2011 ANNUAL MEETING OF STOCKHOLDERS - TIDEWATER INC | dex992.htm |

DEAN E.

TAYLOR DEAN E. TAYLOR

Chairman, President and CEO

Chairman, President and CEO

JEFFREY M. PLATT

JEFFREY M. PLATT

Chief Operating Officer

Chief Operating Officer

QUINN P. FANNING

QUINN P. FANNING

Executive VP and CFO

Executive VP and CFO

FISCAL 2011 ANNUAL

SHAREHOLDERS’

MEETING

FISCAL 2011 ANNUAL

FISCAL 2011 ANNUAL

SHAREHOLDERS’

SHAREHOLDERS’

MEETING

MEETING

Exhibit 99.1

July 14, 2011

July 14, 2011 |

In accordance

with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995,

the Company notes that certain statements set forth in this presentation provide

other than historical information and are forward looking. The actual achievement of any

forecasted results, or the unfolding of future economic or business developments in a way

anticipated or projected by the Company, involve numerous risks and uncertainties that

may cause the Company’s actual performance to be materially different from that

stated or implied in the forward-looking statement. Among those risks and

uncertainties, many of which are beyond the control of the Company, include, without

limitation, volatility in worldwide energy demand and oil and gas prices; fleet additions

by competitors and industry overcapacity; changes in capital spending by customers in the

energy industry for offshore

exploration,

field

development

and

production;

changing

customer

demands

for vessel specifications, which may make some of our older vessels technologically

obsolete for certain customer projects or in certain markets; uncertainty of global

financial market conditions and difficulty in accessing credit or capital; acts of

terrorism and piracy; significant weather conditions; unsettled political conditions,

war, civil unrest and governmental actions, such as expropriation, especially in higher

risk countries where we operate; foreign currency fluctuations; labor influences

proposed by international conventions; increased regulatory burdens and oversight

following the Deepwater Horizon incident;

and enforcement of laws related to the

environment,

labor

and

foreign

corrupt

practices.

Readers

should

consider

all

of

these

risk factors as well as other information contained in this report.

Phone:

504.568.1010

Fax:

504.566.4580

Web:

www.tdw.com

Email:

connect@tdw.com

FORWARD-LOOKING STATEMENTS

FORWARD-LOOKING STATEMENTS

FORWARD-LOOKING STATEMENTS

2 |

3

OPERATIONS REVIEW

Jeff Platt –

Chief Operating Officer

OPERATIONS REVIEW

OPERATIONS REVIEW

Jeff Platt –

Jeff Platt –

Chief Operating Officer

Chief Operating Officer

3 |

4

SAFETY –

A CONTINUED TOP PRIORITY

SAFETY –

SAFETY –

A CONTINUED TOP PRIORITY

A CONTINUED TOP PRIORITY

SM

4 |

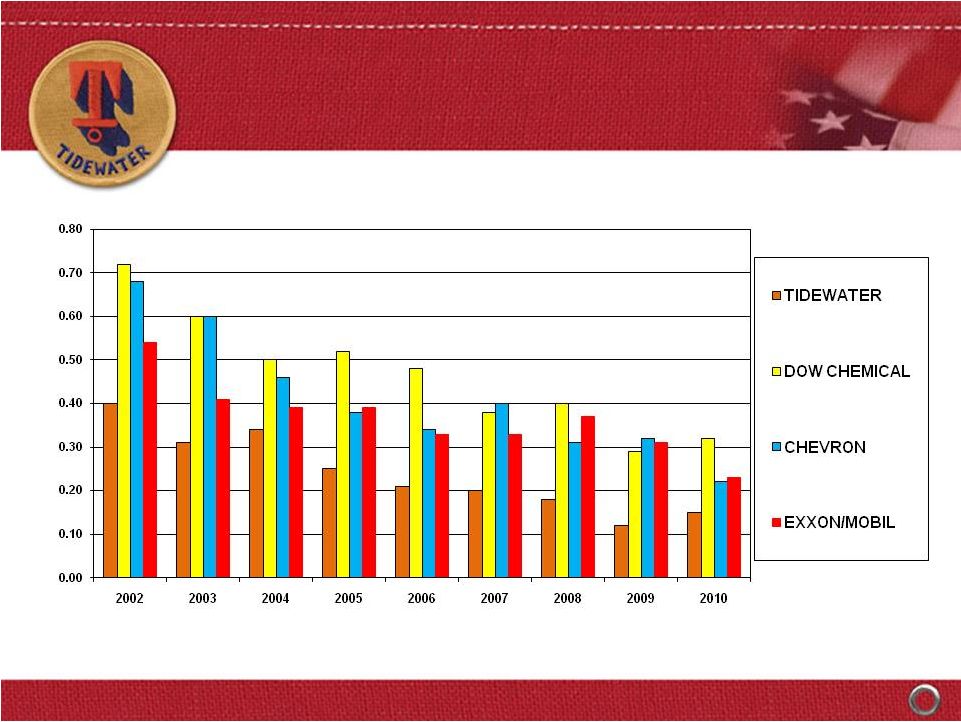

SAFETY RECORD RIVALS

LEADING COMPANIES

SAFETY RECORD RIVALS

SAFETY RECORD RIVALS

LEADING COMPANIES

LEADING COMPANIES

CALENDAR YEARS

TOTAL

RECORDABLE

INCIDENT

RATES

5 |

6

Unique global footprint; 50+ years of Int’l

experience

Unmatched scale and scope of operations

International market opportunities

•

Growth

•

Longer contracts

•

Better utilization

•

Higher dayrates

Solid customer base of NOC’s and IOC’s

INTERNATIONAL STRENGTH

INTERNATIONAL STRENGTH

INTERNATIONAL STRENGTH |

7

North America

16

(6%)

Central/South America

54

(20%)

West Africa

129

(47%)

Europe / M.E.

40

(14%)

Far East

35

(13%)

International / U.S.

2011: 94% / 6%

2000: 62% / 38%

OUR GLOBAL FOOTPRINT

Vessel Distribution by Region

(excludes stacked vessels –

as of 3/31/11)

OUR GLOBAL FOOTPRINT

OUR GLOBAL FOOTPRINT

Vessel Distribution by Region

Vessel Distribution by Region

(excludes stacked vessels –

(excludes stacked vessels –

as of 3/31/11)

as of 3/31/11) |

8

Vessel Count

Estimated Cost

AHTS

99

$1,743m

PSV’s

84

$1,755m

Crewboats & Tugs

67

$289m

TOTALS:

250

$3,787m

.

At 3/31/11, 193 new vessels in fleet with ~5.4 year average age

Vessel Commitments

Jan. ’00 –

March ‘11

29 additional vessels were delivered into our fleet in Fiscal 2011

29 additional vessels were delivered into our fleet in Fiscal 2011

(1) $3,293m (87%) funded through 3/31/11

THE LARGEST MODERN FLEET

IN THE INDUSTRY….

THE LARGEST MODERN FLEET

THE LARGEST MODERN FLEET

IN THE INDUSTRY….

IN THE INDUSTRY….

(1) |

Count

AHTS

15

PSV

20

Crew and Tug

1

Total

36

Vessels Under Construction*

As of March 31, 2011

* Includes eight new vessels committed to purchase as of 3/31/11

Estimated

delivery

schedule

–

25

in

FY

‘12,

10

in

FY

‘13

and

1

thereafter.

CAPX of $368m in FY ‘12, $110m in FY ‘13 and $16m in FY ’14.

…. AND MORE TO COME

…. AND MORE TO COME

…. AND MORE TO COME

9 |

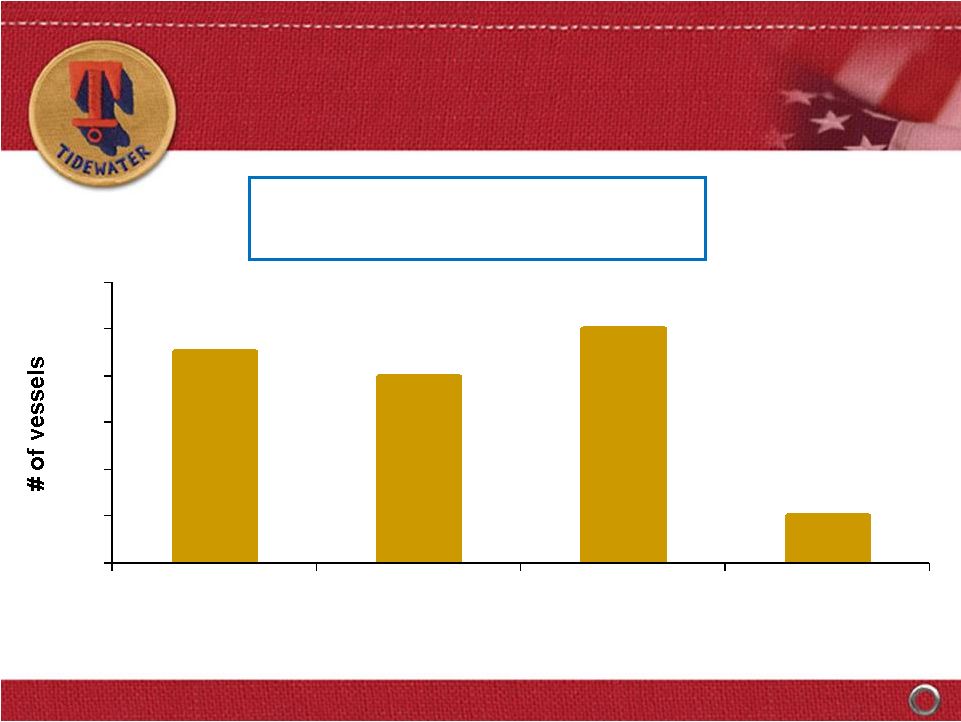

10

0

2

4

6

8

10

12

6/30/10 Qtr

9/30/10 Qtr

12/31/10 Qtr

3/31/11 Qtr

Amounts

depict

vessel

count

and

total

cost

in

quarter

commitment

was

made

to

acquire

(not

when

delivery

or

payments

were

made)

$179M

$179M

6 AHTS

3

PSV’s

29 new vessel commitments in Fiscal 2011

with total capital cost of ~$600 million

$177M

$177M

4 PSV’s

4 AHTS

1 PSV

9 AHTS

$139M

$139M

$101M

$101M

2

PSV’s

FISCAL 2011 NEW

VESSEL COMMITMENTS

FISCAL 2011 NEW

FISCAL 2011 NEW

VESSEL COMMITMENTS

VESSEL COMMITMENTS

Since 3/31/11, commitments for seven additional vessels (~$140m)

were finalized |

11

FINANCIAL REVIEW

Quinn Fanning –

Chief Financial Officer

FINANCIAL REVIEW

FINANCIAL REVIEW

Quinn Fanning –

Quinn Fanning –

Chief Financial Officer

Chief Financial Officer |

12

**

EPS in Fiscal 2004 is exclusive of the $.30 per share after tax impairment charge.

EPS in Fiscal 2006 is exclusive of the $.74 per share after tax gain from the

sale of six KMAR vessels. EPS in Fiscal 2007 is exclusive of $.37 per share of

after tax gains from the sale of 14 offshore tugs. EPS in Fiscal 2010 is

exclusive of $.66 per share Venezuelan provision, a $.70 per share tax benefit

related to favorable resolution of tax litigation and a $0.22 per share charge

for the proposed settlement with the SEC of the company’s FCPA matter. EPS in Fiscal 2011 is exclusive of total $0.21 per share charges for

settlements with DOJ and Government of Nigeria for FCPA matters,

a $0.08 per share charge related to participation in a multi-company

U.K.-based pension plan and a $0.06 per share impairment charge related to

certain vessels. Adjusted Return

On Avg. Equity

4.3% 7.2%

12.4%

18.5% 18.3%

19.5%

11.4% 4.0%

Adjusted EPS**

Adjusted EPS**

HISTORY OF EARNINGS GROWTH

AND SOLID THROUGH-CYCLE RETURNS

HISTORY OF EARNINGS GROWTH

HISTORY OF EARNINGS GROWTH

AND SOLID THROUGH-CYCLE RETURNS

AND SOLID THROUGH-CYCLE RETURNS

$2.40

$5.20

$7.89

$1.03

$1.78

$3.33

$5.94

$6.39

$0.00

$2.00

$4.00

$6.00

$8.00

Fiscal

2004

Fiscal

2005

Fiscal

2006

Fiscal

2007

Fiscal

2008

Fiscal

2009

Fiscal

2010

Fiscal

2011 |

13

Over

a

12-year

period,

Tidewater

invested

$3.8

billion

in

CAPX

($3.3

billion

in

the

“new”

fleet),

and paid out $995 million through dividends and share repurchases. Over the

same period, CFFO and proceeds from dispositions were $3.4 billion and $690

million, respectively $0

$100

$200

$300

$400

$500

$600

$700

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

CAPX

Dividend

Share Repurchase

$ in millions

CFFO

Fiscal Year

FLEET RENEWAL & EXPANSION FUNDED BY

OPERATING CASH FLOW THROUGH FISCAL 2011

FLEET RENEWAL & EXPANSION FUNDED BY

FLEET RENEWAL & EXPANSION FUNDED BY

OPERATING CASH FLOW THROUGH FISCAL 2011

OPERATING CASH FLOW THROUGH FISCAL 2011 |

14

Years Ended

3/31/11

3/31/10

Revenues

$1,055

$1,169

Adjusted Net Earnings*

$123

$269

Adjusted EPS*

$2.40

$5.20

Net Cash from Operations

$264

$328

Capital Expenditures

$615

$452

$ in Millions, Except Per Share Data

RECENT FINANCIAL RESULTS

REFLECT CYCLICAL DOWNTURN

RECENT FINANCIAL RESULTS

RECENT FINANCIAL RESULTS

REFLECT CYCLICAL DOWNTURN

REFLECT CYCLICAL DOWNTURN

* Adjusted Net Earnings and Adjusted EPS for the year ended 3/31/11 exclude an after-tax $4.35

million, or $0.09 per share, charge related to settlement with DOJ and an after-tax

$6.3 million, or $0.12 per share, charge related to settlement with the Government of Nigeria for FCPA matters, an after-tax $3.9 million, or

$0.08 per share, charge related to participation in a multi-company U.K.-based pension plan,

and an after-tax $3.0 million, or $0.06 per share, impairment charge related to

certain vessels. Adjusted net earnings and EPS for the year ended 3/31/10 exclude charges of $33.6 million, or $0.66 per share, related to provisions for

Venezuelan operations, $36.1 million, or $0.70 per share, tax benefit related to favorable resolution

of tax litigation and $11.4 million, or $0.22 per share, charge related to settlement with the

SEC for FCPA matters. |

15

At March 31, 2011

Cash & Cash Equivalents

$246 million

Total Debt

$700 million

Shareholders Equity

$2,514 million

Net Debt / Net Capitalization

15%

Total Debt / Capitalization

22%

Pro forma liquidity as of 3/31/11 of +$800 million, including

$575 million available under credit facilities

STRONG FINANCIAL POSITION

PROVIDES STRATEGIC OPTIONALITY

STRONG FINANCIAL POSITION

STRONG FINANCIAL POSITION

PROVIDES STRATEGIC OPTIONALITY

PROVIDES STRATEGIC OPTIONALITY |

16

Senior Unsecured Notes

$425 million

Average Life to Maturity

~ 9 years

Weighted Average Coupon

4.25%

Term Loan

$125 million

Revolving Line of Credit

$450 million

Term

Five years

Interest Rate

LIBOR plus 1.5% to

2.25%, based on leverage

Private Placement Financing:

Private Placement Financing:

New Credit Facilities:

New Credit Facilities:

< $50 million in debt maturities in Fiscal 2012

RECENT FINANCINGS WILL FUND GROWTH

AT ATTRACTIVE RELATIVE COST

RECENT FINANCINGS WILL FUND GROWTH

RECENT FINANCINGS WILL FUND GROWTH

AT ATTRACTIVE RELATIVE COST

AT ATTRACTIVE RELATIVE COST |

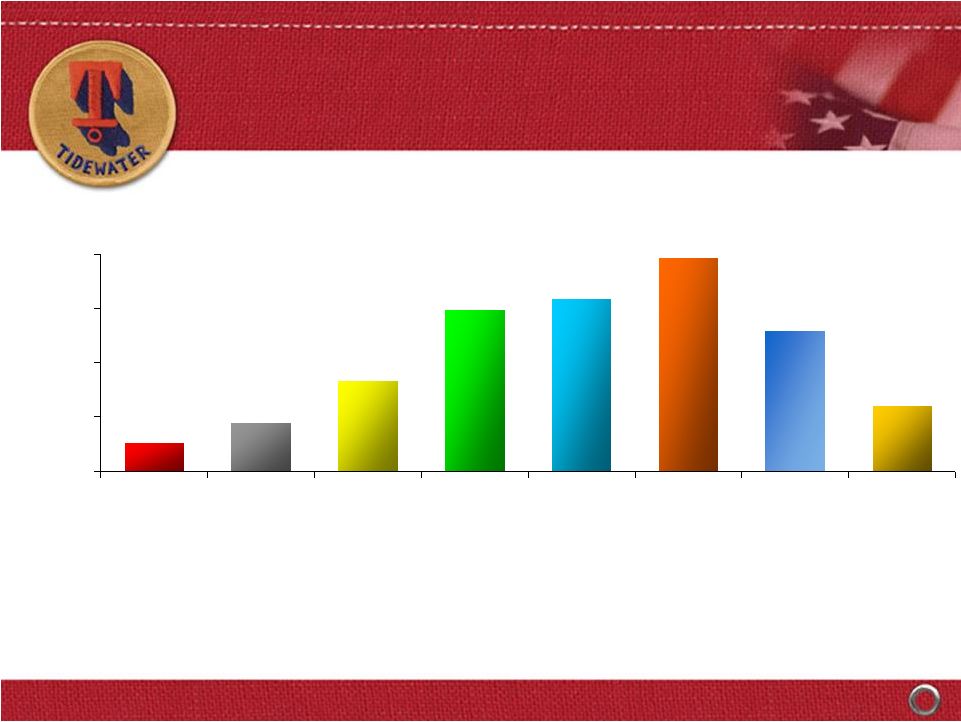

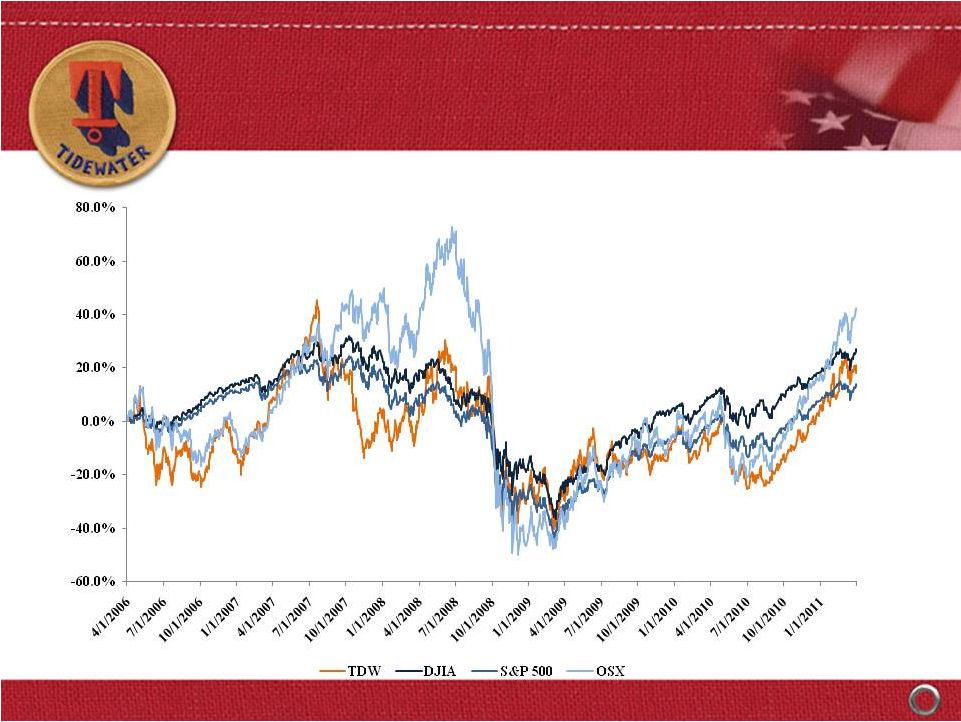

OSX

42% S&P 500 14%

DJIA 27%

TDW 18%

RETURNS vs the MARKET

FIVE YEAR STOCKHOLDER RETURN

RETURNS vs the MARKET

RETURNS vs the MARKET

FIVE YEAR STOCKHOLDER RETURN

FIVE YEAR STOCKHOLDER RETURN

17 |

18

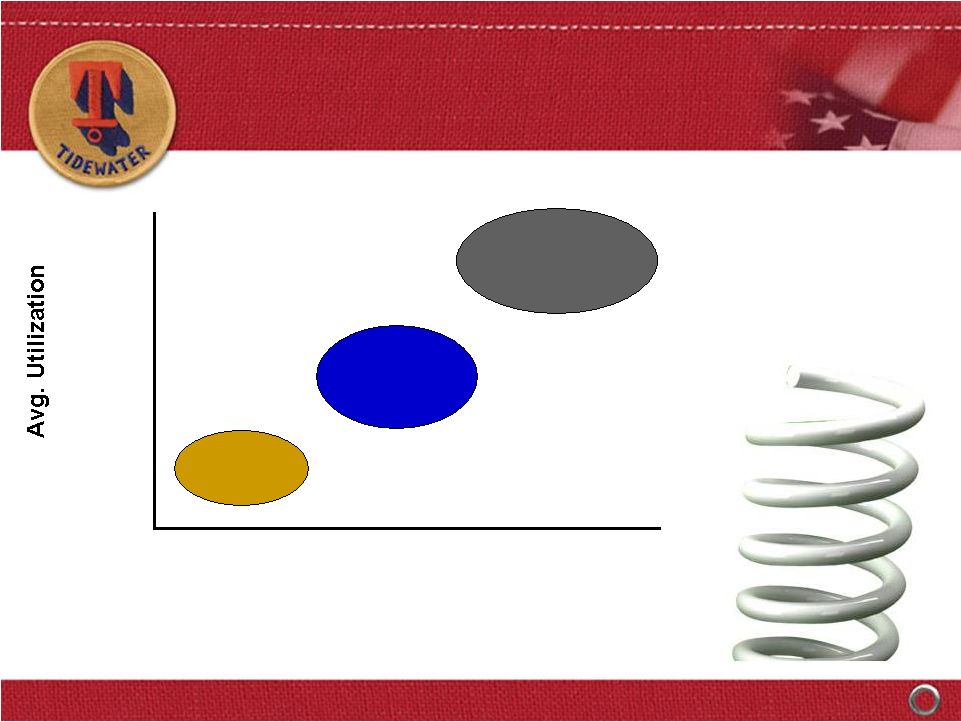

269 vessel assumption (193 current new vessels + 36 under construction + ~ 20

additional new vessels per year for two years).

WHERE COULD FISCAL 2014 FIND US?

Potential for Earnings Acceleration

WHERE COULD FISCAL 2014 FIND US?

WHERE COULD FISCAL 2014 FIND US?

Potential for Earnings Acceleration

Potential for Earnings Acceleration

Avg. Dayrates

$14,381*

$15,819

(+ 10%)

$17,400

(+ 10%)

85.8%*

85.0%

90.0%

~$4.00

EPS

~$5.60

EPS

~$9.10

EPS

* 3/31/11 fiscal year actual stats

This info is not meant to be a

prediction of future earnings

performance, but simply an

indication of earning sensitivities

resulting from future fleet

additions and reductions and

varying operating assumptions

~$400M+

EBITDA

~$520M+

EBITDA

~$730M+

EBITDA |

19

RETIREMENT OF

STEPHEN WALLACE DICK

RETIREMENT OF

RETIREMENT OF

STEPHEN WALLACE DICK

STEPHEN WALLACE DICK |

20

THANKS FOR ALL YOU’VE DONE FOR

TIDEWATER OVER 38 YEARS

THANKS FOR ALL YOU’VE DONE FOR

THANKS FOR ALL YOU’VE DONE FOR

TIDEWATER OVER 38 YEARS

TIDEWATER OVER 38 YEARS |

21

2011 TIDEWATER

CHAIRMAN’S AWARD OBJECTIVES

2011 TIDEWATER

2011 TIDEWATER

CHAIRMAN’S AWARD OBJECTIVES

CHAIRMAN’S AWARD OBJECTIVES

To recognize an individual or team that has:

Performed heroic acts in time of crisis

Significantly impacted the TDW business

Significantly contributed to our customer success or

relationships

Had a breakthrough idea or contribution resulting in

significant improvements for TDW

Went above and beyond on normal duties and

responsibilities to achieve greatness |

22

2011 TIDEWATER

CHAIRMAN’S AWARD

2011 TIDEWATER

2011 TIDEWATER

CHAIRMAN’S AWARD

CHAIRMAN’S AWARD |

DEAN E.

TAYLOR DEAN E. TAYLOR

Chairman, President and CEO

Chairman, President and CEO

JEFFREY M. PLATT

JEFFREY M. PLATT

Chief Operating Officer

Chief Operating Officer

QUINN P. FANNING

QUINN P. FANNING

Executive VP and CFO

Executive VP and CFO

FISCAL 2011 ANNUAL

SHAREHOLDERS’

MEETING

FISCAL 2011 ANNUAL

FISCAL 2011 ANNUAL

SHAREHOLDERS’

SHAREHOLDERS’

MEETING

MEETING

July 14, 2011

July 14, 2011 |