Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - ENERGY KING, INC. | enkg_8k.htm |

EXHIBIT 1.01

STOCK PURCHASE AGREEMENT

THIS STOCK PURCHASE AGREEMENT, (the "Agreement") is entered into and effective this July 14, 2011, and supersedes any and all other agreements whether in writing or orally communicated, by and among Energy King, Inc. a Nevada Corporation, located at Irvine, Ca. 92618, , (hereinafter collectively referred to as "PURCHASER"), and Venue Media a California Limited Liability Corporation, located at 26060 Acero Mission Viejo, Ca. 92691, (hereinafter referred to as the "SELLER" or the “Company”);

WITNESSETH:

WHEREAS, Energy King is a corporation organized in the state of Nevada for the sole purpose, of owning and operating small to medium sized businesses in the United States.

WHEREAS, the Seller is the sole record owner and holder of an aggregate of one-hundred percent (100%) of the Member Units.

WHEREAS, the PURCHASER desires to purchase Venue Media and the SELLER desires to sell, or cause to be sold, Venue Media, upon the terms and subject to the conditions herein.

NOW, THEREFORE, in consideration of the mutual covenants, and agreements contained in this Agreement, and in order to consummate the purchase and the sale of Venue Media, it is hereby agreed as follows:

AGREEMENT:

1. CLOSING.

A. Procedure for Closing. The closing of the transaction contemplated by this Agreement shall be held at the offices of Venue Media, Inc. on or about July 14, 2011 at 5:00 pm PST ("Closing Date") or such other place, date and time as the parties hereto may otherwise agree.

B. Purchase and Sale of Venue Media, LLC. Upon the closing date set forth in this Agreement, and subject to the terms and conditions hereinafter set forth, the SELLER shall sell, convey and transfer, or cause to be sold, conveyed or transferred, Venue Media, LLC on the Closing Date.

C. Amount and Payment of Purchase Price. The total consideration for purchase of Venue Media, LLC and method of payment thereof shall be pursuant to the following:

Page 1 of 6

|

a)

|

Energy King to acquire Venue Media, LLC

|

|

b)

|

All existing officers and directors of Energy King, Inc. to resign immediately after the signing of stock purchase agreement. Larry Weinstein to stay on as a member of the Board of Directors.

|

|

c)

|

Preferred shares will be given to Michael Cummings that converts to common shares, which equals 51% of Authorized Common Shares.

|

|

d)

|

Existing Board of Directors will vote Michael Cummings has the CEO/Chairman and Secretary.

|

|

e)

|

All bank accounts will be turned over to Michael Cummings.

|

|

f)

|

All Corporate books to be turned over to Michael Cummings.

|

|

g)

|

Michael Cummings will complete all filings to get the company current with the State of Nevada, change name, file for Non-Reporting status and symbol change.

|

2. LOCATION OF Energy King both parties acknowledge that as a condition of entering in this Agreement, the location and operation of Energy King will be located at the best location to conduct business.

3. REPRESENTATIONS AND WARRANTIES OF SELLER. SELLER hereby warrants and represents:

A. Authority Relative to this Agreement. Except as otherwise stated herein, the SELLER has full power and authority to execute this Agreement and carry out the transactions contemplated by it and no further action is necessary by the SELLER to make this Agreement valid and binding upon SELLER and enforceable against them in accordance with the terms hereof, or to carry out the actions contemplated hereby. The execution, delivery and performance of this Agreement by the SELLER will not:

|

|

(i)

|

Constitute a breach or a violation of Venue Media, LLC Articles of Organization, or of any law, agreement, indenture, deed of trust, mortgage, loan agreement or other instrument to which it is a party, or by which it is bound;

|

|

|

(ii)

|

Constitute a violation of any order, judgment or decree to which it is a party or by which its assets or properties are bound or affected; or

|

|

|

(iii)

|

Result in the creation of any lien, charge or encumbrance upon its assets or properties, except as stated herein.

|

B. Assets. SELLER represents that the PURCHASER is entitled to all rights of Venue Media, LLC with no exception.

Page 2 of 6

C. Lawsuits, Liens & Taxes. SELLER represents that to the best of SELLER’s knowledge, that neither the SELLER nor Energy King is currently the subject of any lawsuit threatened or filed. SELLER shall be solely responsible for all taxes which may be incurred by SELLER resulting from the receipt of consideration by SELLER pursuant to this Agreement.

D. Brokerage. SELLER has not made any agreement or taken any other action which might cause anyone to become entitled to a broker's fee or commission as a result of the transactions contemplated hereunder.

4. REPRESENTATIONS AND WARRANTIES OF THE PURCHASER. PURCHASER hereby warrants and represents:

A. Authority Relative to this Agreement and Ancillary Documents. Except as otherwise stated herein, the PURCHASER has full power and authority to execute this Agreement, and carry out the transactions contemplated hereby and thereby and no further action is necessary by the PURCHASER to make this Agreement valid and binding upon PURCHASER and enforceable against it in accordance with the terms hereof, or to carry out the actions contemplated hereby and thereby. The execution, delivery and performance of this Agreement by the PURCHASER will not:

|

|

(i)

|

Constitute a breach or a violation of any law, agreement, indenture, deed of trust, mortgage, loan agreement or other instrument to which it is a party, or by which it is bound;

|

|

|

(ii)

|

Constitute a violation of any order, judgment or decree to which it is a party or by which its assets or properties are bound or affected; or

|

|

|

(iii)

|

Result in the creation of any lien, charge or encumbrance upon its assets or properties except as stated herein.

|

B. Brokerage. The PURCHASER has not made any agreement or taken any other action which might cause anyone to become entitled to a broker's fee or commission as a result of the transactions contemplated hereunder.

C. Taxes. PURCHASER shall be solely responsible for all taxes which may be incurred by PURCHASER resulting from the receipt of consideration by PURCHASER pursuant to this Agreement.

5. EXPENSES. Each of the parties hereto shall pay its own expense in connection with this Agreement and the transactions contemplated hereby, including the fees and expenses of its counsel and its certified public accountants and other experts.

6. CLOSING DELIVERIES. At the Closing, the deliveries hereinafter specified shall be made by the respective parties hereto, in order to consummate the transactions contemplated hereby. A best effort shall be made by both parties regarding deliveries by the Closing date or such reasonable time thereafter.

A. Deliveries by SELLER. SELLER shall deliver or caused to be delivered to PURCHASER:

Page 3 of 6

|

|

(i)

|

Stock Certificates, and any and all other instruments of conveyance and transfer as required by Section lA of this Agreement; and

|

|

|

(ii)

|

Copies of all third party consents necessary to consummate the transaction contemplated herein.

|

B. Deliveries by PURCHASER. PURCHASER shall deliver or caused to be delivered to SELLER:

|

|

(i)

|

Any and all instruments of conveyance and transfer as required by Section 1 of this Agreement; and

|

|

|

(ii)

|

All third party consents necessary to consummate the transaction contemplated herein.

|

7. GENERAL.

A. Survival of Representations and Warranties. Each of the parties to this Agreement covenants and agrees that its respective representations, warranties, covenants and statements and agreements contained in this Agreement and the exhibits hereto, and in any documents delivered in connection herewith, shall survive the Closing Date indefinitely. Except agreements between the PURCHASER and certain individual members of SELLER, and as set forth in this Agreement, the exhibits hereto or in the documents and papers delivered in connection herewith, there are no other agreements, representations, warranties or covenants by or among the parties hereto with respect to the subject matter hereof.

B. Waivers. No action taken pursuant to this Agreement, including any investigation by or on behalf of any party shall be deemed to constitute a waiver by the party taking such action or compliance with any representation, warranty, covenant or agreement contained herein, therein and in any documents delivered in connection herewith or therewith. The waiver by any party hereto of a breach of any provision of this Agreement shall not operate or be construed as a waiver of any subsequent breach.

C. Notices. All notices, requests, demands and other communications, which are required or may be given under this Agreement shall be in writing and shall be deemed to have been duly given if delivered or mailed, first class mail, postage prepaid to the addresses first indicated in this Agreement.

D. Entire Agreement. This Agreement (including all documents and papers delivered pursuant hereto and any written amendments hereof executed by the parties hereto) constitutes the entire agreement and supersedes all prior agreements and understandings, oral and written, between the parties hereto with respect to the subject matter hereof.

E. Sections and Other Headings. The section and other headings contained in this Agreement are for reference purposes only and shall not affect the meaning or interpretation of this Agreement.

G. Governing Law. This Agreement and all transactions contemplated hereby, shall be governed by, construed and enforced in accordance with the laws of the State of California. The parties herein waive trial by jury and agree to submit to the personal jurisdiction and venue of a court of subject matter jurisdiction located in Orange County, California. In the event that litigation results from or arises out of this Agreement or the performance thereof, the parties agree to reimburse the prevailing party's reasonable attorney's fees, court costs, and all other expenses, whether or not taxable by the court as costs, in addition to any other relief to which, the prevailing party may be entitled.

Page 4 of 6

H. Contractual Procedures. Unless specifically disallowed by law, should litigation arise hereunder, service of process therefore, may be obtained through certified mail, return receipt requested; the parties hereto waiving any and all rights they may have to object to the method by which service was perfected.

I. Confidentiality and Non-Disclosure: Except to the extent required by law, without the prior written consent, the undersigned will not make, and will each direct its representatives not to make, directly or indirectly, any public comment, statement, or communication with respect to, or to disclose or permit the disclosure of the existence of this transaction prior to closing.

J. Amendment and Waiver. The parties may by mutual agreement amend this Agreement in any respect, and any party, as to such party, may (a) extend the time for the performance of any of the obligations of any other party, and (b) waive: (i) any inaccuracies in representations by any other party, (ii) compliance by any other party with any of the agreements contained herein and performance of any obligations by such other party, and (iii) the fulfillment of any condition that is precedent to the performance by such party of any of its obligations under this Agreement. To be effective, any such amendment or waiver must be in writing and be signed by the party against whom enforcement of the same is sought.

K. Counterparts. This Agreement may be executed in one or more counterparts, each of whom shall for all purposes are deemed to be an original and all of which shall constitute one instrument.

â â â â â â â â

SIGNATURE PAGE IS LOCATED ON LAST PAGE

Page 5 of 6

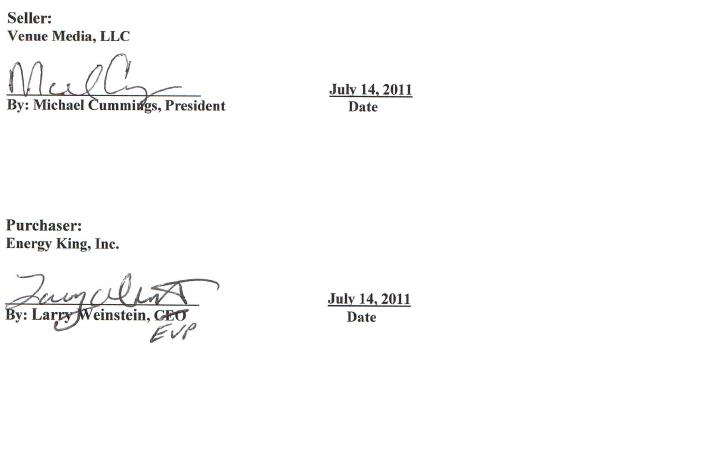

IN WITNESS WHEREOF, this Agreement has been executed by each of the individual parties hereto, on the date so indicated, with the effective date as first above written.

Page 6 of 6