Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - American Water Works Company, Inc. | d8k.htm |

Institutional Investor Meetings

July 2011

Exhibit 99.1 |

2

Certain

statements

in

this

presentation

are

forward-looking

statements

within

the

meaning

of

the

safe

harbor

provisions

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

These

forward-looking

statements

are

predictions

based

on

our

current

expectations

and

assumptions

regarding

future

events

and

may

relate

to,

among

other

things,

our

future

financial

performance,

including

return

on

equity

performance,

our

growth

and

portfolio

optimization

strategies,

our

projected

capital

expenditures

and

related

funding

requirements,

our

ability

to

repay

debt,

our

ability

to

finance

current

operations

and

growth

initiatives,

the

impact

of

legal

proceedings

and

potential

fines

and

penalties,

business

process

and

technology

improvement

initiatives,

trends

in

our

industry,

regulatory

or

legal

developments

or

rate

adjustments.

Actual

results

could

differ

materially

because

of

factors

decisions

of

governmental

and

regulatory

bodies,

including

decisions

to

raise

or

lower

rates;

the

timeliness

of

regulatory

commissions’

actions

concerning

rates;

changes

in

laws,

governmental

regulations

and

policies,

including

environmental,

health

and

water

quality

and

public

utility

regulations

and

policies;

weather

conditions,

patterns

or

events,

including

drought

or

abnormally

high

rainfall;

changes

in

customer

demand

for,

and

patterns

of

use

of,

water,

such

as

may

result

from

conservation

efforts;

significant

changes

to

our

business

processes

and

corresponding

technology;

our

ability

to

appropriately

maintain

current

infrastructure;

our

ability

to

obtain

permits

and

other

approvals

for

projects;

changes

in

our

capital

requirements;

our

ability

to

control

operating

expenses

and

to

achieve

efficiencies

in

our

operations;

our

ability

to

obtain

adequate

and

cost-effective

supplies

of

chemicals,

electricity,

fuel,

water

and

other

raw

materials

that

are

needed

for

our

operations;

our

ability

to

successfully

acquire

and

integrate

water

and

wastewater

systems

that

are

complementary

to

our

operations

and

the

growth

of

our

business

or

dispose

of

assets

or

lines

of

business

that

are

not

complementary

to

our

operations

and

the

growth

of

our

business;

cost

overruns

relating

to

improvements

or

the

expansion

of

our

operations;

changes

in

general

economic,

business

and

financial

market

conditions;

access

to

sufficient

capital

on

satisfactory

terms;

fluctuations

in

interest

rates;

restrictive

covenants

in

or

changes

to

the

credit

ratings

on

our

current

or

future

debt

that

could

increase

our

financing

costs

or

affect

our

ability

to

borrow,

make

payments

on

debt

or

pay

dividends;

fluctuations

in

the

value

of

benefit

plan

assets

and

liabilities

that

could

increase

our

cost

and

funding

requirements;

our

ability

to

utilize

our

U.S.

and

state

net

operating

loss

carryforwards;

migration

of

customers

into

or

out

of

our

service

territories;

difficulty

in

obtaining

insurance

at

acceptable

rates

and

on

acceptable

terms

and

conditions;

the

incurrence

of

impairment

charges

ability

to

retain

and

attract

qualified

employees;

and

civil

disturbance,

or

terrorist

threats

or

acts

or

public

apprehension

about

future

disturbances

or

terrorist

threats

or

acts.

Any

forward-looking

statements

we

make,

speak

only

as

of

the

date

of

this

presentation.

Except

as

required

by

law,

we

do

not

have

any

obligation,

and

we

specifically

disclaim

any

undertaking

or

intention,

to

publicly

update

or

revise

any

forward-

looking

statements,

whether

as

a

result

of

new

information,

future

events,

changed

circumstances

or

otherwise.

Cautionary Statement Concerning Forward-Looking

Statements

July 2011 |

July 2011

American Water: The Premier Water Services Provider in

North America

Geographic Diversity

(1)

Business Diversity

(1)

Market Capitalization: $5.2 Billion

Enterprise Value: $10.8 Billion

Average Daily Volume Traded: 1.1 Million shares

(1)

Based on 2010 Revenues

(2)

Market data as of 6/29/11

(3)

Market-Based includes Other

3

$601.2

$505.9

$232.0

$224.6

$181.7

$158.2

$123.4

NJ

PA

IL

MO

IN

CA

WVA

Regulated,

89.4%

Market

Based ,

(3)

10.6% |

July 2011

4

American Water has achieved impressive Growth

since its IPO

* 2008 and 2009 exclude impairment charges. See slide 42 for reconciliation table

Earnings Per Share*

Cash Flow From

Operations

(millions)

$268

$210

$176

2010

2009

2008

$1.10

$1.25

$1.53

$552

$596

$775

2008

2009

2009

2010

2010

2008

Net Income

(millions) |

The

US Water Industry |

July 2011

The U.S. Water Industry

6

Key

Water

Sector

Themes

Aging

Infrastructure

Fragmented

Industry

Increasing

Environmental

Requirements

Capital

Availability

Technology |

7

Water Industry Has a Favorable Utility Profile

Water Utility

Characteristics

Implications

•

Capital projects focused on maintaining

public health & safety standards

•

Regulators supportive of prudent projects

•

Water bills low portion of household budget

•

Essential

product

–

no

substitutes

•

Demand is more price inelastic than

electric or gas

•

Raw input costs (i.e. water and chemicals)

less volatile than other utility commodity

costs (i.e. coal and natural gas)

•

More stable rates for customers

•

Cost forecasting and regulatory lag is more

manageable

•

M&A primarily small tuck-ins enabling

targets to meet health & safety standards

•

Regulators generally support the

strengthening of water systems via M&A

•

Water storage more feasible and cheaper

than electricity or gas storage

•

Water utilities can be more cost efficient

and responsive to demand fluctuations

•

Large water utilities diversified across

multiple geographies

•

Mitigates impact of localized severe

weather conditions / regulatory outcomes

July 2011 |

July 2011

Aging US Infrastructure Investment Remains Critical

*Source: U.S. Environmental Protection Agency’s 2007 Drinking Water

Infrastructure Needs Survey and Assessment. In billions, adjusted to January

2007 dollars. Transmission &

Distribution:

$200.8

Treatment:

$75.1

Storage:

$36.9

Source:

$19.8

Other:

$2.3

Total: $334.8 Billion

8

**Source: 2002 U.S. Environmental Protection Agency Clean Water and Drinking Water

Gap analysis US EPA Estimated 20 Year Total Needs

of US Public Water Systems*

American Society of Civil Engineers

(ASCE) grades US infrastructure

•

2009: $335 billion

•

2005: $277 billion

•

2002: $154 billion

•

2009 Grade: D-

•

2005 Grade: D-

•

2001 Grade: D

US EPA estimates upwards to $1 trillion needed for public

water and wastewater systems** |

Without renewal or replacement of existing systems, pipe classified

as

poor,

very

poor

or

life

elapsed

will

increase

from

10%

to

44%

by

2020

Aging Pipe Infrastructure Network Propels Need for

Capital Expenditures

Percentage of Pipes by Classification

Source: American Water Works Association, Dawn of the Replacement Era: Reinvesting

in Drinking Water Infrastructure, May 2001

9

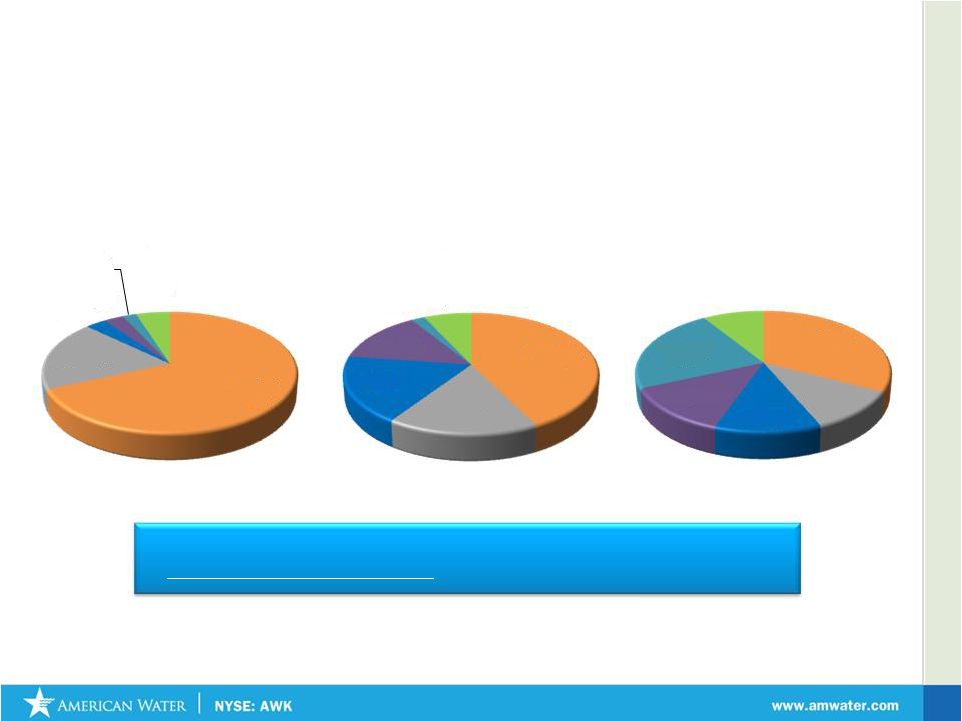

Excellent,

69%

Good, 19%

Fair, 3%

Poor,

3%

Very

Poor, 2%

Life

Elapsed,

5%

1980

Excellent,

43%

Good, 17%

Fair, 18%

Poor, 14%

Very

Poor, 2%

Life

Elapsed,

7%

2000

Excellent,

33%

Good, 11%

Fair, 12%

Poor, 13%

Very Poor,

23%

Life

Elapsed,

9%

2020

July 2011 |

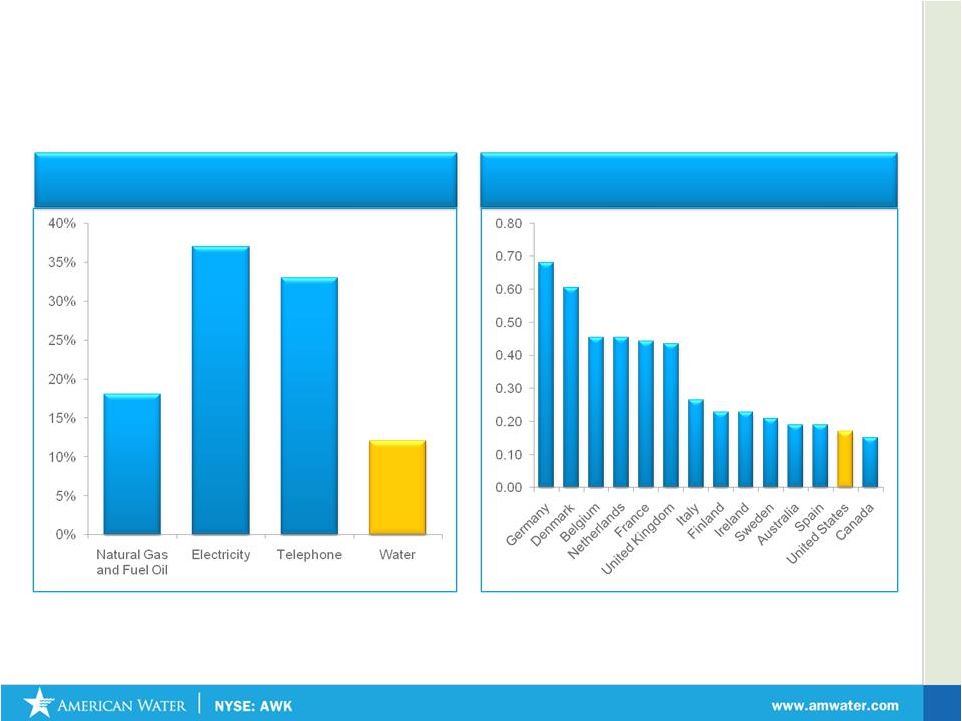

10

Water and wastewater rates in U.S. vs. other countries

(cents per gallon)

(1)

Source: 2008-2009 Bureau of Labor Statistics; Assumes four person

household. (2)

Canadian government data, using standard business conversions

(3)

Assumes purchasing parity pricing index

Domestically: % of Annual Household

Budget

(1)

Internationally: Cost comparison vs other

countries

(cents

per

gallon

(2)

)

July 2011 |

American Water |

July 2011

Note: Numbers may not total due to rounding.

12

Top Seven

States

Customers

Served

(2010)

% of

Total

2010

Revenues

($ mm)

% of

Total

Rate Base

Approved per

Last Rate

Case

Date of Last

Rate Case

DSIC

Test Year

(1)

Tariff

Structure

(2)

Pennsylvania

654,578

19.6%

$505.9

20.9%

$1,956,954,730

1/1/2011

Yes

Historic

Single

New Jersey

645,939

19.4%

$601.2

24.8%

1,771,009,863

1/1/2011

No

Historic

Single

Missouri

452,102

13.6%

$224.6

9.2%

791,837,186

7/1/2010

Yes

Historic

Multiple

Illinois

308,399

9.2%

$232.0

9.6%

607,356,502

4/23/2010

Yes

Future

Multiple

Indiana

284,568

8.5%

$181.7

7.5%

667,501,558

5/3/2010

Yes

Historic

Multiple

California

173,075

5.2%

$158.2

6.5%

337,529,472

7/1/2010

No

Future

Multiple

West Virginia

172,340

5.2%

$123.4

5.1%

427,325,204

4/18/2011

No

Historic

Single

NOTES:

(1)

In most cases historic test year includes adjustments for known and measurable

changes. (2)

Single Tariff Structure represents a single rate structure within a state whereas a

Multiple Tariff Structure includes many different tariffs by district or other subdivision within a

state.

American Water’s Regulated Presence

Largely residential customer base

promotes consistent operating results

Geographic presence hedges both

weather and regulatory risk

Scale enables multiple growth

opportunities across service areas

States we are in process of exiting Regulated Operations

|

July 2011

13

Prudent Investments in US Water Infrastructure drive

Long Term Growth

Net Utility Plant ($ mm)

% Projected CAPEX by Purpose

*Net utility plant as of 1Q 2011 of $10,555,698 excluding Discontinued

Operations Quality of

Service, 20%

Other, 6%

Asset

Renewal,

44%

Regulatory

Compliance,

13%

Capacity

Expansion,

17%

$10,496,524

$10,555,698

Q4 2010

Q1 2011 |

July 2011

American Water’s Portfolio Optimization Initiatives

•

Balanced Portfolio Analysis

•

Focus Achieving Authorized Rates

of Return

•

Monetize Non-Producing Assets

•

Focused Capital Resources

•

Selective Acquisition Opportunities

•

Leverage Internal Growth

14

Continue to Lower Costs

Focus on

Value Drivers

Redeploy Value Into Core

Growth Markets

Explore Opportunities for

Long

-Term Success

Drive Profitability and

Returns

Optimizing

Long-term Value

Through

Proactive

Management |

July 2011

15

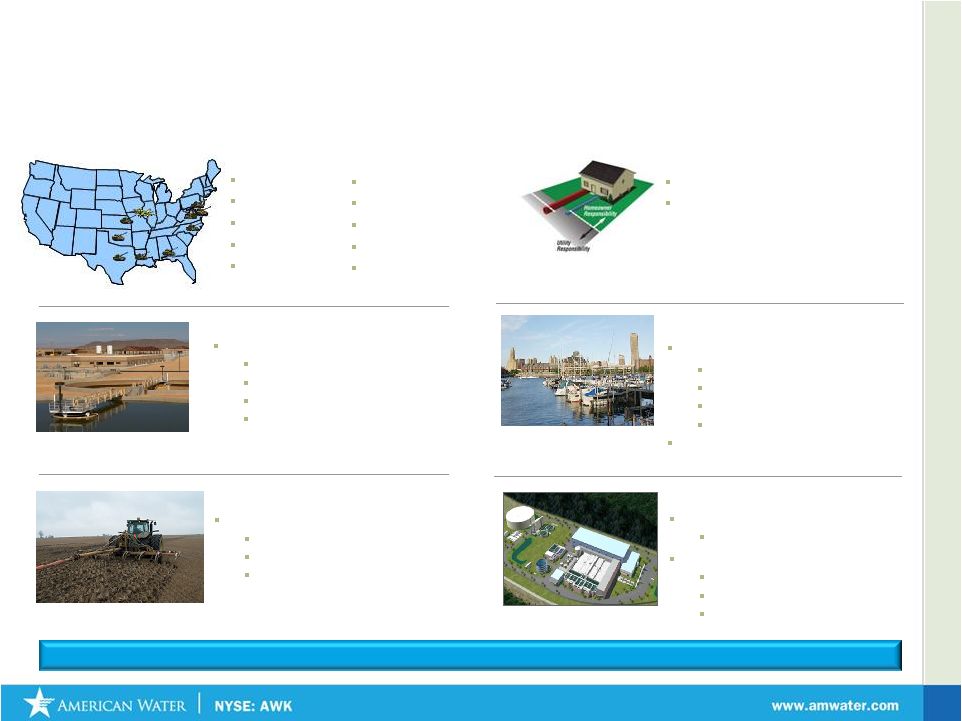

Our Market-Based Operations:

A Portfolio of Water Resource Services

For 2010, American Water reported $311.8 million of Market-Based Operations

revenues Contract Operations

Over 200 contracts**

Serving 3.1m people

Clarksville, IN

Seattle, WA

Warren Township, NJ

25 industrial contracts

Design, Build and Operate

20 current projects*

Lake Pleasant Plant, AZ

Fillmore, CA

Carnegie Abbey, RI

Seattle, WA

*Includes 16 AWM projects

**Includes 137 AWM and 48 EMC projects

Military Bases Privatization

Fort Bragg, NC

Fort Sill, OK

Fort Rucker, AL

Fort AP Hill, VA

Scott AFB, IL

Fort Polk, LA

Fort Hood, TX

Fort Belvoir, VA

Fort Meade, MD

Fort Leavenworth, KS

Biosolids Management

Canada

Halton, ON

Niagara, ON

Hamilton, ON

Emerging Water Technologies

Desalination plant

Tampa Bay Seawater, FL

Water Reuse; 22 Projects; 7 States

Gillette Stadium, MA

Battery Park, NY

Butterball Turkey, NC

Homeowner Services

Over 870,000 contracts

17 States |

July 2011

16

Strategy Specifics: Homeowner Services Growth

Large

Untapped

Market

Strong

Growth

Potential

•

75

Million Single family homes in US

•

3%

Purchase water/sewer service contracts

•

American

Water

has

34%

market

share

•

61%

of HOS customers buy more than 1 product

•

EXTRAORDINARY

customer satisfaction

•

STRONG

contractor network

•

EFFICIENT

AND CONTROLLED

claims processes

•

12%

DEMONSTRATED

GROWTH

over

last

3

years |

July 2011

17

Strategy Specifics: Market Size of Military Utility

Privatizations

2011-13

2014-16

Major Water/Wastewater Contracts

to be Awarded

Contracts Awarded to American Water

Contracts Awarded to Competitors

Contracts Programmed by Dept. of Defense for Award

2002

2005-07

2008-10

Major Water/Wastewater Awards to Date

7

12

4

Market Opportunity

represents approximately

$11Bn in Total Revenues

Over

$2

Billion

in

Revenues

Backlog

3

3

4 |

Financial Update |

July 2011

19

Total Shareholder Return : American Water vs. Indices

(July 12, 2010 –

July 12, 2011)

Shareholder Return

YTD

American Water

S&P 500

Dow Jones Utilities

+45.8%

+24.8%

+18.6% |

American Water: A Solid First Quarter

20

Adjusted Net Income

Adjustment for cessation of depreciation

Adjusted Net Income

Adjustment for cessation of depreciation

July 2011

* Adjusted Net Income reflects the effect of the cessation of depreciation on assets subject to

an agreement of sale – a Non-GAAP measure. Such depreciation would have been

$4.7 million, after tax, or $0.3 per share. See reconciliation table on Slide 41 |

21

Regulated O&M Efficiency Ratio Continues to Improve

* O&M Efficiency Ratio (A Non-GAAP, unaudited measure) = operating

and maintenance expenses / revenues, adjusted

to

eliminate

revenues

and

expenses

related

to

purchased

water.

* Quarterly data reflects the effect of discontinued operations. (See table

in Appendix). 55%

50%

45%

40%

35%

30%

49.4%

48.2%

3/31/2010

3/31/2011

July 2011

Adjusted O & M Efficiency Ratio |

22

Rate Cases Awarded That Will Have an Impact on 2011 Results

(As of July 13, 2011)

July 2011

($ in millions)

Effective Date

for new rates

ROE

Granted

Annualized

Increase to

Revenue

General Rate Cases:

Illinois

4/23/2010

10.38%

41.4

$

New Mexico (Edgewood)

5/10/2010

10.00%

0.5

Indiana

5/3/2010

10.00%

31.5

Virginia (Eastern)

5/8/2010

10.50%

0.6

Ohio

5/19/2010

9.34%

2.6

Missouri

7/1/2010

10.00%

28.0

California (Sac, LA, Lark)

7/1/2010

10.20%

14.6

Michigan

7/1/2010

10.50%

0.2

Kentucky

10/1/2010

9.70%

18.8

New Jersey

1/1/2011

10.30%

39.9

Pennsylvania Wastewater

1/1/2011

10.60%

8.4

Arizona

(Anthem,

etc.)

1/1/2011

9.50%

14.7

Tennessee

4/5/2011

10.00%

5.6

West Virginia

4/19/2011

9.75%

5.1

Subtotal -

General Rate Cases

211.9

$

Infrastructure Charges:

Pennsylvania

19.3

Indiana

5.4

Missouri

6.3

Illinois

1.7

Other

1.4

Subtotal -

Infrastructure Charges

34.1

$

Total

246.0

$ |

Rate

Cases Awaiting Final Order 23

Docket /

Revenue Increase

ROE

Rate Base

Filing

Case Number

Date Filed

Filed

Requested

(Filed)

Status

Virginia*

PUE 2010-00001

03/08/10

6.9

$

11.50%

99.1

$

5

California

A 10-07-007

07/01/10

37.3

10.20%

409.6

3

Arizona

W-01303A-10-0448

11/03/10

20.8

11.50%

148.9

2

Hawaii

2010-0313

02/22/11

1.8

11.85%

25.2

3

Pennsylvania

R-2011-2232243

04/29/11

70.7

11.50%

2,096.2

2

New York

11-W-0200

04/29/11

9.6

11.50%

126.9

2

Iowa

RPU-2011-0001

04/29/11

5.1

11.35%

88.9

2

Indiana

44022

05/02/11

20.4

11.50%

733.4

2

New Mexico

11-00196-UT

05/18/11

2.6

11.75%

33.6

2

Missouri

WR-2011-0037

06/30/10

42.9

11.50%

845.6

2

Ohio

11-4161-WS-AIR

07/01/11

8.3

11.50%

92.3

1

Total

226.4

$

4,699.7

$

* Final Order not yet issued. Interim rates are in effect

Note: Above excludes rate case file in 2007 for Hawaii for which interim

rates have been in effect since October 2008

Index of Rate Case Status 1 - Case Filed

2 - Discovery (Data Requests, Investigation)

3 - Negotiations / Evidentiary Hearings / Briefings

4 - Recommended order issued / settlement reached, without interim rates

5 - Interim rates in effect, awaiting final order

July 2011 |

125

years Investing in Water Infrastructure and paying Dividends to

Shareholders 24

July 2011

1886

1947

2003

2008

Dividend

paid to

private

holders

American Water

Listed on NYSE –

Dividend paid to

common

shareholders

RWE takes

AWK private.

Dividend

paid to

shareholder

AWK IPO

Lists on

NYSE. Pays

dividends to

common

shareholders

Watermain work in Pennsylvania. in the early 1900’s

Infrastructure improvement in New Jersey in 2009

|

Quarterly Dividend Rate Increases

Recent Dividend History

•

Key component of American

Water’s total shareholder return

proposition

•

Dividend Growth –

Board of

Directors increased dividend 5%

to $0.23 or $0.92 annualized

•

Dividend Yield –

3.1% at

7/13/11

•

Growth in Dividend reflects

growth in Net Income

25

July 2011 |

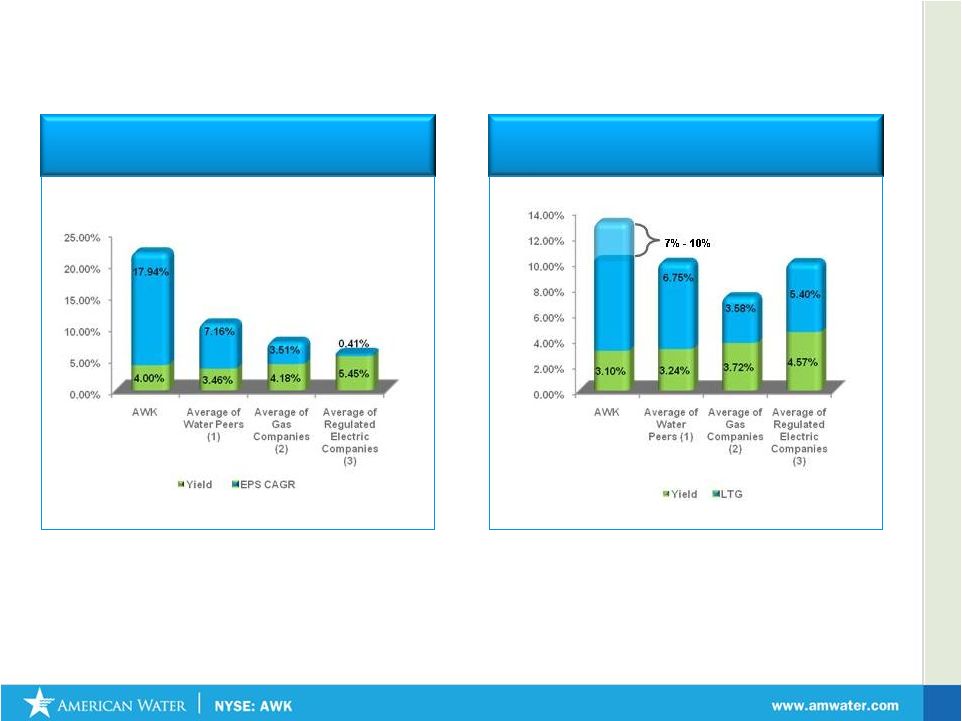

July 2011

26

American Water’s past performance and future growth expectations

compare very favorably vs Water, Electric and Gas Peers

2008 –

2010

EPS CAGR + Average Dividend Yield

(4)

Total Shareholder Return

(Long Term Expected EPS Growth* and

Dividend Yield**)

1)

Water Companies Include: AWR, CTWS, CWT, MSEX, SJW,

WTR, YORW.

2)

Gas Companies include ATO, LG, GAS, NWN, PNY, SJI, SWX,

WGL.

3)

Regulated Electric Companies include HE, NU, TE, LNT, XEL,

SO, CNP, PCG, SCG, POR, DUK, UIL, PGN, AEP.

4)

Average monthly dividend yield for 2008 – 2010 period.

5)

Non GAAP: American Water EPS adjusted to exclude impairment

charges.

Source: Thomson Reuters

* For AWK represents 7-10% Long Term EPS CAGR market guidance . All other data from

First Call Consensus Estimates

** as of 7/11/11

Note: Consensus Estimates are calculated by First Call based on the earnings projections made by the

analysts who cover companies noted (other than AWK). Please note that any opinions, estimates

or forecasts regarding performance made by these analysts (and therefore the Consensus

estimate numbers) are theirs alone and do not represent opinions, forecasts or predictions of

American Water or its management. |

July 2011

Source: Thomson Reuters

* PE data as of July 2011

27

American Water’s higher growth expectations are not

fully reflected in its PE multiple

P/E Compared with Total Return

CTWS

LG

MSEX

SWX

NWN

ATO

YORW

WGL

AWR

PCG

AEP

WTR

PNY

DUK

UIL

XEL

SJI

SO

CNP

NU

TE

AWK

CWT

HE

11.0x

16.0x

21.0x

6%

7%

8%

9%

10%

11%

12%

13%

14%

Forward P/E

Expected Total Return

SCG

POR

LNT

PGN |

What

to Expect from American Water - 2011

Accomplishments

Start execution of Portfolio Optimization Initiative

Missouri acquisition closed May, Texas sale closed June

Filed for regulatory approvals for transactions in NM and AZ

Agreement to purchase Aqua’s NY subsidiary and sell to Aqua our Ohio

subsidiary Resolve Rate Cases worth $93 MM of filed Annualized Revenues

by December 31, 2011

Finalized Tennessee and West Virginia Rate Cases

Initiate state specific efforts to address declining usage

Addressed in rate cases filed in Iowa, Long Island, Pennsylvania, and

Indiana Continue reduction in Operating Efficiency Ratio

Operating

Efficiency

Ratio

improved

120

bps

in

the

first

quarter

2011

vs.

first

quarter

2010, an improvement of 2.5%

Increase Earned return on equity

ROE increased 39 bps or 6% over comparable last twelve months ending March 31,

2011 Expand Market Based businesses with focus on Homeowner Services &

Military Contract Operations

Homeowner Services entered into the Commercial Market

Optimize Municipal Contract Operations Business Model

July 2011

28 |

July 2011

American Water –

A Compelling Value

Value Proposition

Market

Leader

Strong Visible

Growth

Proven

Management

Trades at

Discount to Peers

Sound Regulatory

Framework

29 |

July 2011

Ed Vallejo

Vice

President

–

Investor

Relations

Muriel Lange

Manager

–

Investor

Relations

Tel: 856-566-4005

Fax: 856-782-2782

30

Edward.vallejo@amwater.com

Muriel.lange@amwater.com

Investor

Relations

Contacts: |

Appendix |

July 2011

32

Investment Thesis: Sustained 7-10% EPS Growth

Future Growth

New Services

Regulated Investments

Acquisitions

Operational Excellence/

Efficiencies

ROE improvement

Long Term Growth

Conceptual Representation |

Rate

of Return Regulation in the United States Prudent Investment Drives Need for

Rate Cases American Water has experience in securing appropriate rates of

return and promoting constructive regulatory frameworks

Operating

Expenses

Taxes, Depr &

Amortization

WACC

Allowed

Return

Allowed

Return

Revenue

Requirement

Step 2

Step 1

+

+

x

=

=

33

Establish

Rate

Base

July 2011 |

July 2011

34

AW Parent

Company

Debt

Equity (Capex)

Operating Expenses

Debt

Regulatory

Treatment

Net Income

Impact

•

Neutral, if interest costs

are deemed prudent

and fair to the

consumer by regulator

How is Net Income generated in Rate of Return Regulation?

Pass Through

1:1

Pass Through

1:1

Return of

(Depreciation)

Return on Equity

(ROE)

•

Neutral, if all operating

expenses are deemed

prudent and fair to the

consumer by regulator

•

Depreciation is neutral

if all depreciable assets

are in rate base

•

Rate Base x Earned

ROE + Gross Up for

Taxes is Added

Revenue

* Assuming no regulatory lag between rate cases

Debt

Equity

Equity

If all assets are included in the Company’s Rate Base and all operating

expenses are deemed prudent and recoverable by regulator, Company earns

allowed ROE* |

Water

Utility Expenditures Water vs Other Utility Expenditures

Water Use in the Home

35

July 2011 |

July 2011

Infrastructure Surcharges: A viable mechanism to

address Regulatory Lag

Infrastructure Surcharges allows companies to recover

infrastructure replacement costs without necessity of filing

full rate proceeding

States that currently allow use of infrastructure surcharges

Pennsylvania

Indiana

Illinois

Ohio

Surcharges are typically reset to zero when new base rates

become effective and incorporate the costs of the previous

surcharge investments

Delaware

New York

Missouri (St Louis County)

California -

Trial basis

36 |

Case

in point: Increased investment in Pennsylvania’s Infrastructure

37

July 2011 |

July 2011

Weighted Average Interest Rates

Debt Maturities at March 31, 2011

(in millions)

Parent Company Debt

* Amount excludes Preferred Stock with Mandatory Redemptions

38

$100 million of Parent Company debt swapped from 6.085% to 6 month LIBOR + 3.422%,

to mature with fixed-rate debt in 2017 |

July 2011

Income Statement

39

($ in Thousands, except per share data)

Three Months Ended

March

31,

2011

2010

Operating revenues

$

610,936

$

566,762

Operating expenses

Operation and maintenance

320,571

305,642

Depreciation and amortization

88,019

82,056

General taxes

57,205

54,486

Loss (gain) on sale of assets

268

(71)

Total operating expenses, net

466,063

442,113

Operating income

144,873

124,649

Other income (expenses)

Interest, net

(76,482)

(78,696)

Allowance for other funds used during construction

2,916

2,146

Allowance for borrowed funds used during construction

1,242

1,382

Amortization of debt expense

(1,295)

(1,201)

Other, net

(1,141)

69

Total other income (expenses)

(74,760)

(76,300)

Income from continuing operations before income taxes

70,113

48,349

Provision for income taxes

28,649

18,669

Income from continuing operations

41,464

29,680

Income from discontinued operations, net of tax

5,868

1,128

Net income

$

47,332

$

30,808

Basic and diluted earnings per common share:

Income from continuing operations

$

0.24

$

0.17

Income from discontinued operations, net of tax

$

0.03

$

0.01

Net income

$

0.27

$

0.18

Average common shares outstanding during the period:

Basic

175,259

174,720

Diluted

176,048

174,796

Dividends per common share

$

0.22

$

0.21 |

July

2011 First Quarter 2011 Reconciliation Tables

In thousands

2011

2010

Total Regulated Operation and Maintenance Expenses

270,157

$

256,312

$

Less: Regulated Purchased Water Expenses

21,100

20,633

Adjusted Regulated Operation and Maintenance Expenses (a)

249,057

$

235,679

$

Total Regulated Operating Revenues

537,395

$

498,197

$

Less: Regulated Purchased Water Revenues

21,100

20,633

Adjusted Regulated Operating Revenues (b)

516,295

$

477,564

$

Regulated Operations and Maintenance Efficiency Ratio (a)/(b)

48.2%

49.4%

In thousands except per share data

Three Months Ended

March 31,

2011

Net income

47,332

$

Less: Cessation of depreciation, net of tax

4,729

Adjusted net income, exclusive of the cessation of depreciation

associated with assets of discontinued operations

42,603

$

Basic earnings per common share:

Adjusted net income

0.24

$

Diluted earnings per common share:

Adjusted net income

0.24

$

with assets of discontinued operations (a Non-GAAP, unaudited number)

Three Months Ended

March 31,

Regulated Operations and Maintenance Efficiency Ratio (A Non-GAAP, unaudited measure)

Adjusted net income and earnings per share, exclusive of the cessation of depreciation associated

40 |

July 2011

Financial Tables

GAAP and Non-GAAP Measures

Net Income (Loss) –

Earnings per Share

Excluding Impairment Charge

(A Non-GAAP Unaudited Number)

Historical

($ in thousands, except per share data)

2008

2009

2010

LTM

3/31/11

Net income (Loss)

($562,421)

($233,083)

$267,827

$284,351

Add: Impairment

750,000

450,000

0

0

Net income excluding impairment charge before associated tax benefit

187,579

216,917

267,827

284,351

Less: Income tax benefit relating to impairment charge

11,525

6,976

0

0

Net income excluding impairment charge

$176,054

$209,941

$267,827

$284,351

Income (loss) per common share:

Basic

($3.52)

($1.39)

$1.53

Diluted

($3.52)

($1.39)

$1.53

Net income per common share excluding impairment charge:

Basic

$1.10

$1.25

$1.53

Diluted

$1.10

$1.25

$1.53

41

Rate Base as of March 31, 2011

(1)

($ in Thousands)

Net Utility Plant

$10,421,125

Less

Advances for Construction

408,701

CIAC –

Contributions in Aid of Construction

932,355

Deferred income taxes

1,136,432

Deferred investment tax credits

30,588

Sub Total

$2,508,076

Rate Base

TOTAL

$7,913,049

(1)

An

approximation

of

rate

base,

which

includes

Net

Utility

Plant

not

yet

included

in

rate

base

pending

rate

case filings/outcomes |

|