Attached files

| file | filename |

|---|---|

| EX-32 - EXH 32 CERTIFICATION - CALAIS RESOURCES INC | exh32-certification.htm |

| EX-31 - EXH 31 CERTIFICATION - CALAIS RESOURCES INC | exh31-certification.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.20549

___________________________

FORM 10-K

(Mark One)

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

|

For the fiscal years ended May 31, 2007, 2006 and 2005

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

|

For the transition period from _______ to ______

Commission file number: 0-29392

CALAIS RESOURCES INC.

(Exact name of registrant as specified in its charter)

|

British Columbia

(State or other jurisdiction of

incorporation or organization)

|

98-0434111

(IRS Employer

Identification No.)

|

|

|

4415 Caribou Road, P.O. Box 653

Nederland, Colorado

(Address of principal executive offices)

|

80466-0653

(Zip Code)

|

Registrant’s telephone number, including area code: (303) 258-3806

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

N/A

|

N/A

|

Securities registered pursuant to Section 12(g) of the Act:

|

Common Shares, no par value

|

|

(Title of class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [X]

Page 1 of 111

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§232.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as the last business day of the registrant’s most recently completed second fiscal quarter: $4,218,110 as of November 30, 2006.

As of July 14, 2011, the registrant had 151,684,754 shares of common stock outstanding.

Page 2 of 111

TABLE OF CONTENTS

|

Page

|

||

|

Part I

|

||

|

Item 1. Business.

|

5

|

|

|

Item 1A. Risk Factors.

|

13

|

|

|

Item 1B. Unresolved Staff Comments

|

13

|

|

|

Item 2. Properties.

|

13

|

|

|

Item 3. Legal Proceedings.

|

37

|

|

|

Part II

|

||

|

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

40

|

|

|

Item 6. Selected Financial Data.

|

46

|

|

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

47

|

|

|

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

|

59

|

|

|

Item 8. Financial Statements and Supplementary Data.

|

59

|

|

|

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure.

|

59

|

|

|

Item 9A. Controls and Procedures.

|

61

|

|

|

Item 9B. Other Information.

|

62

|

|

|

Part III

|

||

|

Item 10. Directors, Executive Officers and Corporate Governance.

|

63

|

|

|

Item 11. Executive Compensation.

|

65

|

|

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters.

|

67

|

|

|

Item 13. Certain Relationships and Related Transactions, and Director Independence.

|

68

|

|

|

Item 14. Principal Accounting Fees and Services.

|

73

|

|

|

Part IV

|

||

|

Item 15. Exhibits, Financial Statement Schedules.

|

74

|

|

|

Signatures

|

79

|

|

Page 3 of 111

Through August 31, 2004, we reported our financial information using Canadian Generally Accepted Accounting Principles (“Canadian GAAP”) using the Canadian dollar as our functional and reporting currency. During the fiscal year ended May 31, 2005, we changed our reporting basis to the United States Generally Accepted Accounting Principles (“U.S. GAAP”) and our functional and reporting currency to the United States dollar (“U.S. dollar”). This change was made for several reasons, including the following: (1) substantially all of our assets and employees are now located in the United States; (2) substantially all of our labor, materials and other costs are now denominated in the U.S. dollar; and (3) our recent financing transactions, including both lending activities and cash infusions in exchange for equity, have been denominated in the U.S. dollar and have involved parties and investors located in the United States. Accordingly, unless otherwise noted, historical financial information included in this Annual Report on Form 10-K has been restated using U.S. GAAP with a functional and reporting currency of the U.S. dollar. All references herein to “$” and “US$” refer to U.S. Dollars and all references to “Cdn$” refer to Canadian Dollars. Unless otherwise specified, all dollar amounts are expressed in United States dollars. All references to Common Shares refer to shares of our common stock (without par value) unless otherwise indicated.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

In our effort to make the information in this report more meaningful, this Annual Report on Form 10-K and documents incorporated by reference herein (or otherwise made by us or on our behalf) contain both historical and forward-looking statements. Such forward-looking statements are not based on historical facts, but rather reflect the current expectations of our management concerning future results and events. Forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “plan,” “goal” or other similar words or variations that convey the uncertainty of future events or outcomes. These statements are based on the beliefs an assumptions of our management based on information currently available to us. These statements by their nature are subject to certain risks, uncertainties and assumptions and will be influenced by various factors, some of which are beyond our control. Actual results could vary materially from future results expressed or implied by such forward-looking statements. Important factors that could cause actual results to differ materially from the forward-looking statements include, without limitation, the following risk factors:

|

•

|

our ability to execute against our plans;

|

||

|

•

|

our ability to continue as a going concern;

|

||

|

•

|

the possible loss of our interest in our Caribou properties if we do not meet our debt obligations;

|

||

|

•

|

the potential that we will not obtain good title to a portion of our Manhattan project;

|

||

|

•

|

the volatility and low trading volume of our common stock;

|

||

|

•

|

our ability to secure additional capital;

|

||

|

•

|

the possibility we may never achieve any mineral production;

|

||

|

•

|

the future dilution to our shareholders from future capital-raising activities and payments to employees, directors and consultants;

|

||

|

•

|

the possibility our Board of Directors may issue authorized and unissued shares of our stock;

|

||

|

•

|

the effects the penny stock rules may have on the trading of our stock;

|

||

|

•

|

our dependence on a few key employees;

|

||

|

•

|

the influence of a few large shareholders on our business;

|

||

|

•

|

risks associated with our incorporation in Canada;

|

||

|

•

|

our lack of experience in mining and selling minerals;

|

||

|

•

|

operational end environmental risks associated with the mining industry;

|

||

|

•

|

the effect of government regulations on our business;

|

||

|

•

|

lack of clear title to some of our mineral prospects;

|

||

|

•

|

the fact our mineral interests are not yet proven; and

|

||

|

•

|

fluctuation in the prices of gold and silver.

|

All forward-looking statements speak only as of the date made. All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements. Except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances.

Page 4 of 111

PART I

Glossary

The following is a glossary of geological and technical terms used in this report:

ac - acres

Adits - An underground mine tunnel with only one end daylighting.

Breccia - A rock in which angular fragments are surrounded by a mass of fine-grained minerals.

Chalcopyrite - copper bearing sulphide

CNI 43-101 – NI 43-101 is a national instrument for the ''Standards of Disclosure for Mineral Projects'' within Canada. The Instrument is a codified set of rules and guidelines for reporting and displaying information related to mineral properties owned by, or explored by, companies which report these results on stock exchanges within Canada. This includes foreign-owned mining entities that trade on trading markets overseen by the Canadian securities administrators.

Cretaceous - The geologic time that is part of the Mesozoic era covering the period from 144 to 66 million years ago.

Epithermal - refers to the process of near surface ore deposition by fluids from an intrusive source; said of a mineral deposit formed within about 1 km of the earth's surface and in the temperature range 50 - 200 degrees C, occurring mainly as veins. Also said of that environment.

Exploration stage – Includes all issuers engaged in the search for mineral deposits (reserves) which are not in either the development or production stage.

Galena - Lead sulfide mineral.

Gneiss – A common and widely distributed type of rock formed by high-grade regional metamorphic processes from pre-existing formations that were originally either igneous or sedimentary rocks. Gneissic rocks are coarsely foliated and largely re-crystallized but do not carry large quantities of micas, chlorite or other platy minerals.

ha – hectares

Mineral Resource- Is a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge.

Inferred Mineral Resource -Is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drillholes.

Indicated Mineral Resource - Is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drillholes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

Page 5 of 111

Measured Mineral Resource - Is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drillholes that are spaced closely enough to confirm both geological and grade continuity.

Mineral Reserve- Is the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study – based on CNI 43-101 requirements. This Study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined.

NSR – Net smelter royalty

Phyllite - A metamorphic rock, intermediate in grade between slate and mica schist.

Probable Mineral Reserve - Reserves for which quantity and grade and/or quality are computed form information similar to that used for proven (measure) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation.

Proven Mineral Reserve - Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

Mesothermal - Refers to a mineral deposit formed at moderate depth hence at "moderate" temperature and pressures: said of a hydrothermal mineral deposit formed at considerable depth and in the temperature range of 200 - 300 degrees C. Also said of that environment.

Metamorphism – The process by which the form or structure of rocks is changed by heat and pressure.

Monzonites – Rock that contains abundant and approximately equal amounts of plagioclase and potash feldspar; it also contains subordinate amounts of biotite and hornblende, and sometimes minor quantities of orthopyroxene.

Patented Mining Claim - A mineral claim originally staked on land owned by in the United States Government, where all its associated mineral rights have been secured by the claimant from the U.S. Government in compliance with the laws and procedures relating to such claims, and title to the surface of the claim and the minerals beneath the surface have been transferred from the U.S. Government to the claimant. Annual mining claim assessment work is not required, and the patented claim is taxable real estate. Mining claims located on State of Alaska lands cannot be patented.

Pegmatite- A very coarse-grained, intrusive igneous rock composed of interlocking grains usually larger than 2.5 cm in size.

Precambrian - Noting or pertaining to the earliest era of earth history, ending 570 million years ago, during which the earth's crust formed and life first appeared in the seas.

Pyrite – A yellow iron sulphide mineral, normally of little value. It is sometimes referred to as “fool’s gold”.

Quartz – Common rock-forming mineral consisting of silicon and oxygen.

Schist – Medium-grained to coarse-grained metamorphic rock composed of laminated, often flaky parallel layers of chiefly micaceous minerals.

Page 6 of 111

Shear or sheared – The deformation of rocks by lateral movement along innumerable parallel planes, generally resulting from pressure and producing such metamorphic structures as cleavage and schistosity.

Sphalerite - zinc bearing sulphide.

st – short tons.

stpy – short tons per year

Sulphide – A compound of sulphur and some other element.

t - ton

Tailings - Fine grained or ground up material rejected from a mill after more of the recoverable valuable minerals have been extracted. Can also mean the waste material resulting from placer mining.

Tertiary - Relating to the first period of the Cenozoic era, about 65 to 1.64 million years ago.

tpy – tons per year

Unpatented Mining Claim - A mineral claim staked on federal, state or, in the case of severed mineral rights, private land to which a deed from the U.S. Government or other mineral title owner has not been received by the claimant. Unpatented claims give the claimant the exclusive right to explore for and to develop the underlying minerals and use the surface for such purpose. However, the claimant does not own title to either the minerals or the surface, and the claim is subject to annual assessment work requirements and the payment of annual rental fees which are established by the governing authority of the land on which the claim is located. The claim may or may not be subject to production royalties payable to that governing authority although at this time there are no royalties payable on unpatented mining claims

General Information

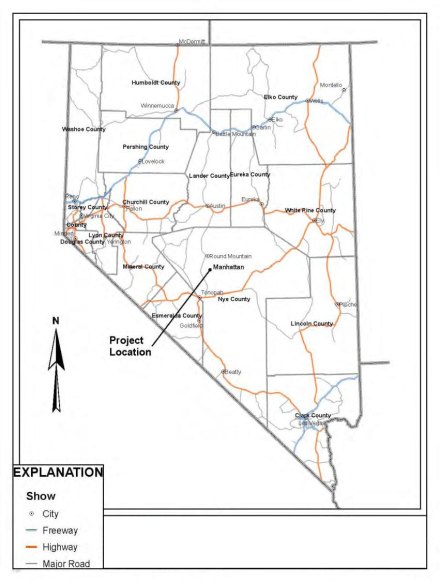

We are a mineral exploration company engaged directly and indirectly through subsidiaries, in the acquisition of properties and the exploration for minerals and metals, primarily gold and silver. Our business is currently in the exploratory or exploration stage as defined by Accounting Standards Codification (“ASC”) 915-10 and SEC Industry Guide 7 and, to date, our activities have not included development or mining operations. Our primary property is the Caribou project (advanced exploration stage) located in Nederland, Colorado; however, we also have properties in Nye County, Nevada.

During the fiscal years ended May 31, 2010, 2009, 2008, 2007, 2006 and 2005, we experienced significant financial difficulties that left us substantially without cash, full-time employees or an ability to fund operations. While we were able to acquire some cash through equity and debt financing transactions, this cash was used primarily to provide operating funds, pay trade creditors and maintain our operating permits, properties and mineral interests. There is no assurance that we will be able to obtain additional funding when needed, or that such funding, if available, can be obtained on terms acceptable to us or at all. If we are unable to obtain additional funds we may be forced to curtail or case our activities. Equity financing, if available, may result in substantial dilution to existing stockholders.

Currently, under U.S. GAAP, we have not completed sufficient and appropriate exploration work to determine if a viable mineral deposit or reserve exists in any of our properties. Although we previously reported the existence of measured, indicated and inferred mineral resources on our Caribou project, these types of mineral resource estimates do not meet the current requirements of National Instrument 43-101 – Standards of Disclosure of Mineral Projects issued by the Canadian Securities Commission. Investors are advised that while terms such as “measured,” “indicated” and “inferred” mineral resources are recognized and required by Canadian regulations and Canadian GAAP, under which we previously reported, these terms are not recognized by the U.S. Securities and Exchange Commission. Accordingly, we will not know whether a commercially viable mineral deposit or a reserve exists on

Page 7 of 111

our properties until sufficient and appropriate exploration work is done and a comprehensive evaluation of such work concludes economic and legal feasibility. The estimation of measured, indicated and inferred mineral resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. U.S. investors are cautioned (i) not to assume that measured or indicated resources will be converted into reserves and (ii) not to assume that estimates of inferred mineral resources exist, are economically minable, or will be upgraded into measured or indicated mineral resources. It cannot be assumed that the Company will identify any viable mineral resources on its properties or that any mineral reserves, if any, can be recovered profitably, if at all. We will require additional funds in the event any of the Company’s properties are capable of being advanced beyond the exploration stage.

All of the Company's property interests are in the exploration stage and do not contain any "reserves", as that term is defined in Industry Guide 7 adopted by the SEC. The term “reserves" is defined in Industry Guide 7 as "that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination." Industry Guide 7 is available from the SEC's website at:

http://www.sec.gov/about/forms/industryguides.pdf.

Mineral exploration involves significant risk and few properties that are explored are ultimately developed into producing mines. The probability of an individual prospect ever having reserves that meet the requirements of Industry Guide 7 is extremely remote. The Company’s property interests, in all probability, do not contain any reserves and any funds spent on exploration of the Company’s property interests will probably be lost. If any of the Company's exploration programs are successful, the Company will require additional funds to advance the property beyond the exploration stage. Substantial expenditures are required to establish reserves through drilling, to develop metallurgical processes to extract the metal from the ore and, in the case of new properties, to develop the mining and processing facilities and infrastructure at any site chosen for mining. If the Company is unable to secure additional funding, the Company may lose its interest in one or more of its mineral claims and/or may be required to cease all activities.

The address of our principal executive offices and our telephone and facsimile numbers at that address are:

Calais Resources Inc.

4415 Caribou Rd (PO Box 653)

Nederland, Colorado 80466-0653

Telephone No.: (303) 258-3806

Facsimile No.: (303) 258-0402

Our legal name is Calais Resources Inc. We were incorporated under the laws of British Columbia, Canada, on December 30, 1986 under the name “Millennium Resources Inc.” We changed our name to Calais Resources Inc. on March 19, 1992. Our Common Shares trade on the Pink Sheets under trading symbol “CAAUF.PK”. Our fiscal year ends May 31st.

Page 8 of 111

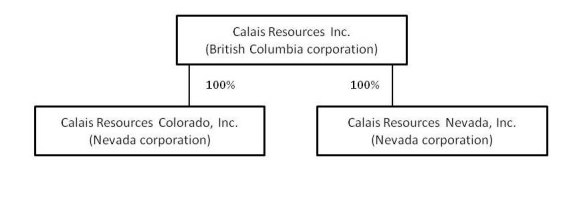

Inter-corporate Relationships

Organization Chart

Calais Resources Inc., a British Columbia corporation, owns 100% of the common shares of Calais Resources Colorado, Inc., a Nevada corporation, and Calais Resources Nevada, Inc., a Nevada corporation.

Calais Resources Colorado, Inc. owns our interests in the Caribou prospect. Calais Resources Nevada, Inc., a Nevada corporation, owns the Company’s interest in mineral prospects in Nevada (the “Manhattan prospect”).

Business of Calais

We are in the business of researching, acquiring, and exploring for minerals on our prospects, with the goal of producing minerals on our prospects. Our corporate philosophy has been to seek out and acquire other potential gold prospects.

If we identify prospects, we endeavor to acquire the rights to the prospect and surrounding claims. During the acquisition process, we also proceed through a due diligence period to the commencement of a full scientific analysis of the district, followed by an exploration program. Suitable results at each step in the process are a prerequisite to further exploration. Upon suitable identification of a mineral deposit and reserve, of which there can be no assurance, we will then make the decision to either proceed with the development and mining thereof, to joint venture with another mining or exploration company, or to sell the prospect outright.

Exploration of mineral resources can be expensive. Through the years, we have accomplished limited exploration activities with funds provided through debt and equity investment. We have been using, and expect to continue to use, the net proceeds from periodic capital raising activities to expand our exploration operations on our Caribou project in Colorado and to commence exploration operations on the Manhattan prospect in Nevada.

If we reach the development and mining stages for any of our prospects, which cannot be assured, we plan to seek additional capital through equity and/or debt financing, and we may have to sell an interest in our prospects, enter into joint venture or other arrangements, or otherwise dilute our interest in our mineral properties in order to attract third-party financing. We will likely only be able to attract interest in our mineral prospects on commercially-reasonable terms if we are able to show positive results from our exploration programs and our other work, such as core drilling, sufficient to attract third-party financing or industry participants. There are no assurances we will be able to obtain any additional funding or, if we do obtain such funding, that it will be on terms acceptable to us.

Our activities on our mineral interests are not significantly affected by seasonality. See “Item 2. Properties.”

Page 9 of 111

The raw materials that we need for our mineral exploration activities consist of readily available consumables such as fuel and equipment. We also contract with third parties for some of these activities and, at this time, we believe there is no shortage of these materials or contractors available at reasonable prices, although the prices and availability of these materials or services can be volatile.

Since we have not yet produced any gold or silver for sale, we have not developed any marketing channels. If we do produce precious metals, which cannot be assured, we believe there are numerous outlets for the sale of any production.

Our operations and our prospective operations are not dependent on any intellectual property patents or licenses, industrial, commercial, or financial contracts, or new manufacturing processes.

Government Regulations and Rules

The prospects which we are exploring are subject to various federal, state and local laws and regulations governing prospecting, exploration, development, production, labor standards, occupational health, mine safety, control of toxic substances, and other matters involving environmental protection and taxation. U.S. and foreign environmental protection laws address, among other things, the maintenance of air and water quality standards, the preservation of threatened and endangered species of wildlife and vegetation, the preservation of certain archaeological sites, reclamation, and limitations on the generation, transportation, storage and disposal of solid and hazardous wastes. There can be no assurance that all the required permits and governmental approvals necessary for any mining project with which we may be associated can be obtained on a timely basis, or maintained as required by the operator of the project. We have spent a significant amount of money complying with the environmental laws in the United States, Colorado and Boulder County in connection with our operations on the Caribou project. We will incur additional expenses for environmental compliance should we undertake any significant activities on our other prospects.

We are not aware of any proposed or existing United States regulations pertaining to environmental matters which might have a material impact on our future financial performance. Nevertheless, the applicable governmental bodies can change the current rules and regulations in accordance with their procedural requirements, and certain governmental employees may interpret existing rules and regulations in a manner that we do not believe is consistent with the intent of those rules or regulations. Should the regulations or their interpretation change, the changes may have a material adverse impact on our operations. See also “Item 3. Legal Proceedings – Nevada Environmental Issues.”

On July 21, 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) was signed into law. Section 1503 of the Dodd-Frank Act requires issuers that either directly or indirectly through a subsidiary operate a “coal or other mine,” as defined in the Federal Mine Safety and Health Act of 1977 (the “Mine Safety Act”), to disclose, in each periodic report filed with the SEC, certain mine safety information relating to the period covered by such report. However, because we are in the exploratory stage, we do not meet the definitions put forth by the Mine Safety Act and, therefore, are exempt from the Dodd-Frank Act Section 1503 disclosures. We are committed to providing a safe and healthy work environment and, upon meeting the Mine Safety Act definitions, will provide mining safety disclosures as required by the Dodd-Frank Act.

Conflict minerals, as defined by the Dodd-Frank Act, are not necessary to the functionality or production of our products.

Competition

There are a large number of other companies in the United States and abroad that are engaged in the exploration and development of prospects for gold and silver. Many of these companies have achieved production and, therefore, have cash flow and have financial strength that exceeds our financial strength. While we compete with these companies in attempting to locate and acquire mineral properties, the market for our possible future production of minerals tends to be commodity-oriented, rather than company or brand oriented. Additionally, readily available markets exist worldwide for the sale of mineral products. Therefore, we will likely be able to sell any mineral products that we identify and produce.

Page 10 of 111

We expect to compete by keeping our production costs low through judicious selection of which portions of the property to develop, if development is warranted, and by keeping overhead charges within industry standards. There can be no assurance that our current mineral interests or any additional mineral resource properties we may acquire in the future will yield reserves or result in commercial mining operations.

Property Exploration and Maintenance Activities

Our property exploration and drilling activities were severely limited during the fiscal years ended May 31, 2010, 2009, 2008, 2007, 2006 and 2005 due to working capital shortages as described previously. The following discussion describes our exploration and maintenance activities during those periods.

During our 2004 fiscal year, we commenced a drilling program on our Caribou project which was intended to expand the mineral resources we had already identified on this property. During September and October 2003, we drilled two core holes at a cost of approximately $250,000, and subsequently drilled an additional four holes at a cost of approximately $500,000. We also have updated all of the geologic information about the Caribou project in a three-dimensional program which we expect will assist us in determining future exploration activities and whether additional development drilling is warranted. We have not identified any reserves or determined whether commencement of commercial production is warranted. Subject to receipt of adequate funding, a pilot scale underground mining program and additional exploration drilling program are expected to commence in the summer of 2011 to further identify potential mining areas and confirm mining methods and operating costs. The results of these programs will be used to further evaluate the Caribou project. We have continuously maintained all of our permits, including exploration, operating, water discharge, air quality control, and explosive licenses. We have also commissioned technical reports on our assets. These Canadian National Instrument 43 – 101 Technical Reports were completed in February 2011 and were filed on SEDAR. We did not conduct any additional exploration work on our Nevada prospect during the years ended May 31, 2010, 2009, 2008, 2007, 2006 and 2005 due to the aforementioned working capital shortages, but we continue to fund a significant amount of work to ascertain the status of title to the Nevada prospect. Furthermore, we obtained an agreement from Marlowe Harvey (a significant shareholder, former officer and director of the Company, and the person who has agreed to transfer a significant portion of the Manhattan prospect to Calais) pursuant to which he recognized his responsibility to provide us evidence of good title to the mineral interests in Nevada. Mr. Harvey and certain affiliates have assigned the title they hold in the Nevada properties to us, but there are other title conflict issues that must be resolved. Although we believe we have enforceable contractual rights to acquire title to the disputed mineral interests in Nevada, at the present time issues surrounding the ownership of those mineral interests remain. See “Item 2. Properties – Manhattan Prospect; Nevada, USA: Gold Exploration.” We have been assigned only portions of the ownership interest in these properties, and have located 56 of our own unpatented claims in the area. We have recorded notice of our joint venture agreement concerning the prospect, and the 2004 Settlement Agreement with Argus Resources, Inc. (“Argus”), Nevada Manhattan Mining, Inc. (“NMMI”) and Moran Holdings, Ltd., in Nye County, Nevada.

During the fiscal year ended May 31, 2005, we sent a team to Panama to explore our Panamanian mineral concessions in the Faja de Oro District due, in part, to performance obligations stipulated in an agreement between us and our partners in Panama dated September 2005. It was later determined that the concession applications and the concession originally issued for the original exploitation concession were not of a status with the Panamanian government that exploration could be pursued without further processing of the concession applications in Panama and the official re-issuance of the exploitation concession. The issuance of these documents was the responsibility of the Panama companies, and the Panama companies were unable to produce written evidence of such issuance, in violation of our agreement with them. After extensive correspondence with the Panama companies regarding these concessions, management determined that it was unable to conduct exploration activities in Panama absent the formal issuance of these concessions by the Panamanian government. In 2007, the Panama companies declared us to be in default; we protested and declared the Panama companies to be in default. We have since initiated arbitration with the International Center of Dispute Resolution (“ICDR”), the international division of the American Arbitration Association, seeking damages of $995,000. There can be no assurance of a positive outcome for this arbitration and, in the event the outcome is positive, there can be no assurance as to the collectability of assets pursuant to a judgment. We do not intend to pursue any further exploration activities in Panama.

Page 11 of 111

During the fiscal years ended May 31, 2010, 2009, 2008, 2007, 2006, and 2005, we incurred exploration and business development and general and administrative expenses as follows:

|

Fiscal Year Ended May 31,

|

||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

2005

|

|

|

Exploration and Business Development Expenses

|

$64,541

|

$61,979

|

$107,164

|

$80,263

|

$84,207

|

$334,658

|

|

General and Administrative Expenses

|

$1,060,289

|

$1,013,858

|

$1,374,817

|

$1,069,686

|

$860,332

|

$918,131

|

Exploration and business development expenses consist of filing fees, legal agreement expense, subcontractor fees associated with exploration activities, salaries, wages and benefits associated with exploration activities, asset retirement costs, and other miscellaneous expenses directly related to exploration activities. General and administrative expenses during this time consisted primarily of accounting and consulting fees, legal fees, administrative salaries, wages and benefits, travel and other general office costs.

Title of Mining Claims in the United States

It has been our practice to obtain policies of title insurance upon our patented mining claims as they have been acquired. However, title insurance has generally been acquired in the amount of the purchase price of the mineral interests acquired. Such coverage would not afford adequate protection against the loss of mineral values, or the expenditure of funds on exploration should a title defect create a loss. If commercial mineral deposits were discovered on our patented mining claims, the value of such deposits would almost certainly greatly exceed the original purchase price of those mineral interests, as the purchase price was often predicated on then current surface values. Title insurance coverage would almost certainly be inadequate to compensate for the loss of such values. The value of the surface land package in the area of our patented mineral claims has tended to increase substantially with time making it more difficult to establish a loss should a defect to title be discovered.

There are unavoidable risks in holding unpatented mining claims located under the United States General Mining Law, including potential challenges to the validity of any claimed discovery, a challenge as to whether claimed discoveries would satisfy the prudent man rule, potential errors in location or recording, and the risk of changes in the law or regulations. Claims upon which no actual discovery exists are held by virtue of the doctrine of pedis possessio, which involves the occupation of claimed mining ground while engaged in a diligent search for a discovery of valuable minerals. There can be no guarantee that pedis possessio rights would be recognized as to any or all of our unpatented mining claims in Colorado or Nevada if challenged by a third party. There can be no guarantee that any claimed discovery on unpatented grounds would survive challenge by the federal government, if the government sought to challenge our title or right to occupy the ground. No challenges are currently outstanding either by adverse locators, or by the Federal government.

Colorado

Calais, its predecessors and their joint venture partners, have periodically dedicated substantial time and effort to detect and to cure any title problems which have been identified concerning the patented mining claims. These past efforts have included full record title searches on key prospects. Recently, we have worked with one of our lenders to remove additional title exceptions from the lender’s policy issued to them. These searches have focused, however, on the Caribou Mine interests and the Cross Mine interests, which were the subject of past or historical mining activity. The majority of the patented acreage owned or controlled by the Company is located at Caribou, Colorado, and past exploration activity has focused on both the Caribou and Cross Mine project areas. We have relied upon title insurance and title searches focusing on the period 1974 to date, and/or updating information contained in the title policies as issued or re-issued. See also “Item 2. Properties.”

Page 12 of 111

Nevada

We have received a litigation title commitment and updated commitment on the patented properties which are a part of the Manhattan prospect in Nevada, and initial title reports, on the unpatented claims, from a qualified Nevada landman. These reports have been utilized in the initiation of the first stages of title curative work. As described in more detail in “Item 2. Properties - Manhattan Prospect; Nevada, USA: Gold Exploration” we cannot offer any assurance that we can obtain full and complete title to the 28 patented mining claims included in the Manhattan prospect. However, we have received record title to a percentage of such patented claims and have recorded a Settlement Agreement granting us the right to purchase NMMI’s interest in the claims, and our 24.5% joint venture interest, and granting Calais exclusive operational rights. Additional title curative work must still be completed to justify a significant expenditure on exploration of the property. Such work is now in the early stages of completion. Likewise, we cannot offer any assurance that we can obtain good title to the 28 patented mining claims that constitute a portion of the Manhattan prospect. See also “Item 2. Properties.”

Employees

As of the end of our 2007 fiscal year, we had two full-time employees: David Young, our President and Chief Executive Officer, and Thomas Hendricks, our Vice President of Exploration and Corporate Development. We have used and continue to use independent contractors for our mineral operations and certain day-to-day business operations, as necessary. In January 2011, R. David Russell was appointed to our Board of Directors and he was elected as the Chairman. He also assumed the position of Chief Executive Officer. David Young remains the President of the Company and, in January 2011, was appointed the Chief Operating Officer.

Not required for Smaller Reporting Companies.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not required for Smaller Reporting Companies.

ITEM 2. PROPERTIES.

Executive Offices

Since August 2010, and as of the date of this report, our U.S. corporate offices have been located in Lakewood, Colorado. We currently lease approximately 200 square feet at a rate of $262 per month for our corporate offices on a month-to-month basis from a non-affiliated third party. From August 2003 to February 2005, we leased offices at 8400 East Crescent Parkway, Suite 675, Greenwood Village, Colorado, on a month-to-month basis, for approximately $6,000 per month. We also have operational offices on our Caribou prospect for which we pay no rent (since we own the property), which served as corporate offices from February 2005 to August 2010.

Caribou project, Colorado, USA: Gold/Silver Exploration

Caribou Project

Calais owns or controls 129 patented claims (consolidating separate interests in the same claim as a single claim) and 105 unpatented mineral claims in a 3.5 square mile area, which comprise the Consolidated Caribou District. In general, these claims can be classified as:

|

·

|

The Calais Patented Claims, which comprise the Caribou and Cross Projects. These claims include most of the currently disturbed and proposed development property at the Cross Mine (which is an underground mine). Calais owns the mineral rights to all these claims; and

|

Page 13 of 111

|

·

|

The Caribou Property (Upper) Claims represent the majority of the Consolidated Caribou District land holdings. Aardvark Agencies, Inc. (“AAI”) is the “nominee owner” of a portion of the claims, which comprise the Caribou Property. As “nominee owner”, AAI holds record title to the parcel, however Calais retains the right to occupy, explore, mine, develop, build, and/or re-acquire the property. AAI is controlled by Marlowe Harvey, a former officer, director and significant shareholder of the Company. Following a series of transactions between AAI, Mr. Harvey, Calais, and Mr. Hendricks, which resulted in litigation brought by Mr. Hendricks against Mr. Harvey, AAI, Mr. Hendricks and Calais entered into a mutual release and settlement agreement effective July 18, 2000. This agreement, which was modified in 2004, provides that we have the right to reacquire the claims held by AAI for a debenture (which we have already paid to AAI) and for a payment from Calais to AAI of “a cash amount equal to pay the capital gains triggered by the transfer” to Calais (which his ultimately deducted from the debenture). In March 2004, Mr. Harvey and his affiliates entered into a settlement agreement with Calais which, among other things, included a more precise definition of Calais’ right (which expires August 31, 2011, but can be extended for an additional ten years if AAI’s right to convert the debenture is extended as well) to repurchase the interest of AAI in the Caribou prospect, including the payment of Cdn$747,728 for the reacquisition, and AAI’s right to convert that debenture before it is paid. That agreement, also defined Calais’ right to borrow against, enter in and upon the mineral interests in the Caribou prospect owned by AAI, construct buildings and mines on those prospects, and remove and sell minerals from Caribou for Calais’ own account.

|

The unpatented mining claims are located on federal lands and are subject to federal as well as state jurisdiction, and the requirements of the U.S. General Mining Law. Patented and unpatented claims are listed in Exhibit 99.1 filed with this report.

We are engaged in the location of additional unpatented mining claims. There is no guarantee that additional federal lands will remain open to location, or that the General Mining Law will not be repealed or amended. Repeated attempts have been made in Congress over recent decades to repeal or to modify the General Mining Law.

The vast majority of exploration to date on Calais’ lands has taken place on patented claims. Under the General Mining Law, as amended, unpatented claims may only be validly located by the making of a discovery, within the meaning of that law, upon open lands within the exterior boundaries of the claims. Though mineralization has been encountered on some of the unpatented claims, there can be no guarantee that there is a valid discovery on any of those claims. The patenting of mining claims, done with relative ease during the period 1872-1920, is now very difficult, and most patent applications are either suspended or prohibited from being filed. Thus, there is no likelihood for the acquisition of a fee title to any of the unpatented lands, and unpatented claims now held are held subject to potentially adverse changes in laws and regulations governing them.

As of May 31, 2005 through May 31, 2010, we had recorded the following amounts for mineral interests and Furniture, fixtures and equipment (net of depreciation and impairments) on the Caribou project:

|

Fiscal Year Ended May 31,

|

||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

2005

|

|

|

Mineral Interests

|

$-

|

$-

|

$495,573

|

$313,073

|

$279,956

|

$-

|

|

Furniture Fixtures and Equipment

|

$-

|

$-

|

$-

|

$-

|

$-

|

$-

|

Location of Property

The Property is approximately 35 minutes from the city of Boulder, to the town of Nederland along Colorado State Highway 119. The road access from Nederland to the Project is about 15 minutes, over 4.7 mi (7.6 km) of County Road 128. The Project has year around access. The Project site is adjacent to the county road. See Figure 2-1.

Page 14 of 111

Figure 2-1

Caribou Project Location Map

Royalties, Agreements and Encumbrances

Calais’ 129 patented claims were acquired in approximately three dozen acquisitions over a period of 39 years. Calais has obtained a master title policy covering nearly all of the project properties, including properties in the permit area. The major acquisitions for patented lands within the resource area and permit area are described below. Additionally, three claims are leased from the Duane Smith Trust, also discussed below. See Exhibit 99.1 t.

Significant Patented Claim Acquisitions

Cross Property Acquisition – Dofflemyer Group

The Cross Property, consisting of 15-patented claims, was acquired in August 1987 by Hendricks Mining Co., from the Dofflemyer family by Warranty Deed. These claims were subsequently transferred to Calais Resources Colorado, Inc. by deed dated March 30, 1998. Twelve of theses patented claims (Cross lode, Cross No. 2, Cross mill site, Crown Point lode, Juliet lode, Mammoth lode, Protection lode, Rare Metals lode, Rare Metals mill site, Romeo lode, Syndicate lode and Tacoma lode) are located in the area of modern underground development and/or permit disturbance area.

Potosi Group Acquisition

The Potosi properties, consisting of 4-patented claims, were acquired in February 1988 by Hendricks Mining Co., from the William M. Warren and Aquarius Mining Co. by Warranty Deed. These claims were subsequently

Page 15 of 111

transferred to Calais Resources Colorado, Inc. by deed dated March 30, 1998. These patented claims (Alpine lode, Gold Coin lode, Potosi lode, and Worcester lode) are in located in the area of resource potential.

Wolcott Group Acquisition

The Wolcott properties, consisting of 4-patented claims, were acquired in February 1988 by Hendricks Mining Co., from the Wolcott family by Warranty Deed. These claims were subsequently transferred to Calais Resources Colorado, Inc. by deed dated April 8, 1998. These patented claims (5/8 interest Garfield lode, Ready Cash lode, Silver Brick lode, and Defiance lode) are located near the area of resource potential. Only the Garfield lode touches the area of resource potential.

Tallman Group

The Tall properties, consisting of 4 patented claims, were acquired in November 1987 by Hendricks Mining Co., from the Tallman family by Warranty Deed. These claims were subsequently transferred to Calais Resources Colorado, Inc. by deed dated April 8, 1998. Of these patented claims (3/8 interest Garfield lode, Ponderosa lode, Monticello lode and Chief lode) only the Garfield lode touches the resource area.

Aardvark Patented Claim Acquisitions

New York Lode and Millsite; the Brazilian lode and Millsite

The New York lode and mill site were acquired by the Company from William M. Warren and Richard A. Sigismond by Warranty Deed in October 1997 as part of a larger acquisition. Only the New York mill site claim is within the area of resource potential and the permit area. The Brazilian lode and Brazilian mill site claims were acquired by Aardvark Agencies, Inc. (“AAI”) by Sheriff’s deed (after assignment of the Certificate of Purchase from LNRS, LLC, the successors in title by Sheriff’s sale to the interest of Nederland Mines, Inc.) on December 17, 1998. The Brazilian lode claim is in the area of resource potential and the Brazilian mill site claim is within the permit area (a small portion is in the area of resource potential).

The New York mill site, Brazilian lode and Brazilian mill site patented claims were transferred (together with others, totaling 78 properties) to AAI as part of a larger financing transaction involving AAI. An agreement executed in 1999 assigned a 100% interest in the right to acquire 35 claims from third parties to AAI for $0.5 million. An agreement executed in 2000 assigned a 100% interest in an additional 43 claims to AAI for $3.5 million ($1.2 million cash and $2.3 million note). Both transfers were made subject to a recorded right to redeem and re-acquire held by the Company and further subject to a note and deed of trust in the amount of $2.3 million, held by the Company. The Company has 10-years to redeem or re-acquire the properties. As discussed above, in March 2004, Mr. Harvey and his affiliates entered into a settlement agreement with Calais which, among other things, included a more precise definition of Calais’ right (which expires August 31, 2011, but can be extended for an additional ten years if AAI’s right to convert the debenture is extended as well) to repurchase the interest of AAI in the Caribou prospect, including the payment of Cdn$747,728 for the reacquisition, and AAI’s right to convert that debenture before it is paid. AAI is delinquent on the $2.3 million note to the Company. No royalties were assigned or transferred to AAI. The Deed of Trust, recorded February 1999, from AAI to the Public Trustee of Boulder County, for the benefit of the Company, securing an original principal indebtedness of $2.3 million affects the New York mill site, Brazilian lode and Brazilian mill site patented claims. This Deed of Trust is purported to subordinate to the lien filed below.

In August 2003, AAI and the Company entered into deeds of trust against the Caribou property in connection with a loan for $4.5 million (the “Broadway Loan”) from Broadway Mortgage Corporation, Michael E. Haws, Kemp Hanley, R. Britton Colbert, Accounts Plus, Inc. and Riviera Holdings, LLC. The Broadway Loan was acquired after a series of assignments by Brigus Gold Corp. as part of the Company’s debt restructuring described below.

Duane Smith Trust Lease

The Duane Smith Trust has leased 3-patented claims to Hendricks Mining Co. The claims are the Laramie County lode, Homestead lode and Gilpin County lode, totaling 9.77ac (3.95ha). Portions of the three claims are part of the

Page 16 of 111

permit area. Portions of the Smith properties are traversed by the historical mine access road, this road pre-dates the location and patent of the Smith claims.

The Smith property was originally leased by Calais’ predecessors in August 1987. The Smith property was re-leased to Calais in 2003 for a period of 15-years, and may be extended for three additional five-year periods. The lease specifically grants to the lessee the right to haul, process, mine, transport, store, mill, treat, or transport on or across the Leased Premises supplies, ore, rock, minerals, waste, concentrates or other material from adjacent or nearby properties worked or owned by lessee and/or its assigns. These rights shall be known as the “Cross Mining Rights”. Each party shall have the right to utilize existing, historical access roads, crossing the properties for all purposes.

The lease provides for a 3.5% NSR royalty on all minerals, ores, metals, concentrates, or other materials extracted and shipped from the Leased Premises. As no mining has or is scheduled to occur on these claims, and all activities involve historical access, no production royalties are incurred. The lease specifies for a minimum advance royalty of $3,000/yr. for years one through five, $4,000/yr. for years six through ten, $5,000/yr. for years 11 through 15. The first 5-year lease extension is $7,500/yr. and then escalated thereafter. The minimum advance royalty may be offset with paid production royalties. The Company is responsible for all property and personal taxes on the leased property. Additionally, any severance or production taxes, levied on the leased claims, are apportioned. We are obligated to maintain liability insurance, accidental injury or death insurance and workman’s compensation insurance for the term of the lease. These leased claims are encumbered by the July 2003 Deed of Trust from Calais for the benefit of Broadway Mortgage Company described above.

Congo Chief Acquisition

On October 26, 2005, we acquired the 20-acre Congo Chief patented lode mining claim from the Estate of John W. Snyder for a price of $280,000. This large, patented lode claim was in the immediate vicinity of other claims held by us and by AAI. We acquired the claim with the assistance MFPI Partners, LLC, which provided funding for the acquisition, and which holds a first deed of trust on the subject property in the amount of $258,956. This note was originally payable on February 21, 2006, subject to any applicable extensions. We defaulted on the note and negotiated with MFPI Partners and were unable to reach a formal resolution to the default. In February 2010 this note was acquired by Brigus Gold as part of our debt restructure discussed below.

Royalties

Calais Patented Claims

All of the Patented Claims carry a 2% NSR royalty expiring no earlier than January 27, 2018. The 2% royalty expires at later dates as to other claims among the 129 patented claims and 105 unpatented claims, which royalty is also subject to the repurchase agreement. The Company has negotiated with the main royalty holder regarding an extension of the royalty agreements. The January 1993 agreement allows repurchasing the 2% NSR royalty at any time during the term for $1.5 million. The royalties are payable to Thomas S. Hendricks, the estate of Marjorie J. Hendricks and John R. Henderson.

The New York mill site claim carries a 2% NSR until April 2018. The April 1998 document allows repurchasing 1% of the 2% NSR royalty at any time during the term for $0.75 million. The royalties are payable to Thomas S. Hendricks, the Estate of Marjorie J. Hendricks and John R. Henderson.

Additionally, several of the mineral interests acquired by us or AAI are subject to royalty reservations in favor of prior owners of those interests, some of which are discussed above. A total of nine of the patented mining claims bear net smelter return royalties in amounts varying from 1.325% to 3.5% of net smelter returns. The terms of these royalties vary from perpetual to a lifetime interest only.

An additional royalty interest may affect 15 claims in the vicinity of the Cross Mine. A royalty buy down which occurred in the 1980’s reduced the applicability of this 5% royalty to periods when the gold price was above $800 per ounce. The price of gold has recently risen above this level for the first time since the buy down occurred. On April 4, 2008, this royalty was renegotiated with the holder, Tusco Incorporated. The new terms of the royalty agreement allow for a complete purchase of the royalty from Tusco for $150,000 payable at any time through April

Page 17 of 111

4, 2028 (or three years after the death of the president of Tusco). As consideration for the execution of the agreement, we issued 250,000 common shares of our stock to Tusco. An additional payment of $1,500 per month will be made to Tusco during the term of this agreement or, if shorter, the lifetime of the president of Tusco.

The payment of royalties upon production, if it occurs, can negatively affect the economics of a prospective mining operation, and may hinder our ability to finance such operations. As no production decision has been reached as to Calais’ mineral interests at Caribou, the impact of existing royalty agreements upon our ability to develop any mineralization discovered has not been determined.

The Duffy Note

On August 1, 2005, the Company issued a note (the “Duffy Note”) payable to a group of shareholders, Duane A. Duffy, Glenn E. Duffy, Luke Garvey and James Ober, (collectively, the “Duffy Group”), for $807,650, in exchange for $681,000 originally infused into the Company as Share Capital, and interest accrued from the date of each infusion totaling $126,650. The Duffy Note was secured by a trust deed on the majority of the patented properties titled in the Company. By October 31, 2005, the Company was in default. Since then, the note was renegotiated and restructured several times until February 2010, when the principal and accrued interest totaled approximately $1.1 million.

In March 2010, the Duffy Note was acquired by Brigus Gold Corp. as part of the Company’s debt restructure as described below.

Defaults

Prior to February 1, 2010, Calais was in default on approximately $10.6 million of indebtedness based on the following:

|

Note Amount

(approximate)

|

||||

| Broadway Loan | $ | 7,700,000 | ||

| Additional Caribou Loan | 1,450,000 | |||

| Congo Chief Note | 380,000 | |||

| Purchase Agreement | 9,530,000 | |||

| Duffy Note | 1,100,000 | |||

| Total Debt | $ | 10,630,000 | ||

Brigus Gold (Apollo Gold) Transaction

On December 9, 2009, Apollo Gold Corporation (now Brigus Gold Corp., “Brigus”) entered into a letter of intent (the “New LOI”) with the Company and Elkhorn Goldfields LLC (“Elkhorn Goldfields”) pursuant to which Elkhorn Goldfields agreed to purchase all the outstanding capital stock in Montana Tunnels Mining, Inc., a wholly owned subsidiary of Brigus (“Montana Tunnels”). Brigus agreed to sell all of the capital stock of Montana Tunnels in exchange for (i) promissory notes held by Elkhorn Goldfields and certain investors in Elkhorn Goldfields or its affiliates (the “Lenders”) from Calais and AAI with an outstanding balance of approximately $7,700,000 relating to the Broadway Loan (the “Original Notes”), (ii) Elkhorn’s and the Lenders’ rights with respect to an additional amount of approximately $1.45 million loaned to Calais (the “Additional Caribou Loan”) and (iii) a promissory note held by Elkhorn Goldfields and the Lenders from Calais with an outstanding balance of approximately $380,000 (the “Congo Chief Note” and, together with the Original Notes and the Additional Caribou Loan, the “Notes”). The Original Notes and the Congo Chief Note are secured by certain deeds of trust registered against the Caribou property.

On February 1, 2010, Brigus, Elkhorn Goldfields and Calais entered into a definitive purchase agreement (the “Purchase Agreement”). Pursuant to terms of the Purchase Agreement, Brigus sold all of the capital stock of Montana Tunnels in exchange for the Notes. The Elkhorn Goldfields’ and the Lenders’ security interests in the properties against which the Original Notes and the Congo Chief Note are secured were transferred to Brigus as part of the transaction. The Original Notes matured on July 31, 2005 (although they were never repaid) and bear interest at the rate of 12.9% per annum. The Congo Chief Note matured on February 21, 2006 (although it was never repaid) and bears interest

Page 18 of 111

at the rate of 12% per annum or a default rate of 18% per annum. Pursuant to the Purchase Agreement, Brigus agreed to forebear on the Original Notes and the Congo Chief Note (each of which, as noted above, is past due) until February 1, 2011. In connection with the Purchase Agreement, Calais agreed to execute and deliver a promissory note to Brigus evidencing the Additional Caribou Loan (the “Additional Unsecured Note”). The Additional Unsecured Note bears interest at the rate of eight percent per annum and has a maturity date of February 1, 2011.

On March 12, 2010, Brigus, Calais, and the Duffy Group entered into a purchase agreement (the “Duffy Purchase Agreement”) pursuant to which Brigus agreed, subject to the terms and conditions contained in the Duffy Purchase Agreement, to issue 1,592,733 common shares to the Duffy Group in exchange for the assignment of their rights, title and interest in and to, among other things, the Duffy Note.

The Duffy Group’s security interests in the property against which the Duffy Note is secured were transferred to Brigus as part of the transaction. Pursuant to the terms of the Duffy Purchase Agreement, Calais agreed to issue 10,306,790 common shares to the Duffy Group in payment of $435,347 of the outstanding balance of principal and accrued interest and fees of the Duffy Note (the “Calais Share Issuance”). Immediately following the Calais Share Issuance, the outstanding balance of the Duffy Note (including accrued interest thereon) was $653,021.

The Duffy Note matured on December 31, 2009 and was not repaid. On January 2, 2010, the Duffy Group called the Duffy Note due and payable and provided notice to Calais of the payment default on the Duffy Note. In accordance with the terms of the Duffy Note, following an uncured default on the Duffy Note, the Duffy Note bears interest at the rate of 24%. Pursuant to the Duffy Purchase Agreement, Brigus agreed to forebear from enforcing its right to collect principal and interest outstanding under the Duffy Note until March 12, 2011 and reduce the interest rate on the Duffy Note during that period to 8%. In addition to the foregoing provision, the Duffy Purchase Agreement includes customary representations, warranties, covenants and indemnities for transactions of this type.

Pursuant to a Forbearance Agreement dated January 15, 2011, Brigus extended the forbearance period of the Notes and the Duffy Note from February 1, 2011, to the earlier of June 30, 2011 or the occurrence of certain events, including insolvency or bankruptcy of the Calais, the borrower. During this extended forbearance period, the Notes will accrue interest at 8% per annum. In connection with the Forbearance Agreement, Calais agreed that it would not undertake certain actions, including the issuance of stock, without Brigus’ prior approval. Although, the Company has issued stock without obtaining formal written approval from Brigus, the Company has kept Brigus apprised of its activities.

In an Extension Agreement dated June 8, 2011, Brigus agreed to extend the forbearance period to October 31, 2011 in exchange for a cash payment of $1,000,000. The funds will be applied to accrued interest on the Notes.

Shareholder Payable

In connection with an Exploration Agreement dated December 31, 2008 (the “Exploration Agreement”) between the Company and DRDMJ, LLC, a company owned and controlled by R. David Russell, on December 20, 2008, the Company issued a one-year note payable to R. David Russell, who at the time was a shareholder of the Company and is currently the Company’s Chief Executive Officer and Chairman of the Board, in the amount of $405,410 in consideration for cash of approximately $300,000. The cash was to be used for development of the Cross Mine and processing ore at the Gold Hill mill. In August 2009 the Company defaulted on its agreement with Mr. Russell and issued 5,067,650 shares of our common stock valued at $861,501 as consideration for our default under the terms of the agreement which was dissolved. We have recorded additional expense of $456,090 in connection with this default.

Geology and Mineralization

This portion of Colorado is underlain by Precambrian basement rocks comprising the North American Craton, which has been intruded by Late Cretaceous igneous units. The basement rocks experienced several periods of Precambrian deformation ranging from deep, ductile to more shallow brittle features. Deeply rooted structural zones within the Precambrian rocks are linked to the development of the much younger Colorado Mineral Belt (CMB).

Page 19 of 111

This belt consists of a northeast-southwest regional trend of mineralization and ore deposits that is approximately 250mi (402km) long and 80mi (129km) wide.

The Project lies near the northeast limit of the CMB. It is hosted within the Precambrian Idaho Springs Gneiss and the Late Cretaceous Caribou Monzonite.

The origin of mineralization at the Project has been explained by two different models. These both involve hydrothermal processes but differ as to whether the deposit was formed within a predominantly mesothermal or epithermal environment.

Mineralization is hosted within several distinct veins striking both east-west and north-northeast. Individual veins range in width from inches to tens of feet and consist of open space fill zones containing quartz and disseminated sulfides flanked by mineralized and non-mineralized alteration zones. Overall, the zone of mineralization and alteration has an average width of 5ft (1.5m). Altered host rocks within and adjacent to veins show more limited sulfide mineralization due to a lesser amount of rock fracturing and open space fill.

Precious metals grades in the Project typically run 0.05-1.0oz/st-Au (1.7-34.3g/t-Au) and 0.2-30.0oz/st-Ag (6.8-1,029g/t-Ag). Weathering has partially oxidized sulfide minerals to all depths tested to date. The veins are distributed within two main sets, those that strike predominately east-west and those striking north-northeast. A large number of these veins have been outlined throughout the modern exploration history of the Project. The major zones of mineralization and their location within the Consolidated Caribou areas are summarized in Table 2-1.

Table 2-1: Major Zones of Mineralization

|

Mineralized Zone

|

Cross

|

Caribou

|

Congo Chief

|

St. Louis

|

Northwestern

|

Silver Point

|

|

Crown Point Vein

|

X

|

|||||

|

Cross Vein

|

X

|

|||||

|

Rare Metals Vein

|

X

|

|||||

|

Romeo Vein

|

X

|

|||||

|

Juliet Stockwork

|

X

|

|||||

|

Anaconda Vein

|

X

|

|||||

|

Apache Vein System

|

||||||

|

South

|

X

|

|||||

|

Main

|

X

|

|

||||

|

Intermediate

|

X

|

|||||

|

North

|

X

|

|||||

|

Potosi Vein

|

X

|

|||||

|

Gold Coin Vein

|

X

|

|||||

|

No Name Vein

|

X

|

X

|

||||

|

Golconda Vein

|

X

|

|||||

|

Nelson System Veins

|

||||||

|

East

|

X

|

|||||

|

Intermediate

|

X

|

|||||

|

West

|

X

|

|||||

|

Poor Man Vein

|

X

|

|||||

|

North Poor Man Vein

|

X

|

|||||

|

5-30 Vein

|

X

|

|||||

|

Caribou Park Zone

|

X

|

X

|

||||

|

Pandora Mine Vein

|

X

|

|||||

|

St. Louis Vein

|

X

|

X

|

The dominant controls on gold, silver, lead and zinc mineralization at the project are structural channeling along dilatational fault and vein planes within an environment chemically favorable for the precipitation of electrum and base metal sulfides. Deep-seated regional structures appear to have been active at the time of mineralization and have played a vital role in the structural preparation of the host rocks and channeling of the mineralizing fluids. The

Page 20 of 111

fluids and their contained metals are believed to have been derived either from a deeper magmatic source rock or from deep metamorphic processes associated with the Laramide Orogeny.

Location of Mineralization

The gold and silver-bearing veins of the project are located within the Grand Island Mining District at the northern limit of the Colorado Mineral Belt. Mineralization is hosted within several distinct veins striking both east-west and north-northeast. The main vein outcroppings are located above Coon Track Creek in and around Caribou Hill. Mineralization tested to date is confined to quartz/sulfide veins hosted with Precambrian Idaho Springs Gneiss and the Tertiary Caribou Monzonite.

A large number of gold-silver veins have been outlined throughout the modern exploration history of the project.

Future Payments

The table below summarizes our future obligations related to the prospect area. Failure to make the minimum payments as presented below might result in the loss of the mining claims, royalty interests, or leases underlying the prospect area.

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

||||||||||||||||||||||

|

Patented

|

$ | 9,907 | (1) | $ | 10,025 | (1) | $ | 9,898 | (1) | $ | 10,139 | (1) | $ | 10,518 | (1) | $ | 11,114 | (1) | $ | 11,114 | (1) | |||||||

|

Unpatented

|

13,125 | 13,125 | 13,125 | 13,125 | 14,700 | 14,700 | 14,700 | |||||||||||||||||||||

|

Royalties

|

- | - | - | 10,500 | 18,000 | 18,000 | 18,000 | |||||||||||||||||||||

|

Leases

|

4,200 | 4,200 | 4,200 | 4,200 | 5,200 | 5,200 | 5,200 | |||||||||||||||||||||

|

Totals

|

$ | 27,232 | $ | 27,350 | $ | 27,223 | $ | 37,964 | $ | 48,418 | $ | 49,014 | $ | 49,014 | ||||||||||||||

(1) Already paid

Environmental Liabilities and Permitting

The Project holds an active mine permit under the Colorado Division of Reclamation Mining and Safety (CDRMS) Permit M1977410, issued Nov 3, 1980. This permit, which limits ore extraction to 70,000stpy, approximately 200stpd (63,500tpy) and land disturbances to less than 2 ac (0.8 ha) total. Current mine disturbance is 2.0ac (0.8ha). A $15,400 bond is held by CDRMS for final reclamation of the property.

Required Permits and Status

The mine can currently produce run of mine (RoM) ore for shipment to a mill. The mine activities are a legal nonconforming use under the Boulder County Land Use Code. Additionally, Calais holds the following permits:

|

·

|

Explosives permit No. 5-CO-013-33-1H-00625

|

|

·

|

Water Quality NPDES permit CO-00322751;

|

|

·

|

MSHA ID 0502730;

|

|

·

|

Colorado Air Pollution Emissions Notice (APEN) Permit No. 09BO0439F;

|

|

·

|

Stormwater Plan Permit No. COR040242; and

|

|

·

|

County building and grading permits.

|

We have announced plans to expand our operations at the Cross Mine. Proposed activities include the development of a new mine access and expanded underground mine workings; construction and operation of an on-site surface mill; construction of an ore storage building; development of a new access and safety road connecting two currently disconnected mine areas; implementation of site drainage controls, and other site improvements. An amendment to the existing CDMRS permit is required for these expansion activities, as well as an increase in the posted reclamation bond. The permit disturbance will be increased to 9.35ac (3.78ha). The current CDRMS permit surface disturbance may be expanded to a maximum of less than 10ac (4ha). RoM production greater than 70,000stpy (63,500tpy) or surface disturbance of 10 ac (4ha) or more acres requires Calais to obtain a new permit. Along with the amendment to the mine permit, the proposed expansion activities require a Special Use Review under the Boulder County Land Use Code. A Special Use Review Application was submitted in April 2008 and approved in

Page 21 of 111

September 2008. Management believes the proposed mine expansion can meet the applicable criteria of the County Land Use Code; however, additional county building permits, county grading permits, and amendments to existing stormwater permits, NPDES permits, and APEN permits may be required following approval of the expansion plans.

Compliance Evaluation

Management believes the Cross Mine complies with all applicable state and federal regulations as well as contemporaneous reclamation of permitted disturbed areas and surrounding historic mining disturbances.

Seasonality

The surface exploration season begins in early May and continues through late November. Underground work can continue year around.

Surface Rights

Most of the claims which constitute the project property are patented private property titled in Calais, or Aardvark subject to Calais’ operational and re-acquisition rights.

Power Supply