Attached files

| file | filename |

|---|---|

| EX-99.1 - TRANSCRIPT OF ALCOA INC. SECOND QUARTER 2011 EARNINGS CALL - Howmet Aerospace Inc. | dex991.htm |

| 8-K - FORM 8-K - Howmet Aerospace Inc. | d8k.htm |

2

Quarter

2011

Earnings

Conference

July 11, 2011

Exhibit 99.2

nd |

2

Cautionary Statement

rationale

for

the

use

of

the

non-GAAP

financial

measures

can

be

found

in

the

Appendix

to

this

presentation

and

on

our

website

at

www.alcoa.com

under the “Invest”

section. Any reference during the discussion today to EBITDA means adjusted

EBITDA, for which we have provided calculations and reconciliations in the

Appendix and on our website. Forward-Looking Statements

This presentation contains statements that relate to future events and expectations and as such

constitute forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements include those containing such words as “estimates,”

“expects,” “forecasts,” “intends,” “outlook,”

“plans,” “projects,” “should,” “targets,” “will,” or other words of similar meaning. All statements that

reflect Alcoa’s expectations, assumptions, or projections about the future other than statements

of historical fact are forward-looking statements, including, without limitation, forecasts

concerning global demand for aluminum, aluminum end-market growth, aluminum consumption rates, or

other trend projections, targeted financial results or operating performance, and statements about

Alcoa’s strategies, targets, outlook, and business and financial prospects.

Forward-looking statements are subject to a number of known and unknown risks, uncertainties, and other

factors and are not guarantees of future performance. Important factors that could cause actual

results to differ materially from those in the forward-looking statements include: (a)

material adverse changes in aluminum industry conditions, including global supply and demand conditions

and fluctuations in London Metal Exchange-based prices for primary aluminum, alumina, and other

products, and fluctuations in indexed-based and spot prices for alumina; (b) unfavorable

changes in general business and economic conditions, in the global financial markets, or in the

markets served by Alcoa, including automotive and commercial transportation, aerospace, building and

construction, distribution, packaging, oil and gas, defense, and industrial gas turbine; (c)

the impact of changes in foreign currency exchange rates on costs and results, particularly the

Australian dollar, Brazilian real, Canadian dollar, Euro, and Norwegian Kroner; (d) increases in

energy costs, including electricity, natural gas, and fuel oil, or the unavailability or

interruption of energy supplies; (e) increases in the costs of other raw materials, including caustic soda and carbon

products; (f) Alcoa’s inability to achieve the level of revenue growth, cash generation, cost

savings, improvement in profitability and margins, fiscal discipline, or strengthening of

operations (including moving its alumina refining and aluminum smelting businesses down on the industry cost

curve and increasing revenues in its Flat-Rolled Products and Engineered Products and Solutions

segments), anticipated from its productivity improvement, cash sustainability and other

initiatives; (g) Alcoa’s inability to realize expected benefits from newly constructed, expanded or

acquired facilities or from international joint ventures as planned and by targeted completion dates,

including the joint venture in Saudi Arabia or the upstream operations in Brazil; (h)

political, economic, and regulatory risks in the countries in which Alcoa operates or sells products, including

unfavorable changes in laws and governmental policies, civil unrest, or other events beyond

Alcoa’s control; (i) the outcome of contingencies, including legal proceedings, government

investigations, and environmental remediation; (j) the business or financial condition of key customers,

suppliers, and business partners; (k) changes in tax rates or benefits; and (l) the other risk factors

summarized in Alcoa’s Form 10-K for the year ended December 31, 2010, Form 10-Q

for the quarter ended March 31, 2011, and other reports filed with the Securities and Exchange

Commission (SEC). Alcoa disclaims any obligation to update publicly any forward-looking

statements, whether in response to new information, future events or otherwise, except as

required by applicable law.

Non-GAAP Financial Measures

Some of the information included in this presentation is derived from Alcoa’s consolidated

financial information but is not presented in Alcoa’s financial statements prepared in

accordance with U.S. generally accepted accounting principles (GAAP). Certain of these data are considered

“non-GAAP financial measures” under SEC rules. These non-GAAP financial

measures supplement our GAAP disclosures and should not be considered an alternative to the

GAAP measure. Reconciliations to the most directly comparable GAAP financial measures and management’s

|

Chuck McLane

Executive Vice President and Chief Financial Officer

|

Q2

2011 – Giving A Success Story Its Due

4

$ Millions (except per share and /MT amounts)

2Q’10

1Q’11

2Q’11

YOY

Change

Sequential

Change

Alumina

3

Party

Sales

$701

$810

$926

32%

14%

ATOI

$94

$142

$186

98%

31%

Adjusted EBITDA/MT

$61

$71

$81

33%

14%

Primary Metals

3

Party

Sales

$1,710

$1,980

$2,145

25%

8%

ATOI

$109

$202

$201

84%

0%

Adjusted EBITDA/MT

$280

$438

$422

51%

-4%

Flat-Rolled Products

3

Party

Sales

$1,574

$1,892

$2,085

32%

10%

ATOI

$71

$81

$99

41%

23%

Adjusted EBITDA/MT

$361

$368

$393

9%

7%

Engineered Products & Solutions

3

Party

Sales

$1,122

$1,247

$1,370

22%

10%

ATOI

$107

$130

$149

39%

15%

Adjusted EBITDA Margin

17%

18%

19%

10%

3%

Consolidated Alcoa Inc.

Sales

$5,187

$5,958

$6,585

27%

11%

Income from Continuing Operations*

$139

$317

$364

162%

15%

Earnings per Share*

$0.13

$0.28

$0.32

146%

14%

Record

Record

*Excluding impact of restructuring and other special items

See appendix for reconciliations to GAAP and additional information

Record

Record

rd

rd

rd

rd |

2 Quarter 2011 Financial Highlights

Income

from

Continuing

Operations

of

$326

million,

or

$0.28

per

share;

Excluding impact of restructuring and other special items, income from continuing

operations

of

$364

million,

or

$0.32

per

share,

up

14%

sequentially

and

up

146%

from second quarter 2010

Revenue

up

11%

sequentially

and

up

27%

versus

second

quarter

2010

Adjusted

EBITDA

of

$1.0

billion,

up

9%

sequentially

and

up

44%

from

second

quarter 2010

Alumina: $81 Adjusted EBITDA/MT, 23% better than ten-year

average of $66/MT Primary Metals: $422 Adjusted EBITDA/MT, 8%

better than ten-year average of $390/MT

Flat-Rolled Products: $393 Adjusted EBITDA/MT was record

result Engineered Products & Solutions: 19% Adjusted EBITDA

margin was record result Days Working

Capital

six

days

lower

than

second

quarter

2010

Debt

to

Capital

of

32.6%,

100

basis

points

lower

sequentially

Net debt balance reduced by $319 million, extended debt maturity

profile

5

See appendix for reconciliations to GAAP and additional information

nd |

Income Statement Summary

$ Millions (except per share amounts)

2Q’10

1Q’11

2Q’11

YOY

Change

Sequential

Change

Sales

$5,187

$5,958

$6,585

$1,398

$627

Cost of Goods Sold

$4,210

$4,715

$5,247

$1,037

$532

COGS % Sales

81.2%

79.1%

79.7%

(1.5 % pts.)

0.6 % pts.

Selling, General Administrative, Other

$208

$245

$253

$45

$8

SGA % Sales

4.0%

4.1%

3.8%

(0.2 % pts.)

(0.3 % pts.)

Restructuring and Other Charges

$30

$6

$34

$4

$28

Effective Tax Rate

25.0%

27.3%

26.3%

1.3

% pts.

(1.0 % pts.)

Income from Continuing Operations

$137

$309

$326

$189

$17

Income Per Diluted Share

$0.13

$0.27

$0.28

$0.15

$0.01

6 |

Restructuring and Other Special Items

$ Millions (except per share amounts)

2Q’10

1Q’11

2Q’11

Income from Continuing Operations

$137

$309

$326

Income Per Diluted Share

$0.13

$0.27

$0.28

Restructuring Related

($20)

($5)

($16)

Acquisition costs

-

($8)

-

Discrete Tax Items

$16

-

-

Mark-to-Market Derivatives

$22

$5

$10

Labor Negotiations

($13)

-

-

Debt Tender Offer

-

-

($32)

Rockdale Luminant Litigation

($7)

-

-

Special Items

($2)

($8)

($38)

Income from Continuing Operations excl Special Items

$139

$317

$364

Income per Diluted Share excluding Special Items

$0.13

$0.28

$0.32

7

See appendix for reconciliations to GAAP and additional information

|

2

nd

Quarter

2011

vs.

1

st

Quarter

2011

Earnings

Bridge

Income from Continuing Operations excluding Restructuring & Other Special Items ($ millions) 8

Income from Continuing Operations excluding Restructuring & Other Special Items ($ millions) +$32

+$87

-$72

See appendix for reconciliations to GAAP and additional information

$317

$72

$40

$41

$20

$26

$15

$43

$14

$364

1Q11

LME

Currency

Volume

Restarts

Productivity

Energy

Raw

Materials

Other

2Q11 |

2Q

10 1Q 11

2Q 11

Production (kmt)

3,890

4,024

4,144

3

rd

Party Shipments (kmt)

2,264

2,206

2,378

3

rd

Party Revenue ($ Millions)

701

810

926

ATOI ($ Millions)

94

142

186

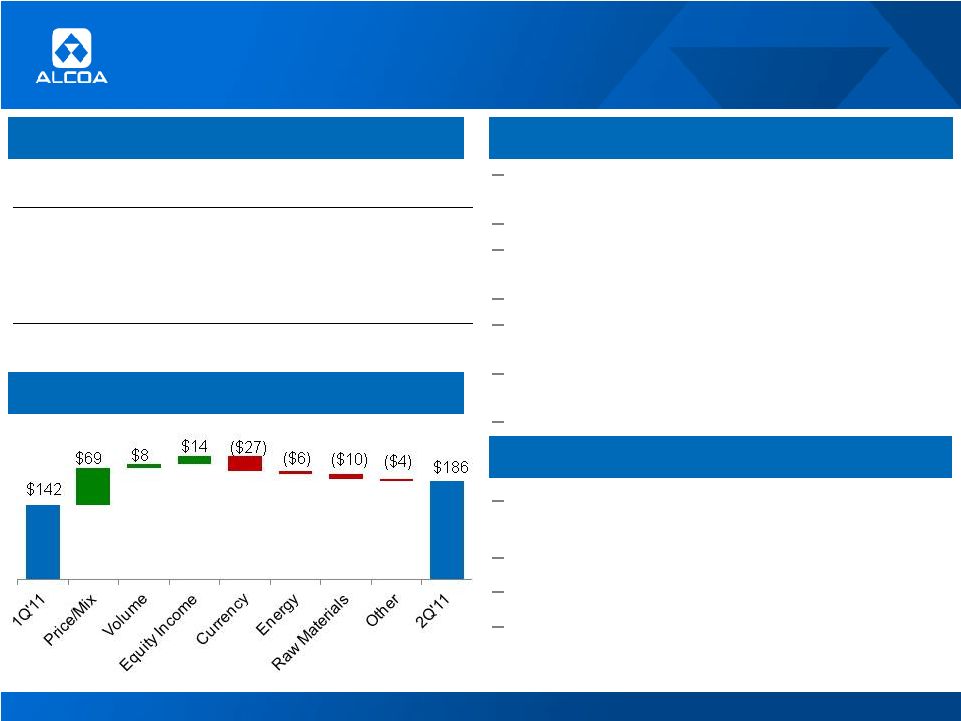

Alumina Segment Results and Outlook

2

nd

Quarter Results

3

rd

Quarter Outlook

2

nd

Quarter Business Highlights

9

Record

quarterly

production,

shipments

and

revenues

Realized third-party

alumina price up 7%

Continued

improvement

in

Adjusted

EBITDA/MT,

reaching $81

Highest

ATOI

since Q3 2008

Days

working

capital

down

10

days

from

Q2

2010

Negative

currency

impact

of

$27

million

primarily

driven by Australian dollar

Higher

fuel

oil

and

caustic

prices

20%

of

3

rd

party

shipments

on

spot

or

prior-

month indexed basis

Other

pricing

to

follow

two-month

lag

on

LME

Production

projected

to

increase

85

kmt

Energy, caustic

and other raw materials inflation

to persist

2

nd

Quarter Performance Bridge

$ Millions

See appendix for reconciliations to GAAP and additional information

|

10

Alumina

Segment

Cost

Structure

and

Sensitivity

Refining Cost Structure

1

CMAI

-

Caustic

Soda

Average

Acquisition

-

FOB

USGC

($/D)

2

Bloomberg Daily Average -

Gulf Coast 3% Sulfur Fuel Oil ($/bbl)

3

NYMEX ($/mm BTU)

4

Natural gas information corresponds to Point Comfort, as Australia is priced on a

rolling 16 quarter average LME Cash

Caustic Soda Index

1

Index Prices

Aluminum $ / MT

Fuel

Oil

Index

2

Natural

Gas

3

Inventory

flow

Input Cost

Pricing

convention

Annual ATOI

Sensitivity

Fuel oil

1 –

2 months

Prior month

$4m per

$1/bbl

Natural gas

N/A

Spot

4

$16m per

$1/GJ

4

Caustic

soda

3 -

6 months

Spot & semi-

annual

$9m per

$10/DMT |

2Q 10

1Q 11

2Q 11

Production (kmt)

893

904

945

3

rd

Party Shipments (kmt)

699

698

724

3

rd

Party Revenue ($ Millions)

1,710

1,980

2,145

3

rd

Party Price ($/MT)

2,309

2,682

2,830

ATOI ($ Millions)

109

202

201

Primary Metals

2

nd

Quarter Results

2

nd

Quarter Business Highlights

3rd Quarter Outlook

11

Production

up

5%

driven

by

U.S.

restarts

Realized

pricing

up

6%

sequentially

Adjusted

EBITDA/MT

of

$422,

$32

better

than

10

-year average

Days

working

capital

down

4

days

from

Q2

2010

Productivity

benefits continue

Restarts

at

U.S.

locations

turn

profitable

Negative

currency

impact

in

regions

outside

U.S.

Higher

raw

material

costs

Structural

increase

in

European

energy

costs

Pricing

to

follow

15-day

lag

to

LME

30

kmt

higher

production

volume

led

by

U.S.

region

Continued

productivity

benefits

as

the

U.S.

restarts deliver full quarter benefit

Coke

and

pitch

inflation

to

persist

$33

million

additional

energy

costs

largely

due

to structural increase in European energy

2nd Quarter Performance Bridge

$ Millions

See appendix for reconciliations to GAAP and additional information

|

12

Smelting Cost Structure

1

PACE -

CPC USGC (PACE MidPoint

2

Platts Alumina Index

3

Pitch –

Pace Coal Tar Pitch (Liquid) Mid-Point

LME Cash

Index Prices

Aluminum $ / MT

CPC Index

1

Alumina Index

2

Liquid Pitch Index

3

Input

Cost

Inventory

flow

Pricing

convention

Annual

ATOI

Sensitivity

Coke

1 -

2 months

Spot, quarterly &

semi-annual

$9m per

$10/MT

Pitch

$2.5m per

$10/MT

1 -

2 months

Spot, quarterly &

semi-annual

Primary Metals Segment Cost Structure and Sensitivity

|

13

3 Quarter Outlook

2 Quarter Business Highlights

2 Quarter Results

ATOI $ Millions

2Q 10

1Q 11

2Q 11

Flat-Rolled Products,

excl Russia, China & Other

71

84

86

Russia, China & Other

0

(3)

13

Total ATOI

71

81

99

Record

ATOI,

Adjusted

EBITDA

and

adjusted

EBITDA/MT,

led

by

volume

increases

Significant improvements in Russia and China

on top-line, bottom-line and productivity

Days

working

capital

down

1

day

from

Q2

2010

Progress toward 2013 $2.5 billion incremental

revenue target, 45 to 60% during 2011

Continued

productivity

improvements

Seasonal demand and strong end markets

Aero

and

commercial

transportation

demand

remains

strong

Additional

productivity

gains

expected

Seasonal impact

from

summer

plant

shutdowns,

with volume impact similar to prior years

Russia

demand

to

remain

strong,

however

China

demand

growth

slowing

2 Quarter Performance Bridge

$ Millions

Flat-Rolled Products

See appendix for reconciliations to GAAP and additional information

nd

nd

nd

rd |

$

Millions 2Q 10

1Q 11

2Q 11

3 Party Revenue

1,122

1,247

1,370

ATOI

107

130

149

Adjusted EBITDA Margin

17%

18%

19%

Engineered Products and Solutions

14

2 Quarter Performance Bridge

$ Millions

2 Quarter Business Highlights

2 Quarter Results

22%

revenue

growth

from

Q2

2010,

supported by

rising volumes

15%

sequential

improvement

in

ATOI,

highest

since

Q2 2008

Record

Adjusted EBITDA margin rose 3%

sequentially and 10% versus Q2 2010

Days

working

capital

down

2

days

sequentially

Progress toward 2013 $1.6 billion incremental

revenue

target,

25

to

30%

during

2011

Productivity

gains

more

than

offset

cost

pressures

3 Quarter Outlook

Building

and

construction

market

remains

weak

Typical

seasonal

impact

from

summer

plant

slowdowns especially in the Europe region and

commercial transportation market

Share

gains

through

innovation

continue

across

all market sectors

Productivity

improvements to continue

See appendix for reconciliations to GAAP and additional information

rd

nd

nd

rd

nd |

2

nd

Quarter 2011 Cash Flow Overview

($ Millions)

2Q’10

1Q’11

2Q’11

Net Income

$170

$366

$377

DD&A

$364

$361

$375

Change in Working Capital

($422)

($646)

($110)

Pension Contributions

($22)

($31)

($72)

Taxes / Other Adjustments

$210

($286)

$228

Cash from Operations

$300

($236)

$798

Dividends to Shareholders

($31)

($33)

($32)

Change in Debt

$35

$101

$30

Distributions to Noncontrolling Interest

($41)

($97)

($90)

Contributions from Noncontrolling Interest

$37

$121

$7

Other Financing Activities

$3

$33

$-

Cash from Financing Activities

$3

$125

($85)

Capital Expenditures

($213)

($204)

($272)

Other Investing Activities

($33)

($348)

($78)

Cash from Investing Activities

($246)

($552)

($350)

15

2Q’11 FCF

$526 million

$1.3 billion

of cash

Debt-to-Cap

in target

range at

32.6%

DWC better

by 6 Days

from Q2

2010

See appendix for reconciliations to GAAP and additional information

|

Sustainable Reductions in Days Working Capital

16

2Q

2009

2Q

2010

2Q

2011

Sustained

historically low

days working

capital

performance

2Q

2009

2Q

2010

2Q

2011

2Q

2009

2Q

2010

2Q

2011

2Q

2009

2Q

2010

2Q

2011

2Q

2009

2Q

2010

2Q

2011

59

50

62

82

49

39

29

47

67

43

29

25

47

68

37

Alumina

Primary

Metals

FRP

EPS

Alcoa |

2011 Cash Sustainability Operational Targets and Actual Performance

17

Sustaining Capital

Growth Capital

Ma’aden Invest

$400

Debt-to-cap

$ Millions

$197

$ Millions

$ Millions

%

2010

Actual

2011

Target

2011

YTD

$152

35.0%

34.9%

2010

Actual

2011

Target

2011

YTD

32.6%

$500

$445

2010

Actual

2011

Target

2011

YTD

$158

$1,000

$570

2010

Actual

2011

Target

2011

YTD

$318

Free Cash Flow

$ Millions

$0

$1,246

$86

2010

Actual

2011

Target *

2011

YTD

30.0%

•Target is to be free cash flow positive. See appendix for

reconciliations to GAAP and additional information Meeting Our

2011 Goals |

Klaus Kleinfeld

Chairman and Chief Executive Officer

18 |

Market Conditions in 2011 Continue Strong

19

Alcoa End Markets: Current Assessment of 2011 vs. 2010 Conditions

Source: Alcoa analysis

8%-11%

sales growth

1%-3%

sales growth

5%-8%

sales growth

4%-8%

sales growth

60%-65%

sales growth

26%-31%

sales growth

7%-12%

sales growth

4%-5%

sales growth

15%-20%

sales growth

2%-3%

sales growth

10%-12%

sales growth

9%-12%

sales decline

3%-6%

sales decline

5%-10% build

rate growth

7% sales

growth

0%-3%

sales growth

2%-3%

Sales decline

1%-3%

sales growth |

15%

2011 Projected Primary Aluminum Consumption by Region (in mmt)

Russia

Brazil

Asia w/o China

North America

Europe

China

2010 vs. 2011

2011 Estimated Consumption

10%

21%

16%

10%

*Other

17%

44.5

2010 Actual

2011 Forecast

15%

20

2010 Global Demand

Growth Rate: 13%

2011 Global Demand

Growth Rate 12%

vs. 2010

(2011 ex China: 10%)

10%

India

15%

7%

*Other consists of: Middle East, Latin America ex Brazil, and Rest of World

including unallocated global increase 14%

End Market Developments Support Strong Demand Growth

6%

1.0

1.1

4%

4%

6%

6% |

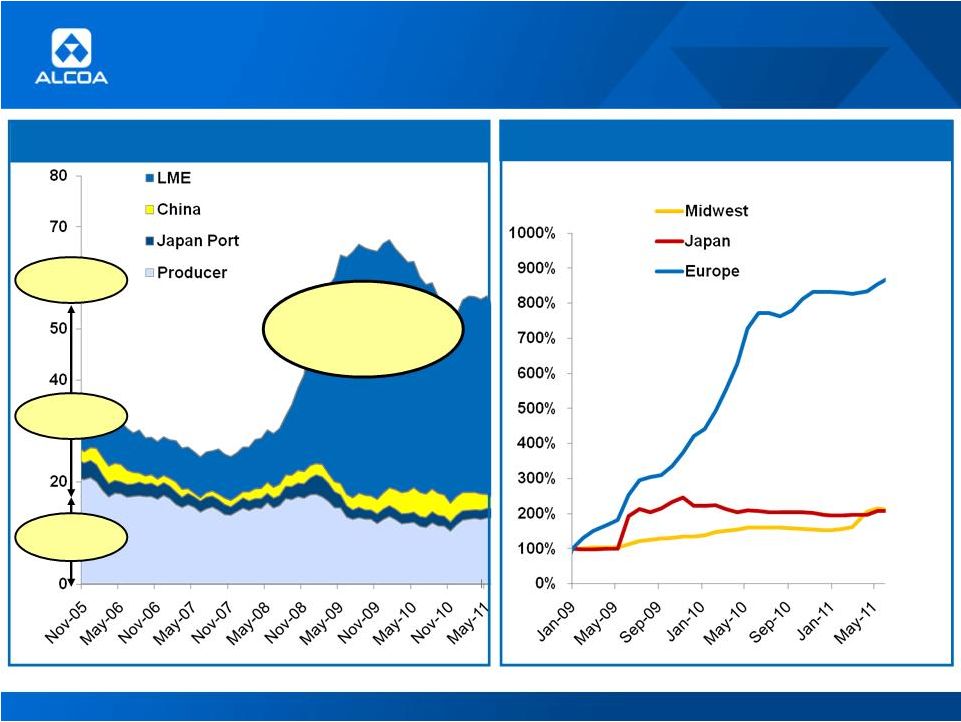

Inventories Flat Sequentially, but Higher Regional Premiums

21

$121 /MT

$215 /MT

$187 /MT

Source: Alcoa estimates, LME, SHFE, IAI, Marubeni, Platt’s Metals Week and

Metal Bulletin Global

Inventories

Flat vs. 1Q’11

56 days of

consumption

LME at 38

days

Non-LME at

18 days

Regional Premiums Continue Upwards

Inventories 7 days Lower Year-on-Year |

Western

World

Annualized Production (May 2011)

25,515

Restarts and Expanded Capacity

739

Total Supply

26,254

Western World Consumption

(25,389)

(Deficit) Surplus

865

China

Annualized Production (May 2011)

18,144

Restarted and Expanded Capacity

206

Total Supply

18,350

Consumption

(19,100)

(Deficit) Surplus

(750)

2011 Primary Aluminum Surplus Tightens to 115 kmt

22

China

Western World

Production

Demand

Source: Alcoa estimates, Brook Hunt, CRU, CNIA, IAI

Production

Demand

2011E Aluminum Supply / Demand Balance (in kmt)

Deficit

Surplus |

China: Recent Data Supports our 2011 Forecast

50% reduction

since May-10

Producers

are

challenged

by

cost

pressures

and

inefficiencies

Smelting:

Would add ~55,000 trucks or rail cars/year to

transport material over 2,000km between East

and West

Refining & Mining:

China Visible Stock (kmt)

Key Issues for Chinese Production

SHFE Primary Market Dynamics

Jan-10

Jul-10

Jan-11

Jul-09

Jan-09

Jun-11

Jan-10

Jul-10

Jan-11

Jul-09

Jan-09

Jun-11

*15%

Export

Duty

+

lost

17%

VAT

Refund

–

$90

regional

premium

**Assumes $120 premium (CIF MJP) for import purchase

–

45% of smelters are in the top quartile of the cost

curve

–

20% use outdated and inefficient technologies –

35% use power from the national grid (high cost) –

New projects / Move to the West

–

More than 50% of new projects based on coal-fired

power

–

Incoming raw materials and outgoing products to/from

East double logistics costs

–

Increasing congestion on Chinese roads leads to

added delays

–

37% of refineries are in the top quartile of the cost

curve, 78% in the top half

–

40% of refineries import bauxite

–

20 to 30% of bauxite mines recover bauxite from

underground

|

2011 Global Alumina Balance Remains at Equilibrium

24

Source: Alcoa estimates, Brook Hunt, CRU, CNIA, IAI

China

Western World

2011 Annualized Production

34,100

Imports from Western World

1,600

Supply

35,700

Demand

(35,600)

(Deficit) / Surplus

100

2011 Annualized Production

53,700

Exports to China

(1,600)

Supply

52,100

Demand

(52,200)

(Deficit) / Surplus

(100)

Production

Demand

Balanced

2011E Alumina Supply / Demand Balance (in kmt) |

Alumina:

Improving

Performance

from

Strong

Portfolio

25

Source: CRU; Platt’s Index; See appendix for Adjusted EBITDA

reconciliations Adjusted EBITDA per Metric Ton

–

Driving down the cost curve

–

Sao

Luis

and

Juruti

consistently

performing

at

high

levels

–

Ma’aden

Alcoa

Project,

lowest

cost

refinery

online

in

2014

–

Sustainable cost advantages

–

20%

of our 3

rd

Party SGA Sales now priced on an

alumina-indexed

or spot basis

Global Capacity: 18,100 kmt per year

Alumina Index Prices

2015 Cost Curve Targets

75

percentile

Alcoa

end 2015

23

Percentile

Alcoa

end 2010

30

Percentile

Cumulative Production (000MT)

25th

percentile

50th

percentile

Alumina Cost Curve

10 Yr Average ~ $66/MT

LME

Adjusted EBITDA/MT

rd

th

th |

2015 Cost Curve Targets

Aluminum: Strong Performance Despite Stiff Headwinds

26

Source: CRU; See appendix for Adjusted EBITDA reconciliations

Aluminum Cost Curve

–

Driving down the cost curve

–

Ma’aden

Alcoa

Project,

lowest

cost

smelter

online in 2013

–

Sustainable cost advantages

–

Repowered

asset

base

–

Capturing optimal value from global casthouses

Global Capacity: 4,500 kmt per year

Adjusted EBITDA per Metric Ton

LME

Adjusted EBITDA/MT

10 YR Average ~ $390/MT |

27

Potlines

Rolling Mill Earth Works

Ma’aden Alcoa Project Progresses On Schedule and Budget

First Locomotive

Rolling Mill Ground

Breaking

Paste Plant

Port |

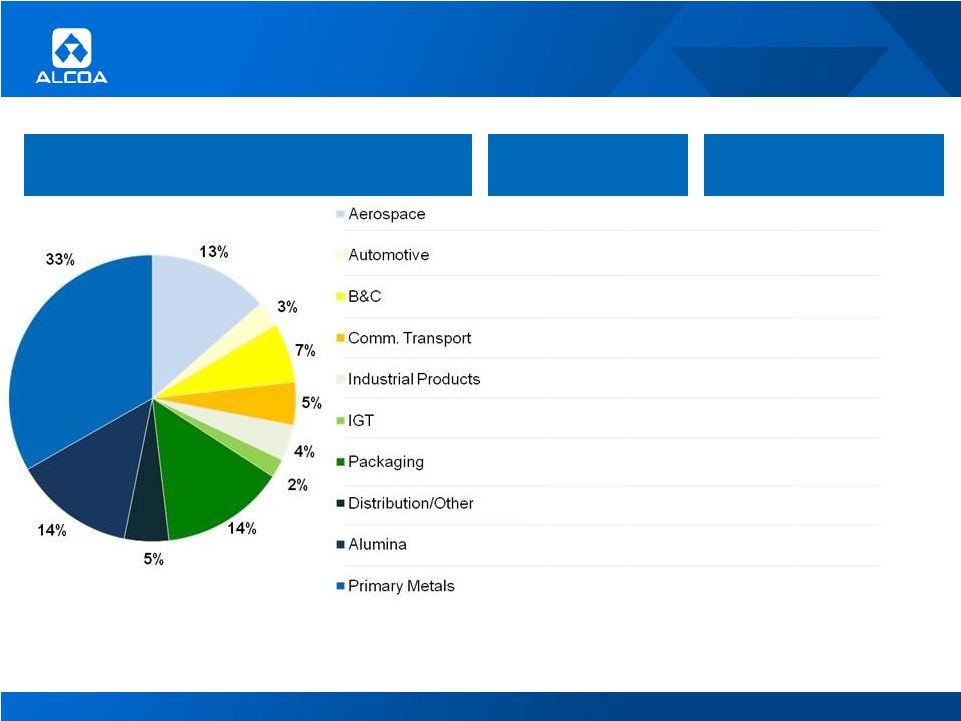

Adjusted EBITDA & Adjusted EBITDA Margin

28

541

495

479

531

620

536

498

254

224

551

173

193

Adjusted EBITDA $Millions

Adjusted EBITDA % Sales

2011 YTD 3

rd

Party Sales by Market

85%

Utilization

–

32% revenue and 23% Adjusted EBITDA

growth

from

Q2

2010

–

On

track

to

reach

45

-

60%

of

the

2013

$2.5B

revenue

growth

target

in

2011

–

Aero,

Commercial

Transportation

&

Packaging

driving

profitable

growth

–

Growth

driven

by

new

regions

and

customers

–

China

and

Russia

continue

to

see

strong

market growth

Leveraging our strategic asset base

Record Adjusted EBITDA per MT

*Actual results from H1 2011 annualized to full year

See appendix for Adjusted EBITDA reconciliations

Total Shipments (mmt)

Adjusted EBITDA per MT

Flat Rolled Products: Strong Top-

and Bottom-Line Growth |

Engineered Products: Continued Growth in Our Margins

Adjusted EBITDA & Adjusted EBITDA Margin

29

436

287

356

495

536

676

783

922

630

762

229

261

Adjusted EBITDA $Millions

2011 YTD 3

rd

Party Sales by Market

Strong Platform for Profitable Growth

Record Adjusted EBITDA Margins

3

Party Sales (US$ billions)

Adjusted EBITDA Margin

*Actual results from H1 2011 annualized to full year

See appendix for Adjusted EBITDA reconciliations

76%

Utilization

68%

Utilization

rd

–

22%

revenue

growth

from

Q2

2010

–

On

track

to

reach

2011

potential

of

25

-

30%

of

$1.6b

2013

revenue

growth

target

–

TransDigm

fastener

acquisition

integration

on

track

with

accretive

earnings

in

2011

–

Product

innovations

and

share

gains

accelerate

growth |

Miracle Metal + Alcoa’s Innovations = Strong Growth for

Alcoa

30

Aluminum truck wheels are better…

Alcoa’s innovations go beyond…

Purchase

Price

Scrap Resale

Value

Fuel Efficiency & Cargo Capacity

Steel

Wheels

Aluminum

Wheels

+3%

Resale Value

Dura-Bright®

Proprietary coating

LvL ONE®

Wheels

5% lighter than

aluminum

competitors

Reduced

painting and

cleaning

With a more sustainable footprint.

-25%

Energy Usage

75%

Higher Yields:

Recaptures

3m

pounds

of scrap

$21m expansion for

advanced recycling and

casting

process

in

Barberton, OH

26 month

payback &

210% ROI for

our customers*

*Sample

calculation

for

a

long-haul

truck

with

22.5”

wheels,

as

calculated

by

Calculighter™

1,350 pounds

saved per

truck/trailer

Before

After

Increased

resale value

at end of life |

Alcoa Takes Flight with Innovations in Aerospace

31

Carbon

Fiber

Alcoa

Innovations

1

-10%

Weight Savings

Alcoa

solutions

are

deployed

in

all

of

Airbus’

programs

First

use

of

Alcoa’s

Al/Li

Alloy

Plate

Carbon

Fiber

Alcoa

Innovations

1

-30%

Life Cycle Cost Savings

Technology: Re-Defining the Possible

Transforming Technology into Orders

Multi-year, ~$1 billion

agreement with Airbus

Leading

the

discussions

on

aero

structures

2

1

Using

Alcoa’s

new

Al/Li

alloys

and

advanced

structural

solutions

Costs to manufacture, operate and maintain

2 |

Giving a Success Story its Due

32

Meeting our Aggressive Targets

EPS: $1.6b in Revenue Growth by 2013 ($b)

GRP: $2.5b in Revenue Growth by 2013 ($b)

*Excluding impact of restructuring and other special items

See appendix for reconciliations to GAAP and additional information

–

Aluminum demand

continues to grow at

12%

in 2011, end

markets remain

resilient

–

Year-over-year and

sequential profitable

growth

in all of our

segments and in

consolidated Alcoa

–

Firm actions to limit

inflationary pressures

in upstream businesses

–

Record results

in Flat-

Rolled Products and

Engineered Products &

Solutions

–

Improving liquidity

and

financial positions

Total Revenue (billion)

Income from Continuing Ops*

(million)

27%

11%

2Q’10

1Q’11

2Q’11

162%

15%

$6.6

$364

$317

$139

$5.2

$6.0

$6.3

$4.6

$4.0

$2.6

$8.8

$6.2

$3.4

to

$3.8

$2.4

to

$2.5

2010

2010

2011

YTD

2011

YTD

2013

Target

2013

Target

Q2: Sets a Successful Milestone |

That's why …

That's why …

Alcoa can't wait

Alcoa can't wait

…for tomorrow

…for tomorrow

A

A |

A

34 |

Roy Harvey

Director, Investor Relations

A

390 Park Avenue

New York, NY 10022-4608

Telephone: (212) 836-2674

www.alcoa.com

Additional Information

35 |

Annual Sensitivity Summary

36

Currency Annual Net Income Sensitivity

+/-

$100/ = +/

-

$200

Million

LME Aluminum Annual Net Income Sensitivity

Australian $

+/-

$10 million

per 0.01 change in USD / AUD

Brazilian $

+/-

$ 3 million

per 0.01 change in BRL / USD

Euro €

+/-

$ 2 million

per 0.01 change in USD / EUR

Canadian $

+/-

$ 4 million

per 0.01 change in CAD / USD

Norwegian Kroner

+/-

$ 6 million

per 0.10 change in NOK / USD |

Revenue Change by Market

6%

5%

12%

16%

9%

8%

13%

19%

14%

8%

21%

18%

27%

45%

8%

12%

41%

21%

32%

25%

2Q’11 Third Party Revenue

Sequential

Change

Year-Over-Year

Change

37 |

Reconciliation of ATOI to Consolidated Net (Loss) Income

Attributable to Alcoa

38

(in millions)

1Q10

2Q10

3Q10

4Q10

2010

1Q11

2Q11

Total segment ATOI

$ 306

$ 381

$ 328

$

409

$ 1,424

$

555

$

635

Unallocated amounts (net of tax):

Impact of LIFO

(14)

(3)

(2)

3

(16)

(24)

(27)

Interest expense

(77)

(77)

(91)

(76)

(321)

(72)

(106)

Noncontrolling interests

(22)

(34)

(48)

(34)

(138)

(58)

(55)

Corporate expense

(67)

(59)

(71)

(94)

(291)

(67)

(76)

Restructuring and other charges

(122)

(21)

1

8

(134)

(6)

(22)

Discontinued operations

(7)

(1)

–

–

(8)

(1)

(4)

Other

(198)

(50)

(56)

42

(262)

(19)

(23)

Consolidated net (loss) income attributable to

Alcoa

$ (201)

$ 136

$ 61

$ 258

$ 254

$ 308

$ 322

|

Reconciliation of Adjusted Income

39

(in millions, except per-

share amounts)

Income

Diluted EPS

Quarter ended

June 30,

2010

March 31,

2011

June 30,

2011

June 30,

2010

March 31,

2011

June 30,

2011

Net income attributable

to Alcoa

$ 136

$ 308

$ 322

$ 0.13

$ 0.27

$ 0.28

Loss from discontinued

operations

(1)

(1)

(4)

Income from

continuing

operations

attributable to Alcoa

137

309

326

0.13

0.27

0.28

Restructuring and

other charges

20

5

16

Discrete tax items*

(16)

–

–

Other special items**

(2)

3

22

Income from

continuing

operations

attributable to Alcoa

–

as adjusted

$ 139

$ 317

$ 364

0.13

0.28

0.32

Income from continuing operations attributable to Alcoa – as adjusted is a non-GAAP financial

measure. Management believes that this measure is meaningful to investors because

management reviews the operating results of Alcoa excluding the impacts of restructuring and other charges, discrete tax

items, and other special items (collectively, “special items”). There can be no

assurances that additional special items will not occur in future periods. To compensate

for this limitation, management believes that it is appropriate to consider both Income from continuing operations attributable to Alcoa

determined under GAAP as well as Income from continuing operations attributable to Alcoa – as

adjusted. *

Discrete tax items include the following:

for the quarter ended June 30, 2010, a benefit for a change in a Canadian provincial tax law

permitting tax returns to be filed in U.S. dollars ($24), a charge based on settlement

discussions of several matters with international taxing authorities ($18), and a benefit for the recovery of a portion of the unfavorable impact included

in the quarter ended March 31, 2010 related to unbenefitted losses in Russia, China, and Italy

($10). ** Other special items include the following:

for the quarter ended June 30, 2011, a net charge comprised of expenses for the early repayment of

Notes set to mature in 2013 due to the premiums paid under the tender offers and call option

and gains from the termination of related “in-the-money” interest rate swaps ($32) and favorable mark-to-market changes in certain

power derivative contracts ($10);

for the quarter ended March 31, 2011, costs related to acquisitions of the aerospace fastener business

of TransDigm Group Inc. and full ownership of carbothermic smelting technology from ORKLA ASA

($8) and favorable mark-to-market changes in certain power derivative contracts ($5); and

for the quarter ended June 30, 2010, favorable mark-to-market changes in derivative contracts

($22), a charge for costs associated with the potential strike and successful execution of a

new agreement with the United Steelworkers ($13), and a charge related to an unfavorable decision in Alcoa’s lawsuit against Luminant

related to the Rockdale, TX facility ($7).

•

•

•

• |

Reconciliation of Free Cash Flow

40

(in millions)

Quarter ended

Year ended

Six months

ended

June 30,

2011

December 31,

2010

June 30,

2011

Cash provided from

operations

$ 798

$ 2,261

$ 562

Capital expenditures

(272)

(1,015)

(476)

Free cash flow

$ 526

$ 1,246

$ 86

Free Cash Flow is a non-GAAP financial measure. Management believes that this measure is

meaningful to investors because management reviews cash flows generated from operations after

taking into consideration capital expenditures due to the fact that these expenditures are

considered necessary to maintain and expand Alcoa’s asset base and are expected to

generate future cash flows from operations. It is important to note that Free Cash Flow

does not represent the residual cash flow available for discretionary expenditures since other

non-discretionary expenditures, such as mandatory debt service requirements, are not

deducted from the measure. |

Reconciliation of Alcoa Adjusted EBITDA

41

($ in millions)

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2Q10

1Q11

2Q11

Net income (loss)

attributable to

Alcoa

$ 908

$ 420

$ 938

$ 1,310

$ 1,233

$ 2,248

$ 2,564

$ (74)

$ (1,151)

$ 254

$ 136

$ 308

$ 322

Add:

Net income

attributable to

noncontrolling

interests

205

181

212

233

259

436

365

221

61

138

34

58

55

Cumulative effect

of accounting

changes

–

(34)

47

–

2

–

–

–

–

–

–

–

–

Loss (income)

from discontinued

operations

5

101

–

27

50

(22)

250

303

166

8

1

1

4

Provision (benefit)

for income taxes

524

307

367

546

464

853

1,623

342

(574)

148

57

138

136

Other (income)

expenses, net

(295)

(175)

(278)

(266)

(478)

(236)

(1,920)

(59)

(161)

5

(16)

(28)

(50)

Interest expense

371

350

314

271

339

384

401

407

470

494

119

111

163

Restructuring and

other charges

530

398

(28)

(29)

266

507

268

939

237

207

30

6

34

Provision for

depreciation,

depletion, and

amortization

1,144

1,037

1,110

1,142

1,227

1,252

1,244

1,234

1,311

1,450

363

361

375

Adjusted EBITDA

$ 3,392

$ 2,585

$ 2,682

$ 3,234

$ 3,362

$ 5,422

$ 4,795

$ 3,313

$ 359

$ 2,704

$ 724

$ 955

$ 1,039

Sales

$19,906

$17,691

$18,879

$21,370

$24,149

$28

,950

$29,280

$26,901

$18,439

$21,013

$ 5,187

$ 5,958

$ 6,585

Adjusted EBITDA

Margin

17%

15%

14%

15%

14%

19%

16%

12%

2%

13%

14%

16%

16%

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net

margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general

administrative, and other expenses; Research and development expenses; and Provision for

depreciation, depletion, and amortization. Adjusted EBITDA is a non-GAAP financial

measure. Management believes that this measure is meaningful to investors because Adjusted

EBITDA provides additional information with respect to Alcoa’s operating performance and the

Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may

not be comparable to similarly titled measures of other companies.

|

Reconciliation of Alumina Adjusted EBITDA

42

($ in millions, except per

metric ton amounts)

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2Q10

1Q11

2Q11

After-tax operating

income (ATOI)

$ 471

$ 315

$ 415

$ 632

$ 682

$ 1,050

$ 956

$ 727

$ 112

$ 301

$ 94

$ 142

$ 186

Add:

Depreciation, depletion,

and amortization

144

139

147

153

172

192

267

268

292

406

107

103

112

Equity (income)

loss

(1)

(1)

–

(1)

–

2

(1)

(7)

(8)

(10)

(4)

(3)

(22)

Income taxes

184

130

161

240

246

428

340

277

(22)

60

41

44

60

Other

(17)

(14)

(55)

(46)

(8)

(6)

2

(26)

(92)

(5)

(2)

–

(1)

Adjusted EBITDA

$ 781

$ 569

$ 668

$ 978

$ 1,092

$ 1,666

$ 1,564

$ 1,239

$ 282

$ 752

$ 236

$ 286

$ 335

Production (thousand

metric tons) (kmt)

12,527

13,027

13,841

14,343

14,598

15,128

15,084

15,256

14,265

15,922

3,890

4,024

4,144

Adjusted

EBITDA/Production ($

per metric ton)

$ 62

$ 44

$ 48

$ 68

$ 75

$ 110

$ 104

$ 81

$ 20

$ 47

$ 61

$ 71

$

81

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales

minus the following items: Cost of goods sold; Selling, general administrative, and other expenses;

Research and development expenses; and Provision for depreciation, depletion, and amortization. The Other line in

the table above includes gains/losses on asset sales and other nonoperating items. Adjusted

EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because

Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and

the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to

similarly titled measures of other companies. |

Reconciliation of Primary Metals Adjusted EBITDA

43

($ in millions, except

per metric ton

amounts)

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2Q10

1Q11

2Q11

After-tax operating

income (ATOI)

$ 905

$ 650

$ 657

$ 808

$ 822

$ 1,760

$ 1,445

$ 931

$ (612)

$ 488

$ 109

$ 202

$ 201

Add:

Depreciation,

depletion, and

amortization

327

300

310

326

368

395

410

503

560

571

142

141

142

Equity (income) loss

(52)

(44)

(55)

(58)

12

(82)

(57)

(2)

26

(1)

(1)

(1)

1

Income taxes

434

266

256

314

307

726

542

172

(365)

96

–

53

55

Other

(8)

(47)

12

20

(96)

(13)

(27)

(32)

(176)

(7)

–

1

–

Adjusted EBITDA

$ 1,606

$ 1,125

$ 1,180

$ 1,410

$ 1,413

$ 2,786

$ 2,313

$ 1,572

$ (567)

$ 1,147

$ 250

$ 396

$ 399

Production

(thousand metric

tons) (kmt)

3,488

3,500

3,508

3,376

3,554

3,552

3,693

4,007

3,564

3,586

893

904

945

Adjusted

EBITDA/Production

($ per metric ton)

$ 460

$ 321

$ 336

$ 418

$ 398

$ 784

$ 626

$ 392

$ (159)

$ 320

$ 280

$ 438

$ 422

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the

following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and

development expenses; and Provision for depreciation, depletion, and amortization. The Other line in the table above includes

gains/losses on asset sales and other nonoperating items. Adjusted EBITDA is a non-GAAP

financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional

information with respect to Alcoa’s operating performance and the Company’s ability to meet

its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.

|

Reconciliation of Flat-Rolled Products Adjusted EBITDA

44

($ in millions,

except per metric

ton amounts)

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2Q10

1Q11

2Q11

2011

Annualized

After-tax operating

income (ATOI)

$ 253

$ 225

$ 222

$ 254

$ 278

$ 233

$ 178

$ (3)

$ (49)

$ 220

$ 71

$ 81

$ 99

$ 360

Add:

Depreciation,

depletion, and

amortization

167

184

190

200

220

223

227

216

227

238

57

58

60

236

Equity loss

2

4

1

1

–

2

–

–

–

–

–

–

–

–

Income taxes

124

90

71

75

121

58

92

35

48

92

28

33

35

136

Other

(5)

(8)

(5)

1

1

20

1

6

(2)

1

1

1

(1)

–

Adjusted EBITDA

$ 541

$ 495

$ 479

$ 531

$ 620

$

536

$ 498

$ 254

$ 224

$ 551

$ 157

$ 173

$ 193

$ 732

Total sales

$ 4,868

$ 4,571

$ 4,768

$ 6,042

$ 7,081

$ 8,610

$ 9,597

$ 9,184

$ 6,182

$ 6,457

$ 1,614

$ 1,961

$ 2,147

Adjusted EBITDA

Margin

11%

11%

10%

9%

9%

6%

5%

3%

4%

9%

10%

9%

9%

Total shipments

(thousand metric

tons) (kmt)

2,376

2,482

2,361

1,888

1,755

435

470

491

1,922

Adjusted

EBITDA/Total

shipments ($ per

metric ton)

$ 226

$ 201

$ 108

$ 119

$ 314

$ 361

$ 368

$ 393

$ 381

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales

minus the following items: Cost of goods sold; Selling, general administrative, and other expenses;

Research and development expenses; and Provision for depreciation, depletion, and amortization. The Other line

in the table above includes gains/losses on asset sales and other nonoperating items. Adjusted

EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors

because Adjusted EBITDA provides additional information with respect to Alcoa’s operating

performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be

comparable to similarly titled measures of other companies. |

Reconciliation of Engineered Products and Solutions

Adjusted EBITDA

45

($ in millions)

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2Q10

1Q11

2Q11

2011

Annualized

After-tax

operating income

(ATOI)

$ 189

$ 63

$ 124

$ 156

$ 271

$ 365

$ 435

$ 533

$ 315

$ 415

$ 107

$ 130

$ 149

$ 558

Add:

Depreciation,

depletion, and

amortization

186

150

166

168

160

152

163

165

177

154

38

38

41

158

Equity loss

(income)

–

–

–

–

–

6

–

–

(2)

(2)

–

(1)

–

(2)

Income taxes

61

39

55

65

116

155

192

222

139

195

48

62

72

268

Other

–

35

11

106

(11)

(2)

(7)

2

1

–

–

–

(1)

(2)

Adjusted EBITDA

$ 436

$ 287

$ 356

$ 495

$ 536

$ 676

$ 783

$ 922

$ 630

$ 762

$ 193

$ 229

$ 261

$ 980

Total sales

$ 4,141

$ 3,492

$ 3,905

$ 4,283

$ 4,773

$ 5,428

$ 5,834

$ 6,199

$ 4,689

$ 4,584

$ 1,122

$ 1,247

$ 1,370

$ 5,234

Adjusted EBITDA

Margin

11%

8%

9%

12%

11%

12%

13%

15%

13%

17%

17%

18%

19%

19%

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes,

depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent

to

Sales

minus

the

following

items:

Cost

of

goods

sold;

Selling,

general

administrative,

and

other

expenses;

Research

and

development

expenses;

and

Provision

for

depreciation,

depletion,

and

amortization.

The

Other

line

in

the

table

above

includes

gains/losses

on

asset

sales

and

other

nonoperating

items.

Adjusted

EBITDA

is

a

non-GAAP

financial

measure.

Management

believes

that

this

measure

is

meaningful to investors because Adjusted EBITDA provides additional information with

respect to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted

EBITDA presented may not be comparable to similarly titled measures of other

companies. |

Reconciliation of Alcoa Net Debt

46

(in millions)

Quarter ended

March 31,

2011

June 30,

2011

Short-term borrowings

$ 221

$ 65

Long-term debt due within

one year

572

510

Long-term debt, less amount

due within one year

8,501

8,773

Total debt

9,294

9,348

Less: Cash and cash

equivalents

887

1,260

Net debt

$ 8,407

$ 8,088

Net debt is a non-GAAP financial measure. Management believes that this

measure is meaningful to investors because management assesses Alcoa’s

leverage position after factoring in available cash that could be used to repay

outstanding debt. |