Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - Vantone International Group, Inc. | f10k2011ex31i_vantone.htm |

| EX-32 - CERTIFICATION - Vantone International Group, Inc. | f10k2011ex32i_vantone.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended March 31, 2011

or

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________ to ___________

Commission file number: 000-28683

VANTONE INTERNATIONAL GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

41-1954595

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

No.195 Zhongshan Road, Heping District

Shenyang, Liaoning Province

People’s Republic of China

|

||

|

(Address of principal executive offices)

|

(Zip Code)

|

86-24-2286-6686

(Registrant’s telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Act: None.

|

|

Securities registered under Section 12(g) of the Act:

|

|

Common Stock, Par Value $0.001 Per Share

|

|

(Title of class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§232.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

x

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, as of September 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter, based on the closing price of the common stock on the OTC Bulletin Board on such date was $8,551,264.

As of June 27, 2011, there were 30,001,000 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

|

Document

|

Parts Into Which Incorporated

|

|

|

None

|

TABLE OF CONTENTS

|

Item Number and Caption

|

Page

|

|||

|

PART I

|

||||

|

Item 1.

|

Business.

|

5 | ||

|

Item 1A.

|

Risk Factors.

|

14

|

||

|

Item 2.

|

Properties.

|

20

|

||

|

Item 3.

|

Legal Proceedings.

|

21

|

||

|

Item 4.

|

(Removed and Reserved).

|

21

|

||

|

PART II

|

||||

|

Item 5.

|

Market for Registrant’s Common Equity, and Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

21

|

||

|

Item 6.

|

Selected Financial Data.

|

22

|

||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

22

|

||

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

27

|

||

|

Item 8.

|

Financial Statements and Supplementary Data.

|

27

|

||

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure.

|

28

|

||

|

Item 9A.

|

Controls and Procedures.

|

28

|

||

|

PART III

|

||||

|

Item 10.

|

Directors, Executive Officers, Promoters and Corporate Governance.

|

29

|

||

|

Item 11.

|

Executive Compensation.

|

32

|

||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

34

|

||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

35

|

||

|

Item 14.

|

Principal Accountant Fees and Services.

|

35

|

||

|

PART IV

|

||||

|

Item 15.

|

Exhibits, Financial Statement Schedules.

|

36

|

||

|

SIGNATURES

|

||||

3

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This annual report contains forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described under Item 1 “Description of Business,” Item 1A “Risk Factors” and Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Forward-looking statements represent our estimates and assumptions only as of the date of this annual report. You should read this annual report and the documents that we reference in this annual report, or that we filed as exhibits to this annual report completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

OTHER PERTINENT INFORMATION

References in this annual report to “we,” “us,” “our” and the “Company” and words of like import refer to Vantone International Group, Inc., its subsidiaries and variable interest entities.

References to China or the PRC refer to the People’s Republic of China.

Our business is conducted in China, using RMB, the currency of China, and our financial statements are presented in United States dollars. In this annual report, we refer to assets, obligations, commitments and liabilities in our financial statements in United States dollars. These dollar references are based on the exchange rate of RMB to United States dollars, determined as of a specific date. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of United States dollars which may result in an increase or decrease in the amount of our obligations (expressed in dollars) and the value of our assets, including accounts receivable (expressed in dollars).

4

PART I

ITEM 1. BUSINESS.

We operate as a diversified company in China, headquartered in Shenyang City, China. Our business currently consists of three segments: production and sales of water purification products and other products, insurance agency service, and small financing loans service.

From April 2007 to April 2010 we developed a sales network across China. We established approximately 400 franchise stores across China, as well as branch offices in the Jilin and Heilongjiang Provinces. Through the sales network, we distributed approximately 70 different products, ranging from daily commodities such as health food and products, cosmetics and skincare products, vitamins, water filters, bamboo fiber product, jade mattresses with regulated temperature control, appliances, kitchenware, and insurance products. In April 2010 we closed our 400 franchise stores and mainly operated our business through our website Vantone Online for the fiscal year ended March 31, 2011. Simultaneously, we decided to significantly change our business model to customer online order and e-payment. Starting in April 2011, in order to increase our sales volume, and satisfy more customers’ demands, we plan to open physical store locations all over China. Customers can make orders on our Vantone online website, and then make payment and pick up products in any of our physical store locations. In April 2011, we retained a strategy company to design a VI logo, create a market analysis report, and conduct strategy development of physical stores. The contract requires the strategy company to complete this work in July 2011. Once this report is complete we will commence the opening of new physical store locations.

We invite more stores to franchise with us. All members who have registered as VIP members on Vantone Online can apply to open a merchandise franchise with us, and the members who meet insurance agent qualifications may apply to open up an insurance franchise. We are not only providing small loans for members to support its business, but also providing online order services and fund settlement services on Vantone Online. The members who open a merchandise or insurance franchise receive professional training and instructions before they can run the franchises.

Corporate History and Structure

We were incorporated on April 20, 1966 under the laws of the State of Minnesota as Polar Homes, Inc. In 1968, we changed our name to Polar Campers, Inc. We were originally formed to build, manufacture, sell, lease, own, buy and otherwise deal with mobile homes, campers, trailers and any other business in vehicles; and to own and otherwise deal with real estate. We ceased all business operations in 1973 and disposed of all assets and liabilities.

In August 1991, in anticipation of a business combination with another entity, we changed our name to Access Plus, Inc. This business combination was unsuccessful and was abandoned in January 1992. Concurrent with the abandonment of the proposed business combination, we changed our name to Environmental Protection Corporation.

On August 15, 2000, we changed our name to Senior Optician Service, Inc. We intended to enter the specialty eyewear products business and to focus our efforts on specialty eyewear sales and services for senior citizens who are either home or facility bound. On March 31, 2003, this business plan was suspended by the management.

On August 31, 2007, we re-domiciled from the State of Minnesota to the State of Nevada. The capital structure of the Company remained unchanged. The change of domicile was implemented by merging the Minnesota entity into a Nevada corporation named Senior Optician Service, Inc. which was formed on June 25, 2007. Senior Optician Service, Inc., the Nevada entity, survived following the completion of the merger.

Change of Control and Reverse Merger Transaction

On April 7, 2008, Mr. Honggang Yu, our current president and chief executive officer, purchased 5,175,000 shares of our common stock from Gregory M. Wilson and Kaniksu Financial Service, Inc., which represented 86.9% of the outstanding shares at the time of the transaction.

On May 14, 2009, we newly issued 23,947,000 shares of common stock in exchange for 100% capital shares of Vantone USA, Inc. Mr. Honggang Yu and Mr. Jichun Li, the sole shareholders Vantone USA, Inc. (“Vantone USA”), received a total of 19,157,600 shares and 4,789,400 shares, respectively. After the transaction, Vantone USA became our wholly-owned subsidiary. Effective August 17, 2009, our corporate name was changed from Senior Optician Service Inc. to Vantone International Group, Inc. (“Vantone International”) to better reflect our current business operations.

Our Subsidiaries

Vantone USA was incorporated under the laws of Nevada on December 5, 2007. It is a holding company that has owned 100% of the equity in Shenyang Vantone Healthcare Products Manufacturing Co., Ltd. (“Vantone Manufacturing”) since July 14, 2008. Most of Vantone International’s activities are conducted through its wholly own subsidiaries, Shenyang Heping District Vantone Small Loan Financing Co., Ltd. (“Vantone Small Financing”), Vantone Manufacturing, and Vantone Manufacturing’s variable interest entities in the PRC.

5

Shenyang Vantone Yuan Trading Co., Ltd. (“Vantone Yuan”) was incorporated under the law of the PRC. It was incorporated under the name Shenyang Tongbida Trading Co., Ltd., but adopted its current name on June 21, 2007. Through contractual agreements, Vantone Manufacturing will enjoy all of the profits and bear all of the losses arising from the business of Vantone Yuan during Vantone Manufacturing’s management period.

Kangping Vantone Trading Co., Ltd. (“Kangping Vantone”) was incorporated under the law of the PRC. Vantone Yuan owns 100% shares of Kangping Vantone.

Liaoning Vantone Insurance Agent Co., Ltd. (“Vantone Insurance”) was incorporated under the law of the PRC. Vantone Yuan owns 88% shares of Vantone Insurance.

Vantone Small Financing was incorporated under the law of the PRC. Vantone Yuan and Vantone International own 29.30% and 70.70% shares of Vantone Small Financing, respectively.

Corporate Structure

The following chart reflects our organizational structure for our active subsidiaries as of the date of this annual report.

Our Industry and Market

Water purifying equipment industry

In recent years, there has been public concern for environmental protection and water hygiene, and consumer capacity for water purifying equipment continues to rise. The water purifying equipment industry in China is growing rapidly and the volume of production is increasing year by year. In 2009, the production volume of water purifiers in China reached more than 20 million units. Concurrently the sales were approximately RMB 30 billion or $458,820,000 in 2009 (http://www.cu-market.com.cn/hgjj/2010-11-16/10520568.html). With increased usage of water appliances in the household, the need for water purifiers is rising.

Furthermore, survey data from the Water Purifying Industry Committee (http://www.cu-market.com.cn/hgjj/2010-11-16/10520568.html) provides that less than 15% of the households in Beijing, Shanghai, and Guangzhou, the largest three cities in China, owns water purifiers. The ownership rate in small and medium-sized cities is below 5% and rural market ownership of water purification systems is nominal, illustrating that the water purifier market has huge potential.

Insurance industry

According to the current insurance operating data in China released by the China Insurance Regulatory Commission, CIRC (http://insurance.jrj.com.cn/2010/09/2615148231742.shtml), during the period from January 2010 to August 2010, the insurance premium income was up to RMB 1,010 billion, or approximately $150 billion, an increase of 32.96% compared to the same period in 2009. The casualty insurance premium income was RMB 263 billion, or approximately $40 billion, an increase of 32.63% compared to the same period in 2009 and the life insurance premium income was RMB 747 billion, or approximately $110 billion, an increase of 33.11% compared to the same period in 2009.

6

Based on data that has been collected from a daily newspaper in Beijing, from January 2010 to August 2010, the insurance industry’s expenses for insurance compensation was RMB 197 billion, or approximately $30 billion, a decrease of 5.41% compared to the same period in 2009. The amount of assets of the insurance industry were RMB 4,753 billion, or approximately $730 billion, an increase of 29.14% compared to the same period in 2009. The bank deposits were RMB 1,284 billion, or approximately $190 billion, an increase of 30.36% compared to the same period in 2009.

According to the Opinions Concerning the Reform and Improvement of Insurance Salesman Management System (No. 84 of 2010) issued by the CIRC on September 20, 2010 (http://www.circ.gov.cn/tabid/106/InfoID/143917/frtid/3871/Default.aspx), the Chinese government encourages insurance agencies to form a solid insurance marketing team, increase the investment in education and training for salesman, and improve the overall quality of insurance sales market. Insurance agency companies are encouraged to improve the income and benefits for individual salesmen, train the sales team and promote the development of the insurance marketing team. Insurance companies and insurance agency companies are also encouraged to actively explore new insurance marketing models and marketing channels in order to realize the specialization and professionalization of insurance sales system. The government encourages the cooperation between insurance companies and insurance agencies to establish a stable exclusive agency relationship and a sales outsourcing model. We believe that with the rapid development of the Chinese economy and the encouragement from the government, the Chinese insurance market has great potential.

According to the statistics prepared by the Insurance Association of China (http://www.iachina.cn/09/03/content/0013_news.html), by the first half year of 2010, there were over 150,000 companies with insurance brokers in China. The sales team has reached more than 3 million people.

Small loan industry

The small loan industry in China is an emerging market, which is different from Chinese traditional banking lending, with the features of flexible operation, a quick and simple loan procedure, and often being unsecured.

A small loan company is incorporated under the relevant provisions of Guidance on the Small Loan Company Pilot of the China Banking Regulatory Commission and the People's Bank of China (No.23, 2008 of China Banking Regulatory Commission), which is a legal private financial institution and a useful complement to traditional bank lending. A non-financial institution can operate small loans business without taking deposits from the public.

It has an incomparable advantage from the traditional Chinese banking and financing industry. This industry is recognized by the features of flexible, convenient and quick operation and is highly supported and encouraged by the government. Because the speed of China’s economic growth has slowed down and the inflation has heated up, the Chinese government has raised the deposit interest, and the deposit reserve rate in order to tighten the monetary policy. This practice provides an opportunity for the small loan business companies, especially in their active supporting roles in the promoting of the “agriculture, farmer and village” policy and satisfying the capital requirements for small and medium-size enterprises and individual businesses.

Our Products and Services

Water Purifiers

For our water purification business, we conduct research and development, assemble, and sell water purification products (We outsource the water purifier parts to other non-related factories). Commencing from April 2011, we are able to sell water purification equipment in physical stores or through our Vantone Online system. For our water purification products, our UF Water Filter patent has been issued by the Chinese government in March 2011. We also have one patent application currently pending with the related Chinese authorities.

Our current water purification products include Standard Direct Drinking Type, Miniature Standard Direct Drinking Type, Desktop Direct Drinking Type, Luxurious B-5 Band Hanging Direct Drinking Type, Luxurious B-6 Band Hanging Direct Drinking Type, Vantone high efficiency filtration water purifier and NM water glass, etc. With our established online distribution networks, we expect we will expand our market shares steadily.

Our Vantone ultra filtration water purifying equipment with double temperature adjustment function, can promote the national health and psycho-thermal safety standards for drinking water. It has a double prevents dry heating design with heating capacity and a beautiful appearance. Our other series products, miniature, desk-top, standard direct drinking water purifying equipment also adopt modern filtration technology – the hollow fiber ultra-filtration technology. They can perform concentration and the self-acting separation of water’s larger molecule or colloid substances, and intercept bacteria, remove a variety of harmful substances and the purify the water to make it drinkable directly. They also include our innovative backwash device.

Our Luxurious B-5/6 Band Hanging Direct Drinking Type, one of the latest products in water purification equipment, can filter harmful substances and bacteria and release the necessary calcium ion with minerals for human body to absorb. It can increase the cell vitality, accelerate the blood circulation, and purify the ordinary tap water into the oxygen-enriched water.

7

We plan to open or franchise approximately 110 physical stores in Shenyang, China by the end of 2011. However, we did not open or franchise any physical stores as of June 30, 2011. Our goal is to open or franchise more physical stores nationwide and increase our active online members who will make regular purchases of our products through the Vantone Online system. We generally charge an annual membership service fee of RMB 480 (equivalent to $73) in connection with the registration as a VIP member. In order to better recruit members, we implemented a discount of annual register membership fee of RMB 320 (equivalent to $49) in the three months ended June 30, 2010 and RMB 440 (equivalent to $67) from July 2010 to November 2010, respectively. However, the sales agents of our Vantone Insurance who have paid the deposit to the Company before March 31, 2010 may enjoy free registration as the permanent VIP membership if such sales agent completed a registration in Vantone online before December 1, 2010. In addition, we charge a permanent membership service fee of RMB 300 (equivalent to $46) to register permanent members who qualify as insurance agents from April 1, 2010 to November 30, 2010, otherwise, we charge a permanent membership service fee of RMB 480 (equivalent to $73).

Our water purifying equipment business is expected to be our major revenue driver, while our insurance and small financing loan businesses will complement our water purification business. For the fiscal year ended March 31, 2011, our water purifying equipment series products and water cups constitutes approximately 22% of our total revenues. For the fiscal year ended March 31, 2012, we expect our water purification and other products sales, insurance agency service, and providing small financing business to generate approximately 70%, 10%, and 20%, respectively, of our annual revenues.

Insurance

As an insurance agent, we primarily represent a variety of insurance products, including home, property, life, health and auto insurance, for insurance companies located in China. For the fiscal year ended March 31, 2011, we primarily sold our insurance products through our Vantone Online system. Commencing from April 2011, we can sell our insurance products either in our physical locations or on our Vantone Online system. In addition, we actively recruit our insurance agents as registered members of our Vantone Online store. Our revenue from this segment is derived from commissions upon insurance products sales. At June 2011, we have more than 700 registered online members as our insurance agents.

Currently, our collaborating insurance companies in China are Generali China Life Insurance Company Ltd., Liaoning Province Branch, Ping’An Insurance (Group) Company of China, Ltd. Shengyang Center (“Ping’An”), New China Life Co., Ltd. Liaoning Branch and Heng’An Standard Life Co., Ltd. Liaoning Branch (“Heng’An”).

Heng’An’s products consist of Heng’An Standard Steady Life Endowment Insurance A, Heng’An Standard “Tian Tian Xiang Shang” of University Education Cumulative Type Participating Insurance C, Heng’An Standard “Nian Nian Ji Xiang” Accident Insurance B, Heng’An Standard “Jin Fu Lai” Annuity Insurance, Heng’An Standard “Zhen Ai Xiang Sui” (Participating Type) A, ”Xing Kui You Ni” Lifelong Major Disease Insurance B, “Huan Xiao Man Tang” Endowment Insurance B, Heng’ An Standard Additional Premium Immunity Term Life Insurance, Heng’An Standard Additional Parenting Annuity Insurance A, Heng’An Standard Additional Accident Insurance, Heng’An Standard Additional Junior high school Education Annuity Insurance (Participating Type), Additional Pre-payment Critical Illness Insurance H, Additional Children Accident Injury Insurance, Additional “Jiang Kang Shi Fu” Long Term Medical Insurance, and Additional Hospitalization Allowances Medical Insurance.

Ping’An sells Enterprise Property Insurance, Transportation Insurance, Fabrication work risks, Liability, Insurance Car Insurance, Compulsory Automobile Insurance, Accident and Health Insurance, Individual Property Insurance, and Leisurely Travel Ping’An insurance.

Our insurance agents are required to be licensed and qualified in engaging in the insurance industry in China. Currently, we are restricted to conduct our insurance sales business in the Liaoning province of China only. We are not currently authorized to conduct our insurance sales business outside the Liaoning province.

Small Loans Business

We provide three types of loans to our customers: credit loans, mortgage loans and pledge loans. We target our members of online stores and small and medium-sized enterprises to provide the loans. The majority of the clients of credit loans are members of Vantone online, who are 25 to 65 years old, with a good credit according to the record from our Vantone website and purchase certain amounts products from Vantone. The majority of clients of mortgaged or pledged loans are members of Vantone online, other small and medium-sized enterprise and individuals. As to mortgaged or pledged loans, the borrower mortgages (pledge) or guarantees with its or the third party’s personal property, real estate or rights to get a small loan from us. Generally, as to property and real estate with strong liquidity, we may provide a loan for as much as 50% of the above assets assessed value; as to the different liquidities of treasury bonds, deposit receipts, bank notes and stock, we provide as much as between 60% and 90% of the assessed value. All of the borrowers are required by us to submit an application and are subject to our approval. The terms of the loan will usually be less than six months.

Vantone Small Financing can solve members’ startup capital shortage by providing small financings to our online start-up business members, and support them to open a Vantone Brand franchised shop to distribute and display the products of our company. As a result, more members will join our Vantone Online, and more Vantone Brand franchised stores (either online or physical) will be opened.

8

Vantone Small Financing also intends to provide capital support for setting up additional insurance franchisees in the future, to improve company’s insurance agency business, to recruit more insurance agents to join us as our members, and to expand the franchised channel in the insurance market.

For the fiscal year ended March 31, 2011, we provided small financing loans to individual customers only. Commencing from April 2011, we started to provide small financing service to individuals and corporate entities, as well. Our loans are not secured by the products that are sold to customers, but are secured by other collateral of the applicants, such as United States public companies outstanding common stock. We may also accept the applicant’s real properties, personal properties, bank funds, and/or future income as collateral in the future. For the fiscal year ended March 31, 2011, all collateral were United States public companies outstanding stocks, and most of them are Vantone International’s outstanding stocks. Since most of the borrowers are our registered members on Vantone Online stores, such borrowers plan to establish the physical stores or expand their business. Therefore, after the physical stores or small business of the borrowers have been set up, we will require the borrowers to use their business operation rights and related assets as additional collateral to cover the full amount of the loans. Furthermore, we request the borrower to purchase casualty insurance to secure those loans, which refer to us as primary beneficiary. For individual and/or corporate applicants, most of borrowers have been approved to obtain the loans between RMB 10,000 to RMB 500,000, or approximately $1,527 to $76,352. In addition, each borrower can apply for multiple loans from us subject to our approval.

E-Commerce Online Products

Additionally, we sell some other products on our Vantone website, such as health care food and related products, skin-care and beauty products, and feminine care products, etc. These sales accounted for approximately 55% of our total revenue for the year ended March 31, 2011. However, we have significantly reduced the sales of these health products since April 2011.

Business Model and Process

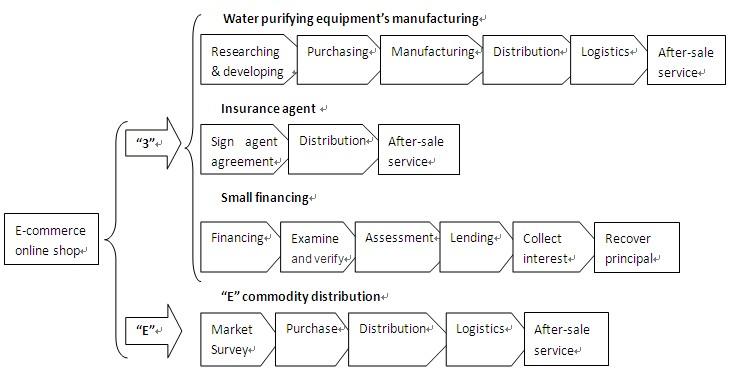

We have combined the sales of water purifiers, insurance service, and small business financing service into one sales platform - Vantone Online by the online sales distribution channels, so called “3 + E” business model.

Water purifier manufacturing business

Our water purification business includes research and development of water purifiers under the Vantone Brand, assembly, distribution and delivery of the products, and after sales customer services and support. We have researched and developed a variety of water purifiers for household and corporate use.

We purchase the raw materials for the production of our water purifiers. The raw materials includes the parts or units of the water purifier that we use for assembly. Our raw material quality control staff inspects these raw materials upon delivery. Upon passing the quality inspection, our staff will sign-in and seal the parts in our warehouse where they are placed in storage. We also require suppliers to provide a product quality certificate by a national authoritative inspection agency. For unqualified raw materials, we will contact the suppliers for returns and exchanges.

9

We implement quality management control on our assembly production line. According to Health Permit Document of Domestic Health and Safety Products in relation to drinking water issued by the Ministry of Public Health of the People’s Republic of China that, by examination and verification, our WTRO-JY type water purifier and WT-UF type UF water purifier comply with the relevant regulations of “Supervision and Management of Drinking Water”. Our measurement of quality objectives and processes were analyzed through planning, process, performance, recognition, execution and supervision, in order to assemble products to meet the requirements of customers and regulators.

We have engaged a third-party logistics transport company for the delivery of the products ordered by our customers. We have entered delivery service agreements with logistics companies. Our products are delivered by trucks through the logistics companies.

We have a strict after-sales customer service management system. The after-sales service department provides a customer hot line telephone service for our customers and performs return and exchange services, as well as process complaints from customers.

We provide a seven day return policy for our products which have quality issues, and a 12 months warranty. During the warranty period, if our products are out of order, we will provide repair service free of charge (excluding the consumable parts such as the filter in the water purifier), or we can exchange the product or provide a refund if the product cannot be repaired due to the quality issue. If the products are impaired due to lack of care or misuse by the customers, the customers will be liable for all the repair service charges.

Insurance agency business

We have entered into insurance agency contracts with various insurance companies in the Liaoning Province, China. The insurance companies are responsible for providing insurance products, pre-sale training of insurance products, sales consultation and after-sales service to our member agents. We are responsible for selling insurance products, recruiting and training insurance agents. Our revenue in this segment is mainly derived from the commissions of sales of insurance products.

Small loan business processes

Our small loan business is composed of sixteen steps, including marketing before the lending, business acceptance, survey before the lending, data acceptance, data input, material review, phone check, approving loans, signing contract, handling guarantee, lending examination, lending operation, file management, the management after the lending, service after the lending, and loan collection.

The stage before the lending includes marketing before the lending, business acceptance, survey before the lending, Our credit department is responsible for completing these items.

The stage during the lending includes data acceptance, data input, material review, phone check, approving loans, signing contract, handling guarantee, lending examination, and lending operation. Our risk control department is responsible for these items.

The stage after the lending includes archiving portfolios, performing after the lending management and service, collecting loans. The risk control department and finance department are responsible for the management after the lending and loan collection. The credit department and comprehensive administration department take charge of service after the lending.

We apply strict controls to make sure there is no conflict of interest in performing the loan and financing services. Our loan approval team must be separated from the guaranty team, while our lending examiner must be independent from our sales persons who reach out to the collaborating business partners.

“E-Commerce”

We purchase and sell our “E-Commerce” merchandises based on the market demands and our customer preferences. Our goal is to meet the demand of our customers to the maximum extent and reduce any possible storages of products.

We sell our assembled products through our online website and our physical stores. We are responsible for the costs and expenses of the product promotions and marketing, quality controls and after-sales and customer services.

As to other products, we generally purchase these products from the manufacturers. If we satisfy certain purchase targets from the product manufacturers, we may serve as the exclusive regional sales agent for the manufacturers. For the fiscal years ended March 31, 2011 and 2010, we were the exclusive regional sales agent for various products. Under the purchase model from the products manufacturers, we make profits margins between the re-sale prices and purchase prices.

Our Suppliers

The following table summarizes raw materials and products purchased from major suppliers (each 10% or more of total raw material and products purchased):

|

Purchased from

|

Number of

|

Percentage of

|

||||||||||

|

For The Fiscal Years Ended March 31,

|

Major Suppliers

|

Suppliers

|

Total Purchased

|

|||||||||

|

2011

|

$

|

1,200,333

|

5

|

94.47%

|

||||||||

|

2010

|

$

|

1,204,129

|

3

|

43.05%

|

||||||||

10

Following is a list of our top ten suppliers for our water purifier and online merchandizes for the fiscal year ended March 31, 2011:

|

Name of Suppliers

|

Products from Suppliers

|

|

Beijing Times Meiye Technology Development Co.Ltd.

|

Magical treasures EGF gift pack

|

|

Beijing Shuainihong Gene Technology Ltd.

|

Shuainihong gene system biology skincare products

|

|

Yongkang Liancheng Trading Ltd.

|

Water cup series

|

|

Wenzhou Jia Tai Latex Ltd.

|

Natural latex mattresses

|

|

Qingdao Juntong Biotechnology Co., Ltd.

|

Qianzhu series marine biological diet therapy products

|

|

Hangzhou Bolaite Electric Ltd.

|

Water purifier accessories

|

|

Shenzhen Shanyue Technology Development Ltd.

|

Lotus brand silver ions soft cotton for sanitary towel

|

|

Tianjin Dinghe Houseware Co., Ltd.

|

Natural latex mattresses

|

|

Shenyang City, Shen He District, Xin zhenfa Electronics trading company.

|

Water purifier accessories

|

|

Kunshan City Jinjiang Electronics Technology Co., Ltd.

|

Water purifier accessories

|

Following are the suppliers for our insurance products sales for the fiscal year ended March 31, 2011:

|

Suppliers

|

Insurance Policies purchased from this supplier USD ($)

|

|

Generali China Life Insurance Company Ltd., Liaoning Province Branch

|

10,781

|

|

Ping An Insurance (Group) Company of China,Ltd. Shengyang Center

|

9,704

|

|

New China Life Co., Ltd. Liaoning Branch

|

8,273

|

|

Heng An Standard Life Co., Ltd. Liaoning Branch

|

5,563

|

|

TOTAL

|

34,321

|

Our Customers

Our customers include both individuals and companies. From April 1, 2010 to March 31, 2011, Shengyang City Heping District Jiuyan Health Care Store (store owner: Shouju Fei) and Dongfang Jixiang Store (store owner: Jinyang Yuan) were our top two customers purchasing 20.06% and 14.46% of our total sold products respectively.

Sales and Marketing

Water purifier business

The current rate of use of water purifiers in mainland China is at a1% level. There is a huge potential market in china. According to Chinese office statistics, by the end of 2010, the demand for water purifiers in china is approximately 30,000,000 sets, changing frequent rate is 20%. For the fiscal year ended March 31, 2011, we have sold approximately 2,500 sets of water purifiers.

Insurance business

According to the statistics conducted by the Insurance Association of China, by the first half year of 2010, there were 2,538 insurance professional agency companies in China and 156,000 companies involved in the insurance business. The total salesmen have reached more than 3,020,000 people. In order to better develop our service and management, we established Vantone Online on April 1, 2010 to operate all of our sales businesses including sales of water purifying equipment, small loan financing, “E-Commerce” merchandises, and insurance-related products on the internet platform. Commencing from April 1, 2011, we plan to open physical stores. As a result, we can sell our insurance products either in our physical locations or on Vantone Online system. We also recruit our insurance agents as registered members of Vantone Online Store to better expand our insurance agent business. By June 2011, we have more than 700 registered online members as our insurance agents.

Small loan financing

By the end of June 30, 2010, there were approximately 1,940 small loan financing companies in China. The total registered cost is RMB124.249 billion, the amount of loan is RMB124.48billion (Source: China's small loan company peak BBS http://finance.ce.cn/rolling/201007/23/t20100723_15997795.shtml). Vantone Small Financing was incorporated on September 27, 2010. As of March 31, 2011, we lent the total principal loans of RMB 46.20 million, or approximately $7,053,111, to our customers. We had a total of 1,234 customers. For the fiscal year ended March 31, 2011, we provided small financing loans to individual customers only. Commencing April 2011, we will provide small financing service to individuals and corporate entities to better develop our business.

Competition

Water purifier industry. The water purifier industry is an emerging industry in China. Our main competitors are Midea Company, which has very high brand recognition and an advantage in the Chinese electrical appliances industry, and Qinyuan, a traditional water purifier manufacturer, which is an early participant in water purifier industry in China. We believe that we need to increase our brand recognition in China to improve our sales and revenues.

11

Insurance agency industry. Due to our limited scope of the insurance agency business, our main competitors in the insurance agency business are the insurance company’s and the insurance agent company’s engaging in the life insurance business in the Liaoning province.

Small Financing industry. The small loan industry is still in the pilot phase in China. We believe that the competition between small financing companies has not yet formed and we have the advantages due to our “3+E” business model.

Our Competitive Advantages

We believe we have the following competitive advantages:

E-Commerce Business Model.

On Vantone Online, we manage and serve our members through electronic information technology. Our E-commerce is conducted electronically for virtual items (including, merchandise, insurance products and small loan financing service) such as access to premium content on a website, as well as the transportation of physical items and online inquires. Our E-commerce is conducted under the business model of “Business to Customer”. This E-Commerce operation has improved our management ability and our processing efficiency so that we can better and faster provide services for members. Members now can use Vantone Online marketing system to make sales and purchases. Meanwhile, we provide members with the ordering services, fund settlements and small financing and loan services online as well. This combined online business model in northeastern China is rarely adopted by other competitors and we are one of the few leading companies in the local market with the E-commerce business model in insurance, small financing and the health related products sales market. The adoption of the E-commerce business model also reduces substantial capital expenditures and other costs and expenses usually associated with the physical commercial leasing of stores and franchises and employment costs.

Market Position. Currently, our members distribute our water purifier and related products other than insurance products in the following cities or provinces in China: Liaoning, Heilongjiang, Jilin, Beijing, Tianjin, Cangzhou of Hebei, and Shijiazhuang. Red dots illustrated in the chart below represent the provinces where we have established distribution channels, with each city containing several distributors through our members.

Advanced Technology. We have the core technology in water purifying products - the “backwash assembly” technology, which is a key component of our water purifier. We have designed, researched and developed this “backwash assembly” technology to adapt our water processing system and equipment products to different area in various water conditions. With this technology, the use life of our water purifying equipment is substantially prolonged. We consider this technology as our key technology as one of our competitive strengths in the current water purifier market in China.

12

Solid Customer Base. After years of development, we have established our loyal client networks nationwide and insurance-related products customer base in the Liaoning Province. When an individual insurance agent or agent company becomes one of our members, they would bring us their existing clients. Moreover, through the efforts of our small loan business to support our members opening “Vantone” brand franchised physical store, we will aggressively explore our client base in the near future.

Experienced Management Team. Our key management team has decades of experience in finance, banking, insurance and water-purifying industries. Our chairman, CEO and CFO, Mr. Honggang Yu, our Directors and Vice Presidents Mr. Dongfeng Liu, Mr. JutieHua and Mr. Jichun Li, our senior executive Managers Mr. Xianzhi Liu and Ms. Hong Jia, all have very extensive working experience in the above industries. Our management has an open mind in internal management of the Company and we are recruiting needed staff and officers at various stages of our business development.

Intellectual Property

We own and utilize the trademarks, patents and domain name listed below. We continuously look to increase the number of our trademarks and potential design and utility model patents where necessary to protect valuable intellectual property. We regard our trademarks and other intellectual property as valuable assets and believe that they have significant value in the marketing of our products. We vigorously protect our trademarks against infringement, including through the use of cease and desist letters, administrative proceedings and lawsuits.

We rely on trademark, patent, copyright and trade secret protection, non-disclosure agreements and licensing arrangements to establish, protect and enforce intellectual property rights in our logos, trade names and in the design of our products. In particular, we believe that our future success will largely depend on our ability to maintain and protect the “VANTONE” trademark. Despite our efforts to safeguard and maintain our intellectual property rights, we cannot be certain that we will be successful in this regard. Furthermore, we cannot be certain that our trademarks, products and promotional materials or other intellectual property rights do not or will not violate the intellectual property rights of others, that our intellectual property would be upheld if challenged, or that we would, in such an event, not be prevented from using our trademarks or other intellectual property rights. Such claims, if proven, could materially and adversely affect our business, financial condition and results of operations. In addition, although any such claims may ultimately prove to be without merit, the necessary management attention to and legal costs associated with litigation or other resolution of future claims concerning trademarks and other intellectual property rights could materially and adversely affect our business, financial condition and results of operations.

The laws of certain foreign countries do not protect intellectual property rights to the same extent or in the same manner as do the laws of the PRC. Although we continue to implement protective measures and intend to defend our intellectual property rights vigorously, these efforts may not be successful or the costs associated with protecting our rights in certain jurisdictions may be prohibitive. From time to time we may discover products in the marketplace that are counterfeit reproductions of our products or that otherwise infringe upon intellectual property rights held by us. Actions taken by us to establish and protect our trademarks and other intellectual property rights may not be adequate to prevent imitation of our products by others or to prevent others from seeking to block sales of our products as violating trademarks and intellectual property rights. If we are unsuccessful in challenging a third party’s products on the basis of infringement of our intellectual property rights, continued sales of such products by that or any other third party could adversely impact the “VANTONE” brand, result in the shift of consumer preferences away from our products and generally have a material adverse effect on our business, financial condition and results of operations.

Trademarks

We have registered the following trademarks with the Trademark Office, State Administration for Industry and Commerce in the PRC:

|

No.

|

Registration No.

|

Trademark

|

Registrant

|

Item Category

|

Expiration Date

|

|||||

|

1

|

7158721

|

SEASIDE NATURAL

|

Vantone Manufacturing

|

Category No. 11: Apparatus for lighting, heating, steam generating, cooking, refrigerating, drying, ventilating, water supply and sanitary purposes.

|

October 20, 2020

|

|||||

|

2

|

5941954

|

VANTONE

|

Vantone Manufacturing

|

Category No. 30: Coffee, tea, cocoa, sugar, rice, tapioca, sago, artificial coffee; flour and preparations made from cereals, bread, pastry and confectionery, ices; honey, treacle; yeast, baking-powder; salt, mustard; vinegar, sauces ( condiments); spices; ice.

|

January 27, 2020

|

|||||

|

3

|

5941888

|

VANTONE

|

Vantone Manufacturing

|

Category No. 34: Tobacco; smokers’ articles; matches.

|

January 6, 2020

|

|||||

|

4

|

5941956

|

VANTONE

|

Vantone Manufacturing

|

Category No. 35: Advertising; business management; business administration; office functions

|

July 27, 2020

|

We plan to file for extension with the Trademark Office of the above trademark before the expiration date.

13

Patents

We have been granted the following patent by the State Intellectual Property Office, or SIPO, of PRC. We enjoy a ten year protection period starting from the patent application date.

|

Patent No.

|

Patent Name

|

Patent Owner

|

Application Date

|

Date of Grant

|

Type

|

|||||||

|

ZL201020138272.5

|

UF Water Filter

|

Vantone Manufacturing

|

03/23/2010

|

01/26/2011

|

Utility model

|

We have another application for patent currently pending with the State Intellectual Property Office, or SIPO, of PRC:

|

Patent No.

|

Patent Name

|

Patent Owner

|

Application Date

|

Date of Grant

|

Type

|

|||||

|

------------

|

Water Filter

|

Vantone Manufacturing

|

03/23/2010

|

--------------

|

Utility Patent

|

Domain Names

Vantone International owns the domain names of www.myvantone.com and http://vantoneint.com.

Employees

As of June 2011, we have a total of 48 full-time employees. The breakdown of our employees by department is:

|

General and Administration Department

|

11

|

|

Financial Department

|

10

|

|

Human Resource Department

|

8

|

|

Production Department

|

6

|

|

Marketing Department

|

9

|

|

Small Loan Financing Department

|

4

|

Our employees are not represented by any collective bargaining agreement and we believe we have never experienced a work stoppage. We believe we have good relations with our employees.

ITEM 1A. RISK FACTORS.

You should carefully consider the risks described below together with all of the other information included in this Form 10-K. The statements contained in or incorporated herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. See “Cautionary Statement Regarding Forward-Looking Statements.” If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, you may lose all or part of your investment.

Risks Relating to Our Business

If the water purifier market, commodities consumer market, insurance product market as well as small financing business fail to develop prospectively in china, our profitability may be reduced.

In recent years, China's economic develop constantly, so our commodities and insurance products market scale expands steadily. The two markets continuously bring in new products, new rivals continuously explore the favor of the client, and current competitors adjusted the strategy to support further promotion and development. We expect the two markets will continue to grow; and we must adjust our strategy to adapt the market development continuously. But now the entire world faces the economic crisis, which made economic growth slowdown, so the long-term trend of China's economy is unpredictable. Meanwhile, consumer’s taste is hard to be predicted accurately. If we are not able to find the suitable products successfully, our profit ability would be affected.

With the enhancement of Chinese consumer spending ability and the quality requirement of daily drinking water, the market of water purifier’s demand expands steadily in China. However, if we cannot develop new products effectively, improve the products quality, reduce the production cost and enhance the brand awareness, we will not have significant competitive advantage, and our profitability would be affected.

Small financing & mortgage company is an emerging non-financial corporation in China, but due to the Chinese economic growth slows down, aggravate of the inflation and influence of the prospective on raising the interest rate, if we can’t expand investment channel effectively for attracting more clients, our profitability is hard to be forecasted. Small financing & mortgage business may incur the risk of which the principal and interest is unable to recover, which might affect our profitability.

14

We are implementing significant changes in our business plan. If we fail to effectively manage the transition, our business and operating results could be harmed.

During the past fiscal year we began to implement significant changes in our business plan. Initially we began to transition from a franchise marketing model to an agency model. Then we added to our product offerings higher priced electronic products in February 2009. Both of these changes have resulted in disruptions in our financial results. In 2010 we cancelled our entire sales network and devoted our business to an e-commerce platform. We established a 3+E operation model. These changes have taken place, and will continue to spread, thus it requires the better basis on our management and financial affairs. In addition, if the necessary funding can be obtained, we will be able to improve our operational, financial and management controls as well as our reporting systems and procedures. The complexity of this business plan means that we are likely to face many challenges, some of which are not foreseeable. Problems may occur with our business relationship with the suppliers, and furthermore some of them cannot be forecasted. It may suffer from some problem that the relationship between supplier and us as well as our ability to sell our products to our customers. If we are not able to obtain the necessary funding and operate efficiently, our business plan may fall short of its goals, and our ability to manage our growth could be hurt.

An increase in wholesale prices for our distributed products could increase our costs and decrease our profits.

Changes in wholesale prices for our distributed products could significantly affect Vantone’s business. Since the cost of the distributed materials is a substantial part of our product price, the increase in the cost will decrease our gross profit margin. We also rely on several major suppliers to provide such products to distribute. Failure to maintain business relationship with these major suppliers may make the distributed products inaccessible, and thus hurt our operating results.

We may have difficulty in establishing adequate management and financial controls in China.

The People’s Republic of China has only recently begun to adopt the management and financial reporting concepts and practices that investors in the United States are familiar with. We may have difficulty in hiring and retaining employees in China who have the experience necessary to implement the kind of management and financial controls that are expected of a United States public company. If we cannot establish such controls, we may be lack of experience in collecting financial data, preparing financial statements, keeping accounts and setting the accounting standard for business according to U.S. standards.

We may incur significant costs to ensure compliance with U.S. corporate governance and accounting requirements.

According to the Sarbanes-Oxley Act of 2002, Sarbanes-Oxley, or other rules implemented by the Securities and Exchange Commission, we may incur the costs associated with the requirement for the financial reports of public companies reporting requirements and for the new corporate governance. We expect all of these applicable rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors, on committees of our board of directors or as executive officers.

As a public company, we are required to comply with rules and regulations of the SEC, including expanded disclosure, accelerated reporting requirements and more complex accounting rules. This will continue to require additional expenditures of cash and management resources. We will need to continue to implement additional finance and accounting systems, procedures and controls as we grow to satisfy these reporting requirements. In addition, we may need to hire additional legal and accounting staff with appropriate experience and technical knowledge, and we cannot assure you that if additional staffing is necessary that we will be able to do so in a timely fashion. If we are unable to complete the required annual assessment as to the adequacy of our internal reporting or if our independent registered public accounting firm is unable to provide us with an unqualified report as to the effectiveness of our internal controls over financial reporting in the future, we could incur significant costs to become compliant.

We rely on highly skilled personnel and, if we are unable to retain or motivate key personnel or hire qualified personnel, we may not be able to grow effectively.

Our performance largely depends on the talents and efforts of highly skilled individuals. Our future success depends on our continuing ability to identify, hire, develop, motivate and retain highly skilled personnel for all areas of our organization.

The elimination of monetary liability against our directors, officers and employees under Nevada law and the existence of indemnification rights to our directors, officers and employees may result in substantial expenditures that could be a drain on our resources by our Company and may discourage lawsuits against our directors, officers and employees.

Our certificate of incorporation and applicable Nevada law limit monetary liability against our directors, officers and employees and provide for the indemnification of our directors, officers, employees, and agents, under certain circumstances, against attorney’s fees and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities on behalf of us. Accordingly, we will have a much more limited right of action against our directors than otherwise would be the case. We will also bear the expenses of such litigation for any of our directors, officers, employees, or agents, upon such person’s promise to repay us if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us that we would be unable to recoup. These provisions and resultant costs may also discourage our company from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our stockholders against our directors and officers even though such actions, if successful, might otherwise benefit us and stockholders.

15

We do not foresee paying cash dividends in the foreseeable future and, as a result, our investors’ sole source of gain will depend on capital appreciation, if any.

We do not plan to declare or pay any cash dividends on our shares of common stock in the foreseeable future and currently intend to retain any future earnings for funding growth. As a result, investors should not rely on an investment in our securities if they require the investment to produce dividend income. Capital appreciation, if any, of our shares may be investors’ sole source of gain for the foreseeable future. Moreover, investors may not be able to resell their shares of the Company at or above the price they paid for them.

We rely on key personnel and the loss of any key employees, officers and/or directors may have a materially adverse effect on our operations.

Our success is substantially dependent on the continued services of our executive officers, particularly Honggang Yu, our Chairman, CEO and CFO, and other key personnel who generally have extensive experience in the water purification industry, small financing industry as well as insurance agency industry. The loss of the services of any key employee, or our failure to attract and retain other qualified and experienced personnel on acceptable terms, could have a material adverse effect on our business and results of operations.

Compliance with changing regulation of corporate governance and public disclosure will result in additional expenses.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and related SEC regulations, have created uncertainty for public companies and have significantly increased the costs and risks associated with accessing the public markets and public reporting. Our management team will need to invest significant management time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to compliance activities.

We may not be able to meet the internal control reporting requirements imposed by the SEC resulting in a possible decline in the price of our common stock and our inability to obtain future financing.

As directed by Section 404 of the Sarbanes-Oxley Act, the SEC adopted rules requiring each public company to include a report of management on the company’s internal controls over financial reporting in its annual reports. Although the Dodd-Frank Wall Street Reform and Consumer Protection Act exempts companies with a public float of less than $75 million from the requirement that our independent registered public accounting firm attest to our financial controls, this exemption does not affect the requirement that we include a report of management on our internal control over financial reporting and does not affect the requirement to include the independent registered public accounting firm’s attestation if our public float exceeds $75 million.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. Regardless of whether we are required to receive a positive attestation from our independent registered public accounting firm with respect to our internal controls, if we are unable to do so, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the SEC, which could also adversely affect the market for and the market price of our common stock and our ability to secure additional financing as needed.

Certain provisions of our Certificate of Incorporation may make it more difficult for a third party to effect a change in control.

Specific rights granted to future holders of preferred stock could be used to restrict our ability to merge with, or sell assets to, a third party. The ability of our board of directors to issue preferred stock could make it more difficult to delay, discourage, prevent or make it more costly to acquire or effect a change-in-control, which in turn could prevent the stockholders from recognizing a gain in the event that a favorable offer is extended as well as could materially and negatively affect the market price of our common stock. Our bylaws or certificate of incorporation do not contain any other provisions that would have the effect of delaying or preventing a change in control.

16

Risks Relating to the People’s Republic of China

Almost all of our assets are located in the PRC and almost all of our revenues are derived from our operations in China, and changes in the political and economic policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and accordingly on the results of our operations and financial condition.

Our business operations may be adversely affected by the current and future political environment in the PRC. The Chinese government exerts substantial influence and control over the manner in which we must conduct our business activities. Our ability to operate in China may be adversely affected by changes in Chinese laws and regulations, including those relating to taxation, import and export tariffs, raw materials, environmental regulations, land use rights, property and other matters. Under the current government leadership, the government of the PRC has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the government of the PRC will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

Our operations are subject to PRC laws and regulations that are sometimes vague and uncertain. Any changes in such PRC laws and regulations, or the interpretations thereof, may have a material and adverse effect on our business.

We conduct our business primarily through Vantone Manufacturing which is a subsidiary company in PRC and its variable interest entities including Vantone Yuan Trading, Vantone Insurance and Vantone Financing. Our operations in China are governed by Chinese laws and regulations. We are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to wholly foreign-owned enterprises. Because Chinese laws are all statute laws, prior court decisions may be referred to but they are not legal precedents.

The legal system in China is a system of civil laws, based on provisions and written codes, therefore precedents and cases are not binding on the future decisions of the courts. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including, but not limited to, the laws and regulations governing our business, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy or criminal proceedings. Only after 1979 did the Chinese government begin to promulgate a comprehensive system of laws that regulate economic affairs in general, deal with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade, as well as encourage foreign investment in China. Although the influence of the law has been increasing, China has not developed a fully integrated legal system and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. Also, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. In addition, there have been constant changes and amendments of laws and regulations over the past 30 years in order to keep up with the rapidly changing society and economy in China. Because government agencies and courts provide interpretations of laws and regulations and decide contractual disputes and issues, their inexperience on new business and new polices or regulations in certain less developed areas causes uncertainty and may affect our business. In some provincial areas, the government agencies and the courts are protectionist and may not fully enforce contractual rights against local parties. In certain areas, the intellectual property and trade secret protections are not as effective as those in the other areas in China or in the U.S. in general. Consequently, we cannot clearly foresee the future direction of Chinese legislative activities with respect to either businesses with foreign investment or the effectiveness on enforcement of laws and regulations in the less developed areas in China. The uncertainties, including new laws and regulations and changes of existing laws, as well judicial interpretation by inexperienced officials in the agencies and courts in certain areas, may cause possible problems to foreign investors.

Investors may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in China based upon U.S. laws, including the federal securities laws or other foreign laws against us or our management.

Most of our current operations, including the manufacturing and distribution of our products, are conducted in China. Moreover, all of our directors and officers are nationals and residents of China. All or substantially all of the assets of these persons are located outside the United States and in the PRC. As a result, it may not be possible to effect service of process within the United States or elsewhere outside China upon these persons. In addition, uncertainty exists as to whether the courts of China would recognize or enforce judgments of U.S. courts obtained against us or such officers and/or directors predicated upon the civil liability provisions of the securities laws of the United States or any state thereof, or be competent to hear original actions brought in China against us or such persons predicated upon the securities laws of the United States or any state thereof.

In insurance supervision, potential legal liabilities may come from market access restrictions of insurance services. Pursuant to the conditions for market access of insurance services under China Insurance Regulatory Commission ‘Provisions on the Supervision and Administration of Specialized Insurance Agencies’ (No.5, 2009 of Order of China Insurance Regulatory Commission), the registered capital of a specialized insurance agency shall be not less than RMB 2 million, while that of a specialized insurance agency whose business area is not limited to the province, autonomous region or municipality directly under the Central Government at the place of registration shall be not less than RMB 10 million. The registered capital of a specialized insurance agency must be paid-in monetary capital. A specialized insurance agency formed with the minimum registered capital allowed by these Provisions is entitled to form three branch offices, and shall increase its registered capital by at least RMB 200,000 each time it applies for forming a new branch office in addition to the three branch offices. In particular, each time when it applies for forming a branch office in a province, autonomous region or municipality directly under the Central Government other than its place of domicile, it shall increase its registered capital by at least RMB 1 million. If the increased registered capital of the specialized insurance agency reaches the requirement of the preceding paragraph when it applies for setting up a branch office, it is not required to increase the registered capital any more. If the registered capital of the specialized insurance agency is RMB 20 million or more, it is not required to increase the registered capital for the purpose of setting up branch offices. Vantone Insurance currently only can provide the insurance service in Liaoning Province, and can’t operate insurance service in other province.

17

In financial supervision, potential legal liabilities may come from the loan interest rate. Pursuant to the Guidance on the Small Loan Company Pilot of the China Banking Regulatory Commission and the People's Bank of China (No.23, 2008 of China Banking Regulatory Commission), small loan companies operate in accordance with market principles, unloosening the cap of loan interest rate, but not exceeding the upper limitation which set by the judicial departments. The lower limit is 0.9 times of the benchmark rate which published by the people's bank of china, and the specific self-floating rate is determined in accordance with market principles. The repayment of the loan term, loan terms, etc. in the contract, shall be fixed by both lenders and borrowers according to law under the principle of fair and voluntary consultation. In other words, the loan interest rate’s interval will between 0.9 times and 4 times of the People's Bank of China’ s benchmark rate during the same term and the same level of the loan.

Although the above mentioned, but we can't guarantee that we will always abide by the laws and regulations or we needn't spend a lot of money to comply with environmental laws, regulations and permits, or pay off the responsibility which incurred by these regulations.

Our labor costs are likely to increase as a result of changes in Chinese labor laws.