Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DYNEGY HOLDINGS, LLC | d8k.htm |

| EX-99.1 - PRESS RELEASE - DYNEGY HOLDINGS, LLC | dex991.htm |

Exhibit 99.2

Executive Summary

Reorganization overview

Summary of the reorganization process

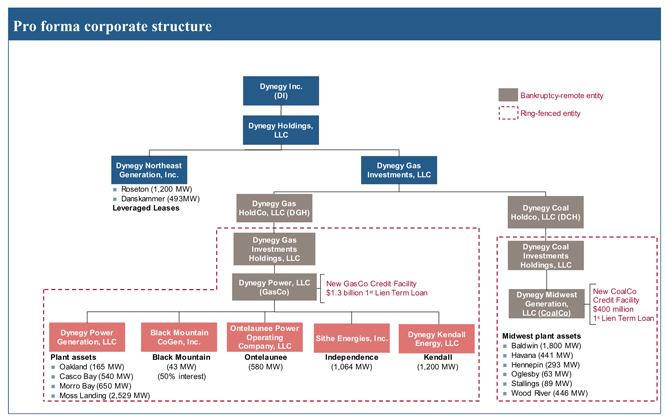

Pursuant to a series of transactions, the Company intends to, in conjunction with the closing of the proposed financings (together, the “Financing”), directly or indirectly, pursue a Reorganization of Dynegy Holdings Inc. (“DHI”) and its subsidiaries whereby, inter alia, (x) substantially all of the Company’s coal-fired power generation facilities would continue to be held by Dynegy Midwest Generation, Inc. (“DMG” or CoalCo), (y) substantially all of the Company’s gas-fired power generation facilities would be held by Dynegy Power Corp. (“DPC” or GasCo) and (z) 100% of the ownership interests of Dynegy Northeast Generation (“DNE”), the entity that indirectly holds the equity interest in the subsidiaries that operate the Roseton and Danskammer power generation facilities, would be held by DHI. The Reorganization will be undertaken via a series of inter-related transactions as outlined below and collectively referred to herein as the “Transactions”:

Step 1: Creation of GasCo, CoalCo and HoldCos

| • | Transfer to DPC of 100% of (i) DHI’s ownership interests in Sithe Energies, Inc. (“Sithe”), the legal entity that indirectly owns the Independence gas-fired power generation facility, (ii) DMG’s ownership interests in Dynegy Kendall Energy, LLC, the legal entity that owns the Kendall gas-fired power generation facility, and (iii) Dynegy Power Marketing, Inc.’s (“DPM”) ownership interests in Ontelaunee Power Operating Company, LLC, the legal entity that owns the Ontelaunee gas-fired power generation facility, thereby creating the GasCo portfolio |

| • | Transfer to DHI of 100% of DPC’s ownership in DNE |

| • | Create (i) two new indirect subsidiaries of DHI (Dynegy Gas Holdco, LLC (“Gas Holdco”) and Dynegy Coal Holdco, LLC (“Coal Holdco”)) to act as holding companies, and (ii) two additional new entities (Dynegy Gas Investments Holdings, LLC (“DGI Holdings”) and Dynegy Coal Investments Holdings, LLC (“DCI Holdings”)) that will be 100% owned by Gas Holdco and Coal Holdco, respectively, and will act as holding companies for the GasCo and CoalCo portfolios. In creating each of the foregoing, the Company will implement the customary “bankruptcy remote” criteria and provisions required by the rating agencies |

| • | Transfer 100% of the ownership interest in DPC/GasCo to DGI Holdings and 100% of the ownership interest in DMG/CoalCo to DCI Holdings |

Step 2: Conversion of GasCo and CoalCo into bankruptcy remote entities

| • | Prior to completing the Financing, the Company intends that GasCo and CoalCo will also be converted into bankruptcy remote limited liability companies through (i) the modification of their constituent documents to, among other things, provide for an independent director or manager at each of GasCo and CoalCo (collectively, the “Borrowers”), (ii) the implementation of customary “bankruptcy remote” criteria and provisions required by the ratings agencies and (iii) in the case of GasCo only, undertaking to sell a 20% ownership interest in GasCo |

Step 3: Potential Tender for Sithe notes

| • | The Company and its subsidiaries may consummate, prior to, concurrently with or following the closing of the proposed Financing, a cash tender offer (“Sithe Tender”) for all outstanding Sithe securities (the “Sithe Debt”); provided that the Company is not required to consummate the Sithe Tender or repay the Sithe Debt prior to its maturity date; provided, further, that to the extent the Sithe Debt is not repaid within six months of the closing date of the GasCo Term Loan Facility, GasCo will be required to repay the GasCo Term Loans in a percentage to be agreed of the principal amount of the outstanding Sithe Debt |

1

Step 4: Enter into GasCo Term Loan Facility and CoalCo Term Loan Facility

| • | Following the closing of the New Credit Facilities, the Finance and Restructuring Committee of the Company’s Board of Directors will continue to work with its advisors in connection with additional potential debt restructuring activities, which may include direct or indirect transfers of equity interests of DCI Holdings and/or DGI Holdings, and/or further reorganizations of the Company and/or various of its subsidiaries |

Note: Abbreviated Chart

Overview of ring-fencing measures

Bankruptcy Remote Entities:

As described in the Summary of the Reorganization process, the Company will create, directly or indirectly, DCI Holdings and DGI Holdings, two newly formed special-purpose bankruptcy remote intermediate holding companies. Each of DGI Holdings and DCI Holdings will be newly formed Delaware entities. Each of DGI Holdings, DCI Holdings, and each Borrower will have at least one independent director or manager. Each of DGI Holdings, DCI Holdings, and each Borrower shall have customary rating agency “separateness” provisions, including without limitation, separately appointed board of directors or managers (as applicable), separate books and records, separately appointed officers or separate members (as applicable), separate bank accounts, holds itself out as separate legal entity and not a division of the Company, pays liabilities from its own funds, conducts business in its own name (other than any business relating to the trading activities of the Company and its subsidiaries), observes entity level formalities, not pledge its assets for the benefit of other persons and any other provisions reasonably required to effect the bankruptcy remoteness of such entities.

Independent Approval Matters:

Unanimous consent of the board of managers, including the independent manager, will be required for filing any bankruptcy proceeding, seeking or consenting to the appointment of any receiver, making or consenting to any assignment for the benefit of creditors, admitting in writing the inability to pay the applicable bankruptcy remote entity’s debts, consenting to substantive consolidation, dissolving or liquidating, engaging in any business

2

beyond those set forth in applicable bankruptcy remote entity’s organizational documents, amending the bankruptcy remoteness provisions in such entity’s organizational documents and, at any time following execution of the applicable credit agreement, amending, terminating or entering material intercompany relationships with Dynegy entities outside the ring fenced group.

Overview of Dynegy

Changes to operational model

Dynegy is implementing a modification of its asset ownership structure, which will:

| • | Eliminate regional organizational structure and replace with the structure depicted below |

| • | Reduce / consolidate non-plant support activities primarily to O’Fallon, IL and Houston, TX (CA / NY regional offices closed) |

| • | Focus on cost efficiencies at both operating facilities and support functions |

| • | Operating fleet supported by Dynegy service contracts |

| • | Adjust corporate functions to support new operational model |

| • | Focus on corporate cost efficiencies |

| GasCo (6,771 MW) | CoalCo (3,132 MW) | DHI (1,693 MW) | ||

| • Casco Bay (540 MW)

• Independence (1,064 MW)

• Kendall (1,200 MW)

• Ontelaunee (580 MW)

• Moss Landing (2,529 MW)

• Morro Bay (650 MW)

• Oakland (165 MW)

• Black Mountain (43 MW) |

• Baldwin (1,800 MW)

• Havana (441 MW)

• Hennepin (293 MW)

• Wood River (446 MW)

• Oglesby (63 MW)

• Stallings (89 MW) |

• Danskammer (493 MW)

• Roseton (1,200 MW) | ||

| Support Activities & Services | ||||

| • South Bay Demo

• Vermilion Mothball Project

• Capital and Budgeting

• Business Services

• Environmental Health & Safety

• NERC Compliance

• Engineering & Programs |

• Accounting

• Finance

• Treasury

• Tax

• Internal Audit

• Investor/Public Relations

• Strategic Planning/Business Development |

• Commercial Hedging, Fuel and Asset Management

• Legal Support

• HR

• IT | ||

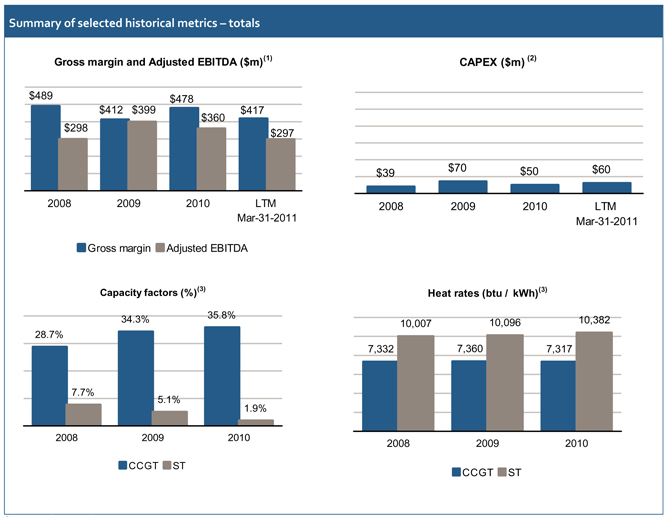

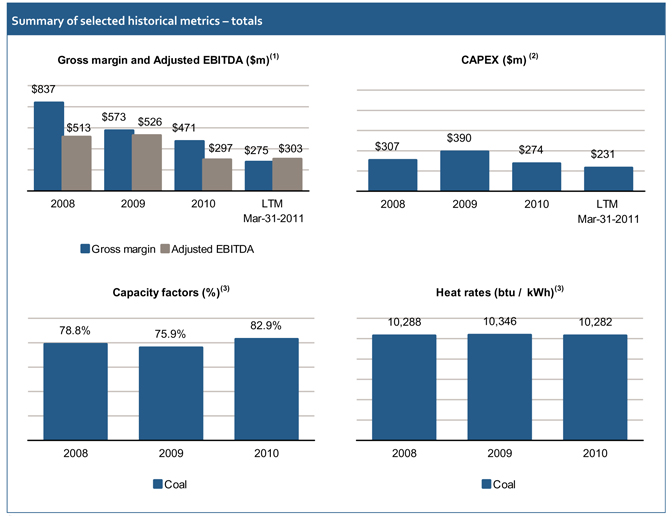

Unaudited selected financial information and operating metrics

The unaudited selected financial information and operating metrics contained herein gives effect to the Reorganization and includes adjustments directly attributable to the Reorganization. The unaudited selected financial information and operating metrics were prepared solely for purposes of the financing described herein and was not prepared with a view toward public disclosure or with a view toward complying with the published guidelines of the US Securities and Exchange Commission, the guidelines established by the American Institute of Certified Public Accountants with respect to such pro forma financial information or generally accepted accounting principles. In order to reflect the Restructuring in the selected financial data, Dynegy has made a number of assumptions, which are described below. Use of different assumptions and judgments could yield different results, and actual adjustments will likely differ from the financial information and operating metrics presented herein. The

3

unaudited selected financial information and operating metrics are for illustrative and informational purposes only and is not intended to reflect GasCo’s and CoalCo’s results of operations that would have actually resulted had the Reorganization been in effect for the periods presented. Further, the unaudited selected financial information and operating metrics are not necessarily indicative of the results of operations that may be obtained in the future, which may differ materially from the unaudited selected financial information and operating metrics presented herein due to various factors.

In preparing the selected financial information and operating metrics presented herein, Dynegy made the following assumptions:

| • | CoalCo includes the historical results of the Baldwin, Stallings, Wood River, Havana, Oglesby and Hennepin generation facilities, which have historically been included in the GEN-MW segment. It also includes the marketing and trading activities related to those generation facilities. |

| • | GasCo includes the historical results of the Moss Landing, Morro Bay, and Oakland generation facilities, which have historically been included in the GEN-WE segment; the historical results of the Kendall and Ontelaunee generation facilities, which have historically been included in the GEN-MW segment; and the historical results of the Casco Bay and Independence generation facilities, which have historically been included in the GEN-NE segment. GasCo also includes the marketing and trading activities related to those generation facilities and the regional administrative and other costs historically associated with the GEN-WE segment. |

| • | Other includes the historical results of the Roseton and Danskammer generation facilities, which have historically been included in the GEN-NE segment and the marketing and trading activities historically associated with these facilities. It also includes the historical results for plants that have been sold or are no longer in service. It includes regional overhead costs and certain trading results historically associated with the GEN-MW and GEN-NE segments which include both natural gas and coal-fired generation facilities. These costs may ultimately be allocated between CoalCo and GasCo. Similar costs historically associated with the GEN-WE segment have been allocated to GasCo as the GEN-WE segment only contains natural gas-fired generation facilities. Other also includes general and administrative and other costs that have not been allocated at the plant level. A portion of any or all of these items may ultimately be allocated to or included in CoalCo and GasCo; however, no allocation has been performed for purposes of the unaudited selected financial information included herein. |

The unaudited selected financial information was prepared using Dynegy’s historical consolidated financial statements and should be read in conjunction with, and is qualified in its entirety by such historical consolidated financial statements and notes thereto, which are publicly available.

Sources & uses of funds – GasCo

| (1) | Management estimate. |

| (2) | The Company may repay the Sithe Debt at its option. |

| Note: | Excludes credit facility repayments which have no net cash impact. |

4

Pro forma capitalization – GasCo

| ($ in millions) | ||||||||||||||

| PF | Debt / | |||||||||||||

| 5/ 2/ 2011 | LTM Adj. EBITDA | kW | Maturity | |||||||||||

| Unrestricted Cash and Equivalents |

$ | 200 | ||||||||||||

| Restricted Cash (Collateral) |

574 | |||||||||||||

| Unrestricted Cash at Dynegy Gas HoldCo LLC |

400 | |||||||||||||

| New 1st Lien Senior Secured Term Loan |

1,300 | Jul-2017 | ||||||||||||

| Total Debt |

$ | 1,300 | 4.4x | $ | 192 | |||||||||

| Net Debt (Total Debt less Unrestricted Cash) |

$ | 1,100 | 3.7x | $ | 163 | |||||||||

| 03/31/2011 LTM Adjusted EBITDA (1) |

$ | 297 | ||||||||||||

| Capacity (MW) |

6,771 | |||||||||||||

| (1) | Includes $38 million related to non-cash Independence amortization. |

Adjusted EBITDA is a non-GAAP financial measure. A reconciliation of this measure to the most directly comparable GAAP measure, to the extent available without unreasonable effort, is contained herein.

Sources & uses of funds – CoalCo

Pro forma capitalization – CoalCo

| ($ in millions) | ||||||||||||||

| PF | Debt / | |||||||||||||

| 5/ 2/ 2011 | LTM Adj. EBITDA | kW | Maturity | |||||||||||

| Unrestricted Cash and Equivalents |

$ | 263 | ||||||||||||

| Restricted Cash (Collateral) |

118 | |||||||||||||

| New 1st Lien Senior Secured Term Loan |

400 | Jul-2017 | ||||||||||||

| Total Debt |

$ | 400 | 1.3x | $ | 128 | |||||||||

| Net Debt (Total Debt less Unrestricted Cash) |

$ | 137 | 0.5x | $ | 44 | |||||||||

| 03/31/2011 LTM Adjusted EBITDA |

$ | 303 | ||||||||||||

| Capacity (MW) |

3,132 | |||||||||||||

Adjusted EBITDA is a non-GAAP financial measure. A reconciliation of this measure to the most directly comparable GAAP measure, to the extent available without unreasonable effort, is contained herein.

5

Certain Investment Considerations

| 1. | Substantive Consolidation Considerations |

In the event of a bankruptcy of DHI or any of its subsidiaries, DHI or its debtor subsidiaries (or their creditors) may seek to substantively consolidate DPC (GasCo), DGI Holdings, DMG (CoalCo) and/or DCI Holdings with the debtors’ estates.

DHI will remain highly leveraged following the closing of the GasCo Term Loan and CoalCo Term Loan (together, the “Loans”) as the issuer of $3.5 billion of senior unsecured notes and as a guarantor of the lease obligations associated with the Roseton and Danskammer facilities. In the absence of successful debt restructuring and/or refinancing, there can be no assurance that DHI or any of its subsidiaries will have sufficient resources to pay existing indebtedness. The Loans will restrict the ability of GasCo and CoalCo to pay dividends or make other restricted payments. If, as a result of such leverage or otherwise, DHI or any of its subsidiaries becomes the subject of a voluntary or involuntary bankruptcy case, DHI or any debtor subsidiary (or any trustee of the bankruptcy estate of DHI or any debtor subsidiary or any creditor thereof or other party in interest thereof) could ask the bankruptcy court with jurisdiction over any bankruptcy case to substantively consolidate one or more of DHI’s non-debtor subsidiaries (i.e., those that are not the subject of such cases) with the estate(s) of DHI and/or its debtor subsidiaries.

Among the conditions precedent to the closing of the GasCo Term Loan, outside counsel to GasCo has agreed to deliver a customary bankruptcy non-consolidation opinion reasonably satisfactory to Credit Suisse Securities (USA) LLC and Goldman Sachs Lending Partners LLC (together, the “Arrangers”) which will, among other things, point to facts that would suggest consolidation would not likely be applied by a court. Among the factors as to which such a non-consolidation opinion will focus is the fact that each of GasCo and DGI Holdings (its direct newly-formed holding company) will have customary rating agency “separateness” provisions, including, without limitation, a separately appointed board of managers, separate books and records, separately appointed officers, hold itself out as a separate legal entity and not as a division of Dynegy, DHI or any of its subsidiaries, pay its liabilities from its own funds, conduct business in its own name (other than using certain Dynegy entities to conduct trading actions on its behalf), observe entity level formalities, not pledge its assets for the benefit of other persons and any other provisions reasonably required to effect the bankruptcy remoteness of such entity. The same provisions will apply in the case of CoalCo and DCI Holdings.

The facts supporting the non-consolidation opinion (and the fact that each of GasCo, DGI Holdings, CoalCo and DCI Holdings are structured as bankruptcy-remote entities, as discussed in Section 3 of Certain Investment Considerations below) would be utilized in defending against a request for substantive consolidation. Nevertheless, a court could order substantive consolidation of the estates of DHI and/or any debtor subsidiaries, on the one hand, and GasCo, DGI Holdings, CoalCo and/or DCI Holdings on the other hand.

| 2. | Investment Considerations Associated With Characterization of Certain Restructurings Following Closing of Loans |

Following the closing of the Loans, Dynegy may engage in transactions that increase the likelihood of its estate or creditors challenging the pre-Loan transactions.

Following the closing of the Loans, the Finance and Restructuring Committee of Dynegy’s Board of Directors will continue to work with its advisors in connection with additional potential debt restructuring activities, which may include direct or indirect transfers of equity interests of DCI Holdings and/or DGI Holdings on terms which would be duly authorized by Dynegy’s Board of Directors as lawful, and/or further reorganizations of Dynegy and/or various of its subsidiaries (collectively, “Post-Closing Restructuring Transactions”). See Step 4 in Summary of the reorganization process. The terms of the Loans will not prevent Dynegy from doing so. To the extent that (a) one or more of such Post-Closing Restructuring Transactions is determined to be an actual or constructive fraudulent transfer because, among other things, a court determines that such Post-Closing Restructuring Transaction(s) is not supported by reasonably equivalent value, and (b) the components and structure of the entire transaction (i.e., the furnishing of the Loans and the effectuation of the applicable Post-Closing Restructuring Transactions) are determined to be part of a single integrated scheme, a court could “collapse” the transaction and, could impose one

6

of the Fraudulent Conveyance Remedies (defined in Section 4 of Certain Investment Considerations below) upon the lenders in respect of the applicable Loans (the “Lenders”). The consequences of such a collapse could include (x) the “unwinding” of all of the steps in the entire transaction including the portion of the transaction related to the furnishing of the Loans in an effort to return the various transferred property to its original estate, and (y) the imposition of a remedy requiring the Lenders (as alleged beneficiaries of the overall transaction) to pay an amount equal to the value of the challenged transfers (plus potentially any post-transfer depreciation in the value of the transferred property, which may include the litigation expense incurred or reimbursed by the transferor).

| 3. | Investment Considerations Associated With Bankruptcy Remote Structures |

Each of DPC (GasCo)’s and DMG (CoalCo)’s bankruptcy-remote structure may be subject to challenge

Each of DPC (GasCo)’s and DMG (CoalCo)’s formation documents will be amended to include provisions that establish it as a bankruptcy-remote entity which will, among other things, have at least one independent director or manager and various other indicia of separateness that, in the case of DPC (GasCo), are necessary for it to obtain the desired rating from the applicable ratings agencies. While structuring each of DPC (GasCo) and DMG (CoalCo) as a bankruptcy remote vehicle is intended to make it less likely that either DPC (GasCo) or DMG (CoalCo) will file for bankruptcy (or be subject to the filing of an involuntary bankruptcy case), there can be no certainty that, under specific facts, such entity will not ultimately be the subject of a bankruptcy case.

| 4. | Investment Considerations Related to GasCo’s Formation and its Upstream Distribution of Loan Proceeds |

While we have no reason to believe that DPC (GasCo) or any of the entities involved in the pre-Loan transfers that embody the formation of DPC (GasCo) are, or upon closing of the applicable transfers or the Loans, will be, rendered insolvent, if that is not the case, DPC (GasCo), as a debtor in possession, or its creditors (on behalf of DPC (GasCo)’s bankruptcy estate or individually if DPC (GasCo) is not in bankruptcy) may claim that (A) the transfers of assets in the creation of DPC (GasCo) constituted fraudulent transfers and seek remedies (either within or outside of a bankruptcy filing), which could include the unwinding of those transfers, and/ or (B) DPC (GasCo)’s distribution of a portion of the proceeds from the GasCo Term Loan to DHI constituted a fraudulent transfer and seek remedies (either within or outside of a bankruptcy filing), which could include the unwinding of those distributions.

As set forth under “Reorganization overview” above, prior to the closing of the Loans, certain preliminary steps will be taken (at entities below the corporate level of DHI) to facilitate the ultimate creation of GasCo (and CoalCo), including, among others, the following: (a) DHI will transfer to DPC (GasCo) its 100% ownership interest in Sithe Energies, Inc.; (b) DMG (CoalCo) will transfer to DPC (GasCo) its 100% ownership interest in Dynegy Kendall Energy, LLC; (c) DPC (GasCo) will transfer to DHI (i) its 100% ownership interest in Dynegy Operating Company and (ii) its 100% ownership interest in DNE; (d) a new subsidiary of DHI will be created (“DHIS”); (e) two new direct subsidiaries of DHIS will be created (Gas Holdco and Coal Holdco); (f) a new direct subsidiary of Gas Holdco(DGI Holdings) and a new direct subsidiary of Coal Holdco (DCI Holdings) will be created; (g) DPM will transfer its 100% ownership interest in DPC (GasCo) to DGI Holdings; and (h) DPC (GasCo) will transfer its 100% ownership interest in DMG (CoalCo) to DCI Holdings.

Thus, upon the completion of the foregoing steps, substantially all of Dynegy’s “coal assets” will continue to reside within DMG (CoalCo) and substantially all of Dynegy’s “gas assets” will reside in direct subsidiaries of DPC (GasCo). An abbreviated organizational chart depicting, in general terms, Dynegy’s corporate structure following the effectuation of the foregoing transactional steps appears in Summary of the reorganization process above.

We have no reason to believe that DPC (GasCo) or any of the entities involved in the pre-Loan transfers that embody the formation of DPC (GasCo) are, or, upon the closing of the applicable transfers or the Loans, will be, rendered insolvent. In addition, we will at closing be receiving (a) a certificate from the chief financial officer of each of DPC (GasCo) and DMG (CoalCo) (i.e., the borrowers under the Loans), in form and substance reasonably satisfactory to the Arrangers, certifying that each of the Borrowers and their respective subsidiaries, on a

7

consolidated basis after giving effect to the Transactions, the Reorganization and the other transactions contemplated thereby (including the Loans), are solvent and (b) a solvency opinion for each of DPC (GasCo) and DMG (CoalCo) from a nationally recognized valuation company, in form and substance reasonably satisfactory to the Arrangers. However, we have not sought and do not currently expect to be provided with an independent opinion or certificate regarding the solvency of the other entities which are the subject of the transfers. Additionally, certain of the transfers described above could be found to have been made without any consideration.

If any of these transferor entities (a) was insolvent on the date that such transfer was made or such obligation was incurred, became insolvent as a result of such transfer or obligation, or otherwise was deemed insolvent, and (b) failed to obtain reasonably equivalent value in exchange for the applicable transfer, a bankruptcy trustee for any such transferor entity or such transferor entity, as a debtor in possession (or, possibly, any creditor of the transferor entity either (x) on behalf of the transferor’s bankruptcy estate with bankruptcy court approval or (y) in its individual capacity in federal or state court if the transferor is not in bankruptcy) (an “Affected Party”) could assert and, if the facts supported such assertion, prevail upon a claim that such transfer should be avoided as a constructive fraudulent conveyance. In addition, to the extent any of these transferor entities made such transfer with the actual intent to hinder, delay or defraud any entity to which such transferor entity was or became indebted, on or after the date that such transfer was made, then such transferor entity or any other Affected Party could assert and, if the facts supported such assertion, prevail upon a claim that such transfer should be avoided as an actual fraudulent conveyance. If any such transfer is avoided as an actual or constructive fraudulent conveyance, pursuant to Section 550 of the Bankruptcy Code (or the corresponding provision of the applicable state fraudulent conveyance statute), a court may require that the transfer be unwound or that the value of the transferred property be repaid to the transferor.

In addition, it is possible that a court could determine to “collapse” the pre-Loan transfers and the financing on the basis that they constituted one integrated scheme. In that event, the court would apply the fraudulent conveyance standards to the entire integrated scheme (and not separately to each component), and, for example, would apply the solvency and reasonably equivalent prongs of the constructive fraudulent conveyance test by taking into account the value received by the transferor entity from being relieved of its guaranty exposure on the $1.8 billion senior secured Fifth Amended and Restated Credit Agreement dated as of April 2, 2007 (the “Existing Secured Credit Facility”). If a court nevertheless concluded that the integrated scheme was an avoidable fraudulent conveyance, and if it further concluded that the Lenders were direct or indirect transferees of the transferred property and/or were the entities for whose benefit such transfer was made, then the court could hold the Lenders liable for the fraudulently conveyed property and require either that (i) the Lenders’ liens on the transferred property be set aside or (ii) the Lenders be required to repay the value of the fraudulently conveyed property to the transferor entity, including potentially the amount of any post-transfer depreciation in the value of such property (which may include the litigation expense incurred or reimbursed by the transferor). If the Lenders are found to have acted in good faith and without knowledge of the voidability of the transfer in question, they should be entitled to retain their liens and claims to the extent of the value they provided to the transferor entity (the fraudulent conveyance remedies against the Lenders described in the last two sentences of this paragraph, collectively referred to herein as the “Fraudulent Conveyance Remedies”).

Notably, to our knowledge, DPM is the only entity that is transferring equity interests in a subsidiary that will be a credit party with respect to the Loans and, assuming that does not change, the foregoing analysis would apply solely to DPM. We have no reason to believe that DPM lacks sufficient assets and credit support to pay its liabilities as they come due.

Additionally, a portion of the proceeds of the GasCo Term Loan will be distributed to DHI at closing to satisfy the obligations outstanding under the Existing Secured Credit Facility, under which DHI is the primary obligor. Up to $400 million of the GasCo Term Loan will also be distributed at closing as a dividend.

In the event of a DPC bankruptcy (or even in the absence of a bankruptcy filing, and a creditor pursues a fraudulent transfer claim in state or federal court), an Affected Party could assert that (i) such transfers were constructively fraudulent, alleging, among other things, that DPC did not receive reasonably equivalent value in exchange for such transfers and/or (ii) such transfers constituted an actual fraudulent conveyance, alleging that such transfers were

8

made with the actual intent to hinder, delay or defraud any entity to which such transferor entity was or became indebted on or after the date that such transfers were made.

Several factors weigh against a finding that such transfers are fraudulent. DPC (GasCo) is already a guarantor under the Existing Secured Credit Facility and the equity interests in DPC (GasCo) and its assets are subject to security interests securing the Existing Secured Credit Facility. For purposes of any constructive fraudulent conveyance analysis, the use of the proceeds of the GasCo Term Loan to fully extinguish DPC (GasCo)’s guaranty liability for the entire amount of such New Credit Facility (via the repayment of the Existing Secured Credit Facility) should be included as part of the value which DPC (GasCo) is receiving on account of such GasCo Term Loan. Furthermore, in order to satisfy Dynegy, the Arrangers and the Lenders as to the solvency of DPC (GasCo) at the time of the upstream distribution (which is a requirement for a constructive fraudulent conveyance claim), as conditions to the making of the Loans, the Arrangers shall have received (a) a certificate from the chief financial officer of DPC (GasCo), in form and substance reasonably satisfactory to the Arrangers, certifying that DPC (GasCo) and its subsidiaries, on a consolidated basis after giving effect to the Transactions, the Reorganization and the other transactions contemplated thereby, are solvent and (b) a solvency opinion for DPC (GasCo) from a nationally recognized valuation company, in form and substance reasonably satisfactory to the Arrangers.

However, a determination of this issue is highly fact sensitive and no assurances with respect to the expected outcome of any such potential future litigation can be provided (except to note that, (i) if the entity is in chapter 11, the economic exposure to such fraudulent conveyance remedy is limited to the aggregate amount of unpaid allowed unsecured claims against such entity, which remedy could be fashioned as (x) a complete unwinding of the fraudulent transfer or a requirement of full repayment by the Lenders of the value of the fraudulent conveyance, in either case, with the Lenders retaining liens and claims sufficient to receive any residual value remaining after payment of all other unpaid allowed unsecured claims, or (y) a partial unwinding of the fraudulent conveyance or a requirement of partial repayment by the Lenders of the value of the fraudulent conveyance, in either case, sufficient to ensure full repayment of the other unpaid allowed unsecured claims against such entity, and (ii) if a fraudulent conveyance claim is asserted by a creditor of such entity outside of bankruptcy, the fraudulent conveyance remedy could be limited to the repayment of such creditor’s claim, or alternatively, to a full or partial unwinding of the fraudulent transfer). In the event an Affected Party were able to demonstrate that DPC (GasCo) was (a) insolvent at the time of the transfer of the Loan proceeds or otherwise failed any of the various aforementioned solvency tests, and (b) that the transfer of the Loan proceeds was for less than reasonably equivalent value, such plaintiff would be entitled to the imposition of one of the Fraudulent Conveyance Remedies, subject to the limitations noted at the end of the immediately preceding sentence.

9

Historical financing and operating metrics

GasCo historical financial and operating metrics

Source: Company data.

| (1) | GasCo’s gross margin and Adjusted EBITDA results include the historical results of the Oakland, Moss Landing, Morro Bay, Kendall, Ontelaunee, Independence and Casco Bay generation facilities. They also include the marketing and trading activities related to those generation facilities and a portion of Dynegy’s regional administrative and other costs historically associated with Dynegy’s GEN-WE segment. They do not include (i) an allocation of regional administrative and other costs historically associated with the GEN-NE segment or GEN-MW segment; or (ii) an allocation of Dynegy’s corporate overhead costs. Gross margin and Adjusted EBITDA are non-GAAP financial measures. Reconciliations of these measures to the most directly comparable GAAP measures, to the extent available without unreasonable effort, are contained herein. Gross margin and Adjusted EBITDA exclude South Bay, exclude a complete allocation of corporate or regional overhead costs, and include an annual non-cash amortization adjustment for Independence of ~$38 million. |

| (2) | GasCo’s capex includes the historical capital expenditures associated with the Oakland, Moss Landing, Morro Bay, Kendall, Ontelaunee, Independence and Casco Bay generation facilities. Capex does not include an allocation of corporate capital expenditures whose facilities and systems are used to support the plant operations. |

| (3) | Reflects weighted average by capacity for individual plants. Excludes Oakland and Black Mountain. |

10

CoalCo historical financial and operating metrics

Source: Company data.

| (1) | CoalCo’s gross margin and Adjusted EBITDA results include the historical results of the Baldwin, Stallings, Wood River, Havana, Oglesby and Hennepin generation facilities. Gross margin and Adjusted EBITDA do not include (i) an allocation of regional administrative and other costs historically associated with the GEN-MW segment; or (ii) an allocation of Dynegy’s corporate overhead costs. Gross margin and Adjusted EBITDA are non-GAAP financial measures. Reconciliations of these measures to the most directly comparable GAAP measures, to the extent available without unreasonable effort, are contained herein. |

| (2) | CoalCo’s capex includes the historical capital expenditures associated with the Baldwin, Stallings, Wood River, Havana, Oglesby and Hennepin generation facilities. Capex does not include an allocation of corporate capital expenditures whose facilities and systems are used to support the plant operations. |

| (3) | Reflects weighted average by capacity for individual plants. Includes coal plants only. |

11

Reconciliation of GasCo and CoalCo financial information to Dynegy Inc.’s historical results

Twelve Months Ended December 31, 2008

(Unaudited) (In Millions)

| GasCo | CoalCo | Other (2) | Total | |||||||||||||

| Net income attributable to Dynegy Inc. |

$ | 174 | ||||||||||||||

| Plus / (Less): |

||||||||||||||||

| Income tax expense |

90 | |||||||||||||||

| Interest expense |

427 | |||||||||||||||

| Depreciation and amortization expense |

346 | |||||||||||||||

| Loss from discontinued operations, net of taxes |

17 | |||||||||||||||

| EBITDA from continuing operations (1) |

$ | 367 | $ | 702 | $ | (15 | ) | 1,054 | ||||||||

| EBITDA from discontinued operations (1) |

— | — | (6 | ) | (6 | ) | ||||||||||

| EBITDA |

367 | 702 | (21 | ) | 1,048 | |||||||||||

| Plus / (Less): |

||||||||||||||||

| Gain on sales of assets and investments |

— | — | (95 | ) | (95 | ) | ||||||||||

| Impairments and other charges |

— | — | 71 | 71 | ||||||||||||

| Loss on dissolution of equity investment |

— | — | 47 | 47 | ||||||||||||

| Gain on liquidation of foreign entity |

— | — | (24 | ) | (24 | ) | ||||||||||

| Release of state franchise tax and sales tax liabilities |

— | — | (16 | ) | (16 | ) | ||||||||||

| Mark-to-market (gains) losses, net |

(69 | ) | (189 | ) | 45 | (213 | ) | |||||||||

| Adjusted EBITDA (1) |

$ | 298 | $ | 513 | $ | 7 | $ | 818 | ||||||||

| Gross margin (1) |

$ | 489 | $ | 837 | $ | 305 | $ | 1,631 | ||||||||

| Capital Expenditures |

$ | 39 | $ | 307 | $ | 265 | $ | 611 | ||||||||

| (1) | EBITDA, Adjusted EBITDA and Gross Margin are non-GAAP financial measures. Please refer to Item 7.01 of the Current Report on Form 8-K furnished on July 11, 2011, for definitions, utility and uses of such non-GAAP financial measures. Reconciliations of EBITDA and Gross Margin to operating income (loss) are presented below. Management does not allocate interest expense and income taxes on a segment level and therefore uses operating income (loss) as the most directly comparable GAAP measure. |

| GasCo | CoalCo | Other (2) | Total | |||||||||||||

| Gross margin |

$ | 489 | $ | 837 | $ | 305 | $ | 1,631 | ||||||||

| Plus/(Less): |

||||||||||||||||

| Operating and maintenance expense |

(122 | ) | (135 | ) | (209 | ) | (466 | ) | ||||||||

| Gain on sale of assets |

— | — | 82 | 82 | ||||||||||||

| Depreciation and amortization expense |

(115 | ) | (138 | ) | (93 | ) | (346 | ) | ||||||||

| General and administrative expenses |

— | — | (157 | ) | (157 | ) | ||||||||||

| Operating income (loss) |

$ | 252 | $ | 564 | $ | (72 | ) | $ | 744 | |||||||

| Losses from unconsolidated investments |

— | — | (123 | ) | (123 | ) | ||||||||||

| Depreciation and amortization expense |

115 | 138 | 93 | 346 | ||||||||||||

| Other items, net |

— | — | 84 | 84 | ||||||||||||

| Net loss attributable to noncontrolling interests |

— | — | 3 | 3 | ||||||||||||

| EBITDA from continuing operations |

367 | 702 | (15 | ) | 1,054 | |||||||||||

| EBITDA from discontinued operations |

— | — | (6 | ) | (6 | ) | ||||||||||

| EBITDA |

$ | 367 | $ | 702 | $ | (21 | ) | $ | 1,048 | |||||||

| (2) | Other includes the results of the Roseton generating facility, the Danskammer generating facility, generating facilities that have been sold or are no longer in service, and unallocated corporate and regional overhead amounts. For additional discussion, please see “Unaudited selected financial information and operating metrics.” |

12

Twelve Months Ended December 31, 2009

(Unaudited) (In Millions)

| GasCo | CoalCo | Other (2) | Total | |||||||||||||

| Net loss attributable to Dynegy Inc. |

$ | (1,247 | ) | |||||||||||||

| Plus / (Less): |

||||||||||||||||

| Income tax benefit |

(315 | ) | ||||||||||||||

| Interest expense |

461 | |||||||||||||||

| Depreciation and amortization expense |

335 | |||||||||||||||

| Loss from discontinued operations, net of taxes |

222 | |||||||||||||||

| EBITDA from continuing operations (1) |

$ | 263 | $ | 418 | $ | (1,225 | ) | (544 | ) | |||||||

| EBITDA from discontinued operations (1) |

— | — | (328 | ) | (328 | ) | ||||||||||

| EBITDA |

263 | 418 | (1,553 | ) | (872 | ) | ||||||||||

| Plus / (Less): |

||||||||||||||||

| Goodwill impairments |

— | — | 433 | 433 | ||||||||||||

| Impairments and other charges |

— | — | 796 | 796 | ||||||||||||

| Loss on sales of assets and investments |

— | — | 302 | 302 | ||||||||||||

| Mark-to-market (gains) losses, net |

136 | 108 | (85 | ) | 159 | |||||||||||

| Net loss attributable to noncontrolling interests |

— | — | (15 | ) | (15 | ) | ||||||||||

| Adjusted EBITDA (1) |

$ | 399 | $ | 526 | $ | (122 | ) | $ | 803 | |||||||

| Gross margin (1) |

$ | 412 | $ | 573 | $ | 289 | $ | 1,274 | ||||||||

| Capital Expenditures |

$ | 70 | $ | 390 | $ | 152 | $ | 612 | ||||||||

| (1) | EBITDA, Adjusted EBITDA and Gross Margin are non-GAAP financial measures. Please refer to Item 7.01 of the Current Report on Form 8-K furnished on July 11, 2011, for definitions, utility and uses of such non-GAAP financial measures. Reconciliations of EBITDA and Gross Margin to operating income (loss) are presented below. Management does not allocate interest expense and income taxes on a segment level and therefore uses operating income (loss) as the most directly comparable GAAP measure. |

| GasCo | CoalCo | Other (2) | Total | |||||||||||||

| Gross margin |

$ | 412 | $ | 573 | 289 | $ | 1,274 | |||||||||

| Plus/(Less): |

||||||||||||||||

| Operating and maintenance expense |

(151 | ) | (157 | ) | (211 | ) | (519 | ) | ||||||||

| Impairment and other charges |

— | — | (538 | ) | (538 | ) | ||||||||||

| Loss on sale of assets |

— | — | (124 | ) | (124 | ) | ||||||||||

| Goodwill impairments |

— | — | (433 | ) | (433 | ) | ||||||||||

| Depreciation and amortization expense |

(124 | ) | (154 | ) | (57 | ) | (335 | ) | ||||||||

| General and administrative expenses |

— | — | (159 | ) | (159 | ) | ||||||||||

| Operating income (loss) |

$ | 137 | $ | 262 | $ | (1,233 | ) | $ | (834 | ) | ||||||

| Losses from unconsolidated investments |

— | — | (71 | ) | (71 | ) | ||||||||||

| Depreciation and amortization expense |

124 | 154 | 57 | 335 | ||||||||||||

| Other items, net |

2 | 2 | 7 | 11 | ||||||||||||

| Net loss attributable to noncontrolling interests |

— | — | 15 | 15 | ||||||||||||

| EBITDA from continuing operations |

263 | 418 | (1,225 | ) | (544 | ) | ||||||||||

| EBITDA from discontinued operations |

— | — | (328 | ) | (328 | ) | ||||||||||

| EBITDA |

$ | 263 | $ | 418 | $ | (1,553 | ) | $ | (872 | ) | ||||||

| (2) | Other includes the results of the Roseton generating facility, the Danskammer generating facility, generating facilities that have been sold or are no longer in service, and unallocated corporate and regional overhead amounts. For additional discussion, please see “Unaudited selected financial information and operating metrics.” |

13

Twelve Months Ended December 31, 2010

(Unaudited) (In Millions)

| GasCo | CoalCo | Other (2) | Total | |||||||||||||

| Net loss |

$ | (234 | ) | |||||||||||||

| Plus / (Less): |

||||||||||||||||

| Income tax benefit |

(197 | ) | ||||||||||||||

| Interest expense |

363 | |||||||||||||||

| Depreciation and amortization expense |

392 | |||||||||||||||

| EBITDA (1) |

$ | 214 | $ | 317 | $ | (207 | ) | 324 | ||||||||

| Plus / (Less): |

||||||||||||||||

| Impairments and other charges |

134 | — | 39 | 173 | ||||||||||||

| Loss on sale of PPEA Holding |

— | — | 28 | 28 | ||||||||||||

| Merger Agreement transaction costs |

— | — | 26 | 26 | ||||||||||||

| Restructuring charges |

1 | 1 | 10 | 12 | ||||||||||||

| Plum Point mark-to-market gains |

— | — | (6 | ) | (6 | ) | ||||||||||

| Mark-to-market (gains) losses, net |

11 | (21 | ) | (8 | ) | (18 | ) | |||||||||

| Adjusted EBITDA (1) |

$ | 360 | $ | 297 | $ | (118 | ) | $ | 539 | |||||||

| Gross margin (1) |

$ | 478 | $ | 471 | $ | 193 | $ | 1,142 | ||||||||

| Capital Expenditures |

$ | 50 | $ | 274 | $ | 9 | $ | 333 | ||||||||

| (1) | EBITDA, Adjusted EBITDA and Gross Margin are non-GAAP financial measures. Please refer to Item 7.01 of the Current Report on Form 8-K furnished on July 11, 2011, for definitions, utility and uses of such non-GAAP financial measures. Reconciliations of EBITDA and Gross Margin to operating income (loss) are presented below. Management does not allocate interest expense and income taxes on a segment level and therefore uses operating income (loss) as the most directly comparable GAAP measure. |

| GasCo | CoalCo | Other (2) | Total | |||||||||||||

| Gross margin |

$ | 478 | $ | 471 | $ | 193 | $ | 1,142 | ||||||||

| Plus/(Less): |

||||||||||||||||

| Operating and maintenance expense |

(132 | ) | (154 | ) | (164 | ) | (450 | ) | ||||||||

| Impairment and other charges |

(134 | ) | — | (14 | ) | (148 | ) | |||||||||

| Depreciation and amortization expense |

(135 | ) | (190 | ) | (67 | ) | (392 | ) | ||||||||

| General and administrative expenses |

— | — | (163 | ) | (163 | ) | ||||||||||

| Operating income (loss) |

$ | 77 | $ | 127 | $ | (215 | ) | $ | (11 | ) | ||||||

| Losses from unconsolidated investments |

— | — | (62 | ) | (62 | ) | ||||||||||

| Depreciation and amortization expense |

135 | 190 | 67 | 392 | ||||||||||||

| Other items, net |

2 | — | 2 | 4 | ||||||||||||

| EBITDA from continuing operations |

214 | 317 | (208 | ) | 323 | |||||||||||

| EBITDA from discontinued operations |

— | — | 1 | 1 | ||||||||||||

| EBITDA |

$ | 214 | $ | 317 | $ | (207 | ) | $ | 324 | |||||||

| (2) | Other includes the results of the Roseton generating facility, the Danskammer generating facility, generating facilities that have been sold or are no longer in service, and unallocated corporate and regional overhead amounts. For additional discussion, please see “Unaudited selected financial information and operating metrics.” |

14

Three Months Ended March 31, 2010

(Unaudited) (In Millions)

| GasCo | CoalCo | Other (2) | Total | |||||||||||||

| Net loss |

$ | 145 | ||||||||||||||

| Plus / (Less): |

||||||||||||||||

| Income tax expense |

65 | |||||||||||||||

| Interest expense |

89 | |||||||||||||||

| Depreciation and amortization expense |

75 | |||||||||||||||

| Income from discontinued operations, net of taxes |

(1 | ) | ||||||||||||||

| EBITDA from continuing operations (1) |

$ | 132 | $ | 263 | $ | (22 | ) | 373 | ||||||||

| EBITDA from discontinued operations (1) |

— | — | 1 | 1 | ||||||||||||

| EBITDA |

132 | 263 | (21 | ) | 374 | |||||||||||

| Plus / (Less): |

||||||||||||||||

| Impairments and other charges |

— | — | 37 | 37 | ||||||||||||

| Mark-to-market gains, net |

(27 | ) | (191 | ) | (41 | ) | (259 | ) | ||||||||

| Adjusted EBITDA (1) |

$ | 105 | $ | 72 | $ | (25 | ) | $ | 152 | |||||||

| Gross margin (1) |

$ | 163 | $ | 302 | $ | 85 | $ | 550 | ||||||||

| Capital Expenditures |

$ | 14 | $ | 85 | $ | 2 | $ | 101 | ||||||||

| (1) | EBITDA, Adjusted EBITDA and Gross Margin are non-GAAP financial measures. Please refer to Item 7.01 of the Current Report on Form 8-K furnished on July 11, 2011 for definitions, utility and uses of such non-GAAP financial measures. Reconciliations of EBITDA and Gross Margin to operating income (loss) are presented below. Management does not allocate interest expense and income taxes on a segment level and therefore uses operating income (loss) as the most directly comparable GAAP measure. |

| GasCo | CoalCo | Other (2) | Total | |||||||||||||

| Gross margin |

$ | 163 | $ | 302 | $ | 85 | $ | 550 | ||||||||

| Plus/(Less): |

||||||||||||||||

| Operating and maintenance expense |

(32 | ) | (39 | ) | (42 | ) | (113 | ) | ||||||||

| Depreciation and amortization expense |

(33 | ) | (39 | ) | (3 | ) | (75 | ) | ||||||||

| General and administrative expenses |

— | — | (31 | ) | (31 | ) | ||||||||||

| Operating income |

$ | 98 | $ | 224 | $ | 9 | $ | 331 | ||||||||

| Losses from unconsolidated investments |

— | — | (34 | ) | (34 | ) | ||||||||||

| Depreciation and amortization expense |

33 | 39 | 3 | 75 | ||||||||||||

| Other items, net |

1 | — | — | 1 | ||||||||||||

| EBITDA from continuing operations |

132 | 263 | (22 | ) | 373 | |||||||||||

| EBITDA from discontinued operations |

— | — | 1 | 1 | ||||||||||||

| EBITDA |

$ | 132 | $ | 263 | $ | (21 | ) | $ | 374 | |||||||

| (2) | Other includes the results of the Roseton generating facility, the Danskammer generating facility, generating facilities that have been sold or are no longer in service, and unallocated corporate and regional overhead amounts. For additional discussion, please see “Unaudited selected financial information and operating metrics.” |

15

Three Months Ended March 31, 2011

(Unaudited) (In Millions)

| GasCo | CoalCo | Other (2) | Total | |||||||||||||

| Net loss |

$ | (77 | ) | |||||||||||||

| Plus / (Less): |

||||||||||||||||

| Income tax expense |

(60 | ) | ||||||||||||||

| Interest expense |

89 | |||||||||||||||

| Depreciation and amortization expense |

126 | |||||||||||||||

| EBITDA (1) |

$ | 62 | $ | 71 | $ | (55 | ) | $ | 78 | |||||||

| Plus / (Less): |

||||||||||||||||

| Merger agreement termination fee and other legal expenses |

— | — | 9 | 9 | ||||||||||||

| Executive separation agreement expenses |

— | — | 3 | 3 | ||||||||||||

| Mark-to-market (gains) losses, net |

(20 | ) | 7 | 10 | (3 | ) | ||||||||||

| Adjusted EBITDA (1) |

$ | 42 | $ | 78 | $ | (33 | ) | $ | 87 | |||||||

| Gross margin (1) |

$ | 102 | $ | 106 | $ | 19 | $ | 227 | ||||||||

| Capital Expenditures |

$ | 24 | $ | 42 | $ | — | $ | 66 | ||||||||

| (1) | EBITDA, Adjusted EBITDA and Gross Margin are non-GAAP financial measures. Please refer to Item 7.01 of the Current Report on Form 8-K furnished on July 11, 2011 for definitions, utility and uses of such non-GAAP financial measures. Reconciliations of EBITDA and Gross Margin to operating income (loss) are presented below. Management does not allocate interest expense and income taxes on a segment level and therefore uses operating income (loss) as the most directly comparable GAAP measure. |

| GasCo | CoalCo | Other (2) | Total | |||||||||||||

| Gross margin |

$ | 102 | $ | 106 | $ | 19 | $ | 227 | ||||||||

| Plus/(Less): |

||||||||||||||||

| Operating and maintenance expense |

(40 | ) | (35 | ) | (35 | ) | (110 | ) | ||||||||

| Depreciation and amortization expense |

(34 | ) | (40 | ) | (52 | ) | (126 | ) | ||||||||

| General and administrative expenses |

— | — | (40 | ) | (40 | ) | ||||||||||

| Operating income (loss) |

$ | 28 | $ | 31 | $ | (108 | ) | $ | (49 | ) | ||||||

| Depreciation and amortization expense |

34 | 40 | 52 | 126 | ||||||||||||

| Other items, net |

— | — | 1 | 1 | ||||||||||||

| EBITDA |

$ | 62 | $ | 71 | $ | (55 | ) | $ | 78 | |||||||

| (2) | Other includes the results of the Roseton generating facility, the Danskammer generating facility, generating facilities that have been sold or are no longer in service, and unallocated corporate and regional overhead amounts. For additional discussion, please see “Unaudited selected financial information and operating metrics.” |

16