Attached files

| file | filename |

|---|---|

| EX-4.2 - Empowered Products, Inc. | v227999_ex4-2.htm |

| EX-3.4 - Empowered Products, Inc. | v227999_ex3-4.htm |

| EX-2.2 - Empowered Products, Inc. | v227999_ex2-2.htm |

| EX-4.1 - Empowered Products, Inc. | v227999_ex4-1.htm |

| EX-2.1 - Empowered Products, Inc. | v227999_ex2-1.htm |

| EX-10.4 - Empowered Products, Inc. | v227999_ex10-4.htm |

| EX-10.2 - Empowered Products, Inc. | v227999_ex10-2.htm |

| EX-16.1 - Empowered Products, Inc. | v227999_ex16-1.htm |

| EX-10.7 - Empowered Products, Inc. | v227999_ex10-7.htm |

| EX-10.8 - Empowered Products, Inc. | v227999_ex10-8.htm |

| EX-10.1 - Empowered Products, Inc. | v227999_ex10-1.htm |

| EX-21.1 - Empowered Products, Inc. | v227999_ex21-1.htm |

| EX-10.6 - Empowered Products, Inc. | v227999_ex10-6.htm |

| EX-10.3 - Empowered Products, Inc. | v227999_ex10-3.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 30, 2011

Empowered Products, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada

|

333-165917

|

27-0579647

|

|

(State or Other Jurisdiction

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

of Incorporation)

|

3367 West Oquendo Road, Las Vegas, Nevada 89118

(Address, including zip code, off principal executive offices)

Registrant’s telephone number, including area code 800-929-0407

ON TIME FILINGS, INC.

260 Newport Center Drive, Suite 100, Newport Beach, CA 92660

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

1

Item 1.01 Entry into a Material Definitive Agreement.

Pursuant to an Agreement and Plan of Merger, dated June 30, 2011 (the “Merger Agreement”), by and among On Time Filings, Inc. (“OTF”), EPI Acquisition Corp. (“Acquisition Sub”), EPI Name Change Corp. (“Name Change Merger Sub”), and Empowered Products Nevada, Inc. (“EP Nevada”), EP Nevada merged with and into Acquisition Sub with EP Nevada continuing as the surviving entity (the “Merger”). OTF changed its name to “Empowered Products, Inc.”

Pursuant to an Assignment and Assumption Agreement (the “Assignment Agreement”) dated June 30, 2011, by and between OTF and OT Filings, Inc., a Nevada corporation wholly owned by OTF (the “OT Filings”), OTF transferred substantially all of its assets and liabilities to OT Filings immediately prior to the consummation of the Merger.

Pursuant to a Share Repurchase and Cancellation Agreement dated June 30, 2011 (the “Repurchase Agreement”) by and between OTF, OT Filings and Suzanne Fischer, OTF repurchased 223,370,000 shares of its common stock (the “Repurchased Shares”) from Suzanne Fischer for a repurchase price of $50,000 and all of the issued and outstanding shares of OT Filings. Upon the repurchase, OTF cancelled all of the Repurchased Shares.

Reference is made to Item 2.01 for a description of the Merger Agreement, the Assignment Agreement, the Repurchase Agreement, the Merger and the related transactions. The description of the Merger Agreement, the Assignment Agreement and the Repurchase Agreement is qualified in its entirety by reference to the complete text of such agreements, which is are attached hereto as Exhibits 2.1, 10.1 and 10.2, respectively, and incorporated by reference herein. You are urged to read the entire Merger Agreement, Assignment Agreement and Repurchase Agreement and the other exhibits attached hereto.

See Item 3.02, below, which is incorporated herein by reference, regarding the discussion of the subscription agreement relating to the sale of 2,000,000 shares of the OTF’s common stock and five-year warrants to purchase 2,000,000 shares of OTF’s common stock at an exercise price of $1.25 per share.

Item 2.01 Completion of Acquisition or Disposition of Assets.

OVERVIEW

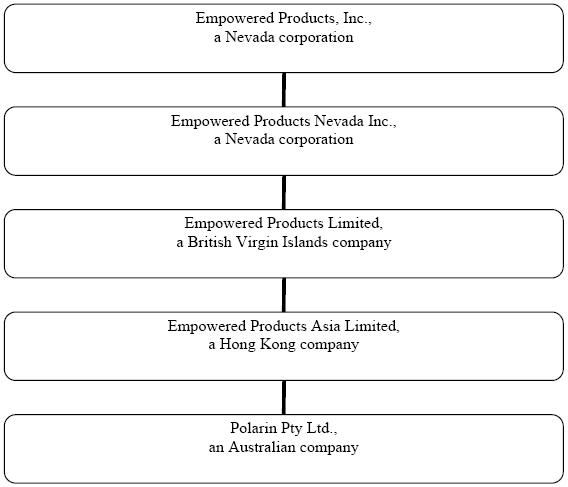

As used in this report, unless otherwise indicated, the terms “we,” “our,” “Company” and “EPI” refer to Empowered Products, Inc., a Nevada corporation, formerly known as On Time Filings, Inc., and its wholly-owned subsidiary EP Nevada, EP Nevada’s wholly-owned subsidiary, Empowered Products BVI, a British Virgin Islands corporation (“EP BVI”), EP BVI’S wholly-owned subsidiary, Empowered Products Asia, a company organized under the laws of Hong Kong (“EP Asia”), EP Asia’s wholly-owned subsidiary Polarin Pty Ltd., an Australian company (“Polarin Australia”).

HISTORY

OTF was incorporated in the State of Nevada on July 10, 2009. Prior to the Merger, OTF was engaged in the business of providing transactional financial, corporate reporting, commercial and digital printing.

On June 30, 2011, OTF (i) closed a reverse merger transaction, described below, pursuant to which OTF became the 100% parent of EP Nevada, (ii) assumed the operations of EP Nevada and its subsidiaries and (iii) changed its name from “On Time Filings, Inc.” to “Empowered Products, Inc.” EP Nevada (which was formerly named Empowered Products, Inc.) changed its name to Empowered Products Nevada, Inc. upon its merger with Acquisition Sub. Immediately after the Merger and the completion of EP Nevada’s name change, OTF changed its name to Empowered Products, Inc. by merging with its wholly owned subsidiary, Name Change Merger Sub.

EP Nevada was incorporated in the State of Nevada on April 22, 2004. In March 2011 we formed EP Asia to acquire certain assets of Polarin Limited, a company organized under the laws of Hong Kong (“Polarin”). Upon acquiring the assets of Polarin on March 31, 2011, we acquired a new indirectly owned subsidiary Polarin Australia.

2

Prior to the Merger, our services included the EDGARization of corporate documents that require filing on EDGAR, the Electronic Data Gathering, Analysis, and Retrieval system maintained by the Securities and Exchange Commission (“SEC”) and financial reporting and bookkeeping services. Pursuant to the Assignment Agreement, the assets and liabilities of this business were transferred to OT Filings immediately after the Merger and the shares of OT Filings were transferred to Suzanne Fischer pursuant to the Repurchase Agreement. Upon the closing of the Merger, we assumed the business and operations of Empowered Products Nevada, Inc. and its subsidiaries, which is now our sole business operations. Through EP Nevada and its subsidiaries, we market and sell a line of topical gels, lotions and oils designed to enhance a person’s sex life and in make people feel good about their sexual health in general.

CORPORATE STRUCTURE

The corporate structure of the Company is illustrated as follows:

Our principal executive offices and corporate offices are located at 3367 West Oquendo Road, Las Vegas, Nevada 89118. Our telephone number is 800-929-0407.

PRINCIPAL TERMS OF THE MERGER

On June 30, 2011, OTF entered into an Agreement and Plan of Merger (the “Merger Agreement”) with EP Nevada, Acquisition Sub and Name Change Merger Sub. Pursuant to the Merger Agreement, EP Nevada agreed to merger with an into Acquisition Sub, with EP Nevada as the surviving corporation, with each share of EP Nevada being exchanged for 4 shares of OTF (the “Merger”). The Merger closed on June 30, 2011.

Upon consummation of the Merger, the sole stockholder of EP Nevada common stock received 40,000,000 shares of our common stock. In connection with the Merger, we repurchased and cancelled 223,370,000 shares of our common stock held by Suzanne Fischer, our corporate secretary and one of our directors pursuant to the Repurchase Agreement (the “Share Cancellation”). Immediately after the closing of the Merger, the Share Cancellation and the closing of the Private Placement (described below), we had 62,388,856 shares of common stock, no shares of preferred stock, no options, and warrants to purchase 2,000,000 shares of common stock issued and outstanding.

3

On June 30, 2011 after the closing of the Merger, OTF changed its corporate name from “On Time Filings, Inc.” to “Empowered Products, Inc.” Our common stock is quoted on the OTC Bulletin Board and OTCQB under the symbol “OTMF.OB”. We expect to receive a new symbol as a result of our name change to Empowered Products, Inc. This market is extremely limited and the prices quoted are not a reliable indication of the value of our common stock. As of July 6, 2011, no shares of our common stock have traded.

The transactions contemplated by the Merger Agreement were intended to be a “tax-free” reorganization pursuant to the provisions of Sections 351 and/or 368(a) of the Internal Revenue Code of 1986, as amended.

The Merger resulted in a change in control of our company from Suzanne Fischer, to the former sole stockholder of EP Nevada, Scott Fraser. In connection with the change in control, Scott Fraser, was appointed as our Chairman of the Board, President and Chief Executive Officer effective upon the closing of the Merger. Ms. Fischer, an officer and director of OTF prior to the consummation of the Merger, resigned from all officer positions with the Company except Corporate Secretary, at the time the transaction was consummated. She also continues as a member of our Board of Directors.

EMPOWERED PRODUCTS, INC.’S BUSINESS

Overview

Through EP Nevada, we offer a line of quality products, including topical gels, lotions and oils, designed to enhance a person’s sex life and make people feel good about their sexual health in general. We currently have 12 exclusively formulated skin lubricants sold under our PINK® for Women and GUN OIL® for Men trademarks and intend to continue to expand our products offerings. Our proprietary formulated products are designed to increase mental focus and to improve the bond of interpersonal relationships. Our trademarked products are currently sold in 30 countries through more than 2,700 retail outlets.

EP Nevada was founded in March 2002 and opened its first logistical center at its headquarters in Las Vegas, Nevada in April 2004. Since then, we have steadily augmented our bottling and packaging equipment to efficiently process our topically applied gels, lotions and interactive lubricants. This proprietary assembly line has been a major factor in our reduction in costs of goods sold by an annual average of 52% over the past five operational years. Presently, we have six products under our PINK® for women trademark and six products under our GUN OIL® for men trademark.

Industry and Market Opportunity

We operate in the rapidly expanding worldwide market of sexual wellness products. This industry's global market value has rapidly expanded as consumers have steadily increased demand for products that enable self-directed therapy and healing. We believe that development of our active and expanding customer niche for our topical gels, lotions and oils in 30 countries thus far demonstrates the growing worldwide appetite for such products. As such products have continued to gain consumer acceptance, many traditional major retailers, pharmacies and online retailers have begun carrying such products in their stores.

The initial target market for our products was adult males. Our first product launch in 2003 was an exclusively formulated cream that gradually created intense physical satisfaction. Our target market has steadily expanded with each new product added to our line and each addition has been inspired by the needs of customers. For example, both our PINK® and GUN OIL® silicone lubricants were custom formulated according to a plethora of feedback received from women and men that comprise our wholesale buyer network. Both formulas were designed to create intense physical sensation during interaction between two individuals leading to stronger emotional unions among couples.

4

Competitive Strengths

We believe the following strengths contribute to our competitive advantages:

Brand awareness

Our topical gels, lotions and oils marketed under our “PINK” and “GUN OIL” trademarks, have a solid reputation and have become a recognized brand name in the industry, which we expect will assist us in growing our business over the course of the next few years.

In-house bottling and labeling capabilities

At our facility in Las Vegas, Nevada, we conduct all of our bottling and labeling operations, except for our sample size products, which allows us to control our production operations.

Experienced Chief Executive Officer

Scott Fraser, our President, Chief Executive Officer and founder, has extensive business and industry experience, including an understanding of changing market trends, consumer needs, and our ability to capitalize on the opportunities resulting from these market changes. Mr. Fraser also has significant experience with respect to key aspects of our operations, including research and development, product design, bottling, and sales and marketing.

Our Strategy

As a recognized brand in the sexual wellness products market, our goal is to increase revenue and improve our profitability by using the following strategies:

Expand our production capacity of our packaging and logistical center

We intend to triple the production capacity of our Las Vegas packaging and logistical center by the end of fiscal 2012. The increase in our bottling capacity will enable us to fulfill the steadily escalating orders for our current line of topical applications. We expect that our expansion will be completed by the end of fiscal 2012.

Begin selling our products directly to retailers

Currently we only sell our products to wholesalers. In the future, we intend to sell our products directly to retailers to increase sales and brand awareness. We are working to obtain a higher Nielsen Rating for our products which we believe will enable us to deal directly with mass retail chain in the U.S. and Canada.

Enhance brand awareness

We believe that continuing to strengthen our brand is critical to our increasing demand for, and achieving widespread acceptance of, our products. We believe a strong brand offers a competitive advantage and we intend to devote additional resources to strategic marketing promotion in order to increase brand awareness and product recognition and heighten customer loyalty. We will continue to exhibit our products at trade shows around the world and devote additional resources into print and radio advertising to promote our brand.

Introduce a line of oral nutritional supplements

We are currently expanding the scope of our proprietary product line by adding a line of ingestible health sustaining supplements that are directed toward enhancing our customers' confidence and wellbeing. We currently intend to introduce two nutritional supplements in 2011. The most momentous growth component on our operational horizon is our development of a nutritional supplements dedicated to providing a favorable solution for the growing number of people socially incapacitated / subdued by prescription anti-depressants.

5

Pursuing acquisitions to broaden our drug candidates and product offerings

We will consider strategic acquisitions that will provide us with a broader range of product offerings. When evaluating potential acquisition targets, we will consider factors such as market position, growth potential and earnings prospects and strength and experience of management.

Products

We launched our first topically applied wellness cream in 2003 and have kept all of our subsequent products competitive with unique formulations with premium ingredients and aggressive pricing. Each product in our current line provides a unique benefit, in response to ongoing feedback from our customers. Our current line of 12 products is divided between six designed and packaged specifically for women under the PINK® trademark and six designed and packaged specifically for men under the GUN OIL® trademark.

GUN OIL for Men

|

·

|

GUN OIL Silicone: Based directly on the weapons lubricant stored in the butt-plate of M-16 rifles just like our Chief Executive Officer carried as a U.S. Marine

|

|

·

|

GUN OIL H2O: Water-based lubricant answer the growing consumer demand for a lighter weighted fluid that washes off without soap

|

|

·

|

GUN OIL Force Recon: Unique combination of water and silicone that is heavier weighted for prolonged interactions when friction is a concern

|

|

·

|

GUN OIL Gel: Keeping with the trends in men's personal toys, our gel keeps functioning properly while protecting the outer silicone coatings

|

|

·

|

GUN OIL Stroke 29: Self-therapy cream to clear mind of primal urges and formulated to gradually attain clarity as time and place permits

|

|

·

|

GUN OIL Jack Jelly: Self-therapy gel that also clears the mind and restores focus before major decisions but faster acting than our cream

|

PINK for Women

|

·

|

PINK Silicone: Formulated with additional vitamin E and Aloe Vera to provide both enhanced comfort and moisture with therapeutic benefit to the skin during intercourse with higher end packaging

|

|

·

|

PINK Water: Lightly weighted lubricant that includes vitamin E and Aloe Vera but no glycerin or pigments for added skin benefit and its water-base cleans easily and does not stain fabrics

|

|

·

|

Hot PINK: An exothermic massage lubricant that heats up upon skin contact with a slick formula that is free of silicon and glycerin to be non-staining

|

|

·

|

PINK Frolic: Thick formulation provides maximum comfort from heavy friction while the surface of personal toys yet is water-based to be non-staining and is highly concentrated to be long-lasting

|

|

·

|

PINK Unity: Hybrid lubricant in gel form that combines the longer lasting thickness of silicone with light dissolvability of water-base

|

|

·

|

PINK Indulgence Crème: Designed to provide triple benefit of a skin moisturizer, a massage cream and a personal lubricant all over body with a light, non-staining silicone formula

|

We also offer products in a “Happy-Pack,” which consists of a box set of our complete product line. Our current “Happy Pack” is a demonstration case that contains our complete product line we send to potential wholesale buyers. Although we do not currently sell our Happy-Pack to retail customers, we plan to offer a retail edition for sale and/or promotion to our end consumers.

6

Product Sourcing and Bottling

We contract with independent third-party companies to mix our topical gels, lotions and oils. The mixed products are then transported to our bottling facility in Las Vegas, Nevada where we bottle and label all of our products. During the years ended December 31, 2010 and 2009, we purchased all of our mixed lubricant product from two suppliers, Chemsil Silicones, Inc. and Creation's Garden Natural Products, Inc. Although we obtain our lubricant products from only two suppliers, we believe there are various other manufacturers who could mix our products and we believes that other suppliers could provide similar lubricant on comparable terms. A change in suppliers, however, could cause a delay in manufacturing and a possible loss of sales, which would affect operating results adversely.

We currently obtain all of our bottles from RoundBridge Inc., a company located in China. We obtain our labels from different third parties for the different sizes and shapes of our bottled products. We do not have long-term agreements with any of our bottle or labels suppliers and place orders with such suppliers on an as-needed basis. Although we obtain our bottles from only one supplier, there are many other bottle manufacturers from whom we may purchase bottles for our products.

We currently have one operational bottling line, which we run in two shifts due to the purchase of higher capacity pumps in late 2010. In June 2011 we began leasing additional manufacturing space in which we intend to place another bottling line to increase production capacity.

Sales, Marketing and Promotion

Through our in-house sales department, we sell our products to wholesalers. Our sales staff works closely with our wholesale customers so that we can better address their needs and improve the quality and features of our products. Our sales staff works with our wholesale customers and visits retail outlets that sell our products to educate such retailers about these products. We offer discounts to our wholesale customers ranging of up to 45% off of our standard list prices to encourage large-volume and long-term customers.

Sales to our customers are based primarily on purchase orders we receive from time to time rather than firm, long-term purchase commitments. Uncertain economic conditions and our general lack of long-term purchase commitments with our customers make it difficult for us to predict revenue accurately over the longer term.

Currently our products are sold in chain stores with less than 100 outlets in the United States and/or Canada and in a limited number of outlets of major retail chains in the U.S. and Canada. Our products are sold in Europe in such countries as Iceland, Ireland, United Kingdom, Portugal, Spain, France, Belgium, Netherlands, Denmark, Germany, Italy and Russia and in Asia in countries such as China, Hong Kong, Japan, Korea, Singapore, Taiwan, Thailand, Indonesia, Australia and New Zealand. We currently have a Nielsen rating for our products and are in the process of obtaining a higher rating for our products from the Nielsen Company. Large chain retailers, which include those with over 1,000 outlets in the United States and/or Canada, often require companies to have a minimum retail Nielsen rating before they will carry specific product lines on a large scale basis across their store locations. We hope to have the minimum required retail Nielsen rating by the end of fiscal 2011 which will allow us to sell our products directly to such large chain retailers.

Revenues based on the location of our customers as a percentage of total revenue is set forth below:

|

Three Months Ended March 31,

|

Years Ended December 31,

|

|||||||||||||||

|

2011

|

2010

|

2010

|

2009

|

|||||||||||||

|

North America

|

91.9 | % | 92.5 | % | 92.4 | % | 97.9 | % | ||||||||

|

Europe

|

6.4 | % | 3.8 | % | 5.9 | % | 0.7 | % | ||||||||

|

Asia

|

1.7 | % | 3.7 | % | 1.7 | % | 1.4 | % | ||||||||

| 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||||

7

In the future we intend to sell our products directly to retailers and directly to consumers through our website.

We engage in marketing activities such as attending industry-specific trade shows both domestically and abroad to promote our products and brand names. Our attendance at these trade shows provides us with valuable feedback from our customers, as well as consumers and retailers, regarding our products and information on emerging industry trends and new customer preferences. We distribute surveys to our wholesale customers and our end consumers, as well as samples of our products, such as our Happy-Pack, at these tradeshows. Customers return completed surveys regarding our products in exchange for coupons for our products. We will expand our post-sales surveys and formal focus group campaign going forward.

We also advertise in magazines and through our website to market our products. We believe these activities help in promote our products and brand name among key industry participants.

We have agreed to allow an independent third party to place their machine that can bottle sample sizes of our products in our new factory location. In exchange for providing this third-party with space in our facility in which to place its sample machine, we will receive a discount on samples of our products bottled using the machine. The exact terms of the discount have yet to be determined. The location of the sample machine in our facilities will greatly reduce the turn-around time for our procurement of sample-sized products. In addition, we will be able to order sample sizes in smaller quantities than we have traditionally been able to order, which we believe will reduce our costs related to our samples.

Major Customers

During the three months ended March 31, 2011 and the years ended December 31, 2010 and 2009, no customer accounted for more than 10% of our revenues.

Seasonality

Our business is not seasonal in nature.

Government Regulation

Most of the lubricants we sell are regulated by the Food and Drug Administration (“FDA”) as “cosmetics,” as defined by the Federal Food, Drug, and Cosmetic (“FDC”) Act. Cosmetic products do not have FDA premarket submission requirements, but they do need to comply with the requirements of the FDC Act, the Fair Packaging and Labeling Act, and FDA’s implementing regulations. Cosmetic products must also comply with the FDA’s ingredient, quality, and labeling requirements and the Federal Trade Commission’s (“FTC”) requirements pertaining to truthful and non-misleading advertising.

We plan to expand our product line to include lubricants that are labeled as “condom safe” or “condom compatible.” The FDA regulates lubricant products that make condom-related claims as “devices,” as defined under the FDC Act. Under the FDC Act, medical devices are categorized by classes- Class I, II, and III. The classification corresponds to the degree of risk associated with the product and the extent of control needed to ensure safety and effectiveness. The FDA regulates lubricants making condom compatibility claims as Class II devices. As such, condom compatible lubricants would require the submission of a 510(k) premarket notification to the FDA and the issuance of a clearance order to be marketed in the United States. Other requirements apply to Class II devices including compliance with the FDA’s Quality System Regulation (“QSR”), facility registration and product listing, reporting of adverse medical events, and appropriate, truthful and non-misleading labeling, advertising, and promotional materials.

In order for the FDA to clear a 510(k) premarket notification, the sponsor must submit information and data demonstrating that the device is “substantially equivalent” to a “predicate” device, which is a device that was either legally marketed prior to May 28, 1976 (the date upon which the Medical Device Amendments of 1976 were enacted) or subsequently cleared through the 510(k) premarket notification process. By statute, the FDA is required to review and clear a 510(k) premarket notification within 90 days of the submission. As a practical matter, clearance often takes considerably longer. A Class II device requiring the submission of a 510(k) premarket notification cannot be marketed in the U.S. without first receiving FDA market clearance.

8

In December 2008, we submitted two 510(k) premarket notifications to FDA to support condom compatible claims for our water-based and silicone-based lubricants. Prior to submitting the 510(k) premarket notifications, we engaged legal counsel to assist in the preparation of the 510(k) premarket notifications and engaged independent laboratories to conduct the necessary studies to support the submissions. In December 2009, after one year of interactive review and discussion with FDA, which included expanding requests for testing data not previously requested of other companies, the FDA notified us that it considered the 510(k) premarket notifications withdrawn since more than 30 days had elapsed since it requested additional information. We contested this conclusion and the FDA agreed to grant us additional time to complete the testing pursuant to the agreed upon protocol. This testing was completed in October 2010. However, when we attempted to submit the final test data, the FDA was unwilling to reopen the 510(k) files and accept the data for review. We contested this position, but the FDA was unwilling to reopen the 510(k) files.

We are currently in the process of updating our 2008 510(k) filings and resubmitting two new 510(k) premarket notifications. We expect to submit the 510(k) premarket notifications before the end of the third quarter of 2011. The new submissions will each be subject to user fees of $2,174 (as a small business with gross sales less than $100 million). As with any regulatory process, there can be no assurance that the device submissions will receive 510(k) clearance within 90 days of submission or that we will be successful in obtaining 510(k) clearances. If the FDA agrees that the products are substantially equivalent to the listed predicate devices, it will grant a clearance order that would allow us to market our water-based and silicone-based lubricant products with condom compatibility claims in the U.S. If the product formulation or intended use is subsequently significantly changed or modified, a new 510(k) premarket notification would need to be submitted and cleared by the FDA. The FDA regulates significant aspects of the device lifecycle, including research, testing, manufacturing, safety, labeling, storage, recordkeeping, promotion, distribution, production, import, and export. Once we receive FDA clearance and begin marketing condom compatible lubricants in the U.S., we will be subject to the FDA’s medical device regulatory authority. Device products must also comply with the FTC’s requirements pertaining to truthful and non-misleading advertising.

Polarin previously distributed our products from Hong Kong to Australia and New Zealand through its wholly-owned Australian subsidiary, Polarin Pty Ltd. (“Polarin Australia”) pursuant to permits issued by Australia and New Zealand. When we acquired the assets of Polarin in the first quarter of 2011, we obtained Polarin’s New Zealand Medsafe Import Permit issued by the New Zealand Medicines and Medical Devices Safety Authority which will allow us to export our products to New Zealand. In addition, Polarin Australia holds a Certificate of Inclusion of a Medical Device issued by the Therapeutic Goods Administration, Department of Health and Ageing of the Australian Government. We will be required to maintain these permits in order to continue to export products to Australia and New Zealand through EP Asia. We will apply for extensions of such permits prior to their expiration, but cannot guarantee that such permits will be renewed.

We believe that our nutritional supplement products will qualify as a “dietary supplement” covered by the Dietary Supplement Health and Education Act of 1994 (“DSHEA”) and will not require FDA approval for their release.

Research and Development

For the three months ended March 31, 2011 and the years ended December 31, 2010 and 2009, we expended $0, $73,459 and $83,033, respectively, in research and development costs.

Intellectual Property

We use trademarks on all of our products to maintain and enhance our competitiveness. We believe that having distinctive identifiable trademarks is an important factor in creating a market for our goods and distinguishing our products from those of other companies. We currently own an aggregate of 89 trademarks for our products registered in the U.S., Australia, Brazil, Canada, China, the European Community, Hong Kong, Iceland, Japan, Mexico, New Zealand, and Taiwan. We consider these trademarks to be of material importance in the operation of our businesses and will protect our trademarks against infringement.

9

Competition

The markets for the products offered by our company are highly fragmented and are characterized by many of small businesses as well as large multi-national companies. With no significant barriers to enter this market, we believe that competition in the industry will intensify. We believe that we compete on the basis of the distinctiveness, quality, performance and price of our products, quality of customer service, promotional activities and brand name recognition. Many of our competitors market products that are well known and trusted by the consumer marketplace, including Johnson & Johnson with its line of K-Y personal lubricants. Our products also compete with Astroglide® made by Biofilm, Inc. and the Wet® line of products made by Trigg Laboratories, Inc. Many of our competitors have significantly greater financial and other resources than we do and have the ability to spend more aggressively on advertising and marketing, spend more on product development and testing, and have more flexibility than we do to respond to changing business and economic conditions and changes in preferences for sexual wellness products.

Employees

As of March 31, 2011, we had 12 employees, all of which are full time. We have not experienced any work stoppages and we consider our relations with our employees to be good.

Properties

We rent approximately 11,000 square feet of office and manufacturing space at our headquarters located at 3367 West Oquendo Road, Las Vegas, Nevada 89118 from an affiliate that is controlled by Scott Fraser, our Chief Executive Officer, under a triple net lease expiring on February 28, 2012. Monthly base rent under the lease is $7,000. We do not expect to experience any difficulties in renewing our leases, or finding additional or replacement office and warehouse space, at their current or more favorable rates.

In June 2011, we entered into a lease agreement to lease approximately 3,800 square feet of additional manufacturing facility space at 3375 W. Oquendo Road in Las Vegas, which is located next to our existing manufacturing facilities. Pursuant to the lease, which expires on May 31, 2013, our annual rent is $48,000, which is payable in equal monthly installments. Pursuant to the lease, we were also granted an option to purchase the leased premises for $608,000, which we may exercise at any time until the expiration date of the lease.

Our facilities are adequate and suitable for our current needs and for our current expansion plans.

Legal Proceedings

We are not involved in any material legal proceedings outside of the ordinary course of our business.

10

RISK FACTORS

Any investment in our common stock involves a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this report before deciding whether to purchase our common stock. Our business, financial condition or results of operations could be materially adversely affected by these risks if any of them actually occur. Our common stock is quoted on the OTC Bulletin Board and OTCQB under the symbol “OTMF.OB”. This market is extremely limited and the prices quoted are not a reliable indication of the value of our common stock. As of July 6, 2011, no shares of our common stock have traded. If and when our common stock is traded, the trading price could decline due to any of these risks, and an investor may lose all or part of his or her investment. Some of these factors have affected our financial condition and operating results in the past or are currently affecting us. This Current Report on Form 8-K also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks described below and elsewhere in this report.

If the outside contractors we currently use for bulk production of our product content fail to produce in the volumes and quality that we require on a timely basis, we may be unable to meet demand for our products and may lose potential revenues.

We currently contract with specially equipped contractors to handle the large-scale mixing of the formulation components in our products. This external contractor relationship entails added costs and potential disruption to our finished goods schedule. These third-party contractors may encounter difficulties in production, including problems with quality control, quality assurance testing, shortages of qualified personnel, and compliance with federal, state and or other governmental regulations. Our contractors may not be able to expand capacity or to produce additional product requirements for us in the event that demand for our products increases. There can be no assurance that our contractors will be able to continue purchasing raw materials for our products from current suppliers or any other supplier on terms similar to current terms or at all. If these contractors were to encounter any of these difficulties, or experience any interruption in the availability of certain ingredients or significant increases in the prices paid for such materials, our ability to fulfill orders on a timely basis to our customers would be jeopardized. In the future we intend to add the necessary industrial level mixing equipment to our current bottling facility, however, we cannot assure you when and if we will begin to mix our products in-house.

Developing and increasing awareness of our brand is crucial to increasing our customer base and our revenues.

We believe that increasing awareness of our PINK® and GUN OIL® brands will be critical to expanding our customer base and our revenues, especially as we expand our line of product offerings. If we fail to advertise and market our products effectively, we may not succeed in maintaining or increasing awareness of our brands and we may lose customers and our revenues will decline. The delivery of quality products to our customers is also of utmost importance to maintaining and enhancing the reputation of our brand. If our customers do not perceive our products to be of high quality, demand for our products will decline, which could lead to a decline in revenues and an adverse effect on our financial condition.

Our new marketing focus to retail buyers might not be successful and may decrease sales to our wholesale customers.

A component of our overall plan to increase sales, through greater inventory capacity and new product genres, includes direct marketing to the end retail consumers of our products. We have not previously sold products directly to retail customer and cannot assure you that this new marketing strategy will be successful. In implementing this new strategy, we will employ various methods to drive and direct consumer traffic, such as issuing coupons redeemable at preferred online and onsite retail outlets. These methods may cause tension with our wholesale customers that want to control such consumer traffic and cause such customers to retaliate by decreasing their purchase orders with us, which could have a material adverse effect on our business, financial condition, liquidity and operating results.

11

Our plan to implement new sales and marketing strategies to reduce sales and marketing related costs may not be successful.

Our sales and marketing strategies, which have predominantly focused on trade conventions and extensive travel to onsite visits to wholesale accounts, must become more efficient to increase profit margins. We plan to implement new sales and marketing strategies to increase sales and lower our costs per new account added and per order attained by using mass-contact methods such as direct mail and online order solicitation from our customer contact management program on our proprietary server. We cannot assure you that these new sales and marketing methods will result in increased sales or decreased costs.

If we are unsuccessful in developing an online marketing strategy for our products, our sales may decline and cause an adverse effect on our results of operations.

In the past three operating years, we have observed a gradual decline in the number of onsite adult product stores in the U.S. in general and within our active wholesale customer database. Although many of these adult trade retail outlets have transformed into online sales venues, we have had to continually update and convert our marketing materials from point-of-purchase displays to online promotional graphics in HTML format. Our marketing strength has traditionally been physical, point-of-purchase displays where consumers can physically see and hold our unique product packaging. It is uncertain whether our new online marketing strategy will be as successful as our physical marketing displays. Our failure to implement a successful online marketing strategy may lead to fewer sales and an adverse effect on our results of operations.

Our failure to obtain a favorable Nielsen Rating for our products within our anticipated timeframe, if at all, will may hamper our plans to expand sales of our products to major retail chain stores in North American and Canada.

Although we do currently command shelf space in chain stores with less than 100 outlets and in a limited amount of outlets of major chains in North America, our company has not attained the minimum Nielsen Rating needed for us to have our products carried on a large scale at mass retail chains. Mass retail chains, those with over 1,000 outlets in the United States and/or Canada, most often require a minimum Nielsen Rating to carry a specific product line on a large scale. Obtaining a favorable Nielsen Rating is crucial to our plans to our goal to obtain mass retail-chain shelf space for our products. We have started the process of obtaining the required minimum Nielsen Rating, however, we cannot assure you when, if at all, we will be able to obtain such a rating. Our failure to obtain a Nielsen Rating within our projected timeline could hinder our expansion plans and adversely affect our business and results of operations.

A deterioration in trade relations between U.S. and China could negatively impact our inventory production capacity.

The majority of components, such as bottles, caps and labels, for our current product line are purchased from manufacturers based in China. Any disruption in the delivery of these components to our bottling facility in Las Vegas, Nevada would negatively impact our immediate ability fulfill orders. Although there are alternate component vendors in North America, their higher costs and longer delivery times would negatively impact to our fulfillment process and financial condition.

Our entry into the South America markets continues to be difficult which could negatively impact our expansion plans.

We have been attempting to gain initial shelf space in South America for the past several years without success. The requirements to attain import licenses, such as the "anavisa" program in Brazil, continue to change without clear explanation. Although Mexico-based wholesalers have presented themselves as gateways to the South American retail system, we have yet to execute an active distribution agreement with any wholesaler with access to the South American market. This largely receptive market to our current product lines continues to be elusive. Our failure to access the South American market could slow our current expansion plans.

12

Impediments to global shipping lanes can delay crucial deliveries and negatively impact our business, financial condition and results of operations.

Both our receipt of product packaging components and our shipment of finished goods depend heavily on ship cargo container delivery. Past events, such as the British Petroleum oil spill in the Gulf of Mexico in 2010, have caused delays in shipping traffic through the Panama Canal and Mississippi Delta cargo terminals. Although our primary cargo ship deliveries are between Hong Kong and Los Angeles, we experienced shipment delays due to the British Petroleum oil spill and remain vulnerable to future disruptions. Any shipment delays in obtaining our product packaging or shipping our finished products to our customers could negatively impact our business, financial condition and results of operations.

Our planned website upgrades require extensive programming time and may not be completed within our anticipated timeline, which may negatively impact our expansion plans and results of operations.

Through May 2011, our online presence has been limited to an online presentation of our product line and basic avenues to contact our company. We are currently in the process launching an interactive sales and service website through which our wholesale customers can place orders, pay outstanding account balances and request all forms of customer service. We expect to have all online programming upgrades functioning before the end of 2011 but cannot guarantee that we meet that deadline. Our failure to launch our new website when anticipated may negatively impact our expansion plans and results of operations.

Our Las Vegas logistical center can be impacted by foul weather which can disrupt our operations.

Our product bottling and order fulfillment shipping operations can be interrupted by abnormal weather conditions in the high desert environment of Las Vegas, Nevada. In the past, a rare snow storm caused enough roof damage to one of our warehouse facilities to temporary halt personnel and machinery functioning inside. The occurrence of any future abnormal weather conditions could cause damage to our facility and possible cause us to have to stop or delay operations again. Although we have insurance to cover damage to our facilities, we may incur expenses relating to such damages, which could have a material adverse effect on our business and results of operations.

We must increase production space, machinery and personnel in order to implement our current plan to expand production capacity.

We currently plan to triple our production capacity and increase the scope of our product lines under our two trademarked logos, which will require us to triple the operational space of our logistical center in Las Vegas, Nevada. The acquisition of the additional required space is approaching completion but the acquisition of all the new required customized machinery could take until the calendar year end of 2011. We have paid approximately $28,000 in deposits for new bottling equipment in 2011 and have a balance due of approximately $77,000 for the equipment by September 1, 2011. We also plan to purchase an additional $80,000 for additional equipment in 2011. It is difficult to estimate the time required for the hiring and training of the additional personnel that will needed to run the new machines and to account for the increase in productions shifts we plan to implement for our expansion. We cannot assure you that we will be able to increase our production space, machinery and personnel needed for our expansion in a timely manner to meet our current expansion timeline.

If we cannot increase the electrical power capacity of our bottling plant, we may be unable to increase our bottling capacity as currently planned.

Each additional bottling line with higher capacity flow pumps and components substantially increases our facility’s power supply needs from the local grid. Our logistical director is currently working with our local utility provider to increase the power supply that will be needed to run all of our new equipment and production lines we intend to add in 2011, however, we cannot assure you that we will be able to obtain an adequate power supply for our new equipment to complete our plan to triple production capacity. We have rented a new facility at which we intend to place our new production line. We believe that this additional facility has sufficient power supply for our anticipated future expansion, however it will take time to prepare the new facility and begin production operations there. If we are unable to obtain an adequate power supply for our equipment at our current location, we may not be able to implement our current expansion plans.

13

The adult nature of our products may prevent some companies from doing business with us.

Some companies we seek to provide products and services to us may be concerned that associating with our company due to the adult nature of our products. These companies may be reluctant to enter into or continue business relationships with us. We cannot assure you that we will be able to maintain our existing business relationships with the companies that currently provide services and products to us. We could be forced to enter into business arrangements on terms less favorable to us than we might otherwise obtain, which could lead to higher transaction costs. If we are unable to maintain our existing business relationships or enter into business relationships with other product and service providers in the future may materially adversely affect our business, financial condition and results of operations.

We may not be successful in attracting new consumer groups for our new nutritional supplement product line.

The retail consumers of our current topical gels, lotions and oils products are predominately onsite and online customers of adult products stores, independent and chain drugstores and women’s accessory boutiques. The success of our new lines of nutritional supplements will depend upon attracting a consumer following from customers of onsite and online grocery stores, wellness product merchants and group medical service providers. The appeal of our new nutritional supplement products to and the recognition of our trademark logos by these new consumer groups could be less than we currently anticipate. Our failure to attract new consumers for these products may result in increased costs and cause a material adverse effect on our results of operations.

Our current management has no experience in developing and selling nutritional supplements.

Since March 2002 through May 2011, the core of our sales revenues has derived from our line of topically applied gels, lotions and interactive lubricants. Our current management is drawing on this specific product-scope experience to launch products in the nutritional supplement category. No member of our management team has previously been involved in the nutritional supplements industry. We cannot assure you that the sales and marketing strategies employed by our current management and sales staff that have been successful for our traditional product lines will be as effective for our launch of products in these new categories.

Our current trademark protections might not translate over to our new nutritional supplement products categories

Our current trademarks cover our product line in category 25 for topical applications in 30 countries under the PINK® and GUN OIL® logos. Our product line expansion into nutritional supplements will qualify under new product categories for trademark protection. We have not yet determined the need and cost for additional trademark registrations for new products under our current logos that may be needed. Costs associated with any new needed trademark registrations would negatively affect our results of operations.

Our inexperience in dealing with the Food & Drug Administration may harm our plans to offer nutritional supplement products.

We expect our product expansion into nutritional supplements to require expert guidance with Food & Drug Administration (FDA) procedures. During a previous labeling application with FDA, Empowered Products spent over three years and $300,000 for a selected expert to guide us through the approval process but no tangible result or decision was attained. We are currently seeking the assistance of an expert in FDA policies and procedures in anticipation of our pending FDA guidance and procedure needs. We cannot guarantee you that we will be successful in obtaining any needed FDA approvals for our products.

We may be subject to product liability claims from our products, which could result in costly litigation and a material adverse effect on our business and results of operations.

The development and sale of our topical lubrication products exposes us to the risk of damages from product liability or other consumer claims. Such claims may arise despite our quality controls, proper testing and instruction for use of our products. We may still incur substantial costs related to a product liability claim, which could adversely affect our business and results of operations.

14

We will be subject to competition from numerous companies, including a number of multi-national companies that have significantly greater financial and other resources.

The sexual wellness business is highly competitive and very fragmented. With no significant barriers to enter the sexual wellness market, we believe that competition in the industry will intensify. We will be competing with hundreds of large and small companies, including large multi-national companies such as Johnson & Johnson, the maker the most recognized personal lubricant product, K-Y Jelly, and numerous other multi-national manufacturers. Most of our competitors market products that are well known and trusted by the consumer marketplace. Since virtually all of our competitors have significantly greater financial and other resources than we do, our competitors have the ability to spend more aggressively on advertising and marketing, spend more on product development and testing, and have more flexibility than we do to respond to changing business and economic conditions and changes in preferences for sexual wellness products. Any delays in our development or release of new products in response to changing customer preferences could materially adversely affect our operating results and financial condition. Our existing competitors and future potential competitors may develop or market products that will be more accepted in the marketplace than our products. Competition in the sexual wellness business is based on product price, product quality of the products, promotional activities, advertising, new product introductions, name recognition, and other factors. It is difficult for us to predict how we will be able to effectively compete with our competitors’ actions in these areas. We cannot assure you that we will have the resources to compete successfully with our competitors.

We may need additional capital to implement our current business strategy, which may not be available to us.

We currently depend on net revenues to meet our short-term cash requirements. In order to grow revenues and sustain profitability, we will need additional capital. Obtaining additional financing will be subject to a number of factors, including market conditions, our operating performance and investor sentiment. These factors may make the timing, amount, terms and conditions of additional financing unattractive to us. We cannot assure you that we will be able to obtain any additional financing. If we are unable to obtain the financing needed to implement our business strategy, we may have to delay, modify or abandon some of our expansion plans. This could slow our growth, negatively affect our ability to compete in the marketplace and adversely affect our financial condition.

Raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights.

We may seek additional capital through a combination of private and public equity offerings, debt financings and collaborations and strategic and licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest will be diluted, and the terms may include liquidation or other preferences that adversely affect your rights as a stockholder. Debt financing, if available, would result in increased fixed payment obligations and may involve agreements that include covenants limiting or restricting our ability to take specific actions such as incurring debt, making capital expenditures or declaring dividends.

We rely heavily on the founder of EP Nevada, Scott Fraser, our current President and Chief Executive Officer. The loss of his services would have a material adverse effect upon the Company and its business and prospects.

Our success depends, to a significant extent, upon the continued services of Scott Fraser, who is the founder of EP Nevada and our current President and Chief Executive Officer. Mr. Fraser is not subject to any agreement that prevents him from soliciting our existing customers or disclosing information deemed confidential to us, we do not have any agreement with Mr. Fraser or any key members of management that would prohibit them from joining our competitors or forming competing companies. If Mr. Fraser or any key management personnel resigns to join a competitor or form a competing company, the loss of such personnel, together with the loss of any customers or potential customers due to such executive’s departure, could materially and adversely affect our business and results of operations.

15

If we are unable to protect our proprietary technology, we may not be able to compete as effectively and our business and financial prospects may be harmed.

We believe that our trademarks, in particular PINK® and GUN OIL®, are crucial to our success, growth potential and competitiveness. Our products are currently sold under these trademarks in over 30 countries. There is no assurance that there will not be any infringement of our brand name or other registered trademarks. Should any such infringement occur, our reputation and business may be adversely affected. We may also incur significant expenses and substantial amounts of time and effort to enforce our trademark rights in the future. Such diversion of our resources may adversely affect our existing business and future expansion plans.

We cannot guarantee the protection of our intellectual property rights and if infringement of our intellectual property rights occurs, including counterfeiting of our products, our reputation and business may be adversely affected.

Should any such infringement and/or counterfeiting occur, our reputation and business may be adversely affected. We may also incur significant expenses and substantial amounts of time and effort to enforce our trademark rights in the future. Such diversion of our resources may adversely affect our existing business and future expansion plans.

If we are subject to Intellectual property litigation, we could incur significant costs and liabilities which could disrupt our business and negatively affect our financial condition and results of operations.

We may be subject to claims of infringement or other violations of intellectual property rights. Whether or not such a claim is valid, receipt of these notices could result in significant costs and diversion of the attention of management from our business operations. To the extent that any claim brought against us against us is successful, we may have to pay monetary damages or discontinue sales of any of our products that are found to be in violation of another party’s rights, which could result in a material adverse effect on our financial condition and results of operations.

Our failure to effectively manage growth could harm our business.

We have rapidly and significantly expanded our operations since our inception and will endeavor to further expand our operations in the future with our current plans to triple our output capacity at our bottling facility. Any additional significant growth in the market for our products or our entry into new markets may require and expansion of our employee base for managerial, operational, financial, sales and marketing and other purposes. During any growth, we may face problems related to our operational and financial systems and controls, including quality control and customer service capacities. We would also need to continue to expand, train and manage our employee base. Continued future growth will impose significant added responsibilities upon the members of management to identify, recruit, maintain, integrate, and motivate new employees.

Aside from increased difficulties in the management of human resources, we may also encounter working capital issues, as we will need increased liquidity to finance the development of new products, to increase our output capacity and to hire additional employees. For effective growth management, we will be required to continue improving our operations, management, and financial systems and controls. Our failure to manage growth effectively may lead to operational and financial inefficiencies that will have a negative effect on our profitability. We cannot assure investors that we will be able to timely and effectively meet that demand and maintain the quality standards required by our existing and potential customers.

Our business and results of operations may be negatively impacted by general economic and financial market conditions and such conditions may exacerbate the other risks that affect our business.

The global economy is currently in a pronounced economic downturn. Global financial markets are continuing to experience disruptions, including severely diminished liquidity and credit availability, declines in consumer confidence, declines in economic growth, increases in unemployment rates, and uncertainty about economic stability. Given these uncertainties, there is no assurance that there will not be further deterioration in the global economy, the global financial markets and consumer confidence. Although we believe we have adequate liquidity and capital resources to fund our operations internally, in light of current market conditions, our inability to access the capital markets on favorable terms, or at all, may adversely affect our financial performance. Current market conditions could impair our ability to raise additional capital when needed for our operations and planned expansion. The inability to obtain adequate financing from debt or capital sources could force us to self-fund strategic initiatives or even forego certain opportunities, which in turn could potentially harm our performance.

16

We are unable to predict the likely duration and severity of the current disruption in financial markets and adverse economic conditions in the U.S. and abroad, but the longer the duration the greater risks we face in operating our business. There can be no assurance, therefore, that current economic conditions or worsening economic conditions or a prolonged or recurring recession will not have a significant adverse impact on our operating results.

We may pursue future growth through strategic acquisitions and alliances which may not yield anticipated benefits and may adversely affect our operating results, financial condition and existing business.

We may seek to grow in the future through strategic acquisitions in order to complement and expand our business. The success of our acquisition strategy will depend on, among other things:

|

·

|

the availability of suitable candidates;

|

|

·

|

competition from other companies for the purchase of available candidates;

|

|

·

|

our ability to value those candidates accurately and negotiate favorable terms for those acquisitions;

|

|

·

|

the availability of funds to finance acquisitions;

|

|

·

|

the ability to establish new informational, operational and financial systems to meet the needs of our business;

|

|

·

|

the ability to achieve anticipated synergies, including with respect to complementary products; and

|

|

·

|

the availability of management resources to oversee the integration and operation of the acquired businesses.

|

If we are not successful in integrating acquired businesses and completing acquisitions in the future, we may be required to reevaluate our acquisition strategy. We also may incur substantial expenses and devote significant management time and resources in seeking to complete acquisitions. Acquired businesses may fail to meet our performance expectations. If we do not achieve the anticipated benefits of an acquisition as rapidly as expected, or at all, investors or analysts may not perceive the same benefits of the acquisition as we do. If these risks materialize, our stock price could be materially adversely affected.

We may adopted an equity incentive plan under which we may grant securities to compensate employees and other services providers, which could result in increased share-based compensation expenses and, therefore, reduce net income.

We may adopt an equity incentive plan under which we may grant shares or options to qualified employees. Under current accounting rules, we would be required to recognize share-based compensation as compensation expense in our statement of operations, based on the fair value of equity awards on the date of the grant, and recognize the compensation expense over the period in which the recipient is required to provide service in exchange for the equity award. We have not made any such grants in the past, and accordingly our results of operations have not contained any share-based compensation charges. The additional expenses associated with share-based compensation may reduce the attractiveness of issuing stock options under an equity incentive plan that we may adopt in the future. If we grant equity compensation to attract and retain key personnel, the expenses associated with share-based compensation may adversely affect our net income. However, if we do not grant equity compensation, we may not be able to attract and retain key personnel or be forced to expend cash or other compensation instead. Furthermore, the issuance of equity awards would dilute the stockholders’ ownership interests in our company.

17

Our charter documents and our stockholder rights plan may have anti-takeover effects that could prevent a change in control, which may cause our stock price to decline.

Our articles of incorporation or our bylaws could make it more difficult for a third party to acquire us, even if closing such a transaction would be beneficial to our stockholders. We are authorized to issue up to 5,000,000 shares of preferred stock. This preferred stock may be issued in one or more series, the terms of which may be determined at the time of issuance by our board of directors without further action by stockholders. The terms of any series of preferred stock may include voting rights (including the right to vote as a series on particular matters), preferences as to dividend, liquidation, conversion and redemption rights and sinking fund provisions. No preferred stock is currently outstanding. The issuance of any preferred stock could materially adversely affect the rights of the holders of our common stock, and therefore, reduce the value of our common stock. In particular, specific rights granted to future holders of preferred stock could be used to restrict our ability to merge with, or sell our assets to, a third party and thereby preserve control by the present management.

Our articles of incorporation and bylaws also contain provisions that could have the effect of discouraging potential acquisition proposals or making a tender offer or delaying or preventing a change in control, including changes a stockholder might consider favorable. In particular, the articles of incorporation and bylaws, as applicable, among other things:

|

•

|

provide the board of directors with the ability to alter the bylaws without stockholder approval; and

|

||

|

•

|

provide that vacancies on the board of directors may be filled by a majority of directors in office, although less than a quorum.

|

These provisions are expected to discourage certain types of coercive takeover practices and inadequate takeover bids and to encourage persons seeking to acquire control of our company to first negotiate with its Board. These provisions may delay or prevent someone from acquiring or merging with us, which may cause the market price of our common stock to decline.

RISKS RELATED TO OUR CAPITAL STRUCTURE

There is no current trading market for our common stock, and there is no assurance of an established public trading market, which would adversely affect the ability of our investors to sell their securities in the public market.

Our common stock is quoted on the OTC Bulletin Board and OTCQB under the symbol “OTMF.OB”, although we expect to receive a new symbol due to our name change. This market is extremely limited and the prices quoted are not a reliable indication of the value of our common stock. As of July 6, 2011, no shares of our common stock have traded. FINRA has enacted changes that limit quotations on the OTC Bulletin Board to securities of issuers that are current in their reports filed with the SEC. The OTC Bulletin Board is an inter-dealer, over-the-counter market that provides significantly less liquidity than the NASDAQ Global Market and NYSE Amex. Quotes for stocks included on the OTC Bulletin Board are not listed in the financial sections of newspapers as are those for the NASDAQ Stock Market and NYSE Amex. Therefore, prices for securities traded solely on the OTC Bulletin Board may be difficult to obtain and holders of common stock may be unable to resell their securities at or near their original offering price or at any price.

The market price and trading volume of shares of our common stock may be volatile.

When and if a market develops for our securities, the market price of our common stock could fluctuate significantly for many reasons, including reasons unrelated to our specific performance, such as reports by industry analysts, investor perceptions, or announcements by our competitors regarding their own performance, as well as general economic and industry conditions. For example, to the extent that other companies within our industry experience declines in their share price, our share price may decline as well. Fluctuations in operating results or the failure of operating results to meet the expectations of public market analysts and investors may negatively impact the price of our securities. Quarterly operating results may fluctuate in the future due to a variety of factors that could negatively affect revenues or expenses in any particular quarter, including vulnerability of our business to a general economic downturn; changes in the laws that affect our products or operations; competition; compensation related expenses; application of accounting standards; and our ability to obtain and maintain all necessary government certifications and/or licenses to conduct our business. In addition, when the market price of a company’s shares drops significantly, shareholders could institute securities class action lawsuits against the company. A lawsuit against us could cause us to incur substantial costs and could divert the time and attention of our management and other resources.

18

Shares eligible for future sale may adversely affect the market price of our common stock, as the future sale of a substantial amount of outstanding stock in the public marketplace could reduce the price of our common stock.

Following the one year anniversary of the filing of this report, the former shareholders of EP Nevada may be eligible to sell all or some of our shares of common stock by means of ordinary brokerage transactions in the open market pursuant to Rule 144, promulgated under the Securities Act (“Rule 144”), subject to certain limitations. Under Rule 144, an affiliate stockholder who has satisfied the required holding period may, under certain circumstances, sell within any three-month period a number of securities which does not exceed the greater of 1% of the then outstanding shares of common stock or the average weekly trading volume of the class during the four calendar weeks prior to such sale. As of the closing of the Merger, the Private Placement and the Share Cancellation, 1% of our issued and outstanding shares of common stock was approximately 623,889 shares. Non-affiliate stockholders are not subject to volume limitations. Any substantial sale of common stock pursuant to any resale prospectus or Rule 144 may have an adverse effect on the market price of our common stock by creating an excessive supply.

Following the Merger, members of our management team have significant influence over us.

Immediately following completion of the Merger, Mr. Fraser owns approximately 64.1% of the outstanding common stock. Mr. Fraser has a controlling influence in determining the outcome of any corporate transaction or other matters submitted to our stockholders for approval, including mergers, consolidations and the sale of all or substantially all of our assets, election of directors, and other significant corporate actions. Mr. Fraser may also have the power to prevent or cause a change in control. In addition, without the consent of Mr. Fraser, we could be prevented from entering into transactions that could be beneficial to us. The interests of Mr. Fraser may differ from the interests of our other stockholders.

If we fail to maintain effective internal controls over financial reporting, the price of our common stock may be adversely affected.

We are required to establish and maintain appropriate internal controls over financial reporting. Failure to establish those controls, or any failure of those controls once established, could adversely impact our public disclosures regarding our business, financial condition or results of operations. Any failure of these controls could also prevent us from maintaining accurate accounting records and discovering accounting errors and financial frauds. Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual assessment of our internal control over financial reporting. The standards that must be met for management to assess the internal control over financial reporting as effective complex, and require significant documentation, testing and possible remediation to meet the detailed standards. We may encounter problems or delays in completing activities necessary to make an assessment of our internal control over financial reporting. If we cannot assess our internal control over financial reporting as effective, investor confidence and share value may be negatively impacted.

In addition, management’s assessment of internal controls over financial reporting may identify weaknesses and conditions that need to be addressed in our internal controls over financial reporting or other matters that may raise concerns for investors. Any actual or perceived weaknesses and conditions that need to be addressed in our internal control over financial reporting, disclosure of management’s assessment of our internal controls over financial reporting, or disclosure of our public accounting firm’s attestation to or report on management’s assessment of our internal controls over financial reporting may have an adverse impact on the price of our common stock.

19

We may not be able to achieve the benefits we expect to result from the Merger.

On June 30, 2011, we entered into a Merger Agreement with Acquisition Sub, Name Change Merger Sub, and EP Nevada, pursuant to which EP Nevada merged with and into Acquisition Sub with EP Nevada continuing as the surviving entity (the “Merger”). Upon the closing of the Merger, we exchanged each outstanding share of EP Nevada common stock for 4 shares of our common stock. As a result of the Merger, EP Nevada became our wholly-owned subsidiary and our operations became that of EP Nevada.

We may not realize the benefits that we hoped to receive as a result of the Merger, which include:

|

·

|

access to the capital markets of the United States;

|

|

·

|

the increased market liquidity expected to result from exchanging stock in a private company for securities of a public company that may eventually be traded;

|

|

·

|

the ability to use registered securities to make acquisition of assets or businesses;

|

|

·

|

increased visibility in the financial community;

|

|

·

|

enhanced access to the capital markets;

|

|

·

|

improved transparency of operations; and

|

|

·

|

perceived credibility and enhanced corporate image of being a publicly traded company.

|

There can be no assurance that any of the anticipated benefits of the Merger will be realized with respect to our new business operations. In addition, the attention and effort devoted to achieving the benefits of the Merger and attending to the obligations of being a public company, such as reporting requirements and securities regulations, could significantly divert management’s attention from other important issues, which could materially and adversely affect our operating results or stock price in the future.

We will incur significantly increased costs as a result of operating as a public company, and our management will be required to devote substantial time to compliance efforts.