Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - LEAP WIRELESS INTERNATIONAL INC | d8k.htm |

Building

Value July 7, 2011

Exhibit 99.1 |

2

Presentation of Financial and Other Important Information

Presentation of Financial Information Historical financial and

operating data in this presentation reflect the consolidated results of Leap Wireless International, Inc. (the “Company” or “Leap”) and its subsidiaries and

consolidated joint ventures for the periods indicated. The term “voice services”

refers to the Company’s Cricket Wireless, Muve Music™ and Cricket PAYGo™ service offerings, and the term

“broadband services” refers to the Company’s Cricket Broadband service.

This presentation includes financial information prepared in accordance with accounting principles generally

accepted in the United States (“GAAP”), as well as other financial measures referred

to as non-GAAP. The non-GAAP financial measures, which include Average Revenue Per User (ARPU),

Cost Per Gross Customer Addition (CPGA), Cash Cost Per User (CCU) and adjusted operating income

before depreciation and amortization (OIBDA), should be considered in addition to, but

not as substitutes for, the information prepared in accordance with GAAP. For definitions of

these non-GAAP financial measures and reconciliations to the most comparable GAAP measures,

please see the information under the heading “Financial Reports – Non-GAAP

Financial Measures” in the Investor Relations section of Leap’s corporate website (investor.leapwireless.com).

Proxy Solicitation

In connection with the solicitation of proxies, Leap filed with the SEC on June

28, 2011 a definitive proxy statement and has filed and will file other relevant documents concerning the

proposals to be presented at Leap’s 2011 Annual Stockholders’ Meeting (the “2011

Annual Meeting”). Leap also mailed the definitive proxy statement to its stockholders. In addition, Leap

files annual, quarterly and special reports, proxy and information statements and other

information with the SEC. Leap’s stockholders are urged to read the proxy statement and other

information because they contain important information about Leap and the proposals to be

presented at the 2011 Annual Meeting. These documents are available for free at the SEC’s

website (www.sec.gov) or from Leap (www.leapwireless.com). The contents of the websites

referenced herein are not deemed to be incorporated by reference into the proxy statement.

Leap and its directors, executive officers and certain employees may be deemed to be

participants in the solicitation of proxies from Leap’s stockholders in connection with the election of

directors and other matters to be proposed at Leap’s 2011 Annual Meeting. Information

regarding the interests, if any, of these directors, executive officers and specified employees is

included in the definitive proxy statement filed by Leap with the SEC. Forward-Looking

Statements

This presentation contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Such statements reflect management’s current

expectations based on currently available operating, financial and competitive information, but

are subject to risks, uncertainties and assumptions that could cause actual results to differ

materially from those anticipated in or implied by the forward-looking statements. Our

forward-looking statements include our discussions about our expected, future financial performance,

including as a result of our current and future product and service plan offerings, future

plans to transition to LTE and expected contributions from management and Leap’s proposed slate

of nominees to the board of directors and are generally identified with words such as

“believe,” “think”, “expect,” “estimate,” “intend,” “seek,” “anticipate,” “continue,” “plan,” “will,” “could,”

“should,” “may” and similar expressions. Risks, uncertainties and

assumptions that could affect our forward-looking statements include, among other things: our ability to attract and retain

customers in an extremely competitive marketplace; the duration and severity of the current

economic downturn in the United States and changes in economic conditions, including interest

rates, consumer credit conditions, consumer debt levels, consumer confidence, unemployment

rates, energy costs and other macro-economic factors that could adversely affect demand for

the services we provide; the impact of competitors’ initiatives; our ability to

successfully implement product and service plan offerings, expand our retail distribution and execute effectively

on our other strategic activities; our ability to obtain and maintain roaming and wholesale

services from other carriers at cost-effective rates; our ability to maintain effective internal control

over financial reporting; our ability to attract, integrate, motivate and retain an experienced

workforce, including members of senior management; future customer usage of our wireless

services, which could exceed our expectations, and our ability to manage or increase network

capacity to meet increasing customer demand; our ability to acquire additional spectrum in the

future at a reasonable cost or on a timely basis; our ability to comply with the covenants in

any credit agreement, indenture or similar instrument governing any of our existing or future

indebtedness; our ability to effectively integrate, manage and operate our new joint venture in

South Texas; failure of our network or information technology systems to perform according

to expectations and risks associated with the upgrade or transition of certain of those

systems, including our billing system; and other factors detailed in the section entitled “Risk Factors”

included in our periodic reports filed with the SEC, including our Quarterly Report on Form

10-Q for the quarter ended March 31, 2011, filed with the SEC on May 6, 2011.

All forward-looking statements included in this presentation should be considered in the

context of these risks. We undertake no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise. In light of

these risks and uncertainties, the forward-looking events and circumstances discussed in this

presentation may not occur and actual results could differ materially from those anticipated or

implied in the forward-looking statements. Investors and prospective investors are cautioned

not to place undue reliance on our forward-looking statements. |

•

Executive Overview

•

Industry Perspective –

Rapid Growth of Prepaid

•

Business Update –

On Trajectory to Grow Stockholder Value

•

Board of Directors –

Experienced and Independent

•

Pentwater Proposal and Proxy Contest –

Opportunistic and Non-Compliant

•

Conclusion –

Vote FOR

Leap’s nominees on the WHITE Proxy Card

3

Agenda |

•

Leap

implemented

significant

changes

in

2010

to

better

position

business

-

Simple, all-inclusive service plans

-

New device portfolio, including smartphones

-

Nationwide voice and data coverage

-

Additions to senior management to better align with customers and improve execution

-

Completion of significant back-office system enhancements

•

Changes

delivered

dramatic

improvements

in

operating

performance,

positioning

Leap

for

improved

financial results and increased stockholder value

-

Customer churn at lowest levels in nearly a decade, with voice churn of 2.8% in 1Q11

-

Smartphones and accompanying $55 service plan comprised approximately 40% of our sales mix at

1Q11, with customer upgrades and migrations continuing at unprecedented rates

-

Significant improvements in average revenue per user (ARPU), driven by adoption of smartphones

and higher-revenue service plans

-

Board and management continuing to implement initiatives to further momentum and position the

Company for the future

•

Leap stock up ~65%

since August 4, 2010, after new initiatives were presented at Leap’s Analyst Day

•

Leap

is

led

by

an

experienced

and

independent

Board

of

Directors

4

Executive Overview –

Leap

Keep

Leap

on

track

for

improved

stockholder

value

–

vote

FOR

Leap’s

nominees

on

the

WHITE

proxy

card |

•

Pentwater

lacks

any

strategy

for

the

Company

beyond

actions

Leap

is

already

pursuing

•

Pentwater

is

interested

only

in

short-term

profit

–

and

has

sold

~40%

of

its

Leap

holdings

since

announcing proxy fight

•

What Pentwater Didn’t Do

-

Discuss operational proposals/suggestions with the Company prior

to initiating proxy fight

-

Disclose all material information when nominating directors

-

Commence

action

in

Delaware

for

months

after

being

informed

on

March

31

that

they

didn’t

comply

with

Bylaws

-

Ask for a waiver under Leap’s NOL preservation plan to purchase 5% or more of Leap

stock •

What Pentwater Did Do

-

Submitted

non-compliant

nomination

one

day

before

end

of

notice

period

-

Sold

~40%

of

its

position

in

Leap

in

the

three

months

after

announcing

proxy

fight,

including

selling

on

day

they

filed initial proxy statement

-

Established

short

position

covering

more

than

1.6M

Leap

shares,

equal

to

~67%

of

its

2.4M

shares

held

as

of

6/20/11

•

Votes

for

Pentwater

will

not

be

counted

absent

contrary

Delaware

court

judgment

5

Executive Overview –

Pentwater Capital Management

st

Keep

Leap

on

track

for

improved

stockholder

value

–

vote

FOR

Leap’s

nominees

on

the

WHITE

proxy

card |

INDUSTRY

PERSPECTIVE Rapid Growth of Prepaid

6 |

7

•

Innovative, leading prepaid wireless carrier in U.S.

with ~6 million customers

•

Nation’s 7th largest wireless carrier

•

Offers unlimited voice, text and data services and

national coverage under Cricket brand; flat rates and

no contracts

•

Targets young, ethnically diverse and value

conscious

customer base –

among the fastest growing market

segments

•

Leverages industry-leading cost structure to provide

services at prices below most competitors

•

Holds spectrum licenses in 35 of top 50 U.S. markets

•

Offers nationwide service via existing network and

strategic roaming partnerships

Leap Snapshot –

Prepaid Wireless Industry Leader |

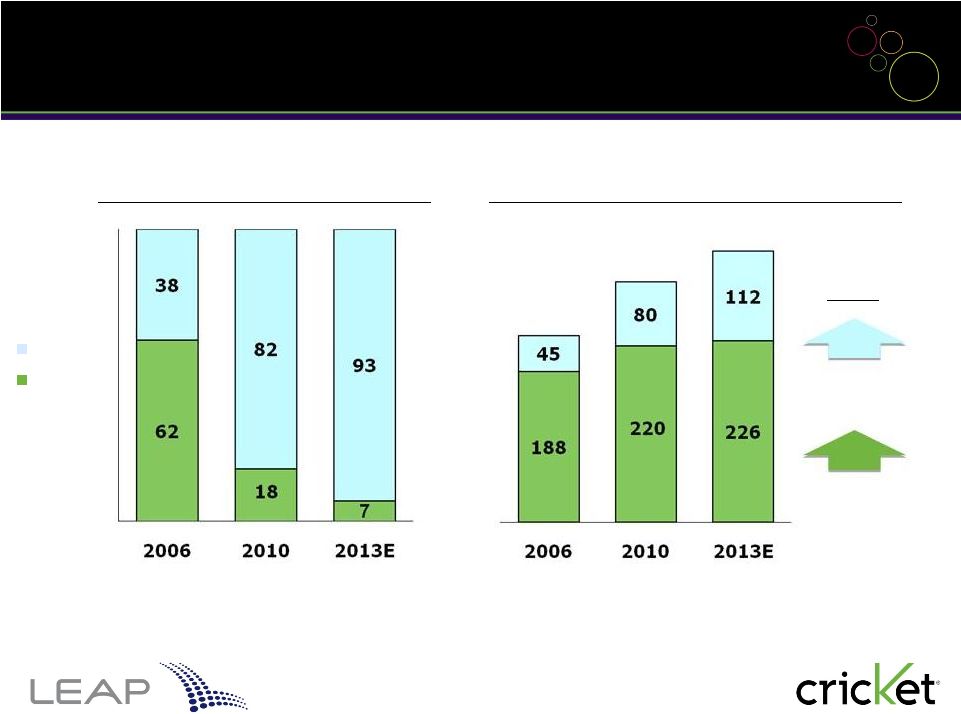

2006

– 2013E

CAGR:

14%

3%

Prepaid

Postpaid

Prepaid

% of total

19%

33%

Share of Net Adds (%)

Subscribers (M)

Source: Oppenheimer Communications and Internet Infrastructure Report, March 8, 2011

8

27%

Prepaid Segment Drives Wireless Industry Growth |

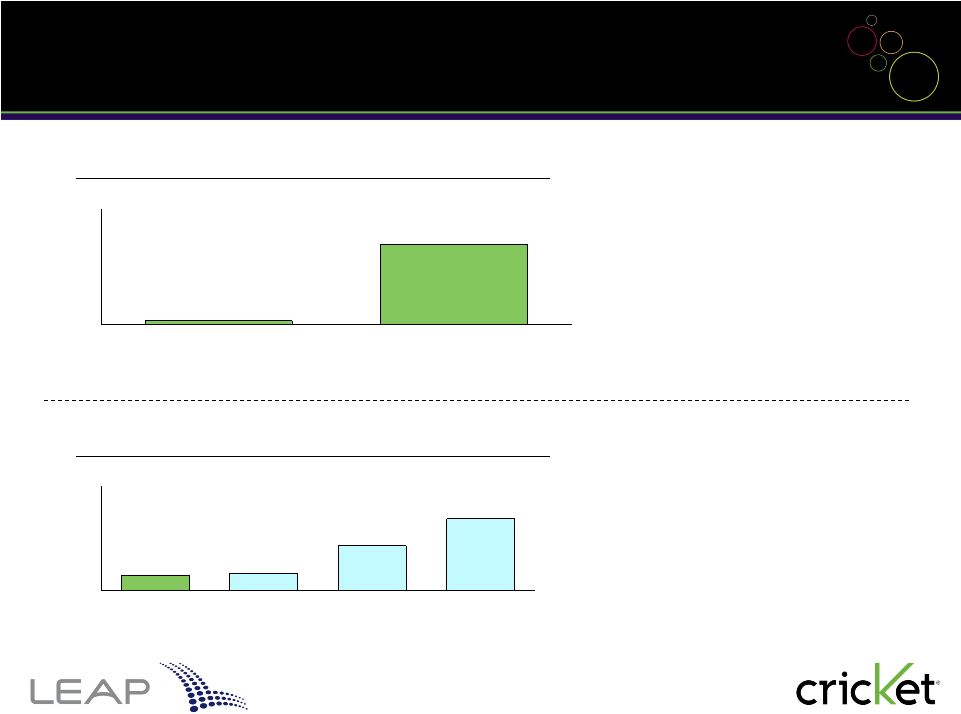

•

Wireless subscribers increasingly using

devices for data services, internet access

and mobile applications

•

Mobile data traffic in North America

expected to grow 80% annually through

2015

Explosive Growth of Mobile-Only Internet Users

Smartphone Opportunity for Prepaid Carriers

•

To date, smartphones

have been sold

predominantly to higher-end customers

•

With increased adoption of data services

and smartphones

by the mass market,

significant opportunity exists for prepaid

carriers

9%

10%

26%

42%

Leap

MetroPCS

Verizon

AT&T

Number of Users in North America (M)

4Q10 Smartphone Penetration

9

2.6

55.6

2010

2015

E

Source:

Morgan

Stanley

Equity

Research.

MetroPCS

penetration

is

a

Morgan

Stanley

research

estimate

Source: Cisco Visual Networking Index: Global Mobile Data Forecast, February 2011

Smartphones

are a Significant Opportunity for Prepaid |

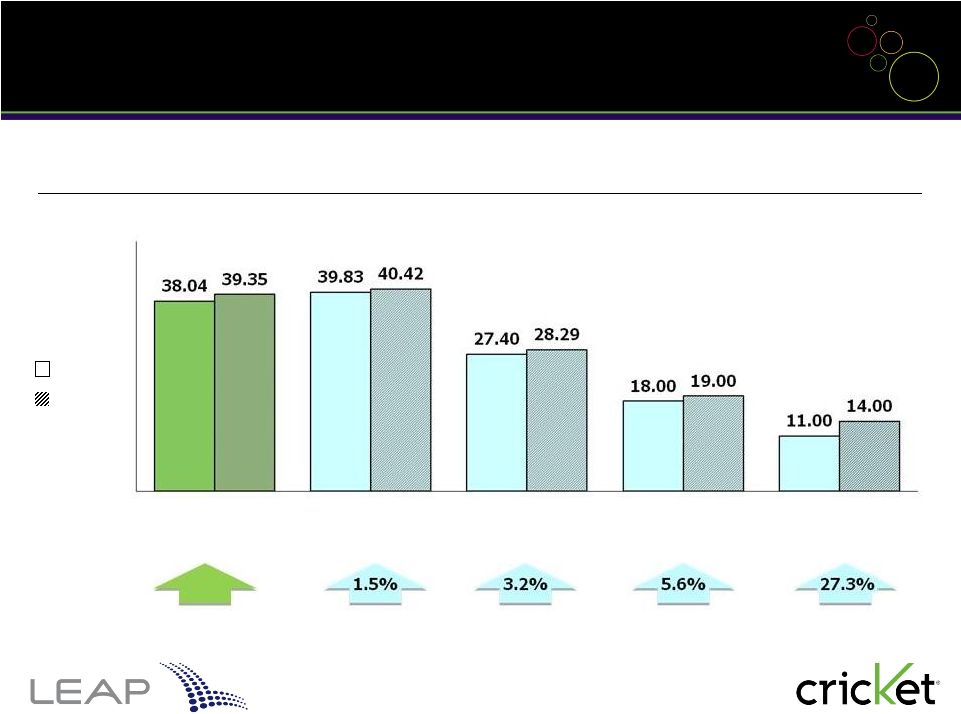

Leap Has

Increased ARPU Near Highest In Industry 10

Prepaid ARPU ($)

Leap

Sprint

T-Mobile

1Q10

1Q11

MetroPCS

3.4%

% Increase

Tracfone

Source: Company Filings, Morgan Stanley Equity Research. Leap includes mobile broadband

metrics. |

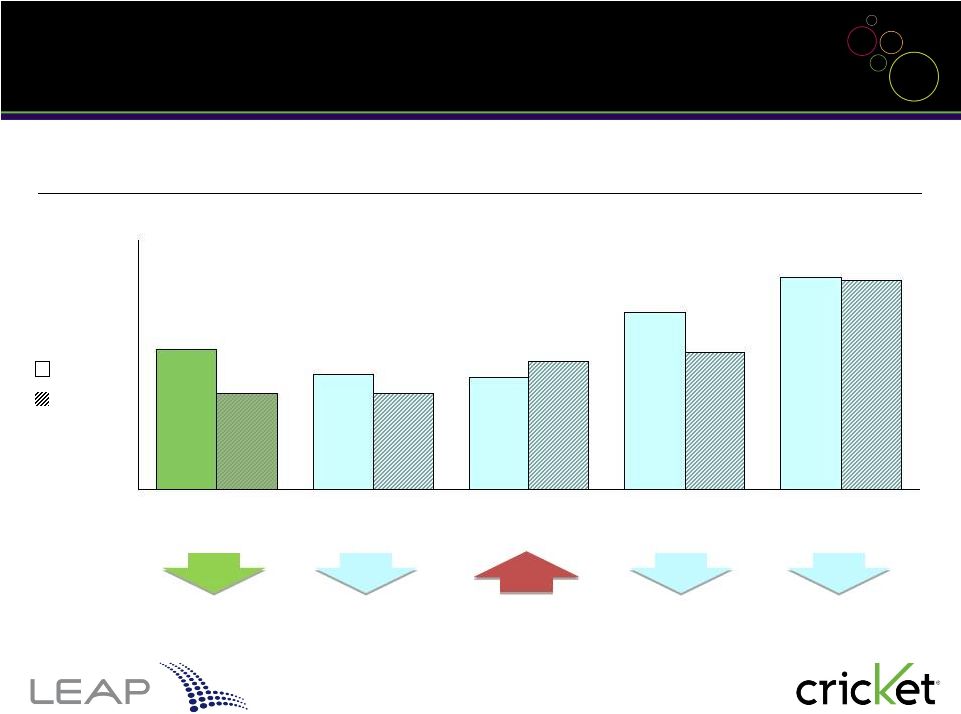

Leap Has

Significantly Lowered Churn to Best in Industry 1Q10

1Q11

Prepaid Churn (%)

4.5

3.7

3.6

5.7

6.8

3.1

3.1

4.1

4.4

6.7

MetroPCS

Leap

Sprint

Increase /

Decrease (bps)

T-Mobile

Tracfone

Source: Company Filings, Morgan Stanley Equity Research. Leap churn includes Cricket

broadband service. 11

140

130

60

10

50 |

BUSINESS

UPDATE On Trajectory to Grow Stockholder Value

12 |

Significant

Business Initiatives in 2010 to Meet Evolving Customer Needs

13

•

Introduced all-inclusive, unlimited

nationwide voice and broadband

service plans

•

Eliminated activation fees and

telecommunications taxes to

improve customer experience

•

Experienced significant customer

adoption and migration to new

service plans

•

Introduced robust, new line-up of

affordable devices, including

smartphones, touchscreens, feature

phones and broadband devices

•

Increasing customer demand for new

smartphones driving selection of

higher-revenue service plans and

increased ARPU

•

Entered into nationwide roaming

agreements to allow nationwide product

and service offerings

•

Entered into nationwide wholesale

agreement to supplement 95M CPOP

network with Sprint’s nationwide 3G

network

•

Agreements improve competitive

position and strengthen brand, attract

new customers and enhance and

expand nationwide retail distribution

New Plans

New Devices

Nationwide Reach |

Other Key

Initiatives Furthering Leap Performance •

Transitioned executive management team to more closely align with customers and improve

execution -

Appointed new EVP/COO to lead customer focused support organizations

-

Appointed new EVP, Field Operations and appointed three area presidents to improve field

execution -

Added other senior management leaders focused on vision and execution

•

Fundamentally

overhauled

back-office

systems

-

Replaced billing, inventory and point-of-sale systems

-

Significantly improved planning, forecasting, supply chain and procurement capabilities

•

Continued management of balance sheet for liquidity and growth

-

Refinanced

$1.1B

of

senior

unsecured

debt

to

2020,

reducing

cash

interest

expense

by

$10M

annually

-

Recently issued $400M of senior notes to provide additional working capital for growth

initiatives •

Entered into key strategic transactions

-

Formed new joint venture in South Texas, acquiring ~323,000 former customers of Pocket

Communications to create Leap’s most deeply-penetrated market

-

Acquired complete ownership and control of Cricket markets in Chicago, Southern Wisconsin and

Oregon -

Transactions improved competitive position by increasing our strength and scale while

expanding offerings to customers •

Better utilization of spectrum resources

-

Entered into agreement to swap 10-MHz of unused spectrum in exchange for 10-MHz of

additional spectrum in 7 existing Cricket markets

•

Developed and launched unique Muve Music

service

-

Unlimited music-download service designed specifically for mobile devices

-

Will provide Leap with differentiated product in nationwide, mass-merchant retail

channels 14

TM |

New Initiatives

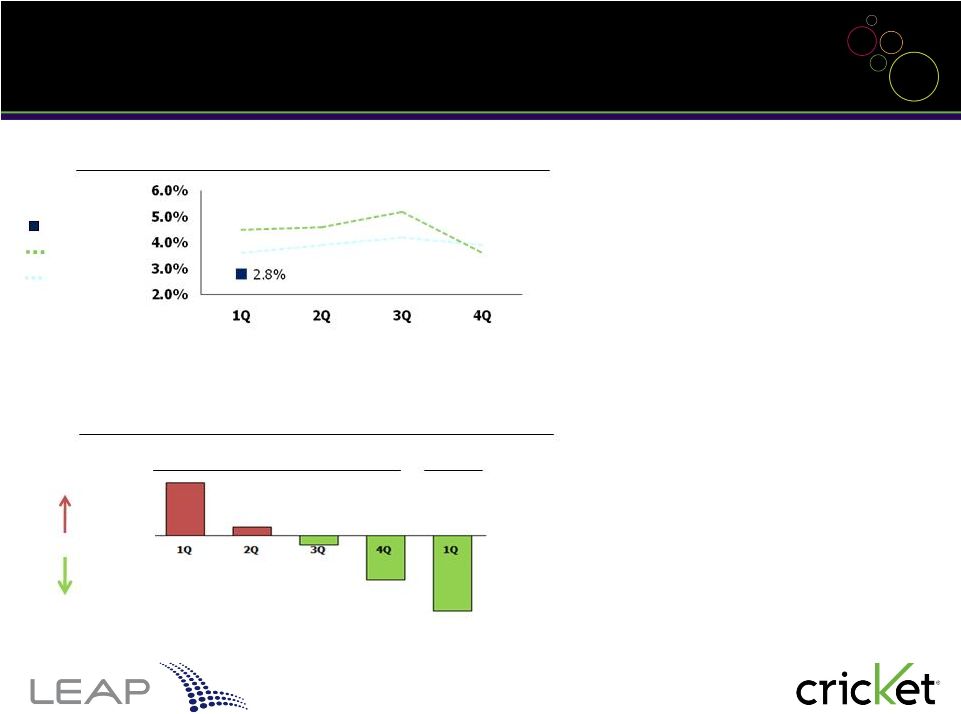

Driving Churn Down … 15

•

1Q11 churn reached lowest level in

almost 10 years:

–

Consolidated churn of 3.1%, improving

140 basis points Y-O-Y

–

1Q11 voice churn of 2.8%, improving

170 basis points Y-O-Y

•

Churn improvements direct result of

changes management implemented:

–

All-inclusive pricing

–

Smartphones at affordable prices

–

Nationwide voice and data coverage

•

Believe lower levels of churn signal

productive, structural business change

–

May experience some near-term

moderation in churn improvement

Voice Churn

2011

2010

2008

Y-O-Y Change in Voice Churn

Worse

Better

2010

2011 |

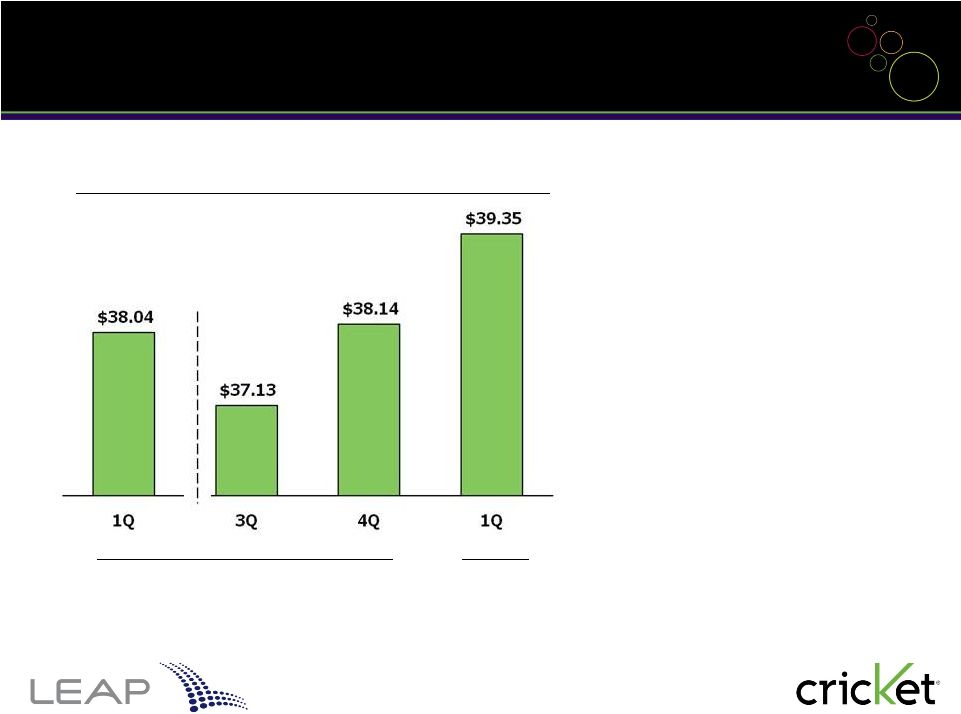

…

And Improving ARPU …

16

Average Revenue Per User

2010

2011

•

ARPU increased over $1 Y-O-Y and

Q-O-Q due to:

–

Improved device portfolio

–

All-inclusive service plans

–

Improved voice churn

•

Expect ARPU improvements to

continue in coming quarters due

to:

–

Increased smartphone penetration

–

Higher Broadband ARPU and

potential Muve Music uptake |

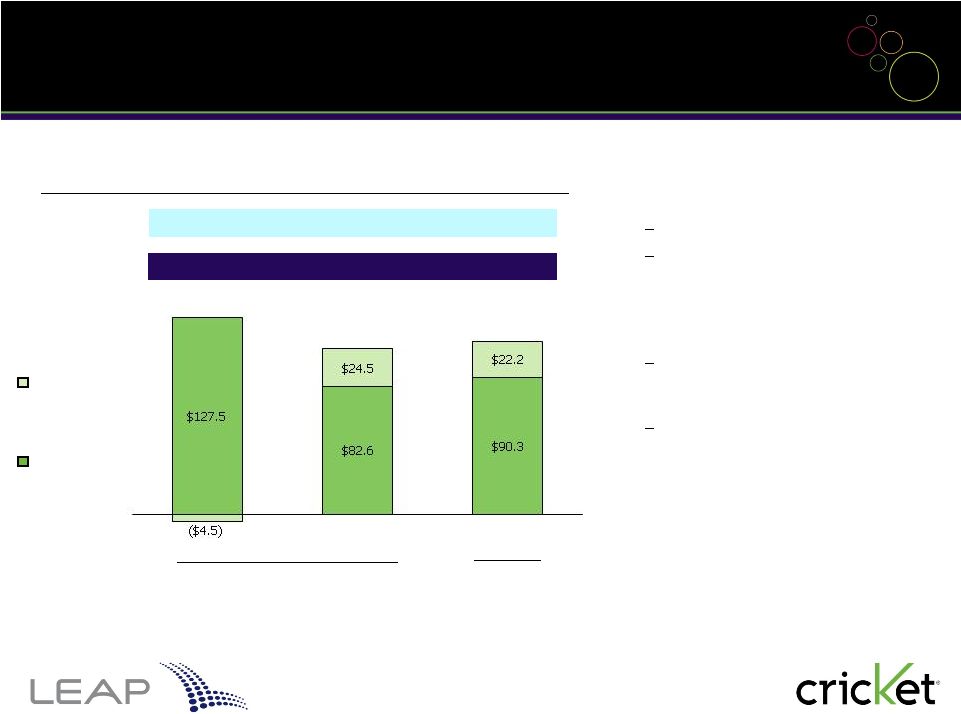

$123.0

…

Putting Leap On Trajectory for

Improved Financial Performance

17

2011

2010

$5.1

($27.0)

($18.1)

$614.6

$636.6

$678.4

Operating Income

(Loss)

Adjusted OIBDA

$107.0

$112.5

(1)

Broadband Services

Adjusted OIBDA

(Investment)

Voice Services

Adjusted OIBDA

($ in millions)

Service Revenues

1Q

1Q

4Q

•

Q-O-Q improvements in service

revenues due to:

Subscriber growth

Uptake of higher-ARPU service

plans

•

Y-O-Y decrease in adjusted OIBDA

reflects:

All-in-monthly pricing which

eliminated ~$130M of annual

revenue from late/other fees

Investments in equipment subsidy

and product cost to support

transition to smartphones and

national coverage

•

Beginning to benefit from cost

leverage

•

Expect adjusted OIBDA margin

improvement in the coming quarters

(1) Includes one-time ~$3M expense associated with South Texas joint venture

Note: Minor calculation differences in reported numbers due to rounding

Adjusted OIBDA |

18

Expect positive voice net additions in 2Q11 and voice gross additions closer to 2Q10 reported

levels Expect decrease in number of Broadband customers

Expect adjusted OIBDA margin improvement from 1Q11 to 2Q11

Expect ARPU improvements to continue at pace similar to recent improvements

Churn expected to follow 2008 patterns but at reduced levels

-

2Q11 Update: Y-O-Y churn improvement in 2Q11, with improvement moderated

CPGA –

Expect sales & marketing spending levels to remain similar quarter over quarter

Expect to have over 100,000 Muve Music customers soon

Expect Cash Cost Per User (CCU) to flatten or decline from 1Q11 to 2Q11

Outlook Discussed at 1Q11 Earnings Conference Call

Current 2Q11

Outlook

Upgrade activity and associated cost expected to decline seasonally in 2Q11

Cost Per

Gross

Customer

Addition

(CPGA)

–

Expect

device

subsidy

expense

to

increase

due

to

change

in

dealer

compensation

-

2Q11 Update: Increased subsidy expense in 2Q11 will also reflect successful promotional

activity in the quarter Positive Trends Continuing |

Strategic

Initiatives Driving Growth in Voice Customers 19

Ground-breaking music service

•Unlimited access to millions of

full-track songs and ringtones that reside

on mobile device, as part of $55/month service plan

•Will provide Leap with differentiated

product in national retail Marketing efforts are resonating with customers

•Expanding appeal to all value-conscious consumers

Leap’s retail presence is growing

•Expanding distribution in

Cricket-branded stores and national retail

•Expect significant portion of retail

expansion in time for holiday selling

season

Improved offerings increase competitive position

•Robust phone lineup, wide variety of

plans and nationwide coverage Improved

Customer

Awareness

Expanded

Branded

Distribution

Competitive

Devices, Service

Plans & Coverage

Expansion of

Unlimited Music

Product |

MVNO Agreement

– Rapid Path to Nationwide Scale

•

National retail playing increasingly

important role in prepaid wireless

-

Scale becoming a competitive advantage

•

MVNO agreement with Sprint entered

into in August 2010 provides Leap with

nationwide reach and scale

-

Rapid, efficient means for Leap to gain

major presence in national retail

-

Provides more cost-effective path to

launching service in additional markets

•

Launch expected in second half of 2011

•

Facilitates launch of Muve Music

nationwide

20 |

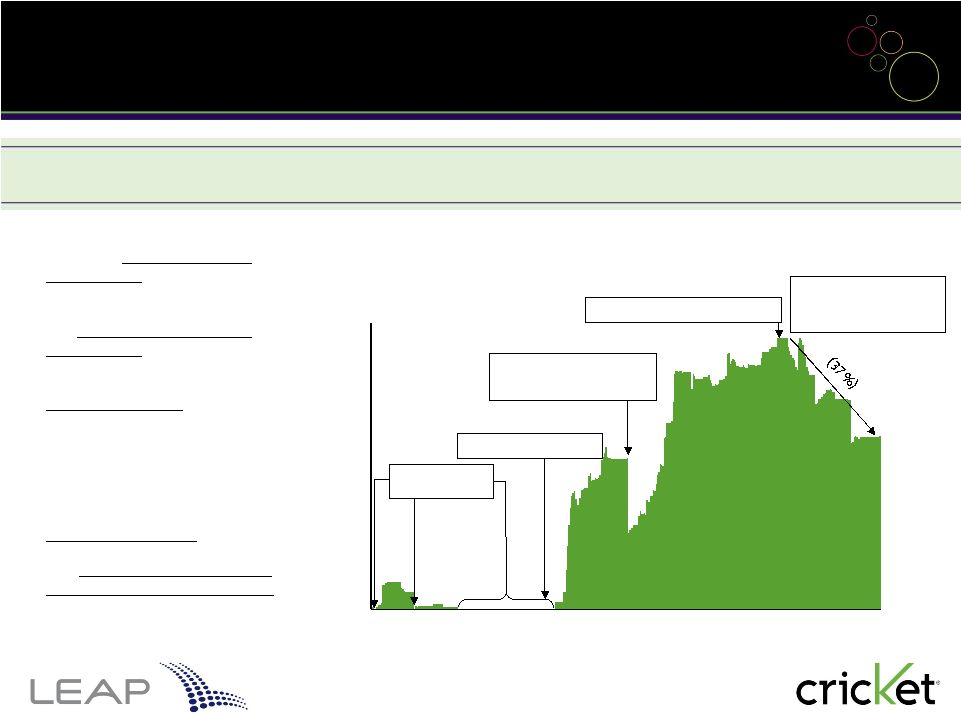

Optimizing our

Network for Multiple Product Opportunities

Utilizing Data Network Capacity

(1)

(1)

Capacity calculation is based on current and expected data product usage and performance and is

subject to change.

•

Continue to see strong demand

for data services due to

continued strength of

smartphone service plans

•

Expanding and managing

network capacity through:

-

Device mix, market-level focus

-

Network management

initiatives

-

Additional equipment and cell

sites

-

Potential for session-based

data

•

Consumer trends driving strong

uptake in smartphones and other

higher-ARPU services

-

Opportunity to generate

significant cash flow

Approximate capacity usage as of 1Q11

4Q10 Capacity Forecast

1Q11 Capacity Forecast |

Strategically

Implementing LTE to Support Next Phase of Growth

22

Leap’s LTE implementation being managed through gradual ramp-up and

phased

to

be

in

place

when

costs

of

LTE

devices

reach

attractive

levels

for

our

customers

Industry Milestones

Leap is launching its own LTE network beginning in 2011 and

expects to supplement its LTE facilities coverage through roaming arrangements

2013

2013

2012

2012

2011

2011

2010

2010

Device costs begin hitting

broadly appealing

consumer price points

Integrated LTE

devices introduced

Integrated LTE

chipset available

First LTE smartphone

launches

First LTE

markets in the

U.S.

Expected growth of

4G on prepaid

Leap Milestones

Leap launches

R&D market

Expected launch of first

Leap LTE trial market

Expected Leap commercial LTE deployment |

23

“Leap executed well by driving growth mainly

through smartphone adoption while containing

opex. Despite upcoming seasonal net add

softness in 2Q and 3Q, we expect the benefits

of rising ARPU to translate into EBITDA

margin expansion

from 17% in 1Q11 to 22%

in 4Q11.”

-

Deutsche Bank, 5/6/11

“We expect continued success in existing markets plus

ramping execution in new markets will allow Leap to

generate

a

16%+

EBITDA

CAGR

2011-2014,

which

at

the current 2012E EBITDA multiple leaves the company, in our

view, among the most attractively valued growth-based

investments in our coverage universe.”

-

Bank of America Merrill Lynch, 5/5/11

“We believe that given the high ASPs for LTE handsets coupled

with the painfully slow smartphone experience of 1xRTT speeds,

Metro finds itself between a rock and a hard place. Leap, on the

other

hand,

might

have

found

itself

in

a

sweet

spot,

where

it could take advantage of falling 3G handset prices and leverage

smartphone growth (and the Android platform) to grow EBITDA

and margins faster than consensus anticipates in 2012.”

-

Citadel, 5/25/11

“We believe the increased smartphone

penetration coupled with the All-

Inclusive plan will continue to improve

churn; as such, we are

trimming 2011E churn by 20 bps to 3.6%.”

-

RBC Capital, 5/6/11

“Leap showed solid execution of its

turnaround

strategy

that began back in

August ’10. While we continue to believe Leap

has good potential, in the near term, its go-to-

market strategy is still in transition and is

carrying substantial near term costs. LEAP’s

focus on smart phones is beginning to

show benefits in ARPU, churn, and

subscriber

growth.”

-

SunTrust, 5/6/11 |

BOARD OF

DIRECTORS Experienced and Independent

24 |

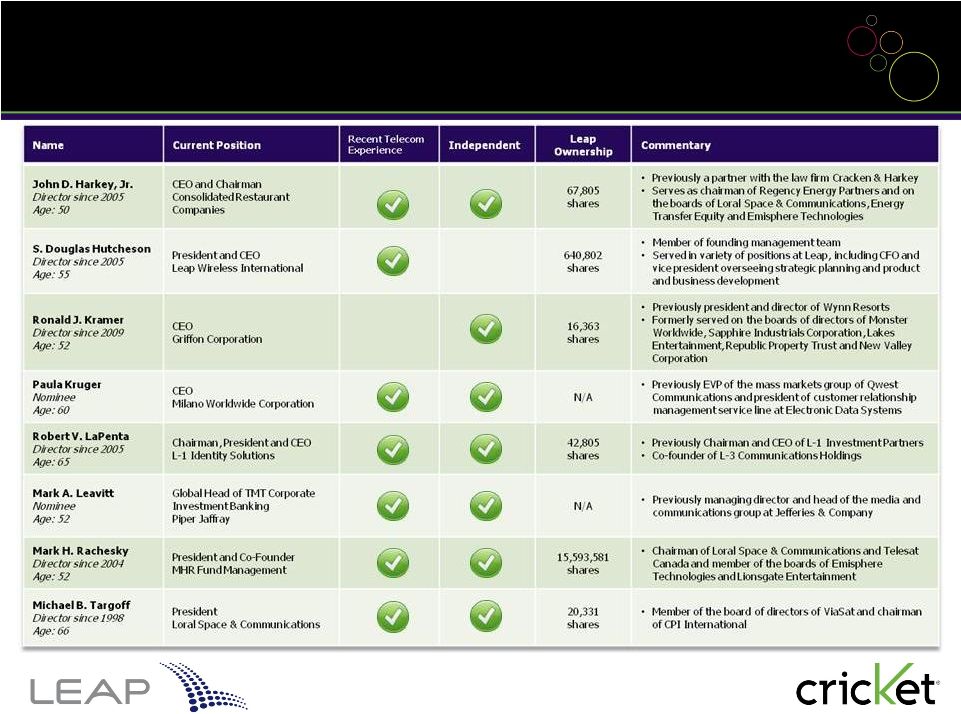

Leap’s

Independent Slate of Nominees 25 |

Leap’s

Commitment to Good Corporate Governance 26

All directors (other than CEO) are independent under NASDAQ rules; all have

alignment of interests with stockholders

Wide range of relevant operational and financial expertise represented

Non-executive Chairman of the Board

Directors are elected annually

Each board committee composed entirely of independent directors

Company has adopted and disclosed Corporate Governance Guidelines

All directors attended more than 75% of Board and committee meetings in 2010

|

Leap’s

Board Continually Looks To Deliver Increased Value To Stockholders

•

In 2007, Leap engaged in discussions with MetroPCS following its unsolicited public

offer –

Board determined Metro’s offer allocated disproportionate synergy value to Metro and

offered essentially no premium to Leap stockholders

–

Leap and Metro’s discussions also limited by Leap’s 4Q07 restatement and

FCC-mandated M&A “quiet period” for spectrum auction

participants •

In

2008

and

2009,

Leap

approached

Metro

regarding

possible

joint

opportunities,

including

partnerships

to

own/operate

certain

markets

–

but

significant

discussions

did

not

develop

•

Leap

also

engaged

in

discussions

with

AWS

spectrum

holders

and

others

regarding

strategic and operating opportunities

•

In

2010,

Leap

undertook

comprehensive

review

of

strategic

alternatives

to

build

stockholder

value

–

Board added additional independent directors to help oversee process and ensure broad

perspective –

Appointed Special Committee of independent directors to oversee review

–

Special Committee and its financial advisors initiated discussions with numerous parties

regarding potential strategic opportunities, including MetroPCS

–

Leap also began developing important new product and service plan offerings, which it believed

would significantly improve operational performance

–

Special Committee and Board unanimously determined to pursue Leap’s current operational

strategy, rolled out in 2010, which has yielded significant results

27 |

•

Leap’s

compensation

program

tied

to

corporate

performance,

aligning

interests

of

management with those of stockholders

–

Substantial majority of total compensation opportunity consists of annual cash bonus and

long-term equity, which are tied to corporate and individual performance

–

2010 was period of continued, intense competition within wireless industry and ongoing

transition in Leap’s business, as new initiatives were implemented to improve

competitive positioning and operational performance

–

Because many of Leap’s new initiatives were introduced in 2H10, they did not

significantly impact full-year 2010 results but are now leading to improved

financial and operational performance •

Compensation

earned

by

senior

management,

including

CEO,

reflects

transition

of

Leap’s

business

and

responsible

executive

compensation

program

–

No increases in CEO’s $750K base salary or annual target bonus in 2010 or 2011, which

were significantly below 50th percentile

provided by peer companies

–

CEO recommended that he receive no cash bonus award for 2010

based upon Company’s business

transition and expected near-term business performance

–

More than

two-thirds

of CEO’s total compensation for 2010 consisted of

long-term equity

compensation,

primarily

consisting

of

performance-vested

restricted

shares

with

vesting

tied

to

stock

price appreciation

–

Remaining executive officers received no increase to 2010 or 2011 base salaries, cash bonus

awards well- below target bonus levels and equity compensation consisting primarily

of performance-vested restricted shares

28

Responsible Executive Compensation Program |

PENTWATER

PROPOSAL AND PROXY CONTEST

Opportunistic and Non-Compliant

29 |

•

Since announcing proxy fight, Pentwater has sold almost 40% of its shares

(even selling on

day it filed its initial proxy statement)

•

Established short position covering more than 1.6M Leap shares, equal to ~67% of its

2.4M shares held as of 6/20/11

•

Announced public proxy fight without first discussing operational proposals or

suggestions with the Company

(and promptly started selling as stock price rose)

•

Waited until end of nomination period

to attempt to nominate directors

•

Did not comply

with bylaw requirements

•

Failed

to

disclose

material

facts

about

Pentwater

and

its

nominees,

including that

one

nominee is related to Pentwater portfolio manager and true size of its short position

•

Has

offered

only

backward-looking

critiques

with

no

specific

strategy

for

the

Company

beyond what management is already doing

30

Pentwater Interested Only In Short-Term Profits

Pentwater Capital Management is an opportunistic investor with no long-term

commitment to Leap and interests that differ from other stockholders

|

•

Leap welcomes stockholder input

on all topics, including director nominations

•

Leap’s

bylaws

designed

to

provide

fairness

and

transparency,

allowing

stockholders

to

fully

evaluate nominees’

independence and qualifications

•

Pentwater’s

nominations

did

not

comply

with

bylaws

in

critical

respects

going

to

heart

of

transparency, independence and alignment of stockholder interests:

-

Failed

to

disclose

that

one

nominee

is

father

of

a

Pentwater

portfolio

manager

and

nature

of

agreements/understandings between nominees and Pentwater

-

Failed

to

adequately

disclose

that

its

ownership

position

in

Leap

common

stock

was

substantially

hedged

by

put options

-

Failed

to

disclose

whether

it

had

formed

group

with

other

activist

investors

who

have

recently

acquired

Leap

common stock and who have acted in concert with Pentwater in past

•

Shares

voted

for

Pentwater

nominees

will

not

be

counted

at

the

Annual

Meeting

absent

contrary

judgment by Delaware courts

•

We

believe

Leap’s

advance

notice

bylaws

are

fair

and

reasonable

and

similar

to

bylaws

of

many

other companies

including:

-

Allstate Corp., Boeing, eBay, Home Depot, FTI Consulting Inc., Fortune Brands, Hewlett

Packard, Gilead Sciences, Inc., Juniper Networks, McGraw-Hill, PepsiCo, Safeway,

Texas Instruments, United Continental Holdings, and VMWare

31

Leap’s Bylaws Ensure Disclosure of

Material Information and Overall Fairness |

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

2/5/10

5/17/10

8/24/10

12/1/10

3/9/11

6/20/11

Cumulative

Ownership

(Millions of shares)

Pentwater’s Actions Are Opportunistic and

Reveal Weak Long-Term Commitment to Leap

Pentwater’s Short-Term Interest in Leap

Not Aligned with Other Stockholders

Shares traded based on Pentwater proxy statement dated June 30, 2011

10/15/10: Pentwater sold

1.04M shares in one day

From 3/15/11 to 6/20/11

Pentwater sold 37%

of its Leap shares

32

•

Pentwater did not own any

Leap shares

as recently as one

year ago

•

Has actively traded in and

out of stock

over last 17

months

•

Sold 1.4M shares

in the three

months prior to its initial proxy

statement filing –

~40% of its

position

•

Even on 6/20/11 (date of

Pentwater’s initial proxy filing)

sold 20,000 shares

•

Had short positions covering

more than 1.6M Leap shares

as recently as 6/20/11

Pentwater held

zero shares

February 5, 2010 –

June 20, 2011

8/3/10: Investor Day

3/10/11: Announced Proxy Fight

(1) |

•

Lacks any strategy

for the Company beyond actions Leap already pursuing

•

Comments

are

backward-looking;

ignore

Leap’s

strong

position

today,

recent strong operating performance and prospects for improved performance

in 2011 and beyond

•

Nominees do not have same level of experience/expertise

as directors

they are trying to replace

•

Criticisms

of

Leap’s

corporate

governance

are

mis-informed

and

inaccurate

33

Pentwater’s Actions Are Ill-timed, Mis-informed and

Would Not Benefit Leap’s Stockholders

Pentwater

appears

to

be

interested

in

only

short-term

profit

–

and

has

sold

~40% of its Leap holdings since announcing proxy contest |

Pentwater’s Claims …

versus the Reality –

Governance

Pentwater’s Claims

Reality

34

Leap’s Board lacks strong

corporate governance and

perspective

Leap adopted “poison pill”

to

entrench management and

stifle the voices of

stockholders

Leap’s 2010 executive

compensation was

unreasonable

•

All

directors

elected

on

annual

basis

•

All directors

NASDAQ-independent

(other

than

CEO),

with

wide

range of

operational and financial expertise

•

Board

expanded

to

eight

in

2009

to

bring

additional

skills

and perspectives

•

Two

new

candidates

bring

highly

relevant

skills

and

expertise

to

help Leap

at this stage of growth

•

MHR’s 19.8% stake aligns its interests with other stockholders.

Unlike Pentwater,

MHR

has

never

reduced

its

stake

or

ever

shorted

Leap’s

stock

•

Tax benefit preservation plan adopted to deter potential “ownership

change”

under tax laws that would jeopardize ~$2B of Leap’s NOLs

•

Board

kept

Plan

in

place

only

as

long

as

necessary

to

protect

NOLs

•

Due to 3-year lookback under tax law, threat to NOLs decreased

and Board

terminated Plan on June 16, 2011 –

before Pentwater filed its initial proxy

statement

•

2010 executive

compensation

responsible

and

appropriate

in

light

of corporate

performance and business transition

•

No

increase

to

2010

or

2011

base

salaries,

no

cash

bonus

award

for

CEO

and awards well below target bonus levels for other executives, and equity

compensation

primarily

in

performance-vested

restricted

shares |

Pentwater’s Claims …

versus the Reality –

Strategic Transactions

Leap’s Board is entrenched, not

open to a strategic transaction

and should not have rejected

MetroPCS’

proposal to merge

with Leap in September 2007

Pentwater’s Claims

Reality

35

•

Leap’s

Board

continually

looks

for

opportunities

to

deliver

increased

value

to

stockholders; management has regularly stated that it sees the logic of further

consolidation

in the industry

•

In

2007,

Leap

entered

discussions

with

Metro

following

its

unsolicited

public

offer

Discussions

limited

by

Leap’s

4Q07

restatement

and

FCC-mandated

M&A

"quiet

period"

for

spectrum

auction

participants

•

In 2008 and 2009,

Leap approached Metro regarding possible joint

opportunities,

including

partnerships

to

own/operate

certain

markets

–

but

significant discussions did not develop

•

Leap also engaged in

discussions with AWS spectrum holders and others

regarding strategic and operating opportunities

•

In

2010,

Leap

undertook

comprehensive

strategic

review

and

initiated

discussions with numerous parties, including Metro

Board

added

additional

independent

directors

to

help

oversee

process

and

ensure

broad

perspective

After

comprehensive

review,

Special

Committee

and

Board

unanimously

determined

to

pursue Leap’s current operational strategy, rolled out in 2010, which has yielded

significant results |

Pentwater’s Claims …

versus the Reality –

Operations

•

Leap

introduced

all-inclusive

service

plans

in

response

to

customer

demand

as soon as possible within constraints of prior customer billing

system

•

Leap

has

experienced

strong

customer

adoption

and

migration

to

new

plans

Mis-timed move to an all-in

pricing model

Pentwater’s Claims

Reality

36

Emphasizing and poorly

executing

a faulty broadband

strategy

•

Leap

deployed

a

3G

strategy

focused

on

increasing

demand

for

data

services

-

Led initially with broadband due to attractive device pricing

-

Consumers now transitioning rapidly

to smartphones as prices decline

•

Broadband

strategy

provided

Leap

a

well

positioned

network

generating

positive

OIBDA

•

As

a

result

of

slow

LTE

adoption,

competitors

now

forced

to

substantially

increase

3G

activities

•

Returns

building

on

Leap's

successful

3G

investment

-

3G investment well-timed

-

Broadband created the opportunity for return in smartphone margins

|

Pentwater’s Claims …

and the Reality –

Operations cont.

Pentwater’s Claims

Reality

37

Mis-managing handset

inventory

Mis-management of cost

structure relative to

competitors

•

Some

momentum

lost

in

mid-2010,

but

issues

addressed

through

senior

management changes and more robust back-office systems and forecasting

•

Leap’s

underlying

cost

structure

is

similar

to

MetroPCS

when

adjusted

for relative market penetration

-

Recurring costs per unit (such as non-product network costs) are sensitive to

customer penetration

-

G&A spend similar when aligned with MetroPCS’

reporting format (which

excludes customer care and billing). See appendix

o

Leap focused on minimizing absolute spend despite challenges associated with

managing approximately three times as many discrete markets

-

Higher CPGA costs reflect direct-channel focus

-

Device subsidy costs are lower due, in part, to lower indirect dealer

compensation costs associated with higher direct sales mix

o

Headcount

reflects

acquisition

of

former

Pocket

markets,

greater

number

of

discrete markets and higher number of direct stores |

CONCLUSION

Vote FOR

Leap’s Nominees on the WHITE

Proxy Card

38 |

•

Leap led by strong, experienced Board and management team that are creating

stockholder value

with strategy delivering results

-

Dramatic

operating

performance

improvements

from

new

business

initiatives,

positioning

Leap

for

improved financial performance and increased stockholder value

-

Changes in executive team and new back-office systems in 2010 improve execution

-

Additional

plans

in

place

to

build

on

momentum

through

expanded

focus

on

value-conscious

customers and expanded nationwide distribution

•

Pentwater only interested in short-term profit

–

Pentwater has already sold ~40% of its Leap holdings since announcing proxy contest

–

Had short positions covering more than 1.6M shares as recently as 6/20/11

•

Pentwater’s

actions

are

ill-timed,

misinformed

and

would

not

benefit

Leap’s

stockholders

-

Pentwater lacks any strategy for the Company beyond actions Leap

already pursuing

-

Pentwater did not comply with Bylaws and their proposals don’t stack up against

management’s on-going execution

•

Pentwater is not the right choice

39

Leap’s Directors Are Creating Stockholder Value and

Committed to Company’s Long-Term Success

Do not jeopardize Leap’s positive momentum –

vote FOR

Leap’s nominees on the WHITE proxy card |

APPENDIX

40 |

•

Frequency of future advisory votes on executive compensation

–

Leap’s

Board

recommends

annual

advisory

vote

•

Stock option exchange program

–

Exchange

of

“underwater”

employee

options

for

lesser

number

of

replacement

options

with

exercise price equal to current FMV

–

Members

of

Leap’s

board

and

executive

officers

will

not

be

allowed

to

participate

–

Only options with exercise price of $30 or higher are eligible for exchange (well exceeds

closing prices of Leap common stock for prior 52-week period)

–

Black-Scholes value of new options will be substantially less than value of surrendered

options; exchange will not result in incremental accounting cost

–

Replacement

options

will

be

subject

to

three

years

of

additional

vesting

–

Options exchanged will be returned to plans for future grants

•

Ratification of selection of PWC as Leap’s independent registered accounting firm for

FY’11

41

Other 2011 Annual Meeting Agenda Items |

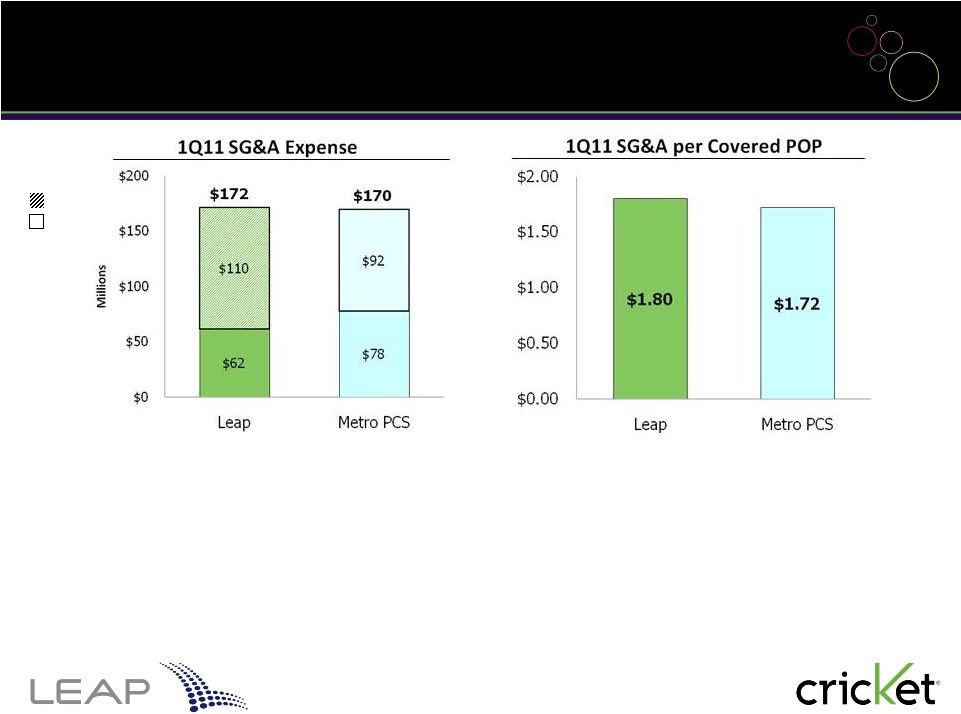

Leap SG&A

Comparable to Metro 42

•

Leap SG&A comparable to Metro SG&A on apples-to-apples comparison

•

Leap includes Customer Care and Billing expense in reported SG&A; Metro does not

-

Bar charts shown above eliminate $33.7M of Leap 1Q11 Customer Care and Billing expense to

align with Metro SG&A reporting methodology

•

Leap sells greater percentage of handsets in Company-owned stores. Leap Selling Cost

reflects expenses related to larger number of retail stores and retail store

employees G&A

Selling Cost |