Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ANSYS INC | d8k.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - ANSYS INC | dex21.htm |

| EX-99.5 - PREPARED REMARKS - ANSYS INC | dex995.htm |

| EX-99.4 - FREQUENTLY ASKED QUESTIONS - ANSYS INC | dex994.htm |

| EX-99.1 - PRESS RELEASE - ANSYS INC | dex991.htm |

| EX-99.3 - LETTER TO EMPLOYEES - ANSYS INC | dex993.htm |

©

2010 ANSYS, Inc. All rights reserved.

ANSYS, Inc. Proprietary

©

2010 ANSYS, Inc. All rights reserved.

1

ANSYS, Inc. Proprietary

Apache Transaction

Highlights

Apache Transaction

Apache Transaction

Highlights

Highlights

June 30, 2011

June 30, 2011

June 30, 2011

Exhibit 99.2 |

©

2010 ANSYS, Inc. All rights reserved.

2

ANSYS, Inc. Proprietary

Certain statements contained in this presentation regarding matters that are not

historical facts, including statements regarding the parties’

ability to consummate the proposed transaction and timing thereof, expectations

that the proposed acquisition, if completed, should be modestly accretive to

non-GAAP earnings per share in the first full year of combined operations and

expectations regarding an increase in non-GAAP combined revenue growth and a

continuation of solid non-GAAP operating margins and cash flows from

operations following the close of this transaction, statements regarding the complementary and

efficient integration of ANSYS and Apache and their ability to minimize disruptions

from the transaction across businesses, and statements regarding the impact

of the pending acquisition, the combined company’s ability to accelerate development and

delivery of new, innovative, world class and customer-driven engineering

simulation products and solutions to the marketplace, to

lower

design

and

engineering

costs

for

customers

and

to

drive

energy-efficient

electronic

product

development

and

the

ability

of

the

combined

company

to

lead

the

evolution

and

innovation

of

engineering

simulation

in

the

21

st

century,

and

the

impact

of

the

transaction on employees and our operational plans, are

"forward-looking" statements (as defined in the Private Securities

Litigation Reform Act of 1995). Because such statements are subject to risks and

uncertainties, actual results may differ materially from those expressed or

implied by such forward-looking statements. All forward-looking statements in this

presentation are subject to risks and uncertainties. These include the risk that

the acquisition of Apache may not be consummated, the risk that the business

of ANSYS and Apache may not be combined successfully or that such combination

may take longer or cost more to accomplish than expected, and the risk that

operating costs, customer loss and business disruption following the

acquisition of Apache may be greater than expected. Additional risks include the risk of a general

economic downturn in one or more of the combined company’s primary

geographic regions, the risk that the assumptions underlying ANSYS'

anticipated revenues and expenditures will change or prove inaccurate, the risk that ANSYS has

overestimated its ability to maintain growth and profitability and control costs,

uncertainties regarding the demand for the combined company’s products

and services in future periods, the risk that ANSYS has overestimated the strength of the demand

among its customers for its products, risks of problems arising from customer

contract cancellations, uncertainties regarding customer acceptance of new

products, the risk that the combined company’s operating results will be adversely affected by

possible delays in developing, completing or shipping new or enhanced products,

risks that enhancements to the combined company’s products may not

produce anticipated sales, uncertainties regarding fluctuations in quarterly results, including

uncertainties regarding the timing of orders from significant customers and other

factors that are detailed from time to time in reports filed by ANSYS, Inc.

with the Securities and Exchange Commission, including the Annual Reports on Form 10-K, the

quarterly reports on Form 10-Q, current reports on Form 8-K and other

documents ANSYS has filed. ANSYS and Apache undertake no obligation to

publicly update or revise any forward-looking statements, whether changes occur as a result of new

information or future events after the date they were made.

Safe Harbor Statement |

©

2010 ANSYS, Inc. All rights reserved.

3

ANSYS, Inc. Proprietary

Where to Find Additional Information

Additional information about this transaction can be found in public filings

of ANSYS, including its current report on Form 8-K dated June 30, 2011,

filed with the U.S. Securities and Exchange Commission at www.sec.gov

and in the “Investor Relations”

section of ANSYS’

Web site at

www.ansys.com.

Any

questions

in

this

regard

should

be

directed

to

Annette Arribas, ANSYS’

Investor Relations Officer, at

annette.arribas@ansys.com.

*ANSYS is currently in a quiet period and will not be accepting

phone call or meeting requests following today’s public conference

call. |

©

2010 ANSYS, Inc. All rights reserved.

4

ANSYS, Inc. Proprietary

Transaction Summary

Transaction Details:

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

Total Consideration:

$310 million in cash, which includes approximately $29 million

in cash on Apache’s balance sheet

Funding:

Cash on-hand from the combined organization

Contingent Payment

(1)

:

$4 million payable annually for three years after closing

provided Dr. Andrew T. Yang remains employed

Management & Employee

Equity-based performance awards of $13 million based on

non-GAAP incentives:

revenue and operating income

achievement for fiscal years 2012, 2013 and 2014

Transaction Timing:

Expected to close in third calendar quarter of 2011, subject

to customary closing conditions and regulatory approval

On June 30, 2011, ANSYS announced that it entered into a definitive

agreement to acquire Apache Design Solutions, Inc., a leading

simulation software provider for advanced, low power solutions in

the electronics industry. The addition of Apache’s technology is

complementary and expands the breadth, depth, functionality,

usability and interoperability of ANSYS’

simulation capabilities.

(1)

Included in $310 million in cash consideration. |

©

2010 ANSYS, Inc. All rights reserved.

5

ANSYS, Inc. Proprietary

Apache Highlights

•

Leading power analysis and optimization software solutions

provider

•

Headquartered in San Jose, CA with offices in Austin (TX),

China, France, India, Israel, Japan, Korea and Taiwan

•

Revenue of $46 million

•

Approximately 275

•

Power-efficient electronics (mobile, data centers, consumer

and computing, automotive)

•

127 (iSuppli

top 20 semiconductor companies)

•

Lease

Business:

Financial

(1)

:

Employees:

Markets:

Customer Base:

Business Model:

(1)

Trailing 12 months as of March 31, 2011 (unaudited). |

©

2010 ANSYS, Inc. All rights reserved.

6

ANSYS, Inc. Proprietary

Today’s Electronics Must Be

Power-Efficient

Consumer & Computing

Consumer & Computing

Data Center

Data Center

Automotive

Energy

cost

Interference

Battery

life

Energy

efficiency

Revenue Growth 28%

37% 35%

27% |

©

2010 ANSYS, Inc. All rights reserved.

7

ANSYS, Inc. Proprietary

Enhanced Functionality and Performance

Increasing Power Budget Gap

ITRS 2010

Power

consumption

Power

Budget

6x

10x

Functionality and performance drivers

Power budget gap

Power-

hungry

applications

Cloud

computing |

©

2010 ANSYS, Inc. All rights reserved.

8

ANSYS, Inc. Proprietary

Engineers Facing Major Power Design

Challenges

•

Right place, right time, right amount

•

Drivers:

power budget constraints,

reliability

•

Electrical interference

•

Drivers:

higher performance,

wireless emissions

Power-Induced

Noise

Power Delivery Integrity

Power Delivery Integrity |

©

2010 ANSYS, Inc. All rights reserved.

9

ANSYS, Inc. Proprietary

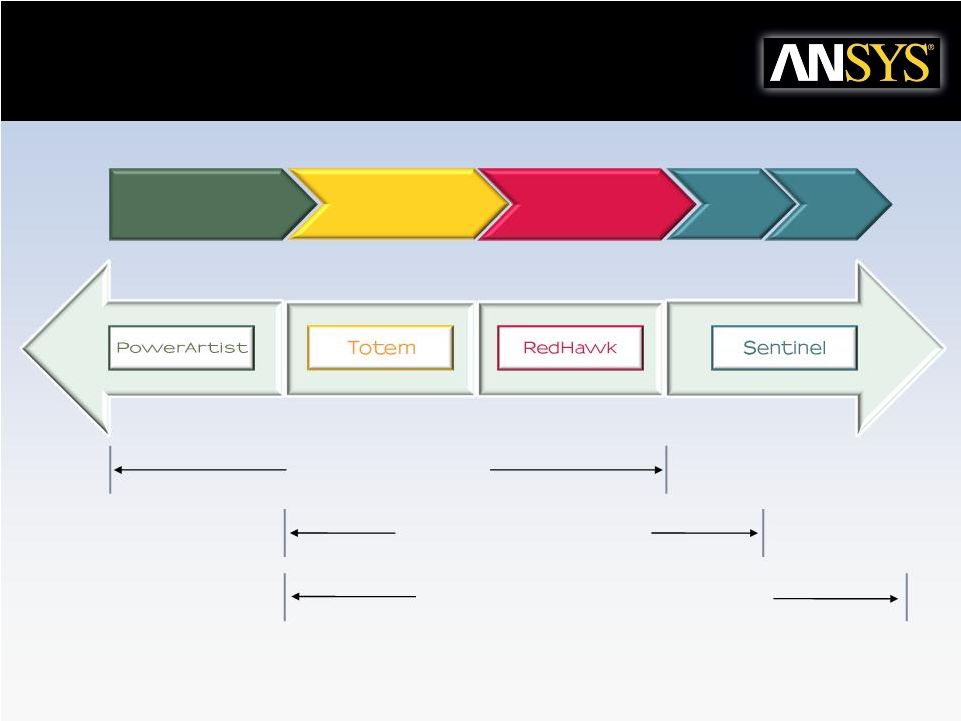

Apache’s Comprehensive Power Analysis

Solutions

Architecture

Intellectual Property

System Chip

Package

System

(PCB)

Power Budgeting

Power Delivery Integrity

Power–Induced Noise Immunity |

Chip-Pkg-Board-System Solutions

Architecture

Intellectual

Property

System-on-

Chip

Package

Printed Circuit

Board

Electronic

System |

©

2010 ANSYS, Inc. All rights reserved.

11

ANSYS, Inc. Proprietary

1.

Highly Complementary Combination

•

Brand

–

recognized technology leader in on-chip dynamic power and is

well-respected in the EDA industry and in the customer base.

•

Customers

–

opportunity for add-on sales; key customers are also key ANSYS

electronics customers.

•

Products

–

consistent

with

ANSYS’

strategic

direction

of

an

integrated

chip/package/board simulation solution.

2.

Expands Breadth and Depth in Simulation Technology

•

Furthers

vision

of

Simulation

Driven

Product

Development™

by

providing

a

more

complete flow for the electronics industry, focusing on integrated circuit (IC)

power delivery.

•

Combining this technology with ANSYS field-solvers creates an

end-to-end chip/package/board solution that will be the most

innovative solution in the electronics industry.

•

This solution grows ANSYS by combining on-chip power technology with

electromagnetic field solvers.

•

Combining the Sentinel product line and ANSYS field-solver technologies offers

opportunity to strengthen solver technologies.

•

Apache’s on-chip electromagnetic interference (EMI) and electrostatic

(ESD) solutions provide a new avenue for growth in a strategically

important ANSYS customer base. Strategic

Rationale |

©

2010 ANSYS, Inc. All rights reserved.

12

ANSYS, Inc. Proprietary

Strategic

Rationale

3.

Combines Two Teams with Deep Industry Expertise & World-Class Engineering

Talent

•

Continued focus on innovation

•

Apache development centers in San Jose, India, China and Taiwan

4.

Strong Sales Channel Benefits

•

Direct sales presences are largely complementary

•

Opportunities for growth through ANSYS direct and indirect channels

5.

Complementary Cultures

•

Strong mutual commitment to customers, employees and partners

•

Innovative technology and execution

6.

Complementary Financial Profiles

•

Combined company revenue growth profile increases

•

Strong operating margins for both companies

7.

Financial Impact

•

$46

million

trailing

12-month

revenues

(1)

with

strong

visibility

into

revenue

stream

•

Expected to be modestly accretive to non-GAAP earnings per share in the first

full year of combined operations after closing

(1) Trailing 12 months as of March 31, 2011 (unaudited).

|

©

2010 ANSYS, Inc. All rights reserved.

13

ANSYS, Inc. Proprietary

Key Financial Metrics

•

Strong revenue growth

–

27% year over year growth in 2010

•

Strong revenue visibility

–

Almost entirely lease with very strong historical renewal rates

•

Strong cash flow

–

Generated

free

cash

flow

of

$10.7

million

(1)

or

approximately

25%

of revenue during 2010

•

Strong combined gross and operating margins

(1)

Operating cash flows less capital expenditures in 2010.

|

©

2010 ANSYS, Inc. All rights reserved.

14

ANSYS, Inc. Proprietary

Financial

Benefits

•

Revenue Opportunity Driven by

–

Entry into power delivery IC for low power electronics while

accelerating growth in thermal, EMI/EMC, signal-

and power-

integrity

–

On-chip EMI and ESD solutions providing a new avenue for growth

in key electronics accounts

–

Stronger relationships in key electronics accounts

•

Potential Ongoing Cost Savings Opportunities

–

Ability to optimize existing R&D activities for mutual product

development initiatives

–

Efficiencies in administrative and development activities

–

Efficiencies in sales and service activities |

©

2010 ANSYS, Inc. All rights reserved.

15

ANSYS, Inc. Proprietary

•

Minimal anticipated disruption

–

No product rationalization

–

Data integration within ANSYS Workbench to support Multiphysics

–

Expanded ANSYS global sales and services infrastructure

–

Apache’s understanding of large IC layout databases presents

opportunity for improving ECAD design flow automation

–

Additional growth due to technology advances with 3DIC structures

–

Combining the Sentinel product line and ANSYS field-solver

technologies offers opportunity to strengthen existing solver

technologies

•

Minimize disruption to existing customers and business operations

•

Maintain employee motivation

•

Adopt best practices enterprise-wide

•

Enhance customer value proposition

•

Pursue revenue and cost synergies

Integration |

©

2010 ANSYS, Inc. All rights reserved.

16

ANSYS, Inc. Proprietary

The Combined ANSYS and Apache:

•

Extends the depth, breadth, functionality, usability and interoperability of

the overall portfolio to create the most comprehensive and innovative

industry and product solutions

•

Increases operational efficiency and lowers design and engineering costs

for customers

•

Expands ANSYS vertical industry expertise

•

Extends ANSYS cross selling opportunities to Apache users

•

Expands ANSYS global sales channel to drive future growth

•

Provides ANSYS stockholders increased value through long-term

increased revenue growth and EPS accretion

Summary |

©

2010 ANSYS, Inc. All rights reserved.

©

2010 ANSYS, Inc. All rights reserved.

17

ANSYS, Inc. Proprietary

Apache Transaction

Highlights

Apache Transaction

Apache Transaction

Highlights

Highlights

June 30, 2011

June 30, 2011

June 30, 2011

©

2010 ANSYS, Inc. All rights reserved. |