Attached files

| file | filename |

|---|---|

| EX-32 - SOX-906 CERTIFICATION - HSBC Finance Corp | exhibit32.htm |

| EX-31 - SOX-302 CERTIFICATION - HSBC Finance Corp | exhibit31.htm |

| 10-K/A - HSBC FINANCE 10-K/A (FORM 11-K) - HSBC Finance Corp | hsbc2010_10ka.htm |

Exhibit 99.1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK PURCHASE, SAVINGS

AND SIMILAR PLANS PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark One)

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended December 31, 2010

|

OR

|

[ ]

|

|

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

|

For the transition period _________ to _________

Commission file number 1-8198

|

|

A.

|

Full title of the plan and the address of the plan, if different from that of the issuer named below:

|

HSBC-NORTH AMERICA (U.S.) TAX REDUCTION INVESTMENT PLAN

|

|

B.

|

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

|

HSBC FINANCE CORPORATION

26525 N. Riverwoods Blvd

Mettawa, Illinois 60045

As of March 28, 2003, all shares of Household International, Inc. common stock held by the plan were converted to American depository shares of HSBC Holdings plc (“HSBC”). HSBC’s executive offices are located at 8 Canada Square, London E14 5HQ, United Kingdom.

Financial Statements and Exhibits

|

(a) Financial Statements

|

Page

Number

|

|

|

1.

|

Report of Independent Registered Public

Accounting Firm

|

F-1

|

|

2.

|

Statements of net assets available for plan

Benefits as of December 31, 2010 and 2009

|

F-2

|

|

3.

|

Statements of changes in net assets available

for plan benefits for each of the years in the

two year period ended December 31, 2010

|

F-3

|

|

4.

|

Notes to financial statements

|

F-4

|

|

(b) Supplemental Schedule

|

||

|

Schedule H – Line 4i – Schedule of Assets Held

(As of December 31, 2010)

|

F-12

|

|

|

(c) Exhibit

|

||

|

1.

|

23(a) Consent of Independent Registered Public

Accounting Firm – KPMG LLP

|

F-13

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Administrative Committee has duly caused this annual report to be signed by the undersigned thereunto duly authorized.

|

HSBC-North America (U.S.) Tax Reduction Investment Plan

|

|||

|

Date: June 29, 2011

|

By:

|

/s/ RICHARD L. BESSE | |

| Name: Richard L. Besse | |||

| Title: Benefits Administration of HSBC Finance Corporation as Member, Administrative Committee | |||

KPMG LLP

303 E. Wacker Drive

Chicago, IL 60601-5212

Report of Independent Registered Public Accounting Firm

The Administrative Committee of the

HSBC – North America (U.S.) Tax Reduction Investment Plan

We have audited the accompanying statements of net assets available for benefits of the HSBC – North America (U.S.) Tax Reduction Investment Plan (the Plan) as of December 31, 2010, and 2009, and the related statement of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with auditing standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2010, and 2009, and the changes in net assets available for benefits for the years then ended in conformity with accounting principles generally accepted in the United States of America.

Our audits were performed for the purpose of forming an opinion on the basic financial statements taken as a whole. The supplemental schedule, Schedule H, Line 4i – Schedule of Assets held as of December 31, 2010 is presented for the purpose of additional analysis and is not a required part of the basic financial statements but is supplementary information required by the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. This supplemental schedule is the responsibility of the Plan's management. The supplemental schedule has been subjected to the auditing procedures applied in the audits of the basic financial statements and, in our opinion, are fairly stated in all material respects in relation to the basic financial statements taken as a whole.

/s/ KPMG

Chicago, IL

June 29, 2011

F-1

HSBC-NORTH AMERICA (U.S.) TAX REDUCTION INVESTMENT PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR PLAN BENEFITS

AS OF DECEMBER 31,

|

2010

|

2009

|

|||||||

|

(in thousands)

|

||||||||

|

ASSETS

|

||||||||

|

Total investments, at fair value

|

$ | 2,588,568 | $ | 2,381,168 | ||||

|

Notes receivable from participants

|

75,647 | 72,674 | ||||||

|

Net assets reflecting investments at fair value

|

$ | 2,664,215 | $ | 2,453,842 | ||||

|

Adjustments from fair value to contract value for fully benefit-responsive investment contracts

|

(8,253 | ) | (4,397 | ) | ||||

|

NET ASSETS AVAILABLE FOR PLAN BENEFITS

|

$ | 2,655,962 | $ | 2,449,445 | ||||

|

The accompanying notes are an integral part of these financial statements.

|

||||||||

F-2

HSBC-NORTH AMERICA (U.S.) TAX REDUCTION INVESTMENT PLAN

FOR THE 12 MONTHS ENDED DECEMBER 31,

|

2010

|

2009

|

|||||||

|

(in thousands)

|

||||||||

|

INVESTMENT ACTIVITY:

|

||||||||

|

Investment income (loss):

|

||||||||

|

Net realized (loss) gain on investments

|

$ | (7,265 | ) | $ | 21,430 | |||

|

Net unrealized appreciation of investments

|

186,708 | 338,854 | ||||||

|

Interest income from investments

|

5,865 | 6,245 | ||||||

|

Interest income from loans

|

3,488 | 4,672 | ||||||

|

Dividend income from HSBC American Depository Shares (“ADS”)

|

2,867 | 11,616 | ||||||

|

Other dividend income

|

45,261 | 34,240 | ||||||

|

Net investment activity

|

236,924 | 417,057 | ||||||

|

CONTRIBUTIONS:

|

||||||||

|

Employer matching

|

95,037 | 105,280 | ||||||

|

Participant

|

135,652 | 138,758 | ||||||

|

Total contributions

|

230,689 | 244,038 | ||||||

|

Total net changes in invested assets

|

467,613 | 661,095 | ||||||

|

DEDUCTIONS:

|

||||||||

|

Participant withdrawals and distributions

|

249,778 | 310,126 | ||||||

|

Assets transferred out

|

10,009 | - | ||||||

|

Administrative expenses

|

1,309 | 981 | ||||||

|

Total deductions

|

261,096 | 311,107 | ||||||

|

Net increase in assets

|

206,517 | 349,988 | ||||||

|

NET ASSETS AVAILABLE FOR PLAN BENEFITS

|

||||||||

|

AT BEGINNING OF YEAR

|

2,449,445 | 2,099,457 | ||||||

|

NET ASSETS AVAILABLE FOR PLAN BENEFITS

|

||||||||

|

AT END OF YEAR

|

$ | 2,655,962 | $ | 2,449,445 | ||||

|

The accompanying notes are an integral part of these financial statements.

|

||||||||

F-3

HSBC-NORTH AMERICA (U.S.) TAX REDUCTION INVESTMENT PLAN

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2010 AND 2009

1. General Description of the Plan

The HSBC-North America (U.S.) Tax Reduction Investment Plan (the “Plan”) is a defined contribution plan for eligible employees of participating subsidiaries and affiliates of HSBC North America Holdings Inc. (“HNAH” or the “Plan Sponsor”), including HSBC Finance Corporation and its subsidiaries (“HSBC Finance”), HSBC Bank USA, N.A. (“HBUS”), HSBC Markets USA Inc. (“HMUS”) and HSBC Technology & Services (USA) Inc. (“HTSU”). Participants should refer to the summary plan description document for a more complete description of the Plan’s provisions.

General

The Plan is funded through a single 401(k) trust with Vanguard Fiduciary Trust Company (“Vanguard”).

Contributions

Employees are eligible to participate in the Plan after 30 days of service and at any age. Employees may contribute up to 40% of their total compensation to the Plan each year. Unless they decline participation, employees that are newly hired or rehired on or after January 1, 2009 are automatically enrolled in the Plan for 3% pre-tax contributions after they become eligible (1% for employees newly hired or rehired between January 1, 2007 and December 31, 2008). These contributions are invested in a Vanguard Target Retirement Fund based on the employee’s age as of December 31 of their year of hire and projected years to retirement (age 65). Contributions by highly compensated employees (as defined by law) or employees affected by IRS limits may be limited. Employees may elect to make contributions on a pre-tax, after-tax (except highly compensated employees), or rollover basis. Pre-tax contributions are taken out of an employee's pay before taxes are deducted. After-tax contributions are taken out of an employee’s pay after it has been reduced for taxes. Rollover is for lump-sum payments (pre-tax or after-tax) from another employer’s qualified plan into a “rollover account” in the Plan. Effective for Plan years beginning on or after January 1, 2002, each eligible participant who has attained age 50 before the close of the Plan year shall be eligible to contribute additional funds or pre-tax catch-up contributions up to IRS limits. There is no Company match on catch-up contributions made by highly compensated employees. After one year of service, each participant’s contribution, other than catch-up contributions made by highly compensated employees, is matched each pay period by employer contributions up to a total of 6% of their compensation as follows:

|

§

|

3% match on the first 1% an employee contributes

|

|

§

|

1% match on the second 1% an employee contributes

|

|

§

|

1% match on the third 1% an employee contributes

|

|

§

|

1% match on the fourth 1% an employee contributes.

|

A participant who makes a contribution of 4% of compensation will receive the maximum employer matching contribution of 6% of compensation, subject to IRS limits.

Employer-matching contributions are made in cash and invested in accordance with the participant’s investment elections. These contributions are fully vested immediately.

If certain conditions are satisfied, a participant’s after-tax contributions may be withdrawn at any time whereas pre-tax contributions and employer matching contributions made on or after January 1, 1999 may not be withdrawn except for an immediate financial hardship, termination of employment or attainment of age 59 1/2. Employer matching contributions made prior to 1999 may be withdrawn after five years of plan participation. If the participant is under age 59 1/2, the withdrawal is subject to a 10% IRS early withdrawal penalty. Distributions may be made as a single sum distribution only.

HNAH generally has the right to discontinue or modify its contributions at any time.

Investments

Participants may elect to invest their employee contributions in various funds. At December 31, 2010, the funds available for investment were the Vanguard Target Retirement Income Fund; Vanguard Target Retirement 2005 Fund; Vanguard Target Retirement 2015 Fund; Vanguard Target Retirement 2025 Fund; Vanguard Target Retirement 2035 Fund; Vanguard Target Retirement 2045 Fund; HSBC Investors Money Market Fund-Class Y; HSBC Investor International Equity Fund-Advisor Class; Vanguard Retirement Savings Trust; Vanguard Inflation-Protected Securities Fund Investor Shares; Vanguard Total Bond Market Index Fund; Vanguard Small-Cap Index Fund Investor Shares; Dodge & Cox Stock Fund; Vanguard 500 Index Fund Investor Shares; Vanguard PRIMECAP Fund Investor Shares; Columbia Marsico International Opportunities Fund Class Z; Alliance Bernstein Small Cap Growth Portfolio-Class I; JPMorgan Small Cap Equity Fund – Class R5 Shares; Laudus Rosenberg US Large Cap Fund – Select Shares; Brandes Institutional International Equity Fund Institutional Shares; Natixis Vaughn Nelson Small Cap Value Fund-Class Y, SRSC Fund, and the HSBC ADS Fund.

F-4

1. General Description of the Plan (continued)

Participant Loans

Loans to participants are available under the Plan. A $40 loan fee is deducted from the amount borrowed when the loan is made ($90 fee effective May 1, 2009 for loans originated through one of Vanguard’s Participant Services associates). Each loan must be for an amount not less than $1,000 up to a maximum equal to the lesser of $50,000 or 50 percent of the participant’s account balance. No more than two non-residential loans and one loan for the construction or acquisition of a principal residence may be outstanding at any time. Loans are secured by the participant’s account balance. Loans must be repaid within four and a half years except that, at the Administrative Committee’s (“Committee”) discretion, loans for the construction or acquisition of a participant’s principal residence may be made for a term of up to 25 years. However, all loans become due upon severance of the participant’s employment. The Committee will determine the interest rate to be charged on each loan based on prevailing market conditions for similarly secured personal loans. The range of interest rates on outstanding loans is 3.75% to 13.0%. Prepayment of a loan in full is allowed at any time without penalty. Loan repayments are made automatically through payroll deductions.

Assets Transferred Out

During 2010, the Plan transferred assets of $10,008,929 to a new recordkeeper following the sale of HSBC Finance’s auto financing business.

Administrative Expenses

The Plan is subject to the requirements of the Employee Retirement Income Security Act of 1974 (ERISA). The Vanguard Fiduciary Trust Company and the Vanguard Group of Investment Companies are the trustee and record keeper of the Plan, respectively. The Plan paid approximately $1,309,212 and $981,009 in 2010 and 2009, respectively, of the expenses related to the administration of the Plan. Other expenses related to the administration of the HSBC ADS Fund were netted from the investment income allocable to the Plan participants. In 2010 and 2009, $68,731 and $91,746 respectively, were netted from the HSBC ADS Fund’s investment income rather than being paid by the Plan Sponsor.

Participant Accounts

Each participant’s account is credited with the participant’s contribution and allocations of (a) the Company’s contribution and (b) Plan earnings, and charged with an allocation of administrative expenses. Allocations are based on participant earnings or account balances, as defined in the plan documents. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Vesting

Participants are 100 percent vested in their contributions, Company matching contributions, and related investment performance.

Payment of Benefits

On termination of services due to any reason, including retirement or long-term disability, the full value of the Participant’s Plan account can be paid to the Participant. In the event of death, the benefit will be paid to the beneficiary. When eligible to receive payment, the benefit will be paid as lump sum direct rollover or distribution to participant. The payment is subject to IRS penalties if the participant is under age 59 1/2 and not rolled into an IRA or other eligible retirement vehicle.

2. Summary of Significant Accounting Policies and New Accounting Pronouncements

Basis of Accounting

The Plan is accounted for on the accrual basis of accounting in accordance with U.S. generally accepted accounting principles (US GAAP).

The Plan, through its investment in a common collective trust, holds investment contracts which are required to be reported at fair value. However, contract value is the relevant measurement attribute for that portion of the net assets available for benefits of the Plan attributable to fully benefit-responsive investment contracts because the contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan. The statements of net assets available for plan benefits presents the fair value of the investment contracts and the adjustment of the fully benefit-responsive investment contracts from fair value to contract value. The statements of changes in net assets available for plan benefits is prepared on a contract value basis.

Use of Estimates

The preparation of financial statements in conformity with US GAAP requires estimates and assumptions that affect the amounts of assets and liabilities and changes therein and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

F-5

2. Summary of Significant Accounting Policies and New Accounting Pronouncements (continued)

Investment Valuation and Income Recognition

Investments are reported at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date.

Net realized gain (loss) is the difference between the selling price of an investment and the average cost of that investment.

Unrealized appreciation (depreciation) of investments is the difference between the market value of an investment at the end of the plan year and the market value of the same investment at the beginning of the plan year or at its acquisition date if acquired during the plan year.

Notes Receivable from Participants

Notes receivable from participants are reported at their unpaid principal balances plus any accrued but unpaid interest. Delinquent loans are reclassified as distributions based upon the terms of the plan document.

Payment of Benefits

Benefits are recorded in the financial statements when paid.

New Accounting Pronouncements

In January 2010, the FASB issued guidance to improve disclosures about fair value measurements. The guidance requires entities to disclose separately the amounts of significant transfers in and out of Level 1 and Level 2 fair measurements and describe the reasons for those transfers. It also requires the Level 3 reconciliation to be presented on a gross basis, while disclosing purchases, sales, issuances and settlements separately. The guidance became effective for interim and annual financial periods beginning after December 15, 2009 except for the requirement to present the Level 3 reconciliation on a gross basis, which is effective for interim and annual periods beginning after December 15, 2010. The Plan adopted the new disclosure requirements in their entirety effective January 1, 2010. Adoption did not have an impact on the Plan’s financial statements.

In February 2010, the FASB amended certain recognition and disclosure requirements for subsequent events. The guidance clarified that an entity that either (a) is an SEC filer, or (b) is a conduit bond obligor for conduit debt securities that are traded in a public market is required to evaluate subsequent events through the date the financial statements are issued and in all other cases through the date the financial statements are available to be issued. The guidance eliminated the requirement to disclose the date through which subsequent events are evaluated for an SEC filer. The guidance was effective upon issuance. Adoption did not have an impact on the Plan’s financial statements.

In September 2010, the FASB issued Accounting Standards Update (ASU) No. 2010 - 25, Plan Accounting – Defined Contribution Pension Plans (Topic 962), Reporting Loans to Participants by Defined Contribution Pension Plans, a consensus of the FASB Emerging Issues Task Force (“Update”). This Update requires that participant loans be classified as notes receivable from participants, which are segregated from plan investments and measured at their unpaid principal balance plus any accrued but unpaid interest. The amendments in the Update are to be applied retrospectively to all prior periods presented, effective for fiscal years ending after December 15, 2010. The Plan now reports participant loans as notes receivable from participants within the statements of net assets available for plan benefits following adoption of this guidance. In 2009, the participant loans were valued at their unpaid principal balance plus any accrued but unpaid interest, which approximated the loans’ fair value. Therefore, adoption had no impact on the measurement of participant loans in either year presented on the statement of net assets.

3. Common Collective Trust

The Vanguard Retirement Savings Trust is a tax-exempt collective trust invested primarily in investment contracts and similar fixed-principal investments. The Plan’s investment as of December 31, 2010 and 2009 is as follows:

F-6

3. Common Collective Trust (continued)

|

2010

|

2009

|

|||||||||||||||

|

Investments at Fair Value

|

Adjustments to Contract Value

|

Investments at Fair Value

|

Adjustments to Contract Value

|

|||||||||||||

|

(in thousands)

|

||||||||||||||||

|

Vanguard Retirement Savings Trust

|

$ | 213,974 | $ | (8,253 | ) | $ | 209,169 | $ | (4,397 | ) | ||||||

The investment contracts held by the Plan are benefit-responsive and are carried at contract value which represents contributions made under the contracts, plus interest at contract rates, less withdrawals and administrative expenses. The Vanguard Retirement Savings Trust Fund operates in a manner similar to a mutual fund, where the investments of the Fund are in various investment contracts whose mix can change daily. The Vanguard Retirement Savings Trust Fund has no minimum crediting interest rate. The average yield for the Vanguard Retirement Savings Trust Fund was 3.36% and 3.15% for 2010 and 2009, respectively. The interest crediting rate, which typically resets quarterly based on the performance of the underlying investment portfolio, was 3.58% and 3.31% at December 31, 2010 and 2009, respectively. No valuation reserves were considered necessary at December 31, 2010 or 2009.

4. Reconciliation to Form 5500

The following is a reconciliation of net assets available for plan benefits per the financial statements at December 31, 2010 and 2009 to Form 5500:

|

2010

|

2009

|

|||||||

|

(in thousands)

|

||||||||

|

Net assets available for plan benefits per the financial statements

|

$ | 2,655,962 | $ | 2,449,445 | ||||

|

Fair value adjustment to Common Collective Trust

|

8,253 | 4,397 | ||||||

|

Amounts allocated to withdrawing participants

|

(8,881 | ) | (6,903 | ) | ||||

|

Deemed distributions

|

(232 | ) | (138 | ) | ||||

|

Net assets available for plan benefits per the Form 5500

|

$ | 2,655,102 | $ | 2,446,801 | ||||

The following is a reconciliation of benefits paid to participants per the financial statements for the years ended December 31, 2010 and 2009 to Form 5500:

|

2010

|

2009

|

|||||||

|

(in thousands)

|

||||||||

|

Benefits paid to participants per the financial statements

|

$ | 249,778 | $ | 310,126 | ||||

|

Add: Amounts allocated to withdrawing participants at December 31, 2010 and 2009

|

8,881 | 6,903 | ||||||

|

Less: Amounts allocated to withdrawing participants at December 31, 2009 and 2008

|

(6,903 | ) | (4,395 | ) | ||||

|

Less: Corrective distributions and other adjustments

|

(50 | ) | (114 | ) | ||||

|

Benefits paid to participants per Form 5500

|

$ | 251,706 | $ | 312,520 | ||||

Amounts allocated to withdrawing participants are recorded on the Form 5500 for benefit claims that have been processed and approved for payment prior to December 31, 2010, but not yet paid as of that date.

5. Tax Status of the Plan

The Plan operates as a qualified plan under Sections 401(a) and 401(k) of the Internal Revenue Code (“the IRC”). Qualification of the Plan means that a participant will not be subject to federal income taxes on pre-tax contributions and employer matching contributions, or on earnings or appreciation on all account balances held in the Plan, until such amounts either are withdrawn by or distributed to the participant or are distributed to the participant’s beneficiary in the event of the participant’s death. The Plan received a favorable determination letter dated November 14, 2008 from the Internal Revenue Service that the Plan is qualified under the IRC. Although the plan has been amended since applying for the determination letter, the Plan administrator and the Plan’s counsel believe that the Plan is designed and is currently being operated in compliance with applicable requirements of the IRC.

No significant income tax uncertainties exist related to plan operations.

F-7

6. Investments

The following presents investments that represent 5 percent or more of the Plan’s net assets as of December 31, 2010 and 2009:

|

2010

|

2009

|

||

|

(in thousands)

|

|||

|

Vanguard 500 Index Fund Investor Shares

|

394,081

|

309,448

|

|

|

Vanguard PRIMECAP Fund Investor Shares

|

324,046

|

307,121

|

|

|

Dodge & Cox Stock Fund

|

244,660

|

222,665

|

|

|

HSBC Investors Money Market Fund-Class Y

|

237,631

|

254,924

|

|

|

Vanguard Total Bond Market Index Fund

|

214,930

|

197,954

|

|

|

Vanguard Retirement Savings Trust

|

205,721

|

204,772

|

|

|

Vanguard Target Retirement 2025

|

141,757

|

116,586 *

|

|

|

HSBC Investor International Equity Fund-Advisor Class

|

- *

|

125,296

|

|

* Indicates investments that do not exceed 5% of the Plan’s net assets, but are presented for comparative purposes.

The Plan’s investments (including gains and losses on investments bought and sold, as well as held during the year) appreciated (depreciated) in value as follows:

|

2010

|

2009

|

|||||||

|

(in thousands)

|

||||||||

|

HSBC ADS Fund

|

$ | (9,661 | ) | $ | 11,373 | |||

|

Mutual funds

|

189,104 | 348,911 | ||||||

|

Total

|

$ | 179,443 | $ | 360,284 | ||||

7. Plan Termination

The Plan Sponsor expects to continue the Plan indefinitely. Nevertheless, it maintains the right to suspend or discontinue Plan Sponsor contributions and/or terminate the Plan at any time and for any reason, to the extent permitted by law. In addition, it may amend or modify the Plan from time to time to the extent permitted by law. Any changes will be communicated to participants in writing. In the event of a termination, all vested benefits will be non-forfeitable and will not be returned to HNAH.

8. Risk and Uncertainties

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market rate, and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for plan benefits.

9. Related-Party Transactions

Certain plan investments are shares of mutual funds managed by subsidiaries of the Plan Sponsor and Vanguard. HSBC Global Asset Management (USA) Inc. is a subsidiary of the Plan Sponsor and Vanguard is the trustee as defined by the plan. Therefore these transactions qualify as party-in-interest transactions.

F-8

10. Commitments and Contingencies

In the ordinary course of business, the Plan may be named as defendant in or be a party to various pending and threatened legal proceedings.

The Plan administrator and the Plan’s counsel believe, based upon current knowledge, that liabilities arising out of any such current proceedings will not have a material adverse effect on the statements of net assets available for plan benefits and the related statements of changes in net assets available for plan benefits.

11. Fair Value Measurements

Accounting principles related to fair value measurements provide a framework for measuring fair value and focus on an exit price in the principal (or alternatively, the most advantageous) market accessible in an orderly transaction between willing market participants (the “Fair Value Framework”). The Fair Value Framework establishes a three-tiered fair value hierarchy with Level 1 representing quoted prices (unadjusted) in active markets for identical assets or liabilities. Fair values determined by Level 2 inputs are inputs that are observable for the asset or liability, either directly or indirectly. Level 2 inputs include quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, and inputs other than quoted prices that are observable for the asset or liability, such as interest rates and yield curves that are observable at commonly quoted intervals. Level 3 inputs are unobservable inputs for the asset or liability and include situations where there is little, if any, market activity for the asset or liability. Transfers between leveling categories are recognized at the end of each reporting period.

The asset or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used maximize the use of observable inputs and minimize the use of unobservable inputs.

Following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the methodologies used at December 31, 2010 and 2009.

Mutual funds (including The HSBC ADS Fund and The SRSC Fund): Valued at the net asset value of shares held by the Plan at the end of the year.

Common Collective Trusts: The fair value comprises the aggregate market value of the underlying investments in bond trusts, and the value of the wrap contracts, if any.

The preceding methods described may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, although the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

Assets and Liabilities Recorded at Fair Value on a Recurring Basis

The following table presents information about Plan assets measured at fair value on a recurring basis as of December 31, 2010 and 2009, and indicates the fair value hierarchy of the valuation techniques utilized to determine such fair value.

F-9

11. Fair Value Measurements (continued)

|

Assets (Liabilities) Measured at Fair Value

(in thousands)

|

Quoted Prices in Active Markets for Identical Assets (Level 1)

(in thousands)

|

Significant Other Observable Inputs (Level 2)

(in thousands)

|

Significant Unobservable Inputs

(Level 3)

(in thousands)

|

|||||||||||||

|

December 31, 2010

|

||||||||||||||||

|

Mutual Funds:

|

||||||||||||||||

|

Growth funds

|

$ | 904,058 | $ | 904,058 | $ | - | $ | - | ||||||||

|

Index funds

|

45,936 | 645,936 | - | - | ||||||||||||

|

Balanced funds

|

454,449 | 454,449 | - | - | ||||||||||||

|

Fixed income funds

|

294,888 | 294,888 | - | - | ||||||||||||

|

Total Mutual Funds

|

2,299,331 | 2,299,331 | - | - | ||||||||||||

|

Common Collective Trusts

|

213,974 | - | 213,974 | - | ||||||||||||

|

HSBC ADS Fund

|

68,731 | 68,731 | - | - | ||||||||||||

|

SRSC Fund

|

6,532 | 6,532 | - | - | ||||||||||||

|

Total investments at fair value

|

$ | 2,588,568 | $ | 2,374,594 | $ | 213,974 | $ | - | ||||||||

|

Assets (Liabilities) Measured at

|

Quoted Prices in Active Markets for Identical Assets

|

Significant Other Observable Inputs

|

Significant Unobservable Inputs

|

|||||||||||||

|

December 31, 2009

|

Fair Value

(in thousands)

|

(Level 1)

(in thousands)

|

(Level 2)

(in thousands)

|

(Level 3)

(in thousands)

|

||||||||||||

|

Mutual Funds:

|

||||||||||||||||

|

Growth funds

|

$ | 865,953 | $ | 865,953 | $ | - | $ | - | ||||||||

|

Index funds

|

524,490 | 524,490 | - | - | ||||||||||||

|

Balanced funds

|

372,583 | 372,583 | - | - | ||||||||||||

|

Fixed income funds

|

308,328 | 308,328 | - | - | ||||||||||||

|

Total Mutual Funds:

|

2,071,354 | 2,071,354 | - | - | ||||||||||||

|

Common Collective Trusts

|

209,169 | - | 209,169 | - | ||||||||||||

|

HSBC ADS Fund

|

91,746 | 91,746 | - | - | ||||||||||||

|

SRSC Fund

|

8,899 | 8,899 | - | - | ||||||||||||

|

Total Investments at Fair Value

|

$ | 2,381,168 | $ | 2,171,999 | $ | 209,169 | $ | - | ||||||||

F-10

12. Prohibited Transaction

On March 13, 2009, holders of ordinary shares of HSBC Holdings plc (including holders of American Depository Shares (“ADS”) of HSBC Holdings plc), received the right (“Right”) to purchase additional shares at the rate of five additional shares for every twelve shares currently owned at a price that was discounted to the current market price at that time. An independent fiduciary appointed by the Plan Sponsor directed the Plan’s trustee to sell the Rights in the open market for which sales occurred on or prior to April 3, 2009.

The Plan Sponsor has determined that it is probable, but not certain, that the Rights meet the definition of an “employer security” under ERISA Section 406 but do not meet the definition of a “qualifying employer security.” The receipt and holding of the Rights, even if for a short period of time and without any action by the Plan or its trust to approve the Rights plan, may be viewed as a prohibited transaction under Section 406 of ERISA and Section 4975 of the Internal Revenue Code.

The Plan Sponsor submitted a request for an exemption from the prohibited transaction rules for the holding and disposition of the Rights to the U.S. Department of Labor, which has yet to issue a final ruling on the request.

F-11

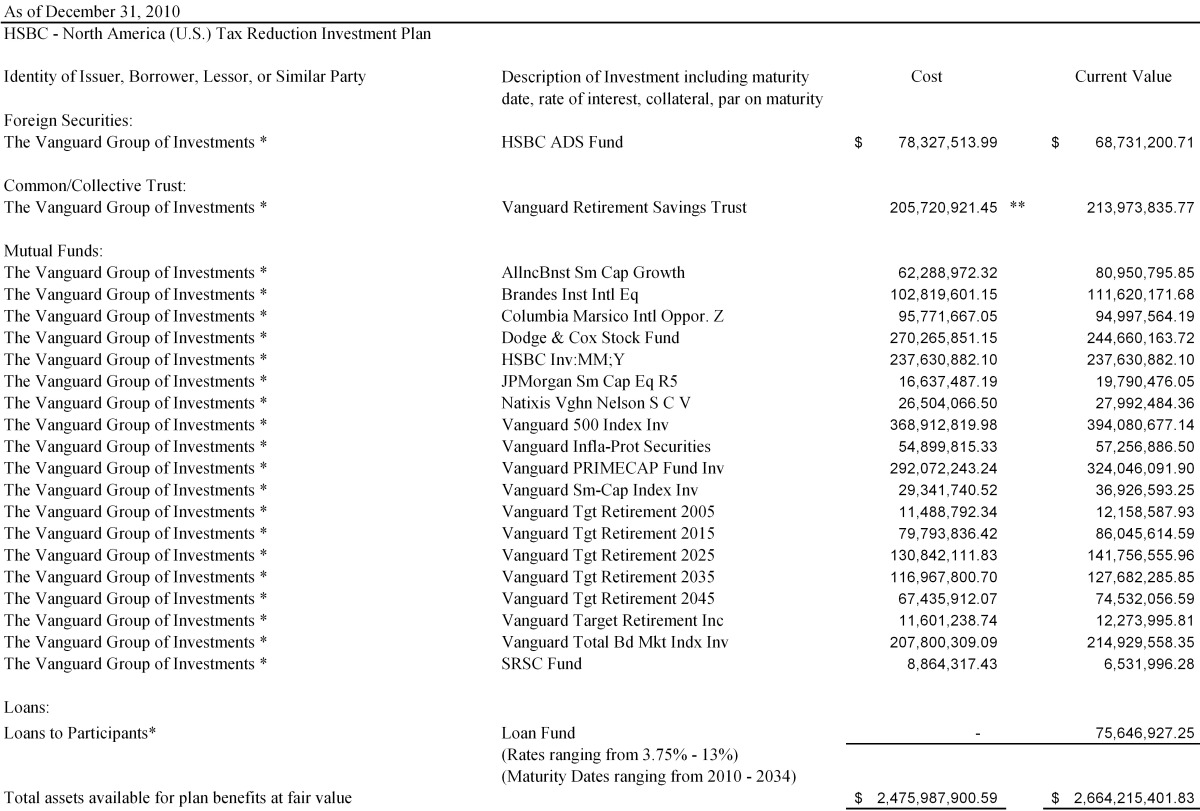

HSBC-NORTH AMERICA (U.S.) TAX REDUCTION INVESTMENT PLAN

Schedule H – Line 4i – Schedule of Assets Held (As of December 31, 2010)

* Party-in-Interest

** Contract Value

F-12

Exhibit 23(a)

KPMG LLP

303 E. Wacker Drive

Chicago, IL 60601-5212

Consent of Independent Registered Public Accounting Firm

The Board of Directors

HSBC Finance Corporation

We consent to the incorporation by reference in the registration statements No. 33-52211, No. 33-58727, No. 333-00397, No. 333-03673, No. 333-39639, No. 333-58287, No. 333-58289, No. 333-58291, No. 333-47073, No. 333-36589, No. 333-30600, No. 333-50000, No. 333-70794, No. 333-71198, No. 333-83474 and No. 333-99107 on Form S-8 of our report dated June 29, 2011 with respect to the statements of net assets available for plan benefits of the HSBC – North America (U.S.) Tax Reduction Investment Plan as of December 31, 2010 and 2009, the related statements of changes in net assets available for plan benefits for the years then ended, and the supplemental schedule, Schedule H, Line 4i – Schedule of Assets held (as of December 31, 2010) which appears in the December 31, 2010 annual report on Form 11-K of the HSBC – North America (U.S.) Tax Reduction Investment Plan.

/s/ KPMG

Chicago, Illinois

June 29, 2011

F-13