Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Nalco Holding CO | d8k.htm |

|

Dave Flitman, President WPS

28th June, 2011

Water and Process Services (WPS)

Segment Review

Exhibit 99.1 |

|

2

Forward-Looking Statements and Regulation G

This presentation includes “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. These forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events,

future revenue or performance, capital expenditures, financing needs, plans or intentions

relating to acquisitions, business trends and other information that is not historical

information. When used in this presentation, the words “estimates,” “expects,” “anticipates,” “projects,” “plans,”

“intends,” “believes,” “forecasts,” or future or conditional

verbs, such as “will,” “should,” “could” or “may,” and variations of such words or similar

expressions are intended to identify forward-looking statements. All forward-looking

statements, including, without limitation, management’s examination of historical

operating trends and data are based upon our current expectations and various assumptions. Our expectations, beliefs and

projections are expressed in good faith and we believe there is a reasonable basis for them.

However, there can be no assurance that management’s expectations, beliefs and

projections will be achieved. There are a number of risks and uncertainties that could cause our actual results to differ

materially from the forward-looking statements contained in this presentation.

Important factors that could cause our actual results to differ materially from the forward-looking statements we make in this

presentation. Such risks, uncertainties and other important factors include, among

others: our leverage; limitations on flexibility in operating our business contained in

our debt agreements; increases in interest rates as a result of our variable rate indebtedness; pricing pressure from our

customers; technological change and innovation; risks associated with our non-U.S.

operations; fluctuations in currency exchange rates; high competition in the markets in

which we operate; adverse changes to environmental, health and safety regulations; operating hazards in our production

facilities; inability to achieve expected cost savings; difficulties in securing or changes in

the pricing of the raw materials we use; our significant pension benefit obligations

and the current underfunding of our pension plans; our ability to realize the full value of our intangible assets; our ability to attract

and retain skilled employees, particularly research scientists, technical sales professionals

and engineers; and our ability to protect our intellectual property rights. There

may be other factors that may cause our actual results to differ materially from the forward-looking statements.

All forward-looking statements attributable to us or persons acting on our behalf apply

only as of the date of this presentation and are expressly qualified in their entirety

by the cautionary statements included in this presentation. We undertake no obligation to update or revise forward-looking

statements which may be made to reflect events or circumstances that arise after the date made

or to reflect the occurrence of unanticipated events. Non-GAAP measures may be discussed in today’s presentation. Management believes

that discussion of these measures provides investors with additional insight into the

ongoing operations of Nalco Holding Company. Non-GAAP measures are reconciled to the closest GAAP measure in

schedules attached to our earnings releases, which may be found at

www.nalco.com. Adjusted EBITDA and Pro Forma EBITDA are non-GAAP measures

used to determine compliance with the Company’s debt covenants or to assess the ongoing

performance of the business. Free Cash Flow is defined as Cash from Operations

less Capital Expenditures and Minority Interest charges. In addition, Nalco may discuss sales growth in terms of nominal (actual),

organic (nominal less foreign currency and acquisition/divestiture/merger/joint venture

impacts), and real (organic growth less that portion of the growth which consists of

price increases that simply pass along higher raw and purchased material costs). The non-GAAP measures should not be

viewed as an alternative to GAAP measures of performance. Furthermore, these measures

may not be consistent with similar measures provided by other companies.

|

|

3

$4.25 Billion Sales by End Market

2010

NALCO –

A SERVICE COMPANY

Water & Process Services (WPS)

•

60% of total company sales

•

Water, 42%

•

Paper, 18%

•

55% of total company profit

•Water

•

Largest Segment

•

Highly Diverse

•

Strong Growth*

•

6-8% per yr

•

High DC Margin

•

~20-21%

•Paper

•

4-5% per yr Growth*

•

High teens DC Margin

* Real growth is defined as organic growth less the impact of sizable raw material

cost driven price swings. Organic growth excludes FX and M&A

impacts. Assumes economic stabilization. New run rate by YE2011. Upstream

Energy

24.3%

Downstream

Energy

16.4%

Paper, Graphic Grades

8.9%

Paper, Board & Packaging

6.5%

Paper, Tissue

2.3%

Water, Manufacturing

6.7%

Water, Food & Beverage

6.1%

Water, Mining & Minerals

5.6%

Water, Primary Metals

5.2%

Water, Institutional

4.6%

Water, Power

4.2%

Water, Chemicals

3.8%

All others

5.4% |

|

4

BRIC+ countries

MACROS SUPPORT COMPELLING GROWTH OPPORTUNITIES |

|

5

WPS GROWTH STRATEGY

•

Leverage our customer intimacy and industry expertise to continue to expand our

core strengths in service, automation, chemistry and specialty

equipment. •

Capture geographic and market trend opportunities in BRIC+ at the interface of

water scarcity and rapid industrial growth.

•

Expand our technology leadership in key areas:

•

Automation and Control

•

3D TRASAR®

Platform

•

OxiPRO®

•

Process Applications in several Industries

•

Paper

•

Mining

•

Light Manufacturing

•

Food and Beverage

•

Industrial Water Recycle and Reuse

•

Integrated Solutions

•

3D TRASAR for Membranes

•

Continue to drive productivity across the business in supply chain and the field

sales force to improve overall efficiency and drive working capital

productivity. |

|

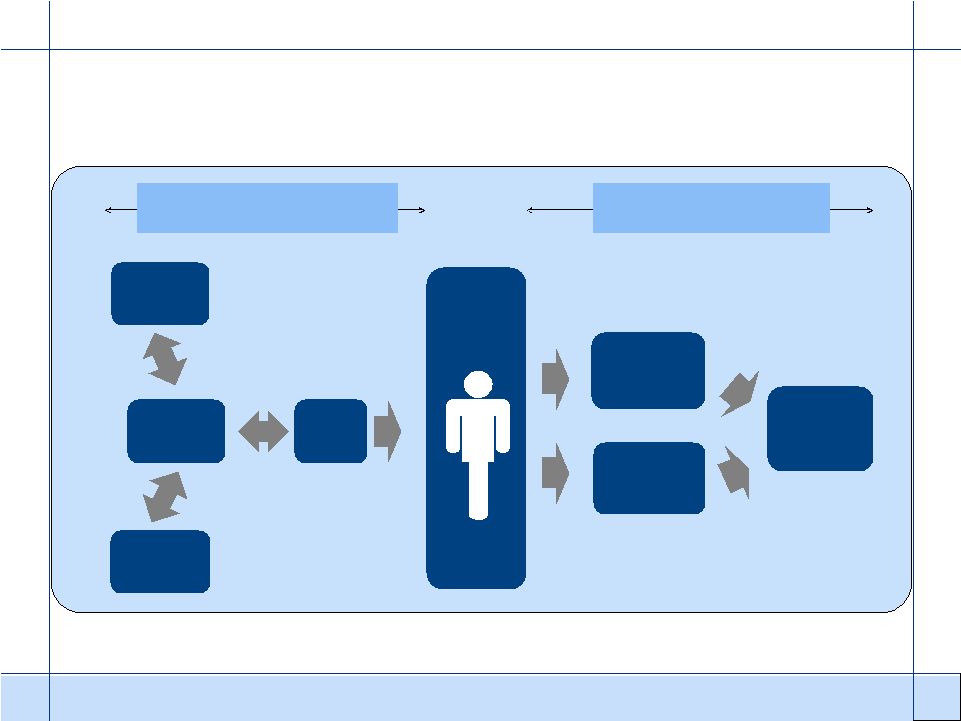

6

Focused

penetration in

BRIC+ markets

Integrated

pre-treatment &

utility solutions

Process

application

solutions

Integrated

waste water

solutions

Integration across entire facility

Automation, Monitoring and Control

Innovation in Chemistry, Equipment, & Service

Professional Services, On-Site Services, Operating Services

WPS STRATEGY DEPLOYMENT

1

2

3

4 |

|

7

•Train & develop

•Create & Maintain Value

•Incent

•Salesforce productivity

•Recurring

•Not cyclical

•Bundled agreements

•

Total cost of

operation (TCO)

•

Create & Maintain

Value

•

Environmental

performance;

eROI

•

Brand loyalty

•Services

•Automation/Process Control

•

Chemistry

•Specialty equipment

Nalco

“Sweet spot”

WPS BUSINESS MODEL, HIGHLY DIFFERENTIATED & DIFFICULT TO REPLICATE

sm |

|

8

WATER

Market Dynamics

Business Model

Growth

Drivers

•

Safety and equipment integrity

•

Productivity

•

Regulatory compliance

•

Water availability and quality

•

Environmental sustainability

•

Total cost of operation (TCO)

Sensitivity

Industrial Production, GDP

Market Size*

$6.4B (4% CAGR chemicals/service)

Market

Share

~ 20%

•

BRIC+

•

Market share gains in key accounts

•

Technology penetration

•

Automation and real time performance

information

•

Integrated solutions

•

Waste

water

reuse

and

recycle

–

eROI

Industries Served

Heavy Industrial (40%)

•Primary Metals

•Power Generation

•Chemicals

Light Industrial (40%)

•Food & Beverage

•Institutional

•Manufacturing

Other (20%)

•

Focused on Industry Leaders in respective

segments

•

Annuity / recurring revenue models

•

Water treatment sales comprise

~70% of Water revenue

•

Measured delivered value utilizing Create &

Maintain Value (CMV) process

•

Pretreatment, process water, and waste

treatment

*See 2010 10K for definition of Water segment market size

|

|

9

example….POWER GENERATION

Business Model

Growth

Drivers

•

Safety

•

Capacity

•

Availability

•

Life extension

•

Environmental compliance

•

Maintenance

•

Heat rate

Sensitivity

Capacity additions through new

construction, GDP

Market Size

$600M (3-4% CAGR)

Market

Share

> 20%

•

Environmental compliance and pollution

reduction (heavy metals removal) programs

•

Water

scarcity

-

recycle

and

usage

minimization programs

•

Integrated water management (IWM) and

pretreatment outsourcing

•

Core technology penetration in BRIC+

Segments Served

•

Nuclear

•

Fossil

•

Renewables (Geo. / waste / thermal solar)

•

Focused on major regional and global

electricity generators

•

Recurring revenue linked to electricity

production

•

Cooling water, boiler water, waste

treatment services, chemistries, and

equipment

Market Dynamics |

|

10

example….FOOD & BEVERAGE

Business Model

Growth

Drivers

•

Brand Protection

•

Food Safety

•

Meet sustainability goals

•

Leverage existing assets

Sensitivity

Food commodity prices,

Capital availability

Market

Size

$1.4B boiler,cooling,waste chemistry~ 4-5%

Market

Share

~ 20% share in target markets

Integrated solutions

•Goal of 100% Nalco 360 penetration in global key

accounts to standardize eROI delivery

Process technology

•

Additives for corn oil recovery improvement

•

Fermentation additives for increased yields in ethanol

•

3D TRASAR for Membranes & Services for Process

Beverage

•

3D TRASAR for Clean in Place to reduce water

consumption

BRIC+

•Penetrate Brazil’s $100MM biofuel (sugar) market

Segments Served

•Beverage (Brewing, Water, Functional)

•Grain, Oil (Edible),

Biofuels

•Processed and Prepared Foods

•Dairy

•Meat & Poultry

•

Focus on global multi-national customers

•

Recurring revenue based on price per pound and

fixed monthly payment are the predominant

globally

•

Long term annuity contracts for Waste Water &

Utility treatment chemistry and services

Market Dynamics |

|

11

PAPER

Market Dynamics

Business Model

Growth

Technology

•Pareto™

–

water and energy savings

•Oxipro –

productivity enhancement

•FillerTEK®

–

TCO enabler

•POSITEK®

3G –

finished product quality

Waste

water

reuse

and

recycle

–

eROI

Grow share every year in BRIC+

Industries Served

•

Graphic Grades

(50%)

•

Board &

Packaging (37%)

•

Tissue (13%)

•

Align with Global Sustainable Assets

•

Focus on Large Multi National Corporations

and Regional Market Leaders

•

Measured delivered value utilizing CMV

process

•

Long term supply agreements (pricing –

indices driven)

Drivers

•

Production Rates

•

Finished product quality

•

Operational productivity

•

Environmental sustainability, eROI

•

Regulations

•

TCO (Total Cost of Operations)

Sensitivity

Industrial Production, GDP,

Regulations

Market Size*

$6.7B (Global CAGR 2.8%)

Market Share

11%

*See 2010 10K for definition of Paper segment market size

|

|

12

MINING

Market Dynamics

Business Model

Growth

Drivers

•

Demand for metals and energy

•

Environmental sustainability

•

High water intensity with mines

located in water scarce regions

•

Declining ore quality will drive

need for “specialized”

additives

•

TCO

Sensitivity

GDP, Regulations

Market Size

~$1.2B (6-8%)

Market Share

> 20%

Technology

•Flotation

•

Pinnacle®-Sulfide Flotation Technology

•

NALFOTE®-Coal Flotation Technology

•OreBind®-Water Recovery Aid

•Perflow-Potash & Phosphate Coatings

BRIC+ (Brazil, China, Chile, Australia, South

Africa)

Industries

Served

•

Onsite problem prevention/solving in our

customers’

dynamic systems

•

Advanced technology support for significant

process problems

•

High service requirements, expert

process and water knowledge,

assured supply chain

•

Long term supply agreements

(pricing –

indices driven)

These industry’s represent

> 90% of the business.

•

Alumina

•

Coal

•

Precious Metals

•

Base Metals

•

Potash/

Phosphate |

|

13

Above Market Growth

At Market Growth

Less than Market Growth

WELL POSITIONED TO OUTPACE MARKET GROWTH |

|

14

New

Account

Production

Scheduled

Sales Calls

Available

Sales Time

Quality of

Opportunity

Quality of

Sales Call

Aligned

Compensation

•

Skill Will Assessments

•

District

Implementation Plans

•

Key Activities &

Milestones of

Sales Stages

Designed into

CRM

•

Compensation Model

With Aligned Rates,

Targets & Deployment

Roles

•

Service Activities Scheduled

Around Sales Calls

•

Sales Calls Scheduled in

Advance (4 Week View)

•

Call Schedule Reviewed by

District Manager at Least

Every Other Week

•

Key Functionality of CRM

•

Target Opportunity

List Created &

Managed Jointly

Between Sales,

SBUs and KAMs

New account targets increased >30% through

COMMERCIAL EXCELLENCE |

|

15

Industry

Marketing

Product &

Solutions

Marketing

Key

Account

Management

Sales

Mngt

Rep List of

Target

Opportunities

& Offerings

Assign Targets

Based on

Goals &

Available

Sales

Resources

Reps Earn Greater Incentives For Selling Strategically Targeted Opportunities

Target Selection Process

“Where”

and “What”

to Sell

Total

Incentive

Earnings

Profitability Of

Entire Territory

vs. Target

Gross Profit

from Targeted

New Business

vs. Target

Actual Gross Profit Attained in Each

Category is Compared to Role-

Specific Targets to Determine

Incentive Earnings

Results

Sales Incentive Design

Rewarding Strategic Sales

STRATEGIC APPROACH TO MARKET VIA INCENTIVE DESIGN |

|

16

Membranes

Wastewater

WPS INNOVATION PIPELINE INTEGRAL TO GROWTH STRATEGY

| |

|

17

% RECOVERY% REJECTION% PRESSURE

WATER USAGE/EFFICIENCY

STEAM FLOW

ENERGY USAGE/ EFFICIENCY

ENERGY/WATER USAGE

FUEL USAGE

BD

ENERGY USAGE/EFFICIENCY

FLOW

ENERGY/ WATER USAGE

TSS

COD

FLOW

TEMP IN

TEMP OUT

ENERGY/PROCESS EFFICIENCY

MU

BD

WATER USAGE

CT FAN SPEED

ENERGY USAGE

BOILER

WASTE

WATER

PROCESS

RO

COOLING

Customer Benefits:

•Reduced Water and Energy Consumption

•Benchmarking Capabilities

•Lower Total Cost of Operation

Not yet

commercialized

3D TRASAR TECHNOLOGY PLATFORM EXPANSION

TOTAL WATER AND

ENERGY IN

MOST EFFICIENT USE OF

WATER AND ENERGY OUT

MINIMIZE

WASTE OUT |

|

18

Key technology aligned with market drivers

expected to add 2-3% growth by 2015

WPS MARKET DRIVERS AND KEY TECHNOLOGIES

Cost Reduction

Energy

(3D

TRASAR,

PARETO

Mixing

Technology,

Metrix®/VELOX®,

POSITEK

®

3G)

Water

(3D

TRASAR,

PARETO

Mixing

Technology,

Sea

Water,

OreBind,

NALFLOTE)

Total

Cost

of

Operation

(TCO)

–

All

key

technologies

Resources

(APEX™, FillerTEK, Metrix, Pinnacle, Perflow)

Production Efficiency

Tons

(PARETO/RDF,

POSITEK

3G,

Metrix®/VELOX,

OxiPRO,

Tissue

Automation)

Yield

(3D

TRASAR,

PARETO/RDF,

POSITEK

3G,

Metrix/VELOX,

OxiPRO,

Pinnacle,

CGMAX)

Environmental Impact, eROI

Water

reduction

(3D

TRASAR,

PARETO

Mixing

Technology,

Sea

Water,

OreBind,

NALFLOTE)

Water

recycle

and

reuse

(3D

TRASAR,

PARETO

Mixing

Technology)

Energy

Conservation

(3D

TRASAR,

PARETO

Mixing

Technology,

Metrix/VELOX,

POSITEK

3G,

Strength,

Geothermal) |

|

19

•

Over 70% of 903 Nalco headcount additions during 2010 in BRIC+ countries

–

~300 Customer Facing headcount additions to BRIC+ in WPS

•

Dedicated training University established in China

–

Three graduating classes in 2010: > 225 sales and service professionals

–

Accelerated time and capability to maximum customer value

•

Investment in New R&D Facilities: >$10MM capex

–

Shanghai, China (2009)

–

Pune, India (2010)

–

Campinas, Brazil (2009)

•

Nanjing, China Manufacturing Facility (2008): $25MM capex

–

Nalco 3 largest production facility

•

Increased local…

–

Nalco Leadership

–

Government Relationships

–

Partnerships with National Industrial Leaders

BRIC+ Sales: Nalco achieved 30% growth in 2010; 18% of total

company revenue

Relatively High Market Share vs. Competitors

BRIC+ INVESTMENTS SHOWING EARLY RETURNS

rd |

|

20

* Real growth is defined as organic growth less the impact of sizable raw material

cost driven price swings. Organic growth excludes FX and M&A

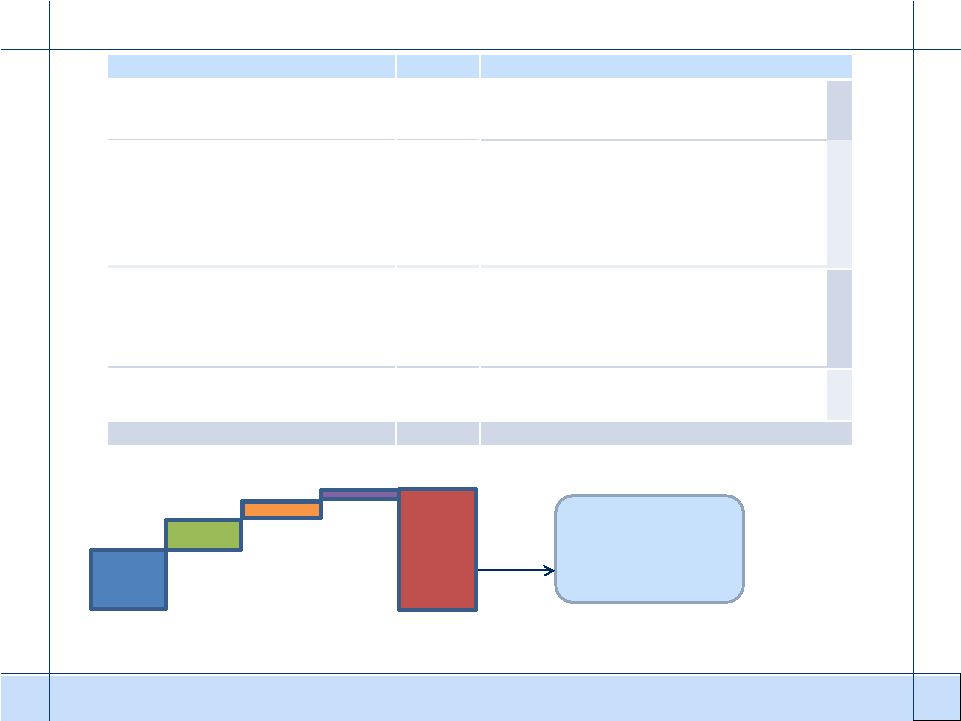

impacts. Assumes economic stabilization. New run rate by YE2011. WPS Growth

Drivers Growth

Results

Next Generation Technology

• 3D TRASAR Cooling Water, Boiler Water,

• 3D TRASAR

Membranes

• Process Initiatives

• OxiPro, Pareto, Thin Stillage, APEX

• Integrated Solutions

• Solutions combining chemistry, equipment,

services and automation

• Align with high growth regions and

industries

• JV in sub-equatorial Africa 2010

• Continued talent acquisition

• Targeted technology expansion,

service bolt-ons (synergy growth)

Expected WPS Real Growth Rate *

5 - 7%

Sustain Historic Base Growth

3%

• Sales channel, leading technology, brand

recognition

.25 - .50%

1 - 2.5%

Historic M&A

Strengthen Key Geographies (BRIC +)

.75 - 1%

2015E

+ $1B

in 5 yrs

WPS GROWING 1.5 –

2X MARKET

3%

1 -

2.5%

.75 -

1%

.25 -

.50%

5 -

7%

Core Water

Technology

BRIC+

M&A

& Paper

Growth

$2.5B

$3.5B |

|

21

WPS RAW MATERIALS AND PRICING EXPECTATIONS

•

Price, and margin restoration, is our number one focus

•

Globally, price negotiations actioned on > 80 percent of

revenue

•

On pace to cover current quarter cost increases with

price by end Q2 |

|

22

WATER AND PROCESS SERVICES 2011 OUTLOOK

•

Forecast high single -

double digit revenue growth

•

Growing 1.5-2x the market

•

Value of account targets up over 30% globally

•

Price is our number one focus

•

On track to support corporate commitment of price catching raw cost

increases on run rate basis by end 3Q

•

Nalco Mobotec gaining significant momentum in Europe

•

Direct Contribution Margin approaching 18% |

|

Questions ? |