Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - Behringer Harvard Opportunity REIT I, Inc. | a11-15382_18k.htm |

Exhibit 99.1

Behringer Harvard Opportunity REIT I, Inc.

![]()

First Quarter Report

Quarter ended March 31, 2011

12600 Whitewater in Minnetonka, Minnesota was sold by Behringer Harvard Opportunity REIT I, Inc. on April 26, 2011.

First Quarter Overview

· As previously reported, the REIT has entered the disposition phase of its lifecycle and expects to divest its portfolio of assets over the next several years. In the near term, sales proceeds will be used for investment in other portfolio assets where we believe we can achieve value for shareholders, interest and principal, including potential paydowns on our outstanding debt, and operational needs of the properties and the program. We anticipate beginning to return capital to shareholders after 2011 via special distributions.

· On April 26, 2011, we closed on the sale of 12600 Whitewater in Minnetonka, Minnesota. The sale price was $9.6 million and netted $5.0 million after repaying debt and closing expenses. The proceeds were used to fund property and company capital and operating needs.

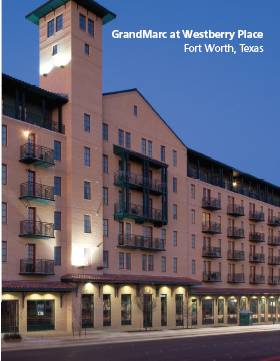

· GrandMarc at Westberry Place, our 95 percent-leased student housing property at Texas Christian University in Fort Worth, Texas, is under contract to sell. We expect to close this transaction by August 2011. At the current contract sales price, this would net more than $8 million in proceeds to the REIT.

· The capital markets have begun to thaw, providing more flexibility in financing quality real estate assets. As a result, we have decided to explore refinancing alternatives for Regency Center and Northpoint Central and took these Houston, Texas, office properties off the market until higher value is recognized for these well-leased assets.

· Effective March 15, 2011, the REIT extended the loans on the Chase Park Plaza Hotel and The Private Residences in St. Louis, Missouri, until November 2011, each with an additional six-month extension option. Also, during 2011 we have sold three condominium units for total net proceeds of $1.9 million, which have been used to pay down the condominium loan. The balance of the condominium loan has been reduced to $6.1 million with 30 units remaining to be sold.

Financial Highlights

Some numbers have been rounded for presentation purposes.

|

(in thousands, except |

|

3 mos. ended |

|

3 mos. ended |

| ||

|

per share data) |

|

Mar. 31, 2011 |

|

Mar. 31, 2010 |

| ||

|

Modified FFO |

|

$ |

(3,502 |

) |

$ |

3,352 |

|

|

Modified FFO, per share |

|

$ |

(0.06 |

) |

$ |

0.06 |

|

|

Distributions declared |

|

$ |

— |

|

$ |

1,405 |

|

|

Distributions per share |

|

$ |

— |

|

$ |

0.025 |

|

|

|

|

|

|

|

| ||

|

(in thousands) |

|

As of Mar. 31, 2011 |

|

As of Dec. 31, 2010 |

| ||

|

Total assets |

|

$ |

682,123 |

|

$ |

697,624 |

|

|

Total liabilities |

|

$ |

367,650 |

|

$ |

381,354 |

|

Investor Information

A copy of the REIT’s Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission, is available without charge at www.sec.gov or by written request to the REIT at its corporate headquarters. You may also elect to sign up for electronic delivery by visiting behringerharvard.com and selecting the option to “Go Paperless” at the top of the home page. For additional information about Behringer Harvard and its real estate programs, please contact us at 866.655.3650.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

behringerharvard.com |

|

|

In support of our continuing efforts to cut costs and save stockholder capital, Behringer Harvard will discontinue mailing quarterly summary reports beginning in 2011. Quarterly summary reports for each program will be made available online at behringerharvard.com. Additionally, quarterly conference calls will be open to stockholders with notices sent to you in your quarterly statements.

Reconciliation of MFFO to Net Loss

|

|

|

3 mos. ended |

|

3 mos. ended |

| ||

|

(in thousands) |

|

Mar. 31 2011 |

|

Mar. 31 2010 |

| ||

|

Net loss |

|

$ |

(11,338 |

) |

$ |

(13,158 |

) |

|

Net loss from noncontrolling interest |

|

198 |

|

364 |

| ||

|

Real estate depreciation and amortization(1) |

|

7,200 |

|

6,778 |

| ||

|

Gain on sale of real estate |

|

(1,288 |

) |

— |

| ||

|

FFO(2) |

|

(5,228 |

) |

(6,016 |

) | ||

|

|

|

|

|

|

| ||

|

Acquisition expenses(3) |

|

101 |

|

— |

| ||

|

Loss from Impairment charges and provisions for loan loss |

|

3,629 |

|

11,366 |

| ||

|

(Gain) loss on derivatives not designated as hedging instruments |

|

— |

|

(3 |

) | ||

|

Straight-line rents(3) |

|

(1,291 |

) |

(1,266 |

) | ||

|

Amortization of net above/ below market intangible lease assets(3) |

|

(713 |

) |

(729 |

) | ||

|

MFFO |

|

$ |

(3,502 |

) |

$ |

3,352 |

|

(1) Real estate depreciation and amortization includes our consolidated real depreciation and amortization expense, as well as our pro rata share of those unconsolidated investments that we acccount for under the equity method of accounting and the noncontrolling interest adjustment for the third-party partners’ share of the real estate depreciation and amortization.

(2) Funds from operations (FFO) is defined by the National Association of Real Estate Investment Trusts as net income (loss), computed in accordance with GAAP, excluding extraordinary items, as defined by GAAP, and gains (or losses) from sales of property, plus depreciation and amortization on real estate assets, and after adjustments for unconsolidated partnerships, joint ventures, and subsidiaries.

(3) Acquisition expenses, straight-line rents and amortization of net above/below market intangible lease assets include our share of expenses incurred by us and our pro rata share of those unconsolidated investments that we account for under the equity method of accounting and the noncontrolling interest adjustment for the third-party partners’ share of expenses.

FFO and MFFO should not be considered as an alternative to net income (loss) or as indications of our liquidity, nor are they indicative of funds available to fund our cash needs, including our ability to fund distributions. Both should be reviewed in connection with other GAAP measurements. A reconciliation of MFFO and MFFO-per-share to net loss can be found in our first quarter 2011 Form 10-Q on file with the SEC.

![]()

15601 Dallas Parkway, Suite 600

Addison, TX 75001

Date Published 6/11

591-1 OP1 Q1 Report 2011

© 2011 Behringer Harvard

First Quarter Report

Behringer Harvard Opportunity REIT I, Inc.