Attached files

| file | filename |

|---|---|

| 8-K - VERECLOUD, INC. 8-K - Network Cadence, Inc. | verecloud8k.htm |

| EX-9.1 - EXHIBIT 9.1 - Network Cadence, Inc. | exh9_1.htm |

Exhibit 9.2

The Opportunity John McCawley Chief Executive Officer June 21, 2011

Verecloud, Inc. (VCLD)

Statements made during today's presentation may include certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, which include without limitation, statements regarding industry trends, customer demand and bookings, sales and installations timing, strategy, network and product plans, market opportunity, demand drivers, future capabilities, churn trends, cash flow trends, disconnections, expense trends, taxes, growth prospects and drivers, anticipated margins and revenue growth, future investments, future cash flow and capital expenditures are based on Company management’s current expectations, and are subject to risks and uncertainties. These risks include those summarized in the Company's filings with the SEC, particularly in the section entitled "Risk Factors" in its Annual Report on Form 10-K for the year ended June 30, 2010, its Quarterly Reports on Form 10-Q for the quarters ended September 30, 2010, December 31, 2010 and March 31, 2011. Verecloud, Inc. is under no obligation, and expressly disclaims any obligation, to update or alter its forward-looking statements whether as a result of new information, future events or otherwise. Safe harbor statement

Agenda Introduction Verecloud at a Glance Cloud Services Market Verecloud’s Solution Channel Strategy The Opportunity

Verecloud at a glance History Began in 2006; Five years as a successful systems integrator in the telecom industry; Publicly traded on the OTC under the symbol VCLD Mission Verecloud’s mission is to simplify the cloud for SMBs. We are a value added reseller of high demand cloud services targeted at the SMB market. We integrate and aggregate cloud services in a single portal making it easier for SMBs to shop for, select, purchase, manage and monitor cloud services and spending Pedigree Level 3, Sprint, AT&T, T-Mobile, Qwest, Hewlett Packard, EchoStar, LightSquared, Verizon, TW Telecom Target SMBs with 20 to 500 employees Technology Verecloud’s history as a successful integrator of carrier-grade IT systems means it is uniquely qualified to design and implement its cloud services brokerage platform Channels Direct to to SMBs, Spiceworks, MSPs, CSPs, VARs Competitive Advantage Unique carrier-grade cloud services brokerage aggregated and integrated on a single platform; Allows for rapid onboarding and provisioning of cloud services

a fragmented cloud market today The problem is the opportunity.

Value can be added by intermediating between the end users and all the different XaaS providers. Vendor, IaaS SaaS PaaS Bpaas Business CSP Voice & Data market & opportunity

Cloud services a $94 billion opportunity $52 $59 $66 $75 $85 $94 2009 2010 2011 2012 2013 2014 World-wide Cloud Services Spend in Billions of Dollars Source: Cloud services momentum is on track among SMBs, AMI Partners, August 12, 2010 market & opportunity

Smbs are poised to embrace the cloud 70% 60% 50% 40% 30% 20% 10% 0% 80% of IT pros are not currently using hosted services Computer Hosting Email Email Spam Collaboration Web Hosting Backup Productivity Web Conferencing Web-based apps Currently on-site, but considering a hosted provider Currently on-site, with no plans to move Currently using a hosted provider Do not use this product Spiceworks survey, May 2011 MARKET & OPPORTUNITY

The proven Brokerage model Google brokers advertising $30 billion (2010) App store brokers applications $33.7 billion in gross profits since launched $94 billion market by 2014 Verecloud enables cloud services brokerage “Cloud Services Brokerage is the single largest revenue opportunity in the Cloud, bar none.”

-Gartner, October 2010 market & opportunity

Verecloud drives convergence and integration Verecloud enables true convergence of communication portfolios – vendor services are integrated. Business verecloud Cloud Services Brokerage Aggregate Simplify Secure Integrate PaaS SaaS IaaS Bpaas Voice Data Managed Services Mobile Vendor Verecloud’s Solution

Verecloud’s Ecosystem Catalog Aggregated and vetted cloud service partners SaaS

IaaS BpaaS Channels Spiceworks 1,500,000 IT pros 850,000 SMBs MSPs CSPs Platform Integrated application platform (IPaaS) Single monitoring and management portal One invoice Verecloud’s Solution

Addressing the objections to adoption of cloud services Simplification—A single portal to do it all Synchronization—A unified experience that integrates multiple cloud services

Security—Centralized control and monitoring of users Safety—Prevents vendor lockout and enables service portability Support—Single point of contact for customer issues

Savings—Learn, shop, compare and buy service bundles Verecloud’s Solution

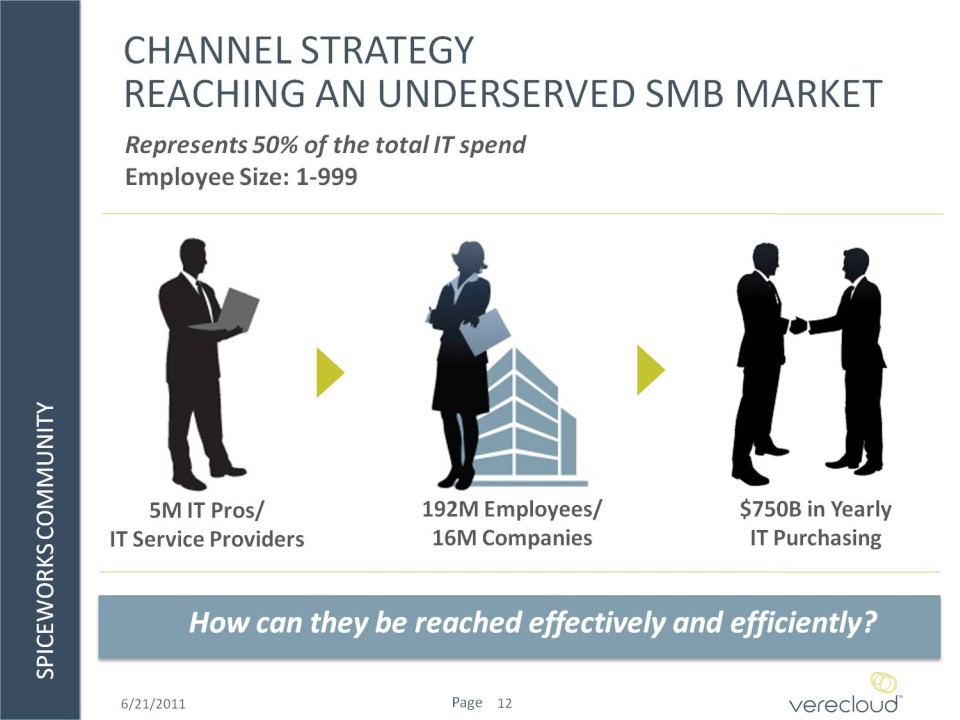

Channel strategy Reaching an underserved smb market Represents 50% of the total IT spend

Employee Size: 1-999

5M IT Pros/IT Service Providers 192M Employees/16M Companies 750B in Yearly

IT Purchasing How can they be reached effectively and efficiently? Spiceworks community

Spiceworks is an ideal channel World’s largest and fastest growing social network of IT professionals Over 1.5 Million IT Pros representing more than 850,000 businesses 1 in 3 SMB IT pros work in Spiceworks! Using the Application Targeted IT Marketing

Vendor Pages Community Engagement Spiceworks community

Strong financial opportunity Our plan reflects a modest ramp in SMB customers and does not yet include channels beyond Spiceworks Customers (000’s) 60 40 20 0 2 12 25 47 2012 2013 2014 2015 At average revenue of less than $1,000/SMB, Verecloud can still generate strong revenue With a low cost and outsourced expense structure, we can drive significant OCF Revenue ($ in millions) $400 $300 $200 $100 $0 $4 $68 $189 $373 2012 2013 2014 2015 OCF ($ in millions) 350 300 250 200 150 100 50 0 -50 -$4 $48 $151 $314 2012 2013 2014 2015 The opportunity

Our strong business model Right Time, Right Market

The market is fragmented and SMBs are looking for a solution

We remove the confusion and simplify the experience for SMBs

Proven Technology Solution

Solid history as system integration

Unique combination of Catalog, Channel and Platform

Strong Go-to-Market Strategy

Reaching an underserved market

Broad reach of Spiceworks

Developing strong suite of service offerings for SMBs

Outstanding Economic Potential

Low operating cost model