Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CARPENTER TECHNOLOGY CORP | d8k.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - CARPENTER TECHNOLOGY CORP | dex21.htm |

| EX-99.1 - PRESS RELEASE - CARPENTER TECHNOLOGY CORP | dex991.htm |

©

2011 CRS Holdings, Inc. All rights reserved

Carpenter Technology’s Acquisition of

Latrobe Specialty Metals, Inc.

June 20, 2011

Exhibit 99.2 |

| ©

2011 CRS Holdings, Inc. All rights reserved

Forward-Looking Statements

This document contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995 and Section 27A of the Securities

Act. These statements, which represent the Company’s expectations or beliefs concerning

various future events, include statements concerning future revenues, EBITDA, synergies,

strategy, earnings and liquidity associated with continued growth in various market

segments, cost reductions expected from various initiatives, our contemplated

acquisition and other events. These forward-looking statements are subject to risks and uncertainties that could

cause actual results to differ from those projected, anticipated or implied. The most

significant of these uncertainties include but are not limited to: the cyclical nature

of the Company’s business and certain end-use markets, including aerospace,

industrial, automotive, consumer, medical, and energy, or other influences on the

Company’s business such as new competitors, the consolidation of competitors,

customers, and suppliers or the transfer of manufacturing capacity from the United

States to foreign countries; the Company’s ability to achieve cost savings, productivity improvements or process

changes; the volatility of, and the Company’s ability to recoup increases in, the cost of

energy, raw materials, freight or other factors; domestic and foreign excess

manufacturing capacity for certain metals; fluctuations in currency exchange rates; the

degree of success of government trade actions; the valuation of the assets and liabilities in

the Company’s pension trusts and the accounting for pension plans; possible labor

disputes or work stoppages; the potential that the Company’s customers may

substitute alternate materials or adopt different manufacturing practices that replace or

limit the suitability of the Company’s products; the ability to successfully

acquire and integrate Latrobe Specialty Metals, Inc. and other acquisitions; the availability

and costs of financing and credit facilities to the Company, its customers or other members of

the supply chain; the ability to obtain energy or raw materials, especially from

suppliers located in countries that may be subject to unstable political or economic

conditions; the Company’s manufacturing processes are dependent upon highly specialized equipment located

primarily in one facility in Reading, Pennsylvania and for which there may be limited

alternatives if there are significant equipment failures or catastrophic events; and

the Company’s future success depends on the continued service and availability of

key personnel, including members of the Company’s executive management team, management, metallurgists and other

skilled personnel. Any of these could have adverse and/or fluctuating effects on the

Company’s results of operations. For additional information about factors

that could cause actual results to differ materially from those described in the forward-

looking statements, please see the document that the Company has filed with the SEC, including

its quarterly reports on Form 10-Q, its most recent annual report on Form 10-K,

its current reports on Form 8-K and its proxy statement. All subsequent

forward-looking statements attributable to the Company or any person acting on its behalf

are expressly qualified in their entirety by the cautionary statements contained or

referred to in this section. The Company is not under any obligation to, and

expressly disclaims any obligation to, update or alter any forward-looking statements

whether as a result of such changes, new information, subsequent events or

otherwise. |

©

2011 CRS Holdings, Inc. All rights reserved

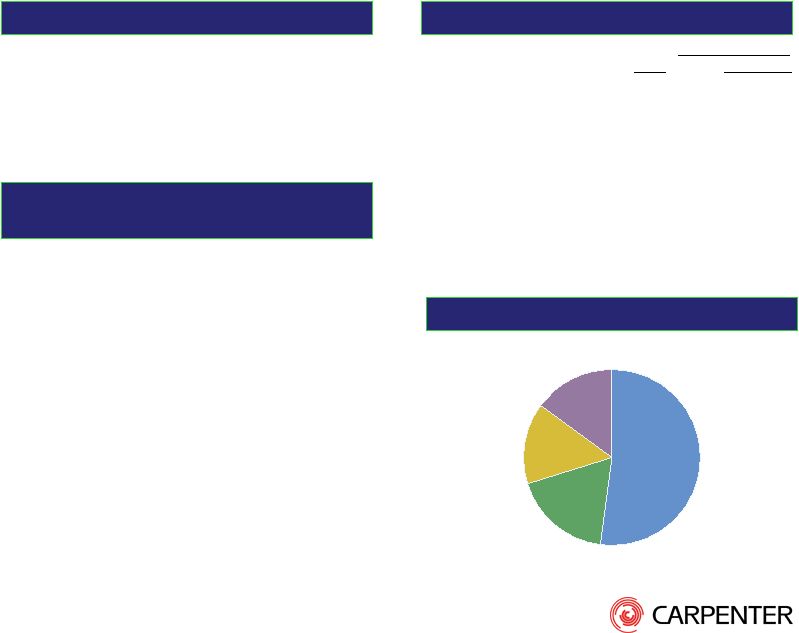

Shareholder Agreements

5-year standstill; voting agreement until 2014 annual

stockholder meeting

Purchase

Price

~$558

M

Enterprise

Value

1

3

Carpenter to Acquire Latrobe Specialty Metals

Consideration

8.1 M shares of CRS stock

$170 M in cash to repay debt/deal costs

Expected Closing

By Sept 30, 2011

EPS Impact

Expected to be highly accretive ($25M net synergies by year 3)

Expected to be accretive in the 1

st

year including one-time

expenses

Valuation

9.6x TTM EBITDA

2

ex. synergies

6.8x FY 2012E

3

EBITDA ex. synergies

Selling shareholder

15.5%

ownership in Carpenter

Key Latrobe Directors to

join Carpenter’s Board

1

Based on pre-announced CRS share price of $47.88

2

TTM for period ending March 31, 2011

3

Carpenter management estimates based on 6/30 FYE

Transaction Highlights

Thomas O. Hicks, Chairman of Hicks Holdings

Steven E. Karol, Managing Partner of Watermill Group |

| ©

2011 CRS Holdings, Inc. All rights reserved

4

Major Strategic Growth Initiative for Carpenter

•

Immediately increases premium melt capacity to meet current

strong customer demand

•

Expands offerings in fast-growth aerospace and energy markets

•

Complementary asset capabilities will lead to enriched, higher-

margin product mix and operating cost synergies

•

Provides volume and efficiencies to justify investment in next

major increment of premium product capability

•

Provides capabilities for commercialization of new Carpenter

products

under

development

(landing

gear,

PremoMet

TM

) |

| ©

2011 CRS Holdings, Inc. All rights reserved

5

Compelling Financial Benefits

•

Highly synergistic

–

Run-rate synergies of > $25M from filling excess premium product

capacity, optimal use/mix of production assets, and cost savings

•

Immediately accretive

•

Increased revenue and EBITDA growth rate

•

Fast payout on cash used for debt pay-off/deal costs

•

100% of equity consideration to be paid in Carpenter stock

–

Selling shareholders see significant value in combination and

Carpenter’s growth plan

–

Stronger pro forma capital structure

–

Preserves liquidity for organic capex and other growth investments

•

Interest savings from absorbing debt into Carpenter capital

structure |

©

2011 CRS Holdings, Inc. All rights reserved

6

Latrobe Overview

Aerospace

52%

Industrial

15%

Defense

15%

Energy

and Other

15%

1

Per Latrobe S-1 filing, including reconciliation of Non-GAAP

measures 2

Based on 2010 manufacturing segment sales

•

Steel Manufacturing

–

Premium

melting

–

VIM,

VAR,

ESR

–

Hot

working

and

Forging

–

Continuous

rolling milling, GFM

–

Coil and bar finishing

•

Products

–

High strength alloys, corrosion resistant

alloys, bearing steels, high-speed steels,

high temperature alloys

•

Distribution

–

Value-added services

–

Extensive distribution network

•

Growth Initiatives

–

New markets

–

Geographic expansion

–

Grade development

Key Business Segments and

Capabilities

Financial

Overview

(FYE

9/30)

End

Market

Sales

Company Overview

•

Continuous operation since 1913 and has

manufactured specialty metals for the aerospace

and defense industries for over 50 years

•

Owned by The Timken Company from 1975 to

2006

•

Acquired by Hicks Equity Partners and The

Watermill Group in 2006

•

Over 800 employees

2010

12 Months

Ended

3/31/2011

Revenues

$309

$379

% growth

6.9%

22.7%

EBITDA

35

58

% margin

11.2%

15.3%

Operating profit

29

52

% margin

9.2%

13.7%

Net income

$7

$14

2

1 |

©

2011 CRS Holdings, Inc. All rights reserved

•

7

Latrobe Capacity and Facilities

•

Main Facility (Latrobe, PA)

–

180 acres, with open space

–

Key Equipment List:

•

35 Ton Arc AOD

(2) 30 T VIM’s

17 VAR’s., 1 ESR

3250 ton Press (dual manipulators)

SX40 GFM

•

Rolling Mill (w/ 3 Koch’s Blocks)

•

Grinding, Heat Treating, Met Lab, Coil

Finishing

•

Recent $60M investment in

premium product equipment

100% increase in VIM furnace capacity

30% increase in VAR furnaces (more planned)

Provides capability to produce nickel-based alloy

grades

•

Additional Sites:

–

Franklin, PA

•

Finishing and warehousing

•

Coil-to-bar and bar processing

–

Wauseon, OH

•

Finishing and warehousing

•

Hot and cold drawing

–

Sheffield, England

•

Warehousing

•

Saw cutting

•

•

• |

©

2011 CRS Holdings, Inc. All rights reserved

•

Pennsylvania

•

South Carolina

•

Sweden

•

Ohio

•

Florida

•

Texas

8

Highly Complementary Operations

•

High temperature alloys

•

Specialty alloys

•

Corrosion resistant alloys

•

Titanium and titanium alloys

•

Stainless steel

•

Powder tool steel

•

Structural alloys

•

Bearing steels

•

High temperature alloys

•

Corrosion resistant alloys

•

High speed and die steels

•

Aerospace

•

Industrial

•

Energy

•

Medical

•

Aerospace & Defense

•

Industrial

•

Energy

•

Pennsylvania

•

Ohio

•

England

•

LTM

1

Statistics:

•

Revenue: $1,556mm

•

EBITDA

2

: $196mm

•

LTM

1

Statistics:

•

Revenue: $379mm

•

EBITDA

3

: $58mm

1

LTM for Carpenter and Latrobe is as of 3/31/2011

2

Carpenter EBITDA adjusted to exclude non-cash net pension and post-retirement

expense 3

For reconciliation of Non-GAAP measures, see Latrobe S-1 filing

Operations

Size

Product mix

Key end

industries |

©

2011 CRS Holdings, Inc. All rights reserved

9

FASTENERS (Airframe/Pylon)

ENGINE COMPONENTS

Complementary Product Portfolio for Aerospace

Applications

STRUCTURAL/ OTHER COMPONENTS

Carpenter

•

Seamless rings

•

Rotating disks

•

Shafts

•

Fasteners

Latrobe

•

Bearings

•

Fasteners

Carpenter

•

Slat tracks

•

Avionics

•

Landing gear (military)

Latrobe

•

Flap tracks

•

Actuators

•

Wing bolts

•

Commercial Landing gear

Carpenter

•

Titanium

•

Ni based superalloy

•

Stainless |

©

2011 CRS Holdings, Inc. All rights reserved

10

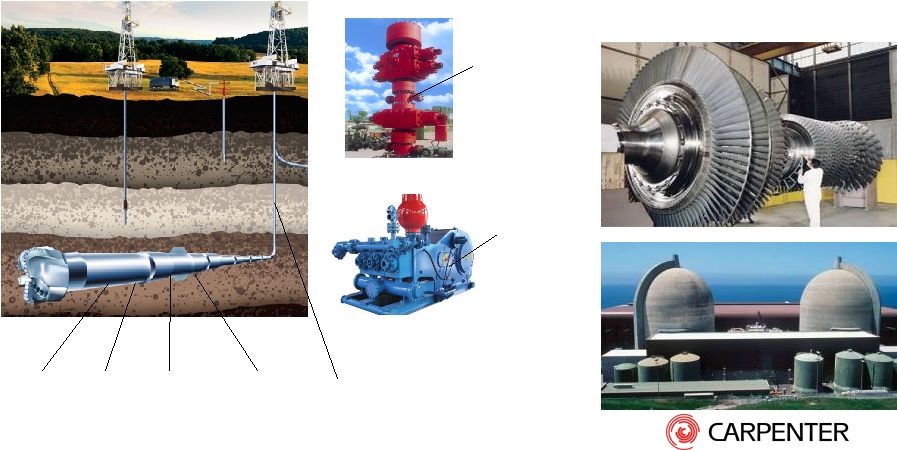

OIL AND GAS

Carpenter

•

Non-mag drill collars

•

Drill pipe

•

Stabilizers

•

Drilling motors

•

MWD/LWD tools

Drilling

Motor

MWD/ LWD

Tools

Non-Mag

Drill Collars

Stabilizers

Ordinary

drill pipe

Latrobe

•

MWD/LWD tools

•

Valves and stems

•

Mud pump components

•

Downhole tubing

POWER GENERATION

Carpenter

•

Gas turbine

–

disks

–

rings

–

blades

–

bolting

•

Nuclear reactor pressure

vessel components

•

Nuclear spent fuel storage

Latrobe

•

Gas/steam turbine

–

rings

–

blades

–

bolting

–

pins

Valves and

stems

Mud Pump for Drilling

Mud pump

shafting

Complementary Product Portfolio for Energy

Applications |

| ©

2011 CRS Holdings, Inc. All rights reserved

11

The Right Move for Carpenter

•

Enables growth of premium product capacity to meet

strong customer demand for Aerospace and Energy

applications with lower capex investment

•

Complementary capabilities enable improved product mix

and commercialization of new product opportunities

•

Significant operational synergies

•

Strongly accretive to earnings

•

Preserves Carpenter’s strong capital structure |