Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - DUCOMMUN INC /DE/ | dex991.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934, as amended

Date of Report (Date of earliest event reported) June 20, 2011

DUCOMMUN INCORPORATED

(Exact name of registrant as specified in its charter)

| Delaware | 001-08174 | 95-0693330 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 23301 Wilmington Avenue, Carson, California | 90745-6209 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (310) 513-7200

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01. | Regulation FD Disclosure. |

The information contained in Item 7.01 of this Current Report is being furnished pursuant to Item 7.01 of Form 8-K, and the information contained herein shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities under such section.

As previously announced, Ducommun Incorporated, a Delaware corporation (“Ducommun”), and DLBMS, Inc., a Delaware corporation and a wholly-owned subsidiary of Ducommun (“Merger Sub”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with LaBarge, Inc., a Delaware corporation (“LaBarge”). Pursuant to the terms of the Merger Agreement, at the effective time of the Merger (the “Effective Time”) Merger Sub will be merged with and into LaBarge with LaBarge continuing as the surviving corporation and a wholly-owned subsidiary of Ducommun (the “Merger”).

Concurrently and subject to the consummation of the Merger, Ducommun expects to offer $200.0 million aggregate principal amount of its senior unsecured notes due 2018 (the “notes”) and enter into a new $190.0 million term loan facility, maturing in June 2017 (the “New Term Loan Facility”) and a $60.0 million new revolving credit facility, maturing in June 2016 (the “New Revolving Credit Facility,” and together with the New Term Loan Facility, the “New Credit Facilities”). The proceeds of the notes offering, together with borrowings under the New Credit Facilities will be used to finance the Merger, repay certain existing indebtedness of Ducommun and LaBarge, pay fees and expenses in connection with the Transactions (as defined below) and add new cash to Ducommun’s balance sheet.

In connection with the anticipated consummation of the Transactions, including, without limitation, the Merger, Ducommun is providing the following additional information concerning the anticipated effects of the Merger, and the transactions contemplated in connection therewith.

For purposes of this Current Report, unless otherwise indicated or the context requires otherwise:

| • | “Ducommun,” “we,” “us” or “our” refers to Ducommun Incorporated and its consolidated subsidiaries, including, where applicable, LaBarge on a pro forma basis; |

| • | “LaBarge” refers to LaBarge, Inc. and its consolidated subsidiaries; |

| • | “on a pro forma basis,” means on a pro forma basis, giving effect to the Transactions, and the other adjustments referred to in the introduction to “Unaudited Pro Forma Condensed Combined Financial Data”; |

| • | “on a stand-alone basis” means without giving effect to the Transactions; and |

| • | “Transactions” means collectively, the Merger, the notes offering and entry into the New Credit Facilities (each as defined above). |

2

Special Note Regarding Forward-Looking Statements

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be preceded by, followed by or include the words “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates” or similar expressions. These statements are based on the beliefs and assumptions of our management. Generally, forward-looking statements include information concerning our possible or assumed future actions, events or results of operations. Forward-looking statements specifically include, without limitation, the information herein regarding: projections; efficiencies/cost avoidance; cost savings; income and margins; earnings per share; growth; economies of scale; combined operations; the economy; future economic performance; conditions to, and the timetable for, completing the transactions; capital expenditures; future financing needs; future acquisitions and dispositions; litigation; potential and contingent liabilities; management’s plans; and merger and integration-related expenses.

Although we believe that the expectations reflected in the forward-looking statements are based on reasonable assumptions, these forward-looking statements are subject to numerous factors, risks and uncertainties that could cause actual outcomes and results to be materially different from those projected. We cannot guarantee future results, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. All written and oral forward-looking statements made in connection with this report that are attributable to us or persons acting on our behalf are expressly qualified in their entirety by “Risk Factors” and other cautionary statements included herein. We are under no duty to update any of the forward-looking statements after the date hereof to conform such statements to actual results or to changes in our expectations.

The information contained herein is not a complete description of our business or the risks associated with an investment in our notes. There can be no assurance that other factors will not affect the accuracy of these forward-looking statements or that our actual results will not differ materially from the results anticipated in such forward-looking statements. While it is impossible to identify all such factors, factors that could cause actual results to differ materially from those estimated by us include, but are not limited to, those factors or conditions described under “Risk Factors” and the following:

| • | the cyclicality of the aerospace market and the level of new commercial aircraft orders; |

| • | customer concentration; |

| • | production rates for various commercial and military aircraft programs; |

| • | the level of U.S. defense spending; |

| • | competitive pricing pressures; |

| • | manufacturing inefficiencies; |

| • | start-up costs and possible overruns on new contracts; |

| • | technology and product development risks and uncertainties; |

| • | product performance; |

| • | increasing consolidation of customers and suppliers in the aerospace industry; |

| • | price erosion within the electronics manufacturing services marketplace; |

| • | the risk of environmental liabilities; |

| • | possible goodwill impairment; |

| • | compliance with applicable regulatory requirements and changes in regulatory requirements, including regulatory requirements applicable to government contracts and sub-contracts; |

| • | imposition of taxes, export controls, tariffs, embargoes and other trade restrictions; |

| • | economic and geopolitical developments and conditions; |

| • | our ability to service our substantial indebtedness; |

| • | our ability to manage and otherwise comply with our covenants with respect to our significant outstanding indebtedness; |

| • | unfavorable developments in the global credit markets, which may make it more difficult to incur new indebtedness or refinance our outstanding indebtedness; |

| • | the risk that LaBarge’s business, operations and employees will not be integrated successfully with our business and operations; |

3

| • | our inability to recognize the benefits of the Merger, including any potential synergies, growth, cost savings or accretive value; |

| • | our ability to retain key employees following the Merger; |

| • | our inability to maintain current customer and supplier relationships following the Merger; |

| • | the risk that the Merger disrupts current plans and operations; |

| • | litigation in respect of either LaBarge, the Merger or us; |

| • | the amount of the costs, fees, expenses and charges related to the Merger and the financings for the Merger, including the notes offering; |

| • | the method of accounting for the Merger; and |

| • | risks associated with other acquisitions and dispositions of businesses by us. |

We caution the reader that undue reliance should not be placed on any forward-looking statements, which speak only as of the date hereof. We do not undertake any duty or responsibility to update any of these forward-looking statements to reflect events or circumstances after the date hereof or to reflect actual outcomes.

Business

Overview

Ducommun provides engineering and manufacturing services primarily to the aerospace and defense industry. We design, engineer and manufacture mission-critical aerostructure and electromechanical components and subassemblies. We also provide engineering, technical and program management services. Our products and services are used on domestic and foreign commercial and military aircraft, helicopter, missile and space programs. We are the successor to a business that was founded in California in 1849 and reincorporated in Delaware in 1970.

On April 3, 2011, we entered into a Merger Agreement to acquire LaBarge for approximately $338.1 million comprised of approximately $310.3 million in equity and $27.8 million of outstanding LaBarge debt, which will be repaid at closing of the Merger. LaBarge provides custom high-performance electronic, electromechanical and interconnect systems on a contractual basis for customers in the aerospace and defense and several other markets. We believe our acquisition of LaBarge (the “LaBarge Acquisition”) will allow us to significantly expand our existing presence in the aerospace and defense industry as well as to diversify our net sales base across new markets, including industrial, natural resources and medical.

Pursuant to the Merger Agreement, subject to the satisfaction of certain conditions, Merger Sub will be merged with and into LaBarge, with LaBarge (which will be renamed Ducommun LaBarge Technologies, Inc.) continuing as the surviving corporation and a wholly-owned subsidiary of Ducommun. In the Merger, each outstanding share of LaBarge common stock will be cancelled and converted (subject to the exercise of appraisal rights) into the right to receive $19.25 per share in cash. The proceeds from the notes offered, together with borrowings under the New Credit Facilities will be used to finance the cost of the LaBarge Acquisition, refinance certain existing indebtedness of Ducommun and LaBarge, pay fees and expenses in connection with the Transactions and add new cash to our balance sheet.

LaBarge

Incorporated in 1968, LaBarge provides EMS services, which involves the manufacture of custom, complex, high-reliability and mission-critical products for customers in diverse technology-driven markets, such as the aerospace and defense, industrial, natural resources, medical and other commercial markets. LaBarge markets its services to customers desiring a manufacturing and engineering partner capable of developing and providing products that can perform reliably in harsh environmental conditions, such as extreme temperatures, severe shock and vibration and with rapid turnaround time. The sophistication and complexity of the products LaBarge designs and manufactures require superior quality. LaBarge is capable of quickly producing multiple sophisticated electronics products utilizing the same manufacturing set up resulting in increased efficiency and higher margins as compared to less-sophisticated high-volume product lines. This low-volume and high-mix production expertise, together with its lean manufacturing culture and service driven business model, enables LaBarge to consistently achieve attractive profit margins relative to other industry participants that may focus on high-volume and low-mix products.

For the twelve months ended April 3, 2011, on a stand-alone basis, LaBarge generated net sales of $332.5 million and Adjusted EBITDA of $41.0 million. See “Summary Consolidated Historical Financial Data of LaBarge” for a reconciliation of net income to Adjusted EBITDA. As of April 3, 2011, on a stand-alone basis LaBarge had firm backlog of $241.6 million.

4

LaBarge Acquisition Rationale

We believe the LaBarge Acquisition will allow us to expand our presence significantly in the aerospace and defense markets as well as diversify our net sales base across new markets, including industrial, natural resources, medical and other commercial end markets. More specifically, we expect to realize the following benefits from the LaBarge Acquisition:

Strengthen our market position as a significant Tier 2 supplier for both structural and electronic assemblies. We believe that we are an important global provider of innovative, value-added products and solutions to the aerospace and defense industries. We believe that the LaBarge Acquisition will add substantial additional technical capabilities, which will increase our ability to serve our customers with a broader base of products and services and strengthen our market position as a Tier 2 supplier for both structural and electronic assemblies. Tier 2 suppliers manufacture subassemblies and are regarded as preferred secondary suppliers to principal OEMs and primary Tier 1 suppliers (those who manufacture aircraft sections and purchase assemblies).

Diversify our end markets. The LaBarge Acquisition will diversify our net sales across new and higher growth markets in addition to the aerospace and defense sectors we already serve. Our more diversified net sales base will reduce dependence on any particular product, platform or market channel, mitigating the impact of any specific industry risk. For the twelve months ended April 3, 2011, approximately 63% of LaBarge’s net sales were related principally to the industrial, natural resources, medical and other commercial end markets. We believe that the addition of these new end markets will increase the number of growth opportunities available to us.

Expand our platform. The LaBarge Acquisition will add new customers and programs and expand our existing platforms. For example, LaBarge is a significant provider of products and services to the UH-60 Black Hawk and F-35 Joint Strike Fighter platforms. Through the LaBarge Acquisition, we believe our presence in these attractive programs will significantly increase. In addition, we believe that the LaBarge Acquisition will enable cross-selling opportunities to current and new customers in aerospace and defense and other markets.

Increase value-added manufacturing services content in our product portfolio. We believe that the LaBarge Acquisition will enable us to be a more significant provider of low-volume, high-mix, complex, high reliability and mission-critical services and products to the aerospace and defense industries and other key industries by expanding our value-added service offerings including engineering, design and program management. For example, the LaBarge Acquisition will enhance our ability to offer complete system integration services to a broader customer base such as mobile radar solutions for Raytheon and Northrop Grumman.

Expand our technology product portfolio. We believe that LaBarge’s products will complement our existing integrated electronics assembly product offerings. For example, one of our primary focus areas following the LaBarge Acquisition will be building on the expertise of both Ducommun and LaBarge in providing electromechanical equipment to support sophisticated airborne radar systems in order to create a platform for DTI to become one of the largest non-OEM aerospace and defense providers of manufacturing services related to radar rack solutions. We believe the high level of commonality between our and LaBarge’s products supports the complementary nature of our technology product portfolios.

Realize potential synergies. We expect that the LaBarge Acquisition will create cost synergy opportunities for us, including savings on a combined basis related to corporate overhead costs and public company costs as well as supply chain and operational improvements. We believe that access to new customers afforded to us by the LaBarge Acquisition will allow for substantial marketing and cross-selling opportunities to both current and new customers.

Combined Company

The combined company will operate in two business segments:

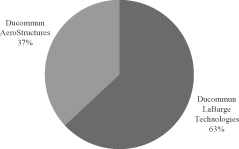

| • | Ducommun LaBarge Technologies (DLT), which will be formed by the combination of our DTI segment and LaBarge. DLT will design, engineer and manufacture a broad range of electronic, electromechanical and interconnect systems and components. DLT products will be used in technology-driven markets, including aerospace and defense, industrial, natural resources, medical and other commercial markets. In addition, DLT will provide technical and program management services (including design, development, integration and testing of prototype products) principally for advanced weapons and missile defense systems. We believe the EMS activities currently conducted through our DTI segment will be significantly complemented in scale, customer, program, product, market and brand presence through the addition of LaBarge’s EMS activities. On a pro forma basis, DLT net sales were $463.1 million for the twelve months ended April 2, 2011. |

| • | DAS, our other segment, will remain intact and will continue to design, engineer and manufacture large and complex contoured aerostructure components and assemblies and serve as an OEM supplier of composite and metal bonded structures, specializing in rotor blades and other flight control assemblies. on a historical and pro forma basis DAS net sales were $273.1 million for the twelve months ended April 2, 2011. |

5

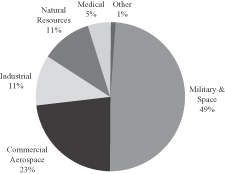

On a pro forma basis, our net sales and Adjusted EBITDA were $736.2 million and $90.5 million, respectively, for the twelve months ended April 2, 2011. See “Summary Consolidated Historical and Pro Forma Financial Data” for a reconciliation of pro forma net income to pro forma Adjusted EBITDA. As of April 2, 2011, our backlog was $600.2 million on a pro forma basis. The following charts set forth our pro forma net sales for the twelve months ended April 2, 2011 by end market and business segment:

| Pro Forma Net Sales By End Market | Pro Forma Net Sales by Business Segment | |

|

| |

Note: Reflects net sales on a pro forma basis for the twelve months ended April 2, 2011.

Competitive Strengths

We believe our key competitive strengths include:

Strong market position. We are an important manufacturing services provider to the aerospace and defense industries. We engineer and manufacture mission critical and highly customized components for the global aerospace and defense industries. We are a non-OEM supplier of composite and metal bonded structures, specializing in rotor blades and other flight control assemblies, fuselage skins, radar systems, electrical harnesses and various other applications. Following the consummation of the LaBarge Acquisition, we believe we will be better positioned in the markets we serve and a more recognizable provider of high-margin, low-volume and high-mix customized manufacturing services to the global aerospace and defense and other technology-driven industries.

Significant obstacles for competitors. We design and manufacture advanced technology products that specifically address the evolving needs of our customers, and we have developed a strong track record of delivering reliable, high-performance product and service solutions. We believe we are the sole source provider for most of the products we sell. The niche nature of our markets, the industry’s stringent regulatory and customer certification requirements, the investments necessary to develop and certify products create significant obstacles for potential competitors.

Diversified end-markets and platforms with strong industry fundamentals. Our diversified net sales base provides stability by reducing our dependence on any particular product, platform or market channel. Within the aerospace and defense sectors, we believe we are entrenched on a number of high growth platforms, including the B787, B737NG, B777, V-22, A350XWB, A380, and the UH-60. We believe we are well positioned to benefit from expected continued growth in our end markets, including strong demand anticipated in the commercial aerospace markets. Through the LaBarge Acquisition we will also benefit from a broadening of our product and end market scope, which will further emphasize our positioning as a diversified provider of systems and services solutions across a multitude of products and platforms.

Long-term relationships with “blue-chip” customers. We serve a broad set of global customers and supply top OEMs such as Boeing, Raytheon and United Technologies, as well as the United States government. We have had a long history with many of our customers, including relationships of thirty years or more with four of our top six customers (based on net sales on a pro forma basis for the twelve months ended April 2, 2011).

Consistent cash flow generation with a sizeable backlog. We have generated consistent operating cash flows through various industry cycles as a result of historically relatively stable net sales and profit margins and relatively modest capital expenditure requirements. For the three most recent fiscal years, each of Ducommun’s and LaBarge’s Adjusted EBITDA margins have ranged from 11% to 13% of net sales on a stand-alone basis while capital expenditures have ranged from 1% to 3% of net sales on a stand-alone basis for Ducommun and 1% to 4% of net sales on a stand-alone basis for LaBarge for the same period. As of April 2, 2011, our backlog on a pro forma basis was approximately $600 million.

6

Management team of industry veterans with a successful track record. Our operations are managed by an experienced management team with a proven track record of growing our business organically, controlling costs, focusing on customers and integrating acquisitions. The management team includes well-seasoned operators who have had significant experience through a variety of industry cycles and have successfully completed and integrated four acquisitions since 2006. Our executive officers have an average of 28 years of industry experience.

Business Strategy

The following are key elements of our business strategy:

Focus on integrating combined company operations and realizing identified cost synergy opportunities. As a results-driven organization, we believe that the realization of the benefits resulting from the LaBarge Acquisition will depend on our ability to successfully and seamlessly integrate LaBarge into our existing operations. Ducommun has devoted considerable time and resources to devising and implementing a framework that we believe will be instrumental in our integration efforts.

Focus on marketing opportunities to the combined company’s customer base. The LaBarge Acquisition will broaden the aerospace and defense platforms we serve as well as expand our existing customer base. We believe the combination will create substantial marketing opportunities as we capitalize on the technical capabilities and customer relationships of both Ducommun and LaBarge to market to the combined company’s customer base.

Internal and external customer focus. We are a customer-oriented organization and our key focus is on maintaining and expanding our base of blue chip customers across our various end markets. We believe that our product and services portfolio adds significant value to our customers’ operations and we will continue to build upon our existing expertise and relationships to further increase the attractiveness of our offerings to existing and new customers.

Leverage “One Ducommun” platform. We believe that sustained profitable growth results from operational excellence and continuing organizational development. Operational excellence is driven by an ongoing focus on improving manufacturing processes, a broadening of capabilities, production efficiencies, capacity control, offshore expansion and supply chain management.

Build brand equity. We believe that both Ducommun’s and LaBarge’s names are well recognized and respected among our respective customers and markets. The preservation and continuous buildup of Ducommun’s and LaBarge’s brand equity remains a priority for us, and we believe that the retention of the two names for our technologies business, Ducommun LaBarge Technologies, Inc., has significant potential to protect and raise brand value and recognition.

Products and Services

Following the Merger, Ducommun will operate in two business segments, each of which will be a reportable operating segment:

| • | Ducommun LaBarge Technologies (DLT), which will design, engineer and manufacture electromechanical components, interconnect systems and subassemblies, and will provide engineering, technical and program management services (including design, development, integration and test of prototype products) primarily for the aerospace and military and defense markets; and |

| • | Ducommun Aerostructures (DAS), which will engineer and manufacture aerospace structural components and subassemblies. |

Ducommun LaBarge Technologies (DLT)

After the consummation of the Merger, DLT will design and manufacture illuminated push button switches and panels, microwave and millimeterwave switches and filters, fractional horsepower motors and resolvers, cable assemblies, wiring harness and interconnect systems, printed circuit board assemblies and mechanical and electromechanical subassemblies, and will provide engineering, technical and program management services. Components and assemblies will be provided principally for domestic and foreign commercial and military aircraft, helicopter and space programs as well as selected non-aerospace applications for the industrial, natural resources and medical industries. Engineering, technical and program management services will be provided principally for advanced weapons and missile defense systems.

Panels, Switches and Related Components. DLT will develop, design and manufacture illuminated switches, switch assemblies, keyboard panels, and edge lit panels, used in many military and commercial aircraft, helicopter, and space programs. DLT will manufacture switches and panels where high reliability is a prerequisite. DLT will also develop, design and manufacture microwave and millimeterwave switches, filters, and other components used principally on commercial and military aircraft and satellites. In addition, DLT will develop, design and manufacture high precision actuators, stepper motors, fractional horsepower motors and resolvers principally for space and oil service applications, and microwave and millimeterwave products for certain non-aerospace applications.

7

Mechanical and Electromechanical Subassemblies. DLT will be a manufacturer of mechanical and electromechanical subassemblies for the defense electronics and commercial aircraft markets and for other commercial uses such as industrial automation, satellites, space launch vehicles, oil wells, mine automation equipment and medical devices. DLT will have a fully integrated manufacturing capability, including manufacturing, engineering, fabrication, machining, assembly, electronic integration and related processes. DLT’s products will include sophisticated radar enclosures, gyroscopes and indicators, aircraft avionics racks and shipboard communications and control enclosures, printed circuit board assemblies and other high level complex assemblies.

Engineering, Technical and Program Management Services. DLT will be a provider of missile and aerospace systems design, development, integration and testing. Engineering, technical and program management services will be provided principally for advanced weapons systems and missile defense primarily for United States defense, space and homeland security programs.

Ducommun AeroStructures (DAS)

DAS will provide aluminum stretch-forming, titanium and aluminum hot-forming, machining, composite lay-up, metal bonding, and chemical milling services principally for domestic and foreign commercial and military aircraft, helicopter and space programs.

Stretch-Forming, Hot-Forming and Machining. DAS will supply the aerospace industry with engineering and manufacturing of complex components using stretch-forming and hot-forming processes and computer-controlled machining. Stretch-forming is a process for manufacturing large, complex structural shapes primarily from aluminum sheet metal extrusions. DAS will have large and sophisticated stretch-forming presses. Hot-forming is a metal working process conducted at high temperature for manufacturing close-tolerance titanium and aluminum components. DAS will design and manufacture the tooling required for the production of parts in these forming processes. Certain components manufactured by DAS will be machined with precision milling equipment, including three 5-axis gantry profile milling machines and seven 5-axis numerically-controlled routers to provide computer-controlled machining and inspection of complex parts up to 100 feet long.

Composites and Metal Bonding. DAS will engineer and manufacture metal, fiberglass and carbon composite aerostructures. DAS will produce helicopter main and tail rotor blades and adhesive bonded assemblies, including spoilers, winglets and fuselage structural panels for aircraft.

Chemical Milling. We believe DAS will be a major supplier of close tolerance chemical milling services for the aerospace industry. Chemical milling removes material in specific patterns to reduce weight in areas where full material thickness is not required. This sophisticated etching process will enable DAS to produce lightweight, high-strength designs that would be impractical to produce by conventional means. DAS will offer production-scale chemical milling on aluminum, titanium, steel, nickel-base and super alloys. Jet engine components, wing leading edges and fuselage skins are examples of products that require chemical milling.

Sales and Marketing

Military components manufactured by Ducommun and its subsidiaries, including LaBarge following the Merger, are employed in many of the country’s front-line fighters, bombers, helicopters and support aircraft, as well as sea-based applications. Engineering, technical and program management services are provided principally for United States defense, space and homeland security programs. Our defense business is diversified among a number of military manufacturers and programs. In the space sector, we continue to support various unmanned launch vehicle and satellite programs. Our commercial sales depend substantially on aircraft manufacturers’ production rates, which in turn depend on deliveries of new aircraft. Deliveries of new aircraft by aircraft manufacturers are dependent on the financial capacity of the airlines and leasing companies to purchase the aircraft. Sales of commercial aircraft could be affected as a result of changes in new aircraft orders, or the cancellation or deferral by airlines of purchases of ordered aircraft. Our sales for commercial aircraft programs also could be affected by changes in its customers’ inventory levels and changes in its customers’ aircraft production build rates.

On a stand-alone basis, Ducommun’s sales related to military and space programs were approximately 60% of total sales in 2010 and sales related to its commercial business were approximately 40% of total sales in 2010. On a pro forma basis, sales related to military and space, commercial aerospace, and other end markets were approximately 49%, 23% and 28%, respectively, of total sales in 2010. Upon consummation of the Merger, we believe the diversification of LaBarge’s existing customer base will help to reduce the impact to the combined company of volatility in any one market sector.

Many of our contracts are fixed price contracts subject to termination at the convenience of the customer (as well as for default). In the event of termination for convenience, the customer generally is required to pay the costs we incurred by us and certain other fees through the date of termination. Larger, long-term government subcontracts may have provisions for milestone payments, progress payments or cash advances for purchase of inventory.

We seek to develop strong, long-term relationships with our customers, which provide the basis for future sales. These close relationships allow us to better understand each customer’s business needs and identify ways to provide greater value to the customer.

8

Major Customers

Ducommun has had substantial sales to Boeing, Raytheon, United Technologies and the U.S. Government. During 2010, on a stand-alone basis, sales to Boeing were $107.5 million, or approximately 26% of total sales; sales to Raytheon were $48.2 million, or approximately 12% of total sales; sales to the United Technologies were $30.7 million, or approximately 8% of total sales; and sales to the U.S. Government were $16.9 million, or approximately 4% of total sales. LaBarge has had substantial sales to Schlumberger Ltd., Owens-Illinois, Inc., American Superconductor and Raytheon. On a pro forma basis, for 2010, sales to Boeing were $109.6 million, or approximately 15% of total sales; sales to Raytheon were $70.4 million, or approximately 10% of its total sales; sales to Owens-Illinois were $47.4 million, or approximately 6% of total sales; sales to United Technologies were $41.0 million, or approximately 6% of total sales; sales to American Superconductor were $30.3 million or 4% of total sales; and sales to the U.S. Government were $22.1 million, or approximately 3% of total sales. Sales to these customers are typically comprised of multiple end products diversified over a number of different programs.

Information About Foreign and Domestic Operations and Export Sales

In 2010, 2009, and 2008, Ducommun’s sales to foreign customers worldwide, on a stand-alone basis, were $38.0 million, $32.1 million and $32.9 million, respectively and on a pro forma basis, were $74.8 million, $49.2 million and $36.1 million, respectively. Ducommun has manufacturing facilities in Thailand and Mexico. LaBarge does not have any foreign facilities. The amounts of net sales, profitability and identifiable assets attributable to foreign sales activity both on a stand-alone and pro forma basis were not material when compared with the net sales, profitability and identifiable assets attributed to United States domestic operations for the corresponding periods. Ducommun, on a stand-alone basis, had no sales to a foreign country greater than 3% of total sales in 2010, 2009 and 2008. The majority of LaBarge’s foreign sales are due to a large contract related to wind power generation equipment. We are not subject to any significant foreign currency risks since all sales are made in United States dollars.

Research and Development

Ducommun and its subsidiaries, including LaBarge following the Merger, perform concurrent engineering with its customers and product development activities under Ducommun-funded programs and under contracts with others. Concurrent engineering and product development activities are performed for commercial, military and space applications. We also perform high technology systems engineering and analysis, principally under customer-funded contracts, with a focus on sensors system simulation, engineering and integration.

Raw Materials and Components

Raw materials and components used in the manufacture of our products, include aluminum, titanium, steel and carbon fibers. These raw materials are generally available from a number of vendors and are generally in adequate supply. However, we from time to time, have experienced increases in lead times for and deterioration in availability of, aluminum, titanium and certain other materials. Moreover, certain components, supplies and raw materials for our operations are purchased from single sources. In such instances, we strive to develop alternative sources and design modifications to minimize the potential for business interruptions.

Competition

The aerospace and EMS industries are highly competitive, and our products and services are affected by varying degrees of competition. We compete worldwide with domestic and international companies in most markets it serves, some of which are substantially larger and have greater financial, sales, technical and personnel resources. Larger competitors offering a wider array of products and services than those offered by us could have a competitive advantage by offering potential customers bundled products and services that we cannot match. In addition, our customers may, in fact, have the ability to produce internally the products contracted to us, but because of cost, capacity, engineering capability or other reasons, outsource production of such products to us. Our ability to compete depends principally upon the quality of our goods and services, competitive pricing, product performance, design and engineering capabilities, new product innovation and the ability to solve specific customer problems.

Patents and Licenses

We have several patents, but we do not believe that our operations are dependent upon any single patent or group of patents. In general, we rely on technical superiority, continual product improvement, exclusive product features, superior lead time, on-time delivery performance, quality and customer relationships to maintain our competitive advantage.

9

Backlog

Backlog is subject to delivery delays or program cancellations, which are beyond our control. As of April 2, 2011, backlog believed to be firm for Ducommun was approximately $358.6 million, compared to $328.0 million at December 31, 2009. The increase in backlog is mainly due to higher backlog for 777, Apache and Black Hawk helicopters. Approximately $209.7 million of total backlog is expected to be delivered during the remainder of 2011. As of April 3, 2011 backlog believed to be firm for LaBarge was approximately $241.6 million, compared to $198.7 million at June 27, 2010. The $42.9 million increase in backlog is primarily attributable to several large defense contracts and partially offset by backlog decreases in the natural resources and industrial sectors of LaBarge. Approximately $98.0 million of total backlog is expected to be delivered during the remainder of 2011.

Trends in Ducommun’s and LaBarge’s overall level of backlog may not be indicative of trends in future sales of the combined company because our backlog is affected by timing differences in the placement of customer orders and because Ducommun’s and LaBarge’s backlog tends to be concentrated in several programs to a greater extent than sales.

Environmental Matters

Our business, operations and facilities are subject to numerous stringent federal, state and local environmental laws and regulations issued by government agencies, including the Environmental Protection Agency (“EPA”). Among other matters, these regulatory authorities impose requirements that regulate the emission, discharge, generation, management, transport and disposal of hazardous materials, pollutants and contaminants. These regulations govern public and private response actions to hazardous or regulated substances that threaten to release, or have been released to the environment, and they require us to obtain and maintain licenses and permits in connection with our operations. We may also be required to investigate and remediate the effects of the release or disposal of materials at sites associated with past and present operations. Additionally, this extensive regulatory framework imposes significant compliance burdens and risks on us. We anticipate that capital expenditures will continue to be required for the foreseeable future to upgrade and maintain its environmental compliance efforts. We do not expect to spend a material amount on capital expenditures for environmental compliance during 2011.

The DAS chemical milling business uses various acid and alkaline solutions in the chemical milling process, resulting in potential environmental hazards. Despite existing waste recovery systems and continuing capital expenditures for waste reduction and management, at least for the immediate future, this business will remain dependent upon the availability and cost of remote hazardous waste disposal sites or other alternative methods of disposal.

DAS has been directed by California environmental agencies to investigate and take corrective action for ground water contamination at its facilities located in El Mirage and Monrovia, California. Based on currently available information, Ducommun has established a reserve for its estimated liability for such investigation and corrective action in the approximate amount of $1.5 million. DAS also faces liability as a potentially responsible party for hazardous waste disposed at two landfills located in Casmalia and West Covina, California. DAS and other companies and government entities have entered into consent decrees with respect to each landfill with the United States Environmental Protection Agency and/or California environmental agencies under which certain investigation, remediation and maintenance activities are being performed. Based upon currently available information, we have established a reserve for its estimated liability in connection with the landfills in the approximate amount of $1.1 million. Our ultimate liability in connection with these matters will depend upon a number of factors, including changes in existing laws and regulations, the design and cost of construction, operation and maintenance activities, the continued cleanup of the Monrovia site by three other potentially responsible parties and the allocation of liability among potentially responsible parties.

In the normal course of business, we are defendants in certain other litigation, claims and inquiries, including matters relating to environmental laws. In addition, we make various commitments and incurs contingent liabilities. While it is not feasible to predict the outcome of these matters, we do not presently expect that any sum we may be required to pay in connection with these matters would have a material adverse effect on our consolidated financial position, results of operations or cash flows.

Employees

On a pro forma basis, we will employ approximately 3,400 people. Ducommun’s DAS subsidiary is a party to a collective bargaining agreement, expiring July 1, 2012, with labor unions at its Monrovia, California facility covering approximately 250 full-time hourly employees at April 2, 2011. LaBarge is also a party to collective bargaining agreements, expiring January 11, 2016, at its two Joplin, Missouri facilities covering approximately 250 employees. If any of these unionized workers were to engage in a strike or other work stoppage, if we are unable to negotiate acceptable collective bargaining agreements with the unions, or if other employees were to become unionized, we could experience a significant disruption of our operations and higher ongoing labor costs and possible loss of customer contracts, which could have an adverse effect on its business and results of operations. We have not experienced any material labor-related work stoppage and consider our relations with our employees to be good.

10

Properties

Ducommun, on a stand-alone basis, occupies approximately 21 facilities with a total office and manufacturing area of approximately 1.5 million square feet, including both owned and leased properties. LaBarge, on a stand-alone basis, occupies approximately 11 facilities with total office and manufacturing area of over 648,800 square feet including both owned and leased properties. At April 2, 2011, facilities of Ducommun and LaBarge which were in excess of 50,000 square feet each were occupied as follows:

| Location |

Company/Segment |

Square Feet |

Expiration of Lease |

|||||||

| Carson, California |

Ducommun AeroStructures |

286,000 | Owned | |||||||

| Monrovia, California |

Ducommun AeroStructures |

274,000 | Owned | |||||||

| Parsons, Kansas |

Ducommun AeroStructures |

120,000 | Owned | |||||||

| Pittsburgh, Pennsylvania |

LaBarge |

135,502 | 2012 | |||||||

| Carson, California |

Ducommun Technologies |

117,000 | 2013 | |||||||

| Phoenix, Arizona |

Ducommun Technologies |

100,000 | 2012 | |||||||

| Appleton, Wisconsin |

LaBarge |

76,728 | Owned | |||||||

| Orange, California |

Ducommun AeroStructures |

76,000 | Owned | |||||||

| El Mirage, California |

Ducommun AeroStructures |

74,000 | Owned | |||||||

| Huntsville, Arkansas |

LaBarge |

69,000 | 2020 | |||||||

| Iuka, Mississippi |

Ducommun Technologies |

66,000 | 2013 | |||||||

| Carson, California |

Ducommun AeroStructures |

65,000 | 2014 | |||||||

| Coxsackie, New York |

Ducommun AeroStructures |

65,000 | 2013 | |||||||

| Joplin, Missouri |

LaBarge |

92,000 | 2016 | |||||||

| Joplin, Missouri |

LaBarge |

55,000 | Owned | |||||||

| Tulsa, Oklahoma |

LaBarge |

55,000 | Owned | |||||||

| Huntsville, Alabama |

Ducommun Technologies |

52,000 | 2015 | |||||||

| Berryville, Arkansas |

LaBarge |

52,000 | Owned | |||||||

Our facilities are, for the most part, fully utilized, although excess capacity exists from time to time based on product mix and demand. Management believes these properties are in good condition and suitable for their present use and for the use of the combined company.

Legal Proceedings

In the normal course of business, Ducommun and its subsidiaries, including LaBarge following consummation of the Merger, are defendants in certain other litigation, claims and inquiries, including matters relating to environmental laws. In addition, we make various commitments and incurs contingent liabilities. While it is not feasible to predict the outcome of these matters, we do not presently expect that any sum we may be required to pay in connection with these matters would have a material adverse effect on our consolidated financial position, results of operations or cash flows.

Ducommun

Ducommun is a defendant in a lawsuit entitled United States of America ex rel Taylor Smith, Jeannine Prewitt and James Ailes v. The Boeing Company and Ducommun Inc., filed in the United States District Court for the District of Kansas (the “District Court”). The lawsuit is a qui tam action brought by three former Boeing employees (“Relators”) against Boeing and Ducommun on behalf of the United States of America for violations of the United States False Claims Act. The lawsuit alleges that Ducommun sold unapproved parts to the Boeing Commercial Airplane Group-Wichita Division which were installed by Boeing in aircraft ultimately sold to the United States government. The number of Boeing aircraft subject to the lawsuit has been reduced to 21 aircraft following the District Court’s granting of partial summary judgment in favor of Boeing and Ducommun. The lawsuit seeks damages, civil penalties and other relief from the defendants for presenting or causing to be presented false claims for payment to the United States government. Although the amount of alleged damages are not specified, the lawsuit seeks damages in an amount equal to three times the amount of damages the United States government sustained because of the defendants’ actions, plus a civil penalty of $10,000 for each false claim made on or before September 28, 1999, and $11,000 for each false claim made on or after September 28, 1999, together with attorneys’ fees and costs. One of Relators’ experts has opined that the United States government’s damages are in the amount of $833 million. After investigating the allegations, the United States government has declined to intervene in the lawsuit. Ducommun intends to defend itself vigorously against the lawsuit. Ducommun, at this time, is unable to estimate what, if any, liability it may have in connection with the lawsuit.

11

DAS has been directed by California environmental agencies to investigate and take corrective action for ground water contamination at its facilities located in El Mirage and Monrovia, California. Based on currently available information, Ducommun has established a reserve for its estimated liability for such investigation and corrective action in the approximate amount of $1,509,000. DAS also faces liability as a potentially responsible party for hazardous waste disposed at two landfills located in Casmalia and West Covina, California. DAS and other companies and government entities have entered into consent decrees with respect to each landfill with the EPA and/or California environmental agencies under which certain investigation, remediation and maintenance activities are being performed. Based upon currently available information, Ducommun has established a reserve for its estimated liability in connection with the landfills in the approximate amount of $963,000. Ducommun’s ultimate liability in connection with these matters will depend upon a number of factors, including changes in existing laws and regulations, the design and cost of construction, operation and maintenance activities, the continued cleanup of the Monrovia site by three other potentially responsible parties and the allocation of liability among potentially responsible parties.

LaBarge

On February 10, 2011, LaBarge received a Wells notice from the staff of the SEC indicating that the staff intended to recommend the filing of a civil enforcement action against LaBarge. The SEC staff indicated to LaBarge that any such action would allege violations of securities laws in connection with certain of LaBarge’s financial reporting processes during primarily 2006 and 2007. The Wells notice related only to a potential proceeding against LaBarge, and the SEC staff indicated that they did not contemplate that a claim would be made against any individuals or would include an allegation of fraud on the part of LaBarge or any of its directors, officers or employees. The SEC staff has also advised LaBarge that it did not expect to request that LaBarge restate its financial statements for the periods in question.

On March 18, 2011, LaBarge reached an understanding with the regional staff of the SEC regarding the terms of a settlement that the regional staff has agreed to recommend to the SEC. The proposed agreement, under which LaBarge will not admit or deny any wrongdoing, will, if approved by the SEC, fully resolve all claims against LaBarge relating to the formal investigation that the SEC commenced in June, 2009, relating to LaBarge’s internal controls regarding its use of estimates of completion costs for certain long-term production contracts. The proposed settlement includes the following principal terms:

| • | LaBarge will agree to a cease and desist order from future violations of the securities laws; and |

| • | LaBarge will pay a monetary penalty of $200,000. |

Litigation Relating to the Merger

Ducommun has been named as a defendant in five putative class actions filed in April, 2011 by purported stockholders of LaBarge against LaBarge, its Board of Directors and Ducommun in connection with the LaBarge Acquisition. Some of these actions also name DLBMS, Inc., a wholly-owned subsidiary of Ducommun formed for the purpose of effecting the LaBarge Acquisition. Two of the stockholder actions (filed by purported class representatives Barry P. Borodkin and Insulators and Asbestos Workers Local No. 14) were filed in the Delaware Chancery Court, and the court consolidated those two actions. The other three stockholder actions (filed by purported class representatives J. M. Foley, Jr., William Wheeler and Doris A. Gastineau) were filed in the Circuit Court of St. Louis County, Missouri, and that court consolidated those three actions.

The consolidated Delaware and Missouri putative class actions generally allege that the individual members of the Board of Directors of LaBarge breached their fiduciary duties to LaBarge stockholders with respect to the proposed merger transaction announced on April 4, 2011. These actions also allege that Ducommun, Merger Sub and LaBarge aided and abetted the breach of fiduciary duties. They seek injunctive relief to prevent the closing of the LaBarge Acquisition, judicial declarations that the Merger Agreement was entered into in breach of the LaBarge directors’ fiduciary duties, rescission of the transactions contemplated by the Merger Agreement, and the award of attorneys’ fees and expenses for the plaintiffs.

In the Delaware consolidated actions, the parties engaged in expedited discovery in connection with a preliminary injunction hearing scheduled for June 17, 2011. After document discovery and depositions, and before the plaintiffs filed their motion for preliminary injunction, the parties negotiated and signed a memorandum of understanding to settle plaintiffs’ claims. The preliminary settlement is subject to a definitive agreement and final approval of the Delaware Chancery Court. There can be no assurance that the parties will ultimately enter into a stipulation of settlement or that the Chancery Court will approve the settlement even if the parties do enter into such stipulation.

In the Missouri consolidated actions, the defendants sought a stay of the Missouri actions from the Missouri court, the plaintiffs opposed that request, and the Missouri court stayed the actions. At a hearing on June 16, 2011, plaintiffs sought reconsideration of the court’s stay, and the defendants opposed that request. The Missouri court stated that it would issue an order shortly thereafter.

Ducommun believes these lawsuits are without merit, and in the event that settlement of these claims is not finalized, intends to defend them vigorously.

12

Risk Factors

In addition to the other information included herein, including the matters addressed in the “Special Note Regarding Forward-Looking Statements,” you should carefully consider the following risks before making an investment in our securities. Additional risks and uncertainties not presently known to us or that are not currently believed to be important also may adversely affect our business following the Transactions.

Unless the context indicates otherwise, when we refer to “we,” “us” and “our” for purposes of this section, we are referring to Ducommun and its subsidiaries including LaBarge and its subsidiaries following consummation of the LaBarge Acquisition.

Risks Related to the Notes

Our substantial indebtedness could adversely affect our financial condition, limit our ability to raise additional capital to fund our operations and prevent us from fulfilling our obligations under the notes.

After the notes offering and the application of the net proceeds therefrom, we will have a significant amount of indebtedness. As of April 2, 2011, on a pro forma basis, we would have had total indebtedness of $393.3 million, including the notes and the principal amount of our New Term Loan Facility, plus, to the extent necessary, limited borrowings, but no greater than $10.0 million, under the New Revolving Credit Facility with the remaining portion of such $60.0 million New Revolving Credit Facility available to be borrowed. Upon the satisfaction of certain conditions including, but not limited to, the agreement of lenders to provide such facilities or commitments, we will also have the option to add one or more incremental term loan facilities or increase commitments under our New Revolving Credit Facility by an aggregate amount of up to $75.0 million. The Existing Ducommun Credit Facility and Existing LaBarge Credit Facility will be repaid and terminated at closing.

If we do not generate sufficient cash flow from operations to satisfy our debt obligations, we may have to undertake alternative financing plans, such as:

| • | refinancing or restructuring our debt; |

| • | selling assets; |

| • | reducing or delaying scheduled expansions and capital investments; or |

| • | seeking to raise additional capital. |

We cannot assure you that we would be able to enter into these alternative financing plans on commercially reasonable terms or at all. Moreover, any alternative financing plans that we may be required to undertake would still not guarantee that we would be able to meet our debt obligations. Our inability to generate sufficient cash flow to satisfy our debt obligations, including our obligations under the notes, or to obtain alternative financing, could materially and adversely affect our business, results of operations, financial condition and business prospects.

Our high level of debt could have important consequences to us and to the holders of the notes, including:

| • | making it more difficult for us to satisfy our obligations with respect to the notes and our other debt; |

| • | the occurrence of an event of default if we fail to satisfy our obligations with respect to the notes or our other indebtedness or fail to comply with the financial and other restrictive covenants contained in the indenture governing the notes or agreements governing other indebtedness, which event of default could result in acceleration of the indebtedness outstanding under the indenture and in a default with respect to, and an acceleration of, our other indebtedness and could permit our lenders to foreclose on any of our assets securing such debt; |

| • | limiting our ability to obtain additional financing to fund future working capital, capital expenditures, investments or acquisitions or other general corporate requirements; |

| • | requiring a substantial portion of our cash flows to be dedicated to debt service payments instead of other purposes, thereby reducing the amount of cash flows available for working capital, capital expenditures, investments or acquisitions or other general corporate purposes; |

| • | increasing our vulnerability to adverse changes in general economic, industry and competitive conditions; |

| • | exposing us to the risk of increased interest rates as certain of our borrowings, including borrowings under our New Credit Facilities, bear interest at variable rates, which could further adversely impact our cash flows; |

| • | limiting our flexibility in planning for and reacting to changes in our business and the industry in which we compete; |

13

| • | restricting us from making strategic acquisitions or causing us to make non-strategic divestitures; |

| • | impairing our ability to obtain additional financing in the future; |

| • | preventing us from raising the funds necessary to repurchase all notes tendered to us upon the occurrence of certain changes of control, which failure to repurchase would constitute an event of default under the indenture governing the notes; |

| • | placing us at a disadvantage compared to other, less leveraged competitors; and |

| • | increasing our cost of borrowing. |

The occurrence of any one of these events could have an adverse effect on our business, financial condition, results of operations and ability to satisfy our obligations in respect of our outstanding debt.

Despite our current indebtedness levels, we may still be able to incur substantially more debt, which could increase the risks associated with the notes.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future, which may be secured. While the indenture governing the notes and our New Credit Facilities will limit our ability and the ability of our subsidiaries to incur additional indebtedness, these restrictions are subject to a number of qualifications and exceptions and, thus, notwithstanding these restrictions, we may still be able to incur substantially more debt. See “Description of Other Indebtedness.” To the extent that we incur additional indebtedness, the risks that we now face related to our substantial indebtedness, including an inability to fulfill our obligations under the notes, could increase.

We will need to repay or refinance borrowings under our New Credit Facilities prior to maturity of the notes. Failure to do so could have a material adverse effect upon us.

We expect that our New Term Loan Facility and our New Revolving Credit Facility will mature in June 2017 and June 2016, respectively. As of April 2, 2011, on a pro forma basis, we would have had $190.0 million of term loan borrowings under the New Term Loan Facility and, to the extent necessary, limited borrowings, but no greater than $10.0 million, under the New Revolving Credit Facility to finance the LaBarge Acquisition and fees and expenses related to the Transactions, with the remaining portion of such $60.0 million New Revolving Credit Facility available to be borrowed after the consummation of the Merger.

Consequently, prior to the maturity of the notes, we will need to repay, refinance, replace or otherwise extend the maturity of our New Credit Facilities. Our ability to repay, refinance, replace or otherwise extend will be dependent on, among other things, business conditions, our financial performance and the general condition of the financial markets. If a financial disruption were to occur at the time that we are required to repay indebtedness outstanding under our New Credit Facilities, we could be forced to undertake alternate financings, negotiate for an extension of the maturity of our New Credit Facilities or sell assets and delay capital expenditures in order to generate proceeds that could be used to repay indebtedness under our New Credit Facilities. We cannot assure you that we will be able to consummate any such transaction on terms that are commercially reasonable, on terms acceptable to us or at all. Our failure to repay, refinance, replace or otherwise extend the maturity of our New Credit Facilities could result in an event of default under the indenture governing the notes and our New Credit Facilities, which could lead to an acceleration or repayment of substantially all of our outstanding debt.

We require a significant amount of cash to service our indebtedness. Our ability to generate cash depends upon many factors beyond our control.

Our ability to make payments on and to refinance our debt, including the notes, and to fund planned capital expenditures and working capital increases, will depend upon our ability to generate cash in the future. If the Transactions are consummated, our debt service requirements will increase substantially due to the higher principal amount of debt that will be outstanding. Our ability to generate cash is subject to economic, financial, competitive, legislative, regulatory and other factors that may be beyond our control. We cannot assure you that our business will generate sufficient cash flow from operations in an amount sufficient to enable us to pay our debt, including the notes, or to fund our other liquidity needs. Any inability to generate sufficient cash flow could have a material adverse effect on our financial condition or results of operations.

14

The notes and the guarantees will be unsecured and effectively subordinated to our and the guarantors’ existing and future secured indebtedness to the extent of the value of the assets securing such indebtedness, and will be structurally subordinated to the indebtedness of any future non-guarantor subsidiaries.

The notes and the guarantees will be our senior unsecured obligations ranking effectively junior in right of payment to all of our and the guarantors’ existing and future secured indebtedness and that of each guarantor, including indebtedness under our New Credit Facilities, to the extent of the value of the assets securing such indebtedness. Additionally, the indenture governing the notes in certain circumstances will permit us to incur additional secured indebtedness in the future. The notes will also be structurally subordinated to any indebtedness and other liabilities of any future non-guarantor subsidiaries.

In the event that we or a guarantor declares bankruptcy, becomes insolvent or is liquidated or reorganized, holders of our and the guarantors’ secured indebtedness will be entitled to be paid in full from our assets or the assets of such guarantor, as applicable, securing such indebtedness before any payment may be made with respect to the notes or the affected guarantee.

Holders of the notes will participate ratably in our remaining assets with all holders of our senior unsecured indebtedness, and potentially with all of our other general creditors, based upon the respective amounts owed to each holder or creditor. In any of the foregoing events, there may not be sufficient assets to pay amounts due on the notes. As a result, holders of the notes would likely receive less, ratably, than holders of our secured indebtedness.

As of April 2, 2011, on a pro forma basis, the notes and the guarantees would have been effectively subordinated in right of payment to approximately $190.0 million of senior secured indebtedness under the New Term Loan Facility and any amounts borrowed under the New Revolving Credit Facility.

The covenants in our New Credit Facilities and the indenture governing the notes will impose restrictions that may limit our operating and financial flexibility and may limit our ability to make payments on the notes.

Our New Credit Facilities and the indenture governing the notes will contain a number of significant restrictions and covenants that limit our ability, among other things, to:

| • | create liens; |

| • | incur additional debt, guarantee debt and issue preferred stock; |

| • | pay dividends; |

| • | make redemptions and repurchases of certain capital stock; |

| • | make capital expenditures and specified types of investments; |

| • | prepay, redeem or repurchase subordinated debt; |

| • | sell certain assets or engage in acquisitions, mergers and consolidations; |

| • | change the nature of our business; |

| • | engage in affiliate transactions; and |

| • | restrict dividends or other payments from restricted subsidiaries. |

In the event that a certain minimum amount is borrowed and outstanding under the New Revolving Credit Facility, for so long as any such amount is outstanding, we will be required to comply with a total leverage ratio. Furthermore, our consolidated EBITDA as of the end of any fiscal quarter on a trailing four-quarters basis is not permitted to be less than $50.0 million.

These covenants could materially and adversely affect our ability to finance our future operations or capital needs. Furthermore, they may restrict our ability to expand, pursue our business strategies and otherwise conduct our business. Our ability to comply with these covenants may be affected by circumstances and events beyond our control, such as prevailing economic conditions and changes in regulations, and we cannot assure you that we will be able to comply with such covenants. These restrictions also limit our ability to obtain future financings to withstand a future downturn in our business or the economy in general. In addition, complying with these covenants may also cause us to take actions that are not favorable to holders of the notes and may make it more difficult for us to successfully execute our business strategy and compete against companies that are not subject to such restrictions.

15

A breach of any covenant in the New Credit Facilities or the agreements and indentures governing any other indebtedness that we may have outstanding from time to time, including the indenture governing the notes, would result in a default under that agreement or indenture after any applicable grace periods. A default, if not waived, could result in acceleration of the debt outstanding under the agreement and in a default with respect to, and an acceleration of, the debt outstanding under other debt agreements. If that occurs, we may not be able to make all of the required payments or borrow sufficient funds to refinance such debt. Even if new financing were available at that time, it may not be on terms that are acceptable to us or terms as favorable as our current agreements. If our debt is in default for any reason, our business, results of operations and financial condition could be materially and adversely affected. See “Description of Other Indebtedness.”

In the event of a default, we may have insufficient funds to make any payments due on the notes.

A default under the indenture governing the notes could lead to a default under existing and future agreements governing our indebtedness, including the credit agreement governing our New Revolving Credit Facility. If, due to a default, the repayment of related indebtedness were to be accelerated after any applicable notice or grace periods, we may not have sufficient funds to repay such indebtedness or the notes.

A subsidiary guarantee could be voided if it constitutes a fraudulent conveyance under U.S. bankruptcy or similar state law, which would prevent the holders of the notes from relying on that subsidiary to satisfy claims.

The guarantors’ guarantees of the notes may be subject to review under federal bankruptcy law or relevant state fraudulent conveyance laws if a bankruptcy lawsuit is commenced by or on behalf of our or the guarantors’ unpaid creditors. Under these laws, if in such a lawsuit a court were to find that, at the time a guarantor incurred debt (including debt represented by the guarantee) or, in some states, when payments become due under the guarantee, such guarantor:

| • | incurred this debt with the intent of hindering, delaying or defrauding current or future creditors; or |

| • | received less than reasonably equivalent value or fair consideration for incurring this debt and the guarantor (i) was insolvent or was rendered insolvent by reason of the related Financing Transactions; (ii) was engaged, or about to engage, in a business or transaction for which its remaining assets constituted unreasonably small capital to carry on its business; or (iii) intended to incur, or believed that it would incur, debts beyond its ability to pay these debts as they mature, as all the foregoing terms are defined in or interpreted under the relevant fraudulent transfer or conveyance statutes, |

then the court could void the guarantee or subordinate the amounts owing under the guarantee to the guarantor’s presently existing or future debt or take other actions detrimental to you.

The measure of insolvency for purposes of the foregoing considerations will vary depending on the law of the jurisdiction that is being applied in any such proceeding. Generally, an entity would be considered insolvent if, at the time it incurred the debt or issued the guarantee:

| • | it could not pay its debts or contingent liabilities as they become due; |

| • | the sum of its debts, including contingent liabilities, was greater than its assets, at fair valuation; or |

| • | the present fair saleable value of its assets was less than the amount required to pay the probable liability on its total existing debts and liabilities, including contingent liabilities, as they become absolute and mature. |

If a guarantee is voided as a fraudulent conveyance or found to be unenforceable for any other reason, you will not have a claim against that guarantor and will only be our creditor or that of any guarantor whose obligation was not set aside or found to be unenforceable. In addition, the loss of a guarantee will constitute an event of default under the indenture governing the notes, which event of default could cause all outstanding notes to become immediately due and payable.

The indenture governing the notes will contain a provision intended to limit each subsidiary guarantor’s liability to the maximum amount that it could incur without causing the incurrence of obligations under its subsidiary guarantee to be a fraudulent conveyance. Such provision may not be effective to protect the subsidiary guarantees from being voided as a fraudulent conveyance under applicable law.

We may not be able to make the change of control offer required by the indenture governing the notes.

We may be unable to purchase the notes upon a change of control, as defined in the indenture governing the notes. Upon a change of control, we will be required to offer to purchase all of the notes then outstanding for cash at 101% of the principal amount on the date of purchase plus accrued and unpaid interest, if any, on the notes purchased to the date of purchase. If a change of control were to occur, we may not have sufficient funds to pay the change of control purchase price and we may be required to secure third-party financing to do so. However, we may not be able to obtain such financing on commercially reasonable terms, on terms acceptable to us or at all.

16

A change of control under the indenture governing the notes may also result in an event of default under our New Credit Facilities which may cause the acceleration of indebtedness outstanding thereunder, in which case, proceeds of collateral pledged to secure borrowings thereunder would be used to repay such borrowings before we repay the notes. In addition, our future indebtedness may also contain restrictions on our ability to repurchase the notes upon certain events, including transactions that could constitute a change of control under the indenture governing the notes. Our failure to repurchase the notes upon a change of control would constitute an event of default under the indenture governing the notes and would have a material adverse effect on our financial condition.

We may enter into transactions that would not constitute a change of control that could affect our ability to satisfy our obligations under the notes.

The provisions of the indenture governing the notes may allow us to enter into transactions, such as acquisitions, refinancing or recapitalizations, that would not constitute a change of control but may increase our outstanding indebtedness or otherwise affect our ability to satisfy our obligations under the notes. The definition of change of control for purposes of the notes includes a phrase relating to the transfer of “all or substantially all” of our assets taken as a whole. Although there is a limited body of case law interpreting the phrase “substantially all,” there is no precise established definition of the phrase under applicable law. Accordingly, your ability to require us to repurchase notes as a result of a transfer of less than all of our assets to another person may be uncertain.

We face risks related to rating agency downgrades.

We expect one or more rating agencies to rate the notes. If such rating agencies either assign the notes a rating lower than the rating expected by the investors or reduce the rating in the future, the market price of the notes would be adversely affected. In addition, if any of our other outstanding debt is rated and subsequently downgraded, raising capital will become more difficult, borrowing costs under our New Revolving Credit Facility and other future borrowings may increase and the market price of the notes may decrease.

There are restrictions on your ability to transfer or resell your notes.

We will be relying on an exemption from registration under the Securities Act and state securities laws in offering the notes. Therefore, the notes may be transferred or resold only in transactions registered, or exempt from registration, under the Securities Act and applicable state securities laws, and you may be required to bear the risk of your investment for an indefinite period of time.

We and the guarantors will agree pursuant to a registration rights agreement to be entered into on the issue date to, under certain circumstances, use commercially reasonable efforts to offer to exchange the notes for equivalent notes registered under U.S. securities laws or, in certain circumstances, register the reoffer and resale of the notes under the U.S. securities laws. The SEC, however, has broad discretion to declare any registration statement with respect to such an exchange offer effective and may delay, defer or suspend the effectiveness of any such registration statement for a variety of reasons. No assurances can be given that any such registration statement, even if required by the registration rights agreement, will be declared effective by the SEC in a timely manner. Failure to have such a registration statement declared effective by the SEC in a timely manner could delay consummation of any exchange offer required by the registration rights agreement and adversely affect the liquidity and trading price of the notes.

An active public market may not develop for the notes, which may hinder your ability to liquidate your investment.