Attached files

| file | filename |

|---|---|

| 10-K - FORM 10-K 110331 - LML PAYMENT SYSTEMS INC | form10k110331.htm |

| EX-21.1 - EXHIBIT 21_1 - LML PAYMENT SYSTEMS INC | exhibit21.htm |

| EX-32.1 - EXHIBIT 32_1 - LML PAYMENT SYSTEMS INC | exhibi32_1.htm |

| EX-3.1 - ARTICLES - LML PAYMENT SYSTEMS INC | exhibit3_1.htm |

| EX-31.1 - EXHIBIT 31_1 - LML PAYMENT SYSTEMS INC | exhibit31_1.htm |

| EX-31.2 - EXHIBIT 31_2 - LML PAYMENT SYSTEMS INC | exhibit31_2.htm |

| EX-23.1 - EXHIBIT 23_1 - LML PAYMENT SYSTEMS INC | exhibit23_1.htm |

| EX-10.24 - EXHIBIT 10_24 - LML PAYMENT SYSTEMS INC | exhibit10_24.htm |

| EX-10.23 - EXHIBIT 10_23 - LML PAYMENT SYSTEMS INC | exhibit10_23.htm |

SETTLEMENT AND LICENSE AGREEMENT

This Settlement and License Agreement (the “Agreement”) is entered into by LML Patent Corp, on the one hand, and PayPal, Inc. and eBay Inc., on the other hand. LML and PAYPAL are individually referred to as a “Party” and collectively as the “Parties.” This Agreement is effective as of March 16, 2011 (“Effective Date”).

RECITALS

WHEREAS, LML represents that it owns rights in U.S. Patent No. RE40,220 (“the ‘220 Patent”), which LML asserts is related to Electronic Check Conversion systems and services;

WHEREAS, LML began an action against PayPal, Inc. and other defendants in the United States District Court for the Eastern District of Texas, Marshall Division alleging infringement of LML’s ‘220 Patent;

WHEREAS, PayPal, Inc. and eBay Inc. began an action against Beanstream Internet Commerce, Inc. in the Canadian federal court alleging infringement of Canadian Patent Number 2,199,942;

WHEREAS, LML’s published standard royalty rate for use of the LML Patents is $0.01 U.S. dollars for each ARC SEC coded ACH transaction and $0.03 U.S. dollars for reach POP, BOC, WEB, or TEL SEC coded ACH transaction;

WHEREAS, PayPal, Inc. is a named defendant in the U.S. Litigation and PayPal, Inc. has denied liability;

WHEREAS, the Parties have agreed to enter into this Agreement to avoid the risk and uncertainty of continued litigation;

WHEREAS, the Parties wish to settle their disputes, and PAYPAL desires to obtain certain rights under the LML Patents (as hereinafter defined) and LML is willing to grant such rights;

NOW, THEREFORE, in consideration of the above premises and mutual covenants contained in this Agreement and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

|

1.

|

DEFINITIONS. The following definitions apply to this Agreement:

|

|

(a)

|

“ACH” is the acronym for the “Automated Clearing House” Network and means the funds transfer system governed by the National Automated Clearing House Association (“NACHA”).

|

-1-

|

(b)

|

“ACH Transaction” means an entry complying with the NACHA ACH Record Format Specifications for NACHA standard entry class codes ARC, WEB, POP, TEL, and BOC.

|

|

(c)

|

“Acquires” means to obtain an interest in an entity either by acquisition, purchase, or merger.

|

|

(d)

|

“Affiliate” of a Party means means any past, present, or future subsidiary, parent, sister company, or other corporation, firm, business, partnership, joint venture, or entity that controls, is controlled by, or is under common control of, that Party or any of its subsidiaries. The term “control” as used in this Agreement, means the possession, directly or indirectly, solely or jointly, of the power to direct or cause the direction of management, actions or policies of a legally recognizable entity, whether through the ownership of voting shares, by contract, or otherwise. The rights conferred by this Agreement on PAYPAL shall automatically and immediately extend to any entity that is not an Affiliate of or a part of PAYPAL as of the Effective Date and subsequently becomes an Affiliate or a part of PAYPAL (e.g., a future Affiliate or acquired business), and shall extend to or continue to be retained by any entity that is an Affiliate or a part of PAYPAL as of the Effective Date and subsequently loses its status as an Affiliate or part of PAYPAL (e.g., a former Affiliate or divested business). Except that the License shall not benefit successors or acquirers after the Effective Date, except as provided in section 6 below.

|

|

(e)

|

“Bank” means any institution that is a member of the Federal Reserve System and that accepts demand deposits to consumer accounts from which a consumer may withdraw funds by check or share draft for payment to others.

|

|

(f)

|

“Canada Lawsuit” or “Canadian Litigation” means the lawsuit in Canada brought by PayPal, Inc. and eBay Inc. against Beanstream Internet Commerce, Inc. alleging infringement of Canadian Patent Number 2,199,942, Court File No. T-242-11.

|

|

(g)

|

“Court” means the United States District Court for the Eastern District of Texas, Marshall Division.

|

|

(h)

|

“Covered Products and Services” means any past, present or future application, product, apparatus, component, machine, system, module, manufacture, software, design, composition of matter, service, process, method or technology made, used, sold, offered for sale, advertised, provided, imported, exported, offered, distributed, supplied, designed, tested, or developed by, on, for, to, through, or on behalf of, PAYPAL that, in the absence of a license granted pursuant to this Agreement, would allegedly infringe, either directly or indirectly, in whole or in part, any of the Patent Rights. Such definition extends only to products and services to the extent they are Exploited through, with, by, for, to, or on behalf of PAYPAL.

|

-2-

|

(i)

|

“Covered Third Parties” means PAYPAL’s customers, buyers, sellers, users, developers, manufacturers, partners, promoters, advertisers, resellers, and/or distributors, and any developer, supplier, partner, vendor or manufacturer that Exploits Covered Products and Services, and only to the extent Exploited through, with, by, for, or on behalf of PAYPAL. Notwithstanding the foregoing, Covered Third Parties shall not include an Excluded Party.

|

|

(j)

|

“Excluded Banks” means Bank of America, N.A.; Capital One National Association; Capital One Services, LLC; Deutsche Bank Trust Company Americas; JPMorgan Chase Bank, N.A.; Wachovia Bank, N.A.; and Wells Fargo Bank.

|

|

(k)

|

“ExcludedParty” means any Bank. Notwithstanding the foregoing, Excluded Party does not include, and shall not be interpreted to include: (a) PAYPAL; (b) any Bank through which any ACH or financial transactions or transfers are processed for or on behalf of PAYPAL, but limited to only the extent such Covered Product or Service is Exploited on behalf of or for PAYPAL; (c) any Entity that: (i) is dismissed with prejudice from a lawsuit for Infringement of any Patent Rights; (ii) is found not to Infringe all asserted claims of Patent Rights that are also not found to be invalid or unenforceable after all appeals are exhausted; (iii) otherwise enters into a settlement agreement with LML concerning any Patent Rights; or (iv) otherwise licensed to Patent Rights

|

|

(l)

|

“Entity” means any individual, trust, corporation, person or company, partnership, joint venture, limited liability company, association, firm, unincorporated organization or other legal or governmental entity.

|

|

(m)

|

“Exploit” means to own, design, develop, acquire, use, make, have made, sell, offer to sell, modify, import, export, supply, incorporate components, steps, features or portions of the Covered Products and Services, or otherwise offer, dispose of, distribute, display, advertise and/or promote, and/or the exercise of all other activities specified under 35 U.S.C. § 271 and foreign counterparts thereto (as the foregoing 35 U.S.C. § 271 and foreign counterparts thereof may be amended or superseded from time to time). “Exploited,” “Exploitation,” and other variations of the word “Exploit” shall have correlative meanings.

|

|

(n)

|

“Infringement” or “Infringes” means direct infringement, indirect infringement, infringement under the doctrine of equivalents, or any other theory of infringement in any jurisdiction worldwide.

|

|

(o)

|

“Infringing Products and Services” means any and all products and services the Exploitation of which, but for the license granted in this Agreement, would Infringe any claim of any LML Patent.

|

|

(p)

|

“PAYPAL” means PayPal, Inc., eBay Inc. and their predecessors, successors and Affiliates.

|

-3-

|

(q)

|

“LML” or “LML Entity” or “LML Entities” means: (a) LML Patent Corp. and its predecessors, successors and Affiliates, including but not limited to Beanstream Internet Commerce, Inc.; (b) all entities controlled by LML Patent Corp., and its predecessors, successors and Affililates; (c) all entities, and its predecessors, successors and Affiliates, in which LML Patent Corp. has a 25% or more ownership share.

|

|

(r)

|

“LML Patents” means (i) U.S. Patent No. RE40,220, (ii) any issued patent and any pending patent application anywhere in the world that LML currently owns or controls (or has the right to own or, control,) as of the Effective Date of this Agreement; (iii) any past, present, or future patent or patent application worldwide to which any of the foregoing patents and/or patent applications described in (i) and (ii) claims priority or are otherwise related, including, but not limited to all parents, provisionals, substitutes, renewals, continuations, continuations-in-part, reissues, reexamination certificates, divisionals, foreign counterparts, oppositions, continued examinations, reexaminations, and extensions of any of the foregoing; and (iv) applications of the foregoing patents and/or patent applications described above. For purposes of this definition, a patent or patent application is deemed to be under LML’s “control” if LML has the right to assert a claim of Infringement or grant a license under such patent or patent application.

|

|

(s)

|

“U.S. Litigation” means the lawsuit pending in the United States District Court for the Eastern District of Texas, Marshall Division, 2-08-CV-448-DF, to which LML and PayPal, Inc. are parties.

|

|

2.

|

SETTLEMENT OF THE LITIGATION

|

|

2.1

|

Dismissal of Litigation. The Parties agree to direct their counsel to file with the Court a joint motion for dismissal with prejudice of the Parties’ respective claims for relief against the other Party in the U.S. Litigation as set forth in Exhibit A within five (5) days after the receipt of payment specified in Section 3.1 and in the Canadian Litigation within five (5) days of the Effective Date. The Parties shall promptly proceed with any and all additional procedures needed to dismiss with prejudice the Parties’ respective claims for relief against the other Party.

|

|

2.2

|

No Award of Fees or Costs. The Parties agree that they shall bear their own expenses, costs and attorneys' fees relating to the U.S. and Canadian Litigation and negotiating the Agreement, including the transactions contemplated herein.

|

-4-

|

2.3

|

No Attempt to Invalidate.PAYPAL agrees that, in the absence of a subpoena or court order requiring its participation or support, PAYPAL shall not participate in or support any suit, claim, action, litigation, administrative proceeding, or proceeding of any nature brought against LML that challenges the validity or enforceability of the LML Patents so long as PAYPAL: (a) has a license to the LML Patents, subject to Section 6 (Change in Control/Acquisitions); (b) is fully released for all claims of Infringement of the LML Patents, subject to Section 6 (Change in Control/Acquisitions); and (c) is not accused of Infringement of any LML Patent, subject to Section 6 (Change in Control/Acquisitions). However, PAYPAL may challenge the validity or enforceability of the LML Patents if: (i) any suit, claim, action, litigation or proceeding to enforce one or more of the LML Patents is brought against PAYPAL related to one or more of the LML Patents, or places PAYPAL in a reasonable apprehension of being sued on one or more of the LML Patents, or (ii) if LML breaches its covenants not to sue (Section 4.4) or releases (Section 4.2) or Licenses (Section 5) made to PAYPAL or Covered Third Parties (acting solely in their role as Covered Third Parties), or (iii) if PAYPAL receives a request for indemnification related to an LML Patent, but only after PAYPAL has provided thirty (30) days written notice to LML of its intent to challenge the validity or enforceability of the asserted LML Patent(s), provided that PAYPAL is able to do so without breaching any contractual or other obligations. Notwithstanding anything to the contrary herein, PAYPAL agrees to discontinue its participation in the pending reexamination proceeding relating to U.S. Patent No. RE40,220 (Reexamination No. 95/000,545), unless further participation is mandated or required by law.

|

|

3.

|

PAYMENT, TERM AND TERMINATION

|

|

3.1

|

Payment by PAYPAL. PAYPAL agrees to pay to LML the non-refundable sum of Seven Million Five Hundred Thousand U.S. dollars ($7,500,000) on or before five (5) days following the Effective Date in consideration of the terms set forth in this Agreement. Such amount will be delivered to LML’s counsel, McKool Smith P.C., via wire or other electronic transfer to the following account:

|

Address: Citibank, N.A.

666 5th Avenue

New York, New York 10103

SWIFT Code:

ABA Routing:

A/C Name: McKool Smith PC IOLTA Trust Account

A/C Number:

-5-

|

3.2

|

Term. Unless earlier terminated as specified in this section, the term of this Agreement shall commence upon the Effective Date and shall continue until the expiration of the latter of all the LML Patents or all causes of action and claims arising out of or related to the LML Patents or the Lawsuits. Otherwise, this Agreement may only be earlier terminated in whole or in part pursuant to Section 3.3 (Termination Due to Non-Payment by PAYPAL) or upon the mutual written agreement of the Parties.

|

|

3.3

|

Termination Due to Non-Payment by PAYPAL. If PAYPAL fails to make the payment specified in Section 3.1 (Payment by PAYPAL) above in the time specified, such failure will constitute a material breach of this Agreement. Upon such breach, LML may then, after ten (10) business days following written notice of such breach to PAYPAL, if PAYPAL does not deliver the payment specified in Section 3.1 (Payment by PAYPAL) to LML within ten (10) business days after receiving such notice from LML, at its option, either terminate this Agreement (in which event this Agreement shall become null and void) or it may petition the Court for specific enforcement of PAYPAL’s payment obligations. PAYPAL hereby consents to the jurisdiction of the Court for enforcement of the payment obligations in Section 3.1 (Payment by PAYPAL), and agrees that specific enforcement of the payment obligations of this Agreement is an available remedy if LML does not elect to terminate this Agreement.

|

|

3.4

|

Tax Liability. Each Party shall bear its own tax liability as a result of the existence of this Agreement or the performance of any obligations hereunder.

|

|

3.5

|

Additional Payments. The payment of the amount set forth in Section 3.1 (Payment by PAYPAL) shall be the total compensation to any LML Entity by PAYPAL for all releases, licenses, covenants and all other rights granted in this Agreement, and no additional payment shall be due or made to any LML Entity or any other Entity by PAYPAL with respect to the releases, licenses, covenants and all other rights granted in this Agreement.

|

-6-

|

3.6

|

PAYPAL’s Retained Rights/Bankruptcy. The Parties acknowledge and agree that the LML Patents are “intellectual property” as defined in Section 101(35A) of the United States Bankruptcy Code, as the same may be amended from time to time (the "Code"), which have been licensed hereunder in a contemporaneous exchange for value. The Parties further acknowledge and agree that if LML: (i) becomes insolvent or generally fails to pay, or admits in writing its inability to pay, its debts as they become due; (ii) applies for or consents to the appointment of a trustee, receiver or other custodian for it, or makes a general assignment for the benefit of its creditors; (iii) commences, or has commenced against it, any bankruptcy, reorganization, debt arrangement, or other case or proceeding under any bankruptcy or insolvency law, or any dissolution or liquidation proceedings; or (iv) elects to reject, or a trustee on behalf of it elects to reject, this Agreement or any agreement supplementary hereto, pursuant to Section 365 of the Code (“365”), or if this Agreement or any agreement supplementary hereto is deemed to be rejected pursuant to 365 for any reason, this Agreement, and any agreement supplementary hereto, shall be governed by Section 365(n) of the Code (“365(n)”) and PAYPAL will retain and may elect to fully exercise its or their rights under this Agreement in accordance with 365(n).

|

|

4.

|

RELEASES AND COVENANTS NOT TO SUE

|

|

4.1

|

Agreement Obligations Not Released. None of the releases or covenants not to sue herein releases any Party or its Affiliates from its respective obligations under this Agreement or under any protective orders entered in the U.S. or Canadian Litigation as of the Effective Date or prevents any Party or any of its Affiliates from enforcing the terms and conditions of this Agreement against the other Party or its Affiliates.

|

-7-

|

4.2

|

LML’s Release to PAYPAL. Subject to the provisions of Section 3.3 (Termination Due to Non-Payment by PAYPAL) and Section 6 (Change in Control/Acquisitions), LML Entities forever release: (a) PAYPAL and its respective directors, officers, employees, agents, attorneys, shareholders, assignees, assignors, insurers, and representatives from any and all claims, causes of action, actions, demands, liabilities, losses, damages, attorneys’ fees, court costs, or any other form of claim or compensation, whether known or unknown, whether in law or equity, accruing before or on the Effective Date (and including any damages that may accrue after the Effective Date for conduct occurring on or before the Effective Date), related in whole or part to the U.S. or Canadian Litigation, any of the LML Patents, or Exploitation of the Covered Products and Services, including without limitation any act of past or present Infringement, misappropriation or other violation of one or more of the LML Patents, and any claim that is or would have been within the scope of either the covenant not to sue or license granted in Sections 4.4 (Covenant-Not-to-Sue by LML) and 5.1 (License), and any claim that LML asserted or could have asserted in the U.S. or Canadian Litigation as of the Effective Date; and (b) the Covered Third Parties from any and all claims, causes of action, actions, demands, liabilities, losses, damages, attorneys’ fees, court costs, or any other form of claim or compensation, whether known or unknown, whether in law or equity, accruing before, on, or after the Effective Date, related in whole or in part to the U.S. or Canadian Litigation, any of the LML Patents, or Exploitation of the Covered Products and Services, including without limitation any act of past, present, or future Infringement, misappropriation, or other violation of one or more of the LML Patents, and any claim that is or would have been within the scope of either the license or covenant not to sue granted in Sections 4.4 (Covenant-Not-to-Sue by LML) and 5.1 (License), and any claim that LML asserted or could have asserted in the U.S. or Canadian Litigation as of the Effective Date.

|

|

4.3

|

PAYPAL’s Release to LML. Subject to the obligations of LML under this Agreement, PAYPAL forever releases LML and its respective directors, officers, employees, agents, attorneys, shareholders, assignees, assignors, insurers, and representatives from any and all claims, causes of action, actions, demands, liabilities, losses, damages, attorneys’ fees, court costs, or any other form of claim or compensation, whether known or unknown, whether in law or equity, accruing before or on the Effective Date, related in whole or part to the U.S. or Canadian Litigation or any of the LML Patents (conserving, subject to Section 2.3, defenses or claims regarding the validity or enforceability of one or more of the LML Patents), that is or would have been within the scope of the covenant not to sue granted in Section 4.5 (Covenant-Not-to-Sue by PAYPAL) and that PAYPAL asserted or could have asserted as of the Effective Date.

|

-8-

|

4.4

|

Covenant-Not-to-Sue by LML. Subject to the provisions of Section 3.3 (Termination Due to Non-Payment by PAYPAL) and Section 6 (Change in Control/Acquisitions), LML, on behalf of itself and its respective successors and permitted assigns, agree that: (a) they will not assert, pursue, maintain, encourage, support, assist, or join in any action or litigation asserting any claim against PAYPAL for Infringement of any claim of the LML Patents with respect to or arising out of the Exploitation of any Covered Products and Services; and (b) they will not assert, pursue, maintain, encourage, support, assist, or join in any action or litigation asserting any claim against any Covered Third Parties for Infringement of any claim of the LML Patents with respect to or arising out of the Exploitation of any Covered Products and Services.

|

|

4.5

|

Covenant-Not-to-Sue by PAYPAL. Subject to the obligations of LML under this Agreement, PAYPAL, on behalf of itself and its respective successors and permitted assigns, agree that they will not assert, pursue, maintain, encourage, support, assist, or join in any action or litigation asserting any claim against any LML Entity in the future for any claims related to or arising out of the LML Patents, unless any claims of Infringement with respect to the LML Patents are asserted against PAYPAL or its successors or assigns or any Covered Third Party, or unless otherwise allowed under Section 2.3 (No Attempt to Invalidate).

|

|

5.

|

GRANT OF LICENSE

|

|

5.1

|

LML grants PAYPAL a nonexclusive, worldwide, fully-paid up license, under the LML Patents to Exploit any Covered Products and Services directly or indirectly through any channel, including through multiple tiers of distribution. The license grant herein also extends to Covered Third Parties solely in their role as Covered Third Parties.

|

|

6.

|

CHANGE IN CONTROL/ACQUISITIONS

|

|

6.1

|

Acquisitions by PAYPAL. In the event PAYPAL Acquires any Excluded Banks after the Effective Date of this Agreement (hereinafter referred to as “Acquired Entity”), the Acquired Entity shall not gain the benefit of the license grant, covenant-not-to-sue, or releases in this Agreement.

|

|

6.2

|

Transfer of Covered Assets of PAYPAL. PAYPAL may assign this Agreement, without the consent of LML, to any successor, except to any Excluded Banks, later acquiring a controlling interest in all, or substantially all, of the business or assets of PAYPAL. The assignment of this Agreement to any such successor provides the successor only with the rights to LML Patents that PAYPAL had prior to the change in control and does not extend this license to any Covered Products and Services made, used, or sold by the successor other than those acquired from PAYPAL.

|

-9-

|

6.3

|

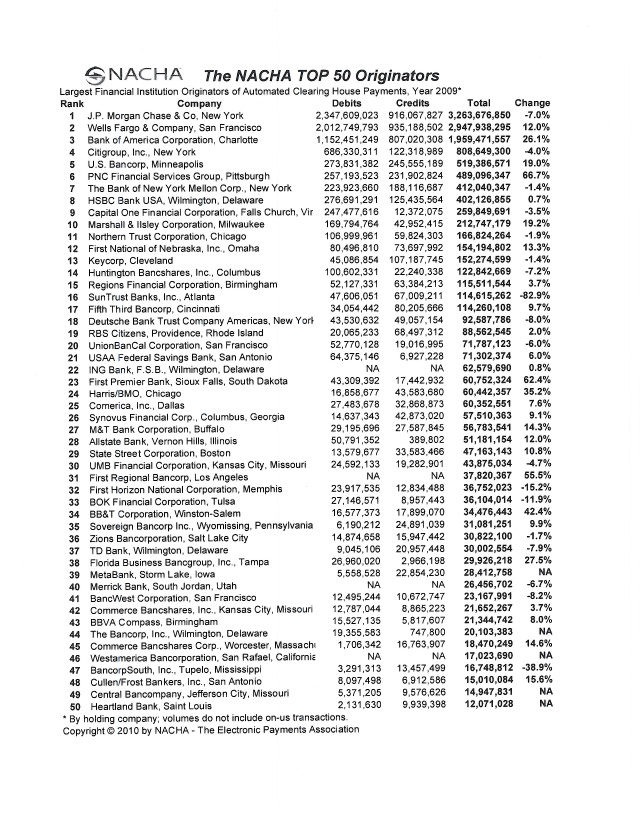

PAYPAL represents that as of the Effective Date, PAYPAL is not in any negotiations or discussions with any banks identified in the 2009 NACHA Top 50 Originators List (attached as Exhibit B) regarding any acquisition by PAYPAL of any such banks or any acquisition by any such banks of PAYPAL.

|

|

7.

|

CONFIDENTIALITY.

|

The Parties may disclose the existence of this Agreement, provided, that neither Party may disclose the specific terms and conditions of this Agreement (including without limitation the payment amount set out in Section 3.1) to any Entity except that each Party may disclose the terms and conditions of this Agreement: (i) in response to a valid subpoena or as otherwise may be required by law, regulation, or order of a court or governmental authority of competent jurisdiction, provided that the Party required to make such a disclosure gives as much notice as is reasonably possible to the other Party to contest such order or requirement and takes all reasonable actions in an effort to minimize the nature and extent of such disclosure; (ii) on a confidential basis to its legal, accounting or financial advisors solely for the purposes of providing such advice and solely to the extent that they have a need for access; (iii) if that Party forms a good faith belief that disclosure is required under applicable securities regulations or listing agency requirements, including for the purpose of disclosure in connection with the Securities and Exchange Act of 1934, as amended, the Securities Act of 1933, as amended, National Instrument NI 51-102 (under Canadian law), as amended, and any other reports filed with the Securities and Exchange Commission, or any other filings, reports or disclosures that may be required under applicable laws or regulations; (iv) in its financial statements as it is required to do under applicable generally accepted accounting principles while acting in reliance on its auditors; (v) to any defendant as part of its disclosure obligations subject to the Court's Protective Order in the applicable litigation brought by LML to enforce an LML Patent, in which event LML will seek to have the production protected under an “Outside Counsel Attorneys Eyes Only” or higher confidentiality designation and LML will take all reasonable actions in an effort to minimize the nature and extent of such disclosure; (vi) upon the express written consent of the other Party; (vii) on a confidential basis to investors and potential investors and acquirers, but subject to any such investor or potential investor or acquirer having first executed an appropriate non-disclosure agreement requiring such investor or potential investor or acquirer to maintain this Agreement and the terms and conditions of this Agreement in confidence; or (viii) as necessary to pursue an indemnification claim from a potential or actual indemnitor, subject to obligations of confidentiality and privilege at least as stringent as those contained herein; and (ix) to a Covered Third Party, subject to obligations of confidentiality and privilege at least as stringent as those contained herein.

|

8.

|

REPRESENTATIONS AND WARRANTIES

|

|

8.1

|

PAYPAL Representations and Warranties. PAYPAL represents and warrants to LML that it has all requisite legal right, power and authority to enter into, execute, deliver and perform this Agreement and grant the releases, covenants not to sue and all other rights provided for under this Agreement.

|

-10-

|

8.2

|

LML Representations and Warranties. LML represents and warrants that: (a) LML is the sole owner of and has good and valid right, title and interest to the LML Patents; (b) LML has the full right, power, and authority to license the LML Patents to PAYPAL and grant the releases and covenants herein, and this Agreement constitutes the legal, valid, and binding obligation of LML, enforceable against LML, in accordance with its terms; (c) other than LML, no other person or entity owns or controls any interest in the LML Patents; and (d) it has not entered into and shall not enter into any agreement in conflict with this Agreement or which would interfere with or diminish the rights granted hereunder.

|

|

8.3

|

Limitations on Representations and Warranties. Nothing contained in this Agreement shall be construed as: (a) a warranty or representation by either Party that any manufacture, sale, use, or other disposition of products by the other Party has been or will be free from Infringement of any patents other than the LML Patents; (b) an agreement by either Party to bring or prosecute actions or suits against any Entity for Infringement, or conferring any right to the other Party to bring or prosecute actions or suits against third parties for Infringement; (c) conferring any right to either Party to use in advertising, publicity, or otherwise, any trademark, service mark, or trade dress of the other Party, or any simulation thereof, without the prior written consent of the other Party; (d) conferring any right to either Party to use any names or trade names of the other Party, or any simulation thereof, without the prior written consent of the other Party; (e) an obligation to furnish any technical information or know-how; or (f) conferring by implication, estoppel or otherwise, upon either party, any right (including a license) under patents other than the LML Patents except for the rights expressly granted hereunder.

|

|

8.4

|

DISCLAIMER OF WARRANTIES. EXCEPT FOR THE EXPRESS WARRANTIES SET FORTH IN THIS AGREEMENT, THE PARTIES MAKE NO EXPRESS REPRESENTATIONS AND GRANT NO WARRANTIES, EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, BY STATUE OR OTHERWISE.

|

|

8.5

|

No Joint and Several Liability. Notwithstanding anything herein to the contrary, PAYPAL and the Covered Third Parties shall not have any liability to any of the LML Entities for any actions or inactions of another defendant in the Lawsuits, or any other Entity against whom any of the LML Entities has asserted or may assert a claim for Infringement of a LML Patent.

|

-11-

|

8.6

|

No Admission. This Agreement is the result of a compromise and settlement to avoid the expense and risk of resolving any dispute through continuation of any litigation. Nothing herein shall be deemed as an admission to any party of any fact, wrongdoing, liability, infringement or non-infringement, of the validity or invalidity, or enforceability or non-enforceability of any of the LML Patents or Canadian Patent Number 2,199,942 or any position taken or proposed to be taken in any proceeding, nor shall it be deemed an admission as to any royalties (or the reasonableness of any royalties) or valuation for any of the technologies, patents, patent applications or other intellectual property rights covered by or under or referred to in this Agreement.

|

|

9.

|

GENERAL PROVISIONS

|

|

9.1

|

Assignment. LML may assign, sell, or otherwise transfer any of the right to LML Patents, but only to an assignee or transferee who shall first agree in writing to assume the obligations of LML under this Agreement and to observe all rights of PAYPAL provided in this Agreement. Any attempted assignment or grant in contravention to this Section shall be null and void.

|

|

9.2

|

Entire Agreement. This Agreement, including all Exhibits attached hereto, constitutes the entire agreement between the Parties and embodies the entire and only understanding of each of them with respect to the subject matter of the Agreement, and merges, cancels and supersedes all prior representations, warranties, assurances, conditions, definitions, understandings and all other statements or agreements, whether express, implied, or arising out of operation of law, whether oral or written, whether by omission or commission, between and among the Parties hereto with respect to the subject matter of the Agreement. There are no representations, warranties, terms, conditions, undertakings or collateral agreements, express, implied or statutory, between the Parties other than as expressly set forth in this Agreement.

|

|

9.3

|

Notices. All notices, requests, approvals, consents and other communications required or permitted under this Agreement will be in writing and addressed as follows:

|

If to LML:

Mr. Patrick H. Gaines

President

LML Patent Corp

505 East Travis St.

Suite 216

Marshall, Texas 75670

-12-

with a copy to:

LML Patent Corp.

Corporate Secretary

1680- 1140 West Pender Street

Vancouver BC, Canada V6E 4G1

If to PAYPAL:

General Counsel

Legal Dept.

eBay Inc.

2145 Hamilton Avenue

San Jose, CA 95125

and will be deemed delivered: (a) upon receipt if delivered by hand; (b) the next day if sent by prepaid, U.S. recognized, overnight air courier; (c) three (3) business days after being sent by registered or certified mail (return receipt requested, postage prepaid). All notices shall be addressed to the other Party at the address set forth above or to such other person or address as the Parties may from time to time designate in writing delivered pursuant to this notice provision.

|

9.4

|

Governing Law. This Agreement and all matters connected with the performance thereof shall be governed by and will be construed, interpreted, and applied in accordance with the laws of the State of Delaware and the federal laws of the United States as applicable therein, without regard to the laws of those jurisdictions governing conflicts of laws.

|

|

9.5

|

Expenses. Except as otherwise specifically provided in this Agreement, the Parties agree that they shall bear their own costs and attorneys’ fees incurred in connection with the negotiation and drafting of this Agreement and the transactions contemplated herein.

|

|

9.6

|

Headings. The section and sub-section headings contained in this Agreement are for convenience of reference only and shall not serve to limit, expand or interpret the sections or sub-sections to which they apply, and shall not be deemed to be a part of this Agreement.

|

|

9.7

|

Disputes. In the event of a breach or any dispute arising out of the performance of this agreement, the aggrieved party shall provide notice to the other party and permit a 60 period to cure. If cure is not made during the 60 day cure period, the aggrieved party may pursue available legal remedies.

|

-13-

|

9.8

|

Interpretation; Construction. The Parties have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as if jointly drafted by the Parties and no presumption or burden of proof shall arise favoring or disfavoring either Party by virtue of the authorship of any provision of this Agreement. This Agreement is in the English language only, which language shall be controlling in all respects, and all notices under this Agreement shall be in the English language. For purposes of construction, the singular includes the plural and vice versa.

|

|

9.9

|

Relationship of the Parties. This Agreement does not constitute and shall not be construed as constituting a partnership, agency, employer-employee, or joint venture between LML and PAYPAL, and neither Party shall have any right to incur any debt, make any commitment for each other, or obligate or bind the other Party in any manner whatsoever, and nothing herein contained shall give or is intended to give any rights of any kind to any third persons, except as expressly provided herein. LML and PAYPAL each expressly disclaim any reliance on any act, word, or deed of the other in entering into this Agreement.

|

|

9.10

|

Binding Effect. Subject to the provisions of Section 6 (Change in Control/Acquisitions), this Agreement shall be binding upon, inure to the benefit of, and be enforceable by the Parties, the licensees and releasees referenced herein, and their predecessors, successors, and permitted assigns.

|

|

9.11

|

Enforceability. The Parties acknowledge and agree that this Agreement is enforceable according to its terms.

|

|

9.12

|

Severability. In the event that any term or provision of this Agreement is deemed illegal, invalid, unenforceable or void by a final, non-appealable judgment of a court or tribunal of competent jurisdiction under any applicable statute or rule of law, such court or tribunal is authorized to modify such provision to the minimum extent possible to effect the overall intention of the Parties as of the Effective Date of this Agreement. The Parties agree to negotiate in good faith to try and substitute an enforceable provision for any invalid or unenforceable provision that most nearly achieves the intent of such provisions.

|

|

9.13

|

Counterparts. This Agreement may be executed in two or more counterparts or duplicate originals, each of which shall be considered one and the same instrument, and which shall be the official and governing version in interpretation of this Agreement. This Agreement may be executed by facsimile signatures or emailed pdf copies of signatures, and such signatures shall be deemed to bind each Party as if they were original signatures.

|

-14-

|

9.14

|

Waiver. No waiver of any breach of any provision of this Agreement shall be construed as a waiver of or consent to any previous or subsequent breach of the same or any other provision.

|

|

9.15

|

Force Majeure. The failure of a Party hereunder to perform any obligations, due to governmental action, law or regulation, or due to events, such as war, act of public enemy, strikes or other labor disputes, fire, flood, acts of God, or any similar cause beyond the reasonable control of such Party, is excused for as long as said cause continues to exist. The Party prevented from performing shall promptly notify the other Party of such non-performance and its expected duration, and shall use all reasonable efforts to overcome the cause thereof as soon as practicable.

|

|

9.16

|

Amendment. This Agreement may not be amended or modified, except by a writing signed by all Parties.

|

|

9.17

|

Sophisticated Parties Represented by Counsel. The Parties each acknowledge, accept, warrant, and represent that: (i) they are sophisticated Entities represented at all relevant times during the negotiation and execution of this Agreement by counsel of their choice, and that they have executed this Agreement with the consent and on the advice of such independent legal counsel; and (ii) they and their counsel have determined through independent investigation and arm’s-length negotiation that the terms of this Agreement shall exclusively embody and govern the subject matter of this Agreement.

|

IN WITNESS WHEREOF, the Parties have caused this Agreement to be executed by their duly authorized officers as of the Effective Date.

|

LML Patent Corp.

|

eBay Inc.

|

|

|

By:/s/ Patrick H. Gaines

|

By:/s/ Mike Jacobson

|

|

|

Name: Patrick H. Gaines

|

Name: Mike Jacobson

|

|

|

Title: President

|

Title: SVP, Legal Affairs and General Counsel

|

|

|

Date: March 16, 2011

|

Date: March 16, 2011

|

-15-

EXHIBIT A

STIPULATED DISMISSAL WITH PREJUDICE

and

ORDER OF DISMISSAL WITH PREJUDICE

(see attached)

IN THE UNITED STATES DISTRICT COURT

FOR THE EASTERN DISTRICT OF TEXAS

MARSHALL DIVISION

|

LML PATENT CORP,

|

§

|

|

|

§

|

||

|

PLAINTIFF

|

§

|

|

|

§

|

||

|

v.

|

§

|

CIVIL ACTION NO. 2:08-CV-448-DF

|

|

§

|

||

|

§

|

JURY

|

|

|

JP MORGAN CHASE & CO., ET AL.,

|

§

|

|

|

§

|

||

|

DEFENDANTS

|

§

|

STIPULATED DISMISSAL WITH PREJUDICE

Pursuant to Rule 41(a) of the Federal Rules of Civil Procedure and the terms of a separate Settlement and License Agreement, the Plaintiff, LML Patent Corp. (“LML”) and Defendant PayPal, Inc. (“PayPal”) have agreed to settle, adjust, and compromise all claims and counterclaims against each other in the above-captioned action. The parties, therefore, stipulate to dismiss all claims by LML against PayPal and all counterclaims by PayPal against LML made therein with prejudice to the re-filing of same, subject to the terms of the Settlement and License Agreement between the parties.

LML and PayPal further stipulate that all costs and expenses relating to this litigation (including, but not limited to, attorneys’ fees and expert fees and expenses) shall be borne solely by the party incurring the same.

A proposed Order accompanies this motion.

-1-

AGREED:

|

Date: March 9, 2011

|

Respectfully submitted,

|

|

|

By: /s/

|

||

|

Robert W. Schroeder III

|

||

|

SBN 24029190

|

||

|

tschroeder@texarkanalaw.com

|

||

|

PATTON, TIDWELL & SCHROEDER, L.L.P.

|

||

|

4605 Texas Boulevard

|

||

|

Post Office Box 5398

|

||

|

Texarkana, Texas 75505-5398

|

||

|

Telephone: 903-792-7080

|

||

|

Facsimile: 903-792-8233

|

||

|

Edward G. Poplawski

|

||

|

Admitted pro hac vice

|

||

|

epoplawski@sidley.com

|

||

|

Bryan K. Anderson

|

||

|

Admitted pro hac vice

|

||

|

banderson@sidley.com

|

||

|

Jeffrey A. Finn

|

||

|

Admitted pro hac vice

|

||

|

jfinn@sidley.com

|

||

|

Sandra Fujiyama

|

||

|

Admitted pro hac vice

|

||

|

sfujiyama@sidley.com

|

||

|

Olivia M. Kim

|

||

|

Admitted pro hac vice

|

||

|

okim@sidley.com

|

||

|

Michael Lee

|

||

|

Admitted pro hac vice

|

||

|

Mlee06@sidley.com

|

||

|

SIDLEY AUSTIN LLP

|

||

|

555 West Fifth Street

|

||

|

Suite 4000

|

||

|

Los Angeles. CA 90013

|

||

|

Telephone: 213-896-6000

|

||

|

Facsimile: 213-896-6600

|

||

|

ATTORNEYS FOR DEFENDANT

PAYPAL INC.

|

||

|

and

|

-2-

|

/s/ Melissa Smith

|

||

|

Melissa Smith

|

||

|

Texas State Bar No. 00794818

|

||

|

GILLAM & SMITH, LLP

|

||

|

303 South Washington

|

||

|

Marshall, Texas 75670

|

||

|

Telephone: 903-934-8450

|

||

|

Facsimile: 903-934-9257

|

||

|

Melissa@gillamsmithlaw.com

|

||

|

Theodore Stevenson, III

|

||

|

Lead Attorney

|

||

|

Texas Bar No. 19196650

|

||

|

tstevensom@mckoolsmith.com

|

||

|

John Austin Curry

|

||

|

Texas State Bar No. 24059636

|

||

|

acurry@mckoolsmith.com

|

||

|

McKool Smith, P.C.

|

||

|

300 Crescent Court, Suite 1500

|

||

|

Dallas, Texas 75201

|

||

|

Telephone: 214-978-4974

|

||

|

Facsimile: 214-978-4044

|

||

|

Sam F. Baxter

|

||

|

Texas Bar No. 01938000

|

||

|

sbaxter@mckoolsmith.com

|

||

|

McKOOL SMITH, P.C.

|

||

|

505 East Travis Street, Suite 105

|

||

|

Marshall, TX 75670

|

||

|

Telephone: 903-927-2111

|

||

|

Facsimile: 903-927-2622

|

||

|

John Garvish

|

||

|

Texas State Bar No. 24043681

|

||

|

jgarvish@mckoolsmith.com

|

||

|

McKool Smith, P.C.

|

||

|

300 W. 6th Street, Suite 1700

|

||

|

Austin, Texas 78701

|

||

|

Telephone: 512-692-8725

|

||

|

Facsimile: 512-692-8744

|

||

|

ATTORNEYS FOR PLAINTIFF

LML PATENT CORP.

|

-3-

IN THE UNITED STATES DISTRICT COURT

FOR THE EASTERN DISTRICT OF TEXAS

MARSHALL DIVISION

|

LML PATENT CORP,

|

§

|

|

|

§

|

||

|

PLAINTIFF

|

§

|

|

|

§

|

||

|

v.

|

§

|

CIVIL ACTION NO. 2:08-CV-448-DF

|

|

§

|

||

|

§

|

JURY

|

|

|

JP MORGAN CHASE & CO., ET AL.,

|

§

|

|

|

§

|

||

|

DEFENDANTS

|

§

|

ORDER OF DISMISSAL WITH PREJUDICE

The Court is of the opinion that the Stipulated Dismissal with Prejudice agreed to by LML Patent Corp. (“LML”) and PayPal, Inc. (“PayPal”) should be GRANTED.

IT IS THEREFORE ORDERED that the above-entitled cause and all claims made by LML against PayPal and all counterclaims made by PayPal against LML therein are hereby DISMISSED WITH PREJUDICE to the re-filing of same, subject to the terms of the Settlement and License Agreement between the parties. All costs and expenses relating to this litigation (including, but not limited to, attorneys’ fees and expert fees and expenses) shall be borne solely by the party incurring the same.

IT IS FURTHER ORDERED that this Court shall retain jurisdiction over this action and the parties for purposes of enforcing the terms of the Settlement and License Agreement entered into by and between the parties.

This is a final judgment as between LML and PayPal.

-1-

EXHIBIT B

The NACHA Top 50 Originators

(see attached)