Attached files

| file | filename |

|---|---|

| 8-K - TRUSTCO BANK CORP NY 8-K 6-15-2011 - TRUSTCO BANK CORP N Y | form8k.htm |

Exhibit 99(a)

1

TrustCo Bank Corp NY

NASDAQ: TRST

June 2011

2

Forward Looking Statements

Safe Harbor Regarding Forward-Looking Statements

This presentation may contain forward-looking information about TrustCo Bank Corp NY (“the Company”) that is intended to be covered by the safe harbor for

forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Actual results and trends could differ materially from those set

forth in such statements due to various risks, uncertainties and other factors. Such risks, uncertainties and other factors that could cause actual results and

experience to differ from those projected include, but are not limited to, the following: credit risk, the effects of and changes in, trade, monetary and fiscal

policies and laws, inflation, interest rates, market and monetary fluctuations, competition, the effect of changes in financial services laws and regulations, real

estate and collateral values, changes in accounting policies and practices, changes in local market areas and general business and economic trends and the matters

described under the heading “Risk Factors” in the prospectus supplement and prospectus for the offering to which this communication relates, our most recent

annual report on Form 10-K and our other securities filings. The statements are valid only as of the date hereof and the Company disclaims any obligation to

update this information except as may be required by applicable law.

forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Actual results and trends could differ materially from those set

forth in such statements due to various risks, uncertainties and other factors. Such risks, uncertainties and other factors that could cause actual results and

experience to differ from those projected include, but are not limited to, the following: credit risk, the effects of and changes in, trade, monetary and fiscal

policies and laws, inflation, interest rates, market and monetary fluctuations, competition, the effect of changes in financial services laws and regulations, real

estate and collateral values, changes in accounting policies and practices, changes in local market areas and general business and economic trends and the matters

described under the heading “Risk Factors” in the prospectus supplement and prospectus for the offering to which this communication relates, our most recent

annual report on Form 10-K and our other securities filings. The statements are valid only as of the date hereof and the Company disclaims any obligation to

update this information except as may be required by applicable law.

The Company has filed a registration statement (including a prospectus and a related prospectus supplement) with the SEC (File No. 333-174331) for the offering

to which this communication relates. Before you invest, you should read the prospectus and the prospectus supplement in that registration statement, the

preliminary prospectus supplement and other documents that the Company has filed with the SEC for more complete information about the Company and the

offering. You may obtain these documents without charge by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, copies of the preliminary

prospectus supplement and the prospectus relating to the offering may be obtained from Sandler O'Neill + Partners, L.P., 919 Third Avenue, 6th Floor, New

York, NY 10022, (866) 805-4128 or and Stifel, Nicolaus & Company, Incorporated at (443) 224-1988.

to which this communication relates. Before you invest, you should read the prospectus and the prospectus supplement in that registration statement, the

preliminary prospectus supplement and other documents that the Company has filed with the SEC for more complete information about the Company and the

offering. You may obtain these documents without charge by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, copies of the preliminary

prospectus supplement and the prospectus relating to the offering may be obtained from Sandler O'Neill + Partners, L.P., 919 Third Avenue, 6th Floor, New

York, NY 10022, (866) 805-4128 or and Stifel, Nicolaus & Company, Incorporated at (443) 224-1988.

3

Issuer: TrustCo Bank Corp NY (the "Company“ or “TRST”)

Ticker/Exchange: TRST / NASDAQ Global Select Market

Offering: Follow-on Public Offering

Type of Security: Common Stock

Transaction Size: 13,600,000 shares, or approximately $75 million¹

Over-Allotment Option: 15%

Use of Proceeds: General corporate purposes, to fund organic growth

Sole Book-Running Manager: Sandler O’Neill + Partners, L.P.

Co-Manager: Stifel Nicolaus Weisel

(1) Based on TRST closing stock price of $5.52 on June 7, 2011

Offering Terms

4

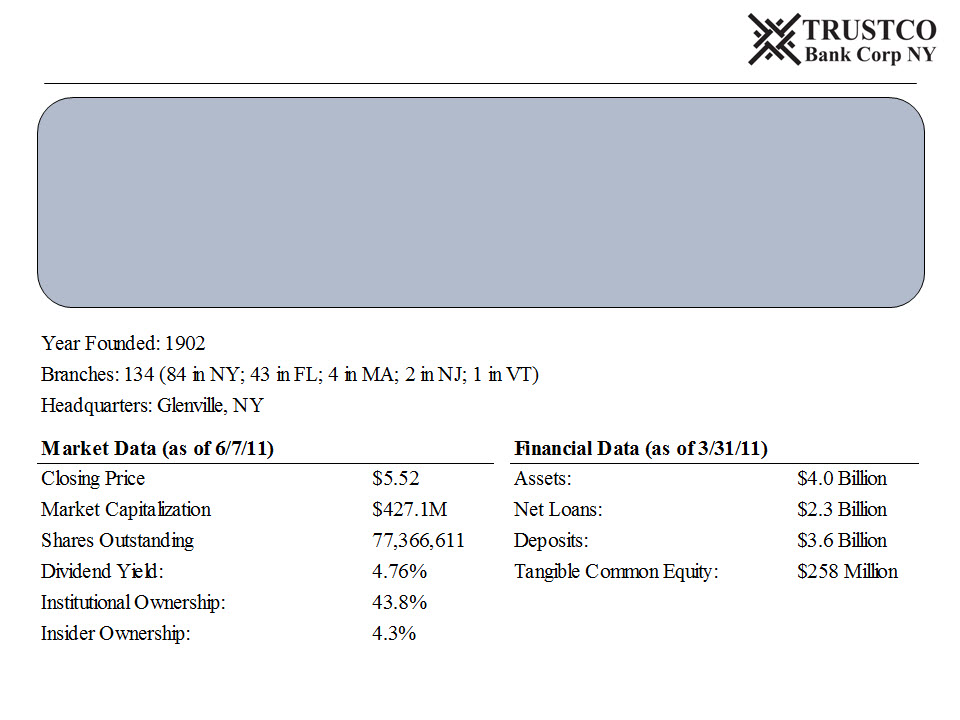

ü New York community-focused financial services company with market presence in

Florida, Massachusetts, New Jersey and Vermont

Florida, Massachusetts, New Jersey and Vermont

ü Provides core banking products and services to retail customers and local

businesses

businesses

ü Strategy of building solid deposit franchise with low cost, core deposit base has led

to strong, consistent balance sheet growth

to strong, consistent balance sheet growth

Market data based on TRST closing stock price of $5.52 on June 7, 2011

Source: SNL Financial

TrustCo Bank Corp NY

5

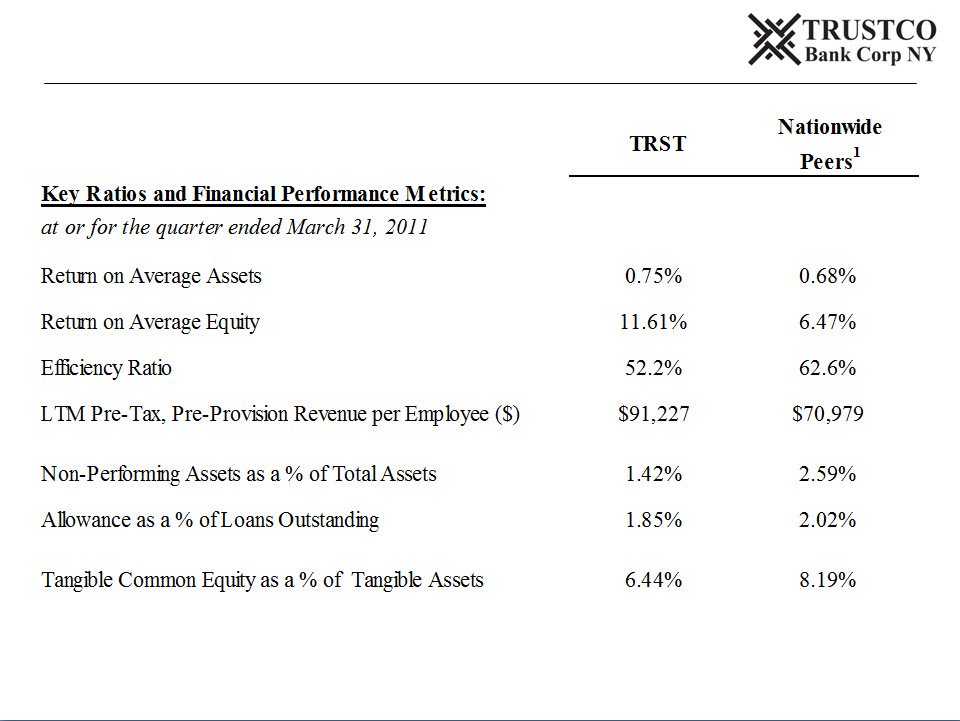

(1) Nationwide peers include publicly-traded banks and thrifts with assets between $2 billion and $10 billion (excludes mutuals and pending acquisition targets) as of March 31, 2011

Note: Nationwide Peers reflects median value of group

Source: SNL Financial, SEC Filings

Key Financial Attributes

6

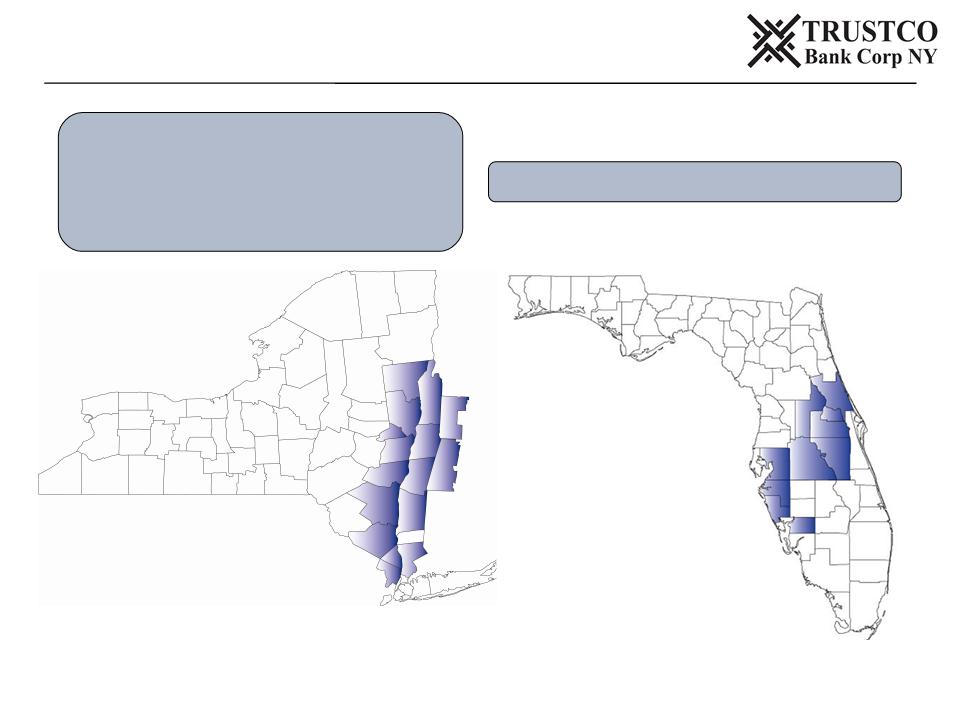

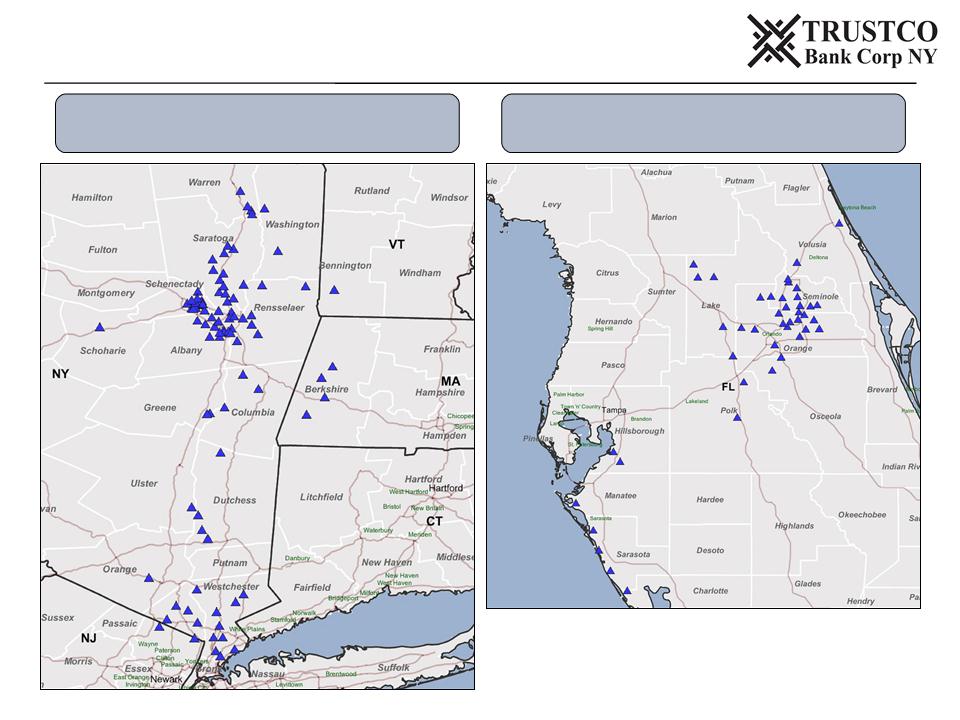

4 De novo expansion has driven the growth of TrustCo over the last decade

4 Over $4.0 billion in assets focused in three major geographic regions:

o Upstate New York: TrustCo’s historical market area, centered around New York’s Capital Region

o Downstate New York: Covers the lower and mid-Hudson River Valley and includes two branches in New

Jersey

Jersey

o Florida Market: Focus primarily around the greater Orlando area, with a second cluster of branches in

Florida’s West Coast communities to the south of Tampa

Florida’s West Coast communities to the south of Tampa

4 Leader in deposit market share for any New York-headquartered bank in the Albany-Schenectady-

Troy, NY MSA with $2.4 billion in deposits1

Troy, NY MSA with $2.4 billion in deposits1

4 From 2003 to 2010, one of the fastest growing community banks in central Florida with 43 new

branches and 71.8% deposit compound annual growth rate²

branches and 71.8% deposit compound annual growth rate²

4 TrustCo Bank Corp NY, organized in 1981 to acquire all of the outstanding stock of Trustco Bank,

N.A., formerly known as Trustco Bank New York, and prior to that, The Schenectady Trust

Company

N.A., formerly known as Trustco Bank New York, and prior to that, The Schenectady Trust

Company

o Schenectady Trust was chartered in 1902

(1) As of June 30, 2010

(2) Measured from June 30, 2003 to June 30, 2010. Includes deposit market share in the following counties in Florida where TrustCo has a branch presence: Charlotte, Hillsborough, Lake, Manatee,

Orange, Osceola, Polk, Sarasota, Seminole and Volusia

Orange, Osceola, Polk, Sarasota, Seminole and Volusia

Source: FDIC, SNL Financial

Company Overview

7

Source: Company Documents

New York - 14 Counties, 84 Branches

Massachusetts - 1 County, 4 Branches

New Jersey - 1 County, 2 Branches

Vermont - 1 County, 1 Branch

Florida - 10 Counties, 43 Branches

Branch Franchise Overview

8

Source: SNL Financial

Upstate and Downstate

New York Market Branches

New York Market Branches

Florida Market Branches

Branch Franchise Details

9

ü Deposit and Loan Portfolio Growth

ü Superior Asset Quality

ü Increasing Market Share in Newer

Markets

Markets

4 Generated through our expanded branch network

4 Intense customer service focus

4 Simple, low cost products

4 Centralized portfolio lending process

4 Conservative lending criteria

4 History of strong portfolio management

4 43 new branches and 71.8% deposit compound

annual growth rate in central Florida from 2003

to 2010¹

annual growth rate in central Florida from 2003

to 2010¹

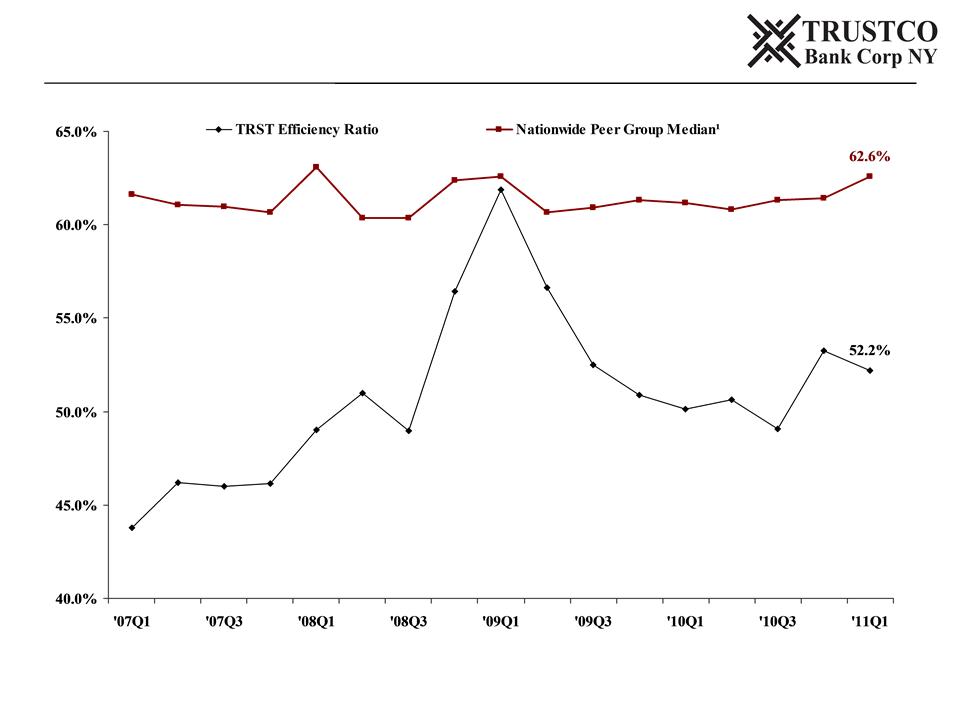

ü Improving Efficiency Ratio

4 Effective cost controls producing superior

results, compared with peers

results, compared with peers

(1) Measured from June 30, 2003 to June 30, 2010. Includes deposit market share in the following counties in Florida where TrustCo has a branch presence: Charlotte, Hillsborough, Lake,

Manatee, Orange, Osceola, Polk, Sarasota, Seminole and Volusia

Manatee, Orange, Osceola, Polk, Sarasota, Seminole and Volusia

Source: FDIC, SNL Financial

Strategy and Philosophy for Continued Growth

10

|

Name

|

Title/Function

|

Years in

Banking |

Years with

TRST |

|

Robert J. McCormick

|

President & Chief Executive Officer

|

26

|

16

|

|

Robert T. Cushing

|

Executive VP & Chief Financial Officer

|

34

|

17

|

|

Scot R. Salvador

|

Executive VP & Chief Banking Officer

|

21

|

16

|

|

Robert M. Leonard

|

Senior Vice President & Corporate Secretary

|

25

|

25

|

|

Eric W. Schreck

|

Senior Vice President & Florida Regional President

|

22

|

22

|

|

Kevin Timmons

|

Vice President - Finance

|

32

|

4

|

|

Average

|

|

27

|

17

|

Experienced Senior Management

11

(1) Nationwide peers include publicly-traded banks and thrifts with assets between $2 billion and $10 billion (excludes mutuals and pending acquisition targets) as of March 31, 2011

(2) Includes all publicly traded banks and thrifts nationwide as of March 31, 2011

Source: FDIC, SNL Financial, Bureau of Labor Statistics

4 Albany-Schenectady-Troy Metropolitan Statistical Area (“MSA”) accounts for about 70% of the

total population of the Upstate market

total population of the Upstate market

o Government jobs constitute approximately 24% of nonfarm employment in the Albany-Schenectady-Troy

MSA

MSA

o In recent years, public and private universities in the area (including Rensselaer Polytechnic Institute and the

University at Albany (State University of New York)) have made significant strides in building the area’s

industry base in advanced technology fields

University at Albany (State University of New York)) have made significant strides in building the area’s

industry base in advanced technology fields

4GlobalFoundries Inc., the world’s third largest independent semiconductor manufacturer, is currently building a new $4.6

billion chip fabrication plant in Saratoga County that is expected to begin initial production in 2012

billion chip fabrication plant in Saratoga County that is expected to begin initial production in 2012

4 Low Unemployment Rate in Primary Markets

o April 2011 unemployment rate in Albany-Schenectady-Troy MSA was 6.8% compared to the national average

of 9.0%

of 9.0%

4 Non-performing loan data for TrustCo is very favorable to peer and national averages

o As of March 31, 2011, TrustCo had nonperforming loans as a % of total loans of 2.14% versus the peer

median of 3.33%¹ and 3.50% for all publicly traded banks and thrifts²

median of 3.33%¹ and 3.50% for all publicly traded banks and thrifts²

Upstate and Downstate New York Economies

12

4 TrustCo’s Florida market covers the greater Orlando area in the eastern/central part of the state,

with a second cluster of branches in Florida’s West Coast communities to the south of Tampa¹

with a second cluster of branches in Florida’s West Coast communities to the south of Tampa¹

4 Economically Diverse Region

o Medical City is a new 650 acre medical campus occupied by The University of Central Florida College of

Medicine, The Sanford Burnham Medical Research Institute, M D Anderson Cancer Research Institute and

The Nemours Childrens Hospital estimated to bring 30,000 jobs and a $7.6 billion economic impact

Medicine, The Sanford Burnham Medical Research Institute, M D Anderson Cancer Research Institute and

The Nemours Childrens Hospital estimated to bring 30,000 jobs and a $7.6 billion economic impact

o The University of Central Florida is a stable major employer as the 2nd largest university in the US

o Central Florida recently surpassed New York City as the #1 tourist destination in America²

o Central Florida and the West Coast of Florida are known as popular retirement destinations

4 Counties included in the Florida market have a total population of approximately 5.33 million, up

24.5% from the population in 2000

24.5% from the population in 2000

4 Overall, the median annual household income in these counties was $53,847 in 2010, which

represents an increase of 28.7% from 2000 data

represents an increase of 28.7% from 2000 data

(1) Florida market consists of the counties of Charlotte, Hillsborough, Lake, Manatee, Orange, Osceola, Polk, Sarasota, Seminole and Volusia

(2) The Orlando Sentinel, May 24, 2011

Source: FDIC, SNL Financial

Florida Economy

13

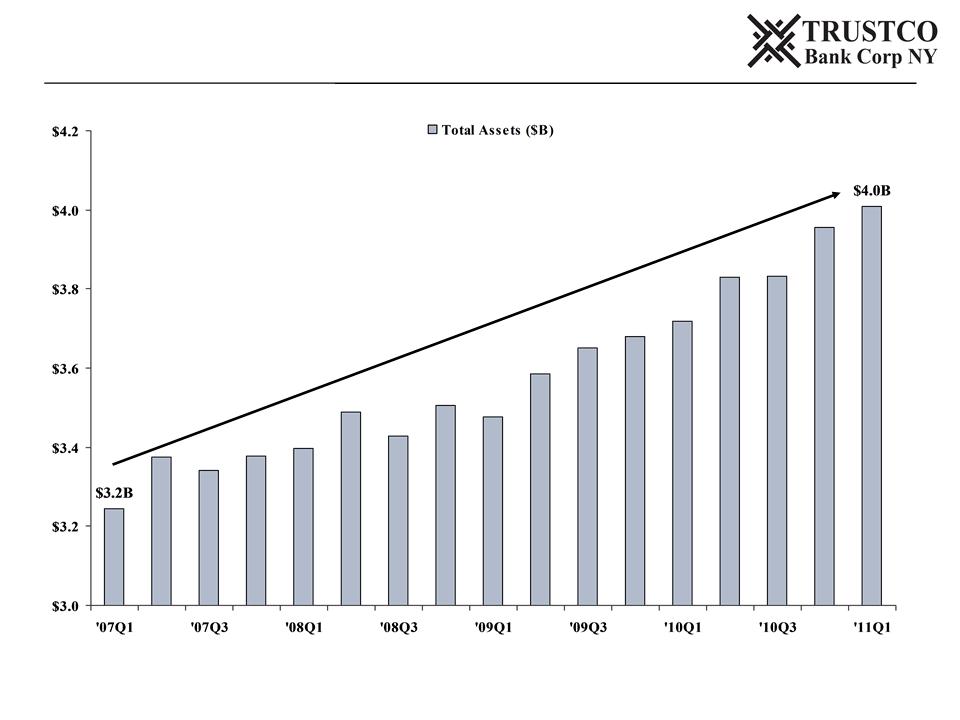

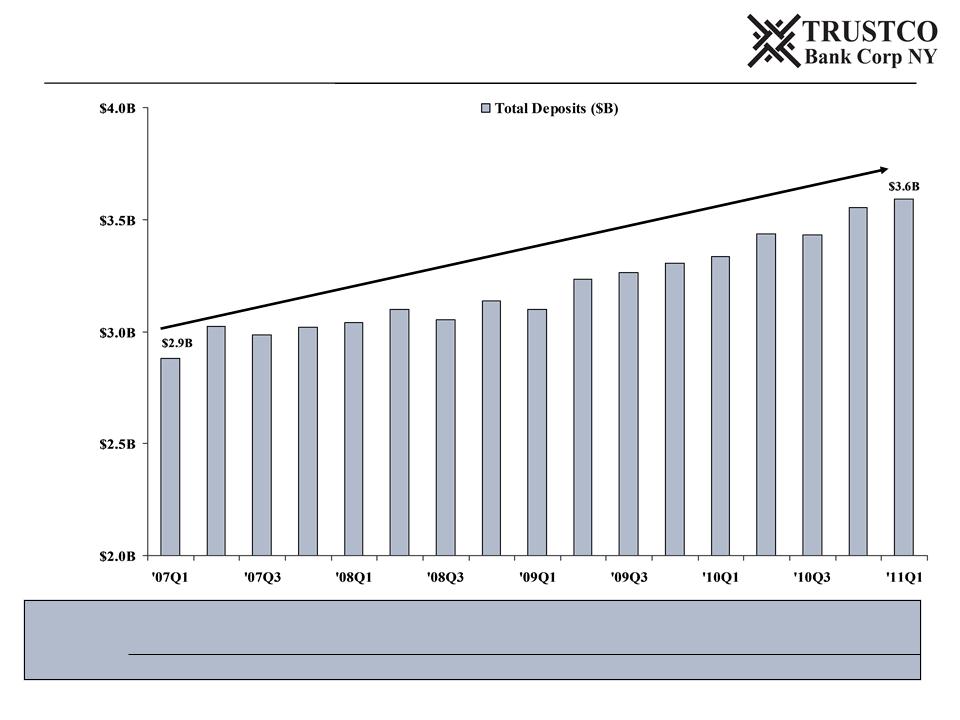

Note: For source data, see page 35 in the Appendix

Dollars in billions

Source: SEC Filings

CAGR: 5.4%

Consistent Balance Sheet Growth

14

Note: For source data, see page 35 in the Appendix

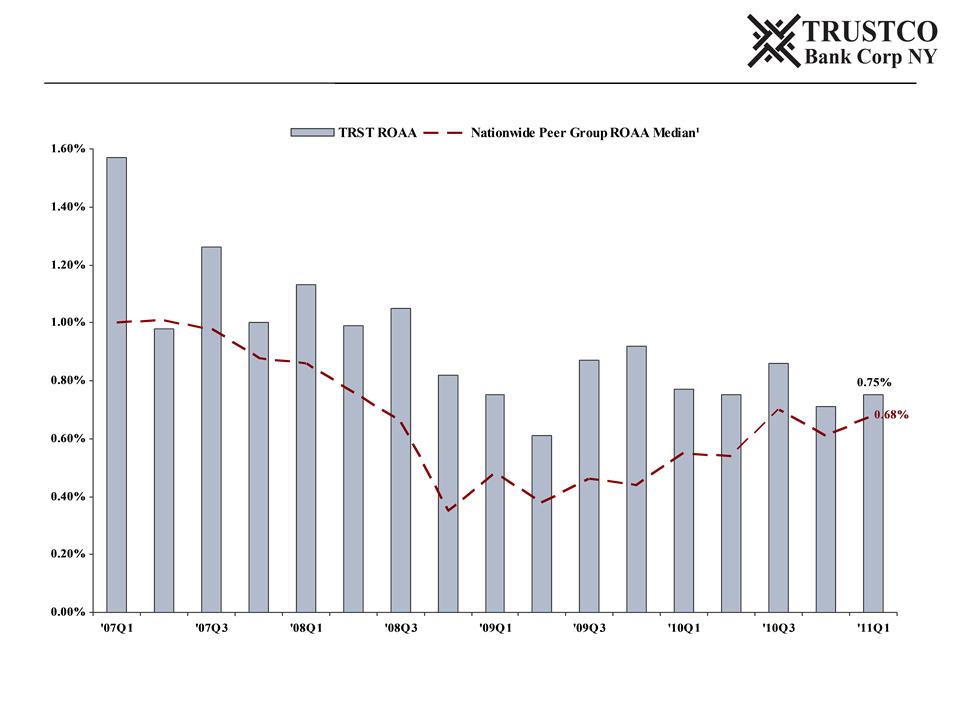

(1) Nationwide peers include publicly-traded banks and thrifts with assets between $2 billion and $10 billion (excludes mutuals and pending acquisition targets) as of March 31, 2011

Source: SEC Filings; SNL Financial

Superior ROAA Compared to Peers

15

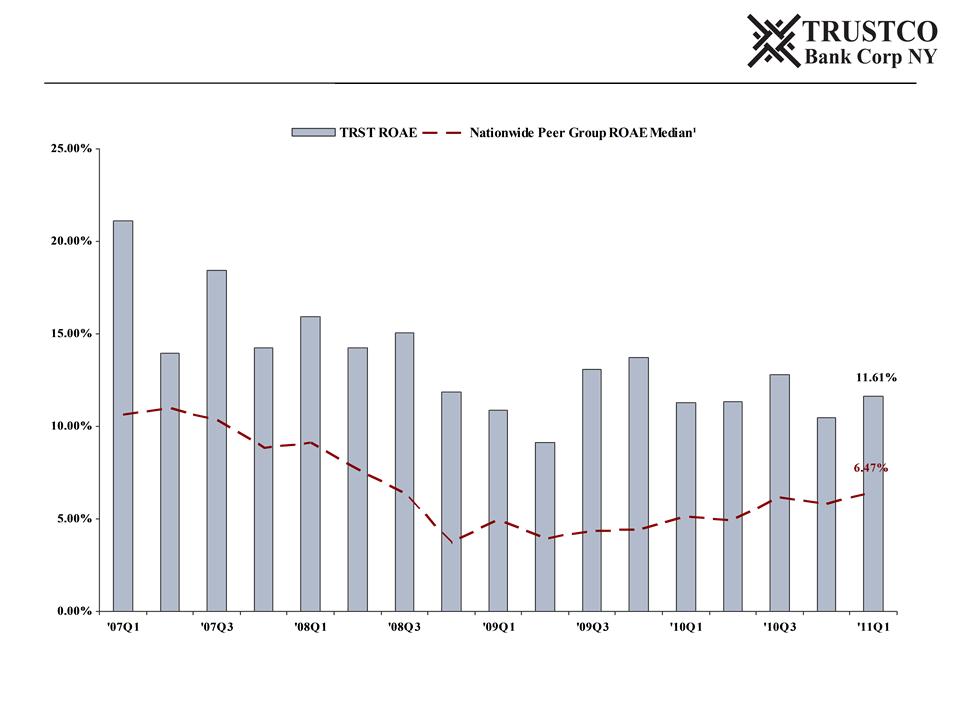

Note: For source data, see page 35 in the Appendix

(1) Nationwide peers include publicly-traded banks and thrifts with assets between $2 billion and $10 billion (excludes mutuals and pending acquisition targets) as of March 31, 2011

Source: SEC Filings; SNL Financial

Superior ROAE Compared to Peers

16

Note: For source data, see page 35 in the Appendix

(1) Nationwide peers include publicly-traded banks and thrifts with assets between $2 billion and $10 billion (excludes mutuals and pending acquisition targets) as of March 31, 2011

Source: SEC Filings; SNL Financial

Superior Efficiency Ratio Compared to Peers

17

4 Since 2000, the Company has increased its network by 80 branches, bringing the total to

134

134

4 All new branches opened on a de novo basis with no stock or debt issuances

4 Expansion included growth in or into five states, with a focus on Florida and Downstate

New York

New York

4 We have built a platform for steady and conservative growth

o Year over year deposits per branch increased $1.8 million or 7.0%¹

4 Our company now has a footprint with economic and geographic diversification

(1) Comparison from 3/31/2011 to 3/31/2010

Source: SEC Filings; Company Documents

Branch Growth Strategy

18

Note: For source data, see page 35 in the Appendix

Source: SEC Filing; Company Documents

Total Branches

107

124

132

133

134

NY Branches

83

86

90

90

91

FL Branches

24

38

42

43

43

CAGR: 5.7%

Deposit Growth and Branch Expansion

19

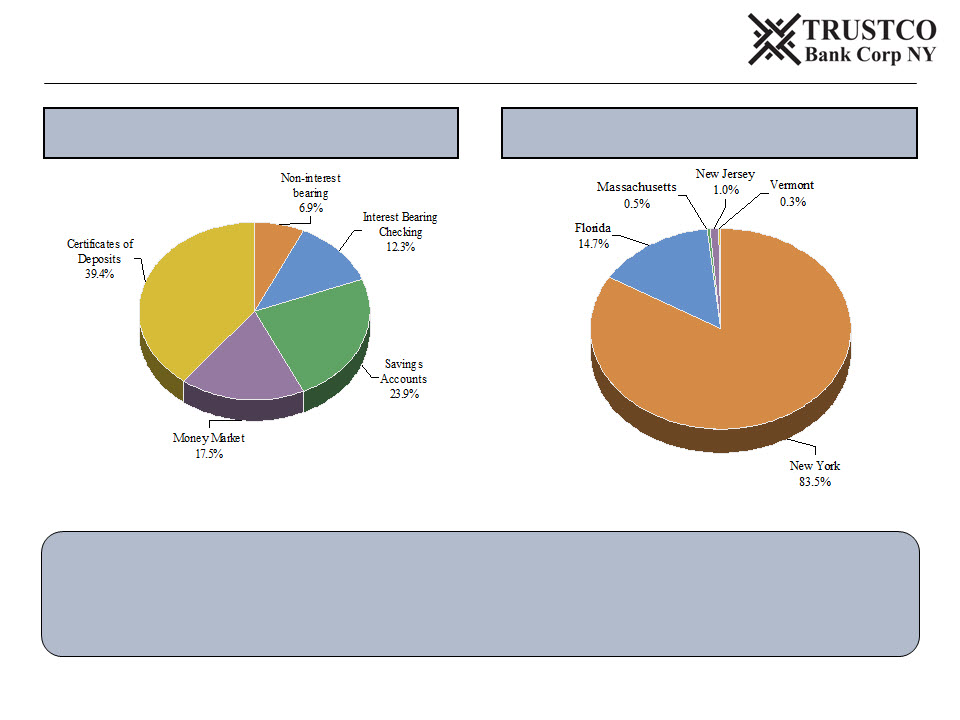

March 31, 2011

Deposit Composition by Geography

ü All deposits are gathered through branch network

ü No brokered deposits

ü No special pricing for jumbo CDs

Total Deposits: $3.6 billion

Avg. Cost of Int. Bearing Deposits: 0.82%

Note: Data as of March 31, 2011

Source: Company Documents, SEC Filings

Deposit Composition

20

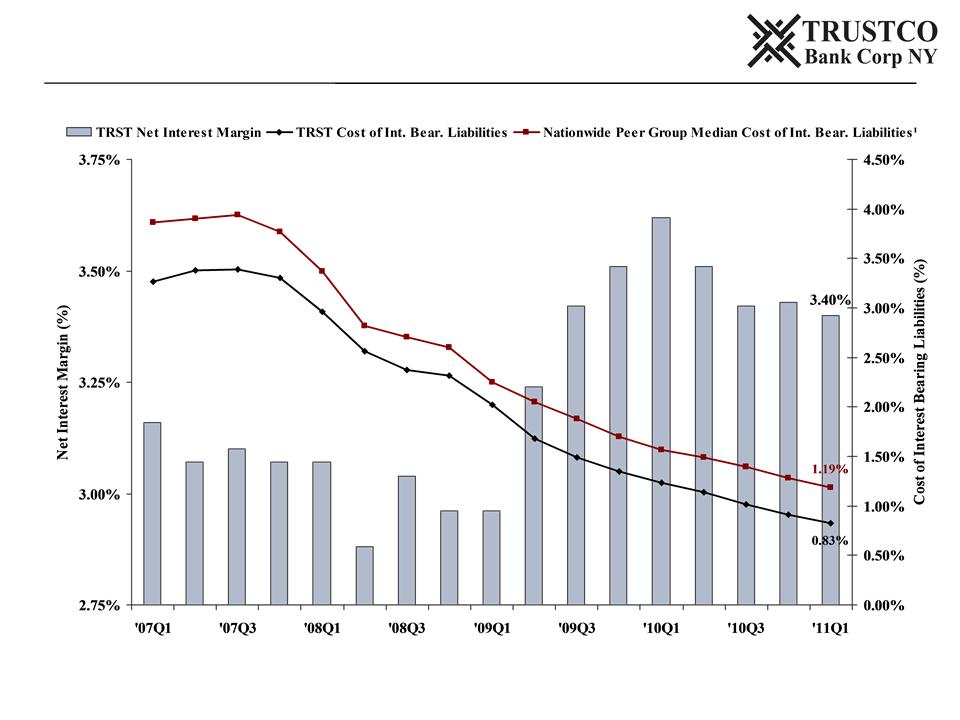

Note: For source data, see page 35 in the Appendix

(1) Nationwide peers include publicly-traded banks and thrifts with assets between $2 billion and $10 billion (excludes mutuals and pending acquisition targets) as of March 31, 2011

Source: Company Documents, SEC Filings, SNL Financial

Net Interest Margin &

Cost of Interest Bearing Liabilities

Cost of Interest Bearing Liabilities

21

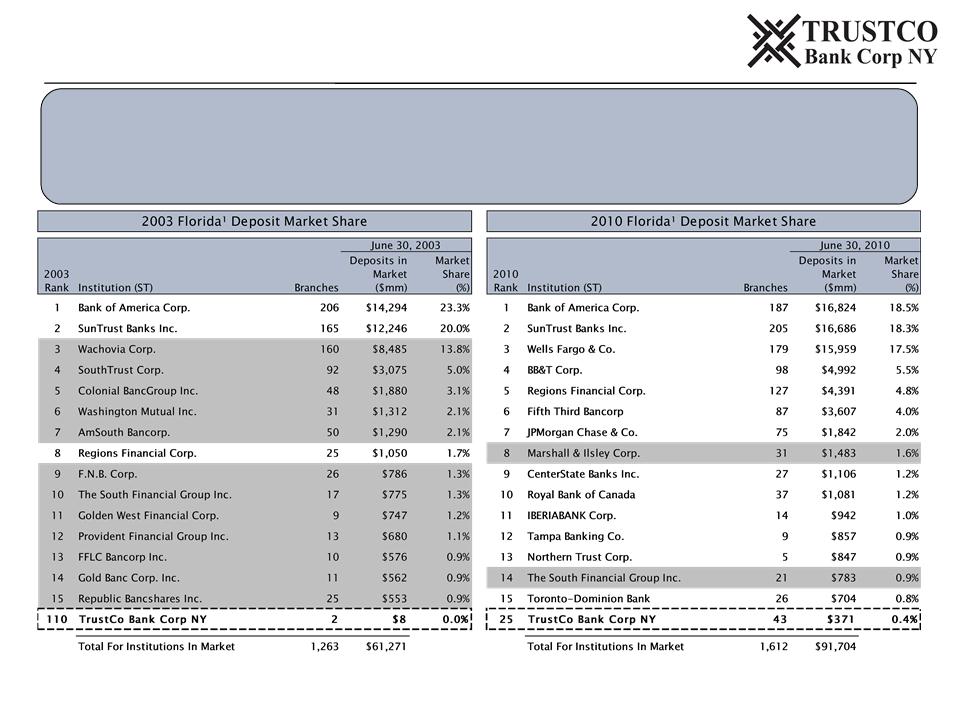

*Note: Shaded institutions represent those institutions that have either failed or been acquired

(1) As of June 30, 2010; Note: Includes deposit market share for banks and thrifts in the following counties in Florida where TrustCo has a branch presence: Charlotte, Hillsborough, Lake,

Manatee, Orange, Osceola, Polk, Sarasota, Seminole and Volusia

Manatee, Orange, Osceola, Polk, Sarasota, Seminole and Volusia

Source: SNL Financial, FDIC

ü Since 2003, TrustCo and the Florida marketplace has seen a significant number of its deposit competitors

either be acquired or fail*

either be acquired or fail*

ü During that same time, TrustCo has grown its Florida deposits at a CAGR of 71.8%

ü In 2010, TrustCo had the 8th largest branch network in its market with 43 locations¹

Deposit Market Share - Florida

22

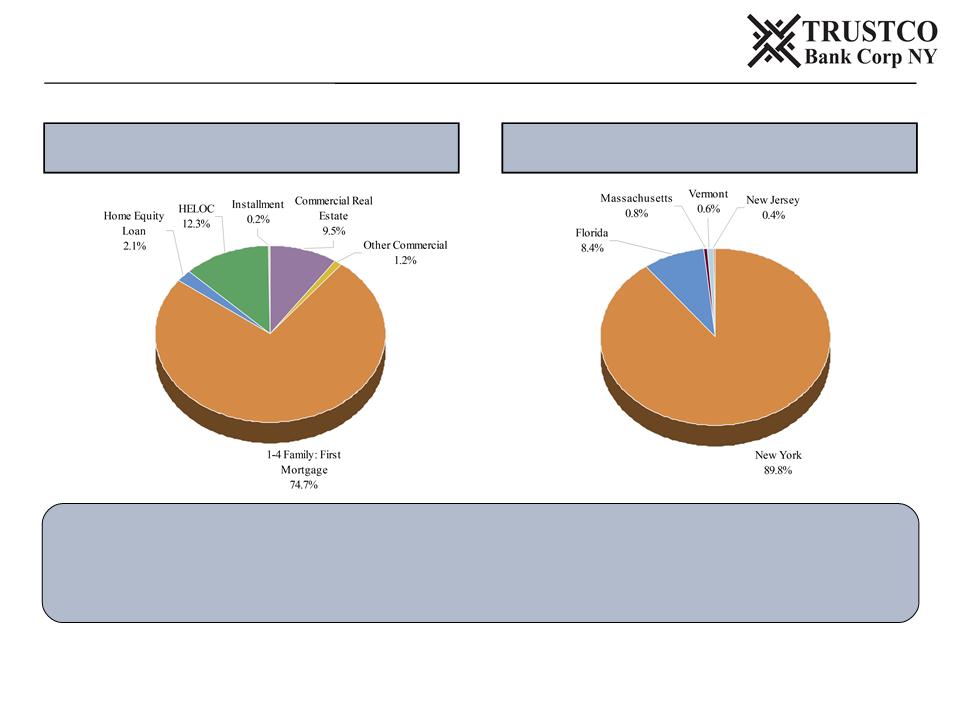

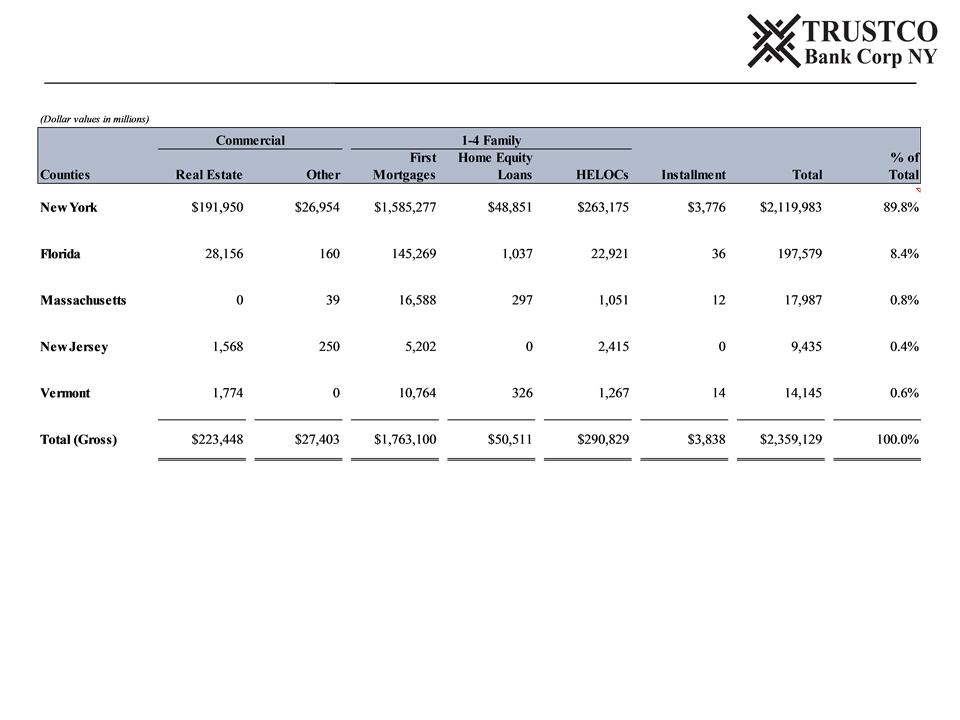

Loan Portfolio by Type

Loan Portfolio by Location

ü Portfolio centered on owner-occupied, single family loans

ü Limited owner-occupied condominium lending (less than $10 million in total)

ü No sub-prime lending

Note: Data as of March 31, 2011

Source: Company Documents, SEC Filings

Loan Portfolio Composition

23

Note: Data as of March 31, 2011

Source: Company Documents, SEC Filings

Geographic Detail of Loan Portfolio

24

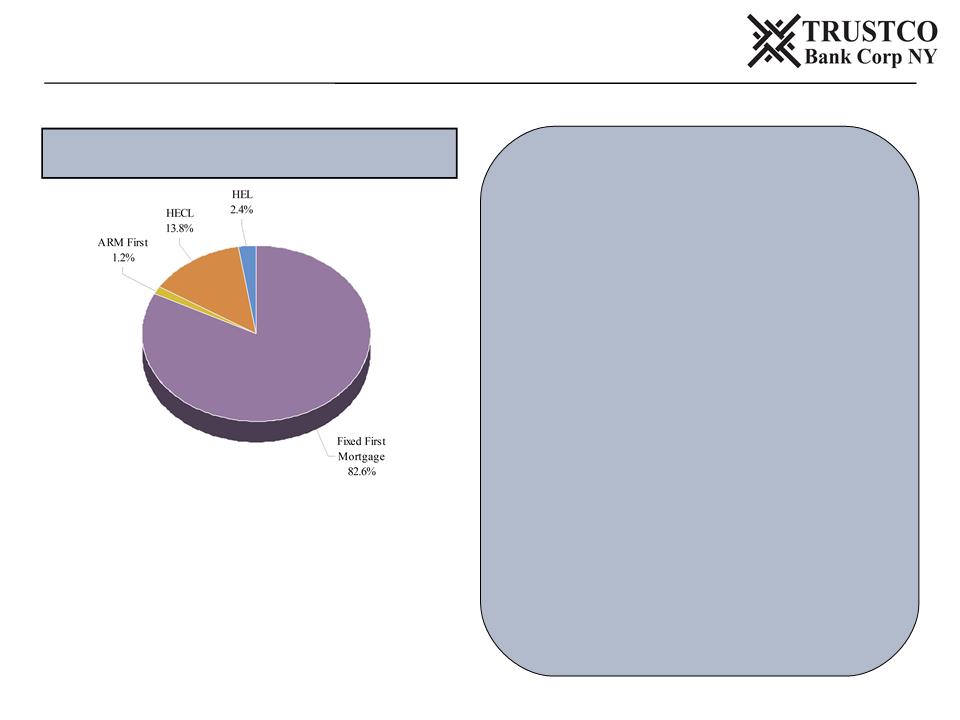

1-4 Family Composition

ü The portfolio is comprised of loans that

are fully-documented using

comprehensive underwriting criteria

without sole reliance on credit scores

are fully-documented using

comprehensive underwriting criteria

without sole reliance on credit scores

ü All applications are taken at branch

locations by company employees

locations by company employees

ü Residential portfolio increased 4.5%

year over year from March 31, 2010 to

March 31, 2011

year over year from March 31, 2010 to

March 31, 2011

ü Average loan size is approximately

$87,000

$87,000

ü Company chose not to compete against

“exotic” offerings that were commonly

offered between 2005 to 2007, e.g. no

Alt-A or Subprime products or

programs

“exotic” offerings that were commonly

offered between 2005 to 2007, e.g. no

Alt-A or Subprime products or

programs

Aggregate: $2.1 Billion

Note: Data as of March 31, 2011

Source: Company Documents, SEC Filings

Detail of Loan Portfolio

25

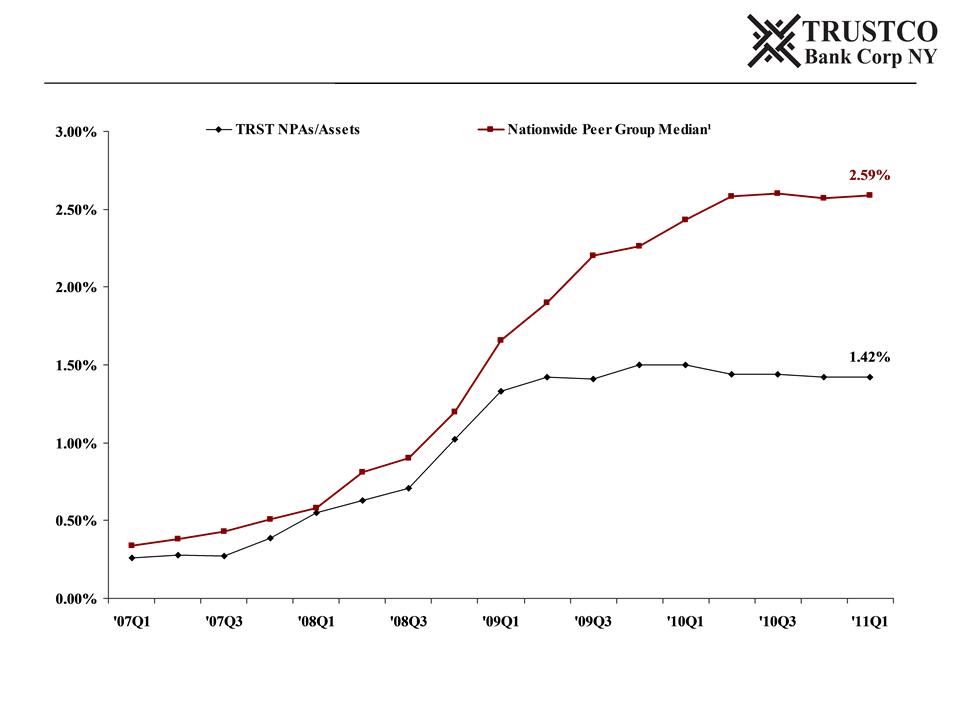

Note: For source data, see page 35 in the Appendix

(1) Nationwide peers include publicly-traded banks and thrifts with assets between $2 billion and $10 billion (excludes mutuals and pending acquisition targets) as of March 31, 2011

Source: SEC Filings; SNL Financial

Superior Credit Quality Compared to Peers

26

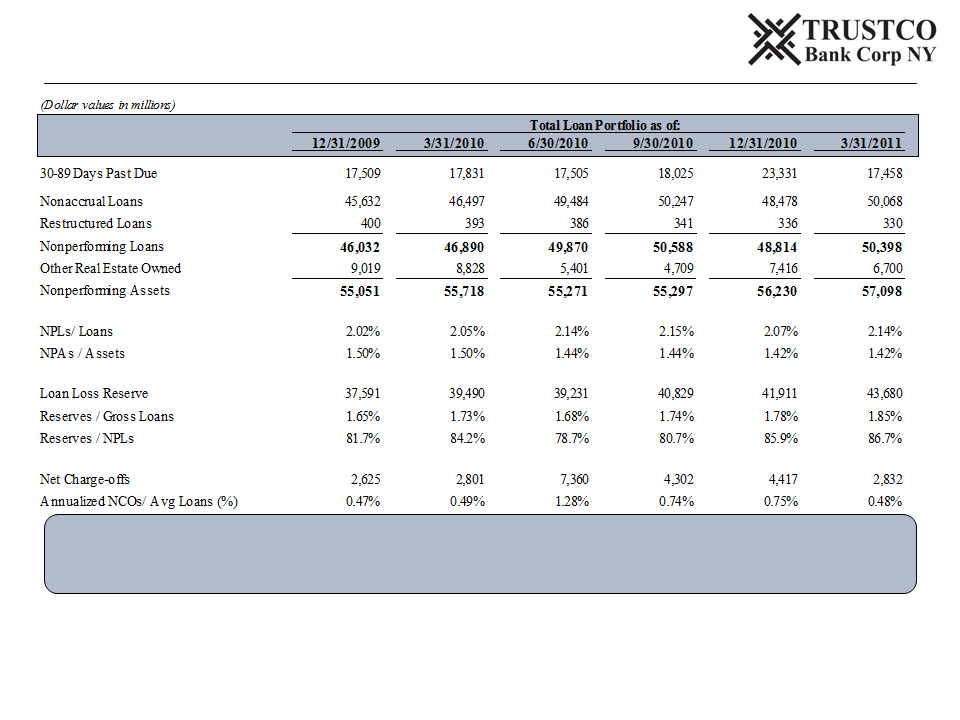

ü TrustCo’s underwriting and lending practices have resulted in relatively low levels of non-

performing assets and net charge-offs, as well as healthy reserve coverage, compared to peers

performing assets and net charge-offs, as well as healthy reserve coverage, compared to peers

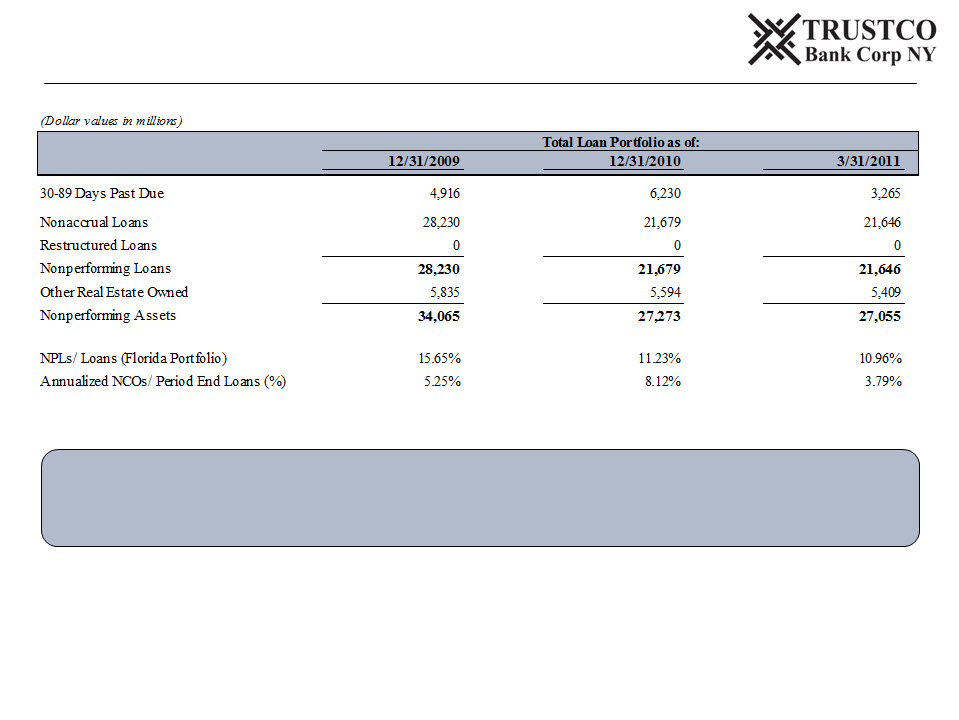

Source: Company Documents, SEC Filings

Credit Quality

27

(1) Includes Florida publicly traded banks and thrifts with assets between $2 billion and $10 billion; excludes TIBB as an outlier due to its recent recapitalization and write-down of loan portfolio

Source: Company Documents, SEC Filings

ü Recent trends in Florida delinquencies are encouraging

ü Superior credit quality improvement to Florida peers¹: TrustCo’s Florida NPLs have decreased

23%, while Florida peers’ NPLs have grown on average 7%, since 12/31/09

23%, while Florida peers’ NPLs have grown on average 7%, since 12/31/09

Historical Credit Quality in Florida

28

As of March 31, 2011

Source: Company Documents, SEC Filings

4 Target a 60/40 split on loans to investments

4 Investment Securities

o High level of liquidity in excess of $1 billion

o Vast majority (86%) of securities are available for sale

o High credit quality portfolio

o No derivatives, trust preferred or “exotic” instruments

4 Interest Rate Risk

o Loans are funded through core deposits

o No borrowings

o Effective deposit lives balance with asset lives

Investment Portfolio and Rate Risk Management

29

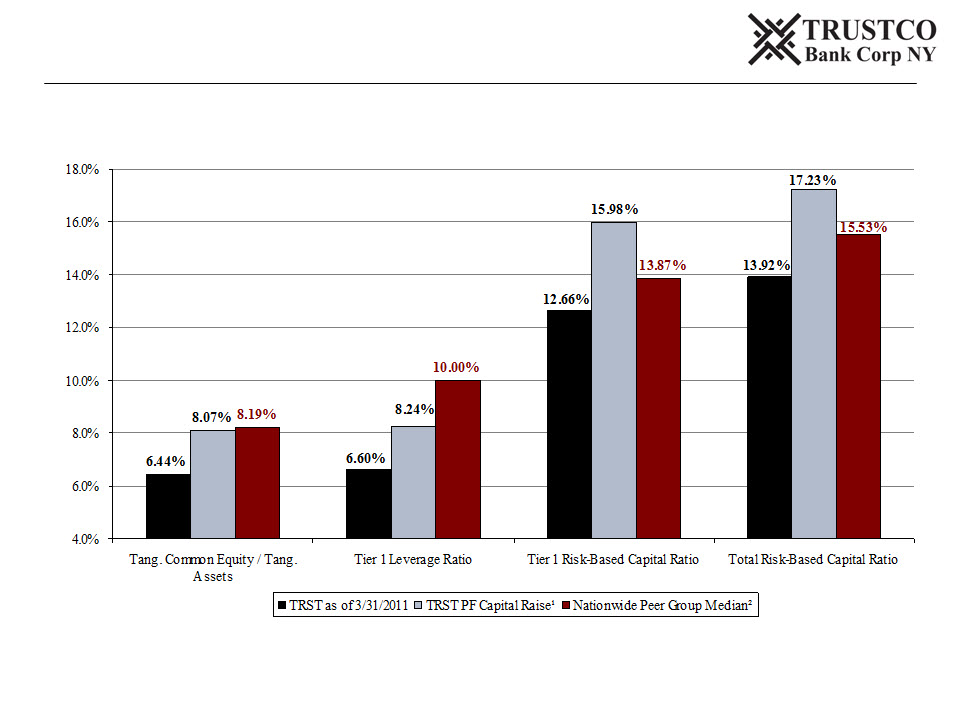

(1) Assumes $75 million in gross proceeds with a 5.00% underwriting spread and 20% risk weighting for use of new capital

(2) Nationwide peers include publicly-traded banks and thrifts with assets between $2 billion and $10 billion (excludes mutuals and pending acquisition targets) as of March 31, 2011

Source: Company Documents, SNL Financial

Pro Forma Capital Ratios

30

Why Invest in TrustCo Bank Corp NY?

4TrustCo has a 100 year history of profitability and dividend payouts

4TrustCo has a geographically diverse branch network in many growth areas

4Experienced management team with a history of strong operating results

4Solid program of interest rate risk management

4With major expansion plan completed and paid for, TrustCo will now be able

to be opportunistic in its continued growth

to be opportunistic in its continued growth

31

TrustCo Awards

4 “Banking’s Top Performers” - ABA Banking Journal

o 12th out of 129 banks with over $3 billion of assets for 2010

4 #1 Home Lender in Capital Region 2010 - Capital District Business Review

4 Top 30 of “Top 150 Performers” - Bank Director Magazine, 2008-2010

4 Top 20 of “Top 100 Thrifts” - SNL Thrift Investor, 2005-2010 .

4 Top 10 of “Top 200 Mid Tier Banks” - US Banker Magazine, 2007-2009

Appendix

33

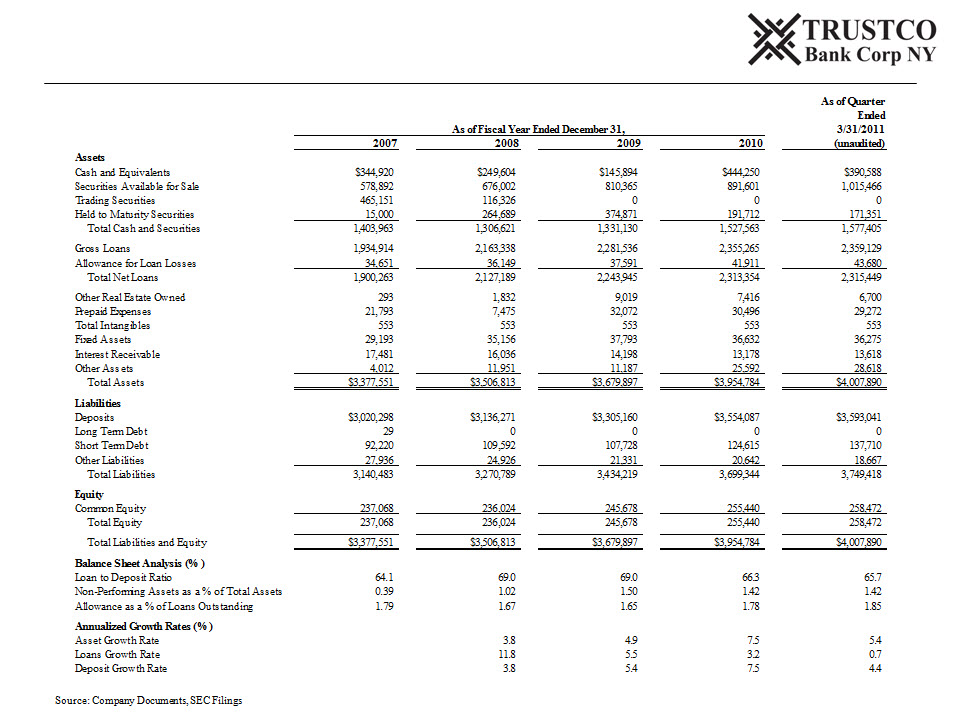

Historical Balance Sheet

34

Source: Company Documents, SEC Filings

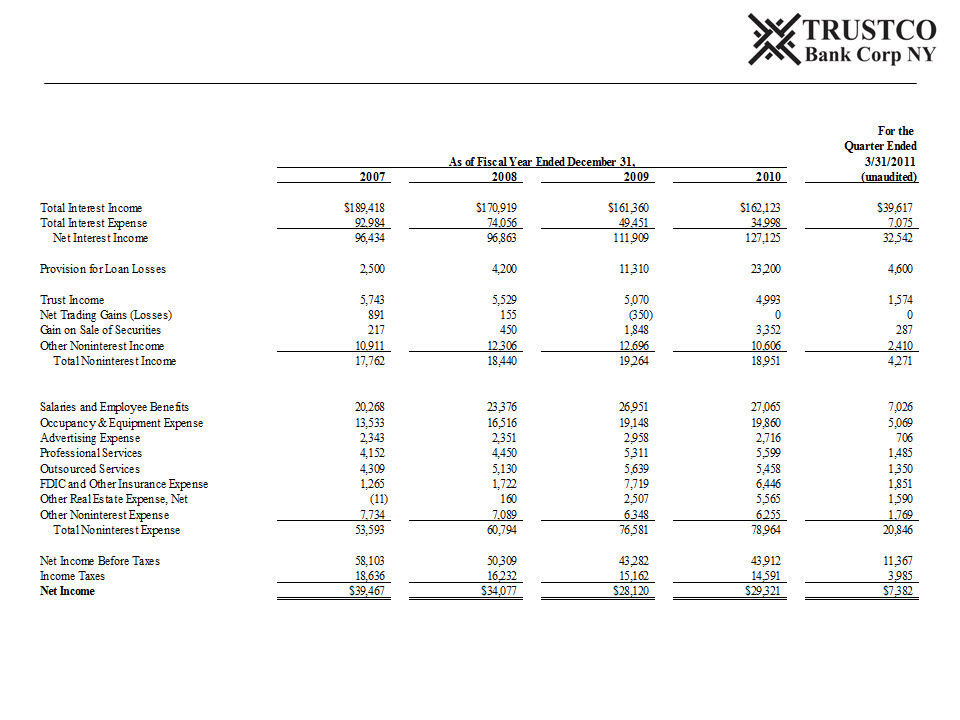

Historical Income Statement

35

Source: Company Documents, SEC Filings

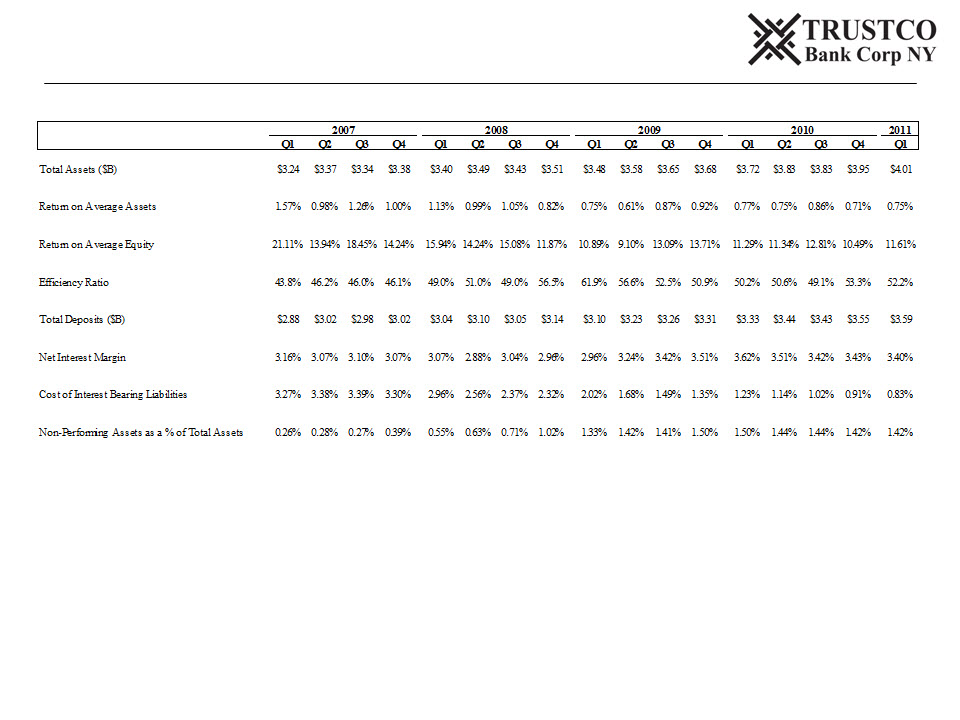

Quarterly Data

36

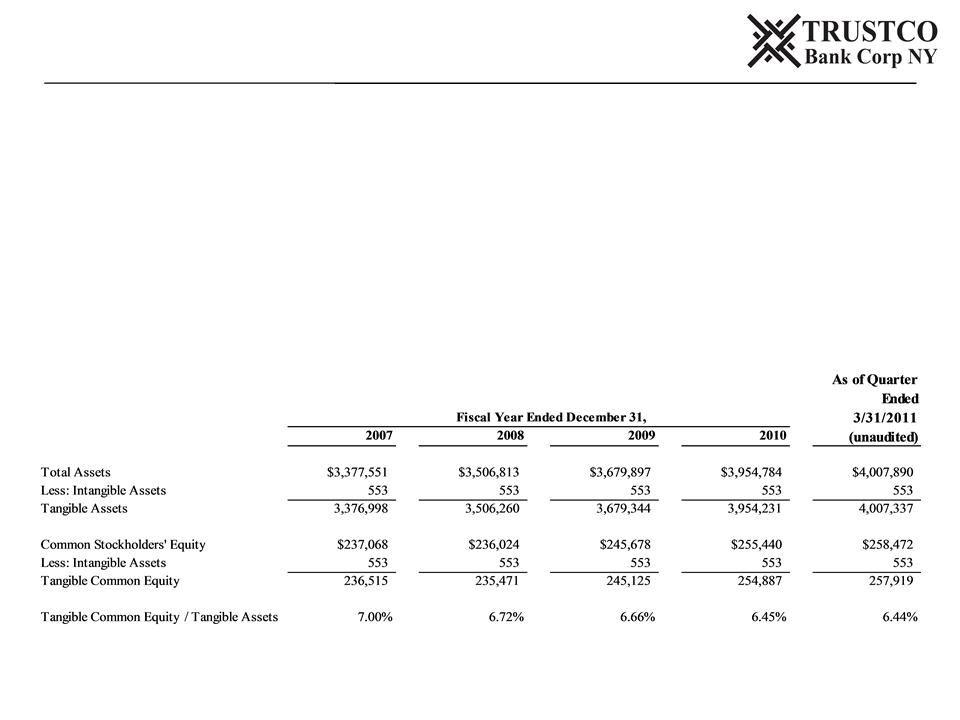

Tangible common equity and tangible common equity to tangible assets are non-GAAP financial measures derived from GAAP-

based amounts. We calculate tangible common equity by excluding the balance of intangible assets from common stockholders’

equity. We calculate tangible common equity to tangible assets by dividing tangible common equity by tangible assets. We believe

that this is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of risk-

based capital ratios. Accordingly, we believe that these non-GAAP financial measures provide information that is important to

investors and that is useful in understanding our capital position and ratios. However, these non-GAAP financial measures are

supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations

for these measures, this presentation may not be comparable to other similarly titled measures reported by other companies. A

reconciliation of the non-GAAP measures of tangible common equity to the GAAP measures of common stockholder’s equity and is

set forth below.

based amounts. We calculate tangible common equity by excluding the balance of intangible assets from common stockholders’

equity. We calculate tangible common equity to tangible assets by dividing tangible common equity by tangible assets. We believe

that this is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of risk-

based capital ratios. Accordingly, we believe that these non-GAAP financial measures provide information that is important to

investors and that is useful in understanding our capital position and ratios. However, these non-GAAP financial measures are

supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations

for these measures, this presentation may not be comparable to other similarly titled measures reported by other companies. A

reconciliation of the non-GAAP measures of tangible common equity to the GAAP measures of common stockholder’s equity and is

set forth below.

Source: Company Documents, SEC Filings

Non-GAAP Financial Measures