Attached files

| file | filename |

|---|---|

| EX-23.1 - SILLENGER EXPLORATION CORP. | ex231.htm |

| EX-31.2 - SILLENGER EXPLORATION CORP. | sillenger10kex312022811.htm |

| EX-31.1 - SILLENGER EXPLORATION CORP. | sillenger10kex311022811.htm |

| EX-32.1 - SILLENGER EXPLORATION CORP. | sillenger10kex321022811.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended February 28, 2011

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 000-53420

SILLENGER EXPLORATION CORP.

(Exact name of registrant as specified in its charter)

| Nevada | N/A | |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

|

277 Lakeshore Rd. E. Suite 206

|

||

|

|

||

|

(Address of principal executive offices)

|

Registrant’s telephone number, including area code: (905) 582-2434

Securities to be registered under Section 12(b) of the Act: None

Securities to be registered under Section 12(g) of the Act: Title of each class to be registered:

Common stock, par value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in

Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

||

|

Non-accelerated filer o

|

Smaller Reporting Company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act. Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked prices of such common equity, as of last business day of the registrant's most recently completed second fiscal quarter.

19,811,000 x $1.185 (August 31,2010 bid/ask price) = $23,476,035

Note - If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions under the circumstances, provided that the assumptions are set forth in this Form.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

As at June 15, 2011, there were 40,811,000 shares of Common Stock issued and outstanding.

Documents Incorporated By Reference –None

Table of Contents

|

FORWARD LOOKING INFORMATION

|

|

|

PART I

|

|

|

Item 1. Business

|

1

|

|

Item 1A. Risk Factors

|

4

|

|

Item 1B. Unresolved Staff Comments

|

4

|

|

Item 2. Properties

|

4

|

|

Item 3. Legal Proceedings

|

7

|

|

Item 4. (Removed and Reserved)

|

7

|

|

PART II

|

|

|

Item 5. Market for Company's Common Equity, Related Stockholder

|

|

|

Matters and Issuer Purchases of Equity Securities

|

7

|

|

Item 6. Selected Financial Data

|

8

|

|

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

|

8

|

|

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

|

12

|

|

Item 8. Financial Statements and Supplementary Data

|

12

|

|

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

13

|

|

Item 9A. Controls and Procedures

|

13

|

|

Item 9B. Other Information

|

14

|

|

PART III

|

|

|

Item 10. Directors, Executive Officers and Corporate Governance

|

14

|

|

Item 11. Executive Compensation

|

17

|

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and

|

|

|

Related Stockholder Matters

|

18

|

|

Item 13. Certain Relationships and Related Transactions, and Director Independence

|

19

|

|

Item 14. Principal Accountant Fees and Services

|

20

|

|

PART IV

|

|

|

Item 15. Exhibits and Financial Statement Schedules

|

21

|

|

SIGNATURES

|

1

FORWARD LOOKING INFORMATION

This annual report contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "will", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors", that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

PART I

Item 1. Description of Business.

General Development of Business

We are a gold exploration company in the pre-exploration stage and were incorporated on February 14, 2007. Sillenger Exploration Corp. ("Sillenger" or the "Company") has acquired a 100% interest in three mineral claims located in the Atlin Mining Division, British Columbia, Canada, in consideration for CDN$379 (the "Bulkley mineral claims"). The claims are registered in the name of our former President, who has executed a trust agreement with us June 4, 2009, whereby she agrees to hold the claims in trust on our behalf. To date we have not performed any exploration or work on the claims. We have not had any bankruptcy, receivership or similar proceeding and have had no material reclassification, merger, consolidation or purchase or sale of a significant amount of assets other than the acquisition of the three Bulkley mineral claims.

In the fall of 2008, our shareholders began selling shares they held in us pursuant to a registration statement filed on Form S-1 with the Securities and Exchange Commission. The terms of the offering is outlined in the Form S-1 registration statement and in the Rule 424(b)(4) prospectus, both of these documents can be found in their entirety on the SEC's website at www.sec.gov, under Registration Number 333-152075.

Our Business

We are a start-up, pre-exploration-stage company, and have not yet generated or realized any revenues from our business operations. We must raise additional capital in order to continue to implement our plan and stay in business. Sillenger has acquired a 100% interest in three mineral claims located in the Atlin Mining Division, British Columbia, Canada, in consideration for CDN$379 (the "Bulkley mineral claims"). The claims are registered in the name of our former President, who has executed a trust agreement with us June 4, 2009, whereby she agrees to hold the claims in trust on our behalf. To date we have not performed any exploration or work on the claim.

On June 2, 2010, Sillenger announced that, through its relationship with FCMI and its African affiliates, the Company had entered into a contract with the Government of the Republic of Equatorial Guinea to conduct an airborne geophysical survey of the continental region (27,000 sq. km) of Equatorial Guinea, known as Rio Muni, as well as 30 km of Continental Platform (4,500 sq. km) off the Atlantic coastline. The survey was intended to provide the Ministry of Mines, Industry and Energy a geological database of the region highlighting the locations where there may be the presence of mineral, hydrocarbon or groundwater deposits, and a preliminary identification of which subsurface structures may present exploration potential, and to identify the likeliest exploration targets within those deposits.

As compensation for assuming the capital risk of the survey, Sillenger was granted the mineral and hydrocarbon rights to 15% of the claim blocks in the entire area surveyed, as chosen by Sillenger, as well as a preferential right to any other claims that Sillenger desired.

Sillenger had the right to determine which claims it will retain for its own account, and had the right to market, as principal or joint-venture, any other properties to prospective mining or oil interests, and to retain a carried interest in those properties. The licensing model reduces the Company’s risk, which is assumed by the exploration partners, who benefit from the upside when a deposit is discovered, developed, and put into production. Sillenger’s strategy is either to sell the whole interest or simply retain a small interest, either through shares or royalties, in every exploration, mining, and oil venture that occurs on its claims, in essence becoming a claims and portfolio manager, and receiving revenues from multiple sources.

On June 11, 2010, Sillenger retained Fugro Airborne Surveys, a subsidiary of one of the world’s leading geophysics companies, Fugro Group, to conduct the airborne geophysical survey of the Rio Muni region of Equatorial Guinea. The survey will help to reveal the locations of potential deposits, and provide a detailed reading of the subsurface structures. The estimated cost of the survey was $8,300,000, and the survey would entail flying 69,000 line kms at a 400 - meter line spacing. The survey was slated to begin sometime in July 2010, as soon as Sillenger and Fugro completed their preparations but it actually began in or about November 2010.

The size and scope of the Equatorial Guinea project meant that large sums of capital would be required to fund the airborne survey. Sillenger began to actively seek funding from various institutional investors, potential strategic partners, and other parties.

Sillenger’s Director of Exploration, Dr. Allan Juhas PhD, and members of the Fugro Airborne Survey team met in mid-June with officials from the Government of Equatorial Guinea in Malabo to begin preparations for the airborne geophysical survey. The team also inspected ground facilities, and began planning operations.

In August 2010 Sillenger received a government delegation from Guinea-Bissau. During their visit, Sillenger arranged meetings in Ottawa with Fugro and also with Government of Canada officials from the Ministry of Foreign Affairs. Sillenger also arranged for a meeting and presentation by the Ministry of Forestry and Mines of the Province of Ontario, one of the world’s leading mining jurisdictions.

The Toronto visit concluded with a signing of The Minutes of Meeting, which stated that a contract would be prepared for consideration by the Guinea Bissau government and that the FCMI/Sillenger team would receive an invitation to visit Guinea Bissau in October 2010.

2

In October 2010, the Company entered into negotiations with a prominent investment group to finance the cost of this survey. As part of these negotiations, Sillenger fully assigned its commitment with Fugro Airborne Surveys to a third-party wholly owned subsidiary of Ivory Resources (“Ivory”), a private company that was formed by Toronto-based Salida Capital L.P. and Lionhart Trading Company for the purpose of funding the airborne geophysical survey for Equatorial Guinea.

Subsequently, Brilliant Mining Corp (“Brilliant”) was brought in by the investment group to be the operator of the project and steps were taken to roll Ivory into Brilliant Mining. On December 1st Brilliant announced it would pay Sillenger Exploration Corp. with shares in Brilliant equal to a value of $2 million and based on a price of $0.27 per share, which shares would be subject to a 2 year escrow provision.

On April 28, 2011, Sillenger executed a settlement agreement with Ivory Resources, Brilliant Mining and others, whereby Sillenger agreed to accept and receive 7,407,407 units of Brilliant [with a 4 month hold period] in exchange for Ivory acquiring from Sillenger an agreement with the government of the Republic of Equatorial Guinea, which included certain preferential rights to request mining and/or oil concessions. Each Unit consists of one Common Share and one Common Share purchase warrant of Brilliant. Each Warrant will entitle the holder thereof to acquire one Common Share of Brilliant upon the payment of $0.45 per Warrant at any time until 24 months following the date of issuance.

The transaction fits into Sillenger’s business model as the Brilliant Units represent Sillenger’s carried interest in the Equatorial Guinea project, and comprise a tangible asset with a value of over $2,000,000 CDN. If the Brilliant shares perform well, the Units have the potential for significant value add for Sillenger’s shareholders.

The Brilliant transaction also serves as an endorsement of Sillenger’s business plan, and enables Sillenger to replicate a proven concept for the next countries with which the Company is pursuing partnerships.

Competitive Conditions

The mineral exploration business is an extremely competitive industry. We are competing with many other exploration companies looking for minerals. We are one of the smallest exploration companies and a very small participant in the mineral exploration business. Being a junior mineral exploration company, we compete with other companies like ours for financing and joint venture partners. Additionally, we compete for resources such as professional geologists, camp staff, helicopters and mineral exploration supplies.1

Raw Materials

The raw materials for our exploration program will be items including camp equipment, sample bags, first aid supplies, groceries, propane, and a global satellite telephone. All of these types of materials are readily available in either the city of Vancouver or town of Atlin in British Columbia, Canada from a variety of suppliers and can be purchased or imported to Guinea-Bissau or any other country with which we may partner with in the future.

Dependence on Major Customers

We have no customers at this time.

Intellectual Property and Agreements

We have no intellectual property such as patents or trademarks. Additionally, we have no royalty agreements or labor contracts.

Government Approvals and Regulations

We are required to comply with all regulations defined in the Mineral Tenure Act of the Province of British Columbia and regulations in Guinea-Bissau.

The effect of these existing regulations on our business is that we are able to carry out our exploration program as we have described in this prospectus. However, it is possible that a future government could change the regulations that could limit our ability to explore our claim, but we believe this is highly unlikely.

Research and Development Expenditures

We have not incurred any research or development expenditures since our inception on February 14, 2007.

Costs and Effects of Compliance with Environmental Laws

We currently have no costs to comply with environmental laws concerning our exploration program.

3

Employees

We have one (1) full time or no part time employees. On May 12, 2010, Mr. Gillespie was appointed as our President and Chief Executive Officer. Mr. Gillespie has agreed to allocate a portion of his time to our activities, without compensation. We anticipate that our business plan can be implemented through the efforts of independent geologists and consultants we retain on a contract basis.

Reports to Securities Holders

We are required to file annual reports on Form 10-K and quarterly reports on Form 10-Q with the SEC on a regular basis, and will be required to timely disclose certain material events (e.g., changes in corporate control; acquisitions or dispositions of a significant amount of assets other than in the ordinary course of business; and bankruptcy) in a current report on Form 8-K.

You may read and copy any materials we file with the SEC at their Public Reference Room Office, 100 F Street, NE, Room 1580, Washington, D.C. 20549-0102. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Additionally, the SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. These materials are also available electronically in Canada on SEDAR at www.sedar.com.

Item 1A. Risk Factors.

No disclosure is required hereunder as the Company is a "smaller reporting company," as defined in Item 10(f) of Regulation S-K.

Item 1B. Unresolved Staff Comments.

None. Note: No disclosure is required hereunder as the Company is a "smaller reporting company," as defined in Item 10(f) of Regulation S-K.

Item 2. Description of Property.

Bulkley Mineral Claims

Legal Status of Bulkley Mineral Claims

Sillenger has acquired a 100% interest in the three mineral claims located in the Atlin Mining Division, British Columbia, Canada, in consideration for CDN$379. The claims are registered in the name of our former President, Ms. Sing, who has executed a trust agreement with us June 2, 2008, whereby she agrees to hold the claim in trust on our behalf. The total cost of the three Bulkley mineral claims charged to operations by us on our financial statements is $379 and this figure represents the reimbursement paid to our president in CDN Dollars.

All Canadian lands and minerals which have not been granted to private persons are owned by either the federal or provincial governments in the name of Her Majesty. Ungranted minerals are commonly known as Crown minerals. Ownership rights to Crown minerals are vested by the Canadian Constitution in the province where the minerals are located. In the case of the Bulkley mineral claims, that is the province of British Columbia.

In the 19th century the practice of reserving the minerals from fee simple Crown grants was established. The legislation ensures that minerals are reserved from Crown land dispositions. The result is that the Crown is the largest mineral owner in Canada, both as fee simple owner of Crown lands and through mineral reservations in Crown grants. Most privately held mineral titles are acquired directly from the Crown. The Bulkley mineral claim is one such acquisition. Accordingly, fee simple title to the Bulkley mineral claims resides with the Crown. The Bulkley mineral claims is a mining lease issued pursuant to the British Columbia Mineral Act to Ms. Sing. The lessee has exclusive rights to mine and recover all of the minerals contained within the surface boundaries of the lease continued vertically downward.

4

The Bulkley mineral claims is unencumbered and in good standing and there are no third party conditions which affect the claim other than conditions defined by the Province of British Columbia described herein. The rights to the claims expired on June 6, 2011 and management is considering renewing the claims. Further, there is no insurance covering the Bulkley mineral claims. We believe that no insurance is necessary since the Bulkley mineral claims is unimproved and contains no buildings or improvements.

Bulkley Mineral Claims Description

The claims are in an area of 947 hectares, which is equivalent to an area of 2,340 acres. The tenure number, name, owner number, work record to date, status, mining division, area, and tag numbers as typically recorded in British Columbia is as follows:

|

Tenure Number

|

Claim Number

|

Number

|

Good to Date

|

Status

|

Area

|

|

605454

|

Bulkley 1

|

208930 100%

|

2010/June/04

|

GOOD

|

294.4642

|

|

605457

|

Bulkley 2

|

208930 100%

|

2010/June/04

|

GOOD

|

310.8017

|

|

605459

|

Bulkley 3

|

208930 100%

|

2010/June/04

|

GOOD

|

343.6187

|

Our consulting geologist on this project is Stephen Butrenchuk and he has provided us with recommendations of how we should explore our claims.

There is no assurance that a commercially viable gold deposit exists on the claims. Explorations required before an evaluation as to the economic feasibility of the claim is determined. It is our intention to incorporate a British Columbia subsidiary company and record the deed of ownership in the name of our subsidiary if gold is discovered on the claims and it appears that it would be economically viable to commercially mine the claims. Until we can validate otherwise, the property is without known reserves and we are planning a three phase exploration program recommended by our consulting geologist. We have not commenced any exploration or work on the claims.

Access and Location of Bulkley Mineral Claims

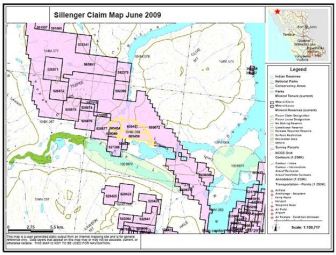

The Bulkley mineral claims are located on the Teepee property to the southeast of the TP showings (104M 048-050) and the Crine Veins (104M 081) near Tee Pee Peak about 54 kilometers west of Atlin British Columbia Lat 59 38' 29'N Long 134 32' 24' W. Elevations vary between 900 meters and about 1200 meters. Map 1, below shows the location of our claims in relation to the province of British Columbia, Canada.

Atlin is a relatively isolated community of about 350 inhabitants that is located on the east shore of Atlin Lake in northwestern British Columbia, Canada. It is 98 km south of Jake's Corner, Yukon on the Alaska Highway and 182 km from Whitehorse, Yukon. A community airstrip enables air access by small planes into Atlin.

The Bulkley claims area is accessed readily by helicopter but can be approached by means of local miners' roads that are not maintained but are passable by wheeled vehicles in the summer months and by snowmobiles in the winter. The most practical means of access is by helicopters that are normally based at Atlin during the summer season.

See maps on following pages.

5

Conditions to Retain Title to Bulkley Mineral Claims

In order to retain title to the Sillenger Mineral Claims, in the Province of British Columbia the recorded holder of a mineral claims shall perform, or have performed, exploration and development work on the claims to a value of CDN$4 per hectare a year per unit plus a CDN$100 recording fee per claim. A statement of work must be submitted on or before the anniversary date of the claim. The anniversary date for our mineral claims was June 6, 2011. Our mineral claims is a 947 hectare area, and thus requires us to spend a minimum of CDN$4,088 on valid exploration work and recording fees to keep the claim in good standing with the Province of British Columbia. Alternately, we can make an annual payment in lieu of work to the Province of British Columbia of CDN$4 per hectare plus a CDN$100 recording fee per claim for the same CDN$4,088 in order to keep the claims in good standing with the Province of British Columbia. If we fail to make the required filings or payments, we could lose title to the claims and this could have an adverse impact on our business. As of the date of this 10K, these claims have expired. Management is currently considering renewing these claims.

6

History of Atlin and of the Bulkley Mineral Claims Area

The Atlin mining area gained prominence in 1898 when placer gold was discovered. A mining "rush" ensued and was most active in the period between 1898 and 1910. Exploration for gold in the Atlin area has been continuous through to the present. We do not have any verifiable information regarding previous operators on the actual Bulkley mineral claims. The Province of British Columbia maintains a free service available on the Internet call "ARIS" that allows us to locate summary reports near our claim. The summary reports are in the public domain.

Present Condition of the Bulkley Mineral Claims

We do not know the present condition of the Bulkley Mineral Claims because we have yet to go on site. However, according to our consulting geologist we should expect to find terrain mostly comprised of glaciated hills with moderately steep slopes and smack streams that occupy broad channels established by glaciers and melt water streams. There is no equipment, infrastructure or electricity on the claims.

Geology of the Bulkley Mineral Claims

The Bulkley mineral claims as of the writing of this report have not been visited by our consulting geologist Stephen Butrenchuk. The geology of the property is based on geological information from the Province of British Columbia. This region lies within a northeasterly trending belt of Precambrian rocks comprised of scists quartzites and orthgneiss. These rocks are unconformably overlain by volcanic rocks of the Upper Triassic Stuhini Group. These rocks have been intruded by Cretaceous to Tertiary igneous intrusions. Also present are minor intrusions of ultramafic rocks. This area has the potential to host economically important mineral deposits, including gold, cobalt, and platinum group element deposits. However, we have yet to prove that any of these types of mineral deposits exist on our claims. Our mineral claims do not have any known resource or reserves.

Description of Other Properties

Sillenger does not either own nor lease office space. At present, offices rented on a monthly basis at $2,000 per month with no long term lease obligation. This arrangement is expected to continue until such time as Sillenger's activities necessitates its relocation, as to which no assurances can be given. Sillenger has no agreements with respect to the maintenance or future acquisition of an office.

Item 3. Legal Proceedings.

Sillenger is not a party to any legal proceedings.

Item 4. (Removed and Reserved) Not Applicable.

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common shares became quoted on the Over-the-Counter Bulletin Board on December 8, 2008, under the symbol "SLGX". On April 4, 2010 our common shares were removed from the OTCBB and moved to the OTCQB market, under the symbol "SLGX". The following quotations reflect the high and low bids for our common stock based on inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. The high and low bid prices for our common shares (obtained from QuoteMedia.com) from March 1, 2009 to February 28, 2011 were as follows:

|

May 31, 2011

|

$ | 0.22 | $ | 0.03 | ||||

|

February 28, 2011

|

$ | 0.55 | $ | 0.29 | ||||

|

November 30. 2010

|

$ | 0.81 | $ | 0.40 | ||||

|

August 31, 2010

|

$ | 1.70 | $ | 0.67 | ||||

|

May 31, 2010

|

$ | 1.59 | $ | 0.10 | ||||

|

February 28, 2010

|

$ | 0.10 | $ | 0.10 | ||||

|

November 30, 2009

|

$ | 0.10 | $ | 0.10 | ||||

|

August 31, 2009

|

$ | 0.105 | $ | 0.10 | ||||

|

May 31, 2009

|

$ | 0.30 | $ | 0.195 | ||||

|

February 28, 2009

|

$ | 0.00 | $ | 0.00 |

Note

(1) The quotations above reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

(2) Sillenger was first quoted on the OTCBB on December 8, 2008 under the symbol "SLGX.OB"

7

Holders of Common Stock

As of June 14, 2011 we had 28 stockholders of record holding 40,811,000 shares of common stock.

Dividend Policy

There are no restrictions in our articles of incorporation or bylaws that restrict us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

1. we would not be able to pay our debts as they become due in the usual course of business; or

2. Our total assets would be less than the sum of our total liabilities, plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution.

We declared a six share for every one share issued and outstanding stock dividend in March 2009. The record date for this stock dividend was March 25, 2009 and the pay date was March 27, 2009. As a result of the issuance of this stock dividend our issued and outstanding share capital increased from 5,853,000 shares to 40,971,000 shares of common stock.

We do not plan to declare any further dividends in the foreseeable future.

Equity Compensation Plan

We do not have any securities authorized for issuance under any equity compensation plans.

Recent Sales of Unregistered Securities

On December 14, 2009, we issued 50,000 shares of our Common Stock to one investor, for an aggregate purchase price of $10,000. We relied on the exemption provided by Rule 903 of Regulation S of the Securities Act of 1934 to the subscriber on the basis that the sale of the shares was completed in an offshore transaction, as defined in Rule 902(h) of Regulation S. The Company did not engage in any directed selling efforts, as defined in Regulation S, in the United States in connection with the sale of the shares. The investor represented to us that he was not a U.S. person, as defined in Regulation S, and was not acquiring the shares for the account or benefit of a U.S. person. The subscription agreement executed between us and the investor included statements that the securities had not been registered pursuant to the Securities Act of 1933 and that the securities may not be offered or sold in the United States unless the securities are registered under the Securities Act of 1933 or pursuant to an exemption from the Securities Act of 1933. The investor agreed by execution of the subscription agreement for the shares: (i) to resell the securities purchased only in accordance with the provisions of Regulation S, pursuant to registration under the Securities Act of 1933 or pursuant to an exemption from registration under the Securities Act of 1933; (ii) that we are required to refuse to register any sale of the securities purchased unless the transfer is in accordance with the provisions of Regulation S, pursuant to registration under the Securities Act of 1933 or pursuant to an exemption from registration under the Securities Act of 1933; and (iii) not to engage in hedging transactions with regards to the securities purchased unless in compliance with the Securities Act of 1933. All securities issued were endorsed with a restrictive legend confirming that the securities had been issued pursuant to Regulation S of the Securities Act of 1933 and could not be resold without registration under the Securities Act of 1933 or an applicable exemption from the registration requirements of the Securities Act of 1933.

Item 6. Selected Financial Data.

No disclosure is required hereunder as the Company is a "smaller reporting company," as defined in Item 10(f) of Regulation S-K.

Item 7. Management Discussion and Analysis or Plan of Operations.

2011 Business Environment

The disruptions in the credit and financial markets through 2009 and 2010 have had a significant material adverse impact on a number of financial institutions and have limited access to capital and credit for many companies. While 2010 seemingly was a turnaround period for stock markets, and a muted positive improvement in consumer optimism and general business conditions, the global economy still appears to be somewhat tepid, and it is still difficult for many junior resource companies to obtain financing. These market conditions could continue to make it difficult for us to obtain, or increase our cost of obtaining, capital and financing for our operations. Our access to additional capital on the equity markets also may not be available on terms acceptable to us or at all.

8

In late 2009 Sillenger decided to seek a strategic and/or financial partner to help take Sillenger forward. We entered into discussions with an interested party with the goal of raising capital and conducting a work program on the Bulkley claims, and possibly some other projects. Unfortunately the two sides could not reach an acceptable deal and we parted ways. With the price of gold at record levels, management believes it would be prudent to continue seeking potential partners.

On June 2, 2010, Sillenger announced that, through its relationship with FCMI and its African affiliates, the Company had entered into a contract with the Government of the Republic of Equatorial Guinea to conduct an airborne geophysical survey of the continental region (27,000 sq. km) of Equatorial Guinea, known as Rio Muni, as well as 30 km of Continental Platform (4,500 sq. km) off the Atlantic coastline. The survey was intended to provide the Ministry of Mines, Industry and Energy a geological database of the region highlighting the locations where there may be the presence of mineral, hydrocarbon or groundwater deposits, and a preliminary identification of which subsurface structures may present exploration potential, and to identify the likeliest exploration targets within those deposits.

As compensation for assuming the capital risk of the survey, Sillenger was granted the mineral and hydrocarbon rights to 15% of the claim blocks in the entire area surveyed, as chosen by Sillenger, as well as a preferential right to any other claims that Sillenger desired.

In August 2010 Sillenger received a government delegation from Guinea-Bissau. During their visit, Sillenger arranged meetings in Ottawa with Fugro and also with Government of Canada officials from the Ministry of Foreign Affairs. Sillenger also arranged for a meeting and presentation by the Ministry of Forestry and Mines of the Province of Ontario, one of the world’s leading mining jurisdictions.

On April 28, 2011, Sillenger executed a settlement agreement with Ivory Resources, Brilliant Mining and others, whereby Sillenger agreed to accept and receive 7,407,407 units of Brilliant [with a 4 month hold period] in exchange for Ivory acquiring from Sillenger an agreement with the government of the Republic of Equatorial Guinea, which included certain preferential rights to request mining and/or oil concessions. Each Unit consists of one Common Share and one Common Share purchase warrant of Brilliant. Each Warrant will entitle the holder thereof to acquire one Common Share of Brilliant upon the payment of $0.45 per Warrant at any time until 24 months following the date of issuance.

Looking at the year ahead, management believes, Brilliant transaction serves as an endorsement of Sillenger’s business plan, and enables Sillenger to replicate a proven concept for the next countries with which the Company is pursuing partnerships.

Results of Operation

For the year ended February 28, 2011 and February 28, 2010 and the period from February 14, 2007 (inception) to February 28, 2011:

Financial Condition and Liquidity

Revenue - Sillenger has not generated revenue from its business operations and does not expect to generate any revenue in the near future.

Common Stock - Management anticipates Sillenger's external sources of liquidity will be private placements for equity conducted outside the United States. During the year ended February 28, 2010, Sillenger completed a private placement on December 14, 2009 where Sillenger issued 50,000 shares of common stock at $0.20 per share for proceeds of $10,000 . There were no share issuances during the year ended February 28, 2011.

Liquidity - At February 28, 2011, Sillenger had assets of $509 consisting of cash ($6,700 - February 28, 2010). Sillenger had $2,737,891 ($ 7,599 - February 28, 2010) in liabilities of which is mostly owed for

Accounts Payable.

Sillenger' internal sources of liquidity will be loans that may be available to Sillenger from management. Although Sillenger has no written arrangements with any of directors and officers, Sillenger expects that the directors and officers will provide Sillenger with internal sources of liquidity, if it is required.

There are no assurances that Sillenger will be able to achieve further sales of its common stock or any other form of additional financing. If Sillenger is unable to achieve the financing necessary to continue its plan of operations, then Sillenger will not be able to continue its exploration programs and its business will fail.

Off-Balance Sheet Arrangements—We do not have any material off-balance sheet arrangements.

Expenses

Summary - Total expenses were $2,736,483 for the year ended February 28, 2011 ($19,598 – February 28, 2010). Expenses have increased as compared to the year ended February 28, 2010 by $2,716,885 from $19,598 in the previous year ended February 28, 2010. A total of $2,798,532 in expenses has been incurred by Sillenger since inception on February14, 2007 through to February 28, 2011. The increase in costs over the past year is primarily related to Sillenger having filed a registration statement to qualify shares held by its stockholders for resale. The costs can be subdivided into the following categories.

9

|

1.

|

General and Administration expenses: $985,350 in general and administration expenses (includes administrative costs and consulting fees) were incurred for the year ended February 28, 2011 as compared to $3,539 for the year ended February 28, 2010 while a total of $999,227 was incurred in the period from inception on February 14, 2007 to February 28, 2011.

|

|

2.

|

Travel: $575,966 in travel expenses were incurred for the year ended February 28, 2011 as compared to $0 for the year ended February 28, 2010 while a total of $575,966 was incurred in the period from inception on February 14, 2007 to February 28, 2011.

|

|

3.

|

Business development: Sillenger incurred $664,708 in business development expenses for the year ended on February 28, 2011 as compared to $0 for the year ended February 28, 2010. From inception to February 28, 2011, we have incurred a total of $664,708 in business development mainly spent on business development for the African contracts..

|

|

4.

|

Professional fees: Sillenger incurred $412,158 in legal and audit fees for the year ended February 28, 2011 and $16,059 was incurred for the year ended February 28, 2010. For the period February 14, 2007 (inception) through February 28, 2011, Sillenger has spent a total of $460,330 on exploration.

|

Sillenger continues to carefully control its expenses and overall costs as it moves forward with the continued development of its business plan. Sillenger does not have any employees and engages personnel through outside consulting contracts or agreements or other such arrangements.

Summary of Critical Accounting Policies

Cash and Cash Equivalents

For purposes of the statements of cash flows, the Company considers all highly liquid investments purchased with a original maturity of three months or less to be cash equivalents.

Estimates

The preparation of financial statements in conformity with generally accepted accounting principles in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Significant estimates and assumptions relate to, but are not limited to, estimation of accrued liabilities. Actual results could differ from those estimates.

Foreign Currency Translation and Transactions

The Company’s reporting and functional currency is the U.S. dollar. Foreign currency denominated monetary balance sheet items are translated into U.S. dollars at the prevailing exchange rates in effect at the end of the reporting period, the historical rate for non-monetary balance sheet items and shareholders’ equity, and the average rate for the year for revenues, expenses, gains and losses. Foreign currency gains or losses on translation are included in the statement of operations.

Fair Value of Financial Instruments

The Company adopted ASC Topic 820 for all financial assets and liabilities measured at fair value on a recurring basis. The Company adopted ASC Topic 820 effective February 28, 2010, for all non-financial assets and liabilities. ASC Topic 820 defines fair value as the price that would be received to sell an asset or paid to transfer a liability (exit price) in an orderly transaction between market participants at the measurement date. The statement establishes market or observable inputs as the preferred sources of values, followed by assumptions based on hypothetical transactions in the absence of market inputs. The statement requires fair value measurements be classified and disclosed in one of the following categories:

Level 1 – Quoted prices in active markets for identical assets and liabilities.

Level 2 – Quoted prices in active markets for similar assets and liabilities, quoted prices for identical or similar instruments in markets that are not active and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3 – Significant inputs to the valuation model are unobservable.

Financial assets and liabilities are classified based on the lowest level of input that is significant to the fair value measurement.

The carrying amounts on the accompanying balance sheet for cash, accounts payable and accrued liabilities are carried at cost, which approximates fair value.

Income Taxes

Income taxes are accounted for under the asset and liability method prescribed by ASC Topic 740 – Income Taxes. Deferred income taxes are recognized for the tax consequences in future years for differences between the tax bases of assets and liabilities and their financial reporting amounts at each year-end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized. Income tax expense is the tax incurred for the period and the change during the period of deferred tax assets and liabilities.

In accordance with accounting literature related to uncertainty in income taxes, tax benefits from uncertain tax positions that are recognized in the financial statements are measured based on the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement.

10

The Company recognizes interest and penalties, if any, related to uncertain tax positions in selling, general and administrative expenses. No interest and penalties related to uncertain tax positions were accrued at February 28, 2011 and 2010.

Loss Per Share

Basic loss per share is computed by dividing net loss by the weighted average number of common shares outstanding for the periods. Diluted loss per share reflects, in addition to the weighted average number of common shares, the potential dilution of stock which is not applicable to Sillenger as of February 28, 2011 and 2010.

Plan of Operations

Our business plan up until April 2010 was to proceed with the exploration of the Bulkley claims to determine whether there are commercially exploitable reserves of base and precious metals. Beginning in May 2010, we have concentrated our focus on pursuing opportunities in African countries.

With the price of gold at record levels, management believes it would be prudent to continue seeking potential partners to explore the Buckley claims.

We will also need to seek additional funding to pursue the new ventures in Africa identified by our new President and Chief Executive Officer Mr. John Gillespie. We anticipate that additional funding will be in the form of equity financing from the sale of our common stock. However, we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock to fund additional phases of the exploration program previously set out for the Buckley claim should we decide to proceed or any new projects identified in Africa. We believe that debt financing will not be an alternative for funding any further phases in our exploration program or potential projects in Africa or elsewhere. The risky nature of these enterprises and lack of tangible assets places debt financing beyond the credit-worthiness required by most banks or typical investors of corporate debt until such time as an economically viable mine or project can be demonstrated. We do not have any arrangements in place for any future equity financing.

Based on the nature of our business, we anticipate incurring operating losses in the foreseeable future. We base this expectation, in part, on the fact that very few mineral claims in the exploration stage ultimately develop into producing, profitable mines. Our future financial results are also uncertain due to a number of factors, some of which are outside our control. These factors include, but are not limited to:

● our ability to raise additional funding;

● the market price for gold;

● the results of our proposed exploration programs on the mineral property; and

● our ability to find joint venture partners for the development of our property interests

Due to our lack of operating history and present inability to generate revenues, our auditors have stated their opinion that there currently exists substantial doubt about our ability to continue as a going concern.

Subsequent Events

On April 28, 2011, Sillenger executed an agreement with Ivory Resources, Brilliant Mining and others, whereby Sillenger agreed to accept and receive 7,407,407 units of Brilliant [with a 4 month escrow] in exchange for Ivory acquiring from Sillenger an agreement with the government of the Republic of Equatorial Guinea, which included certain preferential rights to request mining and/or oil concessions. Each Unit consists of one Common Share and one Common Share purchase warrant of Brilliant. Each Warrant will entitle the holder thereof to acquire one Common Share of Brilliant upon the payment of $0.45 per Warrant at any time until 24 months following the date of issuance. As part of the agreement, all the assets of FCMI Global Inc., including the amounts receivable from Sillenger Exploration Corp., would be transferred to a newly set up wholly owned subsidiary of Sillenger. As of the date of filing this 10K, the agreement had not closed.

On April 28, 2011, Sillenger also entered into an agreement with Mr. Michel Ghostine to compensate him for his role in the African deal. He who was fundamental in acquiring the agreements with the governments of Equatorial Guinea and Guinea-Bissau, and he is also a director of Sillenger. Under the terms of the agreement, Sillenger has agreed to pay Mr. Ghostine $150,000.00 USD and to issue him 2,000,000 shares of Sillenger’s common shares for his extensive efforts in securing the Equatorial Guinea contract.

On June 2, 2011, Sillenger entered into a one year consulting agreement with an investor relations firm for an upfront payment of $25,000 plus one million common shares of Sillenger. Sillenger has a right to buy back the one million shares by July 5, 2011 for $25,000. The agreement provides that, in addition to investor relations services, should the investor relations firm introduce Sillenger to a financing source not known to the Sillenger at the time, they will be entitled to a finder’s fee in the amount of 7% of the gross funding provided by such source.

Sillenger will need to seek additional funding to complete the two transactions referenced immediately above.

11

Recent Accounting Pronouncements

For information with respect to recent accounting pronouncements and the impact of these pronouncements on our consolidated financial statements, see Note 4, “Recently Issued Accounting Standards and Recently Adopted Accounting Pronouncements,” in the Notes to the Financial Statements in this Annual Report on Form 10-K.

Item 7A. Quantitive and Qualitive Disclosure About Market Risk.

No disclosure is required hereunder as the Company is a "smaller reporting company," as defined in Item 10(f) of Regulation S-K.

Item 8. Financial Statements and Supplementary Data.

The financial statements and schedules that constitute Item 8 of Form 10-K immediately follow on the next page.

12

Sillenger Exploration Corp.

(An Exploration Stage Company)

February 28, 2011

|

Index

|

|

|

Reports of Independent Registered Public Accounting Firm

|

F-1 and F-2

|

|

Balance Sheets as of February 28, 2011 and 2010

|

F-3

|

|

Statements of Operations for the years ended

|

|

|

February 28, 2011 and 2010 and the period from

|

|

|

February 14, 2007 (Inception) through February 28, 2011

|

F-4

|

|

Statement of Stockholders' Equity (Deficit) as of February 28, 2011

|

F-5

|

|

Statements of Cash Flows for the years ended

|

|

|

February 28, 2011 and 2010 and the period from

|

|

|

February 14, 2007 (Inception) through February 28, 2011

|

F-6

|

|

Notes to the Financial Statements

|

F-7 - F-13

|

Silberstein Ungar, PLLC CPAs and Business Advisors

Phone (248) 203-0080

Fax (248) 281-0940

30600 Telegraph Road, Suite 2175

Bingham Farms, MI 48025-4586

www.sucpas.com

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Sillenger Exploration Corp.

Vancouver, British Columbia, Canada

We have audited the accompanying balance sheets of Sillenger Exploration Corp., as of February 28, 2010 and 2009, and the related statements of operations, stockholders’ equity (deficit), and cash flows for the years then ended and the period from February 14, 2007 (date of inception) through February 28, 2010. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company has determined that it is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Sillenger Exploration Corp. as of February 28, 2010 and 2009, and the results of its operations and its cash flows for the periods then ended and the period from February 14, 2007 (date of inception) through February 28, 2010 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has negative working capital, has received no revenue from sales of products or services, and has incurred losses from operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans with regard to these matters are described in Note 2. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Silberstein Ungar, PLLC

Silberstein Ungar, PLLC

Bingham Farms, Michigan

May 25, 2010

F - 1

REPORT OF REGISTERED INDEPENDENT PUBLIC ACCOUNTING FIRM

The Board of Directors

Sillenger Exploration Corp.

We have audited the accompanying balance sheet of Sillenger Exploration Corp. (the “Company”) as of February 28, 2011 and the statements of operations, changes in stockholders’ equity and cash flows for the year then ended and for the period from February 14, 2007 (date of inception) through February 28, 2011. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Sillenger Exploration Corp. as of February 28, 2011 and the results of its operations and its cash flows for the year then ended and for the period from February 14, 2007 (date of inception) through February 28, 2011, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 2, the Company has no revenue from sales of products or services and has incurred losses from operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans with regard to these matters are described in Note 2. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Signed: “MSCM LLP”

MSCM LLP

Toronto, Canada

June 15, 2011

F - 2

|

Sillenger Exploration Corp.

|

||||||||

|

(An Exploration Stage Company)

|

||||||||

|

Balance Sheets

|

||||||||

|

February 28, 2011 and 2010

|

||||||||

|

February 28,

|

February 28,

|

|||||||

|

2011

|

2010

|

|||||||

|

ASSETS

|

||||||||

|

Current assets:

|

||||||||

|

Cash

|

$ | 509 | $ | 6,700 | ||||

| 509 | 6,700 | |||||||

| $ | 509 | $ | 6,700 | |||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$ | 2,709,006 | $ | - | ||||

|

Accrued liabilities

|

28,885 | 7,599 | ||||||

|

Total liabilities

|

2,737,891 | 7,599 | ||||||

|

Commitments and Contingencies (Note 7)

|

||||||||

|

Stockholders' deficit

|

||||||||

|

Common stock $0.001 par value,

|

||||||||

|

75,000,000 shares authorized

|

||||||||

|

40,811,000 shares issued and outstanding

|

40,811 | 40,811 | ||||||

|

Additional paid-in-capital

|

3,514,139 | 3,514,139 | ||||||

|

Accumulated deficit

|

(6,292,332 | ) | (3,555,849 | ) | ||||

| 3 | ||||||||

|

Total Stockholders' deficit

|

(2,737,382 | ) | (899 | ) | ||||

|

Total Liabilities and Stockholders' Deficit

|

$ | 509 | $ | 6,700 | ||||

|

The Notes to the Financial Statements are an integral part of these financial statements.

|

||||||||

F - 3

|

Sillenger Exploration Corp.

|

||||||||||||

|

(An Exploration Stage Company)

|

||||||||||||

|

Statements of Operations

|

||||||||||||

|

Years Ended February 28, 2011 and 2010

|

||||||||||||

|

Cumulative From

|

||||||||||||

|

February 14, 2007

|

||||||||||||

|

Years Ended February 28,

|

(Inception) to

|

|||||||||||

|

2011

|

2010

|

February 28, 2011

|

||||||||||

|

Revenues

|

$ | - | $ | - | $ | - | ||||||

|

Operating expenses:

|

||||||||||||

|

General and Administrative

|

985,350 | 3,539 | 999,227 | |||||||||

|

Travel

|

575,966 | 575,966 | ||||||||||

|

Business development

|

664,708 | 664,708 | ||||||||||

|

Professional services

|

412,158 | 16,059 | 460,330 | |||||||||

| 2,638,182 | 19,598 | 2,700,231 | ||||||||||

|

Other income

|

||||||||||||

|

Foreign exchange loss

|

$ | 98,301 | $ | - | $ | 98,301 | ||||||

|

Net Loss and Comprehensive Loss

|

$ | 2,736,483 | $ | 19,598 | $ | 2,798,532 | ||||||

|

Net Loss per share: Basic and Diluted

|

$ | (0.07 | ) | $ | (0.00 | ) | ||||||

|

Weighted average shares outstanding: Basic and Diluted

|

40,811,000 | 40,781,833 | ||||||||||

|

The Notes to the Financial Statements are an integral part of these financial statements.

|

||||||||||||

F - 4

|

Sillenger Exploration Corp.

|

||||||||||||

|

(An Exploration Stage Company)

|

||||||||||||

|

Statements of Cash Flows

|

||||||||||||

|

Years Ended February 28, 2011 and 2010

|

||||||||||||

|

Cumulative From

|

||||||||||||

|

February 14, 2007

|

||||||||||||

|

Years Ended February 28,

|

(Inception) to

|

|||||||||||

|

2011

|

2010

|

February 28, 2011

|

||||||||||

|

Cash Flows from Operating Activities

|

||||||||||||

| Net Loss | $ | (2,736,483 | ) | $ | (19,598 | ) | $ | (2,798,532 | ) | |||

| Items not affecting cash | ||||||||||||

| Write-off of equipment | 27,522 | - | 27,522 | |||||||||

| Foreign exchange loss | - | - | - | |||||||||

| (2,708,961 | ) | (19,598 | ) | (2,771,010 | ) | |||||||

|

Changes in non-cash working capital items

|

||||||||||||

| Accounts payable | 2,709,006 | - | 2,709,006 | |||||||||

| Accrued expenses | 21,286 | 599 | 28,885 | |||||||||

|

Cash Flows Generated From (Used in) Operating Activities

|

21,331 | (18,999 | ) | (33,119 | ) | |||||||

|

Cash Flows from Investing Activities

|

||||||||||||

| Equipment acquired | (27,522 | ) | - | (27,522 | ) | |||||||

|

Cash Flows used in Investing Activities

|

(27,522 | ) | - | (27,522 | ) | |||||||

|

Cash Flows from Financing Activities

|

||||||||||||

| Proceeds from issuance of common stock | - | 10,000 | 61,150 | |||||||||

|

Cash Flows Provided by Financing Activities

|

- | 10,000 | 61,150 | |||||||||

|

Net Increase (Decrease) in Cash

|

(6,191 | ) | (8,999 | ) | 509 | |||||||

|

Cash, Beginning of Period

|

6,700 | 15,699 | - | |||||||||

|

Cash, End of Period

|

509 | 6,700 | 509 | |||||||||

|

Supplemental Cash Flow Information

|

||||||||||||

| Interest paid | $ | - | $ | - | $ | - | ||||||

| Income taxes paid | $ | - | $ | - | $ | - | ||||||

|

Non-Cash Financing Transaction

|

||||||||||||

| Increase in paid-in capital from stock dividend | $ | - | $ | 3,458,862 | $ | 3,458,862 | ||||||

| Increase in accumulated deficit for stock dividend | $ | - | $ | 3,493,800 | $ | 3,493,800 | ||||||

|

The Notes to the Financial Statements are an integral part of these financial statements.

|

||||||||||||

F - 5

|

Sillenger Exploration Corp.

|

||||||||||||||||||||

|

(An Exploration Stage Company)

|

||||||||||||||||||||

|

Statements of Stockholders' Equity (Deficit)

|

||||||||||||||||||||

|

Period From February 14, 2007 (Inception) to February 28, 2011

|

||||||||||||||||||||

|

Common Stock

|

Additional paid-in

|

Accumulated

|

||||||||||||||||||

|

Shares

|

Amount

|

capital |

deficit

|

Total

|

||||||||||||||||

|

Issuance of common stock for cash to founders

|

3,000,000 | $ | 3,000 | $ | - | $ | $ | 3,000 | ||||||||||||

|

Net loss for the period ended February 28, 2007

|

- | - | - | (7 | ) | (7 | ) | |||||||||||||

|

Balance February 28, 2007

|

3,000,000 | 3,000 | - | (7 | ) | 2,993 | ||||||||||||||

|

Issuance of common stock for cash at $.01 per share

|

2,325,000 | 2,325 | 20,925 | - | 23,250 | |||||||||||||||

|

Issuance of common stock for cash at $.05 per share

|

498,000 | 498 | 24,402 | 24,900 | ||||||||||||||||

|

Net loss for the year ended February 29, 2008

|

- | - | - | (10,054 | ) | (10,054 | ) | |||||||||||||

|

Balance, February 29, 2008

|

5,823,000 | 5,823 | 45,327 | (10,061 | ) | 41,089 | ||||||||||||||

|

Net loss for the year ended February 28, 2009

|

- | - | - | (32,390 | ) | (32,390 | ) | |||||||||||||

|

Balance, February 28, 2009

|

5,823,000 | 5,823 | 45,327 | (42,451 | ) | 8,699 | ||||||||||||||

|

Stock dividend

|

34,938,000 | 34,938 | 3,458,862 | (3,493,800 | ) | - | ||||||||||||||

|

Issuance of common stock for cash at $.20 per share

|

50,000 | 50 | 9,950 | - | 10,000 | |||||||||||||||

|

Net loss for the year ended February 28, 2010

|

- | - | - | (19,598 | ) | (19,598 | ) | |||||||||||||

|

Balance, February 28, 2010

|

40,811,000 | 40,811 | 3,514,139 | (3,555,849 | ) | (899 | ) | |||||||||||||

|

Net loss for the year ended February 28, 2011

|

- | - | - | (2,736,483 | ) | (2,736,483 | ) | |||||||||||||

|

Balance, February 28, 2011

|

40,811,000 | $ | 40,811 | $ | 3,514,139 | $ | (6,292,332 | ) | $ | (2,737,382 | ) | |||||||||

|

The Notes to the Financial Statements are an integral part of these financial statements.

|

||||||||||||||||||||

F - 6

Sillenger Exploration Corp.

(An Exploration Stage Company)

Notes To Financial Statements

Years Ended February 28, 2011 and 2010

|

1

|

Basis of Presentation and Nature of Business

|

Sillenger Exploration Corp. (“Sillenger” or the “Company”) was incorporated in Nevada on February 14, 2007. Sillenger is an exploration stage company and has not yet realized any revenues from its planned operations. During the period ended February 28, 2008, the Company acquired a 100% interest in three mining claims in the Bulkley mining district of British Columbia, Canada for cash consideration of $379. The property was being held in trust for the Company by a third party. On May 15, 2009 the Company abandoned the mineral titles and re-staked them in order to reduce exploration costs.

On May 26, 2010, Sillenger introduced its proprietary CLP Claims Licensing Program which is designed to help governments to provide a fast-track process for issuing the necessary documentation to resource companies. The system helps reduce risk to exploration companies and helps market a country as an attractive investment destination. This program is based on Mr. Gillespie’s (the Company’s majority shareholder, President and CEO) proprietary land claims management system.

On June 1, 2010, Sillenger, through its business partnership with FCMI Global Inc., (“FCMI”) whereby FCMI assigns trademarks, intellectual properties, contracts and agreements to Sillenger in exchange for 5% (percent) of Sillenger’s annual net income as per Sillenger’s audited financial statements, entered into a contract with the Government of the Republic of Equatorial Guinea to conduct an airborne geophysical survey of the continental region (27,000 sq. km) of Equatorial Guinea, known as Rio Muni, as well as 30 km of Continental Platform (4,500 sq. km) off the Atlantic coastline. The survey will provide the Ministry of Mines, Industry and Energy a geological database of the region highlighting the locations where there may be the presence of mineral, hydrocarbon or groundwater deposits, and a preliminary identification of subsurface structures which may present exploration potential, and to identify the likeliest exploration targets within those deposits.

In exchange, Sillenger was granted the mineral and hydrocarbon rights to 15% of the claim blocks in the entire area surveyed, as chosen by Sillenger, as well as a preferential right to any other claims that Sillenger desires.

Sillenger will determine which claims it will retain for its own account, and has the right to market, as principal or joint-venture, any other properties to prospective mining or oil interests, and to retain a carried interest in those properties. The licensing model reduces the Company’s risk, which is assumed by the exploration partners, who benefit from the upside when a deposit is discovered, developed, and put into production. Optimally, Sillenger simply retains an interest, either through shares or royalties, in every exploration, mining, and oil venture that occurs on its claims, in essence becoming a claims and portfolio manager, and receiving revenues from multiple sources.

F - 7

Sillenger Exploration Corp.

(An Exploration Stage Company)

Notes To Financial Statements

Years Ended February 28, 2011 and 2010

|

1

|

Basis of Presentation and Nature of Business (continued)

|

The business partnership with FCMI entails fully reimbursing FCMI for expenses it incurs in negotiating trademarks, intellectual properties, contracts and agreements that are assigned to Sillenger. At February 28, 2011 the amount included under accounts payable and reimbursable to FCMI amounted to $2,475,587.

On June 11, 2010, Sillenger retained Fugro Airborne Surveys, a subsidiary of Fugro Group, to conduct the airborne geophysical survey of the Rio Muni region of Equatorial Guinea. The survey will help to reveal the locations of potential deposits, and provide a detailed reading of the subsurface structures.

In October 2010, the Company entered into negotiations to finance the cost of this survey. As part of these negotiations, Sillenger fully assigned its commitment with Fugro Airborne Surveys to a third party. On April 28, 2011, Sillenger executed an agreement with Ivory Resources, Brilliant Mining and others, whereby Sillenger agreed to accept and receive 7,407,407 units of Brilliant [with a 4 month escrow] in exchange for Ivory acquiring from Sillenger an agreement with the government of the Republic of Equatorial Guinea, which included certain preferential rights to request mining and/or oil concessions. Each Unit consists of one common share of Brilliant and one Common Share purchase warrant. Each Warrant will entitle the holder thereof to acquire one Common Share of Brilliant upon the payment of $0.45 per Warrant at any time until 24 months following the date of issuance. As part of the agreement, all the assets of FCMI Global Inc., including the amounts receivable from Sillenger Exploration Corp., would be transferred to a newly set up wholly owned subsidiary of Sillenger. As of the date of filing this 10K, the agreement had not closed

|

2

|

Going Concern

|

Sillenger has recurring losses and has accumulated operating losses during the exploration stage of $2,798,532 as of February 28, 2011. Sillenger's financial statements are prepared using generally accepted accounting principles applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, Sillenger has not realized any revenues. Without raising additional capital, there would be substantial doubt Sillenger’s ability to continue as a going concern. Sillenger's management plans on raising cash from public or private debt or equity financing, on an as needed basis and in the longer term, revenues from the acquisition, exploration and development of mineral interests, if found. Sillenger's ability to continue as a going concern is dependent on these additional cash financings, and, ultimately, upon achieving profitable operations through the development of mineral interests.

|

3

|

Summary of Critical Accounting Policies

|

Cash and Cash Equivalents

For purposes of the statements of cash flows, the Company considers all highly liquid investments purchased with a original maturity of three months or less to be cash equivalents.

F - 8

Sillenger Exploration Corp.

(An Exploration Stage Company)

Notes To Financial Statements

Years Ended February 28, 2011 and 2010

|

3

|

Summary of Critical Accounting Policies (continued)

|

Estimates

The preparation of financial statements in conformity with generally accepted accounting principles in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Significant estimates and assumptions relate to, but are not limited to, estimation of accrued liabilities. Actual results could differ from those estimates.

Foreign Currency Translation and Transactions

The Company’s reporting and functional currency is the U.S. dollar. Foreign currency denominated monetary balance sheet items are translated into U.S. dollars at the prevailing exchange rates in effect at the end of the reporting period, the historical rate for non-monetary balance sheet items and shareholders’ equity, and the average rate for the year for revenues, expenses, gains and losses. Foreign currency gains or losses on translation are included in the statement of operations.

Fair Value of Financial Instruments

The Company adopted ASC Topic 820 for all financial assets and liabilities measured at fair value on a recurring basis. The Company adopted ASC Topic 820 effective February 28, 2010, for all non-financial assets and liabilities. ASC Topic 820 defines fair value as the price that would be received to sell an asset or paid to transfer a liability (exit price) in an orderly transaction between market participants at the measurement date. The statement establishes market or observable inputs as the preferred sources of values, followed by assumptions based on hypothetical transactions in the absence of market inputs. The statement requires fair value measurements be classified and disclosed in one of the following categories:

Level 1 – Quoted prices in active markets for identical assets and liabilities.

Level 2 – Quoted prices in active markets for similar assets and liabilities, quoted prices for identical or similar instruments in markets that are not active and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3 – Significant inputs to the valuation model are unobservable.

Financial assets and liabilities are classified based on the lowest level of input that is significant to the fair value measurement.

F - 9

Sillenger Exploration Corp.

(An Exploration Stage Company)

Notes To Financial Statements

Years Ended February 28, 2011 and 2010

|

3

|

Summary of Critical Accounting Policies (continued)

|

Fair Value of Financial Instruments (continued)

The carrying amounts on the accompanying balance sheet for cash, accounts payable and accrued liabilities are carried at cost, which approximates fair value.

Income Taxes

Income taxes are accounted for under the asset and liability method prescribed by ASC Topic 740 – Income Taxes. Deferred income taxes are recognized for the tax consequences in future years for differences between the tax bases of assets and liabilities and their financial reporting amounts at each year-end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized. Income tax expense is the tax incurred for the period and the change during the period of deferred tax assets and liabilities.

In accordance with accounting literature related to uncertainty in income taxes, tax benefits from uncertain tax positions that are recognized in the financial statements are measured based on the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement.

The Company recognizes interest and penalties, if any, related to uncertain tax positions in selling, general and administrative expenses. No interest and penalties related to uncertain tax positions were accrued at February 28, 2011 and 2010.

Loss Per Share

Basic loss per share is computed by dividing net loss by the weighted average number of common shares outstanding for the periods. Diluted loss per share reflects, in addition to the weighted average number of common shares, the potential dilution of stock which is not applicable to Sillenger as of February 28, 2011 and 2010.

|

4

|

Recently Issued Accounting Standards And Recently Adopted Accounting Pronouncements

|

Changes in Accounting Policies Including Initial Adoption