Attached files

Exhibit 10.4

LEASE AGREEMENT

THIS LEASE AGREEMENT (“Lease”) made this 28 day of March, 2011, by and between Great Dane Realty, LLC, an Indiana limited liability company (hereinafter referred to as “Landlord”), and Vera Bradley Designs, Inc., an Indiana corporation (hereinafter referred to as “Tenant”).

WITNESSETH:

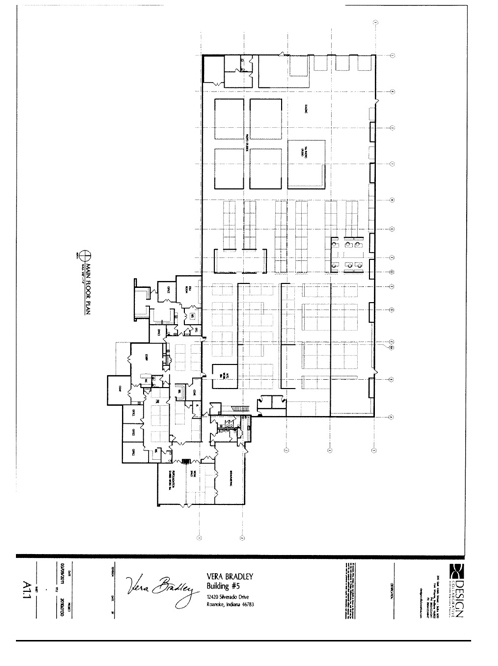

FOR AND IN CONSIDERATION of the full and faithful compliance by the parties hereto with each and all of the terms, covenants and conditions herein contained to be complied with by them, Landlord does hereby lease, let and demise unto Tenant and Tenant does hereby lease from Landlord the real estate described in Exhibit “A” attached hereto and made a part hereof, together with the improvements constructed thereon, including, but not limited to, a commercial manufacturing, warehousing and office building containing approximately 39,249 square feet of rentable space, and all appurtenances thereto (the “Leased Premises”). The Leased Premises shall include the office equipment and furnishings shown on the personal property inventory attached hereto and incorporated herein by reference as Exhibit “B.” The Leased Premises shall not include Landlord’s warehouse and other equipment located upon the Leased Premises, and Landlord covenants and agrees to remove such equipment from the Leased Premises prior to and as a condition to the Delivery Date as provided in Article V of this Lease; provided, however, it is hereby understood and agreed that Landlord shall have the right to continue to store Landlord’s boxed files currently located at the Leased Premises during the Term of this Lease.

ARTICLE I

TERM

1.1 The lease term, subject to all of the provisions and conditions herein contained, shall be for a period of three (3) years (“Term”) commencing the first day of the month following the date which is thirty (30) days following the Delivery Date as defined in Article V of this Lease (the “Commencement Date”), and terminating on the third anniversary of the Commencement Date, unless sooner terminated as provided herein (the “Expiration Date”).

1.2 Within ten (10) days of the Commencement Date, Landlord and Tenant shall execute and deliver to each other a confirmation of the Commencement Date, the Expiration Date and the Base Rent in the form attached hereto and incorporated herein by reference as Exhibit “C.”

1.3 Landlord and Tenant agree that the Term shall be automatically extended for successive periods of one (1) year each (each, a “Renewal Period”) from and after the Expiration Date unless and until either Landlord or Tenant notifies the other that the Lease shall expire on the Expiration Date next occurring at least ninety (90) days prior to the next occurring Expiration Date. All of the terms and conditions of this Lease shall remain in full force and effect during any extension of the Term pursuant to this Section 1.3 except that the Base Rent for each Renewal Period will be equal to an amount equal to the Base Rent in effect immediately prior to the commencement date of such Renewal Period (an “Adjustment Date”) multiplied by a

fraction having as its numerator the CPI Index for the Comparison Month and having as its denominator the CPI Index for the Base Month (as such terms are defined below). As used herein, the term “CPI Index” shall mean the United States Department of Labor, Bureau of Labor Statistics, Consumer Price Index, All Urban Consumers Index (CPI-U), 1982-84 =100. If at any time the CPI Index is no longer published, then Landlord will substitute an official index published by the Bureau of Labor Statistics, or successor or similar agency then in existence, which is, in Landlord’s reasonable opinion, most comparable to the CPI Index. The term “Comparison Month” shall mean the last full calendar month preceding the Adjustment Date. The “Base Month” shall mean the calendar month which is twelve (12) months prior to the Comparison Month. In no event shall the annual Base Rent in a given year be less than the annual base rent for the immediately preceding year.

ARTICLE II

USE AND OCCUPANCY

2.1 Tenant covenants that the Leased Premises shall, during the term of this Lease, be used for manufacturing, warehousing and office purposes, for such other allied purposes as may be incidental thereto, and for no other purpose without the prior written consent of Landlord, which consent Landlord agrees shall not be unreasonably withheld, conditioned or delayed.

2.2 Tenant agrees not to use or suffer or permit any person to use, in any manner whatsoever, the Leased Premises for any purpose calculated to injure the reputation of the Leased Premises or to impair the value of the Leased Premises, nor for any purpose or use in violation of any federal, state, county or municipal law or ordinance. Tenant will neither commit nor permit waste upon the Leased Premises.

ARTICLE III

RENTAL

3.1 Tenant shall pay as base rent for said Leased Premises, without setoff, deduction, counterclaim except as otherwise specifically set forth herein or relief from valuation or appraisement laws, the sum of One Hundred Seventy-Six Thousand Six Hundred Twenty and 50/100 ($176,620.50) per annum, payable in monthly installments of Fourteen Thousand Seven Hundred Eighteen and 38/100 Dollars ($14,718.38). Base Rent shall be payable in advance on the first day of each calendar month throughout the term hereof to the attention of Landlord at 3010 Butler Ridge Parkway, Fort Wayne, Indiana 46808, or such other place as Landlord may from time to time designate in writing. Base Rent shall be adjusted as provided in Section 5.1 of this Lease. Any base rent or other amounts owing hereunder by Tenant that are not paid within five (5) days of the date when due shall be subject to a late charge equal to five percent (5%) of the amount owed.

3.2 It is the purpose and intent of Landlord and Tenant that the rental as herein provided shall be absolutely net to Landlord, so that this Lease shall yield to Landlord the rent specified herein above and accordingly that all taxes, insurance, maintenance and other expense of any type or nature shall be solely the responsibility of Tenant unless otherwise specifically provided herein.

2

ARTICLE IV

REAL ESTATE TAXES

4.1 Tenant agrees that it shall pay, in addition to all other sums agreed to be paid by it in this Lease, all real property taxes and assessments against the real estate and improvements constituting the Leased Premises which fall due during the term of this Lease. Such taxes and assessments shall be prorated for any partial lease years. Tenant shall pay each installment of principal and interest on or before the last day on which payment may be made without penalty. Tenant shall have the right to protest taxes either in its own name or in the name of Landlord and Landlord shall cooperate to whatever extent necessary to protest said taxes, all at the sole expense of Tenant. In contesting any such taxes, Tenant shall obtain such bonds or take such other action as may be necessary to assure that liens or lien rights do not attach to the Leased Premises.

4.2 Tenant shall be solely responsible and shall pay for all personal property taxes on all personal property, inventory and fixtures owned by it or located in or about the Leased Premises which accrue during the term of this Lease.

4.3 It is expressly agreed, however, that Tenant shall not be obligated to pay any capital levy or corporate franchise tax levy imposed upon Landlord or any estate, inheritance, succession or transfer tax upon the passing of Landlord’s interest in the Leased Premises, or any income tax, profits tax, excise tax or other tax or charge that may be payable or chargeable to Landlord under any present or future law of the United States or State of Indiana or imposed by any political or taxing subdivision thereof, or any governmental agency, upon or with respect to the rent received by Landlord under this Lease.

ARTICLE V

IMPROVEMENTS, MAINTENANCE AND REPAIRS

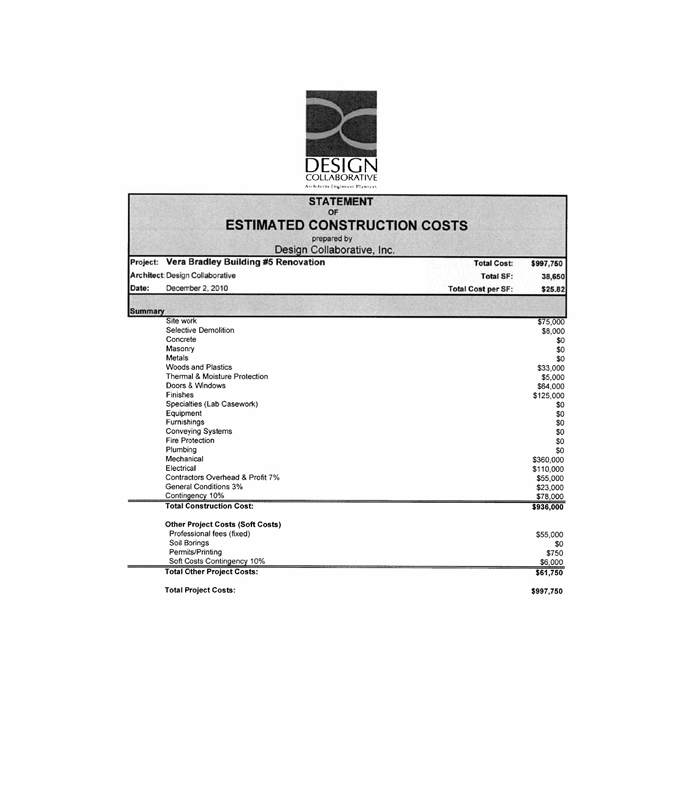

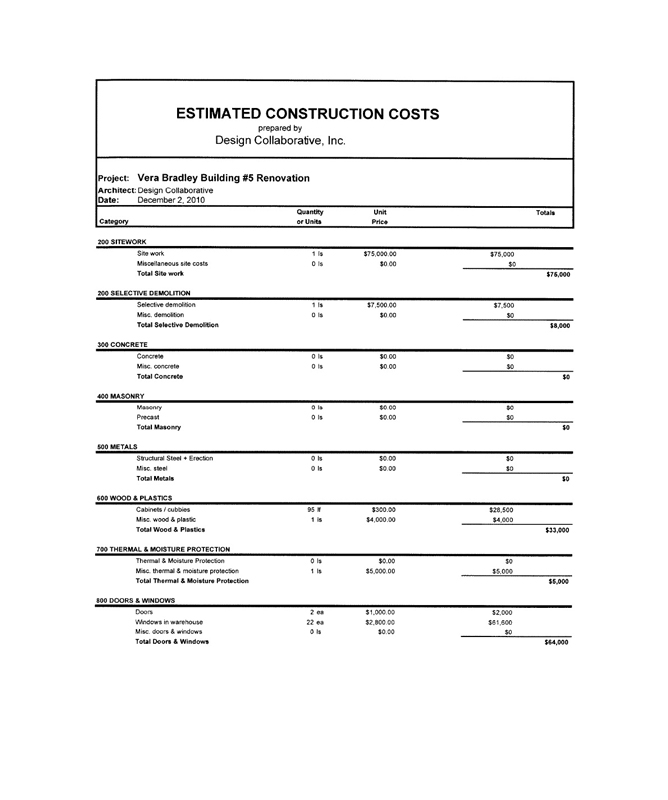

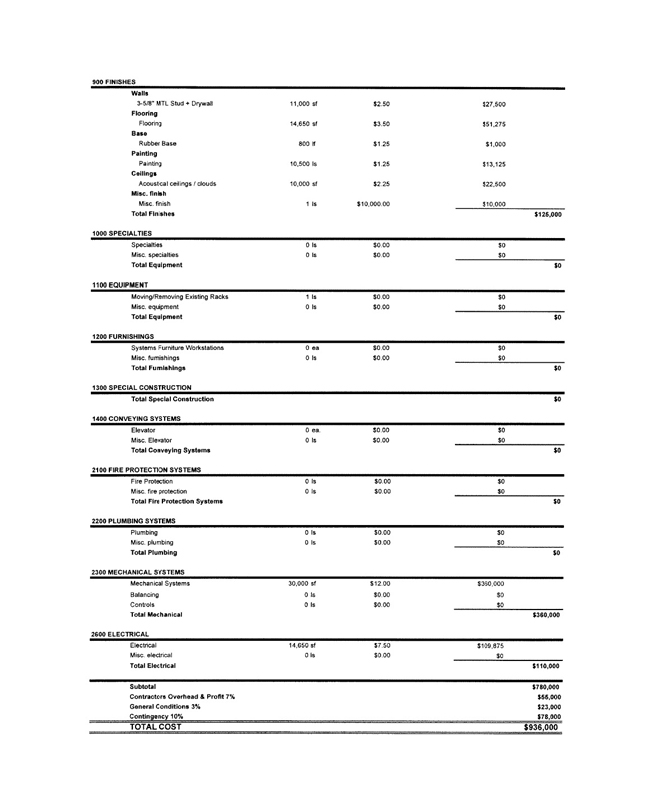

5.1 Tenant shall construct improvements to the Leased Premises in a timely manner (“Improvements”) which such Improvements shall be paid for by Landlord at Landlord’s sole cost and expense pursuant to invoices submitted to Landlord by Tenant during the construction of said Improvements in accordance with plans and specifications approved by Landlord and Tenant in writing and identified on Exhibit “D” attached hereto and incorporated herein by reference. The plans and specifications shall include a construction cost budget and a construction schedule. Landlord and Tenant agree that the plans and specifications including the construction cost budget and construction schedule may only be altered through a written change order executed by both Landlord and Tenant identifying the change to the plans and specifications and providing any appropriate adjustments to the construction cost of the Improvements and the construction schedule. Within ten (10) days after the date set forth in the construction schedule for completion (“Delivery Date”), Tenant shall provide to Landlord a written certification of the total costs of the Improvements together with invoices and receipts in support thereof. Landlord shall have a period of ten (10) days from the receipt of Tenant’s certification to review the same to determine that the Tenant’s written certification is in compliance with Exhibit D to this Lease. If Tenant’s written certification is not in compliance with Exhibit D, Landlord shall provide written notice to Tenant and Tenant shall revise the written certification to comply with Exhibit D within ten (10) days of Landlord’s written notice.

3

Tenant agrees that the base rent shall be increased in an amount equal to the cost of construction shown on Landlord’s written certification of costs of the Improvements amortized over the three (3) year term of the Lease using an assumed interest rate of five percent (5%). In the event the cost to complete the Improvements exceeds the construction budget amount or a change order results in the addition of an item of cost not included in the plans and specifications (each such amount an “Addition”), Tenant shall have the option to either a) increase the base rent by an amount equal to the cost of the Addition amortized over the three (3) year Term of the Lease using an assumed interest rate of five percent (5%) or b) pay to Landlord the cost of the Addition in cash within thirty (30) days of the Commencement Date. Tenant agrees to commence construction of the Improvements promptly in accordance with the construction schedule after the approval of plans and specifications and substantially complete construction of the Improvements as promptly as possible thereafter but no later than the Delivery Date. Tenant shall obtain all necessary insurance, permits and licenses in connection with the Improvements and shall obtain a valid certificate of occupancy and provide evidence thereof to Landlord. All work will be performed by qualified contractors that meet Landlord’s reasonable insurance requirements and are otherwise approved by Landlord which approval shall not be unreasonably withheld, conditioned or delayed. Tenant’s construction shall be free of defects in materials or workmanship and in compliance with all applicable laws, regulations, codes and ordinances. Tenant shall be responsible for any defects in materials or workmanship in the construction of the Improvements during the Term of the Lease. Tenant shall direct and control the Improvements and cause the same to be completed in a timely, first class and workmanlike manner. Tenant agrees that the Improvements shall be complete and the Leased Premises shall be ready for occupancy upon the Delivery Date. From and after the date hereof, Landlord shall provide Tenant with possession and access to the Leased Premises solely for construction of the Improvements, it being understood that all of the monetary and non-monetary of obligations Tenant pursuant to the Lease, other than the obligation to pay Base Rent and the real estate taxes set forth in subparagraph 4.1 hereof (which such amounts shall be due and owing as of the Commencement Date of the Lease as further set forth herein) shall apply during the period that Tenant is constructing the Improvements.

5.2 Except as otherwise specifically set forth herein, Tenant shall, at its sole cost and expense, maintain and repair the Leased Premises in as good a condition as exists as of the Commencement Date, reasonable wear and tear and damage caused by insured casualty excepted Tenant’s obligations shall include all maintenance and repair of the Leased Premises including maintenance, repair and replacement of all interior portions of the Leased Premises, including routine maintenance of mechanical systems, plumbing systems, electrical systems and HVAC systems serving the Leased Premises (“collectively, the “Building Systems”) together with exterior maintenance and repair of the Leased Premises and the removal of snow and ice removal from the parking lots, driveways and walkways located on the Leased Premises. Landlord shall be responsible for maintenance, repair and replacement of the structure, walls, roof and foundation of the Leased Premises and all capital maintenance, repairs and replacements to the Building Systems. For purposes of this Lease, the terms “capital maintenance repair or replacements” shall mean capital expenditures with reference to generally accepted accounting principles that exceed One Thousand and No/100 Dollars ($1,000.00). In the event any repairs or replacements are covered by insurance, the same are to be paid for by the insurance proceeds.

4

5.3 If Tenant refuses and neglects to repair promptly the Leased Premises as required in Section 5.2 hereof, in a reasonable time after written demand by Landlord, then Landlord may make such repairs without liability to Tenant for any loss or damage that may occur to Tenant’s merchandise, fixtures and/or other property, or to the loss of business occasioned by reason thereof, and Tenant shall reimburse Landlord for the cost thereof within thirty (30) days of a written notice thereof.

5.4 Tenant shall not make any structural alterations, additions or leasehold improvements to the Leased Premises or make any contract therefor without first procuring Landlord’s written consent which consent Landlord agrees shall not be unreasonably withheld, conditioned or delayed. All alterations, additions and/or leasehold improvements made by Tenant to or upon the Leased Premises, except Tenant’s trade fixtures, signs, equipment, cases and counters shall at once when made or installed be deemed to have attached to the freehold and to have become the property of Landlord. Tenant shall be responsible for any damages occasioned by removal of its personal property and other trade fixtures.

5.5 Any alterations made by Tenant shall be at Tenant’s cost and expense. Tenant agrees to conform to and comply with all laws, ordinances, rules and regulations of federal, state, county and municipal authorities in making such alterations or repairs, and shall at all times keep the Leased Premises free from claims of mechanics’ liens. All work will be performed by qualified contractors that meet Landlord’s reasonable insurance requirements and are otherwise approved by Landlord which approval shall not be unreasonably withheld, conditioned or delayed.

5.6 Landlord and its agents shall have free access to the Leased Premises during all reasonable and regular business hours for the purpose of examining the same and to make reasonable repairs which Landlord may desire to make hereunder.

ARTICLE VI

INSURANCE AND INDEMNITY

6.1 Tenant agrees to indemnify and save harmless Landlord from and against all claims, liabilities, losses, demands, damages or expenses of whatever nature, except those resulting from the gross negligence of Landlord or its agents, contractors, or employees, arising from any act, omission or negligence of Tenant, or Tenant’s agents, contractors, or employees, or arising from any accident, injury or damage whatsoever caused to any person, or to the property of any person, occurring during the term hereof in or about the Leased Premises or for Tenant’s failure to comply with the terms of this Lease. Landlord, from the commencement of Tenant’s occupancy, agrees to indemnify and save harmless Tenant from and against all claims of whatever nature, except those resulting from the negligent or intentional acts of Tenant, its agents, contractors or employees, arising from the gross negligence or willful misconduct of Landlord or for Landlord’s failure to comply with the terms of this Lease. This indemnity and hold harmless agreement shall include indemnity against all costs, expenses, attorney fees and/or liabilities in, or connected with, any such claim or proceeding brought thereon in defense thereof.

6.2 Tenant shall provide and maintain during the term hereof, for the benefit of Landlord and Tenant, public liability and property damage insurance in the usual form for the

5

protection of itself and Landlord against injury caused to persons or property by reason of its occupancy of the Leased Premises, with limits of not less than TWO MILLION DOLLARS ($2,000,000.00) per personal injury and ONE MILLION DOLLARS ($1,000,000.00) for property damage, and, in addition, in like amounts covering Tenant’s contractual liability under the aforesaid hold harmless clause as provided in Section 6.1 above.

6.3 From and after the commencement date of the Lease and throughout the residue of the term of the Lease, Tenant shall procure and pay for windstorm, fire and extended coverage insurance, insuring the building upon the Leased Premises of not less than the full replacement value thereof in a responsible insurance company authorized to do business in the State of Indiana. Such insurance policies shall insure against loss or damage from fire, windstorm, tornado, hail, disaster, earthquake, vandalism, riot, malicious mischief (and including boiler insurance and war risk insurance if then available), insurance against flood if required by the Federal Flood Disaster Protection Act of 1973 and Regulations issued thereunder, and such other insurance as commonly maintained by those whose business, improvement to and use of the Leased Premises is similar to that of Tenant. Such insurance shall contain the so-called Replacement Cost or Restoration Endorsement, and a provision to the effect that the waiver of subrogation rights by the insured does not void the coverage. Said insurance policies shall be issued in the joint names of Landlord and Tenant as the insured, and any mortgagee of Landlord, if so requested. Tenant shall also provide and keep in place such insurance as may be required by law, including, without limitation, worker’s compensation insurance.

6.4 Each of the insurance policies shall be in a form reasonably satisfactory to Landlord and shall carry an endorsement that before changing or canceling any policy the insurance company issuing the same shall give Landlord at least ten (10) days prior written notice, and Tenant shall be required to furnish Landlord with an acceptable replacement policy before the effective date of any such cancellation. Duplicate originals or certificates of all such insurance policies shall be delivered to Landlord. The first policy shall be issued prior to or on the Commencement Date, and all renewals thereof shall be issued at least ten (10) days prior to the expiration of the then existing policies.

6.5 Tenant agrees that all leasehold improvements and personal property of any type or nature owned by it, in, on or about the Leased Premises shall be at the sole risk and hazard of Tenant. Without intending hereby to eliminate the generality of the foregoing, Tenant agrees that Landlord shall not be liable or responsible for any loss of or damage to Tenant, or anyone claiming under or through Tenant, or otherwise, whether caused by or resulting from any peril required to be insured hereunder, or from water, steam, gas, leakage, plumbing, electricity or electrical apparatus, pipe or apparatus of any kind, the elements or other similar or dissimilar causes, and whether or not originating in the Leased Premises or elsewhere, provided such damage or loss is not the result of any negligent or intentional act of Landlord.

6.6 Whenever (a) any loss, cost, damage or expense resulting from fire, explosion or any other casualty or occurrence is incurred by either of the parties to this Lease or anyone claiming by, through or under them in connection with the Leased Premises and (b) such party is then either covered in whole or in part by insurance with respect to such loss, cost, damage or expenses (or is required under this Lease to be so insured), then the party so insured (or so required) hereby releases the other party from any liability said other party may have on

6

account of such loss, cost, damage or expense to the extent of any amount recovered by reason of such insurance (or which could have been recovered had insurance been carried as so required) and waives any right of subrogation which might otherwise exist in or accrue to any person on account thereof, provided that such release of liability and waiver of the right of subrogation shall not be operative in any case if the effect thereof is to invalidate such insurance coverage or increase the cost thereof (provided that in the case of increased cost, the other party shall have the right, within thirty (30) days following written notice, to pay such increased cost thereon, thereupon keeping such release and waiver in full force and effect).

ARTICLE VII

SIGNS AND ADVERTISING

7.1 Tenant may, at its expense, install identification signage to the exterior of the building located upon the Leased Premises with the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed.

7.2 Tenant shall maintain said signage in good order and condition. Upon termination of this Lease, Tenant shall remove such signage located upon the building and shall be responsible for any damage occasioned thereby.

7.3 Signage by Tenant shall comply with all applicable laws, regulations, codes and ordinances.

ARTICLE VIII

DESTRUCTION OF PREMISES

8.1 Subject to Section 8.3 below, if the Leased Premises shall be damaged or destroyed by any cause during the term of this Lease, this Lease shall remain in full force and effect and Landlord shall as promptly and as reasonably practical, subject to the receipt of adequate insurance proceeds therefor, repair and restore the Leased Premises prior to such damage or destruction and in accordance with plans and specifications mutually agreed upon at that time; or if such plans cannot be agreed upon, then in accordance with the original plans and specifications; provided, however, Landlord shall only be obligated to expend the insurance proceeds actually received by it and shall not be obligated to expend any of its own funds to complete restoration of the Leased Premises . The work of restoration or rebuilding shall be in full compliance with all laws and regulations and governmental ordinances applicable thereto. .

8.2 Should the Leased Premises or any part thereof be made untenantable as a result of such fire, damage or destruction, the rental payable by Tenant shall abate in proportion to the amount of the Leased Premises rendered untenantable as a result of such fire, damage or destruction until said damage is repaired as provided in Section 8.1.

8.3 If the Leased Premises are damaged to such extent that they cannot be repaired within ninety (90) days of such occurrence, or in the event such damage occurs within the last twelve (12) months of the lease term, this Lease may be cancelled at the option of either Landlord or Tenant upon written notice given within thirty (30) days from the date of such occurrence, and in such event, all rent shall be prorated to the date of such occurrence and Landlord shall be entitled to and Tenant shall assign to Landlord all proceeds received from the

7

fire and extended coverage insurance. In the event that there are any amounts owed for the construction of the Improvements pursuant to Section 5.1 of this Lease, Landlord shall be responsible for the payment of those costs, notwithstanding said damage or destruction, and shall indemnify and hold Tenant harmless from and against liability for those costs.

ARTICLE IX

EMINENT DOMAIN

9.1 If not more than Fifteen Percent (15%) of the building located upon the Leased Premises or not more than Twenty-Five Percent (25%) of the parking area located upon the Leased Premises shall be taken under the power of eminent domain, then the term of this Lease shall cease only on the part so taken from the date possession shall be taken for any public purpose, and the minimum rent shall be paid up to that date. If in such event any part of the Leased Premises is taken, Landlord shall rebuild and restore said Leased Premises to the extent of the condemnation award actually received by Landlord but in all events to an architectural whole, and Tenant shall be entitled to an equitable abatement of the fixed minimum rent until the Leased Premises are restored, and thereafter said rent shall be equitably reduced on account of any area taken by such eminent domain proceedings.

9.2 If more than Fifteen Percent (15%) of the building located upon the Leased Premises or more than Twenty-Five Percent (25%) of the parking area located upon the Leased Premises shall be taken under the power of eminent domain, then from that date Tenant shall have either the right to terminate this Lease as of the date possession of the part condemned is so taken, by written notice to Landlord within thirty (30) days after such date, or to continue in possession of the Leased Premises under all of the terms, covenants and conditions of this Lease, except that the fixed rent shall be proportionately and equitably reduced.

9.3 Each party may, as permissible by applicable law, prosecute at their option their respective claims, against the public or private bodies designated as the taking authority, on the account of any taking or appropriation of the Leased Premises. For the purpose of this paragraph, acquisition of all or part of the Leased Premises by governmental or quasi-governmental authority by means of voluntary negotiations and contracts in lieu of condemnation shall be deemed to be acquisition by the exercise of the power of eminent domain.

ARTICLE X

QUIET ENJOYMENT

10.1 Landlord covenants and agrees that if Tenant shall pay and otherwise perform and do all the things and matters herein provided for to be done by Tenant, Tenant shall peaceably and quietly have, hold, possess, use, occupy and enjoy the said Leased Premises during the term of this Lease.

ARTICLE XI

ASSIGNMENT AND SUBLETTING

11.1 Tenant may not assign or sublet the Leased Premises without Landlord’s prior written consent which consent Landlord agrees shall not be unreasonably withheld, conditioned or delayed. In the event that Tenant shall at any time, during the term of this Lease,

8

sublet all or any part of said Leased Premises or assign this Lease, it is hereby mutually agreed that Tenant shall nevertheless remain fully liable under all of the terms, covenants and conditions of this Lease. If this Lease be assigned or if the Leased Premises or any part thereof be subleased or occupied by anybody other than Tenant, Landlord may collect from the assignee, sublessee or occupant any rent or other charges payable by Tenant under this Lease, and apply the amount collected to the rent and other charges herein reserved, but such collection by Landlord shall not be deemed a release of Tenant from the performance by Tenant under this Lease.

11.2 Tenant may assign this Lease without the prior written consent of Landlord to:

(a) an entity controlled by Tenant, an entity controlling Tenant or an entity under common control with Tenant; or,

(b) an entity which acquires all or substantially all of business operations conducted by Tenant upon the Leased Premises.

ARTICLE XII

UTILITIES

12.1 Tenant shall be solely responsible for and shall promptly pay all charges for gas, heat, electricity and any other utilities or services used or furnished to the Leased Premises.

ARTICLE XIII

MORTGAGE SUBORDINATION/ESTOPPEL CERTIFICATES

13.1 Upon written request or notice by Landlord, Tenant agrees to subordinate its rights under this Lease to the liens of any mortgages or deeds of trust that may hereafter be placed upon the building and the Leased Premises, and to any and all advances to be made thereunder, and all renewals, replacements and extensions thereof. Tenant agrees to execute such subordination, non-disturbance and attornment agreements requested by such mortgagees provided that Tenant’s rights pursuant to this Lease shall be honored and its possession of the Leased Premises shall not be disturbed so long as Tenant is not in default pursuant to this Lease.

13.2 Upon written request from Landlord, Tenant shall execute estoppel certificates certifying that this Lease is in full force and effect and free from default and stating that rent has not been paid more than thirty (30) days in advance to the extent the same shall be true as of the date of the request and certifying such other factual matters relating to this Lease as Landlord may reasonably request. The estoppel certificates shall be in a form approved by Tenant which approval Tenant agrees shall not be unreasonably withheld, conditioned or delayed.

9

ARTICLE XIV

DEFAULT

14.1 If Tenant shall be in default in the payment of rental or any other charges provided for herein and such default shall continue for a period of five (5) days after written notice from Landlord to Tenant, or if Tenant shall be in default in the performance of any of the other covenants, promises or agreements herein contained for Tenant to be kept and performed and such default shall continue for thirty (30) days after Landlord shall have notified Tenant in writing of the existence of such default, or if Tenant is adjudicated a bankrupt, or if a receiver is appointed for Tenant’s property, including Tenant’s interest in the Leased Premises, and such receiver is not removed within thirty (30) days after appointment, or if, whether voluntarily or involuntarily, Tenant takes advantage of any debtor relief proceeding under present or future law whereby the rent, or any part thereof, is or is proposed to be reduced or payment thereof deferred, or if Tenant makes an assignment for the benefit of creditors, or if the Leased Premises or Tenant’s effects or interest therein shall be levied upon or attached under process against Tenant, not satisfied or dissolved within thirty (30) days from such levy or attachment, or if Tenant abandons the Leased Premises, then, and in any or all said events, Tenant shall be deemed to have breached this Lease and Landlord shall have the right at its option, without limitation of any other rights available to Landlord at law or in equity to:

(a) Enter upon and take possession of the Leased Premises as Tenant’s agent without terminating this Lease, and use commercially reasonable efforts to re-let the Leased Premises upon such rental and for such term as Landlord deems proper. Tenant shall obligated to pay Landlord all sums due and owing up to the time of such re-letting and upon the reletting shall further become immediately liable and indebted to Landlord and shall then upon demand promptly pay to Landlord the costs and expenses of such reletting, including any alterations or decorations required in connection therewith, plus the difference between the amount of the rent actually collected and received from the Leased Premises and the rental due under this Lease for the residue of the term herein provided remaining after the taking of possession by Landlord; or

(b) Forthwith cancel and terminate this Lease by notice in writing to Tenant; and if such notice shall be given, all rights of Tenant to the use and occupancy of said Leased Premises shall terminate as of the date set forth in such notice and Tenant will at once surrender possession of the Leased Premises to Landlord and remove all of Tenant’s effects therefrom, and Landlord may forthwith re-enter the premises and repossess itself thereof, and Landlord shall be entitled to receive as liquidated damages and not as a penalty a sum equal to all rent and other sums then due and owing together with all sums which would fall due hereunder through the balance of the lease term had this Lease not been terminated reduced by the fair market rental value of the Leased Premises for the same period. No termination of this Lease prior to the normal expiration thereof shall affect Landlord’s right to collect rent for the period prior to the termination thereof.

10

14.2 Landlord shall be entitled to collect from Tenant reasonable attorney fees and court costs incurred in enforcing any obligation of Tenant under this Lease.

14.3 If Landlord shall be in default of any term or covenant of this Lease and said default shall continue for a period of thirty (30) days after written notice thereof from Tenant to Landlord, then Landlord shall be in default of the terms and conditions of this Lease and Tenant have such rights as are available under applicable law upon such a default and, in addition, the right, but not the obligation, to cure said defaults on Landlord’s behalf at Landlord’s cost. In the event Tenant incurs any cost or expense in performing any obligation on Landlord’s behalf Landlord shall, within thirty (30) days of such demand pay such sums to Tenant. Notwithstanding the above, Tenant shall not have the right to terminate this Lease upon a default by Landlord.

ARTICLE XV

SURRENDER OF POSSESSION

15.1 Whenever the said term herein demised shall be terminated, whether by lapse of time, forfeiture or in any other way, Tenant covenants and agrees that it will at once surrender and deliver up said Leased Premises peaceably, free of all of Tenant’s property, in broom-clean condition and in as good of condition as when Tenant took possession, ordinary wear and tear and any damage caused by perils covered by insurance excepted. If Tenant fails to return possession of the Premises to Landlord in this condition, Tenant shall reimburse Landlord for the costs incurred by Landlord to put the Leased Premises in the condition required under this Paragraph 15.1. Tenant’s property left behind in the Leased Premises after the end of the Term will be considered abandoned and Landlord may move, store, retain or dispose of these items at Tenant’s sole cost and expense. Tenant’s obligation hereunder shall survive the expiration or termination of this Lease.

15.2 If Tenant shall hold over after any termination of this Lease, the same shall create no more than a month-to-month tenancy at the rent herein set forth and under all other applicable conditions herein provided, which such tenancy shall be terminable by either party upon thirty (30) days prior written notice to the other.

ARTICLE XVI

MECHANICS’ LIENS

16.1 Nothing in this Lease shall authorize Tenant to do any act which shall in any way encumber the title of Landlord in and to the Leased Premises, nor shall the interest of Landlord in the Leased Premises be subject to any lien arising from any act or omission of Tenant.

16.2 If any mechanics’ lien or liens shall be filed against the Leased Premises for work done or materials furnished to Tenant, Tenant shall within ninety (90) days after it has actual notice of such lien, at its own expense, cause such lien or liens to be discharged by payment of such claims or by filing of bond pursuant to statute.

16.3 Should Tenant fail to pay any such lien or post bond therefor, Landlord may, but it shall not be required to do so, discharge such mechanics’ lien or liens by payment

11

thereof, and the amount paid by Landlord together with Landlord’s costs and expenses shall be due and payable from Tenant forthwith on demand, together with interest at the rate of Six Percent (6%) per annum.

ARTICLE XVII

NOTICES

17.1 All notices, demands and requests hereunder shall be in writing and given by United States registered or certified mail, or by a nationally recognized air courier:

| In the case of Landlord to: | Great Dane Realty, LLC 3010 Butler Ridge Parkway Fort Wayne, Indiana 46808 | |

| In the case of Tenant to: | Vera Bradley Designs, Inc. 2208 Production Road Fort Wayne, Indiana 46808 | |

17.2 Each party from time to time may change its address for purpose of notice under this Article by giving to the other party notice of such change of address. Any notice, demand or request given by the United States, registered or certified mail, as provided herein, shall be deemed served on the date it is deposited in the United States mail or with a nationally recognized air courier properly addressed and with postage fully prepaid.

ARTICLE XVIII

ENVIRONMENTAL REPRESENTATIONS,

WARRANTIES AND INDEMNIFICATION

18.1 During the Term, Tenant shall comply with all applicable federal, state and local laws, regulations and ordinances relating to protection of human health and the environment (“Environmental Laws”), which are applicable to the Leased Premises and/or the conduct of Tenant’s business at the Leased Premises.

18.2 Tenant represents and warrants that during the term hereof it shall not construct, deposit, store, dispose, place or locate upon the Leased Premises any material, element, compound, solution compound, mixture, substance or other matter of any kind, including solid, liquid or gaseous material, that constitutes a Hazardous Material, as hereafter defined. Notwithstanding the above, Tenant may store, utilize and properly dispose de minimis amounts of Hazardous Material as hereafter defined, provided the same are reasonably required for Tenant’s normal business operations upon the Leased Premises, and provided further that such Hazardous Material is stored, processed, utilized and disposed of in compliance with all applicable federal, state and local laws, regulations, codes and ordinances.

18.3 For purposes of this Article XVIII, Hazardous Material shall mean any material or substance:

12

(a) defined as a “Hazardous Substance” or “Hazardous Material” pursuant to the Comprehensive Environmental Response, Compensation and Liability Act (42 U.S.C. § 9601 et. seq.) and amendments thereto and regulations promulgated thereunder or under other applicable Environmental Law;

(b) containing gasoline, oil, diesel fuel or other petroleum products;

(c) defined as a “Hazardous Waste” pursuant to the Federal Resources Conservation and Recovery Act and all regulations promulgated thereunder;

(d) containing Polychlorinated Biphenyls (PCB);

(e) containing Asbestos;

(f) which is radioactive;

(g) the presence of which requires investigation or remediation under any federal, state or local statute, regulation, ordinance or policy, or which is, or becomes defined as “Hazardous Waste” or as “Hazardous Substance” under any federal, state or local statute, regulation, ordinance or policy or any toxic, explosive, corrosive or other hazardous substance, material or waste, that is or becomes, regulated by any federal, state or local governmental authority or which causes a nuisance on the Leased Premises or any portion thereof.

18.4 Tenant agrees to protect, defend, indemnify and save harmless Landlord from and against all liabilities, obligations, claims, damages, penalties, causes of action, response and clean up costs, and other costs and expenses (including, without limitation, reasonable attorney fees, paralegal fees, the cost of any remedial action, consultant fees, investigation and laboratory fees, court costs and litigation expenses), imposed upon or incurred by or asserted against Landlord by reason of Tenant’s violation of Environmental Laws or as a result of, or in connection with, claims arising from the presence, use, storage, transportation, treatment, disposal, release or other handling, on or about or beneath the Leased Premises, of any Hazardous Substance, Hazardous Material or Hazardous Waste introduced or permitted on or about or beneath the Leased Premises by any act or omission of Tenant or its agents, officers, employees, contractors, invitees or licensees during the Term.

18.5 Landlord agrees to protect, defend, indemnify and save harmless Tenant from and against all liabilities, obligations, claims, damages, penalties, causes of action, response and clean up costs, and other costs and expenses (including, without limitation, reasonable attorney fees, paralegal fees, the cost of any remedial action, consultant fees, investigation and laboratory fees, court costs and litigation expenses), imposed upon or incurred by or asserted against Tenant by reason of the presence of Hazardous Material or Hazardous Waste upon the Leased Premises as of the Commencement Date or by reason of violations of Environmental Law which occurred on the Leased Premises prior to the Term of this Lease.

13

18.6 The representations, warranties and indemnification of Tenant pursuant to this Article XVIII shall survive the expiration or termination of this Lease.

ARTICLE XIX

MISCELLANEOUS

19.1 Each term and provision of this instrument performable by Tenant and Landlord shall be construed to be both a covenant and a condition.

19.2 Time is and shall be of the essence of this Lease and of each term or provision hereof.

19.3 If any term or provision of this Lease or the application thereof to any person or circumstance shall, to any extent, be invalid or unenforceable, the remainder of this Lease, or the application of such term or provision to persons or circumstances other than those to which it is held invalid or unenforceable, shall not be affected thereby, and each term and provision of this Lease shall be valid and be enforceable to the fullest extent permitted by law.

19.4 The headings of the articles of this instrument are for convenience and reference only and the words contained therein shall in no way be held to explain, modify, amplify or aid in the interpretation, construction or meaning of the provisions of this Lease.

19.5 Nothing in this Lease shall cause Landlord in any way to be construed as a partner, joint venturer or associated in any way with Tenant in the operation of said Leased Premises, or subject Landlord to any obligation, loss, charge or expense connected with or arising from the operation or use of said Leased Premises or any part thereof. The obligations of each individual tenant hereunder shall be joint and several.

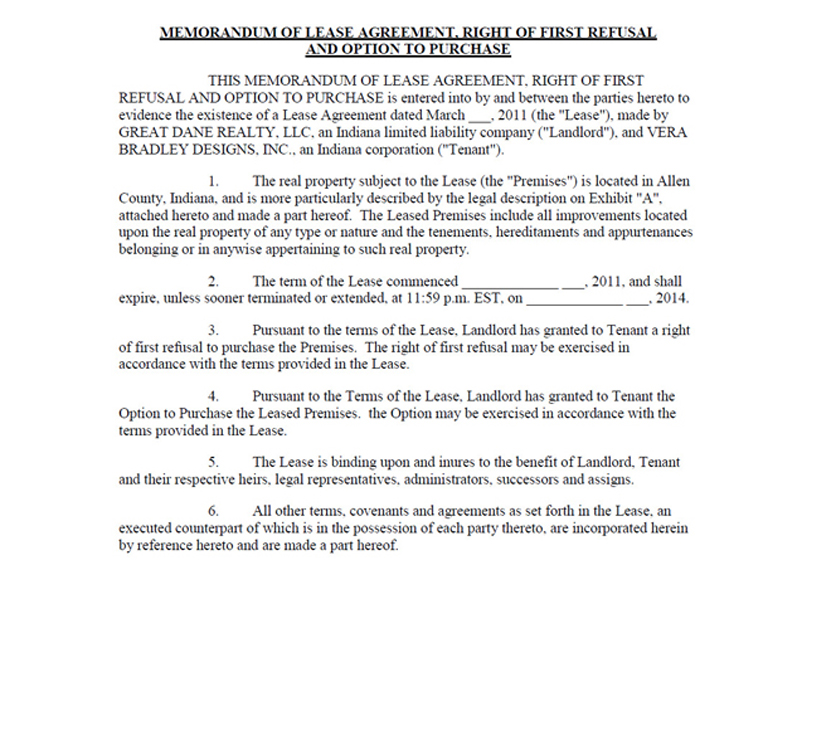

19.6 This Lease shall not be recorded and, in lieu thereof, a memorandum of lease and right of first refusal shall be executed, acknowledged and recorded in the form attached hereto as Exhibit “E.”.

19.7 This Lease shall be governed by the laws of the State of Indiana.

ARTICLE XX

RIGHT OF FIRST REFUSAL

20.1 In the event Landlord shall receive a bona fide offer for the purchase of the Leased Premises, or any part thereof, whether or not in conjunction with any other property, which Landlord desires to accept, Landlord shall give written notice thereof (hereinafter called “Offering Notice”) to Tenant. Said Offering Notice shall contain the following:

(a) The name and address of the proposed purchaser (“Third Party”);

(b) The terms and conditions of said offer; and

14

(c) An offer to sell the Leased Premises to Tenant upon the same terms and conditions of the aforesaid offer made by the Third Party.

20.2 Tenant shall be entitled to purchase such Leased Premises offered by giving written notice thereof to Landlord within fifteen (15) days after receipt of the Offering Notice. If Tenant fails to agree, in writing, to purchase such Leased Premises within the time aforesaid, Landlord shall have the right to complete the sale to the Third Party who shall then become the owner of the Leased Premises.

20.3 In the event of a change in the identity of the Third Party or a substantial change in the terms and conditions of the Offering Notice, notice thereof and opportunity to Tenant shall again be given by Landlord to Tenant in accordance with the terms hereof. Provided, however, if the proposed purchaser is an affiliate or assignee of Third Party, then such change in the proposed purchaser shall not constitute a change in the identity of the Third Party for purposes of this paragraph.

20.4 Exercise of the right to purchase the Leased Premises, by Tenant, shall require that closing on the sale occur (between Landlord and Tenant) under the same terms and conditions as the Offering Notice.

20.5 In the event that Tenant shall exercise its rights to purchase the Leased Premises pursuant to this Article, then the term of this Lease shall be automatically extended, if necessary, to the date of Closing and, upon Closing, this Lease shall terminate and be of no further force or effect.

20.6 In the event that Tenant shall not exercise its rights to purchase the Leased Premises pursuant to this Article, then this Lease shall continue in full force and effect upon the Closing.

ARTICLE XXI

OPTION TO PURCHASE

21.1 Certain terms used in this Article XXI are defined in this Section 1; other terms are defined within the text of this Lease.

(a) “Closing” shall mean the consummation of the purchase and sale of the Premises in accordance with the terms of this Lease upon exercising the option and completion of all conditions precedent herein required.

(b) “Leased Premises” shall mean the Leased Premises pursuant to this Lease constituting that certain parcel of real property located in Allen County, Indiana, as presently identified by legal description on Exhibit “A” attached hereto and made a part hereof. The full legal description of the Leased Premises shall be noted on the survey to be provided by Landlord as hereinafter required. Said Leased Premises include all buildings, improvements, fixtures, tenements, hereditaments and appurtenances belonging or in any wise appertaining to such real property, and all of Landlord’s right, title and interest, if any, in and to (i) any land lying in the bed of any street, road or avenue, open or

15

proposed, in front of or adjoining such real property to the center line thereof to the extent included in the legal description of the Leased Premises, but subject to public rights-of-way and easements; (ii) any strips and gores of land adjacent to, abutting or used in connection with such real property; (iii) any easements and rights, if any, inuring to the benefit of such real property or to Landlord in connection therewith; and (iv) any and all rights in and to any leases, licenses or other assets of any type or nature pertaining to the use of such real property. Notwithstanding the legal descriptions as attached hereto, it is agreed that the Leased Premises shall be deemed to include all right, title and interest of Landlord in and to the land and improvements, including such interests to be hereafter acquired as a condition hereof. The legal description shall be reformed according to survey to include all such interests.

(c) “Purchase Price” shall mean the Purchase Price for the Leased Premises as determined in accordance with Section 21.3 of this Lease.

(d) “Title Commitment” shall mean the Commitment issued by an ALTA approved title insurance company (“Title Company”) approved by the Tenant in which the title insurance company commits itself to issue to Tenant an Owner’s Policy of Title Insurance upon demand, with its general exceptions deleted, in the full amount of the Purchase Price, setting forth the state of the title to the Premises and subject only to those “permitted exceptions” hereinafter described.

21.2 Option to Purchase. Landlord hereby grants, bargains and sells to Tenant the exclusive option to purchase the Leased Premises (“Option”) commencing as of the Commencement Date and expiring as of the Expiration Date. Tenant may exercise the Option by giving notice to Landlord as provided in the Lease before expiration of the Option. Notice shall be deemed to have been given if in writing and made in such manner provided for the giving of notices specified in this Lease. In the event of exercise, Landlord shall sell to Tenant and Tenant shall purchase from Landlord the Leased Premises in accordance with the terms and conditions hereinafter set forth.

21.3 Purchase Price for Leased Premises. Landlord and Tenant may agree in writing upon the Purchase Price within thirty (30) days of the date Tenant exercises the Option. In the event Landlord and Tenant do not agree in writing upon the Purchase Price within thirty (30) days of the date Tenant exercises the Option, then Landlord and Tenant shall each appoint an appraiser licensed in Indiana with an MAI designation and with at least ten (10) years’ experience in preparing appraisals of commercial real estate in the county in which the Leased Premises are located. The appraisers shall then appoint a third appraiser with the same qualifications. Each appraiser shall then prepare an independent appraisal of the Leased Premises and submit a report of each appraisal to Landlord and Tenant. The appraisers shall each determine a) the fair market value of the Leased Premises; and, b) the fair market value of the Leased Premises without the Improvements described in Section 15.1 of this Lease (as if the Improvements had not been constructed). The fair market value of the Leased Premises shall be the mathematical average of the appraisers’ determinations. The fair market value of the Leased Premises without the Improvements shall be the mathematical average of the appraisers’

16

determinations. The Purchase Price shall be the greater of a) the fair market value of the Leased Premises; or b) the fair market value of the Leased Premises without the Improvements increased by the unamortized principal remaining pursuant to the amortization described in Section 5.1 of this Lease as of the Date of Closing. Landlord shall be responsible for the cost of the appraisal prepared by the appraiser appointed by Landlord. Tenant shall be responsible for the cost of the appraisal performed by the appraiser appointed by Tenant. Landlord and Tenant shall share equally the cost of the third appraisal. The Purchase Price subject to such adjustments, credits, deductions and prorations, if any, as herein required, shall be paid in cash at Closing.

21.4 Survey of Premises. Within thirty (30) days of the date of Tenant’s exercise of the Option, Tenant shall order and procure, at the expense of Tenant, a boundary survey of the Leased Premises with all easements (including utility easements), available utility services, encroachments, rights-of-way and other matters (whether or not of record) pertaining to or affecting the Leased Premises plotted thereon, and showing the location, area and dimensions of all improvements, easements, streets, roads, railroad spurs, flood hazard areas and alleys on or abutting said Leased Premises, and providing a legal description of the Leased Premises. Such survey shall be dated or re-dated at a date not more than thirty (30) days prior to the Closing, and unless otherwise approved by Tenant, shall (a) be made in accordance with the “Minimum Standard Detail Requirements for ALTA/ACSM Land Title Surveys.”

21.5 Title to Premises.

(a) State of Title to be Conveyed. At the Closing, Landlord shall convey to Tenant, its nominees, successors or assigns, by special warranty deed, wherein Landlord warrants title to Tenant against all claimants claiming by, through or under Landlord, good and merchantable and insurable fee simple title to the Leased Premises, free from all liens, encumbrances, restrictions, rights-of-way and other matters, excepting only the “permitted exceptions” described as follows: (i) the lien of general real estate taxes not yet due and payable, subject to proration of taxes as hereinafter provided; (ii) liens or encumbrances of a definite or ascertainable amount and which will be paid and discharged in full by or for Landlord at or prior to the Closing; (iii) matters or title created or suffered by Tenant during the Term of this Lease; and (iv) zoning ordinances, easements of record and other documents or restrictions, if any, which do not prevent or materially interfere with Tenant’s use of the Premises.

(b) Title Insurance Commitment and Policy. Within thirty (30) days of Tenant’s exercise of the Option, Tenant shall order and procure the Title Commitment, at the initial expense of Tenant (but subject to reimbursement as a credit at Closing). At the Closing, a Policy of Title Insurance or an endorsement to the Title Commitment shall be issued to Tenant insuring Tenant’s fee simple interest in the Leased Premises in the state required by Section 20.5(a) above, with all general exceptions deleted, and subject only to the “permitted exceptions”. Landlord shall pay for, or Tenant shall receive a credit therefor at the Closing, all charges and costs of such Title Insurance Policy.

17

(c) Objections to State of Title. If title to the Leased Premises is not in the state required by Section 20.5(a) above, Tenant shall give written notice to Landlord within thirty (30) business days after the date it receives the Title Commitment and survey, specifying its objection(s) to the state of title to the Premises. Landlord shall thereupon have a period of thirty (30) days in which it shall use commercially reasonable efforts to remedy the objection(s) or to induce the Title Company to issue an endorsement to the Title Commitment satisfactory to Tenant insuring over or removing such objection(s). If Tenant’s objection(s) to the state of title to the Leased Premises are not remedied by Landlord within such thirty (30) day period, or such further period as Tenant may, in its sole discretion, grant, then Tenant shall have the right, within thirty (30) days thereafter, to give written notice to Landlord that Tenant waives such title defects or objections and elects to proceed to acquire the Leased Premises without any abatement of the Purchase Price and to take title to the Leased Premises subject to such defects or objections; otherwise, this Lease shall be automatically cancelled and rescinded.

21.6 Conditions to Closing. Tenant and Landlord agree that the sale and purchase of the Leased Premises is subject to the satisfaction of the following contingencies and conditions within sixty (60) days of Tenant’s exercise of the Option, and if not so satisfied this Tenant may cancel and rescind the exercise of the Option and this Lease shall continue in full force and effect. Notwithstanding the foregoing, Tenant may, at its option, waive any of the conditions or contingencies set forth in this Section 21.6 and proceed to purchase the Leased Premises from Landlord.

(a) The Leased Premises and all buildings and improvements located thereon will at Closing be in the same state of condition and repair as of the date of exercise of the Option.

(b) That Tenant shall have approved the form and content of the Title Commitment and the Survey in accordance with Sections 20.4 and 20.5. Premises shall have remained in the state reflected by the Title Commitment and the Survey, as approved by Buyer, through the date of the Closing.

(c) That Tenant shall have approved the form and content of the special warranty deed conveying the Leased Premises to Tenant, the vendor’s affidavit, the non-foreign certificate, the closing statement covering the purchase and sale of the Leased Premises, and all other documents and instruments required to effect the sale of the Leased Premises and the agreements of the parties herein set forth; and Landlord shall prepare such documents and instruments promptly upon notification by Tenant that all conditions precedent above set forth have been performed or waived. Landlord shall also furnish to Tenant such proof of authority as requested by Tenant or the Title Company authorizing Landlord to enter into and consummate this transaction.

21.7 Proration of Real Estate Taxes. Tenant shall pay all real property taxes and any general and/or special assessments which are due and payable, if any, on or before the date of the Closing, or which otherwise constitute a lien upon the Premises as of the date of the

18

Closing pursuant to Section 4.1. Current taxes assessed for the year in which the Closing takes place shall be equitably prorated through the date of the Closing on the basis of the latest available tax bills covering the Leased Premises. If, at the Closing, the Leased Premises or any part thereof shall be subject to any assessment(s) which are or may become payable in annual installments of which the first installment is then due or has been paid, then for the purposes of this Lease all the unpaid installments of any such assessment, including those which are to become due and payable after the delivery of the deed to the Leased Premises, shall be deemed to be due and payable at the Closing and to be liens upon the Leased Premises and shall be paid and discharged by the Tenant at or prior to the Closing.

21.8 Closing.

(a) Provided all conditions set forth in Section 20.6 hereof or elsewhere in this Paragraph 21 herein have been satisfied or waived, within the time period therein required, the Closing shall take place at such time and date within thirty (30) days thereafter as agreed between Tenant and Landlord, unless extended in writing by mutual agreement of the parties hereto. The Term of the Lease shall be deemed automatically extended to the Date of Closing. The Closing shall occur at the offices of the Title Company. Tenant and Landlord agree to deposit with Title Company not later than the date of the Closing all executed documents required in connection with this transaction, including such documents as requested by the Title Company issuing the Title Policy. Upon receipt of all necessary documents, and when the Title Company is in a position to issue to Tenant a Policy of Title Insurance, Title Company shall on the date of the Closing, upon instructions from Tenant and Landlord, cause the deed to the Leased Premises and any other necessary or appropriate instruments to be filed for record. In the event all the conditions precedent to be performed by Landlord have not been satisfied within ninety (90) days of the date Tenant exercises the Option, the exercise of the Option may be cancelled, at the option of Tenant, without obligation or liability to Landlord and this Lease shall continue in full force and effect.

(b) Landlord hereby agrees that it shall be solely liable for and shall pay (or provide a credit to Tenant at Closing) for: (i) the premium charged for the issuance of said ALTA owner’s title policy issued pursuant to said commitment, and (ii) attorneys, brokerage, engineering and other professional fees of Landlord. Landlord hereby further agrees that it shall be solely liable for and shall pay any and all taxes as may be legally required for the conveyance of the property being sold hereunder, so as to convey to Tenant the fee simple title to the Leased Premises, free of all encumbrances, except as herein stated, or except as may be mutually agreed upon by the parties hereto. Tenant shall pay all recording fees necessary to effectuate the transfer of the Leased Premises as contemplated herein. Buyer and Seller shall bear equally the title company’s closing fees, with Seller bearing the cost of the title company’s title search and examination fees relating to the Leased Premises. Each party shall be responsible for its other costs and expenses in accordance with the obligations or conditions to be performed by each respective party hereto. At the time of Closing, Landlord

19

and Tenant shall execute and deliver a closing statement setting forth said Purchase Price, with such closing adjustments thereto as may be applicable.

21.9 Remedies Upon Default. In the event Tenant breaches or defaults under any of the terms of the Option, Landlord shall be entitled to terminate the Option and recover the actual, out of pocket fees or expenses incurred by Landlord in connection with Tenant’s execution of the Option and any Tenant default in connection therewith, including, without limitation, brokerage, engineering and other professional fees of Landlord which shall be its sole remedy at law or in equity. In the event Seller breaches or defaults under any of the terms of this Lease, Tenant shall have the right to cancel and rescind the exercise of the Option or, in the alternative, the right to compel specific performance of the Option and the right to recover Tenant’s costs and expenses incurred in enforcing the terms and conditions of the Option, including but not limited to Tenant’s reasonable attorney fees and court costs. Notwithstanding any provision of this Lease to the contrary, in no event shall either Landlord or Tenant be liable for consequential, indirect, special damages or punitive damages arising from a default under this Paragraph 21.

21.10 Brokerage Commission. Landlord and Tenant each warrant and represent that there are no finders or brokers entitled to fees or commissions which may be due from the introduction of the Landlord and Tenant and/or the purchase and sale of the Leased Premises.

21.11 Eminent Domain. In the event that, prior to the date of the Closing, Landlord acquires knowledge of any pending or threatened claim, suit or proceeding to condemn or take all or any part of the Leased Premises under the power of eminent domain, then Landlord shall immediately give notice thereof to Tenant, and Tenant shall have the right to cancel and rescind the exercise of the Option by delivering notice thereof to Landlord within thirty (30) days after receiving notice from Landlord of such condemnation or taking, and thereupon the Tenant’s exercise of the Option shall be deemed cancelled and rescinded. If Tenant shall not elect to cancel and rescind the exercise of the Option pursuant to this Section 21.11, the parties shall proceed with the Closing in accordance with the terms hereof without abatement of the Purchase Price, but all proceeds of any condemnation award shall be payable solely to Tenant, and Landlord shall have no interest there in.

21.12 Indiana Responsible Property Transfer Law. Tenant and Landlord acknowledge that the transactions contemplated by this Lease may be subject to the provisions of the Indiana Responsible Property Transfer Law (Ind. Code 13-25-3-1, et seq.). Landlord agrees that it shall either (a) comply with the provisions of the Indiana Responsible Property Transfer Law and provide the Tenant and Tenant’s Lender, if any, with a “disclosure document” as and when required by the Indiana Responsible Property Transfer Law, or (b) provide the Tenant with a certification acceptable to Tenant on or before Closing that the transactions contemplated by this Lease are not subject to the provisions of the Indiana Responsible Property Transfer Law.

IN WITNESS WHEREOF, Landlord and Tenant have hereunto executed this Lease the day and year first above written.

20

| Landlord: | ||

| GREAT DANE REALTY, LLC, an Indiana limited liability company | ||

| By: |

/s/ Barbara B. Baekgaard | |

| Printed: |

Barbara B. Baekgaard | |

| Its: |

| |

| Tenant: | ||

| VERA BRADLEY DESIGNS, INC., an Indiana corporation | ||

| By: |

/s/ David R. Traylor | |

| Printed: |

David R. Traylor | |

| Its: |

Treasurer | |

21

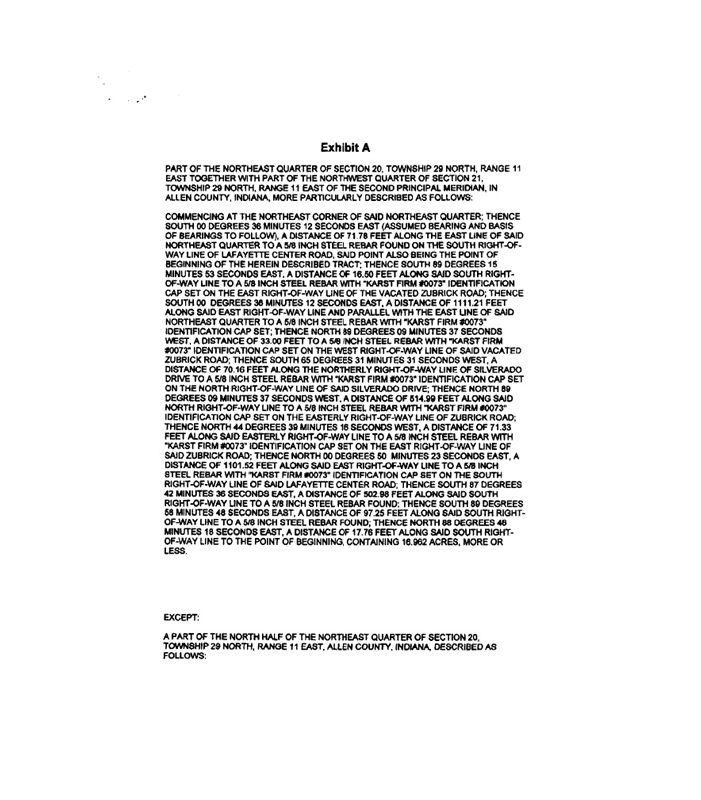

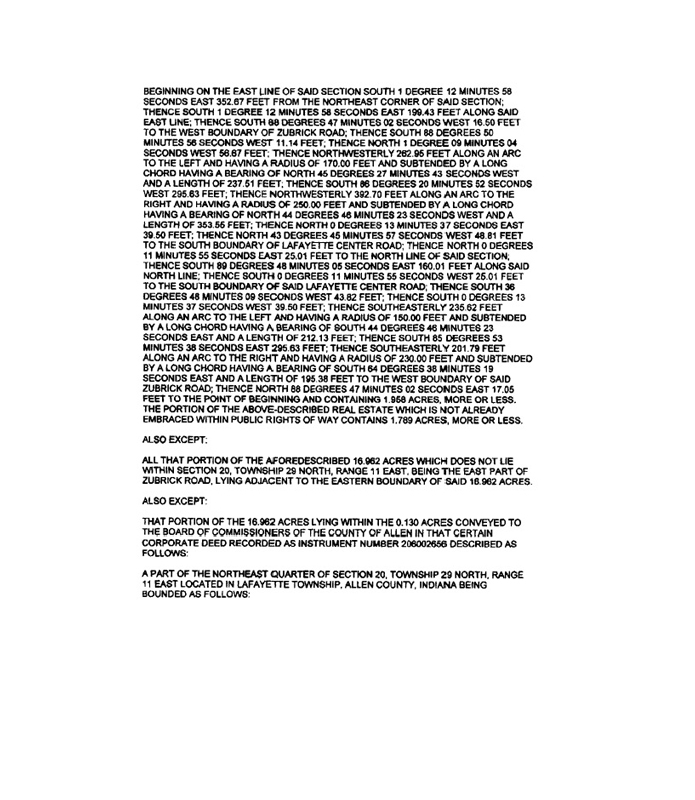

EXHIBIT A

Legal Description of Leased Premises

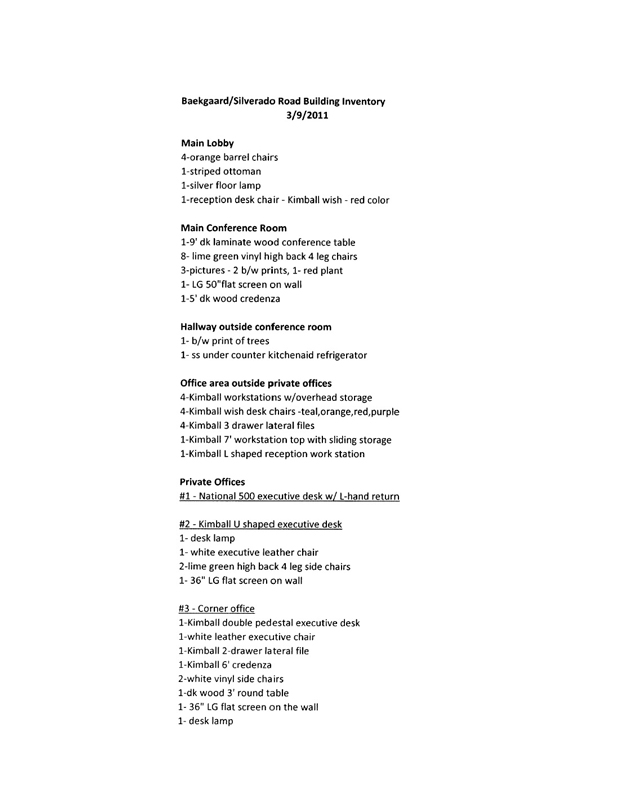

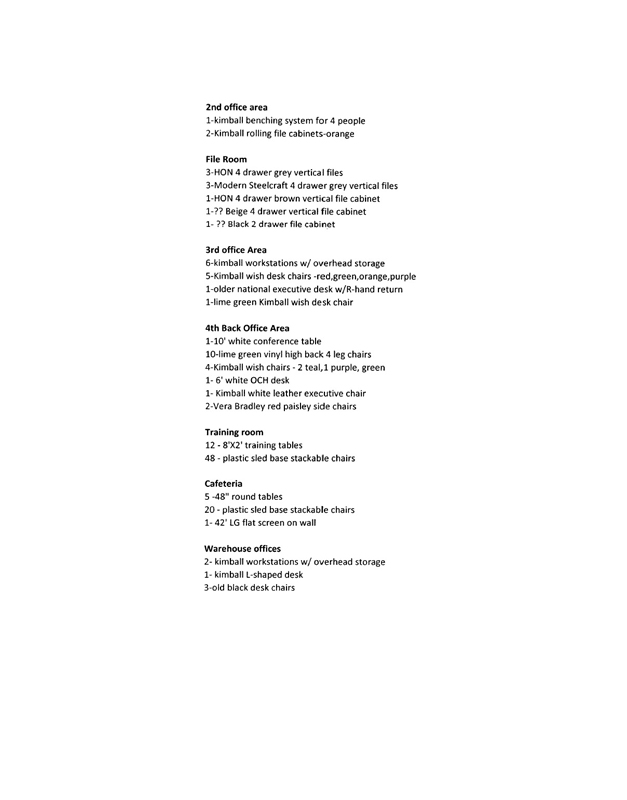

EXHIBIT B

Personal Property Inventory

EXHIBIT C

Confirmation Agreement

CONFIRMATION AGREEMENT

THIS CONFIRMATION AGREEMENT (“Confirmation Agreement”) dated this day of , 2011, is entered into by and between Great Dane Realty, LLC, an Indiana limited liability company (“Landlord”) and Vera Bradley Designs, Inc., an Indiana corporation (“Tenant”).

WHEREAS, Landlord and Tenant entered into that certain Lease Agreement dated March , 2011, wherein Landlord leased to Tenant and Tenant leased from Landlord certain premises located in Allen County, Indiana, as more particularly described therein (the “Lease”); and

WHEREAS, Landlord and Tenant execute this Confirmation Agreement pursuant to Section 2.1 of the Lease.

NOW THEREFORE, Landlord and Tenant, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, do hereby confirm and agree as follows in accordance with the terms and conditions of the Lease:

1. Landlord and Tenant confirm that the base rent pursuant to Article III of the Lease shall be and /100 Dollars ($ ) per annum and and /100 Dollars ($ ) per month.

2. Landlord and Tenant confirm that the Commencement Date is , 2011 and that the Lease shall expire on , 2014, unless sooner terminated or extended.

3. The Lease remains in full force and effect as confirmed hereby.

IN WITNESS WHEREOF, Landlord and Tenant have executed this Confirmation Agreement effective as of the date first written above.

| GREAT DANE REALTY, LLC, an Indiana limited liability company | ||

| By | ||

| Title: | ||

| Date: | ||

| “LANDLORD” | ||

| VERA BRADLEY DESIGNS, INC., an Indiana corporation | ||

| By | ||

| Title: | ||

| Date: | ||

| “TENANT” | ||

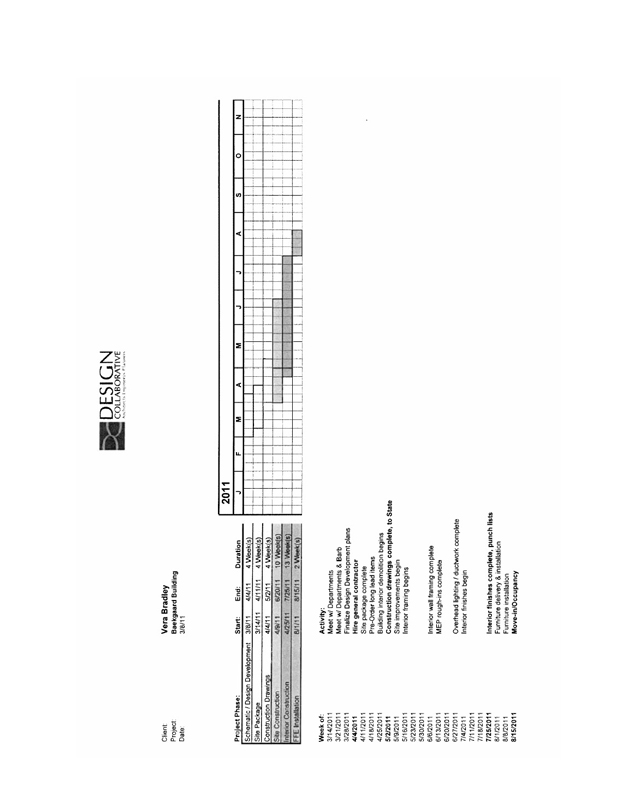

EXHIBIT D

Construction Terms

EXHIBIT E

Memorandum of Lease, Right of First Refusal and Option to Purchase

-2-

-3-