Attached files

| file | filename |

|---|---|

| EX-23.1 - SUPERTEX 10K FY11 EXHIBIT 23.1 - SUPERTEX INC | supx10kfy11exhibit23-1.htm |

| EX-31.2 - SUPERTEX 10K FY11 EXHIBIT 31.2 - SUPERTEX INC | supx10kfy11exhibit31-2.htm |

| EX-21.1 - SUPERTEX 10K FY11 EXHIBIT 21.1 - SUPERTEX INC | supx10kfy11exhibit21-1.htm |

| EX-32.1 - SUPERTEX 10K FY11 EXHIBIT 32.1 - SUPERTEX INC | supx10kfy11exhibit32-1.htm |

| EX-32.2 - SUPERTEX 10K FY11 EXHIBIT 32.2 - SUPERTEX INC | supx10kfy11exhibit32-2.htm |

| EX-31.1 - SUPERTEX 10K FY11 EXHIBIT 31.1 - SUPERTEX INC | supx10kfy11exhibit31-1.htm |

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

|

FORM 10-K

|

|

(MARK ONE)

|

|

|

(x)

|

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 (Fee Required)

For the fiscal year ended April 2, 2011

|

|

or

|

|

|

( )

|

Transition Report Pursuant to Section 13 or 15(d) of the Securities and Exchange Act of 1934

For the transition period from _______ to ________

|

|

Commission File No. 0-12718

|

|

|

SUPERTEX, INC.

|

|

|

(Exact name of Registrant as specified in its charter)

|

|

|

California

|

94-2328535

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

1235 Bordeaux Drive, Sunnyvale, California 94089

|

||

|

(Address of principal executive offices)

|

||

|

Registrant's Telephone Number, Including Area Code: (408) 222-8888

|

||

|

Securities registered pursuant to Section 12(b) of the Act:

|

||

|

Title of each class: Common Stock

|

Name of each exchange on which registered: NASDAQ Global Select Market

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None

|

||

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

|

||

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of Section 15(d) of the Act. Yes o No x

|

||

|

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

|

||

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for shorter period that the registrant was required to submit and post such files). Yes o No o

|

||

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Sec. 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

|

||

|

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act). Check one.

Large accelerated filer o Accelerated filer x Non-accelerated filer o Smaller Reporting Company o

|

||

|

As of October 1, 2010, the last business day of the registrant’s most recently completed second fiscal quarter, there were 12,995,905 shares of the registrant’s common stock outstanding, and the aggregate market value of such shares held by non-affiliates of the registrant was $247,183,092, based on the closing price reported on the NASDAQ National Market on October 1, 2010. Shares of common stock held by officers, directors and other persons who may be deemed “affiliates” of the Registrant have been excluded from this computation. This determination of affiliate status is not necessarily a conclusive determination for other purposes. The total number of shares outstanding of the Registrant's common stock as of June 3, 2011, was 12,714,713.

|

||

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

|

||

|

Documents Incorporated by Reference: Part III incorporates by reference portions of the Company's definitive proxy statement for the Annual Meeting of Shareholders to be held on August 19, 2011 (the "Proxy Statement").

|

||

|

Exhibit Index is on Page 70

|

||

|

Total number of pages is 71

|

||

SUPERTEX, INC.

ANNUAL REPORT - FORM 10K

Table of Contents

|

PART I

|

|||||

|

|

Page

|

||||

|

Item

|

1.

|

Business………………………………………………………………………………………..............................................................................................................

|

1

|

||

|

Item

|

1A.

|

Risk Factors…………………………………………………………………………………................................................................................................................

|

9

|

||

|

Item

|

1B.

|

Unresolved Staff Comments………………………………………………………………….............................................................................................................

|

13

|

||

|

Item

|

2.

|

Properties……………………………………………………………………………………................................................................................................................

|

13

|

||

|

Item

|

3.

|

Legal Proceedings…………………………………………………………………………….............................................................................................................

|

14

|

||

|

Item

|

4.

|

Removed and Reserved………………………………………………………………………...........................................................................................................

|

14

|

||

|

PART II

|

|||||

|

Item

|

5.

|

Market for Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities………………………………...........

|

15

|

||

|

Item

|

6.

|

Selected Financial Data………………………………………………………………………...........................................................................................................

|

19

|

||

|

Item

|

7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations….............................................................................................

|

19

|

||

|

Item

|

7A.

|

Quantitative and Qualitative Disclosures about Market Risk…………………………………...................................................................................................

|

34

|

||

|

Item

|

8.

|

Financial Statements and Supplementary Data……………………………………………….......................................................................................................

|

35

|

||

|

Item

|

9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure…

|

35

|

||

|

Item

|

9A.

|

Controls and Procedures………………………………………………………………………........................................................................................................

|

35

|

||

|

Item

|

9B.

|

Other Information…………………………………………………………………………….............................................................................................................

|

37

|

||

|

PART III

|

|||||

|

Item

|

10.

|

Directors, Executive Officers, and Corporate Governance……………………………………...................................................................................................

|

37

|

||

|

Item

|

11.

|

Executive Compensation……………………………………………………………………….......................................................................................................

|

37

|

||

|

Item

|

12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ............................................................................

|

37

|

||

|

Item

|

13.

|

Certain Relationships and Related Transactions, and Director Independence………………................................................................................................

|

38

|

||

|

Item

|

14.

|

Principal Accountant Fees and Services………………………………………………………....................................................................................................

|

38

|

||

|

PART IV

|

|||||

|

Item

|

15.

|

Exhibits and Financial Statement Schedules…………………………………………………....................................................................................................

|

39

|

||

|

|

|||||

|

Signatures

|

…………………………………………………………………………………………………........................................................................................................

|

41

|

|||

PART I

Item 1. Business

This Annual Report on Form 10-K includes forward-looking statements. These forward-looking statements are not historical facts, and are based on current expectations, estimates, and projections about our industry, our beliefs, our assumptions, and our goals and objectives. Words such as "anticipates," "expects," "intends," "plans," "believes," "seeks," and "estimates," and variations of these words and similar expressions, are intended to identify forward-looking statements. Examples of the kinds of forward-looking statements in this report include statements regarding the following: (1) our expectation that our recently introduced and future new products to be drivers for increased revenue and that our growth strategy relies on our ability to continuously and successfully introduce and market new innovative products that meet our customers’ requirements; (2 ) our expectation to introduce a greater number of products for the ultrasound market in fiscal 2012 than in fiscal 2011 and our belief that we will continue to be a major player in this business; (3) our expectation to introduce a significant number of new LED driver products for the solid-state lighting market in fiscal 2012, that this market will continue to increase in fiscal 2012 and become a large market during the next few years; (4) our expectation to leverage our newly-developed high voltage design processes to introduce many new products and expect to complete many of the approximately 60 products currently under development during fiscal years 2012 and 2013; (5) our belief that our position as a leading supplier in our targeted markets can only be maintained through continuous investments in research and development; (6) our belief that we are well positioned to fulfill our wafer manufacturing capacity needs for the near future and that almost all of the current backlog will be shipped in fiscal 2012; (7) we see significant opportunities with medical ultrasound imaging machine companies in China and Korea for our medical ultrasound products ; (8) our expectation that shipments of our general lighting drivers will continue to increase during fiscal 2012 which will drive increases in our overall sales to the LED lighting market from the current quarterly run rate; (9) our efforts to strive to be the technology enabler for our customers; (10) our belief that our patents may have value and that our success depends primarily on the experience, creative skills, technical expertise, and marketing ability of our personnel rather than on the ownership of patents; (11) our belief that our continued growth and success will depend in part on our ability to attract and retain highly skilled employees; (12) our expectation that our international sales will continue to account for a significant portion of our total sales; (13) our belief that possible claims and assessments are unlikely to result in a material adverse impact; (14) our belief that we will be able to recover our ARS at par value in a future period, that the estimated range of fair value of our ARS is appropriate, that their credit quality is high and that the auction failures will not materially impact our ability to fund our working capital needs, capital expenditures and other business requirements; (15) our board of directors’ intention not to pay a cash dividend; (16) our belief that our deferred tax assets will be utilized; (17) our expectation that R&D spending in fiscal year 2012 will be between 16% and 20% of net sales; (18) our expectation to spend approximately $6,600,000 for capital acquisitions in fiscal 2012; (19) our belief that we have substantial production capacity in place to handle any projected increase in business in fiscal 2012 and our belief that existing cash, cash equivalents and short-term investments, together with cash flow from operations, will be sufficient to meet our liquidity and capital requirements through the next twelve months; (20) our belief that the effect of our contractual obligations will be minimal on liquidity and cash flow in future periods; (21) our belief that our cash exposure to fluctuations on foreign exchange rates is relatively small, thus we do not employ hedging techniques designed to mitigate this foreign currency exposure; and (22) our targeting to repurchase the approximately remaining $54 million of shares in the next two years in our share repurchase program. These statements are only predictions, are not guarantees, of future performance, and are subject to risks, uncertainties, and other factors, some of which are beyond our control and are difficult to predict, and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. These risks and uncertainties include those described in Item 1A “Risk Factors” and elsewhere in this report, as well as the risks (1) that our patents may not have material value and that there may not be a market to cross-license them; (2) that there may be alternative ways for us to maintain our competitive position than through investments in R&D, that these alternatives may cost us less money or be more effective than investments in R&D, that our investments in R&D may not result in new products, and that even if our investments in R&D result in new products, these products may not enable us to maintain our competitive position; (3) that the failures of the auction markets may continue and the government guarantees on our securities may not be as strong as we had thought so that we would incur losses on our ARS; (4) that we will not generate enough cash from operations to meet our cash and working capital requirements through the end of fiscal 2012 especially in light of our stock repurchase program; (5) that we need to spend more on capital acquisitions than anticipated, or that we overestimate or underestimate our need for capital acquisition; (6) that changes in short-term interest rates are significant enough to affect our investment portfolio; (7) that our customers and potential customers will not design our devices into their products or their products containing our devices will not have the demand we anticipate, or competitors will design products in our niche and drive down our prices and gross margins; (8) that our newly introduced products will not be widely adopted so that they do not generate substantial revenue; and (9) that our estimates of trends in our focus markets are inaccurate and in particular that the medical ultrasound opportunities in South Korea and China may not materialize and the use of LEDs in general lighting may not expand. Except as required by law, we undertake no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise.

1

Supertex, Inc. (“Supertex,” the “Company,” “we,” and “us”) is a producer of high voltage analog and mixed signal semiconductor components. We design, develop, manufacture, and market integrated circuits (“ICs”), utilizing state-of-the-art high voltage DMOS, HVCMOS and HVBiCMOS analog and mixed signal technologies. With respect to our DMOS transistor products, we maintain an established application specific position in providing key products for the industrial, telecommunications, instrumentation, medical, and automatic test equipment (“ATE”) industries. We are also an industry leader in high voltage ICs (HVCMOS and HVBiCMOS), taking advantage of the best features of CMOS, bipolar and DMOS technologies and integrating them into the same chip. These ICs are used in the medical ultrasound imaging, LCD TV LED backlighting, LED general lighting, telecommunications, printer, flat panel display, industrial and consumer product industries.

We market and sell our products through direct sales personnel, independent sales representatives and distributors in the United States of America and abroad, primarily to original equipment manufacturers of electronic products. Our executive offices are located at 1235 Bordeaux Drive, Sunnyvale, California, 94089, and our principal manufacturing facilities are located in San Jose, California, and in Hong Kong. We have two design centers, one in our Sunnyvale worldwide headquarters and the other in our wholly owned subsidiary, Supertex, Ltd. in Hong Kong. Our Hong Kong facility also houses the headquarters of Supertex, Ltd., worldwide logistic and distribution center, and production test facilities. We maintain ten direct field sales offices located in the following areas: Irving, Texas; Oley, Pennsylvania; the United Kingdom; Germany; Hong Kong, Shanghai & Shenzhen, China; Taiwan; Japan; and South Korea. Our headquarters’ mailing address is 1235 Bordeaux Drive, Sunnyvale, California 94089 and the telephone number is (408) 222-8888. Our website address is www.supertex.com. The content of the website is not incorporated into this Form 10-K.

Products and Markets

Our four target markets are medical electronics, LED lighting, imaging, and telecom. Our products are primarily used in or with medical ultrasound imaging equipment, large commercial ink-jet printers, LED general lighting and light emitting diodes (“LEDs”) for backlighting LCD TVs, electro-luminescent (“EL”) lamps for backlighting cell phone keypads and LCD displays, and optical MEMS for telecommunications switches. Our products are basically interface products, interfacing between low voltage logic circuits and high voltage “real world” media and vice versa. We supply both standard and custom products. The typical gestation period of our new products from introduction through design-in by the customer to volume production is one year, although certain products for medical applications have longer gestation periods. During fiscal 2011, we introduced twenty new standard products, the majority of which were aimed at high growth markets such as medical ultrasound imaging and solid-state LED lighting. We expect our recently introduced products as well as our future new products to be drivers for increased revenue as our customers design them into their products under development which they then introduce and which start volume production.

We also provide custom processing services for the manufacture of ICs, using customer-owned designs and mask tooling. Under this “custom processing service” or “foundry” arrangement, a tangible product is made and sold, and the Company bears the risk of loss until title is passed. Title to the product under the custom processing service arrangement is passed to the customer at the time of shipment from our facility. During fiscal 2011, sales of custom processed products represented approximately 11% of our total revenues compared to 14% in fiscal 2010. Sales of custom processing services are categorized and included in the sales of our target markets.

2

The products in our target markets are described below.

The Medical Electronics Market

We have provided both standard and high-end custom ICs to the ultrasound imaging market for many years and have established key business relationships with leading OEMs. The products we manufacture for this market include high voltage analog multiplexer switches, pulsers, high-speed MOSFET drivers and discrete high voltage MOSFETs and arrays.

We have dominated the high voltage analog switch and high voltage integrated pulser product offerings in this market segment for many years. In recent years, the overall ultrasound market has been shifting to portable ultrasound imaging units. These high-performance, portable, affordable imaging systems are accelerating the proliferation of ultrasound imaging systems to medical specialties in addition to cardiology and obstetrics/gynecology (“OB/GYN”). Even within these traditional clinical diagnostic segments, cardiology ultrasound imaging is showing an exciting pipeline of technological innovations and strong procedural volume growth. The adoption of ultrasound imaging by new user groups -- surgeons and emergency ward physicians -- is also spurring medical ultrasound imaging system market growth.

Our high voltage expertise affords us a dominant position in the ultrasound “transmit” market with MOSFET drivers, high voltage analog switches and multiplexers, high voltage pulsers, and complementary high voltage MOSFET arrays. We released ten new medical ultrasound products in fiscal 2011, and expect to introduce a greater number of products for the ultrasound imaging market in fiscal 2012.

The market for our ultrasound imaging products continues to grow. The capabilities and performance of the machines that utilize our products continue to improve, allowing them to be used more broadly across a wider spectrum of imaging applications than ever before. Geographically, the market is expanding as well. Traditionally, the United States, Europe and Japan were the main designers and producers of medical ultrasound machines. While companies in these areas continue to grow and develop new machines, today we are also seeing significant opportunities for us from ultrasound machine companies in China and Korea.

The LED Drivers Market

Supertex offers an extensive line of high-performance LED driver products for the solid-state lighting market, ranging from simple, low-cost linear regulators to feature-rich switching regulators configured in buck, boost, buck-boost, and single ended primary inductance converter (“SEPIC”) topologies. As one of the pioneers in the high voltage LED driver IC market, we have established a strong market position. We have developed many efficient and cost effective products for general lighting in automotive, industrial, and consumer applications, and for backlighting LCD TVs, monitors and laptop screens. We expect to introduce a significant number of new LED driver products for the solid-state lighting market in fiscal 2012.

The Imaging Market

We offer the following two product lines:

|

(1)

|

A family of products for driving electroluminescent (“EL”) lamps for backlighting hand-held instruments, such as cell phone keypads, watches, monochrome flat screens and MP3 players. We are one of the key providers of EL drivers for cell phones and watches, and we have a significant share of this market due to our patented inductorless EL driver ICs.

|

|

(2)

|

Driver ICs for driving non-impact printers and plotters, primarily using inkjet technologies. Our printer product family is used in ink-jet and electrostatic types of printers and plotters that are mostly high-end products with full glossy color capability, high resolution and high-speed output.

|

The Telecommunications (“Telecom”) Market

We provide high voltage amplifier ICs to drive optical micro-electro-mechanical systems (MEMS) for the telecommunications market for use in optical switching applications. Our MEMS driver ICs feature 32 channels per chip and are capable of driving output voltages of up to 300 volts. We also produce high voltage electronic switch ICs that replace typical electromechanical or mechanical hook switches in telephones, high voltage ICs for use as ring generators, and protection ICs for line cards.

3

The Industrial/Other Market

This market category primarily represents ICs and DMOS devices we design and manufacture for various industrial and other catch-all applications. Also included in this category are high voltage driver ICs used in ATE and power management ICs.

Net sales generated from each of these markets is discussed under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the “Net Sales” section.

As a leading provider of products to these specific markets, we have been able to work very closely with key Tier-1 customers to define new products and identify their future product needs. Such close collaboration has facilitated our development of a wide range of leading-edge new products and has allowed our customers to quickly develop new and more advanced products for their markets. While we work with certain Tier-1 customers to design new products, generally such products have broader applications so that they are useful to multiple customers.

In the DMOS transistor technology, we focus on certain specific niches such as very low threshold, low capacitance, and low leakage devices where these features justify a premium and are most suitable for special applications such as medical ultrasound imaging, LED lighting, telecommunication, ATE, and hand-held instruments. These high voltage DMOS transistor products also serve as building blocks and predecessors to a fully integrated solution of our high voltage ICs.

We operate in one business segment. Information regarding Supertex, Inc.’s Segment Reporting can be found in Note 13 to the Consolidated Financial Statements.

Research and Development

We incurred expenses of $14,851,000, $15,404,000, and $14,553,000 on research and development activities during fiscal years 2011, 2010 and 2009, respectively. Our research and development activities in fiscal 2011 were dedicated to developing new high voltage processes, both internal and with external foundry partners, resulting in a total of twenty new standard product introductions. The products introduced in fiscal 2011 were primarily targeted for use in the rapidly growing LED and medical ultrasound industries. As we move forward into fiscal 2012, we expect to leverage our newly-developed high voltage design processes to introduce many new products for these markets, as well as for our other target markets. There are currently approximately 60 products in development, many of which are expected to be completed during fiscal years 2012 and 2013, although there is no assurance that all these products will be completed or introduced due to market conditions, technical difficulties, or other factors.

Our products, which we strive to make best in class, have experienced very good traction in the marketplace, leading to significant design wins in all our target markets. We believe best in class products are those that provide the best performance at a competitive price, where in the case of LED drivers performance is measured by receiving high input voltage and producing tightly controlled output current. Most of our design wins resulted from close collaboration with the Tier-1 customers in their respective markets and a shorter design and development cycle to support our customers’ needs. We believe that our position as a leading supplier in our targeted markets can only be maintained through continuous investments in research and development. We focus our efforts on designing new products with existing process technologies while also developing new process technologies to be used for future products. We continuously strive to effectively monitor and control our research and development programs in order to obtain improved performance and greater technological achievements at lower costs. Because we have our own wafer fabrication facility (“fab”) with ample capacity, and our designers have years of experience in our target markets, we can tailor our processes and circuits to meet customer needs which we can respond to much more expediently and ramp up production.

4

Manufacturing

Our manufacturing operations include wafer fabrication in San Jose, California; limited proto-type assembly and packaging in Sunnyvale, California; and product testing and quality control in Sunnyvale, California and Hong Kong. Of our long-lived tangible assets, as further described in Note 13 to our financial statements included in this annual report on Form 10-K, 21% and 17% were located in our Hong Kong facility at the end of fiscal 2011 and 2010, respectively, with the remaining balance located in the U.S. As of the end of fiscal 2011, the carrying value of all our property, plant and equipment located in Hong Kong amounted to $1,183,000.

We subcontract most of our standard product packaging and some production testing to independent contract assemblers, principally located in Thailand, Malaysia, Philippines and China. After assembly, packaged units are shipped back to our Hong Kong and Sunnyvale test facilities for final product testing and quality control before shipment to customers. Although our offshore assemblers have not experienced any serious work stoppages, political instability or other epidemics in these countries may adversely affect our assembly and test operations. Even though we have qualified assemblers in different countries to reduce risk, any prolonged work stoppage or other inability to assemble and test our products would have a material adverse impact on our operating results. Furthermore, economic risks, such as changes in tariff, currency exchange rates, or freight rates or interruptions in air transportation, could adversely affect our operating results. We also maintain a specialized assembly area at our Sunnyvale manufacturing facilities to package engineering proto-types to ensure high priority on-time deliveries and to assemble high reliability circuits required in military and other high reliability applications.

We believe that we are well positioned to fulfill our wafer manufacturing capacity needs for the near future because currently in our first quarter of fiscal 2012 our fab is running at about thirty-five percent utilization and we are able to expand capacity through hiring of additional manufacturing staff. We maintain an inventory balance based on current sales level and forecast of future demand. An amount for tactical inventory is kept in our die bank warehouse to reduce lead time in fulfilling expected, as well as unforecasted, customer orders. In addition, we carry as inventory on our balance sheet products which we own that are stored at customer hubs for some of our customers as well as products that are owned and held for resale by our distributors, both domestic and foreign, even though some of that inventory has been paid for by the distributors.

Availability of raw silicon wafers and epitaxial services began to be in tight supply during the fourth quarter of fiscal 2010 and continued through the third quarter of fiscal 2011, however supplies are currently adequate. The availability of assembly, packaging, and testing services used in the backend of our manufacturing process are also currently adequate after being subject to longer lead times during the fourth quarter of fiscal 2010 through the second quarter of fiscal 2011. These materials and services are currently obtained from multiple sources.

Environmental Laws

Government regulations impose various environmental controls on the waste treatment and discharge of certain chemicals and gases after their use in semiconductor processing. We believe that our activities substantially comply with present environmental regulations. However, increasing attention has been focused on the environmental impact of semiconductor manufacturing operations. While we have not experienced any material adverse effects on our business or financial results from our compliance with environmental regulations and installation of pollution control equipment, there can be no assurance that changes in such regulations, such as the passing of California Assembly Bill 32, “Global Warming Solutions Act”, will not necessitate our acquisition of costly equipment or compliance with other requirements in the future. We work closely with pollution experts from federal, state, and local agencies, especially from the cities of Sunnyvale and San Jose, California, to help us comply with current requirements.

Marketing and Sales

We market our standard and custom products in the United States and abroad through our direct sales and marketing personnel in our Sunnyvale headquarters and Hong Kong facility, as well as through independent sales representatives and distributors supported by our field sales managers out of our sales offices in: Texas; Pennsylvania; the United Kingdom; Germany; Hong Kong, Shanghai & Shenzhen, China; Japan; Taiwan and South Korea.

5

Our marketing organization also helps us create and satisfy customer demand and manages the strategic and tactical marketing plan for the company. Strategic marketing encompasses analyzing current market conditions, anticipating market demands, and gathering competitive information to expeditiously act on future opportunities. We maintain strategic marketing activities in order to keep pace with future customer requirements and technology advancements to stay abreast of competition. Tactical marketing focuses on customer fulfillment for requests of literature, samples and applications assistance, as well as generating quotes for pricing. We are gradually shifting our efforts towards a stronger standard product line as opposed to a mix of standard and custom products that require substantially more resources to support.

Net sales is the sum of our direct sales to original equipment manufacturers (“OEMs”) and our distributors’ resale of our products. We recognize revenue from direct product sales to end customers upon transfer of title and risk of loss, which is upon shipment of the product, provided persuasive evidence of an arrangement exists, the price is fixed or determinable, no significant obligations remain, and collection of the resulting receivable is reasonably assured. For sales to OEMs, we use either a binding purchase order or signed agreement as evidence of an arrangement. For those customers who have a hub arrangement, we recognize sales when our products are drawn from the hub to the customer’s manufacturing facility or to its assembly subcontractor’s manufacturing facility. Sales through our distributors are evidenced by a binding purchase order on a transaction-by-transaction basis. Because of the uncertainty associated with pricing concessions and possible returns, with the exception of certain products, we defer the recognition of such sales and the related costs of sales until our distributors have sold the merchandise to their end customers. Following a prior period change in the terms and conditions to eliminate return rights for distributors for certain products, we continued to defer revenue recognition until the distributors had sold these parts as we would grant concessions and accept some returns for a period of time after the change. Beginning the fourth quarter of fiscal 2009, for sales to distributors of certain products that are not returnable, we had sufficient history of not granting concessions to begin to recognize revenue on such items upon their shipment. Our distributors provide us an inventory balance report at the end of each period, which allows us to determine products sold to their end customers.

A significant portion of our sales is to a small number of customers. We estimate that our OEM customer, General Electric Company, accounted for 12%, 11% and 13% of our net sales from both direct and indirect channels (“combined sales”) for fiscal years 2011, 2010 and 2009, respectively. Combined sales to another OEM customer, Samsung Electronics, accounted for 14% of our net sales for fiscal 2010. No other direct or indirect customers accounted for more than 10% of net sales in fiscal 2011, 2010 and 2009.

International sales represented 71%, 68% and 63% of net sales in fiscal years 2011, 2010 and 2009, respectively, and are made primarily through independent distributors to customers in Europe and Asia. Sales are attributed to a geographic area based on destination locations as opposed to customer headquarters. International sales are denominated only in U.S. dollars. Although export sales are subject to certain governmental commodity controls and restrictions for national security purposes, we have not had any material adverse effects on our business or financial results because of these limitations.

Seasonality

In previous years our medical ultrasound market has been seasonally weaker in the second half of our fiscal year. For example, in three of the past four fiscal years we experienced relatively higher sales to the medical electronics market during the first half of our fiscal year, with either the first or the second fiscal quarter being the highest quarter of our fiscal year. This is largely attributable to the effect of increased demand for our customers’ products in their December quarter as they typically take about 90 days to build a new medical ultrasound machine. This seasonality effect during fiscal 2010 was nullified due to the economic recovery during the second half of fiscal 2010. The historical seasonality pattern returned in fiscal 2011.

Backlog

Our backlog at April 2, 2011 was approximately $15,162,000 compared with $22,317,000 and $12,217,000 at April 3, 2010 and March 28, 2009, respectively. Our backlog at the end of fiscal 2010 was higher than typical due to the unexpected resurgence in customer orders coming out of the recession of 2008 to 2009. We expect that almost all of the current backlog will be shipped in fiscal 2012. However, customers may cancel or reschedule orders without significant penalty, and the price of products may be adjusted between the time the purchase order is booked into backlog and the time the product is shipped to the customer. In addition, the orders contained in our backlog may cover periods of various lengths. For these reasons, we believe that backlog may not be meaningful in predicting our actual net revenue for any future period.

6

Competition

In general, competition among suppliers of semiconductor components is intense, especially in the analog sector where the gross margins are traditionally much higher, including products for the medical electronics, imaging, telecom, LED lighting, and industrial/other markets we primarily serve. In general, we face different competitors in different markets or for different products. For example, we compete with several larger analog semiconductor companies with far greater resources although we believe we have defended our market leading positions successfully for many years. For example, we compete with Maxim, Hitachi and Texas Instruments in the medical electronic market; we compete with Rogers Durel and Micrel in the electroluminescent lighting market; and we compete with Texas Instruments, National Semiconductor, NXP and O2 Micro in the LED lighting and backlighting market. In addition, we may compete with some of our own customers which have in-house semiconductor design capabilities and may develop and in-source products to replace those that we currently sell them as did Samsung in fiscal 2011 for our LED drivers for backlighting their LED TVs.

Our products are generally not sold pursuant to long term contracts, enabling our customers to switch suppliers if they choose and making us more vulnerable to competitors. Competition in the industry is based primarily upon factors such as product prices, product performance, product line diversity, delivery capabilities, customer relationships and the ability to adapt to rapid technological change in the development of new and improved products. The weighing of these factors varies depending on the specific needs of a customer at any given point in time. We believe we are competitive with respect to these factors; however, market statistics are not generally available for many of our products. Many of our domestic and foreign competitors have larger facilities, more financial, technical, and human resources and more diverse product lines.

Among our competitive advantages and core competencies are the following: (1) high voltage analog and mixed signal circuit design and device intellectual property; (2) high voltage DMOS, HVCMOS and HVBiCMOS wafer fabrication (“fab”) processes that are high yielding and low cost and do not require our fab to have the latest submicron feature sizes; (3) owning and operating our own fab to protect our IP; and (4) having long-term close working relationships with our key customers. We capitalize on our leadership position in the niche markets we focus on by working very closely with our customers to help them with next generation products, thereby achieving design-wins in order to maintain or grow market-share in our target markets. We compete primarily on the basis of product innovation and responsiveness to changing needs of customers, including both product specifications and delivery requirements. In short, we strive to be the technology enablers for our customers.

Patents and Licenses

We hold thirty-one United States patents which will expire between 2015 and 2029, and we have additional United States patent applications pending. Although we believe that our patents may have value, there can be no assurance that our current patents or any additional patents that we may obtain in the future will provide meaningful protection from competition. We believe that our success depends primarily on the experience, creative skills, technical expertise, and marketing ability of our personnel rather than on the ownership of patents. Patents may, however, be useful for cross-license purposes and have served us well in the past.

We are not aware of any of our products infringing on any valid patent or other proprietary rights of third parties but we cannot be certain that they do not. If infringement would be alleged, there is no assurance that the necessary licenses could be obtained, or if obtained, would be on terms or conditions that would not have a material adverse effect on the Company.

7

Employees

As of April 2, 2011, we had 373 full time employees primarily located in Northern California and Hong Kong. Many of our employees are highly skilled, and we believe our continued growth and success will depend in part on our ability to attract and retain such employees. At times, like other semiconductor manufacturers, we experience difficulty in hiring and retaining sufficient numbers of skilled personnel, especially experienced analog integrated circuit designers. Engineers with analog circuit experience and training are scarcer than experienced digital engineers. Analog and mixed-signal expertise tends to be learned over time based on experience and on-the-job-training, whereas digital expertise is relatively easier to learn and is extensively taught in universities due to its overall market size. Engineers with high voltage analog circuit experience are even scarcer. We often recruit top college graduates directly from universities and train them ourselves.

We believe that the compensation, benefits, and incentives offered to our employees are competitive with those generally offered throughout the semiconductor industry. There are no collective bargaining agreements between our employees and us, and there has been no work stoppage due to labor difficulties. We consider our employee relations to be good.

Executive Officers of the Company

|

Name

|

Position with the Company

|

Age

|

Officer Since

|

|||

|

Henry C. Pao

|

President and Chief Executive Officer

|

73

|

1976

|

|||

|

Benedict C. K. Choy

|

Senior Vice President, Technology Development

|

65

|

1976

|

|||

|

William P. Ingram

|

Vice President, Wafer Fab Operations

|

63

|

1999

|

|||

|

Michael Lee

|

Vice President, I.C. Design

|

56

|

1999

|

|||

|

William Petersen

|

Vice President, Worldwide Sales

|

58

|

2001

|

|||

|

Michael Tsang

|

Vice President, Standard Products

|

52

|

2006

|

|||

|

Phillip A. Kagel

|

Vice President, Finance and Chief Financial Officer

|

61

|

2006

|

|||

|

Stephen Lin

|

Vice President, Marketing and Business Development

|

52

|

2011

|

Officers are appointed by and serve at the discretion of the Board of Directors. There are no family relationships between any directors or executive officers of the Company.

Henry C. Pao is a founder of Supertex and has served as President and Chief Executive Officer and as a Director since the Company's formation in fiscal 1976. He also served as Chief Financial Officer until October 2006. Previously, he worked at Fairchild Semiconductor, Raytheon, Sperry Rand and IBM. He has B.S., M.S., and Ph.D. degrees in Electrical Engineering from the University of Illinois at Champaign-Urbana.

Benedict C. K. Choy, a founder of the Company, joined Supertex in fiscal 1976 as Vice President, Device Technology and Process Development, and has served as Senior Vice President since February 1988. Previously, he worked at Fairchild Semiconductor, National Semiconductor, and Raytheon. He has a B.S. degree in Electrical Engineering from the University of California, Berkeley. Mr. Choy was a member of the board of directors from 1986 through August 20, 2004. In January 19, 2006, Mr. Choy was appointed by the board as a member of the board of directors of the Company to fill a vacated position and has served since.

William P. Ingram joined Supertex in April 1995 as its Director of Wafer Fab Operations. Prior to joining Supertex, he was Vice President of Technology Development at Crosspoint Solutions, before which he held management positions at Fairchild and National Semiconductor. He began his career at National Semiconductor after receiving his B.S. degree in Electrical Engineering with honors from the North Carolina State University.

Michael Lee re-joined Supertex in October 1993 as Director of I.C. Design and was promoted to Vice President of I.C. Design in 1999. Before that, he had a combined total of fifteen years of industry experience in I.C. Design. Mr. Lee began his career at Supertex in 1978 after receiving his M.S. degree in Electrical Engineering from the University of California, Berkeley.

8

William Petersen first joined Supertex in 1984 as Sales Manager for the Central Region of the United States. From 1990 through 1994, he was the Company's National Sales Manager, overseeing sales operations throughout the United States. Mr. Petersen re-joined Supertex in September 1999 as Director of Sales. He was promoted to Vice President of Worldwide Sales in April 2001. Prior to working at Supertex, he worked at Siemens as Central Area Manager from 1980-1984. Mr. Petersen attended the University of Iowa.

Michael Tsang joined Supertex in 1995 as a Product Engineer. He was promoted to Engineering Director in 2000 and to Vice President in 2006, managing our Power, Analog, Ringer, and Telecom (P.A.R.T.) Product Engineering Department. Prior to joining Supertex, he held positions in Process Engineering, Product Marketing Engineering, and Device Engineering at Siliconix. He holds a Bachelor of Science degree in Electrical Engineering from California State University, San Jose and an MBA from University of Southern California, Marshall School of Business.

Phillip A. Kagel joined Supertex in October, 2006 as Vice President of Finance and Chief Financial Officer. Previously, beginning in April, 2005, he consulted for Supertex on financial and accounting matters, with his engagement converting to full-time beginning in April, 2006, it being part-time initially so that he could consult for other companies as well. He was Senior Vice President of Finance and Chief Financial Officer of Ultra Clean Holdings from August, 2004 to March, 2005 and Senior Vice President of Finance and Chief Financial Officer of Sipex from February, 2003 to April, 2004. In addition, he consulted at Riverstone Networks, Inc. from April, 2004 to July, 2004 and he held the positions of Vice President, Controller and Vice President of Global Tax at Solectron from August, 1997 to November, 2002. He holds a Bachelor of Science degree in Mathematics from Brigham Young University and an MBA from the University of Missouri.

Stephen Lin joined Supertex in February of 2011 as Vice President of Marketing and Business Development. Prior to joining Supertex Mr. Lin consulted for various telecommunications media technology companies in China beginning February, 2010. He was Managing Director of Mobility Ventures from March 2009 to January 2010. He held VP and senior management positions at Legerity from August 2002 to January 2004, and at Zetex Asia from February 2004 to December 2006. Beginning January 2007 he was Vice President & General Manager of BU Mobile and Entertainment, Greater China until January 2009 and Board member of T3G, a TD-SCDMA division of Philips Semiconductor in Shanghai until January 2008. Mr. Lin holds BSEE and MSEE degrees from McGill University and an MBA from Santa Clara University.

Available Information

We file electronically with the SEC our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments, if any, to those reports pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. The Company makes available free of charge on or through its Internet website at its internet address www.supertex.com copies of these reports as soon as reasonably practicable after filing or furnishing the information to the SEC; however the information in, or that can be accessed through, our website is not part of this annual report on Form 10-K. Copies of such documents also may be requested by contacting the Company’s Investor Relations department at (408) 222-4295.

Item 1A. Risk Factors

The following are certain risk factors that could affect our business, financial results and results of operations. These risk factors should be considered in connection with evaluating the forward-looking statements contained in this Annual Report on Form 10-K because these factors could cause the actual results and conditions to differ materially from those projected in the forward-looking statements. Investing in our common stock involves risks, including those described below. These risks are not the only ones that we face. If any of the risks actually occur, our business, financial condition or results of operations could be negatively affected. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

9

Factors Which May Affect Operating Results

Semiconductor companies as a group are subject to many similar risks. These include the risks that (1) the demand for semiconductors decreases, as the industry has historically been very cyclical; (2) there are shortages of raw materials and/or fab capacity; or (3) there are changes in underlying circuit or process technology or fab technology. Other factors that could affect our future results include whether we can generate new bookings from both new and current products; general economic conditions, both in the United States and foreign markets, and economic conditions specific to the semiconductor industry; risks associated with customer concentration; our ability to introduce new products, to enhance existing products, and to meet the continually changing requirements of our customers; our ability to maintain and enhance relationships with our assembly and test subcontractors and independent distributors and sales representatives; and whether we can manufacture efficiently and control costs. In addition, we are subject to the risks described below, which are specific to our business:

|

·

|

The semiconductor industry is historically cyclical and subject to significant volatility. During the second half of fiscal 2009 through the first half of fiscal 2010, the severe global economic downturn caused substantial reduction in demand for our products, thereby adversely affecting our financial results. We are subject to continued fluctuations which could affect future revenues, profit and cash. Many factors affect demand for our products, including credit availability, rising interest rates, consumer spending pricing levels, and costs of materials. There can be no assurance that if the global economy recovers that our sales will increase commensurately.

|

|

·

|

We have focused our product offerings primarily on niche markets which leverage our capabilities and in which we believe we have dominance because we are a technology enabler for our customers. We generally choose markets which are sizable enough to be worth pursuing but which are not large enough to attract fierce competition. These markets could grow sufficiently to attract increased competition or else competitors could enter due to happenstance or downturns elsewhere. One of our emerging markets is driver ICs for LED lighting and backlighting, which has begun to grow and is expected to become a large market during the next few years and is beginning to attract severe competition. In addition, our niche markets might be more susceptible to shrinkage than more diverse markets due to their concentration on a few product offerings.

|

|

·

|

We work with our customers to develop products that they will design into their systems. Even if we do achieve a design win, the customer’s system may never go into production or the production volume may be smaller than we had anticipated. Although we attempt to develop products which will be useful for multiple customers, we may misjudge the market and develop a product which may be useful for only a very few customers.

|

|

·

|

A significant portion of our sales are from a small number of customers and the loss of one of these customers or failure to collect a receivable from them could adversely affect our operations and financial position. We do not have a long-term distributorship agreement with any of our distributors. Normal terms and conditions of sale apply, which include a 60-day notice of cancellation and charges for work-in-process for cancellations less than 60 days from shipment. While we have maintained a good relationship with our significant customers and distributors, deterioration in that relationship could materially and adversely affect our business and financial results. We estimate that the combined sales to General Electric Company accounted for approximately 12% of our net sales for the fiscal year ended April 2, 2011, while combined sales to General Electric Company and Samsung accounted for approximately 25% of our net sales for fiscal 2010.

|

|

·

|

We have several competitors that are substantially larger and could bring to bear substantially more resources than we have in our niche markets. We have been able to maintain profitable margins in part because of our dominance in most of our niche markets. Increased competition could cause our margins to decrease. In addition, some of our own customers have in-house semiconductor design capabilities and may develop and in-source products to replace those that we currently sell them as did Samsung in fiscal 2011 for our LED drivers for backlighting their LED TVs.

|

10

|

·

|

We sell a substantial amount of our products internationally. International sales represent 71%, 68% and 63% of net sales, for fiscal years 2011, 2010 and 2009, respectively. We expect our international sales to continue to account for a significant portion of our total sales. We also package and test most of our products abroad. Problems with foreign economies, political turmoil, wars, epidemics, fluctuations in currency exchange rate, increased freight costs, interruptions in air transportation, and generally longer receivable collection periods could disrupt our business and increase our operating expenses.

|

|

·

|

Our gross margins may fluctuate depending on many factors, including but not limited to, our product mix, competitive pricing dynamics, product yields, various manufacturing costs, plant utilization, provisions for excess and obsolete inventory, absorption of manufacturing overhead, product warranties, and returns and allowances.

|

|

·

|

We are dependent upon one fab which we own and operate. Were this fab to become unable to meet our needs for causes such as obsolescence due to process technology changes, our ability to produce our products would be adversely affected. In addition, we could encounter difficulties in operating our fab after an earthquake or any natural disaster.

|

|

·

|

Our operations may be interrupted and our business would be harmed in the event of an earthquake, terrorist act, and other disasters. Our principal executive offices, our fab facility, and major suppliers are located in areas that have been subject to severe earthquakes. In the event of an earthquake, we and/or our major suppliers may be temporarily unable to continue operations and may suffer significant property damage. Any such interruption in our ability or that of our major suppliers to continue operations at our facilities could delay the development and shipment of our products. Like other U.S. companies, our business and operating results are subject to uncertainties arising out of the economic consequences of current and potential military actions or additional terrorist activities and associated political instability, and the impact of heightened security concerns on domestic and international travel and commerce. Such uncertainties could also lead to delays or cancellations of customer orders, a general decrease in corporate spending or our inability to effectively market and sell our products. Any of these results could substantially harm our business and results of operations, causing a decrease in our revenues.

|

|

·

|

We are dependent upon continued innovation by our engineers. The competition for engineers with relevant experience is extremely intense in the Silicon Valley, where most of our engineers are located. We must compete in terms of salary, benefits, and working conditions with many start-ups which can offer more equity incentives. We established an IC Design Center in Hong Kong in fiscal 2001 where competition for qualified engineers is not as intense as that in Silicon Valley. However, a majority of our process technology activities remains in our Sunnyvale and San Jose facilities. Our innovative product design and applications activities are located in both Sunnyvale and Hong Kong facilities.

|

|

·

|

Our success depends upon our ability to protect our intellectual property, including patents, trade secrets, and know-how, and to continue our technological innovation. We cannot assure that the steps we have taken to protect our intellectual property will be adequate to prevent misappropriation or that others will not develop competitive technologies or products. The failure to obtain necessary licenses or other rights could cause us to lose market share and harm our business.

|

|

·

|

We are dependent upon the continued service of several of our key management and technical personnel. The loss of the services of one or more of our engineers, executive officers and other key personnel or our inability to recruit replacements for, or to attract, retain and motivate these individuals would be harmful to our business. We do not have long-term employment contracts with our employees.

|

11

|

·

|

We operate a fab in San Jose, California, where we use various chemicals and solvents that are regulated by various environmental agencies. We cooperate and work with these agencies to comply with these regulations. Should we nonetheless inadvertently contaminate the soil or ground water, or should the previous operator of the fab have done so, we may be responsible for significant costs to remediate the situation. As of April 2, 2011, we estimated our asset retirement obligation to be $326,000.

|

|

·

|

Failure to comply with present or future laws, rules and regulations of any kind that govern our business could result in suspension of all or a portion of production, cessation of all or a portion of operations, or the imposition of significant administrative, civil, or criminal penalties, any of which could harm our business. Depending on whether certain of our semiconductor products are subject to control under the International Traffic and Arms Regulations (“ITAR”), certain of our testing and assembly operations offshore with respect to such products may have violated ITAR. Upon discovery, we voluntarily notified the U.S. Department of State and submitted a follow-on report after completing our investigation of the facts and circumstances. Should our actions have violated ITAR, we could face substantial civil fines or other penalties at the discretion of the US Department of State, which to date has not imposed any fine or penalty. While at this time we are unable to estimate the extent of any fines or penalties or other potential losses that we may incur with respect to this matter, we believe that it is unlikely, although not remote, that the ultimate outcome would have a material adverse effect on us. Since becoming aware of these potential ITAR issues, we have moved the assembly and testing of these products to ITAR-certified onshore facilities.

|

|

·

|

A director of and the President and CEO of the Company, Henry Pao, along with his brother, Frank Pao, and the estate of their late father, Yunni Pao, collectively own approximately 13% of our outstanding stock. They have no agreement among themselves to act together with respect to the Company or their stockholdings. However, were they to act in concert, they would be our largest beneficial shareholder and may have the ability to elect one or more directors, to direct management, and to delay or prevent a change in control.

|

|

·

|

We are subject to taxation by domestic and foreign taxing authorities. Our business is subject to the application of multiple and sometimes conflicting tax laws and regulations. The application of tax laws is subject to legal and factual interpretation, judgment and uncertainty, and tax laws themselves are subject to change. Consequently, taxing authorities from various jurisdictions may impose tax assessments or judgments against us that could result in a significant change to earnings related to prior periods, and or an increase in our effective income tax rate.

|

|

·

|

The Sarbanes-Oxley Act of 2002 required us to change or supplement some of our corporate governance and securities disclosure and compliance practices. The SEC and NASDAQ have revised, and continue to revise their regulations and listing standards. These developments have increased and may continue to increase our legal compliance and financial reporting costs. These developments also may make it more difficult and more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. This, in turn, could make it more difficult for us to attract and retain qualified members of our board of directors or qualified executive officers.

|

|

·

|

We invest our excess cash in marketable securities consisting primarily of municipal bonds, corporate bonds, auction rate securities (“ARS”), government agency bonds, discount notes and certificates of deposits. As of the end of fiscal year 2011, the ARS we owned had a par value of $32,750,000. Since the fourth fiscal quarter of 2008, the ARS market has experienced failures. The funds associated with securities that experienced failed auctions will not be accessible until a successful auction occurs, a buyer is found outside of the auction process, or the underlying securities have matured or are recalled by the issuer. Given the recent disruptions in the credit markets and the fact that the liquidity for these types of securities remains uncertain, as of April 2, 2011, we classified all of our ARS as long-term assets in our Consolidated Balance Sheet, as our ability to liquidate such securities in the next 12 months is uncertain. We have also recorded a $2,550,000 temporary decline in fair value for these investments, which in accordance with the authoritative guidance, has been recorded in Other Comprehensive Loss. We believe that we will be able to recover these securities at par value in a future period, as they are AAA or Aaa rated and, are guaranteed by the United States Department of Education. However, there is no assurance that we will be able to settle these bonds and recover the cash, nor if we do recover the cash, when this may occur. We may have to incur further impairment if the auctions of our securities continue to fail. If the fair value of these investments declines permanently or is other than temporarily impaired, we would be required to take an impairment charge which would flow through our income statement as an expense and could cause us to incur a loss for the relevant fiscal period.

|

12

|

·

|

Stock option accounting rules require charges to income due to stock compensation associated with options and result in lower reported operating results prepared in accordance with generally accepted accounting principles. The additional expenses resulting from the authoritative guidance in stock compensation may negatively impact our future stock price if we continue to utilize broad-based employee stock plans to attract and retain employees or else, if we cease doing so and others do not, it could result in a competitive disadvantage to us in the employee marketplace.

|

|

·

|

Our stock price is subject to wide fluctuations from many factors such as changing financial market conditions, variations in our quarterly operating results, changes in estimates and recommendations by securities analysts, hedging of our stock and other transactions by investors.

|

|

·

|

In January 2011, our Board of Directors designated $60 million of our cash, cash equivalents and investments for a major stock repurchase during the next twelve to twenty-four months and accordingly increased our share repurchase plan by approximately two million shares to 2,500,000 shares. Whether we utilize that much cash for stock repurchases depends upon such factors as the price of our stock, the dollar volume of transactions in our stock, and whether we learn of material non-public information at a time we do not have a 10b5-1 program in place which permits us to continue buying shares in the market. As of June 3, 2011, we had only repurchased $8.5 million of our shares, which is short of the $2.5 million run rate per month necessary to repurchase $60 million shares in twenty-four months.

|

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

We lease a building at 71 Vista Montana, San Jose, California, covering approximately 61,700 square feet where our six-inch submicron wafer fabrication and process engineering are located. In April 2010, we amended the lease term of this facility by extending the term five years to expire in April 2016.

We lease a portion of a building located at 10 Sam Chuk Street, San Po Kong, Kowloon, Hong Kong, to house our back-end processing operations including: wafer sort, final test, quality control and assembly logistics as well as our Hong Kong Design Center and our International Sales and Distribution Center. The original lease for 23,600 square feet was renewed in September 2009 and expires on November 30, 2012. A lease for additional space of 4,500 square feet was renewed in September 2009 and covers three years from September 16, 2009 to September 15, 2012. A lease for additional space of 10,000 square feet was signed in May 2008 and covers three years and from August 1, 2008 to September 30, 2011. We have an option to renew all three of these Hong Kong leases for an additional three years.

We own our corporate headquarters, a facility of approximately 42,000 square feet on approximately three acres of land at 1235 Bordeaux Drive, Sunnyvale, California, which houses the executive offices, sales and marketing, including applications, product and test engineering, R&D, prototype and hi-rel assembly, quality control, production control, corporate finance and administration staff.

We believe that our existing facilities and equipment are well maintained and are in good operating condition.

13

Item 3. Legal Proceedings

From time to time we are subject to possible claims or assessments from third parties arising in the normal course of business. Management has reviewed such possible claims and assessments with legal counsel and believes that it is unlikely that they will result in a material adverse impact on the Company’s financial position, results of operations or cash flows.

Item 4. Removed and Reserved.

14

PART II

|

Item 5.

|

Market for Registrant's Common Equity and Related Shareholder Matters and Issuer Purchases of Equity Securities

|

Performance Graph

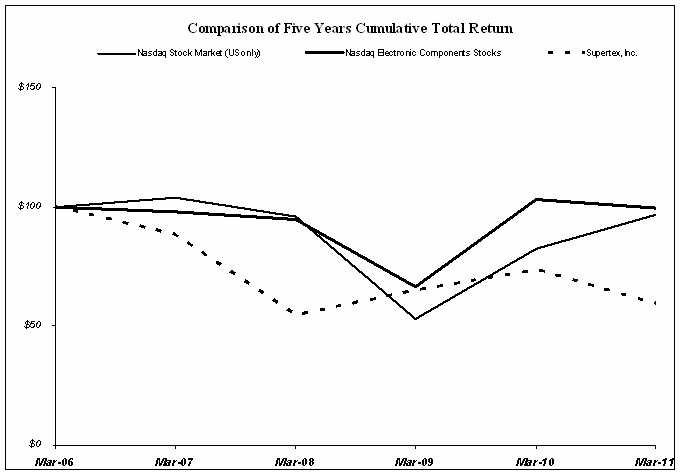

This chart and graph show the value of a $100 cash investment on the last business day of fiscal year 2006 in (i) the Company’s Common Stock, (ii) the NASDAQ Composite Total Return Index – U.S., and (iii) the NASDAQ Electronic Components Total Return Index. All values assume reinvestments of all dividends and are calculated as of the last day of each of our fiscal years, except for the value of fiscal 2011, which was calculated as of March 31, 2011, as the NASDAQ has yet to release the Total Return Index for April 2011. Note that historic stock price performance shown on the graph below is not necessarily indicative of future stock price performance.

|

Fiscal Years

|

||||||||||||||||||||||||

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

|||||||||||||||||||

|

Nasdaq Stock Market (US only)

|

$ | 100.00 | $ | 103.69 | $ | 95.79 | $ | 53.00 | $ | 82.41 | $ | 96.85 | ||||||||||||

|

Nasdaq Electronic Components Stocks

|

$ | 100.00 | $ | 97.94 | $ | 94.65 | $ | 66.34 | $ | 102.86 | $ | 99.49 | ||||||||||||

|

Supertex, Inc.

|

$ | 100.00 | $ | 88.28 | $ | 54.57 | $ | 64.94 | $ | 73.60 | $ | 59.22 | ||||||||||||

The information contained in this Item 5 under the heading “Performance Graph” (i) is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and (ii) shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Exchange Act of 1934, as amended, or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing to this Item 5 Performance Graph information.

15

Market Information

The following table sets forth the range of high and low closing sale prices reported on The NASDAQ Global Select Market under the symbol SUPX for the periods indicated.

|

Fiscal Years Ended

|

||||||||||||||||

|

April 2, 2011

|

April 3, 2010

|

|||||||||||||||

|

High

|

Low

|

High

|

Low

|

|||||||||||||

|

First Quarter

|

$ | 29.58 | $ | 23.91 | $ | 27.30 | $ | 22.49 | ||||||||

|

Second Quarter

|

27.75 | 21.88 | 31.73 | 23.05 | ||||||||||||

|

Third Quarter

|

25.84 | 21.99 | 31.27 | 23.16 | ||||||||||||

|

Fourth Quarter

|

24.88 | 20.55 | 29.80 | 22.64 | ||||||||||||

On June 3, 2011, the last reported sale price was $20.81 per share. There were 91 registered holders of record of SUPX’s common stock as of June 3, 2011. A substantially greater number of holders of its common stock are “street name” or beneficial holders, whose shares are held of record by banks, brokers and other financial institutions. We have not paid cash dividends on our common stock in fiscal years 2011 and 2010, and the Board of Directors presently intends to continue this policy in order to retain earnings for the development of the Company's business. Accordingly, it is anticipated that no cash dividends will be paid to holders of common stock in the foreseeable future.

Securities authorized for issuance under equity compensation plans

We maintain the following three shareholder-approved equity compensation plans, as further described in Note 11 to our Consolidated Financial Statements.

Employee Stock Purchase Plan - Our shareholders approved the adoption of the 2000 Employee Stock Purchase Plan (“ESPP”) and the reservation of shares of common stock for issuance under the ESPP at the August 18, 2000 annual shareholders meeting. The maximum aggregate number of common stock available for purchase under the ESPP is 500,000 shares plus an annual increase on the first day of our fiscal year of the lesser of 100,000 shares or three percent (3%) of the outstanding shares on that date or a lesser amount determined by our board of directors. During fiscal 2011, our board of directors determined not to increase the maximum aggregate number of common stock available for purchase under the ESPP. Eligible employees may elect to withhold up to 20% of their cash compensation to purchase shares of our common stock at a price equal to 95% of the market value of the stock at the end of a six-month offering period. An eligible employee may purchase no more than 500 shares of common stock during any six-month accumulation period. A total of 7,422 shares, 6,504 shares and 7,738 shares of our common stock were issued under the ESPP for fiscal years 2011, 2010 and 2009, respectively. There were 204,928 shares available for future issuance under the ESPP at the end of fiscal year 2011.

Stock Option Plans - The 2001 Stock Option Plan (the “2001 Plan”) provides for granting incentive stock options to employees and non-statutory stock options to employees and consultants; however beginning in August 2006, our board of directors determined to grant only non-statutory options. Our board of directors, acting through its designated stock option committee, determines the terms and conditions for individual options. Options granted under the 2001 Plan were granted at the fair market value of our common stock on the date of grant and generally vested over five years, 20% on the first anniversary of the grant date and 20% at the end of each of the following four years. Options granted prior to August 2007, generally have a seven-year term while options granted during or subsequent to August 2007, generally have a ten-year term, with all options expiring prior to such term thirty days after termination of service. No further options may be granted under the 2001 Plan due to the adoption of our new equity incentive plan as described in the following paragraph.

16

All outstanding stock awards granted under the 2001 Plan will continue to be subject to the terms and conditions as set forth in the agreement evidencing such stock awards and the terms of the 2001 Plan.