Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SUNRISE SENIOR LIVING INC | d8k.htm |

Investor Conference 2011

June 14, 2011 |

Disclaimer

2

•

Some of the statements in this presentation, as well as statements made

by management, may be forward-looking statements that are

based on management’s current assumptions, expectations and projections regarding our business and performance, the

economy and forecasts of future events, circumstances and results.

Forward-looking statements include statements concerning the

projected future performance of Sunrise and the markets in which

we operate.

•

These forward-looking statements speak only as of the date of this

presentation. We undertake no obligation to update any

forward-looking statements to reflect the events or circumstances

arising after the date as of which they are made. As with any

projection or forecast, they are inherently susceptible to uncertainty

and changes in circumstances. Our actual results may differ

materially from those set forth in our forward-looking statements,

depending on various factors including the risks and

uncertainties described in filings made with the Securities and

Exchange Commission. As a result of these risks and uncertainties,

recipients of this presentation are cautioned not to place undue

reliance on the forward-looking statements included in this

presentation or that may be made elsewhere from time to time by,

or on behalf of, us.

•

This presentation may contain statistics and other data that may

have been obtained or compiled from information made available

by third-party service providers. While we believe these sources to

be reliable, accuracy and completeness of the information cannot

be guaranteed.

•

This presentation contains certain supplemental non-GAAP financial

measures. While we believe that non-GAAP financial

measures are helpful in evaluating our operating performance, the use

of non-GAAP financial measures in this presentation should

not be considered in isolation from, or as an alternative for, a

measure of financial or operating performance as defined by

GAAP. You are cautioned that there are inherent

limitations associated with the use of each of these

supplemental non-GAAP financial measures as an analytical

tool. Reconciliations of certain non-GAAP financial measures to the most directly comparable GAAP

financial measures can be found in the Appendix to this presentation

and the Company’s supplemental information packages and

2010 Annual Report, which are available on the Company’s website

at www.sunriseseniorliving.com. •

Unless otherwise noted herein, all the information contained in this

presentation is presented as of June 14, 2011. |

The Sunrise Story and Our Mission

3

Sunrise Founders Terry and Paul Klaassen witnessed 30

years ago how aging men and women had their dignity

and choice taken away from them, simply because they

needed extra assistance. They realized, from deep personal

experience, that

there were no options for seniors other

than the institutional environment of traditional long

-

term care facilities.

Seniors deserved much better.

In 1981, they took

the first step to pioneer a new kind

of senior living. Right from the beginning, they

established

Sunrise’s

Mission

to champion quality of life for all seniors.

The Klaassens created a homelike environment with the unique approach

to care that would become

the foundation of Sunrise: the resident-centered

-

philosophy.

This philosophy anticipated the varying needs of seniors,

including memory care, and the design and staffing of our communities

reflect that foresight.

Sunrise today has been transformed in many ways but remains completely

committed to

our time-tested Mission. This Mission and our Principles of

Service to seniors are as

relevant today as ever. These Principles are also

intertwined with

and true need and

demand for what we do. Sunrise represents the enviable combination of a

life-enriching service

and

a

sound, growing business model.

extraordinary

demographic

advantages |

Sunrise Buildings Are Designed for Seniors

4

The Sunrise-developed mansion was deliberately built with the needs

of seniors in mind. Many of these design elements have been

carried through to buildings we have acquired. •

Homelike

appeal,

lush

landscaping

and

residential

character

•

Comfortable

outdoor

areas

–

wrap-around porches with rocking chairs, garden spaces,

trellises •

Thoughtfully

designed,

senior-friendly

features:

•

Large, open foyer and grand staircase

•

Sunrise Bistro, the community hub

•

Living room/parlor with gas-burning fireplace

•

Individual heating and cooling systems in resident suites

•

Sturdy handrails disguised as decorative chair rails

•

Automatic light sensors

•

Strategic capital expenditure planning for future updates

•

Resident

safety:

•

Built

to

I-2

classification

(most

communities),

including

steel

beams,

fire

sprinklers, fire doors

and non-combustible materials

•

Emergency generators, perimeter door security, e-call

systems •

Skylights

and

emphasis

on

natural

lighting

Note: community features vary by location

|

Service Highlights

5

Premium

product

offering

of

resident-centered

services

for

seniors

Second-largest

provider

of

assisted

living

services

in

the

country*

An

Individualized

Service

Plan

of

care

is

delivered

by

a

team

of

designated

care

managers (DCMs)

As care

needs

increase,

seniors

can

“age

in

place”

Assisted Living (57%)

Skilled Nursing &

Rehabilitative Care (3%)

Focus

on

short-term,

rehabilitative

stays

with

a

goal

of

returning

the

resident

to

the

most

independent

living

setting

possible;

approach

has

more

than

doubled

Medicare mix over the past several years

Generates

several

hundred

move-ins

to

other

Sunrise

neighborhoods

each

year

Due to Total ADR of $390, skilled nursing

represents 7.5% of total revenue in U.S. Independent Living (16%)

Active seniors enjoy an independent, maintenance-free

lifestyle with

on-call

assistance;

additional

services

may

also

be

arranged

as

care

needs

change

Properties are predominantly rental, but also include co-operatives, equity sales

and numerous entrance fee models

Memory Care (24%)

Largest

provider

of

memory

care

services

in

the

country*

DCMs

are

trained

in

therapeutic

techniques

to

validate

resident

emotions

and understand their needs in a secure “Reminiscence

Neighborhood” Life

enrichment

managers

develop

and

adapt

meaningful

activities

that

incorporate resident interests and evoke pleasant memories

*Source: Assisted Living Federation of America

|

Sunrise Signature Experience

6

Sunrise’s special touches and unique approach to personalized care

are just part of what sets us apart. We Create

Relationship-Based Care Our

designated

care

managers

form

rich

relationships

by

getting

to

know

our

residents’

preferences,

from

what

time they like to wake up in the morning to their favorite meal.

A Team of Serving Hearts

Our

teams

hone

their

skills

through

hands-on

experience

and

in-depth

training

programs

at

our

own

Sunrise

University

–

so

each

team

member

is

delivering

care

the

Sunrise

way.

Offering Peace of Mind

Residents

and

families

can

have

peace

of

mind

in

knowing

that

we’re

here

for

them

around

the

clock.

We

work hard to make sure all residents are living life to the fullest,

not worrying about anything else. Celebrating the Joy of Every

Day We

strive

to

give

every

resident

at

Sunrise

a

life

filled

with

purpose

and

hope.

Our

commitment

to

making

every day special is what makes the Sunrise experience so

unique. Enriching Mind, Body & Spirit

Vibrant

activities

programs

designed

around

residents’

interests,

so

there’s

always

something

fulfilling

to

do.

With All the Comforts of Home

Communities

designed

to

look

and

feel

like

home,

from

our

community

cat

and

dog

to

our

fresh-cut

flowers,

and

hundreds

of

special

touches

to

make

life

easier.

Some Highlights: |

Enriching the Mind, Body & Spirit

7

•

Qualified team, led by a coordinator-level position focused solely

on activities, offers several meaningful and engaging

activities a day •

Activities

seek

to

benefit

the

mind,

body

and

spirit

of

all

of

our

residents,

from exercise programs like tai-chi to social activities like wine

& cheese happy hours and group outings

•

Sunrise’s new Dining Program features delicious meals made from

scratch every day

by our trained culinary team

•

Residents enjoy the freshest, local ingredients and an assortment of

menu choices designed with their health, tastes and

preferences in mind (He) mentioned that

he wanted spaghetti

and meatballs. As

soon as it was said,

the chef started

making that special

dish…and every

Tuesday ever since.

Family member, Sunrise

of West Babylon, NY

During

the

(short

time)

mom

has

been

at

Sunrise,

she

has

blossomed

–

she

smiles

more

than

she

has

in

years; she’s made new friends; she’s involved in activities and

she is totally satisfied in her new environment.

She

loves

everything.

Family

member,

Sunrise

at

North

Farmington

Hills,

MI

Our residents enjoy the very best in senior living from fulfilling

activities to home-cooked meals

–

we

stop

at

nothing

to

create

a

warm,

enriching

home. |

Consistent High-Quality Buildings

8

*IL

–

Independent

Living;

AL

–

Assisted

Living;

TC

–

Terrace

Club

(early-stage

memory

care);

REM

–

Reminiscence

(advanced

memory

care);

HC

–

Health

Care/Skilled

Nursing |

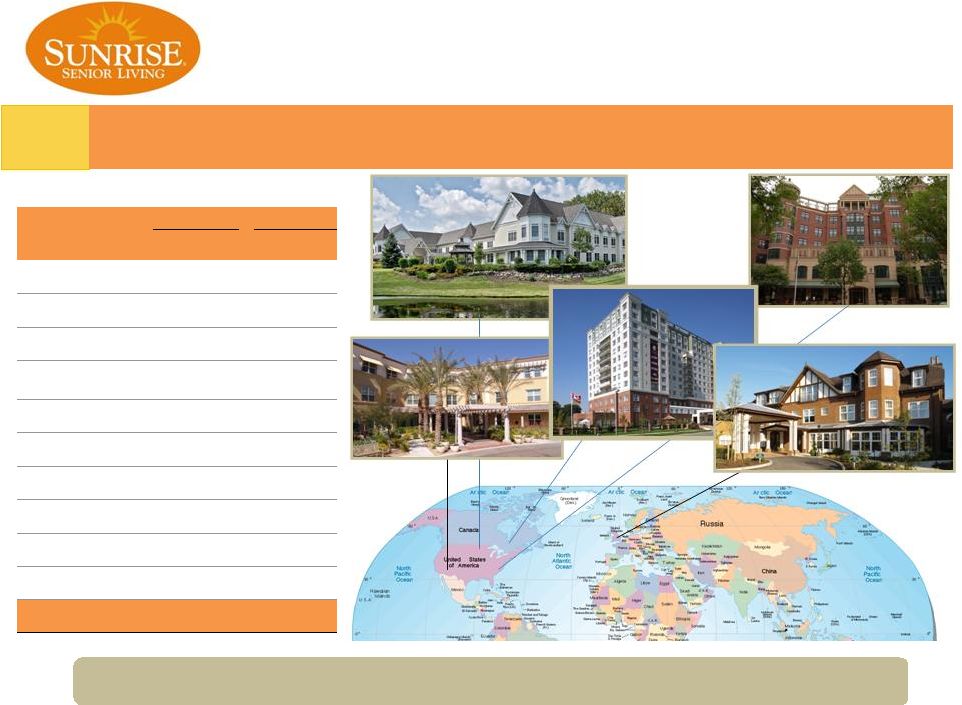

Major Metropolitan Focus

9

Communities

Units

#

% of

Total

#

% of

Total

Washington DC Metro

Market

26

8.2

3,502

11.3

Greater Los Angeles

Market

23

7.3

2,009

6.5

NY Metro Market

22

6.9

1,766

5.7

Greater Chicago Market

20

6.3

1,821

5.9

Greater London

14

4.4

1,145

3.7

Philadelphia Metro

Market

13

4.1

1,509

4.9

San Francisco Market

13

4.1

1,337

4.3

Greater Boston Market

12

3.8

754

2.4

Greater Atlanta

11

3.5

1,099

3.5

Greater Toronto

8

2.5

764

2.5

162

51.1

15,706

50.7

Differentiated

strategy focused on major metropolitan markets with strong fundamentals

|

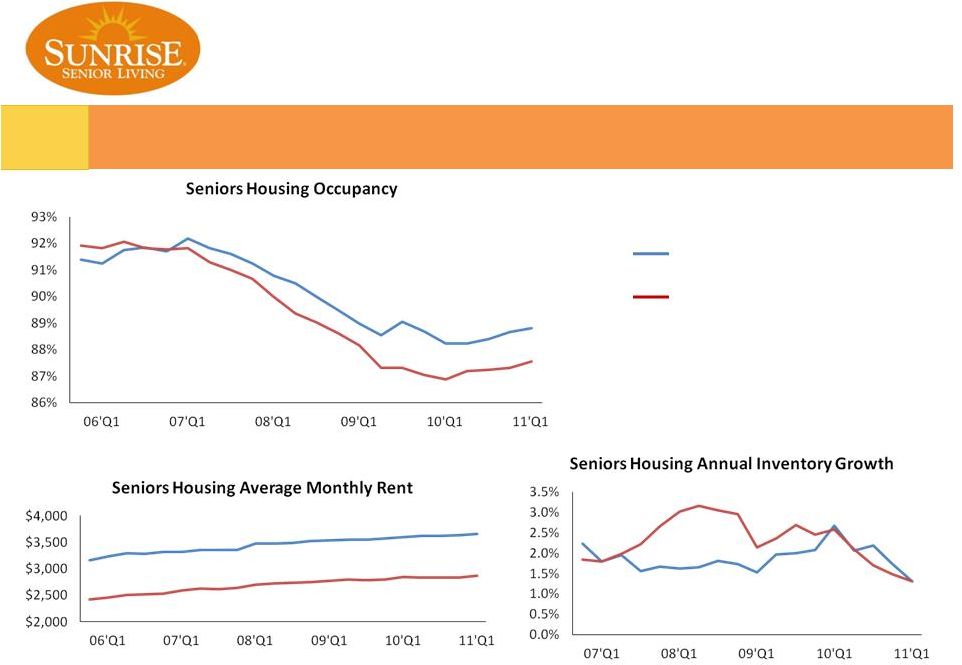

Major Market Performance Over Time

10

Big 6 Markets

MAP31 Excl. Big 6 Markets*

*Big 6 Markets include: New York,

Boston, D.C., Chicago, No. California

and So. California metro markets.

NIC Map Source Data |

High-Quality Business Relationships |

Experienced Senior Management Team

12

Management Team

Name

Title

Years of Relevant Experience

Years with Sunrise

Mark S. Ordan

Chief Executive Officer

25+ years

3+ years

Greg Neeb

Chief Investment & Administrative Officer

20+ years

3+ years

Marc Richards

Chief Financial Officer

15+ years

1+ year

David Haddock

General Counsel and Secretary

15+ years

5+ years

Ron Jeanneault

Co-Head of Operations

20+ years

11+ years

Laura McDuffie

Co-Head of Operations

15+ years

9+ years

Edward Burnett

SVP, Capital Markets

10+ years

2+ years

Gregg Colon

SVP, Resident Care & Services

22+ years

16+ years

Philip Kroskin

SVP, Asset Management & Real Estate

19+ years

2+ years

Meghan Lublin

VP, Corporate Marketing & Communications

11+ years

6+ years

Kelly Myers

SVP, Sales

21+ years

11+ years

David Pratt

SVP, Corporate Finance

10+ years

6+ years

Mike Rodis

SVP, Human Resources

30+ years

2+ years

Founders

Name

Title

Years of Relevant Experience

Years with Sunrise

Paul Klaassen

Founder and Chairman

30+ years

30 years

Terry Klaassen

Founder and Special Advisor

30+ years

30 years

Team successfully navigated the recapitalization and has positioned the company for the

future |

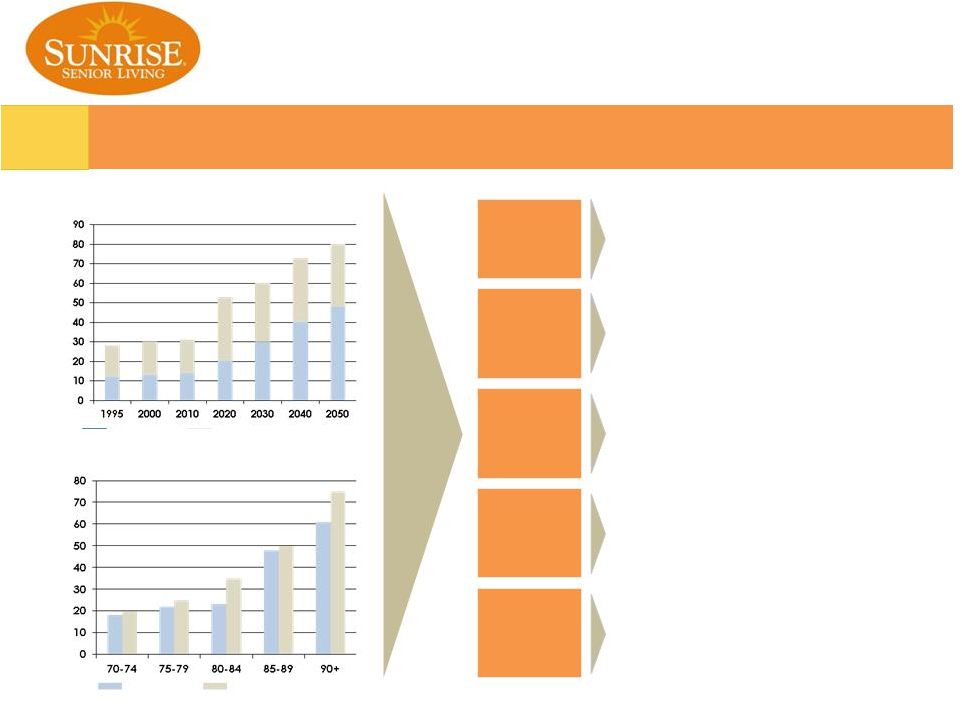

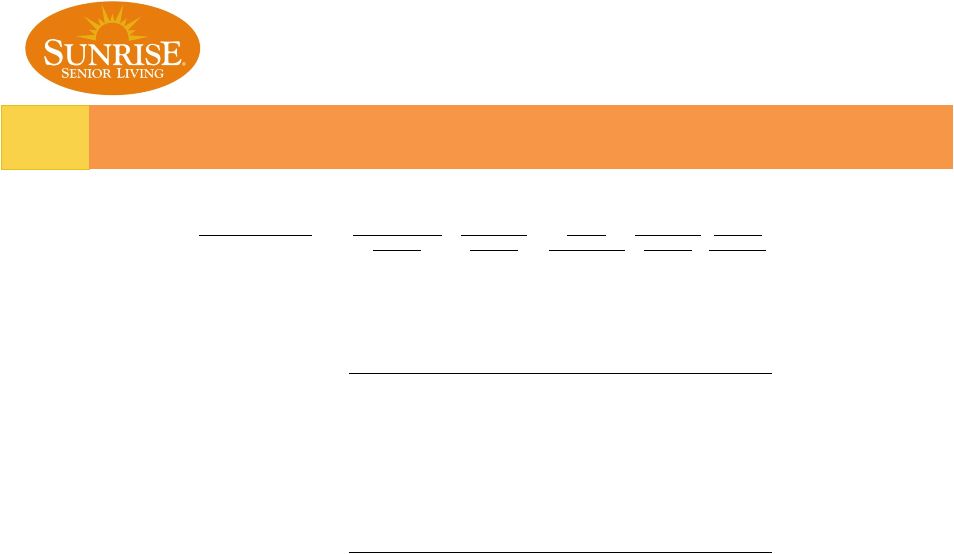

Attractive & Growing Market

13

Growing Senior

Population

•

Over 70MM seniors 65+ by 2040, making

up 20% of the total US population

•

85+ population projected to grow 3%

annually over the next 40 years

Assistance Increases with Age

Need for Care

Increases with

Age

•

Today’s seniors are healthier than in the

past, but many still have difficulty with

Activities of Daily Living (ADLs)

•

19% of 70-74 year olds and 50% of 85+ year

olds require assistance with ADLs

Rising Net

Worth of

Seniors

•

Today’s elderly have more wealth than in

the past (~$163K, up 42% since 1995)

•

Dramatic increase in residential net equity

over the past decade

Increasing

Popularity of

Senior Housing

•

According to a recent NIC survey, 60+

population living in age-qualified housing

increased from 7% to 12% from 1998 –

2007

•

Consumer awareness has increased ~14%

over that same time period

Consistent

Occupancy /

Rental Rate

Growth

•

Median occupancy has remained above

90% since 1994

•

Rents have grown 5% annually for ALF and

4% for ILF since 2000

% Requiring Assistance with ADLs

Population of US Seniors Rising

MM of US Population

75 and over

65 and over

Men

Women

Sources: US Census Bureau, Joint Center of Housing Studies, NIC National Housing Survey,

Federal Reserve Board and ASHA |

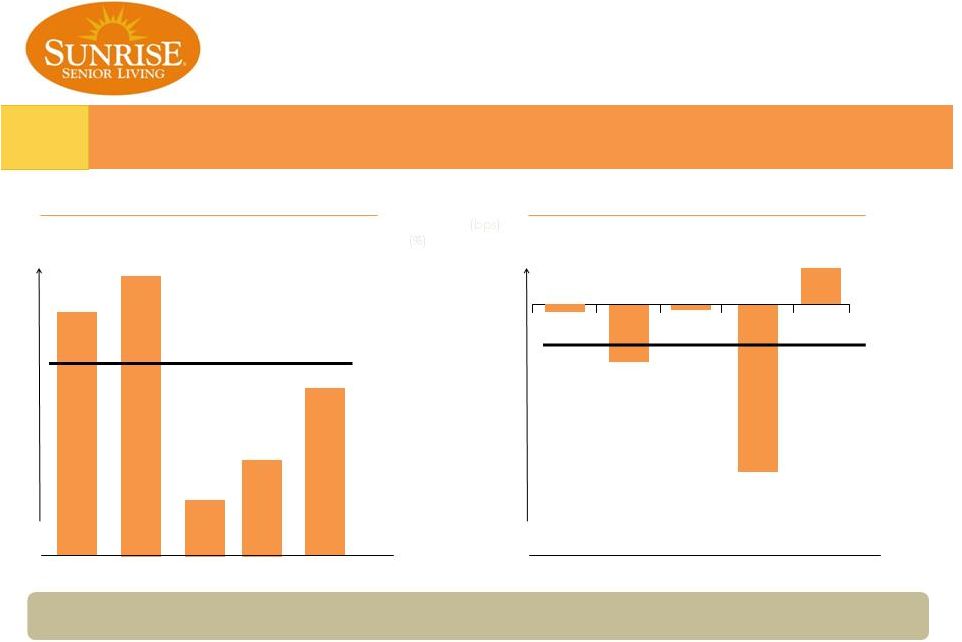

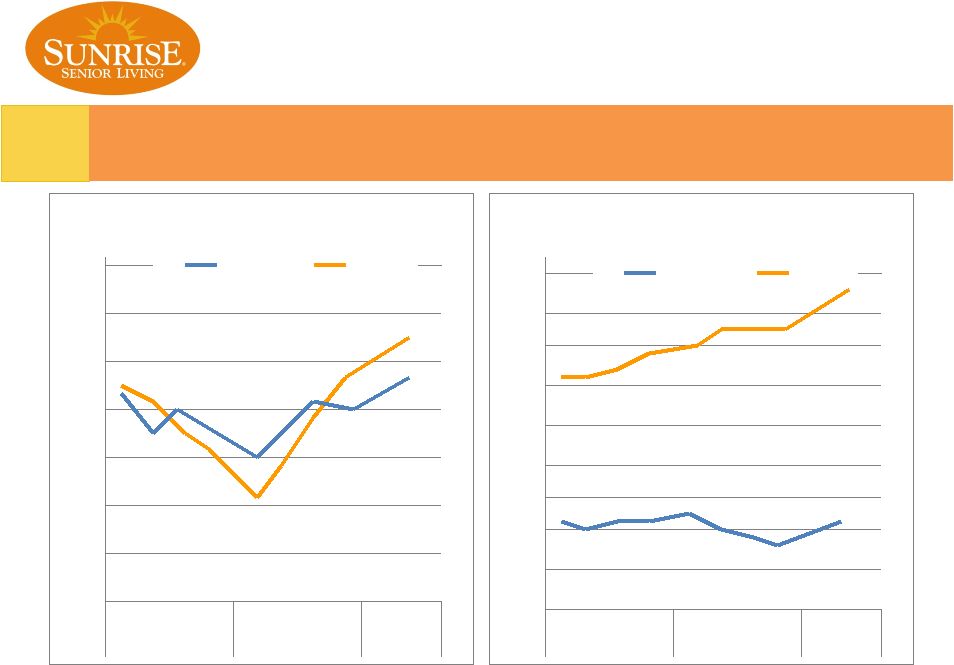

Strong Rate Growth and Well Positioned for Occupancy Rebound

14

Notes

(1)

Compares

same

community

growth

or

change

in

occupancy

for

the

4

th

quarter

of

the

measurement

year

over

the

4

th

quarter

of

the

prior

year

for

the

pool

of

comparable

communities in a given year.

%

(bps)

Same

Community

ADR

Growth

(1)

Same

Community

Occupancy

Change

(1)

2006

2007

2008

2009

2010

7

0

5-Year Average: 4.1%

(%)

100

(500)

(bps)

2006

2007

2008

2009

2010

5-Year Average: (76)bps

High-quality assets translate to consistently strong operating results

|

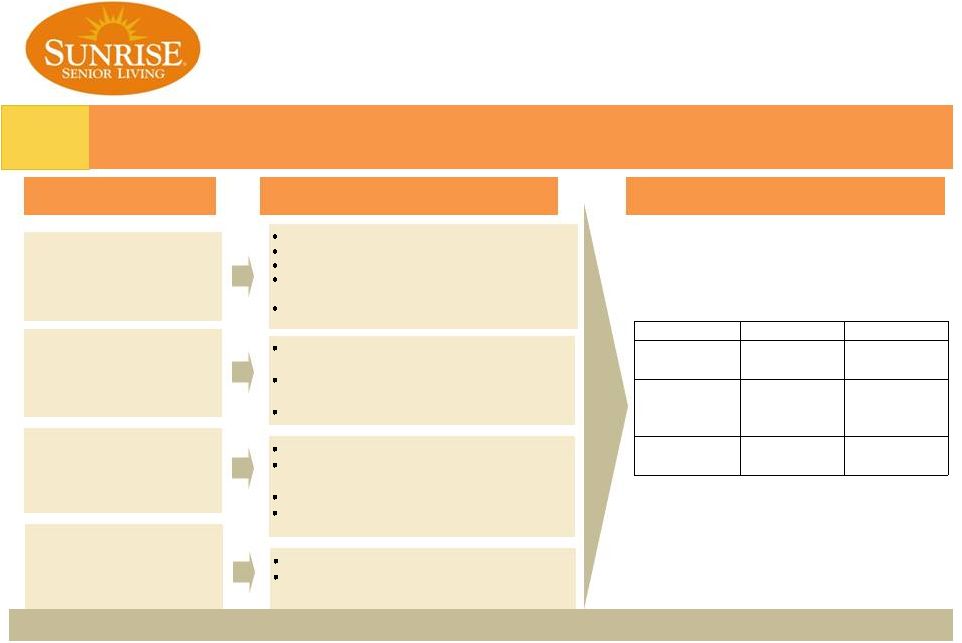

SRZ vs. Large Chains* (>25 Properties)

Senior Housing Occupancy

89.0%

Chains 25+

SRZ

88.0%

87.0%

86.0%

85.0%

84.0%

83.0%

82.0%

1 2 3

4 1 2 3

4

1

2009

2010

2011

Senior Housing AMR

$4,400

Chains 25+

SRZ

$4,200

$4,000

$3,800

$3,600

$3,400

$3,200

$3,000

$2,800

$2,600

1 2 3

4 1 2 3

4

1

2009

2010

2011

15

*Large Chains Not Including SRZ – NIC Map Source Data |

Significant Progress on Key Initiatives

16

Solidified

Balance Sheet

Stabilized

Revenue Streams

Rationalize

Cost Structure

Restructured 4 of the 5 largest management

contracts

Restructured

key

relationships

with

Ventas

and

HCP

Re-focus on Mansion product

Reduced G&A by 30% from 2008 levels

Eliminated approximately 200 corporate

overhead positions

Continuing rationalization in 2011

Deleted non-core businesses and assets and

related costs

Execute Disciplined

Growth Strategy

Arcapita / CNL Transaction

Morgan Stanley Transaction

Initiative

Accomplishments

Sunrise Snapshot

Our recapitalization is substantially complete and we are beginning to implement our disciplined

growth strategy 12/31/08

Current

# of

Properties

435

316

G&A and

Development

Expense

$184MM

$129MM (1)

Equity

Market Cap

$85MM

$475MM (2)

Near finalization of new $50MM revolver

Repaid bulk of consolidated debt

Significantly reduced corporate recourse liabilities

Restructured over $1B of debt in default (venture

and consolidated)

Exited Germany and other unprofitable businesses

(1)

Reflects 2010 figures and includes $21MM of the following items: $6.9MM in professional fees

relating to HCP, CNL, and Ventas transactions, $8.5MM in HCP litigation, $2.6MM in

severance, and $3.0MM in a retention bonus for the CEO. The figure also includes $4.0MM

in non-cash stock compensation.

(2)

As of June 9, 2011. |

Balance Sheet De-Risk

17

(dollars in thousands)

Defaulted Debt at

Total Debt at

Current

Total Debt at

Proforma

6/30/2009

6/30/2009

Defaulted Debt

3/31/2011

3/31/2011

1)

Wells Fargo

56,556

56,556

-

-

-

Connecticut Avenue

39,703

39,703

-

28,010

28,010

Quebec

-

43,837

49,269

48,147

48,147

Germany

190,213

190,213

-

-

-

Line of Credit

-

69,200

-

-

-

Sweet 16

105,366

105,366

-

-

-

Convertible Notes

-

-

-

-

86,250

AL US

-

-

-

-

339,800

Other Consolidated

47,731

109,658

1,365

78,543

78,543

Total Consolidated Debt

439,569

614,533

50,634

154,700

580,750

Pool 7

128,205

303,175

-

435,000

435,000

Pool 12

-

370,500

-

365,342

-

Pool 14

47,901

47,901

-

46,028

46,028

Pool 16 and 17

152,433

152,433

-

153,282

153,282

Pool 18, 19, and 20

234,859

234,859

199,062

275,227

275,227

Pool 21 and 22

56,848

56,848

56,372

70,750

70,750

Pool 23

-

30,729

30,117

30,244

30,244

Pool 25

-

122,651

-

116,355

116,355

Fountains

328,705

328,705

-

-

-

Clayton

55,648

55,648

-

-

-

Other Joint Ventures

17,116

2,412,945

1,545

1,498,127

1,498,127

Total Joint Venture Debt

1,021,715

4,116,394

287,096

2,990,355

2,625,013

Total Debt

1,461,284

4,730,927

337,730

3,145,055

3,205,763

1) Proforma

consolidated debt includes $86.3MM of convertible notes issued April, 2011 and the

AL US debt, net of a $25MM paydown. |

Stabilize

Revenue

Stream

–

Management

Contracts

(Including

JVs)

18

Sunrise has

restructured 4

out of its 5

largest

management

contracts:

Portfolio/Partner

Number of

Communities

Average

Maturities

2010 Fee

($ in 000s)

Notes

Ventas

79

2034-2037

19,307

Entered into amended management

agreements in 2010

HCPI

46

2028-2038

17,079

Litigation dismissed and settlement

reached in 2010

Arcapita

29

2028

9,646

Brought

in

new

partner

in

2011

–

Arcapita

had termination rights

Pool 3 (UK)

15

2037

6,712

Working with lender and partner

Morgan Stanley (US)

15

2037

5,824

Bought out partner in 2011 and modified

loan

All Others

97

49,264

No other relationship has aggregate fees

greater than $5 million

Total

281

107,832

Resulting in

extended

maturities:

Remaining Contract

Term (1) (In years)

Number of

Communities

2010

Management Fee

Revenue

Weighted

Avg. Mgmt.

Fee Percent

0-5

14

$ 6,687

5.32%

6-10

1

64

2.96%

11-15

5

1,237

5.38%

16-20

57

19,891

5.72%

20+

204

65,546

6.89%

Sold/Terminated in 2009 and 2010

N/A

14,407

6.23%

281

107,832

6.41% |

Rationalize Cost Structure –

G&A Completed Initiatives

19

Corporate Costs

2007

2008

2009

2010

Q1 2011

G&A

183,546

150,273

114,566

124,728

32,389

Development Expense

35,076

34,118

12,374

4,484

-

Liquidity Trust

-

-

-

-

407

Accounting Restatement/SEC

51,707

30,224

3,887

(1,305)

-

Restructuring

-

24,178

32,534

11,690

-

Total Corporate Costs

270,329

238,793

163,361

139,597

32,796

Voluntary Separation Program (VSP)

In 2008, we implemented a program to reduce corporate expenses, including a voluntary

separation program for certain team members, as well as a reduction of spending related

to administrative processes, vendors, consultants and other costs. We eliminated

182 positions primarily in our McLean, Virginia headquarters. We recorded severance charges related to this

program of $3.0 million and $15.0 million for 2009 and 2008, respectively.

Re-structure of Office Lease

With the decreased staff, we reconfigured our office space and two floors of leased space in

our headquarters were vacated. We ceased using the space on December 31, 2008.

Additional Corporate Staff Reduction

In 2009 and 2010, we continued to reduce corporate expenses through a further reorganization

of our corporate cost structure, including a reduction in spending related to, among

others, administrative processes, vendors and consultants. The plan was designed

to reduce our annual recurring general and administrative expenses (including expenses previously classified as

venture expense) to approximately $100 million. |

Business Lines Over Time

20

2011 Q1

2011 Q1

2008

2010

Illustrative ¹

Ill. Annlzd. ¹

Revenue adjusted for EBITDA

Management Fees

116.8

106.9

21.3

85.0

Professional fees from development, marketing, and other

44.2

4.3

0.3

1.2

Owned/Consolidated

NOI

2

(12.3)

12.6

23.6

94.3

Leased NOI

94.3

78.6

21.1

84.3

Sunrise's proportionate share of Joint Ventures

39.8

43.2

4.3

17.2

Total Revenues adjusted for EBITDA

282.8

245.5

70.5

282.0

Expenses

adjusted

for

EBITDA

Community lease expense

59.8

60.2

14.8

59.2

General

and

Administrative/D&V

3

181.2

125.2

30.7

122.8

Other

(13.8)

2.8

0.8

3.2

Total Expenses adjusted for EBITDA

227.2

188.2

46.3

185.2

Blackjack

14.7

0.0

0.0

0.0

Greystone

(28.1)

0.0

0.0

0.0

Trinity

(25.6)

0.0

0.0

0.0

Germany

(29.6)

(9.2)

0.0

0.0

Fountains

(11.6)

1.0

0.0

0.0

Aston Gardens

(3.0)

0.0

0.0

0.0

Other

0.7

0.0

0.0

0.0

Total Discontinued Business Lines

(82.5)

(8.2)

0.0

0.0

(26.9)

49.0

24.2

96.8

1) Illustrative 2011 numbers include Q1 actuals adjusted assuming a

100% ownership of the AL US and CC3 portfolios on Jan 1, 2011. This

financial information is for illustrative purposes only. We did

not own a 100% interest in AL US until June 2011. Additionally during 2011

we will only own a 40% interest in CC3, and can only purchase 100%

commencing in 2013 subject to certain terms and conditions. 2)

Owned NOI excludes interest expense of approximately $29M for the CC3 portfolio, $22M for the AL US portfolio

and $5M for other consolidated assets

3) G&A excludes non-cash stock comp expense

4) Discontinued business lines include NOI less guaranty and interest

payments, with the exception of Fountains and Aston Gardens

which are management fees less guaranty payments 5) See appendix

for bridge to Net Income. Total Adj. EBITDA Less Discontinued

Business Lines Discontinued Business Lines

4

5 |

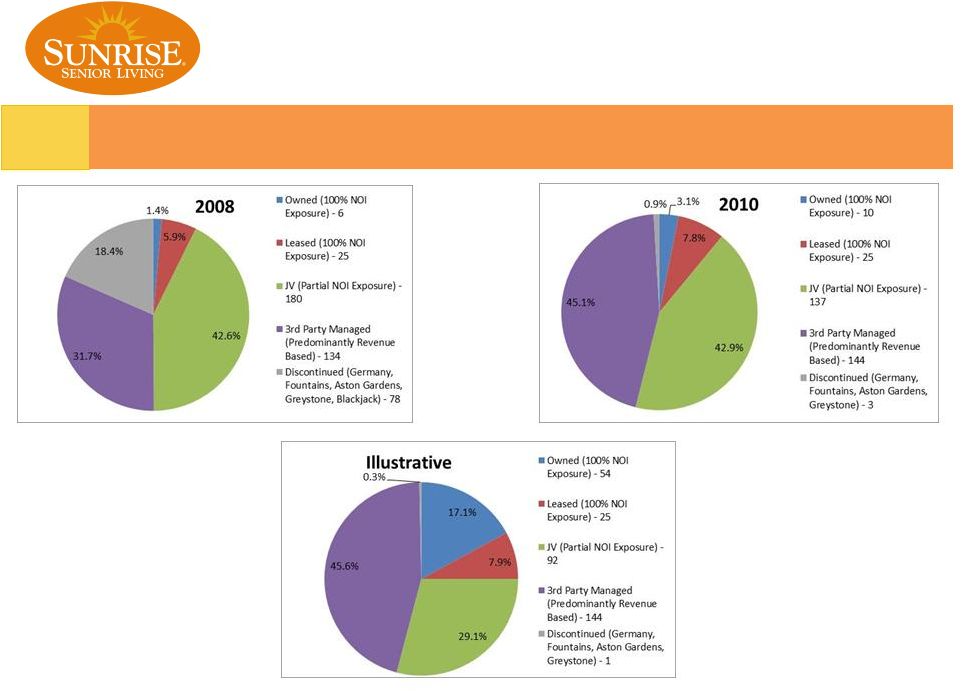

Ownership Mix Over Time

21

-

Illustrative assumes that

Sunrise owned 100% of the AL

US and CCIII ventures. Sunrise

purchased the AL US joint

venture in June 2011, and has

the right to purchase 100% of

the CC3 venture in 2013

subject to certain terms and

conditions. |

Attractive Growth Prospects

22

Focus on improving operating efficiency

Provide additional revenue-generating

services at existing communities

Selectively expand existing facilities/convert

higher productivity uses

Proprietary deal flow

Maximizes benefit from improved

performance of communities

Capitalize on reputation,

senior living sector

expertise and brand

licensing opportunities for

products, services and

locations

Selective acquisition of

platform-enhancing assets

Measured development of

new communities in major

metro markets

Increase Community Income

Buy-out JV Interests

Brand Extension

Acquisition / Development

Growth

Initiatives |

CNL Lifestyle –

CC3 Investment Summary

23

Jan 2011, Sunrise contributed its 10% interest in an

existing JV (CC3) for a 40% interest in a new JV with

CNL Lifestyle Properties

–

29 asset / 2,028 unit portfolio

–

Portfolio valued at $630 million

–

Primarily concentrated in the NY, Chicago,

Washington DC and LA markets, representing 67%

of portfolio NOI

–

High-quality portfolio of primarily purpose-built

mansion products

–

Signed new 30-year management agreements with

5% fees that escalate to 6% plus IMF; previous

agreement was terminable for a fee and possible loss

of equity promote

–

Financed with 3 year CMBS offered through

Goldman Sachs at 6.75%

–

Sunrise secured right to fixed price buy-out of its

new partner, available after year 2 at 13% IRR. In

exchange, CNL earns 11.5% current preference

–

Partners

invested

$11.5M

for

CapEx

improvements

* 2013 estimated results based on standard 3% annual increases from 2011

CC3 Portfolio Investment

Summary

2011B

2013B*

Revenues

$ 157,138

$ 166,707

Less: Exp.

$(101,294)

$(107,463)

Less: Mgmt. (5%)

$ (7,857)

$ (8,335)

NOI

$ 47,986

$ 50,909

Less: Other

$ (1,131)

$ (1,177)

Less: Debt Service

$ (29,770)

$ (29,770)

Equity Cash Flow

$ 17,085

$ 19,962

CNL Cash Equity

$ 135,000

Sunrise Carried Equity

$ 79,959

Sunrise Cash Equity

$ 8,841

Total Cash Flow

$ 223,800

$ 17,085

$ 19,962

Return on Equity

7.6%

8.9%

Unleveraged Yield

Net Operating Income

$ 47,986

$ 50,909

Portfolio Value

$ 630,000

$ 630,000

Unleveraged Yield (%)

7.62%

8.08% |

AL US Investment Summary

24

June 2011, Sunrise bought out its partner’s 80% share in

an existing JV and restructured the JV debt.

–

15 asset /1,091 unit portfolio; high-quality purpose-

built mansions

–

10 of 15 assets in CA, primarily LA market

–

Partner received $45M for 80% equity share

–

Prior to transaction, loan defaulted in Q1 2011 due to

DSCR violation and mgmt contract was terminable by

Lender

–

In Q3 2009, DSCR violation triggered cash flow sweep

and Sunrise began subordinating 3% of mgmt fee

–

Loan was paid down by $25M

–

Loan term extended 3 years to Jun 2015

–

Subordinated management fees (3% of Rev) were

returned to Sunrise

–

Lender to continue sweeping all excess cash flows

–

Loan interest rate reduced through new swap at market

levels

–

Loan covenants adjusted to Sunrise’s benefit

* Cash flow sweep accretive to Sunrise by reducing loan balance and building

equity

** Return on Equity shown on new investment basis due to reduction of

carried equity to effectively zero from over-leverage on portfolio

AL US Portfolio Investment Summary

2011B

Revenues

$ 84,802

Less: Exp.

$ (51,976)

Less: Mgmt. (7%)

$ (5,936)

NOI

$ 26,890

Cash Flow Sweep Amortization *

$ 9,084

Sunrise Subordinated Mgmt Fee (3%)

$ 2,544

Sunrise Incremental Total Cash Flow

$ 11,628

Sunrise Carried Equity

$

- Sunrise Cash Equity

$ 72,000

Sunrise Return on Equity **

16.2%

Unleveraged

Yield (%)

Net Operating Income

$ 26,889

Portfolio Value (Equity + Debt)

$ 423,501

Unleveraged

Yield (%)

6.3% |

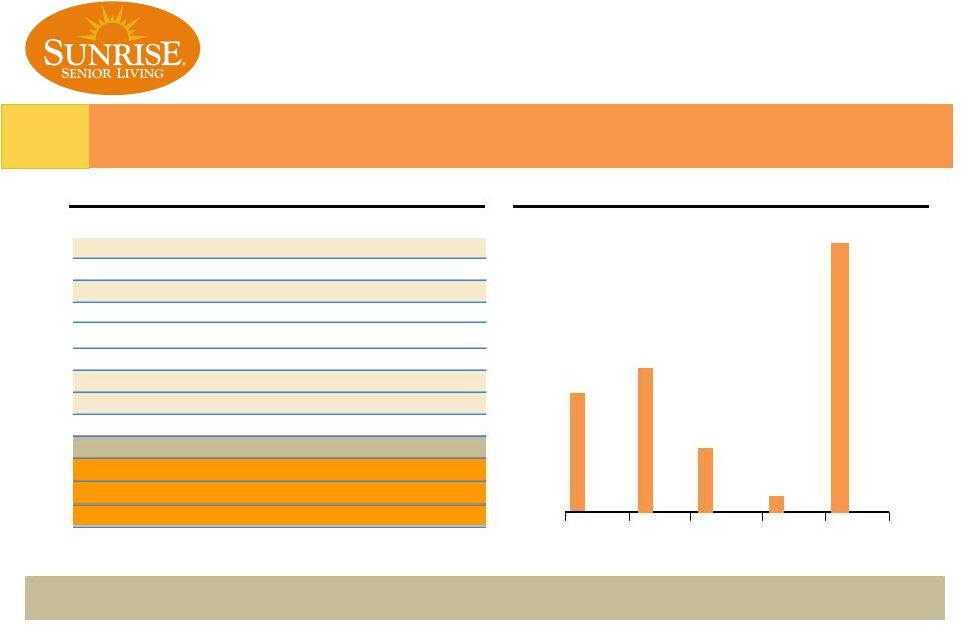

2011

2012

2013

2014

2015+

Capital Structure

Debt Maturity Schedule

(1)

($MM)

Capitalization

(1)

($MM)

48.1

57.9

21.0

5.4

448.4

Equity:

Equity Market Capitalization

(2)

474.6

Debt:

Recourse Debt

85.5

Non-recourse Debt

(1)

409.0

Convertible Debt

86.3

Total Pro Forma Debt

580.8

Total Capitalization

1,055.4

Less: Cash & Cash Equivalents

(3)

(41.0)

Total Enterprise Value (TEV)

1,014.4

Leverage Ratios:

Total Debt / Total Capitalization

55%

Net Debt / Total Enterprise Value

53%

25

400

80

60

40

20

0

Recapitalized balance sheet assuming access to $50MM undrawn credit facility (near

finalization) Notes

(1) Consolidated debt as of 3/31/11 plus the face amount of debt associated with the AL

US purchase and debt modification

(2) As of 6/9/11

(3) Reflects 3/31/11 cash balance of $41M

|

Premium product offering of resident-centered services for

seniors High-quality, purpose-built assets located in

top metropolitan markets Sector leading brand, reputation and

senior living expertise Leading Provider of

Senior Living Services

Favorable Industry Backdrop

Compelling

supply

and

demand

drivers

with

aging

demographics

and

limited

new supply of senior housing

Leader in memory care and assisted living

Strong Growth Prospects

Internal growth from continued occupancy gains and rate

increases Focus on “owning more of what we

manage” Opportunity to capitalize on our brand, expertise

and sector leading care Well-Positioned Capital

Structure

Recapitalization substantially complete

Proposed $50MM credit facility with new lender (near finalization)

Proven Management Team

Significant relevant experience in the industry

Successfully implemented recapitalization strategy

Founders are pioneers of assisted living industry

Company Highlights

26 |

Appendix: Reconciliation of non–GAAP measure

27

The following table reconciles adjusted EBITDA, less discontinued business lines, to net

income (loss) attributable to common shareholders (in millions):

2008

2010

Total Adj. EBITDA Less Discontinued Business Lines

(26.9)

49.0

Plus: Discontinued Business Lines

82.5

8.2

Less: Stock Comp Expense

(3.2)

(4.0)

Less: SRZ proportionate share of JVs

(39.8)

(43.2)

Plus: Buyout fees

0.6

63.3

Less: Depreciation and amortization

(39.2)

(41.1)

Less: Write-off of capitalized project costs

(95.8)

0.0

Less: Accounting Restatement, Special Independent Committee inquiry,

SEC investigation and stockholder litigation

(30.2)

1.3

Less: Restructuring Costs

(24.2)

(11.7)

Less: Other Provision for Doubtful Accounts

(19.5)

(5.4)

Less: Loss on Financial guarantees

(5.0)

(0.5)

Less: Impairment on owned communities and land parcels

(27.8)

(5.9)

Less: Impairment of goodwill and intangible assets

(121.8)

0.0

Plus: Interest Income

6.0

1.1

Less: Interest Expense

(6.6)

(7.7)

Plus/Less: Gain/Loss on Investments

(7.8)

0.9

Plus: Gain on fair value of liquidating trust notes

0.0

5.2

Plus/Less: Other income/ expense

(22.1)

1.2

Plus: Gain on sale of real estate and equity interests

17.4

27.7

Plus/Less: Sunrise's share of earnings (loss) and return on investment

in unconsolidated communities

(13.8)

7.5

Plus/Less: Loss from investments accounted for under the profit sharing

method (1.3)

(9.7)

Plus/Less: Provision for/ benefit from income taxes

47.1

(6.6)

Plus Fountains Management Fees

9.6

1.0

Plus: Aston Garden Management Fees

3.2

0.0

Less: Discontinued operations, net of tax

(120.5)

68.5

Net Income/Loss

(439.2)

99.1 |