Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Wendy's/Arby's Restaurants, LLC | eh1100453_form8k.htm |

| EX-2.1 - EXHIBIT 2.1 - Wendy's/Arby's Restaurants, LLC | eh1100453_ex0201.htm |

| EX-99.1 - EXHIBIT 99.1 - Wendy's/Arby's Restaurants, LLC | eh1100453_ex9901.htm |

EXHIBIT 99.2

|

|

Strategic Alternatives Update

June 13, 2011

|

|

|

Forward-Looking Statements

This presentation may contain statements that are not historical facts, including, importantly, information concerning possible or assumed future results of our operations. Those statements constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). For all our forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Reform Act.

Many important factors could affect our future results and could cause those results to differ materially from those expressed in or implied by our forward-looking statements. Such factors, all of which are difficult or impossible to predict accurately, and many of which are beyond our control, include but are not limited to those identified under the caption “Forward-Looking Statements” in our most recent earnings press release and in the “Special Note Regarding Forward-Looking Statements and Projections” and “Risk Factors” sections of our most recent Form 10-K and subsequent Form 10-Qs.

|

|

|

Disclosure Regarding Non-GAAP

Financial Measures

EBITDA is used by the Company as a performance measure for benchmarking against the Company’s peers and competitors. The Company believes EBITDA is useful to investors because it is frequently used by securities analysts, investors and other interested parties to evaluate companies in the restaurant industry. The Company also uses adjusted EBITDA and pro forma adjusted EBITDA which exclude certain special or non-recurring expenses, net of certain special or non-recurring benefits, detailed in the reconciliation tables included in the Appendix to these slides, as internal measures of business operating performance. The Company believes such financial measures provide a meaningful perspective of the underlying operating performance of the Company’s current business. EBITDA, adjusted EBITDA and pro forma adjusted EBITDA are not recognized terms under U.S. Generally Accepted Accounting Principles (“GAAP”). Because all companies do not calculate EBITDA and similarly titled financial measures in the same way, those measures as used by other companies may not be consistent with the way the Company calculates such measures and should not be considered as alternative measures of operating profit or net loss.

Because certain income statement items needed to calculate net income vary from quarter to quarter, the Company is unable to provide projections of net income and a reconciliation of projected Company pro forma EBITDA to net income.

The Company’s presentation of EBITDA, adjusted EBITDA and pro forma adjusted EBITDA is not intended to replace the presentation of the Company’s financial results in accordance with GAAP.

|

|

|

Transaction Summary

Wendy’s/Arby’s Group announces definitive agreement to sell Arby’s to a buyer formed by Roark Capital Group

Atlanta-based private equity firm that focuses on investing in franchise, brand management and restaurant companies

Owner of McAlister’s Deli® and Focus Brands® (which includes Moe’s Southwest Grill®, Carvel®, Cinnabon®, Schlotzsky’s® and Auntie Anne’s®)

Aggregate value of transaction to Wendy’s/Arby’s is estimated to be $430 million

Closing expected early in the 3rd quarter

|

|

|

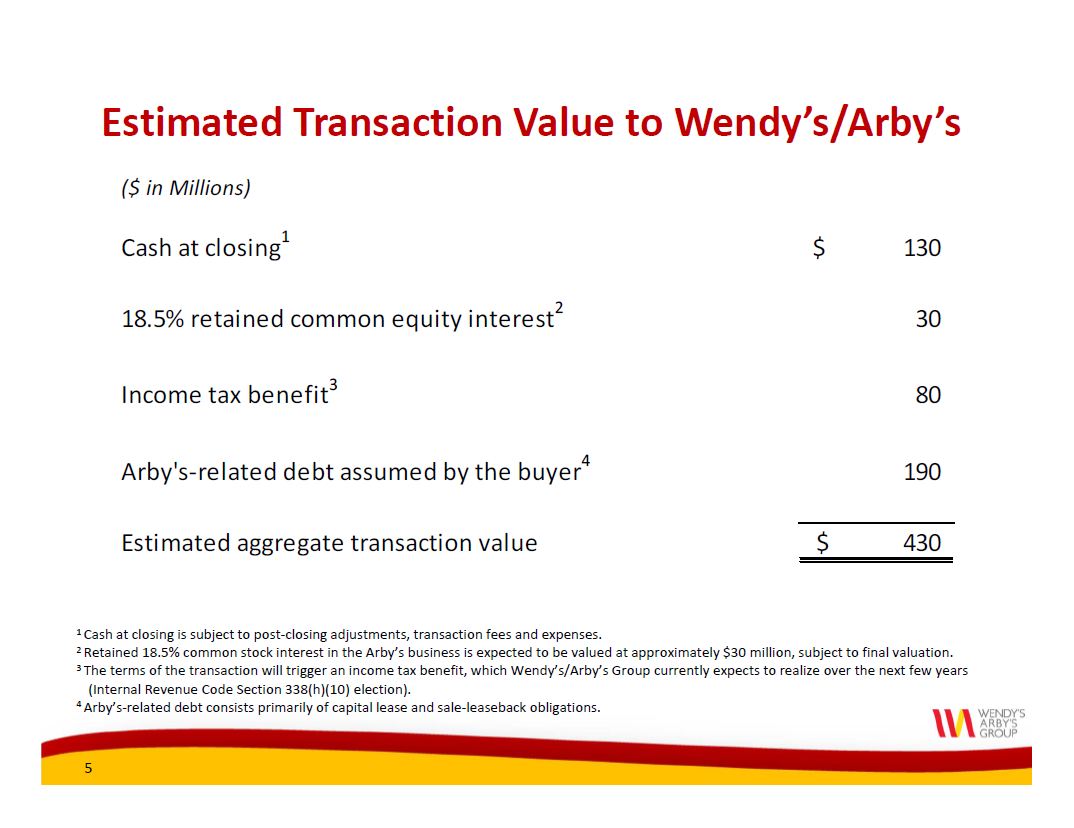

Estimated Transaction Value to Wendy’s/Arby’s

($ in Millions)

Cash at closing (1) $130

18.5% retained common equity interest (2) 30

Income tax benefit (3) 80

Arby’s-related debt assumed by the buyer (4) 190

Estimated aggregate transaction value $430

1 Cash at closing is subject to post-closing adjustments, transaction fees and expenses.

2 Retained 18.5% common stock interest in the Arby’s business is expected to be valued at approximately $30 million, subject to final valuation.

3 The terms of the transaction will trigger an income tax benefit, which Wendy’s/Arby’s Group currently expects to realize over the next few years (Internal Revenue Code Section 338(h)(10) election).

4 Arby’s-related debt consists primarily of capital lease and sale-leaseback obligations.

|

|

|

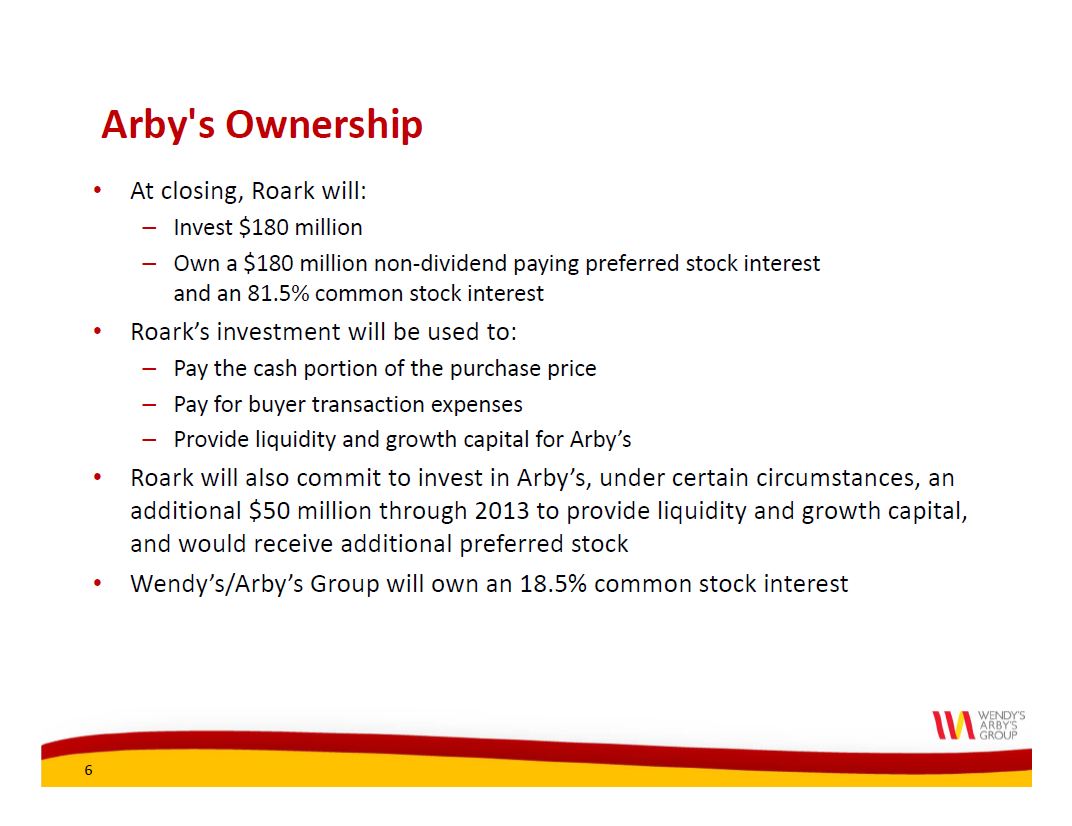

Arby's Ownership • At closing, Roark will: – Invest $180 million – Own a $180 million non-dividend paying preferred stock interest and an 81.5% common stock interest • Roark’s investment will be used to: – Pay the cash portion of the purchase price – Pay for buyer transaction expenses – Provide liquidity and growth capital for Arby’s • Roark will also commit to invest in Arby’s, under certain circumstances, an additional $50 million through 2013 to provide liquidity and growth capital, and would receive additional preferred stock • Wendy’s/Arby’s Group will own an 18.5% common stock interest

|

|

|

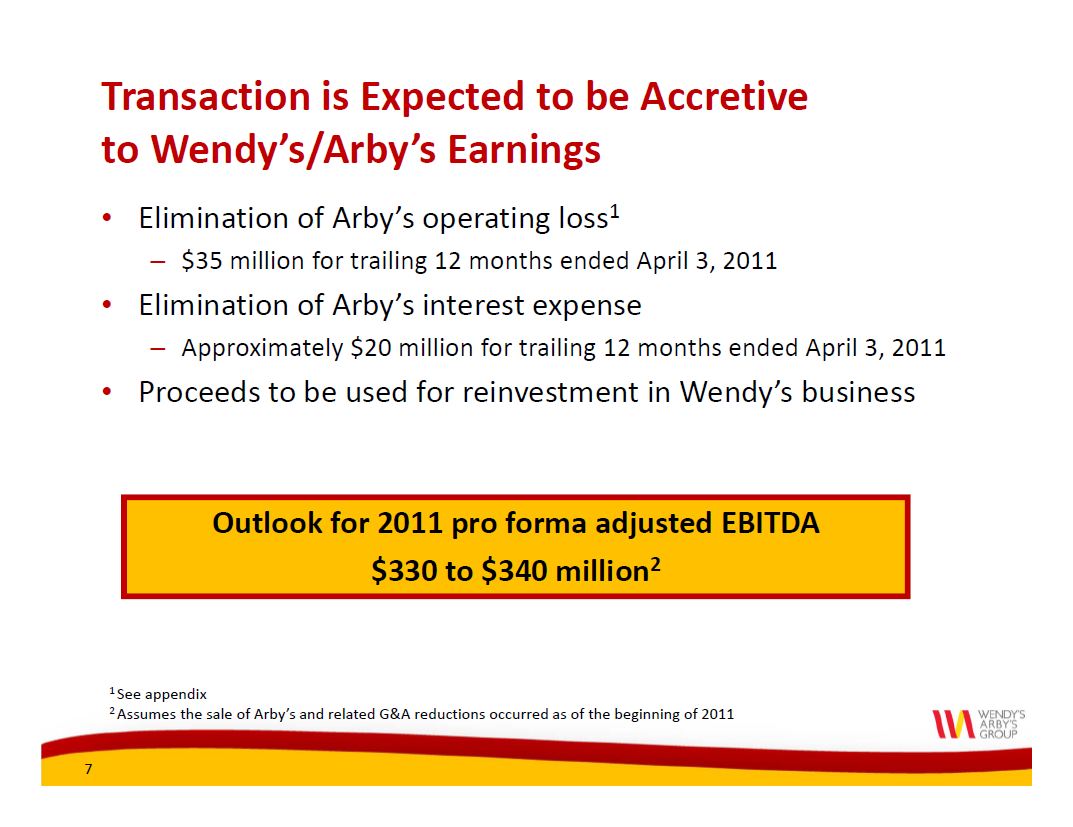

Transaction is Expected to be Accretive to Wendy’s/Arby’s Earnings • Elimination of Arby’s operating loss1 – $35 million for trailing 12 months ended April 3, 2011 • Elimination of Arby’s interest expense – Approximately $20 million for trailing 12 months ended April 3, 2011 • Proceeds to be used for reinvestment in Wendy’s business Outlook for 2011 pro forma adjusted EBITDA $330 to $340 million21 See appendix2 Assumes the sale of Arby’s and related G&A reductions occurred as of the beginning of 2011

|

|

|

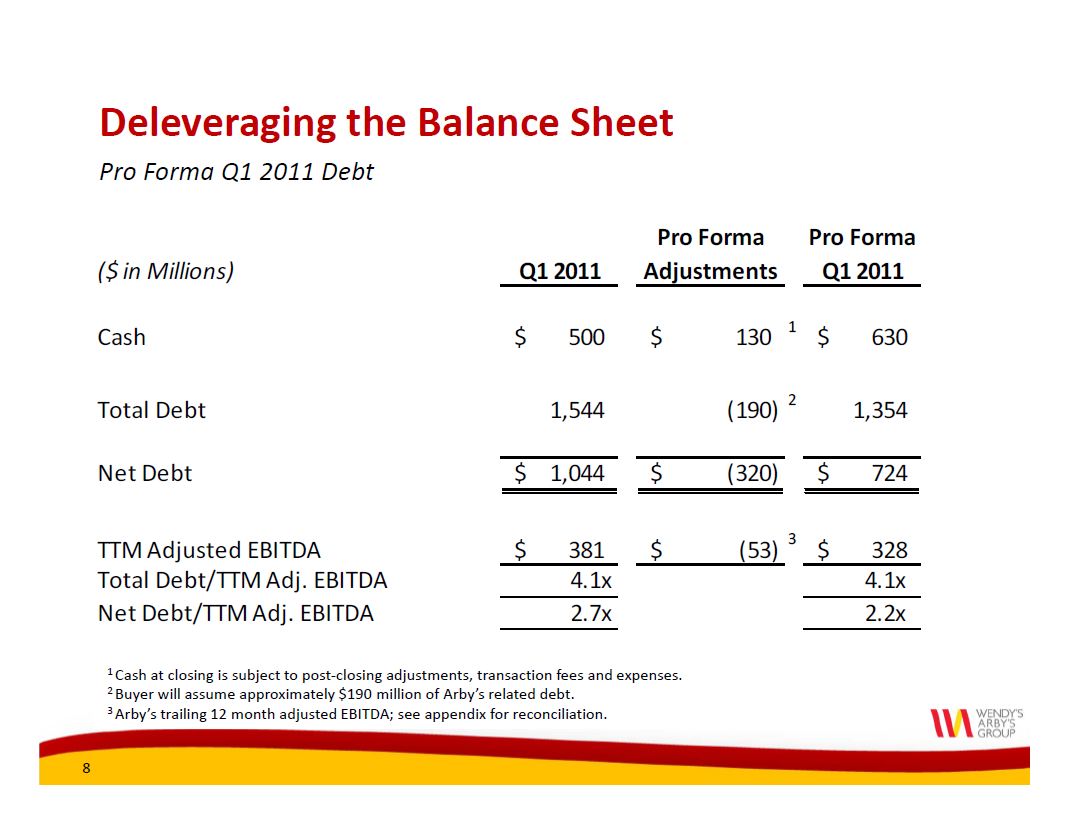

Deleveraging the Balance Sheet Pro Forma Q1 2011 Debt Q1 201 Pro Forma Pro Forma Adjustments Q1 2011 Cash $ 500 $ 130 1 $ 630 Total Debt 1,544 (190) 2 1,354 Net Debt $ 1,044 $ (320) $ 724 TTM Adjusted EBITDA $ 381 $ (53) 3 $ 328 Total Debt/TTM Adj. EBITDA 4.1x 4.1x Net Debt/TTM Adj. EBITDA 2.7x 2.2x 1 Cash at closing is subject to post-closing adjustments, transaction fees and expenses. 2 Buyer will assume approximately $190 million of Arby’s related debt. 3 Arby’s trailing 12 month adjusted EBITDA; see appendix for reconciliation.

|

|

|

Wendy’s Growth Initiatives – Summary• Deliver “Real” brand positioning• Revitalize core menu• Introduce exciting, new products Expand breakfast• Modernize our facilities• Build new restaurants in the U.S.• Pursue global expansionAverage annual EBITDA growth of 10-15%, beginning in 2012

|

|

|

APPENDIX

|

|

|

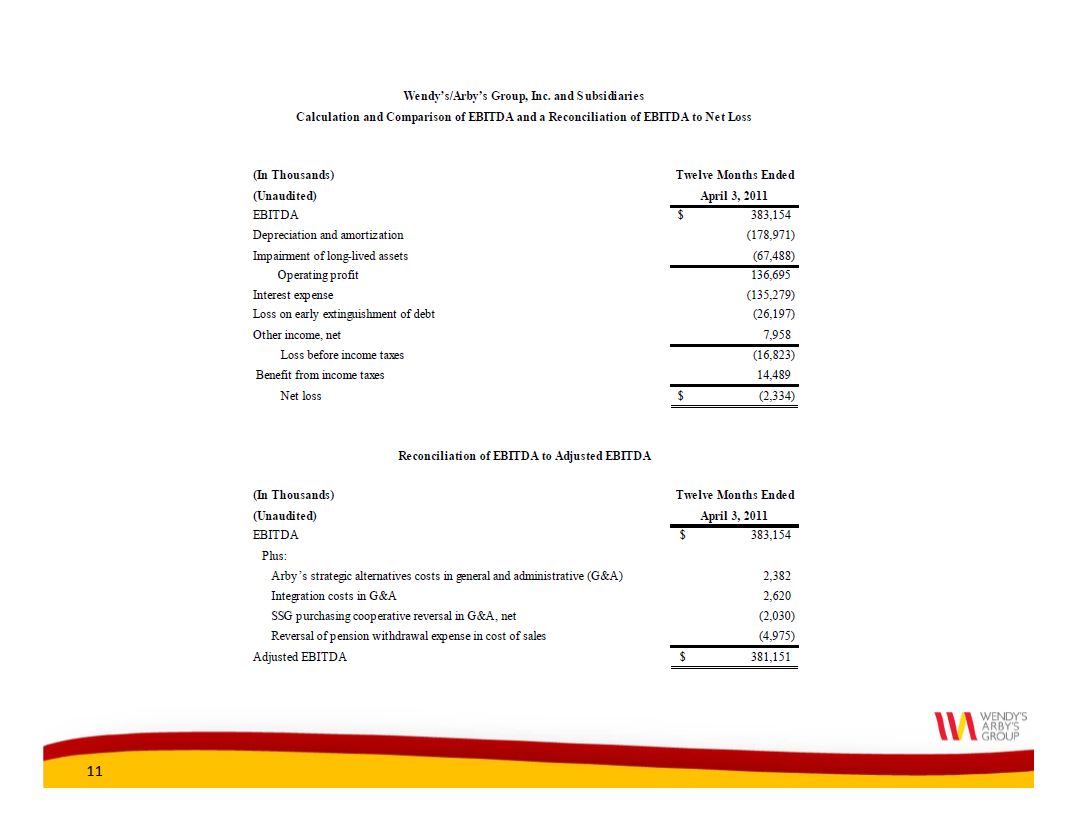

Wendy’s/Arby’s Group, Inc. and Subsidiaries Calculation and Comparison of EBITDA and a Reconciliation of EBITDA to Net Loss (In Thousands) Twelve Months Ended (Unaudited) April 3, 2011 EBITDA $ 383,154 Depreciation and amortization (178,971) Impairment of long-lived assets (67,488) Operating profit 136,695 Interest expense (135,279) Loss on early extinguishment of debt (26,197) Other income, net 7,958 Loss before income taxes (16,823) Benefit from income taxes 14,489 Net loss $ (2,334) Reconciliation of EBITDA to Adjusted EBITDA (In Thousands) Twelve Months Ended (Unaudited) April 3, 2011 EBITDA $ 383,154 Plus: Arby’s strategic alternatives costs in general and administrative (G&A) 2,382 Integration costs in G&A 2,620 SSG purchasing cooperative reversal in G&A, net (2,030) Reversal of pension withdrawal expense in cost of sales (4,975) Adjusted EBITDA $ 381,151

|

|

|

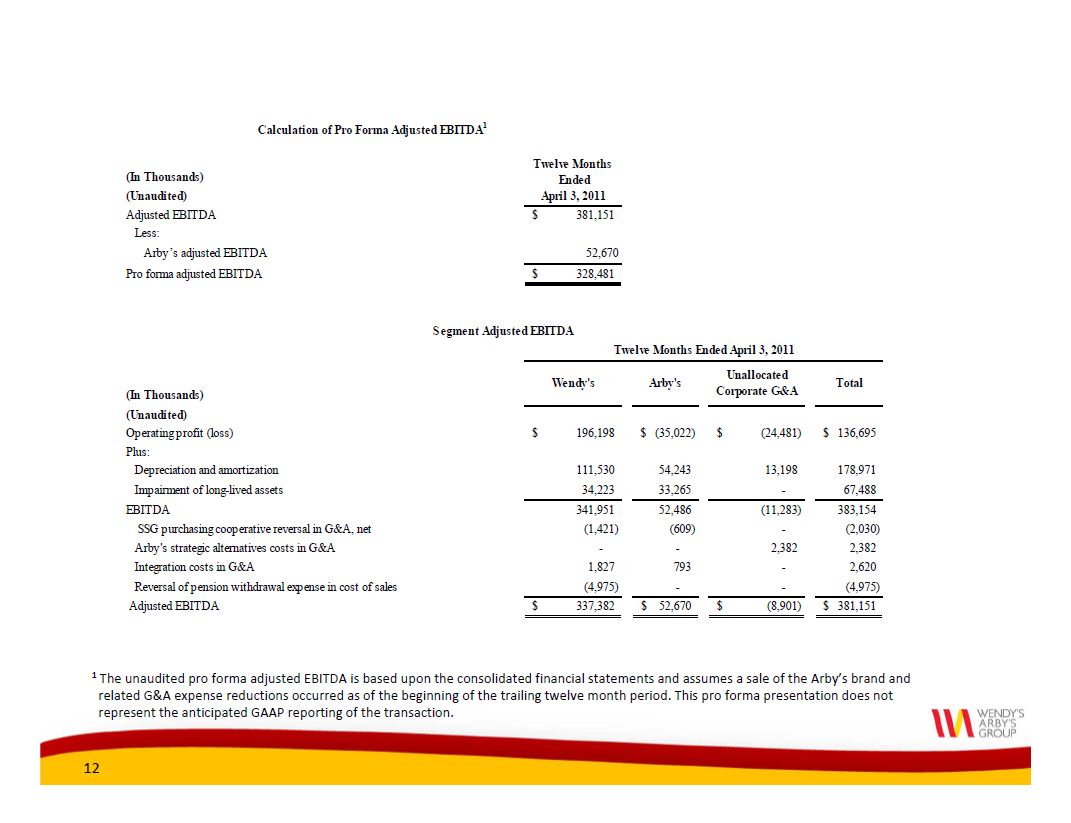

Calculation of Pro Forma Adjusted EBITDA1 (In Thousands) Twelve Months

Ended (Unaudited) April 3, 2011 Adjusted EBITDA $ 381,151 Less: Arby’s adjusted EBITDA 52,670 Pro forma adjusted EBITDA $ 328,481 Segment Adjusted EBITDA Twelve Months Ended April 3, 2011 (In Thousands) Wendy's Arby's Unallocated Corporate G&A Total (Unaudited) Operating profit (loss) $ 196,198 $ (35,022) $ (24,481) $ 136,695 Plus: Depreciation and amortization 111,530 54,243 13,198 178,971 Impairment of long-lived assets 34,223 33,265 - 67,488 EBITDA 341,951 52,486 (11,283) 383,154 SSG purchasing cooperative reversal in G&A, net (1,421) (609) - (2,030) Arby's strategic alternatives costs in G&A - - 2,382 2,382 Integration costs in G&A 1,827 793 - 2,620 Reversal of pension withdrawal expense in cost of sales (4,975) - - (4,975) Adjusted EBITDA $ 337,382 $ 52,670 $ (8,901) $ 381,151

1 The unaudited pro forma adjusted EBITDA is based upon the consolidated financial statements and assumes a sale of the Arby’s brand and related G&A expense reductions occurred as of the beginning of the trailing twelve month period. This pro forma presentation does not represent the anticipated GAAP reporting of the transaction.

|