Attached files

As filed with the Securities and Exchange Commission on June 10, 2011

Registration Statement No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SCRIPSAMERICA, INC.

(Exact Name of Small Business Issuer in its Charter)

|

Delaware

|

5122

|

26-2598594

|

|

(State of Incorporation)

|

(Primary Standard Classification Code)

|

(IRS Employer ID No.)

|

77 McCullough Drive, Suite 7

New Castle, Delaware 19720

(800) 957-7622

(Address and Telephone Number of Registrant’s Principal

Executive Offices and Principal Place of Business)

Robert Schneiderman, CEO

ScripsAmerica, Inc.

77 McCullough Drive, Suite 7

New Castle, Delaware 19720

(800) 957-7622

(Name, Address and Telephone Number of Agent for Service)

Copies of communications to:

Fox Law Offices, P.A.

61 Knickerbocker Lane

Peaks Island, ME 04108

(207) 766-0944

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

|

Non-accelerated filer o (do not check if a smaller reporting company)

|

Smaller reporting company x

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class Of Securities to be Registered

|

Amount to be

Registered (1)

|

Proposed Maximum

Aggregate

Offering Price

per share (2)

|

Proposed Maximum

Aggregate

Offering Price

|

Amount of

Registration fee

|

||||||||||||

|

Common Stock, par value $.001

|

5,229,000

|

$

|

0.20

|

$

|

1,045,800

|

$

|

121.42

|

|||||||||

(1) In the event of a stock split, stock dividend, or similar transaction involving the common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act. The amount of shares to be registered represents the Company’s good faith estimate of the number of shares that the registrant may issue pursuant to a Letter Agreement with the selling security holder.

(2) The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o). Our common stock is not currently trading on any national exchange. Therefore, in accordance with Rule 457, the offering price of $0.20 was determined by the price shares of common stock that we sold in a Regulation S offering that closed in May 2011. The price of $0.20 is a fixed price at which the selling security holders may sell their shares until our common stock is quoted on the OTC Bulletin Board at which time the shares may be sold at prevailing market prices or privately negotiated prices.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the securities act of 1933 or until the registration statement shall become effective on such date as the commission, acting pursuant to said section 8(a), may determine.

|

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and no offer to buy these securities is being solicited in any state where the offer or sale is not permitted.

PRELIMINARY SUBJECT TO COMPLETION, DATED JUNE 10, 2011

PROSPECTUS

SCRIPSAMERICA, INC.

5,229,000 shares of Common Stock

This prospectus covers the offer and sale of up to 5,229,200 shares of our common stock from time to time by the selling security holders named in this prospectus. The shares of common stock covered by this prospectus are shares that are held, beneficially and of record, by the selling security holders. We are not offering any shares of common stock. The selling security holders will receive all of the net proceeds from sales of the common stock covered by this prospectus.

Our common stock is presently not traded on any national market or securities exchange or in the over-the-counter market. The sales price to the public of the shares of our common stock offered by the selling security holders under this prospectus is fixed at $0.20 per share until such time as our common stock is quoted on the Over-The-Counter (OTC) Bulletin Board and/or the OTCQB or OTC Pink markets. Although we intend to request a registered broker-dealer to apply with the Financial Industry Regulatory Authority to have our common stock eligible for quotation on the OTC Bulletin Board, public trading of our common stock may never materialize or, even if materialized, trading may not be sustained. If our common stock is quoted on the OTC Bulletin Board, then the sale price to the public will vary according to prevailing market prices or privately negotiated prices by the selling security holders. To the best of our knowledge, none of the selling security holders are broker-dealers, underwriters or affiliates thereof.

As of May 30, 2011 we had 51,218,680 shares of common stock issued and outstanding and 2,990,252 shares of Series A Preferred Stock issued and outstanding. The Series A Preferred Stock is convertible into shares of our common stock but issuance and/or resale of such conversion shares are not covered by this prospectus.

INVESTING IN OUR COMMON STOCK IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK AND SHOULD BE CONSIDERED ONLY BY PERSONS WHO CAN AFFORD THE LOSS OF THEIR ENTIRE INVESTMENT. PLEASE REFER TO “RISK FACTORS” BEGINNING ON PAGE 4.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Our offices are located at 77 McCullough Drive, New Castle< Delaware 19720. Our telephone number is (800) 957-7622. Our website can be found at www.scripsamerica.com.

The Date of This Prospectus Is: _______ __, 2011

|

TABLE OF CONTENTS

|

PAGE

|

|

|

Prospectus Summary

|

1

|

|

Summary Financial Data

|

2

|

|

Risk Factors

|

3

|

|

Use of Proceeds

|

7

|

|

Determination of Offering Price

|

7

|

|

Selling Shareholders

|

7

|

|

Plan of Distribution

|

12

|

|

Description of Securities to be Registered

|

15

|

|

Interest of Named Experts and Counsel

|

15

|

|

Description of Business

|

15

|

|

Description of Property

|

25

|

|

Legal Proceedings

|

25

|

|

Market for Common Equity and Related Stockholder Matters

|

25

|

|

Where You Can Find More Information

|

26

|

|

Financial Statements

|

27

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

28

|

|

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

|

37

|

|

Directors, Executive Officers, Promoters and Control Persons

|

38

|

|

Executive Compensation

|

41

|

|

Security Ownership of Certain Beneficial Owners and Management

|

41

|

|

Certain Relationships and Related Transactions

|

41

|

|

Disclosure of Commission Position of Indemnification for Securities Act Liabilities

|

42

|

You should rely only on the information contained in this prospectus. We have not, and the selling security holder has not, authorized anyone to provide you with different information. If anyone provides you with different information, you should not rely on it. We are not, and the selling security holder is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date. In this prospectus, “ScripsAmerica”, “the Company”, “we”, “us” and “our” refer to ScripsAmerica, Inc., a Delaware corporation, unless the context otherwise requires.

i

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the common stock. You should carefully read the entire prospectus, including “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements, before making an investment decision .

About ScripsAmerica, Inc.

We are ScripsAmerica, Inc., a Delaware corporation that was formed on May 12, 2008. We are a distributor of prescription and over the counter (OTC) pharmaceuticals.

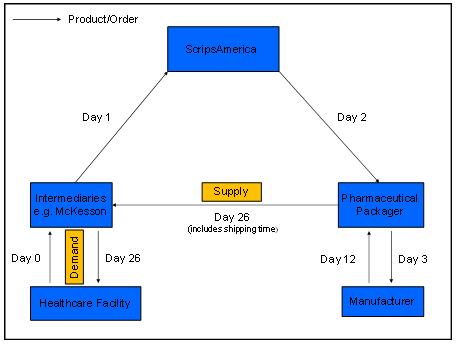

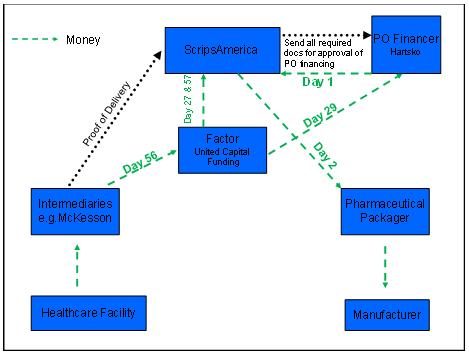

We implement efficient supply chain management on behalf of our clients, from strategic sourcing to delivering niche generic pharmaceuticals to market. Positioned in the center of the pharmaceutical value chain, we receive purchase orders from pharmaceutical distributors, contract with pharmaceutical packagers and their manufacturers to process orders to the end user’s specifications, and deliver product to a wide range of customers across the health care industry.

Our primary value lies in our growing portfolio of end users to whom we market our services. For end users such as hospitals and home care agencies, custom packaging such as unit of use can save staff time and cost, as well as eliminate dispensing errors at the pharmacist level. Further, we maintain a strategic relationship with the largest pharmaceutical distributor in North America.

In addition to purchase order fulfillment, ScripsAmerica seeks to diversify the Company’s revenue sources by securing FDA approval for and bringing to market so-called DESI drugs, while minimizing clinical risk, and by developing rapid melt formulations of vitamins, OTC drugs and certain generic products. We also plan to acquire pharmaceutical packagers and pharmaceutical manufacturers for a vertical expansion of our business as well.

Principal Executive Offices

Our principal executive offices are located at 77 McCullough Drive, New Castle, Delaware 19720. Our telephone number is (800) 957-7622 and our fax number is (215) 405-2650. Our website address is www.scripsamerica.com. The information on our website is not incorporated by reference into this prospectus and should not be relied upon with respect to this offering.

Recent Developments

On April 1, 2011 we closed on the sale of 2,990,252 shares of our Series A Preferred Stock to a single accredited investor for a purchase price of $1,043,000. The sale of shares was exempt under Section 4(2) of the Securities Act as an offer and sale not involving a public offering. Each share of Series A Preferred Stock is convertible into one share of our common stock. The Series A Preferred Stock is paid a dividend at annual rate of 8% of the purchase price, which dividend is paid at the end of each fiscal quarter. Of the seven members of our board of directors, the holder of the Series A Preferred Stock, as a single class, gets to elect one (1) director to the board and will vote with the common stockholders to four (4) directors (the common stockholders will elect, as a single class, two (2) directors). The Series A Preferred Stockholder will have approval right over certain corporate actions, namely our liquidation or dissolution, any merger, share exchange or asset sale that results in a change of control, the payment of any dividends or the redemption of stock (except for stock dividends, change of control transaction and termination of employment or service). The Series A Preferred Stock is convertible into 5,989,680 shares of our common stock (based on a conversion price of $0.1744, which was adjusted as a result of the forward stock split (as described below). The conversion price of the Series A Preferred Stock will be adjusted for any issuances of stock by us at a price per share less than $0.1744 (subject to certain exemptions such as securities issued under an employee stock option plan or securities issued in business transactions approved by our board). The Series A Preferred Stock has priority to assets over the common stockholders in the event of a liquidation, dissolution or any merger, share exchange or consolidation in which we are not the surviving entity or there is a change in control of us). These rights of the Series A Preferred Stockholder continue until all of the shares of Series A Preferred Stock are converted into our common stock.

On April 15, 2011, we had a forward two-for-one stock split. In addition, as a result of the forward stock split, we adjusted the conversion price of the Series A Preferred Stock to $0.1744 (reduced from $0.3488).

In April 2011, we sold 5,200,000 shares of our common stock to four purchasers for an aggregate purchase price of $176,000. Each of the purchasers was a corporation formed outside of the United States with a business address located outside of the United States. This transaction was exempt from the registration provisions of the Securities Act pursuant to Regulation S as an offshore transaction with non-U.S. persons (as such term is defined in Rule 902 of Regulation S).

In May 2011, we sold 29,000 shares of our common stock to 58 purchasers for an aggregate purchase price of $5,800. Each of the purchasers was a non-U.S. citizen with a residence address located outside of the United States. This transaction was exempt from the registration provisions of the Securities Act pursuant to Regulation S as an offshore transaction with non-U.S. persons (as such term is defined in Rule 902 of Regulation S).

1

SUMMARY FINANCIAL DATA

The following tables summarize the financial data for our business. You should read this summary financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes, all included elsewhere in this prospectus.

We derived the statements of income data for the years ended December 31, 2009 and 2010 and the balance sheet data as of December 31, 2009 and 2010, from our audited financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future.

|

For the Year

Ended

|

For the Year

Ended

|

For the Three Months Ended | ||||||||||||||

|

December 31, 2010

(Audited) |

December 31, 2009

(Audited) |

March 31,

2011

(Unaudited)

|

March 31,

2010

(Unaudited)

|

|||||||||||||

|

Net Sales

|

$ | 3,221,320 | $ | -- | $ | 1,641,233 | $ | 310,227 | ||||||||

|

Gross Profit

|

$ | 677,399 | $ | -- | $ | 465,844 | $ | 51,850 | ||||||||

|

Total Operating Expenses

|

$ | 360,900 | $ | (25,599 | ) | $ | 382,428 | $ | 142 | |||||||

|

Net Income

|

$ | 127,072 | $ | 16,090 | $ | 12,056 | $ | 34,128 | ||||||||

|

Earnings Per Common Share – Basic and Diluted

|

$ | -- | $ | -- | $ | -- | $ | -- | ||||||||

|

BALANCE SHEET DATA:

|

As of

December 31, 2010

(Audited) |

As of

December 31, 2009

(Audited) |

As of

March 31, 2011

(Unaudited)

|

|||||||||

|

Cash

|

$

|

171,898

|

$

|

503

|

$ | 532,540 | ||||||

|

Working Capital

|

$

|

55,895

|

$

|

56,503

|

$ | 100,451 | ||||||

|

Notes payable – related parties

|

$

|

60,000

|

$

|

--

|

$ | 80,000 | ||||||

|

Total Current Liabilities

|

$

|

428,310

|

$

|

--

|

$ | 629,375 | ||||||

|

Stockholders’ equity

|

$

|

264,895

|

$

|

63,803

|

$ | 309,451 | ||||||

The Offering

|

Shares of common stock being registered

|

5,229,000 shares of our common stock offered by selling security holders

|

|

|

Total shares of common stock outstanding as of the date of this prospectus

|

51,218,680

|

|

|

Total proceeds raised by us from the disposition of the common stock by the selling security holders or their transferees

|

We will not receive any proceeds from the sale of shares by the selling security holders

|

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements. All statements other than statements of historical facts contained in this prospectus, including statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, the development of the market for our products and the acceptance of our products in these markets, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Risk Factors.” In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

This prospectus contains industry data and other statistical information regarding packaging, distribution and sales and marketing services for the pharmaceutical industry that we obtained from independent publications, government publications, press releases, reports by market research firms or other published independent sources. Although we believe these sources are reliable, we have not independently verified their data.

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. Please note that throughout this prospectus, the words “we”, “our” or “us” refer to the Company and its subsidiary not to the selling stockholders.

Risk Related to Our Company

Disruptions in our supply chain or among other companies providing services to us could adversely affect our ability to fill purchase orders, which would have a negative impact on our financial performance. The failure of a single source in the supply chain would cause only minor delays in our ability to fill purchase orders. In the event of a supply gap, we would either procure product in the market, if available at a reasonable cost, or work with other sources to formulate the drug in question. Such fixes to the supply gap would cause delay of shipment and increase costs, both of which would have negative impact on our profitability and our results of operations.

We have significant credit and sales concentration as we only have one main customer. Substantial defaults in payments by such customer, a material reduction in purchases or the loss of such customer as a customer could have a material adverse impact on ScripsAmerica’s financial condition, results of operations, and liquidity. For the year ended December 31, 2010, McKesson accounted for 100% of our sales. At present, McKesson is our only customer and they provide us access to the end users of our products and services. As a result, our sales and credit concentration is significant. In the event that McKesson experiences difficulties that would result in its default on payments due to us, a material reduction in purchase orders, or a termination of the relationship, our operations would come to a halt until we established an equivalent relationship with another large distributor. Development of additional distributor relationships for risk diversification purposes will be a focus for us as we expand our operations.

Competition from horizontal and vertical markets involved in pharmaceutical distribution business may erode our profit. Our distribution arm faces competition, both in price and service, from national, regional, and local full-line, short-line, and specialty wholesalers, service merchandisers, self-warehousing chains, manufacturers engaged in direct distribution, and large payor organizations. In addition, competition exists from various other service providers and from pharmaceutical and other healthcare manufacturers (as well as other potential customers) which may from time to time decide to develop, for their own internal needs, supply management capabilities that would otherwise be provided by us. Price, quality of service, and in some cases convenience to the customer are generally the principal competitive elements in this segment.

3

Any acquisitions of technologies, products and businesses that we may acquire to expand or complement our business may be difficult to integrate, could adversely affect our relationships with key customers, and/or could result in significant charges to earnings as well potential dilution to existing stockholders. One element of our business strategy is to identify, pursue and consummate acquisitions that either expand or complement our business. Integration of acquisitions entails a number of risks including the diversion of management’s attention to the assimilation of the operations of acquired businesses; difficulties in the integration of operations and systems; the realization of potential operating synergies; the retention of the personnel of the acquired companies; accounting, regulatory or compliance issues that could arise; challenges in retaining the customers of the combined businesses; and a potential material adverse impact on operating results. If we are not able to successfully integrate our acquisitions, we may not obtain the advantages and synergies that the acquisitions were intended to create, which may have a material adverse effect on our business, results of operations, financial condition and cash flows, our ability to develop and introduce new products and the market price of our stock. In addition, in connection with acquisitions, we could experience disruption in our business, technology and information systems, customer or employee base, including diversion of management’s attention from our continuing operations. There is also a risk that key employees of companies that we acquire or key employees necessary to successfully commercialize technologies and products that we acquire may seek employment elsewhere, including with our competitors. Furthermore, In addition, we will require additional financing in order to fund future acquisitions, which may or may not be attainable. In addition, if we acquire businesses or products, or enter into other significant transactions, we expect to experience significant charges to earnings for merger and related expenses. These costs may include substantial fees for investment bankers, attorneys, accountants and financial printing costs and severance and other closure costs associated with the elimination of duplicate or discontinued products, operations and facilities. Charges that we may incur in connection with acquisitions could adversely affect our results of operations for particular quarterly or annual periods. Finally, we may use shares of our common stock to finance some or all of the purchase price of an acquisition, which may result in a downward trend in our stock price, especially if our results of operations are negatively impacted by such acquisition(s).

We could suffer reputational and financial damage in the event of product recalls. We may be held liable if any product we develop or market causes illness or injury or is found otherwise unsuitable. In addition to any reputational damage we would suffer, we cannot guarantee that our supplier’s product liability insurance would fully cover potential liabilities. However, we are named as an additional insured on the product liability insurance policies of our suppliers. Although our management believes that coverage limits specified by these policies are sufficient. In the event of litigation, any adverse judgments against us would have a material adverse effect on our financial condition, including our cash balances, and results of operations.

Our ability to operate effectively could be impaired if we were to lose the services of our key personnel, or if it were unable to recruit key personnel in the future. Our near-term success will depend to a significant extent on the skills and efforts of Robert Schneiderman and Jeffrey Andrews. While the Company plans to enter into employment agreements with Messrs. Schneiderman, and Andrews in the coming months, such agreements do not assure the services of such personnel as employees may voluntarily terminate their employment with us at any time. The loss of one or more current key employees could have a material adverse effect on our business even if replacements were hired. Our success also depends on its ability to attract and retain additional qualified employees in the future. Competition for such personnel is intense, and we will compete for qualified personnel with numerous other employers, many of whom have greater financial and other resources than the Company does. Our plans to incentivize employees to engage in a long-term relationship with the Company through awarding equity as part of overall compensation.

We may not successfully manage any growth that we may experience through the potential acquisitions we are evaluating, which may result in poor results of operations and may harm our growth. Our future success will depend upon not only product development but also on the expansion of our pharmaceutical supply chain management service business and the effective management of any such growth, which will place a significant strain on our management and on our administrative, operational, and financial resources. To manage any such growth, we will need to integrate into our existing new facilities, employees and operational, financial and management systems. For such integration to be done successfully, our management will need to devote its resources and time to the process. That focus may draw management’s attention from other aspects of the business, such as revenue trends, expense management and/or strategic decisions. If we are unable to manage our growth effectively, our business and results of operations would be harmed as our growth could be adversely affected by such mismanagement.

4

Risks Related to Our Industry

Changes in the U.S. healthcare environment could have a material adverse impact on our results of operations. In recent years, the U.S. healthcare industry has changed significantly in an effort to reduce costs. These changes include increased use of managed care, cuts in Medicare and Medicaid reimbursement levels, consolidation of pharmaceutical and medical-surgical supply distributors, and the development of large, sophisticated purchasing groups. Some of these changes, such as adverse changes in government funding of healthcare services, legislation or regulations governing the delivery or pricing of pharmaceuticals and healthcare services or mandated benefits, may cause healthcare industry participants to reduce the amount of our products and services they purchase or the price they are willing to pay for our products and services. Changes in the healthcare industry’s or our pharmaceutical suppliers’ pricing, selling, inventory, distribution or supply policies or practices could also significantly reduce our revenues and net income. Healthcare and public policy trends indicate that the number of generic drugs will increase over the next few years as a result of the expiration of certain drug patents. While this is expected to be a positive development for us, changes in pricing of certain generic drugs could have a material adverse impact on our revenues and our results of operations.

Regulation of our distribution business could impose increased costs, delay the introduction of new products, which could negatively impact our business. The healthcare industry is highly regulated. As a result, we and our suppliers and distributor are subject to various local, state and federal laws and regulations, which include the operating and security standards of the Drug Enforcement Administration (DEA), the FDA, various state boards of pharmacy, state health departments, the HHS, CMS, and other comparable agencies. The process and costs of maintaining compliance with such operating and security standards could impose increased costs, delay the introduction of new products and negatively impact our business. For example, there have been increasing efforts by various levels of government agencies, including state boards of pharmacy and comparable government agencies, to regulate the pharmaceutical distribution system in order to prevent the introduction of counterfeit, adulterated and/or mislabeled drugs into the pharmaceutical distribution system. Certain states have adopted or are considering laws and regulations that are intended to protect the integrity of the pharmaceutical distribution system, while other government agencies are currently evaluating their recommendations. In addition, the U.S. Food and Drug Administration (“FDA”) Amendments Act of 2007, which went into effect on October 1, 2007, requires the FDA to establish standards and identify and validate effective technologies for the purpose of securing the pharmaceutical supply chain against counterfeit drugs. These standards may include any track-and-trace or authentication technologies, such as radio frequency identification devices and other similar technologies. These pedigree tracking laws and regulations could increase the overall regulatory burden and costs associated with our pharmaceutical distribution business, and would have a material adverse impact on our operating expenses and our results of operations.

Risks Related to Our Stock

We may need to raise additional capital by sales of our common stock, which may adversely affect the market price of our common stock and your rights in us may be reduced.

We expect to continue to incur product development and selling, general and administrative costs, and as well as funding for potential acquisitions. In order to satisfy our funding requirements we may consider issuing additional debt or equity securities. If we issue equity or convertible debt securities to raise additional funds, our existing stockholders may experience dilution, and the new equity or debt securities may have rights, preferences and privileges senior to those of our existing stockholders. If we incur additional debt, it may increase our leverage relative to our earnings or to our equity capitalization, requiring us to pay additional interest expenses and potentially lower our credit ratings. We may not be able to market such issuances on favorable terms, or at all, in which case, we may not be able to develop or enhance our products, execute our business plan, take advantage of future opportunities, or respond to competitive pressures or unanticipated customer requirements.

There is currently no public market for our shares and if such a market materializes, our stockholders may still not be able to resell their shares at or above the price at which they purchased their shares.

There is currently no established public trading market for our securities and an active trading market in our securities may not develop or, if developed, may not be sustained. We intend to apply for admission to quotation of our securities on the OTC Bulletin Board, as well as the OTCQB and OTCPink, after this prospectus is declared effective by the SEC. If for any reason our common stock is not quoted on the OTC Bulletin Board (or the OTCQB and OTC Pink) or a public trading market does not otherwise develop, purchasers of the shares may have difficulty selling their common stock should they desire to do so. No market makers have committed to becoming market makers for our common stock and none may do so.

State securities laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell the shares offered by this prospectus.

Secondary trading in common stock sold in this offering will not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted thus causing you to realize a loss on your investment.

5

Our board of directors has the power to designate a series of preferred stock without shareholder approval that could contain conversion or voting rights that adversely affect the voting power of holders of our common stock and may have an adverse effect on our stock price.

Our Certificate of Incorporation provide for the authorization of 10,000,000 shares of “blank check” preferred stock. Pursuant to our Certificate of Incorporation, our Board of Directors is authorized to issue such “blank check” preferred stock with rights that are superior to the rights of stockholders of our common stock, at a purchase price then approved by our Board of Directors, which purchase price may be substantially lower than the market price of shares of our common stock, without stockholder approval. In March 2011, our Board of Directors authorized 2,990,252 shares of Series A Preferred Stock for a private placement of such shares for an aggregate purchase price of $1,043,000. Though we currently do not have any plans to issue any additional shares of preferred stock, such issuance could give the holders of such preferred stock voting control of the Company which would have a negative effect on the voting power of the holders of our common stock and may cause our stock price to decline.

The sale of shares of common stock issuable upon the conversion of our outstanding shares of our Series A Preferred Stock could have a negative impact on the market price of our stock if sold. We have 2,990,252 shares of Series A Preferred Stock that are convertible into 5,980,504 shares of common stock (representing approximately 10.5% of the outstanding stock on a fully diluted basis). On October 1, 2011, the shares of common stock may issuable upon the conversion of the Series A Preferred Stock may be sold to the public under Rule 144 (subject only to the volume limitations of Rule 144(d)). If our common stock does not trade with large enough share volume, the sales of the common stock issued upon the conversion of the Series A Preferred Stock may cause the price of our stock to drop significantly. Additionally, the holder of the Series A Preferred Stock has registration rights for the shares of common stock issuable upon the conversion of the Series A Preferred Stock. If the Series A Preferred stockholder exercises such registration rights, such stockholder could sell a large number of shares of our common stock which could cause significant drop in our stock price.

The outstanding shares of our Series A Preferred Stock are entitled to rights and privileges in regard to distribution of assets and protective provisions which may result in actions adverse to the holders of our common stock. So long as there are shares of Series A Preferred Stock outstanding, the holders of such security are entitled to an annual dividend of 8% of the original purchase price, as well as priorities to our distribution of cash and other assets. The holder Series A Preferred Stockholder also has veto power over certain corporate matters, such as redeeming or repurchasing capital stock or any merger, consolidation or share exchange that would result in a change of control. The rights of the Series A Preferred Stockholder will continue until all of the shares are converted into our common stock (either voluntarily or upon an underwritten IPO in which we have gross proceeds of at least $25 million and a price per share of at least $0.872). The holder of such rights of the Series A Preferred Stock may have interests adverse to the common stockholders and the exercise of such rights may have a negative impact on the value of our common stock or the amount of cash or other assets our common stockholders may receive in connection with a distribution or merger, consolidation or share exchange.

Our principal shareholders have significant voting power and may take actions that may not be in the best interest of our other shareholders, who will have no influence over shareholder decisions. Robert Schneiderman, our Chief Executive Officer and a director, and Steve Urbanski, our Executive Vice President and a director, each own 19,980,000, which is approximately 39% of the outstanding shares of our common stock. Messrs. Schneiderman and Urbanski have the ability to exert virtual control over all matters requiring approval of our shareholders, including the election and removal of directors and the approval of mergers or other business combinations (in each case subject to the rights of the Series A Preferred Stockholder as long as there are any such shares outstanding). This concentration of control could be disadvantageous to other shareholders whose interests are different from those of Messrs. Schneiderman and Urbanski. Although there is no voting arrangement between Messrs. Schneiderman and Urbanksi, this concentration of ownership, nonetheless, may have the effect of delaying, deferring, or preventing a change in control, impeding a merger, consolidation, takeover, or other business combination involving us, or discouraging a potential acquirer from making a tender offer, or otherwise attempting to obtain control of us or our business, even if such a transaction would benefit other shareholders.

We do not intend to pay dividends for the foreseeable future except to the Series A Preferred Stockholder.

We have never declared or paid any cash dividends on our common stock and do not intend to pay any cash dividends in the foreseeable future. Except for any dividends owed to the holder of our Series A Preferred Stock, we anticipate that we will retain all of our future earnings for use in the development of our business and for general corporate purposes. Any determination to pay dividends in the future will be at the discretion of our board of directors. Accordingly, investors must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize any future gains on their investments.

6

Our common stock is expected to be considered “a penny stock” and, as a result, it may be difficult to trade a significant number of shares of our common stock.

The Securities and Exchange Commission (“SEC”) has adopted regulations that generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share, subject to specific exemptions. When our common stock becomes eligible for quotation on the OTC markets (such as the bulletin board or OTCQB), we expect the market price of our common stock to be less than $5.00 per share. As a result of our prior private placements and our forward stock split, we have increased the number of shares outstanding by almost three-fold. Consequently, when our common stock becomes eligible for quotation on the OTC markets it is likely that the market price for our common stock will remain less than $5.00 per share for the foreseeable future and, therefore, may be a “penny stock” according to SEC rules. This designation requires any broker or dealer selling these securities to disclose certain information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to purchase the securities. These rules may restrict the ability of brokers or dealers to sell our common stock and may affect the ability of investors hereunder to sell their shares. In addition, because we are seeking to have our common stock trade on the OTC markets, investors may find it difficult to obtain accurate quotations of the stock and may experience a lack of buyers to purchase such stock or a lack of market makers to support the stock price.

USE OF PROCEEDS

We will not receive any proceeds from the sale of the shares by the selling stockholders.

DETERMINATION OF OFFERING PRICE

Our common stock is presently not traded on any national market or securities exchange or in the over-the-counter market. As there is no existing public market for our securities, the shares offered for resale hereunder by the selling security holders must initially be offered at a fixed price.

The sales price to the public of the shares of our common stock offered by the selling security holders under this prospectus is fixed at $0.20 per share until such time as our common stock is quoted on the Over-The-Counter (OTC) Bulletin Board, the OTCQX and/or the OTCQB and a public market exists for our common stock. This fixed sales price was determined by using the most recent price paid in cash that we received for our stock, which was the price in our Regulation S offering to the selling security holders as described below in the “Selling Security Holders” section. We expect that the selling security holders will offer their stock in lots of at least 100 shares at the fixed price set forth in the Amendment. It is uncertain, however, how much demand there will be for these shares prior to the commencement of the public trading market.

SELLING SHAREHOLDERS

The following table sets forth the name of the selling shareholders, the number of shares of common stock owned, the number of shares of common stock registered by this prospectus and the number and percent of outstanding shares that the selling shareholder will own after the sale of the registered shares, assuming all of the shares are sold. The information provided in the table and discussions below has been obtained from the selling shareholder. As used in this prospectus, “selling shareholder” includes donees, pledges, transferees or other successors in interest selling shares of our common stock received from the named selling shareholder as a gift, pledge, distribution or other non-sale related transfer. Within the past three years, none of the selling security holders has held any position, office, or other material relationship with us or any of our predecessors or affiliates.

Beneficial ownership is determined in accordance with Rule 13d-3(d) promulgated by the Securities and Exchange Commission under the Exchange Act. Unless otherwise noted, each person or group identified possesses sole voting and investment power with respect to the shares, subject to community property laws where applicable. As of May 30, 2011, there were 51,218,680 shares of our common stock issued and outstanding.

|

Beneficial Ownership of Common Stock

Prior to this Offering

|

Number of Shares

to be Sold

|

Beneficial Ownership of Common Stock

after this Offering

|

|||

|

Selling Shareholder

|

Number

of Shares

|

Percent

of Class

|

Under this

Prospectus (1)

|

Number of

Shares (2)

|

Percent of

Class (3)

|

|

Baypointe Investments Ltd. (4)

|

1,300,000

|

2.5%

|

1,300,000

|

0

|

--

|

|

Burnt Rock Investments Ltd. (5)

|

1,300,000

|

2.5%

|

1,300,000

|

0

|

--

|

|

Blue Shade Inc. (6)

|

1,300,000

|

2.5%

|

1,300,000

|

0

|

--

|

|

Harvest Enterprises Limited (8)

|

1,300,000

|

2.5%

|

1,300,000

|

0

|

--

|

7

|

Beneficial Ownership of Common Stock

Prior to this Offering

|

Number of Shares

to be Sold

|

Beneficial Ownership of Common Stock

after this Offering

|

|||

|

Selling Shareholder

|

Number

of Shares

|

Percent

of Class

|

Under this

Prospectus (1)

|

Number of

Shares (2)

|

Percent of

Class (3)

|

|

Zahid Abdullatif

Apt. 33

7030 Ch. De La Cote-Saint Luc

Montreal, Quebec H4V 1J3

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Marc Aboaf

21 Har Rotem Street

44539 Kear Saba

Israel

|

500

|

*

|

500

|

0

|

--

|

|

Claude N. Allard

2 Willow Cresc

Orangeville, Ontario L9V 1A5

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Lori Dawn Allard

2 Willow Crescent

Orangeville, Ontario L9V 1A5

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Arnel Asube

30 Halldorson Avenue

Aurora, Ontario L4G 7Z1

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Rachelle Bat-Amy

55 Russell Avenue

Ottawa, Ontario K1N TW9

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Karen Bell

1614 Avonmore Square

Pickering, Ontario

Canada L1V 7H4

|

500

|

*

|

500

|

0

|

--

|

|

Charles Benedek

5659 Av Jellico

Cote Saint-Luc, Quebec

H4W 1Z5

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Naomi Berkowitz

5755 Leger

Cote-Saint-Luc, Quebec

H4W 2E8

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Robert Biancolin

77 Castlewood Road

Toronto, Ontario M5N 2L3

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Iola Biancolin

77 Castlewood Road

Toronto, Ontario M5N 2L3

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Layla Biancolin

Apt. 804

135 George St. South, Toronto, Ontario M5A 4E8 Canada

|

500

|

*

|

500

|

0

|

--

|

8

|

Beneficial Ownership of Common Stock

Prior to this Offering

|

Number of Shares

to be Sold

|

Beneficial Ownership of Common Stock

after this Offering

|

|||

|

Selling Shareholder

|

Number

of Shares

|

Percent

of Class

|

Under this

Prospectus (1)

|

Number of

Shares (2)

|

Percent of

Class (3)

|

|

Maurice Biancolin

Apt. 804

135 George St. South, Toronto, Ontario M5A 4E8 Canada

|

500

|

*

|

500

|

0

|

--

|

|

Dimitrios Catsiliras

241 Westwood Avenue

Toronto, Ontario M4J 2H3

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Morris Chaikelson

4950 Ponsard Avenue

Montreal, Quebec H4W 2A5

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Roberto Ciancibello

50 Old Mill Road, GLA-6, Oakville, Ontario, L6J 7W1

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Louise Clement

2293 Avenue D'Oxford

Montreal, Quebec H4A 2X7

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Leonard Cohen

Apt. 29

7030 Ch. De La Cote-Saint-Luc

Montreal, Quebec H4V 1J3

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Rosario Cojuangco

30 Halldorson Avenue

Aurora, Ontario L4G 7Z1

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Lucinda Daly

900 - 150 Ferrand Drive

Toronto, Ontario M3C 3E5

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Avraham Einhoren

750 Bay Street

Toronto, Ontario M5G 1N6

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Oher Einhoren

6 Joe Amar Street

Kefar-Saba, Israel

|

500

|

*

|

500

|

0

|

--

|

|

Menahem Einhoren

Am Bergfried 1

Langen Germany 63225

|

500

|

*

|

500

|

0

|

--

|

|

Naama Einhoren

750 Bay Street

Toronto, Ontario M5G 1N6

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Robert Gold

900 - 150 Ferrand Drive

Toronto, Ontario M3C 3E5

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Alpha Huynh

4118 Sunset Valley Court

Mississauga, Ontario L4W 3L5

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Linh Tu Huynh

4118 Sunset Valley Court

Mississauga, Ontario L4W 3L5

Canada

|

500

|

*

|

500

|

0

|

--

|

9

|

Beneficial Ownership of Common Stock

Prior to this Offering

|

Number of Shares

to be Sold

|

Beneficial Ownership of Common Stock

after this Offering

|

|||

|

Selling Shareholder

|

Number

of Shares

|

Percent

of Class

|

Under this

Prospectus (1)

|

Number of

Shares (2)

|

Percent of

Class (3)

|

|

Mai Huynh

4118 Sunset Valley Court

Mississauga, Ontario L4W 3L5

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Sinh Huynh

4118 Sunset Valley Court

Mississauga, Ontario L4W 3L5

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Van Tu Huynh

4118 Sunset Valley Court

Mississauga, Ontario L4W 3L5

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Xuan Thi Huynh

4118 Sunset Valley Court

Mississauga, Ontario L4W 3L5

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Yome Huynh

4118 Sunset Valley Court

Mississauga, Ontario L4W 3L5

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Gerald Issenman

225 Stanstead Avenue

Montreal, Quebec H3R 1X4

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Elisa Maguolo

Via Chiarin 101b

Campalto, Venezia

Italy

|

500

|

*

|

500

|

0

|

--

|

|

Shari McMaster

601 - 130 Bloor Street West

Toronto, Ontario M5S 1N5

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Jodi Parnass

32 Stephenson

Dollard des Ormeaux, Quebec

H9A 2V9 Canada

|

500

|

*

|

500

|

0

|

--

|

|

Paul Rubin

402-3495 Du Musee

Montreal, Quebec H3G 2C8

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Binh Quach

1568 Princelea Place

Mississauga, Ontario L5M 3P2

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Cuc Quach

1568 Princelea Place

Mississauga, Ontario L5M 3P2

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Pat Rubin

402-3495 Du Musee

Montreal, Quebec H3G 2C8

Canada

|

500

|

*

|

500

|

0

|

--

|

10

|

Beneficial Ownership of Common Stock

Prior to this Offering

|

Number of Shares

to be Sold

|

Beneficial Ownership of Common Stock

after this Offering

|

|||

|

Selling Shareholder

|

Number

of Shares

|

Percent

of Class

|

Under this

Prospectus (1)

|

Number of

Shares (2)

|

Percent of

Class (3)

|

|

Stephen Smith

755 Leger

Cote-Saint-Luc, Quebec

H4W 2E8

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Cheryl Stoyanovski

1673 Pepperwood Gate

Pickering, Ontario L1X 2G1

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Tom Stoyanovski

1673 Pepperwood Gate

Pickering, Ontario L1X 2G1

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Jeff Suissa

32 Stephenson

Dollard des Ormeaux, Quebec H9A 2V9

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Chu Thai

4118 Sunset Valley Court

Mississauga, Ontario L4W 3L5

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Andrew Thomas

2559 Burnford Trail

Mississauga, Ontario L5M 5E3

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Paul Thomas

24 Wellesley St. W.

Suite 2110

Toronto, Ontario M4Y 2X6

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Ronald Thomas

350 Doon Valley Drive

Unit 7B

Kitchener, Ontario L5M 3P2

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Shirley Thomas

350 Doon Valley Drive

Unit 7B

Kitchener, Ontario L5M 3P2

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Shizuka Thomas

2559 Burnford Trail

Mississauga, Ontario L5M 5E3

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Sherri Trager

225 Stanstead Avenue

Montreal, Quebec H3R 1X4

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Lorne Wolf

2567 Bedford

Montreal, Quebec H35 1E8

Canada

|

500

|

*

|

500

|

0

|

--

|

11

|

Beneficial Ownership of Common Stock

Prior to this Offering

|

Number of Shares

to be Sold

|

Beneficial Ownership of Common Stock

after this Offering

|

|||

|

Selling Shareholder

|

Number

of Shares

|

Percent

of Class

|

Under this

Prospectus (1)

|

Number of

Shares (2)

|

Percent of

Class (3)

|

|

Gayle Wolf

2567 Bedford

Montreal, Quebec H35 1E8

Canada

|

500

|

*

|

500

|

0

|

--

|

|

Paul Zammit

601 - 130 Bloor Street West

Toronto, Ontario M5S 1N5

Canada

|

500

|

500

|

0

|

--

|

|

|

Peggy Zammit

601 - 130 Bloor Street West

Toronto, Ontario M5S 1N5

Canada

|

500

|

500

|

0

|

--

|

|

|

Rosana Zammit

33 Rosehill Avenue

Apt. 2908

Toronto, Ontario M4T 1G4

|

500

|

500

|

0

|

--

|

|

|

Sondra Zammit

5795 Yonge Street

Apt. 1108

Toronto, Ontario M2m 4J3

Canada

|

500

|

500

|

0

|

--

|

|

|

Robert Zirbi

55 Russell Avenue

Ottawa, Ontario K1N TW9

Canada

|

500

|

500

|

0

|

--

|

*Less than one percent (1%)

|

(1)

|

The number of shares set forth in the table represents an estimate of the number of common shares to be offered by the selling shareholder. We have assumed the sale of all of the common shares offered under this prospectus will be sold. However, as the selling shareholder can offer all, some or none of its common stock, no definitive estimate can be given as to the number of shares that the selling shareholder will offer or sell under this prospectus.

|

|

(2)

|

These numbers assume the selling shareholder sells all of its shares after the completion of the offering.

|

|

(3)

|

Based on 45,989,680 shares of common stock outstanding after the completion of the offering.

|

|

(4)

|

Chang Yong You, the owner of Baypointe Investments Ltd., has the power to vote and dispose of the Company’s securities held by Baypointe Investments Ltd. Baypointe Investments Ltd. has a business address at P.O. Box CR 56766, Suite 1252, #33 Harbour Bay Plaza, East Bay Street, Nassau, Bahamas

|

|

(5)

|

Young Hae Shin, the owner of Burnt Rock Investments Ltd., has the power to vote and dispose of the Company’s securities held by Burnt Rock Investments Ltd. Burnt Rock Investments Ltd. has a business address at PO Box AP 59205, Suite 321, Norfork House, Frederick Street, Nassau Bahamas.

|

|

(6)

|

Wilfred Gatambia Kamau, the owner of Blue Shade Inc., has the power to vote and dispose of the Company’s securities held by Blue Shade Inc. Blue Shade Inc. has a business address at PO Box 14, Clarkes Estate, Cades Bay, Nevis, West Indies.

|

|

(7)

|

Hyo Ki Lim, the owner and Chief Executive Officer of Harvest Enterprises Limited, has the power to vote and dispose of the Company’s securities held by Harvest Enterprises Limited. Harvest Investments Ltd. has a business address at PO Box 14, Clarkes Estate, Cades Bay, Nevis, West Indies.

|

PLAN OF DISTRIBUTION

As of the date of this prospectus, there is no market for our securities. After the date of this prospectus, we expect to have an application filed with the Financial Industry Regulatory Authority for our common stock to be eligible for trading on the OTC Bulletin Board as well as the OTCQB and the OTC Pink. Until our common stock becomes eligible for trading on the OTC Bulletin Board or the OTCQB or the OTC Pink, the selling shareholders will be offering our shares of common stock at a fixed price of $0.20 per share of common stock. After our common stock becomes eligible for trading on the OTC Bulletin Board, the OTCQB or the OTC Pink, the selling shareholders may, from time to time, sell all or a portion of the shares of common stock on OTC Bulletin Board, the OTCQB and/or the OTC Pink or any market upon which the shares of common stock may be listed or quoted currently the OTC Bulletin Board, the OTCQB and/or the OTC Pink in the United States, in privately negotiated transactions or otherwise. After our common stock becomes eligible for trading on the OTC Bulletin Board, the OTCQB and/or the OTC Pink, such sales may be at fixed prices prevailing at the time of sale, at prices related to the market prices or at negotiated prices.

12

After our common stock becomes eligible for trading on the OTC Bulletin Board, the OTCQB or the OTC Pink, the shares of common stock being offered for resale by this prospectus may be sold by the selling shareholders by one or more of the following methods, without limitation:

| ● |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

| ● |

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

| ● |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

| ● |

an exchange distribution in accordance with the rules of the applicable market or exchange;

|

|

| ● |

privately negotiated transactions;

|

|

| ● |

settlement of short sales entered into after the effective date of the registration statement of which this prospectus is a part;

|

|

| ● |

broker-dealers may agree with the selling shareholders to sell a specified number of shares at a stipulated price per share;

|

|

| ● |

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

| ● |

a combination of any of these methods of sale; or

|

|

| ● |

any other method permitted pursuant to applicable law.

|

The selling shareholders may also sell shares under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the selling shareholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling shareholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA/NASD Rule 2440 in the FINRA Manual; and in the case of a principal transaction a markup or markdown in compliance with FINRA/NASD IM-2440. Before our common stock becomes eligible for trading on the OTC Bulletin Board, broker-dealers may agree with a selling shareholder to sell a specified number of the shares of common stock at a price per share of $0.00533. After our common stock becomes eligible for trading on the OTC Bulletin Board, broker-dealers may agree with a selling shareholder to sell a specified number of the shares of common stock at a stipulated price per share.

In connection with the sale of shares, the selling shareholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the shares in the course of hedging the positions they assume. The selling shareholders may also sell shares short and deliver these shares to close out their short positions, or loan or pledge shares to broker-dealers that in turn may sell these shares. The selling shareholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to that broker-dealer or other financial institution of shares offered by this prospectus, which shares that broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect that transaction).

We will be paying certain fees and expenses incurred by us incident to the registration of the shares.

We will keep this prospectus effective until the earlier of (i) the date on which the shares may be resold by the selling shareholders without registration and without regard to any volume limitations by reason of Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the shares have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The shares will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the shares may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

13

Under applicable rules and regulations under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), any person engaged in the distribution of the shares may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the selling shareholders will be subject to applicable provisions of the Exchange Act and the rules and regulations there under, including Regulation M, which may limit the timing of purchases and sales of the shares by the selling shareholders or any other person. We will make copies of this prospectus available to the selling shareholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale or provide adequate notice of this prospectus (in each case in compliance with Rule 172 under the Securities Act).

Blue Sky Restrictions on Resale

When a selling shareholder wants to sell shares of common stock under this registration statement, the selling shareholders will also need to comply with state securities laws, also known as "Blue Sky laws," with regard to secondary sales. All states offer a variety of exemption from registration for secondary sales. Many states, for example, have an exemption for secondary trading of securities registered under Section 12(g) of the Securities Exchange Act of 1934 or for securities of issuers that publish continuous disclosure of financial and non-financial information in a recognized securities manual, such as Standard & Poor's. The broker for a selling shareholder will be able to advise a selling shareholder which states our shares of common stock is exempt from registration with that state for secondary sales.

Any person who purchases shares of common stock from a selling shareholder under this registration statement who then wants to sell such shares will also have to comply with Blue Sky laws regarding secondary sales. When the registration statement becomes effective, and a selling shareholder indicates in which state(s) he desires to sell his shares, we will be able to identify whether it will need to register or will rely on an exemption there from.

Penny Stock Regulations

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| ● |

That a broker or dealer approve a person’s account for transactions in penny stocks; and

|

|

| ● |

That the broker or dealer receives from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

|

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

| ● |

Obtain financial information and investment experience objectives of the person; and

|

|

| ● |

Make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

|

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Securities and Exchange Commission relating to the penny stock market, which, in highlight form:

| ● |

Sets forth the basis on which the broker or dealer made the suitability determination; and

|

|

| ● |

Specifies that the broker or dealer received a signed, written agreement.

|

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

14

DESCRIPTION OF SECURITIES TO BE REGISTERED

Under our Certificate of Incorporation, as amended, we are authorized to issue up to 150,000,000 shares of Common Stock, and 10,000,000 shares of Preferred Stock. As of May 30, 2011 there were 51,218,680 shares of common stock issued and outstanding and 2,990,252 shares of Series A Preferred Stock issued and outstanding. The Series A Preferred Stock is convertible into shares of our common stock but issuance and/or resale of such conversion shares are not covered by this prospectus

Common Stock

The holders of Common Stock are entitled to one vote for each share of such stock held of record by them. The holders of record of the shares of common stock, exclusively and as a separate class, shall be entitled to elect two (2) of our directors, who may only be removed by the affirmative vote of the holders of the shares of common stock. Although the holder of the Series A Preferred Stock has the right to elect one (1) of our director, the holders of record of the shares of Common Stock and of any other class or series of voting stock (including the Series A Preferred Stock), exclusively and voting together as a single class, are entitled to elect the balance of the total number of our directors (subject to the rights of any additional series of Preferred Stock that may be established from time to time).

Subject to the preferences of the outstanding shares of Series A Preferred Stock, the holders of Common Stock are entitled to receive dividends when, as and if declared by the Board of Directors out of funds legally available therefore, subject to the prior rights of the holders of outstanding shares of Preferred Stock. Upon our liquidation or dissolution, and Subject to the preferences of the outstanding shares of Series A Preferred Stock, holders of Common Stock are entitled to receive all assets available for distribution to security holders, after payment of creditors and preferential liquidation distributions to preferred security holders, if any exist at the time of such liquidation. The Common Stock has no preemptive or other subscription rights or redemption or sinking fund provisions with respect to such shares. All outstanding shares of Common Stock are fully paid and non-assessable.

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

The financial statements of ScripsAmerica, Inc. as of December 31, 2010 and 2009 and for each of the years then ended has been included herein and in the Registration Statement in reliance upon the report of Raich Ende Malter & Co. LLP, an independent registered public accounting firm, appearing elsewhere herein, and upon the authority of said firm as experts in accounting and auditing.

Certain legal matters in connection with this offering and Registration Statement are being passed upon by Fox Law Offices, P.A., Peaks Island, Maine.

Overview

We are ScripsAmerica, Inc., a Delaware corporation, and we were formed in May 2008. We currently provide distribution of pharmaceutical products. We are in the process of expanding our operations to two new areas: (i) developing of a line of rapidly dissolving drug formulations for vitamins, Over The Counter (OTC) drugs and certain generic products and (ii) securing approval of the United States Drug and Food Administration (the “FDA”) and developing drugs under the Drug Efficacy Study Implementation (DESI) Program.

We are focused on efficient pharmaceutical supply chain management services, from strategic sourcing to delivering niche generic pharmaceuticals to market. Through the largest pharmaceutical distributors in North America, we deliver pharmaceutical products to a wide range of customers across the health care industry, including physicians’ offices, retail pharmacies, long-term care sites, hospitals, and Government and home care agencies. Current therapeutic categories include pain, arthritis, prenatal, urinary, and hormonal replacement drugs.

15