Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the fiscal year ended March 31, 2011

or

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Transition period from to

Commission File Number: 0-18607

ARCTIC CAT INC.

(Exact name of registrant as specified in its charter)

| Minnesota | 41-1443470 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 505 North Hwy169 Suite 1000 Plymouth, Minnesota |

55441 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code:

(763) 354-1800

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $.01 par value Preferred Stock Purchase Rights |

The NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer x | |||

| Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the Registrant’s most recently completed second fiscal quarter was approximately: $118,144,800.

At June 2, 2011, the registrant had 12,080,184 shares of Common Stock and 6,102,000 shares of Class B Common Stock outstanding.

Documents Incorporated by Reference:

Portions of the registrant’s Proxy Statement for its Annual Meeting of Shareholders currently scheduled to be held on August 3, 2011 are incorporated by reference into Part III of this Form 10-K, to the extent described in such Part.

Table of Contents

FORM 10-K

TABLE OF CONTENTS

| 3 | ||||||

| ITEM 1. |

3 | |||||

| ITEM 1A. |

11 | |||||

| ITEM 1B. |

13 | |||||

| ITEM 2. |

13 | |||||

| ITEM 3. |

13 | |||||

| ITEM 4. |

13 | |||||

| 14 | ||||||

| ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 14 | ||||

| ITEM 6. |

16 | |||||

| ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 18 | ||||

| ITEM 7A. |

25 | |||||

| ITEM 8. |

25 | |||||

| ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 25 | ||||

| ITEM 9A. |

25 | |||||

| ITEM 9B. |

26 | |||||

| 28 | ||||||

| ITEM 10. |

28 | |||||

| ITEM 11. |

28 | |||||

| ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 28 | ||||

| ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 28 | ||||

| ITEM 14. |

28 | |||||

| 29 | ||||||

| ITEM 15. |

29 | |||||

| 32 | ||||||

| 33 | ||||||

| 34 | ||||||

| 35 | ||||||

| 36 | ||||||

| 37 | ||||||

| 51 | ||||||

2

Table of Contents

Arctic Cat Inc., a Minnesota corporation, (the “Company” or “Arctic Cat,” or “we” “our” or “us”), is based in Thief River Falls, Minnesota with principal executive offices in Plymouth, Minnesota. We operate in a single industry segment and design, engineer, manufacture and market snowmobiles and all-terrain vehicles (ATVs) under the Arctic Cat® brand name, as well as related parts, garments and accessories. We market our products through a network of independent dealers located throughout the United States, Canada, and Europe and through distributors representing dealers in Europe, South America, the Middle East, Asia and other international markets. The Arctic Cat brand name has existed for 50 years and is among the most widely recognized and respected names in the snowmobile industry. Our common stock trades on the NASDAQ Global Select Market under the symbol ACAT.

Industry Background

Snowmobiles—The snowmobile, developed in the 1950s, was originally intended to be used as a utility vehicle, but today the overwhelming majority of the industry’s sales are for recreational use. Between the late 1950s and early 1970s, the industry expanded dramatically, reaching a peak of over 100 manufacturers and a high of nearly 495,000 units sold to retail customers in North America in 1971. Today the number of major industry participants has decreased to four: Arctic Cat, Bombardier Recreational Products Inc. (“BRP”), Polaris Industries Inc. (“Polaris”) and Yamaha Motor Co., Ltd. (“Yamaha”). We believe there are currently more significant barriers to entry into the snowmobile market than existed in the 1970s. These barriers include increased brand loyalty, long-standing dealer and distributor networks and relationships, emission regulations, four-stroke engine development costs, manufacturing and engineering expertise and higher initial start-up costs. Industry-wide snowmobile sales to retail customers in North America were approximately 93,000 units for the 2011 model year.

ATVs—The ATV industry evolved from the three-wheel model that was developed in the early 1970s to the four-wheel models that are sold today. The most popular ATV use is general recreation, followed by farming/ranching, hunting/fishing, hauling/towing, transportation, and commercial use. From 1970 to 1986, the number of ATVs sold in the United States continued to grow until reaching an initial peak of 535,000 units in 1986. From 1987 to 1991, the number of ATVs sold declined to a low of approximately 147,000 units. From 1991 to 2004, sales of ATVs grew to 814,000 units; however, ATV sales have declined each year since, primarily driven by overall weak economic conditions and the shift to side-by-side vehicles. Industry-wide sales were 257,000 units in the United States and 56,000 units in Canada in calendar 2010. In addition to the U.S. and Canada, ATVs are also sold in numerous international markets including Europe, Russia, Australia, and Latin America. Major competitors in the industry include Yamaha, BRP, Polaris, Honda Motor Co., Ltd. (“Honda”), Kawasaki Motors Corp. (“Kawasaki”) and Suzuki Motor Corporation (“Suzuki”). In addition to these companies, multiple other companies, including numerous Chinese and Taiwanese manufacturers also sell ATVs.

Products

Snowmobiles—We produce a full line of snowmobiles, consisting of 35 models, marketed under the Arctic Cat brand name, and designed to satisfy all market segments. The 2011 Arctic Cat models carry suggested U.S. retail prices ranging from $6,999 to $14,999 excluding a youth model which is sold at a suggested U.S. retail price of $2,599. Arctic Cat snowmobiles are sold in the United States, Canada, Scandinavia, Russia and other international markets.

Our 2011 year snowmobile models are categorized as Performance, Crossover, Mountain, Touring and Utility. We market: Performance models under the names F series, CFR, Z1, Z1 Turbo and Sno Pro; Crossover models under the name Crossfire; Mountain models under the name M series; Touring models under the name T series; and Utility models under the name Bearcat. In addition, to encourage family involvement in snowmobiling, we offer a youth snowmobile marketed under the Sno Pro 120 name.

3

Table of Contents

We believe the Arctic Cat brand name enjoys a premier image among snowmobile enthusiasts and that our snowmobiles have a long-standing reputation for quality, performance, fuel management, style, comfort, ride and handling. Our snowmobiles offer a wide range of standard and optional features which enhance their operation, riding comfort and performance. Such features include electronic fuel injection (EFI), direct drive, hydraulic disc brakes, remote starters, heated seats, and a technologically advanced front and rear suspension. We were the first in the snowmobile industry to utilize four-stroke engines to reduce emissions. We subsequently introduced a snowmobile with a 177 horsepower turbo charged EFI four stroke inter-cooled engine, the most powerful production snowmobile engine in history, and for the 2007 model year, the first four-stroke engine designed specifically for a snowmobile.

We focus on new product development in order to grow our market share and introduce at least one new model every year. These new models are consistently our best sellers in their respective category. In the 2011 model year, approximately 80 percent of our snowmobile sales were from models or model variations not available three years earlier. Some recent examples of the success of our new products include the following: American Snowmobiler voted the 2011 Sno Pro 500 the “Editors Choice of the Year” and the TZ1 Turbo LXR the “Best Touring Snowmobile”; Sledhead 24-7 Television voted the 2011 TZ1 Turbo Touring the “Touring Sled of the Year”. Arctic Cat snowmobiles won numerous events and championship points titles in the 2011 model year in all major disciplines of racing including snocross, cross-country, oval, and hillclimb.

For the last three fiscal years ended 2011, 2010 and 2009 snowmobiles accounted for 39%, 36% and 37%, respectively, of our revenues.

ATVs—In December 1995, we introduced our first ATV. Since that time, our line has grown to 31 models. Features like fully independent front and rear suspensions, hydraulic disc brakes, hi-low range transmission, long travel suspension with high ground clearance, MRP Speedracks, automatic transmissions, selectable 2WD/4WD shaft drive, locking differentials, EFI, a large fuel tank, and power steering, all make our ATVs consumer friendly. We also have special two rider models that provide a proper alternative for customers that want to ride double on an ATV. In 2007, we introduced the industry’s first diesel ATV, capable of using biodiesel fuels and in 2008 we introduced the Thundercat 1000, the ATV with the largest displacement engine in the industry. During fiscal 2011, we launched our new value line-up of ATVs which included the 350 4X4 automatic with an MSRP of $5,499 and the 425 EFI 4X4 automatic with an MSRP of $5,999. In addition, we also launched the XC450i, a crossover model for consumers seeking 4-wheel drive capabilities in a sport ATV. The 2011 Arctic Cat ATV models carry suggested U.S. retail prices ranging from $3,999 to $13,799, excluding youth models which are sold at suggested U.S. retail prices ranging from $2,699 to $3,399.

Side x Side Vehicles, Recreational Off-highway Vehicles (“ROVs”)—We introduced our new Prowler Utility side by side vehicle into the utility segment in 2006. The Prowler is configured with a variety of different engines that range in size from 550cc to 1000cc that are manufactured by us, and also includes a rear cargo box, dual bucket seats as well as our renowned long travel suspension and ride characteristics. For fiscal 2011, we launched our first heavy duty utility side by side vehicle, the Prowler HDX, with an extended chassis, extra large cargo box, bench seating and power steering standard. In fiscal 2011 the side by side line-up consisted of four models, including the HDX, with retail prices of $10,999 to $15,599.

International ATV Markets—We have continued to expand into international markets by focusing on new product development, adding new distributors, entering new territories, and developing new markets. In July 2005, we acquired a 100% interest in a European company to strengthen our European presence and further expand our ATV model offerings for on-road use, the most prevalent use in Europe. In addition, multiple new distributors were added in fiscal year 2011 to include distributors located in Russia, Argentina, Chile and Saudi Arabia.

Awards—We believe our ATVs are recognized for their power, durability, utility, suspension and style. In 2006, All Terrain Vehicle Magazine awarded the Arctic Cat 250 the best entry level ATV and the Arctic Cat

4

Table of Contents

TRV as the best value. Farm Industry News awarded the Arctic Cat 400 4X4 best ground clearance in class. In 2007, ATV Magazine crowned the Arctic Cat Prowler XT the best trail recreational side-by-side. In 2008, ATV Magazine nominated the Thundercat as ATV of the Year and All Terrain Vehicle Magazine voted the Prowler XTX 700 as Best UTV in the Industry. Also in 2008, Affinity Powersports Media voted the Thundercat “Best in Class.” In 2009, All Terrain Vehicle Magazine voted Prowler 550 Best In Class, which is the third consecutive year the Prowler was voted best UTV. In 2010, ATV Magazine voted the Prowler XTZ 1000 the “Overall Work and Play” category winner, Dirt Trax Television voted the 450 FIS the shoot-out winner and ATV Magazine voted the 300 the shoot-out winner. Racers driving the Arctic Cat Prowler side by side swept first and second place in the 2008 Baja 1000 with the XTZ1000 and the XTX700. This was the first time a ROV had won this grueling terrain race. Again in 2009, the Prowler delivered another record-setting performance and swept the entire 2009 SCORE Series, including the Baja 250, 500 and 1000.

For the last three fiscal years ended 2011, 2010, and 2009, ATVs accounted for 39%, 42%, and 44%, respectively, of our revenues.

Parts, Garments and Accessories—We are the exclusive provider of genuine Arctic Cat Snowmobile, ATV and ROV parts, garments and accessories. Replacement parts for all of our current and noncurrent models of Snowmobiles, ATVs and ROVs are an important part of our product mix along with maintenance supplies such as oil and fuel additives. We also sell a broad array of accessories such as bumpers, cabs, luggage racks, lights, snow plows, backrests, windshields, wheels, track systems and winch kits that consumers buy to increase their comfort factor, shorten their task or personalize their ride. In addition to genuine Arctic Cat parts and accessories, we sell market leading brands in various categories such as Fox Float shocks, Speedpoint attachments and BCA Float Avalanche Airbags.

We offer snowmobile garments for adults and children under the “Arcticwear” and “Drift Racing” labels. Suits, jackets, pants and accessory garments are produced and sold in a wide variety of styles and sizes combining fashion with function. The Arcticwear line of clothing encompasses wearables designed to keep the rider warm and dry during the most demanding snowmobile conditions (insulated outerwear, hats, mittens, helmets, boots) and comfortable relaxing after the ride (sweatshirts, T-shirts, casual wear). The snowmobile garment line includes multiple options with varying levels of performance (insulation warmth, waterproofing, breathability)—to answer the consumer needs in most weather conditions.

Drift Racing garments were launched two years ago to compete with the aftermarket brands and to provide riders of multiple brands of snowmobiles a high performing, fashionable outerwear option. Since that time we have expanded our Drift Racing line (insulated jackets similar to those worn by the snowmobile racers) and have also added more general outerwear options to the Arcticwear line (down filled parkas).

For ATV and ROV riders, we manufacture and sell garments under the “Arcticwear ATV Gear” label. This line of clothing is geared toward function and comfort and includes suits, jackets, gloves, helmets, gear bags, sweatshirts, T-shirts, and caps. While the trend to “wear what you ride” is much stronger with the snowmobile customer than with the ATV and ROV customer we continue to successfully expand our lines with more performance geared clothing to provide more rider comfort.

For the last three fiscal years ended 2011, 2010 and 2009 parts, garments and accessories accounted for 22%, 22% and 19%, respectively, of our revenues.

Manufacturing, Engineering and Research and Development

Arctic Cat snowmobiles and most ATVs are manufactured at our facilities in Thief River Falls, Minnesota. A Taiwanese company manufactures 90cc to 450cc ATVs for us. We have a facility in Bucyrus, Ohio which houses our parts, garments and accessories distribution operations. We have strategically identified specific core manufacturing competencies for vertical integration and have chosen outside suppliers to provide other parts. We

5

Table of Contents

have developed relationships with selected high quality suppliers in order to obtain access to particular capabilities and technologies outside the scope of our expertise. We design component parts often in cooperation with our suppliers, contract with them for the development of tooling, and then enter into agreements with these suppliers to purchase component parts manufactured utilizing the tooling. In our vertically integrated operations, we manufacture foam seats and machine, weld, and paint other components. We complete the total assembly of most of our products at our facilities in Thief River Falls. Manufacturing operations include robotics as well as digital and computer automated equipment to speed production, reduce costs and improve the quality, fit and finish of every product.

During late fiscal 2005, we began manufacturing certain of our own designed ATV engines as part of a strategic first step in a new engine program. We believe that having the capability to design and manufacture our own ATV engines enables us to offer customers more choices, provide excellent value, lower Japanese yen currency exposure and enhance our long-term competitive position. In 2007, we transitioned our engine manufacturing from the Thief River Falls facility to our new facility in St. Cloud, Minnesota.

Suzuki has manufactured snowmobile engines for us pursuant to supply agreements which have been automatically renewed annually unless terminated. On June 4, 2010 we signed an agreement under which we will discontinue the purchase of snowmobile engines from Suzuki after December 31, 2013(2014 model year). Suzuki will continue to provide replacement parts for engines through December 2020. Suzuki has been a good long-term supplier of snowmobile engines. However, this new agreement will allow us to gain more control of our products and enhance our ability to meet regulatory and performance requirements. We will expand our snowmobile engine design capabilities, work with a variety of suppliers for various engine component parts, as well as better utilize the current engine manufacturing capacity at our St. Cloud facility.

Since we began snowmobile production, we have followed a build-to-order policy to control inventory levels. Under this policy, we only manufacture a number of snowmobiles equivalent to the orders received from our dealers and distributors, plus a number of uncommitted units used for dealer and market development, in-house testing and miscellaneous promotional purposes.

Most sales of snowmobiles to retail customers begin in the early fall and continue during the winter. Orders by dealers and distributors for each year’s production are placed in the spring following dealer and distributor meetings. Snowmobiles are built commencing in the late spring and continuing through late autumn.

Retail sales of ATVs and ROVs occur throughout the year with seasonal highs occurring in the spring and fall. We build and purchase ATVs and build ROVs throughout the year to coincide with dealer and consumer demand.

We are committed to an ongoing engineering and research and development program dedicated to innovation and to continued improvements in the quality and performance of our products as well as new product introduction. We currently employ 131 individuals in the design and development of new and existing products, with an additional 22 individuals directly involved in the testing of snowmobiles, ATVs and ROVs in normal and extraordinary conditions. In addition, these units are tested in conditions and locations similar to those in which they are used. We use computer aided design and manufacturing systems to shorten the time between initial concept and final production. For fiscal years ended 2011, 2010 and 2009, we spent approximately $15,029,000, $12,926,000 and $18,404,000, respectively, on engineering, research and development. In addition, utilizing their particular expertise, our suppliers regularly test and apply new technologies to the design and production of component parts.

Sales and Marketing

Our products are currently sold through an extensive network of independent dealers located throughout the United States, Canada, and Europe and through distributors representing dealers in Europe, South America, the Middle East, Asia and other international markets. To promote new dealerships and to service our existing dealer network, we also employ district sales managers throughout the United States and Canada.

6

Table of Contents

Our dealers enter into a three year contract and are required to maintain status as an authorized dealer in order to continue selling our products. To obtain and maintain such status, dealers are expected to order a sufficient number of snowmobiles, and/or ATVs and ROVs to adequately service their market area. In addition, the dealers must perform service on these units and maintain satisfactory service performance levels, and their mechanics are expected to complete special training provided by us. Dealers are also expected to carry adequate levels of inventory of genuine Arctic Cat parts, garments and accessories. As is typical in the industry, most of our dealers also sell some combination of motorcycles, marine products, lawn and garden products and other related products.

We utilize distributors in some countries outside the United States and Canada to take advantage of their knowledge and experience in their respective markets and to increase market penetration of our products. Canadian sales are made in Canadian dollars, nearly all of which are financed through a Canadian financial institution. Most sales to distributors outside North America are made in U.S. dollars and are supported to some extent by letters of credit.

Our sales and marketing efforts are comprised of dealer and consumer promotions, direct advertising and cooperative advertising programs with our dealers. We and our distributors usually conduct dealer shows annually in order to introduce the upcoming year’s models and to promote dealer orders. Marketing activities are designed to promote directly to consumers. Products are advertised and promoted by us in consumer magazines, online and through other media. In addition, we engage in extensive dealer cooperative advertising, on a local and national level, whereby we and our dealers share advertising costs. Each season we produce product brochures, point of purchase displays, leaflets, posters and banners, and other promotional items for use by our dealers. We also participate in key regional consumer shows and rallies with dealers and sponsors independent racers who participate in snowmobile races throughout the world. In order for our dealers and distributors to remain price competitive and to reduce retail inventories, we will from time to time make available to them rebate programs, discounts, or other incentives. In order to build brand loyalty we publish online magazines called Pride (snowmobile) and Ride (ATV and Prowler).

We place strong emphasis on identifying and addressing the specific needs of our customers by periodically conducting dealer and consumer focus group meetings and surveys.

We warrant our snowmobiles and ATVs under a limited warranty against defects in materials and workmanship for a period generally ranging from six months to one year from the date of retail sale or for a period of 90 days from the date of commercial or rental use. Repairs or replacements under warranty are administered through our dealers and distributors.

Competition

The snowmobile, ATV and ROV markets are highly competitive, based on a number of factors, including performance, ride, suspension, innovation, technology, styling, fit and finish, brand loyalty, reliability, durability, price and distribution. We believe Arctic Cat snowmobiles, ATVs and ROVs are highly regarded by consumers in all of these competitive categories. Certain of our competitors are more diversified and have financial and marketing resources which are substantially greater than ours. For a list of snowmobile and ATV competitors, please see “Industry Background” above.

Regulation

Both federal and state authorities have vigorous environmental control requirements relating to air, water and noise pollution that affect our manufacturing operations. We endeavor to insure that our facilities comply with all applicable environmental regulations and standards.

Certain materials used in snowmobile, ATV and ROV manufacturing that are toxic, flammable, corrosive or reactive are classified by federal and state governments as “hazardous materials.” Control of these substances is

7

Table of Contents

regulated by the Environmental Protection Agency (EPA) and various state pollution control agencies, which require reports and inspection of facilities to monitor compliance. Our manufacturing facilities are subject to the regulations promulgated by, and may be inspected by, the Occupational Safety and Health Administration.

The Consumer Product Safety Commission (“CPSC”) has federal oversight over product safety issues related to snowmobiles, ATVs and ROVs and from time to time promulgates rules related to safety. For example, in August 2006, the CPSC issued a Notice of Proposed Rulemaking to establish mandatory safety standards for ATVs. The proposed rule became a mandatory rule under the Consumer Product Safety Improvement Act (the “Act”) passed by Congress in August2008, and requires all ATV manufacturers to comply with certain safety standards, all of which we have been and are in compliance with. In October 2009, the CPSC issued an Advance Notice of Proposed Rulemaking to establish mandatory safety standards for ROVs. The CPSC has not issued final rules in either of these matters. Various states have also promulgated safety regulations regarding snowmobiles, ATVs and ROVs, none of which have had a materially more burdensome impact on us than CPSC regulations.

The Act also includes a provision that requires all manufacturers and distributors who import into or distribute certain products in the United States to comply with provisions which limit the amount of lead paint and lead content that can exist in snowmobiles and ATVs designed and intended primarily for children 12 years of age and younger and requires strict testing to determine relevant lead levels. We do not believe these restrictions have had or will have a material adverse effect on us or negatively impact our business to any greater degree than those of our competitors that sell children’s products in the United States.

The EPA adopted regulations affecting snowmobiles and ATVs for model years 2006 and beyond. We believe that we are and will be in compliance with these regulations. We support balanced and appropriate programs that educate the customer on the safe use of our products and protect the environment.

We are a member of the International Snowmobile Manufacturers Association (ISMA), a trade association formed to promote safety in the manufacture and use of snowmobiles, among other things. The ISMA is currently made up of Arctic Cat, BRP, Yamaha, and Polaris. The ISMA members are also members of the Snowmobile Safety and Certification Committee (SSCC), which promulgates voluntary safety standards for snowmobiles. The SSCC standards, which require testing and evaluation by an independent testing laboratory of each model category produced by participating snowmobile manufacturers, have been adopted by the Canadian Ministry of Transport. Following the development of the SSCC standards, the U.S. CPSC denied a petition to develop a mandatory federal safety standard for snowmobiles in light of the high degree of adherence to the SSCC standards in the United States. Since our inception, all of our models have complied with the SSCC standards.

We are a member of the Specialty Vehicle Institute of America (SVIA), a trade association organized to foster and promote the safe and responsible use of ATVs manufactured and/or distributed throughout the United States. We are also a member of the Canadian Off-Highway Vehicle Distributors Council (COHV), as well as the All-Terrain Vehicle Association Europe (ATVEA).

Effects of Weather

While from time to time lack of snowfall in a particular region may adversely affect snowmobile retail sales within that region, we work to mitigate this effect by taking snowmobile orders in the spring for the following winter season. In the past, weather conditions have materially affected snowmobile sales and weather conditions may materially affect our future sales of snowmobiles, ATVs, ROVs and parts, garments and accessories.

Employees

At March 31, 2011, we had 1,323 employees including 308 salaried and 1,015 hourly and production personnel. Our employees are not represented by a union or subject to a collective bargaining agreement. We have never experienced a strike or work stoppage and consider our relations with our employees to be excellent.

8

Table of Contents

Intellectual Property

We make an effort to patent significant innovations that we consider patentable and we own numerous patents for our snowmobiles, ATVs and other products. Trademarks are also important to our snowmobile, ATV and related parts, garments and accessories business activities. We have a program of trademark enforcement to eliminate the unauthorized use of our trademarks, thereby strengthening their value. We believe that our “Arctic Cat” registered trademark is our most significant trademark. Additionally, we have numerous registered trademarks, trade names and logos, both in the United States and internationally.

Financial Information about Geographic Areas

Financial information regarding domestic and geographic areas is included in Note K, Segment Reporting, of the Notes to Consolidated Financial Statements of this Annual Report on Form 10-K.

Available Information

We are subject to the reporting requirements of the Securities Exchange Act of 1934 and its rules and regulations (the “1934 Act”). The 1934 Act requires us to file periodic reports, proxy statements and other information with the Securities and Exchange Commission (SEC). Copies of these reports, proxy statements and other information can be read and copied at the SEC Public Reference Room, 100 F Street, N.E., Washington D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains a Web site that contains reports, proxy statements, and other information regarding issuers that file electronically with the SEC. These materials may be obtained electronically by accessing the SEC’s home page at http://www.sec.gov.

We maintain a Website at www.arcticcat.com, the contents of which are not part of or incorporated by reference into this Annual Report on Form 10-K. We make our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and amendments to those reports, available on our Website, free of charge, as soon as reasonably practicable after such report has been filed with or furnished to the SEC. Our Code of Conduct, as well as any waivers from and amendments to the Code of Conduct, are also posted on our Website.

9

Table of Contents

EXECUTIVE OFFICERS OF REGISTRANT

| Name |

Age | Position | ||||

| Christopher A. Twomey |

63 | Chairman of the Board of Directors | ||||

| Claude J. Jordan |

54 | President and Chief Executive Officer | ||||

| Timothy C. Delmore |

57 | Chief Financial Officer and Corporate Secretary | ||||

| Bradley D. Darling |

45 | Vice President—General Manager, Snowmobile | ||||

| Paul A. Fisher |

54 | Vice President—Operations | ||||

| William J. Nee |

50 | Vice President—Human Resources | ||||

| Roger H. Skime |

68 | Vice President—Snowmobile Research & Development | ||||

| Mary Ellen Walker |

56 | Vice President—General Manager, Parts, Garments and Accessories | ||||

Mr. Twomey has been our Chairman since 2003, and a Director since 1987. Mr. Twomey was our President and Chief Executive Officer from 1986 to December 31, 2010.

Mr. Jordan has been our Chief Executive Officer and President since January 1, 2011 and was our President and Chief Operating Officer from August 2008 to December 31, 2011. Prior to joining us, Mr. Jordan worked for The Home Depot, Inc. in Atlanta, Georgia for five years, most recently serving as a Vice President, with responsibility for running the THD At-Home Services, Inc. business. Previously, Mr. Jordan held various management positions at General Electric Company.

Mr. Delmore has been our Chief Financial Officer since 1986 and has been our Corporate Secretary since 1989. Mr. Delmore, a CPA with seven years of prior public accounting experience, joined us in 1985 as Controller.

Mr. Darling has been our Vice President—General Manager, Snowmobile since January 2011. Prior to that, he was our North American Sales Director since July 2008 and National Sales Manager (Canada) since October 2004. He started with us in May 2000 as District Sales Manager.

Mr. Fisher has been our Vice President—Operations since May 2010. Prior to joining us, Mr. Fisher worked for Ingersoll Rand from 2005 to 2010, where he served as business leader of the Trane Residential Division operations for five years. Before joining Ingersoll Rand, Mr. Fisher was employed by Maytag Corporation for approximately 21 years, most recently as Vice President of Southwest Operations for Maytag’s Hoover Vacuum Division.

Mr. Nee has been our Vice President—Human Resources since August 2010. Prior to joining us, Mr. Nee worked for Express Scripts from September 2008 to April 2010, where he served as Vice President—Human Resources, Operations. Before joining Express Scripts, Mr. Nee was employed as Senior Vice President at Fiskars Brands, Inc. from October 2004 to September 2008. Prior to that, Mr. Nee spent twelve years with Newell Rubbermaid in senior human resources assignments as a Vice President of several operating divisions and subsequently as Group Vice President of Human Resources. Mr. Nee started his career with The Timken Company, spending eight years in various manufacturing human resources positions.

Mr. Skime has been our Vice President—Snowmobile Research and Development since our inception in 1983 and has been employed in the snowmobile industry for nearly 50 years.

Ms. Walker has been our Vice President—General Manager, Parts, Garments and Accessories since November 2007. Prior to joining us, Ms. Walker had worked for 3M for 26 years, most recently serving as General Manager of Building Safety Solutions, a position that had global responsibility for business units containing window film and fire protection products.

10

Table of Contents

The following are significant factors known to us that could adversely affect our business, financial condition, or operating results, as well as adversely affect the value of an investment in our common stock. These risks could cause our actual results to differ materially from our historical experience and from results predicted by forward-looking statements. All forward-looking statements made by us are qualified by the risks described below. There may be additional risks that are not presently material or known. You should carefully consider each of the following risks and all other information set forth in this Annual Report on Form 10-K.

General economic conditions and other external factors may adversely affect our industry and results of operations

Companies within the snowmobile and ATV industry are subject to volatility in operating results due to external factors such as general economic conditions, including high unemployment and economic recession. Specific factors affecting the industry include:

| • | Overall consumer confidence and the level of discretionary consumer spending; |

| • | Interest rates and related higher dealer floorplan costs; |

| • | Sales incentives and promotional costs; |

| • | Adverse impact on margins due to increases in raw material and transportation costs which companies are unable to pass on to dealers without negatively affecting sales; and |

| • | Fluctuation in foreign currency exchange rates. |

Our products are subject to extensive federal and state safety, environmental and other government regulation that may require us to incur expenses or modify product offerings in order to maintain compliance with the actions of regulators.

Our products are subject to extensive laws and regulations relating to safety, environmental and other regulations promulgated by the U.S. and Canadian federal governments and individual states and provinces as well as international regulatory authorities. Although we believe that our snowmobiles and ATVs have always complied with applicable vehicle safety and emissions standards and related regulations, future regulations may require additional safety standards or emission reductions that would require additional expenses and/or modification of product offerings in order to maintain such compliance. Although we are unable to predict the ultimate impact of adopted or proposed regulations on our business and operating results, we believe that our business would be no more adversely affected than those of our competitors by the adoption of any pending laws or regulations.

A significant adverse determination in any material product liability claim against us could adversely affect our operating results or financial condition.

Accidents involving personal injury and property damage occur in the use of snowmobiles and ATVs. Claims have been made against us from time to time. It is our policy to vigorously defend against these actions. We presently maintain product liability insurance on a “per occurrence” basis (with coverage being provided in respect of accidents which occurred during the policy year, regardless of when the related claim is made) in the amount of $10,000,000 in the aggregate, with a $10,000,000 self-insured retention. While we do not believe the outcome of any pending product liability litigation will have a material adverse effect on our operations, material product liability claims against us may be made in the future. Adverse determination of material product liability claims made against us may adversely affect our operating results or financial condition.

Significant repair and/or replacement with respect to product warranty claims or product recalls could have a material adverse impact on our results of operations.

We provide a limited warranty for a period of six months for our ATVs and one year for our snowmobiles. We may provide longer warranties in certain geographical markets as determined by local regulations and market

11

Table of Contents

conditions. Although we employ quality control procedures, sometimes a product is distributed which requires repair or replacement. Our standard warranties require us through our dealers to repair or replace defective products during such warranty periods at no cost to the consumer. Historically, product recalls have been administered through our dealers and distributors and have not had a material effect on our business. See Note A of the Notes to Consolidated Financial Statements in this Annual Report on Form 10-K.

Changing weather conditions may reduce demand for certain of our products and negatively impact net sales.

Lack of snowfall in any year in any particular region of the United States or Canada may adversely affect snowmobile retail sales and related parts, garments and accessories sales in that region. Weather conditions may materially affect our future sales of snowmobiles, ATVs, and parts, garments and accessories.

We face intense competition in all product lines, from competitors that have greater financial and marketing resources. Failure to compete effectively against competitors would negatively impact our business and operating results.

The snowmobile and ATV markets in the United States and Canada are highly competitive. Competition is based upon a number of factors, including performance, ride, suspension, innovation, technology, styling, fit and finish, brand loyalty, reliability, durability, price and distribution. At the dealer level, competition is based on a number of factors including sales and marketing support programs (such as sales incentives and cooperative advertising). Many of our competitors are more diversified and have financial and marketing resources which are substantially greater than ours. In addition, our products compete with other recreational products for the discretionary spending of consumers. If we are not able to effectively compete in this environment, our business and operating results will be negatively impacted.

Termination or interruption of engine and other supply arrangements could have a material adverse effect on our business or results of operations.

Suzuki has manufactured snowmobile engines (and through fiscal 2008 certain ATV engines) for us pursuant to supply agreements which have been automatically renewed annually. During late fiscal 2005, we began manufacturing certain of our own designed ATV engines as part of a strategic first step in a new engine program. We believe that having the capability to design and manufacture our own ATV engines enables us to offer customers more choices, provide excellent value, lower Japanese yen currency exposure and enhance our long-term competitive position. In 2007, we transitioned our engine manufacturing from the Thief River Falls, Minnesota facility to our new facility in St. Cloud, Minnesota. Beginning in fiscal 2009, substantially all our ATVs use engines that are produced from our engine facility or purchased separately or as part of the 50cc to 450cc units we receive from a Taiwanese supplier.

On June 4, 2010, we signed an agreement under which we will discontinue the purchase of snowmobile engines from Suzuki after December 31, 2013(2014 model year). Suzuki will continue to provide replacement parts for engines through December 2020. While Suzuki has been a good long-term supplier of snowmobile engines, this new agreement will allow us to gain more control of our products, offer customers more choices, provide excellent value, lower Japanese yen currency exposure and enhance our ability to meet regulatory and performance requirements. We will expand our snowmobile engine design capabilities, work with a variety of vendors for various engine components, as well as better maximize our current engine manufacturing capacity.

While we anticipate no significant difficulties in obtaining substitute supply arrangements for other raw materials or components for which we rely upon limited sources of supply, alternate supply arrangements may not be made on satisfactory terms.

12

Table of Contents

Interruption of dealer floorplan financing could have a material impact on our business operations.

We have agreements with GE Commercial Distribution Finance in the United States and TCF Commercial Finance Canada in Canada to provide snowmobile and ATV floorplan financing for our North American dealers. These agreements improve our liquidity by financing dealer purchases of products without requiring substantial use of our working capital. We are paid by the floorplan companies shortly after shipment and as part of our marketing programs we pay the floorplan financing of our dealers for certain set time periods depending on the size of a dealer’s order. While we expect to continue with our current multi-year dealer floorplan arrangements, these arrangements may not remain available or the costs and other terms of new financing arrangements may be significantly less favorable to us than has historically been available.

Termination, interruption or nonrenewal of bank credit agreements could have a material adverse affect on our business or results of operations.

The seasonality of our snowmobile and ATV production cycles generates significant fluctuations in our working capital requirements during each year. Historically, we have financed our working capital requirements out of available cash balances at the beginning and end of the production cycle and with short-term bank borrowings during the middle of this cycle. While we expect to continue with our current multi-year working capital financing agreement from our lender, working capital financing arrangements may not remain available or the costs and other terms of new financing arrangements may be significantly less favorable to us than has historically been available. In addition, our current bank credit agreement contains covenants which we might be unable to meet in some future period requiring the need for waivers or replacement financing.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

The following sets forth our material property holdings as of March 31, 2011.

| Location |

Facility Type / Use |

Owned or Leased |

Sq Ft. | |||||

| Thief River Falls, Minnesota |

Manufacturing / Corporate Office | Owned | 585,000 | |||||

| Thief River Falls, Minnesota |

Warehouse | Leased | 9,000 | |||||

| Thief River Falls, Minnesota |

Warehouse | Leased | 25,000 | |||||

| Bucyrus, Ohio |

Distribution Center | Owned | 202,000 | |||||

| Winnipeg, Manitoba |

Service Center | Leased | 9,929 | |||||

| Island Park, Idaho |

Test & Development Facility | Owned | 3,000 | |||||

| St. Johann, Austria |

Manufacturing/Distribution | Leased | 44,409 | |||||

| St. Cloud, Minnesota |

Manufacturing | Owned | 60,800 | |||||

| Plymouth, Minnesota |

Corporate Office | Leased | 11,420 | |||||

Accidents involving personal injury and property damage occur in the use of recreational products. Claims have been made against us from time to time. It is our policy to vigorously defend against these actions. We are not involved in any legal proceedings which we believe will have the potential for a materially adverse impact on our business or financial condition.

We presently maintain product liability insurance on a “per occurrence” basis (with coverage being provided in respect of accidents which occurred during the policy year, regardless of when the related claim is made) in the amount of $10,000,000 in the aggregate, with a $10,000,000 self-insured retention. We believe such insurance is adequate.

ITEM 4. (REMOVED AND RESERVED)

13

Table of Contents

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is traded on The NASDAQ Global Select Market under the NASDAQ symbol “ACAT.” Quotations below represent the high and low sale prices as reported by NASDAQ. Our stock began trading on NASDAQ on June 26, 1990.

| Years ended March 31, Quarterly Prices |

2011 | 2010 | ||||||||||||||

| High | Low | High | Low | |||||||||||||

| First Quarter |

$ | 16.10 | $ | 8.44 | $ | 5.01 | $ | 3.30 | ||||||||

| Second Quarter |

10.99 | 6.92 | 7.99 | 3.77 | ||||||||||||

| Third Quarter |

16.75 | 10.04 | 9.32 | 5.67 | ||||||||||||

| Fourth Quarter |

17.97 | 12.10 | 12.76 | 8.15 | ||||||||||||

As of June 2, 2011, we had approximately 352 stockholders of record, including the nominee of Depository Trust Company which held 11,540,303 shares of common stock.

Cash Dividends Paid

Cash dividends were declared and paid quarterly from 1995 through the third quarter of fiscal year 2009. In response to the economic recession and to conserve cash, we suspended quarterly cash dividends in the fourth quarter of fiscal 2009. We continually consider our cash balance and projected cash needs and current dividend policy.

Company Purchases of Company Equity Securities

The following table presents the total number of shares repurchased during the fourth quarter of fiscal 2011 by fiscal month, the average price paid per share, the number of shares that were purchased as part of a publicly announced repurchase plan, and the approximate dollar value of shares that may yet be purchased pursuant to our stock repurchase program as of the end of fiscal 2011:

| Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs(1) |

Maximum Number of Shares that May Yet be Purchased Under the Plans or Programs |

||||||||||||

| January 1, 2011 - January 31, 2011 |

0 | $ | — | 0 | 473,221 | (2) | ||||||||||

| February 1, 2011 - February 28, 2011 |

0 | $ | — | 0 | 596,459 | (2) | ||||||||||

| March 1, 2011 - March 31, 2011 |

0 | $ | — | 0 | 487,524 | (2) | ||||||||||

| Total |

0 | $ | — | 0 | 487,524 | (2) | ||||||||||

| (1) | We have in the past maintained publicly announced stock repurchase programs which have been approved by the Board of Directors. On January 4, 2008, we announced that the Board of Directors approved a $10 million stock repurchase program. Pricing under this program has been delegated to management. There is no expiration date for this program. |

| (2) | Number of shares purchasable at closing price of our common stock on the last trading day of the month. |

We have historically purchased our common stock primarily to offset the dilution created by employee stock option programs and because the Board of Directors believed investment in our common stock was a good use of our excess cash.

Stock purchases have been executed in accordance with Rule 10b-18 of the Securities Exchange Act of 1934. There have been no other purchases of our common stock.

14

Table of Contents

Performance Graph

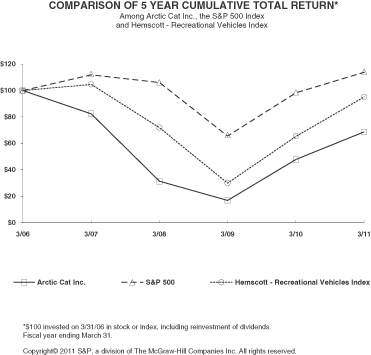

In accordance with the rules of the SEC, the following performance graph compares the performance of our common stock on The NASDAQ Stock Market to the Standard & Poor’s 500 Index, and to the Recreational Vehicles Index prepared by Hemscott, Inc., of which we are a component. The graph compares on an annual basis the cumulative total shareholder return on $100 invested on March 31, 2006, assumes reinvestment of all dividends and has been adjusted to reflect stock splits. The performance graph is not necessarily indicative of future investment performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Arctic Cat Inc., the S&P 500 Index

and Hemscott—Recreational Vehicles Index

Assumes $100 invested on 3/31/06 in stock or index

Assumes Dividend Reinvested

Fiscal year ending March 31,

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |||||||||||||||||||

| Arctic Cat Inc. |

$ | 100.00 | $ | 82.27 | $ | 31.40 | $ | 16.95 | $ | 48.01 | $ | 68.80 | ||||||||||||

| S&P 500 Index |

100.00 | 111.83 | 106.15 | 65.72 | 98.43 | 113.83 | ||||||||||||||||||

| Hemscott—Recreational Vehicles Index |

100.00 | 104.71 | 71.90 | 30.10 | 65.38 | 95.25 | ||||||||||||||||||

15

Table of Contents

ITEM 6. SELECTED FINANCIAL DATA

| (In thousands, except per share amounts) Years ended March 31, |

2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

| OPERATING STATEMENT DATA: |

||||||||||||||||||||

| Net sales |

||||||||||||||||||||

| Snowmobile & ATV units |

$ | 363,015 | $ | 350,871 | $ | 454,589 | $ | 512,170 | $ | 678,522 | ||||||||||

| Parts, garments & accessories |

101,636 | 99,857 | 109,024 | 109,398 | 103,909 | |||||||||||||||

| Total net sales |

464,651 | 450,728 | 563,613 | 621,568 | 782,431 | |||||||||||||||

| Cost of goods sold |

||||||||||||||||||||

| Snowmobile & ATV units |

302,783 | 309,217 | 411,776 | 447,633 | 578,533 | |||||||||||||||

| Parts, garments & accessories |

60,359 | 58,275 | 68,665 | 68,395 | 66,951 | |||||||||||||||

| Total cost of goods sold |

363,142 | 367,492 | 480,441 | 516,028 | 645,484 | |||||||||||||||

| Gross profit |

101,509 | 83,236 | 83,172 | 105,540 | 136,947 | |||||||||||||||

| Operating expenses |

||||||||||||||||||||

| Selling & marketing |

33,540 | 33,929 | 43,971 | 47,634 | 54,108 | |||||||||||||||

| Research & development |

15,029 | 12,926 | 18,404 | 18,343 | 20,262 | |||||||||||||||

| General & administrative |

34,805 | 35,045 | 33,904 | 48,276 | 30,644 | |||||||||||||||

| Goodwill impairment charge |

— | — | 1,750 | — | — | |||||||||||||||

| Total operating expenses |

83,374 | 81,900 | 98,029 | 114,253 | 105,014 | |||||||||||||||

| Operating profit (loss) |

18,135 | 1,336 | (14,857 | ) | (8,713 | ) | 31,933 | |||||||||||||

| Interest income |

107 | 12 | 117 | 632 | 1,139 | |||||||||||||||

| Interest expense |

(11 | ) | (250 | ) | (1,015 | ) | (1,066 | ) | (1,026 | ) | ||||||||||

| Earnings (loss) before income taxes |

18,231 | 1,098 | (15,755 | ) | (9,147 | ) | 32,046 | |||||||||||||

| Income tax expense (benefit) |

5,224 | (777 | ) | (6,247 | ) | (5,888 | ) | 9,976 | ||||||||||||

| Net earnings (loss) |

$ | 13,007 | $ | 1,875 | $ | (9,508 | ) | $ | (3,259 | ) | $ | 22,070 | ||||||||

| Net earnings (loss) per share |

||||||||||||||||||||

| Basic |

$ | 0.71 | $ | 0.10 | $ | (0.53 | ) | $ | (0.18 | ) | $ | 1.16 | ||||||||

| Diluted |

$ | 0.70 | $ | 0.10 | $ | (0.53 | ) | $ | (0.18 | ) | $ | 1.15 | ||||||||

| Cash dividends per share |

$ | — | $ | — | $ | 0.21 | $ | 0.28 | $ | 0.28 | ||||||||||

| Weighted average shares outstanding |

||||||||||||||||||||

| Basic |

18,232 | 18,220 | 18,070 | 18,137 | 19,030 | |||||||||||||||

| Diluted |

18,539 | 18,291 | 18,070 | 18,137 | 19,128 | |||||||||||||||

| As of March 31, |

2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

| BALANCE SHEET DATA (In thousands): |

||||||||||||||||||||

| Cash and short-term investments |

$ | 125,113 | $ | 71,062 | $ | 11,413 | $ | 35,063 | $ | 75,277 | ||||||||||

| Working capital |

144,596 | 125,695 | 109,524 | 113,274 | 110,382 | |||||||||||||||

| Total assets |

272,906 | 246,084 | 251,165 | 305,898 | 326,204 | |||||||||||||||

| Long-term debt |

— | — | — | — | — | |||||||||||||||

| Shareholders’ equity |

183,036 | 167,339 | 164,848 | 180,862 | 192,221 | |||||||||||||||

16

Table of Contents

QUARTERLY FINANCIAL DATA (unaudited)

| (In thousands, except per share amounts) |

Total Year | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | |||||||||||||||

| Net Sales |

||||||||||||||||||||

| 2011 |

$ | 464,651 | $ | 63,406 | $ | 175,812 | $ | 151,976 | $ | 73,457 | ||||||||||

| 2010 |

450,728 | 69,370 | 166,300 | 131,040 | 84,018 | |||||||||||||||

| 2009 |

563,613 | 93,877 | 204,314 | 174,699 | 90,723 | |||||||||||||||

| Gross Profit |

||||||||||||||||||||

| 2011 |

$ | 101,509 | $ | 10,759 | $ | 51,258 | $ | 32,732 | $ | 6,760 | ||||||||||

| 2010 |

83,236 | 7,548 | 45,211 | 22,581 | 7,896 | |||||||||||||||

| 2009 |

83,172 | 12,877 | 47,122 | 20,367 | 2,806 | |||||||||||||||

| Net Earnings (Loss) |

||||||||||||||||||||

| 2011 |

$ | 13,007 | $ | (4,478 | ) | $ | 17,809 | $ | 9,262 | $ | (9,586 | ) | ||||||||

| 2010 |

1,875 | (5,947 | ) | 14,780 | 2,602 | (9,560 | ) | |||||||||||||

| 2009 |

(9,508 | ) | (6,963 | ) | 16,915 | (2,724 | ) | (16,736 | ) | |||||||||||

| Net Earnings (Loss) Per Share |

||||||||||||||||||||

| 2011 Basic |

$ | 0.71 | $ | (0.25 | ) | $ | 0.98 | $ | 0.51 | $ | (0.52 | ) | ||||||||

| Diluted |

0.70 | (0.25 | ) | 0.97 | 0.50 | (0.52 | ) | |||||||||||||

| 2010 Basic |

0.10 | (0.33 | ) | 0.81 | 0.14 | (0.52 | ) | |||||||||||||

| Diluted |

0.10 | (0.33 | ) | 0.81 | 0.14 | (0.52 | ) | |||||||||||||

| 2009 Basic |

(0.53 | ) | (0.39 | ) | 0.94 | (0.15 | ) | (0.93 | ) | |||||||||||

| Diluted |

(0.53 | ) | (0.39 | ) | 0.93 | (0.15 | ) | (0.93 | ) | |||||||||||

17

Table of Contents

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following management’s discussion and analysis of financial condition and results of operations should be read in conjunction with the consolidated financial statements and note thereto included elsewhere in this Annual Report on Form 10-K.

Executive Level Overview

We continued our improvement in net sales and profitability in fiscal 2011. Fiscal 2011 net sales increased 3.1% to $464.7 million from $450.7 million in fiscal 2010. Fiscal 2011 net earnings were $13.0 million or $0.70 per diluted share compared to a net earnings of $1.9 million or $0.10 per diluted share in fiscal 2010. The increase in net sales was mainly due to increased snowmobile sales and snowmobile related parts, garments and accessory sales. During the fiscal year, gross margins improved 330 basis points, operating expenses as a percent of sales decreased to 17.9%, and operating profits increased to $18.1 million from $1.3 million. In addition, we improved our liquidity by ending the fiscal year with $125.1 million in cash and short-term investments driven by a 24% reduction in factory inventory.

Industry-wide retail sales of snowmobiles in North America increased in fiscal 2011 and, similar to last year, snowmobile retail sales out performed many other recreational vehicle categories in North America. While retail sales of snowmobiles are certainly affected by the economic environment, they are also impacted by snow conditions. In the U.S., snow conditions were generally good for the fourth year in a row, which helped snowmobile retail sales out perform many other recreational vehicle categories. During fiscal 2011 we lost two points of market share in North America, however, we were successful in reducing North American dealer inventories 22%. Our focus for fiscal 2012 will be regaining market share with our exciting 2012 model line-up.

Industry-wide retail sales of ATVs again declined throughout the year driven by continued uncertainties in the economy, relatively weak consumer confidence and unemployment figures at near historic levels. We expect these same factors to impact retail sales of ATVs during fiscal 2012 as well. Our focus for fiscal 2012 will again be gaining market share in certain segments and reducing dealer inventories. During fiscal 2011, our ATV business gained market share in certain segments in North America and our dealer inventories declined by 23% over the prior year. In view of the current North American economic environment, we do not expect ATV retail sales to improve significantly over last year, although we may see a slight uptick in the ATV market by the end of fiscal 2012 if the economy strengthens.

Reviewing fiscal 2011 net sales: Snowmobile sales increased 12% in fiscal 2011 to $182.0 million from $162.9 million in fiscal 2010, primarily due to increased U.S. and international snowmobile shipments. Snowmobiles comprised 39% of our net sales in fiscal 2011. ATV sales decreased 4% in fiscal 2011 to $181.1 million from $188.0 million in fiscal 2010. ATV net sales comprised 39% of our net sales in fiscal 2011. Parts, garments and accessories sales increased 2% in fiscal 2011 to $101.6 million from $99.9 million in fiscal 2010, primarily due to increased snowmobile related parts, garments and accessories. Parts, garments and accessories sales were 22% of our net sales in fiscal 2011.

Results of Operations

Product Line Sales for the Fiscal Year Ended March 31,

| ($ in thousands) |

2011 | Percent of Total Sales |

2010 | Percent of Total Sales |

Change 2011 vs 2010 |

2009 | Percent of Total Sales |

Change 2010 vs 2009 |

||||||||||||||||||||||||

| Snowmobile |

$ | 181,965 | 39 | % | $ | 162,918 | 36 | % | 12 | % | $ | 207,280 | 37 | % | (21 | )% | ||||||||||||||||

| ATV |

181,050 | 39 | % | 187,953 | 42 | % | (4 | )% | 247,309 | 44 | % | (24 | )% | |||||||||||||||||||

| Parts, garments & accessories |

101,636 | 22 | % | 99,857 | 22 | % | 2 | % | 109,024 | 19 | % | (8 | )% | |||||||||||||||||||

| Net Sales |

$ | 464,651 | 100 | % | $ | 450,728 | 100 | % | 3 | % | $ | 563,613 | 100 | % | (20 | )% | ||||||||||||||||

18

Table of Contents

Product Line Sales During fiscal 2011, net sales increased 3% to $464.7 million from $450.7 million in fiscal 2010. Snowmobile unit volume increased 15%, ATV unit volume increased 0.3%, and parts, garments and accessories sales increased $1.8 million. The increase in net sales is mainly due to U.S. and international sales increases on snowmobile and related parts, garments and accessory sales. During fiscal 2010, net sales decreased 20% to $450.7 million from $563.6 million in fiscal 2009. Snowmobile unit volume decreased 28%, ATV unit volume decreased 34%, and parts, garments and accessories sales decreased $9.2 million. The decrease in net sales for all product lines was mainly due to decreased sales caused by challenging retail market conditions.

Cost of Goods Sold for the Fiscal Year Ended March 31,

| ($ in thousands) |

2011 | Percent of Total Sales |

2010 | Percent of Total Sales |

Change 2011 vs. 2010 |

2009 | Percent of Total Sales |

Change 2010 vs. 2009 |

||||||||||||||||||||||||

| Snowmobiles & ATV units |

$ | 302,783 | 65.2 | % | $ | 309,217 | 68.6 | % | (2.1 | )% | $ | 411,776 | 73.1 | % | (24.9 | )% | ||||||||||||||||

| Parts, garments & accessories |

60,359 | 13.0 | % | 58,275 | 12.9 | % | 3.6 | % | 68,665 | 12.2 | % | (15.1 | )% | |||||||||||||||||||

| Total Cost of Goods Sold |

$ | 363,142 | 78.2 | % | $ | 367,492 | 81.5 | % | (1.2 | )% | $ | 480,441 | 85.2 | % | (23.5 | )% | ||||||||||||||||

Cost of Goods Sold During fiscal 2011 cost of sales decreased 1.2% to $363.1 million from $367.5 million for fiscal 2010. Fiscal 2011 snowmobile and ATV unit cost of sales decreased 2.1% to $302.8 million from $309.2 million due primarily to ongoing efforts to reduce the cost of our products and distribution costs. The fiscal 2011 cost of sales for parts, garments and accessories increased to $60.4 million from $58.3 million for fiscal 2010 due primarily to increased sales. Fiscal 2010 cost of sales decreased 23.5% to $367.5 million from $480.4 million for fiscal 2009. Fiscal 2010 snowmobile and ATV unit cost of sales decreased 24.9% to $309.2 million from $411.8 million in line with the decrease in unit sales in fiscal 2010 compared to fiscal 2009. The fiscal 2010 cost of sales for parts, garments and accessories decreased to $58.3 million compared to $68.7 million for fiscal 2009. Cost of sales for fiscal 2010 also decreased due to efforts to reduce the cost of our products.

Gross Profit for the Fiscal Year Ended March 31,

| ($ in thousands) |

2011 | 2010 | Change 2011 vs 2010 |

2009 | Change 2010 vs 2009 |

|||||||||||||||

| Gross Profit Dollars |

$ | 101,509 | $ | 83,236 | 22.0 | % | $ | 83,172 | 0.1 | % | ||||||||||

| Percentage of Sales |

21.8 | % | 18.5 | % | 3.3 | % | 14.8 | % | 3.7 | % | ||||||||||

Gross Profit Gross profit increased 22% to $101.5 million in fiscal 2011 from $83.2 million in fiscal 2010. The gross profit percentage for fiscal 2011 increased to 21.8% versus 18.5% in fiscal 2010. The increase in the fiscal 2011 gross profit percentage was primarily due to product cost reductions, price increases and a favorable Canadian dollar exchange rate. Gross profit increased 0.1% to $83.2 million in fiscal 2010 from $83.2 million in fiscal 2009. The gross profit percentage for fiscal 2010 increased to 18.5% versus 14.8% in fiscal 2009. The increase in the fiscal 2010 gross profit percentage was due primarily to higher margin percentages for all product lines resulting from the efforts undertaken to rescale the business, reduce the cost of products, pricing increases and a stronger Canadian dollar exchange rate.

19

Table of Contents

Operating Expenses for the Fiscal Year Ended March 31,

| ($ in thousands) |

2011 | 2010 | Change 2011 vs 2010 |

2009 | Change 2010 vs 2009 |

|||||||||||||||

| Selling & Marketing |

$ | 33,540 | $ | 33,929 | (1.1 | )% | $ | 43,971 | (22.8 | )% | ||||||||||

| Research & Development |

15,029 | 12,926 | 16.3 | % | 18,404 | (29.8 | )% | |||||||||||||

| General & Administrative |

34,805 | 35,045 | (0.7 | )% | 33,904 | 3.4 | % | |||||||||||||

| Goodwill Impairment Charge |

— | — | — | 1,750 | — | |||||||||||||||

| Total Operating Expenses |

$ | 83,374 | $ | 81,900 | 1.8 | % | $ | 98,029 | (16.5 | )% | ||||||||||

| Percentage of Sales |

17.9 | % | 18.2 | % | 17.4 | % | ||||||||||||||

Operating Expenses Selling and Marketing expenses decreased 1% to $ 33.5 million in fiscal 2011 from $33.9 million in fiscal 2010, primarily due to lower ATV marketing expenses. Selling and Marketing expenses decreased 23% to $33.9 million in fiscal 2010 from $44.0 million in fiscal 2009 due primarily to lower advertising expenses. Research and Development expenses increased 16% to $15.0 million in fiscal 2011 compared to $12.9 million in fiscal 2010 due primarily to higher compensation and development expenses. Research and Development expenses decreased 30% to $12.9 million in fiscal 2010 compared to $18.4 million in fiscal 2009 due primarily to lower compensation and development expenses. General and Administrative expenses decreased 1% to $34.8 million in fiscal 2011 from $35.0 million in fiscal 2010 due primarily to decreased Canadian hedge costs offset by higher compensation costs . General and Administrative expenses increased 3% to $35.0 million in fiscal 2010 from $33.9 million in fiscal 2009 due primarily to increased Canadian hedge costs. During the fourth quarter of fiscal 2009, we recorded a $1.75 million non-cash goodwill impairment charge.

Other Income /Expense Interest income increased to $107,000 in fiscal 2011 from $12,000 in fiscal 2010. Interest expense decreased from $250,000 in fiscal 2010 to $11,000 in fiscal 2011. Interest income was primarily affected by the higher cash levels at the beginning of the fiscal year compared to last year. Interest expense is lower due to lower borrowing levels primarily driven by reduced inventory levels and our improved cash levels. Interest income decreased from $117,000 in fiscal 2009 to $12,000 in fiscal 2010. Interest expense decreased from $1.0 million in fiscal 2009 to $250,000 in fiscal 2010. Interest income was primarily affected by the lower cash levels at the beginning of the fiscal year compared to the last year as well as lower interest rates during fiscal 2010. Interest expense was lower due to lower borrowing levels primarily driven by reduced inventory levels and our improved cash levels.

Net Earnings (Loss) Fiscal 2011 net earnings were $13.0 million or $0.70 per diluted share versus a net earnings of $1.9 million or $0.10 per diluted share for fiscal 2010. Net earnings as a percent of net sales were 3% and 0.4% in fiscal 2011 and 2010, respectively. The increased earnings are attributable to improved gross margin and continued efforts to control operating expenses. Fiscal 2010 net earnings were $1.9 million or $0.10 per diluted share compared to a net loss of $9.5 million or $0.53 per share for fiscal 2009. Net earnings as a percent of net sales were 0.4% and (1.7%) in fiscal 2010 and 2009, respectively. The increased earnings are attributable to the reduction in our cost structure through aggressive expense controls, manufacturing efficiencies and low cost sourcing which led to higher gross margins and operating profits in fiscal 2010.

Inflation

Inflation historically has not significantly impacted our business. We generally have been able to offset the impact of increasing costs through a combination of productivity gains and product price increases.

Critical Accounting Policies

The preparation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States requires management to make certain estimates and assumptions that affect the amount of reported assets and liabilities and disclosure of contingent assets and liabilities at the date of the

20

Table of Contents

consolidated financial statements and revenues and expenses during the periods reported. Actual results may differ from those estimates. We reviewed the development and selection of the critical accounting policies and believe the following are the most critical accounting policies that could have an effect on our reported results. These critical accounting policies and estimates have been reviewed with the Audit Committee of the Board of Directors.

Revenue Recognition

We recognize revenue and provide for estimated marketing and sales incentive costs when products are shipped to dealers and distributors pursuant to their order, the price is fixed and collection is reasonably assured. We have agreements with finance companies to repurchase products repossessed up to certain limits. Our financial exposure to repurchase products is limited to the difference between the amount paid to the finance company and the resale value of the repossessed products. Historically, we have not incurred material losses as a result of repurchases nor has it provided a financial reserve for repurchases. Adverse changes in retail sales could cause this situation to change.

Marketing and Sales Incentive Costs

We provide for various marketing and sales incentive costs which are offered to our dealers and consumers at the later of when the revenue is recognized or when the marketing and sales incentive program is approved and communicated. Examples of these costs include: dealer and consumer rebates, dealer floorplan financing assistance and other incentive and promotion programs. Adverse market conditions resulting in lower than expected retail sales or the matching of competitor programs could cause accrued marketing and incentive costs to materially increase if we authorize and communicate new programs to our dealers. We estimate marketing and sales incentive costs based on expected usage and historical experience. The accrual for marketing and sales incentive costs at March 31, 2011 and 2010 was $9.4 million and $7.9 million, respectively, and is included in accrued marketing in our balance sheet. The increase in this accrual was a result of current announced and communicated marketing and sales incentive programs and retail market conditions. Historically, marketing and sales incentive program expenses have been within our expectations. To the extent current experience differs with previous estimates the accrued liability for marketing and sales incentives is adjusted accordingly.

Product Warranties

We generally provide a limited warranty to the owner of snowmobiles for 12 months from the date of consumer registration and for 6 months on ATVs. We provide for estimated warranty costs at the time of sale based on historical rates and trends and makes subsequent adjustments to their estimate as actual claims become known or the amounts are determinable. Adverse changes in actual warranty costs compared to our initial estimates could cause accrued warranty costs to materially change. The accrual for warranty costs was $14.1 million at March 31, 2011 and 2010. Historically, actual warranty costs have been within our expectations.

Inventories

Our inventories are recorded at the lower of cost or market, with cost based on a first-in, first-out basis. We periodically assess inventories for obsolescence and potential excess. This assessment is based primarily on assumptions and estimates regarding future production demands, anticipated changes in technology or design, historical and expected future sales patterns. Our inventories consist of materials and products that are subject to changes in our planned production of future snowmobile and ATV products and competitive market conditions which may cause lower of cost or market adjustments to our finished goods inventory. If market conditions or future demand are less favorable than our current expectations, additional inventory write downs or reserves may be required, which could have an adverse effect on our reported results in the period the adjustments are made. Inventory items that are identified as obsolete or excess are fully reserved on our balance sheet and are generally scrapped. Historically, inventory obsolescence and potential excess costs adjustments have been within our expectations.

21

Table of Contents

Product Liability and Litigation

We are subject to product liability claims and other litigation in the normal course of business. We insure for product liability claims although we retain a self-insured retention accrual within the balance sheet caption “Insurance” within accrued expenses. The estimated costs resulting from any losses over insured amounts are charged to operating expenses when it is probable a loss has been incurred and the amount of the loss is reasonably determinable.

We utilize historical trends and other analysis to assist in determining the appropriate loss. Adverse changes in the final determination of product liability or other claims made against us could have a material impact on our financial condition. Historically, actual product liability and litigation costs have been within our expectations.

Stock-Based Compensation

We recognize stock based compensation based on certain assumption inputs within the Black-Scholes Model. These assumption inputs are used to determine an estimated fair value of stock based payment awards on the date of grant and require subjective judgment. Because employee stock options have characteristics significantly different from those of traded options, and because changes in the input assumptions can materially affect the fair value estimate, the existing models may not provide a reliable single measure of the fair value of the employee stock options. We assess the assumptions and methodologies used to calculate estimated fair value of stock-based compensation on a regular basis. Circumstances may change and additional data may become available over time, which could result in changes to these assumptions and methodologies and thereby materially impact our fair value determination. If factors change and we employ different assumptions, the amount of compensation expense may differ significantly from what was recorded in the current period.

Liquidity and Capital Resources

The seasonality of our snowmobile and ATV production cycles generates significant fluctuations in our working capital requirements during the year. The following table represents sales and ending inventories by each quarter in the fiscal years ended March 31, 2011 and 2010.

| First | Second | Third | Fourth | Total | ||||||||||||||||

| 2011 |

||||||||||||||||||||

| Snowmobile |

$ | 17,105 | $ | 91,525 | $ | 77,822 | $ | (4,487 | ) | $ | 181,965 | |||||||||

| ATV |

27,833 | 56,641 | 48,559 | 48,017 | 181,050 | |||||||||||||||

| PG&A |

18,468 | 27,646 | 25,595 | 29,927 | 101,636 | |||||||||||||||

| Total Sales |

$ | 63,406 | $ | 175,812 | $ | 151,976 | $ | 73,457 | $ | 464,651 | ||||||||||

| Inventories |

$ | 88,069 | $ | 95,894 | $ | 77,150 | $ | 61,478 | ||||||||||||

| 2010 |

||||||||||||||||||||

| Snowmobile |

$ | 17,916 | $ | 85,740 | $ | 58,665 | $ | 597 | $ | 162,918 | ||||||||||

| ATV |

32,172 | 51,726 | 48,214 | 55,841 | 187,953 | |||||||||||||||

| PG&A |

19,281 | 28,835 | 24,161 | 27,580 | 99,857 | |||||||||||||||

| Total Sales |