Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HOPFED BANCORP INC | d8k.htm |

INVESTKentucky

Churchill Downs, Louisville, KY

John E. Peck,

President & Chief Executive Officer

Billy C. Duvall,

Senior Vice President & Chief Financial Officer

June 9, 2011

1

Exhibit 99.1 |

Certain statements contained herein are forward-looking statements,

within the meaning of Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934 and are subject to the safe

harbor provisions of the Private Securities Litigation Reform Act of

1995, that involve risks and uncertainties. Actual results may

differ materially from the results in these forward-looking statements.

Factors that might cause such a difference include, among other

matters, changes in interest rates, economic conditions,

governmental regulation and legislation, credit quality and competition affecting the Company’s

business; the risk of natural disasters and future catastrophic events

including terrorist related incidents; and other factors

discussed in the Company’s Annual Report on Form 10-K for the year ended December 31,

2010 and in subsequent reports filed on Form 10-Q and Form 8-K.

We can give no assurance that any of the events anticipated by

the forward-looking statements will occur or, if any of them

does, what impact they will have on our results of operations and financial condition. We

disclaim any intent or obligation to publicly update or revise any

forward-looking statements, regardless of whether new

information becomes available, future developments occur or otherwise, except as required by

law.

2

Cautionary and Forward Looking Statements |

3

Headquarters:

Hopkinsville, Kentucky

18 branches: 11 in Kentucky; 7

in Tennessee

Total Assets:

$1.07 billion

Common

Stockholders’

Equity:

$108.3 million

Total Loans:

$594.7 million

Total Deposits:

$833.9 million

Source: SNL Financial LC and Company reports

Financials as of March 31, 2011

Company Profile |

4

Experienced Management

Our management team has over 125 years of combined industry

experience and strong ties to the Western Kentucky and Middle

Tennessee markets

Years with

Industry

Name

Position

HFBC

Experience

Previous experience

John Peck

President & CEO

11

30

President and CEO of United Commonwealth Bank

President of Firstar Bank-Calloway County

Mike Woolfolk

Chief Operating Officer

11

39

President of Firstar Bank-Marshall County

Senior Vice President of Operations of Citizens Bank

Billy Duvall

Chief Financial Officer

10

21

Auditor with Rayburn, Betts & Bates, P.C.

Examiner with National Credit Union Administration

Michael Stalls

SVP & Chief Credit Officer

8

37

Senior Lending Officer at Regions Bank (Southern TN)

|

5

Business Strategy

Focus on relationship banking

We operate our franchise in a manner that provides local decision

making in our retail offices We have a local market president

and a local market advisory board within our larger markets Focus

on our existing market footprint Our markets are ideal for a

community bank as they provide both stability and growth Ft.

Campbell military base, located within our markets, is a major source of stability

Considerable population growth is projected for both the Clarksville

and Nashville MSAs Take advantage of our unique position as a

middle market player Our primary competitors are either large

regional banks or smaller community banks We are small enough

to present ourselves to our customers as a locally-based community bank, yet

large enough to attract businesses that require a larger capital

base to service their needs

Continue to reposition our balance sheet

In the last ten years we have transformed our Bank from a traditional

mutual savings bank into a highly diversified financial

institution We believe that the continued diversification of our

loan portfolio and improved

deposit mix will result in improved operating results

We distinguish our self from our competition by offering comprehensive

banking services to businesses and individuals in our markets with

personalized service |

Summary

Rationale

Pricing date: June 16, 2010

Gross proceeds: $32.4 million (including

overallotment)

Price per share: $9.00

Shares issued: 3,583,334

Shares issued / total shares: 49.9%

Price/ pro forma tang. book value: 69.0%

2% Stock Dividend September 30, 2010

Further strengthens our balance sheet and

regulatory capital ratios

Supports ongoing and future growth

Eventual redemption of our TARP preferred

capital

Current Pricing Multiples

Stock Price (as of 6/05/11):

$9.37

TBV ($12.17):

68.6%

Source: SNL Financial LC and Company reports

6

2010 Common Stock Offering |

Balance Sheet Strength

Consolidated Capital Ratios

Asset Quality as of March 31, 2011

Tier 1 Capital Ratio

(1)

:

10.94%

RBC Ratio

(1)

:

19.27%

TCE / TA:

8.47%

Non-accrual loans / Loans:

1.02%

Performing TDRs / Loans:

1.38% NPAs / Total assets:

Including TDRs:

2.17%

Excluding TDRs:

1.41%

LLR / Non-accrual loans:

229%

LLR / Total loans:

2.35%

(1) Includes $18..4 million in TARP preferred equity

7 |

Market Areas –

Clarksville/Hopkinsville

8 Offices in 4 counties

Clarksville, TN is ninth fastest

growing city in United States

Entire market area home to Ft.

Campbell Army Base with 22,000

active personnel –

largest employer

in TN and KY

“Green Energy Corridor”

–

future

home of Hemlock Semiconductor

Diverse agricultural production –

corn, wheat, soybeans, cattle and

tobacco

Strong retail and service industries

Home to Austin Peay State

University with 10,000+ students

Recognized for growth potential,

talented labor pool and affordable

living

Clarksville/Hopkinsville MSA Market Share

(1)

(1) Source: FDIC Summary of Deposit data as of June 30, 2010

Institution Name

Number

Deposits

Market

Market

Of

In

Share

Rank

State

Offices

Market

Percent

1

PLANTERS BANK INC

KY

8

422,909

13.13%

2

F&M BANK

TN

9

410,122

12.74%

3

HERITAGE BANK

KY

7

364,325

11.32%

4

REGIONS BANK

AL

7

343,073

10.66%

5

BRANCH BANKING&TRUST CO

NC

6

257,748

8.01%

6

LEGENDS BANK

TN

6

249,970

7.76%

7

U S BANK NATIONAL ASSN

MN

12

245,376

7.62%

8

FIRST FEDERAL SAVINGS BANK

TN

5

218,468

6.79%

9

BANK OF AMERICA NA

NC

6

203,812

6.33%

10

GREENBANK

TN

5

122,550

3.81%

11

CUMBERLAND BANK&TRUST

TN

5

120,076

3.73%

12

UNITED SOUTHERN BANK

KY

4

117,757

3.66%

13

BANK OF CADIZ&TRUST CO

KY

4

72,992

2.27%

14

INTEGRA BANK NATIONAL ASSN

IN

2

69,995

2.17%

15

FORT SILL NATIONAL BANK

OK

1

645

0.02%

TOTALS

87

3,219,818

100.00%

8 |

Market Areas –

Western Kentucky

6 Offices in 3 counties

Significant agricultural base

with prominent wheat, corn

and soybean production

Light manufacturing

Tourism focused on

Kentucky Lake and Land

Between the Lakes

Home to Murray State with

10,000+ students

Market Share

Fulton, Marshall and Calloway Counties

(1)

(1) Source: FDIC Summary of Deposit data as of June 30,

2010 Market

Number of

In Market

Market

Ranking

Institution Name

State

Offices

Deposits

Share

1

CFSB

KY

6

361,920

23.47%

2

HERITAGE BANK

KY

6

359,921

23.34%

3

BB&T

NC

4

207,650

13.46%

4

REGIONS BANK

KY

5

189,480

12.29%

5

MURRAY BANK

KY

2

177,834

11.53%

6

U.S. BANK N/A

OH

3

108,332

7.02%

7

CITIZENS BANK

KY

2

77,530

5.03%

8

REELFOOT BANK

KY

1

32,938

2.14%

9

FIRST KENTUCKY BANK

KY

2

16,772

1.09%

10

FNB BANK

KY

1

7,757

0.50%

11

BANK OF CADIZ

KY

1

1,475

0.10%

12

WOODFOREST BANK

TX

1

545

0.04%

GRAND TOTAL

34

1,542,154

100.00%

9 |

10

Market Areas –

Middle Tennessee

3 Offices in Cheatham County

and 1 in Houston County

Cheatham County is in

Nashville MSA and currently

serves as a Nashville bedroom

community

Light manufacturing

Management values good

deposit mix, long term growth

prospects and proximity to

Nashville

Nashville MSA Market Share

(1)

(1) Source: FDIC Summary of Deposit data as of June 30, 2010

Number

Deposits

Market

Offices

in

Market

Rank

Institution Name

State

In Market

Market

Share

1

REGIONS BANK

AL

66

6,610,975

17.79%

2

BANK OF AMERICA NA

NC

38

5,940,444

15.98%

3

SUNTRUST BANK

GA

56

4,332,099

11.66%

4

PINNACLE NATIONAL BANK

TN

30

3,557,595

9.57%

5

FIRST TENNESSEE BANK NA

TN

48

1,975,700

5.32%

6

FIFTH THIRD BANK

OH

30

1,466,635

3.95%

7

WILSON BANK&TRUST

TN

20

1,248,176

3.36%

8

TENNESSEE COMMERCE BANK

TN

1

1,244,551

3.35%

9

U S BANK NATIONAL ASSN

OH

52

1,066,240

2.87%

10

WELLS FARGO BANK NA

SD

12

833,982

2.24%

48

HERITAGE BANK

KY

3

61,537

0.17%

60

Grand Total

564

37,169,372

100.00% |

Over the last 10 years, we have transformed our franchise from traditional

mutual to a vibrant community bank

Dec. 2000

Dec. 2008

Mar.2011

(Dollars in Thousands)

Non-interest bearing

3,828

2.3%

57,134

8.0%

$72,503

8.7%

Interest bearing

checking

9,527

5.7%

89,549

12.6%

135,785

16.3%

Total checking

13,355

8.0%

146,683

20.6%

208,288

25.0%

MMDA & Savings

34,371

20.8%

58,374

8.2%

67,012

8.0%

Time Deposits

Retail < 100K

103,446

62.5%

289,063

40.5%

349,269

41.9%

Retail > 100K

14,432

8.7%

218,885

30.7%

121,962

14.6%

Brokered

---

---

---

---

87,372

10.5%

Total time deposits

117,878

71.2%

507,948

71.2%

558,603

67.0%

Total deposits

165,604

100.0%

713,005

100.0%

$833,903

100.0%

Franchise Transformation -

Funding

11 |

Deposit Portfolio

Total Deposit Growth ($M)

Marketing campaign focused

on increasing our market share

of checking accounts that

began in 2008 has netted 4,000

new noninterest bearing

checking accounts in each of

the last three years

Our base of core deposits has

been a driver of our net interest

margin and profitability

throughout our recent history

Company is reducing

outstanding balances of

brokered deposits and FHLB

borrowings.

Source: SNL Financial LC and company reports

12 |

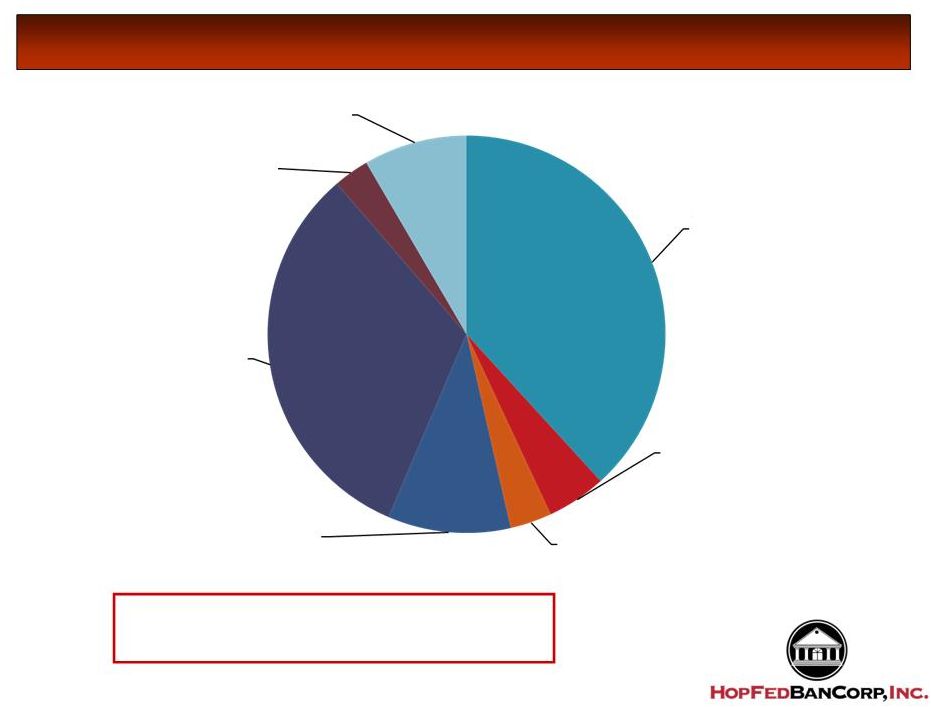

Deposits at March 31, 2011

Cost of Deposits

1

st

Qtr. 2010 Overall Cost of Deposits: 2.27%

1

st

Qtr. 2011 Overall Cost of Deposits: 1.86%

13 |

Dec.2000

Dec.2008

Mar.2011

(Dollars in Thousands)

Loans:

1-4 family

$93,147

71.1%

$223,598

35.3%

$227,137

38.2%

Multi-family

2,841

2.2%

36,857

5.8%

28,664

4.8%

Non-residential real estate

21,695

16.6%

162,980

25.7%

191,673

32.3%

Construction & Development

5,729

4.4%

122,500

19.3%

79,578

13.4%

Commercial

946

0.7%

64,595

10.2%

50,076

8.4%

Franchise Transformation -

Lending

14 |

15

Loans at March 31, 2011

Total Loans:

$594.3 million

Weighted Average

Yield:

5.73%

1 -

4 family

38%

5%

Constr.

3%

Land

10%

CRE

32%

Consumer

3%

C&I

9%

Multi-family |

Loan Concentrations / Risk Based Capital

(Dollars in Thousands)

Outstanding

% of Total

% of Risk

Balance

Loans

Based Capital

Consumer

$17,218

2.9%

13.8%

RE - 1 - 4 family

227,137

38.3%

182.0%

Multi-family

28,664

4.8%

23.0%

CRE (investor)

28,402

4.8%

22.8%

CRE (owner occupied)

163,271

27.5%

130.8%

Construction

20,164

3.4%

16.2%

Land & land development

59,414

10.0%

47.6%

C&I

50,076

8.4%

40.1%

Total

$594,346

100.0%

518.4%

Consolidated Risk Based Capital

$124,816

16 |

Loans Past Due 30 -

89 Days

17 |

Non-Performing Loans / Total Loans

18 |

Non-Performing Assets/ Total Assets

19 |

Allowance / Total Loans

20 |

Net Interest Margin

21 |

(1) Excludes goodwill impairment and foreclosed property expense.

(2) KY Banks & Thrifts include all banks and thrifts headquartered in

Kentucky that are listed on a major stock exchange. 0.69%

0.56%

0.53%

0.55%

0.74%

0.09%

0.00%

0.25%

0.50%

0.75%

1.00%

1.25%

1.50%

2005

2006

2007

2008

2009

YTD

61.95%

70.66%

73.30%

69.84%

66.88%

62.58%

40.00%

50.00%

60.00%

70.00%

80.00%

2005

2006

2007

2008

2009

YTD

2.61%

2.71%

2.89%

3.06%

2.97%

3.28%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

2005

2006

2007

2008

2009

YTD

9.24%

8.33%

7.65%

7.84%

8.08%

1.18%

0.00%

2.50%

5.00%

7.50%

10.00%

12.50%

15.00%

2005

2006

2007

2008

2009

YTD

Return on Average Equity

Net Interest Margin

Efficiency Ratio

(1)

Return on Average Assets

HopFed Bancorp, Inc.

KY Banks & Thrifts

(2)

Source: SNL Financial LC and company reports

22

Historical Performance |

Why Invest in HopFed Bancorp, Inc.

History of strong financial performance

We have remained profitable during the recent economic downturn and

believe that we are positioned to take advantage of future

growth opportunities Strong Asset Quality

Our asset quality metrics have remained superior to our peers

Experienced Management Team

We

have

an

experienced

and

energetic

management

team

with

strong

relationships

in

our market areas

Disciplined approach to internal and external growth

We

are

confident

in

our

ability

to

successfully

integrate

future

branch

or

whole

bank

acquisitions as well as grow through de novo branches

Attractive Entry Point

Opportunity to invest in a high quality franchise with a proven track

record and at a significant discount to tangible book value and

peer trading multiples We believe there will be exceptional

opportunities for responsible strategic growth in our market

areas 23 |

Appendix: Company History

1879:

The Bank was founded under the name Hopkinsville Building and Loan

Association 1940:

The Bank converted to a savings association and began insuring

deposits 1983:

The Bank became a federal mutual savings bank

1997:

HopFed Bancorp, Inc. was incorporated under the laws of Delaware

1998:

The Bank converted from a federal mutual savings bank to a federal

stock savings bank and the Company became listed on the

NASDAQ 2000:

John E. Peck named President and Chief Executive Officer

2002:

Bank

changed

name

from

Hopkinsville

Federal

Savings

Bank

to

Heritage

Bank

2002:

Acquired two branch offices in Fulton, Kentucky from Old National

Bancorp 2006:

Acquired four branch offices in Middle Tennessee from AmSouth

Bancorp 2006:

Opened first of three branch offices in Clarksville, Tennessee

2008:

Issued $18.4 million of Series A Preferred Stock under

CPP to the Treasury

June 2010:

Completed sale of 3,583,334 shares of common stock

We

are

a

Kentucky-based

unitary

savings

and

loan

holding

company.

Our

wholly-owned savings bank subsidiary is Heritage Bank.

24 |

John E. Peck

Billy C. Duvall

President & Chief Executive Officer

SVP & Chief Financial Officer

(270) 887-8401

(270) 887-8404

john.peck@bankwithheritage.com

billy.duvall@bankwithheritage.com

25 |