Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENCORE CAPITAL GROUP INC | d8k.htm |

2011 Investor Day

June 9, 2011

Exhibit 99.1 |

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

2

FORWARD-LOOKING STATEMENTS

The statements in this presentation that are not historical facts, including, most

importantly, those statements preceded by, or that include, the words “may,”

“believe,” “projects,” “expects,” “anticipates” or the

negation thereof, or similar expressions, constitute “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform

Act”). These statements may include, but are not limited to, statements

regarding our future operating results and growth. For all “forward-looking

statements,” the Company claims the protection of the safe harbor for forward-looking

statements contained in the Reform Act. Such forward-looking statements involve

risks, uncertainties and other factors which may cause actual results, performance or

achievements of the Company and its subsidiaries to be materially different from any future

results, performance or achievements expressed or implied by such forward-looking

statements. These risks, uncertainties and other factors are discussed in the reports filed by

the Company with the Securities and Exchange Commission, including the most recent reports on

Forms 10-K, 10-Q and 8-K, each as it may be amended from time to time. The

Company disclaims any intent or obligation to update these forward-looking

statements.

|

INVESTMENT HIGHLIGHTS

3

•

Investments made over the past few years have driven

significant improvements in collections, cash flow and earnings

•

Difficult regulatory environment being managed proactively

•

Expanding presence in India, combined with new strategic

initiatives, are expected to continue increasing cash flow from

operations

•

Demonstrated ability to raise and profitably deploy capital in

favorable and unfavorable business cycles |

PRESENTING TODAY

4

Brandon Black

President and Chief Executive Officer

Paul Grinberg

EVP, Chief Financial Officer

Amy Anuk

VP, Business Development

Manu Rikhye

Managing Director, India Operations |

ENCORE

IS A LEADER IN THE CONSUMER DEBT BUYING AND RECOVERY INDUSTRY

5

Revenue Composition

As of March 31, 2011

Global Capabilities

Debt Purchasing & Collections

Bankruptcy Servicing

•

Purchase and collection

of

charged-off unsecured

consumer receivables

(primarily credit card)

•

Robust business model

emphasizing consumer

intelligence and

operational

specialization

•

Invested ~$1.9 billion to

acquire receivables with a face

value of ~$58 billion since

inception

•

Acquired ~34 million consumer

accounts since

inception

•

Process secured consumer bankruptcy accounts for leading

auto

lenders and other financial institutions

•

Proprietary software dedicated to bankruptcy servicing

•

Operational platform that integrates lenders, trustees,

and

consumers

St Cloud, MN

Arlington, TX

Phoenix, AZ

Delhi, India

Call Center /

Technology Site

Call Center Site

Ascension

Call Center Site

San Diego, CA

Headquarters/

Call Center Site

Debt Purchasing & Collections

Bankruptcy Servicing |

THE

COMPANY’S FINANCIAL RESULTS OVER THE PAST TWO YEARS HAVE BEEN STRONG

6

2010

2009

YOY Growth

Annual Variance

$605

$117

24%

$488

Collections

$381

$65

21%

$316

Revenue

$347

$82

31%

$265

Adjusted EBITDA*

$362

$105

41%

$257

Purchases

$1.95

$0.58

42%

$1.37

EPS

($ millions, except EPS and ratios)

*

Adjusted EBITDA is a non-GAAP number. The Company considers Adjusted EBITDA to

be a meaningful indicator of operating performance and uses it as a measure

to assess the operating performance of the Company. See Reconciliation of Adjusted EBITDA to GAAP Net Income at the end

of this presentation.

Q1 11

$191

$110

$116

$91

$0.54

Q1 10

$141

$87

$83

$82

$0.44 |

WE HAVE

GENERATED STRONG RESULTS DESPITE THE MACROECONOMIC DOWNTURN

7

($ millions)

*

Adjusted EBITDA is a non-GAAP number. The Company considers Adjusted EBITDA to

be a meaningful indicator of operating performance and uses it as a measure to

assess the operating performance of the Company. See Reconciliation of Adjusted

EBITDA to GAAP Net Income at the end of this presentation **

LTM data as of 03/31/2011

Adjusted EBITDA* and Gross Collections by Year |

STRATEGIC DECISIONS MADE OVER THE PAST DECADE

DEMONSTRATE OUR ABILITY TO FORESEE AND ADAPT TO CHANGES

8

•

Established our operating

center in India

•

Created an activity-level cost

database

•

Built and implemented the

industry’s first known ability-to-

pay (capability) model

Overconfidence and

Irrational Pricing

2005

2007

2006

2008

•

Created first generation

consumer-level underwriting

models

An Emerging

Market

Demand

Supply

2001

2002

2003

2004

Attractive

Opportunities

2009

2010

2011

•

Expanded access to

capital |

WE HAVE

ALSO POSITIONED OURSELVES TO ADDRESS REGULATORY CHALLENGES AS THEY EMERGE

Building a consumer intelligence platform, focused on

financially distressed consumers, that can inform policy

discussions and identify strategies to promote financial

recovery

Revamped our consumer relations process and introduced

a Consumer Bill of Rights

Met with leadership of the CFPB and the staff of key federal

and state legislators

Hired a government relations firm and lobbyists in key

states

9

Consumer

Alignment

Regulatory

Outreach

Advisors

Analytics |

OUR

BUSINESS MODEL IS CRITICALLY IMPORTANT, AS IT PROVIDES THE CONSUMER WITH TIME

TO RECOVER 10

Timeframe

Process and

relationship

with consumers

Outcome

•

Charge-off threshold

extends a maximum of

6 months

Transactional

•

Attempt immediate

resolution during

delinquency cycle

(days 30 –

180)

•

Consumer is “charged-

off”

by issuer on day 181

•

Issuer offers to sell

unsecured, charged-off

debt or service through

3rd party agencies

ORIGINAL

CREDITOR

•

Four-to-six month

collection cycle

Pressured

•

Artificial deadlines

•

Multiple collection

companies

•

Counterproductive

incentive structure

•

Consumer is

confused and

frustrated

CONTINGENCY

COLLECTION

AGENCY

•

Consumer has 84 months

to recover financially

Partnership

•

Create partnership strategy

and set goals

•

Tailor work strategies to

individual circumstances,

giving them time for a

consumer to recover

•

Maximizes likelihood of

repayment, creates

consistency, and ensures

that consumers are treated

fairly |

OUR

LONG-TERM MODEL HAS ALLOWED MORE THAN TWO MILLION CONSUMERS TO MOVE

TOWARD FINANCIAL RECOVERY 11

Consumers with Whom We Have Partnered to Retire Their Debt (Cumulative)

|

WE

HAVE TAKEN A LEADERSHIP STANCE BY OUTLINING OUR CORE PRINCIPLES IN AN

INDUSTRY-FIRST CONSUMER BILL OF RIGHTS 12 |

A

Closer Look at Our Consumers and Our Financial Results

|

OUR

BUSINESS MODEL DEPENDS UPON A VERY SMALL PERCENTAGE OF PAYERS

14

Portfolio Face Amount

$15,000,000

Average Balance

$3,000

Number of Accounts

5,000

Purchase Factor

$0.05

Purchase Price

$750,000

Projected Return (2.5x)

$1,875,000

As a result, we only need 19% of all consumers to

pay us two-thirds of what they owe, over a seven

year period, to achieve significant returns

ILLUSTRATIVE |

TRYING

TO UNDERSTAND AND PREDICT BEHAVIOR IS EVEN MORE DIFFICULT WHEN IT OCCURS

INFREQUENTLY 15

5% -

9%

(350 consumers)

Purchased portfolio

(5,000 consumers)

Payers in

year 1

2% -

3%

(125 consumers)

Payers in

year 3

Payers in

year 5

~1%

(50 consumers) |

Metric

Recent trend

•

Payer rates

•

Upward

•

Average payment size

•

Stable

•

Payment style

•

More payment plans

•

Broken payer rates

•

Mild improvement

•

Settlement rates

•

Stable

16

OUR CONSUMERS HAVE SHOWN THAT THEY ARE RESILIENT DESPITE

THE MACROECONOMIC ENVIRONMENT |

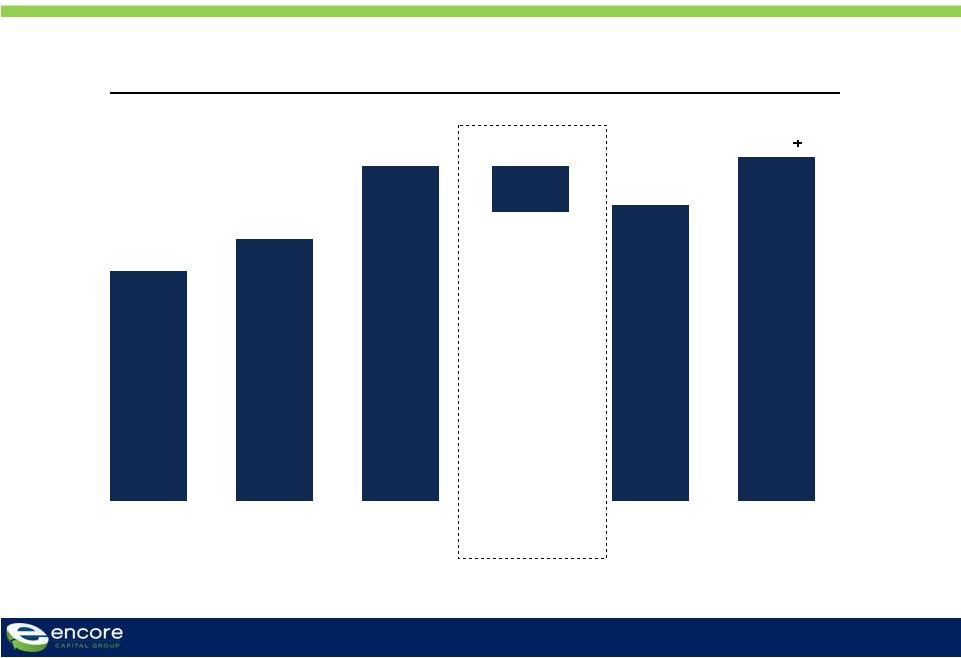

17

Overall Payer Rate For All Active Inventory

PAYER RATES HAVE ACTUALLY INCREASED OVER THE PAST FEW

YEARS

2008

2009

2010

2011 |

AVERAGE PAYMENT SIZE REMAINS CONSISTENT, EVEN AS PAYMENT

PLANS CONTINUE TO BE THE NORM

18

Average Payment Size For All Paying Accounts

2009

2010

2011

2008

Single Settlement Payers as a Percentage of

Total Payers

2009

2010

2011

2008 |

OUR

CONSUMERS ARE HONORING THEIR OBLIGATIONS AND SETTLING THEIR ACCOUNTS AT RATES

CONSISTENT WITH PAST PERIODS Overall

“Broken”

Payer

Rate,

Excluding

Settled Accounts Through Time

19

Legal Settlement Rate

2009

2010

2011

2008

2009

2010

2011

2008 |

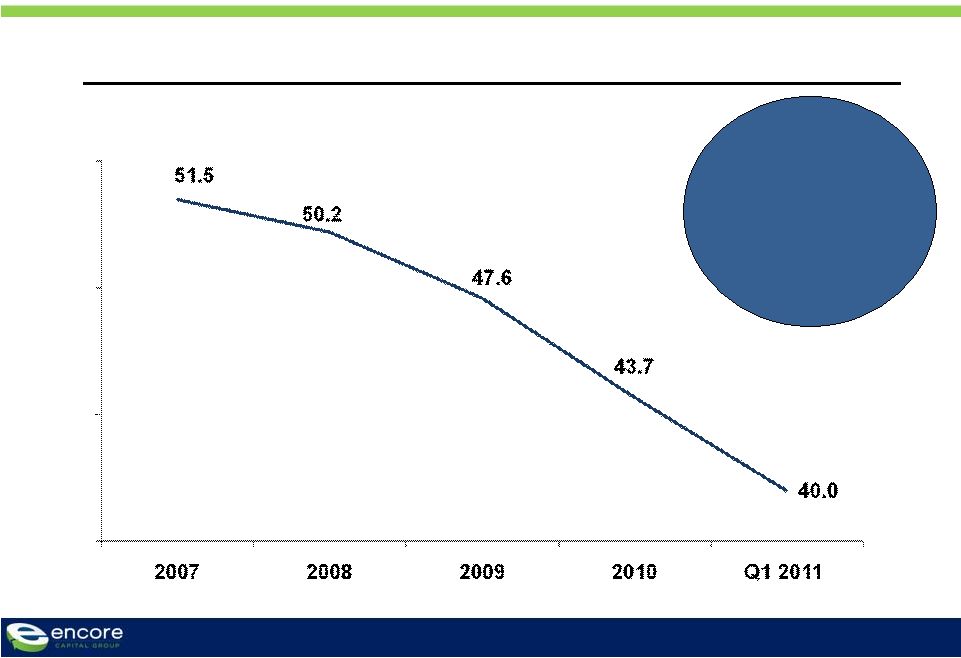

WE

HAVE

FUNDAMENTALLY

CHANGED

THE

COST

STRUCTURE

OF

THE COMPANY OVER THE PAST FOUR YEARS

20

Overall Cost-to-Collect

(%)

An 1150 basis point

reduction in cost-to-

collect translated into

$22 million in cost

savings in Q1 2011 |

LED BY

OUR INDIA CENTER, WHICH IS EXPECTED TO PRODUCE HALF OF ALL 2011 CALL CENTER

COLLECTIONS 21

Collections from all Call Centers

($ millions)

$126

$157

$186

$268

Percent

of Total:

10%

19%

30%

44%

~$340

50% |

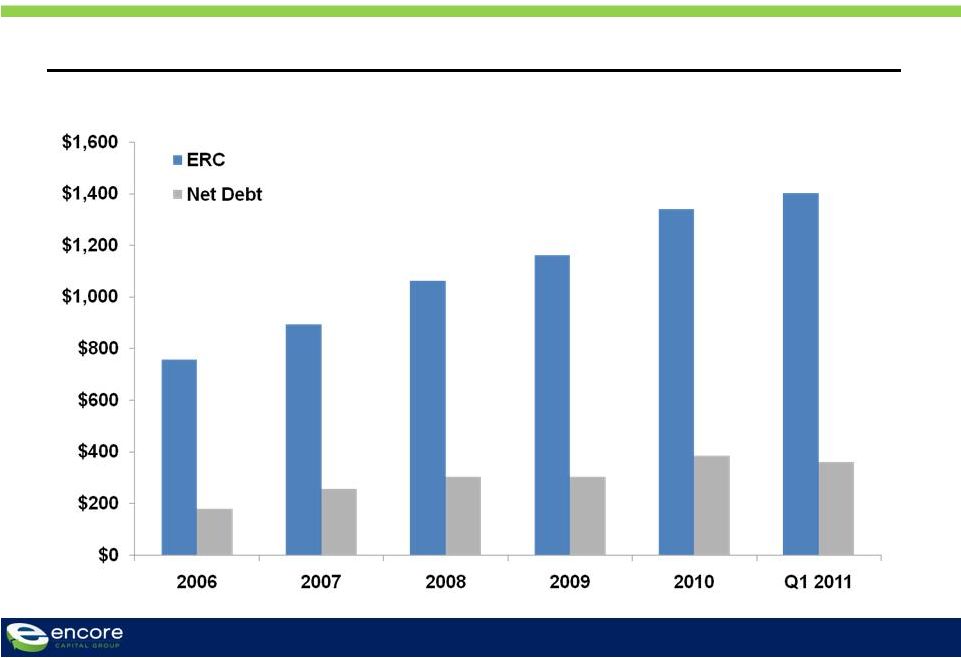

WE

CONTINUE TO BUILD A SUBSTANTIAL RESERVOIR FOR THE FUTURE

22

Annual Estimated Remaining Gross Collection (ERC) and Total Debt

($ millions, at end of period) |

WE

BELIEVE THAT OUR CURRENT ESTIMATE OF REMAINING COLLECTIONS IS

CONSERVATIVE 23

Cumulative Collections (initial expectation vs. actual)

($ millions, March 01 –

March 11)

Actual cash

collections

Initial

projections |

WE

ADJUST IRRS OVER TIME TO REFLECT OVER-PERFORMANCE 24

Purchase Period

Q1 2009

Q2 2009

Q3 2009

Q4 2009

IRR at purchase

4.2%

4.4%

4.4%

4.4%

Current IRR*

5.8%

6.0%

8.0%

7.3%

Average life-to-date IRR*

4.9%

5.2%

6.2%

6.3%

*As of 3/31/2011 |

FROM A

CAPITAL PERSPECTIVE, WE HAVE SIGNIFICANT ROOM TO GROW THE BUSINESS

($ millions)

Cash flow leverage ratio

Debt

Trailing 4-quarter adjusted EBITDA*

Debt/Adj. EBITDA [Maximum 2.0x]

Minimum net worth

Total stockholders' equity

Minimum net worth

Excess room

Interest coverage ratio

Trailing 4-quarter EBIT

Trailing 4-quarter consolidated interest expense

EBIT/Interest expense [Minimum 2.0x]

303.1

264.6

1.15

243.1

183.0

60.1

69.9

16.2

4.3

2010

385.3

346.7

1.11

302.7

207.6

95.1

97.0

19.3

5.0

Q1 2011

382.4

380.4

1.01

318.8

214.4

104.4

103.1

20.4

5.1

2009

Based on our

cash flow and

LTM Adj.

EBITDA, our

leverage ratio

would allow us

to increase total

debt to $761

million, nearly

double the

present level

Covenant Analysis

25

Aggregate Revolving Loan Commitment

Drawn on Line of Credit

300.0

410.5

327.0

360.5

260.0

327.5

*

Adjusted EBITDA is a non-GAAP number. See Reconciliation of Adjusted EBITDA to

GAAP Net Income at the end of this presentation |

We

Continue to Invest in the Future |

Full Year Purchases for 2008 –

2010, 2011 Estimate

WE ARE EXPECTING 2011 TO BE ANOTHER YEAR OF STRONG

PURCHASING GROWTH

27

$62

2011E

$380

($ millions)

2008

$230

2009

$257

2010

$362

2010 Adj.

$316

Large December

Purchase

($46) |

OUR

ABILITY TO INCREASE PURCHASES IS A RESULT OF NOT BEING LIMITED TO A PARTICULAR

ASSET CLASS OR AGE OF RECEIVABLE 28

Historical Purchase Mix by Year, 2011 Estimate

($ millions) |

TELECOM RECEIVABLES WILL BE AN AREA OF PURCHASING FOCUS IN

2011, WHICH WE HAVE EVOLVED INTO A COMPETITIVE STRENGTH

29

•

Historical telecom challenges

–

U.S. based servicing inflated

cost-to-collect

–

Long-term liquidation was over-

estimated

–

Prices were higher

•

As a result, our early investments

yielded lower-than-expected IRRs

Historical Telecom Cost-to-Collect

2005 -

2007 Purchases |

LOWER

SERVICING COSTS AND TARGETED COLLECTION EFFORTS HAVE DRAMATICALLY IMPROVED

TELECOM PROFITABILITY Telecom Servicing Costs

Cost-to-collect

Telecom IRRs

%

30

2005-2007

2011

> 20%

Shorter collection curve duration

Servicing in India

Better operational models

Expect to deploy $30 million in 2011 |

Our

India Operation Continues to be a Competitive Advantage

|

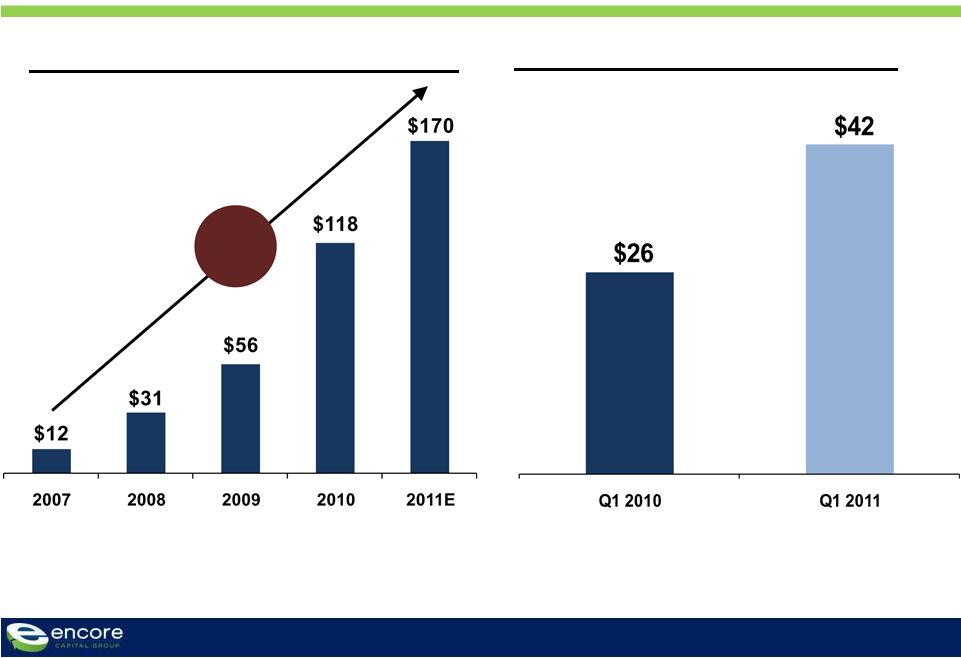

32

India Collections*

($ Millions)

* Includes all collections on accounts maintained by the India site

QoQ India Collections

($ millions)

2011 IS SHAPING UP TO BE ANOTHER YEAR OF SUBSTANTIAL

COLLECTIONS GROWTH FOR OUR OPERATIONS IN INDIA

93%

CAGR |

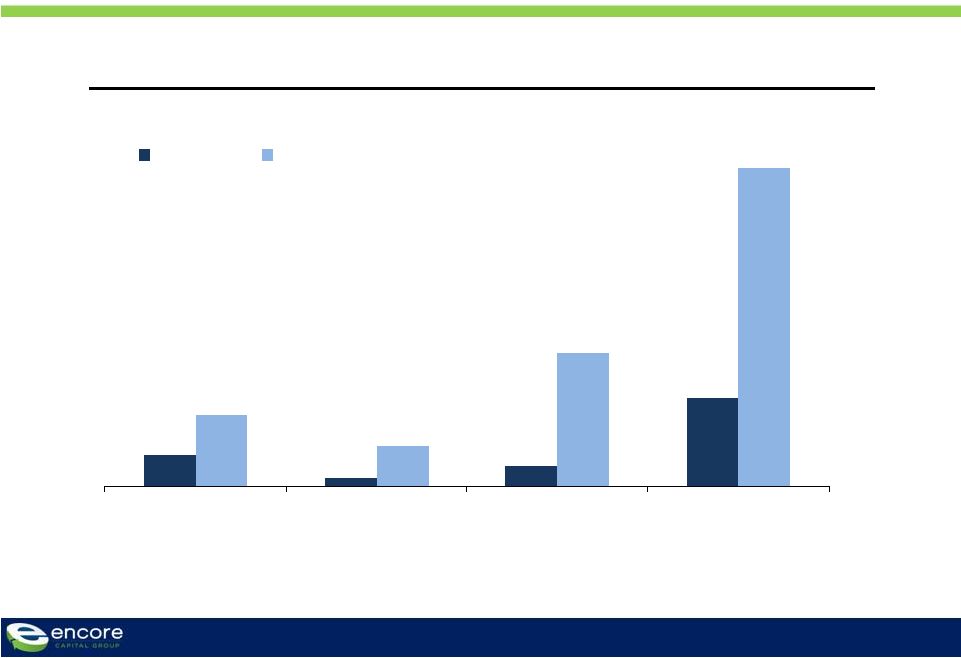

Encore India Account Manager Headcount and Indicative Cash Average

Headcount (number); Cash average (indicative)

MUCH OF THE GROWTH IS DRIVEN BY OUR MATURING WORKFORCE

33

0

5

10

15

20

25

30

50

100

150

200

250

300

350

400

0-3 Months

4-6 Months

7-15 Months

15+ Months

Dec 2010

Mar 2011

Indicative cash average

- |

34

DESPITE

LOCAL

WAGE

INFLATION,

WE

HAVE

BEEN

ABLE

TO

MAINTAIN

OUR TOTAL COST PER EMPLOYEE

* Cost per FTE includes all India site costs

Monthly Cost per Account Manager (FTE)*

($) |

35

11

3

7

31

25

14

47

113

Customer Support

MIS/ Analytics

IT

Bankruptcy

Servicing

Dec 2007

Mar 2011

Encore India Non-Collection Headcount Growth

(Count )

TODAY, INDIA IS MUCH MORE THAN A CALL CENTER |

36

2007

2009

2011

Local Support

Global Support

7

9

9

47

•

Only supporting the India site

•

First programmers hired in 2008

•

Added server administrators,

telecommunications’

specialists

and software quality assurance

team

•

All helpdesk functionality for

Encore handled in India

AND IS SUPPORTING OUR TECHNOLOGY NEEDS IN BOTH THE U.S.

AND INDIA

India IT Diversification

(Count )

Our India IT

staff provides

similar cost

savings to their

AM

counterparts |

37

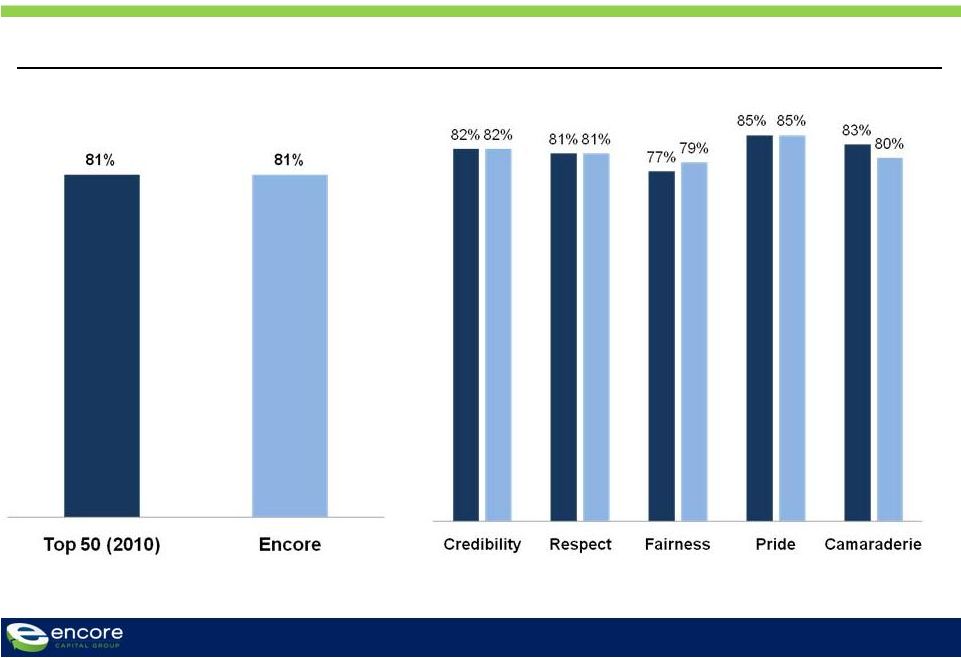

WE ASPIRE TO BECOME ONE OF INDIA’S LEADING EMPLOYERS, AS

DEFINED BY THE GREAT PLACE TO WORK INSTITUTE (GPTW)

Trust

Relationship

between

employees and

management

Pride

Relationship

between

employees and

Encore

Camaraderie

Relationship

between

employees

themselves |

38

WHILE THE RESULTS HAVE NOT BEEN ANNOUNCED, OUR SCORES

COMPARE FAVORABLY TO THE TOP 50 EMPLOYERS

GPTW Survey Results Comparing Encore’s 2011 Results to the 2010 Winners

(% favorable) |

Analytic-based Insights Driving

Performance |

WE

BELIEVE LONG-TERM PROFITABILITY IN THIS INDUSTRY WILL BE DRIVEN BY

EXCELLENCE IN THREE KEY AREAS 40

Consumer-

level

underwriting

Superior

collection

approach

Low-cost

collection

platform |

TO SUCCEED IN THOSE

AREAS, YOU MUST UNDERSTAND THE CONSUMER

41

Strong partnership

opportunities

with

willing

and

able

consumers

Our attempts to contact or

work with consumers are

typically ignored,

and

the

legal

option becomes necessary

Hardship

strategies

Offer

significant

discounts

and plans

that accommodate

many small payments

Remind consumers of their

obligation

through

legal

communications

Focus

on

payment

plans

and

opportunities to build longer

relationships

with

consumers

Willingness to pay

Is the debtor willing to resolve the debt on fair terms?

HIGH

HIGH

LOW

LOW |

OUR

STRONG PORTFOLIO PURCHASING TRACK RECORD IS DRIVEN BY AN UNDERWRITING MODEL

FOCUSED ON INDIVIDUAL CONSUMERS 42

Deal Accuracy Since 2000

858

Total purchase

transactions

809

Total

profitable

deals

(39)

Principal not

fully recovered

(Count based on actual results plus forecast)

Principal recovered,

but not all servicing

costs

(10)

Since 2000, 94%

of our portfolio

purchases have

been profitable |

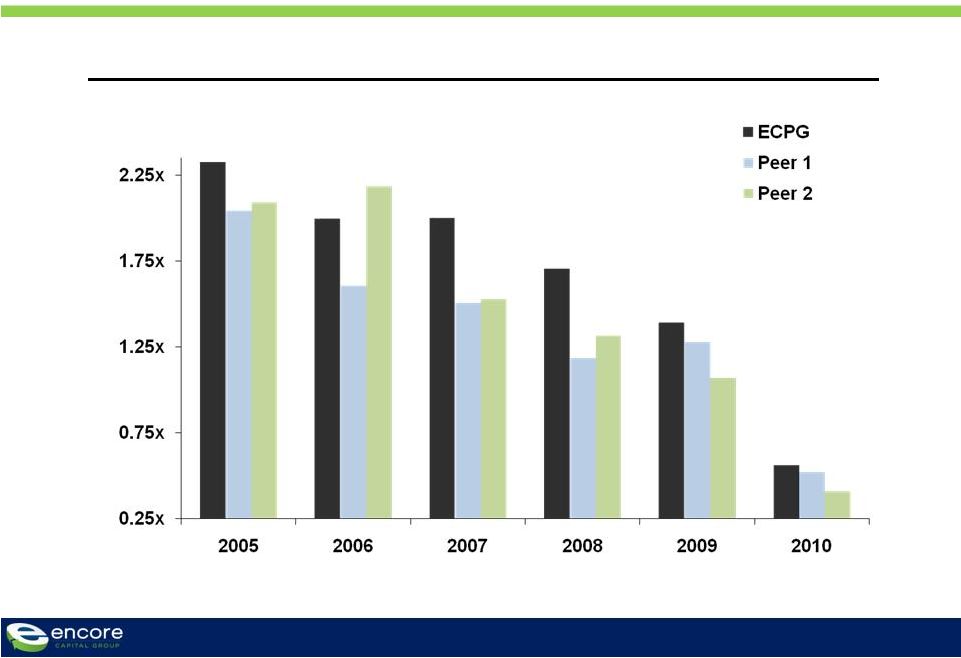

PURCHASING ACCURACY AND OUR ANALYTIC OPERATING MODEL

HAVE LED US TO CONSISTENTLY OUTPERFORM OUR PEERS

43

Cumulative Actual Collection Multiples by Vintage Year as of March 31, 2011

(Total Collections / Purchase Price)

Source: SEC Filings, Encore Capital Group Inc. |

New

Strategic Initiatives That Will Leverage Our Strengths

|

WE ARE

IN THE PROCESS OF BUILDING UPON OUR PRIOR SUCCESSES WITH POWERFUL STRATEGIC

INITIATIVES 45

Drive a meaningful portion of our legal

collections through internal resources

1.

Diversify our legal

platform

Create a world class near-shore facility

2.

Capture incremental

value through

increased offshore

activities

Collaborate with accomplished academics to

extend our deep consumer knowledge

3.

Develop new insights

about our consumers |

WE

HAVE CONSISTENTLY ENHANCED OUR LEGAL COLLECTION INFRASTRUCTURE

46

2006

2007

2008

2009

2010

Strengthened firm

management processes

and operational support

to firms

Further strengthened

infrastructure and

governance

Began process of

building an internal legal

collection process

Dramatically increased

volumes to adapt to

changing consumer

behavior

Implemented new

placement models to

better optimize returns

2011

Considered, but rejected,

the idea of building an

internal process |

THESE

IMPROVEMENTS HAVE DRAMATICALLY IMPROVED BOTH COLLECTIONS AND COST TO

COLLECT 47

$193.2

$232.7

$266.8

$88.5

2008

2009

2010

2011 Q1

Legal Collections and Costs as a Percentage of Legal Collections

($ millions)

45.4%

48.4%

41.3%

49.8% |

48

SEVERAL FACTORS DURING LATE 2009 AND EARLY 2010 DROVE THE

DECISION TO BUILD AN INTERNAL LEGAL CAPABILITY

Legal/regulatory

environment

Rationale

for

internal

legal

•

Increased control over consumer

and court interaction

•

Reduced risk from firm failures

•

Ability to deploy our account-level

analytics against legal workflows

•

Champion / challenger approach to

improve performance

•

A 5% collection increase will

generate an incremental $15 million

in annual collections

•

We gain $0.06 in EPS for every 1%

reduction in overall cost

•

•

•

•

State-level legal requirements

changing rapidly

Limited number of firms who are

able to scale their operations

Flaws exposed in the traditional

model, including limited oversight

of service providers

Financial instability led to the

failure of some firms, including the

largest firm at the time |

SINCE

THEN, WE HAVE MADE SIGNIFICANT PROGRESS 49

Hired dedicated legal

teams in 4 states

Developed and deployed

a customized litigation

technology platform

We plan to

operate in 6

states by the

end of 2011

Built a reliable service

provider network

Launched back-office

and collections teams |

IT

WILL TAKE SOME TIME BEFORE THIS INITIATIVE CONTRIBUTES TO THE BOTTOM LINE

50

Number of

states

6

16

25

25

EoY

headcount

80-90

225-250

350-375

350-400

Placements, Collections

(#, $ millions) |

51

Spanish Account Inventory

(in thousands)

WE ARE ALSO ADDRESSING OUR GROWING POPULATION OF

SPANISH-SPEAKING CONSUMERS

Our presence in San

Diego and Phoenix

provides us with a

natural hiring pool, but

hiring cannot keep pace

with inventory growth

US-based Spanish

servicing is challenging

because of labor

availability and cost |

THE

SOLUTION IS BUILDING A NEAR-SHORE CALL CENTER BY LEVERAGING INSIGHTS FROM

OUR SUCCESS IN INDIA 52

We expect this site to increase overall call center capacity by as

many as 300 AMs, at a cost-to-collect under 20%

We are focused on Costa Rica and Panama because of their

proven ability to effectively address the U.S. marketplace

We expect to have the facility up and running in early 2012

|

FINALLY, WE ARE CREATING A CENTER OF EXCELLENCE DEDICATED

TO UNDERSTANDING FINANCIALLY DISTRESSED CONSUMERS

53

A new demographic

segment has emerged

It has unique features, is

growing, and has needs that

are only marginally served

by existing business models

Unique consumer

demographics

Focus on broader

population confounds

efforts to understand

and respond to new

population

Confusing policy

environment

Consumer decisions are

poorly understood, many

voices confuse the

issues, and discussions

often substitute

anecdotes for data

Accelerating industry

maturation

Leading companies now

capable of making

investments in R&D and

integrating their discoveries

Clear educational

opportunities

Strengthen personal finance,

planning, and credit skills

through focused outreach

and expert instruction |

ENCORE’S DEBT RESEARCH INSTITUTE WILL SERVE MULTIPLE

CONSTITUENCIES

54

Create and manage a

tailored suite of programs

that provide significant,

measureable benefit to

consumers

Promote

financial literacy

Conduct research to

understand financially

distressed consumers’

choice, consumptive, and

financial behaviors

Enhance consumer

intelligence

Integrate experimental

psychology and

behavioral finance into

collection practices

Increase collection

efficacy

DEBT

RESEARCH

INSTITUTE |

SUMMARY

55

•

Investments made over the past few years have driven

significant improvements in collections, cash flow and earnings

•

Difficult regulatory environment being managed proactively

•

Expanding presence in India, combined with new strategic

initiatives, are expected to continue increasing cash flow from

operations

•

Demonstrated ability to raise and profitably deploy capital in

favorable and unfavorable business cycles |

APPENDIX |

APPENDIX A: CUMULATIVE COLLECTIONS BY PORTFOLIO VINTAGE

57

Cumulative Collections through March 31, 2011 (000’s)

Year

of

Purchase

Purchase

Price

<2005

2005

2006

2007

2008

2009

2010

2011

Total

CCM

<2005

$385,479

$749,791

$224,620

$164,211

$85,333

$45,893

$27,708

$19,986

$4,352

$1,321,894

3.4

2005

192,585

66,491

129,809

109,078

67,346

42,387

27,210

5,510

447,831

2.3

2006

141,029

42,354

92,265

70,743

44,553

26,201

5,316

281,432

2.0

2007

204,114

68,048

145,272

111,117

70,572

13,460

408,469

2.0

2008

227,885

69,049

165,164

127,799

26,645

388,657

1.7

2009

253,449

96,529

206,773

49,738

353,040

1.4

2010

359,843

125,853

77,752

203,605

0.6

2011

90,355

8,262

8,262

0.1

Total

$1,854,739

$749,791

$291,111

$336,374

$354,724

$398,303

$487,458

$604,394

$191,035

$3,413,190

1.8 |

APPENDIX B: RECONCILIATION OF ADJUSTED EBITDA

58

Reconciliation of Adjusted EBITDA to GAAP Net Income

(Unaudited, In Thousands)

Three Months Ended

Note: The periods 3/31/07 through 12/31/08 have been adjusted to reflect the retrospective application

of ASC 470-20 3/31/07

6/30/07

9/30/07

12/31/07

3/31/08

6/30/08

9/30/08

12/31/08

3/31/09

6/30/09

9/30/09

12/31/09

3/31/10

6/30/10

9/30/10

12/31/10

3/31/11

GAAP net income, as reported

4,991

(1,515)

4,568

4,187

6,751

6,162

3,028

(2,095)

8,997

6,641

9,004

8,405

10,861

11,730

12,290

14,171

13,679

Interest expense

4,042

4,506

4,840

5,260

5,200

4,831

5,140

5,401

4,273

3,958

3,970

3,959

4,538

4,880

4,928

5,003

5,593

Contingent interest expense

3,235

888

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Pay-off of future contingent interest

-

11,733

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Provision for income taxes

3,437

(1,031)

1,315

2,777

4,509

4,225

2,408

(1,442)

5,973

4,166

5,948

4,609

6,490

6,749

6,632

9,075

8,601

Depreciation and amortization

869

840

833

810

722

766

674

652

623

620

652

697

673

752

816

958

1,053

Amount applied to principal on receivable portfolios

28,259

29,452

26,114

29,498

40,212

35,785

35,140

46,364

42,851

48,303

49,188

47,384

58,265

64,901

63,507

53,427

85,709

Stock-based compensation expense

801

1,204

1,281

1,001

1,094

1,228

860

382

1,080

994

1,261

1,049

1,761

1,446

1,549

1,254

1,765

Adjusted EBITDA

45,634

46,077

38,951

43,533

58,488

52,997

47,250

49,262

63,797

64,682

70,023

66,103

82,588

90,458

89,722

83,888

116,400 |