Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF

1934

Date of Report (Date of earliest event reported): June 9,

2011

CADUCEUS SOFTWARE SYSTEMS

CORP.

(Exact name of registrant as specified in its

charter)

| Nevada | 333-144509 | 98-0534794 |

| (State or other jurisdiction of | (Commission File Number) | (I.R.S. Employer Identification |

| incorporation) | No.) |

42a High Street, Sutton Coldfield,

West

Midlands, United Kingdom, B72 1UJ

(Address of principal executive

offices)

+44 0121 695 9585

(Registrant’s telephone

number, including area

code)

______________________________________________

(Registrant’s

former name, address and telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

TABLE OF CONTENTS

Page

2

| Item 1.01 | Entry into Material Definitive Agreement |

| Item 2.01 | Completion of Acquisition or Disposition of Assets |

| Item 3.02 | Unregistered Sales of Equity Securities |

| Item 5.01 | Changes in Control of Registrant |

As used in this Current Report on Form 8-K, unless otherwise stated, all references to the “Company”, “we,” “our” and “us” refer to Caduceus Software Systems Corp.

Licensing Agreement

On June 9, 2011 we entered into a Licensing Agreement with Sygnit Corporation (“Sygnit”). Pursuant to the Licensing Agreement we received an exclusive license to the Cadeus MMS software system developed by Sygnit as well as all peripheral documentation, source code and object code relating to this software and any of its accompanying parts. The license is for a period of 5 years, but if we are able to raise an aggregate of $200,000 in financing within 6 months, the license extends perpetually. As consideration for the license we issued 66,200,000 shares of our common stock and our director, Alexander Dannikov transferred an additional 63,800,000 shares of our common stock to Sygnit. Mr. Dannikov retained 56,200,000 shares of our common stock in his name.

A copy of the Licensing Agreement is attached as Exhibit 10.1 to this Current Report on Form 8-K.

Description of Business

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements. To the extent that any statements made in this report contain information that is not historical, these statements are essentially forward-looking. Forward-looking statements can be identified by the use of words such as “expects”, “plans”, “may,”, “anticipates”, “believes”, “should”, “intends”, “estimates”, and other words of similar meaning. These statements are subject to risks and uncertainties that cannot be predicted or quantified and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, marketability of our products; legal and regulatory risks associated with the share exchange our ability to raise additional capital to finance our activities; the effectiveness, profitability and; the future trading of our common stock; our ability to operate as a public company; our ability to protect our proprietary information; general economic and business conditions; the volatility of our operating results and financial condition; our ability to attract or retain qualified senior management personnel and research and development staff; and other risks detailed from time to time in our filings with the Securities and Exchange Commission (the “SEC”), or otherwise.

Information regarding market and industry statistics contained in this report is included based on information available to us that we believe is accurate. It is generally based on industry and other publications that are not produced for purposes of securities offerings or economic analysis. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. We do not undertake any obligation to publicly update any forward-looking statements. As a result, investors should not place undue reliance on these forward-looking statements.

3

Overview

We were incorporated as a Nevada company on December 13, 2006. On March 1, 2011 we changed our name from Bosco Holdings Inc., to Caduceus Software Systems Corp., and increased our authorized capital to 400,000,000 shares of common stock. As of March 3, 2011 we also undertook a forward split of our issued and outstanding shares on a basis of 1 old for 8 new. We maintain our business offices at 42a High Street, Sutton Coldfield, West Midlands, United Kingdom, and our telephone number is +44-0121-695-9585.

Previous Business

We were engaged in the business of marketing and distributing laminate flooring in both the mass wholesale and retail markets throughout North America. We entered into a marketing and sales distribution agreement with our supplier, Bossco-Laminate Co., Ltd., a private Russian company. However, we were not able to find sufficient investment in order to expand our business and our management was forced to change our business focus.

Current Business

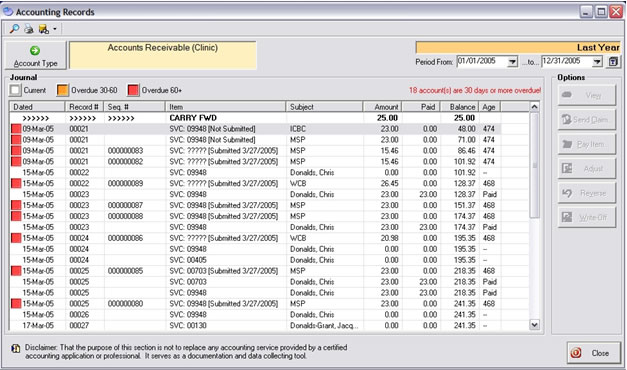

On June 9, 2011 we entered into and closed the Licensing Agreement with Sygnit for the exclusive license to software optimized for use in medical the medical industry for patient management, patient appointment scheduling, physician memorandum recording, medical symptom and ailment recording and digital image recording. We are now a medical software company that offers a suite of medical management applications, collectively named Caduceus MMS, that focus on an alternative to traditional patient administration systems: reducing the time and expense involved in managing appointment scheduling; providing practitioners with a comprehensive set of resource, prescription, and contraindication libraries, and; a sophisticated architecture designed to minimize the billing submission time while maximizing the successful reimbursements to the clinic.

Products and Services

Through the license agreement with Sygnit, we are able to provide a suite of software to medical professionals. Our software offerings are designed in stages so that each component and phase carefully addresses both the practitioner’s administrative and level-of-service requirements. Unlike most EHR (Electronic Health Recording) or EMB (Electronic Medical Billing) systems that handle either billing or scheduling, Caduceus MMS is equipped to manage an entire practice. In order to remain streamlined Caduceus MMS is structured as a set of closely inter-related service units, scalable modules, and upgradeable libraries.

We expect that Caduceus MMS will primarily be installed and used in a clinical or office environment, thus it was primarily designed to be implemented in a local network on standard Windows-based computer systems. In this configuration, the software requires almost no additional hardware outlay; it can be installed and used almost immediately. With the addition of server and imaging modules, Caduceus MMS can be adapted to take advantage of more equipment. This premise gives the client a shallow investment curve to overcome, rather than being forced to pay tens to hundreds of thousands to prepare the typical complex EHR.

4

Caduceus MMS Accounting Records Screenshot

Caduceus MMS Patient Billing Screenshot

5

The service units of the Caduceus MMS, such as the highly predictive ‘Recall and Reminder’ service, perform specific universal tasks giving the software adaptive intelligence. The Recall and Reminder service continuously monitors the status of appointments, remittance deadlines, overdue accounts, claims remitting, and follow-ups. Building Caduceus MMS with many dedicated processing units greatly improves its adaptability and automation when compared to competing EHRs that rely on a complex system core.

Caduceus MMS Appointment Scheduler Screenshot

Given the above, each installation of Caduceus MMS can be configured with anywhere from the most minimal set of modules to a full complement of features depending on the requirements, budget, and hardware layout of the target client. Modules like the Human Anatomical Mapping Tool, Imaging Module, or Document Editor or Prescription Writer can be added, as the clinic’s needs change. Additionally, some modules will also introduce new service units, which in turn expand the usefulness of the software system. Some of the more common modules that the software will come equipped with are as follows:

6

Human Anatomical Mapping Tool

The Human Anatomical Mapping Tool is a graphical image of the human body. This tool allows the doctor to visually mark on the human body symptoms and ailments of the patient, and put notes on that specific area. It is a lot easier to use than writing notes about ailments without a visual picture. It aims to allow the doctor to quickly see and remember where the ailment is and it can track the progression of treatment for that precise part of the body.

Caduceus MMS Anatomical Mapping Module Screenshot

7

Imaging Module

The imaging module is an add-on (an extra component that is separate from the core software) to save and store scanned images and associate them to the patient. X-rays and medical images can be scanned digitally at clinics. (Most clinics are equipped with specialized scanners for x-rays.) It is saved in a digital file. The imaging module will allow it to store the image in a secure manner into the database.

This module has been created but is not fully tested. It will need to be tested for various images and image sizes to see if the software's database can handle them.

Document Editor or Prescription Writer

These modules allow the doctor to write down official documents that are requested by the patient or to issue doctor referrals or for formal correspondence. The prescription writer is a module that allows the doctor to write prescriptions with the doctor letter head, and replaces the need for doctors to carry prescription notepads as the official way to write-up prescriptions

Without the ability to install modules Caduceus MMS would offer the client limited scope, become cumbersome and too large to navigate effectively if it were to be developed past its initial scope, and be virtually impossible to stage to grow with a growing practice.

Many libraries within the Caduceus MMS such as codes, treatments, localization resources, contraindications, regulatory protocols, reports, and facilities are continuously updated, thus allowing the client to stay up-to-date. Caduceus MMS is supplied to the customer with over 650 diagnostic explanatory codes, almost 5000 treatments (virtually covering all medical treatments known today), more than 6100 ICD-9 and ICD-10 diagnostic codes, and it understands over 80 parts of the body. These numbers are not for bragging, but do exceed the resources provided by Caduceus’ closest competitors. A comprehensive set of libraries translates into an application than can immediately manage different medical situations quickly.

Other libraries can be built by the consumer over time. An example is the Insurance Module, which has no restrictions on the data input which can be included by the consumer, and can therefore record a variety of insurance providers.

We anticipate undertaking further development into mobile device interfaces, Linux operating system support, biometrics and additional modules.

Market, Customers and Distribution Methods

We believe that we will market our software product in the following four areas of the healthcare industry:

- Healthcare patient information management.

- Electronic Healthcare Recording (EHR)

- Electronic Medical Billing systems (EMBs)

- Contact management and Appointment Scheduling and booking

In 2007, US healthcare expenditures accounted more than $2.26 trillion or $7,439 per person. Given this figure, the US had the third highest healthcare expenditure per capita, and except for East Timor, spent more than any other nation-state on earth.

8

Our management believes that given the general outlook towards reform of the medical system, American healthcare providers and consumers are interested in reducing the costs of healthcare without compromising service.

The Congressional Budget Office has pointed out that, "about half of all growth in health care spending in the past several decades was associated with changes in medical care made possible by advances in technology." Although currently prepared for use in Canada, the software can be easily expanded to any region or jurisdiction in Canada, the United States, United Kingdom, Australia, and the Caribbean. With the implementation of future language libraries, it can be offered in French, Spanish, German, Italian, Japanese or Chinese.

The Bureau of Labor Statistics in the United States estimated that in 2008 there were approximately 661,400 practicing physicians, and projected that number to increase to 805,500 by 2018. Since Caduceus MMS was constructed to accommodate 47 of the 49 recognized medical specialties (excluding surgical specialties), it is well poised to work with most of the industry. WE anticipate that we will begin selling our software to 0.5% of the active market, or about 3,307 physicians. Furthermore, because Caduceus MMS can be made to operate in any jurisdiction, this target market covers all geographic regions in the United States, all ages, both sexes and in both public and private settings.

We anticipate that we will distribute our software largely through online sources. Software used to be sold off-the-shelf from software vendors. The current model is via the Internet, where customers buy the software by paying for it online or by calling into a payment centre, and the software is distributed by online download. For certain cases where the software requirements setup, depending on the licensing and support levels purchased, if pricing permits, the distribution, or rather installation of the software may be done onsite at the premises of the customers’ offices.

Competition

We have various competitors in our market. Some of the competitors are large software providers who can supply software which is able to be used, though not tailored for, the medical services industry, and some have specialized medical software.

Competitors in the appointment and booking, scheduling space are Maximizer, Microsoft Windows and Office & Outlook. Competitors for the Electronic Medical Billing include ClinCare, and EZClaim. Competitors for the Electronic Health Records include AdvancedMD, QHR, and PowerMed.

Our largest potential competition will come from EMR vendors currently operating in the industry. However, most EMR vendors have chosen to develop their applications concentrating on either billing or scheduling. Caduceus MMS includes structures that handle billing, remitting, diagnosing, patient recording, scheduling, expense and accounting ledger, an insurance provider database, direct medical agency server connection, as well as predictive logic. Our most notable potential competitors are QHR Software Inc.’s Optimed and Accuro systems and Clinic Essentials.

Many of the software companies with which we compete for financing and consumers have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on developing their software systems. This advantage could enable our competitors to develop a more competitive, more attractive software system. Such competition could adversely impact our ability to attain the financing necessary for us to further develop, market and distribute our software.

In the face of competition, we may not be successful in developing, marketing and distributing our software. Despite this, we hope to compete successfully in the software industry by:

9

- keeping our development costs low;

- Focusing on the competitive advantages of our product;

- Efficiently marking to our core customer base; and

- using our size and experience to our advantage by adapting quickly to changing market conditions or responding swiftly to potential opportunities.

Competitive Advantages

Caduceus MMS is supplied to the customer with over 650 diagnostic explanatory codes, almost 5000 treatments (virtually covering all medical treatments known today), more than 6100 ICD-9 and ICD-10 diagnostic codes, and it understands over 80 parts of the body. These figures provide the Caduceus MMS suite a competitive advantage over any other software system currently on the market.

Caduceus MMS is the only mainline EMR system that is designed for three-dimensional adaptability: vertically through the use of powerful, predictive services such as the Recall and Reminder, Code Control, or Claims Remittances services; horizontally by way of its coverage of almost all specialties, and; laterally in its complete scalability via modules and localization libraries. Fundamentally, its core is relatively small compared to competing systems, but when measured with its many features and capabilities can rival even the most hardened application.

Caduceus MMS’ interface – the part of the software that will interact directly with the user, whether receptionist or doctor – has been designed to employ a shallow learning curve by using cleanly arranged screens. Most competitors present data in cluttered screens, leading to user fatigue and inevitably data entry errors.

In order to gain access to the widest possible market, we have kept the initial cost of ownership low by ensuring that Caduceus MMS can be implemented into specifically simple network environments.

Most importantly, rather than concentrating Caduceus MMS in either the back office as an administrative tool, or reception area, it is capable of running an entire clinic from front to back.

Intellectual Property

Sygnit Inc. owns a copyright to the Caduceus MMS software which we license from them. We have we have not filed for any protection of our trademark, and we do not have any other intellectual property other than a copyright to the contents of our website: www.caduceusmms.com.

Research and Development

We did not incur any research and development expenses during the period from December 13, 2006 (inception) to our most recent fiscal year ended May 31, 2010. We anticipate that we will spend $20,000 on research and development during the next 12 months.

10

Reports to Security Holders

We intend to furnish our shareholders annual reports containing financial statements audited by our independent registered public accounting firm and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year. After the effectiveness of this Registration Statement we will begin filing Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K and Current Reports on Form 8-K with the Securities and Exchange Commission in order to meet our timely and continuous disclosure requirements. We may also file additional documents with the Commission if they become necessary in the course of our company’s operations.

The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

Government Regulations

We are not currently subject to direct federal, state or local regulation and we do not believe that government regulation will have a material impact on the way we conduct our business.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Employees

As of June 9, 2011 we did not have any employees. Derrick Gidden, one of our directors and our sole officer spends about 20 hours per week on our operations on a consulting basis.

Description of Property

We currently rent an office totaling approximately 200 square feet in area at a cost of approximately $1,000 per month and leased out by Derrick Gidden, one of our directors and our sole officer. Our office is located at 5614C 42a High Street, Sutton Coldfield, West Midlands, United Kingdom, B72 1UJ. Our telephone number is +44-0121-695-9585.

11

Financial Information

Management's Discussion and Analysis of Financial Condition and Results of Operations

We did not acquire Sygnit Corporation, or its entire business. Consequently we are not including the financial statements of an acquired business. The financial statements included in this Current Report on Form 8-K are those of Caduceus Software Systems Corp. (formerly Bosco Holdings Inc.), for the year ended March 31, 2010 and the nine month period ended December 31, 2010.

The following discussion should be read in conjunction with the financial statements of including the notes thereto, appearing elsewhere in this report. The discussion of results, causes and trends should not be construed to imply any conclusion that these results or trends will necessarily continue into the future. All references to currency in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section are to U.S. dollars, unless otherwise noted.

Forward-Looking Statements

This report contains forward-looking statements that involve risks and uncertainties. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology including, "could", "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "predict", "potential" or the negative of these terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested in this current report.

Liquidity and Capital Resources as at March 31, 2010

As of March 31, 2010, we had cash of $4,506 in our bank accounts and a working capital deficit of $51,258 compared to $12,527 cash and working capital deficit of $31,833 as of March 31, 2009. As of March 31, 2010, we had total assets of $4,506 and total liabilities of $55,764. As of March 31, 2010 we have accumulated a deficit of $76,658.

From December 13, 2006 (date of inception) to March 31, 2010, we raised net proceeds of $25,400 in cash from the issuance of common stock.

We used net cash of $18,703 in operating activities for the year ended March 31, 2010 compared to $26,476 for the year ended March 31, 2009.

As of March 31, 2010 we had cash of $4,506 in our bank account. We intend to meet the balance of our cash requirements for the next 12 months through a combination of debt financing and equity financing by way of private placements. We currently do not have any arrangements in place for the completion of any further private placement financings and there is no assurance that we will be successful in completing any further private placement financings. There is no assurance that any financing will be available or if available, on terms that will be acceptable to us. We may not raise sufficient funds to fully carry out any business plan.

Liquidity and Capital Resources for the Nine-Month Period Ended December 31, 2010

As at the nine-month period ended December 31, 2010, our current assets were $655 and our current liabilities were $61,324, which resulted in a working capital deficiency of ($60,669). As at the nine-month period ended December 31, 2010, current assets were comprised of $655 in cash. As at the nine-month period ended December 31, 2010, current liabilities were comprised of $54,394 in loan from related party, $5,255 in accounts payable and accrued liabilities and $1,675 in accrued interest.

12

As at the nine-month period ended December 31, 2010, our total assets were $655 comprised entirely of current assets compared to $4,506 at fiscal year ended March 31, 2010.

As at the nine-month period ended December 31, 2010, our total liabilities were $61,324 comprised entirely of current liabilities compared to $55,764 at fiscal year ended March 31, 2010.

Stockholders’ deficit increased from ($51,258) for fiscal year ended March 31, 2010 to ($60,669) for the nine-month period ended December 31, 2010.

Cash Flows from Operating Activities

We have not generated positive cash flows from operating activities. For the nine-month period ended December 31, 2010, net cash flows used in operating activities was ($9,313), consisting of a net loss of ($9,410) , accounts payables and accrued liabilities of ($468) and accrued interest $565. For the nine-month period ended December 31, 2009, net cash flows used in operating activities was ($7,182), consisting of a net loss of ($7,747) and accrued interest $565.

Cash Flows from Financing Activities

We have financed our operations primarily from either advancements or the issuance of equity and debt instruments. For the nine-month period ended December 31, 2010, net cash flows provided from financing activities was $5,462 compared to $9,932 for the nine-month period ended December 31, 2009.

We estimate that our expenses over the next 12 months (beginning July 2011) will be approximately $227,000 as described in the table below. These estimates may change significantly depending on the nature of our future business activities and our ability to raise capital from shareholders or other sources.

| Estimated | Estimated | ||

| Description | Completion Date | Expenses | |

| ($) | |||

| Legal and accounting fees | 12 months | 100,000 | |

| Research and Development | 12 months | 20,000 | |

| Management and operating costs | 12 months | 30,000 | |

| Salaries and consulting fees | 12 months | 60,000 | |

| Fixed asset purchases | 12 months | 5,000 | |

| General and administrative expenses | 12 months | 12,000 | |

| Total | 227,000 |

We intend to meet our cash requirements for the next 12 months through a combination of debt financing and equity financing by way of private placements. We currently do not have any arrangements in place to complete any private placement financings and there is no assurance that we will be successful in completing any private placement or debt financings. However, there is no assurance that any such financing will be available or if available, on terms that will be acceptable to us. We may not raise sufficient funds to fully carry out our business plan.

13

Results of Operations as of March 31, 2010

Lack of Revenues

We have earned no revenues and have sustained operational losses since our inception on December 13, 2006 to March 31, 2010. As of March 31, 2010, we had an accumulated deficit of $76,658. We anticipate that we will not earn any revenues during the current fiscal year.

At this time, our ability to generate any revenues continues to be uncertain. The auditor's report on our audited financial statements on March 31, 2010 and 2009 contains an additional explanatory paragraph which identifies issues that raise substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustment that might result from the outcome of this uncertainty.

Expenses

From December 13, 2006 (date of inception) to March 31, 2010, our total expenses were $76,658. Our total expenses consisted solely of general and administrative expenses.

Our total expenses decreased by $8,677 to $19,425 for the year ended March 31, 2010 from $28,102 for the year ended March 31, 2009. The decrease in total expenses was mainly due a minor decrease in operating expenses.

Net Loss

For the year ended March 31, 2010 we incurred net loss of $19,425 compared to $28,102 for the year ended March 31, 2009. From December 13, 2006 (date of inception) to March 31, 2010, we incurred an aggregate net loss of $76,658. The net loss was primarily due to operating expenses. We incurred net loss of $0.00 per share for the year ended March 31, 2010 and a net loss of $0.00 per share for the year ended March 31, 2009.

Results of Operations for the Nine-Month Period Ended December 31, 2010 compared to Nine-Month Period Ended December 31, 2009

Our net loss for the nine-month period ended December 31, 2010 was ($9,410) compared to a net loss of ($7,747) during the nine-month period ended December 31, 2009 (an increase of 1,663). During the nine-month periods ended December 31, 2010 and 2009, we did not generate any revenue.

During the nine-month period ended December 31, 2010, we incurred general and administrative expenses of approximately $9,410 compared to $7,747 incurred during the nine-month period ended December 31, 2009 (an increase of $1,663). The general and administrative expenses incurred during the nine-month period ended December 31, 2010 consisted of corporate overhead, financial and administrative contracted services, marketing, and consulting costs.

Our net loss during the nine-month period ended December 31, 2010 was ($9,410) or ($0.00) per share compared to a net loss of ($7,747) or ($0.00) per share during the nine-month period ended December 31, 2009. The weighted average number of shares outstanding was 26,200,000 for the nine-month periods ended December 31, 2010 and 2009, respectively.

14

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

Inflation

The effect of inflation on our revenues and operating results has not been significant.

Critical Accounting Policies

Our financial statements are affected by the accounting policies used and the estimates and assumptions made by management during their preparation. A complete listing of these policies is included in Note 2 of the notes to our financial statements for the years ended March 31, 2010 and 2009. We have identified below the accounting policies that are of particular importance in the presentation of our financial position, results of operations and cash flows, and which require the application of significant judgment by management.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

Basic and Diluted Loss Per Share

We compute loss per share in accordance with “ASC-260”, “Earnings per Share” which requires presentation of both basic and diluted earnings per share on the face of the statement of operations. Basic loss per share is computed by dividing net loss available to common shareholders by the weighted average number of outstanding common shares during the period. Diluted loss per share gives effect to all dilutive potential common shares outstanding during the period. Dilutive loss per share excludes all potential common shares if their effect is anti-dilutive.

We have no potential dilutive instruments and accordingly basic loss and diluted loss per share are equal.

Fair Value of Financial Instruments

The carrying value of cash and accounts payable and accrued liabilities approximates their fair value because of the short maturity of these instruments. Unless otherwise noted, it is management’s opinion that we are not exposed to significant interest, currency or credit risks arising from these financial instruments.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth the ownership, as of June 9, 2011, of our common stock by each of our directors, by all of our executive officers and directors as a group and by each person known to us who is the beneficial owner of more than 5% of any class of our securities. As of June 9, 2011, there were 275,800,000 shares of our common stock issued and outstanding. All persons named have sole or shared voting and investment control with respect to the shares, except as otherwise noted. The number of shares described below includes shares which the beneficial owner described has the right to acquire within 60 days of the date of this Form 8-K.

15

| Title of Class | Name and

Address of Beneficial Owner |

Amount

and Nature of Beneficial Ownership |

Percent

of Class (1) |

|

| Common Stock |

Derek Gidden (2)

42a High Street, Sutton Coldfield, West Midlands, United Kingdom, B72 1UJ |

0 |

0% |

|

| Common Stock |

Alexander Dannikov (3)

26 Utkina Street, Suite 10 Irtkutsk, Russia 664007 |

56,200,000 |

20% |

|

| All Officers and Directors as a Group | 56,200,000 | 20% | ||

| Common Stock |

Sygnit Corporation 253 N Jackson St Frankfort, In 46041 |

130,000,000 |

47% |

|

| (1) |

(1) Based on 275,800,000 issued and outstanding shares of our common stock as of June 9, 2011. |

| (2) |

Derek Gidden is our President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Secretary, Treasurer and director. |

| (3) |

Mr. Dannikov is our director and our former President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Secretary, and Treasurer. |

Changes in Control

As of June 9, 2011 we had no pension plans or compensatory plans or other arrangements which provide compensation in the event of termination of employment or a change in our control.

Directors and Executive Officers

Directors and Officers

Our Articles state that our authorized number of directors shall be not less than one and shall be set by resolution of our Board of Directors. Our Board of Directors has fixed the number of directors at one, and we currently have one director.

Our current directors and officers are:

| Name | Age | Position |

| Derrick Gidden | 53 | President, Chief Executive Officer,

Chief Financial Officer, Principal Accounting Officer Secretary, Treasurer, and Director. |

| Alexander Dannikov | 30 | Director |

16

Our Director will serve in that capacity until our next annual shareholder meeting or until their successors are elected and qualified. Officers hold their positions at the will of our Board of Directors. There are no arrangements, agreements or understandings between non-management security holders and management under which non-management security holders may directly or indirectly participate in or influence the management of our affairs.

Derrick Gidden, President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer Secretary, Treasurer and Director

Derrick Gidden is a graduate from Converty Technical College in Telecommunication and Electronic Engineering (Oct 1978) and the University of Wolverhampton where has obtained a Post Graduate in Training Management (July 1994) and has successfully completed a wide array of other business management, training, auditing, project management and information technology programs (May 1992 – February 2010).

For more than twenty five years he has provided management consulting and business development services to a number of private, public service and voluntary companies/organizations.

Mr. Gidden’s entrepreneurship began with two business ventures, between March of 2003 and April of 2008, called Oracle Business Development Partnership (UK) Limited and The Property Investor Group (UK) Limited. While operating Oracle Business Development Partnership (UK), he provided business development consultancy services to businesses across UK, in addition to offering specific consultancy on business planning/development and raising finance. His duties also included supporting companies for sustainability, growth and competitiveness with consultancy on sales/marketing, IT, technology, manufacturing and import/export. While working for The Property Investor Group (UK) Limited, Mr. Gidden provided relevant property investments to prospective investors.

Since April of 2010, Mr. Gidden has been a director of the Poet’s Wood Management Services working in conjunction with Redrow Homes Midlands Ltd., one of the leading companies in the residential home construction sector in the United Kingdom. He is also a school governor at King Edward VI School which is one of the top selective grammar school in the United Kingdom.

Alexander Dannikov, Director

Mr. Dannikov has acted as our director since our inception on December 13, 2006. Since November 2006, Mr. Dannikov has worked as General Manager of Irkut Corporation, a private company that sells building materials in Russia and abroad. From January 2005 to November 2006, Mr. Dannikov has worked for Avalon Video company as Assistant Director where he was involved in marketing, recruiting, staff training, performing supervisory functions, monitoring service quality and employee performance. Since August 2001, Mr. Dannikov was initially employed as a manager for Hoztorg, a wholesale company involved in distributing household goods in the Irkutsk region where he was responsible for organizing cargo transportation, wholesale and retail trade. He became a director of the company in June 2003. From June 2003 to January 2005, when Mr. Dannikov acted as a director of Hoztorg, his responsibilities were business administration, staff management, and customer relations and marketing. Mr. Dannikov graduated with a Bachelor of Social Sciences Degree in regional studies from Irkutsk State University in June 2003. His degree specialization was "Administration of Territories (Siberian region)".

Other than as disclosed elsewhere, there have been no transactions between the Company and our directors and officers since our last fiscal year which would be required to be reported herein.

17

Other Directorships

Other than as disclosed above, during the last 5 years, none of our directors held any other directorships in any company with a class of securities registered pursuant to section 12 of the Exchange Act or subject to the requirements of section 15(d) of such Act or any company registered as an investment company under the Investment Company Act of 1940.

Board of Directors and Director Nominees

Since our Board of Directors does not include a majority of independent directors, the decisions of the Board regarding director nominees are made by persons who have an interest in the outcome of the determination. The Board will consider candidates for directors proposed by security holders, although no formal procedures for submitting candidates have been adopted. Unless otherwise determined, at any time not less than 90 days prior to the next annual Board meeting at which a slate of director nominees is adopted, the Board will accept written submissions from proposed nominees that include the name, address and telephone number of the proposed nominee; a brief statement of the nominee’s qualifications to serve as a director; and a statement as to why the security holder submitting the proposed nominee believes that the nomination would be in the best interests of our security holders. If the proposed nominee is not the same person as the security holder submitting the name of the nominee, a letter from the nominee agreeing to the submission of his or her name for consideration should be provided at the time of submission. The letter should be accompanied by a résumé supporting the nominee's qualifications to serve on the Board, as well as a list of references.

The Board identifies director nominees through a combination of referrals from different people, including management, existing Board members and security holders. Once a candidate has been identified, the Board reviews the individual's experience and background and may discuss the proposed nominee with the source of the recommendation. If the Board believes it to be appropriate, Board members may meet with the proposed nominee before making a final determination whether to include the proposed nominee as a member of the slate of director nominees submitted to security holders for election to the Board.

Conflicts of Interest

Our directors are not obligated to commit their full time and attention to our business and, accordingly, they may encounter a conflict of interest in allocating their time between our operations and those of other businesses. In the course of their other business activities, they may become aware of investment and business opportunities which may be appropriate for presentation to us as well as other entities to which they owe a fiduciary duty. As a result, they may have conflicts of interest in determining to which entity a particular business opportunity should be presented. They may also in the future become affiliated with entities that are engaged in business activities similar to those we intend to conduct.

In general, officers and directors of a corporation are

required to present business opportunities to the corporation if:

18

- the corporation could financially undertake the opportunity;

- the opportunity is within the corporation’s line of business; and

- it would be unfair to the corporation and its stockholders not to bring the opportunity to the attention of the corporation.

We have adopted a code of ethics that obligates our directors, officers and employees to disclose potential conflicts of interest and prohibits those persons from engaging in such transactions without our consent.

Significant Employees

Other than as described above, we do not expect any other individuals to make a significant contribution to our business.

Legal Proceedings

To the best of our knowledge, none of our directors or executive officers has, during the past ten years:

- been convicted in a criminal proceeding or been subject to a pending

criminal proceeding (excluding traffic violations and other minor offences);

- had any bankruptcy petition filed by or against the business or property

of the person, or of any partnership, corporation or business association of

which he was a general partner or executive officer, either at the time of the

bankruptcy filing or within two years prior to that time;

- been subject to any order, judgment, or decree, not subsequently reversed,

suspended or vacated, of any court of competent jurisdiction or federal or

state authority, permanently or temporarily enjoining, barring, suspending or

otherwise limiting, his involvement in any type of business, securities,

futures, commodities, investment, banking, savings and loan, or insurance

activities, or to be associated with persons engaged in any such activity;

- been found by a court of competent jurisdiction in a civil action or by

the SEC or the Commodity Futures Trading Commission to have violated a federal

or state securities or commodities law, and the judgment has not been

reversed, suspended, or vacated;

- been the subject of, or a party to, any federal or state judicial or

administrative order, judgment, decree, or finding, not subsequently reversed,

suspended or vacated (not including any settlement of a civil proceeding among

private litigants), relating to an alleged violation of any federal or state

securities or commodities law or regulation, any law or regulation respecting

financial institutions or insurance companies including, but not limited to, a

temporary or permanent injunction, order of disgorgement or restitution, civil

money penalty or temporary or permanent cease-and-desist order, or removal or

prohibition order, or any law or regulation prohibiting mail or wire fraud or

fraud in connection with any business entity; or

- been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

19

Except as set forth in our discussion below in “Certain Relationships and Related Transactions, and Director Independence – Transactions with Related Persons,” none of our directors, director nominees or executive officers has been involved in any transactions with us or any of our directors, executive officers, affiliates or associates which are required to be disclosed pursuant to the rules and regulations of the SEC.

Audit Committee and Charter

We do not currently have an audit committee.

Code of Ethics

We have not yet adopted a corporate code of ethics. When we do adopt a code of ethics, we will announce it via the filing of a current report on form 8-K.

Family Relationships

There are no family relationships among our officers, directors, or persons nominated for such positions.

Executive Compensation

The following summary compensation table sets forth the total annual compensation paid or accrued by us to or for the account of our principal executive officer during the last completed fiscal year and each other executive officer whose total compensation exceeded $100,000 in either of the last two fiscal years:

Summary Compensation Table (1)

| Name and Principal

Position |

Year |

Salary ($) |

Total ($) |

| Alexander Dannikov, (2)

Former President, Chief Executive Officer, Principal Executive Officer, Chief Financial Officer, Principal Financial Officer, Principal Accounting Officer and Director |

2010 | 0 | 0 |

| 2009

|

| (1) |

We have omitted certain columns in the summary compensation table pursuant to Item 402(a)(5) of Regulation S-K as no compensation was awarded to, earned by, or paid to any of the executive officers or directors required to be reported in that table or column in any fiscal year covered by that table. | |

| (2) |

Mr. Dannikov remains as one of our directors. |

Option Grants

As of the date of this report we had not granted any options or stock appreciation rights to our named executive officers or directors.

20

Management Agreements

We have not currently entered into any agreement with our sole officer, Mr. Gidden.

Compensation of Directors

Our directors did not receive any compensation for their services as directors from our inception to the date of this report. We have no formal plan for compensating our directors for their services in the future in their capacity as directors, although such directors are expected in the future to receive options to purchase shares of our common stock as awarded by our Board of Directors or by any compensation committee that may be established.

Pension, Retirement or Similar Benefit Plans

There are no arrangements or plans in which we provide pension, retirement or similar benefits to our directors or executive officers. We have no material bonus or profit sharing plans pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that stock options may be granted at the discretion of the Board of Directors or a committee thereof.

Compensation Committee

We do not currently have a compensation committee of the Board of Directors or a committee performing similar functions. The Board of Directors as a whole participates in the consideration of executive officer and director compensation.

Certain Relationships and Related Transactions, and Director Independence

On February 27, 2008 our director loaned us $10,000. The loan is non-interest bearing, due upon demand and unsecured.

On July 18, 2008 our director loaned us $7,500. The loan is non-interest bearing, due upon demand and unsecured.

On September 16, 2008 our director loaned us $14,000. The loan is non-interest bearing, due upon demand and unsecured.

On October 8, 2008 our director loaned us $7,500 at the interest rate of 10%. The loan is due upon demand and unsecured.

On December 21, 2009 our director loaned us $4,966. The loan is non-interest bearing, due upon demand and unsecured.

On December 22, 2009 our director loaned us $4,966. The loan is non-interest bearing, due upon demand and unsecured.

On May 27, 2010 our director loaned us $4,966. The loan is non-interest bearing, due upon demand and unsecured.

On May 28, 2010 our director loaned us $496. The loan is non-interest bearing, due upon demand and unsecured.

As of December 31, 2010 we accrued interest on related party note of $1,675.

As of December 31, 2010 total loan amount was $54,394:

1.

$46,894 of that loan is non-interest bearing and

2. $7,500 is at the interest

rate of 10%.

On June 9, 2011, in conjunction with the closing of the Licensing Agreement with Sygnit, our director, Alexander Dannikov transferred 63,800,000 shares of our common stock held by him to Sygnit and cancelled all debts owed to him by our company.

There have been no other transactions since the beginning of our last fiscal year or any currently proposed transactions in which we are, or plan to be, a participant and the amount involved exceeds $120,000 or one percent of the average of our total assets at year end for the last two completed fiscal years, and in which any related person had or will have a direct or indirect material interest.

21

Director Independence

Our securities are quoted on the OTC Bulletin Board which does not have any director independence requirements. Once we engage further directors and officers, we plan to develop a definition of independence and scrutinize our Board of Directors with regard to this definition.

Legal Proceedings

We are not aware of any material pending legal proceedings to which we are a party or of which our property is the subject. We also know of no proceedings to which any of our directors, officers or affiliates, or any registered or beneficial holders of more than 5% of any class of our securities, or any associate of any such director, officer, affiliate or security holder are an adverse party or have a material interest adverse to us.

Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

Market Information

Our common stock is not traded on any exchange. Our common stock is quoted on OTC Bulletin Board, under the trading symbol “CSOC”. We cannot assure you that there will be a market in the future for our common stock.

OTC Bulletin Board securities are not listed and traded on the floor of an organized national or regional stock exchange. Instead, OTC Bulletin Board securities transactions are conducted through a telephone and computer network connecting dealers. OTC Bulletin Board issuers are traditionally smaller companies that do not meet the financial and other listing requirements of a national or regional stock exchange.

The following table reflects the high and low bid information for our common stock obtained from Stockwatch and reflects inter-dealer prices, without retail mark-up, markdown or commission, and may not necessarily represent actual transactions.

The closing prices of our common stock for the periods indicated below are as follows:

| OTC Bulletin Board | ||

| Quarter Ended(1) | High | Low |

| March 31, 2011 December 31, 2010 September 31, 2010 June 30, 2010 |

0.1875 - - $ 0.25 |

0.0063 - - $ 0.0088 |

(1) The first trade of our common stock on the OTC Bulletin Board occurred on September 3, 2008. The last trade occurred on June 7, 2011 at $0.10 per share..

Holders

As of the date of this report there were 13 holders of record of our common stock.

Dividends

To date, we have not paid dividends on shares of our common stock and we do not expect to declare or pay dividends on shares of our common stock in the foreseeable future. The payment of any dividends will depend upon our future earnings, if any, our financial condition, and other factors deemed relevant by our Board of Directors.

Equity Compensation Plans

As of the date of this report we did not have any equity compensation plans.

22

Recent Sales of Unregistered Securities

During the last three years, we completed the following sales of unregistered securities:

- • On June 9, 2011 we issued 66,200,000 shares to Sygnit pursuant to the terms of the Licensing Agreement. These shares were issued without a prospectus in reliance on exemptions from registration found in Section 4(2) of the Securities Act of 1933.

- We completed an offering of 3,000,000 pre-split shares of our common stock

at a price of $0.001 per share on March 7, 2007. The total amount received

from this offering was $3,000. We completed this offering pursuant to

Regulation S of the Securities Act. These 3,000,000 shares were issued to

Alexander Dannikov, our director.

- We completed an offering of 2,240,000 pre-split shares of our common stock at a price of $0.01 per share to a total of 28 purchasers on March 28, 2007. The total amount received from this offering was $22,400. We completed this offering pursuant to Regulation S of the Securities Act.

Since our inception we have made no purchases of our equity securities.

Description of Registrant’s Securities to be Registered

Our authorized capital stock consists of 400,000,000 shares of common stock, $0.001 par value.

Common Stock

As of the date of this report we had 275,800,000 shares of our common stock issued and outstanding.

Holders of our common stock have no preemptive rights to purchase additional shares of common stock or other subscription rights. Our common stock carries no conversion rights and is not subject to redemption or to any sinking fund provisions. All shares of our common stock are entitled to share equally in dividends from sources legally available, when, as and if declared by our Board of Directors, and upon our liquidation or dissolution, whether voluntary or involuntary, to share equally in our assets available for distribution to our security holders.

Our Board of Directors is authorized to issue additional shares of our common stock not to exceed the amount authorized by our Articles of Incorporation, on such terms and conditions and for such consideration as our Board may deem appropriate without further security holder action.

Voting Rights

Each holder of our common stock is entitled to one vote per share on all matters on which such stockholders are entitled to vote. Since the shares of our common stock do not have cumulative voting rights, the holders of more than 50% of the shares voting for the election of directors can elect all the directors if they choose to do so and, in such event, the holders of the remaining shares will not be able to elect any person to our Board of Directors.

Dividend Policy

Holders of our common stock are entitled to dividends if declared by our Board of Directors out of funds legally available for the payment of dividends. From our inception to June 9, 2011 we did not declare any dividends.

We do not intend to issue any cash dividends in the future. We intend to retain earnings, if any, to finance the development and expansion of our business. However, it is possible that our management may decide to declare a stock dividend in the future. Our future dividend policy will be subject to the discretion of our Board of Directors and will be contingent upon future earnings, if any, our financial condition, our capital requirements, general business conditions and other factors.

23

Indemnification of Directors and Officers

The only statute, charter provision, bylaw, contract, or other arrangement under which any controlling person, director or officer of us is insured or indemnified in any manner against any liability which he may incur in his capacity as such, is as follows:

- Chapter 78 of the Nevada Revised Statutes (the “NRS”).

Nevada Revised Statutes

Section 78.138 of the NRS provides for immunity of directors from monetary liability, except in certain enumerated circumstances, as follows:

“Except as otherwise provided in NRS 35.230, 90.660, 91.250, 452.200, 452.270, 668.045 and 694A.030, or unless the Articles of Incorporation or an amendment thereto, in each case filed on or after October 1, 2003, provide for greater individual liability, a director or officer is not individually liable to the corporation or its stockholders or creditors for any damages as a result of any act or failure to act in his capacity as a director or officer unless it is proven that:

| (a) |

his act or failure to act constituted a breach of his fiduciary duties as a director or officer; and |

| (b) |

his breach of those duties involved intentional misconduct, fraud or a knowing violation of law.” |

Section 78.5702 of the NRS provides as follows:

| 1. |

A corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except an action by or in the right of the corporation, by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with the action, suit or proceeding if he: | |

| (a) |

is not liable pursuant to NRS 78.138; or | |

| (b) |

acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. | |

| 2. |

A corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses, including amounts paid in settlement and attorneys’ fees actually and reasonably incurred by him in connection with the defense or settlement of the action or suit if he: | |

24

| (a) |

is not liable pursuant to NRS 78.138; or | |

| (b) |

acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation. |

To the extent that a director, officer, employee or agent of a corporation has been successful on the merits or otherwise in defense of any action, suit or proceeding referred to in subsections 1 and 2, or in defense of any claim, issue or matter therein, the corporation shall indemnify him against expenses, including attorneys’ fees, actually and reasonably incurred by him in connection with the defense.

25

Financial Statements and Supplementary

Data

BOSCO HOLDINGS, INC

(A DEVELOPMENT

STAGE COMPANY)

FINANCIAL

STATEMENTS

(UNAUDITED)

DECEMBER 31,

2010

| BALANCE SHEETS | F-1 |

| STATEMENTS OF OPERATIONS | F-2 |

| STATEMENTS OF CASH FLOWS | F-3 |

| NOTES TO THE FINANCIAL STATEMENTS | F-4 |

BOSCO HOLDINGS, INC

(A DEVELOPMENT STAGE

COMPANY)

FINANCIAL STATEMENTS

MARCH 31,

2010

| BALANCE SHEETS | F-11 |

| STATEMENTS OF OPERATIONS | F-12 |

| STATEMENT OF STOCKHOLDERS’ DEFICIT | F-13 |

| STATEMENTS OF CASH FLOWS | F-14 |

| NOTES TO THE FINANCIAL STATEMENTS | F-15 |

F-1

| BOSCO HOLDINGS, INC |

| (A Development Stage Company) |

| Balance Sheets |

| (Unaudited) |

| Assets | ||||||

| December 31 | March 31 | |||||

| 2010 | 2010 | |||||

| Current Assets | ||||||

| Cash | $ | 655 | $ | 4,506 | ||

| Prepaid Expenses | - | |||||

| Total Current Assets | 655 | 4,506 | ||||

| Total Assets | $ | 655 | $ | 4,506 | ||

| Liabilities and Stockholders’ Equity (deficit) | ||||||

| Current Liabilities | ||||||

| Accounts payables and accrued liabilities | $ | 5,255 | $ | 5,722 | ||

| Accrued Interest – Related Party Note | 1,675 | 1,110 | ||||

| Loans from related party | 54,394 | 48,932 | ||||

| Total Current Liabilities | $ | 61,324 | $ | 55,764 | ||

| Stockholders’ Equity (deficit) | ||||||

| Common

stock, $0.001par value, 75,000,000 shares authorized; 26,200,000 shares issued and outstanding |

26,200 | 26,200 | ||||

| Additional paid-in-capital | (800 | ) | (800 | ) | ||

| Deficit accumulated during the development stage | (86,069 | ) | (76,658 | ) | ||

| Total stockholders’ equity (deficit) | (60,669 | ) | (51,258 | ) | ||

| Total liabilities and stockholders’ equity (deficit) | $ | 655 | $ | 4,506 | ||

The accompanying notes are an integral part of these financial statements.

F-2

| BOSCO HOLDINGS, INC |

| (A Development Stage Company) |

| Statements of Operations |

| (Unaudited) |

| From | |||||||||||||||

| Nine | Nine | Inception on | |||||||||||||

| Months | Months | Months | Months | December 13, | |||||||||||

| Ended | Ended | Ended | Ended | 2006 through | |||||||||||

| December | December | December | December | December 31, | |||||||||||

| 31, 2010 | 31, 2009 | 31, 2010 | 31, 2009 | 2010 | |||||||||||

| Expenses | |||||||||||||||

| General and Administrative Expenses | $ | 2,174 | $ | 627 | $ | 8,845 | $ | 7,182 | $ | 84,394 | |||||

| Total Expenses | 2,174 | 627 | 8,845 | 7,182 | 84,394 | ||||||||||

| Net (loss) before Income Taxes | (2,174 | ) | (627 | ) | (8,845 | ) | (7,182 | ) | (84,394 | ) | |||||

| Other Expenses | |||||||||||||||

| Interest Expense | 189 | 189 | 565 | 565 | 1,675 | ||||||||||

| Income Tax Expense | - | - | - | - | |||||||||||

| Net (loss) for a period | $ | (2,363 | ) | $ | (816 | ) | $ | (9,410 | ) | $ | (7,747 | ) | $ | (86,069 | ) |

| (Loss) per common share – Basic and diluted | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | |||

| Weighted Average Number of Common Shares Outstanding |

26,200,000 | 26,200,000 | 26,200,000 | 26,200,000 |

The accompanying notes are an integral part of these financial statements.

F-3

| BOSCO HOLDINGS, INC |

| (A Development Stage Company) |

| Statements of Cash Flows |

| (Unaudited) |

| From Inception | |||||||||

| on December 13, | |||||||||

| Nine Months | 2006 through | ||||||||

| Nine Months Ended | Ended | December 31, | |||||||

| December 31, 2010 | December 31, 2009 | 2010 | |||||||

| Operating Activities | |||||||||

| Net (loss) | $ | (9,410 | ) | $ | (7,747 | ) | $ | (86,069 | ) |

| Prepaid Expenses | - | - | - | ||||||

| Accounts payables and accrued liabilities | (468 | ) | - | 5,255 | |||||

| Accrued Interest – Related Party Note | 565 | 565 | 1,675 | ||||||

| Net cash (used) for operating activities | (9,313 | ) | (7,182 | ) | (79,139 | ) | |||

| Investing Activities | |||||||||

| Net Cash Provided (Used) by Investing Activities | - | - | - | ||||||

| Financing Activities | |||||||||

| Loans from related party | 5,462 | 9,932 | 54,394 | ||||||

| Sale of common stock | - | - | 25,400 | ||||||

| Net cash provided by financing activities | 5,462 | 9,932 | 79,794 | ||||||

| Net increase (decrease) in cash and equivalents | (3,851 | ) | 2,750 | 655 | |||||

| Cash and equivalents at beginning of the period | 4,506 | 12,527 | - | ||||||

| Cash and equivalents at end of the period | $ | 655 | $ | 15,277 | $ | 655 | |||

| Supplemental cash flow information: | |||||||||

| Cash paid for: | |||||||||

| Interest | $ | - | $ | - | $ | - | |||

| Taxes | $ | - | $ | - | $ | - | |||

| Non-Cash Activities | $ | - | $ | - | $ | - |

The accompanying notes are an integral part of these financial statements.

F-4

| BOSCO HOLDINGS, INC |

| (A Development Stage Company) |

| Notes To The Financial Statements |

| December 31, 2010 |

| (Unaudited) |

1. NATURE AND CONTINUANCE OF OPERATIONS

Bosco Holdings, Inc. (“the Company”) was incorporated under the laws of the State of Nevada, U.S. on December 13, 2006. The Company is in the development stage as defined under Accounting Codification Standard, Development Stage Entities (“ASC-915”) and its efforts are primarily devoted marketing and distributing laminate flooring to the wholesale and retail markets throughout North America. The Company has not generated any revenue to date and consequently its operations are subject to all risks inherent in the establishment of a new business enterprise.

2. GOING CONCERN

The financial statements have been prepared on a going concern basis which assumes the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. For the period from inception, December 13, 2006 through December 31, 2010 the Company has accumulated losses of $86,069. There is substantial doubt as to the ability of the company to continue as a going concern. The ability to continue as a going concern is dependent upon the Company generating profitable operations in the future and/or to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management intends to finance operating costs over the next twelve months with existing cash on hand and loans from directors and or private placement of common stock.

As of December 31, 2010, the Company's has excess of current liabilities over its current assets by $60,669, with cash and cash equivalents representing $655.

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The financial statements of the Company have been prepared in

accordance with generally accepted accounting principles in the United States of

America and are presented in US dollars.

Cash and Cash equivalents

For purposes of Statement of Cash Flows the Company considers

all highly liquid debt instruments purchased with a maturity date of three

months or less to be cash equivalent.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with

generally accepted accounting principles requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the period.

Actual results could differ from those estimates.

Foreign Currency Translation

The financial statements are presented in United States

dollars. In accordance with Accounting Standards Codification (“ASC-830”),

“Foreign Currency Matters”, foreign denominated monetary assets and liabilities

are translated into their United States dollar equivalents using foreign

exchange rates which prevailed at the balance sheet date. Non monetary assets

and liabilities are translated at the exchange rates prevailing on the

transaction date. Revenue and expenses are translated at average rates of

exchange during the year. Gains or losses resulting from foreign currency

transactions are included in results of operations.

F-5

| BOSCO HOLDINGS, INC |

| (A Development Stage Company) |

| Notes To The Financial Statements |

| December 31, 2010 |

| (Unaudited) |

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Fair Value of Financial Instruments

The carrying value of cash and accounts payable and accrued liabilities approximates their fair value because of the short maturity of these instruments. Unless otherwise noted, it is management’s opinion the Company is not exposed to

significant interest, currency or credit risks arising from these financial instruments.

Income Taxes

The Company follows the liability method of accounting for income taxes. Under this method, deferred income tax assets and liabilities are recognized for the estimated tax consequences attributable to differences between the financial statement

carrying values and their respective income tax basis (temporary differences). The effect on deferred income tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. At December 31,

2010 a full-deferred tax asset valuation allowance has been provided and no deferred tax asset has been recorded.

Basic and Diluted Loss Per Share

The Company computes loss per share in accordance with “ASC-260”, “Earnings per Share” which requires presentation of both basic and diluted earnings per share on the face of the statement of operations. Basic loss per share is

computed by dividing net loss available to common shareholders by the weighted average number of outstanding common shares during the period. Diluted loss per share gives effect to all dilutive potential common shares outstanding during the period.

Dilutive loss per share excludes all potential common shares if their effect is anti-dilutive.

The Company has no potential dilutive instruments and accordingly basic loss and diluted loss per share are equal.

Long-Lived Assets

The Company has adopted Accounting Standards Codification No. 360(“ASC-360”). The Statement requires that long-lived assets and certain identifiable intangibles held and used by the Company be reviewed for impairment whenever events or

changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Events relating to recoverability may include significant unfavorable changes in business conditions, recurring losses, or a forecasted inability to

achieve break-even operating results over an extended period. The Company evaluates the recoverability of long-lived assets based upon forecasted undiscounted cash flows. Should impairment in value be indicated, the carrying value of intangible

assets will be adjusted, based on estimates of future discounted cash flows resulting from the use and ultimate disposition of the asset. ASC-360 also requires assets to be disposed of be reported at the lower of the carrying amount or the fair

value less costs to sell.

Research and Development

The Company accounts for research and development costs in accordance with the Financial Accounting Standards Board’s Accounting Standards Codification (“ASC-730”), “Research and Development”. Under ASC-730, all research and

development costs must be charged to expense as incurred. Accordingly, internal research and development costs are expensed as incurred. Third-party research and developments costs are expensed when the contracted work has been performed or as

milestone results have been achieved. Company-sponsored research and development costs related to both present and future products are expensed in the period incurred. The Company incurred expenditures $0 the period from December 13, 2006 (date

of inception) to December 31, 2010.

F-6

| BOSCO HOLDINGS, INC |

| (A Development Stage Company) |

| Notes To The Financial Statements |

| December 31, 2010 |

| (Unaudited) |

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Concentrations of Credit Risk

Financial instruments and related items, which potentially subject the Company to concentrations of credit risk, consist primarily of cash, cash equivalents and related party receivables. At December 31, 2010, the Company has cash in the amount of

$655. The Company places its cash and temporary cash investments with credit quality institutions. All of the Company’s cash is in non FDIC insured accounts. The Company periodically reviews its trade receivables in determining its

allowance for doubtful accounts. The Company does not have accounts receivable and allowance for doubtful accounts at December 31, 2010.

Revenue Recognition

The Company will recognize revenue in accordance with Accounting Standards Codification No. 605, Revenue Recognition ("ASC-605"), ASC-605 requires that four basic criteria must be met before revenue can be recognized: (1) persuasive evidence of an

arrangement exists; (2) delivery has occurred; (3) the selling price is fixed and determinable; and (4) collectibility is reasonably assured. Determination of criteria (3) and (4) are based on management's judgments regarding the fixed nature of the

selling prices of the products delivered and the collectability of those amounts.

Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded. The Company will defer any revenue for which the product has not been delivered or is subject to refund until such time that the Company and the customer jointly determine that the product has been delivered or no refund will be required.

Advertising

The Company follows the policy of charging the costs of advertising to expenses incurred. The Company incurred $0 in advertising costs during the period ended December 31, 2010.

Stock-based Compensation

The Company records stock based compensation in accordance with the guidance in ASC Topic 718 which requires the Company to recognize expenses related to the fair value of its employee stock option awards. This eliminates accounting for share-based

compensation transactions using the intrinsic value and requires instead that such transactions be accounted for using a fair-value-based method. The Company recognizes the cost of all share-based awards on a graded vesting basis over the vesting

period of the award.

Recent accounting pronouncements

The Company management has reviewed recent accounting pronouncements issued through the date of the issuance of financial statements. In management’s opinion, except for those pronouncements detailed below, no other pronouncements apply or will

have a material effect on the Company’s financial statements.

In May 2009, the FASB issued ASC 855 Subsequent Events, which establishes principles and requirements for subsequent events. In accordance with the provisions of ASC 855, the Company currently evaluates subsequent events through the date the financial statements are available to be issued.

F-7

| BOSCO HOLDINGS, INC |

| (A Development Stage Company) |

| Notes To The Financial Statements |

| December 31, 2010 |

| (Unaudited) |

4. COMMON STOCK

The total number of common shares authorized that may be issued by the Company is 75,000,000 shares with a par value of one tenth of one cent ($0.001) per share and no other class of shares is authorized. As of December 31, 2010 and the company has issued and outstanding 26,200,000 shares of common stock.