Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VIRTUS INVESTMENT PARTNERS, INC. | d8k.htm |

Keefe, Bruyette & Woods

Investment Management & Specialty Finance Conference

June 8, 2011

Exhibit 99.1 |

Important Disclosures

2 |

Speakers

George R. Aylward

President and

Chief Executive Officer

Michael A. Angerthal

Executive Vice President

and Chief Financial Officer

3 |

Introduction

LISTING

NASDAQ: VRTS

COMMENCED TRADING

January 2, 2009

FIRST TRADE

$9.00

CLOSING PRICE, JUNE 6, 2011

$57.01

COMMON SHARES

OUTSTANDING (DILUTED)

6.9 million

SERIES B CONVERT. PREF.

35,217 (Convertible to 1.3MM Common)

MARKET CAPITALIZATION

1

$471 million

1

Fully converted, as of June 6, 2011

4 |

Virtus

Value Proposition Business Model

•

Multi-boutique manager, multi-strategy model

•

Broad investment capabilities from affiliates and subadvisers

•

Shared distribution and support services

•

Platform model that allows for new teams and firms

Products

•

Diversified and balanced product set

•

Active product management

•

Strong relative performance

•

Competitive mutual fund offerings

Distribution

•

Multi-market distribution

•

Broad and balanced retail distribution reach

•

Well-defined value proposition

•

Experienced retail sales force and effective strategy

Financial and Operating

Attributes

•

Significant growth in assets, sales and net flows

•

Bottom-line growth and margin expansion

•

Solid balance sheet and capital flexibility

•

Significant tax attributes

5 |

Business Model

Product

Distribution

Financial and Operating

Attributes

Multi-boutique manager,

multi-strategy model

Broad investment

capabilities from affiliates

and subadvisers

Shared distribution and

support services

Platform model that allows

for new teams and firms

Business Model

Products

Distribution

Financial and Operating

Attributes

6 |

Virtus

Brand We are unconstrained by a single investment approach.

Rather, we

provide access to independent, specialized investment philosophies

through our multi-discipline, multi-strategy approach.

We have the flexibility, agility and responsiveness of a boutique

asset

management

firm

with

the

product

breadth,

distribution

reach,

and investment talent similar to some larger firms.

Virtus is committed to thoughtfully providing investment solutions,

adhering to the highest standards of product quality, operational

excellence and fiduciary responsibility.

We are a distinctive partnership of boutique investment managers

singularly committed to the long-term success

of individual and institutional investors.

7 |

Multi-Boutique, Multi-Strategy Model

Affiliates that comprise Virtus

External subadvisers

8 |

Business Model

Products

Distribution

Financial and Operating

Attributes

Diversified and balanced

product set

Active product management

Strong relative performance

Competitive mutual fund

offerings

9 |

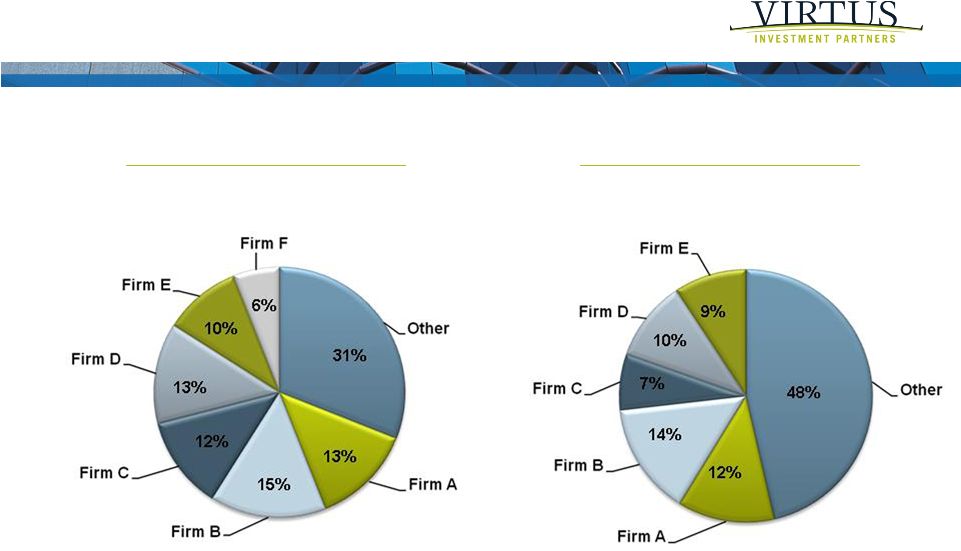

Diversified Product Set

Total AUM $31.9 billion

$ in billions

As of March 31, 2011

10 |

Active Product Management

Monitor performance and change or replace managers when needed

Identify investment needs of clients and introduce new offerings

Identify

strong

performing

product

capabilities

that

can

benefit

from

our distribution

Enhance and expand capabilities through fund adoptions

11 |

Strong Relative Performance

PERFORMANCE AS OF MARCH 31, 2011

1

Mutual funds and institutional products

All analysis excludes closed-end funds and money market products

% of AUM Exceeding Benchmarks

% of AUM in Top Half of Peer Category

1

12 |

Competitive Mutual Fund Offerings

Load Waived Morningstar as of May 31, 2011

U.S. EQUITY

Quality Small-Cap

AlphaSector™

Rotation

Core Equity

Small-Cap Core

Value Equity

Growth & Income

Mid-Cap Value

Quality Large-Cap Value

Small-Cap Sustainable Growth

Strategic Growth

Mid-Cap Growth

ASSET ALLOCATION FUNDS

Tactical Allocation

Balanced Allocation

Balanced

FIXED INCOME

Multi-Sector Short-Term Bond

Senior Floating Rate Fund

Short/Intermediate Bond

Tax-Exempt Bond

Intermediate Tax-Exempt Bond

Institutional Bond

Bond

CA Tax-Exempt Bond

Multi-Sector Fixed Income

Intermediate Government Bond

High Yield

High Yield Income

ALTERNATIVE

International REIT

Global Infrastructure

REIT

Alternatives Diversifier

Market Neutral

INTERNATIONAL EQUITY

Emerging Mkts Opportunities

Foreign Opportunities

Global Opportunities

13 |

Business Model

Products

Distribution

Financial and Operating

Attributes

Multi-market distribution

Broad and balanced retail

distribution reach

Well-defined value

proposition

Experienced retail sales

force and effective strategy

14 |

ATTRIBUTES

CHANNELS

RETAIL

Segmentation

Well-defined value proposition

Diagnostic sales approach

Metric driven accountability

Wirehouse

Regional

Planners

RIA

DCIO / VIT

INSTITUTIONAL

Affiliate-centric

Consultative approach

Consultants

Direct

Multi-Market Distribution

15 |

Broad

and Balanced Reach As of March 31, 2011

* Figures include both long-term mutual funds and sponsored managed

accounts AUM BY FIRM*

YTD SALES BY FIRM*

$15.3 billion

$2.3 billion

16 |

Well-Defined Value Proposition

One point access to a number of differentiated and diverse high quality

boutique managers

Assist financial advisors to gather, place and retain assets

Utilize a consultative approach to help financial advisors better manage their

book of business

17 |

Business Model

Products

Distribution

Financial and Operating

Attributes

Significant growth in assets,

sales and net flows

Bottom-line growth and

margin expansion

Solid balance sheet and

capital flexibility

Significant tax attributes

18 |

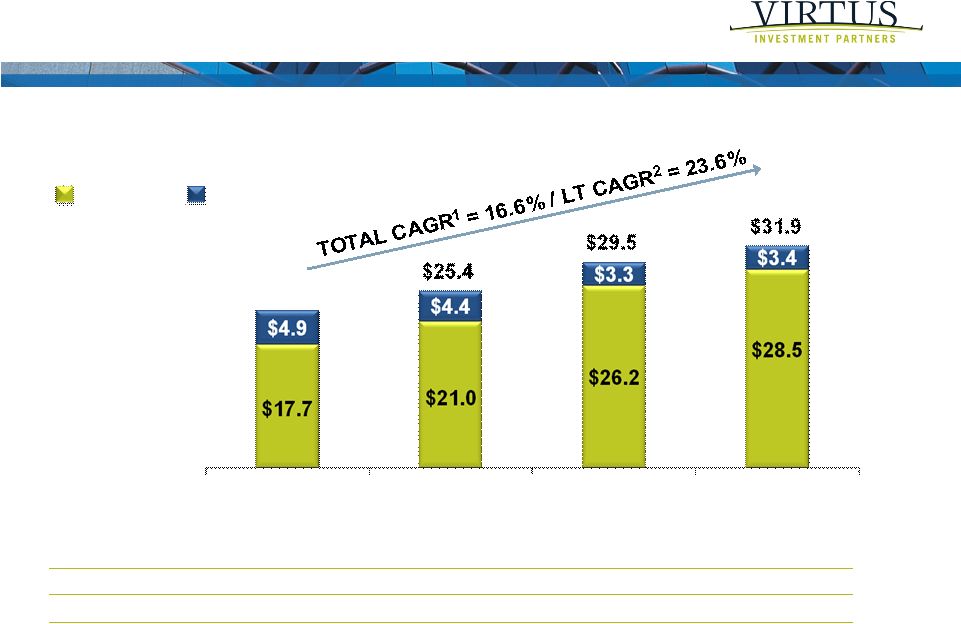

ASSETS UNDER MANAGEMENT

$ in billions

1

TOTAL CAGR –

Reflects compound annual growth rate for Long-Term and Cash AUM from

12/31/08 to 3/31/11 2

LT CAGR –

Reflects compound annual growth rate for Long-Term AUM from 12/31/08 to

3/31/11 Financial and Operating Attributes

AUM DRIVERS

Sales

-

$3.9

$5.8

$2.6

Net Flows

-

$0.1

$1.6

$1.4

Market Appreciation

-

$3.0

$2.3

$0.9

12/31/08

12/31/09

12/31/10

3/31/11

Long-Term

Cash

$22.6

19 |

$

in millions 1

Annualized

Financial and Operating Attributes

20 |

Financial and Operating Attributes

OPERATING INCOME, AS ADJUSTED

$ in millions

1

See Appendix for Reconciliation from GAAP to Non-GAAP Reporting.

2

Percentage of Revenues, as adjusted

21

1 |

Financial and Operating Attributes

1

Working Capital divided by annualized quarterly operating expenses

$ in millions

WORKING CAPITAL TREND

12/31/08

12/31/09

12/31/10

3/31/11

% of Spend

1

27%

25%

28%

27%

Cash

$51.1

$28.6

$43.9

$33.0

Debt

$20.0

$15.0

$15.0

$15.0

Stockholders’

equity

$36.6

$29.7

$48.3

$50.6

22 |

Financial and Operating Attributes

$ in millions

FEDERAL DEFERRED TAX ASSET INVENTORY

COMPONENTS

DEFERRED

TAX ASSETS

ORDINARY INCOME

TAX SHIELD

Net Operating Losses

$10.4

$29.6

Intangible Assets

60.0

192.1

Subtotal-Ordinary Income Attributes

$70.4

$221.7

Capital Losses

$81.5

-

Subtotal-Capital Income Attributes

$81.5

-

TOTAL

$151.9

$221.7

Note:

Amounts are reduced by Section 382 limitations;

substantially all assets have a full valuation allowance recorded

23 |

Financial and Operating Attributes

KEY ATTRIBUTES

AUM (5/31/11)

$5.2B

Q1 2011 organic growth rate

1

49.0%

Fee rate on internalized AUM

25 bps

Run rate incremental revenue

$12.8M

Team members

13

1

Annualized

MULTI-SECTOR TEAM

24 |

Growth Opportunities

Product offerings

–

New strategies from existing managers

–

New products from existing strategies

–

New affiliated subadvisers and teams

Distribution capabilities

–

Institutional market

–

Further retail penetration outside of wirehouses

–

Selective resource expansion

Operational and infrastructure enhancements

25 |

Virtus Value Proposition

Multi-boutique manager, multi-strategy model

Diversified and balanced product set

Distribution through multiple channels with broad retail access

Sales and profitability momentum

Improved profitability by leveraging business model

26 |

********************************************************

*****************************************************

27 |

Appendix

Q1:09

Q2:09

Q3:09

Q4:09

Q1:10

Q2:10

Q3:10

Q4:10

Q1:11

Revenues, GAAP Basis

$26,251

$27,181

$30,395

$33,325

$33,447

$34,788

$35,582

$40,739

$44,121

Less:

Distribution and administration expenses

6,838

7,449

7,510

8,142

7,344

7,786

8,217

9,858

11,077

Revenues, as adjusted

$19,413

$19,732

$22,885

$25,183

$26,103

$27,002

$27,365

$30,881

$33,044

Operating Expenses, GAAP Basis

$30,722

$30,003

$31,017

$32,033

$32,740

$33,571

$32,685

$36,289

$39,678

Less:

Distribution and administrative expenses

6,838

7,449

7,510

8,142

7,344

7,786

8,217

9,858

11,077

Depreciation and amortization

2,268

2,217

2,436

2,070

2,024

1,793

1,588

1,524

1,535

Stock-based compensation

333

1,203

949

1,035

845

1,163

988

898

841

Restructuring and severance charges

437

193

450

22

30

1,100

228

277

147

Operating Expenses, as adjusted

$20,846

$18,941

$19,672

$20,764

$22,497

$21,729

$21,664

$23,732

$26,078

Operating Income (Loss), as adjusted

($1,433)

$791

$3,213

$4,419

$3,606

$5,273

$5,701

$7,149

$6,966

Operating margin, GAAP basis

(17%)

(10%)

(2%)

4%

2%

3%

8%

11%

10%

Operating margin, as adjusted

(7%)

4%

14%

18%

14%

20%

21%

23%

21%

$ in thousands

Reconciliation from GAAP to Non-GAAP Reporting

28 |

Appendix

Notes for Reconciliation to GAAP Reporting

1)

Revenues, as adjusted, is a non-GAAP financial measure calculated by netting

distribution and administration expenses from GAAP revenues.

Management believes revenues, as adjusted, provides useful information to investors because distribution and administrative

expenses are costs that are generally passed directly through to

external parties. Effective with the 2010 first quarter, the company no

longer pays outside service providers for certain fund administration and

transfer agency services from the fees it collects for open-end funds it

manages. These amounts are now paid by the funds directly to the

third-party service providers and, as a result, the revenue and expense

previously recorded by the company for these services are no longer

reflected. These payments were reported in the above reconciliation of

GAAP to non-GAAP revenue and expenses for the 2009 period.

2)

Operating expenses, as adjusted, is a non-GAAP financial measure that

management believes provides investors with additional information because

of the nature of the specific excluded operating expenses. Specifically, management adds back amortization and impairments

attributable to acquisition related intangible assets as this is

useful to an investor to consider our operating results with the results of other

asset management firms that have not engaged in significant acquisitions. In

addition, we add back restructuring and severance charges as we believe that

operating expenses exclusive of these costs will aid comparability of the

information to prior reporting periods. We believe that because of the

variety of equity awards used by companies and the varying methodologies for determining stock-based compensation

expense, excluding stock-based compensation enhances the ability of management

and investors to compare financial results over periods. Distribution and

administrative expenses are excluded for the reason set forth above.

3)

Operating income (loss), as adjusted, and operating margin, as adjusted, are

calculated using the basis of revenues, as adjusted, and operating expenses,

as adjusted, as described above. The above measures should not be considered

as substitutes for any measures derived in accordance with GAAP and may not be

comparable to similarly titled measures of other companies. Exclusion of

items in our non-GAAP presentation should not be considered as an

inference that these items are unusual, infrequent or non-recurring.

Virtus Investment Partners reports its financial results on a Generally Accepted

Accounting Principles (GAAP) basis; however management believes that

evaluating

the

company's

ongoing

operating

results

may

be

enhanced

if

investors

have

additional

non-GAAP

financial

measures.

Management

reviews

non-GAAP

financial

measures

to

assess

ongoing

operations

and

considers

them

only

to

be

additional

metrics

for

both

management

and

investors

to

consider

the

company's

financial

performance

over

time,

as

noted

in

the

footnotes

below.

Management

does

not

advocate

that

investors

consider

such

non-GAAP

financial

measures

in

isolation

from,

or

as

a

substitute

for,

financial

results

prepared

in

accordance

with

GAAP.

29 |