Attached files

| file | filename |

|---|---|

| EX-31.2 - UNIVERSAL TRAVEL GROUP | v215988_ex31-2.htm |

| EX-21.1 - UNIVERSAL TRAVEL GROUP | v215988_ex21-1.htm |

| EX-31.1 - UNIVERSAL TRAVEL GROUP | v215988_ex31-1.htm |

| EX-32.2 - UNIVERSAL TRAVEL GROUP | v215988_ex32-2.htm |

| EX-10.8 - UNIVERSAL TRAVEL GROUP | v215988_ex10-8.htm |

| EX-32.1 - UNIVERSAL TRAVEL GROUP | v215988_ex32-1.htm |

| EX-23.1 - UNIVERSAL TRAVEL GROUP | v215988_ex23-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

or

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _____________to ______________

Commission file number 001-34284

UNIVERSAL TRAVEL GROUP

(Exact name of registrant as specified in its charter)

|

Nevada

|

90-0296536

|

|

State or other jurisdiction of

Incorporation or organization

|

(I.R.S. Employer

Identification No.)

|

5th Floor, South Block, Building 11, Shenzhen Software Park, Zhongke 2nd Road, Nanshan District,

Shenzhen, PRC 518000

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code 011-86- 755-836-68489

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 par value per share

|

New York Stock Exchange, LLC

|

Securities registered pursuant to section 12(g) of the Act:

Preferred Stock, $0.001 par value per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. x Yes ¨ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

¨ Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

|

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

¨ Yes x No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Note.—If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in this Form.

The aggregate market value of the voting and non-voting common stock of the issuer held by non-affiliates as of June 30, 2010 was approximately $ 69,812,746.08 (9,919,522 shares of common stock) based upon the closing price of the common stock as quoted by NYSE on such date.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.¨ Yes ¨ No

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

As of June 7, 2011, there are presently 19,898,235 shares of common stock, par value $0.001 issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980).

Table of Contents

|

|

|

Page

|

|

|

PART I

|

|||

|

Item 1.

|

Business

|

3 | |

|

Item 1A.

|

Risk Factors

|

18 | |

|

Item 1B.

|

Unresolved Staff Comments

|

24 | |

|

Item 2.

|

Properties

|

24 | |

|

Item 3.

|

Legal Proceedings

|

25 | |

|

Item 4.

|

(Removed and Reserved)

|

||

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

26 | |

|

Item 6.

|

Selected Financial Data

|

29 | |

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

29 | |

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

42 | |

|

Item 8

|

Financial Statements and Supplementary Data

|

42 | |

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

43 | |

|

Item 9A.

|

Controls and Procedures

|

44 | |

|

Item 9B.

|

Other Information

|

45 | |

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

46 | |

|

Item 11.

|

Executive Compensation

|

51 | |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

53 | |

|

Item 13.

|

Certain Relationships and Related Transactions and Director Independence

|

56 | |

|

Item 14.

|

Principal Accountant Fees and Services

|

56 | |

|

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

58 |

2

PART I

Item 1. Business.

History and Organization

Universal Travel Group (the “Company”) was incorporated on January 28, 2004, pursuant to the laws of the state of Nevada.

On March 15, 2006, we entered into an Acquisition Agreement and Plan of Merger (the "Acquisition Agreement") with TAM of Henderson, Inc. ("TAM"), whereby TAM acquired all of our outstanding shares of Common Stock from our then sole stockholder and simultaneously merged with and into the Company, with the Company as the surviving corporation.

On June 20, 2006, Mr. Xiao Jun ("Jun"), our former officer and director, acquired from the then-majority-shareholder of our Company 2,666,667 shares of our Common Stock, for an aggregate purchase price of $435,000 (the "Stock Transaction"). After giving effect to such acquisition, Jun held 2,666,667 of the 3,483,333 shares of our Common Stock then issued and outstanding, constituting, in the aggregate, 77% of the then issued and outstanding shares of Common Stock of the Company. In connection with his acquisition of shares in the Company, Jun was appointed as our Chief Executive Officer.

On July 12, 2006, we consummated the transaction contemplated by the Agreement and Plan of Merger, dated as of June 26, 2006 (the "Merger Agreement"), by and among the Company, Merger Sub of Tam, Inc. ("Merger Subsidiary"), a wholly owned subsidiary of us, Full Power Enterprise Global Limited (“Full Power”), and the shareholders of Full Power. In accordance with the Merger Agreement, Merger Subsidiary merged with and into Full Power, Merger Subsidiary ceased to exist and Full Power was the surviving entity (the "Merger Transaction").

The Full Power Shareholders received 6,666,667 shares of Common Stock in exchange for all of the issued and outstanding shares of Full Power. As a result of the Merger Transaction, Full Power became the Company's wholly owned subsidiary. Full Power owns all of the issued and outstanding capital stock of Shenzhen Yu Zhi Lu Aviation Service Company Limited (“YZL”).

In connection with the Merger Transaction, Jiangping Jiang (who, prior to the Merger Transaction was a shareholder of Full Power), Xin Zhang and Hoi-Yui Lee were appointed to our Board of Directors and Jun resigned from all positions with us.

Business Overview

With the acquisition of Full Power and hence YZL, we shifted our business to the online travel service industry in the People’s Republic of China (“PRC”). YZL, a company organized under the laws of the PRC, is primarily engaged in the business of providing domestic and international airline ticketing services. Additionally, YZL provides hotel reservations, packaged tours, and air delivery services both online and through customer representative offices. YZL also owns an aviation network (www.cnutg.com) that provides a complete air ticket sales network.

2007 Acquisitions

During 2007, we made several acquisitions, which expanded our scope of business.

On April 10, 2007, we acquired Shenzhen Speedy Dragon Enterprise Limited ("SSD") in exchange for 238,095 shares of our shares of Common Stock and an interest-free promissory note in the principal amount of $3,000,000, payable no later than April 10, 2008. The note has been repaid in full. SSD is mainly a cargo logistics company providing commercial, point-to-point parcel and container transportation services within the PRC.

3

On June 12, 2009, the Company entered into a termination agreement with Xiangsheng Song, the legal representative of SSD to return all its equity interest in SSD to him, the original sole shareholder of SSD before our acquisition in 2007. As a result of the termination agreement, SSD was spun off from our business.

Current PRC laws and regulations impose substantial restrictions on foreign ownership of the air-ticketing, travel agency, advertising and value-added telecommunications businesses in the PRC. According to the Rules on Cognizance of Qualification for Civil Aviation Transporting Marketing Agencies (2006) and relevant foreign investment regulations regarding civil aviation business, a foreign investor currently cannot own 100% of an air- ticketing agency in the PRC, except for Hong Kong and Macau aviation marketing agencies. In addition, foreign-invested air-ticketing agencies are not permitted to sell airline tickets for domestic flights in the PRC.

We, through YZL, entered into share escrow agreements with Shenzhen Yuzhixing Aviation Service Co., Ltd. (“YZX”), a PRC domestic company funded by YZL and two PRC individuals (collectively, the “XGN Nominees”) to hold 100% of the equity interest in Xi'an Golden Net Travel Serve Service Company Limited ("XGN"), a PRC travel company which we acquired on August 6, 2007 in exchange for 50,588 shares of our Common Stock and interest-free promissory notes in the aggregate principal amount of $1,542,000, payable no later than August 6, 2008. The note has been repaid in full.

The significant details of the share escrow agreements are outlined below:

|

|

·

|

YZL and Universal Travel Group funded the start-up activities and incorporation of XGN and related subsidiaries, through cash or common stock issuance;

|

|

|

·

|

YZL entrusted the XGN Nominees as the name holders only of YZL equity interest in XGN;

|

|

|

·

|

The XGN Nominees shall neither participate in the management of operation nor shareholder meeting decisions of XGN;

|

|

|

·

|

YZL, as the actual fund provider of XGN, will enjoy all shareholder rights and profit sharing;

|

|

|

·

|

YZL, is entitled to all profits and is required to absorb all losses of XGN and its subsidiaries;

|

|

|

·

|

The XGN Nominees are not responsible for losses nor to benefit from any income of XGN;

|

|

|

·

|

YZL will cover any capital infusion requirements of XGN and related subsidiaries; and

|

|

|

·

|

If XGN were to dissolve, YZL will enjoy the right to allocate and divide assets.

|

XGN was established in 2001 and focuses on the domestic tourism market. It provides air tickets, train tickets and other travel-related services including servicing individuals and groups attending conferences and exhibitions, making travel arrangements for business studies, academic exchanges, travel adventures, cultural education, sports competition, and theatrical performances. XGN also specializes in central plains tours of Xi'an. Since 2005, XGN has formed joint ventures with other travel agencies in Tibet, Xinjiang, Shanxi and Inner Mongolia that focus on western plains routes.

In August 8, 2007, we acquired Shanghai Lanbao Travel Service Company Limited ("SLB") in exchange for 200,000 shares of our Common Stock and interest-free promissory notes in the aggregate principal amount of $2,828,000, payable no later than August 8, 2008. The note has been repaid in full.

SLB was established in 2002 and its core business focus is a centralized real-time booking system providing consumers and travel related businesses with hotel bookings, air ticket and tourism information via the internet and mobile phone text-messaging technology. It owns and manages the award winning China Booking Association website, http://www.cba-hotel.com/, which receives approximately 200,000 visitors daily.

In October 29, 2007, we acquired Foshan Overseas International Travel Service Co., Ltd. ("FOI") in exchange for 374,329 shares of our Common Stock and interest-free promissory notes in the aggregate principal amount of $3,153,500, payable no later than October 29, 2008. This note has been repaid in full.

4

FOI was established in 1990. Its core business focuses on both domestic and international tourism, as well as packaged airfare, hotel and conference reservations with ground transportation within the PRC. For three consecutive years, FOI has been recognized as one of the 100 outstanding enterprises by the China Tourism Bureau and in 2004 was voted one of the most credible enterprises in the country. It served more than 120,000 people with packaged tours and conferences in 2009.

2008 Expansion

On December 16, 2008, we established Shenzhen Universal Travel Agency Co. Ltd., a PRC company (“STA”), to meet the increasing packaged-tour demand in Shenzhen City. However, operations of STA did not start until June 6, 2009.

As in the case of the acquisition of XGN described above and for the same legal reasons, YZL entered into share escrow agreements with three domestic residents, including Jing Xie, our present Chief Financial Officer to hold 100% of the equity interest of STA as nominees of YZL. The terms of the share escrow agreements relating to the STA Nominees are similar to those as described above for the YZL Nominees.

2009 Expansion

On March 23, 2009, in order to seize upon opportunities arising from the economic promotion by the Chinese government of the middle and western regions of the PRC, we strategically set up Chongqing Universal Travel E-Commerce Co., Ltd, a PRC company (“CTE”), to strengthen our presence in that region. However, operations of CTE did not start until June 16, 2009.

On December 10, 2009, we entered into Subscription Agreements with certain investors to sell to them an aggregate of 2,222,222 shares of common stock of the Company, for a purchase price of $9.00 per share and an aggregate gross purchase consideration of $19,999,998. The offer and sale of the shares were made pursuant to an effective Registration Statement on Form S-3 (Registration No. 333- 161139) initially filed with the Securities and Exchange Commission on August 7, 2009 and amended on November 2, 2009. The Registration Statement was declared effective on November 5, 2009. The sale and purchase of the shares closed on December 15, 2009.

On June 15, 2010, we entered into an underwriting agreement (the "Underwriting Agreement") with Brean Murray, Carret & Co., LLC, as representative of the underwriters (the "Representative"), related to a public offering of 2,857,143 shares of the Company's common stock at a price of $7.00 per share less a 5% underwriting commission. Under the terms of the Underwriting Agreement, we granted the Representative an option, exercisable for 30 days, to purchase up to an additional 428,572 shares of common stock to cover over-allotments, if any. The offering was made pursuant to an effective registration statements on Form S-3, as amended and supplemented (Registration Statement No. 333-161139) filed with the Securities and Exchange Commission. On June 21, 2010, we closed the common stock offering announced on June 16, 2010. In the transaction, we issued 2,857,143 shares of common stock at $7.00 per share for an aggregate amount of $20 million.

With the completion of the raise, we then sought to seek out acquisition targets that would both complement our strategic growth and service products.

Acquisitions in 2010

On March 26, 2010, the Company through its VIE structure and strategy executed an acquisition agreement to acquire all the equity interest of Huangshan Holiday Travel Service Company (“Huangshan Holiday”) with shareholders of Huangshan Holiday. Pursuant to the acquisition agreement, the purchase consideration was RMB 20 million, which was payable as follows: (i) 20% of the purchase consideration was to be paid in shares of restricted common stock of the Company with a per stock price of $ 9.47, being the average closing price of the Company’s shares for the 15 days prior to the date of execution of the Agreement and amounting to 61,847 shares of restricted common stock; (ii) 40% or RMB 8 million (approximately $1.17 million) to be paid within 10 days of the announcement of the acquisition; (iii) 20% or RMB 4 million (approximately, $588,235) within 10 days of completion of the share exchange formalities with the local business authorities and (iv) the remaining 20% of the purchase consideration within 10 days of the formal close of the acquisition transaction. The shareholders of Huangshan Holiday agreed to continue their service at Huangshan Holiday for the next five fiscal years and to accomplish certain projected financial goals. In the event that they or Huangshan Holiday breach the acquisition agreement, Shenzhen Universal Travel Agency Co. Ltd shall be entitled to terminate the acquisition agreement and receive a full refund of the purchase consideration and up to $1 million in damages.

5

Founded in 1999, Huangshan Holiday provides comprehensive travel services in the Huangshan district in the Anhui Province of China. Huangshan, a national geological park and UNESCO World Heritage Site, is one of China’s most popular travel destinations, with over eight million tourists annually. Huangshan Holiday provides guided and self-guided package tours and airline and hotel reservation services for both leisure and business travelers. Huangshan Holiday serves as the exclusive hotel reservation agency for several major online travel service providers in China, including eLong and 12580, and has over 70% share of the mid to high end hotel reservation market in the Huangshan Tourism District.

On March 29, 2010, our subsidiary, the Company through its VIE structure and strategy executed an acquisition agreement (the “Tianyuan Agreement”) to acquire all the equity interest of Hebei Tianyuan International Travel Agency Co., Ltd (“Tianyuan”) with shareholders of Tianyuan and another acquisition agreement (the “Yulongkang Agreement”) to acquire all the equity interest in Zhengzhou Yulongkang Travel Agency Co., Ltd with shareholders of Yulongkang.

Founded in 1999, Tianyuan was the first authorized travel agency in the Hebei Province in China. In addition, Tianyuan is the exclusive provider of travel agency services to Mount Lu and Lushan National Park, both domestic tourist attractions listed on the UNESCO World Heritage Site. Tianyuan was the organizer of the International Economy & Culture Communication Forum sponsored by the local government and the exclusive organizer of the Young Journalist Summer Camp sponsored by the Yanzhao Evening Paper. We believe that Taiyuan’s exclusive service with these regional sites and unique partnership with the government provides Tianyuan with an advantage to be a market leader in travel services in the region.

Zhengzhou Yulongkang Travel Service Company was established in 2000 in Zhengzhou, Henan Province of China. The company currently has a management team of 25 people and over 60 tour organizers and guides. The Company provides comprehensive travel services and maintains long-term cooperation relations with transportation agents, travel destinations, hotels, and air ticket agencies. Its regional tour routes include “Charming Tibet”, “Winter Hot Spring”, “Passion Ski Trip”, etc. Zhengzhou Yulongkang Travel Service Company has received a series of industry and corporate awards from 2003 to 2006.

Pursuant to the Tianyuan Agreement, the purchase consideration was RMB 30 million (approximately $4.4 million), which was payable as follows: (i) 20% of the purchase consideration was to be paid in shares of restricted common stock of the Company with a per stock price of $ 9.42, being the average closing price of the Company’s shares for the 15 days prior to the date of execution of the Agreement and amounting to 93,282 shares of restricted common stock; (ii) 40% or RMB 12 million (approximately $1.76 million) within 10 days of the announcement of the acquisition; (iii) 20% or RMB 6 million (approximately, $882,353) within 10 days of completion of the share exchange formalities with the local business authorities and (iv) the remaining 20% of the purchase consideration within 10 days of the formal close of the acquisition transaction.

The shareholders of Tianyuan agreed to continue their service at Tianyuan for the next five fiscal years and to accomplish certain projected financial goals. In the event that they or Tianyuan breach the Agreement, Shenzhen Universal Travel Agency Co. Ltd shall be entitled to terminate the Tianyuan Agreement and receive a full refund of the purchase consideration and up to $1 million in damages.

6

Pursuant to the Yulongkang Agreement, the purchase consideration was RMB 39 million as previously stipulated in our letter of intent, which was payable as follows: (i) 10% of the purchase consideration was to be paid in shares of restricted common stock of the Company with a per stock price of $ 9.42, being the average closing price of the Company’s shares for the 15 days prior to the date of execution of the Agreement and amounting to 60,633 shares of restricted common stock; (ii) 45% or RMB 17.55 million (approximately $2.58 million) within 10 days of the announcement of the acquisition; (iii) 25% or RMB 9.75 million (approximately, $1.4 million) within 10 days of completion of the share exchange formalities with the local business authorities and (iv) the remaining 20% of the purchase consideration within 10 days of the formal close of the acquisition transaction.

The shareholders of Yulongkang also agreed to continue their service at Yulongkang for the next five fiscal years and to accomplish certain projected financial goals. In the event that they or Yulongkang breach the Agreement, Shenzhen Universal Travel Agency Co. Ltd shall be entitled to terminate the Agreement and receive a full refund of the purchase consideration and up to $1 million in damages.

On June 28, 2010, our subsidiary, the Company through its VIE structure and strategy executed an acquisition agreement (the “Kunming Agreement”) to acquire all the equity interest of Kunming Business Travel Agency Co., Ltd. ("Kunming Business Travel") with shareholders of Kunming Business Travel Tianyuan and another acquisition agreement (the “Shanxi Agreement”) to acquire all the equity interest in Shanxi Jinyang Travel Agency Co., Ltd. ("Shanxi Jinyang") with shareholders of Shanxi Jinyang..

Kunming Business Travel was founded in 1993 in Kunming, Yunnan Province and is the premier golf travel service agency in its region. Kunming Business Travel has partnerships with seven golf clubs and provides services, including reservations, event planning, hosting business trips and golf competitions. Kunming Business Travel is the only professional golf travel service provider in the Yunnan Province.

Shanxi Jinyang was founded in 1988 in Taiyuan, Shanxi Province and is one of the largest travel agencies in Shanxi Province in terms of tourist volume and revenues. Shanxi Jinyang provides comprehensive travel services and has good business relationships with travel destinations, hotels, and air ticketing agencies.

Pursuant to the Kunming Agreement, the purchase consideration was payable as follows: (i) 10% of the purchase consideration was to be paid in shares of restricted common stock of the Company with a per stock price of $7.20, being the average closing price of the Company’s shares for the 15 days prior to the date of execution of the Agreement and amounting to 79,487 shares of restricted common stock within 90 days after the announcement of acquisition and to be circulated five years later ; (ii) 45 % or RMB 17.55 million (approximately $2.58 million) within 10 days of the signing of the agreement; (iii) 45% or RMB 17.55 million (approximately, $2.58 million) within 10 days of completion of the share exchange formalities with the local business authorities.

The shareholders of Kunming Business Travel agreed to continue their service at Kunming Business Travel for the next five fiscal years and to accomplish certain projected financial goals. In the event that they or Kunming Business Travel breach the Agreement, Shenzhen Universal Travel Agency Co. Ltd shall be entitled to terminate the Agreement and receive a full refund of the purchase consideration and up to $1 million in damages.

Pursuant to the Shanxi Agreement, the purchase consideration was payable as follows: (i) 10% of the purchase consideration was to be paid in shares of restricted common stock of the Company with a per stock price of $ 7.20, being the average closing price of the Company’s shares for the 15 days prior to the date of execution of the Agreement and amounting to 31,387 shares of restricted common stock within 90 days after the announcement of acquisition and to be circulated five years later ; (ii) 45% or RMB 6.93 million (approximately $1.02 million) within 10 days of the signing of the agreement; (iii) 45% or RMB 6.93 million (approximately, $1.02 million) within 10 days of completion of the share exchange formalities with the local business authorities.

The shareholders of Shanxi Jinyang agreed to continue their service at Shanxi Jinyang for the next five fiscal years and to accomplish certain projected financial goals. In the event that they or Shanxi Jinyang breach the Agreement, Shenzhen Universal Travel Agency Co. Ltd shall be entitled to terminate the Agreement and receive a full refund of the purchase consideration and up to $1 million in damages.

The Company refers to collectively here within and throughout this annual report, all wholly owned subsidiaries and variable interest entities as subsidiaries.

7

The issuance of shares of common stock pursuant to the abovementioned agreements was exempt from registration in reliance upon Regulation S and Section 4(2) of the Securities Act of 1933, as amended. Shareholders of Huangshan Holiday, Tianyuan, Yulongkang, Kunming Business Travel and Shanxi Jinyang are non-U.S. persons, as defined in Rule 902(k) of Regulation S, In addition, our shares were issued without registration under Section 5 of the Securities Act in reliance on the exemption from registration contained in Section 4(2) of the Securities Act. Specifically, (1) we had determined that the they were knowledgeable and experienced in finance and business matters and thus they are able to evaluate the risks and merits of acquiring our securities; (2) they had advised us that they were able to bear the economic risk of purchasing our common stock; (3) we had provided them with access to the type of information normally provided in a prospectus; and (4) we did not use any form of public solicitation or general advertising in connection with the issuance of the shares.

Corporate Structure

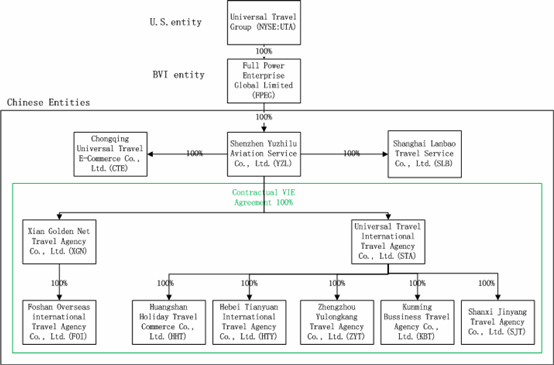

The following diagram illustrates our corporate structure.

Disposition of TRIPEASY Kiosks

On September 9, 2010, our subsidiary, Shenzhen Yuzhilu Aviation Service Co. Ltd. executed a purchase and sale agreement to sell all of our 1,523 TRIPEASY kiosks to Shenzhen Xunbao E-Commerce Co., Ltd. for a total of RMB 40,301,417.73, or approximately $5.93 million. Pursuant to the agreement, although we shall no longer operate or retain ownership rights to the kiosks, we will continue to have exclusive air ticketing, hotel reservation and package tour travel product sales rights in all TRIPEASY kiosks for a two-year period from the closing date of the agreement.

8

Pursuant to the agreement, the purchase price was to be paid in three installments: (i) RMB10,000,000 shall be paid by September 14, 2010, (ii) RMB15,000,000 shall be paid by October 9, 2010, and the remaining portion of the purchase price shall be paid on or prior to the earlier of December 9, 2010, or within 5 days of our completion of making certain developments to the interface and functionality of the kiosks. The first and second installments were paid in full before December 31, 2010 and the third installment was paid in full on February 24, 2011.

International Travel License

On December 24, 2010, we obtained the International Travel License issued by the National Travel Authority, granting us the right to operate and offer global package tours in mainland People’s Republic of China. In the past, we had only been able to offer such packages through agencies which possess this license. There are over 20,000 travel agencies in the PRC, of which only approximately 1,300 travel agencies have this International Travel License.

Franchises

In order to leverage on our International Travel License, we have decided to franchise our license to local travel agencies. Recently, we granted our franchise to eight local travel agencies in Shenyang, Dalian and Qingdao. They have converted their business model, adopted our franchise operating scheme, and updated their local business registration to run this franchise officially. As of present date, we have had no revenues from our franchises but expect to generate revenues from them soon.

Sources of Revenue

We have three lines of business and revenue, namely (i) air-ticketing (Shenzhen Yu Zhi Lu Aviation Service Company Limited and Chongqing Universal Travel E-Commerce Co., Ltd), (ii) hotel reservations (Shanghai Lanbao Travel Service Company Limited), and (iii) packaged tours (Xi'an Golden Net Travel Serve Service Co., Ltd., Foshan Overseas International Travel Service Co., Ltd., Universal Travel International Travel Agency Co. Ltd, (formerly Shenzhen Universal Travel Agency Co., Ltd.), Huangshan Holiday Travel Service Co., Ltd., Hebei Tianyuan Travel Agency Co., Ltd., Zhengzhou Yulongkang Travel Agency Co., Kunming Business Travel Service Co., Ltd., and Shanxi Jinyang Travel Agency Co., Ltd.). We previously provided air cargo agency services through Shenzhen Speedy Dragon Enterprise Limited, which we spun off in June 2009. SSD has been accounted for under discontinued operations.

Air-ticketing

We are, through our subsidiary, YZL and CTE, in the air-ticketing business. YZL has contracted with certain Chinese domestic airlines such as Air China, China Southern Airlines and China Eastern Airlines and 34 international airlines such as United Airlines, Cathay Pacific and Virgin Airlines to sell Chinese domestic and international air tickets. YZL holds the “First Class Air-Ticketing Agency” license from the General Administration of Civil Aviation of China (“CAAC”). YZL has been in operation for more than ten years.

We and our agents utilize a centralized air-ticketing booking system called the “eTerm system” maintained and owned by the PRC government to issue air tickets. We pay a license fee the use of the “eTerm system” and charge our agents a pro-rated portion of that fee for their use of the system through us.

YZL receives commissions (averaging 6%) from travel suppliers for air-ticketing under various services agreements. Commissions from air-ticketing services rendered are recognized at the time when the air tickets are issued. Our customers pay for their tickets online or through TRIPEASY Travel Service Kiosks (the “Kiosks”), self-service terminals owned by Shenzhen Xunbao E-commerce Co. Ltd., with credit cards or bank debit cards and are then issued their tickets. Our revenue from such transactions is on a net basis in the consolidated statements of income as we generally do not assume inventory risks and have no obligations for cancelled air-ticket reservations. We are, typically, paid our aggregated commissions once a month.

Our air-ticketing business is affected by the conditions of the travel industry in China. Travel expenditures are highly sensitive to business and personal discretionary spending levels and thus tend to decline during general economic downturns, such as the slowdown in economic growth arising from the international financial crisis which began in 2008. Adverse trends or events that tend to reduce travel and are likely to reduce our revenues include:

9

|

|

·

|

declines in economic growth, recessions, and financial or other economic crises;

|

|

|

·

|

increases in prices in the hotel, airline or other travel-related sectors;

|

|

|

·

|

the occurrence of travel-related accidents;

|

|

|

·

|

outbreaks, or the fear of outbreaks, of H1N1 flu (swine flu), severe acute respiratory syndrome, avian flu or other diseases;

|

|

|

·

|

terrorist attacks or threats of terrorist attacks or wars;

|

|

|

·

|

natural disasters or poor weather conditions;

|

|

|

·

|

increase in oil prices;

|

|

|

·

|

a decrease in the number of extended holiday periods like the Spring Festival and long weekend holidays.

|

As a result of any of these events, over which we have no control, our results could be severely and adversely affected.

Further, because we are agents for the sale of air tickets, we do not have any control over air ticket prices, which directly affect their demand and our profitability. Conversely, we do not bear any risk for unsold tickets and maintain no inventory. Also, we are affected by the seasonality of travel in general and global events such as the World Expo in Shanghai in 2010 which, as we anticipated, increased the demand for travel.

Hotel reservations

We are, through our subsidiary SLB, are involved in the hotel reservations business.

We have contracted with approximately 9,000 hotels and have established a China Booking Association comprising more than 1,000 travel agencies which share more than 200,000 hotel resources internationally.

Our customers are able to inquire via either our centralized website (www.cnutg.com). Additionally, SLB maintains a 100 square meters call center in Shanghai with 20 seats to handle hotel reservation enquiries.

We act as agent in substantially all of our hotel-related transactions. Our customers receive confirmed bookings and generally pay the hotels directly upon completion of their stays, and in general, we pay no penalty to the hotels if our customers do not check in. For our hotel suppliers, we earn pre-negotiated fixed commissions on hotel rooms we sell.

We contract with hotels for rooms under two agency models, the “guaranteed allotment” model and the “on-request” model. Under our agreements with our hotel suppliers, hotels are generally required to offer us prices that are equal to or lower than their published prices, and notify us in advance if they have promotional sales, so that we can lower our prices accordingly.

In addition to the agreements that we enter into with all of our hotel suppliers, we enter into a supplemental agreement with each of the hotel suppliers with which we have a guaranteed allotment arrangement. Pursuant to this agreement, a hotel guarantees us a specified number of available rooms every day, allowing us to provide instant confirmations on such rooms to our customers before notifying the hotel. The hotel is required to notify us in advance if it will not be able to make the guaranteed rooms available to our customers due to reasons beyond its control.

We receive commission from travel suppliers for hotel room reservations based on the transaction value of the rooms. Commission from hotel reservation services rendered is recognized after hotel customers have completed their stay at the applicable hotel and upon confirmation of pending payment of the commission by the hotel. Our revenue from such transactions is on a net basis in the consolidated statements of income. We, generally, do not assume inventory risks and have no obligations for cancelled hotel reservations. Our customers reserve hotel rooms through us, our website, or our Kiosks and pay for their rooms directly to the hotel.

Our primary customers in this segment are business and leisure travelers in China who do not travel in groups. These types of travelers, who are referred to in the travel industry as FITs (free individual travelers) and whom we refer to as independent travelers, form a traditionally under-served yet fast-growing segment of the China travel market. We act as agent in substantially all of our transactions and generally do not take inventory risks with respect to the hotel rooms booked through us.

10

Apart from the same factors affecting our air-ticketing business, other factors affecting our hotel reservations segment include:

|

·

|

our ability to secure more room supply relationships with hotels;

|

|

|

·

|

the quality and depth of our hotel supplier network and our ability to provide a diverse range of hotel rooms, locations and price points to appeal to our customers;

|

|

·

|

our commission rates which are largely determined by the hotels;

|

|

|

·

|

our ability to offer reservations at highly rated hotels is particularly appealing to our customers.

|

On July 13, 2010, we announced a partnership with Agoda, a subsidiary of Priceline.com, to strengthen our hotel reservation business segment. Under the partnership, we offer our customers access to Agoda’s international network of hotels. Through the updated cnutg.com website, travelers will be able to enjoy special Agoda promotions and instant confirmation at tens of thousands of hotels worldwide. However, as our business has largely been focused on domestic travel for Chinese residents, this partnership has not been productive during the year.

Packaged Tours

We are, through our subsidiaries, FOI, XGN, STA, HHT, HTY, ZTY, KBT and SJT, in the business of providing domestic and cross border packaged tour travel services.

We contract with traffic service providers, accommodation providers and leisure service providers so that we are able to purchase air tickets, train and coach tickets, accommodation and leisure or entertainment packages in bulk and then resell them to our customers with a mark-up. We have two sources of revenue: one from payment by individual customers and the other, through group sales. We recognize gross revenue when a tour is completed.

As we are the agent for packaged tours, we do not have any control over the components for air-ticket prices, hotel accommodation, transportation and tourism attraction ticket prices, which directly relates to the demand for packaged tours and their popularity or lack thereof.

We also bear no risk because we maintain no inventory of air tickets, hotel rooms or attraction tickets. We only purchase the various components comprising a packaged tour when an order or request for such a tour is made and paid for by a customer. Our customers may make an order for a packaged tour by booking it directly through us, our website or Kiosks. However, they may only pay for the packaged tour at our offices.

Because the packaged tour segment is tourism related and a packaged tour typically comprises a bundled travel and accommodation package, the significant factors, trends, demands and uncertainties affecting this segment are the same for air-ticketing and hotel reservations.

On December 24, 2010, we obtained the International Travel License issued by the National Travel Authority, granting us the right to operate and offer global package tours in mainland People’s Republic of China. In the past, we had only been able to offer such packages through agencies which possess this license. There are over 20,000 travel agencies in the PRC, of which only approximately 1,300 travel agencies have this International Travel License.

Reward Program and Gift Vouchers

We established a reward program for our air-ticketing and hotel reservations customers.

Our individual customers earn one point for each RMB they spend on air tickets or hotel reservations and can redeem gifts or vouchers when they have accumulated sufficient points.

11

Our corporate customers receive a cashback reward ranging from 0.5%-2% on on sales. This percentage varies according to sales volume and is written in agreements with our corporate customers. We account for these rewards as expenses.

We do not allocate any position of the revenue generating activities to the points earned and accrue for the cost of the point reward when the points are redeemed. We do not sell points separately and may discontinue this program or change the terms without any liability.

In 2010, FOI sold gift vouchers to customers and recorded these as customer advances. Customers can redeem them for package tours in FOI only. As of December 31, 2010, the balance of customer advances for gift vouchers was $28,427. FOI does not plan to issue more vouchers of such kind, and the vouchers will expire by the end of 2011.

Insurance

We presently have directors and officers insurance with Navigators Insurance Company. The policy is for a term of one year commencing June 23, 2010 to June 23, 2011 for an aggregate liability of $5,000,000. We have paid a premium of $42,000 for the policy. We do not have any other insurance.

Intellectual Property

We have applied to register the following trademarks with the Trademark Bureau of the State Administration for Industry & Commerce:

|

Trademark

|

Class

|

Registrant

|

||

|

UTG

|

16, 39, 42, 43

|

Shenzhen Yu Zhi Lu Aviation Service Company Limited

|

||

|

宇之路*

|

39, 43

|

Shenzhen Yu Zhi Lu Aviation Service Company Limited

|

||

|

旅程天下*

|

|

18,35,39,42,43

|

|

Shenzhen Yu Zhi Lu Aviation Service Company Limited

|

*宇之路 is the Chinese name of Yuzhilu and 旅程天下 is the Chinese name of Universal Travel Group.

We, through our subsidiary, XGN, have the “古都之旅” (the Chinese name of “Tour to Ancient Capital”) trademark registered under Class 39 with the Trademark Bureau of the State Administration for Industry & Commerce. The term of the registration is valid from January 7, 2005 through to January 6, 2015.

Class 16 (Paper goods and printed matter) covers paper, cardboard and goods made from these materials, not included in other classes; printed matter; bookbinding material; photographs; stationery; adhesives for stationery or household purposes; artists' materials; paint brushes; typewriters and office requisites (except furniture); instructional and teaching material (except apparatus); plastic materials for packaging (not included in other classes); playing cards; printers' type; printing blocks.

Class 18 covers leather, bag, backpack, travel accessories (leather), umbrella, climbing tools, harness, home tools (leather) and leather ropes.

Class 35 covers advertisement, advertising planning, business conference organizing, agency for import/export, agency marketing, human resources consulting, business site removal, systematic development for computer and database information, accounting, sales of self-service machines.

Class 39 covers transport, packaging and storage of goods and travel arrangements.

Class 42 (Computer, scientific & legal) covers scientific and technological services and research and design relating thereto: industrial analysis and research services; design and development of computer hardware and software; legal services.

12

Class 43 (Hotels and Restaurants) covers services for providing food and drink; temporary accommodations.

We have also registered the following domain names:

|

Domain Name

|

Owner

|

Registration

Date

|

Expiration Date

|

|||

|

www.cnutg.com

|

Shenzhen Yuzhilu Aviation Service Company Ltd

|

2006-05-05

|

2011-05-05

|

|||

|

www.cnutg.com.cn

|

Shenzhen Yuzhilu Aviation Service Company Ltd

|

2006-07-27

|

2013-07-27

|

|||

|

www.cnutg.cn

|

Shenzhen Yuzhilu Aviation Service Company Ltd

|

2006-07-27

|

2012-07-27

|

|||

|

www.cnutg.net

|

Shenzhen Yuzhilu Aviation Service Company Ltd

|

2006-07-27

|

2012-07-27

|

|||

|

www.cnutg.net.cn

|

|

Shenzhen Yuzhilu Aviation Service Company Ltd

|

|

2006-07-27

|

|

2012-07-27

|

Customers

Our customer base is very diversified and numerous. Almost all our customers are individuals and none of our customers comprise more than 1% of our revenue. The loss of any one of our customer will not have a material adverse effect on any segment of our business or our business, as a whole.

Revenue Breakdown

Packaged Tours

Below is a breakdown the number of sales of our packaged tours for the past two years:

|

Year

|

Visitors

|

Number of visitors multiplied by

the number of days comprising the tour

|

|||||

|

2009

|

|

|

212,460

|

|

|

807,300

|

|

|

2010

|

410,000

|

1,260,000

|

|||||

Air-ticketing

Below is a breakdown of the number of air tickets sold for the past two years:

|

Year

|

Number of Tickets

|

|

|

2009

|

|

2,360,000

|

|

2010

|

2,960,000

|

Hotel Reservations

Below is a breakdown of the number of hotel room nights booked through us for the past two years:

|

Year

|

Number of Room Nights

|

|

|

2009

|

|

2,349,000

|

|

2010

|

2,966,000

|

The management of the Company uses these performance metrics to monitor the performance of each of its business segments on a continuing basis and to assess, discern and anticipate any trends or cycles in the industry. With such tools, the Company is able to make calculated decisions and take any pre-emptive measures to safeguard the Company’s interests.

13

However, because of a confluence of other pertinent factors affecting the segments, the actual results of each segment may differ materially from what the metrics would suggest and any undue weight on these metrics in isolation is discouraged. For example, an increase in the number of room nights booked should conceivably mean an increase in revenue and hence an increase on commissions earned. However, this may be offset by lower room rates and lower commission rates.

Suppliers

For our air-ticketing business, our major suppliers are mainly the PRC domestic airlines. We contract directly and individually with each hotel and supplier of the various components of our packaged tours.

We do not have long term contracts with any one of our suppliers. We typically signed one year contracts which renew for successive one-year terms unless earlier terminated by either party. The main terms of such contracts would typically comprise terms pertaining to authorizations, trade deposits and payment method.

We are not dependent on any one supplier and most of our suppliers are competitors against each other within their own industry. Accordingly, we are able to choose the supplier with the most favorable terms to contract with and because such terms vary from time to time, our list of suppliers constantly changes too.

Our online reservation database is managed in-house and we are not dependent on a third party service provider to maintain our database and ensure that it is stable and secure.

Sales and Marketing

We advertise our services for the general public through roadside billboards, brochures, internet ads, cell phone message ads, newspapers and magazines ads.

Sales and marketing for the past two years account for very small percentage of our revenue, and as our Kiosks will be serving as an effective media platform in coming years and a marketing tool for us, we believe our sales and marketing expenses will not increase materially.

|

Subsidiary

|

Amount (RMB)/ (US$)

|

|

|

Foshan Overseas International Travel Service Co., Ltd.

|

38,313/$5,652

|

|

|

Shenzhen Yu Zhi Lu Aviation Service Company Limited

|

822,900/ $ 121,394 (Media Advertisement expenses)

240,000 / $35,405 (Internet Advertisement)

316,039/$46,622(Advertisements)

|

|

|

Shanghai Lanbao Travel Service Company Limited

|

29,360/ $4,331 (Advertisements)

408,000/ $60,188 (Internet advertisements)

|

|

|

Chongqing Universal Travel E-Commerce Co., Ltd

|

2,270/ $335 (Advertisements)

|

|

|

Shenzhen Universal Travel Agency Co., Ltd

|

374,441/ $55,237 (Advertisements)

|

|

|

Huangshan Holiday Travel Service Co., Ltd.

|

74,800/$11,035 (Advertisements)

|

|

|

Zhengzhou Yulongkang Travel Agency Co., Ltd.

|

81,486/$12,021 (Advertisements)

|

|

|

Kunming Business Travel Service Co., Ltd.

|

136,000/$20,063 (Advertisements)

|

We anticipate that our sales and marketing expenses for fiscal year 2011 will increase proportionally with our sales volume.

14

Competition

Our main competitors in China in the online booking industry for air-tickets and hotel reservations include Ctrip.com International, Ltd. and eLong, Inc.

It is very difficult to assess our competitors in the packaged tour business as there are numerous packaged tour providers in the PRC that operate different routes every year.

Many of our competitors, particularly those engaged in the online booking industry, are better established than us, are more widely known to consumers, and have larger infrastructures and greater capital resources.

Our Competitive Advantage

We believe that we have the following advantages over our competitors:

|

|

·

|

our business model and sources of revenue are diversified in that we are involved in the air ticketing, hotel reservations, and packaged tours businesses and any negative impact on one line of business may be buffered by our other lines of businesses; and

|

|

|

·

|

our businesses and presence are spread out throughout the PRC, which makes us less susceptible to a total loss or interruption to our business in the event of a natural calamity.

|

Our Future Goals and Expansion Plans

We will integrate our acquisitions made in 2010, which have been largely involved in the packaged tour business, by installing our air-ticketing and hotel reservation systems to their local offices, and providing them with training so that they may establish new sources of revenue on air-ticketing and hotel reservations.

We will further utilize our international travel license and expand our geographic service coverage by establishing more franchise offices, instead of making more acquisitions with cash and/or stock, as our franchise model has been well accepted in the industry and it will not create significant dilution to our existing shareholders. We will set up call centers in some of our franchise offices where we observe have more customer inquiries on air-ticketing and hotel reservations.

We will also further integrate our offline businesses with our online platform, including, but not limited to improving our website surfing speed and layouts, enriching our travel product content, and strengthening our English website development as our website is increasingly accessed by foreign travelers.

Employees

At the current time, including our officers, we have approximately 771 full-time employees, including 60 administrative employees, 75 marketing employees, 320 employees working at our three call centers and approximately 316 employees working at our nine packaged tour office. We did not include the salesperson whose salary based on commissions as our employee. None of our employees is a member of a union and our relationships with our employees are generally satisfactory. In accordance with Chinese Labor Law, we provide social security and medical insurance to all our employees.

Government Regulations

General Regulation of Businesses

Air-ticketing. The air-ticketing business is subject to the supervision of China National Aviation Transportation Association, or CNATA, and its regional branches. Prior to March 31, 2006, the principal regulation governing air-ticketing in China is the Administration on Civil Aviation Transporting Marketing Agency Business Regulations (1993). The said regulation was abolished by PRC government on January 24, 2008. Currently the principal regulation governing air-ticketing in the PRC is the Rules on Cognizance of Qualification for Civil Aviation Transporting Marketing Agencies (2006) which became effective on March 31, 2006.

15

Under these regulations, prior to May 19, 2005, an air-ticketing agency was required to obtain a permit from CAAC or its regional branch in every city in which the agency propose to conduct its air-ticketing business. On and after May 19, 2005, any entity that wishes to conduct the air-ticketing business in the PRC must apply for an air-ticketing permit from CNATA. The regulations provide for a transitional grace period for air-ticketing agencies that have obtained a valid license from CAAC or its regional branch prior to the promulgation of the new rules. These agencies are permitted to use their original licenses until such licenses expire.

Travel Agency. The travel industry is subject to the supervision of the China National Tourism Administration and local tourism administrations. The principal regulations governing travel agencies in the PRC include:

|

•

|

Administration of Travel Agencies Regulations (1996), as amended in December 2001; and

|

|

•

|

Administration of Travel Agencies Regulations Implementing Rules (2001).

|

Under these regulations, a travel agency must obtain a license from the China National Tourism Administration to conduct cross-border travel business, and a license from the provincial-level tourism administration to conduct domestic travel agency business.

Advertising. The State General Administration of Industry and Commerce is responsible for regulating advertising activities in the PRC. The principal regulations governing advertising (including online advertising) in China include:

|

•

|

Advertising Law (1994);

|

|

•

|

Administration of Advertising Regulations (1987); and

|

|

•

|

Implementing rules of the Administration of Advertising Regulations (2004).

|

Under these regulations, any entity conducting advertising activities must obtain an advertising permit from the local Administration of Industry and Commerce.

Value-added Telecommunications Business and Online Commerce. Our provision of travel-related content on our websites is subject to PRC laws and regulations relating to the telecommunications industry and Internet, and regulated by various government authorities, including the Ministry of Information Industry and the State General Administration of Industry and Commerce. The principal regulations governing the telecommunications industry and Internet include:

|

•

|

Telecommunications Regulations (2000);

|

|

•

|

The Administrative Measures for Telecommunications Business Operating Licenses (2001); and

|

|

•

|

The Internet Information Services Administrative Measures (2000).

|

Under these regulations, Internet content provision services are classified as value-added telecommunications businesses, and a commercial operator of such services must obtain a value-added telecommunications business license from the appropriate telecommunications authorities to conduct any commercial value-added telecommunications operations in the PRC.

With respect to online commerce, there are no specific PRC laws at the national level governing online commerce or defining online commerce activities, and no government authority has been designated to regulate online commerce. There are existing regulations governing retail business that require companies to obtain licenses to engage in the business. However, it is unclear whether these existing regulations will be applied to online commerce.

16

Regulation of Foreign Currency Exchange and Dividend Distribution

Foreign Currency Exchange. The principal regulation governing foreign currency exchange in the PRC is the Foreign Currency Administration Rules (1996), as amended. Under these Rules, RMB is freely convertible for trade and service-related foreign exchange transactions, but not for direct investment, loan or investment in securities outside China unless the prior approval of the State Administration for Foreign Exchange of the People’s Republic of China is obtained.

Pursuant to the Foreign Currency Administration Rules, foreign investment enterprises in the PRC may purchase foreign currency without the approval of the State Administration for Foreign Exchange of the PRC for trade and service-related foreign exchange transactions by providing commercial documents evidencing these transactions. They may also retain foreign exchange (subject to a cap approved by the State Administration for Foreign Exchange of the PRC) to satisfy foreign exchange liabilities or to pay dividends. In addition, if a foreign company acquires a company in the PRC, the acquired company will also become a foreign investment enterprise. However, the relevant PRC government authorities may limit or eliminate the ability of foreign investment enterprises to purchase and retain foreign currencies in the future. In addition, foreign exchange transactions for direct investment, loan and investment in securities outside the PRC are still subject to limitations and require approvals from the State Administration for Foreign Exchange of the PRC.

Dividend Distribution. The principal regulations governing distribution of dividends of wholly foreign-owned companies include:

|

•

|

The Foreign Investment Enterprise Law (1986), as amended in October 2000;

|

|

•

|

Administrative Rules under the Foreign Investment Enterprise Law (2001);

|

|

•

|

Company Law of the PRC (2005); and

|

|

•

|

Enterprise Income Tax Law and its Implementation Rules (2007).

|

Under these regulations, foreign investment enterprises in the PRC may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, wholly foreign-owned enterprises in the PRC are required to set aside at least 10% of their respective accumulated profits each year, if any, to fund certain reserve funds, unless such reserve funds have reached 50% of their respective registered capital. These reserves are not distributable as cash dividends.

Under the new EIT Law, dividends, interests, rent, royalties and gains on transfers of property payable by a foreign-invested enterprise in the PRC to its foreign investor who is a non-resident enterprise will be subject to a 10% withholding tax, unless such non-resident enterprise’s jurisdiction of incorporation has a tax treaty with the PRC that provides for a reduced rate of withholding tax.

Under the new EIT Law, an enterprise established outside the PRC with its “de facto management body” within the PRC is considered a resident enterprise and will be subject to the enterprise income tax at the rate of 25% on its worldwide income. The “de facto management body” is defined as the organizational body that effectively exercises overall management and control over production and business operations, personnel, finance and accounting, and properties of the enterprise. It remains unclear how the PRC tax authorities will interpret such a board definition.

According to the new EIT law, enterprises that currently enjoy a preferential tax rate will transition to the statutory enterprise income tax rate of 25% over five years. The applicable tax rate would increase to 18% for 2008, 20% in 2009, 22% in 2010, 24% in 2011 and 25% in 2012. Enterprises that were currently subject to an enterprise income tax rate of 24% had their rates increased to 25% in 2008.

17

The tax rates of our various subsidiaries in 2010 were all 25% except for YZL, the tax rate of which was 22%. For 2011, these rates will remain 25% except for YZL, the tax rate of which will become 24%.

Notwithstanding the foregoing provision, the new EIT Law also provides that, if a resident enterprise directly invests in another resident enterprise, the dividends received by the investing resident enterprise from the invested enterprise are exempted from income tax, subject to certain conditions.

Moreover, under the new EIT Law, foreign ADS holders may be subject to a 10% withholding tax upon dividends payable by a Chinese entity and gains realized on the sale or other disposition of ADSs or ordinary shares, if such income is sourced from within the PRC and we are classified as a PRC resident enterprise.

Approvals, licenses and certificates

We have received the following licenses and approvals:

|

|

·

|

“First Class Air-Ticketing Agency” awarded by the CAAC and IATA to YZL;

|

|

|

·

|

“International Travel Agency” awarded by the China Travel Bureau to FOI;

|

|

|

·

|

“Domestic Travel Agency” awarded by the China Travel Bureau to XGN; and

|

|

|

·

|

International Travel License issued by the National Travel Authority.

|

Item 1A. Risk Factors.

The reader should carefully consider each of the risks described below. If any of the following risks described below should occur, our business, financial condition or results of operations could be materially adversely affected and the trading price of our common stock could decline significantly.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information contained in this prospectus before deciding to invest in our common stock.

Risks Related to the Company

Risks associated with business declines or disruptions in the travel industry generally could reduce our revenue.

A large part of our revenue is driven by the trends that occur in the travel industry in the PRC, including the hotel, airline and packaged-tour industries. As the travel industry is highly sensitive to business and personal discretionary spending levels, it tends to decline during general economic downturns. Other adverse trends or events that tend to reduce travel and are likely to reduce our revenue include the following:

|

|

·

|

an outbreak of political or economic unrest in China;

|

|

|

·

|

a recurrence of SARS or any other serious contagious diseases;

|

|

|

·

|

increased prices in the hotel, airline, or other travel-related industries;

|

|

|

·

|

increased occurrence of travel-related accidents;

|

|

|

·

|

outbreak of war or conflict in the Asia-Pacific region;

|

|

|

·

|

increases in terrorism or the occurrence of a terrorist attack in the Asia-Pacific region;

|

|

|

·

|

poor weather conditions; and

|

|

|

·

|

natural disasters.

|

18

We could be severely affected by changes in the travel industry and will, in many cases, have little or no control over those changes. As a result of any of these events, our operating results and financial conditions could be materially and adversely affected.

Loss of key personnel could affect our ability to successfully grow our business.

We are highly dependent upon the services of our senior management team. The permanent loss for any of the key executives could have a material adverse effect upon our operating results.

Our management is comprised almost entirely of individuals residing in the PRC with very limited English skills.

Our management is comprised almost entirely of individuals born and raised in the PRC. As a result of differences in culture, educational background and business experiences, our management may analyze, evaluate and present business opportunities and results of operations differently from the way they are analyzed, evaluated and presented by management teams of public companies in Europe and the United States. In addition, our management has very limited skills in English. Consequently, it is possible that our management team will emphasize or fail to emphasize aspects of our business that might customarily be emphasized in a different manner by comparable public companies from different geographical and political areas.

Our management is not familiar with the United States securities laws.

Our management and the former owners of the businesses we acquire are generally unfamiliar with the requirements of the United States securities laws and may not appreciate the need to devote the resources necessary to comply with such laws. A failure to adequately respond to applicable securities laws could lead to investigations by the Securities and Exchange Commission and other regulatory authorities that could be costly, divert management's attention and disrupt our business.

Our operating history is not an adequate basis to judge our future prospects.

We have encountered and will continue to encounter risks and difficulties frequently experienced by companies in evolving industries such as the travel service industry in the PRC. Some of the risks relate to our ability to:

|

|

·

|

attract and retain customers and encourage our customers to engage in repeat transactions;

|

|

|

·

|

retain our existing agreements with travel suppliers such as hotels and airlines and to expand our service offerings on satisfactory terms with our travel suppliers;

|

|

|

·

|

operate, support, expand and develop our operations, our call center, our website, and our communications and other systems;

|

|

|

·

|

diversify our sources of revenue;

|

|

|

·

|

maintain effective control of our expenses; and

|

|

|

·

|

respond to changes in our regulatory environment.

|

If we are not successful in addressing any or all of these risks, our business may be materially affected in an adverse manner.

19

The travel industry in China is seasonal.

Our business travel operations experience seasonal fluctuations, reflecting seasonal variations in demand for travel services. During the first quarter, demand for travel services generally declines in the PRC and the number of bookings flattens or decreases, in part due to a slowdown in business activity during the Chinese New Year holiday. Demand for travel services generally peaks during the second half of the year and there may be seasonal fluctuations in allocations of travel services made available to us by travel suppliers. Consequently, our revenue may fluctuate from quarter to quarter.

Our business depends on the technology infrastructure of third parties.

We rely on third-party computer systems and other service providers, including the computerized reservation systems of airlines and hotels to make reservations and confirmations. Other third parties provide, for instance, our back-up data center, telecommunications access lines, significant computer systems and software licensing, support and maintenance service and air-ticket delivery. Any interruption in these or other third-party services or deterioration in their performance could impair the quality of our service.

Risks Related to our Common Stock

We have not and do not anticipate paying any dividends on our Common Stock.

We have paid no dividends on our Common Stock to date and it is not anticipated that any dividends will be paid to holders of our Common Stock in the foreseeable future. While our future dividend policy will be based on the operating results and capital needs of the business, it is currently anticipated that any earnings will be retained to finance our future expansion and for the implementation of our business plan. As an investor, you should take note of the fact that a lack of a dividend can further affect the market value of our stock, and could significantly affect the value of any investment in our Company.

We will incur significant costs as a result of operating as a public company and our management will be required to devote substantial time to compliance requirements.

As a public company we incur significant legal, accounting and other expenses under the Sarbanes-Oxley Act of 2002, together with rules implemented by the Securities and Exchange Commission and applicable market regulators. These rules impose various requirements on public companies, including requiring certain corporate governance practices. Our management and other personnel will need to devote a substantial amount of time to these compliance requirements.

In addition, the Sarbanes-Oxley Act requires, among other things, that we maintain effective internal controls for financial reporting and disclosure controls and procedures. In particular, commencing in 2007, we must perform system and process evaluations and testing of our internal controls over financial reporting to allow management to report on the effectiveness of our internal controls over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act. Our testing may reveal deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses. Compliance with Section 404 may require that we incur substantial accounting expenses and expend significant management efforts. If we are not able to comply with the requirements of Section 404 in a timely manner, or if our accountants later identify deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses, the market price of our stock could decline and we could be subject to sanctions or investigations by the SEC or other applicable regulatory authorities.

Our Board of Directors has the authority, without stockholder approval, to issue preferred stock with terms that may not be beneficial to common stock holders.

Our Amended and Restated Articles of incorporation authorizes the issuance of preferred shares which may be issued with dividend, liquidation, voting and redemption rights senior to our Common Stock without prior approval by the stockholders. The Preferred Stock may be issued for such consideration as may be fixed from time to time by the Board of Directors. The Board of Directors may issue such shares of Preferred Stock in one or more series, with such designations, preferences and rights or qualifications, limitations or restrictions thereof as shall be stated in the resolution of resolutions.

20

The issuance of preferred stock could adversely affect the voting power and other rights of the holders of common stock. Preferred stock may be issued quickly with terms calculated to discourage, make more difficult, delay or prevent a change in control of our Company or make removal of management more difficult. As a result, the Board of Directors' ability to issue preferred stock may discourage the potential hostile acquirer, possibly resulting in beneficial negotiations. Negotiating with an unfriendly acquirer may result in, among other things, terms more favorable to us and our stockholders. Conversely, the issuance of preferred stock may adversely affect any market price of, and the voting and other rights of the holders of the Common Stock. We presently have no

plans to issue any preferred stock.

The issuance of shares through our stock compensation plans may dilute the value of existing stockholders and may affect the market price of our stock.

We may use stock options, stock grants and other equity-based incentives, to provide motivation and compensation to our officers, employees and key independent consultants. The award of any such incentives will result in an immediate and potentially substantial dilution to our existing stockholders and could result in a decline in the value of our stock price. The exercise of these options and the sale of the underlying shares of common stock and the sale of stock issued pursuant to stock grants may have an adverse effect upon the price of our stock.

Risks Related to Doing Business in the People’s Republic of China

It may be difficult for our stockholders to enforce their rights against the Company or its officers or directors.

Because our principal assets are located outside of the United States and some of our directors and all of our executive officers reside outside of the United States, it may be difficult for you to enforce your rights based on the United States Federal securities laws against us and our officers and directors in the United States or to enforce judgments of United States courts against us or them in the People's Republic of China.