Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - ODYSSEY MARINE EXPLORATION INC | dex991.htm |

| 8-K - FORM 8-K - ODYSSEY MARINE EXPLORATION INC | d8k.htm |

Follow-On Offering

Roadshow Presentation

June 2011

Exhibit 99.2 |

Alternatively, the issuer, any underwriter or any dealer participating in the

offering will arrange to send you the prospectus after filing if you request

it by calling (813) 876-1776. 2

Safe Harbor Statement

Forward Looking Statements

Odyssey Marine Exploration believes the information set forth in this presentation may include

"forward looking statements" within the meaning of the Private Securities Litigation

Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Act of 1934. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements

including those made in this presentation. Certain factors that could cause results to differ

materially from those projected in the forward-looking statements are set forth in

"Risk Factors" in the Part I, Item 1A of the Company's Annual Report on Form 10-K for the

year ended December 31, 2010, which was filed with the Securities and Exchange Commission on February

28, 2011. All forward- looking statements are based on information available to management

on this date, and Odyssey Marine Exploration, Inc. assumes no obligation to, and expressly

disclaims any obligation to, update or revise any forward-looking statements, whether as a result of

new information, future events or otherwise.

Industry Information

Information regarding market and industry statistics contained in this presentation is based on

information available to us that we believe is accurate. It is generally based on management

estimates and publications that are not produced for investment or economic analysis. The

financial and operating projections are based solely on the assumptions developed by Odyssey that it believes are reasonable.

The financial and operating projections are based upon information available to Odyssey as of the date

of the presentation, are subject to material uncertainties, and should not be viewed as a

prediction or an assurance of actual future performance. The validity and accuracy of

Odyssey’s projections will depend upon unpredictable future events, many of which are beyond Odyssey’s control

and, accordingly, no assurance can be given that Odyssey’s assumptions will prove true, that its

projected results will be achieved, or that variations between the projections and actual future

results will not be material.

Additionally, the information contained in the presentation was prepared to assist interested parties

in making their own evaluation of Odyssey and does not purport to contain all the information

that a prospective investor may desire. The information in the presentation is for background

purposes only and is subject to change. In all cases, interested parties should conduct their own

investigation, analysis and evaluation of Odyssey and the information set forth in the

presentation.

Notice of Prospectus The

issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication

relates. Before you invest, you should read the prospectus in that registration statement and other

documents the issuer has filed with the SEC for more complete information about the issuer and

this offering. You may get these documents for free by visiting EDGAR on the SEC website at

www.sec.gov. |

Offering Summary

Issuer:

Odyssey Marine Exploration (NASDAQ: OMEX)

Offering:

Underwritten Follow-On Offering

Offering Size:

4.0 Million Shares

Over-Allotment:

15%

Use of Proceeds:

-

Search & Recovery Projects

-

Working Capital and General Corporate Purposes

Bookrunner:

Craig-Hallum Capital Group

Co-Manager:

B. Riley & Co.

Expected Pricing:

June 15

, 2011

Management:

Greg Stemm –

Chief Executive Officer

Mark Gordon –

President & Chief Operating Officer

Mike Holmes –

Chief Financial Officer

3

th |

Investment Highlights

4

•

Strongest backlog of advanced-stage shipwreck

projects in company history

–

5 potential recoveries in next 12-18 months

•

Raising capital primarily to:

–

Accelerate operations on several shipwreck search

and recovery projects

–

To take advantage of opportunities in deep ocean

mining

•

Enable monetization of deep ocean assets –

shipwrecks and minerals:

–

Targeting approximately 100 high value shipwrecks

with total cargo value estimated in billions of dollars

–

Leading position in emerging field of deep ocean

mineral exploration and mining

•

Monetization of recovered assets over multi-year

period will generate significant recurring revenue

•

Building partnership model with nations |

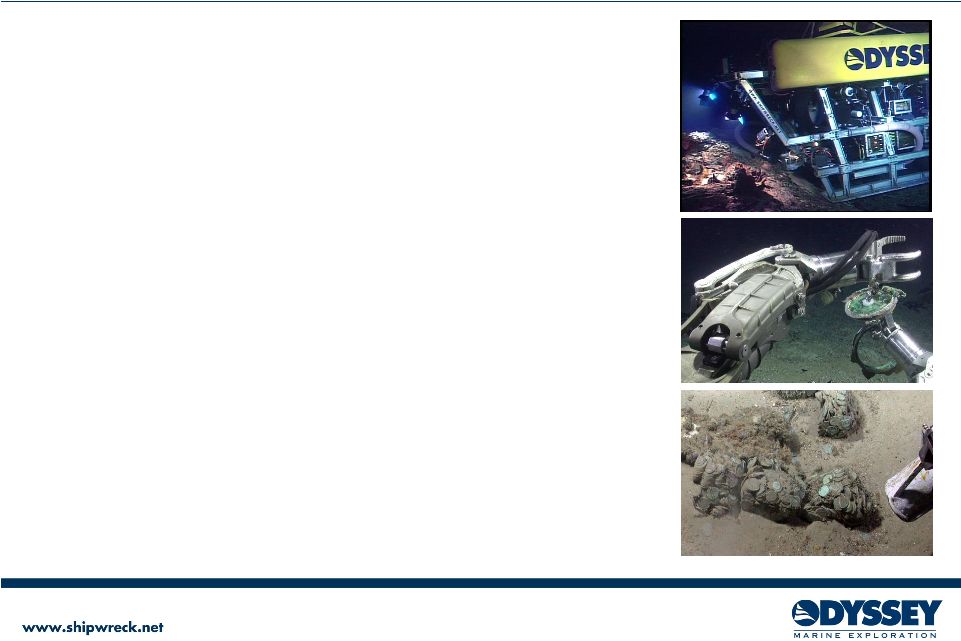

Shipwreck Industry

•

Large, underserved markets

•

UNESCO estimates over 3 million shipwrecks in

the world

–

OMEX proprietary database contains over 6,000

targets

–

Includes a minimum of 100 potential high-value

targets (each >$50MM retail)

–

Potential value in the billions of dollars

•

Recovered shipwreck cargo monetized in

various markets

–

Collectors

o

$10 billion annual US retail coin collectors market

o

Sold at a premium (20-300 times commodity value)

with longer sales period

–

Commodities markets

o

Sold at commodities pricing very quickly

•

Nations seeking to collect and manage heritage

5 |

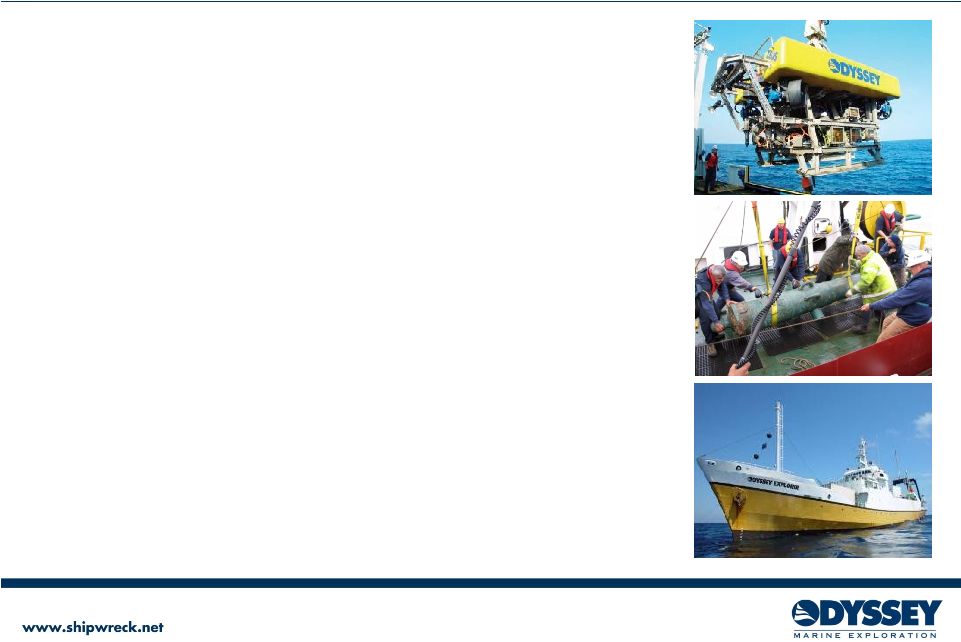

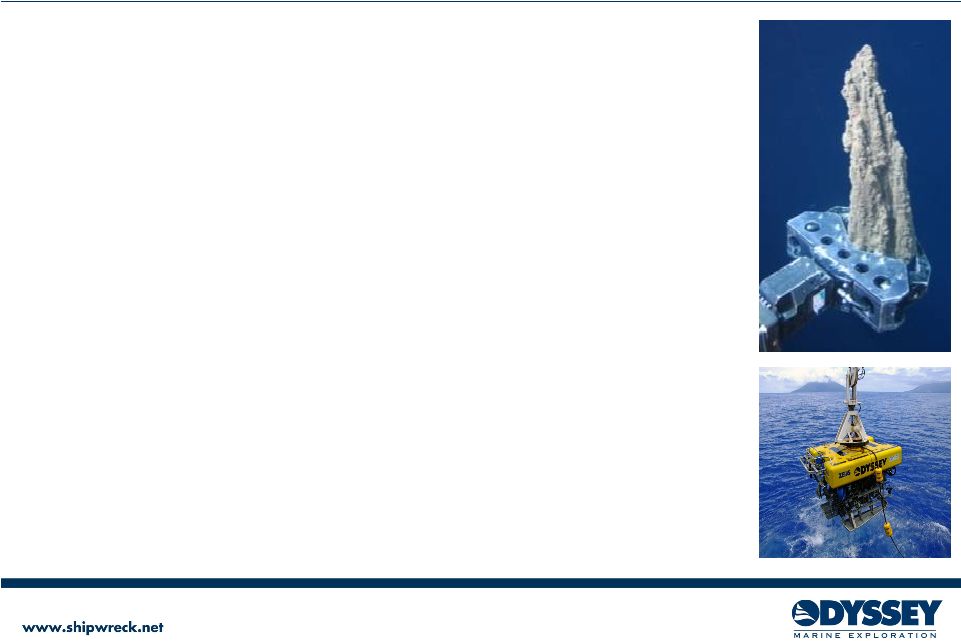

A World

Leader: Deep-Ocean Shipwreck Exploration •

Over $100MM invested in technology,

infrastructure and operations

•

17 years of experience

•

Advanced technological capabilities

•

World-class archaeological expertise and

experience

•

Knowledgeable and skilled marine

operations team

•

Legal and contractual rights to key

shipwrecks

•

Expansive proprietary research

•

Extensive legal and diplomatic

experience

•

Growing number of government

partnerships

6 |

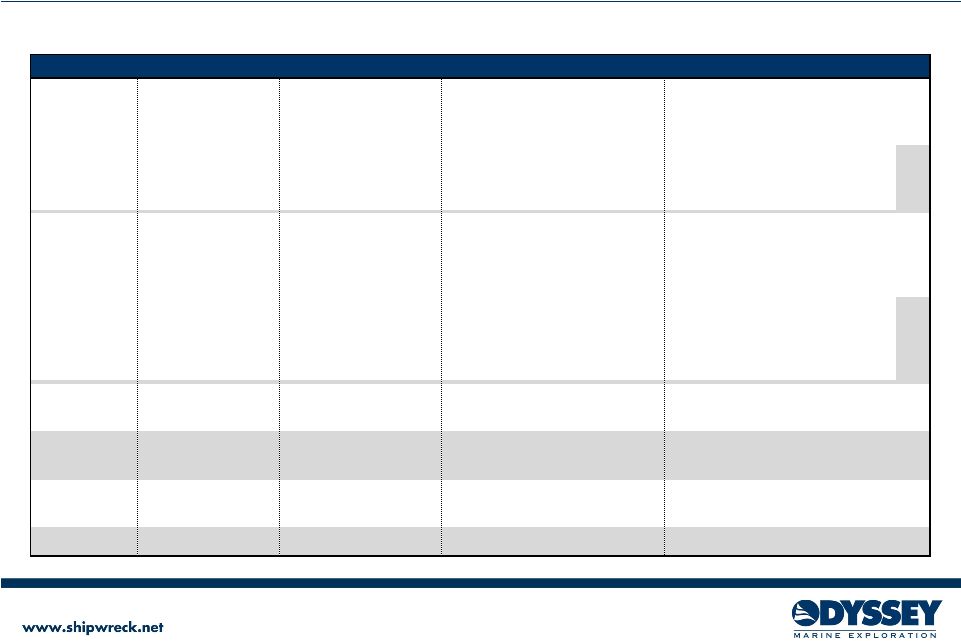

Odyssey

Disclosed Shipwreck Projects •

8 announced advanced stage shipwreck projects

7

Project

Stage

OMEX Ownership

Next Steps

Comments

SS Republic

Recovered:

100%

•

•

- 51,000+ Coins

- 14,000+ Artifacts

"Black Swan

"

Recovered:

Pending

•

Pending outcome of legal

•

Oral arguments held on 5/23/11

~ 594,000 coins

proceedings

•

Coins held in OMEX custody

weighing ~17 tons

HMS Sussex

Verification

80% up to $45M

•

On hold pending Black Swan

•

Believed to have found the site but

50% btw. $45M - $500M

legal proceedings

operations to verify wreck on hold

40% above $500M

•

Research suggests large cargo of gold

or silver specie

HMS Victory

Recovery

OMEX proposal

•

Reach agreement with UK

•

Received 80% salvage award on

submitted to UK Govt.

government

recovered cannon in 2009

•

Potential to begin archaeological

•

Research suggests over 3 tons of gold

excavation in 2H 2011

coins

SS Gairsoppa

Search process

80%

•

Begin search in 2H 2011

•

Research indicates large cargo of

•

Potential recovery in 2H 2011-12

silver bullion (commodity sale)

"Enigma"

Verification

50% or more

•

Verification of wreck & cargo

•

High value cargo reported aboard

•

Potential recovery in 2H 2011

"Shantaram"

Verification

50% or more

•

Verification of wreck & cargo

•

High value cargo reported aboard

•

Potential recovery in 2H 2011

"Firebrand"

Search process

50% or more

•

Continue search operations

•

High value cargo reported aboard

Continue to monetize coins

through established distribution

channels on 4 continents

Sold approximately 50% of coins for an

aggregate value of ~$42M |

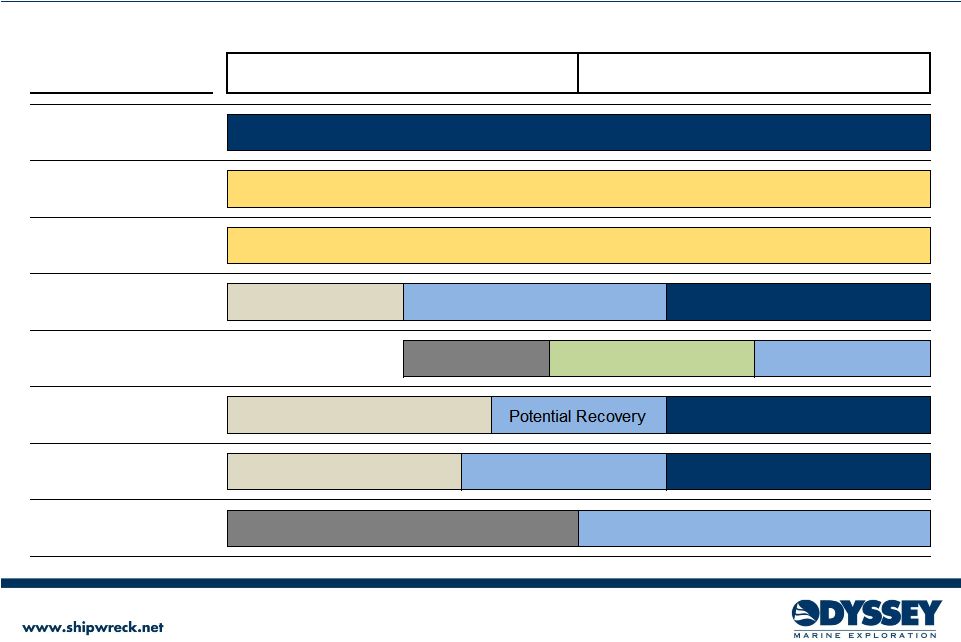

Shipwreck Projects –

Estimated Timeline

8

•

8 announced advanced stage shipwreck projects

Project

SS Republic

"Black Swan"

HMS Sussex

HMS Victory

SS Gairsoppa

"Enigma"

"Shantaram"

"Firebrand"

2011

2012

Monetization

Search Operations

Potential Monetization

Potential Monetization

On Hold - Pending Outcome of "Black Swan" Legal Proceedings

Cargo Recovered - Monetization Pending Outcome of Legal Proceedings

Potential Recovery

Potential Monetization

Search Operations

Recovery Planning

Potential Recovery

Verification

Potential Recovery

Verification

Potential Recovery

Finalize UK Agmt. |

Ocean

Floor Mining Opportunity •

Market Characteristics

–

Discovery of new land-based deposits shrinking and cost of

land-based exploration increasing

–

Ocean floor mineral deposits are concentrated and untapped

o

High concentrations of gold, copper, zinc and silver

o

Capital expenses can be spread across many deposits

o

Smaller impact on the environment

o

Lower costs of recovery and transport

–

Similar opportunity as deep ocean oil drilling in 1940’s

•

Economics:

–

Projected recoverable ore: 1 –

100 million tons/mineral deposit

–

Potential metal values range from $500 –

$1,200/ton and more

–

Expected cost to recover & process less than $150-$200/ton

–

Hedged raw commodities –

gold & copper

9 |

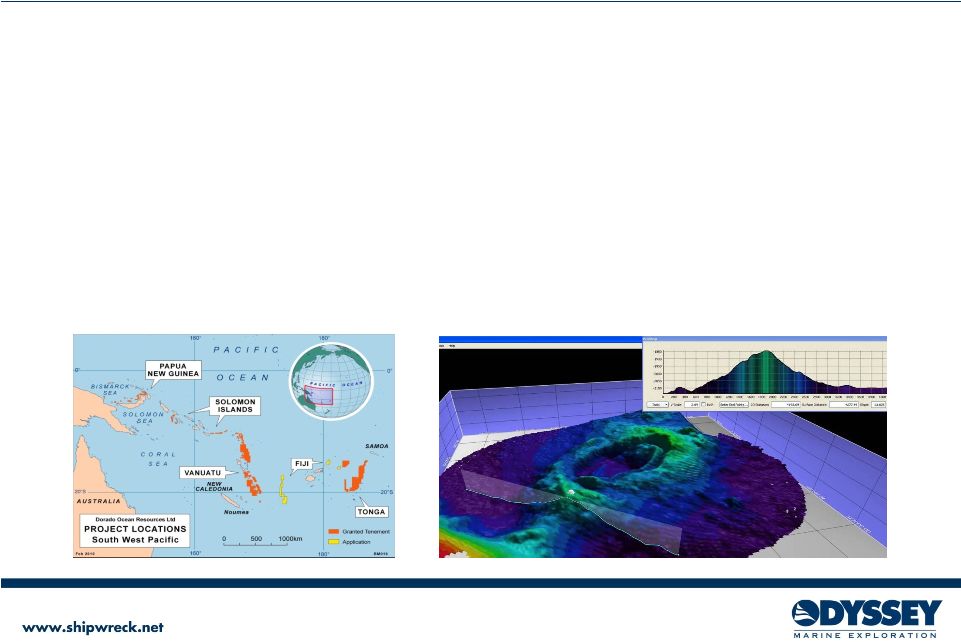

Neptune Minerals, Inc.

•

Odyssey is the largest shareholder of Neptune Minerals, Inc. (private company)

•

Neptune seeks to commercialize mineral deposits from the ocean floor

•

Recently merged with Dorado bringing two of the largest players in the space

together

•

Neptune holds the second largest tenement position in the Southwest Pacific

“Ring of Fire”

area –

nearly 150,000 km²

and also holds valuable tenements off New Zealand

and Japan

•

Odyssey is generating profitable revenue by providing marine exploration services to

Neptune

under

a

charter

agreement,

the

potential

exists

to

offer

these

services

to

other players in this emerging market

10 |

•

Joined Odyssey in 2004, became CFO in 2005

•

25+ years experience in senior financial management including Anheuser-Busch

Companies, Inc., SeaWorld Orlando and Busch Gardens •

Joined Odyssey in 2005, served as Executive Vice President of Business Development,

promoted to President and Chief Operating Officer in 2007 •

20+ years owning and/or managing entrepreneurial ventures including founding

Synergy Networks •

Co-founded Odyssey in 1994

•

25+ years shipwreck exploration operations including deep-ocean search and

robotic archaeological excavation Executive Management

•

Has served as Secretary since 1997

•

20+ years experience in shipwreck exploration operations and administration

•

Joined Odyssey in 1998, became Director of Communications and Marketing in 2003,

appointed Vice President in 2007 •

25+ years experience including promotion and marketing for several major television

networks •

Joined Odyssey in in 2006, became General Counsel in 2007, appointed Vice President

in 2008 •

20+ years practicing law as a litigation consultant, providing counsel to attorneys

in all areas of law •

Joined Odyssey in 2003 as Director of Operations

•

40+ years marine engineering experience, including Project Manager for the first

and second phase of Space Shuttle Challenger recovery •

Joined Odyssey in 2004 as Senior Project Manager

•

35+ years of ocean exploration experience, including Scientific Engineer on Jacques

Cousteau’s Calypso and led Dr. Ballard’s Titanic expedition

•

Joined Odyssey in 2007 as Director of International Business Development

•

25+

years

with

the

U.S.

Navy

as

Liaison

and

Consul

to

Gibraltar,

as

well

as

various

operational

and

leadership

positions

in

international

Navy

11

Mike Holmes |

CFO –

25+ years experience

Melinda

MacConnel

|

Vice

President

and

General

Counsel

–

20+

years

experience

Laura

Barton

|

Vice

President

and

Director

of

Communications

and

Marketing

–

25+

years

experience

David Morris |

Secretary –

20+ years experience

Roy

Truman

|

Director

of

Marine

Operations

–

40+

years

experience

Tom

Dettweiler

|

Senior

Project

Manager

–

35+

years

experience

Aladar

Nesser

|

Director

of

Government

Relations

–

25+

years

experience

Greg Stemm |

CEO –

25+ years experience

Mark

Gordon

|

President

and

COO

–

20+

years

experience |

Project Financing

•

Shipwreck Project Syndication (Robert Fraser & Partners)

–

Intellectual property purchased (research)

–

Paid contract services (search, recovery, conservation, sales)

–

Above recorded as revenue

–

Odyssey retains 50% + of the back-end

net revenue

•

Project Rights Agreements (Galt)

–

Upfront cash to OMEX for right to participate

in a project’s net proceeds

–

Not recorded as revenue

–

No restriction on use of funds

–

A less dilutive method of project financing for projects with potential income

over $75 million

12 |

Revenue Sources –

Developing Recurring Revenue Model

Shipwrecks

Current Year

1 -

5 Years

5+ Years

Mining

Contracted

Projects

Revenue from Operations –

Cash Flow

Revenue from Operations –

Cash Flow

Revenue from Operations –

Cash Flow

Revenue from Cargo Sales

Revenue from Mining

(Gold / Silver / Copper / Zinc)

13 |

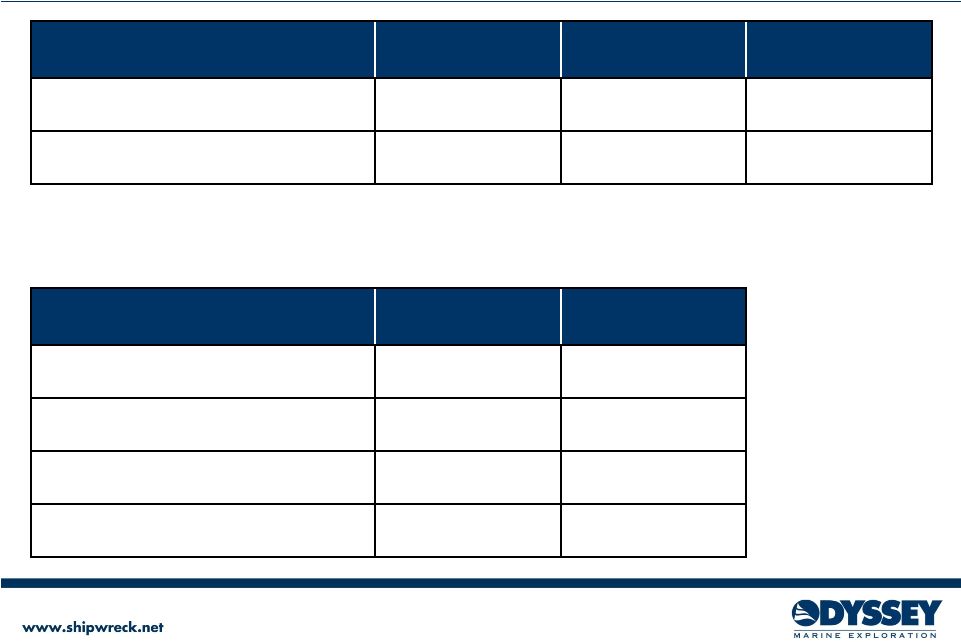

Financial Data

14

(1)

(2)

(1)

Operations Data

2009

2010

Q1 '11

Revenue ($ in Millions)

4.3

$

21.0

$

2.1

$

Adj. EBITDA

(14.1)

$

(12.1)

$

(2.8)

$

(1)

Odyssey has an NOL of $110MM

(2)

See Exhibit A

Balance Sheet Data

3/31/11

ProForma

Cash ($ in Millions)

6.1

$

21.4

$

Mortgage & Loans Payable

7.9

$

7.9

$

Preferred Stock -

Series G

4.4

$

4.4

$

Shares Outstanding (MM)

67.2

71.2

(1) |

•

Potential positive “Black Swan”

ruling

–

“Aqua Log”

decision subsequent to district court ruling sets favorable

precedent and requires possession for sovereign immunity

–

WikiLeaks documentation of U.S. Government’s attempted interference in the

case

•

Potential for identification, recovery and/or monetization of one or more

projects:

–

HMS Victory

–

Two advance-stage Robert Fraser projects in verification phase, both

of which exhibit evidence that corresponds with the target shipwrecks

–

SS Gairsoppa

operations planned for this season (contract with UK already in

place for 80% salvage award)

–

Multiple other undisclosed projects

•

Positive assay, verification mining and core drilling results from mining

exploration

•

Additional government partnerships to conduct operations in territorial

waters and/or on sovereign shipwrecks

Potential Events in 2011

15 |

Investment Highlights

16

•

Strongest backlog of advanced-stage shipwreck

projects in company history

–

5 potential recoveries in next 12-18 months

•

Raising capital primarily to:

–

Accelerate operations on several shipwreck search

and recovery projects

–

To take advantage of opportunities in deep ocean

mining

•

Enable monetization of deep ocean assets –

shipwrecks and minerals:

–

Targeting approximately 100 high value shipwrecks

with total cargo value estimated in billions of dollars

–

Leading position in emerging field of deep ocean

mineral exploration and mining

•

Monetization of recovered assets over multi-year

period will generate significant recurring revenue

•

Building partnership model with nations |

Exhibit A

17

Non-GAAP Financial Measures

Odyssey

uses

adjusted

EBITDA

as

a

measure

of

performance

to

demonstrate

earnings

exclusive

of

interest

and

certain

non-cash

events.

Odyssey,

in

its

daily

management

of

its

business

affairs

and

analysis

of

its

monthly,

quarterly

and

annual

performance,

makes

its

decisions

based

on

cash

flows,

not

on

the

depreciation

of

assets

obtained

through

historical

activities.

Odyssey,

in

managing

its

current

and

future

affairs,

cannot

affect

the

depreciation

and

amortization

of

its

assets

to

any

material

degree,

and

therefore

uses

adjusted

EBITDA

as

its

primary

management

guide.

Since

an

outside

investor

may

base its evaluation of Odyssey’s performance based on Odyssey’s net

income or loss not its cash flows, there is a limitation to the adjusted EBITDA

measurement.

Adjusted EBITDA is not, and should not be considered, an alternative to net income

or loss, loss from operations, or any other measure for determining

operating performance of liquidity, as determined under accounting principles generally accepted in the United States (GAAP).

Adjusted

EBITDA

is

a

supplemental

non-GAAP

financial

measure.

The

most

directly

comparable

GAAP

measure

to

adjusted

EBITDA

in

Odyssey’s case

is net income (loss). Adjusted EBITDA is equal to net income (loss) excluding: (a)

total other income (expense); (b) depreciation and amortization; (c)

stock-based compensation; and (d) income taxes.

Three Months

Ended

(amounts in thousands)

March 31,

December 31,

December 31,

2011

2010

2009

(unaudited)

EBITDA Reconciliation:

Net Loss on a GAAP Basis:

(5,174)

$

(23,343)

$

(18,628)

$

Adjustments:

Interest income

(0)

(4)

(38)

Interest expense

98

516

334

Change in derivative liabilities

fair value 1,289

3,638

-

Loss

on debt extinguishment -

383

-

Income (loss) from unconsolidated entity

-

2,447

53

Other income

5

(45)

(75)

Depreciation and

amortization 528

2,162

2,276

Stock-Based Compensation

449

2,137

2,027

Income Taxes

-

-

-

Adjusted EBITDA

(2,806)

$

(12,108)

$

(14,051)

$

Year Ended |