Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Sabra Health Care REIT, Inc. | d8k.htm |

INVESTOR

PRESENTATION June 2011

Exhibit 99.1 |

FORWARD LOOKING

STATEMENTS 2

Statements made in this presentation that are not historical facts are

“forward-looking” statements (as defined in the Private

Securities Litigation Reform Act of 1995) that involve risks and

uncertainties and are subject to change at any time. These

statements may be identified, without limitation, by the use of “expects,”

“believes,”

“intends,”

“should”

or comparable terms or

the negative thereof. Forward-looking statements in this presentation also include all

statements regarding our liquidity, financing plans, business strategy, the expected

amounts and timing of dividends, growth opportunities, acquisition plans and plans and

objectives of management for future operations. These statements are made as of the date

hereof and are subject to known and unknown risks, uncertainties, assumptions and other

factors—many of which are out of our control and difficult to forecast—that

could cause actual results to differ materially from those set forth in or implied by our

forward-looking statements. These risks and uncertainties include but are not

limited to: our dependence on Sun Healthcare Group, Inc., formerly known as SHG Services, Inc.

(“Sun”), until we are able to diversify our portfolio; our ability to qualify and

maintain our status as a real estate investment trust (“REIT”); changes in

general economic conditions and volatility in financial and credit markets; our ability to pursue and complete

acquisitions and the costs and management attention required to do so; the significant amount

of our indebtedness; covenants in our debt agreements that may restrict our ability to

make acquisitions, incur additional indebtedness and refinance indebtedness on favorable

terms; increases in market interest rates; the impact of healthcare reform legislation on our business; competitive

conditions in our industry; and other factors discussed from time to time in our news

releases, public statements and/or filings with the Securities and Exchange Commission

(the “SEC”), especially the “Risk Factors” sections of our Annual

and Quarterly Reports on Forms 10-K and 10-Q, including our Annual Report on

Form 10-K for the fiscal year ended December 31, 2010. We assume no, and hereby

disclaim any, obligation to update any of the foregoing or any other forward-looking statements as a result

of new information or new or future developments, except as otherwise required by law.

SUN INFORMATION

This presentation includes information regarding Sun. Sun is subject to the reporting

requirements of the SEC and is required to file

with the SEC annual reports containing audited financial information and quarterly reports

containing unaudited financial information. The information related to Sun provided in

this presentation has been provided by Sun or derived from Sun’s public filings.

We have not independently verified this information. We have no reason to believe that

such information is inaccurate in any material respect. We are providing this data for

informational purposes only. Sun’s filings with the SEC can be found at

www.sec.gov. |

NON-GAAP

FINANCIAL MEASURES 3

This presentation includes the following financial measures defined as non-GAAP financial

measures by the SEC: EBITDA, Adjusted EBITDA, funds from operations (“FFO”),

adjusted FFO (“AFFO”), and normalized AFFO. These measures may be different

than non-GAAP financial measures used by other companies and the presentation of these measures is not intended to

be considered in isolation or as a substitute for financial information prepared and presented

in accordance with U.S. generally accepted accounting principles.

EBITDA is defined as net income before interest expense, income tax expense and depreciation

and amortization. Adjusted EBITDA is defined as EBITDA adjusted to exclude

stock-based compensation expense and acquisition pursuit costs. FFO is

calculated in accordance with The National Association of Real Estate Investment

Trusts’ (“NAREIT”) definition of “funds from

operations,”

and is defined as net income, computed in accordance with GAAP,

excluding gains or losses from real estate

dispositions, plus real estate depreciation and amortization. AFFO is defined as FFO excluding

straight-line rental income adjustments, acquisition pursuit costs,

stock-based compensation expense and amortization of deferred financing costs.

Normalized AFFO represents AFFO adjusted for one-time start up costs.

Reconciliations of these non-GAAP financial measures to the GAAP financial measures we

consider most comparable are included under “Actual and Pro Forma

Reconciliation” in this presentation. |

4

|

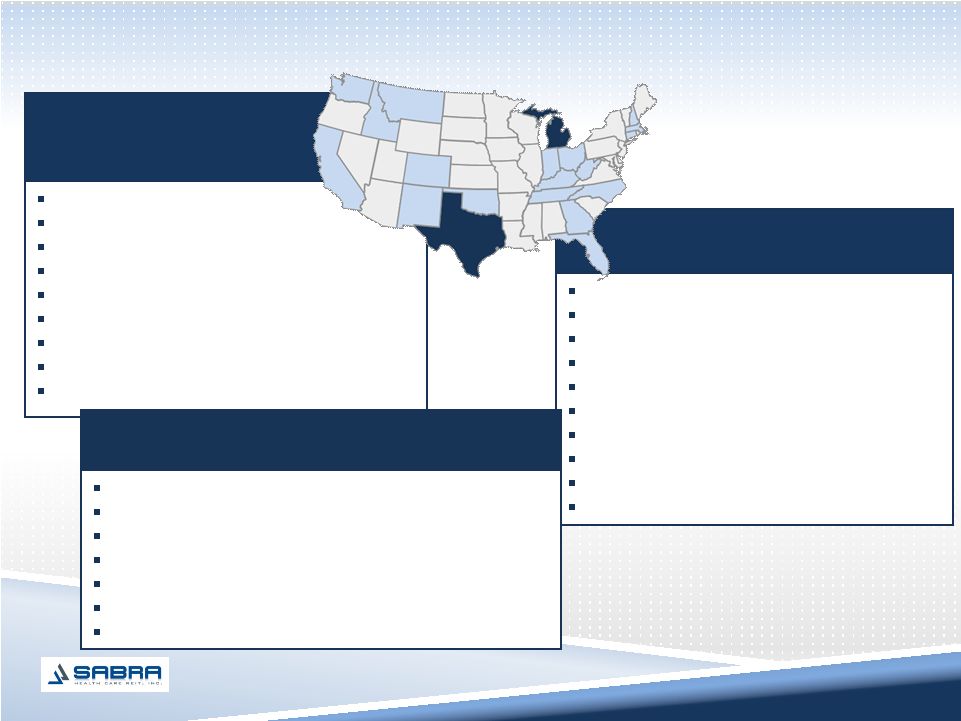

SABRA HAS

COMPETITIVE INDUSTRY PRESENCE 5

Formed by Opco/ Propco split of Sun Healthcare Group

Independently traded as of November 2010 (NASDAQ: SBRA)

Structured as an UPREIT

B/B2 rating (S&P/ Moody’s)

87 health care investments*

67 skilled nursing facilities

86 leased to Sun Healthcare Group

Presence in 20 states*

$441.7mm equity market cap*

$747.2mm total enterprise value*

$68.0mm of capital invested (as of June 1, 2011)

$100.0mm untapped revolver

Management team with over 20 years total operational experience

Rick Matros, Chairman & CEO

Harold Andrews, CFO

Talya Nevo-Hacohen, CIO

Formation

Portfolio

Capitalization

Management

*As of March 31, 2011. |

OPPORTUNITY

Few capital providers serving the smaller operators

Over

90%

of

senior

housing

facilities

are

owned

in

portfolios

of

less

than

10

properties

(1)

Larger health care REITs have made transformational deals and grown

significantly

Lack of debt sources limits private equity activity

Uncertainty surrounding government reimbursement (Medicare and

Medicaid) chills new investor interest

Opportunities for quality, accretive acquisitions

6

(1)

Source: NIC MAP Q12011 Ownership Summary for MAP 100 as of Q12011. Statistic includes

assisted living, independent living and nursing care facilities. Be the capital provider

of choice to local and regional operators of healthcare facilities

|

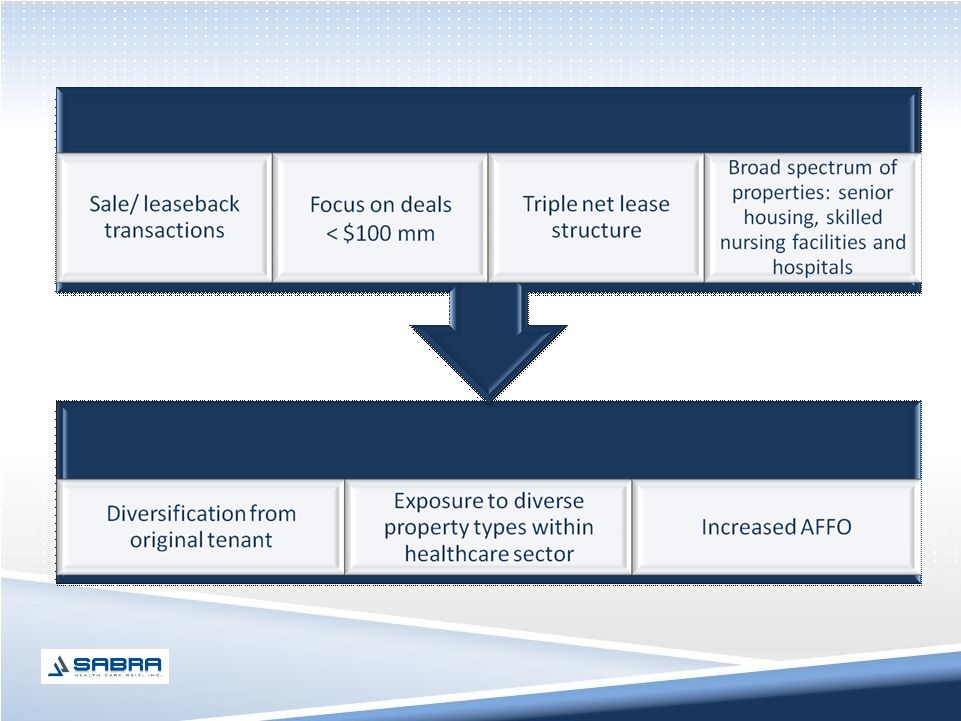

SABRA

CAPITALIZES ON OPPORTUNITY 7

Execution

Execution

Focused Tactics |

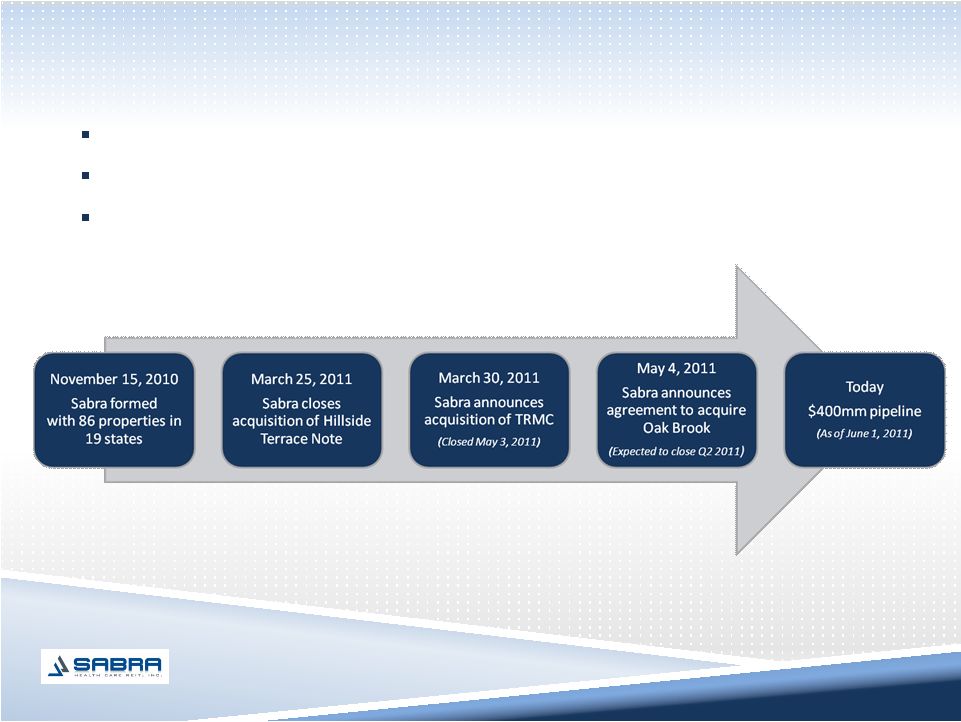

ACQUISITIONS

YIELD DIVERSIFICATION Acquisition of Texas Regional Medical Center and Hillside Terrace

Note Agreement to acquire Oak Brook Health Care Facility

Steady pipeline across spectrum of healthcare real estate

8 |

Oak Brook

Health Care Facility (Expected to close Q2 2011)

Texas Regional Medical

Center at Sunnyvale

(Closed May 3, 2011)

9

Purchase Price: $62.7mm

Investment Type: Equity

Property Type: Acute Care Hospital

Available Beds: 70

Facility Age: 1.5 years

Facility EBITDAR

(1)

: $17.5mm

Facility EBITDAR Coverage: 3.02x

Annualized GAAP Rental Income: $6.6mm

Initial Cash Yield: 9.25%

Purchase Price: $11.3mm

Investment Type: Equity

Property Type: SNF

Available Beds: 120

Facility Age: 24 years

Facility EBITDAR

(1)

: $1.6mm

Facility EBITDAR Coverage: 1.50x

Annualized GAAP Rental Income: $1.3mm

Occupancy as of March 31, 2011: 96.0%

Initial Cash Yield: 9.50%

Purchase Price: $5.3mm

Investment Type: Debt

Property Type: AL, IL and Memory Care

Facility Age (based on renovation): 2 years

Occupancy as of March 31, 2011: 86.5%

Annualized GAAP Interest Income: $0.7mm

Initial Cash Yield (based on interest income): 12.22%

Hillside Terrace Mortgage Note

(Closed March 25, 2011)

*

**

INVESTMENT HIGHLIGHTS

(1)

Facility EBITDAR is for 12 months ended March 31, 2011 and

has been provided to Sabra by the applicable tenant.

|

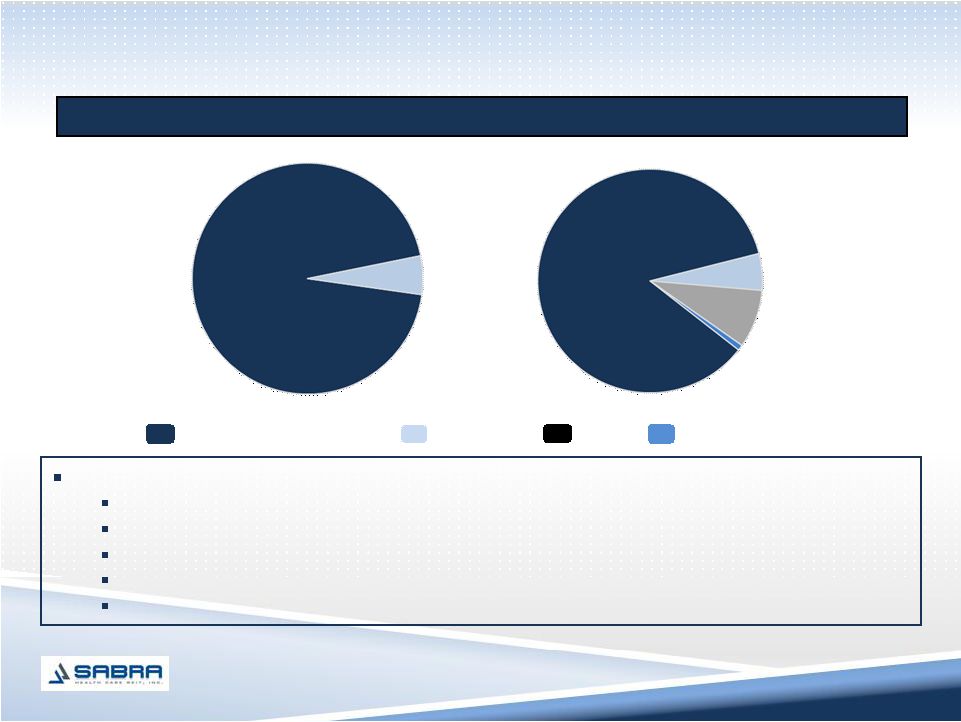

10

Senior Housing

(3)

Skilled Nursing/ Healthcare Facilities

(2)

Actual

Pro Forma

(1)

Acquisitions are changing the revenue makeup of our portfolio

(1)

Pro forma assumes TRMC, Hillside Terrace Note and Oak Brook acquisitions occurred on January

1, 2011. (2)

Skilled nursing and healthcare facilities include skilled nursing, multi-license

designation and mental health facilities. (3)

Senior housing facilities include independent living, assisted living and CCRC

facilities. (4)

Interest income includes impact of Hillside Terrace Note.

(5)

Inception

refers

to

the

date

from

which

Sabra

separated

from

Sun

Healthcare,

November 15, 2010 (86 properties).

94.6%

5.3%

8.4%

85.5%

0.8%

Sabra’s Revenue

$79.3 million of invested capital leads to (pro forma impact

(1)

):

Annualized normalized AFFO increase from $37.5 million to $44.9 million (20% increase)

Interest coverage increase from 2.28x to 2.57x

Leverage decrease from 5.96x to 5.27x

Invested capital from inception grew 14.0%

Sun concentration reduced to 89.0% since inception

(5)

5.4%

Hospital

Interest Income

(4)

IMPACT OF ACQUISITIONS

(as of March 31, 2011) |

CAPITAL

DEPLOYMENT AND GROWTH STRATEGY 11

Sabra’s capital deployment strategy

Deploy available liquidity into

accretive acquisitions

Reduce Sun revenue concentration

and diversify asset base

Improve credit rating statistics

Replenish or expand revolver

Continue accretive acquisitions

Long-term benefits for Sabra and investors |

12

|

STRONG

PORTFOLIO PERFORMANCE Strong occupancy and skilled mix trends in Sabra’s

portfolio Historical

Skilled

Nursing/

Healthcare

Facilities

Occupancy

(1)

Historical Overall Occupancy

(1)

Skilled nursing and healthcare facilities include skilled nursing, multi-license

designation and mental health facilities (79 properties). (2)

Senior housing facilities include independent living, assisted living and CCRC facilities (7

properties). (3)

Skilled mix is defined as the total Medicare and non-Medicaid managed care patient

revenue divided by the total skilled nursing revenues for any given period.

13 |

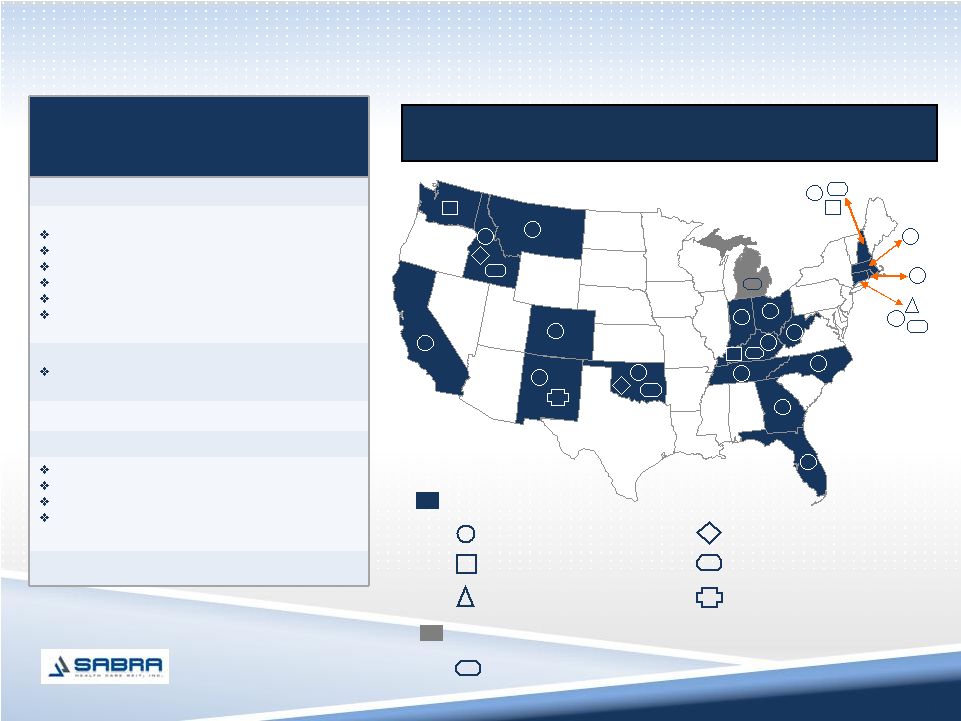

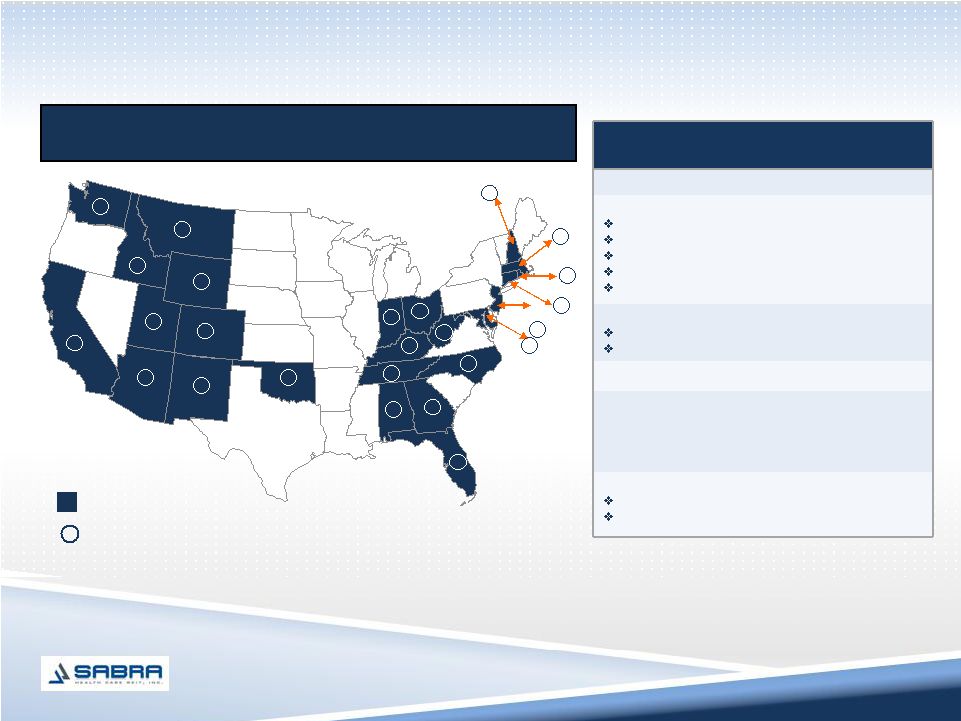

PROPERTY

DIVERSIFICATION (as of March 31, 2011)

1

1

1

1

3

2

2

1

4

3

1

1

5

2

1

1

2

2

11

2

1

8

5

2

8

3

2

8

1

1

States with facilities

(Equity

investments

–

86

total)

CCRC (total: 1)

Multi-Licensed Designation (total: 10)

Mental Health (total: 2)

Assisted Living (total: 5)

Skilled Nursing (total: 67)

Independent Living (total: 1)

Key real estate

portfolio information

(as of March 31, 2011)

Investments:

Equity Investments:

Skilled Nursing

Multi-License Designation

Assisted Living

Mental Health

Independent Living

CCRC

TOTAL Equity Investments:

67

10

5

2

1

1

86

Debt Investments:

Hillside Terrace

TOTAL Debt Investments:

1

1

TOTAL Investments:

87

Bed/ Unit Count (Equity Investments):

Skilled Nursing

Assisted Living

Independent Living

Mental Health

TOTAL Beds/ Units

8,488

912

121

82

9,603

Facility EBITDAR Coverage:

(1)

1.45x

States with facilities

(Debt

investments

–

1

total)

Geographically diversified portfolio of skilled nursing and

senior housing assets

14

(1)

Based on trailing 12 months ended March 31, 2011.

Multi-Licensed Designation (total: 1)

1 |

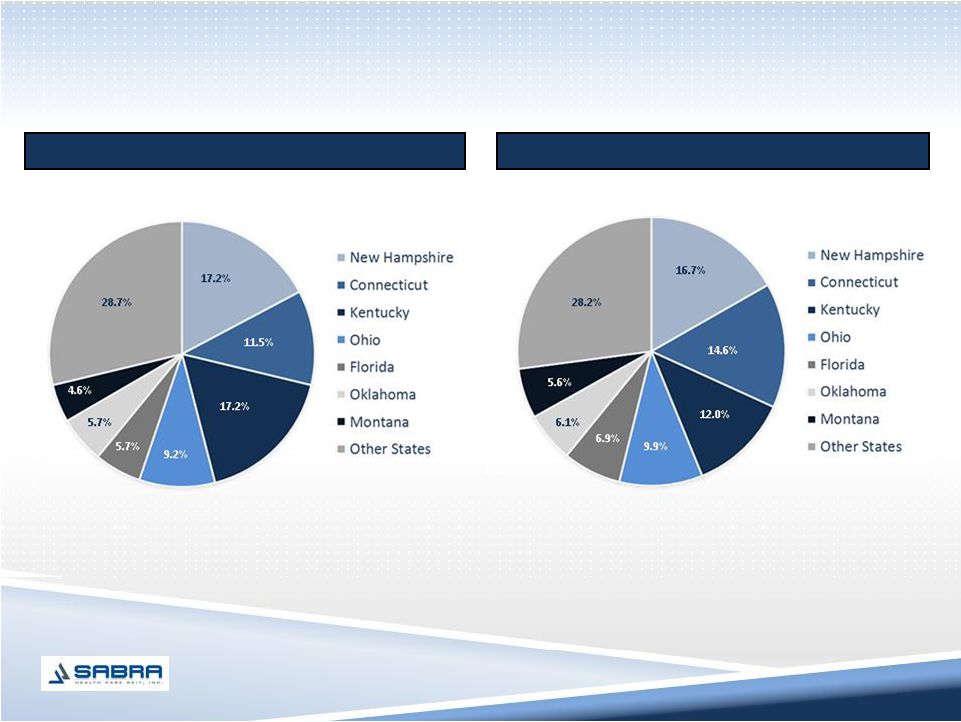

GEOGRAPHICALLY

DIVERSE PORTFOLIO (as of March 31, 2011)

87 investments in 20 states

9,603 licensed beds

(1)

Sabra has 86 equity investments in 19 states and 1 debt investment in 1 state as of March 31,

2011. (2)

The above information refers to Sabra’s licensed beds in 86 equity investments as of

March 31, 2011. Licensed beds are the number of beds for which a license has been

issued, which may vary in some instances from licensed beds available for use, which is used in the

computation of occupancy. Available beds for the 86 properties aggregated 9,266.

(2)

(1)

9.9%

15

Properties/ Facilities by State

Beds/ Units by State

17.2%

9.2%

5.7% |

PRIMARY TENANT

OVERVIEW (as of March 31, 2011)

States with facilities

Number of facilities per state

Key portfolio information

(as of March 31, 2011)

Number of Centers:

199

Property Type:

Skilled Nursing

Multi-License Designation

Assisted Living

Mental Health

Independent Living

163 (82%)

16 (8%)

10 (5%)

8 (4%)

2 (1%)

Beds:

Licensed

Available

22,916

22,060

States:

25

As of 3/31/2011 Adjusted EBITDAR (000s):

Margin

As of 3/31/2011 SNF Skilled Mix %

(1)

As of 3/31/2011 Occupancy %

$63,949

13.2%

41.1%

87.0%

Facilities with Specialty Units:

(2)

RRS Units

Solana Units

68

47

11

15

9

9

5

7

9

9

8

8

20

7

2

17

15

18

2

10

Sun operates 199 inpatient centers in 25 states

(1)

Skilled mix defined as number of Medicare and non-Medicaid managed care revenues divided

by the total skilled nursing revenues.

(2)

As of December 31, 2010.

5

1

1

1

7

2

1

16 |

FINANCIALLY

SECURE MAJOR TENANT 17

$145.6 million of liquidity

(1)

*

0.63x Net Debt-to-Adjusted EBITDA ratio*

*For the quarter ended March 31, 2011.

(1)

Includes $60.0 million available under Sun’s revolving credit facility.

Strong Operating Performance

$483.9 million in Revenue*

$63.9 million in Adjusted EBITDAR*

Corporate guarantee across diverse healthcare services

Sun Healthcare Group, SunBridge Healthcare, CareerStaff, SolAmor

Hospice, SunDance

Rehabilitation

Attractive business profile

Strong operating performance

Transparency and visibility

Balance sheet strength

Public entity

Sabra management team has substantial experience with Sun’s operations

|

18

|

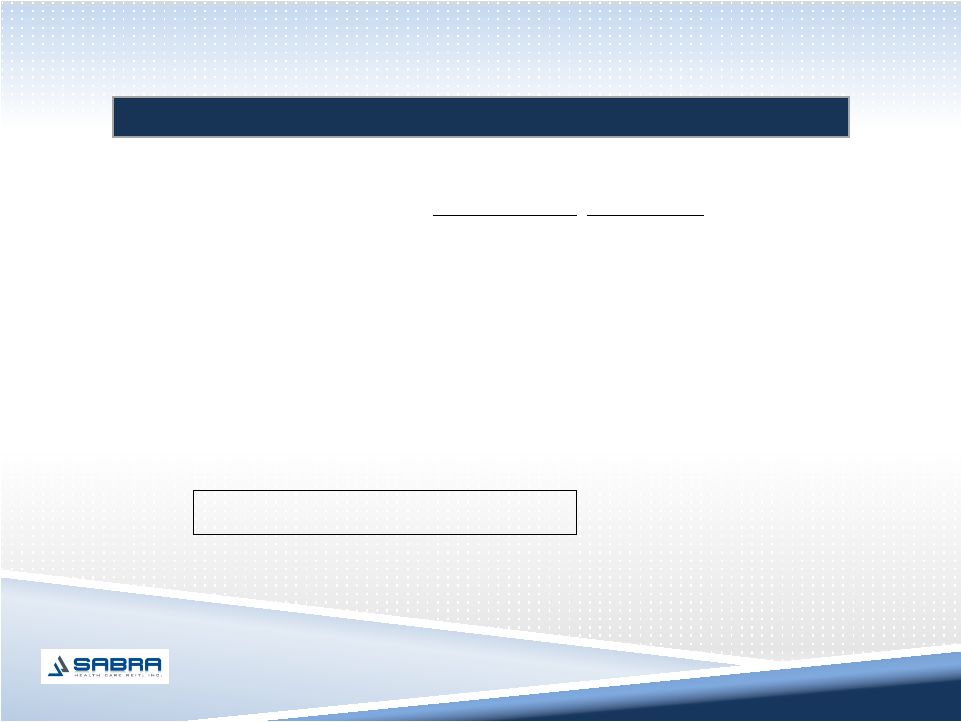

FINANCIAL

HIGHLIGHTS 19

Income statement and other data

Pro Forma

(1)

Revenues

$

17.6

$

19.7

G&A costs

2.7

4.3

EBITDA

14.9

15.5

Net income

1.2

1.4

Adjusted EBITDA

16.2

18.3

FFO

7.3

7.9

AFFO

9.0

10.9

Normalized AFFO

9.3

11.2

Per share data:

Diluted EPS

$

0.05

$

0.05

Diluted FFO

0.29

0.31

Diluted AFFO

0.35

0.43

Diluted Normalized AFFO

0.36

0.44

Dividend per share

(2)

$

0.32

Dividend yield

(3)

7.4%

(in millions, except per share data and %)

(1)

Pro Forma assumes Texas Regional Medical Center, Hillside Terrace Note and Oak

Brook were acquired on January 1, 2011.

(2)

Declaration date of May 3, 2011 and payment date of June 2, 2011.

(3)

Based on current dividend annualized and stock price as of May 31, 2011.

Actual

For Three Months Ended March 31, 2011 |

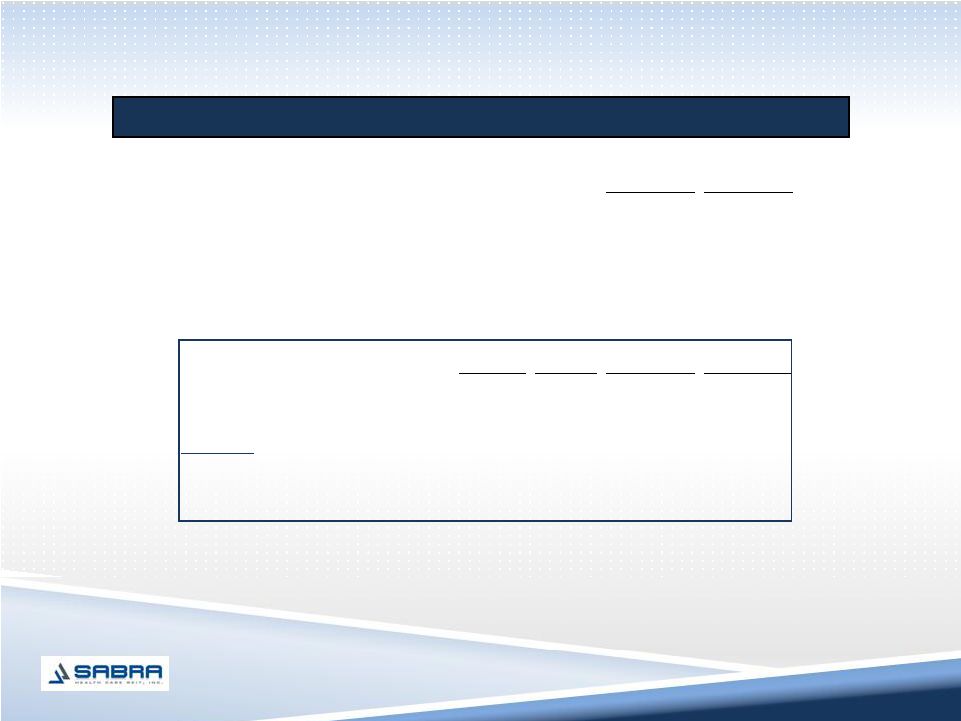

FINANCIAL

HIGHLIGHTS 20

Balance sheet and other data

Actual

Pro Forma

(1)

Cash

$

80.2

$

4.6

Real Estate, Gross Book Value

571.0

645.0 Real Estate, Asset Value

(2)

720.0

794.0 Mortgage Note Receivable

5.3

5.3

Total Debt

385.7

385.7

Total Equity

179.9

179.9

Capitalization

565.6

565.6

Liquidity

167.8

92.2

Debt Covenants

(3)

MAX

Actual

Pro Forma

(1)

Incurrence:

Total Debt/ Asset Value

60%

47%

47%

Secured Debt/ Asset Value

40%

20%

20%

Minimum Interest Coverage

2.00x

2.28x

2.57x

Maintenance:

Leverage Ratio

6.25x

5.96x

5.27x

Fixed Charge Coverage Ratio

1.75x

2.06x

2.32x

Tangible Net Worth

$

162.0

$

263.8

$

263.8

Unencumbered Assets/ Unsecured Debt

150%

168%

168%

(dollars in millions)

MIN

As of March 31, 2011

As of March 31, 2011

(1)

Pro forma assumes Texas Regional Medical Center, Hillside Terrace Note and Oak Brook

were acquired on January 1, 2011 (except for the pro forma calculations of

Consolidated Tangible Net Worth, Total Debt/ Asset Value, Secured Debt/ Asset Value

and Unencumbered Asset/ Unsecured Debt, which assumes the acquisition of Texas Regional Medical and Oak Brook

occured on March 31, 2011).

(2)

Actual based on cap rate of 9.75% and $70.2 million annual rental revenue. Pro forma

acquisitions based on purchase price. (3)

Based on defined terms in notes indenture and credit

agreement. |

INVESTMENT

HIGHLIGHTS SUMMARY 21

Geographically

Diverse Portfolio

Attractive Industry

Fundamentals

Favorable Long-Term

Lease Structure

Strong Lease

Coverage

Strong Asset

Coverage

Financially Secure

Primary Tenant

Growth

Opportunities

Experienced

Management Team |

ACTUAL AND PRO

FORMA RECONCILIATION 22

Reconciliation of Net Income to EBITDA, Adjusted EBITDA, Funds from Operations (FFO),

Adjusted Funds from Operations (AFFO) and Normalized AFFO

Actual

Pro Forma

(1)

Net income

$

1.2

$

1.4

Interest expense

7.6

7.6

Depreciation and amortization

6.1

6.5

EBITDA

$

14.9

$

15.5

Stock-based compensation

1.1

1.1

Acquisition pursuit costs

0.1

1.7

Adjusted EBITDA

$

16.2

$

18.3

Net

income $

1.2

$

1.4

Depreciation of real estate assets

6.1

6.5

Funds from Operations (FFO)

$

7.3

$

7.9

Straight-line rental income adjustments

-

(0.3)

Acquisition pursuit costs

0.1

1.7

Stock-based compensation expense

1.1

1.1

Amortization of deferred financing costs

0.5

0.5

Adjusted Funds from Operations (AFFO)

$

9.0

$

10.9

Start-up costs

0.3

0.3

Normalized AFFO

$

9.3

$

11.2

(1)

Pro Forma assumes Texas Regional Medical Center, Hillside Terrace Note and Oak

Brook were acquired on January 1, 2011. (in millions)

Three Months Ended March 31, 2011 |