Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DUKE REALTY CORP | d8k.htm |

RELIABLE.

ANSWERS. REIT Week: NAREIT Investor Forum

June 7-9, 2011

Exhibit 99.1 |

RELIABLE. ANSWERS.

2011 Duke Realty Corporation

2

2009

2010

FOCUS:

Liquidity

More than $1.5 billion

capital raised

Strategy refined

FOCUS:

Strategy execution

Operating

fundamentals

Balance sheet

strength

FOCUS:

Asset quality

Cash flow growth

Shareholder return

Where we’ve been and where we’re going…

2011 and beyond |

RELIABLE. ANSWERS.

2011 Duke Realty Corporation

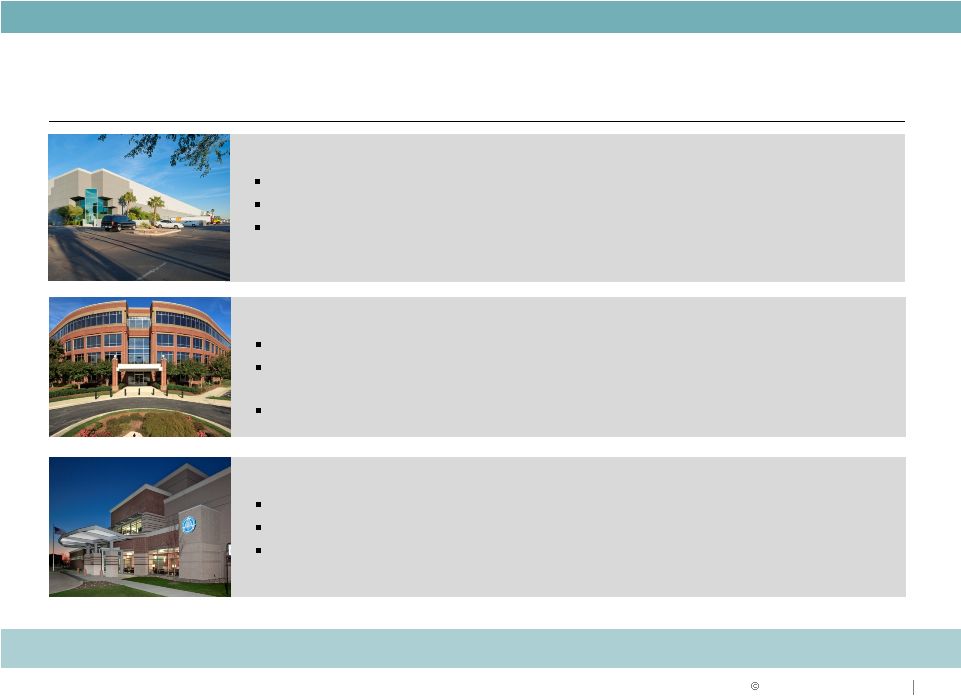

Suburban Office Market Still Challenging

Economic uncertainty limiting business investment and expansion decisions

Continued improvements in consumer spending, corporate profits and job outlook

will be catalyst

Recovery will be at slower pace

Medical Office Regaining Traction

Operators re-visiting expansion decisions

Relationships are a key driver of on campus MOB business

Demographics and economics positive growth drivers

3

Market Outlook

Fundamentals beginning to recover

Industrial Recovery Taking Shape

Net absorption in U.S. for Q1 2011 was positive for the third consecutive

quarter Retailers posting good results; container traffic volumes continuing

to increase Consumer confidence improving |

RELIABLE. ANSWERS.

2011 Duke Realty Corporation

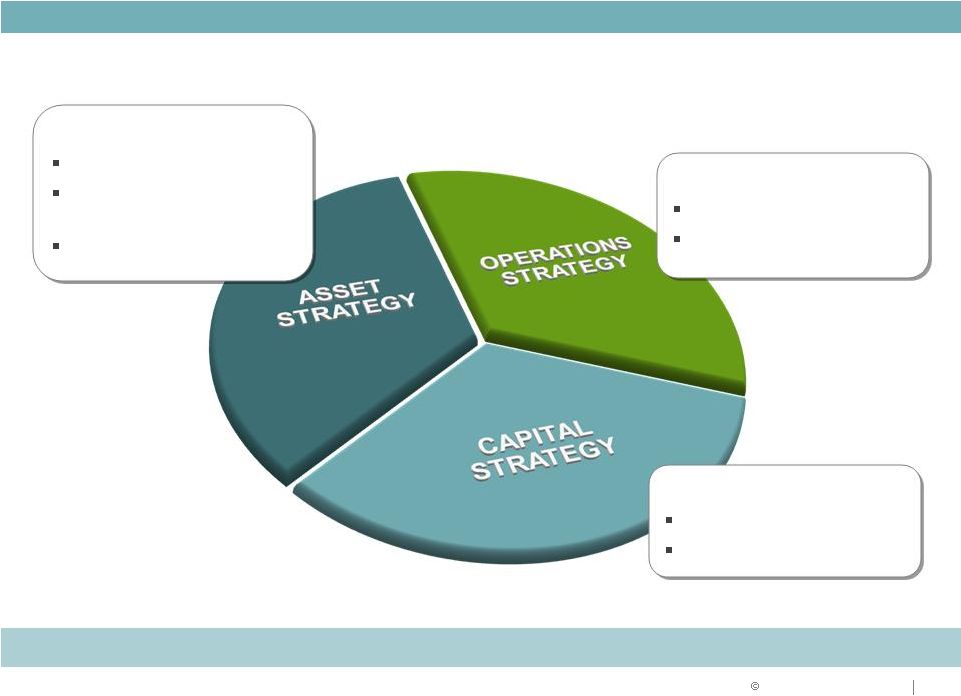

Focus on:

Increasing cash flow

Maximizing return on

assets

4

Strategy for Success

Focus on:

Improving coverage ratios

Improving ratings

Focus on:

Portfolio repositioning

Strategic acquisitions &

dispositions

Development opportunities

Delivering on what we say we will do |

RELIABLE. ANSWERS.

2011 Duke Realty Corporation

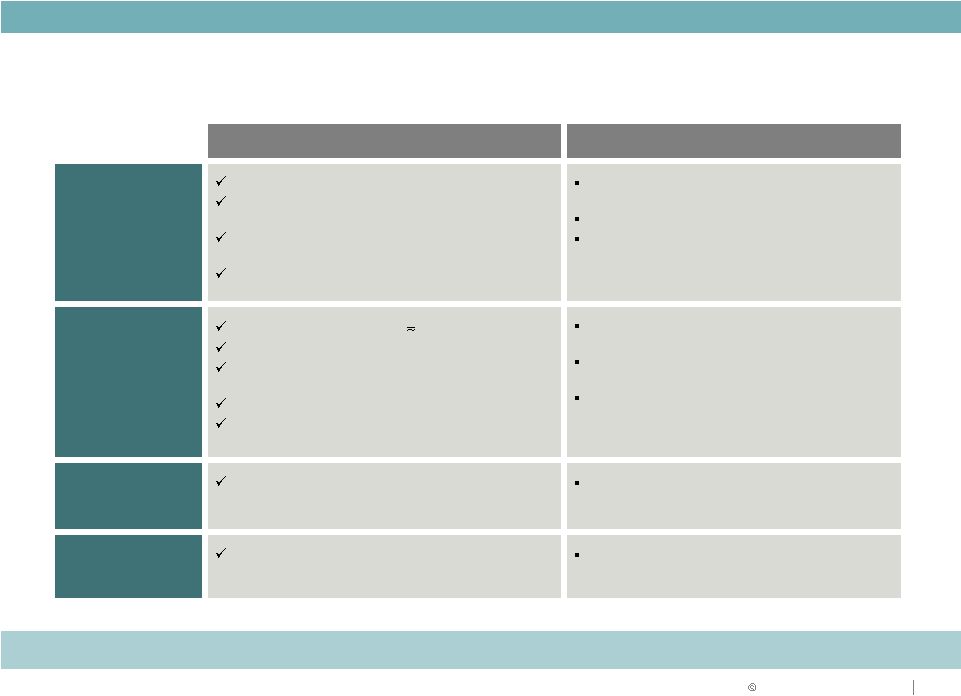

Strategic Focus

2011 Goals and Objectives

Q1 2011 Update

•

Lease-up portfolio, manage cap ex; reach

positive same property income growth

•

Balance execution with capital strategy relative

to level and quality of cash flow and same

property NOI; Debt to EBITDA <7.0x

•

Development starts of $100 to $200 million

focus on medical office and Build-to-Suit

•

Total portfolio occupancy as of March 31, 2011 of 88.9%;

industrial portfolio at 90.2%

•

More than 5.3 million square feet of leases completed; in-line

with Q1 2010 volume of 5.5 million square feet

•

Debt

to

EBITDA

@

6.7x;<6.0x

by

2013;

0.9%

Same

Property

•

One medical office development project started during quarter

•

Continue strong momentum from 2010 on

repositioning of portfolio

•

Pursue acquisitions of medical and industrial

assets

•

Planned asset dispositions of primarily Midwest

office

•

Closed on remaining $173 million of Premier assets (final

closing in April)

•

Asset dispositions totaled $456 million, including completion of

$274 million CBRERT transaction

•

Opportunistically access capital markets . . .

push out maturity schedule further

•

Continue improving our coverage ratios

•

Maintain minimal balance on line of credit

•

Retired $42.5 million of unsecured bonds

•

Fixed charge ratio of 1.81x

•

Zero balance outstanding on line of credit, $167 million cash

Asset

Strategy

Operations

Strategy

Capital

Strategy

Executing across all three aspects of our strategy

5 |

2011 Duke Realty Corporation

ASSET STRATEGY

6 |

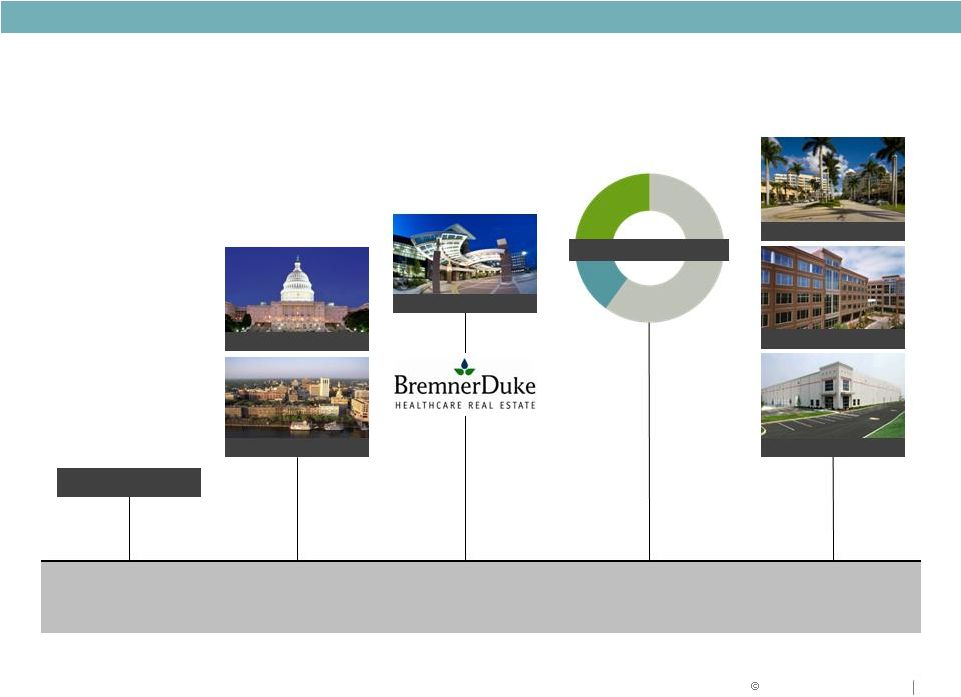

Depth & experience of team = Consistent execution

7

Proven Performance

ASSET STRATEGY

Flex disposition

$1 Billion

2005

2006

Savannah

Washington DC

2007

Healthcare

2009

Asset Strategy

2010

Dugan

CBRERT

Premier

2011 Duke Realty Corporation |

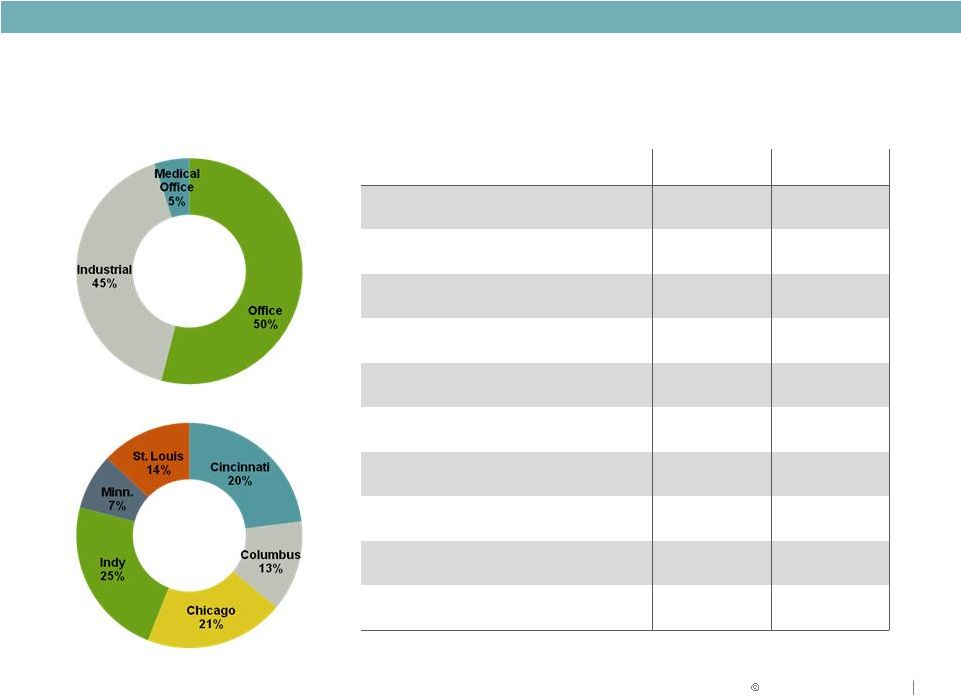

8

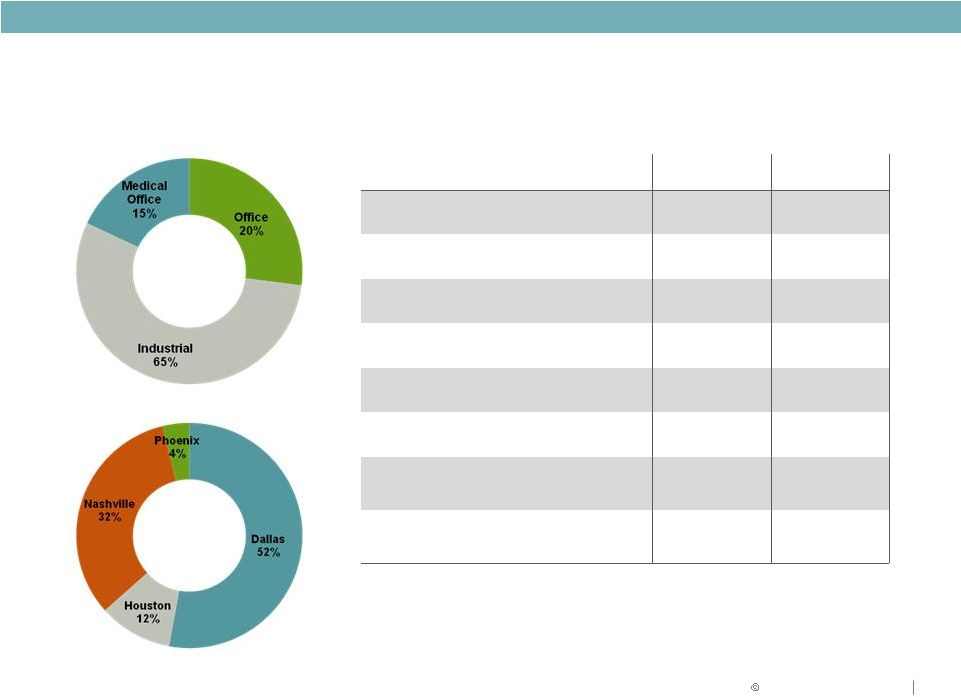

Portfolio Strategy

BY PRODUCT

2009

2013

BY GEOGRAPHY

Q1 2011

ASSET STRATEGY

2009

2013

Q1 2011

Southeast

21%

Southeast

27%

Southeast

30%

2011 Duke Realty Corporation |

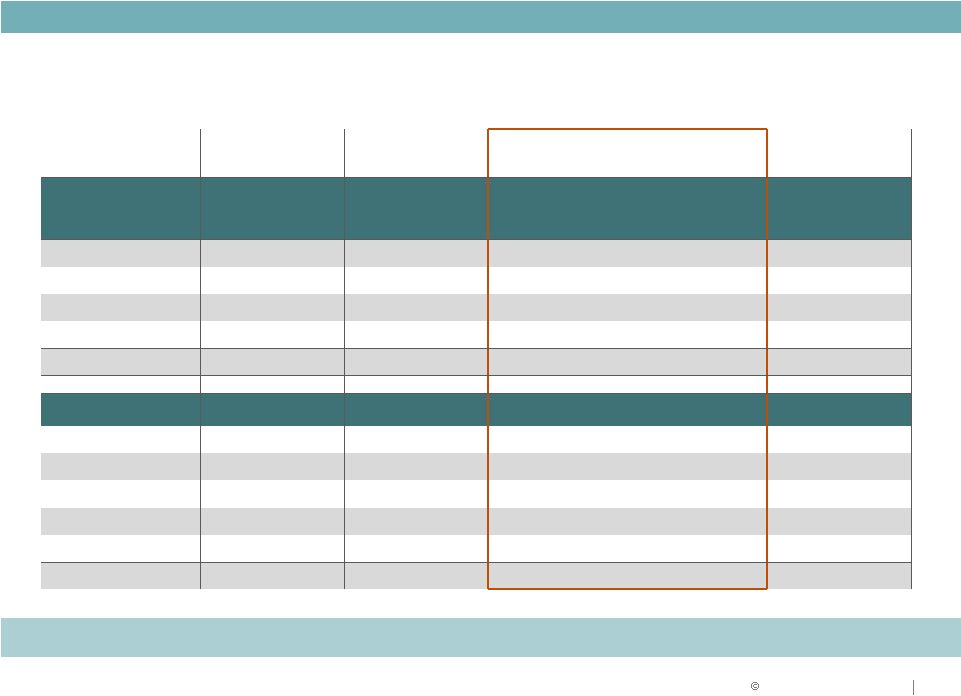

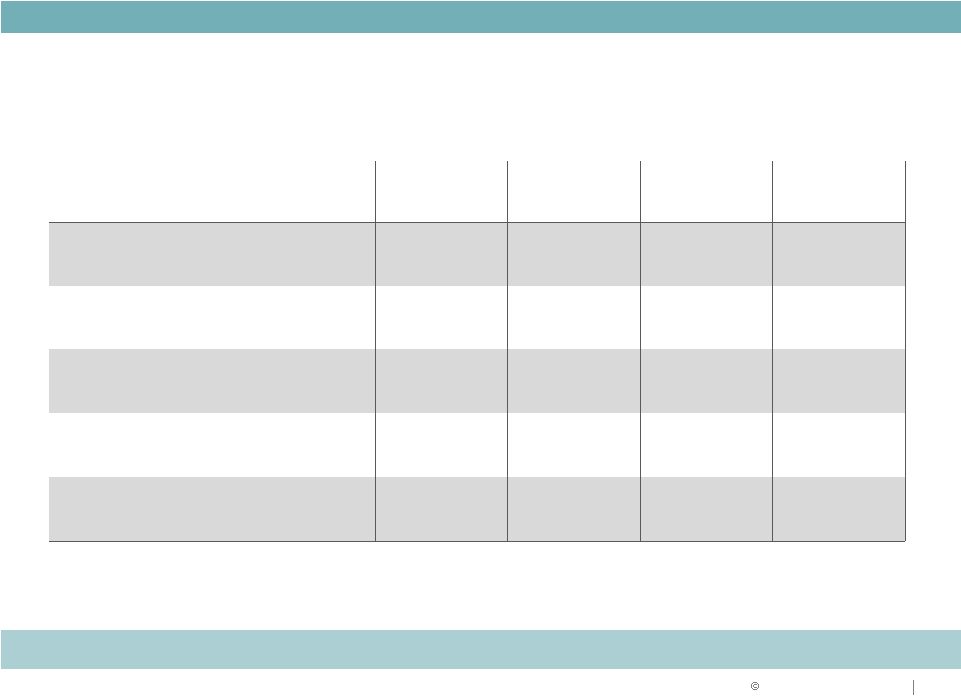

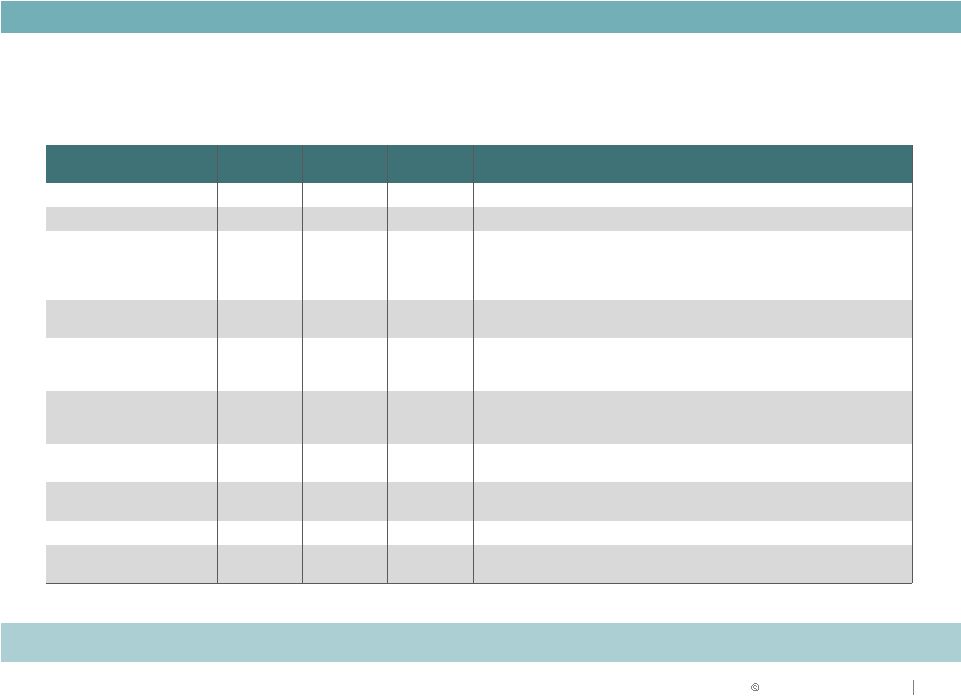

2011 Duke Realty Corporation

9

Asset Strategy: Road Map

($ in millions)

Investment

9/30/09

Investment

3/31/11

ACTION PLAN

Investment

2013

PRODUCT TYPE

Amount

%

Amount

%

Proceeds from

Targeted

Dispositions

Acquisitions/

Developments/

Repositioning

Amount

%

Industrial

$2,930

36%

$3,650

45%

($55)

$1,250

$4,920

60%

Office

4,515

55%

3,750

46%

(500)

(810)

2,050

25%

Medical Office

440

5%

520

6%

0

730

1,230

15%

Retail

290

4%

280

3%

(305)

0

0

0%

$8,175

100%

$8,200

100%

($860)

$1,170

$8,200

100 %

REGION

Midwest

$4,310

53%

$3,960

48%

($530)

$125

$3,280

40%

Southeast

1,755

21%

2,250

27%

(165)

150

2,460

30%

East

1,035

13%

975

12%

(120)

355

1,230

15%

South

970

12%

950

12%

(45)

200

820

10%

West

105

1%

65

1%

0

340

410

5%

$8,175

100%

$8,200

100%

($860)

$1,170

$8,200

100%

ASSET STRATEGY

Significant progress to date…

on target to meet 2013 goals |

2011 Duke Realty Corporation

OPERATIONS STRATEGY

10 |

11

Focus on Fundamentals

LEASING OF

PORTFOLIO

STRATEGIC

NEW DEVELOPMENT

AND LAND DISPOSITION

AFFO PAYOUT

OPERATIONS STRATEGY

Maximize return on assets

2011 Duke Realty Corporation |

2011 Duke Realty Corporation

12

OPERATIONS STRATEGY

Portfolio Occupancy

2011 Guidance: Average Occupancy 87.5% to 90.5%

•

Occupancy at March 31, 2011 at 88.9%

•

Managing through anticipated tenant terminations

•

Upside to guidance from lease-up of portfolio and renewals

Unstabilized Portfolio

Significant progress on lease-up since March 31, 2010

•

Original portfolio was comprised of 48 buildings totaling

11.8 million square feet that were 59.2% leased at March

31, 2010

•

Progress to date:

12 buildings have been leased-up to at least 90% occupancy or

have been sold

Original portfolio is 77.9% leased as of March 31, 2011

•

Current portfolio comprised of the following:

Industrial: 16 projects, 5.7M square feet, 70% leased

Office: 8 projects, 8.6M square feet, 57% leased

Retail: 6 projects, 1.2M square feet, 85.2% leased

Same Property NOI

2011 Guidance: 1% to (3%)

•

Same property net operating income increased by 0.9%

over the twelve months ended March 31, 2011

•

Results in Q1 in line with expectations

Recurring AFFO Payout Ratio

2011 Guidance: 85% to 100%

•

Annual dividend of $0.68

•

2011 components of AFFO reflect current environment:

Recurring capital expenditures $85 million to $100 million

Straight line rent adjustment $20 million to

$25 million Non cash interest

expense $15 million to $20 million

•

Property level AFFO a critical metric for our business;

part of compensation performance criteria

2011 Performance Metrics

Company

performance

goals

and

objectives

aligned

with

key

operational

success

factors |

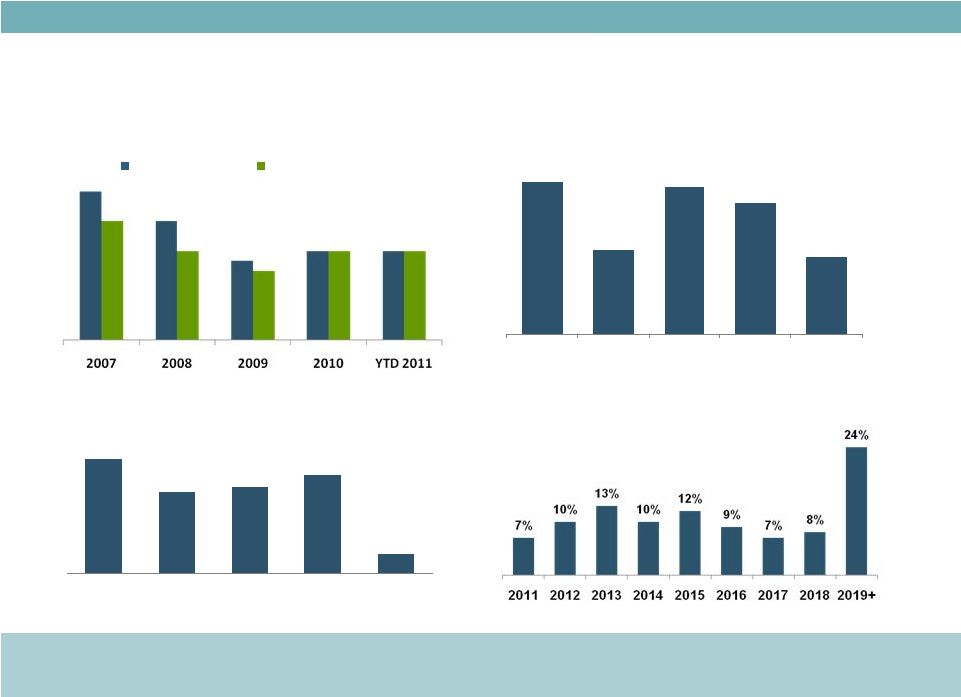

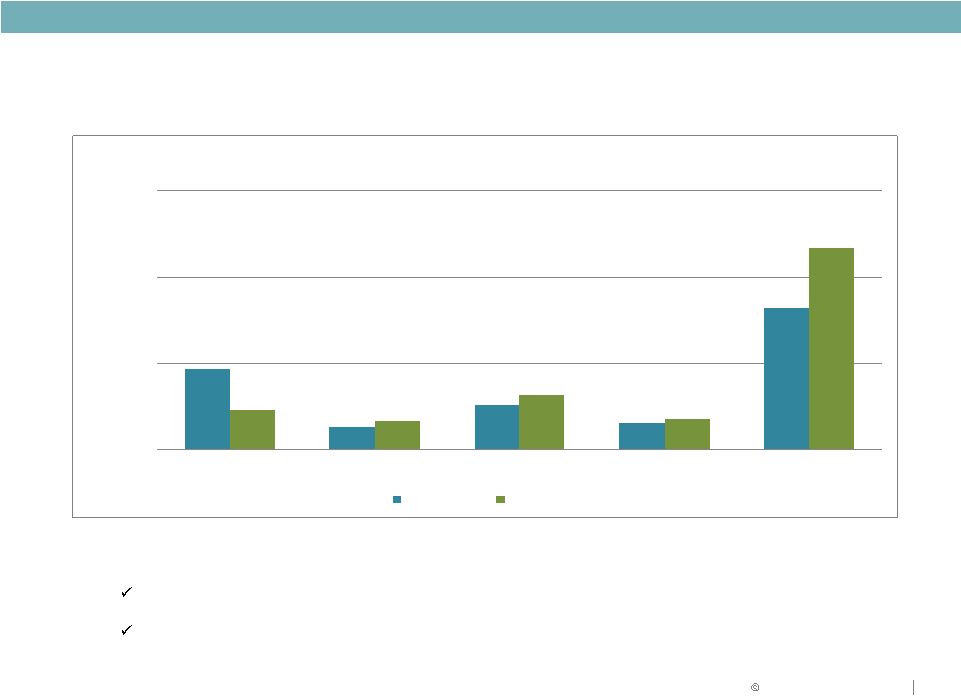

Operations Strategy: Consistent Operating Performance

Stabilized Occupancy (%)

Strong historical stabilized occupancy –

fundamentals improving

Lease Renewals (%)

Strong lease renewal percentages

Stabilized occupancy

In-service occupancy

80%

72%

79%

77%

2007

2008

2009

2010

YTD 2011

70%

29.9

21.4

22.7

25.9

2007

2008

2009

2010

YTD 2011

Leasing Activity

New

Leases

and

Renewals

–

Consistent

Execution

(in

millions

of

square feet)

Lease Maturity Schedule

Lease maturities are well balanced with no one year accounting for

more than 13%

95%

92%

92%

89%

88%

89%

89%

89%

89%

87%

OPERATIONS STRATEGY

5.3

Demonstrated ability to maintain consistency through difficult operating

environments

13 |

2011 Duke Realty Corporation

14

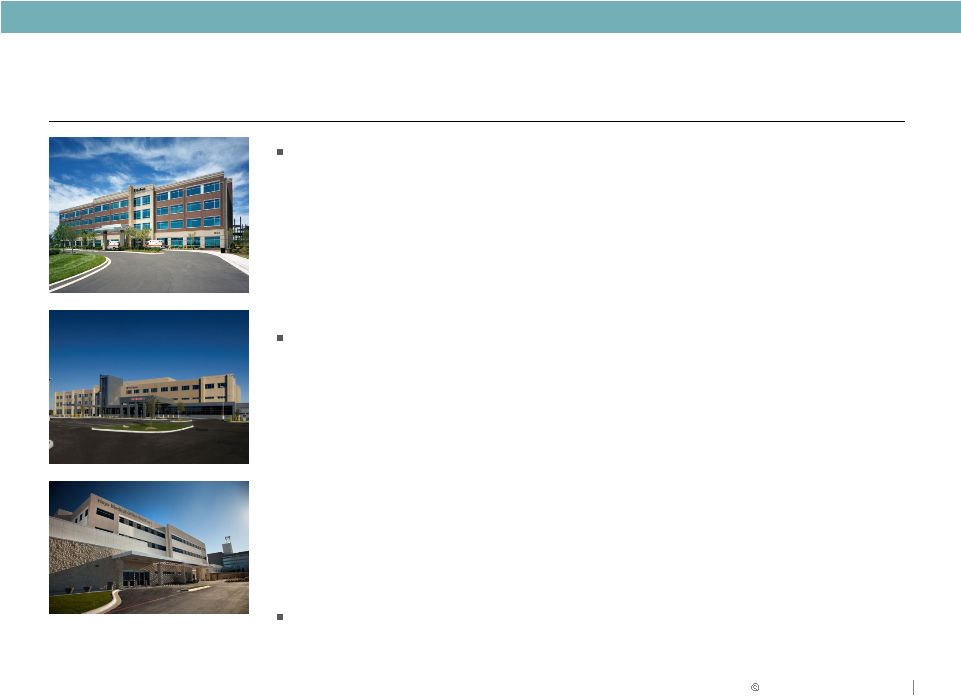

New, High Quality Portfolio with Long-term Leases

Bulk

Industrial

Suburban

Office

Medical Office

Property age

10.1 years

11.7 years

2.0 years

Property size

212,000 SF

118,000 SF

97,000 SF

Lease term

7.0 years

7.2 years

11.7 years

Tenant size

70,000 SF

12,000 SF

11,000 SF

OPERATIONS STRATEGY |

2011 Duke Realty Corporation

15

December 31

Historical Focus on Occupancy

OPERATIONS STRATEGY |

2011 Duke Realty Corporation

REGIONAL MARKET OVERVIEWS

16 |

2011 Duke Realty Corporation

RECENT TRANSACTIONS

17

Midwest

Renewal Industrial

Hebron

I

-

Cincinnati

646,000 SF

100% leased

New Lease Office

Atrium

II

-

Columbus

121,000 SF

Tenant:

Alcatel

-

Lucent

MARKET OVERVIEW & KEY POINTS

Strong distribution base: Over 30% of U.S.

population within one day’s drive

74 Fortune 500 headquarters

High growth and return opportunities, particularly in

Chicago, Columbus, and Indianapolis

Duke Realty’s roots and a position of strength

Original

location

–

since

1972

Low cost basis product

Dominant market position

48% of our total investment

Committed to Midwest because we perform…

Remains a key component to our strategy

Disposition -

Office (CBD)

312 Elm & 312 Plum

Cincinnati

609,000 SF

MIDWEST OVERVIEW |

18

Midwest Overview

Location

Product

Type

Industrial

Office

Average Age

11.6 years

16.3 years

Average Building Size

236,000 SF

130,000 SF

Total Square Footage

51.5 million

16.4 million

Current Occupancy

93.0%

84.4%

Indianapolis

96.7%

86.5%

Chicago

96.1%

88.6%

Cincinnati

86.4%

82.5%

St. Louis

88.6%

79.5%

Columbus

96.2%

82.0%

Minneapolis

84.5%

96.8%

MIDWEST OVERVIEW

Note: All information as of March 31, 2011

2011 Duke Realty Corporation |

2011 Duke Realty Corporation

RECENT TRANSACTIONS

19

Southwest

Acquisition -

Industrial

Estrella Buckeye –

Phoenix

250,000 SF

100% Leased

Disposition Office

Lakeview office assets-

Nashville

379,000 SF

MARKET OVERVIEW & KEY POINTS

Duke Realty presence since 1999 (Weeks merger)

52 Fortune 500 headquarters

Demographic drivers: modern transportation and

infrastructure, population and job growth

Strong industrial demand expected post-recovery

Port, inland port and logistics key for bulk distribution

markets

13% of our total investment

Expand industrial presence by pursuing select

acquisition opportunities in Houston, Phoenix and

Southern California

New Development -

Industrial

Westland II Houston

300,000 SF

73% Leased

SOUTHWEST OVERVIEW |

20

Southwest Overview

Location

Product

Type

Industrial

Office

Average Age

8.6 years

6.5 years

Average Building Size

256,500 SF

108,600 SF

Total Square Footage

20.0 million

2.1 million

Current Occupancy

85.6%

91.9%

Dallas

83.8%

83.3%

Nashville

80.9%

95.0%

Houston

98.0%

100%

Phoenix

97.1%

N/A

SOUTHWEST OVERVIEW

Note: All information as of March 31, 2011

2011 Duke Realty Corporation |

2011 Duke Realty Corporation

RECENT TRANSACTIONS

21

East & Southeast Overview

Acquisition –

Office/Industrial

Premier Portfolio -

South Fl

4.9 million SF

MARKET OVERVIEW & KEY POINTS

Strong presence: entered Southeast in 1999 (Weeks

merger) and East in 2006 (acquisition of Winkler

portfolio)

15 Fortune 500 headquarters

East and Southeast cities among top growth markets

in country…

strong in-migration

Diversified economies; Government, healthcare,

finance and education

Eastern cities maintained highest employment rate

through downturn

Atlanta and Northeast corridor strong in bulk

industrial

39% of our total investment

New Leases -

Office

3630

Peachtree

–

Atlanta

Currently 44% leased

EAST & SOUTHEAST OVERVIEW |

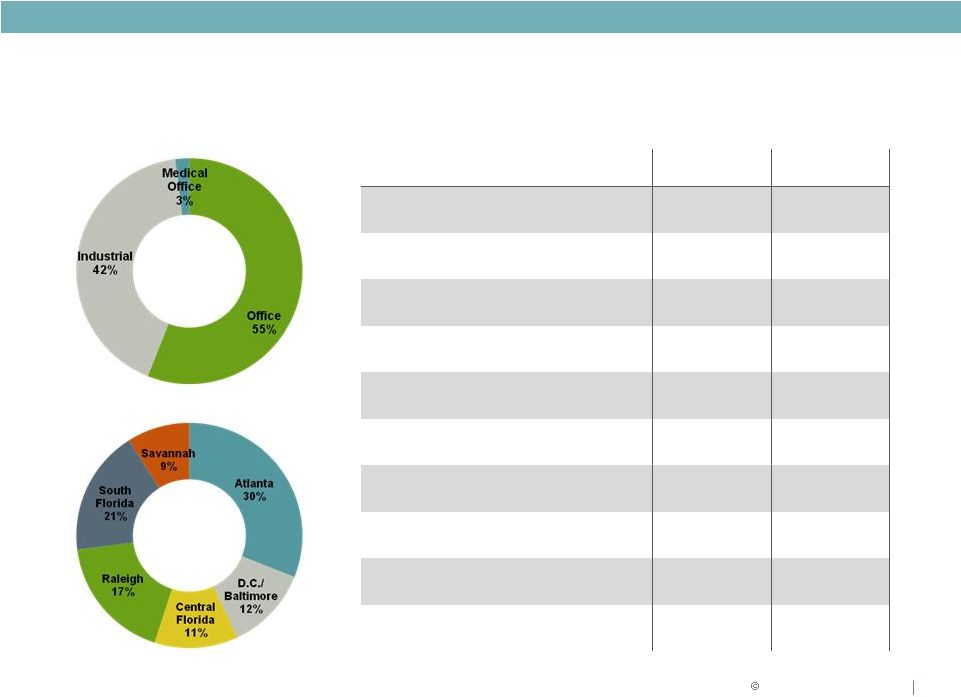

22

East and Southeast Overview

Location

Product

Type

Industrial

Office

Average Age

8.8 years

9.7 years

Average Building Size

225,000 SF

110,000 SF

Total Square Footage

26.9 million

13.7 million

Current Occupancy

89.0%

88.5%

Atlanta

85.2%

87.3%

South Florida

80.5%

89.2%

Raleigh

98.1%

89.5%

Washington D.C./Baltimore

94.2%

90.9%

Central Florida

91.0%

85.4%

Savannah

88.7%

NA

EAST & SOUTHEAST OVERVIEW

2011 Duke Realty Corporation |

2011 Duke Realty Corporation

MEDICAL OFFICE OVERVIEW

23 |

24

Portfolio Strategy

BY PRODUCT

2009

2013

BY GEOGRAPHY

2009

2013

Focus on “core”

assets

(on-campus)

Focus on national and

regional Hospital system

relationships

Focus on Duke Realty

office locations

Focus on demographic

healthcare growth cities

MEDICAL OFFICE OVERVIEW

2011 Duke Realty Corporation |

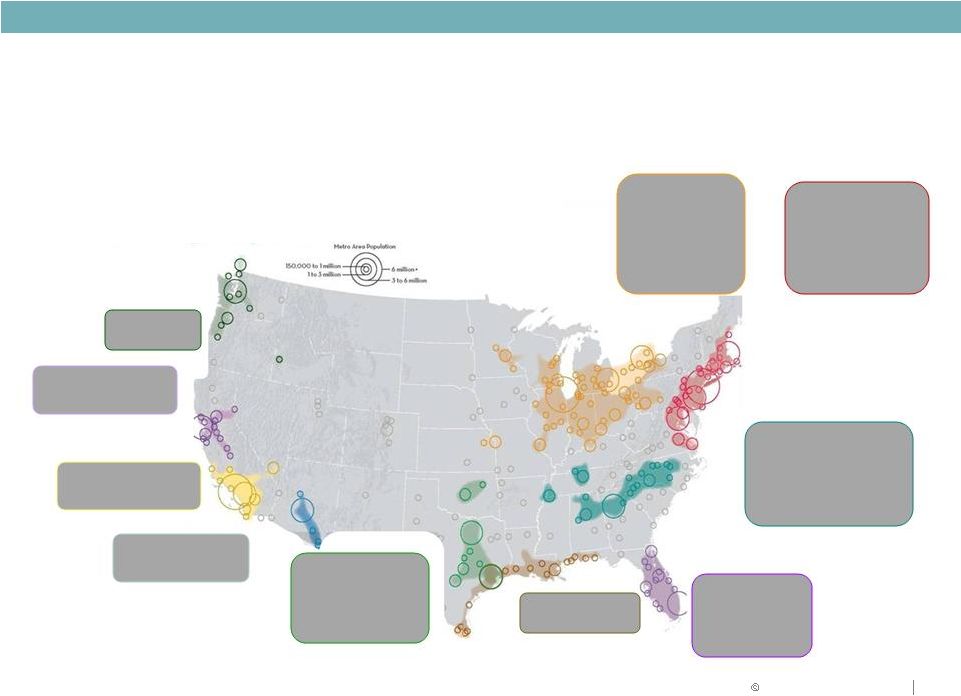

PIEDMONT ATLANTIC

Atlanta*

Birmingham

Charlotte

Nashville*

Raleigh*

NORTHEAST

Baltimore*

Boston

Philadelphia

Richmond

Washington, D.C.*

GREAT LAKES

Chicago*

Columbus*

Indianapolis*

Louisville

Minneapolis*

St. Louis*

FLORIDA

Jacksonville

Miami

Orlando*

Tampa*

GULF COAST

ARIZONA SUN

CORRIDOR

NORTHERN

CALIFORNIA

SOUTHERN

CALIFORNIA

CASCADIA

Megaregions

by

2050:

Populations

in

contiguous

regions

with

major cities that produce more than $100 billion in goods and

services. Mega-regions will drive need for healthcare,

transportation infrastructure and jobs through 2050

Duke Realty Markets: Demographic Focus

*

Duke Realty market

Map Source: ATLANTA REGIONAL COMMISSION MEGAREGIONS REPORT

MEDICAL OFFICE OVERVIEW

TEXAS TRIANGLE

Austin*

Dallas

*

Houston*

San

Antonio

2011 Duke Realty Corporation

25 |

2011 Duke Realty Corporation

26

Healthcare Data Points

The nation’s largest industry

•

Represents more than 17% of GDP, predicted to exceed 23%

by 2020

•

Americans spend more than 5% of pre-tax income on

healthcare. Lower income brackets pay 15% or more ($7,800

per capita health expenditures in 2008/2009)

Reform

•

Increased number of people insured expected to increase by

30 to 50 million –

increased demand for care

•

Number

of

physicians

will

increase

–

more

space

demand

•

Hospitals expect margin pressure and need to increase

market share –

Hospitals seeking capital partners for

“non-core assets”

•

May

reduce

reimbursements

–

real

estate

efficiency

a

priority –

larger deals and floor plates

As many as 40% (20% now) of primary care physicians and 24%

(10% now) of specialists will be employed by hospitals by 2012 –

more Hospital credit on leases

MEDICAL OFFICE OVERVIEW |

2011 Duke Realty Corporation

CAPITAL STRATEGY

27 |

2011 Duke Realty Corporation

28

Key Metrics & Goals

2009

Actual

2010

Actual

Q1 2011

Actual

Goal

Debt to Gross Assets

44.5%

46.3%

46.1%

45.0%

Debt + Preferred to Gross

Assets

54.9%

55.5%

55.3%

50.0%

Fixed Charge Coverage Ratio

1.79 : 1

1.79 : 1

1.81 : 1

2.00 : 1

Debt/EBITDA

6.65

7.31

6.66

< 6.00

Debt + Preferred/EBITDA

8.47

8.88

8.20

< 7.75

CAPITAL STRATEGY

Progressing toward strategic plan goals |

2011 Duke Realty Corporation

29

CAPITAL STRATEGY

Current Liquidity Position

$934

$256

$516

$310

$1,644

$460

$332

$632

$351

$2,335

$0

$1,000

$2,000

$3,000

2011

2012

2013

2014

Thereafter

Debt Maturity and Amortization Schedule

($ in millions)

3/31/2009

3/31/2011

•

Provide for $290 Million 2011 Unsecured Bond Maturities

$122 million due 8/15/11

$168 million due 12/1/11 |

2011 Duke Realty Corporation

KEY TAKEAWAYS

30 |

2011 Duke Realty Corporation

31

2010 Accomplishments and 2011 Opportunities

Drive Shareholder Return

2010

2011

Capital

Strategy

Raised nearly $1.1 billion of capital

Executed Capital Strategy in alignment with operating

and asset strategy

Operating with minimal balance outstanding on our

line of credit

2011 maturities provided for

Opportunistically access capital markets . . . push

out maturity schedule further

Continue improving our coverage ratios

Maintain minimal balance on our line of credit

Operating

Strategy

Reduced

operating

overhead

6.5%

Leased nearly 26 million square feet

Maintained high tenant retention @

77% renewal rate

Achieved strong service operations performance

Achieved $130 million development starts at attractive

yields; 40% of investment medical office

Balance capital strategy relative to level and quality

of cash flow and same property NOI

Maintain fixed charge coverage above 1.75x and

Debt/EBITDA below 7.0x

Lease-up portfolio; manage cap ex; reach positive

same property income growth

Development

Expertise

Third party volume totaled $619 million and exceeded

budget by $57 million

Increase our new development starts to

$200 million

Asset

Strategy

Made significant progress on strategic plan

Continue making significant progress on strategic

plan

RELIABLE. ANSWERS. |

32

WHY DUKE REALTY?

Quality portfolio improving with asset strategy

Solid balance sheet improving with capital strategy

Unmatched ability to execute on daily operations

Development capabilities in place with existing land bank

Talent and leadership depth to execute

RELIABLE. ANSWERS.

2011 Duke Realty Corporation |

RELIABLE. ANSWERS.

2011 Duke Realty Corporation

33

2011 Range of Estimates

2011 RANGE

Metrics

2010

Actual

Pessimistic

Optimistic

Key Assumptions

Core FFO Per Share

$1.15

$1.06

$1.18

AFFO Payout Ratio

89%

100%

85%

•

Annual dividend maintained at $0.68 per share

Average Occupancy

88.2%

87.5%

90.5%

•

First half expirations cause dip in occupancy

•

Upside to guidance driven by higher occupancy

•

Downside

assumes

“worst

case”

scenario

from

unknown

bankruptcies,

defaults and terminations

Same Property NOI

0.9%

(3.0%)

1.0%

•

Rental rate pressure remains

•

Coming off higher year

Building Acquisitions

$919

$200

$400

•

Aligned with long-term strategy

•

Focus on industrial and medical office

•

Includes $173 million remaining acquisition of Premier

Building Dispositions

$499

$400

$600

•

Strong backlog of non-strategic assets under contract

•

2011 pipeline consists primarily of office product

•

Includes $275 million sale to CBRERT

Land Dispositions

$35

$20

$50

•

Selling identified non-strategic parcels

•

Local market demand still sluggish

Construction and

Development Starts

$313

$200

$400

•

Anticipate medical office starts in the $75 million to $125 million range

•

Remaining starts from industrial build-to-suit and third party

construction Construction Volume

$751

$600

$800

•

BRAC volume consistent with 2010

General and Administrative

Expenses

$41

$45

$40

•

2011 total overhead expenses flat

•

No severance costs in 2011 guidance

Leasing actions continue to drive upside |