Attached files

| file | filename |

|---|---|

| 8-K - MAINBODY - Amarantus Bioscience Holdings, Inc. | mainbody.htm |

Generex Biotechnology Corporation

33 Harbour Square, Suite 202

Toronto, Ontario

Canada M5J 2G2

May 30, 2011

"STRICTLY PRIVATE & CONFIDENTIAL"

Amarantus BioSciences, Inc.

c/o The Parkinson’s Institute

675 Almanor Avenue

Sunnyvale, CA 94085

Attention: Mr. Gerald E. Commissiong,

Chief Operating Officer

Dear Sirs:

Re: Intellectual Properties Licensing and Collaboration Arrangements

This letter agreement sets forth our agreement and understanding as to the essential terms of the intellectual property licensing arrangements (collectively, the “Transaction”) between Generex Biotechnology Corporation (“Generex”) and Amarantus BioSciences, Inc. (“Amarantus”). The parties intend this letter agreement to be binding and enforceable, and that it will inure to the benefit of the parties and their respective successors and assigns.

|

The Transaction Parties

|

|

1.

|

Generex. Generex is a corporation incorporated under the laws of the State of Delaware, USA, the common stock of which is traded on the Over-the-Counter Bulletin Board (the “OTCBB”) under the symbol “GNBT.OB”.

|

|

2.

|

Amarantus. Amarantus is a corporation incorporated under the laws of the State of Delaware, USA, the common stock of which is traded on the OTCBB under the symbol “JKIK.OB” (which symbol may be changed prior to the Closing Date (as that term is hereinafter defined)).

|

Page | 1

The Transaction Technologies

|

3.

|

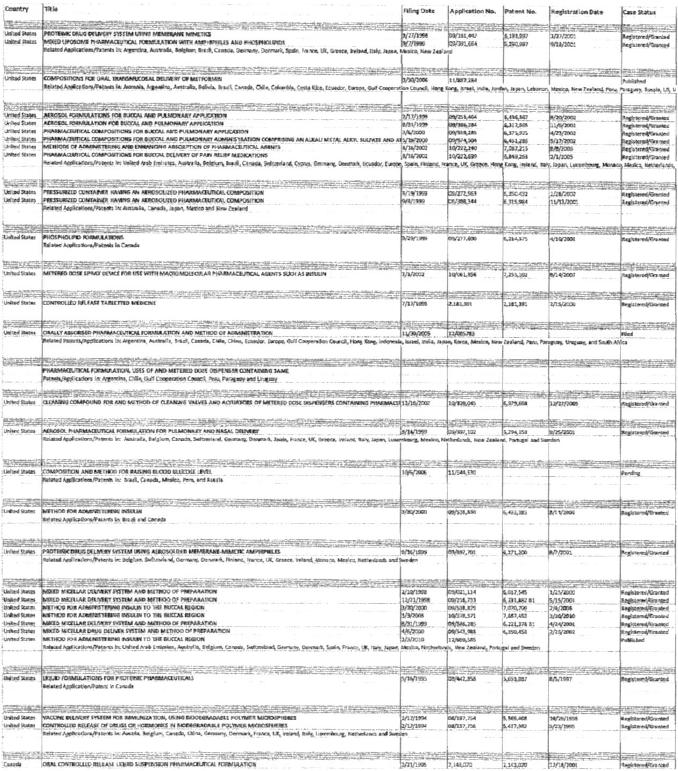

Generex Technologies. Generex and its wholly-owned subsidiaries are the sole legal and beneficial owners of certain patented and other intellectual properties in respect of buccal drug delivery technologies (collectively, the “Generex Technologies”). The patents included in the Generex Technologies are listed in Exhibit “A” annexed hereto.

|

|

4.

|

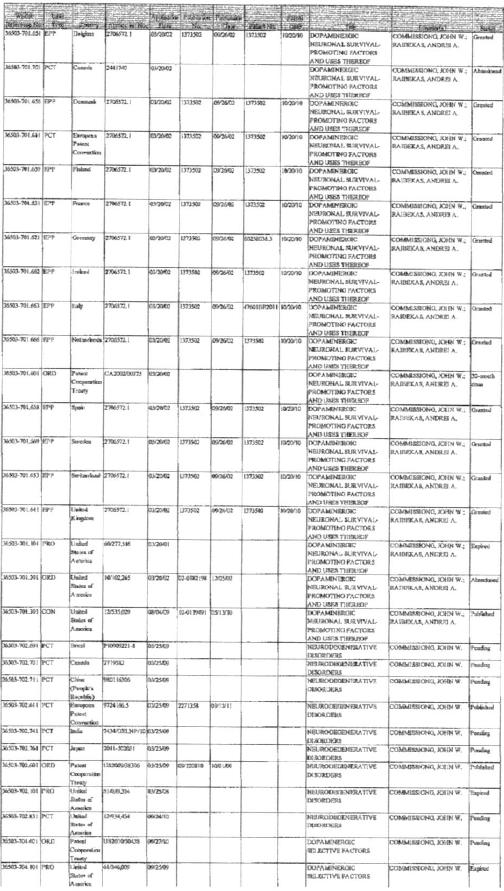

Amarantus Technologies. Amarantus is the sole legal and beneficial owner of patented and other intellectual properties in respect of (A) Mescencephalic Astrocyte-Derived Neurotrophic Factor (MANF) (AMBH-001) and molecules derived therefrom, and (B) the PhenoGuard™ process for the immortalization of mammalian cells that retain the phenotype of their parent cells (collectively, the “Amarantus Technologies”). The patents included in the Amarantus Technologies are listed in Exhibit “B” annexed hereto.

|

|

The Intellectual Properties Licensing & Collaboration Arrangements

|

|

5.

|

License. Generex will grant to Amarantus an exclusive worldwide license (the “License”) for the clinical & regulatory development and commercialization of the Generex Technologies in connection with any and all therapeutic applications of the Amarantus Technologies; provided that the License will not apply to the Diabetes Field (as that term is hereinafter defined) (the “License Field”).

|

|

6.

|

Amarantus License Obligations. In connection with the License, Amarantus will, in its sole discretion and at its sole expense, design, develop, implement, and diligently prosecute clinical & regulatory programs for United States Food and Drug Administration (FDA) approval (and approvals from equivalent foreign governmental agencies) for the commercial sale (“Approvals”) of products utilizing the Generex Technologies in the License Field (“Products”).

|

|

7.

|

Generex License Obligations. In connection with FDA applications by Amarantus for Approvals, Generex will, at its sole expense, provide commercially reasonable assistance to Amarantus in respect of: the design, review and refinement of non-clinical and clinical trial protocols and quality studies; and, review and refinement of FDA applications for Approvals.

|

|

8.

|

Ownership of Intellectual Property (License). In the event of any improvements to, or derivatives of, the Generex Technologies are achieved pursuant to or under the auspices of the License, any and all such improvements or derivates will be the sole and exclusive property of Generex and will be included as Generex Technologies under the License (for no additional consideration).

|

Page | 2

|

9.

|

Research & Development Collaboration. Generex and Amarantus will design, implement, and diligently pursue a collaboration (the “Collaboration”) for the research and development of the Amarantus Technologies for indications and therapeutics (“Indications”) in respect of diabetes mellitus, including glyco-metabolic and lipo-metabolic dysfunction and other medical complications attributable to diabetes mellitus (collectively, the “Diabetes Field”). The Indications will include, but will not be limited to, the following indications: diagnostics for beta-cell dysfunction; diabetes mellitus biomarkers; kidney disease attributable to diabetes mellitus; neuropathy attributable to diabetes mellitus; and, beta-cell islet transplantation, preservation, and regeneration.

|

|

10.

|

Collaboration Programs. The specific Indications to be pursued in the Collaboration will be chosen by Generex in its sole discretion, but with consultation with Amarantus. Non-clinical, clinical, quality, and regulatory Collaboration programs for Indications, including, without limitation, non-clinical and clinical trial protocols, will be designed jointly by Generex and Amarantus.

|

|

11.

|

Amarantus Collaboration Obligations. In connection with the Collaboration, Amarantus will, at its sole expense: allow and make available the Amarantus Technologies for unrestricted use in the Collaboration, including, without limitation, any and all know-how and data; and, provide commercially reasonable assistance to Generex in respect of (a) the design, review and refinement of non-clinical, clinical, quality, and regulatory programs for Indications, including, without limitation, clinical trial protocols, and (b) review and refinement of FDA submissions.

|

|

12.

|

Generex Collaboration Obligations. Generex will fund direct expenditures incurred in respect of the Collaboration in accordance with the Budget (as that term is hereinafter defined) to a maximum aggregate amount of Five Million United States Dollars (US$5,000,000) over the course of a period of three (3) years following the Closing Date in accordance with a budget to be jointly agreed upon by Generex and Amarantus on or before the Closing Date (the “Budget”). Generex and Amarantus will work jointly to establish the Budget, timelines, and Collaboration protocols prior to the Closing Date. Generex will provide the initial funding called for by the Budget within thirty (30) days of the Closing Date.

|

|

13.

|

Collaboration Commercialization Option. Generex will have options (each a “Collaboration Option”) to acquire exclusive or non-exclusive Indication commercialization licenses for the Amarantus Technologies in the Diabetes Field (“Collaboration Licenses”) from Amarantus for up to three (3) Indications funded by Generex pursuant to the Collaboration in consideration of the payment of commercially reasonable consideration. The terms of any Collaboration Licenses will be commercially reasonable and fairly reflect the nature of the Indication, the relative contributions of the parties to the Indication, the risks incurred by Generex in respect of the Indication, the costs required to commercialize the Indication, and the anticipated benefits to be gained from the particular Collaboration License. A Collaboration Option must be exercised within six (6) months following the filing of a patent or other intellectual property protection application in respect of the Indication. Exercise of a Collaboration Option will initiate a good faith negotiation period that expires six (6) months after the exercise of the Collaboration Option.

|

Page | 3

|

14.

|

Ownership of Intellectual Property (Collaboration). In the event of any improvements to, or derivatives of, the Generex Technologies are achieved pursuant to or under the auspices of the Collaboration, any and all such improvements or derivatives will be the sole and exclusive property of Generex (subject to the License). In the event of any improvements to, or derivatives of, the Amarantus Technologies are achieved pursuant to or under the auspices of the Collaboration, any and all such improvements or derivatives will be the sole and exclusive property of Amarantus (subject to any Collaboration Licenses). Subject to the foregoing, any discovery, development, invention (whether patentable or not), improvement, work of authorship, formula, process, composition of matter, formulation, method of use or delivery, specification, computer program or model and related documentation, know-how or trade secret, that is conceived and/or made pursuant to or under the auspices of the Collaboration will be owned jointly by Generex and Amarantus (“Joint Intellectual Property”). Provided that in no event will the following be Joint Intellectual Property: intellectual properties related solely to the immortalization processes included in the Amarantus Technologies (referred to as “PhenoGuard”) to the extent that the same does not include any Generex Technologies.

|

|

15.

|

Joint Intellectual Property Commercialization License Options (“JIP Options”). Amarantus will have a JIP Option to acquire an exclusive or non-exclusive commercialization license from Generex for any Joint Intellectual Property that is not the subject of any Collaboration Licenses in consideration of the payment of commercially reasonable consideration. Generex will have a JIP Option to acquire an exclusive or non-exclusive commercialization license from Amarantus for any Joint Intellectual Property that is not the subject of any Collaboration Licenses in consideration of the payment of commercially reasonable consideration. Provided that, in the event that Generex has acquired Collaboration Licenses for three (3) Indications, Amarantus will have a right of first refusal in respect of the exercise thereafter by Generex of any JIP Option The terms of any such JIP Option licenses will be commercially reasonable and fairly reflect the nature of Joint Intellectual Property being licensed, the relative contributions of the parties to such Joint Intellectual Property, the relative risks incurred by the parties in respect of such Joint Intellectual Property, the costs required to commercialize such Joint Intellectual Property, and the anticipated benefits to be gained from the particular JIP Option license. Any JIP Option must be exercised within six (6) months following the filing of a patent or other intellectual property protection application in respect of the relevant Joint Intellectual Property. Exercise of a JIP Option will initiate a good faith negotiation period that expires six (6) months after the exercise of the JIP Option.

|

Page | 4

License Fees, Milestone Payments, & Royalties Payments

|

16.

|

License Fee. Amarantus will pay to Generex an up-front non-refundable license fee in respect of the License of Ten Million United States Dollars (US$10,000,000) (the “License Fee”).

|

|

17.

|

Amarantus Stock. Subject to the strictures and requirements set forth in paragraph 18 hereof, the License Fee will be satisfied in whole, or in part, as the case may be, by the issuance by Amarantus to Generex of shares of Amarantus common stock (the “Amarantus Stock Consideration”). Subject to the strictures set forth in paragraph 18 hereof, the number of shares of Amarantus common stock comprising the Amarantus Stock Consideration will be equal to the number of shares of Amarantus common stock determined by dividing 10,000,000 by the average closing price of the Amarantus common stock on the OTCBB (and/or such other exchange on which the Amarantus stock may be traded at the relevant time) for the ten (10) trading days immediately preceding the Closing Date (as that term is hereinafter defined) (adjusted for any forward stock splits, reverse stock splits, or other transactions of similar import) (the “Closing Date Conversion Price”).

|

|

18.

|

Amarantus Stock Consideration Cap. In the event that the number of shares of the Amarantus Stock Consideration exceeds 9.99% of the number of issued and outstanding shares of Amarantus common stock as at the Closing Date: (A) the number of shares issued to Generex by Amarantus on the Closing Date in respect of the Amarantus Stock Consideration will be equal to 9.99% of the number of issued and outstanding shares of Amarantus common stock as at the Closing Date (the “Closing Date Amarantus Stock Consideration”); and (B) on the Closing Date Amarantus will execute and deliver to Generex a promissory note (the “Promissory Note”) evidencing the obligation of Amarantus to pay to Generex that portion of the License Fee not represented by the Amarantus Stock Consideration issued to Generex on the Closing Date. Provided, however, that if: (i) the Closing Date Amarantus Stock Consideration constitutes less than Seven Million One Hundred Twenty Five Thousand (7,125,000) shares of Amarantus common stock; or, (ii) the aggregate principal amount of the Promissory Note is greater than Five Million United States Dollars (US$5,000,000), then Generex will be entitled in its sole discretion to terminate this letter agreement on the Closing Date by written notice to Amarantus whereupon Generex and Amarantus will be released from their respective obligations hereunder. On the Closing Date, Amarantus will deliver to Generex a stock certificate evidencing the aggregate Closing Date Amarantus Stock Consideration registered in the name of Generex; Generex acknowledges that such stock certificate will include standard restrictive legends.

|

Page | 5

|

19.

|

Promissory Note. The Promissory Note will have a term of three (3) years commencing on the Closing Date and will bear interest at eight percent (8%) per annum, accrued monthly, and calculated and payable on the maturity date. Amarantus may, upon five (5) business day’s prior written notice (a “Prepayment Notice”) to Generex, prepay all or any portion of the Promissory Note from time to time (any such prepayment to be applied firstly in respect of accrued and unpaid interest) (a “Prepayment”). Generex may elect, upon written notice to Amarantus within two (2) business days of receipt by Generex of a Prepayment Notice, to take all or any portion of the amount payable by Amarantus pursuant to the Prepayment Notice in shares of Amarantus common stock valued at the Post-Closing Conversion Price (as if the date of the Prepayment was a Conversion Date).

|

|

20.

|

Promissory Note Conversion. At any time, and from time to time, following the eighteen (18) month anniversary of the Closing Date, Generex will be entitled, upon five (5) trading days’ notice to Amarantus, to effect a conversion (a “Conversion”) of all or any portion of the outstanding balance of principal and interest then due under the Promissory Note into shares of Amarantus common stock; provided that: (a) as at the effective date of any Conversion (the “Conversion Date”), Generex will not, following the Conversion, be the beneficial owner of more than 9.99% of the number of issued and outstanding shares of Amarantus common stock as at the Conversion Date (and Generex will provide to Amarantus a certification of its beneficial ownership of shares of Amarantus common stock in respect of each Conversion); and, (b) the aggregate number of shares of Amarantus common stock issuable pursuant to Conversions in any period of ninety (90) days will not constitute more than 4.99% of the number of issued and outstanding shares of Amarantus common stock as at the Conversion Date. The number of shares of Amarantus common stock issued in respect of a Conversion will be equal to the number of shares of Amarantus common stock determined by dividing the amount of principal and/or interest being converted in the Conversion by the price determined by the following formula (the “Post-Closing Conversion Price”): the lesser of (A) an amount equal to four (4) times the Closing Date Conversion Price; and, (B) the greater of: (x) the Closing Date Conversion Price; and, (y) the price that is equal to eighty percent (80%) of the average closing price of the Amarantus common stock on the OTCBB (and/or such other exchange on which the Amarantus stock may be traded at the relevant time) for the five (5) trading days immediately preceding the Conversion Date.

|

|

21.

|

Investment Intent. Generex confirms that the Closing Date Amarantus Stock Consideration and any shares of Amarantus common stock acquired pursuant to a Conversion or a Prepayment will be acquired by Generex for investment and that Generex will not offer, sell, or otherwise dispose of such securities except pursuant to registration under the Securities Act of 1933, as amended, or pursuant to an available exemption for such registration.

|

Page | 6

|

22.

|

Registration of Amarantus Stock Consideration. On or before the earlier of: (a) the date that is six (6) months following the date of this letter agreement; and (b) the date upon which Amarantus files a registration statement in respect of a private placement or public offering of its securities following the date hereof, Amarantus will prepare and file a registration statement (the “Registration Statement”) with the United States Securities and Exchange Commission (SEC) for the registration for public resale of the Amarantus Stock Consideration, including, for greater certainty, any shares of Amarantus common stock issuable pursuant to Conversion and Prepayment (collectively, the “Registrable Securities”), for public resale (including, without limitation, the issuance by Generex of all or any portion of the Registrable Securities to the Generex stockholders as a stock dividend) and will use its best and reasonable efforts to cause the Registration Statement to become and stay effective of a period of not less than two (2) years.

|

|

23.

|

Royalties re Gross Sales. Amarantus will pay to Generex a cash royalty equal to ten percent (10%) of Amarantus’ gross sales of Products worldwide (“Gross Sales”), such royalty to be calculated and payable quarterly.

|

|

24.

|

Milestone Payments re Gross Sales. Amarantus will pay to Generex cash milestone payments in respect of Gross Sales as follows:

|

|

a.

|

Two Million United States Dollars (US$2,000,000), payable within thirty (30) days of the end of the calendar quarter in which Amarantus first realizes an aggregate of Forty Million United States Dollars (US$40,000,000) in Gross Sales;

|

|

b.

|

Two Million United States Dollars (US$2,000,000), payable within thirty (30) days of the end of the calendar quarter in which Amarantus first realizes an aggregate of Eighty Million United States Dollars (US$80,000,000) in Gross Sales; and

|

|

c.

|

Two Million United States Dollars (US$2,000,000), payable within thirty (30) days of the calendar quarter in which Amarantus first realizes an aggregate of One Hundred Seventy Million United States Dollars (US$170,000,000) in Gross Sales.

|

|

25.

|

Royalties re Licensing Pre-Oral-lyn. In the event that Amarantus enters into any licensing or sub-licensing arrangements (a “Product Licensing Arrangement”) in respect of the commercialization of any Products prior to the date of receipt by Generex of FDA approval of the commercial sale of Generex Oral-lyn™, Generex’s proprietary buccal insulin spray product (“Oral-lyn”), Amarantus will pay to Generex cash royalty payments as follows:

|

|

a.

|

for a Product Licensing Arrangement in respect of a Product in respect of which no Phase 1 clinical trial has been completed, an amount equal to two percent (2%) of any and all amounts received by Amarantus in respect of that Product Licensing Arrangement (including, without limitation, license fees, royalties, milestone payments, and any other fees or payments) (“License Income”), payable within thirty (30) days of Amarantus’ receipt thereof;

|

Page | 7

|

b.

|

for a Product Licensing Arrangement in respect of a Product in respect of which a Phase I clinical trial has been completed but no Phase 2b clinical trial has been completed, an amount equal to three percent (3%) of any and all License Income received by Amarantus in respect of that Product Licensing Arrangement, payable within thirty (30) days of Amarantus’ receipt thereof; and

|

|

c.

|

for a Product Licensing Arrangement in respect of a Product in respect of which a Phase 2 clinical trial has been completed but no Phase 3 clinical trial has been completed, an amount equal to four percent (4%) of any and all License Income received by Amarantus in respect of that Product Licensing Arrangement, payable within thirty (30) days of Amarantus’ receipt thereof.

|

|

26.

|

Royalties re Licenses Post-Oral-lyn. In the event that Amarantus enters into any Product Licensing Arrangement following the date upon which Generex receives FDA approval for the commercial sale of Oral-lyn, Amarantus will pay to Generex cash royalty payments equal to six percent (6%) of any and all amounts received by Amarantus in respect of any such Product Licensing Arrangement, payable within thirty (30) days of Amarantus’ receipt thereof.

|

|

27.

|

Generex Obligations re Product Licensing Arrangements. Generex will provide all commercially reasonable cooperation to Amarantus in respect of the negotiation and establishment of any Product Licensing Arrangements, including, without limitation: third party confidential due diligence investigations in respect of Generex and the Generex Technologies; and, the execution, delivery, and performance of commercially reasonable sub-licenses in respect of the Generex Technologies.

|

|

|

|

|

General Matters

|

|

28.

|

Transaction Documentation. On the Closing Date, the parties will execute and deliver any and all documentation required to evidence the Transaction.

|

|

29.

|

Closing Date. The Transaction closing date (the “Closing Date”) will be no later than July 15, 2011.

|

|

30.

|

Confidentiality. This letter agreement and the Transaction are subject to the reciprocal confidential disclosure agreement made as of the 25th day of January, 2011 executed and delivered by the parties.

|

Page | 8

|

31.

|

Board Approvals. Generex represents and warrants to Amarantus that: the Board of Directors of Generex has approved and authorized the execution, delivery, and performance of this letter agreement by Generex; and, no third party consents are required in respect of the execution, delivery, and performance of this letter agreement by Generex. Amarantus represents and warrants to Generex that: the Board of Directors of Amarantus has approved and authorized the execution, delivery, and performance of this letter agreement by Amarantus; and, no third party consents are required in respect of the execution, delivery, and performance of this letter agreement by Amaranus (other than the SEC’s declaration of the effectiveness of the Registration Statement).

|

|

32.

|

Public Announcements. All press releases and other public announcements or filings related to the Transaction will be agreed to and prepared jointly by Generex and Amarantus. Neither party will issue a public announcement in respect of the Transaction without the prior written consent (which may be effected via email) of the other party.

|

|

33.

|

Expenses. All costs and expenses incurred in respect of this letter agreement and the Transaction, including legal and accounting charges, will be paid by the party which incurs the same.

|

|

34.

|

Exclusive Dealing. Until the Closing Date, neither party will enter into any agreement, discussion, or negotiation with, or provide information to, or solicit, encourage, entertain, or consider any inquiries or proposals from, any other party with respect to any transaction that conflicts with the Transaction.

|

[signature page follows]

Page | 9

If you are in agreement with the terms of this letter agreement, please sign in the space provided below and return a scanned signed copy to Mark Fletcher at mfletcher@generex.com by the close of business on May30, 2011. Upon receipt of a signed copy of this letter, we will proceed to consummate the Transaction in a timely manner.

Yours truly,

Generex Biotechnology Corporation

/s/ Mark A. Fletcher

Name: Mark A. Fletcher

Title: President & Chief Executive Officer

/s/ John P. Barratt

Name: John P. Barratt

Title: Chairman of the Board

AGREED THIS 30TH DAY OF MAY, 2011.

Amarantus BioSciences, Inc.

/s/ Martin D. Cleary

Name: Martin D. Cleary

Title: Chairman & Chief Executive Officer

Page | 10

EXHIBIT A

Page | 11

EXHIBIT B

Page | 12