Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OCEANFIRST FINANCIAL CORP | d8k.htm |

NASDAQ: OCFC

1

OceanFirst Financial Corp.

OceanFirst Financial Corp.

John

John

R.

R.

Garbarino

Garbarino

-

-

Chairman,

Chairman,

CEO

CEO

Vito

Vito

R.

R.

Nardelli

Nardelli

-

-

President,

President,

COO

COO

Michael

Michael

J.

J.

Fitzpatrick

Fitzpatrick

-

-

Executive

Executive

Vice

Vice

President,

President,

CFO

CFO

INVESTOR PRESENTATION

INVESTOR PRESENTATION

JUNE 2011

JUNE 2011

Exhibit 99.1 |

NASDAQ: OCFC

2

OceanFirst Financial Corp.

OceanFirst Financial Corp.

Forward Looking Statements:

This

presentation

contains

certain

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Reform

Act

of

1995,

which

are

based

on

certain

assumptions

and

describe

future

plans,

strategies

and

expectations

of

the

Company.

These

forward-

looking

statements

are

generally

identified

by

use

of

the

words

“believe”,

“expect”,

“intend”,

“anticipate”,

“estimate”,

“project”,

“will”,

“should”,

“may”,

“view”,

“opportunity”,

“potential”,

or

similar

expressions

or

expression

of

confidence.

The

Company’s

ability

to

predict

results

or

the

actual

effect

of

future

plans

or

strategies

is

inherently

uncertain.

Factors

which

could

have

a

material

adverse

effect

on

the

operations

of

the

Company

and

the

subsidiaries

include,

but

are

not

limited

to,

changes

in

interest

rates,

general

economic

conditions,

levels

of

unemployment

in

the

Bank’s

lending

area,

legislative/regulatory

changes,

monetary

and

fiscal

policies

of

the

U.S.

Government,

including

policies

of

the

U.S.

Treasury

and

the

Board

of

Governors

of

the

Federal

Reserve

System,

the

quality

or

composition

of

the

loan

or

investment

portfolios,

demand

for

loan

products,

deposit

flows,

competition,

demand

for

financial

services

in

the

Company’s

market

area

and

accounting

principles

and

guidelines.

These

risks

and

uncertainties

are

further

discussed

in

the

Company’s

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2010

and

its

subsequent

securities

filings

and

should

be

considered

in

evaluating

forward-looking

statements

and

undue

reliance

should

not

be

placed

on

such

statements.

The

Company

does

not

undertake

–

and

specifically

disclaims

any

obligation

–

to

publicly

release

the

result

of

any

revisions

which

may

be

made

to

any

forward-looking

statements

to

reflect

events

or

circumstances

after

the

date

of

such

statements

or

to

reflect

the

occurrence

of

anticipated

or

unanticipated

events. |

NASDAQ: OCFC

3

Our 109-Year History

Our 109-Year History

Founded in Point Pleasant, NJ, in 1902, OceanFirst has

grown from a small one-town savings and loan to a full-service

community bank serving the Jersey shore.

Completed a follow-on common stock offering in November 2009

with part of the

$54.2 million proceeds used on December 30 to redeem the Preferred Stock

investment made by the U.S. Treasury. OceanFirst went public in 1996 and since

then has been successful

as a public company generating value for our shareholders.

|

NASDAQ: OCFC

4

#

#

#

#

#

!

(

!

(

!

(

!

(

!

(

!

(

!

(

!

(

!

(

!

(

!

(

!

(

!

(

!

(

!

(

!

(

!

(

!

(

!

(

!

(

!

(

!

(

!

(

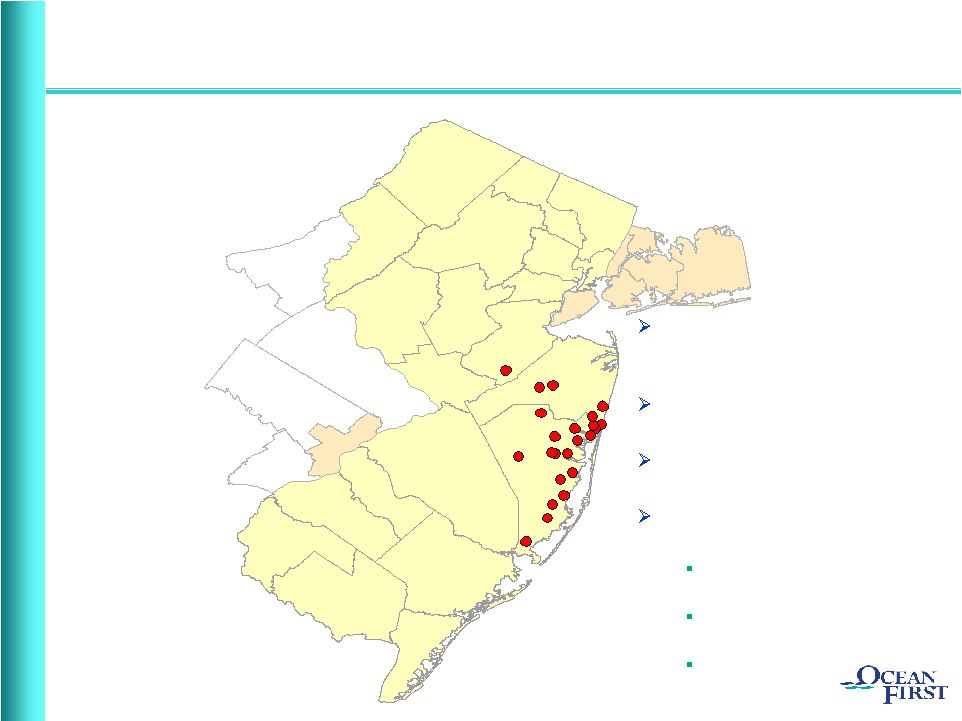

Ocean

Burlington

Morris

Sussex

Atlantic

Salem

Warren

Monmouth

Hunterdon

Cumberland

Bergen

Mercer

Somerset

Middlesex

Gloucester

Camden

Passaic

Cape May

Essex

Union

Hudson

Community Bank serving the

Jersey

Shore

-

$2.3

billion

in

assets and 23 branch offices

Market Cap $256 million (as of

May 31,

2011)

Core

deposit

funded

–

83.4%

of

total deposits

Locally originated loan portfolio

with no brokered loans

Residential and commercial

mortgages

Consumer equity loans and

lines

C&I loans and lines

Corporate Profile

Corporate Profile

Philadelphia

New York

Note: See Appendix 1 for Market Demographic information.

|

NASDAQ: OCFC

5

Experienced Executive Management Team

Experienced Executive Management Team

Insider ownership of 27.5% is

substantial –

aligned with shareholders

OceanFirst Bank ESOP 10.3%

OceanFirst Foundation 7.1%

Directors & Senior Executive Officers 10.1% (CEO 5.3%)

As of the March 9, 2011 proxy

record date.

Name

Position

# of Years in

Banking

# of Years

at OCFC

John R. Garbarino

Chairman, Chief Executive Officer

40

40

Vito R. Nardelli

President, Chief Operating Officer

37

7

Michael J. Fitzpatrick

Executive Vice President, Chief Financial Officer

30

19 |

NASDAQ: OCFC

6

Our Strategy

Our Strategy

Positioned as the leading Community Bank alternative in attractive

Central

Jersey

Shore

market

–

growing

revenue

and

creating

additional value for our shareholders

Offering a full range of consumer and commercial banking products

generating diversified income streams

Guarding

credit

quality

in

ALL

business

cycles

Transitioning the balance sheet with emphasis on core deposit

funding and commercial lending growth

Ready for roll-up opportunities presented by smaller, in-market

“regulatory fatigued”

competitors |

NASDAQ: OCFC

7

Diluted earnings per share increased 16.7% to $0.28. Return on

average stockholders’

equity was 10.1%

The net interest margin expanded 8 bps over the linked quarter to

3.60%

Core

deposits

(i.e.,

all

deposits

excluding

time

deposits)

comprise

83.4% of total deposits

Non-performing loans decreased by $1.8 million, 4.9%, and

represent 2.15% of total loans receivable

Strong capital position, tangible common equity of 9.1% of assets.

Book value grew 24¢

to $10.93

Highlights –

Highlights –

First Quarter 2011

First Quarter 2011 |

NASDAQ: OCFC

8

Increasing Primary Market Deposit Share

Increasing Primary Market Deposit Share

June 30, 2010

# of

Dep. In Mkt.

Mkt. Shr.

Rank

Institution

Branches

($000)

(%)

Ocean County, NJ

1

Hudson City Bancorp Inc. (NJ)

13

2,773,130

21.66

2

Wells Fargo & Co. (CA)

27

1,810,777

14.14

3

TD Bank National Association (Canada)

20

1,776,218

13.87

4

OceanFirst Financial Corp. (NJ)

18

1,282,436

10.02

5

Banco Santander S.A. (Spain)

25

1,254,237

9.80

6

Bank of America Corp. (NC)

23

1,234,572

9.64

7

Investors Bancorp Inc. (MHC) (NJ)

7

637,788

4.98

8

PNC Financial Services Group (PA)

12

420,227

3.28

9

Sun Bancorp Inc. (NJ)

6

235,558

1.84

10

Manasquan Savings Bank (NJ)

3

225,540

1.76

Total For Institutions In Market

191

12,803,921

Source: FDIC

Moving from 6

th

to 4

th

in Last Year |

NASDAQ: OCFC

9

Interest

Bearing

Demand

Deposits,

28.2%

Non-Interest

Bearing

Demand

Deposits,

8.9%

Jumbo Time

Deposits(1),

8.1%

Retail Time

Deposits,

27.7%

MMDA &

Savings,

27.1%

Deposit Composition Transition

Deposit Composition Transition

Interest

Bearing

Demand

Deposits,

7.6%

Non-Interest

Bearing

Demand

Deposits,

0.7%

Jumbo Time

Deposits(1),

4.7%

Retail Time

Deposits,

61.4%

MMDA &

Savings,

25.6%

Interest

Bearing

Demand

Deposits,

55.0%

Non-Interest

Bearing

Demand

Deposits,

8.3%

Jumbo Time

Deposits(1),

4.9%

Retail Time

Deposits,

11.7%

MMDA &

Savings,

20.1%

(1) Jumbo CDs have a balance of $100,000 or greater.

December 31, 2005

March 31, 2011

December 31, 1996 |

NASDAQ: OCFC

10

Commercial

R.E., 26.2%

Residential

R.E., 56.3%

Commercial

& Industrial,

4.6%

Construction

R.E., 0.7%

Consumer &

Other(1),

12.2%

Loan Composition Transition

Loan Composition Transition

Commercial

R.E., 3.2%

Residential

R.E., 89.6%

Commercial

& Industrial,

0.4%

Construction

R.E., 1.1%

Consumer &

Other(1),

5.7%

Commercial

R.E., 16.5%

Residential

R.E., 69.8%

Commercial

& Industrial,

3.8%

Construction

R.E., 1.3%

Consumer &

Other(1),

8.6%

(1)

Consumer and other loans primarily consist of home equity lines and loans.

Note:

See Appendix 2 for specific portfolio metrics and commercial portfolio

segmentation. December 31, 2005

March 31, 2011

December 31, 1996 |

NASDAQ: OCFC

11

NPL’s in a Diversified Portfolio

NPL’s in a Diversified Portfolio

Non-performing loan (“NPL”).

Data as of December 31 unless otherwise indicated.

0.00%

0.25%

0.50%

0.75%

1.00%

1.25%

1.50%

1.75%

2.00%

2.25%

2.50%

2008

2009

2010

3/31/2011

One-to-Four Family

Consumer

Commercial Real Estate and Construction

Commercial

Recent Improvement in Credit Quality –

Modest Commercial Exposure |

NASDAQ: OCFC

12

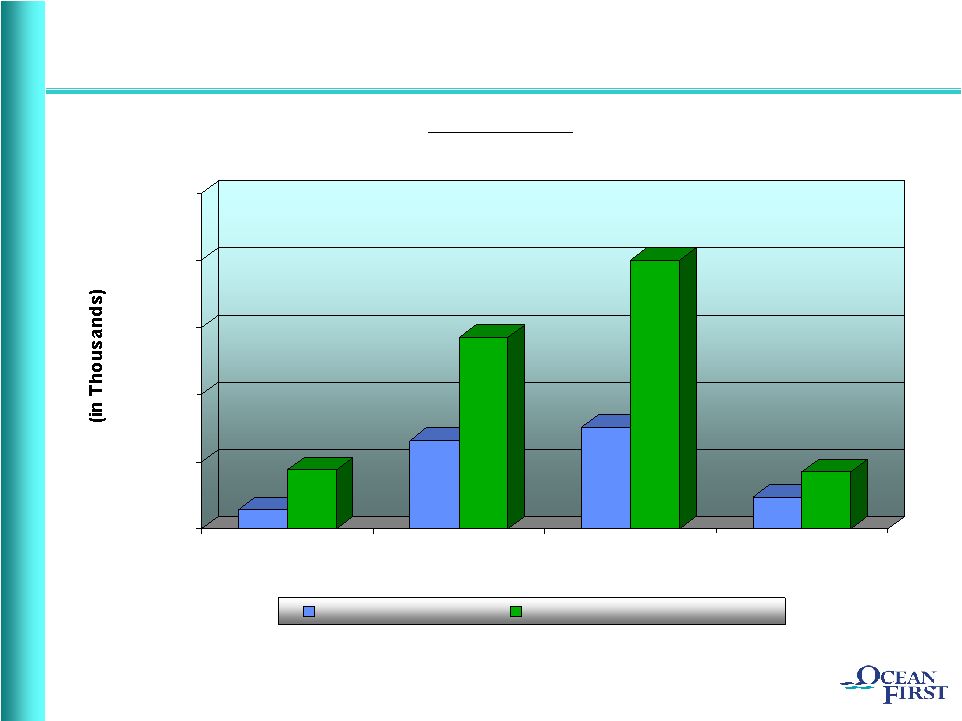

Provision for Loan Losses Exceed Charge-Offs

Provision for Loan Losses Exceed Charge-Offs

Building ALLL

$0

$2,000

$4,000

$6,000

$8,000

$10,000

12/31/08

12/31/09

12/31/10

3/31/2011

Net Charge-Offs

Provision for Loan Losses |

NASDAQ: OCFC

13

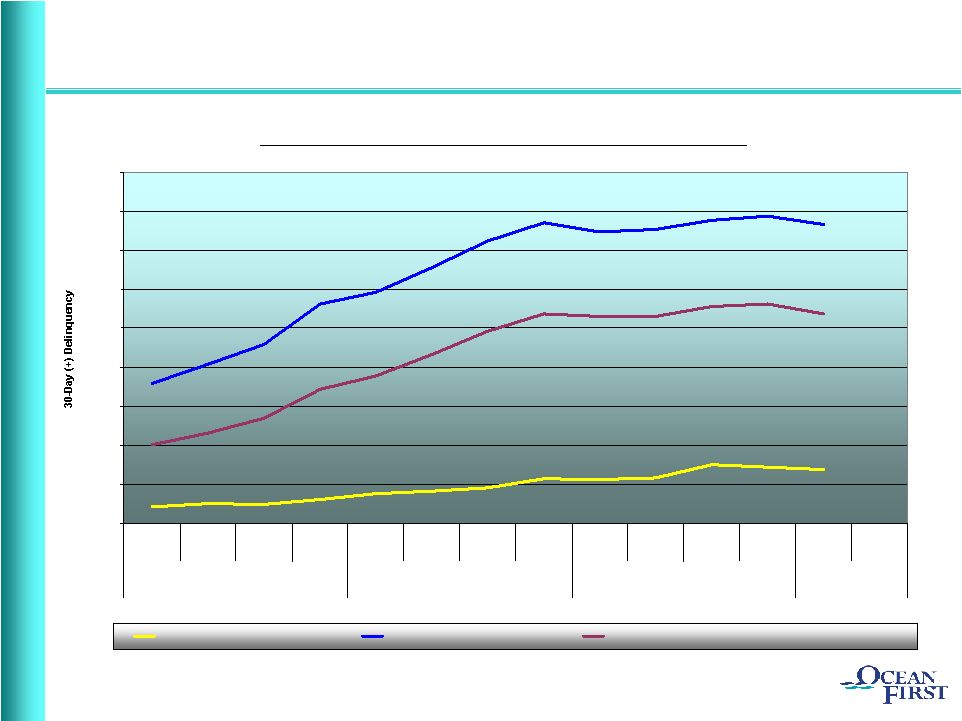

Quarterly Residential Delinquency Trends

Quarterly Residential Delinquency Trends

OceanFirst Well Below New Jersey Benchmarks

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

2008

2009

2010

2011

OCFC All Mortgage Loans

MBA NJ Mortgage Loans

MBA NJ Conventional (Prime) Mortgage Loans |

NASDAQ: OCFC

14

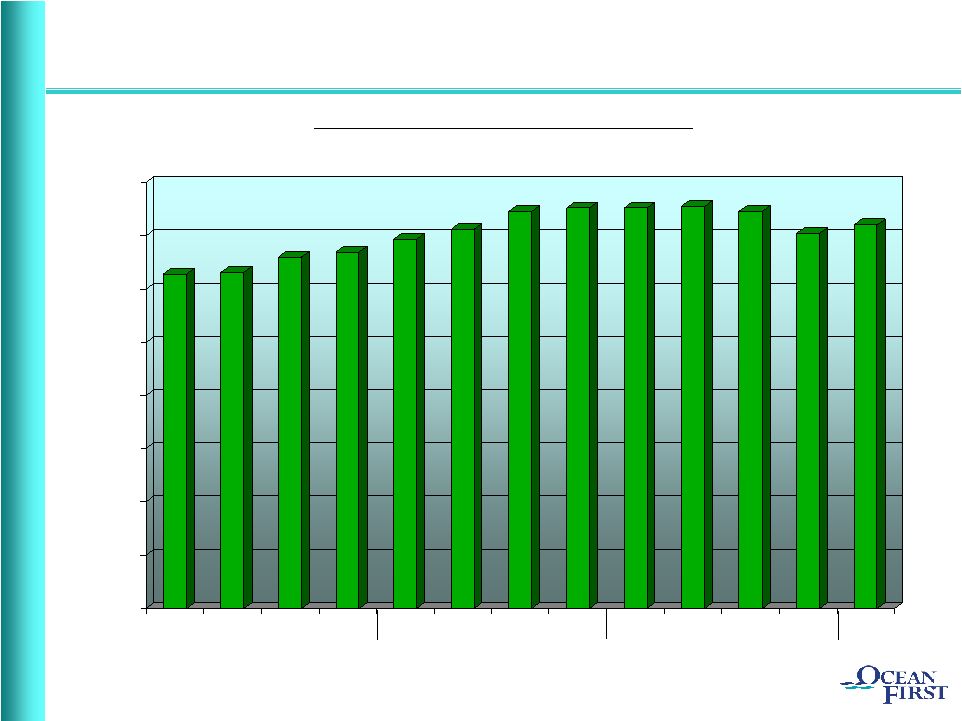

Net Interest Margin

Net Interest Margin

Off Cyclical High But Expanded in Q1

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

2008

2009

2010

2011

2011 |

NASDAQ: OCFC

15

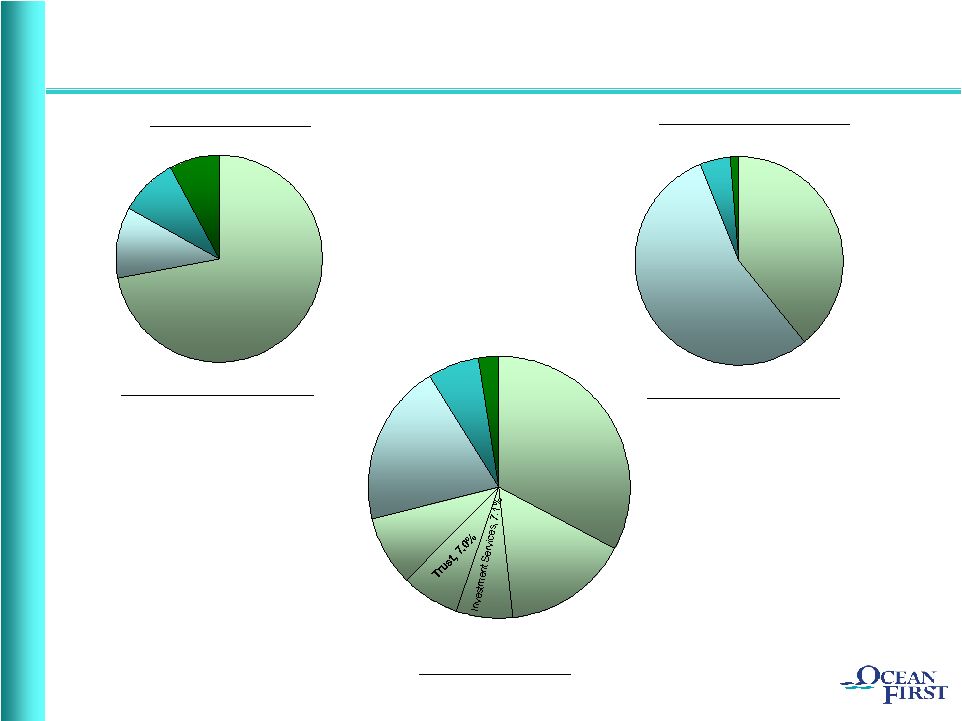

Diversified Streams of Non-Interest Income (NII)

Diversified Streams of Non-Interest Income (NII)

BOLI, 9.2%

Gain on Sale

of Loans,

11.0%

Other, 7.8%

Fees and

Service

Charges,

72.0%

December 31, 1996

BOLI, 4.7%

Gain on Sale

of Loans(1),

54.7%

Other, 1.4%

Fees and

Service

Charges,

39.2%

December 31, 2005

Gain on Sale of

Loans, 19.8%

Merchant

Services,

15.4%

Deposit Fees,

32.9%

Other, 8.8%

Other, 2.5%

BOLI, 6.5%

NII -

$3.8 Million (3 months)

March 31, 2011

NII -

$2.5 Million

NII -

$24.1 Million

(1)

Fees and

Service

Charges,

71.2%

Non-Interest Income (NII) excludes gain (loss) from other real estate

operations. (1)

Includes income from the Bank’s mortgage banking subsidiary which existed from

2001 through 2007. |

NASDAQ: OCFC

16

Delivering Double-Digit Return on Equity

Delivering Double-Digit Return on Equity

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

2008

2009

2010

2011

(1) Annualized

(1) |

NASDAQ: OCFC

17

Challenge Today is to Grow Revenue

Challenge Today is to Grow Revenue

Build Shareholder Value

Build Shareholder Value

Business

Plan

targets

growth

within

existing

footprint

–

increasing

market share

Twelve

new

branches

since

2000

have

performed

well

–

still

present room for additional growth

Non-interest income streams have been diversified, more important

as margin expansion may have run its course

Opportunistic roll-up of smaller community banks in market

Financial performance to Plan earns OceanFirst the right to remain

independent |

NASDAQ: OCFC

18

(1)

Peers include: ALNC, CNBC, DCOM, FFIC, FLIC, HUVL, KRNY, LBAI, PBNY, PGC, RCKB,

STBC, STL, SUBK, and TRST Note:

Financial data for the period ended March 31, 2011. Share price as of May

31, 2011. Source: Sandler O’Neill.

Attractive Valuation Metrics

Attractive Valuation Metrics

OCFC

Peers

(1)

Valuation

Price / Tang. Book Value

124%

146%

Price / LQA EPS

12.1x

14.8x

Price / Estimated EPS

11.1x

12.5x

Cash Dividend Yield

3.53%

2.74% |

NASDAQ: OCFC

19

Why OCFC…?

Why OCFC…?

Fundamental

franchise

value

–

superior

market

demographics

Experienced management team with substantial insider ownership –

aligned with shareholders

Increasing deposit market share

Conservative credit culture and profile

Solid financial performance –

developing shareholder value

Strong balance sheet and capital base

Attractive current valuation |

NASDAQ: OCFC

20

THANK YOU

THANK YOU

FOR YOUR INTEREST IN

FOR YOUR INTEREST IN

OCEANFIRST FINANCIAL CORP.

OCEANFIRST FINANCIAL CORP. |

NASDAQ: OCFC

21

Market Demographics

Market Demographics

APPENDIX 1

Ocean

Monmouth

Middlesex

New Jersey

National

Number of Offices

18

4

1

% of OceanFirst Deposits

83.3

13.4

3.3

Market Rank

4

17

34

Market Share (%)

10.0

1.1

0.2

Population

578,728

649,429

794,605

Projected 2010-2015

Population Growth (%)

4.0

2.0

1.8

1.2

3.8

Median Household Income ($)

60,936

82,974

78,561

72,519

54,442

Projected 2010-2015 Median

Household Income Growth (%)

15.5

14.3

17.5

14.7

12.4

Deposit data as of June 30, 2010.

Demographic data as of June 30, 2010.

Source: SNL Financial |

NASDAQ: OCFC

22

One-to-Four Family Loans

Average size of mortgage loans

$185,000

Interest-only loans - Amount

$73.3 million

- Percent of total one-to-four family

loans 7.7%

Stated income loans - Amount

$58.9 million

- Percent of total

one-to-four family loans 6.2%

Portfolio weighted average loan-to-value ratio (using original appraisal)

58%

Weighted average loan-to-value ratio of loans originated for the year ended December 31, 2010

60%

Weighted average loan-to-value ratio of loans originated for the quarter

62%

Average FICO score

746

Average FICO score of loans originated for the year ended December 31, 2010

764

Average FICO score of loans originated for the quarter

758

Percent of jumbo loans at origination

45.2%

Percent of loans outside the New York/New Jersey market

5.8%

Percent of loans for second homes

7.8%

APPENDIX 2

Residential Portfolio Metrics

Residential Portfolio Metrics

As of March 31, 2011, unless

otherwise noted. |

NASDAQ: OCFC

23

Commercial Real Estate

Average size of commercial real estate loans

$719,000

Largest commercial real estate loan

$13.5 million

Commercial Loans

Average size of commercial loan

$275,000

Largest commercial loan

$16.6 million

APPENDIX 2

(Cont’d)

Commercial Portfolio Metrics

Commercial Portfolio Metrics

As of March 31, 2011. |

NASDAQ: OCFC

24

Commercial Portfolio Segmentation

Commercial Portfolio Segmentation

Construction, 8.9%

Retail Trade, 4.3%

Miscellaneous, 11.6%

Healthcare, 5.5%

Accommodations/

Food Services, 6.5%

Wholesale Trade,

7.1%

Arts/Entertainment/

Recreation, 9.1%

Manufacturing, 5.3%

Real Estate

Investment, 33.1%

Educational Services,

4.1%

Other Services, 4.5%

Total Commercial Loan Exposure

by Industry Concentration

Real Estate Investment by

Property Concentration

Office, 31.8%

Multi-Family, 8.3%

Land, 4.3%

Commercial

Development, 1.0%

Residential

Development, 8.1%

Miscellaneous, 10.0%

Retail Store, 8.5%

Industrial/

Warehouse, 18.6%

Shopping Center, 9.4%

As of March 31, 2011.

APPENDIX 2

(Cont’d) |