Attached files

| file | filename |

|---|---|

| 8-K - FORM8K - DYCOM INDUSTRIES INC | form8k.htm |

Exhibit 99.1

Credit Suisse 2011 Engineering

and Construction Conference

June 2, 2011

and Construction Conference

June 2, 2011

1

Forward-Looking Statements and Non-GAAP

Information

Information

Forward-Looking Statements and Non-GAAP

Information

Information

This presentation contains “forward-looking statements” which are statements relating to future

events, future financial performance, strategies, expectations, and competitive environment. All

statements, other than statements of historical facts, contained in this presentation, including

statements regarding our future financial position, future revenue, prospects, plans and objectives of

management, are forward-looking statements. Words such as “believe,” “expect,” “anticipate,”

“estimate,” “intend,” “forecast,” “may,” “should,” “could,” “project” and similar expressions, as well as

statements in future tense, identify forward-looking statements. You should not read forward-looking

statements as a guarantee of future performance or results. They will not necessarily be accurate

indications of whether or at what time such performance or results will be achieved. Forward-looking

statements are based on information available at the time those statements are made and/or

management’s good faith belief at that time with respect to future events. Such statements are subject

to risks and uncertainties that could cause actual performance or results to differ materially from those

expressed in or suggested by the forward-looking statements. Important factors that could cause such

differences include, but are not limited to factors described under Item 1A, “Risk Factors” of the

Company’s Annual Report on Form 10-K for the year ended July 31, 2010, and other risks outlined in

the Company’s periodic filings with the Securities and Exchange Commission (“SEC”). The forward-

looking statements in this presentation are expressly qualified in their entirety by this cautionary

statement. Except as required by law, the Company may not update forward-looking statements even

though its situation may change in the future.

events, future financial performance, strategies, expectations, and competitive environment. All

statements, other than statements of historical facts, contained in this presentation, including

statements regarding our future financial position, future revenue, prospects, plans and objectives of

management, are forward-looking statements. Words such as “believe,” “expect,” “anticipate,”

“estimate,” “intend,” “forecast,” “may,” “should,” “could,” “project” and similar expressions, as well as

statements in future tense, identify forward-looking statements. You should not read forward-looking

statements as a guarantee of future performance or results. They will not necessarily be accurate

indications of whether or at what time such performance or results will be achieved. Forward-looking

statements are based on information available at the time those statements are made and/or

management’s good faith belief at that time with respect to future events. Such statements are subject

to risks and uncertainties that could cause actual performance or results to differ materially from those

expressed in or suggested by the forward-looking statements. Important factors that could cause such

differences include, but are not limited to factors described under Item 1A, “Risk Factors” of the

Company’s Annual Report on Form 10-K for the year ended July 31, 2010, and other risks outlined in

the Company’s periodic filings with the Securities and Exchange Commission (“SEC”). The forward-

looking statements in this presentation are expressly qualified in their entirety by this cautionary

statement. Except as required by law, the Company may not update forward-looking statements even

though its situation may change in the future.

This presentation includes certain “Non-GAAP” financial measures as defined by SEC rules. As

required by the SEC we have provided a reconciliation of those measures to the most directly

comparable GAAP measures on the Regulation G slide included at the end of this presentation.

required by the SEC we have provided a reconciliation of those measures to the most directly

comparable GAAP measures on the Regulation G slide included at the end of this presentation.

2

Dycom Industries Introduction

n Leading provider of specialty contracting services principally to

telephone and cable companies

telephone and cable companies

n Telecommunications industry dynamics driving growth potential

n Major participant in a large, but fragmented industry, which offers

acquisition opportunities

acquisition opportunities

n Significant portion of revenues from multi-year Master Service

Agreements

Agreements

n Experienced management team operating through a decentralized,

customer-focused organizational structure

customer-focused organizational structure

n Strong cash flows and liquidity

3

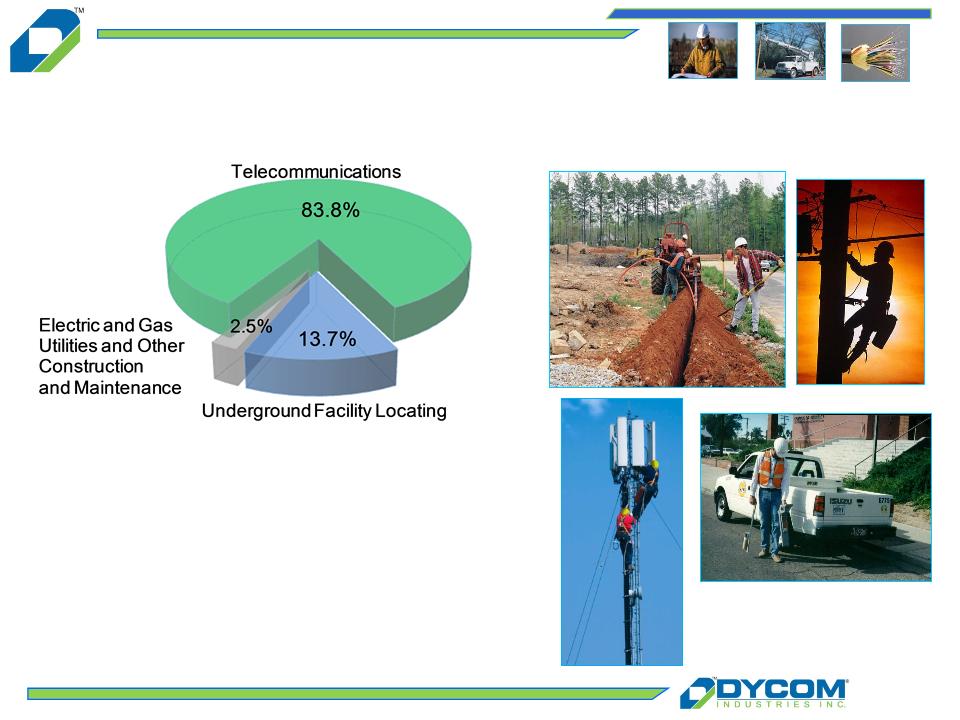

Customer Revenue Mix

Contract Revenue $252.4 million*

Quarter Ended April 30, 2011

* Includes revenues from businesses acquired in Q2-11 since acquisition dates.

4

Providing End-To-End Services

Engineering

Underground Facility Locating

Outside Plant & Equipment Installation

Wireless Services

5

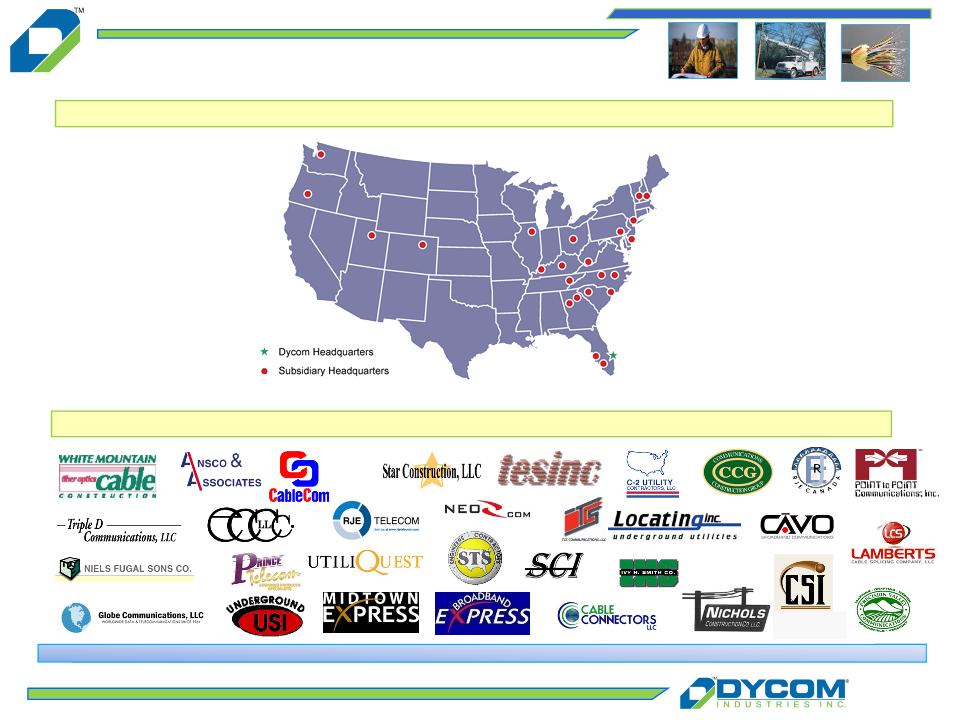

Dycom Industries At a Glance

Dycom is a leading telecommunications infrastructure provider in the United States

n Headquartered in Palm Beach Gardens, Florida

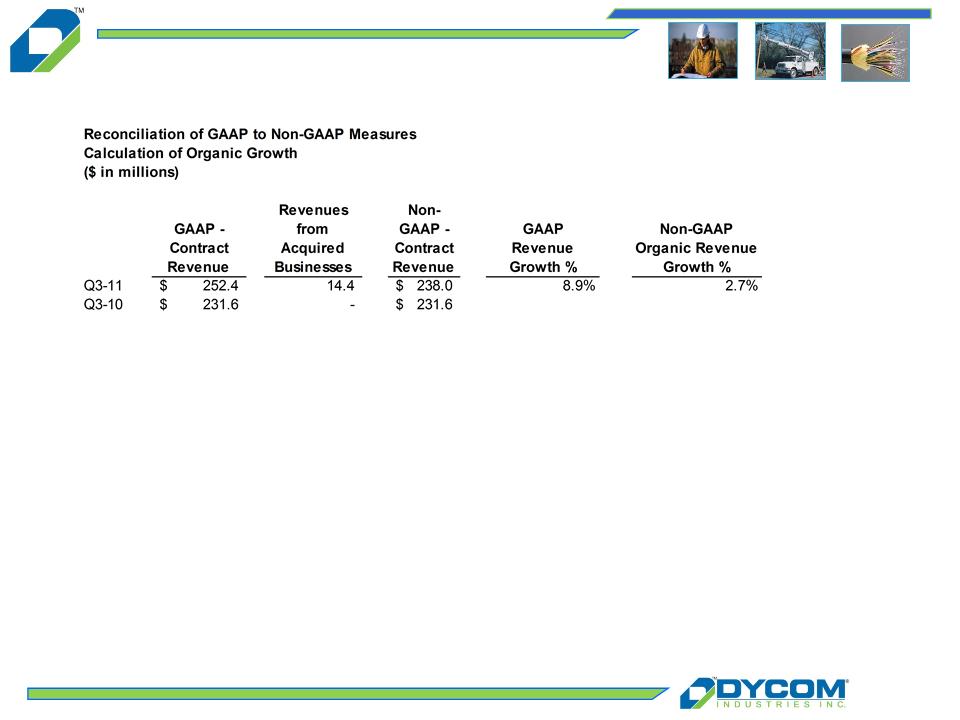

n Q3-2011 revenues of $252.4 million grew organically 2.7% after adjusting for

revenues from acquired companies

revenues from acquired companies

n Strong financial profile

} Cash and equivalents $89.0 million at April 30, 2011

} 7.125% Senior Subordinated Notes due 2021 issued in Q2-11

} Shareholders’ equity $346.4 million at April 30, 2011

} Repurchased over $55 million in common shares in the first nine months of

fiscal 2011

fiscal 2011

} Approximately $274 million in share repurchases since fiscal 2006

n Nationwide footprint

} Operates in 48 states and to a limited extent in Canada

} 31 operating subsidiaries and hundreds of field offices

n Over 8,100 employees

n Listed on the NYSE under the ticker: DY

See “Regulation G disclosure” slides for a reconciliation of Non-GAAP financial measures to GAAP financial measures.

6

Strong subsidiaries, broad national footprint

Subsidiaries

Dycom’s Nationwide Presence

Dycom Operating Overview

7

Industry Developments…

n Telephone / cable industry convergence - a reality

} Competition for customers drives growth

n Network bandwidth expansion - an imperative

} Telephone companies expanding network capacity

} Cable responding to match capabilities and facilitate new

products such as VOIP, HDTV, and wideband

products such as VOIP, HDTV, and wideband

} Wireless service providers upgrading to 4G to accommodate

new services and increased data usage

new services and increased data usage

n Product bundles - key to telephone / cable success

} Decrease customer churn

} Provide revenue growth opportunities to offset market share

erosion

erosion

8

…And Industry Opportunities

n Continued capital spending

} Telephone company deployments of Fiber (FTTx)

} Cable company bandwidth expansion

} Customer premise equipment deployments

} 4G upgrades and fiber to the cell site wireless backhaul

} Rural broadband deployment

n Renewed focus on network reliability and availability as

subscribers demand better service levels

subscribers demand better service levels

n Continued outsourcing as time to market and installation quality

are crucial for new product launches

are crucial for new product launches

9

Telecom Capital Spending

Lowell McAdam - Verizon Communications, Inc. President, COO May 2011

n Continued capital spending in wireline reflects burgeoning demand for voice, data and

video transmission

video transmission

n Wireless capital spending accelerating as 4G networks proliferate and new competitors

emerge

emerge

n Significant portion of RBOCs’ capital budgets are expected to be from fiber deployments,

including fiber to the cell site initiatives

including fiber to the cell site initiatives

n Carriers are shifting capital spending to address growth needs and increased

competition from cable companies

competition from cable companies

Capital Expenditure Commentary

“….I think our -- our goal right now is to go out and streamline further the wireline assets,

and by that, I mean the core performance, as well as FiOS. As I've gone into this new job over

the last six months, and I travel around the wireline side of the business, I see what I call lots

of pots of gold here where we can become more efficient, so we're very focused on that. And

I think there's also an opportunity to streamline FiOS. There are too many network elements

between the central office and the customer. We're using technology to streamline those.

That also gives you the ability to improve the productivity of the technician; it doesn't take

him as long to do an installation. So I want to see how we can get more efficient and get

better penetration, and then I think it's -- maybe we expand FiOS a little bit, if I can make the

math work.”

and by that, I mean the core performance, as well as FiOS. As I've gone into this new job over

the last six months, and I travel around the wireline side of the business, I see what I call lots

of pots of gold here where we can become more efficient, so we're very focused on that. And

I think there's also an opportunity to streamline FiOS. There are too many network elements

between the central office and the customer. We're using technology to streamline those.

That also gives you the ability to improve the productivity of the technician; it doesn't take

him as long to do an installation. So I want to see how we can get more efficient and get

better penetration, and then I think it's -- maybe we expand FiOS a little bit, if I can make the

math work.”

10

Cable Capital Spending

“… And finally, carrier wholesale which includes cell backhaul services. Given our largely to

tier 2 footprint, we believe we are in a unique position to enable high-capacity last mile

services for wholesale providers. For the latter two segments, there is an especially long lead

time from the sales effort, to installation, and billable revenue, and you will continue to see

some quarter-to-quarter variability in both revenue and CapEx for the commercial side of the

house. As we've said before, we see significant growth opportunity in each of these

commercial segments and I believe we're making the right investments to capitalize on that

opportunity.”

tier 2 footprint, we believe we are in a unique position to enable high-capacity last mile

services for wholesale providers. For the latter two segments, there is an especially long lead

time from the sales effort, to installation, and billable revenue, and you will continue to see

some quarter-to-quarter variability in both revenue and CapEx for the commercial side of the

house. As we've said before, we see significant growth opportunity in each of these

commercial segments and I believe we're making the right investments to capitalize on that

opportunity.”

n Continued capital expenditures on bandwidth reclamation, VOIP and HDTV product

offerings, and cellular backhaul

offerings, and cellular backhaul

n Ongoing plant and network enhancements are critical as cable operators continue to

offer services that require greater reliability

offer services that require greater reliability

n Network capacity and reliability increasingly crucial as cable companies compete with

traditional telecom firms

traditional telecom firms

Capital Expenditure Commentary

Don Detampel- Charter Communications

EVP of Technology & President of Commercial Services May 2011

11

Underground Facility Locating Services

n “Dig Safe” laws in all 50 states require owners of underground utilities to

identify and mark their facilities prior to excavation

identify and mark their facilities prior to excavation

} Regulates telephone, cable, power, gas and water & sewer utilities

} Seeks to minimize network outages, protect job-site workers and

safeguard the general public

safeguard the general public

} Locates often required as a condition for permit issuance

n Generally outsourced by telecom companies and cable operators

} Work generated by excavators via “800 number” call centers

} High volume of transactions must be completed within 48-72 hours

n Regulatory backdrop promotes steady workflow

} Driven by regional macro-economic factors

12

Dycom’s Competitive Advantages

n Established customer relationships and reputation

n Broad geographic coverage

n Scale to satisfy customer time and service requirements

n Responsive, local decentralized business units

n Access to capital

n Senior management operating expertise

13

Growth Strategy As Opportunities

Expand

Expand

n Build and maintain long-term customer relationships at the local level

} Position business to capture both recurring maintenance and new capital

spending

spending

n Empower subsidiary management

} Build relationships with customer contracting decision makers

} Utilize detailed knowledge of local pricing dynamics

} Leverage subcontractors and local trade relationships

n Deliberately select attractive customers with profitable business

} Focus on higher quality, long-term telecommunications industry leaders

n Selectively screen potential acquisitions

} Healthy players that bring long-term, established customer relationships

} Complement existing Dycom customer footprint

} Position Company for significant customer capital or maintenance

spending

spending

Dycom employs a deliberate and methodical growth strategy

14

Blue-chip, predominantly investment grade clients comprise the vast majority of revenue

Well Established Customers

Fiscal Quarter Ended April 30, 2011

Customer Revenue Breakdown

Comcast

AT&T

CenturyLink

Verizon

Windstream

Cablevision

Charter

Duke Energy

Time Warner

Cable

Other

Edison International

15

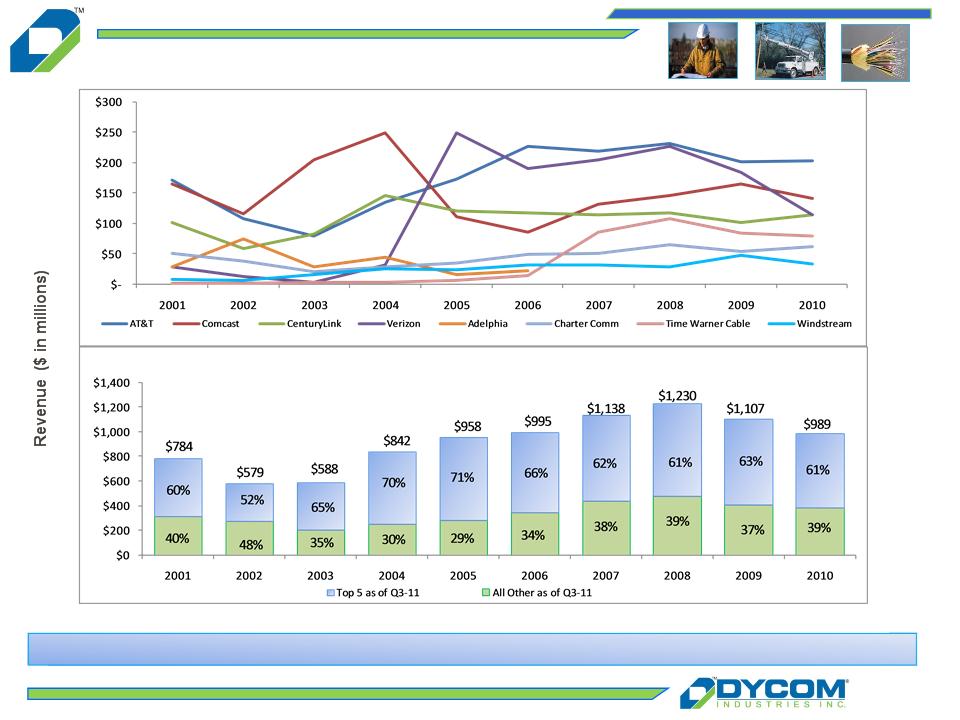

Customer Rotation

Key long-term relationships help Dycom manage the cyclical nature of telecom and cable capex spending

For comparison purposes, when customers have been combined through acquisition or merger, their revenues have been combined for all periods.

16

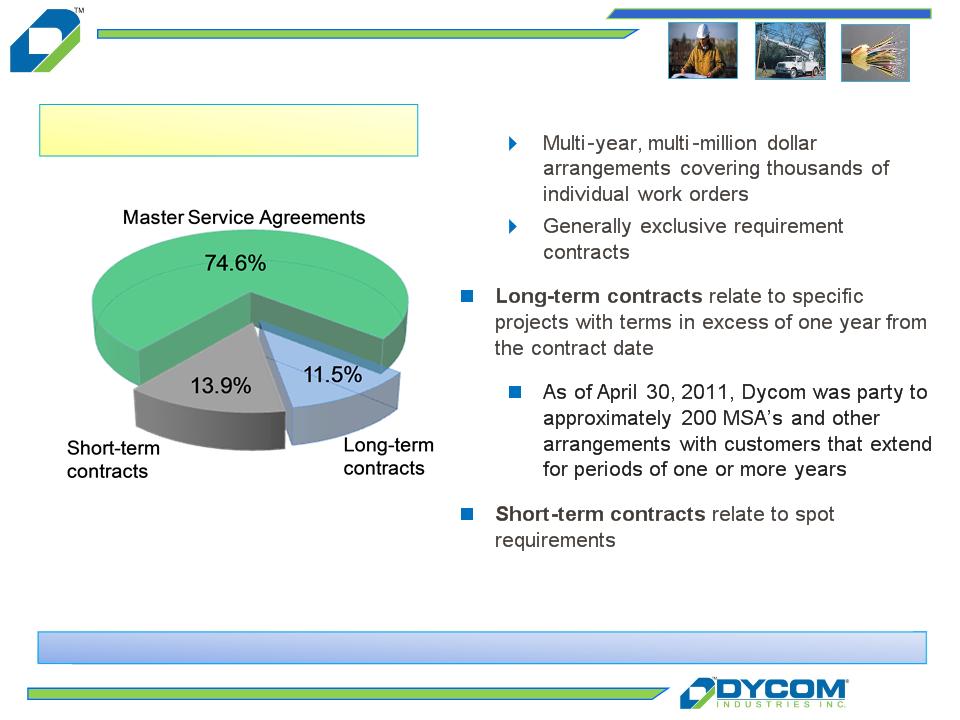

Dycom’s revenue stream is primarily generated by long-term contractual agreements

n Master Service Agreements (MSA’s)

n Significant majority of contracts are based on

units of delivery

units of delivery

Revenue By Contract Type

Quarter Ended April 30, 2011

Quarter Ended April 30, 2011

Revenue - Q3 Fiscal 2011

17

Senior Management

Seasoned management team with several decades of combined industry experience

Financial Update

19

nCentralize activities which yield synergistic benefits

} Treasury

} Tax

} Risk management

} Capital asset procurement

} Information technology resources

nDecentralize financial operations to provide solid support

and flexibility at operating unit level

and flexibility at operating unit level

nMaintain financial resources to support internal growth

and acquisition opportunities

and acquisition opportunities

Financial Overview

20

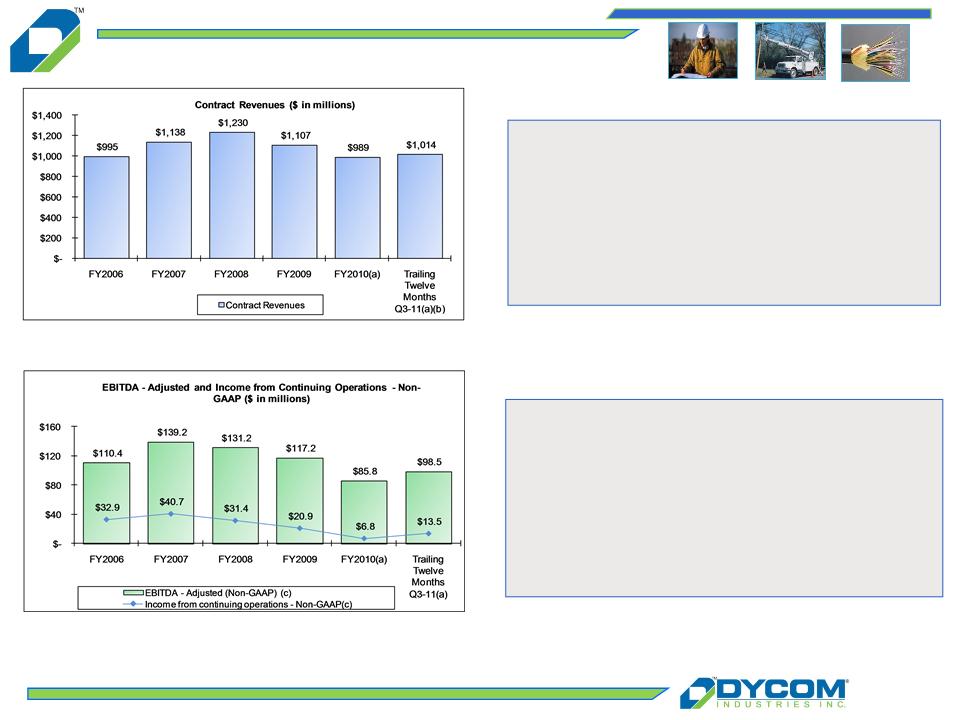

Fiscal Year Results - Revenue and Earnings

(a) Q4-10 Fiscal 2010 includes an incremental week as the result of our 52/53 week fiscal year.

(b) Trailing Twelve Months Q3-11 includes contract revenues of $732.1 million for the nine months ended April 30, 2011 and $281.5 million for the three months ended July 31, 2011 (including an

incremental week during Q4-10 as the result of our 52/53 week fiscal year)

incremental week during Q4-10 as the result of our 52/53 week fiscal year)

(c) The amounts for EBITDA - Adjusted and Income from continuing operations -Non-GAAP are Non-GAAP financial measures adjusted to exclude certain items. See “Regulation G Disclosure”

slide for a reconciliation of Non-GAAP financial measures to GAAP financial measures.

slide for a reconciliation of Non-GAAP financial measures to GAAP financial measures.

n Fiscal 2009 - 2010 revenues

impacted by reductions in

customer spending in response to

economic conditions

impacted by reductions in

customer spending in response to

economic conditions

n Trailing Twelve Months Q3-11

trends improving

trends improving

n Operating results responsive to

contract revenues

contract revenues

n With fiscal 2011 results increasing

from growth and improved

operating efficiencies

from growth and improved

operating efficiencies

21

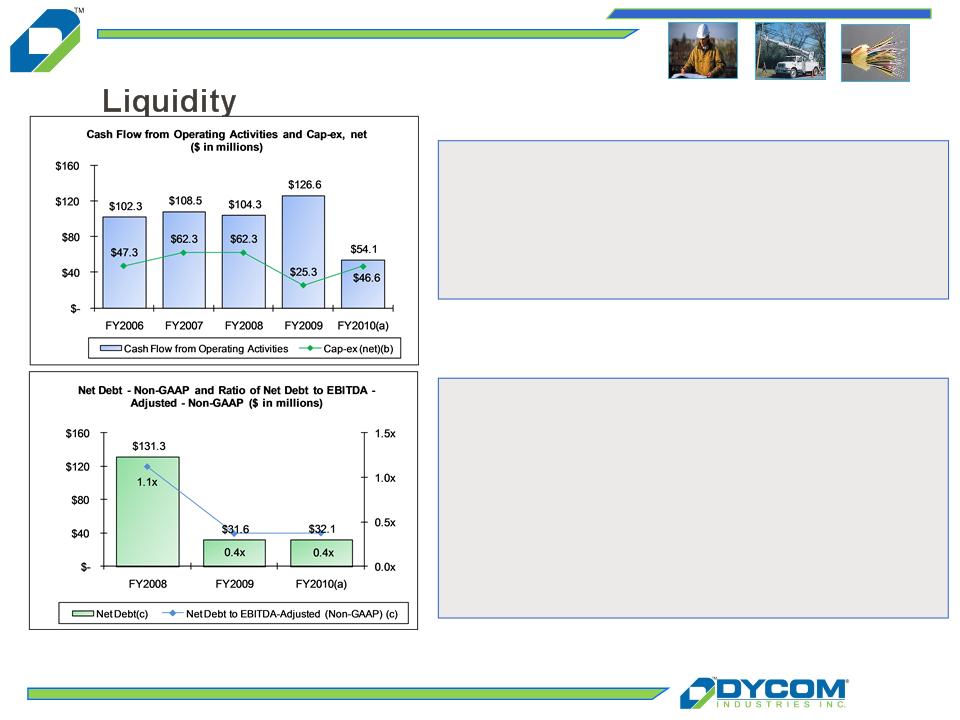

Fiscal Year Results - Cash Flow and

n Strong cash flow from operations. Fiscal

2010 cash flows impacted by lower levels

of operations

2010 cash flows impacted by lower levels

of operations

n Ample cash flows to support capital

expenditures and fund operations

expenditures and fund operations

n Long term financing in place

} $187.5 million 7.125% Senior

Subordinated Notes; due 2021

Subordinated Notes; due 2021

} $225 million Credit Facility; due 2015

} No borrowings outstanding

n 0.4x ratio of Net Debt to EBITDA-Adjusted

(a) Fiscal 2010 includes an incremental week as the result of our 52/53 week fiscal year.

(b) Capital expenditures net of proceeds from the sale of assets

(c) The amounts for EBITDA - Adjusted and Net Debt used in the calculations herein are Non-GAAP financial measures adjusted to exclude certain items. See

“Regulation G Disclosure” slide for a reconciliation of Non-GAAP financial measures to GAAP financial measures.

“Regulation G Disclosure” slide for a reconciliation of Non-GAAP financial measures to GAAP financial measures.

22

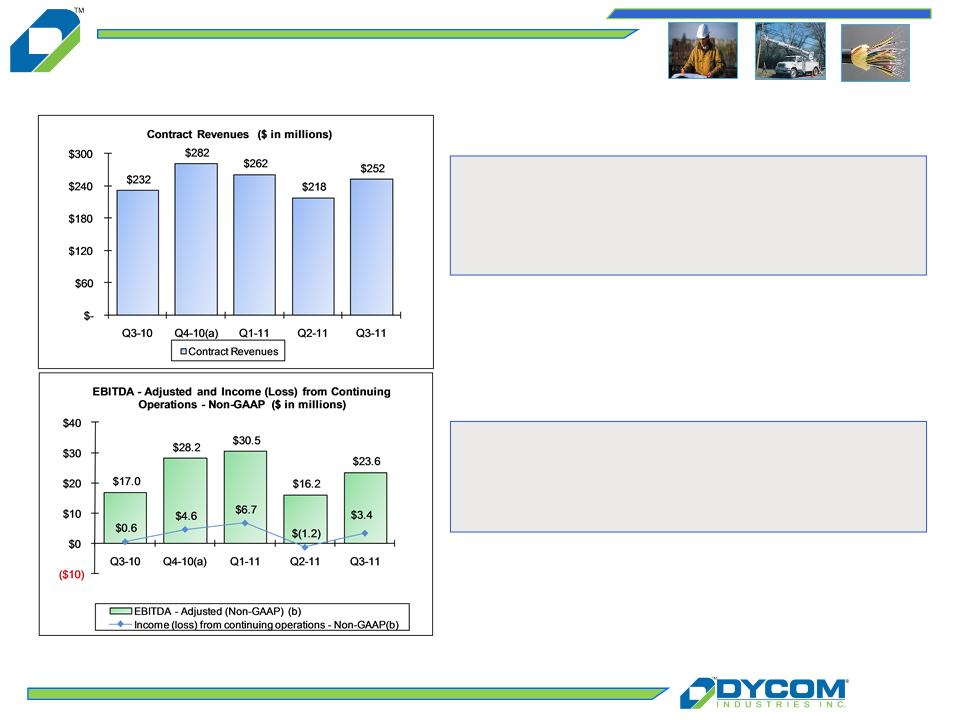

Quarterly Results - Revenue and

Earnings

Earnings

n Year-over-year revenue trends

improving as a result of organic growth

and revenues from acquired

businesses

improving as a result of organic growth

and revenues from acquired

businesses

(a) Q4-10 includes an incremental week as the result of our 52/53 week fiscal year.

(b) The amounts for EBITDA - Adjusted and Income (Loss) from continuing operations -Non-GAAP are Non-GAAP financial measures adjusted to exclude certain

items. See “Regulation G Disclosure” slide for a reconciliation of Non-GAAP financial measures to GAAP financial measures.

items. See “Regulation G Disclosure” slide for a reconciliation of Non-GAAP financial measures to GAAP financial measures.

n EBITDA - Adjusted and Income from

Continuing Operations improved from

operating efficiencies year over year

Continuing Operations improved from

operating efficiencies year over year

23

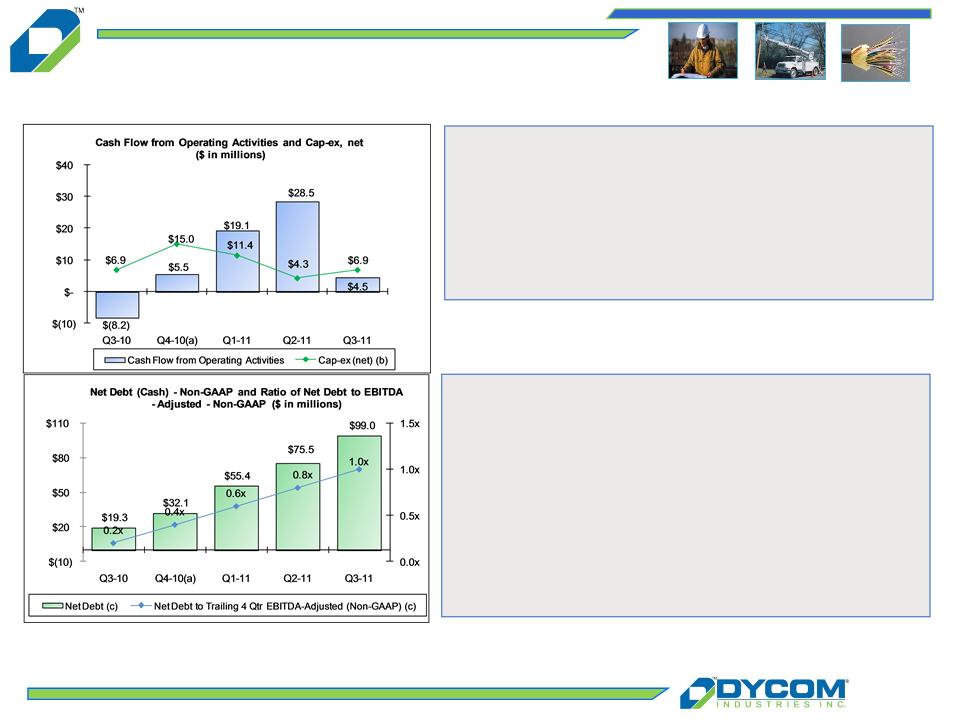

Quarterly Results - Cash Flow and

Liquidity

(a) Fiscal 2010 includes an incremental week as the result of our 52/53 week fiscal year.

(b) Capital expenditures net of proceeds from the sale of assets

(c) The amounts for EBITDA - Adjusted and Net Debt used in the calculations herein are Non-GAAP financial measures adjusted to exclude certain items. See

“Regulation G Disclosure” slide for a reconciliation of Non-GAAP financial measures to GAAP financial measures.

“Regulation G Disclosure” slide for a reconciliation of Non-GAAP financial measures to GAAP financial measures.

n Cash flows from operations reflects

seasonality, grew year-over-year from

improved operating results

seasonality, grew year-over-year from

improved operating results

n Capital expenditures, net of disposals

totaled $6.9 million during Q3-11

totaled $6.9 million during Q3-11

n Strong financial profile and ample

liquidity as of April 30, 2011

liquidity as of April 30, 2011

} $89.0 million cash and equivalents

} $187.5 million 7.125% Senior

Subordinated Notes due 2021

issued Q2-11

Subordinated Notes due 2021

issued Q2-11

} $127.8 million availability under

Revolving Credit Facility

Revolving Credit Facility

24

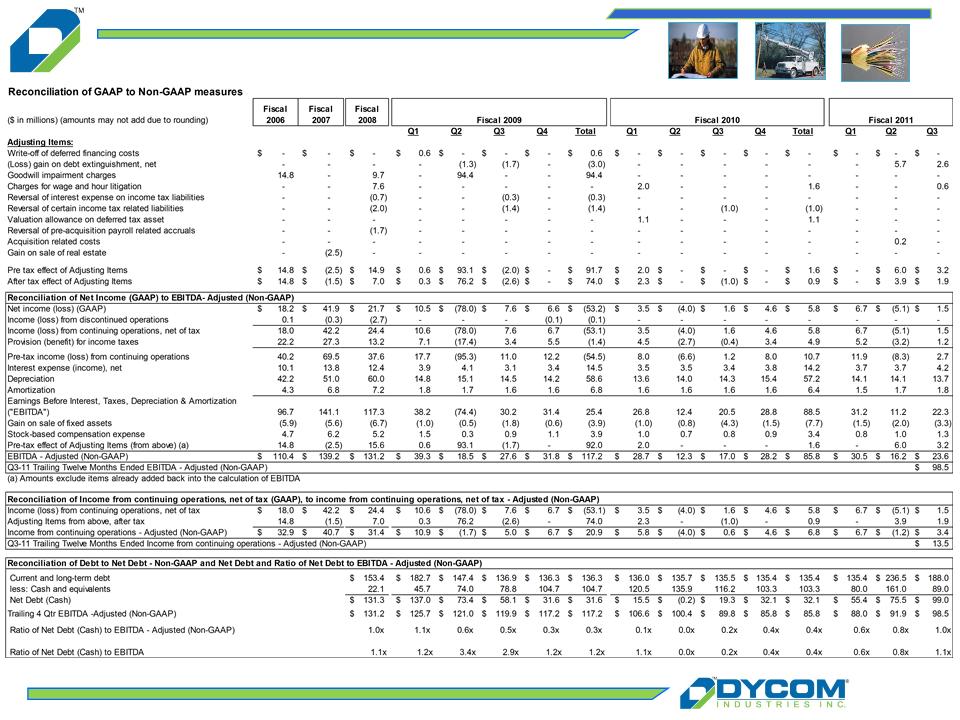

Regulation G Disclosure

25

Regulation G Disclosure

Credit Suisse 2011 Engineering

and Construction Conference

June 2, 2011

and Construction Conference

June 2, 2011