Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - CHART INDUSTRIES INC | d8k.htm |

Chart 2011

Investment Highlights Exhibit 99.1 |

Disclosure

1 |

Technology leader

- energy industry is the largest end-user of Chart’s products

Leading position -

#1 or #2 in all primary markets served

Global footprint –

operations on four continents with about 3,200 employees

Worldwide earnings –

approximately 60% of sales derived from outside the U.S.

Company Overview

Chart Industries is a leading provider of highly engineered cryogenic equipment

for the hydrocarbon, industrial gas, and biomedical markets.

2 |

Energy & Chemicals (E&C) Segment Overview

Heat Exchanger

Cold Box

Production

2010 Sales by Product / Region

Highlights

Technology

leader

-

providing

heat

exchangers

and

cold

boxes

critical

to

LNG,

Olefin

petrochemicals,

natural

gas

processing

and

industrial

gas

markets

–

Separation,

liquefaction

and

purification

of

hydrocarbon

and

industrial

gases

Market

leader

–

leading

market

positions

worldwide

Manufacturing

leader

-

one

of

three

global

suppliers

of

mission-critical

LNG

and

LNG

liquefaction

equipment

Selected Products

3 |

Distribution & Storage (D&S) Segment Overview

2010 Sales by Product / Region

Highlights

Balanced

customer

base

-

45%

of

segment

sales

derived

from

products

used

in

energy

applications

Strategic

footprint

–

manufacturing

located

near

growing

end

markets

and

lower-cost

countries

–

Positioned

to

capitalize

on

strong

expected

growth

in

Asia

and

Eastern

Europe

–

Continued

investment

in

key

global

manufacturing

facilities

Bulk

MicroBulk

Storage

Selected Products

Satellite LNG

Storage

4 |

BioMedical Segment Overview

2010 Sales by Product / Region

Highlights

Strong

growth

-

increase

in

oxygen

respiratory

therapy

and

biomedical

research,

led

by

international

markets,

expected

Robust

end

markets

include:

–

Home

healthcare

and

nursing

homes

–

Hospitals

and

long-term

care

–

Biomedical

and

pharmaceutical

research

–

Animal

breeding

Portable Oxygen

Lab Storage

Stainless Steel Freezer

End-Use Consumption

Respiratory

Therapy

Systems

65%

Biological

Storage

Systems

35%

Selected Products

Americas

(Non-US)

5%

U.S.

34%

Europe

49%

Asia

11%

RoW

1%

5 |

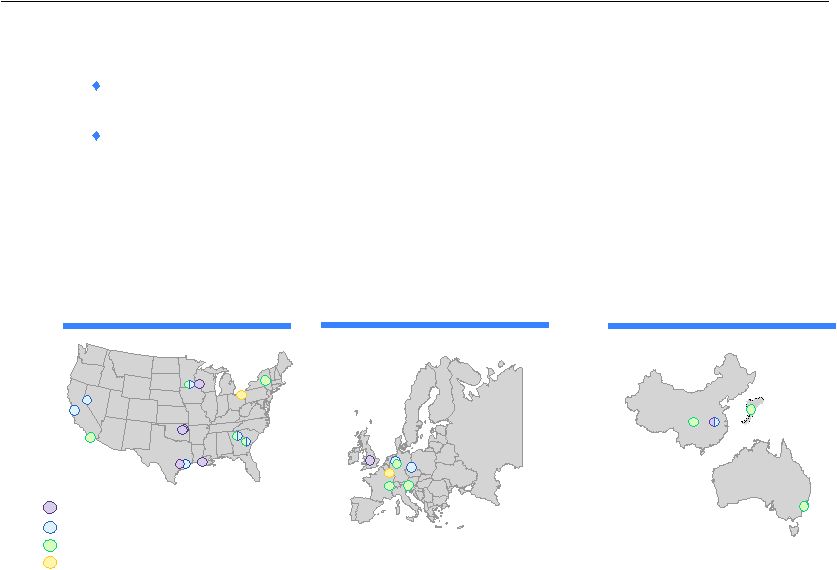

Global Manufacturing and Distribution Platform

Operating

leverage

provides

the

flexibility

to

expand

and

reduce

capacity

as

needed

with

minimal

capital

expenditures

Major manufacturing locations include:

China,

Changzhou

(D&S

and

E&C)

and

Chengdu

(BioMedical)

Czech

Republic,

Decin

(D&S)

Georgia,

Canton

and

Minnesota,

New

Prague

(D&S

and

BioMedical)

Wisconsin,

La

Crosse

and

Oklahoma,

Tulsa

(E&C)

Manufacturing facilities are strategically located in lower-cost countries

and near centers of demand

Corporate

Energy & Chemicals

Distribution & Storage

BioMedical

Asia-Pacific

North America

Europe

6 |

Growth Opportunities

Energy & Chemicals

Significant exposure to expected global

energy demand growth, especially in

emerging economies

Small, mid and base load LNG global

projects

North American Natural Gas processing

(e.g., Shale fields and potential LNG export)

Distribution & Storage

Global relationships with major industrial gas

companies and distributors

World demand for industrial gases is forecast to

increase 8% annually to over $50 billion in 2014

(Source: Freedonia Group Inc. August 2010 “World Industrial

Gases”)

Supply equipment for the full LNG value chain,

including transportation equipment, terminal

storage, and vehicle tanks

BioMedical

Oxygen respiratory therapy growth with

aging demographics, especially in emerging

markets

Expansion of product portfolio to non-

delivery modalities with recent SeQual and

CFIC acquisitions

Increasing biological research expenditures

7 |

Growing

industry

-

Natural

gas

demand

is

expected

to

continue

to

grow

at

a

pace

faster

than

coal

and

oil,

and

will

be

heavily

weighted

towards

emerging

economies,

which

is

expected

to

drive

demand

for

Chart’s products.

Natural

gas

expansion

-

U.S.

natural

gas

processing

is

rising

with

production

of

unconventional gas.

World

primary

demand

for

natural

gas

expands

on

average

by

1.4%

per

year

(2008-2035)

with

the

biggest

increases

in

the

Middle

East,

China

and

India.

(Source:

International

Energy

Agency

–

World

Energy

Outlook

2010,

New

Policies

Scenario)

LNG

growth

leader

-

“Global

gas

demand

is

likely

to

rise

by

25%,

while

the

use

of

LNG

is

set

to

surge

by

40%

by

2020.”

(Source:

ExxonMobil

quoted

at

CWC

World

LNG

Summit,

Barcelona

–

December

2009)

Global Natural Gas Production and Demand

8 |

Natural

gas

penetration

–

Increasing

as

a

viable

energy

source

and

transportation

fuel

due

to

its

high

energy

density,

lower

costs,

cleaner

emissions

profile,

and

plentiful

supply

due

to

improved

drilling

technologies

(e.g.

shale

gas)

Broad

product

offering

-

Chart

provides

products

and

solutions

for

the

full

LNG

value

chain:

LNG

liquefiers,

transportation

equipment,

terminal

storage

equipment

and

vehicle

tanks

for

both

on-road

and

off-road

heavy

duty

vehicles

and

marine

applications

Shift

is

beginning

–

Starting

to

see

U.S.

fleets

convert

to

natural

gas

as

a

fuel.

Administration

appears

to

be

shifting

policy

towards

the

use

of

more

natural

gas

in

the

U.S.

Adoption

of

a

U.S.

energy

bill

could

significantly

boost

natural

gas

vehicle

adoption

and

drive

a

multi-year

build-out

of

LNG

production,

storage

and

distribution

infrastructure,

creating

additional

market

opportunities

LNG Value Chain Opportunities

9 |

Dramatic

increase

in

imported

LNG

in

China

has

already

begun

and

is

expected

to

accelerate,

with

China

aggressively

investing

in

LNG

infrastructure,

including

LNG

transportation

and

storage

equipment

China’s

twelfth

5-year

plan

(2011

-

2015)

mandates

an

increase

of

gas

as

a

percentage

of

energy

consumption

from

less

than

4%

to

over

8%

(compared

to

over

20%

for

the

U.S.)

China

road

transit

authority

expects

to

add

2

million

new

gas

fueled

vehicles,

with

2/3

being

LNG

Lack

of

pipeline

infrastructure

in

China

requires

“virtual

pipeline”

with

LNG,

and

Chart

D&S

equipment

(e.g.,

storage,

transportation,

etc.)

can

fill

this

gap

China LNG Demand Outlook

10 |

Acquisition Initiatives

Organic growth

Consolidation

Internal product

development

Bolt-on

New Platform

Internal market

development

Bolt-on

Existing

Products

New Products

Existing

Markets

New Markets

Organic

Inorganic

Emerging Markets

-

China/Asia LNG

Emerging Products

-

Natural Gas Production

-

LNG “Virtual Pipeline”

Acquisitions

-

Nine acquisitions since 2005

New Business Platform

-

Energy, Industrial Gas and/or other

segments

11 |

Strong Track Record of Successful Execution

During

last

growth

cycle

Company

leveraged

its

flexible

manufacturing

platform

resulting

in

operating

income

growth

that

outpaced

sales

Flexible

cost

structure

and

good

execution

allowed

for

aggressive

response

to

economic

downturn

resulting

in

higher

operating

income

level

than

last

cycle

low

point

Improving

markets

and

good

performance

continue

to

drive

favorable

earnings

and

cash

generation,

resulting

in

strong

balance

sheet

with

significant

liquidity

Similar

or

higher

growth,

leveraged

by

acquisitions,

expected

to

occur

again

during

the

current

growth

cycle

Current

2011

sales

forecast

of

$740

-

$780

million

exceeds

prior

peak

sales

of

$753

million

achieved

in

2008

12 |

Historical

Orders

and

Backlog

Orders

Backlog

13 |

2011

Outlook Global markets continue their recovery during 2011 with the return of significant project

work in the E&C business and continued growth in LNG-related orders in the D&S

business

Recent contract awards in Saudi Arabia and Qatar totaling in excess of $110 million

increase our optimism about additional large project opportunities in the E&C business

First quarter results exceeded expectations with record orders leading the way. Based on

first quarter performance, current backlog and strong order trends, we raised our 2011

sales and earnings guidance with a sales forecast of $740 to $780 million and earnings of

$1.65 to $1.85 per diluted share

This guidance includes approximately $0.15 per diluted share for

anticipated restructuring

charges for the recently completed SeQual acquisition and trailing costs associated with

the shutdown of the Plainfield, Indiana facility acquired from Covidien. Therefore, our

adjusted EPS would be $1.80 to $2.00 per share

14 |

Summary of Investment Highlights

Positioned for continued significant growth

–

Substantial organic growth expected, especially across Asian markets

–

New product development taking advantage of leading proprietary technology and designs

–

Strong track record of maximizing operating efficiencies and growth

–

Continued

inorganic

growth

initiatives

with

continued

strategic,

accretive

acquisition

activity

Flexible Manufacturing Platform

–

Ability to rapidly adjust production as demand fluctuates

–

Necessary

capacity

expansion

or

contraction

is

easily

attainable

without

significant

spend

Very strong balance sheet

–

Low net debt position, but will continue to optimize capital structure

–

Substantial

free

cash

flow

growth

and

liquidity,

especially

with

new

senior

credit

facility

Very stable business model

–

Attractive industry with long-term customer relationships

–

Solid platform with worldwide presence and leading market positions in all segments

Chart continues to represent a unique investment opportunity to capitalize on

global energy demand, growth in industrial gas use, and biomedical opportunities

15 |