Attached files

| file | filename |

|---|---|

| EX-99.1 - PDF OF CONFERENCE SLIDES - NORTHERN TRUST CORP | dex9911.pdf |

| 8-K - FORM 8-K - NORTHERN TRUST CORP | d8k.htm |

Sanford Bernstein Strategic Decisions Conference

northerntrust.com

©

2011 Northern Trust Corporation

Service

Expertise

Integrity

Service

Expertise

Integrity

P R I N C I P L E S T H A T E N D U R E

Northern Trust

Corporation

Frederick H. Waddell

Chairman & Chief Executive Officer

Sanford C. Bernstein & Co.

Strategic Decisions Conference 2011

The Waldorf=Astoria Hotel

New York, New York

June 1, 2011

EXHIBIT 99.1 |

2

Sanford Bernstein Strategic Decisions Conference

Forward Looking Statement

This presentation may include forward-looking statements such as statements that relate to

Northern Trust’s financial goals, capital adequacy, dividend policy, expansion and business

development plans, risk management policies, anticipated expense levels and projected profit

improvements, business prospects and positioning with respect to market, demographic and

pricing trends, strategic initiatives, re-engineering and outsourcing activities, new

business results and outlook, changes in securities market prices, credit quality including

reserve levels, planned capital expenditures and technology spending, anticipated tax benefits

and expenses, and the effects of any extraordinary events and various other matters (including

developments with respect to litigation, other contingent liabilities and obligations, and

regulation involving Northern Trust and changes in accounting policies, standards and

interpretations) on Northern Trust’s business and results. These statements speak of

Northern Trust’s plans, goals, targets, strategies, beliefs, and expectations, and refer

to estimates or use similar terms. Actual results could differ materially from those indicated

by these statements because the realization of those results is subject to many risks and

uncertainties. Our 2010 annual report and periodic reports to the SEC contain information

about specific factors that could cause actual results to differ, and you are urged to read

them. Northern Trust disclaims any continuing accuracy of the information provided in this

presentation after today. |

3

Sanford Bernstein Strategic Decisions Conference

Agenda

Northern Trust Corporation

Excellent Strategic Positioning

Personal Financial Services

Corporate & Institutional Services

Northern Trust Global Investments

Looking Toward the Future |

4

Sanford Bernstein Strategic Decisions Conference

Founded in 1889, Northern Trust Corporation is a global leader in asset management

and asset servicing for institutional and personal clients

Operations & Technology:

Integrated global operating platform

Serving personal and

institutional clients

$1.4 billion in technology

spending, 2008-2010

Personal Financial Services:

Leading advisor to affluent market

$168 billion AUM

$385 billion AUC

Corporate & Institutional Services:

Leading global custodian

$4.0 trillion AUC

$494 billion AUM

Northern Trust Global Investments:

Leading asset manager for

personal & institutional clients

$662 billion AUM

As of March 31, 2011

Client Centric, Highly Focused Business Model

Personal

Clients

Institutional

Clients

Integrated Operations & Technology Platform

Asset

Servicing

Asset

Management

$4.4T Assets

Under Custody

$662B Assets

Under Mgmt. |

5

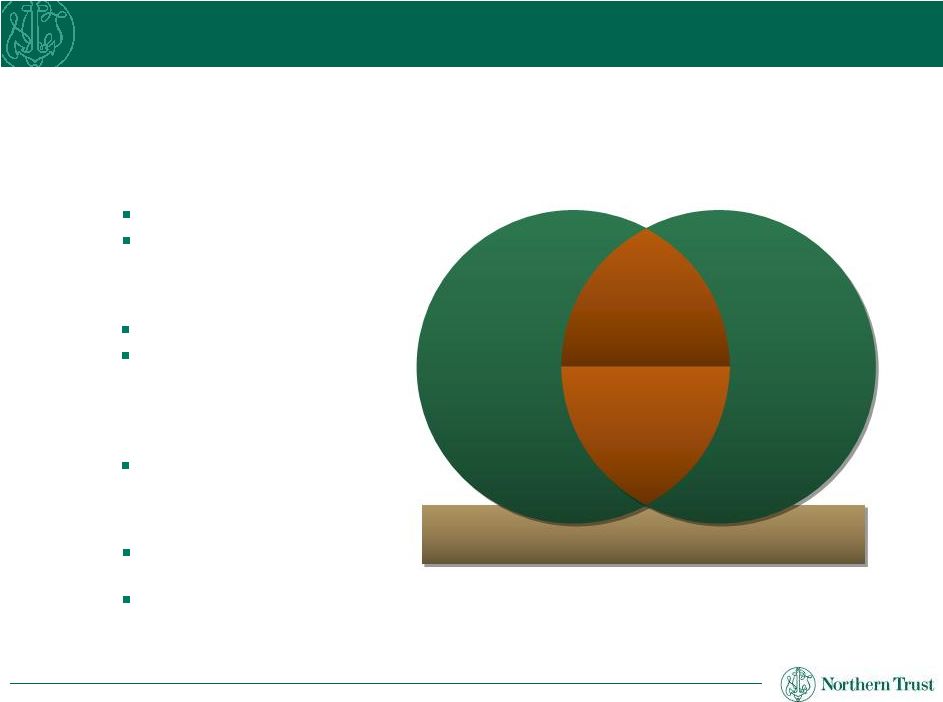

Sanford Bernstein Strategic Decisions Conference

Excellent strategic positioning

Outstanding client base

Strong and supportive

demographic trends

Continued globalization

fueling international growth

Attractive profitability dynamics

The strategic businesses that Northern Trust has focused on –

consistently for many years –

continue to offer compelling and attractive growth opportunities

Client Centric, Highly Focused Business Model

As of March 31, 2011

Personal

Clients

Institutional

Clients

Integrated Operations & Technology Platform

Asset

Servicing

Asset

Management

$4.4T Assets

Under Custody

$662B Assets

Under Mgmt. |

6

Sanford Bernstein Strategic Decisions Conference

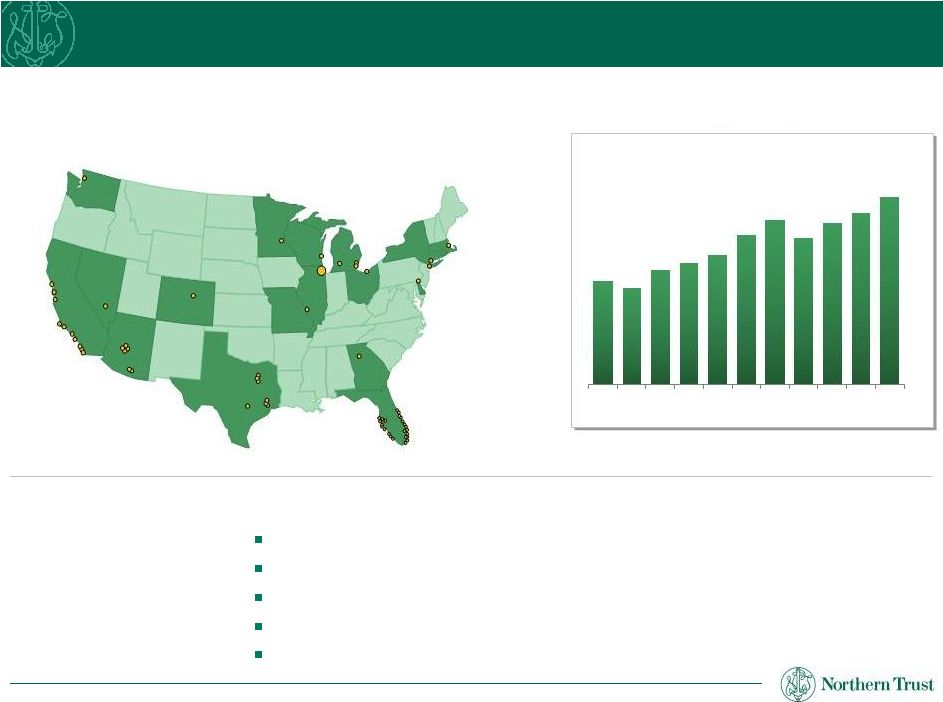

Network of PFS Offices in 18 States

Over 50% of the U.S. millionaire market resides within

a 45-minute drive of Northern Trust offices.

Personal Financial Services

Extensive Reach in the Affluent Market

Investing in the Business:

Strategic hiring to bolster presence around the U.S.

Acquisition of Los Angeles-based Waterline Partners

Continuing to augment investment capabilities

Opening in Washington, D.C. in 2011

Evaluating international opportunities

PFS Assets Under Management

($ Billions)

CAGR

+7%

S&P500 CAGR +2%

94.0

87.7

148.3

132.4

145.2

154.4

168.4

104.3

110.4

117.2

134.7

2001

2003

2005

2007

2009

1Q

2011

Florida

(25)

Texas

(7)

Arizona

(6)

Illinois

(15)

Colorado

(1)

Nevada

(1)

Missouri

(1)

Washington

(1)

Michigan

(3)

California

(10)

New York (1)

Connecticut (1)

Delaware (1)

Georgia

(1)

Wisconsin

(1)

Ohio

(1)

Minnesota

(1)

Massachusetts (1) |

7

Sanford Bernstein Strategic Decisions Conference

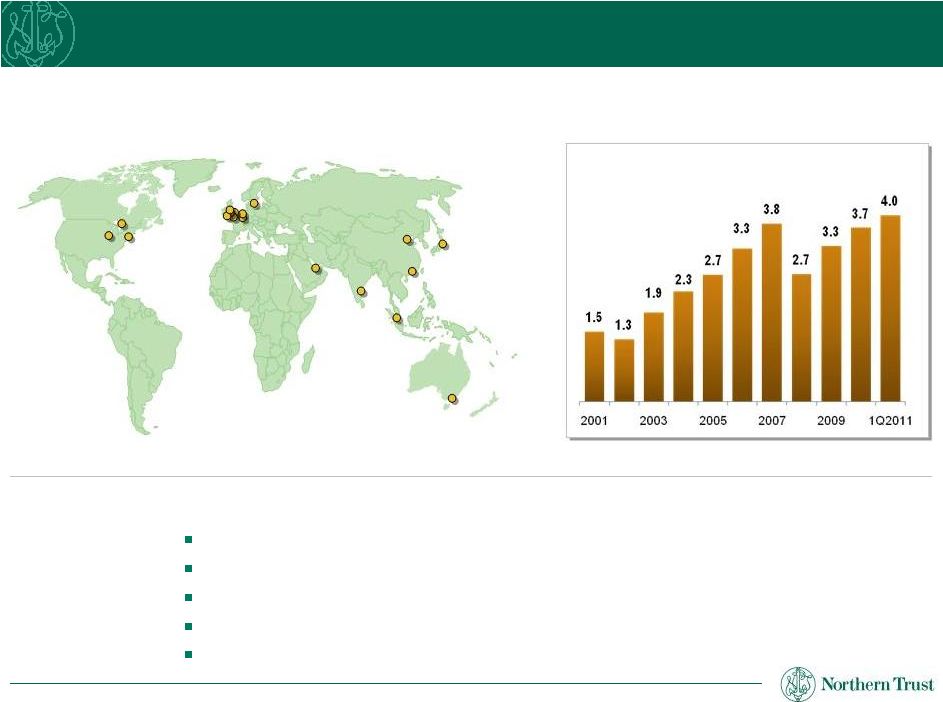

Corporate & Institutional Services

Positioned Globally for Growth

C&IS Assets Under Custody

($ Trillions)

Strategically Positioned

in Three Dynamic Regions

Investing in the Business:

Growing our Global Fund Services business

Acquiring Bank of Ireland Securities Services

Adding hedge fund administration capabilities with the acquisition of Omnium

Building relationships with SWFs, financial institutions, and insurance

companies Continuing to enhance our technology platform to provide

innovative solutions CAGR

+11%

S&P500 CAGR +2%

US$EAFE CAGR +4%

The

Americas

Europe,

Middle East,

and Africa

Asia Pacific |

8

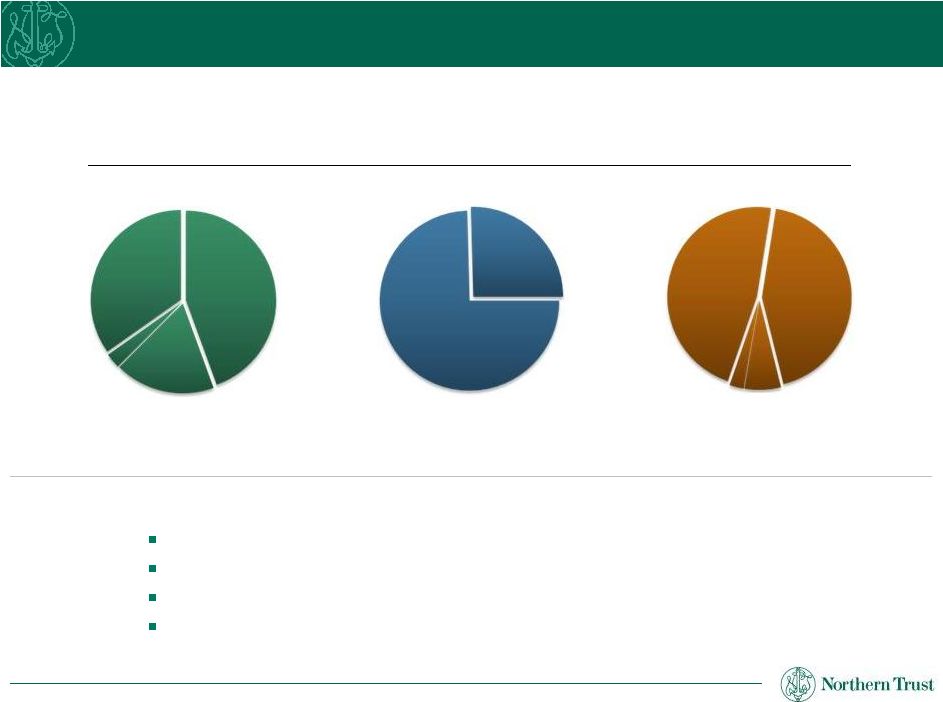

Sanford Bernstein Strategic Decisions Conference

Investing in the Business:

Focusing on international growth through strategic hires and product

development Building exchange traded fund products

Expanding alternative investment capabilities

Driving

revenue growth through direct sales of our core capabilities

Assets Under Management: $662.2 Billion

A Diversified Asset Manager

Across Asset Classes

Across Client Segments

Across Styles

Northern Trust Global Investments

Client Focused, Diversified Investment Manager

$44 Billion

(7%)

$313 Billion

(47%)

Active

$289 Billion

(44%)

Index

Manager

of Managers

$494 Billion

Institutional

$168 Billion

Personal

Equities

$294 Billion

(44%)

Fixed Income

$119 Billion

(18%)

Short

Duration

$233 Billion

(35%)

Other

$16 Billion

(3%)

Other

$16 BN

(2%)

As of March 31, 2011 |

Looking Toward

the Future |

10

Sanford Bernstein Strategic Decisions Conference

Looking Toward the Future

Acquisitions

Omnium LLC*

Bank of Ireland Securities Services*

Waterline Partners

Strategic office openings

Washington, D.C. in summer 2011

Beijing branch conversion

Technology & product development

Invested $518 million in 2010

Revenue growth

Continuing to win in the marketplace

Positioned to benefit from higher rates

Operational efficiency

Ongoing evolution of integrated, global

operating model

Evaluation of expense base

Pursuing initiatives to slow rate of

expense growth

Investing in the Business

Improving Core Earnings Trajectory

* Announced on May 16, 2011 and February 24, 2011, respectively.

|

11

Sanford Bernstein Strategic Decisions Conference

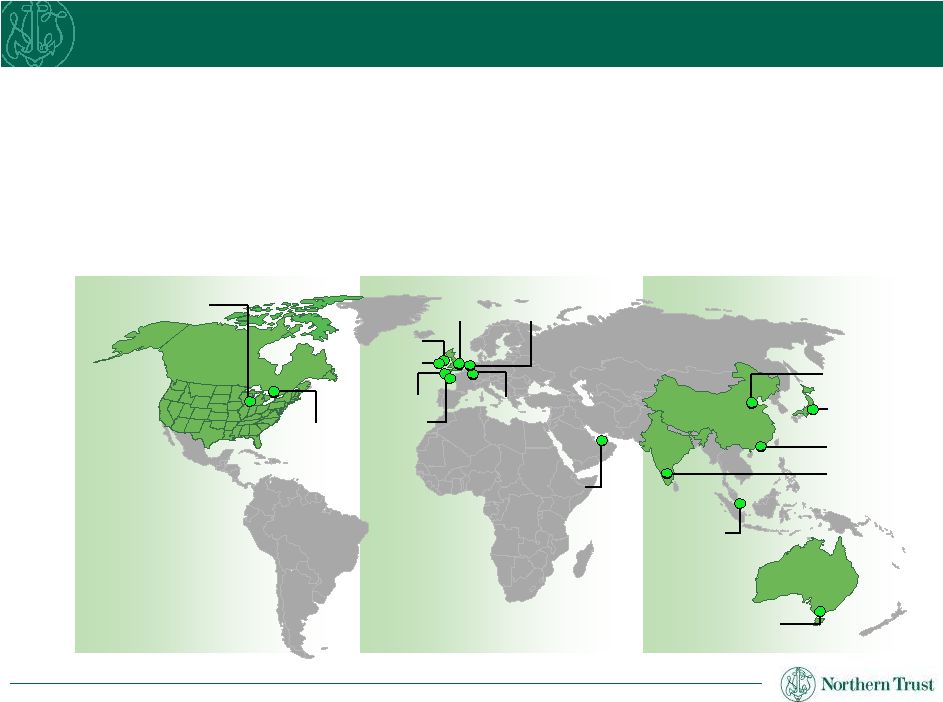

Evolution of Global Operating Model

North America

8,645/91%

7,248/80%

8,243/63%

Europe,

Middle East & Africa

789/8%

1,682/19%

2,297/18%

Asia Pacific

61/1%

110/1%

2,498/19%

Abu Dhabi

Dublin

Toronto

London

Limerick

Amsterdam

Luxembourg

Guernsey

Melbourne

Singapore

Hong Kong

Bangalore

Beijing

Tokyo

Jersey

Chicago

FTE Staff

2000

2005

1Q2011 |

12

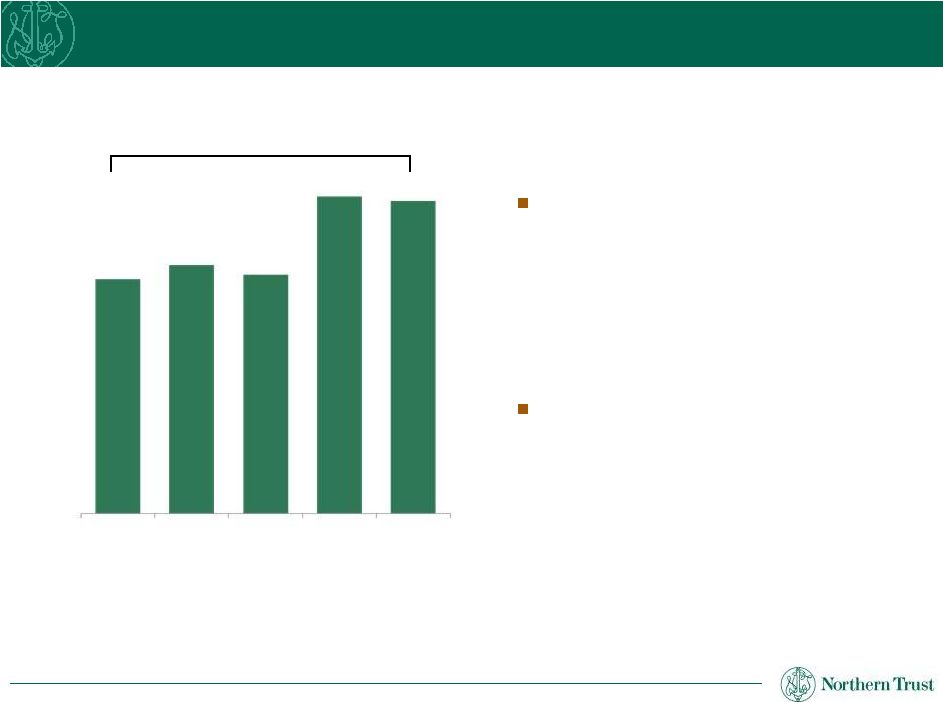

Sanford Bernstein Strategic Decisions Conference

Evaluation of Expense Base

+6.5%

Year-over-year expense

growth outpaced revenue

growth** by 2.0 percentage

points in the 1

st

quarter of

2011.

We are pursuing expense

initiatives that will slow the rate

of future expense growth.

$620

$627

$622

$662

$660

1Q2010

2Q2010*

3Q2010

4Q2010*

1Q2011*

*NOTE: The second and fourth quarters of 2010 and the first quarter of 2011 exclude Visa related

benefits of $13 million,

$20 million and $10 million, respectively. The first quarter of 2011 also excludes acquisition related

expenses of $3 million. **NOTE: Revenue growth is adjusted to exclude securities lending mark-to-market impacts, which

totaled $38 million in the first quarter of 2010 and $114 million for the full year 2010. |

Concluding Thoughts |

14

Sanford Bernstein Strategic Decisions Conference

Market Leader in Focused Businesses

Best Private Bank in North America (Financial Times, November 2010 and

2009) Custodian

of

the

Year

(Professional

Pensions

–

UK

Pensions

Awards,

May

2010

and

2011)

One of the largest Fund Administrators in Ireland and Guernsey

11

th

largest manager of worldwide institutional assets (Pensions &

Investments, May 2010) Strong History of Organic Growth

Assets

under

custody

CAGR

of

11%

2001

–

1Q2011

Net new business up 28% in 2010 versus prior year

Distinctive Financial Strength

85% of securities portfolio rated triple A

NPAs to loans relatively low at 1.36%

Tier 1 Common Equity ratio of 13.0%

96% of total Tier 1 Capital is Tier 1 Common Equity

Invested & Experienced Management Team

Combined service at Northern Trust of 216 years

As of March 31, 2011

Strategically Positioned for Growth |

Sanford Bernstein Strategic Decisions Conference

northerntrust.com

©

2011 Northern Trust Corporation

Service

Expertise

Integrity

Service

Expertise

Integrity

P R I N C I P L E S T H A T E N D U R E

Northern Trust

Corporation

Frederick H. Waddell

Chairman & Chief Executive Officer

Sanford C. Bernstein & Co.

Strategic Decisions Conference 2011

The Waldorf=Astoria Hotel

New York, New York

June 1, 2011 |