Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - REXNORD LLC | d8k.htm |

| EX-99.2 - PRESS RELEASE OF REXNORD CORPORATION - REXNORD LLC | dex992.htm |

Exhibit 99.1

MARKET AND INDUSTRY DATA AND FORECASTS

This exhibit includes industry data that we obtained from periodic industry publications and internal company surveys. This exhibit includes market share and industry data that we prepared primarily based on management’s knowledge of the industry and industry data. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Unless otherwise noted, statements as to our market share and market position relative to our competitors are approximated and based on management estimates using the above-mentioned latest-available third-party data and our internal analyses and estimates.

While we are not aware of any misstatements regarding any industry data presented herein, our estimates, in particular as they relate to market share and our general expectations, involve risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors” and “Cautionary Notice Regarding Forward-Looking Statements” in this exhibit.

TRADEMARKS

The following terms used in this exhibit are our Process & Motion Control trademarks: Falk®, Rexnord®, Rex® and FlatTop™. The following terms used in this exhibit are our Water Management trademarks: Zurn®, Wilkins®, Rodney Hunt® and Fontaine®. All other trademarks appearing in this exhibit are the property of their holders.

1

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This exhibit includes “forward-looking statements” within the meaning of the federal securities laws that involve risks and uncertainties. Forward-looking statements include statements we make concerning our plans, objectives, goals, strategies, future events, future revenues or performance, capital expenditures, financing needs and other information that is not historical information and, in particular, appear under the headings “Summary Information” and “Risk Factors.” When used in this exhibit, the words “estimates,” “expects,” “anticipates,” “projects,” “forecasts,” “plans,” “intends,” “believes,” “foresees,” “seeks,” “likely,” “may,” “might,” “will,” “should,” “goal,” “target” or “intends” and variations of these words or similar expressions (or the negative versions of any such words) are intended to identify forward-looking statements. All forward-looking statements are based upon information available to us on the date of this exhibit.

These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of our control, that could cause actual results to differ materially from the results discussed in the forward-looking statements, including, among other things, the matters discussed in this exhibit in the sections captioned “Summary Information” and “Risk Factors.”

There are likely other factors that could cause our actual results to differ materially from the results referred to in the forward-looking statements. All forward-looking statements attributable to us apply only as of the date of this exhibit and are expressly qualified in their entirety by the cautionary statements included in this exhibit. We undertake no obligation to publicly update or revise forward-looking statements to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events, except as required by law.

2

Unless otherwise noted, “Rexnord,” “we,” “us,” “our” and the “Company” mean Rexnord Corporation (formerly known as Rexnord Holdings, Inc.) and its predecessors and consolidated subsidiaries, including RBS Global, Inc. (“RBS Global”) and Rexnord LLC, and “Rexnord Corporation” means Rexnord Corporation and its predecessors but not its subsidiaries. As used in this exhibit, “fiscal year” refers to our fiscal year ending March 31 of the corresponding calendar year (for example, “fiscal year 2011” or “fiscal 2011” means the period from April 1, 2010 to March 31, 2011).

Our Company

Rexnord is a growth-oriented, multi-platform industrial company with what we believe are leading market shares and highly trusted brands that serve a diverse array of global end-markets. Our heritage of innovation and specification have allowed us to provide highly engineered, mission critical solutions to customers for decades and affords us the privilege of having long-term, valued relationships with market leaders. We operate our company in a disciplined way and the Rexnord Business System (“RBS”) is our operating philosophy. Grounded in the spirit of continuous improvement, RBS creates a scalable, process-based framework that focuses on driving superior customer satisfaction and financial results by targeting world-class operating performance throughout all aspects of our business.

Our strategy is to build the Company around multiple, global strategic platforms that participate in end-markets with sustainable growth characteristics where we are, or have the opportunity to become, the industry leader. We have a track record of acquiring and integrating companies and expect to continue to pursue strategic acquisitions within our existing platforms that will expand our geographic presence, broaden our product lines and allow us to move into adjacent markets. Over time, we anticipate adding additional strategic platforms to our Company. Currently, our business is comprised of two platforms, Process & Motion Control and Water Management.

We believe that we have one of the broadest portfolios of highly engineered, mission and project critical Process & Motion Control products in the industrial and aerospace end-markets. Our Process & Motion Control product portfolio includes gears, couplings, industrial bearings, aerospace bearings and seals, FlatTop™ modular belting, engineered chain and conveying equipment. Our Water Management platform is a leader in the multi-billion dollar, specification-driven, non-residential construction market for water management products. Through recent acquisitions, we have gained entry into the municipal water and wastewater treatment markets. Our Water Management product portfolio includes professional grade specification drainage products, flush valves and faucet products, backflow prevention pressure release valves, Pex piping and engineered valves and gates for the water and wastewater treatment market.

Our products are generally “specified” or requested by end-users across both of our strategic platforms as a result of their reliable performance in demanding environments, our custom application engineering capabilities and our ability to provide global customer support. Typically, our Process & Motion Control products are initially incorporated into products sold by original equipment manufacturers (“OEMs”) or sold to end-users as critical components in large, complex systems where the cost of failure or downtime is high and thereafter replaced through industrial distributors as they are consumed or require replacement.

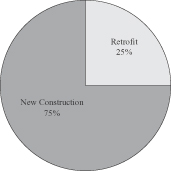

The demand for our Water Management products is primarily driven by new infrastructure, the retro-fit of existing structures to make them more energy and water efficient, commercial construction and, to a lesser extent, residential construction. We believe we have become a market leader in the industry by meeting the stringent third party regulatory, building and plumbing code requirements and subsequently achieving specification of our products into projects and applications.

We are led by an experienced, high-caliber management team that employs RBS as a proven operating philosophy to drive excellence and world class performance in all aspects of our business by focusing on the “Voice of the Customer” process and ensuring superior customer satisfaction. Our global footprint encompasses 36 principal Process & Motion Control manufacturing, warehouse and repair facilities located around the world and 23 principal Water Management manufacturing and warehouse facilities which allow us to meet the needs of our increasingly global customer base as well as our distribution channel partners.

We believe we have a sustainable competitive advantage in both of our platforms as a result of the following attributes:

| • | We are a leading designer, manufacturer and marketer of highly-engineered, end-user and/or third-party specified products that are mission- or project-critical for applications where the cost of failure or downtime is high or there is a requirement to provide and enhance water quality, safety, flow control and conservation. |

| • | We believe our portfolio includes premier and widely known brands in the Process & Motion Control and Water Management markets in which we participate, as well as one of the broadest and most extensive product offerings. |

3

| • | We estimate that over 85% of our total net sales come from products in which we have leading market share positions. |

| • | We believe we have established a sustainable revenue profile. Within our Process & Motion Control platform, we have an extensive installed base of our products that provides us the opportunity to capture significant, recurring aftermarket revenues at attractive margins as a result of a “like-for-like” replacement dynamic. Within our Water Management platform, we pursue the retrofit of existing structures to improve water conservation and efficiency, thereby reducing our exposure to the new construction cycle. |

| • | We have extensive distribution networks in both of our platforms—in Process & Motion Control, we have over 2,600 distributor locations serving our customers globally and, in Water Management, we have more than 1,100 independent sales representatives across approximately 210 sales agencies that work directly with our in-house technical team to drive specification of our products. |

We employ approximately 6,300 employees across 59 locations around the world. For the fiscal year ended March 31, 2011, we generated net sales of $1.7 billion, income from operations of $219.1 million and a net loss of $51.3 million. Fiscal 2011 results reflect the effect of a $100.8 million loss on debt extinguishment recorded during the year as a result of the early repayment of debt pursuant to cash tender offers. We generated net sales of $1.5 billion, income from operations of $161.4 million and net income of $88.1 million for the fiscal year ended March 31, 2010. Fiscal 2010 results reflect the effect of a $167.8 million gain on debt extinguishment recorded during the year as a result of a repurchase and extinguishment of debt and a debt exchange offer.

In addition to net income (loss), we believe Adjusted EBITDA is an important measure under our senior secured credit facilities, as our ability to incur certain types of acquisition debt or subordinated debt, make certain types of acquisitions or asset exchanges, operate our business and make dividends or other distributions, all of which will impact our financial performance, is impacted by our Adjusted EBITDA, as our lenders measure our performance by comparing the ratio of our senior secured bank debt to our Adjusted EBITDA. Adjusted EBITDA for the twelve months ended March 31, 2011 was $335.7 million. For the twelve months ended March 31, 2010, Adjusted EBITDA was $285.0 million.

Our Strategic Platforms

Process & Motion Control

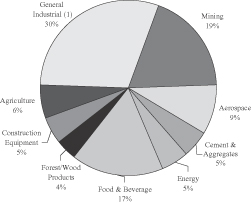

Our Process & Motion Control platform designs, manufactures, markets and services specified, highly-engineered mechanical components used within complex systems where our customers’ reliability requirements and cost of failure or downtime is high. The Process & Motion Control product portfolio includes gears, couplings, industrial bearings, aerospace bearings and seals, FlatTop™ modular belting, engineered chain and conveying equipment and are marketed and sold globally under several brands, including Rexnord®, Rex®, Falk® and Link-Belt®. We sell our Process & Motion Control products into a diverse group of attractive end-markets, including mining, general industrial applications, cement and aggregate, agriculture, forest and wood products, petrochemical, energy, food and beverage, aerospace and wind energy.

| FY2011 Process & Motion Control Net Sales by End-Market |

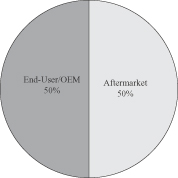

FY2011 Process & Motion Control Net Sales End-User/OEM vs. Aftermarket | |

|

|

| (1) | General Industrial includes, but is not limited to, material handling, package handling, utilities, automation and robotics, marine and steel processing, none of which individually represented more than 2% of fiscal 2011 net sales. |

4

We have established long-term relationships with OEMs and end-users serving a wide variety of industries. As a result of our long-term relationships with OEMs and end-users, we have created a significant installed base for our Process & Motion Control products, which are consumed or worn in use and have a relatively predictable replacement cycle. We believe this replacement dynamic drives recurring aftermarket demand for our products. We estimate that approximately 50% of our Process & Motion Control net sales are to distributors, who primarily serve the end-user/OEM aftermarket demand for our products.

Most of our products are critical components in large scale manufacturing processes, where the cost of component failure and resulting down-time is high. We believe our reputation for superior quality, application expertise and ability to meet lead time expectations are highly valued by our customers, as demonstrated by their preference to replace their worn Rexnord products with new Rexnord products, or “like-for-like” product replacements. We believe this replacement dynamic for our products, combined with our significant installed base, enables us to achieve premium pricing, generates a source of recurring revenue and provides us with a competitive advantage. We believe the majority of our products are purchased by customers as part of their regular maintenance budget, and in many cases do not represent significant capital expenditures.

Water Management

Our Water Management platform designs, procures, manufactures and markets products that provide and enhance water quality, safety, flow control and conservation. The Water Management product portfolio includes professional grade specification drainage products, flush valves and faucet products, engineered valves and gates for the water and wastewater treatment market and Pex piping and are marketed and sold through widely recognized brand names, including Zurn®, Wilkins®, Rodney Hunt® and Fontaine®.

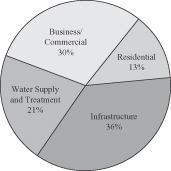

Over the past century, the businesses that comprise our Water Management platform have established themselves as innovators and leading designers, manufacturers and distributors of highly engineered products and solutions that control the flow, delivery, treatment and conservation of water to the infrastructure construction (which is comprised of various segments, including those identified as “Water Supply and Treatment” in the chart below), commercial construction and, to a lesser extent, the residential construction end-markets. Segments of the infrastructure end-market include: municipal water and wastewater, transportation, government, health care and education. Segments of the commercial construction end-market include: lodging, retail, dining, sports arenas, and warehouse/office. The demand for our Water Management products is primarily driven by new infrastructure, the retro-fit of existing structures to make them more energy and water efficient, commercial construction and, to a lesser extent, residential construction.

| FY2011 Water Management Net Sales by End-Market |

FY2011 Water Management Net Sales New Construction vs. Retrofit | |

|

|

Our Water Management products are principally specification-driven and project-critical and typically represent a low percentage of the overall project cost. We believe these characteristics, coupled with our extensive distribution network, create a high level of end-user loyalty for our products and allow us to maintain leading market shares in the majority of our product lines. We believe we have become a market leader in the industry by meeting the stringent third party regulatory, building and plumbing code requirements and subsequently achieving specification of our products into projects and applications. The majority of these stringent testing and regulatory approval processes are completed through the University of Southern California (“USC”), the International Association of Plumbing and Mechanical Codes (“IAPMO”), the National Sanitation Foundation (“NSF”), the Underwriters Laboratories (“UL”), Factory Mutual (“FM”), or the American Waterworks Association (“AWWA”), prior to the commercialization of our products.

5

Our Water Management platform has an extensive network of approximately 1,100 independent sales representatives across approximately 210 sales agencies in North America who work with local engineers, contractors, builders and architects to specify, or “spec-in,” our products for use in construction projects. Approximately 85% of our Water Management platform net sales come from products that are specified for use in projects by engineers, contractors, owners or architects. Specifically, it has been our experience that, once an architect, engineer, contractor or owner has specified our product with satisfactory results, that person will generally continue to use our products in future projects. The inclusion of our products with project specifications, combined with our ability to innovate, engineer and deliver products and systems that save time and money for engineers, contractors, builders and architects, has resulted in growing demand for our products. Our distribution model is predicated upon maintaining high product availability near our customers. We believe that this model provides us with a competitive advantage as we are able to meet our customer demand with local inventory at significantly reduced lead times as compared to others in our industry.

Our Markets

We evaluate our competitive position in our markets based on available market data, relevant benchmarks compared to our relative peer group and industry trends. We generally do not participate in segments of our served markets that are thought of as commodities or in applications that do not require differentiation based on product quality, reliability and innovation. In both of our platforms, we believe the end-markets we serve span a broad and diverse array of commercial and industrial end-markets with solid fundamental long-term growth characteristics.

Process & Motion Control Market

Within the overall Process & Motion Control market, we estimate that the addressable North American market for our current product offerings is approximately $5.0 billion in net sales per year. Globally, we estimate our addressable market to be approximately $12.0 billion in net sales per year. The market for Process & Motion Control products is very fragmented with most participants having single or limited product lines and serving specific geographic markets. While there are numerous competitors with limited product offerings, there are only a few national and international competitors of a size comparable to us. While we compete with certain domestic and international competitors across a portion of our product lines, we do not believe that any one competitor directly competes with us on all of our product lines. The industry’s customer base is broadly diversified across many sectors of the economy. We believe that growth in the Process & Motion Control market is closely tied to overall growth in industrial production, which fundamentally, we believe has significant long-term growth potential. In addition, we believe that Process & Motion Control manufacturers who innovate to meet changes in customer demands and focus on higher growth end-markets can grow at rates faster than overall United States industrial production.

The Process & Motion Control market is also characterized by the need for sophisticated engineering experience, the ability to produce a broad number of niche products with very little lead time and long-standing customer relationships. We believe entry into our markets by competitors with lower labor costs, including foreign competitors, will be limited due to the fact that we manufacture highly specialized niche products that are critical components in large scale manufacturing processes, where the cost of component failure and resulting downtime is high. In addition, we believe there is an industry trend of customers increasingly consolidating their vendor bases, which we believe should allow suppliers with broader product offerings, like us, to capture additional market share.

Water Management Market

Within the overall Water Management market, we estimate that the addressable North American market for our current product offerings is approximately $2.3 billion in net sales per year. Globally, we estimate our addressable market to be approximately $3.0 billion in net sales per year. We believe the markets in which our Water Management platform participates are relatively fragmented with competitors across a broad range of industries and product lines. Although competition exists across all of our Water Management businesses, we do not believe that any one competitor directly competes with us across all of our product lines. We believe that, by focusing our efforts and resources towards end-markets that have above average growth characteristics, we can continue to grow our platform at rates above the growth rate of the overall market and the growth rate of our competition.

We believe the areas of the Water Management industry in which we compete are tied to growth in infrastructure and commercial construction, which we believe have significant long-term growth fundamentals. Historically, the infrastructure and commercial construction industry has been more stable and less vulnerable to down-cycles than the residential construction industry. Compared to residential construction cycles, downturns in infrastructure and commercial construction have been shorter and less severe, and upturns have lasted longer and had higher peaks in terms of spending as well as units and square footage. In addition, through successful new product innovation, we believe that water management manufacturers are able to grow at a faster pace than the broader infrastructure and commercial construction markets, as well as mitigate downturns in the cycle.

6

The Water Management industry’s specification-driven end-markets require manufacturers to work closely with engineers, contractors, builders and architects in local markets across the United States to design specific applications on a project-by-project basis. As a result, building and maintaining relationships with architects, engineers, contractors and builders who specify or “spec-in” products for use in construction projects and having flexibility in design and product innovation are critical to compete effectively in the market. Companies with a strong network of such relationships have a competitive advantage. Specifically, it has been our experience that, once an engineer, contractor, builder or architect has specified our product with satisfactory results, that person often will continue to use our products in future projects.

Our Competitive Strengths

Key characteristics of our business that we believe provide us with a competitive advantage and position us for future growth include the following:

The Rexnord Business System. We operate our company in a disciplined way. The Rexnord Business System is our operating philosophy and it creates a scalable, process-based framework that focuses on driving superior customer satisfaction and financial results by targeting world-class operating performance. RBS is based on the following principles: (1) strategy deployment—a long-term strategic planning process that determines annual improvement priorities and the actions necessary to achieve those priorities; (2) measuring our performance based on customer satisfaction, or the “Voice of the Customer;” (3) involvement of all our associates in the execution of our strategy; and (4) a culture that embraces Kaizen, the Japanese philosophy of continuous improvement. We believe applying RBS can yield superior growth, quality, delivery and cost positions relative to our competition, resulting in enhanced profitability and ultimately the creation of stockholder value. As we have applied RBS over the past several years, we have experienced significant improvements in growth, productivity, cost reduction and asset efficiency and believe there are substantial opportunities to continue to improve our performance as we continue to apply RBS.

Experienced, High-Caliber Management Team. Our management team is led by Todd Adams, President and Chief Executive Officer. George Sherman, our Non-Executive Chairman of the Board and, from 1990 to 2001, the CEO of the Danaher Corporation, collaborates with the management team to establish the strategic direction of the Company. Other members of the management team include Michael Shapiro, Vice President and Chief Financial Officer, Praveen Jeyarajah, Executive Vice President—Corporate and Business Development and George Moore, Executive Vice President. We believe the overall talent level within our organization is a competitive strength, and we have added a number of experienced key managers across our platforms over the past several years. Mr. Sherman and the management team currently maintain a significant equity investment in the Company. As of March 31, 2011, their ownership interest represented approximately 20% of our common stock on a fully diluted basis.

Strong Financial Performance and Free Cash Flow. Since implementing RBS, we have established a solid track-record of delivering strong financial performance measured in terms of net sales growth, margin expansion and free cash flow conversion (cash flow from operations less capital expenditures compared to net income). Since fiscal 2004, net sales have grown at a compound annual growth rate of 13% inclusive of acquisitions, and Adjusted EBITDA margins (Adjusted EBITDA divided by net sales) have expanded to 19.8%. Additionally, we have consistently delivered strong free cash flow over the past several years by improving working capital performance and maintaining capital expenditures at reasonable levels. By continually focusing on improving our overall operating performance and free cash flow conversion, we believe we can create long-term stockholder value by using our cash flows to manage our leverage, as well as to drive growth through acquisitions over time.

Leading Market Positions in Diversified End-Markets. Our high-margin performance is driven by industry leading positions in the diversified end-markets in which we compete. We estimate that greater than 85% of our net sales are derived from products in which we have leading market share positions. We believe we have achieved leadership positions in these markets through our focus on customer satisfaction, extensive offering of quality products, ability to service our customers globally, positive brand perception, highly engineered product lines, extensive specification efforts and market/application experience. We serve a diverse set of end-markets with our largest single end-market, mining, accounting for 13% of consolidated net sales in fiscal 2011.

Broad Portfolio of Highly Engineered, Specification-Driven Products. We believe we offer one of the broadest portfolios of highly engineered, specification-driven, project-critical products in the end-markets we serve. Our array of product applications, knowledge and expertise applied across our extensive portfolio of products allows us to work closely with our customers to design and develop solutions tailored to their individual specifications. Within our Water Management platform, our representatives work directly with engineers, contractors, builders and architects to “spec-in” our Water Management products early in the design phase of a project. We have found that once these customers have specified a company’s product with satisfactory results, they will generally use that company’s products in future projects. Furthermore, we believe our strong application engineering and new product development capabilities have contributed to our reputation as an innovator in each of our end-markets.

7

Large Installed Base, Extensive Distribution Network and Strong Aftermarket Revenues. Over the past century we have established relationships with OEMs and end-users across a diverse group of end-markets, creating a significant installed base for our Process & Motion Control products. This installed base generates significant aftermarket sales for us, as our Process & Motion Control products are consumed in use and must be replaced in relatively predictable cycles. In order to provide our customers with superior service, we have cultivated relationships with over 2,600 distributor locations serving our customers globally. Our Water Management platform has 23 manufacturing and warehouse facilities and uses approximately 90 third-party distribution facilities at which it maintains inventory. This broad distribution network provides us with a competitive advantage and drives demand for our Water Management products by allowing quick delivery of project-critical products to our customers facing short lead times. In addition, we believe this extensive distribution network also provides us with an opportunity to capitalize on the expanding renovation and repair market as building owners begin to upgrade existing commercial and institutional bathroom fixtures with high efficiency systems.

Significant Experience Identifying and Integrating Strategic Acquisitions. We have successfully completed and integrated several acquisitions in recent years totaling more than $1.3 billion of total transaction value, including our $942.5 million acquisition of Zurn. These strategic acquisitions have allowed us to establish and expand our Water Management platform, widen our geographic presence, broaden our product lines and, in other instances, move into adjacent markets. Since 2005, we have completed strategic acquisitions that have significantly expanded our Process & Motion Control platform and established and expanded our Water Management platform. We believe these acquisitions have created stockholder value through the implementation of RBS operating principles, which has resulted in identifying and achieving cost synergies, as well as driving growth and operational and working capital improvements.

Our Business Strategy

We strive to create stockholder value by seeking to deliver sales growth, profitability and asset efficiency, which we believe will result in superior financial performance and free cash flow generation when compared to other leading multi-platform industrial companies by driving the following key strategies:

Drive Profitable Growth. Our key growth strategies are:

| • | Accelerate Growth in Key Vertical End-Markets—We believe that we have an opportunity to accelerate our overall net sales growth over the next several years by deploying resources to leverage our highly engineered product portfolio, industry expertise, application knowledge and unique manufacturing capabilities into certain key vertical end-markets that we expect to have above market growth rate potential. We believe those end-markets include, but are not limited to, mining, energy, aerospace, cement and aggregates, food and beverage, water infrastructure and the renovation and repair of existing commercial buildings and infrastructure. |

| • | Product Innovation and Resourcing “Break-throughs”—We intend to continue to invest in strong application engineering and new product development capabilities and processes. Our disciplined focus on innovation begins with our extensive “Voice of the Customer” process and follows a systematic process, ensuring that the commercialization and profitability of new products meet both the markets’ and our expectations. Additionally, we will continue resourcing “break-throughs,” which we define as potential products or other growth opportunities that have an annual net sales potential of $20 million or more over 3 to 5 years. We believe growing demands for more energy and water conservation products will also provide opportunities for us to grow through innovation in both platforms. |

| • | Drive Specification for Our Products—We intend to increase our installed base and grow aftermarket revenues by continuing to partner with OEMs to specify our Process & Motion Control products on original equipment applications. Within our Water Management platform, we intend to leverage our sales and distribution network and to increase specification for our products by working directly with our customers to drive specification for our products in the early design stages of a project. |

| • | Expand Internationally—We believe there is substantial growth potential outside the United States for many of our existing products by expanding distribution, further penetrating key vertical end-markets that are growing faster outside the United States and selectively pursuing acquisitions that will provide us with additional international exposure. |

| • | Pursue Strategic Acquisitions—We believe the fragmented nature of our Process & Motion Control and Water Management markets will allow us to continue to identify attractive acquisition candidates in the future that have the potential to complement our existing platforms by either broadening our product offerings, expanding geographically or addressing an adjacent market opportunity. |

Platform Focused Strategies. We intend to build our business around leadership positions in platforms that participate in multi-billion dollar, global, growing end-markets. Within our two existing platforms, we expect to continue to leverage our overall market presence and competitive position to provide further growth and diversification and increase our market share.

8

The Rexnord Business System. We operate our company in a disciplined way through the Rexnord Business System. RBS is our operating philosophy and it creates a scalable, process-based framework that focuses on driving superior customer satisfaction and financial results by targeting world-class operating performance. We believe applying RBS can yield superior growth, quality, delivery and cost positions relative to our competition, resulting in enhanced profitability and ultimately the creation of stockholder value.

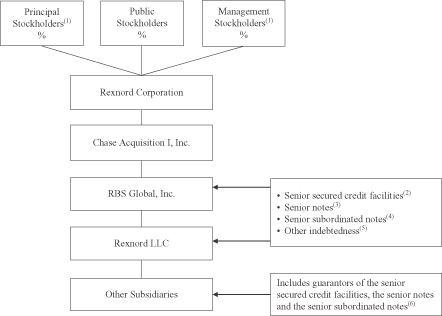

Our Ownership Structure

The chart below is a summary of our organizational structure after giving effect to our anticipated initial public offering (the “Parent offering”) and the redemption and prepayment of all of our PIK toggle senior indebtedness, which is expected to be completed in the first quarter of fiscal 2012 as described in “Capitalization.” Unless otherwise indicated, the indebtedness information below is as of March 31, 2011.

| (1) | Includes investment funds affiliated with, or co-investment vehicles managed by, Apollo Management VI, L.P., an affiliate of Apollo Management, L.P., which, as of March 31, 2011, collectively beneficially owned 93.8% of our common stock, with the balance beneficially owned by the management stockholders. |

| (2) | As of March 31, 2011, $761.5 million was outstanding. |

| (3) | As of March 31, 2011, $1,147.0 million was outstanding. |

| (4) | As of March 31, 2011, $300.0 million was outstanding. We intend to use a portion of the proceeds of the Parent offering to redeem $300.0 million in principal amount of the 11.75% senior subordinated notes due 2016. |

| (5) | As of March 31, 2011, $12.4 million was outstanding. Primarily consists of foreign borrowings and capitalized lease obligations. |

| (6) | Guarantors of the senior secured credit facilities, the senior notes and the senior subordinated notes include substantially all of the domestic operating subsidiaries of RBS Global as of the date of this exhibit other than Rexnord LLC, which is a co-issuer of the notes, but do not include any of its foreign subsidiaries. |

Our Principal Stockholders

Our principal stockholders are investment funds affiliated with, or co-investment vehicles managed by, Apollo Management VI, L.P., an affiliate of Apollo Management, L.P., which we collectively refer to herein as “Apollo” (unless the context otherwise indicates) and which prior to the Parent offering collectively beneficially owned 93.8% of our common stock. Apollo Investment Fund VI, L.P., which is the sole member of one of our principal stockholders, is an investment fund with committed capital, along with its co-investment affiliates, of approximately $10.1 billion. Apollo Management, L.P., is an affiliate of Apollo Global Management, LLC, a leading global alternative asset manager with offices in New York, Los Angeles, London, Frankfurt, Luxembourg, Singapore, Hong Kong and Mumbai. As of March 31, 2011, Apollo Global Management, LLC and its subsidiaries have assets under management of approximately $70 billion in private equity, hedge funds, distressed debt and mezzanine funds invested across a core group of industries where Apollo Global Management, LLC has considerable knowledge and resources.

9

The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or those we currently view to be immaterial may also materially and adversely affect our business, financial condition, results of operations or cash flows. Any of the following risks could materially and adversely affect our business, financial condition, results of operations or cash flows.

Apollo controls us and its interests may conflict with or differ from the interests of our stockholders.

After the consummation of the Parent offering, Apollo will beneficially own approximately % of our common stock, assuming the underwriters do not exercise their option to purchase additional shares, or % if the underwriters exercise their option in full. In addition, representatives of Apollo comprise 4 of our 8 directors. As a result, Apollo will continue to have the ability to prevent any transaction that requires the approval of our board of directors or stockholders, including the approval of significant corporate transactions such as mergers and the sale of substantially all of our assets.

The interests of Apollo could conflict with or differ from the interests of a holder of our common stock. For example, the concentration of ownership held by Apollo could delay, defer or prevent a change of control of us or impede a merger, takeover or other business combination that a stockholder may otherwise view favorably. Apollo is in the business of making or advising on investments in companies and holds, and may from time to time in the future acquire, interests in or provide advice to businesses that directly or indirectly compete with certain portions of our business or are suppliers or customers of ours. They may also pursue acquisitions that may be complementary to our business, and, as a result, those acquisition opportunities may not be available to us.

So long as Apollo continues to beneficially own a significant amount of our equity, even if such amount is less than 50%, it may continue to be able to strongly influence or effectively control our decisions.

Our organizational documents may impede or discourage a takeover, which could deprive our investors of the opportunity to receive a premium for their shares.

Provisions of our certificate of incorporation and bylaws may make it more difficult for, or prevent a third party from, acquiring control of us without the approval of our board of directors. These provisions include:

| • | having a classified board of directors; |

| • | establishing limitations on the removal of directors; |

| • | prohibiting cumulative voting in the election of directors; |

| • | empowering only the board to fill any vacancy on our board of directors, whether such vacancy occurs as a result of an increase in the number of directors or otherwise; |

| • | as long as Apollo continues to own more than 50% of our common stock, granting Apollo the right to increase the size of our board of directors and to fill the resulting vacancies at any time; |

| • | authorizing the issuance of “blank check” preferred stock without any need for action by stockholders; |

| • | eliminating the ability of stockholders to call special meetings of stockholders; |

10

| • | prohibiting stockholders to act by written consent if less than 50.1% of our outstanding common stock is controlled by Apollo; |

| • | requiring the approval of a majority of the board of directors (including a majority of the Apollo directors) to approve business combinations so long as Apollo owns 331/3% of the shares of common stock; and |

| • | establishing advance notice requirements for nominations for election to our board of directors or for proposing matters that can be acted on by stockholders at stockholder meetings. |

Our issuance of shares of preferred stock could delay or prevent a change of control of us. Our board of directors has the authority to cause us to issue, without any further vote or action by the stockholders, shares of preferred stock, par value $0.01 per share, in one or more series, to designate the number of shares constituting any series, and to fix the rights, preferences, privileges and restrictions thereof, including dividend rights, voting rights, rights and terms of redemption, redemption price or prices and liquidation preferences of such series. The issuance of shares of our preferred stock may have the effect of delaying, deferring or preventing a change in control without further action by the stockholders, even where stockholders are offered a premium for their shares.

Together, these charter and statutory provisions could make the removal of management more difficult and may discourage transactions that otherwise could involve payment of a premium over prevailing market prices for our common stock. Furthermore, the existence of the foregoing provisions, as well as the significant common stock beneficially owned by Apollo, could limit the price that investors might be willing to pay in the future for shares of our common stock. They could also deter potential acquirers of us, thereby reducing the likelihood that a stockholder could receive a premium for such common stock in an acquisition.

Despite our substantial indebtedness, we may still be able to incur significantly more indebtedness, which could have a material adverse effect on our business, financial condition, results of operations or cash flows.

The terms of the indentures governing our senior notes and senior subordinated notes and our senior secured credit facilities contain restrictions on our ability to incur additional indebtedness. These restrictions are subject to a number of important qualifications and exceptions, and the indebtedness, if any, incurred in compliance with these restrictions could be substantial. Accordingly, we or our subsidiaries could incur significant additional indebtedness in the future. As of March 31, 2011, we had approximately $121.7 million available for additional borrowing under the senior secured credit facilities (net of $28.3 million that was considered utilized as a result of the letters of credit), and the covenants under our debt agreements would allow us to borrow a significant amount of additional indebtedness. Additional leverage could have a material adverse effect on our business, financial condition, results of operations or cash flows and could increase the following risks described in the RBS Global and Rexnord LLC Annual Report on Form 10-K for the fiscal year ended March 31, 2011 filed with the Securities and Exchange Commission (“SEC”) on May 13, 2011 (the “RBS Global 10-K”): “Our substantial indebtedness could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry and prevent us from making debt service payments,” “Our debt agreements impose significant operating and financial restrictions, which could have a material adverse effect on our business, financial condition, results of operations or cash flows” and “Because a substantial portion of our indebtedness bears interest at rates that fluctuate with changes in certain prevailing short-term interest rates, we are vulnerable to interest rate increases.”

11

The additional requirements of having a class of publicly traded equity securities may strain our resources and distract management.

Even though RBS Global and Rexnord LLC currently file reports with the SEC, after the consummation of the Parent offering, we will be subject to additional reporting requirements of the Securities Exchange Act of 1934, or the Exchange Act, the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, and the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act. The Dodd-Frank Act, signed into law on July 21, 2010, effects comprehensive changes to public company governance and disclosures in the United States and will subject us to additional federal regulation. We cannot predict with any certainty the requirements of the regulations ultimately adopted or how the Dodd-Frank Act and such regulations will impact the cost of compliance for a company with publicly traded common stock. We are currently evaluating and monitoring developments with respect to the Dodd-Frank Act and other new and proposed rules and cannot predict or estimate the amount of the additional costs we may incur or the timing of such costs. These laws, regulations and standards are subject to varying interpretations, in many cases due to their lack of specificity, and, as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We intend to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expenses and a diversion of management’s time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, regulatory authorities may initiate legal proceedings against us and our business may be harmed. We also expect that being a company with publicly traded common stock and these new rules and regulations will make it more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. These factors could also make it more difficult for us to attract and retain qualified members of our board of directors, particularly to serve on our audit committee, and qualified executive officers.

The Sarbanes-Oxley Act requires that we maintain effective disclosure controls and procedures and internal control for financial reporting. These requirements may place a strain on our systems and resources. Under Section 404 of the Sarbanes-Oxley Act, we will be required to include a report of management on our internal control over financial reporting in our Annual Reports on Form 10-K. After consummation of the Parent offering, our independent public accountants auditing our financial statements must attest to the effectiveness of our internal control over financial reporting. This requirement will first apply to our Annual Report on Form 10-K for our year ending March 31, 2013. In order to maintain and improve the effectiveness of our disclosure controls and procedures and internal control over financial reporting, significant resources and management oversight will be required. This may divert management’s attention from other business concerns, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. If we are unable to conclude that our disclosure controls and procedures and internal control over financial reporting are effective, or if our independent public accounting firm is unable to provide us with an unqualified report as to management’s assessment of the effectiveness of our internal control over financial reporting in future years, investors may lose confidence in our financial reports and our stock price may decline.

12

We intend to use the net proceeds of the Parent offering (i) to redeem up to $300.0 million in aggregate principal amount of our 11.75% senior subordinated notes due 2016 plus early redemption premiums of $ million and accrued interest, (ii) to pay Apollo or its affiliates a fee of $ million upon the consummation of the Parent offering in connection with the termination of our management services agreement and (iii) for general corporate purposes. As of March 31, 2011, we had $300.0 million in aggregate principal amount of our 11.75% senior subordinated notes outstanding, which bear interest at a rate of 11.75% per annum and mature on August 1, 2016.

Any net proceeds used to redeem all $300.0 million of outstanding aggregate principal amount of our 11.75% senior subordinated notes would be first contributed by the Company to RBS Global so that RBS Global may effect such redemption or repayment. Pending the application of the net proceeds of the Parent offering, as described above, all or a portion of the net proceeds of the Parent offering may be invested by us in short-term interest bearing investments.

13

The following table sets forth Rexnord Corporation’s capitalization as of March 31, 2011:

| • | on an actual basis; |

| • | on a pro forma, as adjusted, basis giving effect to the repayment of the PIK toggle senior indebtedness as described below (which is occurring irrespective of the Parent offering); and |

| • | on a pro forma, as further adjusted, basis giving effect to our sale of shares of common stock in the Parent offering at an assumed offering price of $ , and our expected use of the net proceeds of the Parent offering, as well as the repayment of the PIK toggle senior indebtedness as described below (which is occurring irrespective of the Parent offering). |

You should read this table in conjunction with the financial statements and related notes for the fiscal year ended March 31, 2011 included in the RBS Global 10-K, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the RBS Global 10-K and “Use of Proceeds” included in this exhibit.

| As of March 31, 2011 (1) | ||||||||||||

| (in millions, except share amounts) | Actual | Pro forma as adjusted for extinguishment of PIK toggle senior indebtedness |

Pro forma as further adjusted (2) |

|||||||||

| Debt: |

||||||||||||

| Term loans |

$ | 761.5 | $ | 761.5 | $ | 761.5 | ||||||

| Borrowing under revolving credit facility |

— | — | — | |||||||||

| Accounts receivable securitization program |

— | — | — | |||||||||

| PIK toggle senior indebtedness (3) |

93.2 | — | — | |||||||||

| 8.50% senior notes due 2018 |

1,145.0 | 1,145.0 | 1,145.0 | |||||||||

| 8.875% senior notes due 2016 |

2.0 | 2.0 | 2.0 | |||||||||

| 11.75% senior subordinated notes due 2016 |

300.0 | 300.0 | — | |||||||||

| Other (4) |

12.4 | 12.4 | 12.4 | |||||||||

| Total debt, including current portion |

2,314.1 | 2,220.9 | 1,920.9 | |||||||||

| Stockholders’ equity (deficit): |

||||||||||||

| Common stock, $0.01 par value; shares authorized and shares issued (5) |

0.2 | 0.2 | ||||||||||

| Additional paid-in capital |

293.3 | 293.3 | ||||||||||

| Retained earnings (deficit) (6) |

(391.5 | ) | (392.0 | ) | ||||||||

| Accumulated other comprehensive income |

16.1 | 16.1 | ||||||||||

| Treasury stock at cost (216,423 shares) |

(6.3 | ) | (6.3 | ) | ||||||||

| Total stockholders’ equity (deficit) |

(88.2 | ) | (88.7 | ) | ||||||||

| Total capitalization |

$ | 2,225.9 | 2,132.2 | |||||||||

| (1) | As of March 31, 2011 we had cash and cash equivalents of $391.0 million on a historical basis, $296.9 million on a pro forma basis, as adjusted for the extinguishment of our PIK toggle senior indebtedness, and $ million, on a pro forma basis, as further adjusted to give effect to the Parent offering. |

| (2) | A $1.00 increase (decrease) in the assumed initial public offering price of $ per share each of cash, additional paid-in capital and total capitalization by $ , assuming the number of shares offered by us remains the same and after deducting the estimated underwriting discounts and commissions and estimated expenses payable by us. |

14

| (3) | Includes unamortized original issue discount of $0.4 million at March 31, 2011. We have prepaid $53.7 million in principal amount of this indebtedness on May 13, 2011, and have commenced procedures to extinguish the remaining balance of the Company’s PIK toggle senior indebtedness at face value in June 2011. This extinguishment has been or will be funded through our existing liquidity and is not dependent on proceeds from the Parent offering. |

| (4) | Primarily consists of foreign borrowings and capital lease obligations. |

| (5) | We expect to complete a for one stock split of our common stock prior to the completion of the Parent offering. All share amounts have been retroactively adjusted to give effect to this stock split. |

| (6) | Pro forma as further adjusted retained deficit reflects the impact of the Parent offering and the intended use of proceeds. |

15

Board of Directors and Executive Officers

The following table sets forth information concerning our directors and executive officers as of the date of this exhibit:

| Name |

Age |

Position(s) | ||||

| George M. Sherman |

69 | Chairman of the Board and Director | ||||

| Todd A. Adams |

40 | President, Chief Executive Officer and Director | ||||

| George C. Moore |

56 | Executive Vice President | ||||

| Michael H. Shapiro |

40 | Vice President and Chief Financial Officer | ||||

| Praveen R. Jeyarajah |

43 | Executive Vice President-Corporate & Business Development and Director | ||||

| Laurence M. Berg |

45 | Director | ||||

| Peter P. Copses |

52 | Director | ||||

| Damian J. Giangiacomo |

34 | Director | ||||

| Steven Martinez |

42 | Director | ||||

| John S. Stroup |

45 | Director | ||||

The following is information about the experience and attributes of the members of our board of directors as of the date of this exhibit.

Board of Directors

George M. Sherman has been our Non-Executive Chairman and a director since 2002. Mr. Sherman is a principal of Cypress Group LLC. Mr. Sherman also currently serves as the non-executive Chairman of Jacuzzi Brands Corp. and has served as the Chairman of Campbell Soup Company from 2001 to 2004. Prior to his service with Campbell Soup, Mr. Sherman was the Chief Executive Officer at Danaher Corporation, a manufacturer of process/environmental controls and tools and components, from 1990 to 2001. Prior to joining Danaher, he was Executive Vice President at Black & Decker Corporation. Mr. Sherman serves on our board of directors because he has significant experience and expertise in the manufacturing industry (including as chief executive officer), mergers and acquisitions and strategy development and continues to serve because of his in-depth knowledge of Rexnord and our business.

Todd A. Adams became our President and Chief Executive Officer in September 2009 and became a director in October 2009. Mr. Adams joined us in 2004 as Vice President, Treasurer and Controller; he has also served as Senior Vice President and Chief Financial Officer from April 2008 to September 2009 and as President of the Water Management platform in 2009. Prior to joining us, Mr. Adams held various positions at The Boeing Company, APW Ltd. and Applied Power Inc. (currently Actuant Corporation). Mr. Adams serves on our board of directors because he has significant experience in the manufacturing industry and an in-depth knowledge of Rexnord and our business and because he is our Chief Executive Officer.

Praveen R. Jeyarajah became our Executive Vice President—Corporate & Business Development in April 2010. Mr. Jeyarajah first became a director in connection with the Carlyle Acquisition in 2002 and served in that capacity until the Apollo acquisition in July 2006. Mr. Jeyarajah again became a director in October 2006. Prior to becoming our Executive Vice President—Corporate & Business Development, Mr. Jeyarajah was a Managing Director at Cypress Group, LLC from 2006 to 2010 and a Director of Jacuzzi Brands Corp. until 2010. Mr. Jeyarajah was also a Managing Director of Carlyle from 2000 to 2006. Prior to joining Carlyle, Mr. Jeyarajah was with Saratoga Partners from 1996 to 2000 and, prior to that, he worked at Dillon, Read & Co., Inc. Mr. Jeyarajah serves on our board of directors because he has significant investment expertise and experience with mergers and acquisitions, including leveraged buyouts, and he continues to serve because of his in-depth knowledge of Rexnord and our business.

Laurence M. Berg became a director in July 2006 upon consummation of the Apollo acquisition. Mr. Berg is a Senior Partner of Apollo Management, L.P., where he has worked since 1992. Prior to joining Apollo, Mr. Berg was a member of the Mergers and Acquisition Group at Drexel Burnham Lambert, an investment banking firm. Mr. Berg is also a director of Jacuzzi Brands Corp., Connections Academy LLC, Panolam Industries International, Inc. and ABC Supply Co. Inc., and has previously served as a director of Bradco Supply Corp., Educate, Inc., GNC Corp., Goodman Global Holdings, Inc., Hayes Lemmerz International, Inc. and Rent A Center, Inc. Mr. Berg serves on our board of directors because he has significant experience making and managing private equity investments on behalf of Apollo and has over 20 years of experience financing, analyzing and investing in public and private companies. In addition, Mr. Berg worked with the diligence team for Apollo at the time of the Apollo acquisition and has worked closely with our management since that time; therefore, pursuant to a stockholders agreement, Apollo appointed him to the board.

16

Peter P. Copses became director in July 2006 upon consummation of the Apollo acquisition. Mr. Copses is a Senior Partner of Apollo Management, L.P., where he has worked since 1990. Prior to joining Apollo, Mr. Copses was an investment banker at Drexel Burnham Lambert, and subsequently at Donaldson, Lufkin & Jenrette Securities, primarily concentrating on the structuring, financing and negotiation of mergers and acquisitions. Mr. Copses is also a director of Claire’s Stores, Inc. and CKE Restaurants, Inc., and has previously served as a director of Linens N’ Things, Inc., GNC Corp., Rent A Center, Inc. and Smart & Final, Inc. Mr. Copses serves on our board of directors because he has significant experience making and managing private equity investments on behalf of Apollo and has over 25 years of experience financing, analyzing and investing in public and private companies; therefore, pursuant to a stockholders agreement, Apollo appointed him to the board.

Damian J. Giangiacomo became a director in October 2006. Mr. Giangiacomo is a principal of Apollo Management, L.P., where he has been employed since July 2000. Prior to joining Apollo, Mr. Giangiacomo was an investment banker at Morgan Stanley & Co. Mr. Giangiacomo is also a director of Jacuzzi Brands Corp. and Connections Academy LLC, and has previously served as director of Linens N’ Things, Inc. Mr. Giangiacomo serves on our board of directors because he has significant experience making and managing private equity investments on behalf of Apollo and has over 10 years of experience financing, analyzing and investing in public and private companies. In addition, Mr. Giangiacomo worked with the diligence team for Apollo at the time of the Apollo acquisition and has worked closely with our management since that time; therefore, pursuant to a stockholders agreement, Apollo appointed him to the board.

Steven Martinez became a director in July 2006 upon the consummation of the Apollo acquisition. Mr. Martinez is a Senior Partner of Apollo Management, L.P. Prior to joining Apollo in 2000, Mr. Martinez worked for Goldman Sachs & Co. and Bain & Company, Inc. Mr. Martinez also serves as a director of Prestige Cruise Holdings, Inc., NCL Corporation Ltd., Hughes Telematics, Inc., Jacuzzi Brands Corp., Principal Maritime and Veritable Maritime Holdings, LLC, and has previously served as a director of Allied Waste Industries, Inc. and Goodman Global Holdings, Inc. Mr. Martinez serves on our board of directors because he has significant experience making and managing private equity investments on behalf of Apollo and has over 15 years of experience financing, analyzing and investing in public and private companies. In addition, Mr. Martinez worked with the diligence team for Apollo at the time of the Apollo acquisition and has worked closely with our management since that time; therefore, pursuant to a stockholders agreement, Apollo appointed him to the board.

John S. Stroup became a director in October 2008. Mr. Stroup is currently president and chief executive officer and a member of the board of directors of Belden Inc., a company listed on the New York Stock Exchange, that designs, manufactures, and markets cable, connectivity, and networking products in markets including industrial automation, enterprise, transportation, infrastructure, and consumer electronics. Prior to joining Belden Inc. in 2005, Mr. Stroup was employed by Danaher Corporation, a manufacturer of process/environmental controls and tools and components. At Danaher, Mr. Stroup initially served as Vice President, Business Development. He was promoted to President of a division of Danaher’s Motion Group and later to Group Executive of the Motion Group. Prior to that, he was Vice President of Marketing and General Manager with Scientific Technologies Inc. Mr. Stroup serves on our board of directors because he has significant experience in strategic planning and general management of business units of public companies (including as chief executive officer).

Executive Officers

The following is information about the executive officers of the Company as of the date of this exhibit.

Todd A. Adams became our President and Chief Executive Officer in September 2009 and became a member of our board of directors in October 2009. See “Board of Directors” above.

George C. Moore became our Executive Vice President in September 2006. During his tenure with Rexnord, Mr. Moore has served as Chief Financial Officer from 2006 to April 2008, as Acting Chief Financial Officer from September 2009 to February 2010 and as Treasurer from 2006 to 2010. Mr. Moore has also served as a Director of Jacuzzi Brands Corp. from 2008 to 2009 and as the Executive Vice President and Chief Financial Officer of Maytag Corporation, a manufacturer of major appliances and household products, from 2003 to 2006. Prior to that, Mr. Moore served as Group Vice President of Finance at Danaher Corporation, where he was employed since 1993. Mr. Moore also serves on the advisory board of FM Global.

Michael H. Shapiro became our Vice President and Chief Financial Officer in February 2010. Prior to joining Rexnord, Mr. Shapiro served as Vice President, Finance and Business Development for the Renal Division of Baxter International Inc., a global medical device and biopharmaceutical manufacturer, since 2008. Mr. Shapiro, who joined Baxter in 1995, also held various other positions with Baxter, including Vice President, Corporate Financial Planning and Analysis; Vice President and Assistant Treasurer, Corporate Treasury; Director of Investor Relations, Corporate; Director of Global Operations Finance, BioScience Division; and Director of Global Finance, BioScience Division. Mr. Shapiro, a certified public accountant, worked at Deloitte & Touche LLP, a public accounting firm, from 1992 to 1995.

17

Praveen R. Jeyarajah became our Executive Vice President—Corporate & Business Development in April 2010 and became a member of our board of directors in October 2006 (he also served as a member of the board of directors from 2002 to May 2006). See “Board of Directors” above.

Composition of Board of Directors

Upon the closing of the Parent offering, the Company will have directors. We intend to avail ourselves of the “controlled company” exception under the New York Stock Exchange rules, which eliminates the requirements that we have a majority of independent directors on our board of directors and that we have compensation and nominating/corporate governance committees composed entirely of independent directors. We will be required, however, to have an audit committee with one independent director during the 90-day period beginning on the date of effectiveness of the registration statement filed with the SEC in connection with the Parent offering. After such 90-day period and until one year from the date of effectiveness of the registration statement, we will be required to have a majority of independent directors on our audit committee. Thereafter, we will be required to have an audit committee comprised entirely of independent directors.

If at any time we cease to be a “controlled company” under the New York Stock Exchange rules, the board of directors will take all action necessary to comply with the applicable New York Stock Exchange rules, including appointing a majority of independent directors to the board of directors and establishing certain committees composed entirely of independent directors, subject to a permitted “phase-in” period.

Upon consummation of the Parent offering, our board of directors will be divided into three classes. The members of each class will serve staggered, three-year terms (other than with respect to the initial terms of the Class I and Class II directors, which will be one and two years, respectively). Upon the expiration of the term of a class of directors, directors in that class will be elected for three-year terms at the annual meeting of stockholders in the year in which their term expires. Upon consummation of the Parent offering:

| • |

, and will be Class I directors, whose initial terms will expire at the 2012 annual meeting of stockholders; |

| • |

, and will be Class II directors, whose initial terms will expire at the 2013 annual meeting of stockholders; and |

| • | , , and will be Class III directors, whose initial terms will expire at the 2014 annual meeting of stockholders. |

Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors. This classification of our board of directors may have the effect of delaying or preventing changes in control.

At each annual meeting, our stockholders will elect the successors to our directors. Any director may be removed from office by a majority of our stockholders. Our executive officers and key employees serve at the discretion of our board of directors. Directors may be removed for cause by the affirmative vote of the holders of a majority of our common stock.

Committees of our Board of Directors

Upon consummation of the Parent offering, our board of directors will have three standing committees: an audit committee, a compensation committee and a nominating and corporate governance committee.

Audit Committee

Following the consummation of the Parent offering, our Audit Committee will consist of (Chair), and . Our board of directors has determined that qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K and that is independent as independence is defined in Rule 10A-3 of the Exchange Act and under the New York Stock Exchange listing standards. The principal duties and responsibilities of our Audit Committee will be as follows:

| • | to prepare annual Audit Committee report to be included in our annual proxy statement; |

| • | to oversee and monitor our financial reporting process; |

| • | to oversee and monitor the integrity of our financial statements and internal control system; |

18

| • | to oversee and monitor the independence, retention, performance and compensation of our independent auditor; |

| • | to oversee and monitor the performance, appointment and retention of our senior internal audit staff person; |

| • | to discuss, oversee and monitor policies with respect to risk assessment and risk management; |

| • | to oversee and monitor our compliance with legal, ethical and regulatory matters; and |

| • | to provide regular reports to the board. |

The Audit Committee will also have the authority to retain counsel and advisors to fulfill its responsibilities and duties and to form and delegate authority to subcommittees.

Compensation Committee

Following the consummation of the Parent offering, our Compensation Committee will consist of (Chair), and . The principal duties and responsibilities of the Compensation Committee will be as follows:

| • | to review, evaluate and make recommendations to the full board of directors regarding our compensation policies and programs; |

| • | to review and approve the compensation of our chief executive officer, other officers and key employees, including all material benefits, option or stock award grants and prerequisites and all material employment agreements, confidentiality and non-competition agreements; |

| • | to review and make recommendations to the board of directors with respect to our incentive compensation plans and equity-based compensation plans; |

| • | to administer incentive compensation and equity-related plans; |

| • | to review and make recommendations to the board of directors with respect to the financial and other performance targets that must be met; |

| • | to set and review the compensation of members of the board of directors; and |

| • | to prepare an annual compensation committee report and take such other actions as are necessary and consistent with the governing law and our organizational documents. |

We intend to avail ourselves of the “controlled company” exception under the New York Stock Exchange rules which exempts us from the requirement that we have a compensation committee composed entirely of independent directors.

Nominating and Corporate Governance Committee

Prior to consummation of the Parent offering, our board of directors will establish a Nominating and Corporate Governance Committee. Following the consummation of the Parent offering, our Nominating and Corporate Governance Committee will consist of (Chair), and . The principal duties and responsibilities of the Nominating and Corporate Governance Committee will be as follows:

| • | to identify candidates qualified to become directors of the Company, consistent with criteria approved by our board of directors; |

| • | to recommend to our board of directors nominees for election as directors at the next annual meeting of stockholders or a special meeting of stockholders at which directors are to be elected, as well as to recommend directors to serve on the other committees of the board; |

| • | to recommend to our board of directors candidates to fill vacancies and newly created directorships on the board of directors; |

| • | to identify best practices and recommend corporate governance principles, including giving proper attention and making effective responses to stockholder concerns regarding corporate governance; |

| • | to develop and recommend to our board of directors guidelines setting forth corporate governance principles applicable to the Company; and |

| • | to oversee the evaluation of our board of directors and senior management. |

19

We intend to avail ourselves of the “controlled company” exception under the New York Stock Exchange rules which exempts us from the requirement that we have a Nominating and Corporate Governance Committee composed entirely of independent directors.

Code of Business Conduct and Ethics

We have a Code of Business Conduct and Ethics that applies to all of our associates, including our principal executive officer, principal financial officer and principal accounting officer, or persons performing similar functions. These standards are designed to deter wrongdoing and to promote honest and ethical conduct. Excerpts from the Code of Business Conduct and Ethics, which address the subject areas covered by the SEC’s rules, will be posted on our website: www.rexnord.com under “Investor Relations.” Any substantive amendment to, or waiver from, any provision of the Code of Business Ethics with respect to any senior executive or financial officer will also be posted on our website. The information contained on our website is not part of this exhibit.

20