Attached files

Table of Contents

As filed with the Securities and Exchange Commission on May 26, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GenMark Diagnostics, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 3841 | 27-2053069 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

5964 La Place Court

Carlsbad, CA 92008

(760) 448-4300

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Hany Massarany

Chief Executive Officer and President

GenMark Diagnostics, Inc.

5964 La Place Court

Carlsbad, CA 92008

(760) 448-4300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Michael S. Kagnoff, Esq. DLA Piper LLP (US) 4365 Executive Drive, Suite 1100 San Diego, CA 92121 Tel: (858) 677-1400 Fax: (858) 677-1401 |

Timothy R. Curry, Esq. Jones Day 1755 Embarcadero Road Palo Alto, CA 94303 Tel: (650) 739-3939 Fax: (650) 739-3900 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer |

¨ |

Accelerated filer | ¨ | |||

| Non-accelerated filer |

x (Do not check if a smaller reporting company) |

Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Proposed Aggregate Offering Price(1) |

Amount of Registration Fee | ||

| Common Stock, $0.0001 par value per share |

$28,750,000 | $3,338 | ||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act. Includes the offering price of additional shares of common stock that the underwriters have the option to purchase. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange Commission declares our registration statement effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated May 26, 2011

shares

GENMARK DIAGNOSTICS, INC.

Common Stock

We are offering shares of our common stock. Our common stock is traded on the NASDAQ Global Market under the symbol “GNMK.” On May 25, 2011, the last reported sale price of our common stock on the NASDAQ Global Market was $5.85 per share.

Investing in our common stock involves a high degree of risk. Please see the section entitled “Risk Factors” starting on page 9 of this prospectus to read about risks you should consider carefully before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to GenMark Diagnostics, Inc. |

$ | $ | ||||||

We have granted the underwriters a 30-day option to purchase up to an additional shares of our common stock at the public offering price, less the underwriting discount, to cover any over-allotments.

The underwriters expect to deliver the shares on or about , 2011.

Sole Book-Running Manager

Canaccord Genuity

Co-Lead Manager

William Blair & Company

The date of this prospectus is , 2011

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 9 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 35 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

37 | |||

| 50 | ||||

| 71 | ||||

| 77 | ||||

| 89 | ||||

| 91 | ||||

| 93 | ||||

| 96 | ||||

| CERTAIN MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX CONSIDERATIONS TO NON-U.S. HOLDERS |

98 | |||

| 101 | ||||

| 104 | ||||

| 104 | ||||

| 104 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell, nor are we or the underwriters seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus is complete and accurate as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

No action is being taken in any jurisdiction outside of the United States to permit a public offering of the common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in any jurisdiction outside of the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

eSensor®, Osmetech®, GenMarkDx™ and our logo are our trademarks. This prospectus also includes trademarks, trade names and service marks that are the property of other organizations.

i

Table of Contents

The items in the following summary are described in more detail later in this prospectus. This summary provides an overview of selected information and does not contain all the information you should consider. Therefore, you should also read the more detailed information set out in this prospectus and the financial statements included elsewhere in this prospectus. In this prospectus, unless the context otherwise requires, references to “we,” “us” or “our” refer to GenMark Diagnostics, Inc.

Our Company

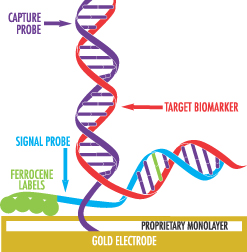

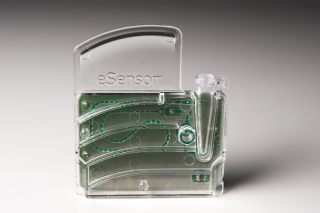

We are a molecular diagnostics company focused on developing and commercializing our proprietary eSensor detection technology. Our proprietary electrochemical technology enables fast, accurate and highly sensitive detection of up to 72 distinct biomarkers in a single sample. Our XT-8 system received 510(k) clearance from the Food and Drug Administration, or FDA, and is designed to support a broad range of molecular diagnostic tests with a compact and easy-to-use workstation and self-contained, disposable test cartridges. Within 30 minutes of receipt of an amplified DNA sample, our XT-8 system produces clear and accurate results. Our XT-8 system supports between one and three analyzers. Each analyzer holds up to eight independent test cartridges, resulting in the XT-8 system supporting up to 24 test cartridges, each of which can be run independently, resulting in a convenient and flexible workflow for our target customers, which are hospitals and reference laboratories. As of March 31, 2011, we had an installed base of 102 analyzers, or placements, with our customers.

We have developed four diagnostic tests for use with our XT-8 system and expect to expand this test menu by introducing two to four new tests annually. Three of our diagnostic tests have received FDA clearance, including our Cystic Fibrosis Genotyping Test, which detects pre-conception risks of cystic fibrosis, our Warfarin Sensitivity Test, which determines an individual’s ability to metabolize the oral anticoagulant warfarin, and our Thrombophilia Risk Test, which detects an individual’s increased risk of blood clots. We have demonstrated 100% accuracy in clinical studies compared to DNA sequencing in our Cystic Fibrosis Genotyping Test, our Warfarin Sensitivity Test and our Thrombophilia Risk Test. We have also developed a Respiratory Viral Panel Test, which detects the presence of major respiratory viruses and is labeled for investigational use only, or IUO. We intend to seek FDA clearance for our Respiratory Viral Panel Test in 2011. We also have a pipeline of several additional potential products in different stages of development or design, including diagnostic tests for an individual’s sensitivity to Plavix, a commonly prescribed anti-coagulant, and for mutations in a gene known as K-ras, which is predictive of an individual’s response rates to certain prescribed anti-cancer therapies.

We are also developing our next-generation platform, the NexGen system. We are designing the NexGen system (formerly referred to as the AD-8 system) to integrate automated nucleic acid extraction and amplification with our eSensor detection technology to enable technicians to place a raw or a minimally prepared patient sample into our test cartridge and obtain results without any additional steps. This sample-to-answer capability is enabled by the robust nature of our eSensor detection technology, which is not impaired by sample impurities that we believe hinder competing technologies. We are designing our NexGen system to further simplify workflow and provide powerful, cost-effective molecular diagnostics solutions to a significantly expanded group of hospitals and reference laboratories.

Our XT-8 system and planned menu of tests are intended to improve patient care and physician practices by providing high value, clinically useful information that aids in the diagnosis of disease and the selection of treatments tailored to an individual’s genetic profile. We believe that these improvements in patient care are economically attractive to our customers who are generally reimbursed for these tests by third-party payors and managed care providers through established reimbursement codes. Because the XT-8 system is designed to be flexible and easy-to-use, we believe that our customers will choose to perform a broad range of tests on our platform, in some cases providing our customers with the capability to perform diagnostic tests that they were

1

Table of Contents

not previously able to complete. By focusing our product development and commercialization efforts on high value, clinically useful opportunities in genetic and infectious diseases, cancer and personalized medicine, we believe we will drive widespread clinical adoption of our products.

Our Strategy

Our goal is to become the market leading provider of automated, multiplex molecular diagnostic testing systems. We intend to expand the use of our XT-8 system and diagnostic tests targeting mainly those reference laboratories and hospitals in the United States which perform a high volume of molecular diagnostic tests. To achieve this objective, we intend to:

| • | expand our menu of clinical diagnostic products; |

| • | grow our installed base of customers; |

| • | increase utilization of tests with our customers; |

| • | develop and commercialize our NexGen system; and |

| • | expand internationally and explore out-licensing opportunities. |

Market Opportunity and Limitations of Current Technologies

The U.S. market for molecular diagnostics was estimated to be $1.9 billion in 2009 and is anticipated to reach $3.4 billion in 2014 according to L.E.K., a market research firm. Many factors are driving growth of this market, including the expansion of genetic testing for disease predisposition, advances in personalized medicine, such as the tailoring of cancer therapies to those individuals most likely to respond, and increased demand for infectious disease diagnostics panels.

Commercially available molecular diagnostic testing systems, as well as “home-brew” or laboratory developed tests, or LDTs, are characterized by the following limitations:

Limited Menu of Diagnostic Tests. We believe LDTs are typically custom designed for one specific genetic biomarker or disease. In addition, we believe testing systems marketed as alternatives to LDTs currently offer only a limited number of tests for use with such systems.

Inability to Multiplex. Testing systems often lack the capacity to multiplex, or test for multiple biomarkers at the same time on a single patient sample. As a result, the laboratory must perform multiple, separate tests.

Poor Laboratory Workflow. Many LDTs and testing systems require significant sample preparation and washing steps, frequent calibration and time-consuming maintenance.

Risk of Human Error and Contamination. Many LDTs and testing systems require technicians to perform complex manual procedures, which may lead to contamination. In addition, LDTs and many testing systems require the operator to interpret results, which increases the potential for human error.

Intensive Resource Requirements. Laboratories need highly skilled technicians and dedicate significant capital, labor and laboratory space to conduct molecular diagnostic tests. Many multiplex tests currently used by national reference laboratories are so specialized that we believe only a limited number of their sites can perform these tests.

Shifting Regulatory Environment. Many LDTs and testing systems have not been submitted for FDA clearance. The FDA has imposed regulatory requirements on laboratories that use these tests. In the future, the FDA may further restrict use of non-FDA-cleared tests.

2

Table of Contents

Our Solution

Our XT-8 system is an automated molecular diagnostic system that enables reference laboratories and hospitals to perform fast, accurate and easy-to-use molecular diagnostic tests. The XT-8 system, which employs our proprietary electrochemical detection technology, consists of a compact bench-top workstation with an integrated touch screen computer and an analyzer module into which the self-contained, disposable test cartridges are inserted. The XT-8 system is user-friendly, intuitive, requires minimal maintenance and provides laboratories with the ability to perform multiplex molecular diagnostic tests in an efficient and cost-effective manner. Specifically, we believe that our XT-8 system and related diagnostic tests offer reference laboratories and hospitals the following benefits:

Versatile Platform for a Broad Menu. Our XT-8 system has broad application across a number of areas in molecular diagnostic testing. In addition to our FDA-cleared Cystic Fibrosis Genotyping Test, Warfarin Sensitivity Test and Thrombophilia Risk Test, and our Respiratory Viral Panel Test, which is labeled for IUO, we have a pipeline of several additional products in development or design in the fields of pharmacogenetics, genetic diseases, infectious diseases and cancer. We are currently developing a Plavix Sensitivity Test and a K-ras Mutation Test, and we have a pipeline of potential products in various stages of development or design. Laboratories using our system will be able to run our additional tests without any further capital investment or operator training.

FDA-Cleared Products. We have received FDA clearance for our Cystic Fibrosis Genotyping Test, Warfarin Sensitivity Test and Thrombophilia Risk Test, while our Respiratory Viral Panel Test is labeled for IUO. We intend to submit our Respiratory Viral Panel Test to the FDA for clearance in 2011. We intend to utilize IUO-labeled products in clinical studies within the broader process of seeking FDA clearance for our diagnostic tests.

Ease of Use. Our XT-8 system eliminates the need to use complex instrumentation to generate test results. Our XT-8 system minimizes manual processing steps and streamlines data analysis, making molecular diagnostic testing available to a broad spectrum of laboratories without the need for highly skilled technicians. As a result, our XT-8 system can provide national reference laboratories with the ability to perform our menu of molecular diagnostic tests across all of their locations. We also designed our XT-8 system to require minimal maintenance.

Accuracy and Reliability. Our XT-8 system provides accurate and reliable molecular diagnostic test results. We have demonstrated 100% accuracy in clinical studies compared to DNA sequencing in our Cystic Fibrosis Genotyping Test, our Warfarin Sensitivity Test and our Thrombophilia Risk Test. Our XT-8 system limits technician contact with a patient sample, thereby reducing contamination risk. It also provides clear reports, minimizing the risk of human error and increasing the repeatability of test results.

Enhanced Laboratory Work Flow. Our unique platform allows for random access, or the ability to initiate tests while other tests are in progress, resulting in a highly convenient and flexible workflow. Our XT-8 system provides random access for up to 24 independent test cartridges. In addition, our proprietary electrochemical detection technology streamlines the sample preparation process and eliminates the need for the additional washing steps required by some other detection methods, such as optical or fluorescent detection. Laboratories using our XT-8 system can expect to obtain test results within 30 minutes of receipt of the amplified DNA sample, resulting in a total turnaround time of generally under four hours.

Multiplex Capability. Our XT-8 system can detect up to 72 separate biomarkers in a single test cartridge. This allows laboratories to run multiple tests or panels on an individual patient sample in a one-step detection process. This capability reduces the time required for a laboratory to perform a diagnostic analysis that involves multiple genetic markers or infectious disease pathogens, which otherwise would require the laboratory to run multiple, separate molecular diagnostic tests.

3

Table of Contents

Our Diagnostic Tests

We currently offer four diagnostic tests for use with our XT-8 System, three of which have received 510(k) clearance from the FDA and one of which is currently labeled for IUO. We also have eight additional diagnostic tests in the development or design stage.

| Test |

Intended Application | |

| FDA-Cleared Tests |

||

| Cystic Fibrosis Genotyping |

Detects the most common mutations associated with cystic fibrosis | |

| Warfarin Sensitivity |

Identifies biomarkers associated with an individual’s ability to metabolize the oral anti-coagulant warfarin | |

| Thrombophilia Risk |

Detects the most common mutations associated with increased risk of blood clots | |

| IUO Test |

||

| Respiratory Viral Panel |

Detects major respiratory viruses and aids in the identification of respiratory infections | |

| Tests in Development or Design |

||

| Plavix Sensitivity |

Identifies biomarkers associated with the metabolism of Plavix, a commonly prescribed anti-coagulant | |

| K-ras Mutation |

Detects mutations in the K-ras gene associated with response to anti-epidermal growth factor receptor therapy, or anti-EGFR therapy, a type of cancer treatment that interferes with the growth of cancer cells | |

| Lower Respiratory Tract Infections |

Detects major viral and bacterial causes of lower respiratory tract infections | |

| Central Nervous System Infections |

Detects major infectious agents associated with meningitis and encephalitis | |

| Hepatitis C Virus Genotyping |

Identifies type and subtype of the hepatitis C virus | |

| 2D6 Tamoxifen Metabolism |

Identifies patients with altered 2D6 metabolism that can affect the effectiveness of tamoxifen, a drug used for the prevention and treatment of breast cancer | |

| EGFR Pathway |

Detects mutations in other genes besides K-ras involved in EGFR signaling | |

| Human Papillomavirus Genotyping |

Identifies human papillomavirus types associated with cervical cancer | |

Our NexGen System

We are developing our next-generation testing system to integrate automated nucleic acid extraction and amplification. We are designing the NexGen system (formerly referred to as our AD-8 system) to allow a technician to place a raw or minimally prepared patient sample into our test cartridge and then insert the cartridge into the NexGen system with no further user intervention. The NexGen system is designed to achieve full sample-to-answer capability. The NexGen system will provide the same customer benefits of the XT-8 system and further enhance workflow by significantly reducing or eliminating the level of sample processing required and incorporating amplification. We believe this advancement will make our eSensor technology attractive to the broad range of institutions that currently lack the technical or economic resources to perform molecular diagnostic testing. We believe the NexGen system may expand our target user base from approximately 1,000 to over 5,000 potential laboratories and hospitals in the United States.

The NexGen system is currently in development with substantial technical feasibility completed using diluted blood in our Warfarin Sensitivity Test. The NexGen system leverages the base technology and system hardware from our XT-8 system to reduce risk and accelerate the development of the automated sample preparation and amplification features. We believe our approach to a sample-to-answer system will achieve benefits over other competitive multiplex systems, which require extensive sample processing procedures in addition to other complex sample manipulations throughout their test process.

4

Table of Contents

Selected Risk Factors

Investing in our common stock involves substantial risk. Before participating in this offering, you should carefully consider all of the information in this prospectus, including risks discussed in “Risk Factors” beginning on page 9. Some of our most significant risks are:

| • | We have a history of net losses and we may never achieve or maintain profitability. |

| • | We may need to raise additional funds in the future, and such funds may not be available on a timely basis, or at all. |

| • | We are reliant on the commercial success of our XT-8 System and our FDA-cleared diagnostic tests. |

| • | We may fail to successfully expand the menu of diagnostic tests for our XT-8 System, obtain licenses to additional biomarkers on commercially reasonable terms or effectively predict the types of tests our existing customers want. |

| • | Our products could infringe patent rights of others, which may require costly litigation and, if we are not successful, could cause us to pay substantial damages or limit our ability to commercialize our products. |

| • | Our sales depend on third-party payors reimbursing our customers for the use of our products at levels sufficient for us to sell our products profitably. |

| • | We may not be successful in developing our NexGen system. |

Reorganization

GenMark Diagnostics, Inc., or GenMark, was formed by Osmetech plc, or Osmetech, in Delaware in February 2010 and had no operations prior to our initial public offering which was completed in June 2010. Immediately prior to the closing of our initial public offering, GenMark acquired all of the outstanding ordinary shares of Osmetech in a reorganization under the applicable laws of the United Kingdom. As a result of the reorganization, all of the issued ordinary shares in Osmetech were cancelled in consideration of (i) the issuance of common stock of GenMark to the former shareholders of Osmetech and (ii) the issuance of new shares in Osmetech to GenMark. Following the reorganization, Osmetech became a wholly-owned subsidiary of GenMark, and the former shareholders of Osmetech held shares of GenMark. Any historical discussion of GenMark prior to the reorganization relates to Osmetech and its consolidated subsidiaries.

Office Location

Our principal corporate offices are located at 5964 La Place Court, Carlsbad, California 92008 and our telephone number is (760) 448-4300.

5

Table of Contents

The Offering

| Common stock we are offering |

shares of common stock |

| Over-allotment option |

The underwriters have been granted an option to purchase up to additional shares of our common stock at the initial public offering price for a period of 30 days after the date of this prospectus. |

| Offering price |

The public offering price is $ per share of common stock |

| Common stock outstanding after the offering |

shares of common stock |

| Use of proceeds |

We intend to use the net proceeds from this offering to continue to develop a broad menu of tests, to fund our planned sales and marketing initiatives, to develop our NexGen System, to acquire complementary businesses, technologies or licenses, to fund working capital and for general corporate purposes. We have no commitment with respect to any future acquisitions or licenses. See “Use of Proceeds.” |

| NASDAQ Global Market Symbol |

GNMK |

The number of shares of our common stock outstanding immediately after this offering is based on 11,738,233 shares outstanding as of March 31, 2011, and assumes all of the shares offered hereby are sold. The number of shares of common stock excludes:

| • | 1,314,975 shares of common stock issuable upon exercise of options outstanding as of March 31, 2011, at a weighted average exercise price of $6.06 per share; |

| • | 88,317 shares of common stock issuable upon exercise of warrants outstanding as of March 31, 2011, at a weighted average exercise price of $9.98 per share; |

| • | 701,957 shares of common stock which will be available for future grant or issuance under our 2010 Equity Incentive Plan, or our 2010 Plan, and the annual increases in the number of shares authorized under this plan; and |

| • | shares of common stock to cover over-allotments. |

Unless otherwise indicated, all information in this prospectus assumes:

| • | that the underwriters do not exercise their option to purchase up to additional shares of our common stock to cover over-allotments, if any; and |

| • | no options, warrants or shares of common stock were issued after March 31, 2011, and no outstanding options or warrants were exercised after March 31, 2011. |

6

Table of Contents

SUMMARY CONSOLIDATED HISTORICAL FINANCIAL DATA

The following table summarizes our financial data. The summary consolidated historical financial data as of and for the year ended December 31, 2010, and as of and for the three months ended March 31, 2011 relate to GenMark. The summary consolidated historical financial data as of December 31, 2009 and for the three months ended March 31, 2010 and the years ended December 31, 2009 and 2008 relate to Osmetech and its consolidated subsidiaries, which became subsidiaries of GenMark in a reorganization under the applicable laws of the United Kingdom in 2010. We have derived the following summary consolidated statement of operations data for the years ended December 31, 2010, 2009 and 2008 and the consolidated balance sheet data as of December 31, 2010 and 2009 from our audited consolidated financial statements included elsewhere in this prospectus, which have been prepared in accordance with U.S. generally accepted accounting principles, or U.S. GAAP. The consolidated statements of operations data for the three months ended March 31, 2011 and 2010, and the consolidated balance sheet data as of March 31, 2011, are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. We have prepared the unaudited financial information on the same basis as the audited consolidated financial statements and have included, in our opinion, all adjustments, consisting only of normal recurring adjustments, that we consider necessary for a fair presentation of the financial information set forth in those statements.

Our historical results are not necessarily indicative of the results that may be expected in the future, and our interim results are not necessarily indicative of the results to be expected for the full fiscal year. The summary consolidated historical financial data should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and unaudited condensed consolidated financial statements of GenMark and Osmetech and related notes included elsewhere in this prospectus.

| Three Months Ended March 31, | Year Ended December 31, | |||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | 2008 | ||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||

| Revenue: |

||||||||||||||||||||

| Product sales |

$ | 692,739 | $ | 384,249 | $ | 2,340,996 | $ | 910,527 | $ | 559,592 | ||||||||||

| License revenue and other |

71,664 | 15,015 | 163,872 | 87,889 | 87,500 | |||||||||||||||

| Total revenue |

764,403 | 399,264 | 2,504,868 | 998,416 | 647,092 | |||||||||||||||

| Cost of sales |

1,643,456 | 567,396 | 4,377,701 | 4,332,299 | 3,237,869 | |||||||||||||||

| Gross loss |

(879,053 | ) | (168,132 | ) | (1,872,833 | ) | (3,333,883 | ) | (2,590,777 | ) | ||||||||||

| Operating expenses: |

||||||||||||||||||||

| Sales and marketing |

1,130,389 | 1,058,285 | 4,282,521 | 3,181,762 | 3,393,665 | |||||||||||||||

| Research and development |

2,528,252 | 1,453,759 | 6,522,112 | 5,633,717 | 13,423,679 | |||||||||||||||

| General and administrative |

2,111,336 | 2,167,264 | 7,353,802 | 8,288,762 | 9,632,708 | |||||||||||||||

| Total operating expenses |

5,769,977 | 4,679,308 | 18,158,435 | 17,104,241 | 26,450,052 | |||||||||||||||

| Loss from operations |

(6,649,030 | ) | (4,847,440 | ) | (20,031,268 | ) | (20,438,124 | ) | (29,040,829 | ) | ||||||||||

| Other income: |

||||||||||||||||||||

| Foreign exchange gain (loss) |

11,899 | (1,110 | ) | (1,110 | ) | 303,523 | 504,921 | |||||||||||||

| Interest income |

6,258 | 4,654 | (582 | ) | 33,222 | 420,011 | ||||||||||||||

| Therapeutic discovery credit |

— | — | 1,645,292 | — | — | |||||||||||||||

| Total other income |

18,157 | 3,544 | 1,643,600 | 336,745 | 924,932 | |||||||||||||||

| Loss before income taxes |

(6,630,873 | ) | (4,843,896 | ) | (18,387,668 | ) | (20,101,379 | ) | (28,115,897 | ) | ||||||||||

| (Provision) benefit for income taxes |

(10,968 | ) | (5,049 | ) | (15,324 | ) | 138,770 | (246,736 | ) | |||||||||||

| Net loss from continuing operations |

$ | (6,641,841 | ) | $ | (4,848,945 | ) | $ | (18,402,992 | ) | $ | (19,962,609 | ) | $ | (28,362,633 | ) | |||||

| Net loss |

$ | (6,641,841 | ) | $ | (4,848,945 | ) | $ | (18,402,992 | ) | $ | (19,962,609 | ) | $ | (28,362,633 | ) | |||||

| Unaudited net loss from continuing operations per common share, basic and diluted |

$ | (0.56 | ) | $ | (0.68 | ) | $ | (1.88 | ) | $ | (4.41 | ) | $ | (28.13 | ) | |||||

| Weighted average shares used in unaudited per share amounts |

11,771,014 | 7,113,922 | 9,796,588 | 4,526,758 | 1,008,386 | |||||||||||||||

7

Table of Contents

| As of March 31, | As of December 31, | |||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 17,054,095 | $ | 18,329,079 | $ | 16,482,818 | ||||||

| Total assets |

21,955,353 | 24,925,509 | 19,333,477 | |||||||||

| Long-term obligations |

2,622,644 | 612,932 | 795,334 | |||||||||

| Total liabilities |

7,055,185 | 3,858,091 | 4,008,659 | |||||||||

| Accumulated deficit |

(151,134,719 | ) | (144,492,881 | ) | (126,089,889 | ) | ||||||

| Total stockholders’ equity |

14,900,168 | 21,067,418 | 15,324,818 | |||||||||

8

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the other information set forth in this prospectus, including our consolidated financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before deciding to invest in our common stock. If any of the events or developments described below occurs, our business, financial condition or results of operations could be negatively affected. In that case, the market price of our common stock could decline, and you could lose all or part of your investment.

Risks Related to Our Business

We have a history of net losses, and we may never achieve or maintain profitability.

We have a history of significant net losses and a limited history commercializing our molecular diagnostic products. We obtained FDA clearance for our first generation molecular diagnostic system in 2006, and commenced a limited marketing effort for this system. We commenced offering our XT-8 system and our Warfarin Sensitivity Test in July 2008. We commenced offering our Cystic Fibrosis Genotyping Test in July 2009 and our Thrombophilia Risk Test in April 2010. Our Respiratory Viral Panel Test is currently labeled for IUO. Our net losses from continuing operations were approximately $6.6 million for the three months ended March 31, 2011, $18.4 million for the twelve months ended December 31, 2010, $20.0 million in 2009 and $28.4 million in 2008. At March 31, 2011, we had an accumulated deficit of approximately $151.1 million. We will continue to incur significant expenses for the foreseeable future for our sales and marketing, research and development and regulatory activities and maintaining our existing and obtaining additional intellectual property rights. We cannot provide you any assurance that we will ever achieve profitability and, even if we achieve profitability, that we will be able to sustain or increase profitability on a quarterly or annual basis. Further, because of our limited commercialization history and because the market for molecular diagnostic products is relatively new and rapidly evolving, we have limited insight into the trends that may emerge and affect our business. We may make errors in predicting and reacting to relevant business trends, which could harm our business and financial condition.

We will need to raise additional funds in the future, and such funds may not be available on a timely basis, or at all. If additional capital is not available, we may have to curtail or cease operations.

Until such time, if ever, as we can generate substantial product revenues, we will be required to finance our operations with our cash resources. We will need to raise additional funds in the future to support our operations. We cannot be certain that additional capital will be available as needed or on acceptable terms, or at all. If we require additional capital at a time when investment in our company, in molecular diagnostics companies or the marketplace in general is limited, we may not be able to raise such funds at the time that we desire, or at all. If we do raise additional funds through the issuance of equity or convertible securities, the percentage ownership of holders of our common stock could be significantly diluted and these newly issued securities may have rights, preferences or privileges senior to those of holders of our common stock. If we obtain debt financing, a substantial portion of our operating cash flow may be dedicated to the payment of principal and interest on such indebtedness, and the terms of the debt securities issued could impose significant restrictions on our operations. If we raise additional funds through collaborations and licensing arrangements, we could be required to relinquish significant rights to our technologies, and products or grant licenses on terms that are not favorable to us.

If our products do not perform as expected or the reliability of the technology on which our products are based is questioned, our operating results and business will suffer.

Our success depends on the market’s confidence that we can provide reliable, high-quality diagnostic systems and tests. We believe that customers in our target markets are likely to be particularly sensitive to product defects and errors. As a result, our reputation and the public image of our products or technologies will

9

Table of Contents

be significantly impaired if our products fail to perform as expected. Although our diagnostic systems are designed to be user-friendly, the functions they perform are quite complex, and our products may develop or contain undetected defects or errors.

If we experience a material defect or error, this could result in loss or delay of revenues, increased costs to produce our tests, delayed market acceptance, damaged reputation, diversion of development and management resources, legal claims, increased insurance costs or increased service and warranty costs, any of which could materially harm our business, financial condition and results of operations.

We also face the risk of product liability exposure related to the sale of our products. We currently carry product liability insurance that covers us against specific product liability claims up to an annual aggregate limit of $7.0 million. We also carry a separate general liability and umbrella policy that covers us against certain claims but excludes coverage for product liability. Any claim in excess of our insurance coverage, or for which we do not have insurance coverage, would have to be paid out of our cash reserves, which would harm our financial condition. We cannot assure you that we have obtained sufficient insurance or broad enough coverage to cover potential claims. Also, we cannot assure you that we can or will maintain our insurance policies on commercially acceptable terms, or at all. A product liability claim could significantly harm our business, financial condition and results of operations.

We may fail to successfully expand the menu of diagnostic tests for our XT-8 system or effectively predict the types of tests our existing and target customers want.

We currently market three FDA-cleared diagnostic tests and have developed one other diagnostic test currently labeled for IUO. In addition, we have several diagnostic tests in the development or design stage. Some hospital-based and reference laboratories may not consider adopting our XT-8 system until we offer a broader menu of diagnostic tests. Although we are developing additional tests to respond to the needs of these laboratories, we cannot guarantee that we will be able to license the appropriate technology, or develop and obtain required regulatory clearances or approvals, for enough additional tests quickly enough or in a manner that is cost-effective. The development of new or enhanced products is a complex and uncertain process requiring the accurate anticipation of technological and market trends, as well as precise technological execution. In addition, in order to commercialize our products, we are required to undertake time consuming and costly development activities, including clinical studies for which the outcome is uncertain. Products that appear promising during early development and preclinical studies may, nonetheless, fail to demonstrate the results needed to support regulatory approval or, if approved, may not generate the demand we expect. If we are unable to successfully develop and commercialize additional diagnostic tests for use with our XT-8 system, our revenues and our ability to achieve profitability will be significantly impaired.

We may not be able to correctly estimate or control our future operating expenses, which could lead to cash shortfalls.

Our operating expenses may fluctuate significantly in the future as a result of a variety of factors, many of which are outside of our control. These factors include:

| • | the time and resources required to develop, conduct clinical studies and obtain regulatory clearances for the additional diagnostic tests we develop; |

| • | the expenses we incur for research and development required to maintain and improve our technology, including developing our next-generation molecular diagnostic system; |

| • | the costs of preparing, filing, prosecuting, defending and enforcing patent claims and other patent related costs, including litigation costs and the results of such litigation. |

| • | the expenses we incur in connection with commercialization activities, including product marketing, sales and distribution; |

| • | the expenses we incur in licensing biomarkers from third parties to expand the menu of diagnostics tests we plan to offer; |

10

Table of Contents

| • | our sales strategy and whether the revenues from sales of our test cartridges or XT-8 system will be sufficient to offset our expenses; |

| • | the costs to attract and retain personnel with the skills required for effective operations; and |

| • | the costs associated with being a public company. |

Our budgeted expense levels are based in part on our expectations concerning future revenues from sales of our XT-8 system and diagnostic tests. We may be unable to reduce our expenditures in a timely manner to compensate for any unexpected shortfall in revenue. Accordingly, a significant shortfall in demand for our products could have an immediate and material impact on our business and financial condition.

We face intense competition from established and new companies in the molecular diagnostics field and expect to face increased competition in the future.

The markets for our technologies and products are very competitive, and we expect the intensity of competition to increase. We compete with many companies in the United States engaged in the development, commercialization and distribution of similar products intended for clinical molecular diagnostic applications. Categories of competitors include:

| • | companies developing and marketing multiplex molecular diagnostics systems, including Luminex Corporation; Nanosphere; Qiagen NV; Abbott Diagnostics; Hologic, Inc. and Innogenetics Inc.; |

| • | large hospital-based laboratories and reference laboratories who provide large-scale testing using their own proprietary testing methods including Quest Diagnostics and Laboratory Corporation of America; and |

| • | companies that manufacture laboratory-based tests and analyzers including Cephid; Gen-Probe, Inc.; Siemens; Hologic, Inc.; Qiagen NV; Roche Diagnostics; and Abbott Diagnostics. |

Our diagnostic tests also face competition with the laboratory-developed-tests, or LDTs, developed by national and regional reference laboratories and hospitals. Such laboratory-developed tests may not be subject to the same requirements for clinical trials and FDA submission requirements that may apply to our products.

We anticipate that we will face increased competition in the future as new companies enter the market with new technologies and our competitors improve their current products and expand their menu of diagnostic tests. Many of our current competitors, as well as many of our potential competitors, have greater name recognition, more substantial intellectual property portfolios, longer operating histories, significantly greater resources to invest in new technologies, more substantial experience in new product development, greater regulatory expertise, more extensive manufacturing capabilities and the distribution channels to deliver products to customers. The impact of these factors may result in our technologies and products becoming obsolete before we recover the expenses incurred to develop them or before they generate significant revenue.

We are reliant on the commercial success of our XT-8 system and our diagnostic tests.

We have primarily placed our XT-8 systems with customers at no initial charge through placement agreements, under which customers commit to purchasing minimum quantities of test cartridges over a period of one to three years, with a component of the reagent cartridge price allocated to recover the instrument cost. While we also offer our XT-8 systems for sale, we have sold only 12 of our systems. We expect sales of our diagnostic tests associated with our XT-8 system will account for the vast majority of our revenues for at least the next several years. We intend to dedicate a significant portion of our resources to the commercialization of our XT-8 system and our existing FDA-cleared diagnostic tests. Although we intend to develop a broad range of additional diagnostic tests for use with the XT-8 system and our NexGen system, we cannot assure you when or if we will obtain FDA clearance for the tests we develop in the future, or whether the market will accept such new products. As a result, to the extent that our XT-8 system and our existing and future FDA-cleared diagnostic tests are not commercially successful or are withdrawn from the market for any reason, our revenues will be harmed and our business, operating results and financial condition will be harmed.

11

Table of Contents

We may not be successful in developing our NexGen system.

We are developing a sample-to-answer platform, the NexGen system. We are designing this system to integrate automated nucleic acid extraction and amplification with our eSensor technology to allow technicians to be able to place a patient sample into our test cartridge and obtain results with significantly reduced or no processing. The development of the NexGen system is a complex process, and we may not be successful in completing the development of all the currently intended features and benefits of the system, which may limit its marketability. In addition, before commercializing the NexGen system we will be required to obtain regulatory approval for the system as well as each of the diagnostic tests to be used on the system, including those tests that previously received approval for use with our XT-8 system. If we are unable to successfully develop and obtain regulatory approval for our NexGen system and related diagnostic tests, our business plan will be impaired. Additionally, prior to or upon release of our NexGen System, sales of our XT-8 system may decrease as customers migrate over to our newer technology.

Our financial results will depend on the acceptance among reference laboratories and hospitals, third-party payors and the medical community of our molecular diagnostic technology and products.

Our future success depends on the acceptance by our target customers, third-party payors and the medical community that our molecular diagnostic products are a reliable, accurate and cost-effective replacement for other molecular diagnostic testing methods.

Medical offices and many hospitals outsource their molecular diagnostic testing needs to national or regional reference laboratories. Our business success depends on our ability to convince these target laboratories and hospitals to replace their current testing platforms and/or send-out tests, with our XT-8 system and related diagnostic tests. We must also continue to increase the number of available tests, and test sell-through, on our installed systems.

Many other factors may affect the market acceptance and commercial success of our molecular diagnostic technology and products, including:

| • | the relative convenience and ease of use of our diagnostic systems over competing products; |

| • | the introduction of new technologies and competing products that may make our technologies and products a less attractive solution for our target customers; |

| • | the breadth of our menu of available diagnostic tests relative to our competitors; |

| • | our success in training reference and hospital-based laboratories in the proper use of our products; |

| • | the acceptance in the medical community of our molecular diagnostic technology and products; |

| • | the extent and success of our marketing and sales efforts; and |

| • | general economic conditions. |

Manufacturing risks and inefficiencies may adversely affect our ability to produce products; we have a sole source of supply for our XT-8 System.

We must manufacture, or engage third parties to manufacture, components of our products in sufficient quantities and on a timely basis, while maintaining product quality, acceptable manufacturing costs and complying with regulatory requirements. In determining the required quantities of our products and the manufacturing schedule, we must make significant judgments and estimates based on inventory levels, current market trends and other related factors. Because of the inherent nature of estimates and our limited experience in marketing our products, there could be significant differences between our estimates and the actual amounts of products we require. This can result in shortages if we fail to anticipate demand, or excess inventory and write-offs if we order more than we need.

We currently manufacture our proprietary test cartridges at our Carlsbad, California manufacturing facility. We outsource manufacturing of our XT-8 system and much of the disposable component molding and

12

Table of Contents

component assembly for our test cartridges. Our XT-8 system is manufactured by Aubrey Group Inc., our single source supplier that specializes in contract design and manufacturing of electronic and electromechanical devices for medical use. While we work closely with Aubrey Group Inc. to try to ensure continuity of supply while maintaining high quality and reliability, we cannot guarantee that these efforts will be successful. Should Aubrey Group Inc. become unable or unwilling to continue to meet our supply needs, we may experience delays in qualifying a new source or may not obtain as favorable pricing or other terms, any of which could harm our business, financial condition or results of operation. In addition, our components are custom-made by only a few outside vendors. Reliance on third-party manufacturers entails risks to which we would not be subject if we manufactured these components ourselves, including:

| • | reliance on third parties for regulatory compliance and quality assurance; |

| • | possible breaches of manufacturing agreements by the third parties because of factors beyond our control; |

| • | possible regulatory violations or manufacturing problems experienced by our suppliers; and |

| • | possible termination or non-renewal of agreements by third parties, based on their own business priorities, at times that are costly or inconvenient for us. |

We may not be able to meet the demand for our products if one or more of these third-party manufacturers are not able or are unwilling to supply us with the necessary components that meet our specifications. It may be difficult to find alternate suppliers in a timely manner and on terms acceptable to us.

The manufacturing operations for our test cartridges in Carlsbad, California use highly technical processes involving unique, proprietary techniques. In addition, the manufacturing equipment we use would be costly to repair or replace and could require substantial lead time to repair or replace. Any interruption in our operations or decrease in the production capacity of our manufacturing facility or the facilities of any of our suppliers because of equipment failure, natural disasters such as earthquakes, tornadoes and fires or otherwise, would limit our ability to meet customer demand for the XT-8 system and tests and would have a material adverse effect on our business, financial condition and results of operations. Other possible disruptions may include power loss and telecommunications failures. In the event of a disruption, we may lose customers and we may be unable to regain those customers thereafter. Our insurance may not be sufficient to cover all of our potential losses and may not continue to be available to us on acceptable terms, or at all.

If we are unable to retain key members of our senior management and scientists or hire additional skilled employees, we may be unable to achieve our goals.

Our performance is substantially dependent on the performance of our senior management and key scientific and technical personnel. Our senior managers and other key employees can terminate their relationship with us at any time. We have a small number of senior managers, and the loss of services of any of these managers or our scientific or technical personnel could have a material adverse effect on our business, financial condition and results of operations. We do not maintain key-man life insurance on any of our employees.

In addition, our product development and marketing efforts could be delayed or curtailed if we are unable to attract, train and retain highly skilled employees and scientific advisors. To expand our research, product development and sales efforts, we will need to retain additional people skilled in areas such as electrochemical and molecular science, information technology, manufacturing, sales, marketing and technical support. Because of the complex and technical nature of our systems and the dynamic market in which we compete, any failure to attract and retain a sufficient number of qualified employees could materially harm our ability to develop and commercialize our technology. We may not be successful in hiring or retaining qualified personnel, and any failure to do so could have a material adverse effect on our business, financial condition and results of operations.

13

Table of Contents

Our success may depend upon how we and our competitors anticipate and adapt to market conditions.

The markets for our products are characterized by rapidly changing technology, evolving industry standards, changes in customer needs, emerging competition and new product introductions. New technologies, techniques or products could emerge with similar or better performance or may be perceived as providing better value than our systems and related tests and could exert pricing pressures on our products. It is critical to our success that we anticipate changes in technology and customer requirements and successfully introduce enhanced and competitive technology to meet our customers’ and prospective customers’ needs on a timely basis. We will need to respond to technological innovation in a rapidly changing industry and may not be able to maintain our technological advantages over emerging technologies in the future. If we fail to keep pace with emerging technologies, our systems and related tests will become uncompetitive and our market share will decline, which would harm our business, financial condition and results of operations.

We may be unsuccessful in our long-term goal of expanding sales of our product offerings outside the United States.

Assuming we receive the applicable regulatory approvals, we intend to market our diagnostic products outside the United States through third-party distributors. These distributors may not commit the necessary resources to market and sell our products to meet our expectations. If distributors do not perform adequately or in compliance with applicable laws and regulations in particular geographic areas, or if we are unable to locate distributors in particular geographic areas, our ability to realize long-term international revenue growth would be harmed.

In order to market our products in the European Union and many other foreign jurisdictions, we, or our distributors or partners, must obtain separate regulatory approvals and comply with numerous and varying regulatory requirements regarding safety and efficacy and governing, among other things, clinical studies and commercial sales and distribution of our products. The approval procedure varies among countries and can involve additional testing. The regulatory approval process outside the United States may include all of the risks associated with obtaining FDA approval, as well as additional risks. In addition, in many countries outside the United States, it is required that the product be approved for reimbursement before the product can be approved for sale in that country. We may not obtain approvals from regulatory authorities outside the United States on a timely basis, if at all, which could harm our ability to expand into markets outside the United States.

If we expand sales of our products outside the United States, our business will be susceptible to risks associated with international operations.

If we execute our plan to expand our operations outside the United States, our inexperience in operating in foreign countries increases the risk that our international expansion will not be successful. Conducting international operations would subject us to new risks that, generally, we have not faced in the United States, including:

| • | fluctuations in currency exchange rates; |

| • | unexpected changes in foreign regulatory requirements; |

| • | longer accounts receivable payment cycles and difficulties in collecting accounts receivable; |

| • | competition from companies located in the countries in which we offer our products, which may be a competitive disadvantage; |

| • | difficulties in managing and staffing international operations; |

| • | potentially adverse tax consequences, including the complexities of foreign value added tax systems, tax inefficiencies related to our corporate structure and restrictions on the repatriation of earnings; |

| • | the burdens of complying with a wide variety of foreign laws and different legal standards; |

| • | increased financial accounting and reporting burdens and complexities; |

| • | political, social and economic instability abroad, terrorist attacks and security concerns in general; and |

| • | reduced or varied protection for intellectual property rights in some countries. |

14

Table of Contents

The occurrence of any one of these risks could harm our business, results of operations and prospects. Additionally, operating internationally requires significant management attention and financial resources. We cannot be certain that the investment and additional resources required in establishing operations in other countries will produce desired levels of revenues or profitability.

Our Respiratory Viral Panel Test and other menu items that we develop in the future may have sales that fluctuate on a seasonal basis and, as a result, our results of operations for any particular quarter may not accurately reflect full-year trends.

Our Respiratory Viral Panel Test and other tests that we develop in the future may have sales that fluctuate on a seasonal basis. As a result, our results of operations for any particular quarter may not accurately reflect full-year trends. For example, we expect volume of testing for our Respiratory Viral Panel Test generally will decline during the spring and summer season and accelerate during the fall and winter season. As a result, comparison of our results from quarter-to-quarter may not accurately reflect trends or results for the full year.

We have limited experience in sales and marketing and may be unable to successfully commercialize our XT-8 system and related diagnostic tests.

We have limited marketing, sales and distribution experience and capabilities. In connection with our XT-8 system, we commenced offering our Warfarin Sensitivity Test in July 2008, our Cystic Fibrosis Genotyping Test in July 2009 and our Thrombophilia Risk Test in April 2010. We are currently in varying stages of development of 4 additional tests:

| • | Respiratory Viral Panel: A qualitative nucleic acid multiplex test designed for the simultaneous detection and identification of multiple respiratory virus nucleic acids and mutations; |

| • | Plavix Sensitivity: For the multiplexed detection and genotyping of the *2, *3, *4, *5, *6, *7, *8, *9, *10, *13 and *17 alleles of the cytochrome P450 (CYP450) 2C19 gene locus; |

| • | Kras-Mutation: Designed for the multiplexed detection and genotyping of 12 mutations in codons 12 and 13 of KRAS and the V600E mutation in BRAF; and |

| • | Hepatitis C Virus Genotyping: Designed to detect and subtype the different genotypes for the Hepatitis C Virus (HCV). |

As of March 31, 2011, we had 102 analyzers installed with customers. Our ability to achieve profitability depends on attracting customers for the XT-8 system, expanding the number of tests we offer, and building brand loyalty. To successfully perform sales, marketing, distribution and customer support functions ourselves, we face a number of risks, including:

| • | our ability to attract and retain the skilled support team, marketing staff and sales force necessary to commercialize and gain market acceptance for our technology and our products; |

| • | the ability of our sales and marketing team to identify and penetrate the potential customer base, including hospitals, national and regional reference laboratories; and |

| • | the difficulty of establishing brand recognition and loyalty for our products. |

In addition, we may seek to enlist one or more third parties to assist with sales, distribution and customer support globally or in certain regions of the world. If we do seek to enter into these arrangements, we may not be successful in attracting desirable sales and distribution partners, or we may not be able to enter into these arrangements on favorable terms, or at all. If our sales and marketing efforts, or those of any third-party sales and distribution partners, are not successful, our technologies and products may not gain market acceptance, which would harm our business operations.

Providing XT-8 systems to our customers through reagent rental agreements may harm our liquidity.

The majority of our XT-8 systems are sold to customers via “reagent rental” agreements, under which customers obtain the XT-8 System in return for a commitment to purchase minimum quantities of test cartridges over a period of one to three years. Accordingly, we must incur the expense of manufacturing XT-8

15

Table of Contents

Systems well in advance of receiving sufficient revenues from test cartridges to recover our manufacturing expenses. We also offer our XT-8 systems for sale. In 2010, we sold ten XT-8 systems to customers which included the sale of twelve analyzers. The amount of additional capital we may need to raise depends on the amount of our revenues from sales of test cartridges sold through these reagent rental agreements. We do not currently sell enough test cartridges to recover all of our fixed manufacturing expenses associated with the production of our systems and test cartridges, and therefore we currently have a high cost of sales relative to revenue, resulting in a gross loss. If we continue not to sell a sufficient number of test cartridges to offset our expenses associated with these reagent rental agreements, our liquidity will be adversely affected.

We use hazardous chemicals, biological materials and infectious agents in our business. Any claims relating to improper handling, storage or disposal of these materials could be time consuming and costly.

Our research, product development and manufacturing processes involve the controlled use of hazardous materials, including chemicals, biological materials and infectious disease agents. Our operations produce hazardous waste products. We cannot eliminate the risk of accidental contamination or discharge and any resultant injury from these materials. We may be sued for any injury or contamination that results from our use or the use by third parties of these materials, and our liability may exceed our insurance coverage and our total assets. Federal, state and local laws and regulations govern the use, manufacture, storage, handling and disposal of these hazardous materials and specified waste products, as well as the discharge of pollutants into the environment and human health and safety matters. Compliance with environmental laws and regulations may be expensive and may impair our research, development and production efforts. If we fail to comply with these requirements, we could incur substantial costs, including civil or criminal fines and penalties, clean-up costs or capital expenditures for control equipment or operational changes necessary to achieve and maintain compliance. In addition, we cannot predict the impact on our business of new or amended environmental laws or regulations or any changes in the way existing and future laws and regulations are interpreted and enforced.

Our corporate structure may create tax inefficiencies.

As a result our reorganization in 2010, Osmetech became a wholly-owned subsidiary of GenMark and a controlled foreign corporation for U.S. federal income tax purposes. This organizational structure may create inefficiencies, as certain types of income and investments of Osmetech that otherwise would not be currently taxable under general tax rules, may become taxable. In addition, conveyance of intellectual property rights from one subsidiary to another could create taxable income. Distributions from GenMark to its operating subsidiaries or amongst the U.S. operating subsidiaries of GenMark may be subject to additional U.S. and foreign income tax withholding and result in lower profits. It is our intention by the end of the first half of 2011 to streamline our corporate structure and, by doing so, we may lose some, if not most, of our tax loss carryforward benefits and/or certain activities of the restructuring could become taxable transactions in the United States. We cannot predict the outcome of such transactions and the impact such reorganization may have on U.S. and foreign tax liability and financial condition.

Our ability to use our net operating loss carryforwards might be limited.

As of December 31, 2010, we had net operating loss carryforwards of approximately $77.9 million for U.S. federal income tax purposes. These loss carryforwards will expire in varying amounts through 2030. To the extent these net operating loss carryforwards are available, we intend to use them to reduce the corporate income tax liability associated with our operations. Section 382 of the U.S. Internal Revenue Code generally imposes an annual limitation on the amount of net operating loss carryforwards that might be used to offset taxable income when a corporation has undergone significant changes in stock ownership. As a result, prior or future changes in ownership could put limitations on the availability of our net operating loss carryforwards. In addition, our ability to use the current net operating loss carryforwards might be further limited by the issuance of common stock in the future. To the extent our use of net operating loss carryforwards is significantly limited, our income could be subject to corporate income tax earlier than it would if we were able to use net operating loss carryforwards, which could result in lower profits.

16

Table of Contents

We have determined that we have experienced multiple ownership changes under Section 382. We have estimated that approximately $24.7 million of federal net operating losses may be utilized in the future based on limitations that we have calculated under Section 382. We are currently analyzing alternative positions and additional factual information that may increase the amount of net operating losses that could subsequently be utilized. To the extent that this additional information becomes available and could increase net operating losses available for use, we will adjust our deferred tax assets accordingly, with a corresponding adjustment to our valuation allowance. We also had non-U.S. net operating loss carryforwards of approximately $30.4 million as of December 31, 2010. Upon completion of our planned corporate restructuring, these non-U.S. net operating loss carryforwards will not be available for use.

Risks Related to Regulation

The regulatory clearance or approval process is expensive, time consuming and uncertain, and the failure to obtain and maintain required clearances or approvals could prevent us from commercializing our future products.

We are investing in the research and development of new diagnostic tests to expand our menu of testing options, as well as to develop our next-generation NexGen system, which we anticipate will reduce the need for sample preparation when using our system. Our products are subject to 510(k) clearance or pre-market approval by the FDA prior to their marketing for commercial use in the United States, and to any approvals required by foreign governmental entities prior to their marketing outside the United States. In addition, any changes or modifications to a device that has received regulatory clearance or approval that could significantly affect its safety or effectiveness, or would constitute a major change in its intended use, may require the submission of a new application for 510(k) clearance, pre-market approval or foreign regulatory approvals.

The 510(k) clearance and pre-market approval processes, as well as the process of obtaining foreign approvals, can be expensive, time consuming and uncertain. It generally takes from four to twelve months from submission to obtain 510(k) clearance, and from one to three years from submission to obtain pre-market approval; however, it may take longer, and 510(k) clearance or pre-market approval may never be obtained. Delays in receipt of, or failure to obtain, clearances or approvals for future products, including tests that are currently in design or development, would result in delayed, or no, realization of revenues from such products and in substantial additional costs which could decrease our profitability. We have limited experience in filing FDA applications for 510(k) clearance and pre-market approval. In addition, we are required to continue to comply with applicable FDA and other regulatory requirements once we have obtained clearance or approval for a product. There can be no assurance that we will obtain or maintain any required clearance or approval on a timely basis, or at all. Any failure to obtain or any material delay in obtaining FDA clearance or any failure to maintain compliance with FDA regulatory requirements could harm our business, financial condition and results of operations.

If third-party payors do not reimburse our customers for the use of our clinical diagnostic products or if reimbursement levels are set too low for us to sell our products at a profit, our ability to sell our products and our results of operations will be harmed.

We sell our products to hospital-based and reference laboratories, substantially all of which receive reimbursement for the health care services they provide to their patients from third-party payors, such as Medicare, Medicaid, other domestic and foreign government programs, private insurance plans and managed care programs. Reimbursement decisions by particular third-party payors depend upon a number of factors, including each third-party payor’s determination that use of a product is:

| • | a covered benefit under its health plan; |

| • | appropriate and medically necessary for the specific indication; |

| • | cost effective; and |

| • | neither experimental nor investigational. |

17

Table of Contents

Third-party payors may deny reimbursement for covered products if they determine that a medical product was not used in accordance with cost-effective diagnosis methods, as determined by the third-party payor, or was used for an unapproved indication. Third-party payors also may refuse to reimburse for procedures and devices deemed to be experimental.

Obtaining coverage and reimbursement approval for a product from each government or third-party payor is a time consuming and costly process that could require us to provide supporting scientific, clinical and cost-effectiveness data for the use of our product to each government or third-party payor. We may not be able to provide data sufficient to gain acceptance with respect to coverage and reimbursement. For example, Medicare and Medicaid generally do not reimburse providers who use our Warfarin Sensitivity Test. In addition, eligibility for coverage does not imply that any product will be covered and reimbursed in all cases or reimbursed at a rate that allows our potential customers to make a profit or even cover their costs.

In the United States, the American Medical Association assigns specific Current Procedural Terminology, or CPT, codes, which are necessary for reimbursement of diagnostic tests. Once the CPT code is established, the Centers for Medicare and Medicaid Services establish reimbursement payment levels and coverage rules under Medicaid and Medicare, and private payors establish rates and coverage rules independently. We cannot guarantee that any of our tests are or will be covered by the CPT codes that we believe may be applied to them or that any of our tests or other products will be approved for coverage or reimbursement by Medicare and Medicaid or any third-party payor. Third-party payors may nonetheless choose to reimburse our customers on a per test basis based on individual biomarker detection, rather than on the basis of the number of results given by the test. This may result in reference laboratories, public health institutions and hospitals electing to use separate tests to screen for each disease so that they can receive reimbursement for each test they conduct. In that event, these entities may purchase separate tests for each disease, rather than products, such as ours, that can be used to return multiple test results.

Third-party payors are increasingly attempting to contain health care costs by limiting both coverage and the level of reimbursement for medical products and services. Increasingly, Medicare, Medicaid and other third-party payors are challenging the prices charged for medical services, including clinical diagnostic tests. In addition, Medicare’s current freeze on its clinical laboratory fee schedule may harm the growth of the molecular diagnostics market for patients in the United States who are over 65 or have specific disabilities. Levels of reimbursement may decrease in the future, and future legislation, regulation or reimbursement policies of third-party payors may harm the demand for and reimbursement available for our products, which in turn, could harm pricing and sales. If our customers are not adequately reimbursed for our products, they may reduce or discontinue purchases of our products, which would cause our revenues to decline.

We and our suppliers, contract manufacturers and customers are subject to various governmental regulations, and we may incur significant expenses to comply with, and experience delays in our product commercialization as a result of, these regulations.

Our manufacturing processes and facilities, and those of some of our contract manufacturers, are required to comply with the federal Quality System Regulation, or the QSR, which covers the procedures and documentation of the design, testing, production, control, quality assurance, labeling, packaging, sterilization, storage and shipping of our devices. The FDA enforces the QSR through periodic announced and/or unannounced inspections of manufacturing facilities. We and our contract manufacturers have been, and anticipate in the future being, subject to such inspections, as well as to inspections by other federal and state regulatory agencies.

We must also file reports of device corrections and removals and adhere to the FDA’s rules on labeling and promotion. The FDA and other agencies actively enforce the laws and regulations prohibiting the promotion of off-label uses, and a company that is found to have improperly promoted off-label uses may be subject to significant liability, including substantial monetary penalties and criminal prosecution.

18

Table of Contents

Failure to comply with applicable FDA requirements, or later discovery of previously unknown problems with our products or manufacturing processes, including our failure or the failure of one of our contract manufacturers to take satisfactory corrective action in response to an adverse QSR inspection, can result in, among other things:

| • | administrative or judicially imposed sanctions; |

| • | injunctions or the imposition of civil penalties; |